Management Accounting Report: Cost Analysis and Financial Statements

VerifiedAdded on 2022/12/29

|19

|4264

|25

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on cost analysis and financial statement preparation. It begins by defining management accounting and its essential requirements, contrasting it with financial accounting, and exploring different types of management accounting systems like cost accounting and inventory management. The report then delves into various management accounting reporting methods, including budget reports, job cost reports, and performance reports. Furthermore, it demonstrates cost calculation using marginal and absorption costing techniques to prepare income statements, along with break-even analysis and variance analysis. The report includes detailed calculations, income statements, and a break-even graph, providing a thorough understanding of the practical application of management accounting principles. This report is a valuable resource for students and professionals seeking to understand the core concepts and techniques used in management accounting.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Management Accounting is the finance division that refers to the application of technical

qualifications, expertise, instruments and procedures to help compose statements that aid

management in measuring its results and promote the development of plans and tactics with both

the financial available information. It concentrates on the optimal use and protecting of limited

resources, operating excellence and efficiency, important and strategic choice processes,

resulting in high returns and trying to make investors happy and proud. The recipients of these

financial documents are merely the organization's central management team. These forms of

knowledge contain both financial and non-financial variables. This data has a huge effect on the

corporate processes that are overlooked in the other financial reports. It helps management to

define main issues of concern that support the management team in taking corrective action to

address these challenges and increase operating performance. Management accounting, in the

sense of the Institute of Cost Management Accounting, London, corresponds to the application

of accounting information in relation to professional expertise in a manner that permits the

management of the organization in strategy formulation, management and control as well as in

the formulation of policies (ICMA). In addition, according to the International Accounting

Standards board (AAA), it is the method and concept required for a successful development

process that helps the organization in selecting the best option after assessment, then trying to

control and interpreting its outcomes.

This study related to Link Catering Services' situation. Created in 1989 by John Herring, this is

one of the best labels in the UK and has its headquarters in Oxford shire. This article addresses

the principle of accounting for management, its aspects and numerous publications prepared in

conjunction with reporting for management. Cost estimation with multiple approaches, benefits

and drawbacks of financial instruments and the contrast between two organizations in terms of

the methodology they use to address financial problems.

Management Accounting is the finance division that refers to the application of technical

qualifications, expertise, instruments and procedures to help compose statements that aid

management in measuring its results and promote the development of plans and tactics with both

the financial available information. It concentrates on the optimal use and protecting of limited

resources, operating excellence and efficiency, important and strategic choice processes,

resulting in high returns and trying to make investors happy and proud. The recipients of these

financial documents are merely the organization's central management team. These forms of

knowledge contain both financial and non-financial variables. This data has a huge effect on the

corporate processes that are overlooked in the other financial reports. It helps management to

define main issues of concern that support the management team in taking corrective action to

address these challenges and increase operating performance. Management accounting, in the

sense of the Institute of Cost Management Accounting, London, corresponds to the application

of accounting information in relation to professional expertise in a manner that permits the

management of the organization in strategy formulation, management and control as well as in

the formulation of policies (ICMA). In addition, according to the International Accounting

Standards board (AAA), it is the method and concept required for a successful development

process that helps the organization in selecting the best option after assessment, then trying to

control and interpreting its outcomes.

This study related to Link Catering Services' situation. Created in 1989 by John Herring, this is

one of the best labels in the UK and has its headquarters in Oxford shire. This article addresses

the principle of accounting for management, its aspects and numerous publications prepared in

conjunction with reporting for management. Cost estimation with multiple approaches, benefits

and drawbacks of financial instruments and the contrast between two organizations in terms of

the methodology they use to address financial problems.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

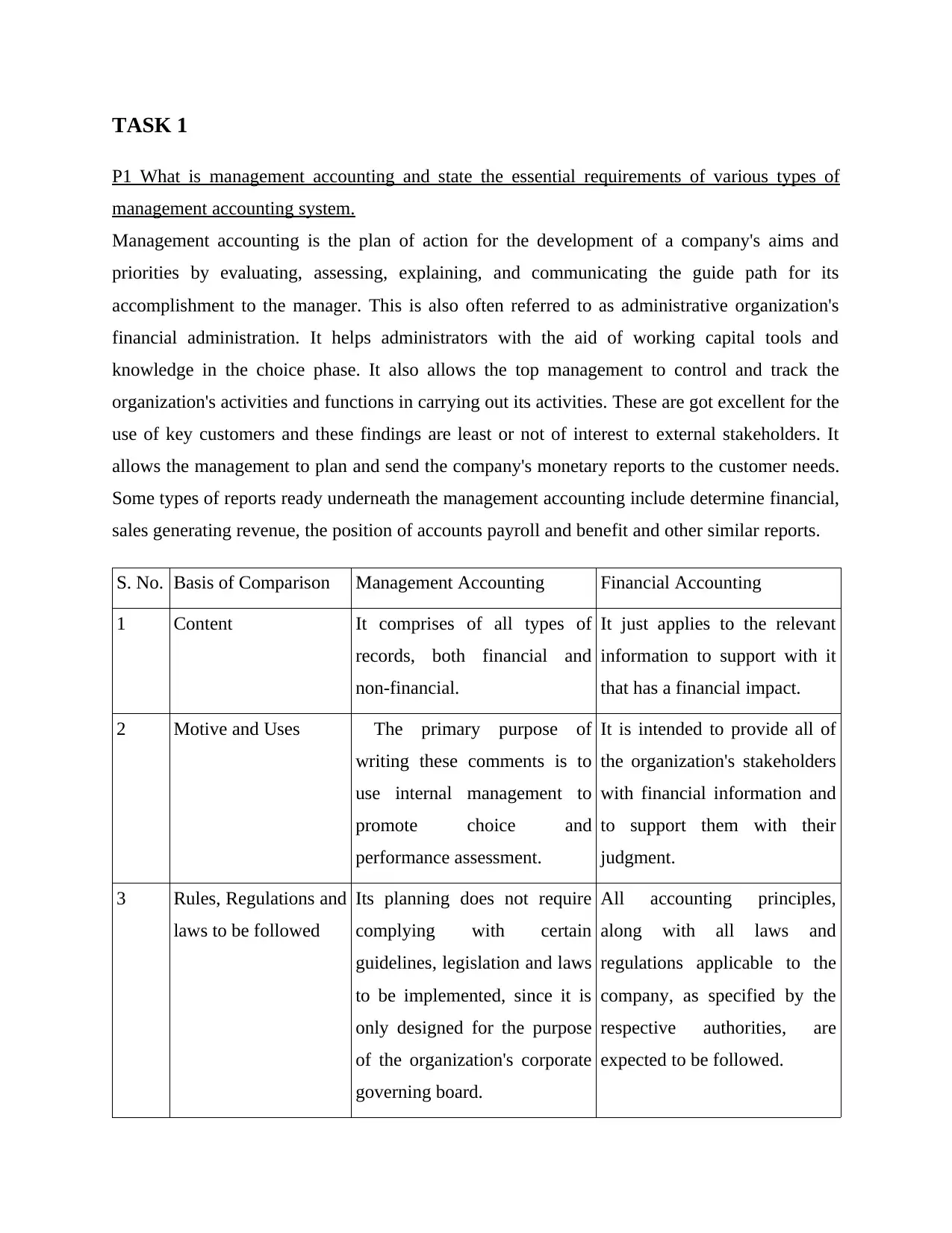

TASK 1

P1 What is management accounting and state the essential requirements of various types of

management accounting system.

Management accounting is the plan of action for the development of a company's aims and

priorities by evaluating, assessing, explaining, and communicating the guide path for its

accomplishment to the manager. This is also often referred to as administrative organization's

financial administration. It helps administrators with the aid of working capital tools and

knowledge in the choice phase. It also allows the top management to control and track the

organization's activities and functions in carrying out its activities. These are got excellent for the

use of key customers and these findings are least or not of interest to external stakeholders. It

allows the management to plan and send the company's monetary reports to the customer needs.

Some types of reports ready underneath the management accounting include determine financial,

sales generating revenue, the position of accounts payroll and benefit and other similar reports.

S. No. Basis of Comparison Management Accounting Financial Accounting

1 Content It comprises of all types of

records, both financial and

non-financial.

It just applies to the relevant

information to support with it

that has a financial impact.

2 Motive and Uses The primary purpose of

writing these comments is to

use internal management to

promote choice and

performance assessment.

It is intended to provide all of

the organization's stakeholders

with financial information and

to support them with their

judgment.

3 Rules, Regulations and

laws to be followed

Its planning does not require

complying with certain

guidelines, legislation and laws

to be implemented, since it is

only designed for the purpose

of the organization's corporate

governing board.

All accounting principles,

along with all laws and

regulations applicable to the

company, as specified by the

respective authorities, are

expected to be followed.

P1 What is management accounting and state the essential requirements of various types of

management accounting system.

Management accounting is the plan of action for the development of a company's aims and

priorities by evaluating, assessing, explaining, and communicating the guide path for its

accomplishment to the manager. This is also often referred to as administrative organization's

financial administration. It helps administrators with the aid of working capital tools and

knowledge in the choice phase. It also allows the top management to control and track the

organization's activities and functions in carrying out its activities. These are got excellent for the

use of key customers and these findings are least or not of interest to external stakeholders. It

allows the management to plan and send the company's monetary reports to the customer needs.

Some types of reports ready underneath the management accounting include determine financial,

sales generating revenue, the position of accounts payroll and benefit and other similar reports.

S. No. Basis of Comparison Management Accounting Financial Accounting

1 Content It comprises of all types of

records, both financial and

non-financial.

It just applies to the relevant

information to support with it

that has a financial impact.

2 Motive and Uses The primary purpose of

writing these comments is to

use internal management to

promote choice and

performance assessment.

It is intended to provide all of

the organization's stakeholders

with financial information and

to support them with their

judgment.

3 Rules, Regulations and

laws to be followed

Its planning does not require

complying with certain

guidelines, legislation and laws

to be implemented, since it is

only designed for the purpose

of the organization's corporate

governing board.

All accounting principles,

along with all laws and

regulations applicable to the

company, as specified by the

respective authorities, are

expected to be followed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

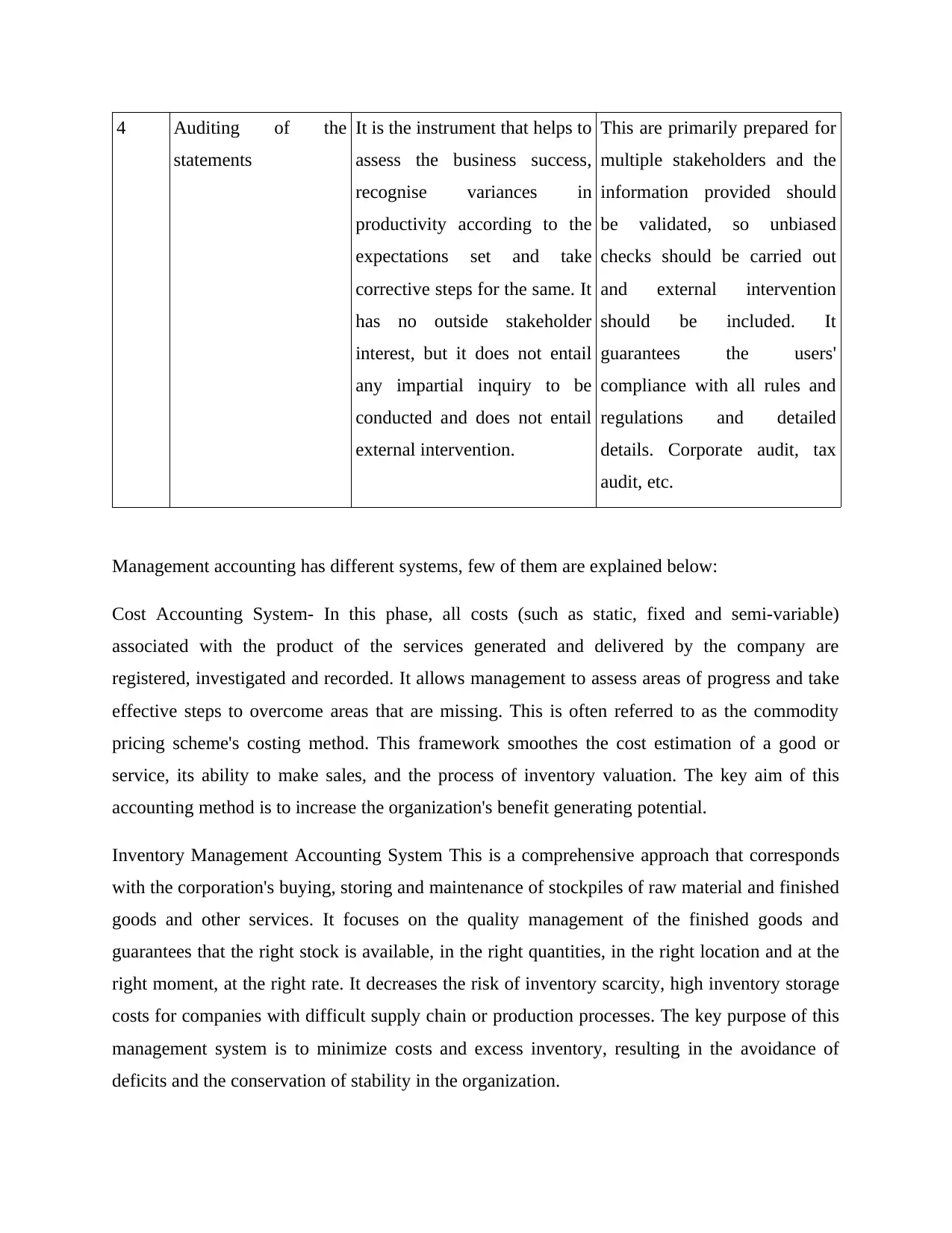

4 Auditing of the

statements

It is the instrument that helps to

assess the business success,

recognise variances in

productivity according to the

expectations set and take

corrective steps for the same. It

has no outside stakeholder

interest, but it does not entail

any impartial inquiry to be

conducted and does not entail

external intervention.

This are primarily prepared for

multiple stakeholders and the

information provided should

be validated, so unbiased

checks should be carried out

and external intervention

should be included. It

guarantees the users'

compliance with all rules and

regulations and detailed

details. Corporate audit, tax

audit, etc.

Management accounting has different systems, few of them are explained below:

Cost Accounting System- In this phase, all costs (such as static, fixed and semi-variable)

associated with the product of the services generated and delivered by the company are

registered, investigated and recorded. It allows management to assess areas of progress and take

effective steps to overcome areas that are missing. This is often referred to as the commodity

pricing scheme's costing method. This framework smoothes the cost estimation of a good or

service, its ability to make sales, and the process of inventory valuation. The key aim of this

accounting method is to increase the organization's benefit generating potential.

Inventory Management Accounting System This is a comprehensive approach that corresponds

with the corporation's buying, storing and maintenance of stockpiles of raw material and finished

goods and other services. It focuses on the quality management of the finished goods and

guarantees that the right stock is available, in the right quantities, in the right location and at the

right moment, at the right rate. It decreases the risk of inventory scarcity, high inventory storage

costs for companies with difficult supply chain or production processes. The key purpose of this

management system is to minimize costs and excess inventory, resulting in the avoidance of

deficits and the conservation of stability in the organization.

statements

It is the instrument that helps to

assess the business success,

recognise variances in

productivity according to the

expectations set and take

corrective steps for the same. It

has no outside stakeholder

interest, but it does not entail

any impartial inquiry to be

conducted and does not entail

external intervention.

This are primarily prepared for

multiple stakeholders and the

information provided should

be validated, so unbiased

checks should be carried out

and external intervention

should be included. It

guarantees the users'

compliance with all rules and

regulations and detailed

details. Corporate audit, tax

audit, etc.

Management accounting has different systems, few of them are explained below:

Cost Accounting System- In this phase, all costs (such as static, fixed and semi-variable)

associated with the product of the services generated and delivered by the company are

registered, investigated and recorded. It allows management to assess areas of progress and take

effective steps to overcome areas that are missing. This is often referred to as the commodity

pricing scheme's costing method. This framework smoothes the cost estimation of a good or

service, its ability to make sales, and the process of inventory valuation. The key aim of this

accounting method is to increase the organization's benefit generating potential.

Inventory Management Accounting System This is a comprehensive approach that corresponds

with the corporation's buying, storing and maintenance of stockpiles of raw material and finished

goods and other services. It focuses on the quality management of the finished goods and

guarantees that the right stock is available, in the right quantities, in the right location and at the

right moment, at the right rate. It decreases the risk of inventory scarcity, high inventory storage

costs for companies with difficult supply chain or production processes. The key purpose of this

management system is to minimize costs and excess inventory, resulting in the avoidance of

deficits and the conservation of stability in the organization.

Job Costing Accounting System- It is a characteristic mechanism that accumulates data relating

to all the costs involved with a single good or service, carried out in compliance with the

specifications of the consumer. The primary goal behind this scheme is to determine the benefit

or loss produced from each job or service. It encourages the corporation to quote the expense that

helps the business to make fair profits.

Price Optimization Accounting System- This is a statistical instrument used to consider the cost

of a given object. It helps to anticipate increases in quality and quantity and fix a desired price

where a consumer is prepared, ready and eager to pay for the commodity of the company to be

consumed or bought. This encourages the corporation to use the price as a strong profit

generator.

P2 Explain the different methods used under management accounting reporting.

Accounting records play an integral role in offering a full description of the results of the

company in relation to the sector's patterns. This helps to assess whether the company's actions

are in the context of meeting the priorities and targets of the enterprise. In order to make a

decision and devise plans and determine success by management, these documents should be

full, correct, specific and valid to depend on.

Budget Report- - This is a basic report that allows the owners to understand and manage the

organization's running costs. It is focused on previous interactions and offers advice to

management and staff to improve morale and provide employees with better compensation, to

negotiate prices with vendors and suppliers.

Job Cost Report- - This provides a simple view of the overall expenses paid on a single

commodity or work. Its aim is to determine the feasibility of a particular project or mission. It

helps to recognize the most productive business unit and offer the units receiving lower returns

the most emphasis and less concentration.

Inventory and Manufacturing Report- It is the subsequently measured of the company’s supply

chain kept at the time specified. The key goal of this analysis is to increase manufacturing

process productivity which covers elements such as labor costs, overheads generated in the

manufacture of a single commodity.

to all the costs involved with a single good or service, carried out in compliance with the

specifications of the consumer. The primary goal behind this scheme is to determine the benefit

or loss produced from each job or service. It encourages the corporation to quote the expense that

helps the business to make fair profits.

Price Optimization Accounting System- This is a statistical instrument used to consider the cost

of a given object. It helps to anticipate increases in quality and quantity and fix a desired price

where a consumer is prepared, ready and eager to pay for the commodity of the company to be

consumed or bought. This encourages the corporation to use the price as a strong profit

generator.

P2 Explain the different methods used under management accounting reporting.

Accounting records play an integral role in offering a full description of the results of the

company in relation to the sector's patterns. This helps to assess whether the company's actions

are in the context of meeting the priorities and targets of the enterprise. In order to make a

decision and devise plans and determine success by management, these documents should be

full, correct, specific and valid to depend on.

Budget Report- - This is a basic report that allows the owners to understand and manage the

organization's running costs. It is focused on previous interactions and offers advice to

management and staff to improve morale and provide employees with better compensation, to

negotiate prices with vendors and suppliers.

Job Cost Report- - This provides a simple view of the overall expenses paid on a single

commodity or work. Its aim is to determine the feasibility of a particular project or mission. It

helps to recognize the most productive business unit and offer the units receiving lower returns

the most emphasis and less concentration.

Inventory and Manufacturing Report- It is the subsequently measured of the company’s supply

chain kept at the time specified. The key goal of this analysis is to increase manufacturing

process productivity which covers elements such as labor costs, overheads generated in the

manufacture of a single commodity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Order Information Report- It enables the measurement of productivity and performance in

market patterns. It consists of details about the different orders issued by the organization. It

allows the corporation to maintain cost leadership and combines numerous management

practices.

Accounts Receivable Aging Report- It is linked to shoppers' credit balances. It aligns the strategy

of the organization with its customers' paying ability. It is used by executives to recognize the

challenges associated with the credit policies of the company. This guarantees the reduction of

old loans that are actually poor debts.

Performance Report- A negative perception of the success of the company is given in this report.

It summarizes the final outcome of all the tasks or an individual's success in terms of the work

undertaken. It is the normal performance sets, the detection of anomalies and the proper steps to

resolve performance differences. This covers metrics such as milestones made, goals achieved,

projects completed, etc.

TASK 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

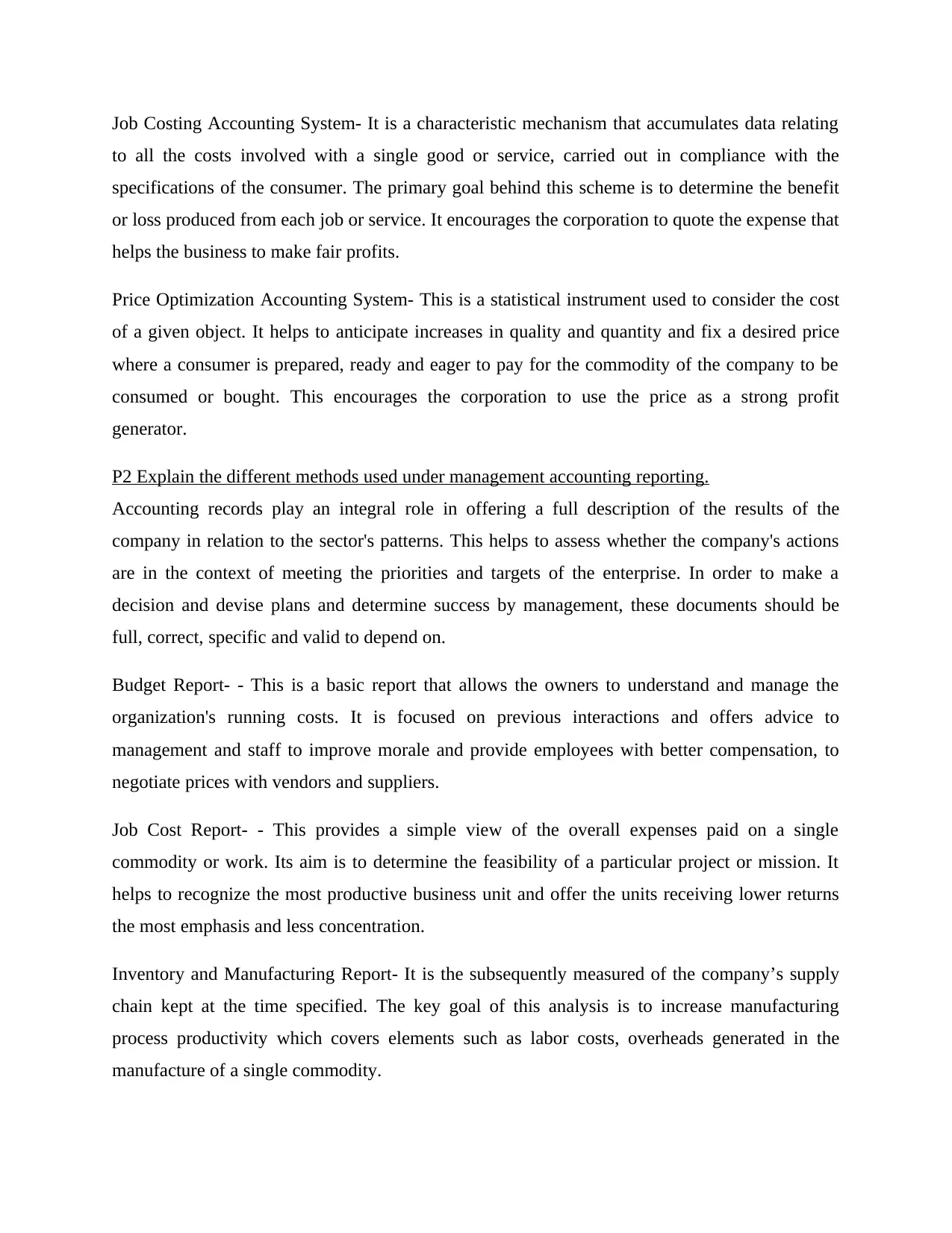

1 Preparation of income statements:

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per unit 6 5

Total 10 9

Income statement under absorption costing-

Particulars April May

market patterns. It consists of details about the different orders issued by the organization. It

allows the corporation to maintain cost leadership and combines numerous management

practices.

Accounts Receivable Aging Report- It is linked to shoppers' credit balances. It aligns the strategy

of the organization with its customers' paying ability. It is used by executives to recognize the

challenges associated with the credit policies of the company. This guarantees the reduction of

old loans that are actually poor debts.

Performance Report- A negative perception of the success of the company is given in this report.

It summarizes the final outcome of all the tasks or an individual's success in terms of the work

undertaken. It is the normal performance sets, the detection of anomalies and the proper steps to

resolve performance differences. This covers metrics such as milestones made, goals achieved,

projects completed, etc.

TASK 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

1 Preparation of income statements:

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per unit 6 5

Total 10 9

Income statement under absorption costing-

Particulars April May

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales 16000 16000

Less: Cost of sales 20000 23000

Fixed Manufacturing Overhead 15000 15000

Variable Manufacturing cost 10000 12000

Closing stock 5000 9000

Opening stock 0 5000

Gross loss -4000 -7000

Less: Fixed Non Manufacturing Cost -4000 -4000

Net Loss -8000 -11000

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Particulars April May

Sales 16000 16000

Less: Marginal cost of sales 8000 10000

Variable Manufacturing cost 10000 12000

Closing stock 2000 4000

Opening stock 0 2000

Less: Cost of sales 20000 23000

Fixed Manufacturing Overhead 15000 15000

Variable Manufacturing cost 10000 12000

Closing stock 5000 9000

Opening stock 0 5000

Gross loss -4000 -7000

Less: Fixed Non Manufacturing Cost -4000 -4000

Net Loss -8000 -11000

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Particulars April May

Sales 16000 16000

Less: Marginal cost of sales 8000 10000

Variable Manufacturing cost 10000 12000

Closing stock 2000 4000

Opening stock 0 2000

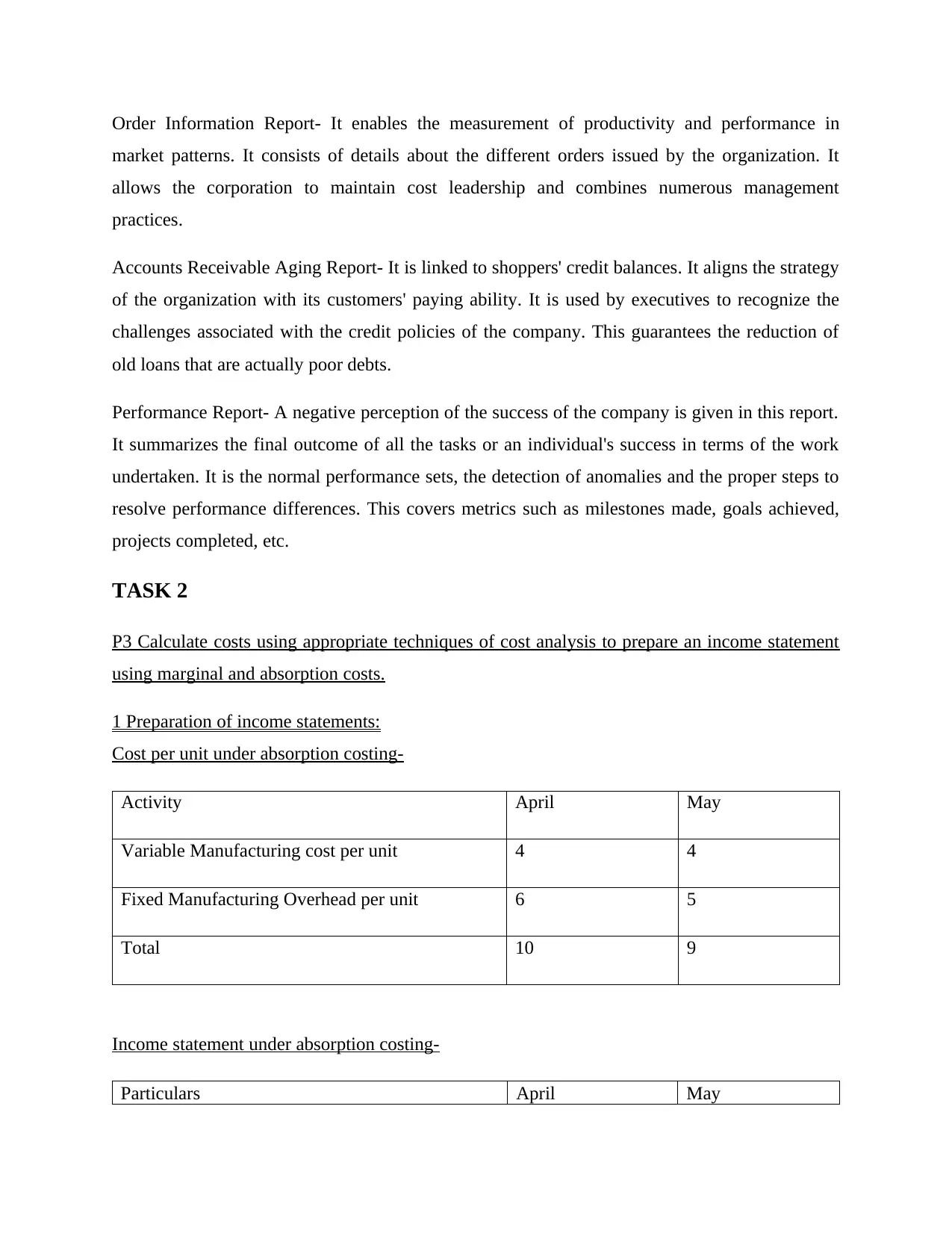

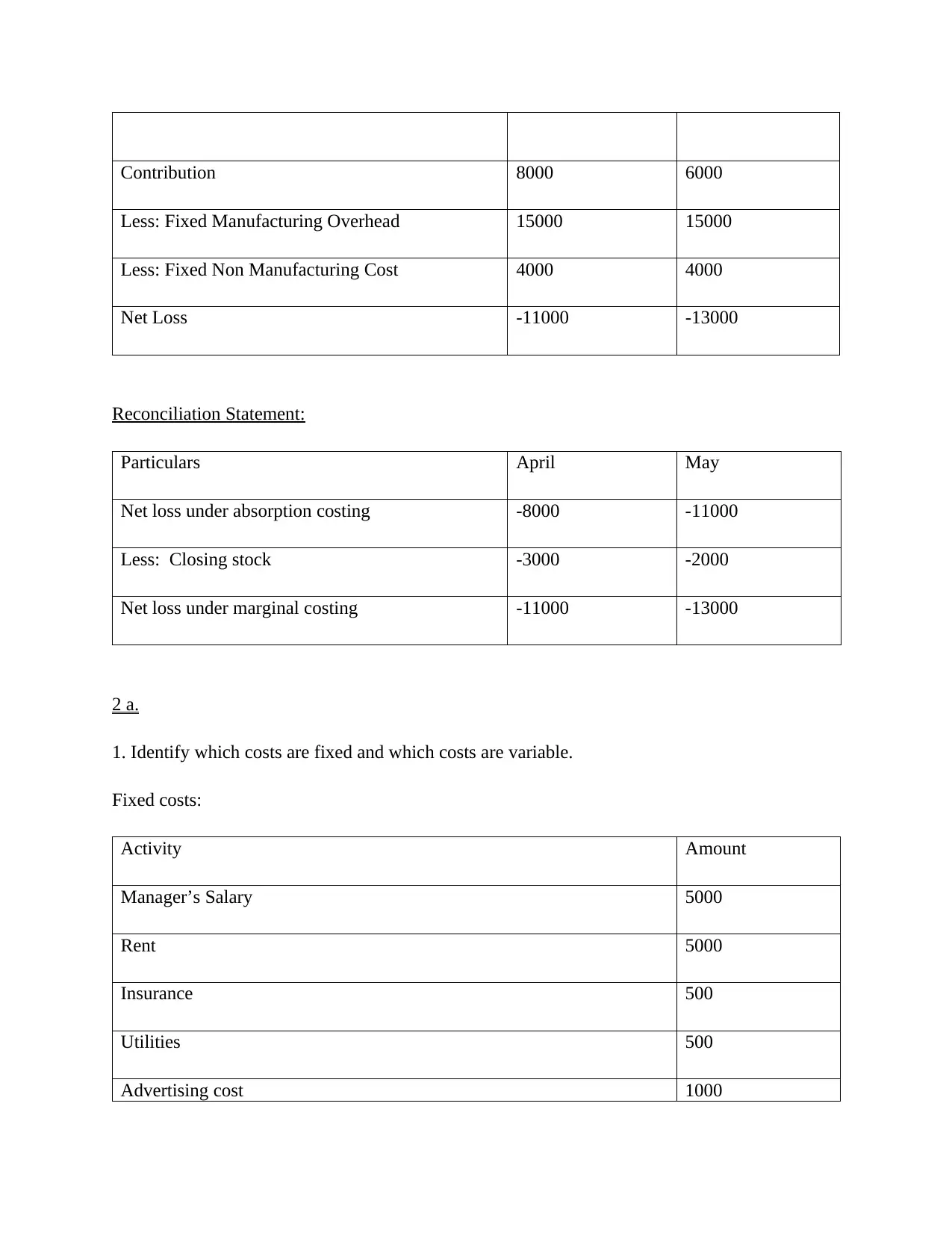

Contribution 8000 6000

Less: Fixed Manufacturing Overhead 15000 15000

Less: Fixed Non Manufacturing Cost 4000 4000

Net Loss -11000 -13000

Reconciliation Statement:

Particulars April May

Net loss under absorption costing -8000 -11000

Less: Closing stock -3000 -2000

Net loss under marginal costing -11000 -13000

2 a.

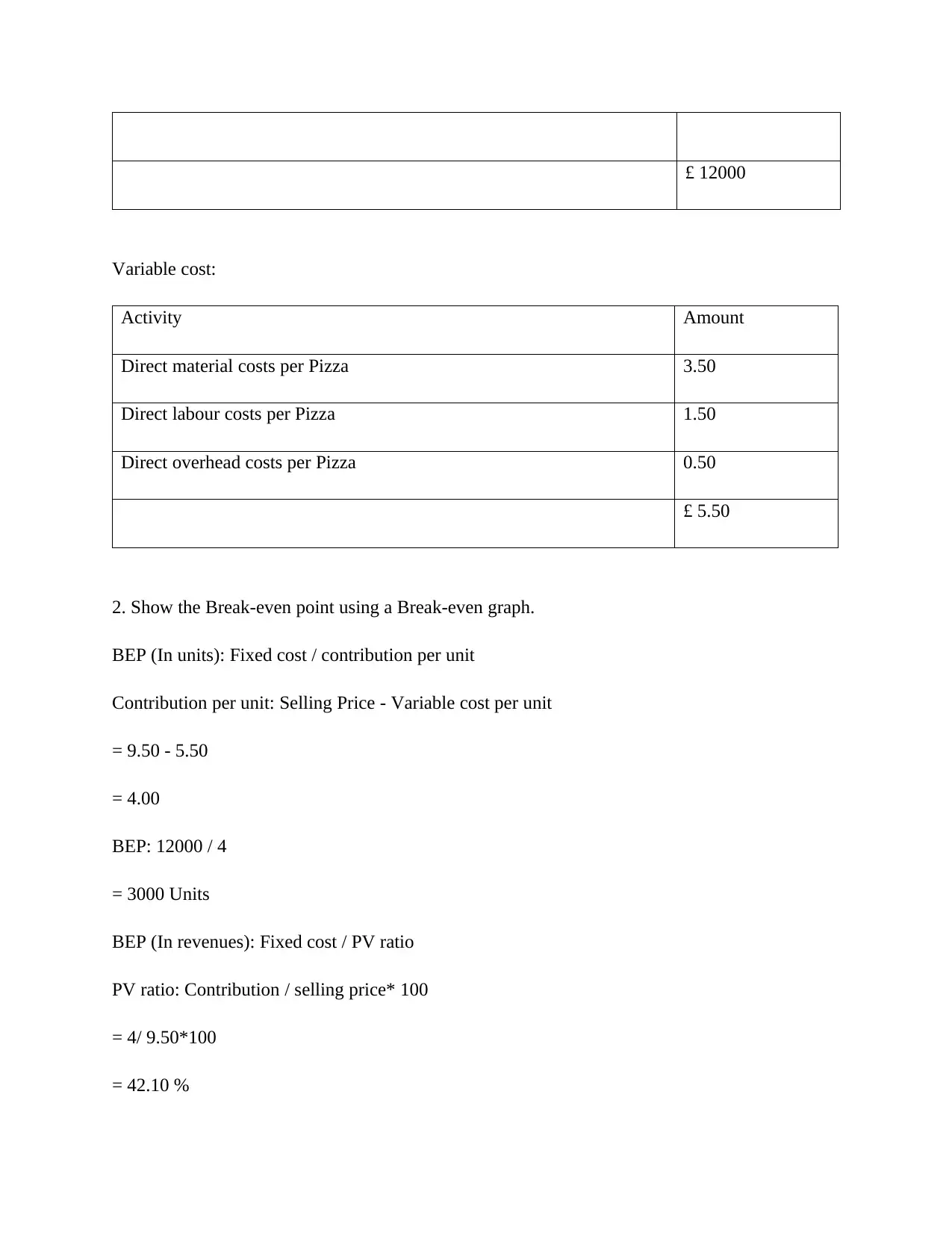

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

Less: Fixed Manufacturing Overhead 15000 15000

Less: Fixed Non Manufacturing Cost 4000 4000

Net Loss -11000 -13000

Reconciliation Statement:

Particulars April May

Net loss under absorption costing -8000 -11000

Less: Closing stock -3000 -2000

Net loss under marginal costing -11000 -13000

2 a.

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

£ 12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£ 5.50

2. Show the Break-even point using a Break-even graph.

BEP (In units): Fixed cost / contribution per unit

Contribution per unit: Selling Price - Variable cost per unit

= 9.50 - 5.50

= 4.00

BEP: 12000 / 4

= 3000 Units

BEP (In revenues): Fixed cost / PV ratio

PV ratio: Contribution / selling price* 100

= 4/ 9.50*100

= 42.10 %

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£ 5.50

2. Show the Break-even point using a Break-even graph.

BEP (In units): Fixed cost / contribution per unit

Contribution per unit: Selling Price - Variable cost per unit

= 9.50 - 5.50

= 4.00

BEP: 12000 / 4

= 3000 Units

BEP (In revenues): Fixed cost / PV ratio

PV ratio: Contribution / selling price* 100

= 4/ 9.50*100

= 42.10 %

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEP (In revenues) = 12000 / 42.10 %

= £ 28503

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety = Sales units - BEP in Units

= 2500 - 3000

= - 500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000 / 4

= 3250 Units

New BEP (In revenues): 13000 / 42.10 %

= £ 30878

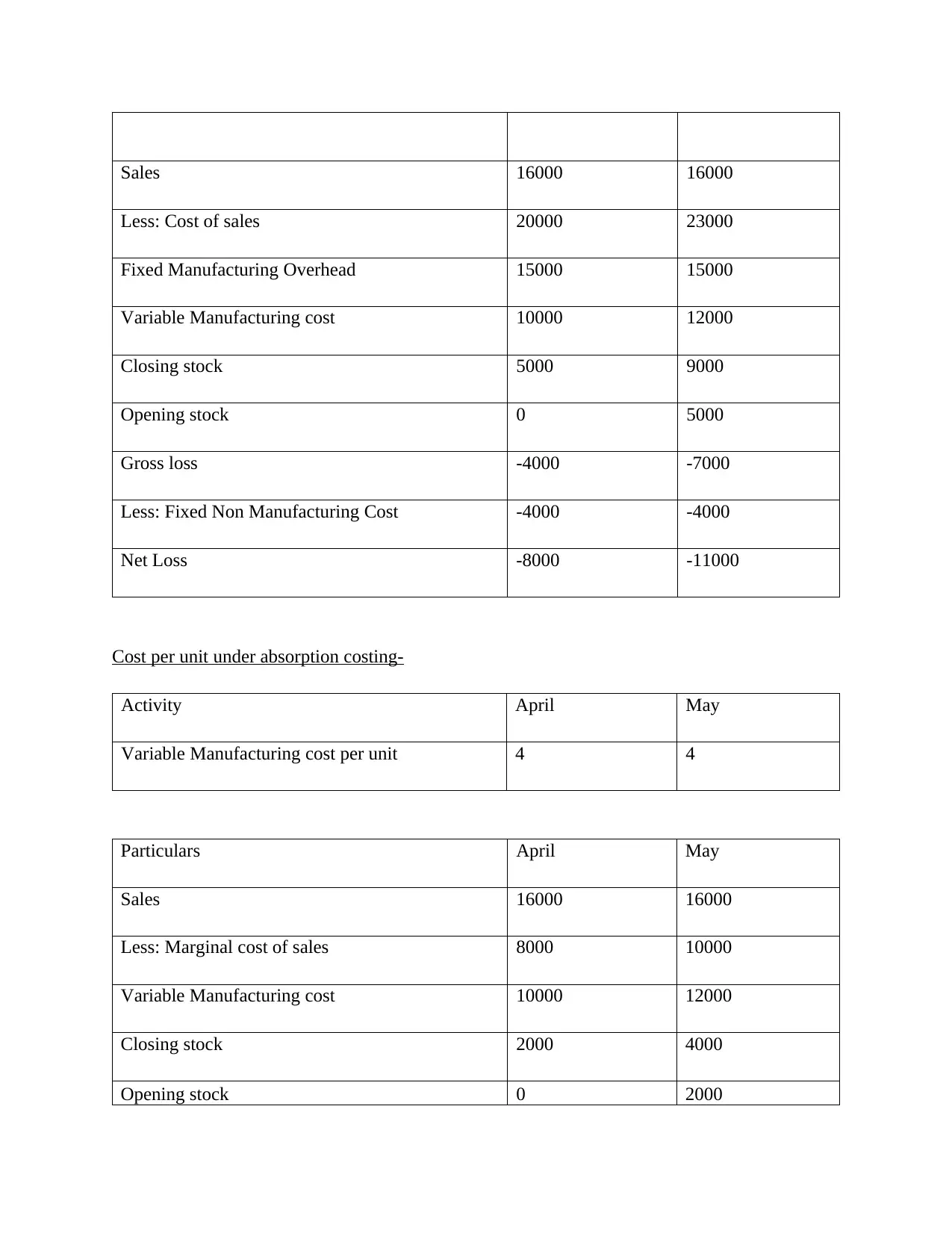

2 b. Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

= £ 28503

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety = Sales units - BEP in Units

= 2500 - 3000

= - 500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000 / 4

= 3250 Units

New BEP (In revenues): 13000 / 42.10 %

= £ 30878

2 b. Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

T ot a l Cos ts

( 12 0 0 0 +5 5 0 00 ) R e ve nue s pe r

U ni t ( 9 50 0 0 -

6 70 0 0 ) / 1 00 0 0

T ot a l F i xe d Cos t B E P poi nt

0

10000

20000

30000

40000

50000

60000

70000

80000

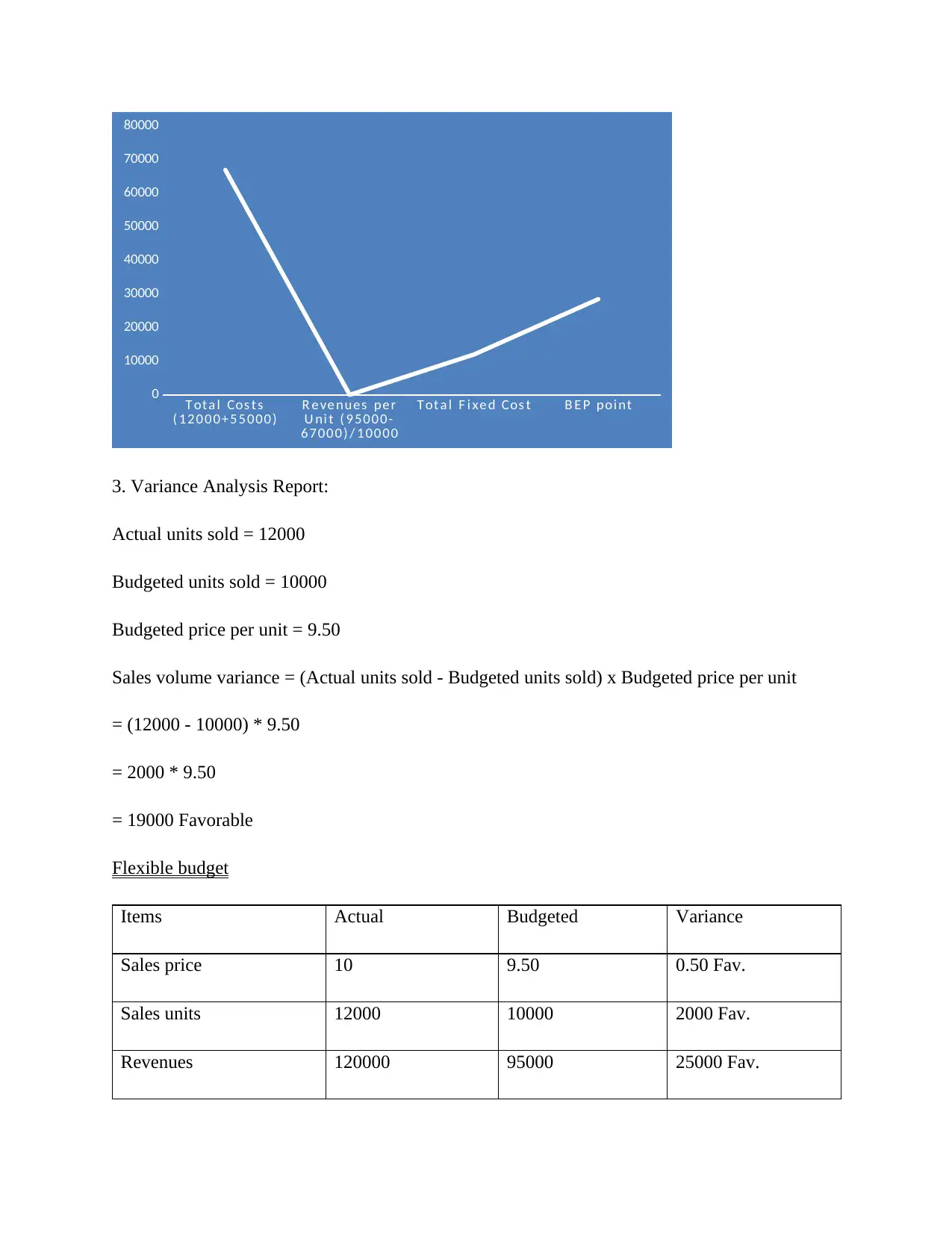

3. Variance Analysis Report:

Actual units sold = 12000

Budgeted units sold = 10000

Budgeted price per unit = 9.50

Sales volume variance = (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000 - 10000) * 9.50

= 2000 * 9.50

= 19000 Favorable

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 0.50 Fav.

Sales units 12000 10000 2000 Fav.

Revenues 120000 95000 25000 Fav.

( 12 0 0 0 +5 5 0 00 ) R e ve nue s pe r

U ni t ( 9 50 0 0 -

6 70 0 0 ) / 1 00 0 0

T ot a l F i xe d Cos t B E P poi nt

0

10000

20000

30000

40000

50000

60000

70000

80000

3. Variance Analysis Report:

Actual units sold = 12000

Budgeted units sold = 10000

Budgeted price per unit = 9.50

Sales volume variance = (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000 - 10000) * 9.50

= 2000 * 9.50

= 19000 Favorable

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 0.50 Fav.

Sales units 12000 10000 2000 Fav.

Revenues 120000 95000 25000 Fav.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.