Comprehensive Report on Management Accounting at ABC Ltd

VerifiedAdded on 2023/01/18

|18

|5050

|41

Report

AI Summary

This report provides a detailed analysis of management accounting practices at ABC Ltd, a medium-sized manufacturing firm. It covers the explanation of management accounting, different types of management accounting systems, and reporting methods used by the company. The report includes a discussion on cost accounting, inventory management, job costing, and price optimization systems, highlighting their benefits and how they are applied within ABC Ltd. Furthermore, it addresses the importance of reliable, up-to-date, and accurate financial information and the need for understandable presentation. The report also touches upon microeconomic techniques such as cost analysis, cost-volume-profit analysis, and flexible budgeting, and their role in management accounting. This document is available on Desklib, a platform providing various study tools and resources for students.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1............................................................................................................................................3

TASK 2............................................................................................................................................8

TASK 3..........................................................................................................................................13

TASK 4..........................................................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1............................................................................................................................................3

TASK 2............................................................................................................................................8

TASK 3..........................................................................................................................................13

TASK 4..........................................................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Management accounting is considered as the procedures of facilitating financial data as

well as resources to managers. It is also called the managerial accounting. Moreover, it is the

practices to find, measure, evaluate, interpretation and communicate financial data for pursuing

the objectives of company (Liff and Wahlstrom, 2018). This practices is essential as it acts as a

bridge among function of finance as well as another aspects of business. Management accounting

is related with methods of obtaining qualitative as well as quantitative data for producing internal

reports. It plays crucial role in respect of managing firm's inside activities and functions. As per

the given scenario, the chosen company for this report is ABC Ltd., which is a medium size

manufacturing firm. This report covers the explanation of management accounting, kinds of

management accounting system and reports, computation of income statement using costing

techniques, benefits as well as drawbacks of several forms of planning tools that is utilised for

budgetary control. Apart from this, identification of financial problems and how management

accounting system responds to that issues are also discussed in this report.

MAIN BODY

TASK 1

Management accounting- It is an accounting system that is aligned in the process of gathering

monetary and non monetary data with an aim of producing internal reports of various aspects

(Fleischman and Parker, 2017). On the basis of these reports, managers of companies take

corrective action for success of business entities.

Definition of MA-

According to CIMA (charted institute of management accountants), “The term MA is a

systematic process of finding, evaluating, accrediting, analysing, preparing and interpreting of

information needed by management to plan and control in a business entity.”

Management accounting system (MAS)- The term MAS can be defined as a kind of system that

a business entity uses in order to measure and assess process for management. These systems are

linked with various aspects of companies in order to better management.

Management accounting is considered as the procedures of facilitating financial data as

well as resources to managers. It is also called the managerial accounting. Moreover, it is the

practices to find, measure, evaluate, interpretation and communicate financial data for pursuing

the objectives of company (Liff and Wahlstrom, 2018). This practices is essential as it acts as a

bridge among function of finance as well as another aspects of business. Management accounting

is related with methods of obtaining qualitative as well as quantitative data for producing internal

reports. It plays crucial role in respect of managing firm's inside activities and functions. As per

the given scenario, the chosen company for this report is ABC Ltd., which is a medium size

manufacturing firm. This report covers the explanation of management accounting, kinds of

management accounting system and reports, computation of income statement using costing

techniques, benefits as well as drawbacks of several forms of planning tools that is utilised for

budgetary control. Apart from this, identification of financial problems and how management

accounting system responds to that issues are also discussed in this report.

MAIN BODY

TASK 1

Management accounting- It is an accounting system that is aligned in the process of gathering

monetary and non monetary data with an aim of producing internal reports of various aspects

(Fleischman and Parker, 2017). On the basis of these reports, managers of companies take

corrective action for success of business entities.

Definition of MA-

According to CIMA (charted institute of management accountants), “The term MA is a

systematic process of finding, evaluating, accrediting, analysing, preparing and interpreting of

information needed by management to plan and control in a business entity.”

Management accounting system (MAS)- The term MAS can be defined as a kind of system that

a business entity uses in order to measure and assess process for management. These systems are

linked with various aspects of companies in order to better management.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Importance to integrate accounting systems within a business entity:

There are vital range of accounting systems that are aligned with various activities of

business. Basically, this is crucial for business entities to apply a suitable accounting system with

different kind of departments. Such as in the aspect of chosen business entity, ABC limited their

manufacturing department is linked with inventory management system in order to better

utilisation of available raw material.

Origin, role and principle of MA:

Origin- The origin of MA can be traced since last 300 years when it was firstly used during time

of industrial revolution (Kerr, Rouse and de Villiers, 2015). This accounting was evolved after

the evaluation of financial accounting. Though, in current time period this accounting is not

compulsory for business entities to apply.

Role of MA- This accounting is very useful for companies in the aspect of vital range of

department. It has below mentioned roles that are as follows:

Beneficial in planning- It is essential for all types of businesses to make effective plan for

futuristic activities. In this aspect, MA plays a key role by providing key information

regards to business transactions which are acquired by managers. In the above ABC

limited company, their managers make effective planning by help of this accounting.

Beneficial in controlling- Along with the above mentioned benefit, another role of this

accounting is to control various kind of activities in an effective manner. Such as in ABC

limited company, they control their different operations of manufacturing by help of this

accounting.

Beneficial for decision making- As well as the MA is useful for companies' managers in

order to take corrective decisions. It becomes possible by providing detailed information

regards to different elements of business (Cooper, 2017). The managers of ABC limited

take accurate decision by help of this accounting.

Principles of MA:

There are vital range of accounting systems that are aligned with various activities of

business. Basically, this is crucial for business entities to apply a suitable accounting system with

different kind of departments. Such as in the aspect of chosen business entity, ABC limited their

manufacturing department is linked with inventory management system in order to better

utilisation of available raw material.

Origin, role and principle of MA:

Origin- The origin of MA can be traced since last 300 years when it was firstly used during time

of industrial revolution (Kerr, Rouse and de Villiers, 2015). This accounting was evolved after

the evaluation of financial accounting. Though, in current time period this accounting is not

compulsory for business entities to apply.

Role of MA- This accounting is very useful for companies in the aspect of vital range of

department. It has below mentioned roles that are as follows:

Beneficial in planning- It is essential for all types of businesses to make effective plan for

futuristic activities. In this aspect, MA plays a key role by providing key information

regards to business transactions which are acquired by managers. In the above ABC

limited company, their managers make effective planning by help of this accounting.

Beneficial in controlling- Along with the above mentioned benefit, another role of this

accounting is to control various kind of activities in an effective manner. Such as in ABC

limited company, they control their different operations of manufacturing by help of this

accounting.

Beneficial for decision making- As well as the MA is useful for companies' managers in

order to take corrective decisions. It becomes possible by providing detailed information

regards to different elements of business (Cooper, 2017). The managers of ABC limited

take accurate decision by help of this accounting.

Principles of MA:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Influence- It is a kind of principle of MA which defines that communication provides

insight of business entities. In broad manner, the MA is useful for communicating

information about monetary and non monetary aspects.

Relevance- As per this principle, the information that is provided by MA should be

relevant to transactions of business entities.

Value- This principle states that MA is useful for analysing impact on value. It is so

because each segment of information of this accounting play an important role for

business entities.

Credibility- Stewardship formulates credibility that plays an important role in process of

making decisions lot more purposeful (Morillo et.al 2015).

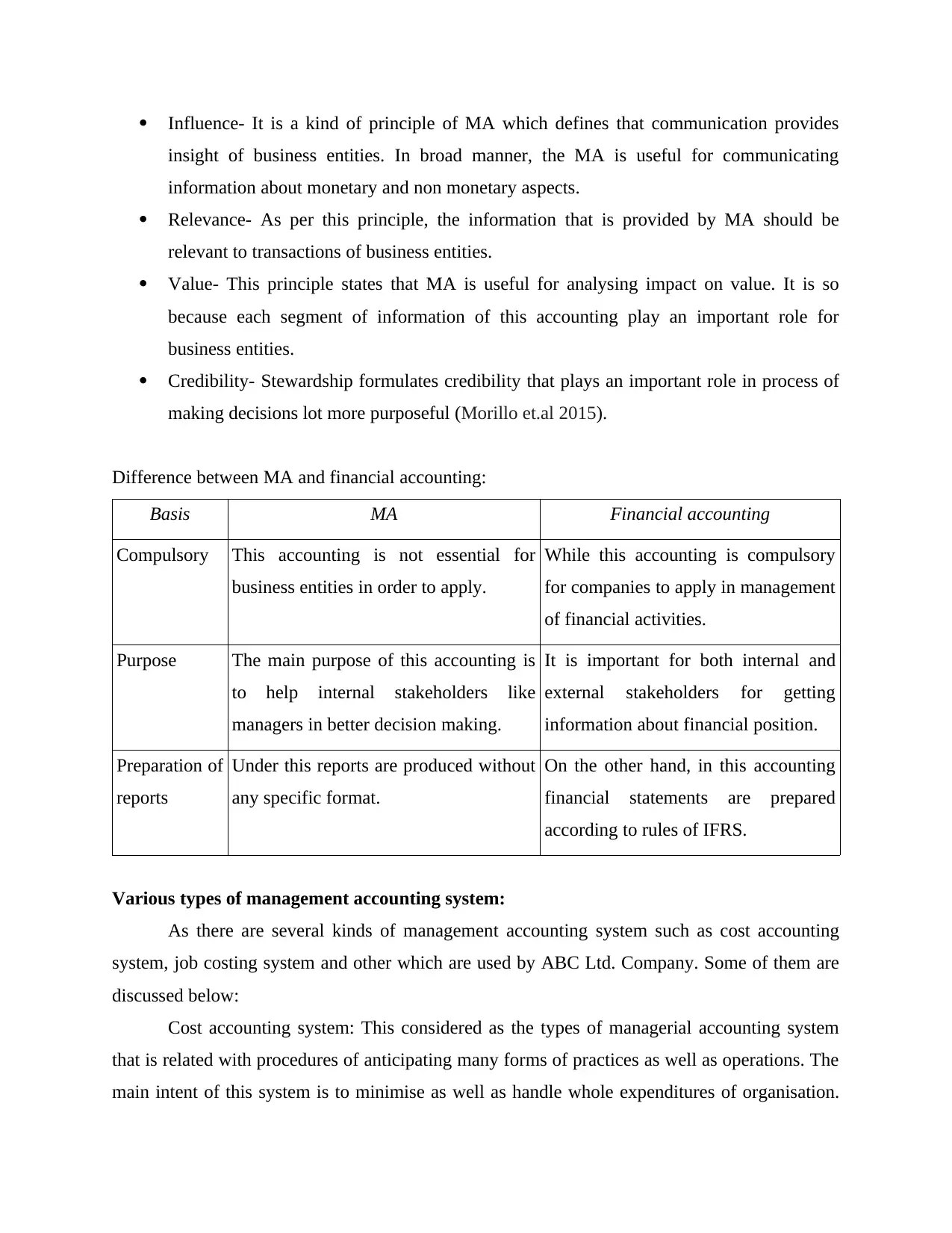

Difference between MA and financial accounting:

Basis MA Financial accounting

Compulsory This accounting is not essential for

business entities in order to apply.

While this accounting is compulsory

for companies to apply in management

of financial activities.

Purpose The main purpose of this accounting is

to help internal stakeholders like

managers in better decision making.

It is important for both internal and

external stakeholders for getting

information about financial position.

Preparation of

reports

Under this reports are produced without

any specific format.

On the other hand, in this accounting

financial statements are prepared

according to rules of IFRS.

Various types of management accounting system:

As there are several kinds of management accounting system such as cost accounting

system, job costing system and other which are used by ABC Ltd. Company. Some of them are

discussed below:

Cost accounting system: This considered as the types of managerial accounting system

that is related with procedures of anticipating many forms of practices as well as operations. The

main intent of this system is to minimise as well as handle whole expenditures of organisation.

insight of business entities. In broad manner, the MA is useful for communicating

information about monetary and non monetary aspects.

Relevance- As per this principle, the information that is provided by MA should be

relevant to transactions of business entities.

Value- This principle states that MA is useful for analysing impact on value. It is so

because each segment of information of this accounting play an important role for

business entities.

Credibility- Stewardship formulates credibility that plays an important role in process of

making decisions lot more purposeful (Morillo et.al 2015).

Difference between MA and financial accounting:

Basis MA Financial accounting

Compulsory This accounting is not essential for

business entities in order to apply.

While this accounting is compulsory

for companies to apply in management

of financial activities.

Purpose The main purpose of this accounting is

to help internal stakeholders like

managers in better decision making.

It is important for both internal and

external stakeholders for getting

information about financial position.

Preparation of

reports

Under this reports are produced without

any specific format.

On the other hand, in this accounting

financial statements are prepared

according to rules of IFRS.

Various types of management accounting system:

As there are several kinds of management accounting system such as cost accounting

system, job costing system and other which are used by ABC Ltd. Company. Some of them are

discussed below:

Cost accounting system: This considered as the types of managerial accounting system

that is related with procedures of anticipating many forms of practices as well as operations. The

main intent of this system is to minimise as well as handle whole expenditures of organisation.

Moreover, it is crucially required through firms for delegating financial resources into its

operations according to the anticipated expenditures of several activities. Therefore, ABC ltd.

can utilise cost accounting system as it assist their manager to approximate the product cost for

analysing profit, valuation of inventory and cost control.

Inventory management system: This is defined as the aggregation of two activities that

are observing as well as maintenance of stored stock into storage warehouse (Monden, 2019).

The storage things may be the raw material, assets and many others. This is crucially required

within firms through production departments in order to develop effectual decisions related to

manufacturing. Therefore, it is utilised by ABC Ltd. as inventory management system assists its

manager in managing several stock items, keeping records of all stocks and others which

enhance their potential and profitability in effective and efficient manner.

Job costing system: This is considered as the forms of managerial accounting system that

is linked with finding revenue as well as expenses through every task which is delegated to

several practices. It is mostly utilised in that kinds of organisation in which manufactured goods

portfolio is bigger. So, with the help of this particular system manufacturing division can get

knowledge regarding every single unit that re manufactured. Mainly, the main benefits of this

particular system is that this enables managers in computing profit upon specific jobs which

delegates upon many enterprise practices. Therefore, the ABC Ltd. can utilise job costing system

to know about the cost of single job that is included into several practices.

Price optimisation system- As name assists, it is a kinds of accounting system that is

involved in detailed systematic procedure of identification of customers' requirement about

products' price and its utility (Brustbauer, 2016). By this accounting system companies become

able to get a vital range of data about market trend and customers demand. Basically, this

accounting system is essentially required by companies in order to make modification in prices

of products and services. On the basis of it, price of products and services are set by businesses.

In the aspect of above chosen business entity ABC limited their sales department makes changes

in strategies regards to pricing as accordance of customers' demand.

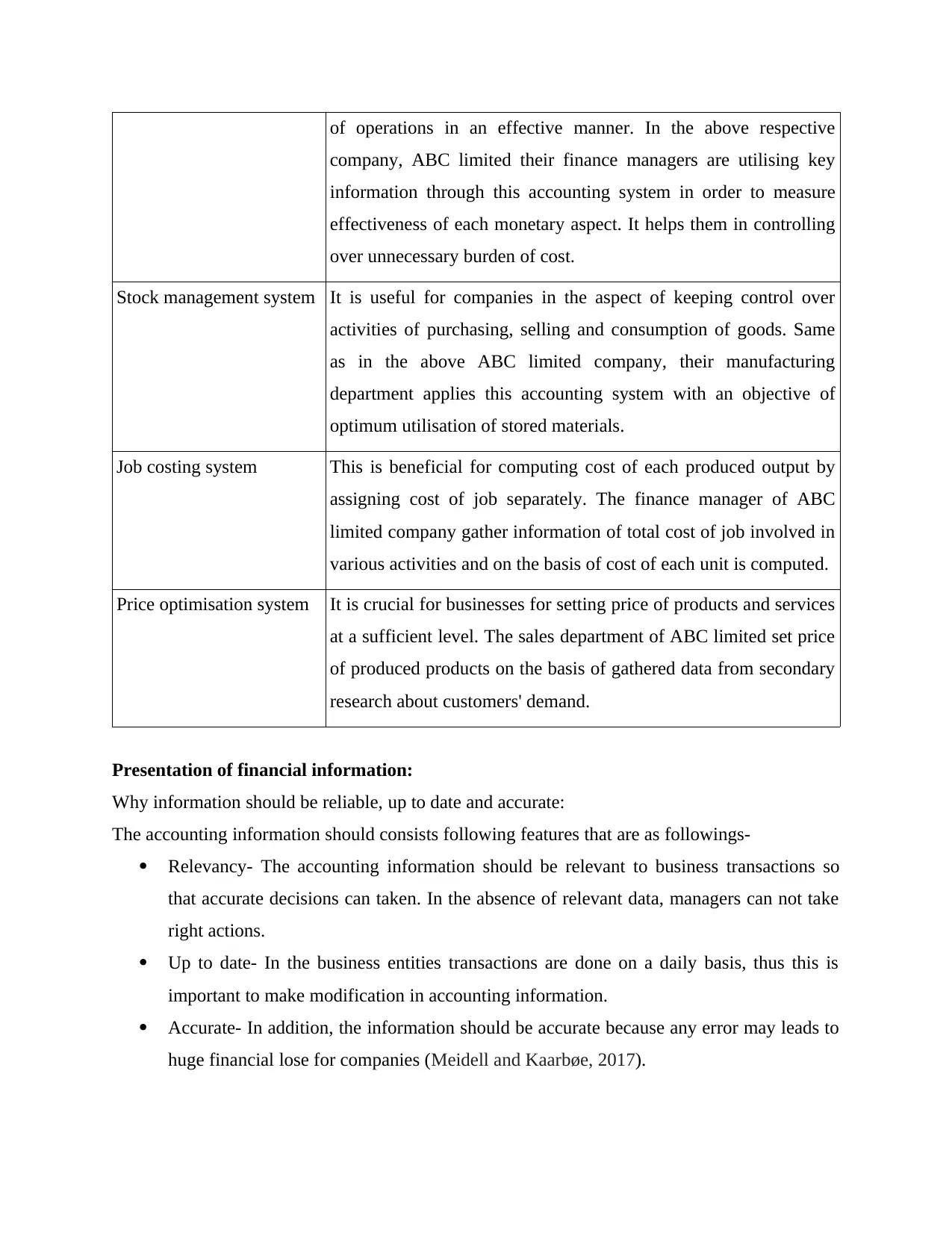

Benefits of various kinds of systems:

Name of accounting system Benefits

Cost accounting system This is useful for companies in order to prevent unwanted expenses

operations according to the anticipated expenditures of several activities. Therefore, ABC ltd.

can utilise cost accounting system as it assist their manager to approximate the product cost for

analysing profit, valuation of inventory and cost control.

Inventory management system: This is defined as the aggregation of two activities that

are observing as well as maintenance of stored stock into storage warehouse (Monden, 2019).

The storage things may be the raw material, assets and many others. This is crucially required

within firms through production departments in order to develop effectual decisions related to

manufacturing. Therefore, it is utilised by ABC Ltd. as inventory management system assists its

manager in managing several stock items, keeping records of all stocks and others which

enhance their potential and profitability in effective and efficient manner.

Job costing system: This is considered as the forms of managerial accounting system that

is linked with finding revenue as well as expenses through every task which is delegated to

several practices. It is mostly utilised in that kinds of organisation in which manufactured goods

portfolio is bigger. So, with the help of this particular system manufacturing division can get

knowledge regarding every single unit that re manufactured. Mainly, the main benefits of this

particular system is that this enables managers in computing profit upon specific jobs which

delegates upon many enterprise practices. Therefore, the ABC Ltd. can utilise job costing system

to know about the cost of single job that is included into several practices.

Price optimisation system- As name assists, it is a kinds of accounting system that is

involved in detailed systematic procedure of identification of customers' requirement about

products' price and its utility (Brustbauer, 2016). By this accounting system companies become

able to get a vital range of data about market trend and customers demand. Basically, this

accounting system is essentially required by companies in order to make modification in prices

of products and services. On the basis of it, price of products and services are set by businesses.

In the aspect of above chosen business entity ABC limited their sales department makes changes

in strategies regards to pricing as accordance of customers' demand.

Benefits of various kinds of systems:

Name of accounting system Benefits

Cost accounting system This is useful for companies in order to prevent unwanted expenses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of operations in an effective manner. In the above respective

company, ABC limited their finance managers are utilising key

information through this accounting system in order to measure

effectiveness of each monetary aspect. It helps them in controlling

over unnecessary burden of cost.

Stock management system It is useful for companies in the aspect of keeping control over

activities of purchasing, selling and consumption of goods. Same

as in the above ABC limited company, their manufacturing

department applies this accounting system with an objective of

optimum utilisation of stored materials.

Job costing system This is beneficial for computing cost of each produced output by

assigning cost of job separately. The finance manager of ABC

limited company gather information of total cost of job involved in

various activities and on the basis of cost of each unit is computed.

Price optimisation system It is crucial for businesses for setting price of products and services

at a sufficient level. The sales department of ABC limited set price

of produced products on the basis of gathered data from secondary

research about customers' demand.

Presentation of financial information:

Why information should be reliable, up to date and accurate:

The accounting information should consists following features that are as followings-

Relevancy- The accounting information should be relevant to business transactions so

that accurate decisions can taken. In the absence of relevant data, managers can not take

right actions.

Up to date- In the business entities transactions are done on a daily basis, thus this is

important to make modification in accounting information.

Accurate- In addition, the information should be accurate because any error may leads to

huge financial lose for companies (Meidell and Kaarbøe, 2017).

company, ABC limited their finance managers are utilising key

information through this accounting system in order to measure

effectiveness of each monetary aspect. It helps them in controlling

over unnecessary burden of cost.

Stock management system It is useful for companies in the aspect of keeping control over

activities of purchasing, selling and consumption of goods. Same

as in the above ABC limited company, their manufacturing

department applies this accounting system with an objective of

optimum utilisation of stored materials.

Job costing system This is beneficial for computing cost of each produced output by

assigning cost of job separately. The finance manager of ABC

limited company gather information of total cost of job involved in

various activities and on the basis of cost of each unit is computed.

Price optimisation system It is crucial for businesses for setting price of products and services

at a sufficient level. The sales department of ABC limited set price

of produced products on the basis of gathered data from secondary

research about customers' demand.

Presentation of financial information:

Why information should be reliable, up to date and accurate:

The accounting information should consists following features that are as followings-

Relevancy- The accounting information should be relevant to business transactions so

that accurate decisions can taken. In the absence of relevant data, managers can not take

right actions.

Up to date- In the business entities transactions are done on a daily basis, thus this is

important to make modification in accounting information.

Accurate- In addition, the information should be accurate because any error may leads to

huge financial lose for companies (Meidell and Kaarbøe, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Why the way in which the information is presented must be understandable:

The way in which information presented should be understandable because this

information is utilised by different stakeholders of businesses. Such as the managers take critical

decisions on the basis of this accounting information and if it will not understandable to them

then they will not be able to take correct action.

Various kind of managerial accounting report:

MA reports are kind of reports that are produced by accountants in order to detailing

information of various elements of financial & non financial terms. There are some kinds of

reports such as:

Budget report- It is a report that is contains detailed information regards to projected

amount of income & expenditures as well as value of variation that occurs by making

comparison with actual outcome. On the basis of it, managers take further step in order to

operate different kind of activities. Such as in the ABC limited company, their managers

utilise key information through this report and take right decisions.

Performance report- This is a kind of report that is produced by accountant containing

information about each employees and activities performance. The purpose of this report

is to helping managers so that they can take decision about growth and progress of their

employees. In the above company, their managers take corrective actions about

promotion of their employees.

Cost report- It is a report which consists information about estimated and actual

expenditures (Tucker and Leach, 2017). Along with data about variation in cost is also

mentioned under this report. The purpose of this report is to helping finance department

in order to analyse about evaluation of each activities' cost. In the ABC limited company,

their managers take corrective action about overall expenditures.

TASK 2

Micro economics techniques:

The way in which information presented should be understandable because this

information is utilised by different stakeholders of businesses. Such as the managers take critical

decisions on the basis of this accounting information and if it will not understandable to them

then they will not be able to take correct action.

Various kind of managerial accounting report:

MA reports are kind of reports that are produced by accountants in order to detailing

information of various elements of financial & non financial terms. There are some kinds of

reports such as:

Budget report- It is a report that is contains detailed information regards to projected

amount of income & expenditures as well as value of variation that occurs by making

comparison with actual outcome. On the basis of it, managers take further step in order to

operate different kind of activities. Such as in the ABC limited company, their managers

utilise key information through this report and take right decisions.

Performance report- This is a kind of report that is produced by accountant containing

information about each employees and activities performance. The purpose of this report

is to helping managers so that they can take decision about growth and progress of their

employees. In the above company, their managers take corrective actions about

promotion of their employees.

Cost report- It is a report which consists information about estimated and actual

expenditures (Tucker and Leach, 2017). Along with data about variation in cost is also

mentioned under this report. The purpose of this report is to helping finance department

in order to analyse about evaluation of each activities' cost. In the ABC limited company,

their managers take corrective action about overall expenditures.

TASK 2

Micro economics techniques:

Cost- It can be defined as value of money that occurs in process of producing any commodity or

delivering services. There are different kind of costs such as fixed cost, variable cost, direct-

indirect cost etc.

Cost analysis- It can be defined as a process through which actual occurred expenditures are

measured in a systematic manner.

Cost volume profit analysis- It is a kind of analysis that is being used for assessing how changes

in cost and volume can effect companies' incomes.

Flexible budgeting- This is a type of budgeting that has nature of change as volume or cost

fluctuate.

Cost variances- This has been defined as difference between actual occurred cost and estimated

cost (Cowton, 2018). If actual cost is less then estimated then it will be favourable condition. On

the other hand, if actual cost is more then this will be considered as adverse condition.

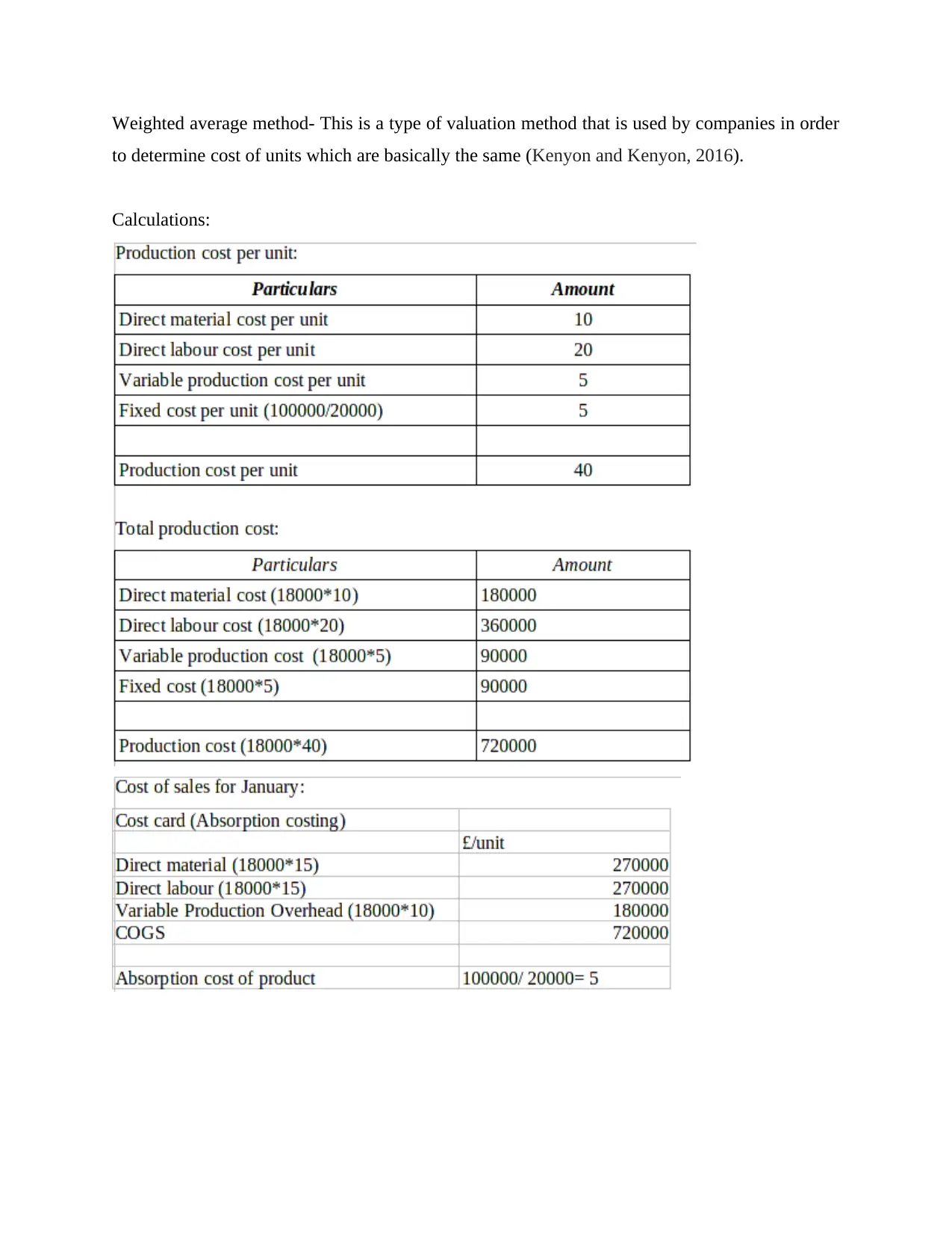

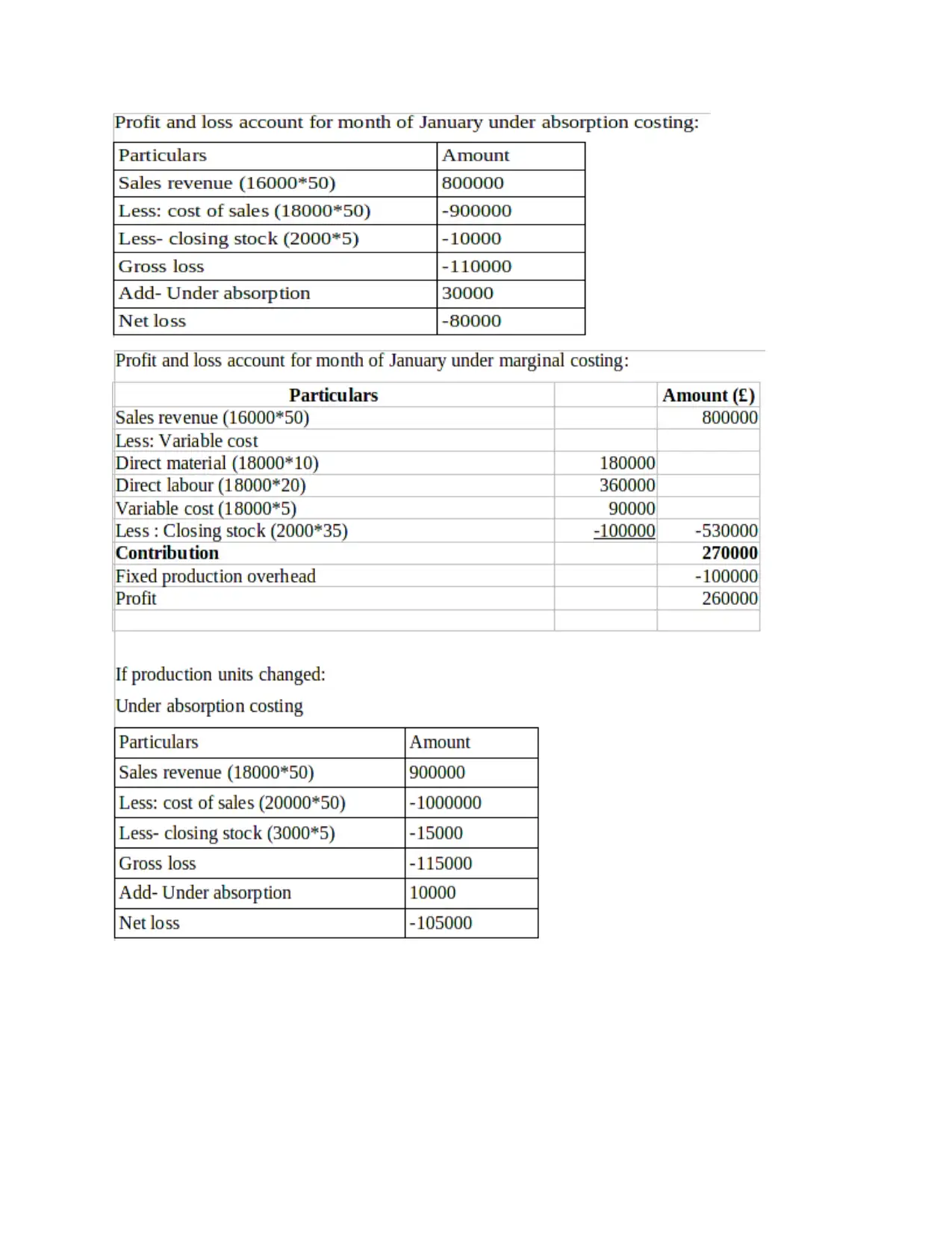

Absorption costing- This is a type of costing in which cost of a product is calculated by taking

fixed and variable cost fully absorbed.

Marginal costing- It is a kind of costing technique in that variable cost is charged to unit cost and

fixed cost to period cost. This is being used for preparation of income statements by accountants.

Product costing:

Fixed cost- It is a kind of cost that remain constant whether quantity of produced units

increase or decrease.

Variable cost- This cost is different from above mentioned fixed cost. It is a type of cost

that changes in proportion to change in quantity of production.

Cost allocation- This can be defined as a kind of systematic process that is related with

process of identifying, aggregating and allocating costs to particular objective.

Normal costing- It can be defined as a kind of cost that is occurred in actual in the

process of completing different types of activities and operations.

Standard costing- It is a type of cost that is estimated not occurred in actual. The

projection of this cost is done as accordance to last years' accounting informations.

Activity based costing- This is a type of costing in that different activities are identified

in order to assign cost to each activity regards to production and services (Mahmoudi

et.al, 2017).

delivering services. There are different kind of costs such as fixed cost, variable cost, direct-

indirect cost etc.

Cost analysis- It can be defined as a process through which actual occurred expenditures are

measured in a systematic manner.

Cost volume profit analysis- It is a kind of analysis that is being used for assessing how changes

in cost and volume can effect companies' incomes.

Flexible budgeting- This is a type of budgeting that has nature of change as volume or cost

fluctuate.

Cost variances- This has been defined as difference between actual occurred cost and estimated

cost (Cowton, 2018). If actual cost is less then estimated then it will be favourable condition. On

the other hand, if actual cost is more then this will be considered as adverse condition.

Absorption costing- This is a type of costing in which cost of a product is calculated by taking

fixed and variable cost fully absorbed.

Marginal costing- It is a kind of costing technique in that variable cost is charged to unit cost and

fixed cost to period cost. This is being used for preparation of income statements by accountants.

Product costing:

Fixed cost- It is a kind of cost that remain constant whether quantity of produced units

increase or decrease.

Variable cost- This cost is different from above mentioned fixed cost. It is a type of cost

that changes in proportion to change in quantity of production.

Cost allocation- This can be defined as a kind of systematic process that is related with

process of identifying, aggregating and allocating costs to particular objective.

Normal costing- It can be defined as a kind of cost that is occurred in actual in the

process of completing different types of activities and operations.

Standard costing- It is a type of cost that is estimated not occurred in actual. The

projection of this cost is done as accordance to last years' accounting informations.

Activity based costing- This is a type of costing in that different activities are identified

in order to assign cost to each activity regards to production and services (Mahmoudi

et.al, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

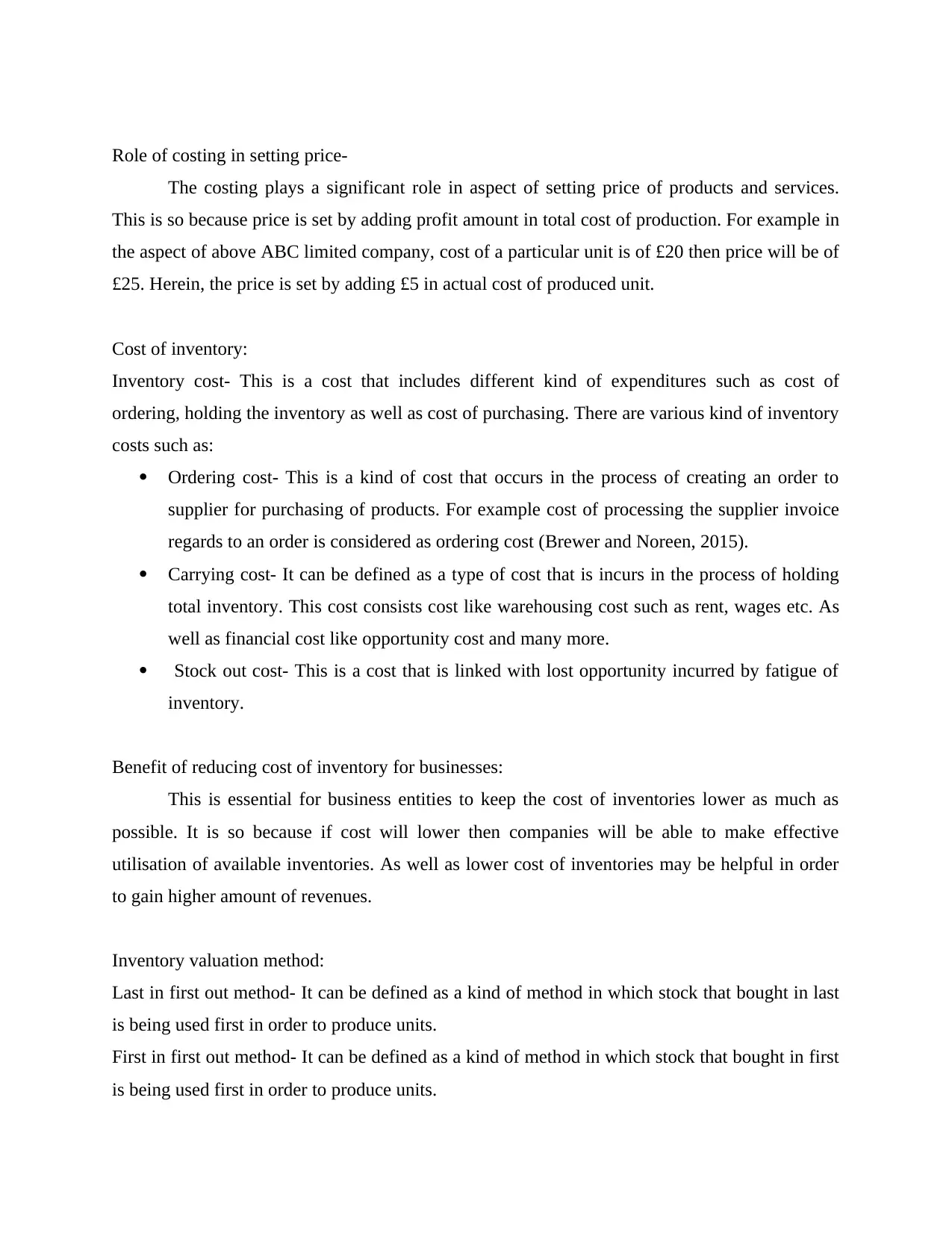

Role of costing in setting price-

The costing plays a significant role in aspect of setting price of products and services.

This is so because price is set by adding profit amount in total cost of production. For example in

the aspect of above ABC limited company, cost of a particular unit is of £20 then price will be of

£25. Herein, the price is set by adding £5 in actual cost of produced unit.

Cost of inventory:

Inventory cost- This is a cost that includes different kind of expenditures such as cost of

ordering, holding the inventory as well as cost of purchasing. There are various kind of inventory

costs such as:

Ordering cost- This is a kind of cost that occurs in the process of creating an order to

supplier for purchasing of products. For example cost of processing the supplier invoice

regards to an order is considered as ordering cost (Brewer and Noreen, 2015).

Carrying cost- It can be defined as a type of cost that is incurs in the process of holding

total inventory. This cost consists cost like warehousing cost such as rent, wages etc. As

well as financial cost like opportunity cost and many more.

Stock out cost- This is a cost that is linked with lost opportunity incurred by fatigue of

inventory.

Benefit of reducing cost of inventory for businesses:

This is essential for business entities to keep the cost of inventories lower as much as

possible. It is so because if cost will lower then companies will be able to make effective

utilisation of available inventories. As well as lower cost of inventories may be helpful in order

to gain higher amount of revenues.

Inventory valuation method:

Last in first out method- It can be defined as a kind of method in which stock that bought in last

is being used first in order to produce units.

First in first out method- It can be defined as a kind of method in which stock that bought in first

is being used first in order to produce units.

The costing plays a significant role in aspect of setting price of products and services.

This is so because price is set by adding profit amount in total cost of production. For example in

the aspect of above ABC limited company, cost of a particular unit is of £20 then price will be of

£25. Herein, the price is set by adding £5 in actual cost of produced unit.

Cost of inventory:

Inventory cost- This is a cost that includes different kind of expenditures such as cost of

ordering, holding the inventory as well as cost of purchasing. There are various kind of inventory

costs such as:

Ordering cost- This is a kind of cost that occurs in the process of creating an order to

supplier for purchasing of products. For example cost of processing the supplier invoice

regards to an order is considered as ordering cost (Brewer and Noreen, 2015).

Carrying cost- It can be defined as a type of cost that is incurs in the process of holding

total inventory. This cost consists cost like warehousing cost such as rent, wages etc. As

well as financial cost like opportunity cost and many more.

Stock out cost- This is a cost that is linked with lost opportunity incurred by fatigue of

inventory.

Benefit of reducing cost of inventory for businesses:

This is essential for business entities to keep the cost of inventories lower as much as

possible. It is so because if cost will lower then companies will be able to make effective

utilisation of available inventories. As well as lower cost of inventories may be helpful in order

to gain higher amount of revenues.

Inventory valuation method:

Last in first out method- It can be defined as a kind of method in which stock that bought in last

is being used first in order to produce units.

First in first out method- It can be defined as a kind of method in which stock that bought in first

is being used first in order to produce units.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Weighted average method- This is a type of valuation method that is used by companies in order

to determine cost of units which are basically the same (Kenyon and Kenyon, 2016).

Calculations:

to determine cost of units which are basically the same (Kenyon and Kenyon, 2016).

Calculations:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.