Management Accounting System, Techniques, and Reporting Analysis

VerifiedAdded on 2021/02/21

|19

|4280

|126

Report

AI Summary

This report provides a comprehensive introduction to management accounting, focusing on its application within a financial advisory firm, Hargreaves Lansdown plc. It begins with an overview of management accounting concepts and essential system requirements, including cost accounting, price optimization, job costing, and inventory management systems. The report then explores various management accounting reporting methods, such as inventory reports, cost reports, budgetary reports, and performance reports, detailing their benefits and applications. A critical evaluation of management accounting systems and reporting is presented, highlighting the advantages and disadvantages of implementation. The report also includes a practical section demonstrating the preparation of financial reports using marginal costing and absorption costing techniques, followed by a comparison of these methods. This analysis offers valuable insights into cost management, financial reporting, and decision-making processes within a business context. The report emphasizes the importance of these tools for effective financial planning and control within an organization.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Management accounting system is a set of various guidelines and procedures along with

various rules and regulations for the purpose of providing company's performance relating to

financial activities to the managers (Albaddad and Nassar, 2018) . With the help of this system,

managers can be informed in more effective way and managerial accountants can help managers

in formation of more effective strategies and plans for the business organisation. In addition,

there are also various tools and techniques available in the management accounting system with

the help of which the business organisation can include more effective control and management

of each business activity relating to various financial transactions of the firm.

Hargreaves Lansdown plc is a medium sized financial advisory firm. it was established in

the year 1981. Presently the company provides financial advice to a range of hospitality, trust,

manufacturing companies, etc. in the present assignment, a brief introduction regarding overall

management accounting system is being provided along with numerous methods of management

accounting reporting and their advantages and disadvantage. Further, the study also includes a

calculative part. In that part of study, it shows preparation of various financial reports by using

the most appropriate techniques of management accounting system. In addition, the study also

provides a detailed discussion about different planning tools of budgetary control system to be

used by the managers while performing their managerial functions. At the end of project, it

shows numerous management accounting systems that can be used by the managers in order to

help the corporation in responding to various financial problems arise the business.

LO1.

P1. Explaining the concept of management accounting and the essential requirements of its

systems

Management accounting refers to the application of the appropriate concepts and the

techniques in order to process the historical and the projected economic data of the enterprise

that assist in developing the reasonable objectives for making rational decisions towards

achieving these objectives (Xiong and Zhang, 2019. It is mainly concerned with effective and

efficient management of the business through presenting the information that facilitate efficient

planning and the control. Management accounting relates with the accounting information that is

useful for the management of an entity. There are various systems under the management

accounting which plays an essential role in smooth functioning of the business are as follows-

Management accounting system is a set of various guidelines and procedures along with

various rules and regulations for the purpose of providing company's performance relating to

financial activities to the managers (Albaddad and Nassar, 2018) . With the help of this system,

managers can be informed in more effective way and managerial accountants can help managers

in formation of more effective strategies and plans for the business organisation. In addition,

there are also various tools and techniques available in the management accounting system with

the help of which the business organisation can include more effective control and management

of each business activity relating to various financial transactions of the firm.

Hargreaves Lansdown plc is a medium sized financial advisory firm. it was established in

the year 1981. Presently the company provides financial advice to a range of hospitality, trust,

manufacturing companies, etc. in the present assignment, a brief introduction regarding overall

management accounting system is being provided along with numerous methods of management

accounting reporting and their advantages and disadvantage. Further, the study also includes a

calculative part. In that part of study, it shows preparation of various financial reports by using

the most appropriate techniques of management accounting system. In addition, the study also

provides a detailed discussion about different planning tools of budgetary control system to be

used by the managers while performing their managerial functions. At the end of project, it

shows numerous management accounting systems that can be used by the managers in order to

help the corporation in responding to various financial problems arise the business.

LO1.

P1. Explaining the concept of management accounting and the essential requirements of its

systems

Management accounting refers to the application of the appropriate concepts and the

techniques in order to process the historical and the projected economic data of the enterprise

that assist in developing the reasonable objectives for making rational decisions towards

achieving these objectives (Xiong and Zhang, 2019. It is mainly concerned with effective and

efficient management of the business through presenting the information that facilitate efficient

planning and the control. Management accounting relates with the accounting information that is

useful for the management of an entity. There are various systems under the management

accounting which plays an essential role in smooth functioning of the business are as follows-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting system- This system relates with the ascertainment of the cost involved

in the process of production. It plays a crucial role in the decision making process of the

company as it helps in improving the planning of the resources and its allocation which in turn

helps in gaining the efficiency in the cost and in the overall profitability. Cost accounting system

provides the firm in estimating accurate cost of the products which is very critical for running the

operations as per the standards and the strategies set. Mainly there are two major kinds of the

cost accounting system that includes job order costing and the process costing. Job order costing

is the method that accumulates the manufacturing cost of each job and in process costing,

accumulation is made for manufacturing cost of each process.

Benefits:

It is beneficiary for Hargreaves Lansdown plc in maintaining cost control within the

firm.

It helps in elimination of cost wastage within the firm. It helps in improving profit earning capacity of the business.

Price optimization system- It is called as the mathematical tool that is used by the

company in order to determine the response of the customers at different price level towards the

product and the services of the organization. Price optimization system is essential for the

enterprise for fixing the best prices that meets the profit maximization objective efficiently. It is

the best tool for determining the retail value of the consumer product and the services.

Benefits:

Adoption of price optimisation system is essential for setting the most appropriate price

of each product.

This system helps in analysing the maximum price of product that customer would be

ready to pay. It is required to be adopted in order to sustain the customers with the firm for long time.

Job costing system- This system of the management accounting refers to the process that

accumulates the information relating to the cost attached with the particular production and the

services job. This information is critical to the organization in order to quote the prices that

allows for the reasonable profits (Shiqi and Yuan, 2019). It includes the details regarding the cost

of the direct material, overhead and they direct labour cost. The information provided by this

system is also used for assigning the invariable cost to the goods manufactured.

in the process of production. It plays a crucial role in the decision making process of the

company as it helps in improving the planning of the resources and its allocation which in turn

helps in gaining the efficiency in the cost and in the overall profitability. Cost accounting system

provides the firm in estimating accurate cost of the products which is very critical for running the

operations as per the standards and the strategies set. Mainly there are two major kinds of the

cost accounting system that includes job order costing and the process costing. Job order costing

is the method that accumulates the manufacturing cost of each job and in process costing,

accumulation is made for manufacturing cost of each process.

Benefits:

It is beneficiary for Hargreaves Lansdown plc in maintaining cost control within the

firm.

It helps in elimination of cost wastage within the firm. It helps in improving profit earning capacity of the business.

Price optimization system- It is called as the mathematical tool that is used by the

company in order to determine the response of the customers at different price level towards the

product and the services of the organization. Price optimization system is essential for the

enterprise for fixing the best prices that meets the profit maximization objective efficiently. It is

the best tool for determining the retail value of the consumer product and the services.

Benefits:

Adoption of price optimisation system is essential for setting the most appropriate price

of each product.

This system helps in analysing the maximum price of product that customer would be

ready to pay. It is required to be adopted in order to sustain the customers with the firm for long time.

Job costing system- This system of the management accounting refers to the process that

accumulates the information relating to the cost attached with the particular production and the

services job. This information is critical to the organization in order to quote the prices that

allows for the reasonable profits (Shiqi and Yuan, 2019). It includes the details regarding the cost

of the direct material, overhead and they direct labour cost. The information provided by this

system is also used for assigning the invariable cost to the goods manufactured.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefits:

Job costing system is required by those business organisations that provides customised

goods or services to its customers. This system helps in determining the cost incurred by the firm in each stage of production

of customised products.

Inventory management system- This system means the management of the inventory

where it helps in tracking the goods over the entire supply chain in which the business operates.

It facilitates monitoring of the stocked goods. Adoption of this system is helpful in maintaining

sufficient amount of inventories with the business and avoiding shortage of inventory. In this

regard, it can be said that this system of management accounting is required by those business

units that maintains inventory in the business for either using it for production purpose of for the

reselling purpose as well. With the help of this system, managers can ensure efficiency of the

firm in controlling the wastage of inventories in the company.

Benefits:

This system is required to be adopted by each business organisation as each firm needs to

maintain some amount of inventory with it.

It helps managers in maintaining their eyes of flow of inventory within or outside the

business organisation.

Management accounting reporting:

Management accounting reporting can be defined as a process of analysing various

monitory and non monitory transactions relating to financial activities of the company and

prepare the report and recording all the transactions in it. Adoption of management accounting

system can help the Hargreaves Lansdown plc can help its managers in understanding

performance of business organisation in an effective way so as to develop their strategies, plans

and procedures more efficiently.

Following are the methods that can be adopted by the managerial accountants in order to

obtain management accounting reporting within the business organisation:

Inventory reports:

It is the method that can be adopted by the business organisation in order to summarise

various activities regarding movement of the stock of the company either within the business or

Job costing system is required by those business organisations that provides customised

goods or services to its customers. This system helps in determining the cost incurred by the firm in each stage of production

of customised products.

Inventory management system- This system means the management of the inventory

where it helps in tracking the goods over the entire supply chain in which the business operates.

It facilitates monitoring of the stocked goods. Adoption of this system is helpful in maintaining

sufficient amount of inventories with the business and avoiding shortage of inventory. In this

regard, it can be said that this system of management accounting is required by those business

units that maintains inventory in the business for either using it for production purpose of for the

reselling purpose as well. With the help of this system, managers can ensure efficiency of the

firm in controlling the wastage of inventories in the company.

Benefits:

This system is required to be adopted by each business organisation as each firm needs to

maintain some amount of inventory with it.

It helps managers in maintaining their eyes of flow of inventory within or outside the

business organisation.

Management accounting reporting:

Management accounting reporting can be defined as a process of analysing various

monitory and non monitory transactions relating to financial activities of the company and

prepare the report and recording all the transactions in it. Adoption of management accounting

system can help the Hargreaves Lansdown plc can help its managers in understanding

performance of business organisation in an effective way so as to develop their strategies, plans

and procedures more efficiently.

Following are the methods that can be adopted by the managerial accountants in order to

obtain management accounting reporting within the business organisation:

Inventory reports:

It is the method that can be adopted by the business organisation in order to summarise

various activities regarding movement of the stock of the company either within the business or

outside the firm. With the help of inventory management reporting, managers of Hargreaves

Lansdown plc can maintain records of all the stocks held by the business either for the

production purpose or for the further selling purpose (Hoang and Joseph, 2019). Inventory

reports of the company provides details about both units of inventory purchased, sold or

maintained by the firm along with the price of stocks in which it has been bough or sold. In this

regard, it can be seen that inventory reports can help the managers in maintaining a detailed

information regarding flow of stocks within the company.

Benefits:

Maintenance of inventory reports can help managers in maintaining a detailed record of

inventories held by the company.

With the help of this report, managers of Hargreaves Lansdown plc can detect wastage of

inventories within the firm.

With the help of this report, company can identify the total amount of inventories held by

the company at a specific day.

Cost reports:

As the name describes, cost reports are those that contains details regarding numerous

types of costs incurred by the firm within a specific time period for the purpose of performing

various business operations. By maintaining cost reports, Hargreaves Lansdown plc can help its

managers in providing details regarding various types of costs incurred by each department of

the firm. In this regard, they can easily identify the areas in which company can cut down the

cost and areas in which business is wasting cost (Wnuk-Pel, 2018). Along with this, they can

develop their new plans and procedures for performing various business activities through which

they can develop cost efficiency within overall business organisation.

Benefits:

Cost reports are beneficiary for Hargreaves Lansdown plc in order to maintain records of

various costs incurred by it during a specific time period.

It helps the company in detecting the areas of cost wastage within the firm.

It is essential to be maintained in order to eliminate cost wastage within the company.

Budgetary reports:

Budgetary reports are those that provides details regarding forecasts of managers for the

business in performing numerous activities. These reports helps managers in predicting needs of

Lansdown plc can maintain records of all the stocks held by the business either for the

production purpose or for the further selling purpose (Hoang and Joseph, 2019). Inventory

reports of the company provides details about both units of inventory purchased, sold or

maintained by the firm along with the price of stocks in which it has been bough or sold. In this

regard, it can be seen that inventory reports can help the managers in maintaining a detailed

information regarding flow of stocks within the company.

Benefits:

Maintenance of inventory reports can help managers in maintaining a detailed record of

inventories held by the company.

With the help of this report, managers of Hargreaves Lansdown plc can detect wastage of

inventories within the firm.

With the help of this report, company can identify the total amount of inventories held by

the company at a specific day.

Cost reports:

As the name describes, cost reports are those that contains details regarding numerous

types of costs incurred by the firm within a specific time period for the purpose of performing

various business operations. By maintaining cost reports, Hargreaves Lansdown plc can help its

managers in providing details regarding various types of costs incurred by each department of

the firm. In this regard, they can easily identify the areas in which company can cut down the

cost and areas in which business is wasting cost (Wnuk-Pel, 2018). Along with this, they can

develop their new plans and procedures for performing various business activities through which

they can develop cost efficiency within overall business organisation.

Benefits:

Cost reports are beneficiary for Hargreaves Lansdown plc in order to maintain records of

various costs incurred by it during a specific time period.

It helps the company in detecting the areas of cost wastage within the firm.

It is essential to be maintained in order to eliminate cost wastage within the company.

Budgetary reports:

Budgetary reports are those that provides details regarding forecasts of managers for the

business in performing numerous activities. These reports helps managers in predicting needs of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the company in advance through which they can efficiently maintain the sufficiency of each

resource required by the company during a specific period. In this regard, it can be analysed that

with the help of budgets, managers can set short term goals of the company and can formulate

their plans for the company in order to achieve them. Therefore, maintenance of budgetary

reports are helpful for Hargreaves Lansdown plc in order to make the company in achieving its

set goals and objectives in more efficient way.

Benefits:

Budget reports are helpful for short term planning of the company.

It helps in analysing the needs and demands of the company in the near future.

Preparation of budgets can help the managers in maintaining sufficient amount of

resources with the business and elimination of shortage as well.

Performance reports:

These are the reports that provides information regarding performance of each

department of the company. Performance reports are helpful for the companies in analysing

improvement or decline in the overall performance of company. While preparing performance

reports, managers analyse and summarise performance of various departments of business

(Coyte, 2019). Therefore, these reports can help Hargreaves Lansdown plc in maintaining

records of performance of each department including managerial performance so that the

managers can evaluate the performance and develop their strategies in order to improve the

performance of overall company.

Benefits:

Performance reports are helpful in detection of overall efficiency of the business.

It helps in detecting various inefficient areas of the firm.

It is required to be adopted in order to help managers in developing their strategies

regarding improving the efficiency of each department and overall business organisation

as well.

Critical evaluation of management accounting system and management accounting

reporting

From the above analysis of management accounting system and management accounting

reporting, it can be analysed that both, management accounting reporting and management

accounting systems are essential part of each business unit. Adoption of both in the Hargreaves

resource required by the company during a specific period. In this regard, it can be analysed that

with the help of budgets, managers can set short term goals of the company and can formulate

their plans for the company in order to achieve them. Therefore, maintenance of budgetary

reports are helpful for Hargreaves Lansdown plc in order to make the company in achieving its

set goals and objectives in more efficient way.

Benefits:

Budget reports are helpful for short term planning of the company.

It helps in analysing the needs and demands of the company in the near future.

Preparation of budgets can help the managers in maintaining sufficient amount of

resources with the business and elimination of shortage as well.

Performance reports:

These are the reports that provides information regarding performance of each

department of the company. Performance reports are helpful for the companies in analysing

improvement or decline in the overall performance of company. While preparing performance

reports, managers analyse and summarise performance of various departments of business

(Coyte, 2019). Therefore, these reports can help Hargreaves Lansdown plc in maintaining

records of performance of each department including managerial performance so that the

managers can evaluate the performance and develop their strategies in order to improve the

performance of overall company.

Benefits:

Performance reports are helpful in detection of overall efficiency of the business.

It helps in detecting various inefficient areas of the firm.

It is required to be adopted in order to help managers in developing their strategies

regarding improving the efficiency of each department and overall business organisation

as well.

Critical evaluation of management accounting system and management accounting

reporting

From the above analysis of management accounting system and management accounting

reporting, it can be analysed that both, management accounting reporting and management

accounting systems are essential part of each business unit. Adoption of both in the Hargreaves

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Lansdown plc can help its managers in improving efficiency of managers in formulation of their

plans and procedure of the firm for managing and controlling system. Both provides several

methods and guidelines for the managers with the help of which they can formulate their

strategies and plans in more effective way.

Although, if the Hargreaves Lansdown plc adopts these systems, it would results in

increase in various managerial functions of the company. In addition to this, it would also need

to employ more professionals within the business which would increase the cost of the firm. On

the other hand, as these systems will improve the efficiency of the company through which it

will become able to generate more profits for the company. In this regard, it can be said that

Hargreaves Lansdown plc should adopt these systems within its business operations.

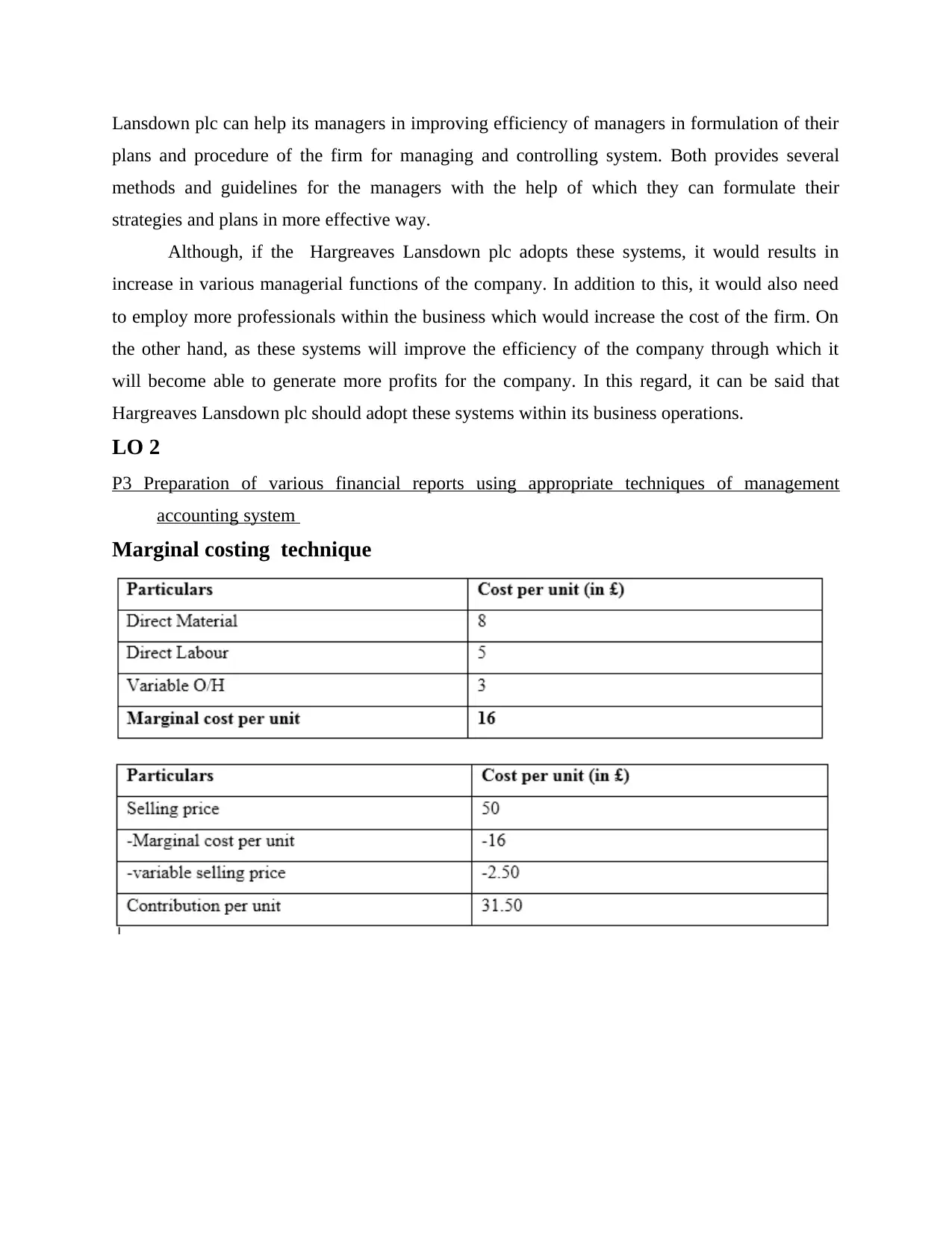

LO 2

P3 Preparation of various financial reports using appropriate techniques of management

accounting system

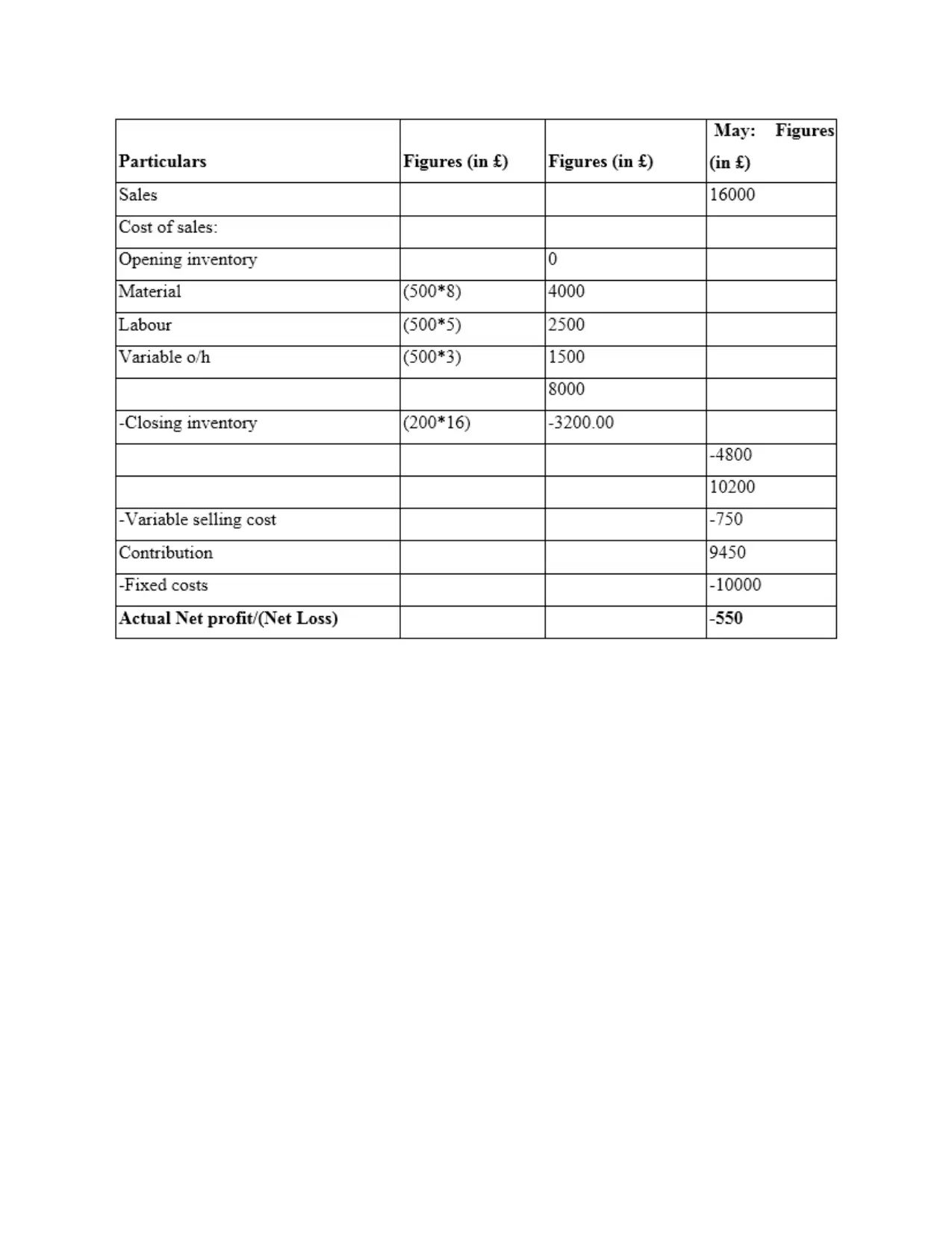

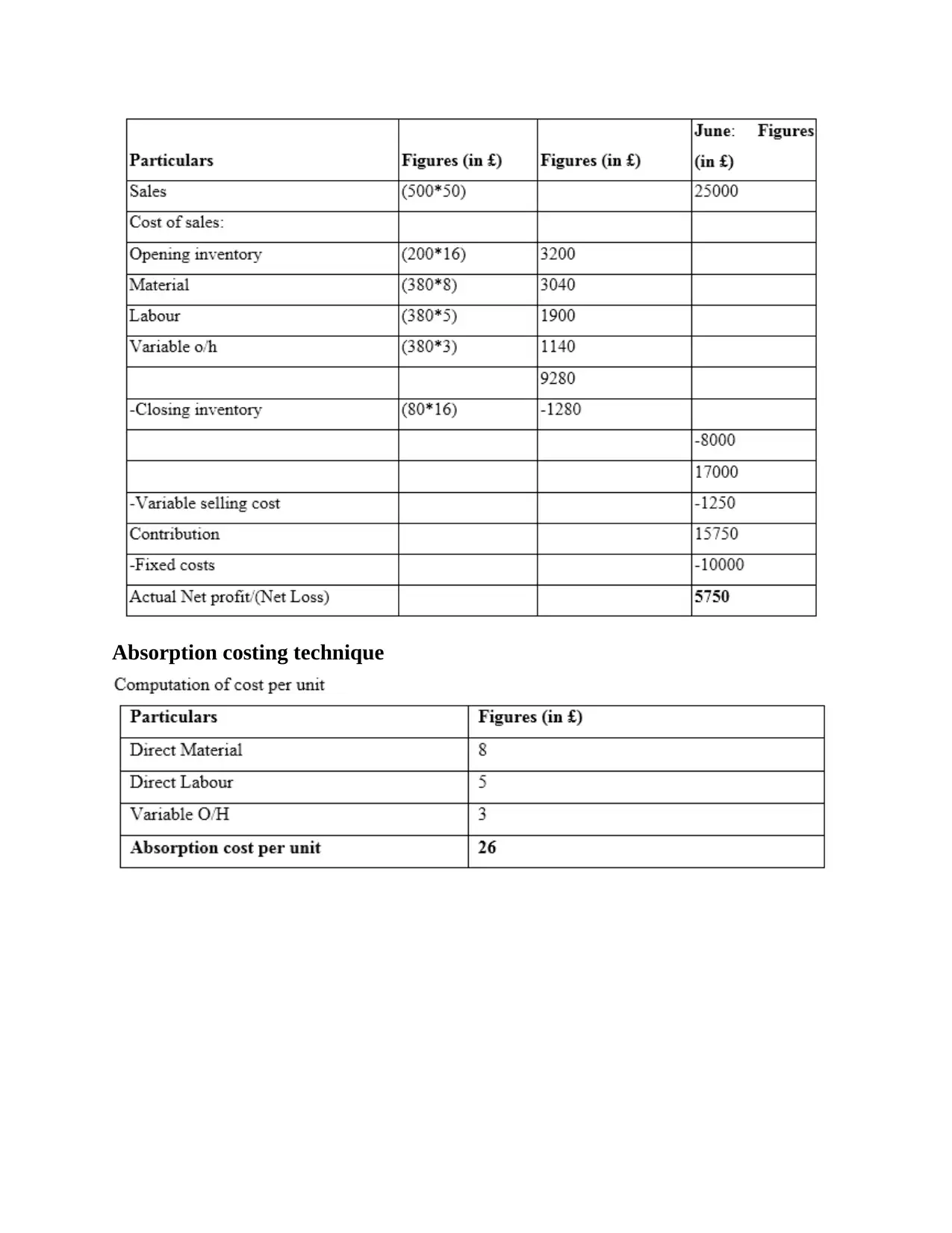

Marginal costing technique

plans and procedure of the firm for managing and controlling system. Both provides several

methods and guidelines for the managers with the help of which they can formulate their

strategies and plans in more effective way.

Although, if the Hargreaves Lansdown plc adopts these systems, it would results in

increase in various managerial functions of the company. In addition to this, it would also need

to employ more professionals within the business which would increase the cost of the firm. On

the other hand, as these systems will improve the efficiency of the company through which it

will become able to generate more profits for the company. In this regard, it can be said that

Hargreaves Lansdown plc should adopt these systems within its business operations.

LO 2

P3 Preparation of various financial reports using appropriate techniques of management

accounting system

Marginal costing technique

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

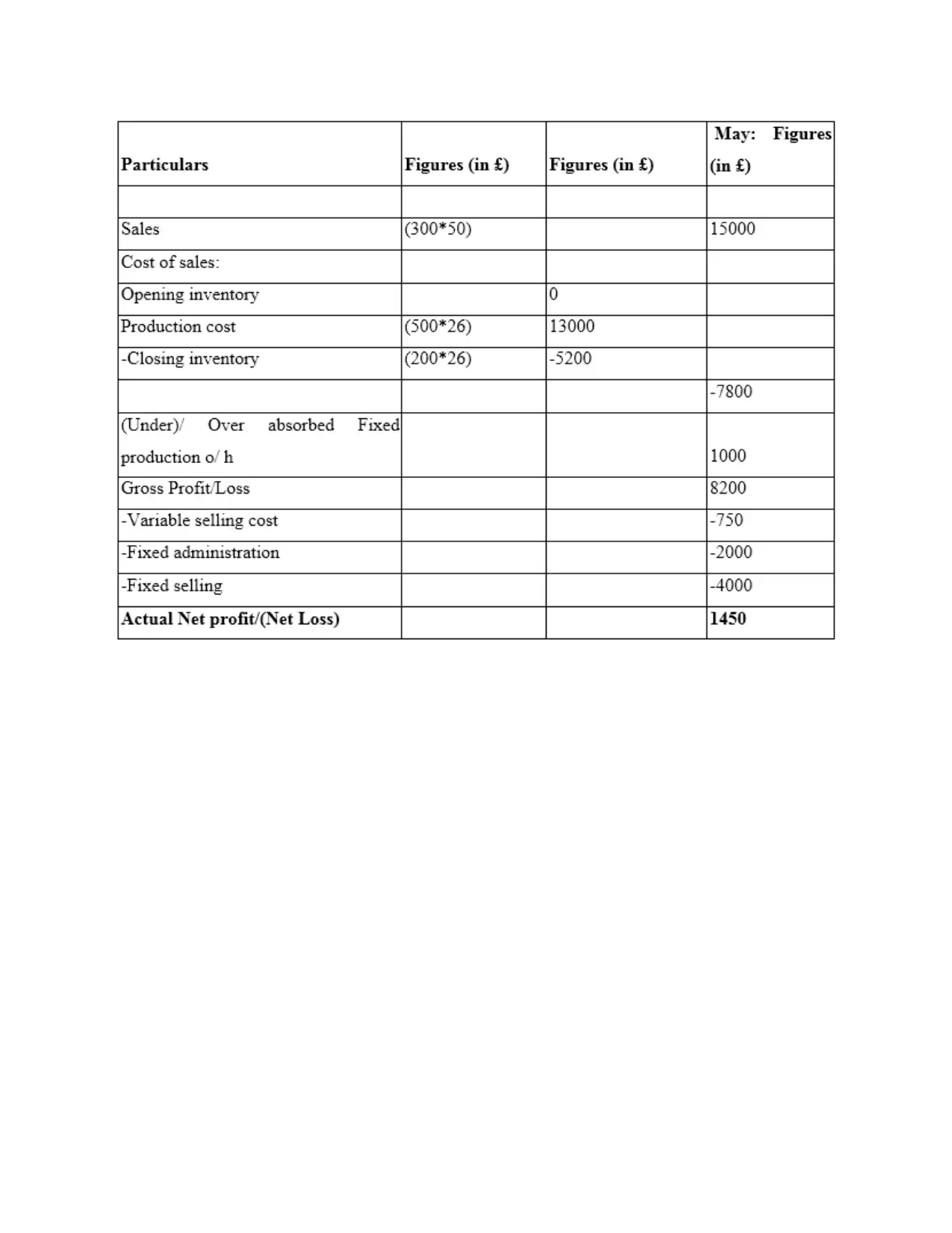

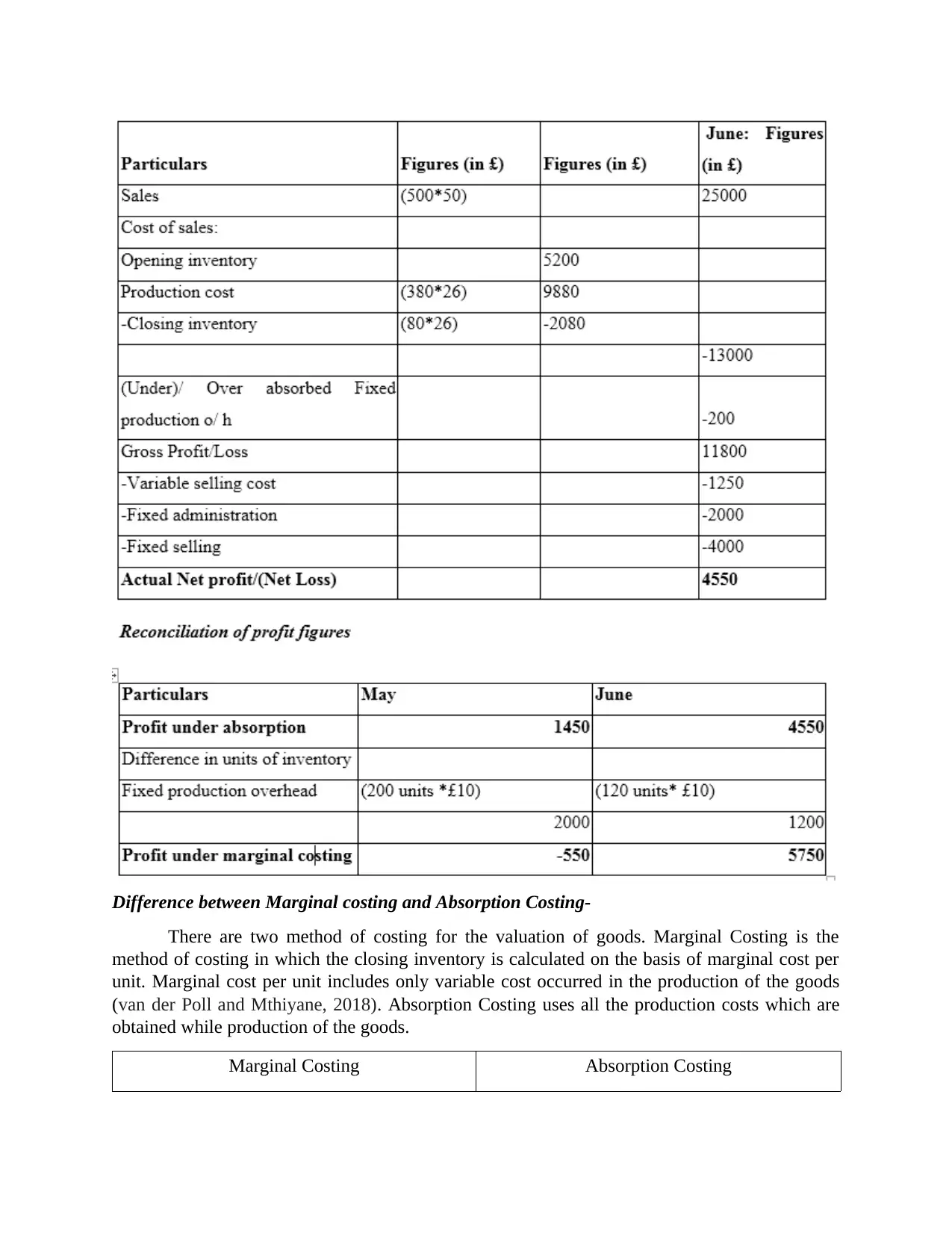

Absorption costing technique

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Difference between Marginal costing and Absorption Costing-

There are two method of costing for the valuation of goods. Marginal Costing is the

method of costing in which the closing inventory is calculated on the basis of marginal cost per

unit. Marginal cost per unit includes only variable cost occurred in the production of the goods

(van der Poll and Mthiyane, 2018). Absorption Costing uses all the production costs which are

obtained while production of the goods.

Marginal Costing Absorption Costing

There are two method of costing for the valuation of goods. Marginal Costing is the

method of costing in which the closing inventory is calculated on the basis of marginal cost per

unit. Marginal cost per unit includes only variable cost occurred in the production of the goods

(van der Poll and Mthiyane, 2018). Absorption Costing uses all the production costs which are

obtained while production of the goods.

Marginal Costing Absorption Costing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.