Management Accounting Report: ABC Ltd's Financial Performance Analysis

VerifiedAdded on 2020/12/24

|17

|4826

|494

Report

AI Summary

This management accounting report provides a comprehensive analysis of financial strategies employed by ABC Ltd. It delves into various management accounting systems, including inventory management, cost accounting, job costing, and price optimization, detailing their benefits and applications within an organizational context. The report explores different methods of management accounting reporting, such as budget reports, accounts receivable aging reports, performance reports, and cost managerial accounting reports, emphasizing their roles in planning, decision-making, and performance evaluation. Furthermore, the report includes a detailed analysis of total production costs and sales for January, along with techniques to prepare a budgeted profit and loss statement. It also examines planning tools used for budgetary control, forecasting budgets, and compares different companies' approaches to handling financial problems, offering an evaluation of these tools' effectiveness in addressing financial challenges. The report concludes by highlighting how effective management accounting can lead companies to attain success.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

Management accounting system and their essential requirements..............................................3

Different methods of management accounting reporting............................................................5

Benefits of management accounting system and their application within an organisational

context..........................................................................................................................................6

Evaluation of various system and reports integrated with organisation process.........................8

TASK 2............................................................................................................................................8

Total Production cost and sales of January..................................................................................8

Various techniques to produce budgeted profit and loss statement.............................................9

Financial Report.........................................................................................................................11

TASK 3..........................................................................................................................................11

Explain Advantage & disadvantage of different type of planning tools which is used for

budgetary control.......................................................................................................................11

Analyse of various planning tool to prepare forecasting budgets..............................................13

TASK 4..........................................................................................................................................13

Comparison of companies with the use of different system to respond financial problems.....13

Management accounting can lead companies to attain success................................................15

Evaluation of planning tool to deal with financial problems.....................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION...........................................................................................................................3

Management accounting system and their essential requirements..............................................3

Different methods of management accounting reporting............................................................5

Benefits of management accounting system and their application within an organisational

context..........................................................................................................................................6

Evaluation of various system and reports integrated with organisation process.........................8

TASK 2............................................................................................................................................8

Total Production cost and sales of January..................................................................................8

Various techniques to produce budgeted profit and loss statement.............................................9

Financial Report.........................................................................................................................11

TASK 3..........................................................................................................................................11

Explain Advantage & disadvantage of different type of planning tools which is used for

budgetary control.......................................................................................................................11

Analyse of various planning tool to prepare forecasting budgets..............................................13

TASK 4..........................................................................................................................................13

Comparison of companies with the use of different system to respond financial problems.....13

Management accounting can lead companies to attain success................................................15

Evaluation of planning tool to deal with financial problems.....................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION

Management accounting is defined as the process of making internal decision within an

organisation in order to attain the predefined goals (Bedford, 2015). In business scenario, the

process of collecting, analysing, recording and reporting useful fiscal information into final

account by the internal manager of company is defined as the management accounting.

Management of businesses gather, displays, quantity, mechanise and examine the composed

material that supports them to make strategies and approaches to flourish objective. It is a

scheme that is monitored by the administration for determination numerous monetary problems

that may rise within an organisation. Through the help of authentic, accurate and appropriate

information meaning full decision are made to attain the future goals. To better understand the

concept of relevant topic, ABC Ltd has been selected. The respective company is a medium size

enterprise that deals in manufacturing industry. Management of company use to prepare final

account so that actual measurement, analyses can be made at the end of financial year.

In this project, the importance of several management accounting system and reports

have been discussed with their essential requirements. Report also cover kind of costing

techniques such as marginal and absorption costing approaches to calculate net profit during a

year. Apart this different planning tool and their importance to company and how companies

adopt different accounting system in order to overcome financial problems have been described

in this report.

Management accounting system and their essential requirements.

In present era, management accounting has evolved with time and its concepts help the internal

and external stakeholder to acquire the beneficial knowledge about the company’s performance

during a year (Kastberg and Siverbo, 2013). As it is a systematic approach of recording and

maintaining beneficial information about companies performance within specific period of time.

Assorted system which helps managers in making financial and non financial decisions. There

are several system such as inventory management system, cost accounting system, prime

optimisation system and job costing system that makes better decision for manager. Main

objective of this accounting system is to identify cost occuring in production, then to make plans

and strategies to reduce cost.

3

Management accounting is defined as the process of making internal decision within an

organisation in order to attain the predefined goals (Bedford, 2015). In business scenario, the

process of collecting, analysing, recording and reporting useful fiscal information into final

account by the internal manager of company is defined as the management accounting.

Management of businesses gather, displays, quantity, mechanise and examine the composed

material that supports them to make strategies and approaches to flourish objective. It is a

scheme that is monitored by the administration for determination numerous monetary problems

that may rise within an organisation. Through the help of authentic, accurate and appropriate

information meaning full decision are made to attain the future goals. To better understand the

concept of relevant topic, ABC Ltd has been selected. The respective company is a medium size

enterprise that deals in manufacturing industry. Management of company use to prepare final

account so that actual measurement, analyses can be made at the end of financial year.

In this project, the importance of several management accounting system and reports

have been discussed with their essential requirements. Report also cover kind of costing

techniques such as marginal and absorption costing approaches to calculate net profit during a

year. Apart this different planning tool and their importance to company and how companies

adopt different accounting system in order to overcome financial problems have been described

in this report.

Management accounting system and their essential requirements.

In present era, management accounting has evolved with time and its concepts help the internal

and external stakeholder to acquire the beneficial knowledge about the company’s performance

during a year (Kastberg and Siverbo, 2013). As it is a systematic approach of recording and

maintaining beneficial information about companies performance within specific period of time.

Assorted system which helps managers in making financial and non financial decisions. There

are several system such as inventory management system, cost accounting system, prime

optimisation system and job costing system that makes better decision for manager. Main

objective of this accounting system is to identify cost occuring in production, then to make plans

and strategies to reduce cost.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Different type of management accounting systems and their essential requirement:

This system includes many methods which helps to the organisation. It provides all the

accounting reports to the managers, which help them in plan and strategy making. There are four

types of management accounting which are following:

Inventory management system: Inventory management system is a kind of system

which tracks the stock in warehouses and as well as it also check the availability of raw material,

assets etc. This system is very beneficial for all kind of organisation, specially for those which

are involved in manufacturing (Kolk and Perego, 2015). This is why because it tracks the

movement of raw material when it goes in production system and tracks till the selling of

product. In short it can be said that this system helps in supply chain management system. ABC

ltd follow this system of inventory management which will be beneficial for them because it

solve the problem regarding to stock management.

Price optimization system: Price optimization system helps an organisation in setting a

level of price which is suitable for both company and as well as for customers. It consists various

tools and techniques which helps in anlysis customer's respond on different pricing for products

and services. This system make price setting easy to the company. Management team of ABC ltd

use this tool in proper price setting. This system can help the company in to set a price which

will be beneficial in meeting company's goals and objectives. In addition it can also help to ABC

ltd to get competitive advantage over rivalry firms.

Job costing system: Job costing system provides a method of calculating cost of each

product's unit. This type of system is suitable in those organisations which produces different

kind of products and services. In those organisations it calculates the cost of each product's unit

individually and if cost is high of each unit then it helps in making suitable strategies for cost

reduction. ABC ltd follow this system and they are able to check that what is cost of their each

product's unit. This method can also help in cost reduction of company's products. It will help

company to get higher profit because if cost will be low then price will also down and this will

increase the selling of products (Mahesha and Akash, 2013. ).

Cost accounting system: Cost accounting system gives compeletly information about

the cost to the management which helps managers in making future plans and policies. This

system works in a particular manner first it record the cost occuerd in production then analyse it

and allocate to each product and if cost is high then this system gives advice to the top

4

This system includes many methods which helps to the organisation. It provides all the

accounting reports to the managers, which help them in plan and strategy making. There are four

types of management accounting which are following:

Inventory management system: Inventory management system is a kind of system

which tracks the stock in warehouses and as well as it also check the availability of raw material,

assets etc. This system is very beneficial for all kind of organisation, specially for those which

are involved in manufacturing (Kolk and Perego, 2015). This is why because it tracks the

movement of raw material when it goes in production system and tracks till the selling of

product. In short it can be said that this system helps in supply chain management system. ABC

ltd follow this system of inventory management which will be beneficial for them because it

solve the problem regarding to stock management.

Price optimization system: Price optimization system helps an organisation in setting a

level of price which is suitable for both company and as well as for customers. It consists various

tools and techniques which helps in anlysis customer's respond on different pricing for products

and services. This system make price setting easy to the company. Management team of ABC ltd

use this tool in proper price setting. This system can help the company in to set a price which

will be beneficial in meeting company's goals and objectives. In addition it can also help to ABC

ltd to get competitive advantage over rivalry firms.

Job costing system: Job costing system provides a method of calculating cost of each

product's unit. This type of system is suitable in those organisations which produces different

kind of products and services. In those organisations it calculates the cost of each product's unit

individually and if cost is high of each unit then it helps in making suitable strategies for cost

reduction. ABC ltd follow this system and they are able to check that what is cost of their each

product's unit. This method can also help in cost reduction of company's products. It will help

company to get higher profit because if cost will be low then price will also down and this will

increase the selling of products (Mahesha and Akash, 2013. ).

Cost accounting system: Cost accounting system gives compeletly information about

the cost to the management which helps managers in making future plans and policies. This

system works in a particular manner first it record the cost occuerd in production then analyse it

and allocate to each product and if cost is high then this system gives advice to the top

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

management in cost reduction. ABC ltd use this system in cost management because this system

makes proper analysis of cost after the production. In addition it gives suggestion to the

managers by which they can make plans and strategies for future as well as for cost reduction.

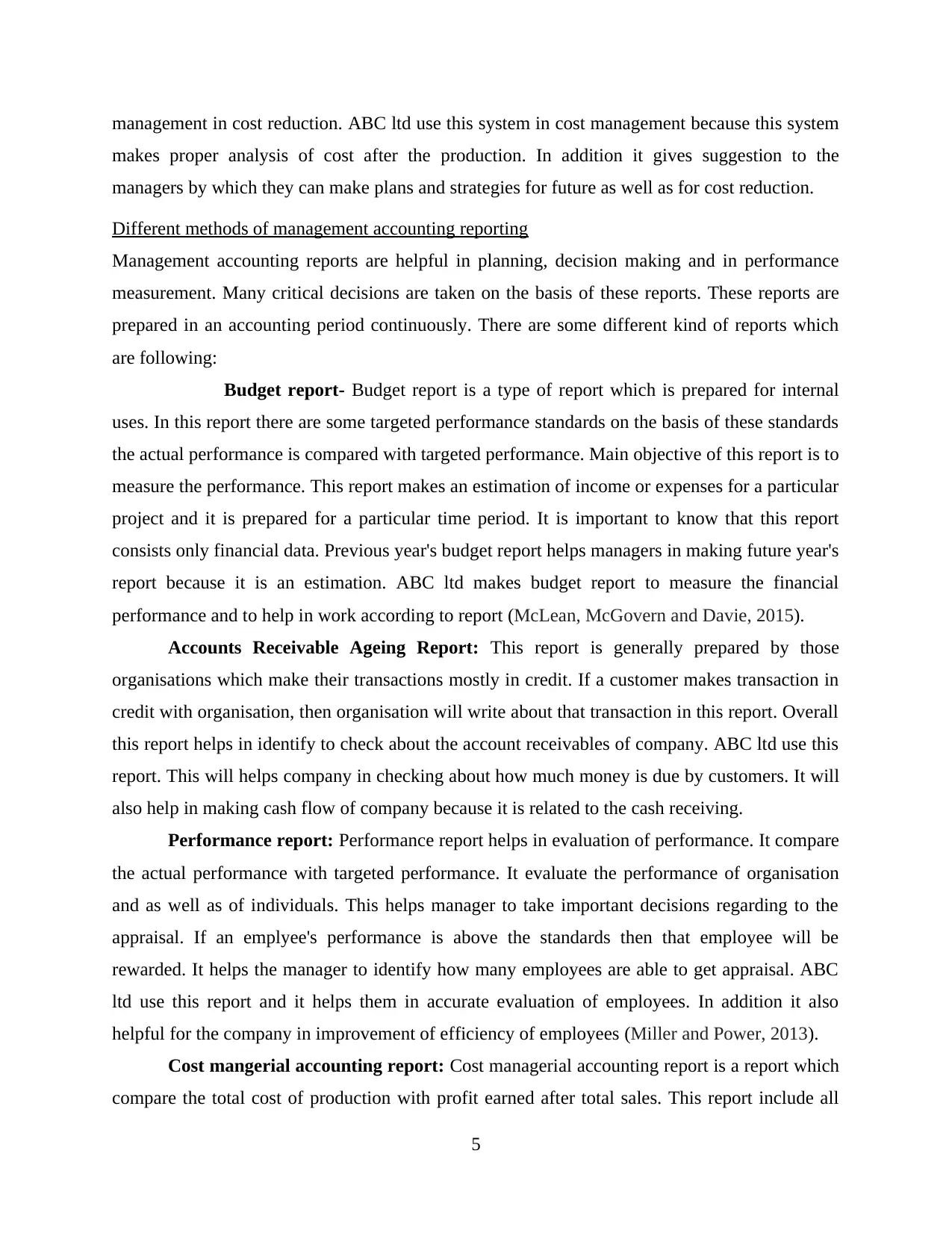

Different methods of management accounting reporting

Management accounting reports are helpful in planning, decision making and in performance

measurement. Many critical decisions are taken on the basis of these reports. These reports are

prepared in an accounting period continuously. There are some different kind of reports which

are following:

Budget report- Budget report is a type of report which is prepared for internal

uses. In this report there are some targeted performance standards on the basis of these standards

the actual performance is compared with targeted performance. Main objective of this report is to

measure the performance. This report makes an estimation of income or expenses for a particular

project and it is prepared for a particular time period. It is important to know that this report

consists only financial data. Previous year's budget report helps managers in making future year's

report because it is an estimation. ABC ltd makes budget report to measure the financial

performance and to help in work according to report (McLean, McGovern and Davie, 2015).

Accounts Receivable Ageing Report: This report is generally prepared by those

organisations which make their transactions mostly in credit. If a customer makes transaction in

credit with organisation, then organisation will write about that transaction in this report. Overall

this report helps in identify to check about the account receivables of company. ABC ltd use this

report. This will helps company in checking about how much money is due by customers. It will

also help in making cash flow of company because it is related to the cash receiving.

Performance report: Performance report helps in evaluation of performance. It compare

the actual performance with targeted performance. It evaluate the performance of organisation

and as well as of individuals. This helps manager to take important decisions regarding to the

appraisal. If an emplyee's performance is above the standards then that employee will be

rewarded. It helps the manager to identify how many employees are able to get appraisal. ABC

ltd use this report and it helps them in accurate evaluation of employees. In addition it also

helpful for the company in improvement of efficiency of employees (Miller and Power, 2013).

Cost mangerial accounting report: Cost managerial accounting report is a report which

compare the total cost of production with profit earned after total sales. This report include all

5

makes proper analysis of cost after the production. In addition it gives suggestion to the

managers by which they can make plans and strategies for future as well as for cost reduction.

Different methods of management accounting reporting

Management accounting reports are helpful in planning, decision making and in performance

measurement. Many critical decisions are taken on the basis of these reports. These reports are

prepared in an accounting period continuously. There are some different kind of reports which

are following:

Budget report- Budget report is a type of report which is prepared for internal

uses. In this report there are some targeted performance standards on the basis of these standards

the actual performance is compared with targeted performance. Main objective of this report is to

measure the performance. This report makes an estimation of income or expenses for a particular

project and it is prepared for a particular time period. It is important to know that this report

consists only financial data. Previous year's budget report helps managers in making future year's

report because it is an estimation. ABC ltd makes budget report to measure the financial

performance and to help in work according to report (McLean, McGovern and Davie, 2015).

Accounts Receivable Ageing Report: This report is generally prepared by those

organisations which make their transactions mostly in credit. If a customer makes transaction in

credit with organisation, then organisation will write about that transaction in this report. Overall

this report helps in identify to check about the account receivables of company. ABC ltd use this

report. This will helps company in checking about how much money is due by customers. It will

also help in making cash flow of company because it is related to the cash receiving.

Performance report: Performance report helps in evaluation of performance. It compare

the actual performance with targeted performance. It evaluate the performance of organisation

and as well as of individuals. This helps manager to take important decisions regarding to the

appraisal. If an emplyee's performance is above the standards then that employee will be

rewarded. It helps the manager to identify how many employees are able to get appraisal. ABC

ltd use this report and it helps them in accurate evaluation of employees. In addition it also

helpful for the company in improvement of efficiency of employees (Miller and Power, 2013).

Cost mangerial accounting report: Cost managerial accounting report is a report which

compare the total cost of production with profit earned after total sales. This report include all

5

type of cost which occurs in production like raw material cost, labour cost, electricity cost,

labelling and packaging cost etc. Further, it makes total of all the cost and after selling of all

products it compares total sales amount with cost. It shows that whether profit is earned or not. If

selling amount is more than cost then it will be profit and if cost is more then selling amount then

it will be loss to company. With the help of this report managers can check that organisation is in

profit or in loss. ABC ltd use this report in analysing about the profit and loss. This helps

company to make further strategies and plan if they are getting loss.

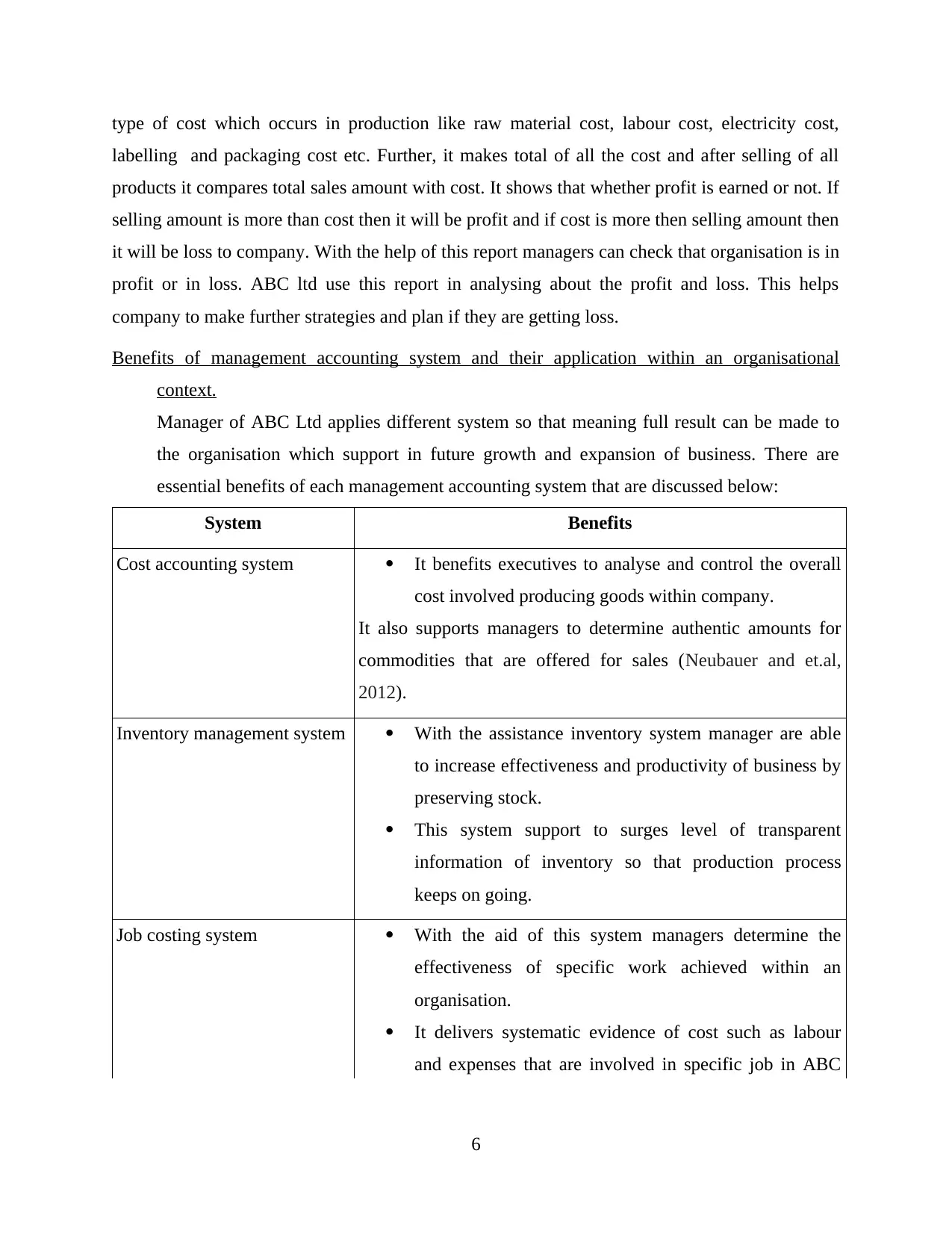

Benefits of management accounting system and their application within an organisational

context.

Manager of ABC Ltd applies different system so that meaning full result can be made to

the organisation which support in future growth and expansion of business. There are

essential benefits of each management accounting system that are discussed below:

System Benefits

Cost accounting system It benefits executives to analyse and control the overall

cost involved producing goods within company.

It also supports managers to determine authentic amounts for

commodities that are offered for sales (Neubauer and et.al,

2012).

Inventory management system With the assistance inventory system manager are able

to increase effectiveness and productivity of business by

preserving stock.

This system support to surges level of transparent

information of inventory so that production process

keeps on going.

Job costing system With the aid of this system managers determine the

effectiveness of specific work achieved within an

organisation.

It delivers systematic evidence of cost such as labour

and expenses that are involved in specific job in ABC

6

labelling and packaging cost etc. Further, it makes total of all the cost and after selling of all

products it compares total sales amount with cost. It shows that whether profit is earned or not. If

selling amount is more than cost then it will be profit and if cost is more then selling amount then

it will be loss to company. With the help of this report managers can check that organisation is in

profit or in loss. ABC ltd use this report in analysing about the profit and loss. This helps

company to make further strategies and plan if they are getting loss.

Benefits of management accounting system and their application within an organisational

context.

Manager of ABC Ltd applies different system so that meaning full result can be made to

the organisation which support in future growth and expansion of business. There are

essential benefits of each management accounting system that are discussed below:

System Benefits

Cost accounting system It benefits executives to analyse and control the overall

cost involved producing goods within company.

It also supports managers to determine authentic amounts for

commodities that are offered for sales (Neubauer and et.al,

2012).

Inventory management system With the assistance inventory system manager are able

to increase effectiveness and productivity of business by

preserving stock.

This system support to surges level of transparent

information of inventory so that production process

keeps on going.

Job costing system With the aid of this system managers determine the

effectiveness of specific work achieved within an

organisation.

It delivers systematic evidence of cost such as labour

and expenses that are involved in specific job in ABC

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ltd.

Price optimisation system This system helps an organisation to fix suitable price of

product so that company can attain profit in future

The price system support to company to expand its

customer base by delivering best product at reasonable

price.

7

Price optimisation system This system helps an organisation to fix suitable price of

product so that company can attain profit in future

The price system support to company to expand its

customer base by delivering best product at reasonable

price.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

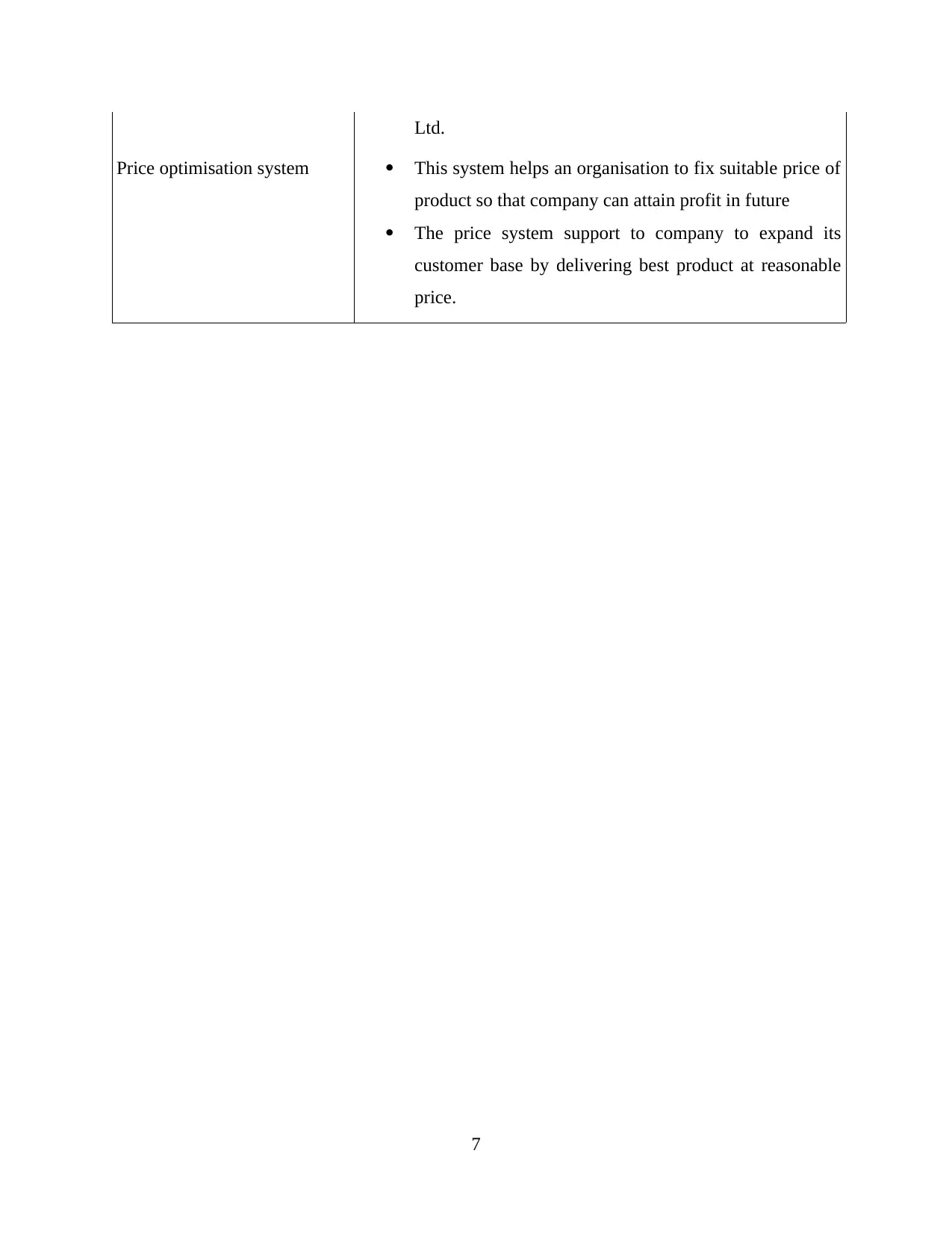

Evaluation of various system and reports integrated with organisation process

It has been evaluated from the above discussed reports and system and their benefits that

accounting report and system are very significant for each business firm to grow their business

and build global image. As these report and system advantage to reports and expand business and

grow profit during a specific year. All essential system and reports gives feature material to

regulate cost, total amount possessed by borrowers and actual or current economic situation and

status of company (Padovani, Orelli and Young, 2014). Manger of ABC Ltd uses budget report

in there organisational process as it is valuable in guessing entire cost; account receivable reports

support the management to strength the credit strategies and gathering procedure. Inventory

management report is suitable to path the standard accessible in storeroom and stock used in

entire supply business. However, performance report is mainly used to keep systematic record of

daily business operation performance and performance of employees working within ABC Ltd.

In last it has been critically evaluated that complete report maintenance to development the

productivity of company and improve presentation of business.

TASK 2

Total Production cost and sales of January

Budget – Absorption costing technique January

Production cost per

unit

Total

Direct Material 10 18000*10 180000

Direct Labour 20 18000*20 360000

Variable overhead 5 18000*5 90000

Fixed overhead 5

40 18000*40 720000

Total Cost of sales (January)

£

Cost of production 720000

Opening inventory 0

8

It has been evaluated from the above discussed reports and system and their benefits that

accounting report and system are very significant for each business firm to grow their business

and build global image. As these report and system advantage to reports and expand business and

grow profit during a specific year. All essential system and reports gives feature material to

regulate cost, total amount possessed by borrowers and actual or current economic situation and

status of company (Padovani, Orelli and Young, 2014). Manger of ABC Ltd uses budget report

in there organisational process as it is valuable in guessing entire cost; account receivable reports

support the management to strength the credit strategies and gathering procedure. Inventory

management report is suitable to path the standard accessible in storeroom and stock used in

entire supply business. However, performance report is mainly used to keep systematic record of

daily business operation performance and performance of employees working within ABC Ltd.

In last it has been critically evaluated that complete report maintenance to development the

productivity of company and improve presentation of business.

TASK 2

Total Production cost and sales of January

Budget – Absorption costing technique January

Production cost per

unit

Total

Direct Material 10 18000*10 180000

Direct Labour 20 18000*20 360000

Variable overhead 5 18000*5 90000

Fixed overhead 5

40 18000*40 720000

Total Cost of sales (January)

£

Cost of production 720000

Opening inventory 0

8

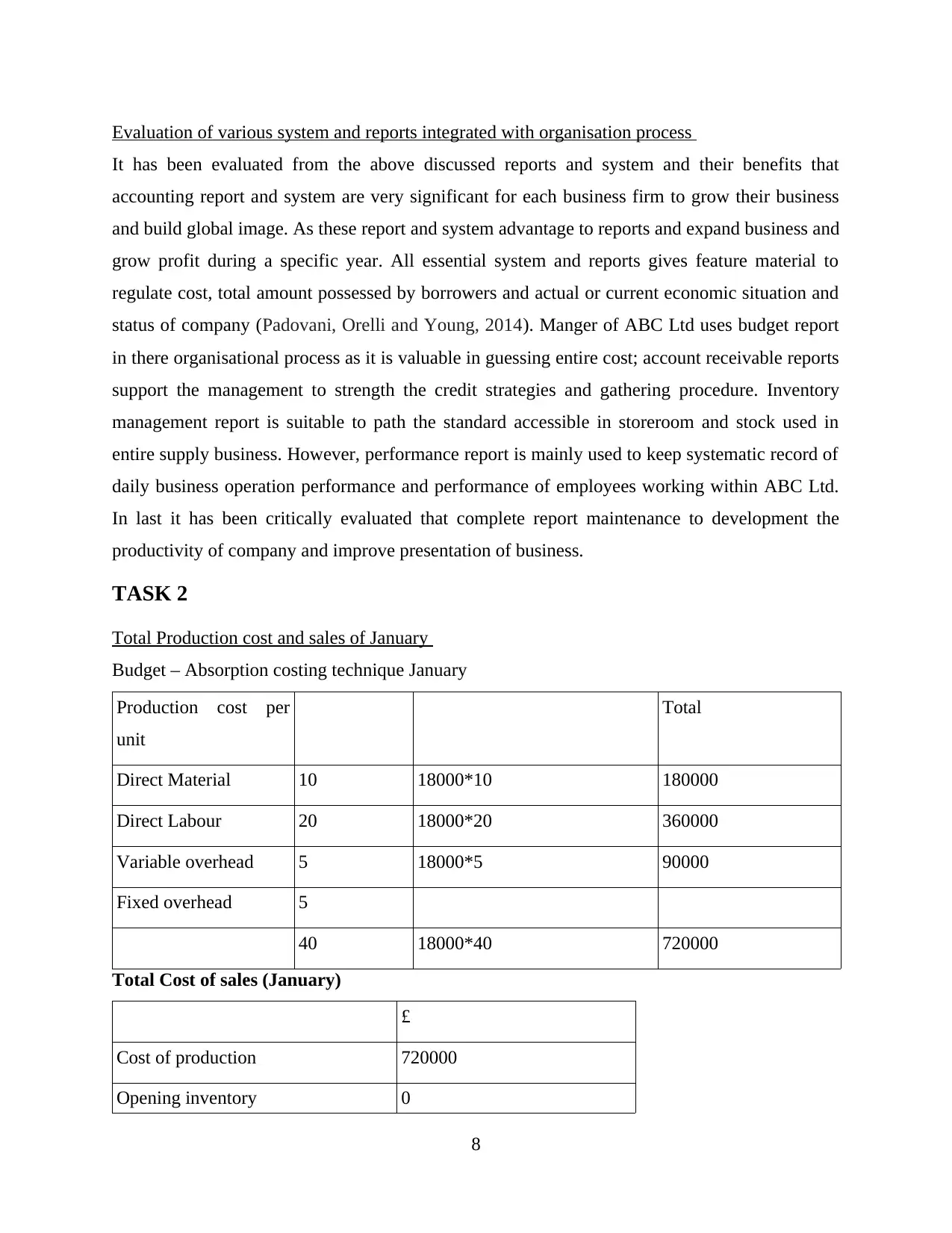

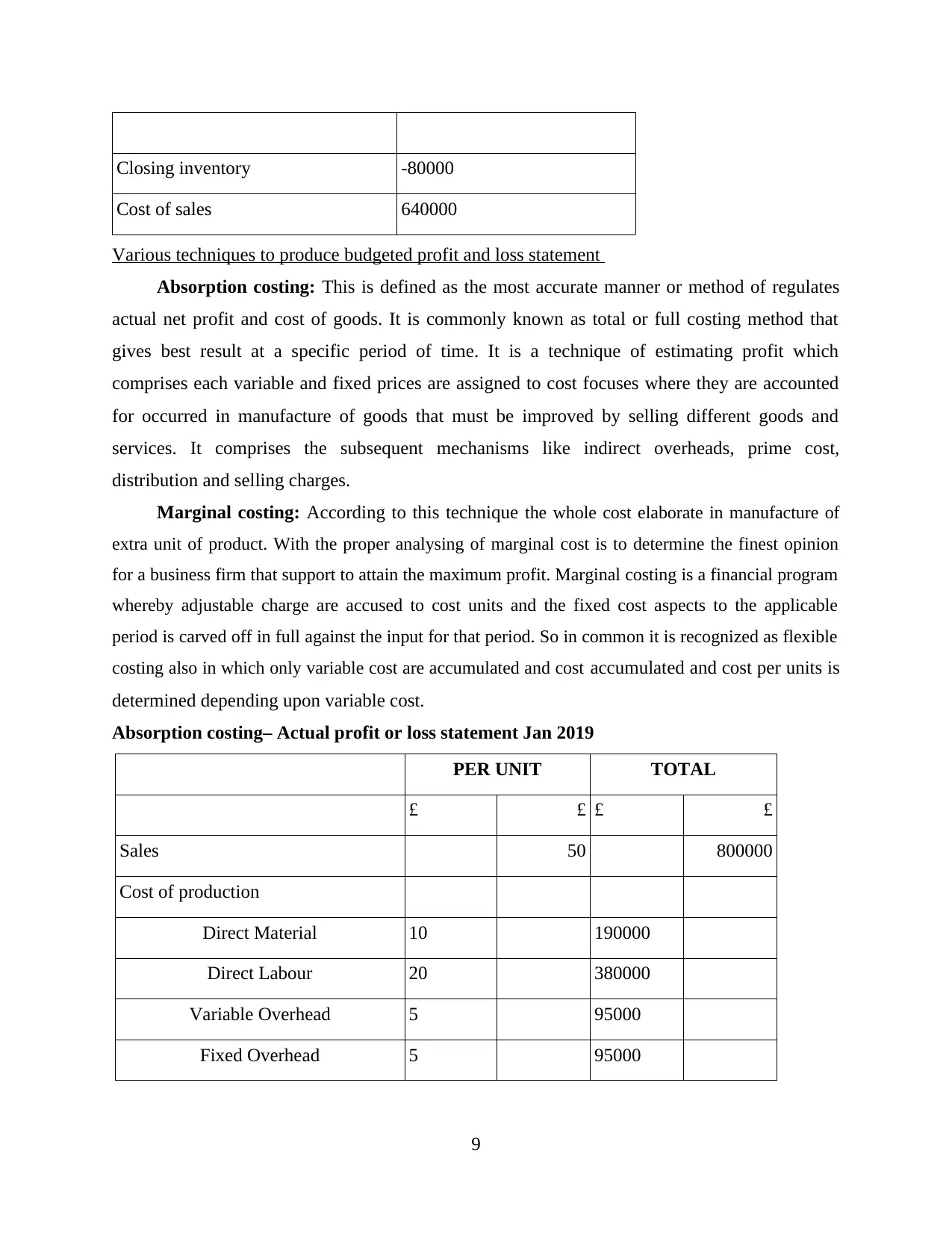

Closing inventory -80000

Cost of sales 640000

Various techniques to produce budgeted profit and loss statement

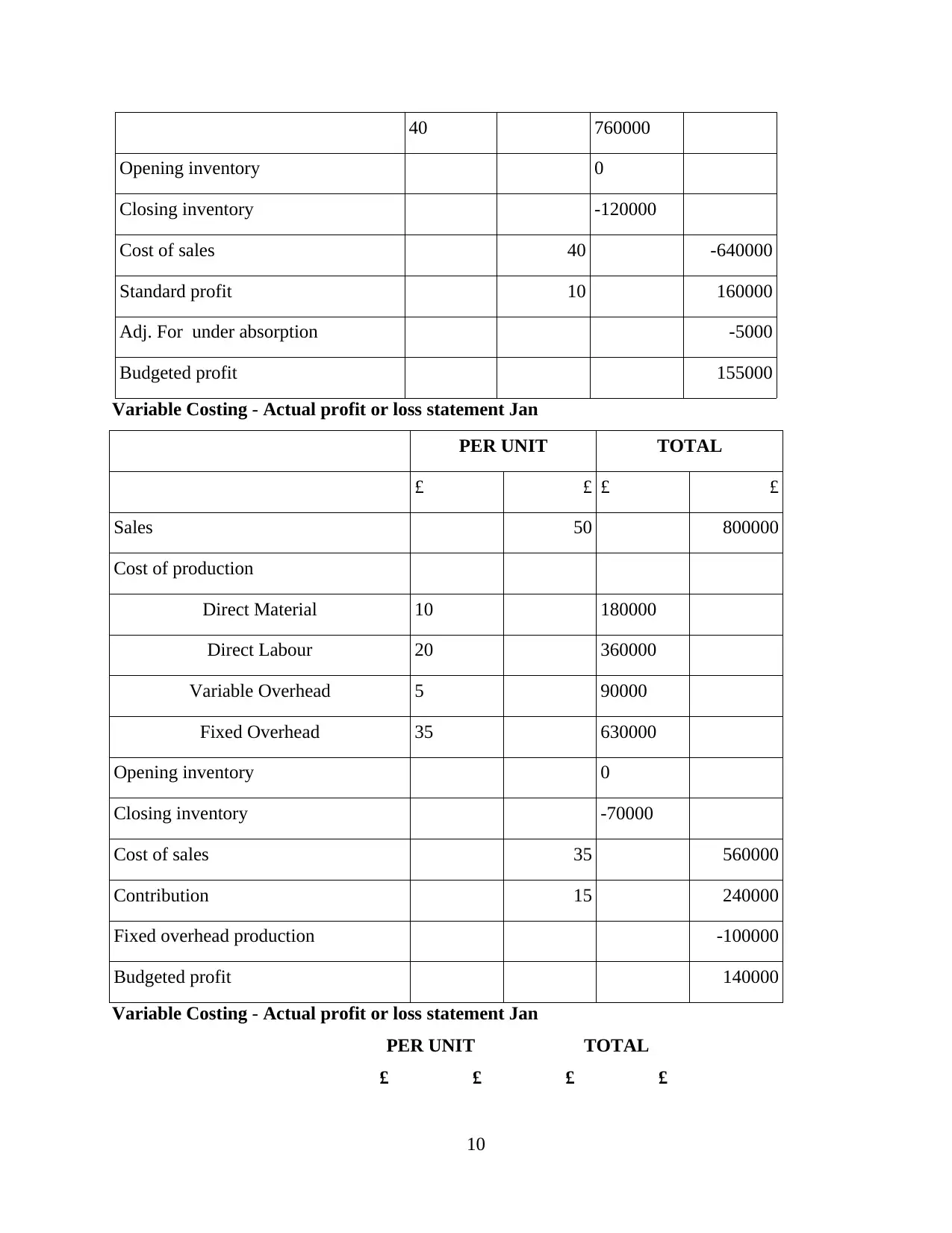

Absorption costing: This is defined as the most accurate manner or method of regulates

actual net profit and cost of goods. It is commonly known as total or full costing method that

gives best result at a specific period of time. It is a technique of estimating profit which

comprises each variable and fixed prices are assigned to cost focuses where they are accounted

for occurred in manufacture of goods that must be improved by selling different goods and

services. It comprises the subsequent mechanisms like indirect overheads, prime cost,

distribution and selling charges.

Marginal costing: According to this technique the whole cost elaborate in manufacture of

extra unit of product. With the proper analysing of marginal cost is to determine the finest opinion

for a business firm that support to attain the maximum profit. Marginal costing is a financial program

whereby adjustable charge are accused to cost units and the fixed cost aspects to the applicable

period is carved off in full against the input for that period. So in common it is recognized as flexible

costing also in which only variable cost are accumulated and cost accumulated and cost per units is

determined depending upon variable cost.

Absorption costing– Actual profit or loss statement Jan 2019

PER UNIT TOTAL

£ £ £ £

Sales 50 800000

Cost of production

Direct Material 10 190000

Direct Labour 20 380000

Variable Overhead 5 95000

Fixed Overhead 5 95000

9

Cost of sales 640000

Various techniques to produce budgeted profit and loss statement

Absorption costing: This is defined as the most accurate manner or method of regulates

actual net profit and cost of goods. It is commonly known as total or full costing method that

gives best result at a specific period of time. It is a technique of estimating profit which

comprises each variable and fixed prices are assigned to cost focuses where they are accounted

for occurred in manufacture of goods that must be improved by selling different goods and

services. It comprises the subsequent mechanisms like indirect overheads, prime cost,

distribution and selling charges.

Marginal costing: According to this technique the whole cost elaborate in manufacture of

extra unit of product. With the proper analysing of marginal cost is to determine the finest opinion

for a business firm that support to attain the maximum profit. Marginal costing is a financial program

whereby adjustable charge are accused to cost units and the fixed cost aspects to the applicable

period is carved off in full against the input for that period. So in common it is recognized as flexible

costing also in which only variable cost are accumulated and cost accumulated and cost per units is

determined depending upon variable cost.

Absorption costing– Actual profit or loss statement Jan 2019

PER UNIT TOTAL

£ £ £ £

Sales 50 800000

Cost of production

Direct Material 10 190000

Direct Labour 20 380000

Variable Overhead 5 95000

Fixed Overhead 5 95000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

40 760000

Opening inventory 0

Closing inventory -120000

Cost of sales 40 -640000

Standard profit 10 160000

Adj. For under absorption -5000

Budgeted profit 155000

Variable Costing - Actual profit or loss statement Jan

PER UNIT TOTAL

£ £ £ £

Sales 50 800000

Cost of production

Direct Material 10 180000

Direct Labour 20 360000

Variable Overhead 5 90000

Fixed Overhead 35 630000

Opening inventory 0

Closing inventory -70000

Cost of sales 35 560000

Contribution 15 240000

Fixed overhead production -100000

Budgeted profit 140000

Variable Costing - Actual profit or loss statement Jan

PER UNIT TOTAL

£ £ £ £

10

Opening inventory 0

Closing inventory -120000

Cost of sales 40 -640000

Standard profit 10 160000

Adj. For under absorption -5000

Budgeted profit 155000

Variable Costing - Actual profit or loss statement Jan

PER UNIT TOTAL

£ £ £ £

Sales 50 800000

Cost of production

Direct Material 10 180000

Direct Labour 20 360000

Variable Overhead 5 90000

Fixed Overhead 35 630000

Opening inventory 0

Closing inventory -70000

Cost of sales 35 560000

Contribution 15 240000

Fixed overhead production -100000

Budgeted profit 140000

Variable Costing - Actual profit or loss statement Jan

PER UNIT TOTAL

£ £ £ £

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

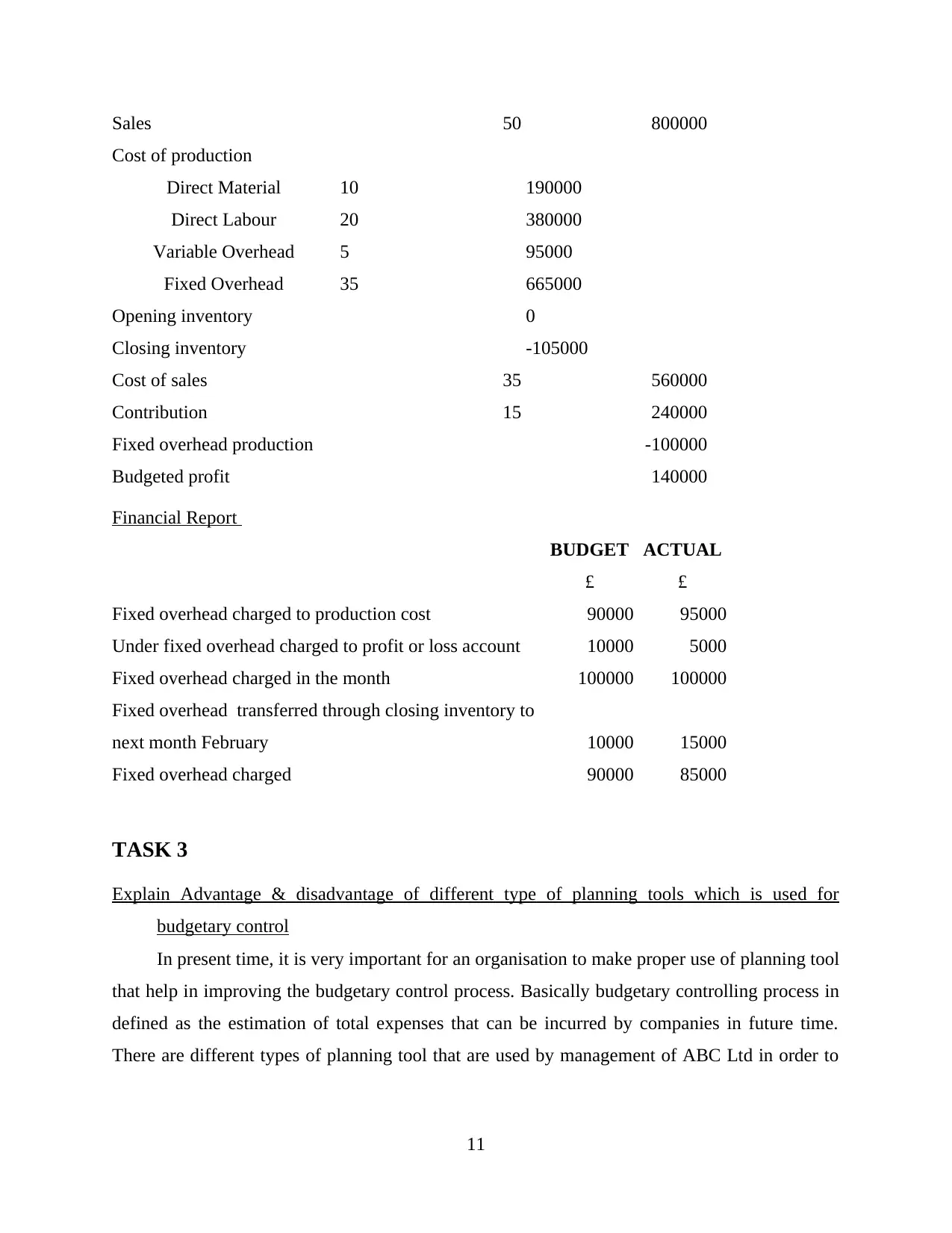

Sales 50 800000

Cost of production

Direct Material 10 190000

Direct Labour 20 380000

Variable Overhead 5 95000

Fixed Overhead 35 665000

Opening inventory 0

Closing inventory -105000

Cost of sales 35 560000

Contribution 15 240000

Fixed overhead production -100000

Budgeted profit 140000

Financial Report

BUDGET ACTUAL

£ £

Fixed overhead charged to production cost 90000 95000

Under fixed overhead charged to profit or loss account 10000 5000

Fixed overhead charged in the month 100000 100000

Fixed overhead transferred through closing inventory to

next month February 10000 15000

Fixed overhead charged 90000 85000

TASK 3

Explain Advantage & disadvantage of different type of planning tools which is used for

budgetary control

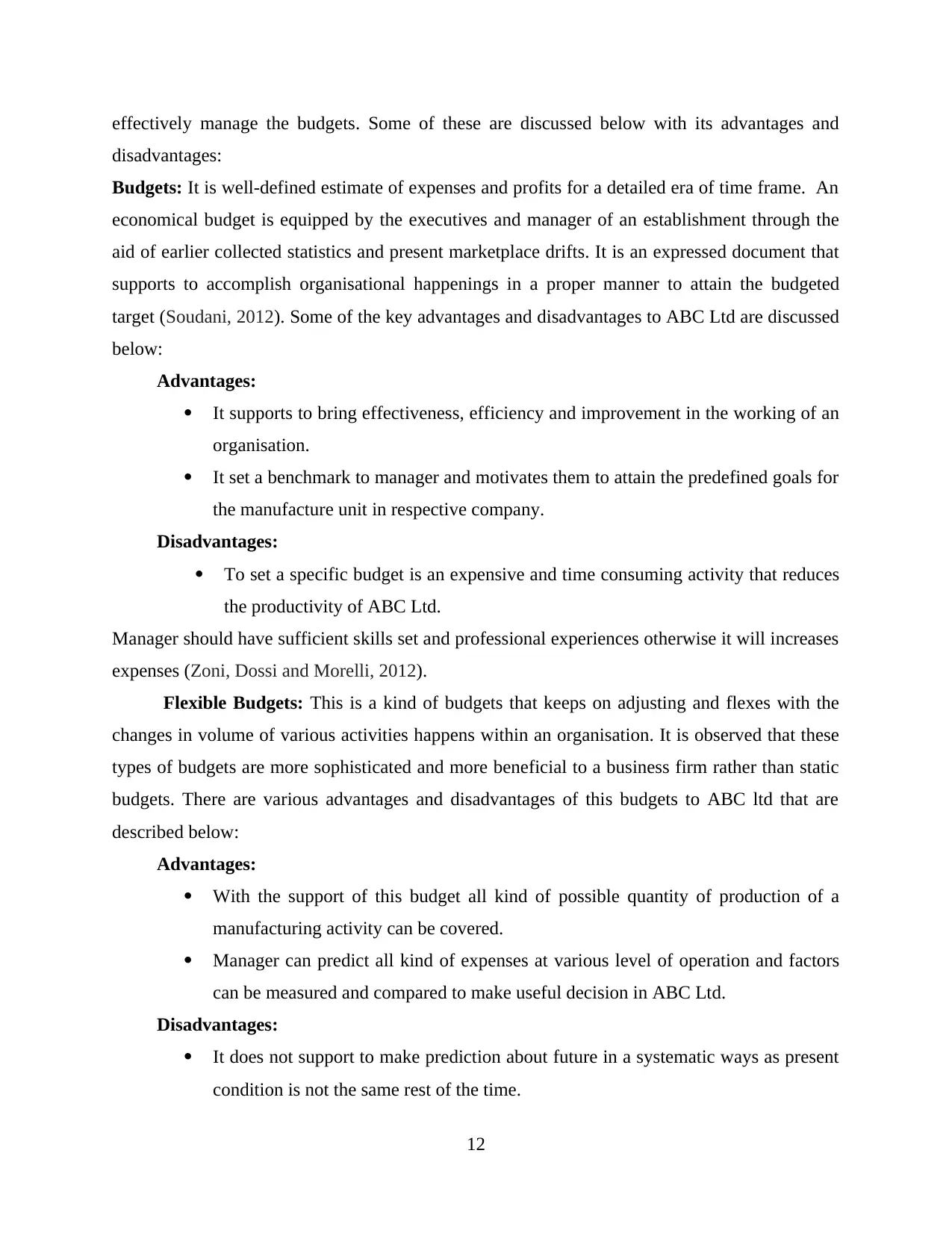

In present time, it is very important for an organisation to make proper use of planning tool

that help in improving the budgetary control process. Basically budgetary controlling process in

defined as the estimation of total expenses that can be incurred by companies in future time.

There are different types of planning tool that are used by management of ABC Ltd in order to

11

Cost of production

Direct Material 10 190000

Direct Labour 20 380000

Variable Overhead 5 95000

Fixed Overhead 35 665000

Opening inventory 0

Closing inventory -105000

Cost of sales 35 560000

Contribution 15 240000

Fixed overhead production -100000

Budgeted profit 140000

Financial Report

BUDGET ACTUAL

£ £

Fixed overhead charged to production cost 90000 95000

Under fixed overhead charged to profit or loss account 10000 5000

Fixed overhead charged in the month 100000 100000

Fixed overhead transferred through closing inventory to

next month February 10000 15000

Fixed overhead charged 90000 85000

TASK 3

Explain Advantage & disadvantage of different type of planning tools which is used for

budgetary control

In present time, it is very important for an organisation to make proper use of planning tool

that help in improving the budgetary control process. Basically budgetary controlling process in

defined as the estimation of total expenses that can be incurred by companies in future time.

There are different types of planning tool that are used by management of ABC Ltd in order to

11

effectively manage the budgets. Some of these are discussed below with its advantages and

disadvantages:

Budgets: It is well-defined estimate of expenses and profits for a detailed era of time frame. An

economical budget is equipped by the executives and manager of an establishment through the

aid of earlier collected statistics and present marketplace drifts. It is an expressed document that

supports to accomplish organisational happenings in a proper manner to attain the budgeted

target (Soudani, 2012). Some of the key advantages and disadvantages to ABC Ltd are discussed

below:

Advantages:

It supports to bring effectiveness, efficiency and improvement in the working of an

organisation.

It set a benchmark to manager and motivates them to attain the predefined goals for

the manufacture unit in respective company.

Disadvantages:

To set a specific budget is an expensive and time consuming activity that reduces

the productivity of ABC Ltd.

Manager should have sufficient skills set and professional experiences otherwise it will increases

expenses (Zoni, Dossi and Morelli, 2012).

Flexible Budgets: This is a kind of budgets that keeps on adjusting and flexes with the

changes in volume of various activities happens within an organisation. It is observed that these

types of budgets are more sophisticated and more beneficial to a business firm rather than static

budgets. There are various advantages and disadvantages of this budgets to ABC ltd that are

described below:

Advantages:

With the support of this budget all kind of possible quantity of production of a

manufacturing activity can be covered.

Manager can predict all kind of expenses at various level of operation and factors

can be measured and compared to make useful decision in ABC Ltd.

Disadvantages:

It does not support to make prediction about future in a systematic ways as present

condition is not the same rest of the time.

12

disadvantages:

Budgets: It is well-defined estimate of expenses and profits for a detailed era of time frame. An

economical budget is equipped by the executives and manager of an establishment through the

aid of earlier collected statistics and present marketplace drifts. It is an expressed document that

supports to accomplish organisational happenings in a proper manner to attain the budgeted

target (Soudani, 2012). Some of the key advantages and disadvantages to ABC Ltd are discussed

below:

Advantages:

It supports to bring effectiveness, efficiency and improvement in the working of an

organisation.

It set a benchmark to manager and motivates them to attain the predefined goals for

the manufacture unit in respective company.

Disadvantages:

To set a specific budget is an expensive and time consuming activity that reduces

the productivity of ABC Ltd.

Manager should have sufficient skills set and professional experiences otherwise it will increases

expenses (Zoni, Dossi and Morelli, 2012).

Flexible Budgets: This is a kind of budgets that keeps on adjusting and flexes with the

changes in volume of various activities happens within an organisation. It is observed that these

types of budgets are more sophisticated and more beneficial to a business firm rather than static

budgets. There are various advantages and disadvantages of this budgets to ABC ltd that are

described below:

Advantages:

With the support of this budget all kind of possible quantity of production of a

manufacturing activity can be covered.

Manager can predict all kind of expenses at various level of operation and factors

can be measured and compared to make useful decision in ABC Ltd.

Disadvantages:

It does not support to make prediction about future in a systematic ways as present

condition is not the same rest of the time.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.