Management Accounting: Methods, Reporting, and Cost Analysis Report

VerifiedAdded on 2021/02/21

|23

|5084

|51

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and practices, focusing on their application within Avon Rubber Plc. It begins by defining management accounting and outlining its essential requirements, differentiating it from financial accounting. The report then delves into various management accounting systems, including cost accounting, price optimization, inventory management, and job costing, explaining their functionalities and importance. It further explores different methods used in management accounting reporting, such as budget reports, account receivable reports, job cost reports, and inventory and manufacturing reports, highlighting their roles in decision-making, controlling, and planning. Additionally, the report includes calculations and an income statement analysis using marginal and absorption costing methods, with an annexure showcasing these calculations. Finally, the report compares how organizations adapt management accounting systems to address financial issues, offering valuable insights into the practical application of these concepts.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1 Explain management accounting and its essential requirements of different accounting

system..........................................................................................................................................1

P2 Explain the different methods used for management accounting reporting..........................3

LO 2.................................................................................................................................................5

P3 Calculation and income statement.........................................................................................5

ANNEXURE A ..........................................................................................................................5

ANNEXURE B .......................................................................................................................11

ANNEXURE C.........................................................................................................................12

LO 3...............................................................................................................................................13

P4. Identification of advantages and disadvantages of various planning tool utilised for

budgetary control ....................................................................................................................13

LO 4...............................................................................................................................................15

P5. Comparing the way organization are adapting management accounting system for

responding to financial issues ..................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1 Explain management accounting and its essential requirements of different accounting

system..........................................................................................................................................1

P2 Explain the different methods used for management accounting reporting..........................3

LO 2.................................................................................................................................................5

P3 Calculation and income statement.........................................................................................5

ANNEXURE A ..........................................................................................................................5

ANNEXURE B .......................................................................................................................11

ANNEXURE C.........................................................................................................................12

LO 3...............................................................................................................................................13

P4. Identification of advantages and disadvantages of various planning tool utilised for

budgetary control ....................................................................................................................13

LO 4...............................................................................................................................................15

P5. Comparing the way organization are adapting management accounting system for

responding to financial issues ..................................................................................................15

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Management accounting is the precondition of fiscal information as well as utilised by

management in an enterprise. Accounting is represented the various accounting information and

results of management in term of framing policies and daily routine work in organisation. This

help to management of company to perform their function like planning, organizing, staffing,

directing and controlling of accounting results (Alsharari, Dixon and Youssef, 2015). It is

through the financial accounting company is get proper financial information on the time that

helps manager in forecasting and analysing different activities to be undertaken for the growth of

organisation. The present report will be based on “Avon Rubber Plc” which is British

engineering company. The company is manufacturing of respiratory protection equipment for

military, milking products for the farmers and rubber products for personal protection.

The study lays emphasis on the management accounting and give essential requirements

of different types of management accounting system. The report will explain by the different

methods which are used for management accounting reporting.

LO 1

P1 Management accounting

The management accounting is term which has refers the provision of accounting

information for better informing to manager. It is adds performance and management for control

functions. It is the practical application of professed skills as well as knowledge in collecting

accountancy content (Weetman, 2019). This is provided in financial reporting and control for

assessing management implementation of company strategy. This defined as an outcome which

is happened surrounding the business by considering needs and wants.

This provide financial data and statistical information to manager of Avon company with

the help of making the short term and day by day decision. Managing professional practices of

accounting that is highly important and essential for growth and development of business

(Järvenpää and Länsiluoto, 2016). This help to take each and every decision-making process of

the organisation which is help to manage records, financial reports.

Different types of management accounting system and its requirements

Cost accounting system

Management accounting is the precondition of fiscal information as well as utilised by

management in an enterprise. Accounting is represented the various accounting information and

results of management in term of framing policies and daily routine work in organisation. This

help to management of company to perform their function like planning, organizing, staffing,

directing and controlling of accounting results (Alsharari, Dixon and Youssef, 2015). It is

through the financial accounting company is get proper financial information on the time that

helps manager in forecasting and analysing different activities to be undertaken for the growth of

organisation. The present report will be based on “Avon Rubber Plc” which is British

engineering company. The company is manufacturing of respiratory protection equipment for

military, milking products for the farmers and rubber products for personal protection.

The study lays emphasis on the management accounting and give essential requirements

of different types of management accounting system. The report will explain by the different

methods which are used for management accounting reporting.

LO 1

P1 Management accounting

The management accounting is term which has refers the provision of accounting

information for better informing to manager. It is adds performance and management for control

functions. It is the practical application of professed skills as well as knowledge in collecting

accountancy content (Weetman, 2019). This is provided in financial reporting and control for

assessing management implementation of company strategy. This defined as an outcome which

is happened surrounding the business by considering needs and wants.

This provide financial data and statistical information to manager of Avon company with

the help of making the short term and day by day decision. Managing professional practices of

accounting that is highly important and essential for growth and development of business

(Järvenpää and Länsiluoto, 2016). This help to take each and every decision-making process of

the organisation which is help to manage records, financial reports.

Different types of management accounting system and its requirements

Cost accounting system

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting is the process of summarizing, recording, classifying, assessing and

allocating of current cost and prospectives expenditure that are related to the procedure and

developing after in different courses of actions for controlling cost.. It is advising the

management and also optimising practices of business which has totally based on the capabilities

and efficiency of cost. This is also provided the detail and prefect information of the cost which

is help to manage and required controlling actual transaction and planning. If Avon organization

is follow this than they are able control current operations of business.

Cost accounting system is required for taking decision which optimize revenue and

profitability of company (Different types of management accounting system, 2018.). It is internal

reporting system for management take all decision as per requirements. This is important

because with the help of this manager able to understand cost of running business.

Price optimisation system

The price improvement scheme is a mathematical model which is help to calculate

various demands prices level for recommended price which are help to improve profit and

revenue. This is also uses the data and analyse to predict potential buyer and their behaviour at

different price of product and services. This allow to Avon company to use price of product as a

powerful profit level which is under developed. With the help of this company is able to manage

their account and price optimism of system by profit. This is start with the segmentation of

customers where seller estimates customers at various segments and it will respond to various

pricing strategy by many channels.

Inventory management system

Stock administration method is a software tracking system at the different level like sales, orders,

deliveries and others. Mostly this system is used in manufacturing company and industry for

creating and tracking orders of work, bills materials and all the documents which are related to

production. The Avon company is manufacturing company which is used inventory management

software for reducing wastages from outages and overstocks by inventory control management.

It is important tools and techniques which are help to organize inventory data before and it was

generally stored in hard copy and spreadsheets.

This system is essential and important for raise sales and tracking each and every units by

prefect stock management, fulfil the orders and control software of the inventory. This help to

specifying place and shape of stock goods in stores area (De Villiers and Maroun, 2015). It is

allocating of current cost and prospectives expenditure that are related to the procedure and

developing after in different courses of actions for controlling cost.. It is advising the

management and also optimising practices of business which has totally based on the capabilities

and efficiency of cost. This is also provided the detail and prefect information of the cost which

is help to manage and required controlling actual transaction and planning. If Avon organization

is follow this than they are able control current operations of business.

Cost accounting system is required for taking decision which optimize revenue and

profitability of company (Different types of management accounting system, 2018.). It is internal

reporting system for management take all decision as per requirements. This is important

because with the help of this manager able to understand cost of running business.

Price optimisation system

The price improvement scheme is a mathematical model which is help to calculate

various demands prices level for recommended price which are help to improve profit and

revenue. This is also uses the data and analyse to predict potential buyer and their behaviour at

different price of product and services. This allow to Avon company to use price of product as a

powerful profit level which is under developed. With the help of this company is able to manage

their account and price optimism of system by profit. This is start with the segmentation of

customers where seller estimates customers at various segments and it will respond to various

pricing strategy by many channels.

Inventory management system

Stock administration method is a software tracking system at the different level like sales, orders,

deliveries and others. Mostly this system is used in manufacturing company and industry for

creating and tracking orders of work, bills materials and all the documents which are related to

production. The Avon company is manufacturing company which is used inventory management

software for reducing wastages from outages and overstocks by inventory control management.

It is important tools and techniques which are help to organize inventory data before and it was

generally stored in hard copy and spreadsheets.

This system is essential and important for raise sales and tracking each and every units by

prefect stock management, fulfil the orders and control software of the inventory. This help to

specifying place and shape of stock goods in stores area (De Villiers and Maroun, 2015). It is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

required or supplying the facilities at different location for preceding planned and regular courses

of production and stock of all materials.

LIFO is the method which is used in the inventory accounting. In this method, cost is most

important and recent products purchased are the first to be expended. As per this method,

company is use last inventory in first and first inventory in last.

FIFO is stand as the first in first out, as per this method company is use first inventory and raw

material first in use of production.

Job costing system

Job costing system is types which is utilized for trade good are made on the basis of

specific customer requirement and order. It is allowed the job numbers which has been assigned

to the single products of revenues and expenses. This helps to assess all expenditure which are

included in the construction of job and manufacturing products and services in discrete batches.

All the cost are keep in the account book throughout the job. After, then it had been summarized

in the final trial balance earlier set up the statements of manufacturing and job cost.

Those are highly important and essential for business and its growth for keep their records and

control resources in proper manner. Those are important for company with the help of this

company make their accounting and records of their raw material in effective manner.

P2 Explain the different methods used for management accounting reporting.

). It is specifically used for decision-making, controlling and planning of business which is

depends on the financial statements (Wagenhofer, 2016. There are different methods which are

used in management reporting. Those are as follows:

Budget report

Budget management accounting report is very critical which is help to measures

performance department wise. Every company is make budget for understand their business. It is

estimation which is based on the previous experience and report estimation. The budget report

helps to owner of the business for assessing manager and employees performance of their

departments. This is generally made for apply before financial year plan and also adjust future

projections (Types of management accounting reporting, 2017). Avon company is spend list of

all sources of income and expenses. With the help of this company is tried to achieve gaols and

objectives of company. Manager of Avon company used budget report in order to providing

of production and stock of all materials.

LIFO is the method which is used in the inventory accounting. In this method, cost is most

important and recent products purchased are the first to be expended. As per this method,

company is use last inventory in first and first inventory in last.

FIFO is stand as the first in first out, as per this method company is use first inventory and raw

material first in use of production.

Job costing system

Job costing system is types which is utilized for trade good are made on the basis of

specific customer requirement and order. It is allowed the job numbers which has been assigned

to the single products of revenues and expenses. This helps to assess all expenditure which are

included in the construction of job and manufacturing products and services in discrete batches.

All the cost are keep in the account book throughout the job. After, then it had been summarized

in the final trial balance earlier set up the statements of manufacturing and job cost.

Those are highly important and essential for business and its growth for keep their records and

control resources in proper manner. Those are important for company with the help of this

company make their accounting and records of their raw material in effective manner.

P2 Explain the different methods used for management accounting reporting.

). It is specifically used for decision-making, controlling and planning of business which is

depends on the financial statements (Wagenhofer, 2016. There are different methods which are

used in management reporting. Those are as follows:

Budget report

Budget management accounting report is very critical which is help to measures

performance department wise. Every company is make budget for understand their business. It is

estimation which is based on the previous experience and report estimation. The budget report

helps to owner of the business for assessing manager and employees performance of their

departments. This is generally made for apply before financial year plan and also adjust future

projections (Types of management accounting reporting, 2017). Avon company is spend list of

all sources of income and expenses. With the help of this company is tried to achieve gaols and

objectives of company. Manager of Avon company used budget report in order to providing

incentives and compensation to their employees. This is also helped to comparing set of data and

evaluates accurate and realistic data by predictions.

Account receivable report

. The report of management accounting is break into remaining balance of clients and

customers into specific time which is allowed manager of Avon company for identifying issues

in company collection of process. It is basically presents money which is generated by entities of

organisation on sales of credit products and services (Schaltegger and Burritt, 2017). This can be

mailing and electronically delivering to their customers. The account receivable is charge get

funds on the place of organisation. This is applies on its actual pending balance. This is effective

and best accounting report which is help to manage credit sales of product and services. It is

important for company because with the help of this manager is able to manage accounts

inventory on daily basis.

Job cost report

The job cost report shows expenses for a specific projects which are financed by

business. The main goal of job methods is to estimation of profitability and revenues that are

evaluated by profitability of job. It has also helped to research the higher earning of area which is

focused on the additional and hard efforts of money in wasting time on lower profit margin. This

also used for observing the expenses while the project in progress of company. This process is

help to determine labour cost and material cost of every aye work in effective manner and also in

systematic manner (Boiral, 2016). This is basically used in virtually in the Avon company which

is help to management for ensure price of products and cover accurate, current cost and its

provide revenue.

Inventory and manufacturing report

The inventory and manufacturing system is help to manage the physical inventory and

produce item which can be used in the managerial accounting report in order to remove hurdles

from manufacturing process and also make it more efficient and effective (Kaplan and Atkinson,

2015). This can includes the waste inventory, per hours labour cost at per unit overhead costs.

This help to compare in different lines and departments of business which highlight those areas

where have need fir improvement and best performance of different department.

Execution report

evaluates accurate and realistic data by predictions.

Account receivable report

. The report of management accounting is break into remaining balance of clients and

customers into specific time which is allowed manager of Avon company for identifying issues

in company collection of process. It is basically presents money which is generated by entities of

organisation on sales of credit products and services (Schaltegger and Burritt, 2017). This can be

mailing and electronically delivering to their customers. The account receivable is charge get

funds on the place of organisation. This is applies on its actual pending balance. This is effective

and best accounting report which is help to manage credit sales of product and services. It is

important for company because with the help of this manager is able to manage accounts

inventory on daily basis.

Job cost report

The job cost report shows expenses for a specific projects which are financed by

business. The main goal of job methods is to estimation of profitability and revenues that are

evaluated by profitability of job. It has also helped to research the higher earning of area which is

focused on the additional and hard efforts of money in wasting time on lower profit margin. This

also used for observing the expenses while the project in progress of company. This process is

help to determine labour cost and material cost of every aye work in effective manner and also in

systematic manner (Boiral, 2016). This is basically used in virtually in the Avon company which

is help to management for ensure price of products and cover accurate, current cost and its

provide revenue.

Inventory and manufacturing report

The inventory and manufacturing system is help to manage the physical inventory and

produce item which can be used in the managerial accounting report in order to remove hurdles

from manufacturing process and also make it more efficient and effective (Kaplan and Atkinson,

2015). This can includes the waste inventory, per hours labour cost at per unit overhead costs.

This help to compare in different lines and departments of business which highlight those areas

where have need fir improvement and best performance of different department.

Execution report

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting is used for spending plan to contrast genuine uses and also

incomes by planned sums. The finding of new budget can be changed all intend has been

analysed to all data amount which are listed in the performance report. Every pass year is

performance report is calculated (Mårtensson and et.al., 2016). This types of report enable for

director to ready for address future wants and demand in the production and in the cost. There

are many of reports which are help to arranged records with the help of management accounting.

In order to analysis placed and received order and booking company is use information report

because in company there are lots of products and services are manufactured and ordered which

are summarized in this report. This report is made for assessing opportunities to settle all the

choices with respect to present for future organisation conditions.

Those are the management accounting reporting which are help to manager of Avon

company to keep record of employee performance and get ready for future situation (Warren Jr

and et.al,, 2015).

LO 2

P3 Calculation and income statement..

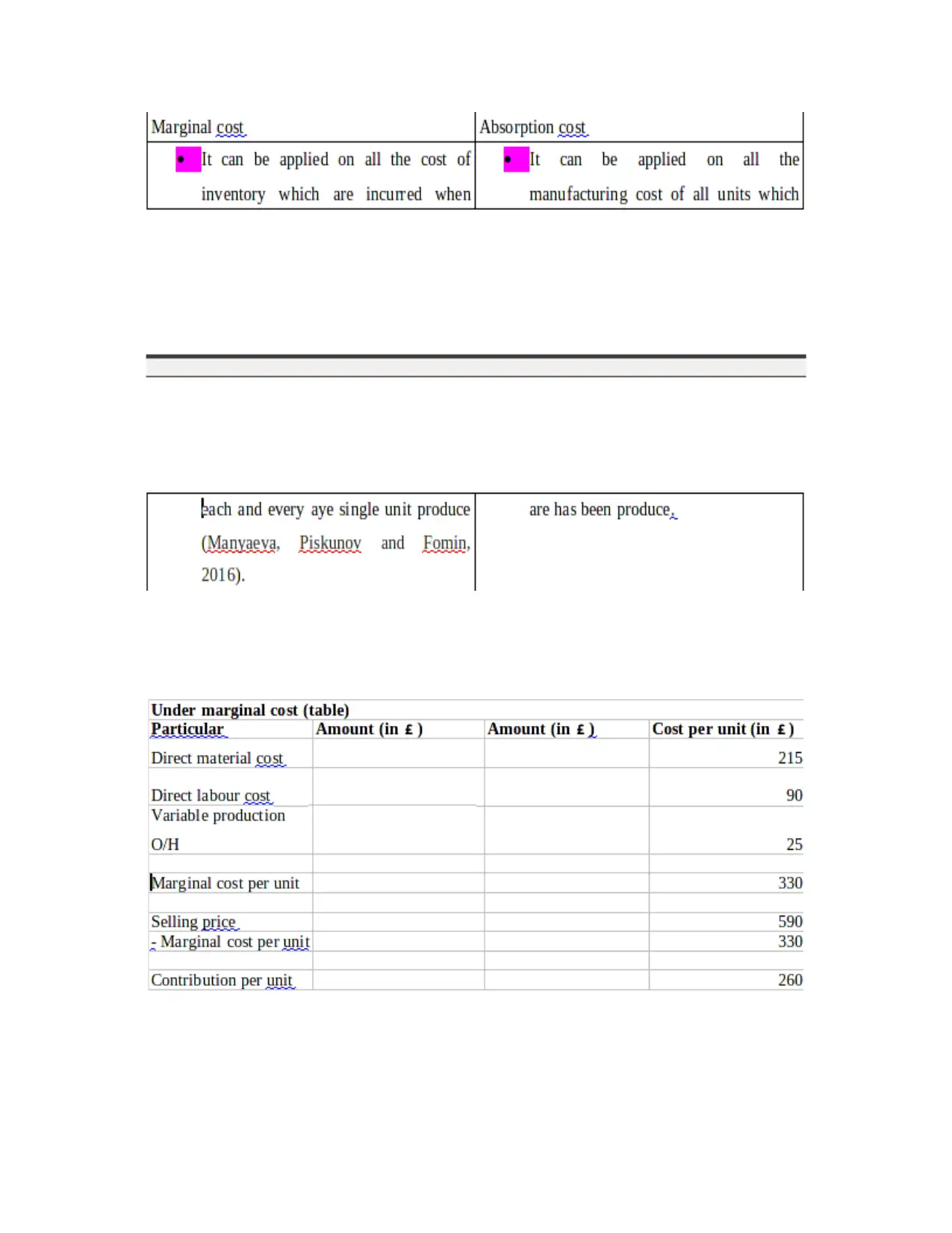

Cost accounting is very important and effective part of the company. This is the process

of recording, analysing and summarizing cost of production process. There are four types of cost

which are as follows:

Fixed cost is not varied according to the amount of work.

Variable cost is cost which is variable in company like packaging, shipping and

processing cost.

Direct cost is directly related to the production and selling the company products.

ANNEXURE A

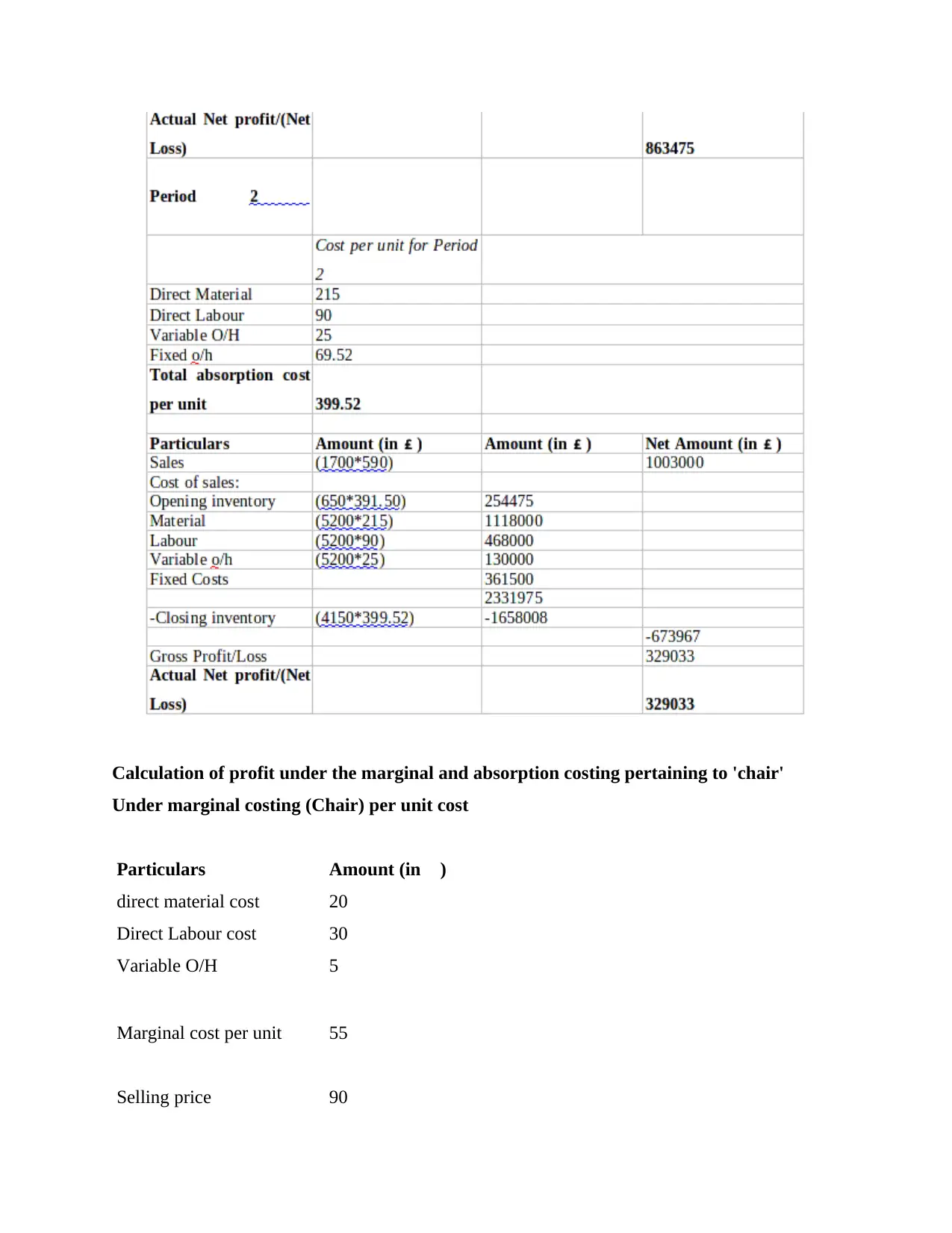

Calculation of profit in marginal and absorption costing pertaining to table:

incomes by planned sums. The finding of new budget can be changed all intend has been

analysed to all data amount which are listed in the performance report. Every pass year is

performance report is calculated (Mårtensson and et.al., 2016). This types of report enable for

director to ready for address future wants and demand in the production and in the cost. There

are many of reports which are help to arranged records with the help of management accounting.

In order to analysis placed and received order and booking company is use information report

because in company there are lots of products and services are manufactured and ordered which

are summarized in this report. This report is made for assessing opportunities to settle all the

choices with respect to present for future organisation conditions.

Those are the management accounting reporting which are help to manager of Avon

company to keep record of employee performance and get ready for future situation (Warren Jr

and et.al,, 2015).

LO 2

P3 Calculation and income statement..

Cost accounting is very important and effective part of the company. This is the process

of recording, analysing and summarizing cost of production process. There are four types of cost

which are as follows:

Fixed cost is not varied according to the amount of work.

Variable cost is cost which is variable in company like packaging, shipping and

processing cost.

Direct cost is directly related to the production and selling the company products.

ANNEXURE A

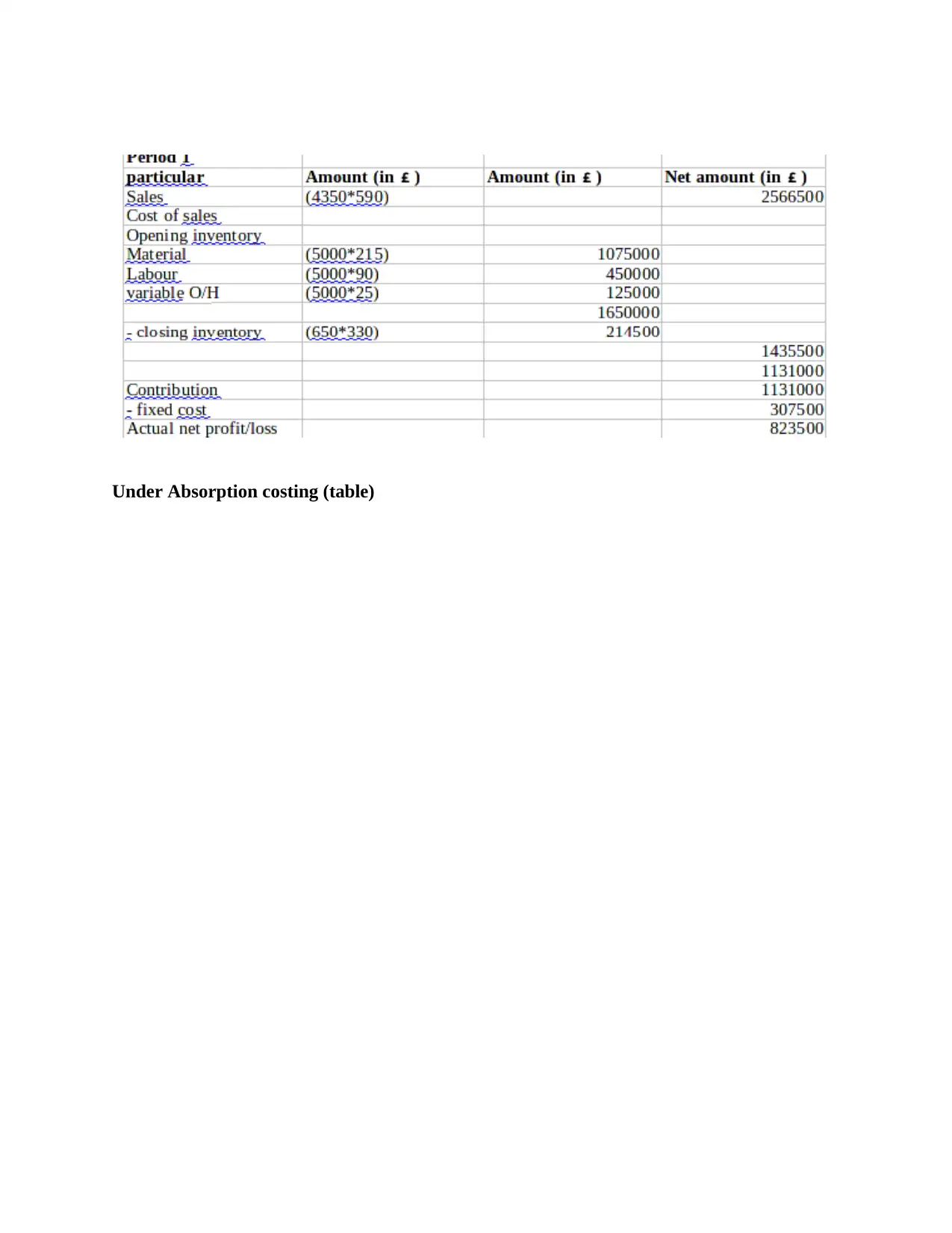

Calculation of profit in marginal and absorption costing pertaining to table:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Under Absorption costing (table)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

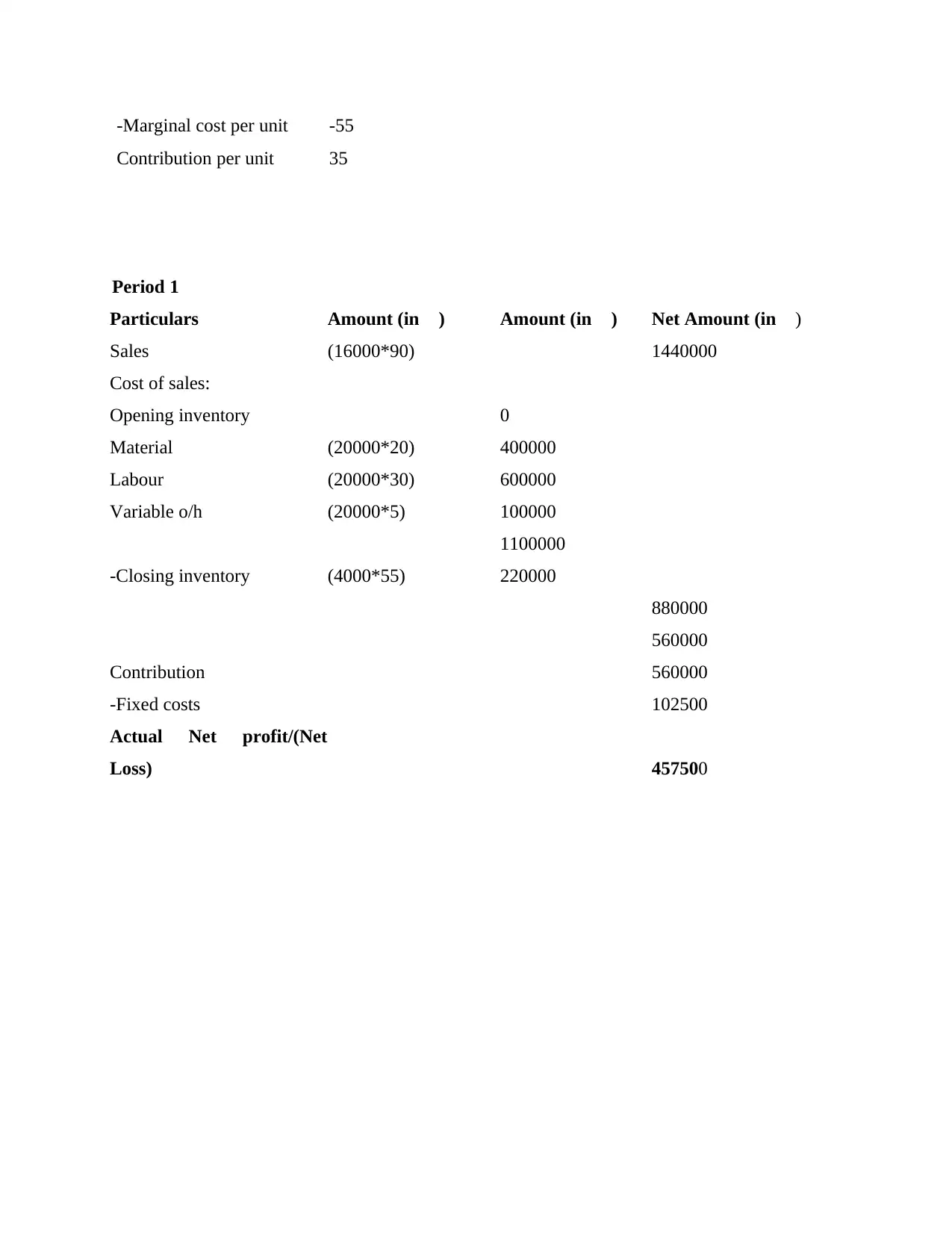

Calculation of profit under the marginal and absorption costing pertaining to 'chair'

Under marginal costing (Chair) per unit cost

Particulars Amount (in £)

direct material cost 20

Direct Labour cost 30

Variable O/H 5

Marginal cost per unit 55

Selling price 90

Under marginal costing (Chair) per unit cost

Particulars Amount (in £)

direct material cost 20

Direct Labour cost 30

Variable O/H 5

Marginal cost per unit 55

Selling price 90

-Marginal cost per unit -55

Contribution per unit 35

Period 1

Particulars Amount (in £) Amount (in £) Net Amount (in £)

Sales (16000*90) 1440000

Cost of sales:

Opening inventory 0

Material (20000*20) 400000

Labour (20000*30) 600000

Variable o/h (20000*5) 100000

1100000

-Closing inventory (4000*55) 220000

880000

560000

Contribution 560000

-Fixed costs 102500

Actual Net profit/(Net

Loss) 457500

Contribution per unit 35

Period 1

Particulars Amount (in £) Amount (in £) Net Amount (in £)

Sales (16000*90) 1440000

Cost of sales:

Opening inventory 0

Material (20000*20) 400000

Labour (20000*30) 600000

Variable o/h (20000*5) 100000

1100000

-Closing inventory (4000*55) 220000

880000

560000

Contribution 560000

-Fixed costs 102500

Actual Net profit/(Net

Loss) 457500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.