Management Accounting Report: AB Dynamics, UK Business

VerifiedAdded on 2020/07/22

|15

|4848

|37

Report

AI Summary

This report provides a comprehensive overview of management accounting principles, focusing on their application within the context of AB Dynamics, a medium-sized automotive company in the UK. The report begins by establishing the significance of management accounting systems, emphasizing their role in short-term decision-making, identifying deviations, and ensuring long-term business sustainability. It then explores various types of management accounting systems, including traditional and lean accounting, highlighting their advantages and relevance to AB Dynamics. The report further delves into different methods of management accounting reporting, such as budget reports, job cost reports, and inventory reports, and their utility in effective project management. Additionally, the report illustrates the process of calculating costs for preparing an income statement, distinguishing between fixed, variable, direct, and indirect costs, and discussing marginal and absorption costing. The report aims to provide insights into how management accounting can be effectively used to address financial problems and support strategic planning within a manufacturing business like AB Dynamics.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1 Management accounting and requirement of various types of management accounting

system..........................................................................................................................................1

P2 Various methods for management accounting reporting.......................................................3

P3 Calculation of cost for preparing a income statement for a company...................................4

PART B............................................................................................................................................7

P4 Advantages and disadvantages of different types of planning tool.......................................7

P5 Use of management accounting is responding to financial problems....................................9

CONCLSUION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1 Management accounting and requirement of various types of management accounting

system..........................................................................................................................................1

P2 Various methods for management accounting reporting.......................................................3

P3 Calculation of cost for preparing a income statement for a company...................................4

PART B............................................................................................................................................7

P4 Advantages and disadvantages of different types of planning tool.......................................7

P5 Use of management accounting is responding to financial problems....................................9

CONCLSUION..............................................................................................................................10

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management is important for every business as it enable an organisation to manage their

working. In such relation planning, organising, controlling and directing are the major things

which are includes in management. As another necessary aspects for a business is management

accounting. Management accounting is a helpful decision taking tool under which reports get

framed on the basis of short term. As such reports get formulate on weekly, monthly or quarterly

basis. Managers play an effective role for presenting such statement in front of senior

management at the time for removing deviations from business (Zimmerman and Yahya-Zadeh,

2011). This assignment is based on management accounting for a medium sized enterprise AB

dynamics in UK. Their business establishment is from South West England with a revenue band

from £6M to £10M. This report will focus on the importance of management accounting system

for a business. There are various types of accounting system can be used by a company in

making their work and operations effective. As this process is helpful for removing deviations

from business and take adequate decision for short term purpose and provide strength long term

existence. Hence, whole focus on based on usefulness of management accounting system.

PART A

P1 Management accounting and requirement of various types of management accounting system

A managed organisation is one in which all necessary activities and operations get done

on time. As this is helpful for a company in attain their targets on time in adequate time period

(Ward, 2012). Along with this, by timely inspecting the statements of a company, authority and

governance can frame adequate strategies which enable them in operating work effectively and

efficiently. Management accounting is a process which used by many small and medium sized

organisation in identify the deviations and differences which are taking place on regular basis.

Unlike financial accounting system in which reports get framed by analysing the whole year

operations. Management accounting provides a opportunity under which statement are based on

short term period.

A major advantage of using this approach is gaining strength in a business by resolved all

issues and conflicts of short period. Decisions taken on frequent basis by not considering the

whole year facts. Many small problems which arise long term issues get resolved by using

management accounting concept. Development and growth with high profitability is an

1

Management is important for every business as it enable an organisation to manage their

working. In such relation planning, organising, controlling and directing are the major things

which are includes in management. As another necessary aspects for a business is management

accounting. Management accounting is a helpful decision taking tool under which reports get

framed on the basis of short term. As such reports get formulate on weekly, monthly or quarterly

basis. Managers play an effective role for presenting such statement in front of senior

management at the time for removing deviations from business (Zimmerman and Yahya-Zadeh,

2011). This assignment is based on management accounting for a medium sized enterprise AB

dynamics in UK. Their business establishment is from South West England with a revenue band

from £6M to £10M. This report will focus on the importance of management accounting system

for a business. There are various types of accounting system can be used by a company in

making their work and operations effective. As this process is helpful for removing deviations

from business and take adequate decision for short term purpose and provide strength long term

existence. Hence, whole focus on based on usefulness of management accounting system.

PART A

P1 Management accounting and requirement of various types of management accounting system

A managed organisation is one in which all necessary activities and operations get done

on time. As this is helpful for a company in attain their targets on time in adequate time period

(Ward, 2012). Along with this, by timely inspecting the statements of a company, authority and

governance can frame adequate strategies which enable them in operating work effectively and

efficiently. Management accounting is a process which used by many small and medium sized

organisation in identify the deviations and differences which are taking place on regular basis.

Unlike financial accounting system in which reports get framed by analysing the whole year

operations. Management accounting provides a opportunity under which statement are based on

short term period.

A major advantage of using this approach is gaining strength in a business by resolved all

issues and conflicts of short period. Decisions taken on frequent basis by not considering the

whole year facts. Many small problems which arise long term issues get resolved by using

management accounting concept. Development and growth with high profitability is an

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

necessary objective and target for every firm. They require to sustain at market for long period of

time. Hence, in such relation they require to implement managerial accounting concept in an

entity (Parker, 2012). AB dynamics is a manufacturing automotive company whom lead to

inspect their books on regular basis for taking a beneficial decision which support in long term.

By preferring this concept by managers or leaders of a company, appropriate decision can be

carried down which provide strength to a business. As this also aid in rapid increment in sales

and delivering more quality products as well as services to final users. Conflicts between each

other also get minimise through this terminology.

Various type of management accounting system are identified in financial terms as they

are required to maximise the growth and removing deviations and wastage from business.

Management accounting is completely concerned with cost accounting because it takes some

essence of it. In short term period, cost is an essential thing for making a product effective.

Hence, managers have to show their concern towards this. AB dynamics have to apply this

accounting procedure in their business for making their productivity better and delivering of

quality cars to final users become adequate with high service facility. Following are the several

management accounting forms which are required in short medium sized business: Traditional accounting: Accrual base accounting is termed as traditional accounting in

which all the expenses which paid by a company rather on such which not paid by them.

As this is helpful in tracking the cost of products or goods which manufacture by a

company by adopting two techniques: job order costing and process costing (Granlund,

2011). Job order costing is for the large projects in which whole cost can be traced easily.

In process costing, tracking of price is high due to manufacturing taking place on

continuous basis. Lean accounting: According to this sort of management accounting, a major focus is

based on reducing the wastage which occur at the time of production. Products get

deliver to users on adequate cost which will used at the time of production.

Transfer pricing: Values get added in good according to departments. As by this every

division add some value in products which leads to increase price of offered good.

AB dynamics can use either of the concept of management accounting system through which

they can minimise the wastage of resources and offer products at such prices which are adequate

in nature. Hence, lean accounting is best option which have to use by managers of AB dynamics

2

time. Hence, in such relation they require to implement managerial accounting concept in an

entity (Parker, 2012). AB dynamics is a manufacturing automotive company whom lead to

inspect their books on regular basis for taking a beneficial decision which support in long term.

By preferring this concept by managers or leaders of a company, appropriate decision can be

carried down which provide strength to a business. As this also aid in rapid increment in sales

and delivering more quality products as well as services to final users. Conflicts between each

other also get minimise through this terminology.

Various type of management accounting system are identified in financial terms as they

are required to maximise the growth and removing deviations and wastage from business.

Management accounting is completely concerned with cost accounting because it takes some

essence of it. In short term period, cost is an essential thing for making a product effective.

Hence, managers have to show their concern towards this. AB dynamics have to apply this

accounting procedure in their business for making their productivity better and delivering of

quality cars to final users become adequate with high service facility. Following are the several

management accounting forms which are required in short medium sized business: Traditional accounting: Accrual base accounting is termed as traditional accounting in

which all the expenses which paid by a company rather on such which not paid by them.

As this is helpful in tracking the cost of products or goods which manufacture by a

company by adopting two techniques: job order costing and process costing (Granlund,

2011). Job order costing is for the large projects in which whole cost can be traced easily.

In process costing, tracking of price is high due to manufacturing taking place on

continuous basis. Lean accounting: According to this sort of management accounting, a major focus is

based on reducing the wastage which occur at the time of production. Products get

deliver to users on adequate cost which will used at the time of production.

Transfer pricing: Values get added in good according to departments. As by this every

division add some value in products which leads to increase price of offered good.

AB dynamics can use either of the concept of management accounting system through which

they can minimise the wastage of resources and offer products at such prices which are adequate

in nature. Hence, lean accounting is best option which have to use by managers of AB dynamics

2

for reducing the wastage of their resources and deliver quality cars to all customers of a company

(Otley and Emmanuel, 2013).

P2 Various methods for management accounting reporting

Every division require appropriate management through which they are going to deal

with various problems which arise in an entity. For such relation, managers and leaders play an

effective role through which they are going to deal with them. As a results, deviations get resolve

and a firm could become able to sustain at market for long term. Accountant and manager of

accounts have to investigate their books of account on short term basis for taking a crucial

decision which is beneficial in long term existence. By inspecting such financial statement, a

clear picture of whole operations whether in short term or in long term described properly.

Every firm set several number of targets as well as objectives before executing every task

(Fullerton, Kennedy and Widener, 2013). Hence, for their attainment, it is must to analyse their

reports in taking any beneficial decision. Managerial accounting is based on short term analysis

of business through which deviations get resolved and arise problems get removed from

business.

It is a duty of manager to take care of accounts on daily basis which aid them in improve

business properly. Feasibility of project is in the hands of managers are they are in direct day to

day relation with business and operations. Hence, managerial accounting provide a facility

through which health of a business can maintain (What are the Different Types of Management

Accounting Systems?, 2017). AB dynamics is dealing in a automotive sector and their managers

have to actively participate in inspecting the financial statement of a company so that they can

maintain their company fit and adequate for long term purpose. For a perfect picture of all

operations of a business, managers and leaders have to identify the problems which are

associated with project by measuring them regularly. As this is helpful for them in making their

operations effective. There are various type of management accounting reporting are used by a

AB dynamics through which they can make project feasible and sustainability rises for long term

(Fullerton, Kennedy and Widener, 2014). Budget report: Budget is an essential part of any project before its execution. As this

provide a estimate under which all investment and expenses for a task can be done.

According to managerial accounting, perfect budget get framed and necessary changes

can made in any project which further want to implement by a company. Effective budget

3

(Otley and Emmanuel, 2013).

P2 Various methods for management accounting reporting

Every division require appropriate management through which they are going to deal

with various problems which arise in an entity. For such relation, managers and leaders play an

effective role through which they are going to deal with them. As a results, deviations get resolve

and a firm could become able to sustain at market for long term. Accountant and manager of

accounts have to investigate their books of account on short term basis for taking a crucial

decision which is beneficial in long term existence. By inspecting such financial statement, a

clear picture of whole operations whether in short term or in long term described properly.

Every firm set several number of targets as well as objectives before executing every task

(Fullerton, Kennedy and Widener, 2013). Hence, for their attainment, it is must to analyse their

reports in taking any beneficial decision. Managerial accounting is based on short term analysis

of business through which deviations get resolved and arise problems get removed from

business.

It is a duty of manager to take care of accounts on daily basis which aid them in improve

business properly. Feasibility of project is in the hands of managers are they are in direct day to

day relation with business and operations. Hence, managerial accounting provide a facility

through which health of a business can maintain (What are the Different Types of Management

Accounting Systems?, 2017). AB dynamics is dealing in a automotive sector and their managers

have to actively participate in inspecting the financial statement of a company so that they can

maintain their company fit and adequate for long term purpose. For a perfect picture of all

operations of a business, managers and leaders have to identify the problems which are

associated with project by measuring them regularly. As this is helpful for them in making their

operations effective. There are various type of management accounting reporting are used by a

AB dynamics through which they can make project feasible and sustainability rises for long term

(Fullerton, Kennedy and Widener, 2014). Budget report: Budget is an essential part of any project before its execution. As this

provide a estimate under which all investment and expenses for a task can be done.

According to managerial accounting, perfect budget get framed and necessary changes

can made in any project which further want to implement by a company. Effective budget

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

is one in which all expenses and investment lead take place. AB dynamics have to

prepare their budget and modified it according to requirement of time. As this support in

making project more feasible and effective and target achievement become easy. Job cost report: Considered as one of a major report which enable in taking decision for

such specified project which are highly beneficial for a company. As this provide support

in invest in such project rather than focus on such which are less profit earning capacity.

Along with this, another major advantage of this method is providing a side by side

reflection of a task (Qian, Burritt and Monroe, 2011). Minimisation of wastage is major

things which get performed under this and cost escalation is important term. Account receivable aging report: This is completely related with the inflow or receivable

of a company. As this is helpful for making such policies which are beneficial for the

company in relation to their receivables. By considering this account receivable aging

report, managers become able to take decision for such debtors who are less responsible

in paying their debts.

Inventory and manufacturing report: This concept is appropriate for the AB dynamics, as

they are already dealing in cars and other items. Management have to maintain

appropriate report for all of their inventory so that they can take adequate decisions fore

that.

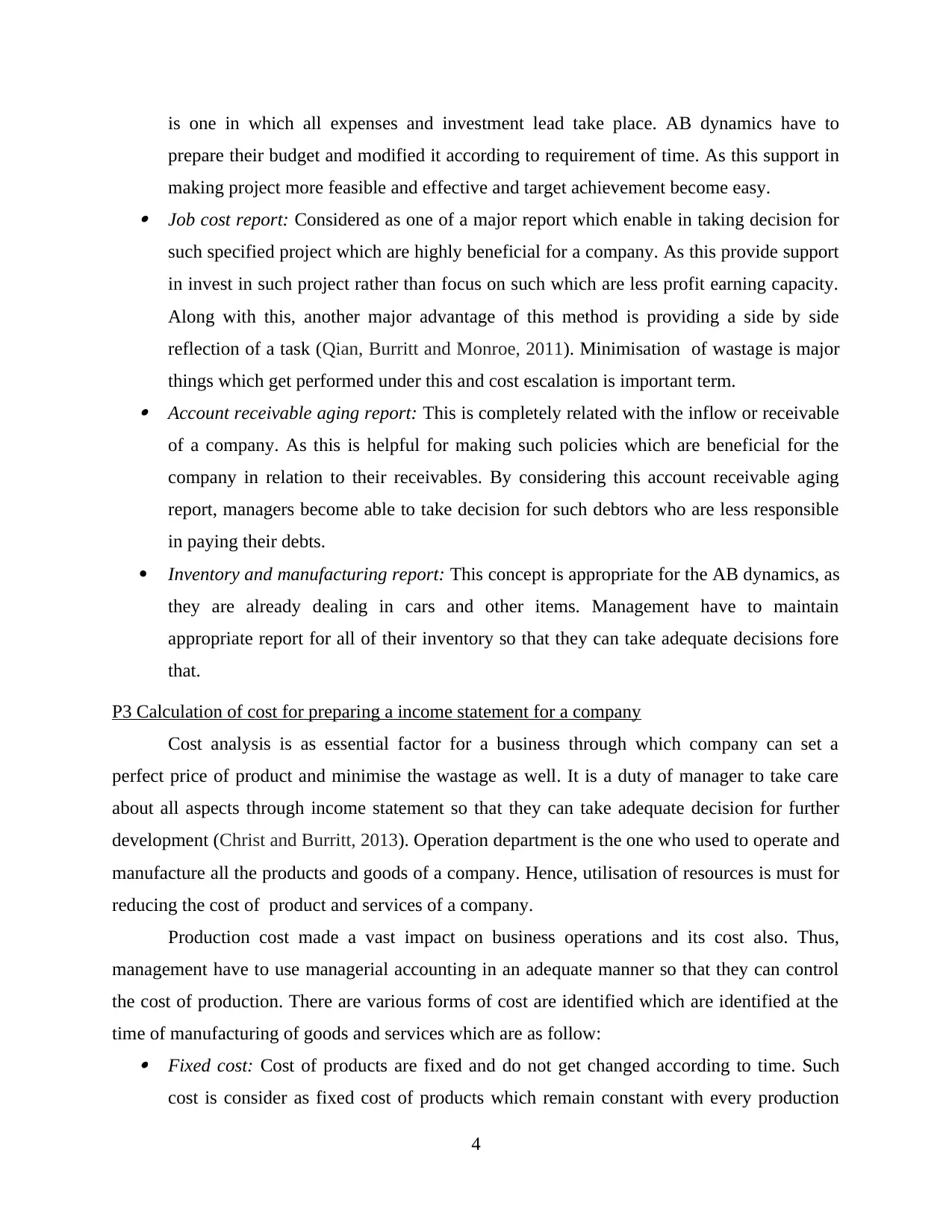

P3 Calculation of cost for preparing a income statement for a company

Cost analysis is as essential factor for a business through which company can set a

perfect price of product and minimise the wastage as well. It is a duty of manager to take care

about all aspects through income statement so that they can take adequate decision for further

development (Christ and Burritt, 2013). Operation department is the one who used to operate and

manufacture all the products and goods of a company. Hence, utilisation of resources is must for

reducing the cost of product and services of a company.

Production cost made a vast impact on business operations and its cost also. Thus,

management have to use managerial accounting in an adequate manner so that they can control

the cost of production. There are various forms of cost are identified which are identified at the

time of manufacturing of goods and services which are as follow: Fixed cost: Cost of products are fixed and do not get changed according to time. Such

cost is consider as fixed cost of products which remain constant with every production

4

prepare their budget and modified it according to requirement of time. As this support in

making project more feasible and effective and target achievement become easy. Job cost report: Considered as one of a major report which enable in taking decision for

such specified project which are highly beneficial for a company. As this provide support

in invest in such project rather than focus on such which are less profit earning capacity.

Along with this, another major advantage of this method is providing a side by side

reflection of a task (Qian, Burritt and Monroe, 2011). Minimisation of wastage is major

things which get performed under this and cost escalation is important term. Account receivable aging report: This is completely related with the inflow or receivable

of a company. As this is helpful for making such policies which are beneficial for the

company in relation to their receivables. By considering this account receivable aging

report, managers become able to take decision for such debtors who are less responsible

in paying their debts.

Inventory and manufacturing report: This concept is appropriate for the AB dynamics, as

they are already dealing in cars and other items. Management have to maintain

appropriate report for all of their inventory so that they can take adequate decisions fore

that.

P3 Calculation of cost for preparing a income statement for a company

Cost analysis is as essential factor for a business through which company can set a

perfect price of product and minimise the wastage as well. It is a duty of manager to take care

about all aspects through income statement so that they can take adequate decision for further

development (Christ and Burritt, 2013). Operation department is the one who used to operate and

manufacture all the products and goods of a company. Hence, utilisation of resources is must for

reducing the cost of product and services of a company.

Production cost made a vast impact on business operations and its cost also. Thus,

management have to use managerial accounting in an adequate manner so that they can control

the cost of production. There are various forms of cost are identified which are identified at the

time of manufacturing of goods and services which are as follow: Fixed cost: Cost of products are fixed and do not get changed according to time. Such

cost is consider as fixed cost of products which remain constant with every production

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and manufacturing cost of production. The ups and downs is hard to calculate and

managers do not measure the fluctuation. Variable cost: Every time production cost get changed and vary according to time. Such

sort of cost is signified as variable cost which are not constant in nature and get vary

according to time. Managers have to measure such things which are associated with the

manufacturing of product and then take appropriate action for that (Shah, Malik and

Malik, 2011). Direct cost: Overheads and expenses are a part of project which occur at any time. Direct

cost increase the cost of product and thus managers have to formulate budget through

which they can minimise the direct cost of product.

Indirect cost: Few times project incur some unnecessary cost on project which is not

appropriate at all. As such cost always lead to increase the price of product and its a main

reason behind overcharging.

Income statement for a manufacturing products get framed by taking two major cost

concept in account which are: marginal costing and absorption costing. Managers are liable to

take adequate decision for their growth and development and offer products to user on right cost

and quality (Dillard and Roslender, 2011). Cost of products have to analyse by preparing a

income statement in which information which is related to overheads, sales etc. all get included.

Hence, all of them have to take in account by company. AB dynamics is one of a automotive

company whom have to analyse their income statement for taking better growth in business.

Absorption costing for Quarter 1:

Particulars Amount (in £)

Sales 6600

Less: Cost of sales

Opening inventory

production cost (78000*0.85) 66300

Closing stock (12000*0.85) 10200

7650

Gross profit -10500

Less: Fixed & selling expenses 520

Net profit -1570

5

managers do not measure the fluctuation. Variable cost: Every time production cost get changed and vary according to time. Such

sort of cost is signified as variable cost which are not constant in nature and get vary

according to time. Managers have to measure such things which are associated with the

manufacturing of product and then take appropriate action for that (Shah, Malik and

Malik, 2011). Direct cost: Overheads and expenses are a part of project which occur at any time. Direct

cost increase the cost of product and thus managers have to formulate budget through

which they can minimise the direct cost of product.

Indirect cost: Few times project incur some unnecessary cost on project which is not

appropriate at all. As such cost always lead to increase the price of product and its a main

reason behind overcharging.

Income statement for a manufacturing products get framed by taking two major cost

concept in account which are: marginal costing and absorption costing. Managers are liable to

take adequate decision for their growth and development and offer products to user on right cost

and quality (Dillard and Roslender, 2011). Cost of products have to analyse by preparing a

income statement in which information which is related to overheads, sales etc. all get included.

Hence, all of them have to take in account by company. AB dynamics is one of a automotive

company whom have to analyse their income statement for taking better growth in business.

Absorption costing for Quarter 1:

Particulars Amount (in £)

Sales 6600

Less: Cost of sales

Opening inventory

production cost (78000*0.85) 66300

Closing stock (12000*0.85) 10200

7650

Gross profit -10500

Less: Fixed & selling expenses 520

Net profit -1570

5

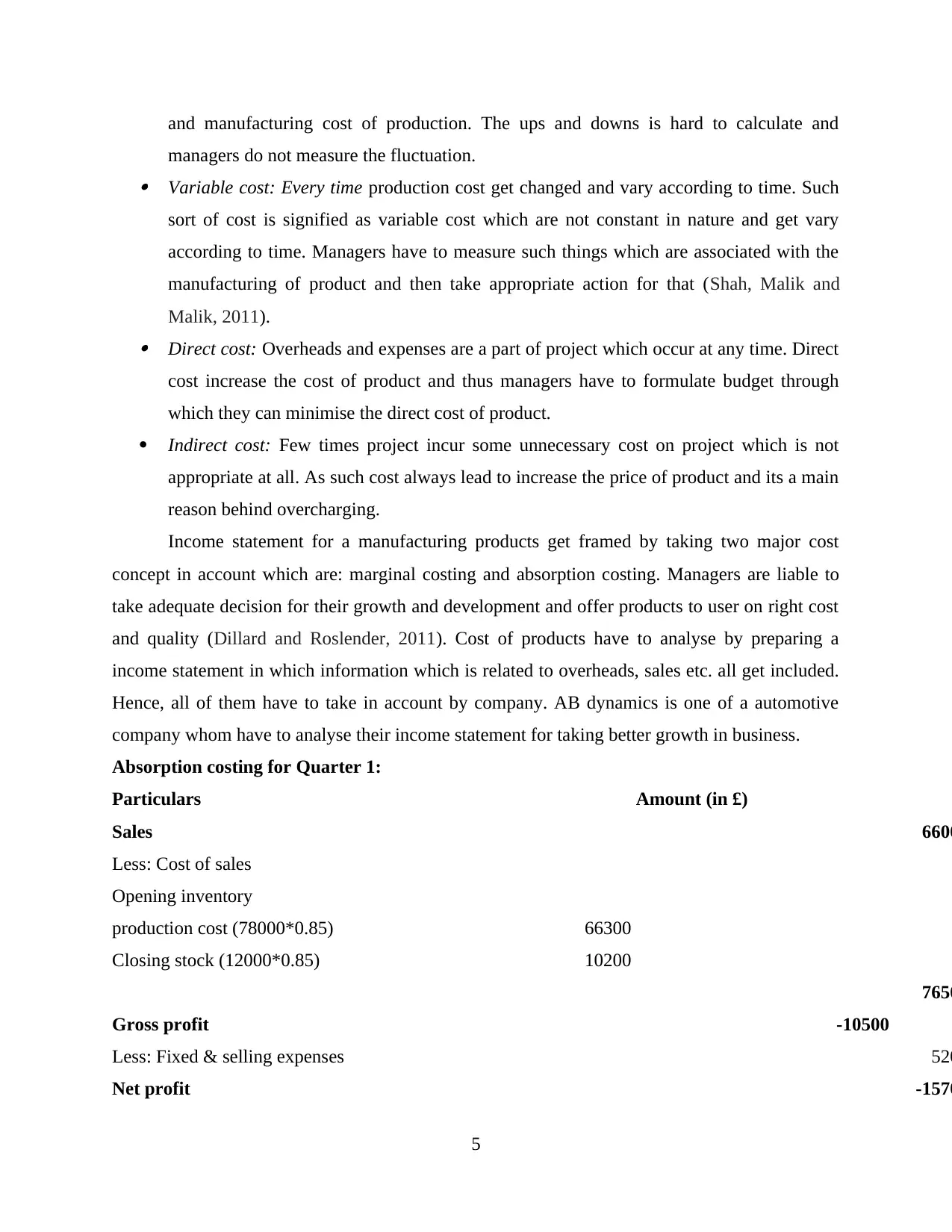

Absorption costing for Quarter 2:

Particulars

Sales 7400

Less: Cost of sales

Opening inventory (12000*0.85) 10200

production cost (66000*0.85) 56100

Closing stock (4000*0.85) 3400

6970

Gross profit -430

Less: Fixed & selling expenses -520

Net profit -950

Marginal costing for Quarter 1:

Quarter-1

Particulars Amount (in £)

Sales 66000

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Closing stock (12000*0.85) 10200

60900

Gross profit 5100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit -16100

Marginal costing for Quarter 2:

6

Particulars

Sales 7400

Less: Cost of sales

Opening inventory (12000*0.85) 10200

production cost (66000*0.85) 56100

Closing stock (4000*0.85) 3400

6970

Gross profit -430

Less: Fixed & selling expenses -520

Net profit -950

Marginal costing for Quarter 1:

Quarter-1

Particulars Amount (in £)

Sales 66000

Less: Cost of sales

Opening inventory 0

production cost (78000*0.65) 50700

Closing stock (12000*0.85) 10200

60900

Gross profit 5100

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit -16100

Marginal costing for Quarter 2:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

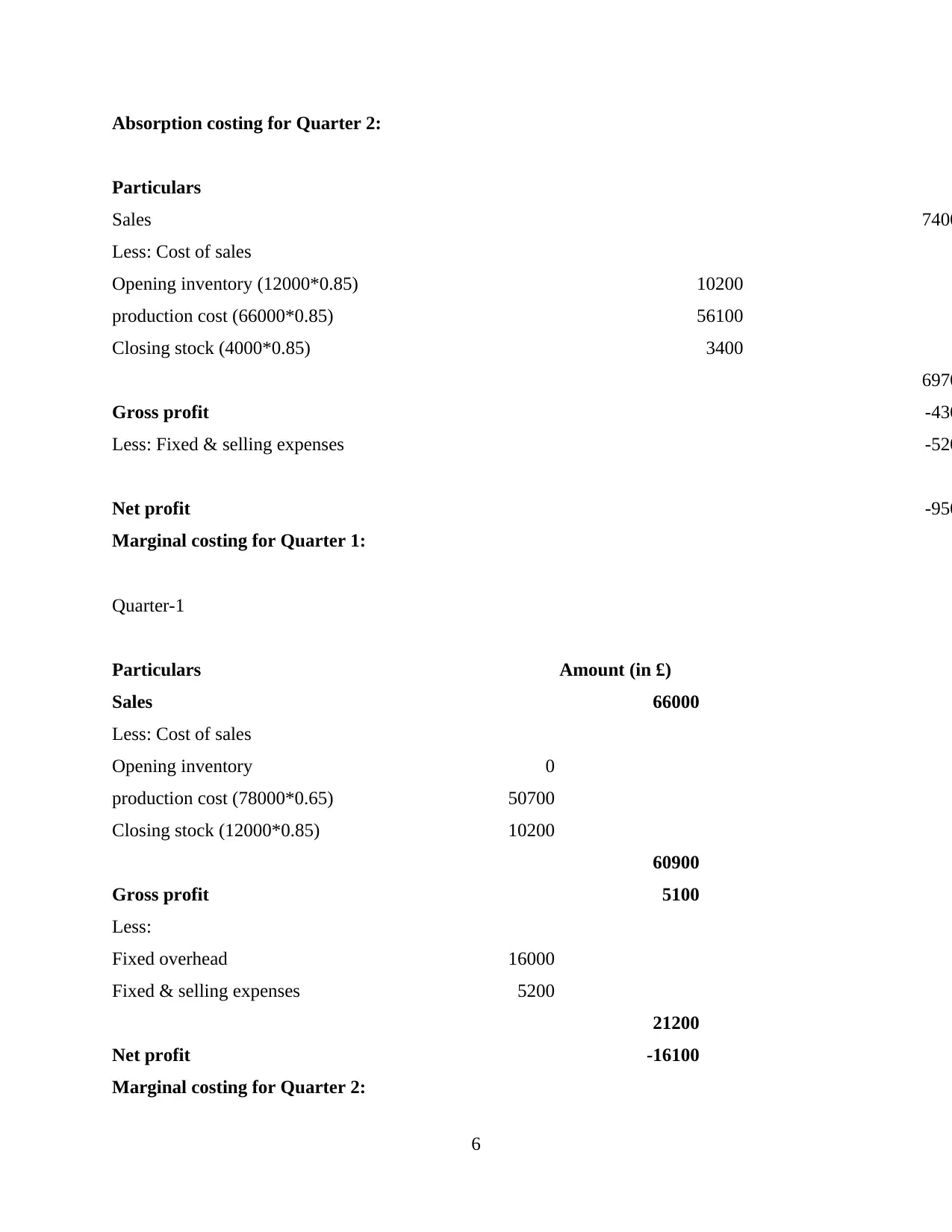

Quarter- 2

Particulars Amount (in £)

Sales 74000

Less: Cost of sales

Opening inventory (12000*0.85) 10200

production cost (66000*0.65) 42900

Closing stock (4000*0.85) 3400

56500

Gross profit 17500

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit -3700

As per the above calculation it get identified that management have to take both of these

concepts in their account through which appropriate decision can be carried down. As per the

marginal costing for 2 quarter it get identified that management have worst profit rate and thus

this is consider as major factor for their weakness. But in 1 quarter company have to suffer heavy

loss which signifies that they do not have appropriate condition at all.

Along with that absorption costing, is such cost in which whole value for product is

measure. Management have to take this thing in their account for taking any beneficial decision

for their long term. For this purpose, income statement analysis is an essential concept for them

to attain their targets in an effective manner without any kind of deviations for long term and in

future.

PART B

P4 Advantages and disadvantages of different types of planning tool

There are various type of planning tool are used by a company so that they can take

adequate decision which are beneficial for them. It is a major duty of manager to use appropriate

7

Particulars Amount (in £)

Sales 74000

Less: Cost of sales

Opening inventory (12000*0.85) 10200

production cost (66000*0.65) 42900

Closing stock (4000*0.85) 3400

56500

Gross profit 17500

Less:

Fixed overhead 16000

Fixed & selling expenses 5200

21200

Net profit -3700

As per the above calculation it get identified that management have to take both of these

concepts in their account through which appropriate decision can be carried down. As per the

marginal costing for 2 quarter it get identified that management have worst profit rate and thus

this is consider as major factor for their weakness. But in 1 quarter company have to suffer heavy

loss which signifies that they do not have appropriate condition at all.

Along with that absorption costing, is such cost in which whole value for product is

measure. Management have to take this thing in their account for taking any beneficial decision

for their long term. For this purpose, income statement analysis is an essential concept for them

to attain their targets in an effective manner without any kind of deviations for long term and in

future.

PART B

P4 Advantages and disadvantages of different types of planning tool

There are various type of planning tool are used by a company so that they can take

adequate decision which are beneficial for them. It is a major duty of manager to use appropriate

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

planning tool for making their work effective (Chenhall and Smith, 2011). As per the planning

tool it become helpful for an organisation to invest in projects which provide high return to them.

For this purpose, budget is considered as major effective tool in relation to invest and take

appropriate decision for further improvements.

One of an important tool which is helpful in taking short term decision and provide long

term strength to a business is managerial accounting. By utilising such approach, effective

decisions can be carried down which facilitate in removing deviations from business. Nero

limited is an organisation who involves in dealing with funding activities. As they require more

and more money for their operation purpose along with that appropriate budget allocation is also

compulsory for them. Nero limited have to use appropriate planning tools for budgetary control

system through which they can operate all task in an adequate manner.

Budget usually have four control purpose which are defined as below:

They help manager in coordinating the resources properly.

Set standard which are helpful in every division of company (Contrafatto and Burns,

2013).

Help in utilising all the resources in an appropriate manner.

Facilitate a platform through which managers and unit performance get evaluated

Budget is consider as helpful tool through which management can utilise all of their resources in

an adequate manner for making the results and outcome better. Nero limited is a funding

company and thus their overall resource is finance through investors and stakeholders of a

company. Hence, if an entity will lead to allocate fund or invest in any project then they have to

take appropriate step and divide their budget according to departments. This provide support to

them in operating all task and project in an adequate manner.

There are various types of budget are identified which can use by a Nero limited in

relation to use them according to time. Following are the several type of budget which have to

undertake by a company:

Financial budget

Operating budget

Non monetary budget

Budgetary control is consider as an approach under which it get identify and monitor that how a

firm will utilise their budget and control cost and operations which are taking place during an

8

tool it become helpful for an organisation to invest in projects which provide high return to them.

For this purpose, budget is considered as major effective tool in relation to invest and take

appropriate decision for further improvements.

One of an important tool which is helpful in taking short term decision and provide long

term strength to a business is managerial accounting. By utilising such approach, effective

decisions can be carried down which facilitate in removing deviations from business. Nero

limited is an organisation who involves in dealing with funding activities. As they require more

and more money for their operation purpose along with that appropriate budget allocation is also

compulsory for them. Nero limited have to use appropriate planning tools for budgetary control

system through which they can operate all task in an adequate manner.

Budget usually have four control purpose which are defined as below:

They help manager in coordinating the resources properly.

Set standard which are helpful in every division of company (Contrafatto and Burns,

2013).

Help in utilising all the resources in an appropriate manner.

Facilitate a platform through which managers and unit performance get evaluated

Budget is consider as helpful tool through which management can utilise all of their resources in

an adequate manner for making the results and outcome better. Nero limited is a funding

company and thus their overall resource is finance through investors and stakeholders of a

company. Hence, if an entity will lead to allocate fund or invest in any project then they have to

take appropriate step and divide their budget according to departments. This provide support to

them in operating all task and project in an adequate manner.

There are various types of budget are identified which can use by a Nero limited in

relation to use them according to time. Following are the several type of budget which have to

undertake by a company:

Financial budget

Operating budget

Non monetary budget

Budgetary control is consider as an approach under which it get identify and monitor that how a

firm will utilise their budget and control cost and operations which are taking place during an

8

accounting period (Albelda, 2011). As this terminology is helpful for a company for making and

conducting operations efficiently.

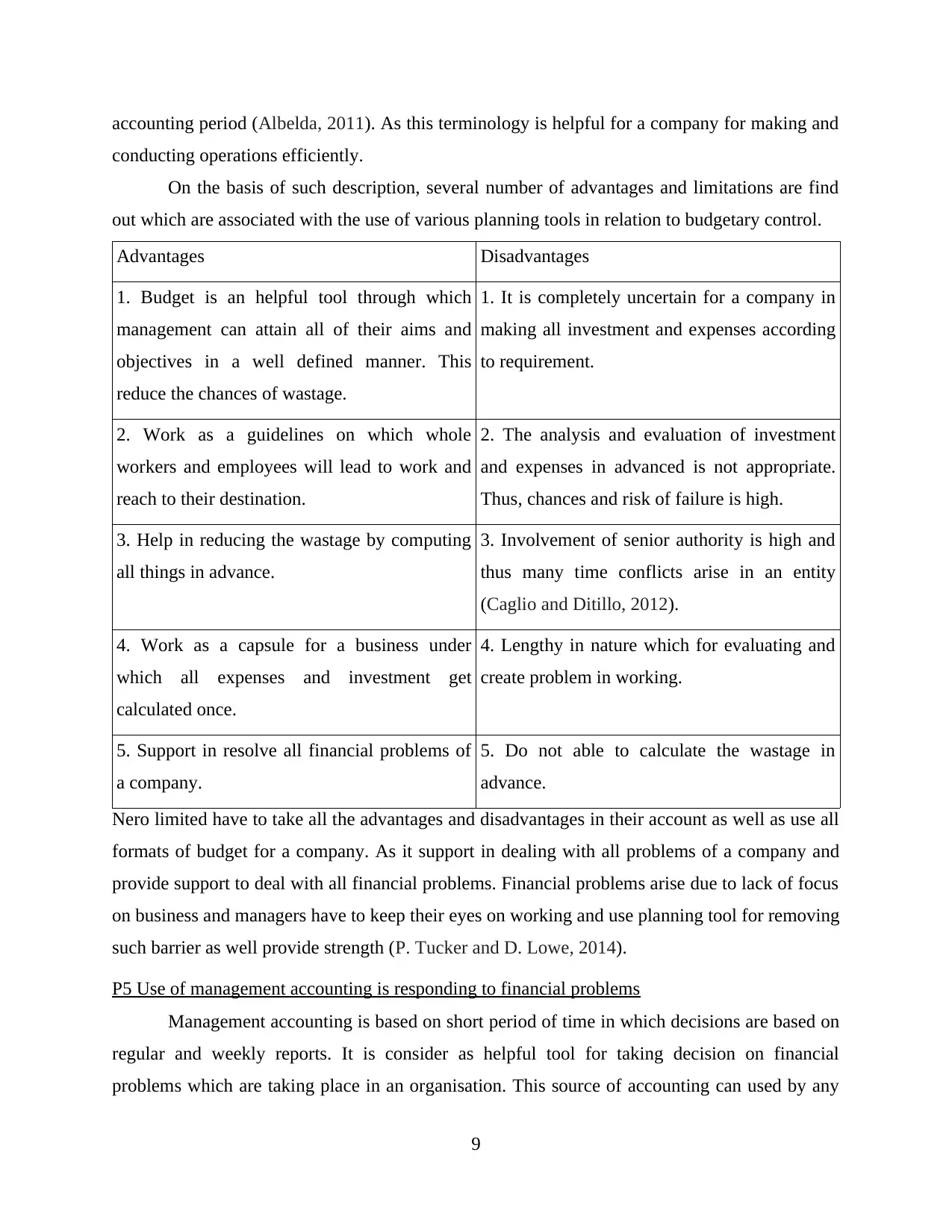

On the basis of such description, several number of advantages and limitations are find

out which are associated with the use of various planning tools in relation to budgetary control.

Advantages Disadvantages

1. Budget is an helpful tool through which

management can attain all of their aims and

objectives in a well defined manner. This

reduce the chances of wastage.

1. It is completely uncertain for a company in

making all investment and expenses according

to requirement.

2. Work as a guidelines on which whole

workers and employees will lead to work and

reach to their destination.

2. The analysis and evaluation of investment

and expenses in advanced is not appropriate.

Thus, chances and risk of failure is high.

3. Help in reducing the wastage by computing

all things in advance.

3. Involvement of senior authority is high and

thus many time conflicts arise in an entity

(Caglio and Ditillo, 2012).

4. Work as a capsule for a business under

which all expenses and investment get

calculated once.

4. Lengthy in nature which for evaluating and

create problem in working.

5. Support in resolve all financial problems of

a company.

5. Do not able to calculate the wastage in

advance.

Nero limited have to take all the advantages and disadvantages in their account as well as use all

formats of budget for a company. As it support in dealing with all problems of a company and

provide support to deal with all financial problems. Financial problems arise due to lack of focus

on business and managers have to keep their eyes on working and use planning tool for removing

such barrier as well provide strength (P. Tucker and D. Lowe, 2014).

P5 Use of management accounting is responding to financial problems

Management accounting is based on short period of time in which decisions are based on

regular and weekly reports. It is consider as helpful tool for taking decision on financial

problems which are taking place in an organisation. This source of accounting can used by any

9

conducting operations efficiently.

On the basis of such description, several number of advantages and limitations are find

out which are associated with the use of various planning tools in relation to budgetary control.

Advantages Disadvantages

1. Budget is an helpful tool through which

management can attain all of their aims and

objectives in a well defined manner. This

reduce the chances of wastage.

1. It is completely uncertain for a company in

making all investment and expenses according

to requirement.

2. Work as a guidelines on which whole

workers and employees will lead to work and

reach to their destination.

2. The analysis and evaluation of investment

and expenses in advanced is not appropriate.

Thus, chances and risk of failure is high.

3. Help in reducing the wastage by computing

all things in advance.

3. Involvement of senior authority is high and

thus many time conflicts arise in an entity

(Caglio and Ditillo, 2012).

4. Work as a capsule for a business under

which all expenses and investment get

calculated once.

4. Lengthy in nature which for evaluating and

create problem in working.

5. Support in resolve all financial problems of

a company.

5. Do not able to calculate the wastage in

advance.

Nero limited have to take all the advantages and disadvantages in their account as well as use all

formats of budget for a company. As it support in dealing with all problems of a company and

provide support to deal with all financial problems. Financial problems arise due to lack of focus

on business and managers have to keep their eyes on working and use planning tool for removing

such barrier as well provide strength (P. Tucker and D. Lowe, 2014).

P5 Use of management accounting is responding to financial problems

Management accounting is based on short period of time in which decisions are based on

regular and weekly reports. It is consider as helpful tool for taking decision on financial

problems which are taking place in an organisation. This source of accounting can used by any

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.