Management Accounting Report: Financial Analysis for QBIC Hotel

VerifiedAdded on 2020/09/17

|16

|4646

|33

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its application within the hospitality sector, specifically using the example of QBIC Hotel. The report begins by explaining the core principles of management accounting, including cost accounting, job costing, batch costing, price optimization, and inventory management systems. It then details the differences between financial and management accounting, highlighting their distinct purposes and users. The report proceeds to explore various accounting reports, such as job cost reports, accounts receivable aging, and budgetary reports, emphasizing their importance in providing financial insights. A key component of the report involves calculating and comparing income statements using both marginal and absorption costing methods, illustrating their impact on profit calculations. The report also discusses the merits and demerits of planning tools and how management accounting systems can be utilized to solve financial problems within the hospitality context. The analysis includes calculations for the QBIC hotel and provides a comprehensive understanding of the subject matter.

MANAGEMENT ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P 1 Explaining management accounting system and its essential types................................1

P 2 Explaining methods of accounting reports.......................................................................3

TASK 2............................................................................................................................................4

P 3 Calculation cost and income statement on the basis of marginal and absorption costing

and their differences...............................................................................................................4

TASK 3............................................................................................................................................7

P 4 Explaining Merits and demerits of planning tools...........................................................7

P 5 use of management accounting system to solve financial problems..............................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P 1 Explaining management accounting system and its essential types................................1

P 2 Explaining methods of accounting reports.......................................................................3

TASK 2............................................................................................................................................4

P 3 Calculation cost and income statement on the basis of marginal and absorption costing

and their differences...............................................................................................................4

TASK 3............................................................................................................................................7

P 4 Explaining Merits and demerits of planning tools...........................................................7

P 5 use of management accounting system to solve financial problems..............................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Management accounting system deals with the internal operations of business. With the

help of various reports such as budgets, inventory managements and costing the managerial

professional will be able to make estimation about expected expenses. These accounting systems

will help in generating innovative ideas to control the cost expended over a particular task. In

this present report, to understand managerial accounting there will be use of various budgetary

reports and cost accounting. Report will also depict the manner through which QBIC hotel would

become able to assess income marginal and absorption costing. Hence, in this report discussion

will be made on the wide range of managerial accounting tools that can be used in the hospitality

sector.

TASK 1

P 1 Explaining management accounting system and its essential types

Management accounting assists managers in acquiring detailed information on monetary

terms regarding internal activities of organisation. Thus, management accounting will help in

measuring the internal operations of business such as sales, profit and investments made by

managers (Turner, 2014). It will be fruitful for them in making estimation regarding costs will be

required in coming time to meet the operational needs of entity. With the help of management

accounting the professionals of QBIC would become able to make corrective decisions regarding

innovative changes in operational aspect of business.

Cost accounting: It will be described as calculating the cost used in producing products

such as labour, machinery, purchase of raw material as well as the time consumed in

manufacturing the products (Kerzner, 2013). A part form manufacturing and producing a unit,

the cost can be estimated for the other operational tasks of the QBIC hotel such as cost occurred

on selling and distribution, infrastructural development, employee salary as well as requirement

of the number of workforce at various departments.

Job costing: It helps in making estimation of the expenses iccurred on the particular

tasks or job. By using this accounting tool managers at QBIC hotel would be able to make the

estimation of the amount required by particular job (Burke, 2013). Likewise there will be need to

recruit number of workers for the particular area like in kitchen and restaurant side of the hotel

were the need of chef, waiters, cleaners arises. Salary and wages to be paid to them as per their

skills and the job they are performing.

1

Management accounting system deals with the internal operations of business. With the

help of various reports such as budgets, inventory managements and costing the managerial

professional will be able to make estimation about expected expenses. These accounting systems

will help in generating innovative ideas to control the cost expended over a particular task. In

this present report, to understand managerial accounting there will be use of various budgetary

reports and cost accounting. Report will also depict the manner through which QBIC hotel would

become able to assess income marginal and absorption costing. Hence, in this report discussion

will be made on the wide range of managerial accounting tools that can be used in the hospitality

sector.

TASK 1

P 1 Explaining management accounting system and its essential types

Management accounting assists managers in acquiring detailed information on monetary

terms regarding internal activities of organisation. Thus, management accounting will help in

measuring the internal operations of business such as sales, profit and investments made by

managers (Turner, 2014). It will be fruitful for them in making estimation regarding costs will be

required in coming time to meet the operational needs of entity. With the help of management

accounting the professionals of QBIC would become able to make corrective decisions regarding

innovative changes in operational aspect of business.

Cost accounting: It will be described as calculating the cost used in producing products

such as labour, machinery, purchase of raw material as well as the time consumed in

manufacturing the products (Kerzner, 2013). A part form manufacturing and producing a unit,

the cost can be estimated for the other operational tasks of the QBIC hotel such as cost occurred

on selling and distribution, infrastructural development, employee salary as well as requirement

of the number of workforce at various departments.

Job costing: It helps in making estimation of the expenses iccurred on the particular

tasks or job. By using this accounting tool managers at QBIC hotel would be able to make the

estimation of the amount required by particular job (Burke, 2013). Likewise there will be need to

recruit number of workers for the particular area like in kitchen and restaurant side of the hotel

were the need of chef, waiters, cleaners arises. Salary and wages to be paid to them as per their

skills and the job they are performing.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Batch costing: Cost required for the completions of the particular batch or unit will be

measured by the firm by using such tool (Leach, 2014). It includes measuring the expenses such

as requirements of the labour force in completion of a unit operation. In batch costing, figure

will be analysed as per the operations made for the particular operations. This in turn helps

manager in estimating the requirements of finance for such activities.

Price optimisation: This management accounting techniques helps the managers in

making the estimation about the price required by the particular product or services. It can also

be analysed on the basis of consumer preference for the prices (Boud, Cohen and Sampson, eds.,

2014). QBIC managers will be able to make beneficial decisions regarding choices of clients

such as price variations as per size of room they took for rest. It will be fruitful for them in

implementing the favourable prices as per quality of services needed by buyers.

Inventory management system: It helps managers in making the proper quota or

budgets for managing inventory. There will be requirements of various technical tools such as

warehouse, refrigerator as well as devices to make the proper storage of goods. QBIC will

require adequate number of staff to take look over requirements of inventory as well as quality of

goods (Meredith, Mantel Jr and Shafer, 2013). They must be concerned about the use of the best

quality ingredients in meal preparation in kitchen area as well as other areas of operational

requirements by the business. There must be determination of stock management, measurement

of inventory turnover ratio as well as the control system.

Principles of management accounting system

This technique will be fruitful in analysing the internal strength of the organisation.

Managers at QBIC will be helpful with this tool so they can make decisions and take corrective

actions to overcome any problem. It will be beneficial in analysing cost to be utilised to achieve

the targeted goals (Heagney, 2016). Cost incurred on developing the infrastructural facilities will

be analysed by the managers such as, reconstruction, renovation etc. It also describes the ability

of entity to meet the expected future cost requirements. Decisions made by the organisational

heads by analysing the various filed of activities with the main consideration of consumer’s

satisfaction. In hospitality sector there is need to have adequate services for the buyers as they

will be satisfied with the services provided to them. There must be trained employees as well as

accountants who will keep the records of all the transactions held in the premises.

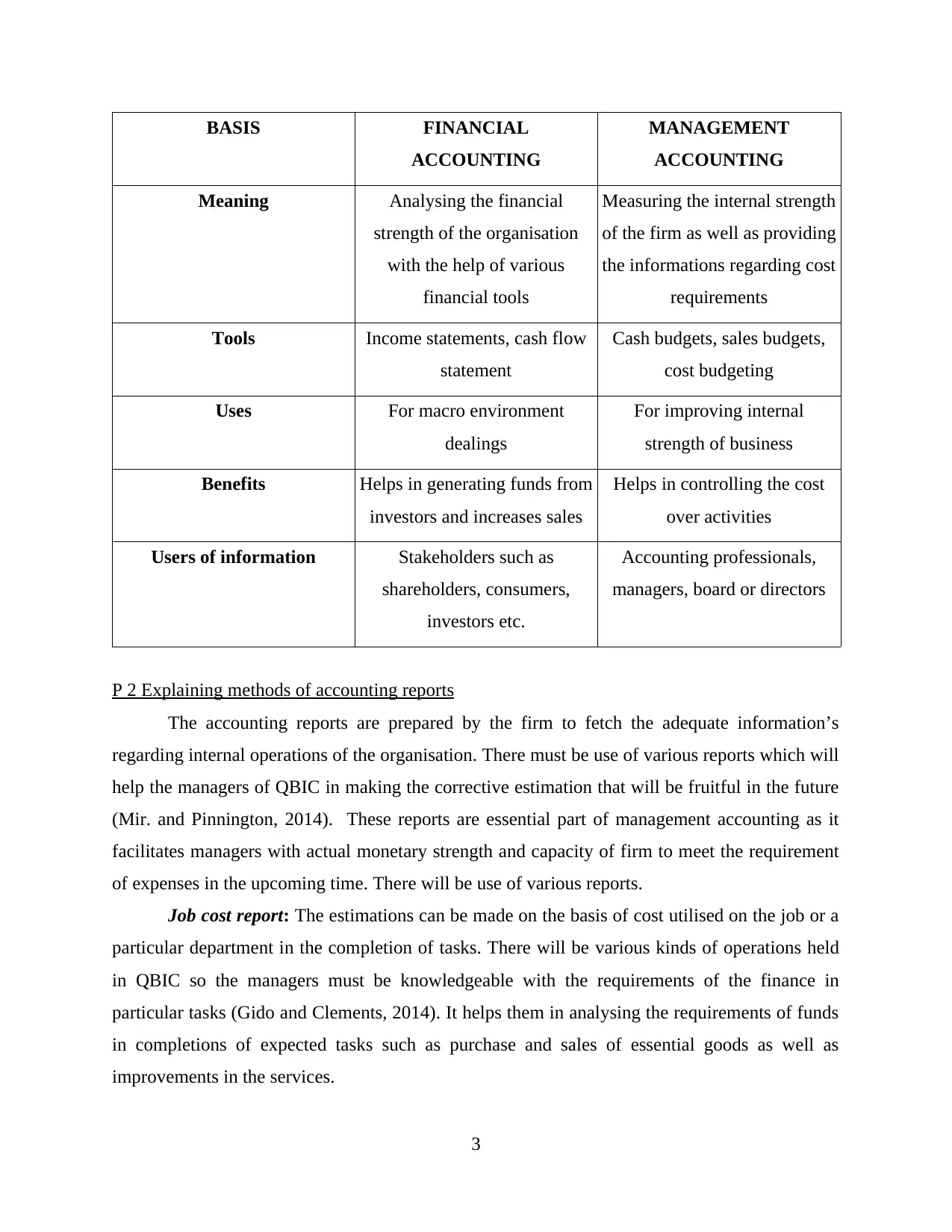

Difference between financial and management accounting

2

measured by the firm by using such tool (Leach, 2014). It includes measuring the expenses such

as requirements of the labour force in completion of a unit operation. In batch costing, figure

will be analysed as per the operations made for the particular operations. This in turn helps

manager in estimating the requirements of finance for such activities.

Price optimisation: This management accounting techniques helps the managers in

making the estimation about the price required by the particular product or services. It can also

be analysed on the basis of consumer preference for the prices (Boud, Cohen and Sampson, eds.,

2014). QBIC managers will be able to make beneficial decisions regarding choices of clients

such as price variations as per size of room they took for rest. It will be fruitful for them in

implementing the favourable prices as per quality of services needed by buyers.

Inventory management system: It helps managers in making the proper quota or

budgets for managing inventory. There will be requirements of various technical tools such as

warehouse, refrigerator as well as devices to make the proper storage of goods. QBIC will

require adequate number of staff to take look over requirements of inventory as well as quality of

goods (Meredith, Mantel Jr and Shafer, 2013). They must be concerned about the use of the best

quality ingredients in meal preparation in kitchen area as well as other areas of operational

requirements by the business. There must be determination of stock management, measurement

of inventory turnover ratio as well as the control system.

Principles of management accounting system

This technique will be fruitful in analysing the internal strength of the organisation.

Managers at QBIC will be helpful with this tool so they can make decisions and take corrective

actions to overcome any problem. It will be beneficial in analysing cost to be utilised to achieve

the targeted goals (Heagney, 2016). Cost incurred on developing the infrastructural facilities will

be analysed by the managers such as, reconstruction, renovation etc. It also describes the ability

of entity to meet the expected future cost requirements. Decisions made by the organisational

heads by analysing the various filed of activities with the main consideration of consumer’s

satisfaction. In hospitality sector there is need to have adequate services for the buyers as they

will be satisfied with the services provided to them. There must be trained employees as well as

accountants who will keep the records of all the transactions held in the premises.

Difference between financial and management accounting

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BASIS FINANCIAL

ACCOUNTING

MANAGEMENT

ACCOUNTING

Meaning Analysing the financial

strength of the organisation

with the help of various

financial tools

Measuring the internal strength

of the firm as well as providing

the informations regarding cost

requirements

Tools Income statements, cash flow

statement

Cash budgets, sales budgets,

cost budgeting

Uses For macro environment

dealings

For improving internal

strength of business

Benefits Helps in generating funds from

investors and increases sales

Helps in controlling the cost

over activities

Users of information Stakeholders such as

shareholders, consumers,

investors etc.

Accounting professionals,

managers, board or directors

P 2 Explaining methods of accounting reports

The accounting reports are prepared by the firm to fetch the adequate information’s

regarding internal operations of the organisation. There must be use of various reports which will

help the managers of QBIC in making the corrective estimation that will be fruitful in the future

(Mir. and Pinnington, 2014). These reports are essential part of management accounting as it

facilitates managers with actual monetary strength and capacity of firm to meet the requirement

of expenses in the upcoming time. There will be use of various reports.

Job cost report: The estimations can be made on the basis of cost utilised on the job or a

particular department in the completion of tasks. There will be various kinds of operations held

in QBIC so the managers must be knowledgeable with the requirements of the finance in

particular tasks (Gido and Clements, 2014). It helps them in analysing the requirements of funds

in completions of expected tasks such as purchase and sales of essential goods as well as

improvements in the services.

3

ACCOUNTING

MANAGEMENT

ACCOUNTING

Meaning Analysing the financial

strength of the organisation

with the help of various

financial tools

Measuring the internal strength

of the firm as well as providing

the informations regarding cost

requirements

Tools Income statements, cash flow

statement

Cash budgets, sales budgets,

cost budgeting

Uses For macro environment

dealings

For improving internal

strength of business

Benefits Helps in generating funds from

investors and increases sales

Helps in controlling the cost

over activities

Users of information Stakeholders such as

shareholders, consumers,

investors etc.

Accounting professionals,

managers, board or directors

P 2 Explaining methods of accounting reports

The accounting reports are prepared by the firm to fetch the adequate information’s

regarding internal operations of the organisation. There must be use of various reports which will

help the managers of QBIC in making the corrective estimation that will be fruitful in the future

(Mir. and Pinnington, 2014). These reports are essential part of management accounting as it

facilitates managers with actual monetary strength and capacity of firm to meet the requirement

of expenses in the upcoming time. There will be use of various reports.

Job cost report: The estimations can be made on the basis of cost utilised on the job or a

particular department in the completion of tasks. There will be various kinds of operations held

in QBIC so the managers must be knowledgeable with the requirements of the finance in

particular tasks (Gido and Clements, 2014). It helps them in analysing the requirements of funds

in completions of expected tasks such as purchase and sales of essential goods as well as

improvements in the services.

3

Accounts receivable aging: This technique will be helpful for managers in making

estimation over the accounts recoverable of organisation. It provides information regarding the

unpaid creditors of the QBIC as well as helps the managers in overcoming such invoices

(Martinelli and Milosevic, 2016). These accounting tool contains all the records of cash memos

that will help organisations in making m\payments of the which memo is due.

Inventory management: Requirements of the adequate amount of stock is the necessity

of QBIC. It shows that ability of the organisation in meeting the adequate amount of goods in as

per the requirements. In the hospitality sector there will be requirement of the optimum volume

of stock (Shields and Rangarajan, 2013). Thus, this accounting tool will be fruitful in maintain

the records of all the transactions such as the receiving the goods with proper details such as

quality, quality and prices. Inputs of the material or ingredients must contain the necessary

information’s on it as it will be easily discoverable and an individual can make good use of it. It

includes record of all the goods and services which are provided to consumers. It helps managers

in maintaining favourable records that can help the managers in making the adequate records.

Budgetary report: It includes reports of cash budgets, sales budgets, purchase budgets as

well as requirements of the labour and workforce for the completion of the tasks. Managers of

QBIC will be beneficial with the help of these reports (Sears and et.al., 2015). It provides the

necessary information’s regarding expenses to be done by the managers in fulfilling the

requirements of such tasks. Budgets need to be prepared as to fix the limit or quota in which

business will make the expenses.

M 1 Evaluating the benefits of management accounting systems their application over QBIC

QBIC organization will be benefited with the use of all the management accounting

system such as budgetary reports, costings and inventory management systems. These methods

facilitate valuable analysis of the costs and expenses by organization. Managers or the

supervisors of firm will be benefited with such tools as they can be able to plan the foretasted

budgets for the particular operations.

D 1 Critically evaluating the managemsdnt accounting system and reporting methods

Management accounting system facilitates the professionals of the organization in

analyzing the financial or intranet economic condition. It helps in gaining the information related

with the firm's ability to meet the short and long term debts. Thus, management accounting

4

estimation over the accounts recoverable of organisation. It provides information regarding the

unpaid creditors of the QBIC as well as helps the managers in overcoming such invoices

(Martinelli and Milosevic, 2016). These accounting tool contains all the records of cash memos

that will help organisations in making m\payments of the which memo is due.

Inventory management: Requirements of the adequate amount of stock is the necessity

of QBIC. It shows that ability of the organisation in meeting the adequate amount of goods in as

per the requirements. In the hospitality sector there will be requirement of the optimum volume

of stock (Shields and Rangarajan, 2013). Thus, this accounting tool will be fruitful in maintain

the records of all the transactions such as the receiving the goods with proper details such as

quality, quality and prices. Inputs of the material or ingredients must contain the necessary

information’s on it as it will be easily discoverable and an individual can make good use of it. It

includes record of all the goods and services which are provided to consumers. It helps managers

in maintaining favourable records that can help the managers in making the adequate records.

Budgetary report: It includes reports of cash budgets, sales budgets, purchase budgets as

well as requirements of the labour and workforce for the completion of the tasks. Managers of

QBIC will be beneficial with the help of these reports (Sears and et.al., 2015). It provides the

necessary information’s regarding expenses to be done by the managers in fulfilling the

requirements of such tasks. Budgets need to be prepared as to fix the limit or quota in which

business will make the expenses.

M 1 Evaluating the benefits of management accounting systems their application over QBIC

QBIC organization will be benefited with the use of all the management accounting

system such as budgetary reports, costings and inventory management systems. These methods

facilitate valuable analysis of the costs and expenses by organization. Managers or the

supervisors of firm will be benefited with such tools as they can be able to plan the foretasted

budgets for the particular operations.

D 1 Critically evaluating the managemsdnt accounting system and reporting methods

Management accounting system facilitates the professionals of the organization in

analyzing the financial or intranet economic condition. It helps in gaining the information related

with the firm's ability to meet the short and long term debts. Thus, management accounting

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

reporting helps the managers getting the information related with QBIC's loopholes in the

operating years.

TASK 2

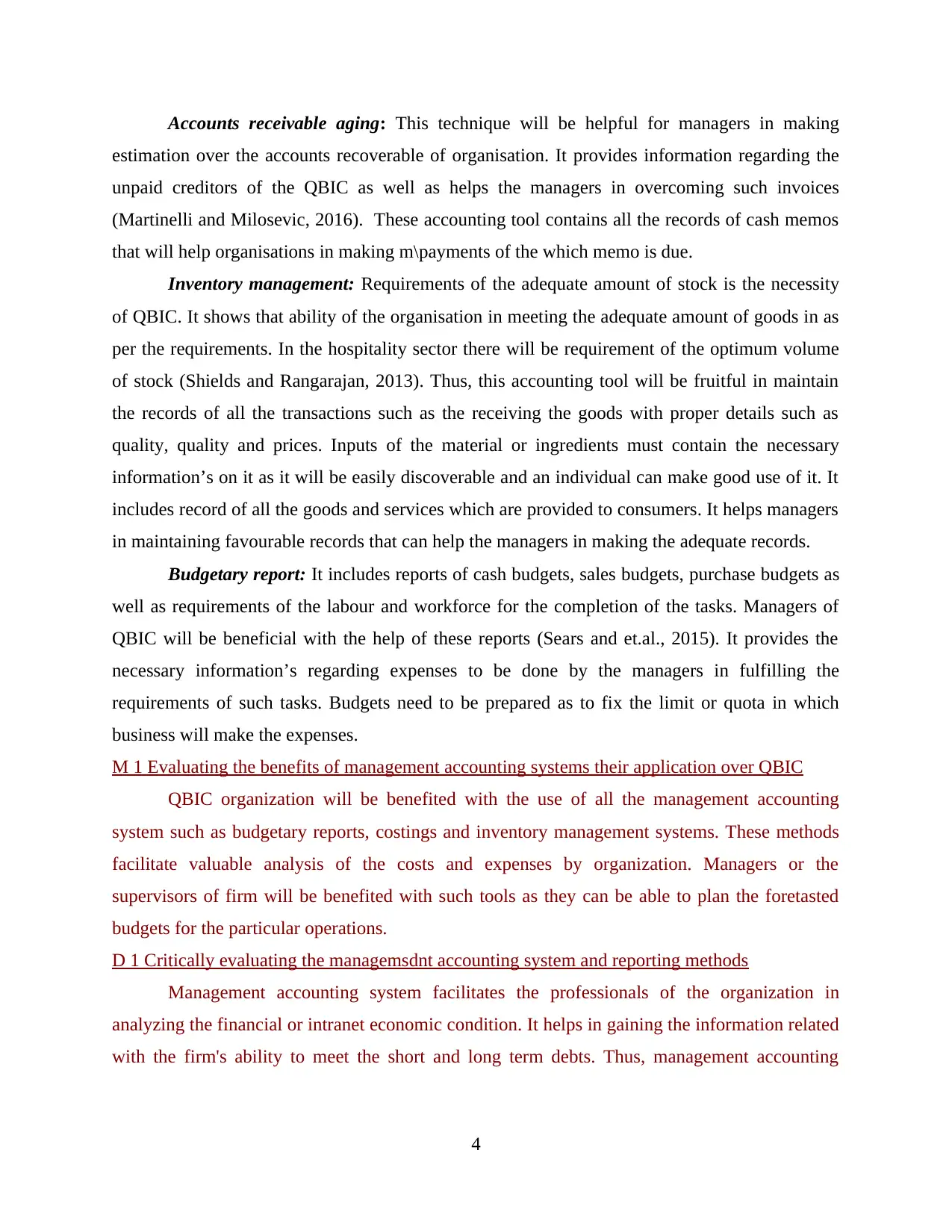

P 3 Calculation cost and income statement on the basis of marginal and absorption costing and

their differences

Income statement of QBIC (Marginal costing):

Particulars Amount £ Amount £

Sales over production 700* 35 21000

Cost over production 700*13 9100

Less: Closing inventory 100*13 -1300

Variable cost 7800

Contribution (per unit) 13200

Less: variable selling overheads 1*600 600

Less: FC

Production overheads 2000

Selling fixed cost 600

Administrative fixed cost 700 3900

Profit earned 9300

Interpretation: Inthe above calculation marginal costing technique has been used to

assess profit. This method furnishes information regarding the profit will be earned by Qbic over

cost or expenses. It this tool the variable costs are to be deducted at very first than there will be

calculations made for the other measurements. In the case of selling 700 units at 35 of the rate

concerned figure will account for 21000 respectively. The cost of production will be shown in

the working note calculate at 700 of unit at rate of 13. Completion of following calculations the

profits can be generated by organisation at 9300.

5

operating years.

TASK 2

P 3 Calculation cost and income statement on the basis of marginal and absorption costing and

their differences

Income statement of QBIC (Marginal costing):

Particulars Amount £ Amount £

Sales over production 700* 35 21000

Cost over production 700*13 9100

Less: Closing inventory 100*13 -1300

Variable cost 7800

Contribution (per unit) 13200

Less: variable selling overheads 1*600 600

Less: FC

Production overheads 2000

Selling fixed cost 600

Administrative fixed cost 700 3900

Profit earned 9300

Interpretation: Inthe above calculation marginal costing technique has been used to

assess profit. This method furnishes information regarding the profit will be earned by Qbic over

cost or expenses. It this tool the variable costs are to be deducted at very first than there will be

calculations made for the other measurements. In the case of selling 700 units at 35 of the rate

concerned figure will account for 21000 respectively. The cost of production will be shown in

the working note calculate at 700 of unit at rate of 13. Completion of following calculations the

profits can be generated by organisation at 9300.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

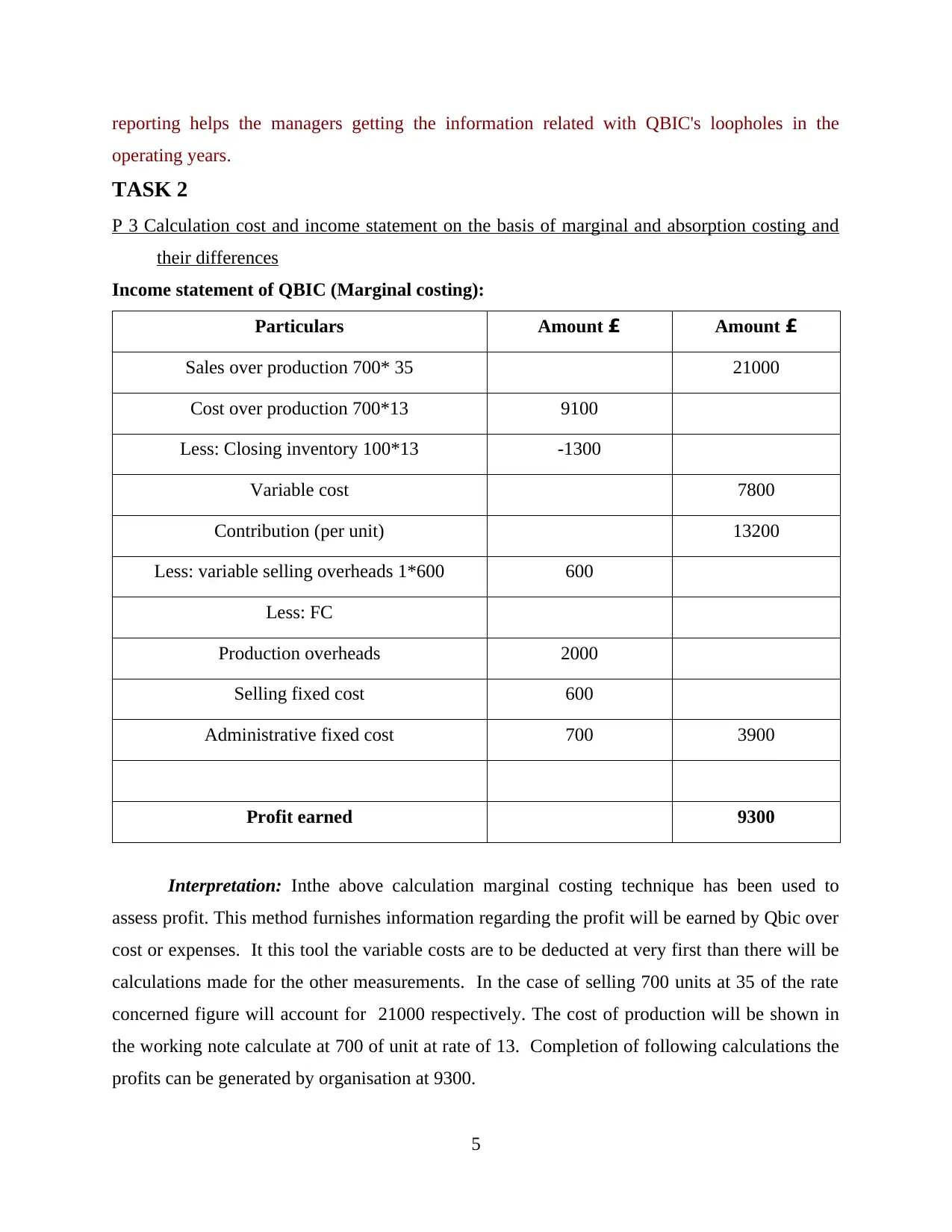

Income statement of QBIC (Absorption costing)

Particulars Amount (in £) Amount (in £)

Sales (700*35) 21000

Less: production cost (700*16) 11200

Closing inventory (100*16) -1600

Less: fixed overheads over

production

-100

Production cost 9500

GP 11500

Less: variable overheads

(sales) 1*600

600

Less: fixed costs

Selling costs 600

Administrative cost 700 1900

Profit earned 9600

Interpretation: As per the income statement of QBIC on the basis of absorption costing

method the fixed production cost will be deducted before the deductions of variable overheads

such as sells and administration. The cost of production will be measured on the 700 units at rate

of 16 as well as the remaining inventory 100 unit at 16 of the rate will be deducted. The gross

profit can be earned by hotel as 11500. There will be deduction of variable and fixed overheads

after GP and which bring the profit of 9600.

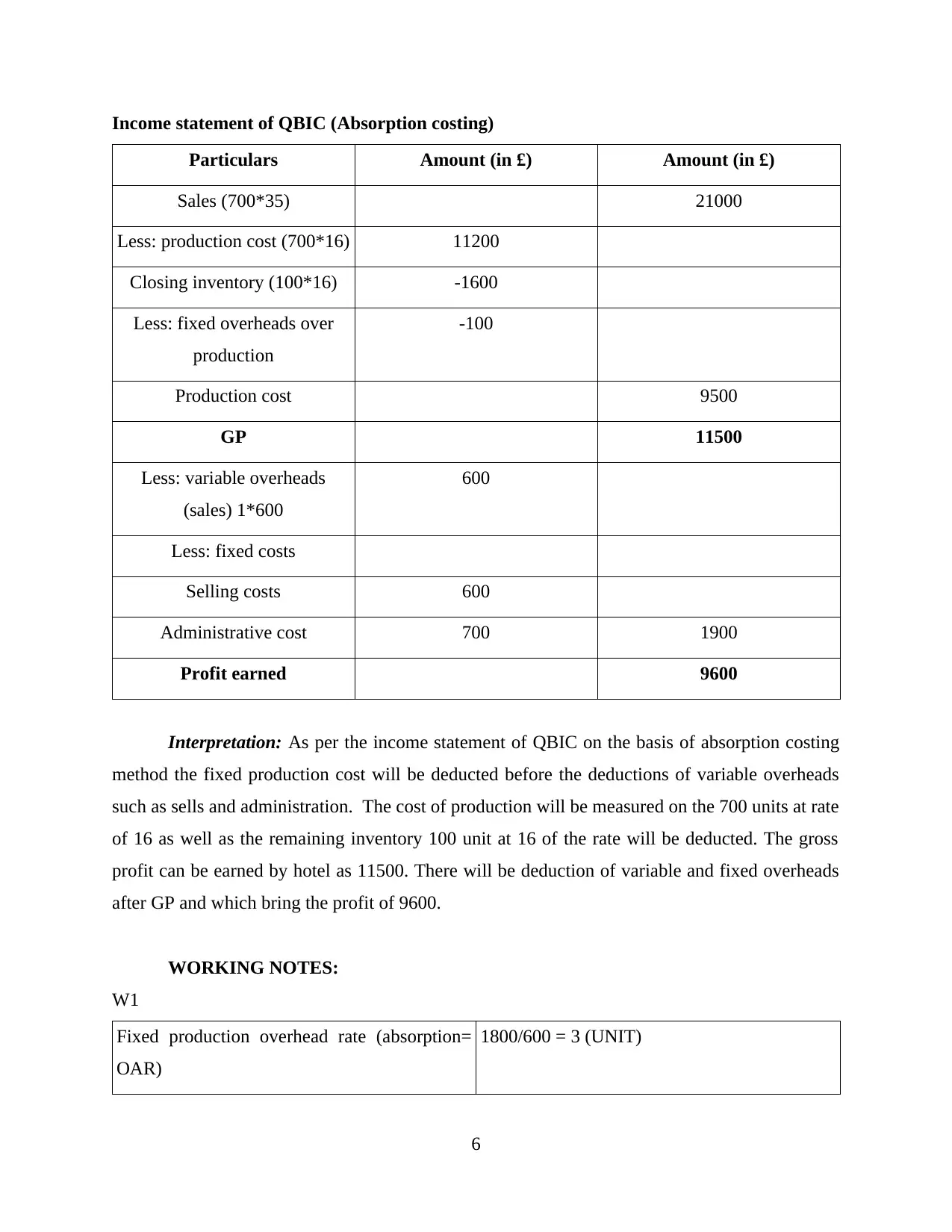

WORKING NOTES:

W1

Fixed production overhead rate (absorption=

OAR)

1800/600 = 3 (UNIT)

6

Particulars Amount (in £) Amount (in £)

Sales (700*35) 21000

Less: production cost (700*16) 11200

Closing inventory (100*16) -1600

Less: fixed overheads over

production

-100

Production cost 9500

GP 11500

Less: variable overheads

(sales) 1*600

600

Less: fixed costs

Selling costs 600

Administrative cost 700 1900

Profit earned 9600

Interpretation: As per the income statement of QBIC on the basis of absorption costing

method the fixed production cost will be deducted before the deductions of variable overheads

such as sells and administration. The cost of production will be measured on the 700 units at rate

of 16 as well as the remaining inventory 100 unit at 16 of the rate will be deducted. The gross

profit can be earned by hotel as 11500. There will be deduction of variable and fixed overheads

after GP and which bring the profit of 9600.

WORKING NOTES:

W1

Fixed production overhead rate (absorption=

OAR)

1800/600 = 3 (UNIT)

6

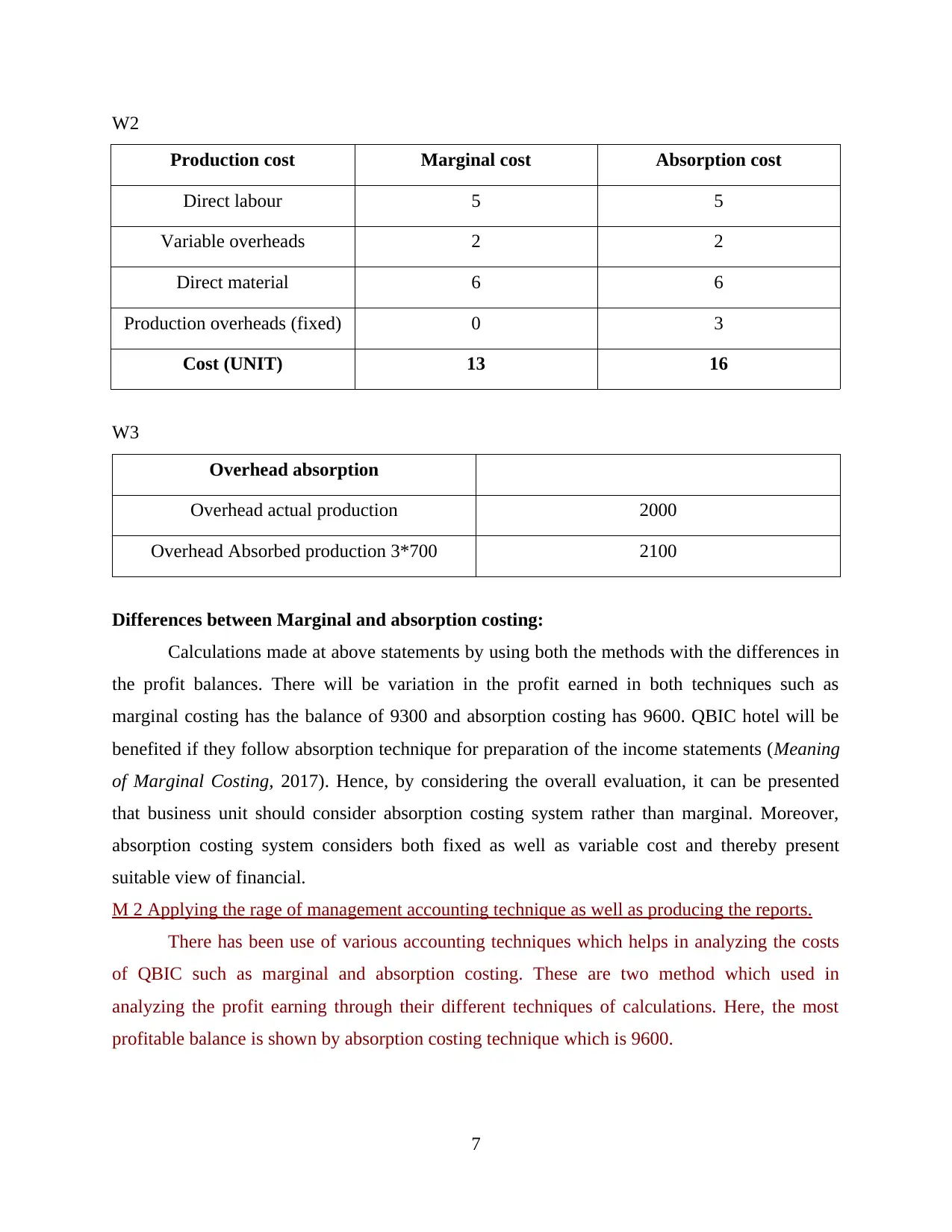

W2

Production cost Marginal cost Absorption cost

Direct labour 5 5

Variable overheads 2 2

Direct material 6 6

Production overheads (fixed) 0 3

Cost (UNIT) 13 16

W3

Overhead absorption

Overhead actual production 2000

Overhead Absorbed production 3*700 2100

Differences between Marginal and absorption costing:

Calculations made at above statements by using both the methods with the differences in

the profit balances. There will be variation in the profit earned in both techniques such as

marginal costing has the balance of 9300 and absorption costing has 9600. QBIC hotel will be

benefited if they follow absorption technique for preparation of the income statements (Meaning

of Marginal Costing, 2017). Hence, by considering the overall evaluation, it can be presented

that business unit should consider absorption costing system rather than marginal. Moreover,

absorption costing system considers both fixed as well as variable cost and thereby present

suitable view of financial.

M 2 Applying the rage of management accounting technique as well as producing the reports.

There has been use of various accounting techniques which helps in analyzing the costs

of QBIC such as marginal and absorption costing. These are two method which used in

analyzing the profit earning through their different techniques of calculations. Here, the most

profitable balance is shown by absorption costing technique which is 9600.

7

Production cost Marginal cost Absorption cost

Direct labour 5 5

Variable overheads 2 2

Direct material 6 6

Production overheads (fixed) 0 3

Cost (UNIT) 13 16

W3

Overhead absorption

Overhead actual production 2000

Overhead Absorbed production 3*700 2100

Differences between Marginal and absorption costing:

Calculations made at above statements by using both the methods with the differences in

the profit balances. There will be variation in the profit earned in both techniques such as

marginal costing has the balance of 9300 and absorption costing has 9600. QBIC hotel will be

benefited if they follow absorption technique for preparation of the income statements (Meaning

of Marginal Costing, 2017). Hence, by considering the overall evaluation, it can be presented

that business unit should consider absorption costing system rather than marginal. Moreover,

absorption costing system considers both fixed as well as variable cost and thereby present

suitable view of financial.

M 2 Applying the rage of management accounting technique as well as producing the reports.

There has been use of various accounting techniques which helps in analyzing the costs

of QBIC such as marginal and absorption costing. These are two method which used in

analyzing the profit earning through their different techniques of calculations. Here, the most

profitable balance is shown by absorption costing technique which is 9600.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

D 2

To,

The general manager,

(QBIC)

sir,

it is to informed you that the analysis can be made over the given data and the use of

various costing techniques such as marginal and absorption. There has been changes in the

profitability of both the methods. Marginal costing has the balance of 9300 while the absorption

costing has the balance for 9600. It can be said the organization need to follow the absorption

costing technique as it will be fruitful for the operating activities as well as it produces the

favorable outcomes.

Management accounting officer

(QBIC)

TASK 3

P 4 Explaining Merits and demerits of planning tools

By using the below mentioned tools and techniques manager of Qbic hotel can develop highly

effectual plan such as:

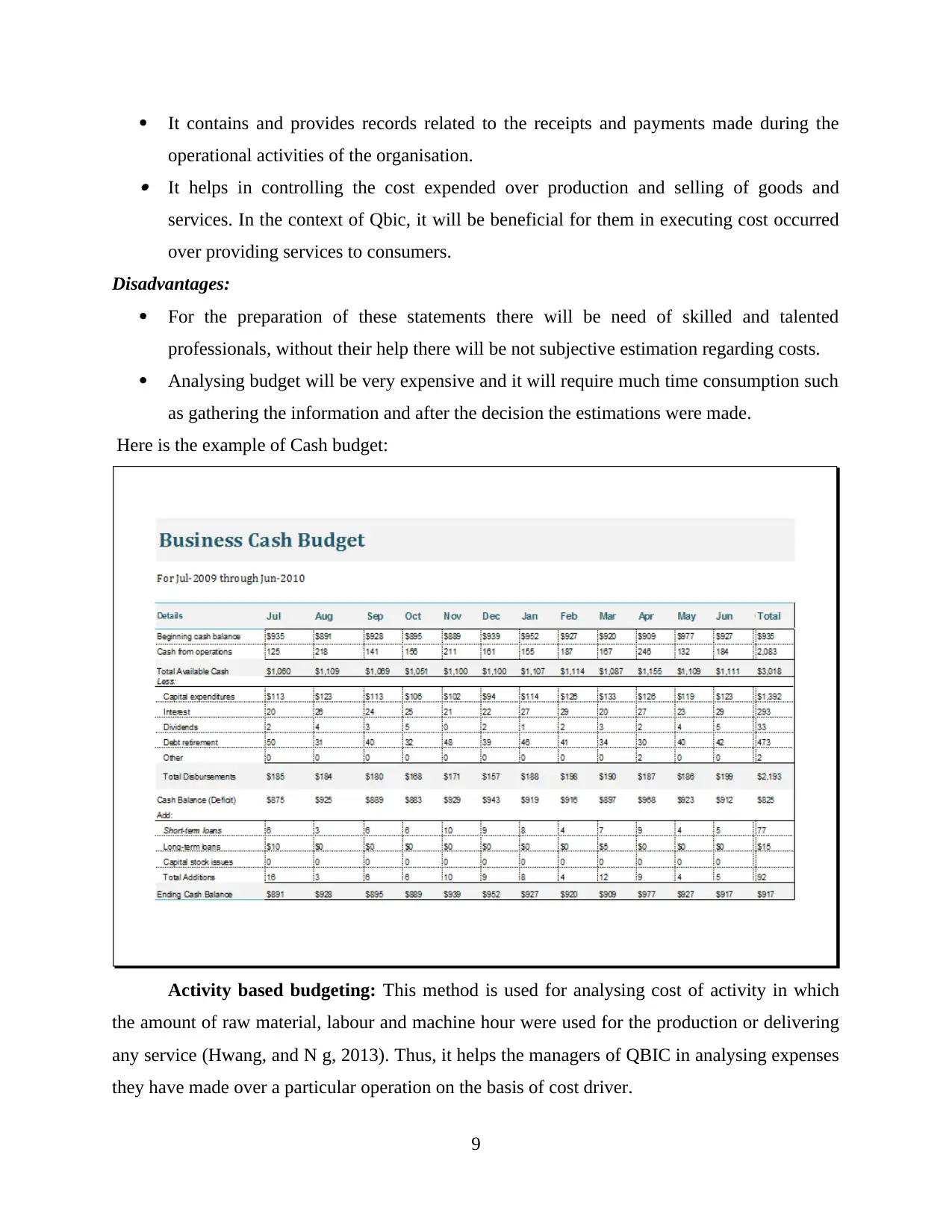

Cash budget: It follows the method at which managers of the organisation can make the

estimation about the cash will be received during the certain time frame over the expenses. There

will be need of finance in fulfilling the requirements of cash disbursement and receipts during

the expected period (Sears and et.al., 2015). It is the project where accounting professional of

QBIC will make the favourable decision related with analysing current expenses over various

operations in entity. They make budgeted report with the estimation that there will be growth in

future if they make investments in the particular activity. It helps them in fixing the rates,

quantity and requirements of workforce for such functions.

Advantages:

Cash budget is the effective tool which helps in identifying its cash inflows and outflows.

This will be helpful for the managers in making the proper estimation regarding

requirements of finance.

8

To,

The general manager,

(QBIC)

sir,

it is to informed you that the analysis can be made over the given data and the use of

various costing techniques such as marginal and absorption. There has been changes in the

profitability of both the methods. Marginal costing has the balance of 9300 while the absorption

costing has the balance for 9600. It can be said the organization need to follow the absorption

costing technique as it will be fruitful for the operating activities as well as it produces the

favorable outcomes.

Management accounting officer

(QBIC)

TASK 3

P 4 Explaining Merits and demerits of planning tools

By using the below mentioned tools and techniques manager of Qbic hotel can develop highly

effectual plan such as:

Cash budget: It follows the method at which managers of the organisation can make the

estimation about the cash will be received during the certain time frame over the expenses. There

will be need of finance in fulfilling the requirements of cash disbursement and receipts during

the expected period (Sears and et.al., 2015). It is the project where accounting professional of

QBIC will make the favourable decision related with analysing current expenses over various

operations in entity. They make budgeted report with the estimation that there will be growth in

future if they make investments in the particular activity. It helps them in fixing the rates,

quantity and requirements of workforce for such functions.

Advantages:

Cash budget is the effective tool which helps in identifying its cash inflows and outflows.

This will be helpful for the managers in making the proper estimation regarding

requirements of finance.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It contains and provides records related to the receipts and payments made during the

operational activities of the organisation. It helps in controlling the cost expended over production and selling of goods and

services. In the context of Qbic, it will be beneficial for them in executing cost occurred

over providing services to consumers.

Disadvantages:

For the preparation of these statements there will be need of skilled and talented

professionals, without their help there will be not subjective estimation regarding costs.

Analysing budget will be very expensive and it will require much time consumption such

as gathering the information and after the decision the estimations were made.

Here is the example of Cash budget:

Activity based budgeting: This method is used for analysing cost of activity in which

the amount of raw material, labour and machine hour were used for the production or delivering

any service (Hwang, and N g, 2013). Thus, it helps the managers of QBIC in analysing expenses

they have made over a particular operation on the basis of cost driver.

9

operational activities of the organisation. It helps in controlling the cost expended over production and selling of goods and

services. In the context of Qbic, it will be beneficial for them in executing cost occurred

over providing services to consumers.

Disadvantages:

For the preparation of these statements there will be need of skilled and talented

professionals, without their help there will be not subjective estimation regarding costs.

Analysing budget will be very expensive and it will require much time consumption such

as gathering the information and after the decision the estimations were made.

Here is the example of Cash budget:

Activity based budgeting: This method is used for analysing cost of activity in which

the amount of raw material, labour and machine hour were used for the production or delivering

any service (Hwang, and N g, 2013). Thus, it helps the managers of QBIC in analysing expenses

they have made over a particular operation on the basis of cost driver.

9

Advantages:

This technique helps in making accurate estimation on deciding the production cost to be

required in organisational operations.

It helps in providing the information regarding the cost behaviour of consumers such as

on which services they are highly satisfied with entity. Managers at business will be benefited in making positive and profitable decisions that

helps in attaining the targeted goals.

Disadvantages:

It cannot be affordable by the small scale units as it requires professionals to make

reports for analysing the costs over each activity held in organisation.

There will be difficulties in measuring information as there is need to make analysis over

each activity in organisation.

Zero based budgeting: This method of preparing the budget for QBIC which denotes all

the activity starts with the zero value (Lock, 2014). It works as every task in the entity need to be

justified and explained in manners to gain the adequate cost or revenue over such operations.

Advantages:

It helps managers in acquiring the accurate data as it works as making the changes in the

previously made data. It facilitates identification of opportunities as well as shows most cost efficient ways to

managers in controlling expenses of the firm.

Disadvantages:

In the completion of this technique there will be requirements of high workforce as well

as much time duration.

There will obstacle in preparing these budgets as per the requirement of the expertise. It

can be prepared by skilled and experienced accounting professionals.

Sales budget: This budget helps managers of QBIC in making the adequate estimation

regarding future expected sales along with the units (Pemsel and Wiewiora, 2013).

Advantages

Sales budget helps organisational professionals in making adequate estimation regarding

sales and demand in future for the particulate product or services.

10

This technique helps in making accurate estimation on deciding the production cost to be

required in organisational operations.

It helps in providing the information regarding the cost behaviour of consumers such as

on which services they are highly satisfied with entity. Managers at business will be benefited in making positive and profitable decisions that

helps in attaining the targeted goals.

Disadvantages:

It cannot be affordable by the small scale units as it requires professionals to make

reports for analysing the costs over each activity held in organisation.

There will be difficulties in measuring information as there is need to make analysis over

each activity in organisation.

Zero based budgeting: This method of preparing the budget for QBIC which denotes all

the activity starts with the zero value (Lock, 2014). It works as every task in the entity need to be

justified and explained in manners to gain the adequate cost or revenue over such operations.

Advantages:

It helps managers in acquiring the accurate data as it works as making the changes in the

previously made data. It facilitates identification of opportunities as well as shows most cost efficient ways to

managers in controlling expenses of the firm.

Disadvantages:

In the completion of this technique there will be requirements of high workforce as well

as much time duration.

There will obstacle in preparing these budgets as per the requirement of the expertise. It

can be prepared by skilled and experienced accounting professionals.

Sales budget: This budget helps managers of QBIC in making the adequate estimation

regarding future expected sales along with the units (Pemsel and Wiewiora, 2013).

Advantages

Sales budget helps organisational professionals in making adequate estimation regarding

sales and demand in future for the particulate product or services.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.