Macroeconomics Report: Analysis of Singapore's Economic Conditions

VerifiedAdded on 2019/09/13

|22

|4012

|91

Report

AI Summary

This macroeconomics report analyzes the economic conditions of Singapore, focusing on two articles that discuss inflation and recession. The report examines key economic concepts such as Real Gross Domestic Product (RGDP), inflation, cost-push inflation, recession, aggregate demand and supply, unemployment, and expansionary fiscal policy. It provides an economic analysis of the factors contributing to price determination, the impact of falling oil prices, and the effects of government policies. The analysis includes diagrams illustrating the determination of price, the impact on the retail sector, and the effects of expansionary fiscal policy. The report concludes by summarizing the key findings related to Singapore's economic performance, including the impact of global demand, government interventions, and the looming threat of a technical recession.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACRO ECONOMICS 1

Table of Contents

Summary of the Article 1................................................................................................................ 2

Economics Concepts related to article.............................................................................................2

Economics Analysis.........................................................................................................................4

Conclusion....................................................................................................................................... 9

Summary of the Article 2.............................................................................................................. 10

Economics Concepts related to article...........................................................................................10

Economics Analysis.......................................................................................................................12

Conclusion..................................................................................................................................... 17

Table of Contents

Summary of the Article 1................................................................................................................ 2

Economics Concepts related to article.............................................................................................2

Economics Analysis.........................................................................................................................4

Conclusion....................................................................................................................................... 9

Summary of the Article 2.............................................................................................................. 10

Economics Concepts related to article...........................................................................................10

Economics Analysis.......................................................................................................................12

Conclusion..................................................................................................................................... 17

MACRO ECONOMICS 2

Article 1)

Singapore consumer prices rise for 2nd straight month in January on

recovering oil prices.

Summary of the article 1

Singapore oil prices are recovering from a recession period and gradually showing positive

inflation in the month of January 2017. According to figures released by the Singapore

department of statistics on February 23 2017. The base for measuring the inflation is CPI:

consumer price index which rose 0.6 percent from last month compared with the same month a

year ago. This scenario is seen after 2 years of recession from November 2014 to October 2016,

and a flat CPI in November. Finally, in December this data turned positive and increased 0.2

percent gradually. Recession in the oil market and car market ultimately affect the whole

economy and main drivers behind that long session of negative inflation. In the oil market, a

sudden increase in services and cost of oil-related items leads to increase the price of oil in

January. Overall inflation is predictable to pick up to 0.5 to 1.5 % this year, from negative 0.5 %

in 2016. This mainly reflects the positive contribution of energy-related components as well as

some administrative price increases.

Economics Concepts related to article

Real gross domestic products: during a given period of time, the quality of all the products

produce inside the border of a nation is known as RGDP.

Inflation: a rate at which prices of goods and services increase consistently, as inflation

prevailing in an economy, every currency an individual holds can buy small percent of goods and

services he can buy before.

Article 1)

Singapore consumer prices rise for 2nd straight month in January on

recovering oil prices.

Summary of the article 1

Singapore oil prices are recovering from a recession period and gradually showing positive

inflation in the month of January 2017. According to figures released by the Singapore

department of statistics on February 23 2017. The base for measuring the inflation is CPI:

consumer price index which rose 0.6 percent from last month compared with the same month a

year ago. This scenario is seen after 2 years of recession from November 2014 to October 2016,

and a flat CPI in November. Finally, in December this data turned positive and increased 0.2

percent gradually. Recession in the oil market and car market ultimately affect the whole

economy and main drivers behind that long session of negative inflation. In the oil market, a

sudden increase in services and cost of oil-related items leads to increase the price of oil in

January. Overall inflation is predictable to pick up to 0.5 to 1.5 % this year, from negative 0.5 %

in 2016. This mainly reflects the positive contribution of energy-related components as well as

some administrative price increases.

Economics Concepts related to article

Real gross domestic products: during a given period of time, the quality of all the products

produce inside the border of a nation is known as RGDP.

Inflation: a rate at which prices of goods and services increase consistently, as inflation

prevailing in an economy, every currency an individual holds can buy small percent of goods and

services he can buy before.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MACRO ECONOMICS 3

Cost-push inflation: when the prices of inputs like labor, raw material, etc. lead to increase the

cost of production; as a result price of that product increases as well, known as cost-push

inflation.

Recession: consistent fall in prices and output in two successive quarters which leads to falling

in RGDP and a period of temporary decline of trade and production activities.

Aggregate demand: at a given period of time, the final demand of goods and services from all

the individuals in an economy is referred as aggregate demand.

Aggregate supply: during a specific period of time, the total quantity of goods and services an

economy is planning to supply is refers as aggregate supply.

Unemployment – workforce those are willing to work and looking for work but not able to find

any work are refers as unemployed and percentage of them with reference to total population is

unemployment.

Expansionary fiscal policy: It is a policy by the government which is adopted so that the

money supply in the economy gets increased and the rate of inflation is raised. This is done by

decreasing the rate of taxes and increasing the expenditure of the government (Hansen, 2013).

Thus, this helps in fighting the recessionary pressures of the economy. When the taxes are

reduced, the disposable income of the people gets increased. Thus they spend more and consume

more. When the goods and services are invested into, and the people spend more, the GDP of the

country gets improved.

Full employment: It is a condition where all the people who can work and they are willing to

work are employed in the economy at a particular time (Beveridge, 2014).

Cost-push inflation: when the prices of inputs like labor, raw material, etc. lead to increase the

cost of production; as a result price of that product increases as well, known as cost-push

inflation.

Recession: consistent fall in prices and output in two successive quarters which leads to falling

in RGDP and a period of temporary decline of trade and production activities.

Aggregate demand: at a given period of time, the final demand of goods and services from all

the individuals in an economy is referred as aggregate demand.

Aggregate supply: during a specific period of time, the total quantity of goods and services an

economy is planning to supply is refers as aggregate supply.

Unemployment – workforce those are willing to work and looking for work but not able to find

any work are refers as unemployed and percentage of them with reference to total population is

unemployment.

Expansionary fiscal policy: It is a policy by the government which is adopted so that the

money supply in the economy gets increased and the rate of inflation is raised. This is done by

decreasing the rate of taxes and increasing the expenditure of the government (Hansen, 2013).

Thus, this helps in fighting the recessionary pressures of the economy. When the taxes are

reduced, the disposable income of the people gets increased. Thus they spend more and consume

more. When the goods and services are invested into, and the people spend more, the GDP of the

country gets improved.

Full employment: It is a condition where all the people who can work and they are willing to

work are employed in the economy at a particular time (Beveridge, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACRO ECONOMICS 4

Economics Analysis

Determination of price in the economy

At a given period of time, the final demand of goods and services from all the individuals in an

economy is referred as aggregate demand. Aggregate demand is a combination of consumption,

investment , government and net export.

AD = C+ I + G + (X-M)

Where,

AD is aggregate demand

C is consumption

I is investment

G is government expenditure

X is export

M is import

During a specific period of time, the total amount of products and services an economy is

planning to supply is refers as aggregate supply. Aggregate supply is different in the long and

short run, in short run aggregate supply is upward sloping because an economy is below full

Economics Analysis

Determination of price in the economy

At a given period of time, the final demand of goods and services from all the individuals in an

economy is referred as aggregate demand. Aggregate demand is a combination of consumption,

investment , government and net export.

AD = C+ I + G + (X-M)

Where,

AD is aggregate demand

C is consumption

I is investment

G is government expenditure

X is export

M is import

During a specific period of time, the total amount of products and services an economy is

planning to supply is refers as aggregate supply. Aggregate supply is different in the long and

short run, in short run aggregate supply is upward sloping because an economy is below full

MACRO ECONOMICS 5

employment and able to achieve full employment gradually. On the other hand, in long run

aggregate supply is vertical, and economy ultimately reaches full employment level. In an

economy, the price of all the goods and services are determined by the intersection of aggregate

demand and aggregate supply. As shown in below diagram:

Determination of price by intersection of AD & AS

In the above diagram, the prices of goods and services are determined at point ‘e’ when the

aggregate demand (AD) curve intersects aggregate demand (AS) curve. This is the level at which

the optimal level of price and output of the economy can be determined.

Due to fall in oil prices in, the whole economy gets affected, Recession in the oil market, and car

market ultimately affects the whole economy and main drivers behind that long session of

negative inflation.

employment and able to achieve full employment gradually. On the other hand, in long run

aggregate supply is vertical, and economy ultimately reaches full employment level. In an

economy, the price of all the goods and services are determined by the intersection of aggregate

demand and aggregate supply. As shown in below diagram:

Determination of price by intersection of AD & AS

In the above diagram, the prices of goods and services are determined at point ‘e’ when the

aggregate demand (AD) curve intersects aggregate demand (AS) curve. This is the level at which

the optimal level of price and output of the economy can be determined.

Due to fall in oil prices in, the whole economy gets affected, Recession in the oil market, and car

market ultimately affects the whole economy and main drivers behind that long session of

negative inflation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MACRO ECONOMICS 6

Fall in RGDP & Output, due to fall in oil prices

In the above diagram, due to fall in oil prices, short run supply curve shift leftward, which leads

to fall in RGDP and output. As a result, income of people fall, so does the aggregate demand of

other goods and services as well. Thus, the scenario continue and turn into a recession.

P↓ → AS↓→RGDP↓→Y↓→AD↓

The retail sector of Singapore is negatively impact as unemployment increased in Singapore's.

Thus, the purchasing power of Singapore citizens shrink as there income reduced. Aggregate

demand and consumption will also fall, and then the RGDP will decline. As shown in the below

diagram:

Fall in RGDP & Output, due to fall in oil prices

In the above diagram, due to fall in oil prices, short run supply curve shift leftward, which leads

to fall in RGDP and output. As a result, income of people fall, so does the aggregate demand of

other goods and services as well. Thus, the scenario continue and turn into a recession.

P↓ → AS↓→RGDP↓→Y↓→AD↓

The retail sector of Singapore is negatively impact as unemployment increased in Singapore's.

Thus, the purchasing power of Singapore citizens shrink as there income reduced. Aggregate

demand and consumption will also fall, and then the RGDP will decline. As shown in the below

diagram:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACRO ECONOMICS 7

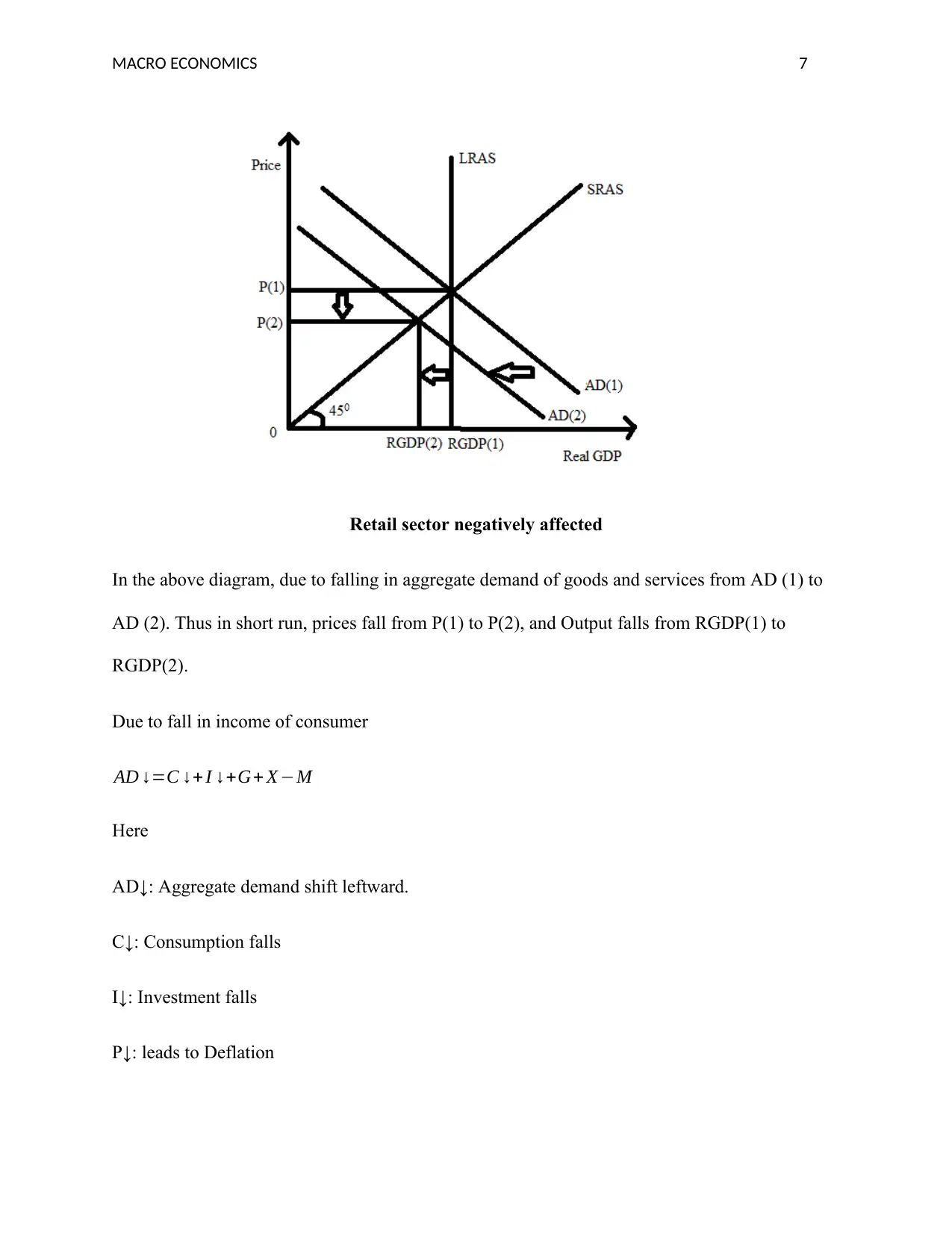

Retail sector negatively affected

In the above diagram, due to falling in aggregate demand of goods and services from AD (1) to

AD (2). Thus in short run, prices fall from P(1) to P(2), and Output falls from RGDP(1) to

RGDP(2).

Due to fall in income of consumer

AD ↓=C ↓+ I ↓+G+ X −M

Here

AD↓: Aggregate demand shift leftward.

C↓: Consumption falls

I↓: Investment falls

P↓: leads to Deflation

Retail sector negatively affected

In the above diagram, due to falling in aggregate demand of goods and services from AD (1) to

AD (2). Thus in short run, prices fall from P(1) to P(2), and Output falls from RGDP(1) to

RGDP(2).

Due to fall in income of consumer

AD ↓=C ↓+ I ↓+G+ X −M

Here

AD↓: Aggregate demand shift leftward.

C↓: Consumption falls

I↓: Investment falls

P↓: leads to Deflation

MACRO ECONOMICS 8

RGDP↓: show Recession and High Unemployment

To rectify the above problem, an expansionary fiscal policy was needed to stimulate the

economic growth, each Asian country was under pressure, as central bank reduced interest rates

to resort the situation, government are compel to do expansionary fiscal policy. Global demand

affects Singapore the most as it is more exposed among all Asia countries. Government provide

tax rebates to SME and access to more than S$2 billion of loans, industrial transformation plan

supported financially by S$4.5 billion and for stimulate worker’s wages S$770 million a year

spend by Government (https://www.bloomberg.com/.../2016..). The government boosting the

aggregate demand by spending on infrastructure which ultimately creates jobs and wages reduce

the unemployment.

At the same time, the government support individuals and company by reducing corporate and

personal income. After reducing corporate tax company have benefit of grabbing more marginal

of profit.

As a result, aggregate demand increases and so did the output, after the policy implication by the

government, from December onwards price, start rising upwards and Singapore consumer prices

rise for 2nd straight month in January on recovering oil prices. As shown in the diagram:

RGDP↓: show Recession and High Unemployment

To rectify the above problem, an expansionary fiscal policy was needed to stimulate the

economic growth, each Asian country was under pressure, as central bank reduced interest rates

to resort the situation, government are compel to do expansionary fiscal policy. Global demand

affects Singapore the most as it is more exposed among all Asia countries. Government provide

tax rebates to SME and access to more than S$2 billion of loans, industrial transformation plan

supported financially by S$4.5 billion and for stimulate worker’s wages S$770 million a year

spend by Government (https://www.bloomberg.com/.../2016..). The government boosting the

aggregate demand by spending on infrastructure which ultimately creates jobs and wages reduce

the unemployment.

At the same time, the government support individuals and company by reducing corporate and

personal income. After reducing corporate tax company have benefit of grabbing more marginal

of profit.

As a result, aggregate demand increases and so did the output, after the policy implication by the

government, from December onwards price, start rising upwards and Singapore consumer prices

rise for 2nd straight month in January on recovering oil prices. As shown in the diagram:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MACRO ECONOMICS 9

Singapore government apply expansionary fiscal policy

In the above diagram, an economy is not at the equilibrium level and is operating below full

employment, the above situation arises. Due to this government use expansionary fiscal policy. As

a result, In long-run, an aggregate increase from AD(1) to AD(2) and Real GDP increases from

RGDP(1) to RGDP(2). Thus, as a resulting economy attains its full employment level, and

gradually prices of goods and services s start rising from P (1) to P (2).

AD ↑=C + I +G ↑+ X −M

Here

AD↑: aggregate demand shift rightward

G↑: Government increases

Singapore government apply expansionary fiscal policy

In the above diagram, an economy is not at the equilibrium level and is operating below full

employment, the above situation arises. Due to this government use expansionary fiscal policy. As

a result, In long-run, an aggregate increase from AD(1) to AD(2) and Real GDP increases from

RGDP(1) to RGDP(2). Thus, as a resulting economy attains its full employment level, and

gradually prices of goods and services s start rising from P (1) to P (2).

AD ↑=C + I +G ↑+ X −M

Here

AD↑: aggregate demand shift rightward

G↑: Government increases

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MACRO ECONOMICS 10

With the expansionary policy, the economy of a country grows in terms of GDP, increase in the

rate of employment, etc. With the rise in people getting absorbed in the labor market, the

employment rate will rise, and thus, the full employment will be reached after a certain point of

time. When all the people who are able to work and who want to work are earning in the economy,

then the money supply in the country will rise. They will spend more and invest more. With the

increase in investment, the rate of interest is likely to fall, and thus, Fed will not be able to increase

these rates.

Conclusion

According to figures released by the Singapore department of statistics on February 23,

2017. The inflation rose 0.6 percent from last month compared with the same month a year

ago. This situation arises because there is a recession in the economy. As a result price of goods

and services falls and output, as well as income level, decreases in an economy. In recession, an

expansionary fiscal policy was needed to stimulate the economic growth, each Asian country

was under pressure, as central bank reduced interest rates to resort the situation, government are

compel to do expansionary fiscal policy. Global demand affects Singapore the most as it is more

exposed among all Asia countries. Government provide tax rebates to SME and access to more

than S$2 billion of loans, industrial transformation plan supported financially by S$4.5 billion

and for stimulate worker’s wages S$770 million a year spend by Government (The government

boosting the aggregate demand by spending on infrastructure which ultimately creates jobs and

wages reduce the unemployment. At the same time, the government support individuals and

company by reducing corporate and personal income. After reducing corporate tax company

have benefit of grabbing more marginal of profit. Thus, by giving less income in tax payment,

With the expansionary policy, the economy of a country grows in terms of GDP, increase in the

rate of employment, etc. With the rise in people getting absorbed in the labor market, the

employment rate will rise, and thus, the full employment will be reached after a certain point of

time. When all the people who are able to work and who want to work are earning in the economy,

then the money supply in the country will rise. They will spend more and invest more. With the

increase in investment, the rate of interest is likely to fall, and thus, Fed will not be able to increase

these rates.

Conclusion

According to figures released by the Singapore department of statistics on February 23,

2017. The inflation rose 0.6 percent from last month compared with the same month a year

ago. This situation arises because there is a recession in the economy. As a result price of goods

and services falls and output, as well as income level, decreases in an economy. In recession, an

expansionary fiscal policy was needed to stimulate the economic growth, each Asian country

was under pressure, as central bank reduced interest rates to resort the situation, government are

compel to do expansionary fiscal policy. Global demand affects Singapore the most as it is more

exposed among all Asia countries. Government provide tax rebates to SME and access to more

than S$2 billion of loans, industrial transformation plan supported financially by S$4.5 billion

and for stimulate worker’s wages S$770 million a year spend by Government (The government

boosting the aggregate demand by spending on infrastructure which ultimately creates jobs and

wages reduce the unemployment. At the same time, the government support individuals and

company by reducing corporate and personal income. After reducing corporate tax company

have benefit of grabbing more marginal of profit. Thus, by giving less income in tax payment,

MACRO ECONOMICS 11

individual can spend more and invest more, which leads to increase aggregate demand as well as

output and stimulate economic growth.

Article 2)

Technical recession looms for Singapore

Summary of Article

In 2016, Singapore economy faced recession in Technical looms which were effect of United

States election's result. OCBC economists said this is a result of weak global growth and rising

market volatility. Thus, in 2016 the Singapore economy shrank 4.1 percent in July to September

period as compared with the previous quarter (Min, C. 2017)

As the definition refers, consistent fall in prices and output in two successive quarters which

leads to falling in RGDP is known as a recession. The Same scenario happened in Singapore,

occurs due to another quarter of contraction. As a result, 2016 become the slowest year for

economy growth with 1 to 2 percent increase in RGDP. US new policies by president Donald

Trump may hinder small open economy of Singapore, which has minor contribution in global

trade and facing slowdown as well. At the same time, the US dollar has appreciated aginst Asian

individual can spend more and invest more, which leads to increase aggregate demand as well as

output and stimulate economic growth.

Article 2)

Technical recession looms for Singapore

Summary of Article

In 2016, Singapore economy faced recession in Technical looms which were effect of United

States election's result. OCBC economists said this is a result of weak global growth and rising

market volatility. Thus, in 2016 the Singapore economy shrank 4.1 percent in July to September

period as compared with the previous quarter (Min, C. 2017)

As the definition refers, consistent fall in prices and output in two successive quarters which

leads to falling in RGDP is known as a recession. The Same scenario happened in Singapore,

occurs due to another quarter of contraction. As a result, 2016 become the slowest year for

economy growth with 1 to 2 percent increase in RGDP. US new policies by president Donald

Trump may hinder small open economy of Singapore, which has minor contribution in global

trade and facing slowdown as well. At the same time, the US dollar has appreciated aginst Asian

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.