Management Accounting Report: Cost Analysis and Reporting Methods

VerifiedAdded on 2020/07/23

|18

|4414

|276

Report

AI Summary

This report delves into the core concepts of management accounting, encompassing the recognition, analysis, recording, and demonstration of financial information for internal stakeholders. It explores the role of management accounting in strategic planning, decision-making, and controlling business activities. The report outlines various methods for management accounting reporting, including budgeting, marginal costing, ratio analysis, and segmented reporting. It evaluates cost analysis techniques to prepare income statements using marginal costing. Furthermore, it examines the advantages and disadvantages of planning tools like budgetary control and compares how enterprises adapt management accounting systems to address financial problems. The report emphasizes the importance of management accounting in providing insights for effective business plans, financial stability, and operational improvements.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1 Explaining management accounting and important requirement of several forms of

management accounting..............................................................................................................2

P2 Methods that can be utilised for management accounting reporting....................................4

TASK 2............................................................................................................................................6

P3 Evaluating costs by utilising suitable techniques of cost analysis to prepare income

statement ....................................................................................................................................6

TASK 3..........................................................................................................................................10

P4 Advantages and disadvantages of several types of planning tools that can be utilised for

budgetary control......................................................................................................................10

P5 Comparing the way an enterprise is required to adapt management accounting system for

providing response to financial problem...................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

1

INTRODUCTION...........................................................................................................................2

TASK 1............................................................................................................................................2

P1 Explaining management accounting and important requirement of several forms of

management accounting..............................................................................................................2

P2 Methods that can be utilised for management accounting reporting....................................4

TASK 2............................................................................................................................................6

P3 Evaluating costs by utilising suitable techniques of cost analysis to prepare income

statement ....................................................................................................................................6

TASK 3..........................................................................................................................................10

P4 Advantages and disadvantages of several types of planning tools that can be utilised for

budgetary control......................................................................................................................10

P5 Comparing the way an enterprise is required to adapt management accounting system for

providing response to financial problem...................................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

1

INTRODUCTION

Management accounting is defined as the procedure of recognising, analysing, recording

and demonstrating the financial information. This data can be utilised by management for

making plan, decision, and controlling various business activities. The objective of management

accounting is to provide useful information to various stakeholders. Information provided by

management information assist manager in formulating effective business plans and controlling

various operations. It also helps manager in recognising the financial status of the company and

creating appropriate tactics to aid organisation in maintaining financial stability. The

management accounting present the various information such as availability of cash,revenue

generated, income earned, inventories, account receivable etc. It also may present data like trend

charts, variance analysis and other useful statistics. Management accounting is considered as

important tool that assist manager in strategic planning.

The report emphasizes on understanding the concept of management accounting . It will

highlight the several methods that are utilised for reporting of management accounting

information. The project will include the way an enterprise is required to adapt the system of

management accounting for responding to financial problem. It will also present the advantages

as well as disadvantages of management accounting.

TASK 1

P1 Explaining management accounting and important requirement of several forms of

management accounting

Management accounting is refers to as the provision of financial as well as non financial

decision making. As per the Institutes of management accounting , it is basically considered as a

profession that includes partnering in decision making process by management, formulating

plans, and developing performance management system. This procedure also includes

preparation of financial statement (Renz,2016.) The purpose of management accounting is to

help manager in development and implementation of business strategy. The management

accounting is concerned with analysing the business activities and identifying the various

business requirement. It deals mainly with three fields these are strategic, performance and risk

management. Strategic management advances the function of management accountant as a

strategic planner in the business entity. The role of management accounting is to support

2

Management accounting is defined as the procedure of recognising, analysing, recording

and demonstrating the financial information. This data can be utilised by management for

making plan, decision, and controlling various business activities. The objective of management

accounting is to provide useful information to various stakeholders. Information provided by

management information assist manager in formulating effective business plans and controlling

various operations. It also helps manager in recognising the financial status of the company and

creating appropriate tactics to aid organisation in maintaining financial stability. The

management accounting present the various information such as availability of cash,revenue

generated, income earned, inventories, account receivable etc. It also may present data like trend

charts, variance analysis and other useful statistics. Management accounting is considered as

important tool that assist manager in strategic planning.

The report emphasizes on understanding the concept of management accounting . It will

highlight the several methods that are utilised for reporting of management accounting

information. The project will include the way an enterprise is required to adapt the system of

management accounting for responding to financial problem. It will also present the advantages

as well as disadvantages of management accounting.

TASK 1

P1 Explaining management accounting and important requirement of several forms of

management accounting

Management accounting is refers to as the provision of financial as well as non financial

decision making. As per the Institutes of management accounting , it is basically considered as a

profession that includes partnering in decision making process by management, formulating

plans, and developing performance management system. This procedure also includes

preparation of financial statement (Renz,2016.) The purpose of management accounting is to

help manager in development and implementation of business strategy. The management

accounting is concerned with analysing the business activities and identifying the various

business requirement. It deals mainly with three fields these are strategic, performance and risk

management. Strategic management advances the function of management accountant as a

strategic planner in the business entity. The role of management accounting is to support

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

manager in designing the business practice, assist in making suitable decision. It also aids

organisation in managing as well as improving business performance. Management accounting

contributes to guidelines and practices for recognising, evaluating, managing and reporting risks

in order to achieve goals and objectives for the enterprise (Owusu,2016) The preparation of

management accounting require specialise knowledge and skills in order to develop and present

financial or other decision oriented data or other useful information. Management accounting

helps management team in development of business policies , planning and controlling

organisational activities. It is considered as value creator as it has focus on planning and making

decisions for the future of an enterprise. The professional knowledge and related to management

accounting and experience can be gained from several areas and function within a company like

treasury, information management system, auditing. Valuation, pricing, logistics and marketing.

The number of tools that can be adopted by manager for effective as well as suitable decision

making. These methods are budget , forecasts and analysis etc. (Suomala, Lyly-Yrjänäinen and

Lukka,2014.) The management accounting provides a detail data about goods, employees

activities, operational, various projects, divisional plants and operations. The objective of

utilising management accounting system is to identify the additional expenses and planning

strategies to reduce costs. It also aids business entity in recognising the overheads that has great

impact on the overall profit and growth of organisation. Management accounting assist manager

in Answer lab company in analysing its existing business profits and losses. It also supports cited

venture in predicting the benefits that can be gained in the future by an enterprise. Management

accounting system helps manager in identifying the current business performance and

formulating strategies in order to enhance the operations. It also supports management in

establishing bench marks for measuring the actual business performance with standard.

Management accounting system enables firm in ensuring the effective as well as efficient

utilisation of business financial resources. It aids business entity in controlling the cash flow and

reducing various costs. Hence, it is proved that management accounting plays significant role in

identifying the need of resources and assist account manager in making suitable as well as

effective decision. Management accounting is also recognised as cost control device that enables

organisation to reduce the prices of products. It also allows business entity to provide good

quality products at reasonable price to customers.

3

organisation in managing as well as improving business performance. Management accounting

contributes to guidelines and practices for recognising, evaluating, managing and reporting risks

in order to achieve goals and objectives for the enterprise (Owusu,2016) The preparation of

management accounting require specialise knowledge and skills in order to develop and present

financial or other decision oriented data or other useful information. Management accounting

helps management team in development of business policies , planning and controlling

organisational activities. It is considered as value creator as it has focus on planning and making

decisions for the future of an enterprise. The professional knowledge and related to management

accounting and experience can be gained from several areas and function within a company like

treasury, information management system, auditing. Valuation, pricing, logistics and marketing.

The number of tools that can be adopted by manager for effective as well as suitable decision

making. These methods are budget , forecasts and analysis etc. (Suomala, Lyly-Yrjänäinen and

Lukka,2014.) The management accounting provides a detail data about goods, employees

activities, operational, various projects, divisional plants and operations. The objective of

utilising management accounting system is to identify the additional expenses and planning

strategies to reduce costs. It also aids business entity in recognising the overheads that has great

impact on the overall profit and growth of organisation. Management accounting assist manager

in Answer lab company in analysing its existing business profits and losses. It also supports cited

venture in predicting the benefits that can be gained in the future by an enterprise. Management

accounting system helps manager in identifying the current business performance and

formulating strategies in order to enhance the operations. It also supports management in

establishing bench marks for measuring the actual business performance with standard.

Management accounting system enables firm in ensuring the effective as well as efficient

utilisation of business financial resources. It aids business entity in controlling the cash flow and

reducing various costs. Hence, it is proved that management accounting plays significant role in

identifying the need of resources and assist account manager in making suitable as well as

effective decision. Management accounting is also recognised as cost control device that enables

organisation to reduce the prices of products. It also allows business entity to provide good

quality products at reasonable price to customers.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Importance of management accounting in context of organisation's

Cost analysis-The management accounting assists manager in identifying the costs that have

direct effect on the business profits. It also aids organisation in planning and formulating policies

as well as strategies in order to reduce expenses. Management accounting also support business

entity in determining the products that should be sold and recognising the appropriate profit

margins that can be earned by selling particular products. Cost analysis technique aids manager

in controlling the flow cash.

Use of information-management accounting system provides several techniques such as

financial statement, budgeting, balance scorecards and projections that can be utilise for

analysing the financial as well as non financial information. The manager in cited venture can

adopt this technique for making importance decision. It also assists business entity in identifying

the sources of raising funds and financial resources.

Decision making-The management accounting plays significant role by assisting the firm in

making important financial decision. As these conclusions can have great effect on the success

and growth of the business. These factors can also have great impact ion the profitability and

sustainability of organisation.

Activity oriented Costing-This is the costing technique, the manager in cited venture can

determine the operations that is needed to produce or develop goods and services.

Variance analysis-This the systematic approach that is used by cited venture for making

comparison actual costs with budgeted expenses that beard by firm in order to purchase raw

material that is required to produce goods and services. This is the effective concept or technique

as it provides the ability to derive costs directly from operational resource data or to isolate and

measure unused capacity costs.

Management accounting support business Venture in increasing its efficiency- The objectives

as well as goals of several departments in an organisation are determined and established in

advance. These targets helps management in evaluating or identifying business efficiency

(Deegan, 2013)

P2 Methods that can be utilised for management accounting reporting

The account manager in cited venture is required to provide management report to the top

level management team in organisation. As this reports assist top level management in making

4

Cost analysis-The management accounting assists manager in identifying the costs that have

direct effect on the business profits. It also aids organisation in planning and formulating policies

as well as strategies in order to reduce expenses. Management accounting also support business

entity in determining the products that should be sold and recognising the appropriate profit

margins that can be earned by selling particular products. Cost analysis technique aids manager

in controlling the flow cash.

Use of information-management accounting system provides several techniques such as

financial statement, budgeting, balance scorecards and projections that can be utilise for

analysing the financial as well as non financial information. The manager in cited venture can

adopt this technique for making importance decision. It also assists business entity in identifying

the sources of raising funds and financial resources.

Decision making-The management accounting plays significant role by assisting the firm in

making important financial decision. As these conclusions can have great effect on the success

and growth of the business. These factors can also have great impact ion the profitability and

sustainability of organisation.

Activity oriented Costing-This is the costing technique, the manager in cited venture can

determine the operations that is needed to produce or develop goods and services.

Variance analysis-This the systematic approach that is used by cited venture for making

comparison actual costs with budgeted expenses that beard by firm in order to purchase raw

material that is required to produce goods and services. This is the effective concept or technique

as it provides the ability to derive costs directly from operational resource data or to isolate and

measure unused capacity costs.

Management accounting support business Venture in increasing its efficiency- The objectives

as well as goals of several departments in an organisation are determined and established in

advance. These targets helps management in evaluating or identifying business efficiency

(Deegan, 2013)

P2 Methods that can be utilised for management accounting reporting

The account manager in cited venture is required to provide management report to the top

level management team in organisation. As this reports assist top level management in making

4

suitable decisions related to the business or its activities. It also supports top level manager in

recognising the performance gaps and formulating policies as well as strategies in order to bring

improvement in the business system and practices (Williams,2014) The several methods that can

be adopted for presenting the information of management accounting are:

Budget-This methods helps manager in establishing the standards and principle that are to be

followed by all functional unit within an enterprise. The budget methods assist organisation in

controlling the cost and managing cash Flows. It enables top level management to identify the

performance gap and analyse the appropriate solution for making improvement in business

operations. This method or techniques provide top level management and opportunity to

compare actual figures such bas related to profits, sales, income etc. The budgeted methods helps

manager in identifying appropriates for bringing drastic improvement in business performance.

The Budgeted statement is preprepared by middle level management and presented to the top

level management team through with they can analyse the financial performance of organisation.

The budgeting method is effective tool that support an enterprise in ensuring the effective as well

as efficient utilisation of business resource also aid business entity ion eliminating wastage of

financial resources and assist manager in managing cash flows. This method can also be utilise

for evaluating the performance of workers. It allows employees develop understanding about the

technique that is required for managing financial resources and spending money in such a way

that the maximum output can be gained.

Marginal cost- This method helps organisation in formulating effective pricing strategy. This

plan further assist firm in increasing their profit margin and enabling business entity to provide

quality goods at reasonable price to its customers. It supports manager in making suitable

decision related to pricing of products or services. In simple terms, management accounting

assist enterprise in increasing profitability and sales. The various aspects that are required to be

considered by manager in making pricing decisions are break event point, profit margin,

marginal safety etc. (Weil, Schipper and Francis,2013.) Marginal costing refers top the rise or

decline in aggregate cost of production , if in case the output is raised by one or more additional

unit. If the price that is charged by organisation for particular product per unit is higher than the

marginal cost of producing additional unit, then the business entity should develop and sales that

product. The marginal costing methods helps enterprise in analysing the break event point. It is

5

recognising the performance gaps and formulating policies as well as strategies in order to bring

improvement in the business system and practices (Williams,2014) The several methods that can

be adopted for presenting the information of management accounting are:

Budget-This methods helps manager in establishing the standards and principle that are to be

followed by all functional unit within an enterprise. The budget methods assist organisation in

controlling the cost and managing cash Flows. It enables top level management to identify the

performance gap and analyse the appropriate solution for making improvement in business

operations. This method or techniques provide top level management and opportunity to

compare actual figures such bas related to profits, sales, income etc. The budgeted methods helps

manager in identifying appropriates for bringing drastic improvement in business performance.

The Budgeted statement is preprepared by middle level management and presented to the top

level management team through with they can analyse the financial performance of organisation.

The budgeting method is effective tool that support an enterprise in ensuring the effective as well

as efficient utilisation of business resource also aid business entity ion eliminating wastage of

financial resources and assist manager in managing cash flows. This method can also be utilise

for evaluating the performance of workers. It allows employees develop understanding about the

technique that is required for managing financial resources and spending money in such a way

that the maximum output can be gained.

Marginal cost- This method helps organisation in formulating effective pricing strategy. This

plan further assist firm in increasing their profit margin and enabling business entity to provide

quality goods at reasonable price to its customers. It supports manager in making suitable

decision related to pricing of products or services. In simple terms, management accounting

assist enterprise in increasing profitability and sales. The various aspects that are required to be

considered by manager in making pricing decisions are break event point, profit margin,

marginal safety etc. (Weil, Schipper and Francis,2013.) Marginal costing refers top the rise or

decline in aggregate cost of production , if in case the output is raised by one or more additional

unit. If the price that is charged by organisation for particular product per unit is higher than the

marginal cost of producing additional unit, then the business entity should develop and sales that

product. The marginal costing methods helps enterprise in analysing the break event point. It is

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the point in which the firm incur no loss or no profits .Break even analysis support business

entity in identifying the unit which it requires producing or sell for attaining the situation of no

profit and no loss. This is the point at which the cited venture can recover the cost or additional

expenses .In simple words it can be stated that marginal costing methods can be adopted by cited

venture for determining the expenses which the enterprise has to bear in manufacturing or

producing additional unit of product.

Ratio analysis-This is the other method or system of management accounting that can be

adopted by organisation for measuring the financial as well as overall business performance. It

assists firm in increasing efficiency, profitability, solvency and liquidity. Ratio analysis indicates

the financial performance of enterprise. Ratio analysis is considered as the procedure that assist

manager in determining and explaining the relationship that are based on financial statement.

This method assist enterprise in predicting, coordinating various business operations. It also

supports stakeholders such as investors in obtaining the clear information about the financial

stability and analysing the profitability status of the firm. Liquidity ratio helps manager in

recognising the amount of business funds and determining the additional financial resources

required to fulfil the current liabilities. It also supports cited venture in identifying the effective

sources through which the funds can be raised. Ratio analysis assist manager in determining the

need and importance of changes in the policies, procedures and system. This activity will allow

business entity in improving business performance and assist enterprise in maintaining financial

stability.

Segmented report- This statement is prepared by accountant in order to share organisation

financial information with public. It supports creditors and investors to obtain all financial

information about the company (Ionescu, 2014.)

TASK 2

P3 Evaluating costs by utilising suitable techniques of cost analysis to prepare income statement

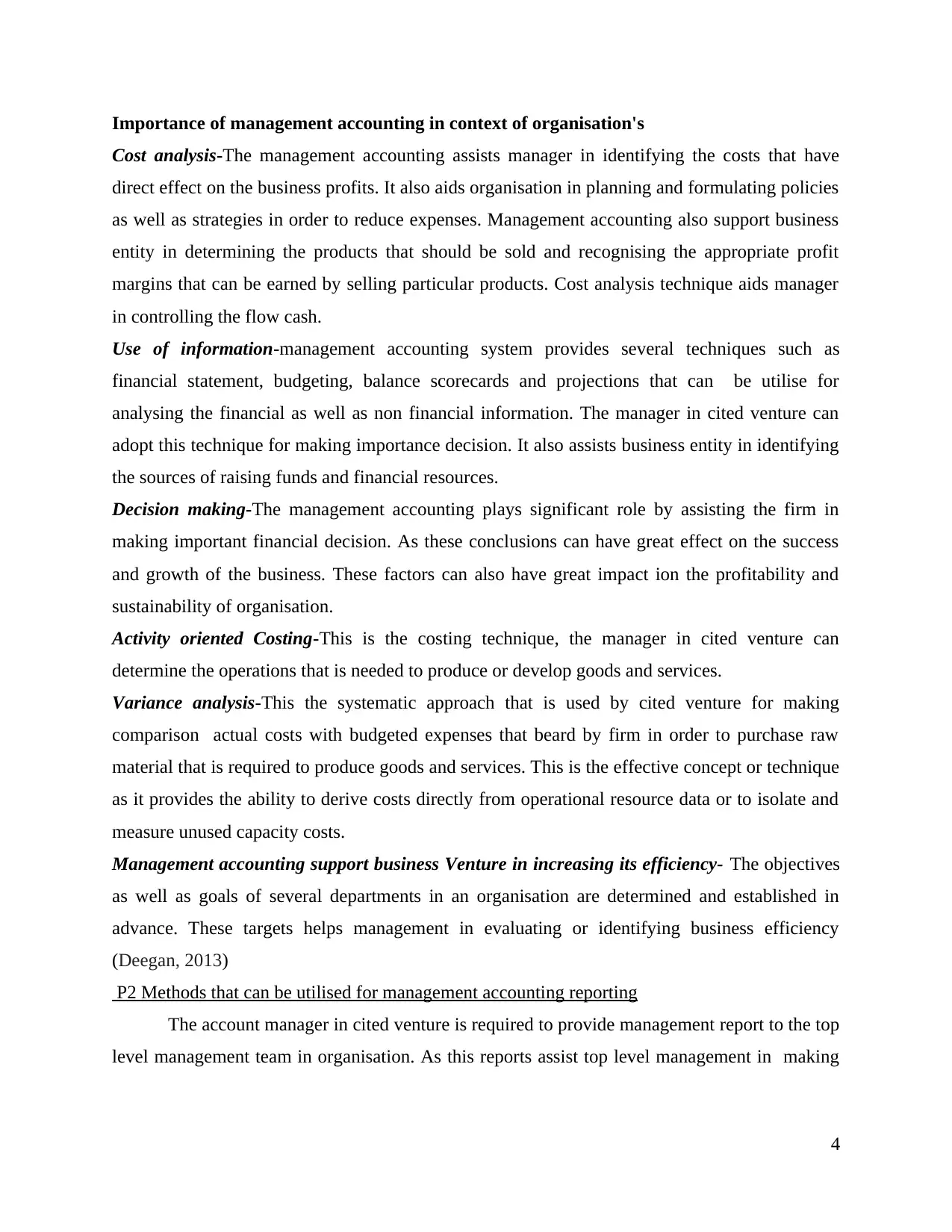

Net profit calculation through marginal costing method

Marginal costing is also recognised as incremental costing. This costing method is

adopted by cited venture for selecting the product and choosing the procedure to conduct. This

activity is facilitated to in for identifying the product or procedure that yield maximum output or

6

entity in identifying the unit which it requires producing or sell for attaining the situation of no

profit and no loss. This is the point at which the cited venture can recover the cost or additional

expenses .In simple words it can be stated that marginal costing methods can be adopted by cited

venture for determining the expenses which the enterprise has to bear in manufacturing or

producing additional unit of product.

Ratio analysis-This is the other method or system of management accounting that can be

adopted by organisation for measuring the financial as well as overall business performance. It

assists firm in increasing efficiency, profitability, solvency and liquidity. Ratio analysis indicates

the financial performance of enterprise. Ratio analysis is considered as the procedure that assist

manager in determining and explaining the relationship that are based on financial statement.

This method assist enterprise in predicting, coordinating various business operations. It also

supports stakeholders such as investors in obtaining the clear information about the financial

stability and analysing the profitability status of the firm. Liquidity ratio helps manager in

recognising the amount of business funds and determining the additional financial resources

required to fulfil the current liabilities. It also supports cited venture in identifying the effective

sources through which the funds can be raised. Ratio analysis assist manager in determining the

need and importance of changes in the policies, procedures and system. This activity will allow

business entity in improving business performance and assist enterprise in maintaining financial

stability.

Segmented report- This statement is prepared by accountant in order to share organisation

financial information with public. It supports creditors and investors to obtain all financial

information about the company (Ionescu, 2014.)

TASK 2

P3 Evaluating costs by utilising suitable techniques of cost analysis to prepare income statement

Net profit calculation through marginal costing method

Marginal costing is also recognised as incremental costing. This costing method is

adopted by cited venture for selecting the product and choosing the procedure to conduct. This

activity is facilitated to in for identifying the product or procedure that yield maximum output or

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

benefits. Marginal costing is concerned with identifying the fixed cost that remains still but there

is rise or decline in the unit produced. It will also affect the total variable cost incurred in an

entity as it is influence in the unit level of business entity. This method or system is also adopted

by manager or accountant in firm for analysing the effect or influence of variable overheads on

complete production cost of cited venture. Marginal costing method can also be utilise for

determining the value of inventory.

Interpretation-It has been identified from the table that marginal cost Answer Lab has assisted

cited venture in improving the production procedure. It has aid business entity in minimising the

cost of production that has direct effect on the profitability of firm. As it has been identified from

the evaluation that the manager in cited business venture need to focus on developing strategies

as well as policies for increasing sales and revenue. The sales volume also have great effect on

the marginal cost. The various business operation has great impact on the marginal cost , raw

material and cost of productions. The cited venture is recommended that it should utilise good

quality of raw material in producing the product. As this activity will help enterprise in

improving the quality of products and gaining customer loyalty. It will further aid organisation in

7

is rise or decline in the unit produced. It will also affect the total variable cost incurred in an

entity as it is influence in the unit level of business entity. This method or system is also adopted

by manager or accountant in firm for analysing the effect or influence of variable overheads on

complete production cost of cited venture. Marginal costing method can also be utilise for

determining the value of inventory.

Interpretation-It has been identified from the table that marginal cost Answer Lab has assisted

cited venture in improving the production procedure. It has aid business entity in minimising the

cost of production that has direct effect on the profitability of firm. As it has been identified from

the evaluation that the manager in cited business venture need to focus on developing strategies

as well as policies for increasing sales and revenue. The sales volume also have great effect on

the marginal cost. The various business operation has great impact on the marginal cost , raw

material and cost of productions. The cited venture is recommended that it should utilise good

quality of raw material in producing the product. As this activity will help enterprise in

improving the quality of products and gaining customer loyalty. It will further aid organisation in

7

increasing its sales and profitability. Innovation is another strategy that will provides enterprise

an opportunity to attract more customers. The utilisation of better quality of raw material in the

production procedure assists enterprise in saving cost. It also aids business entity in minimising

the wastage of resources and reduction of short term losses.

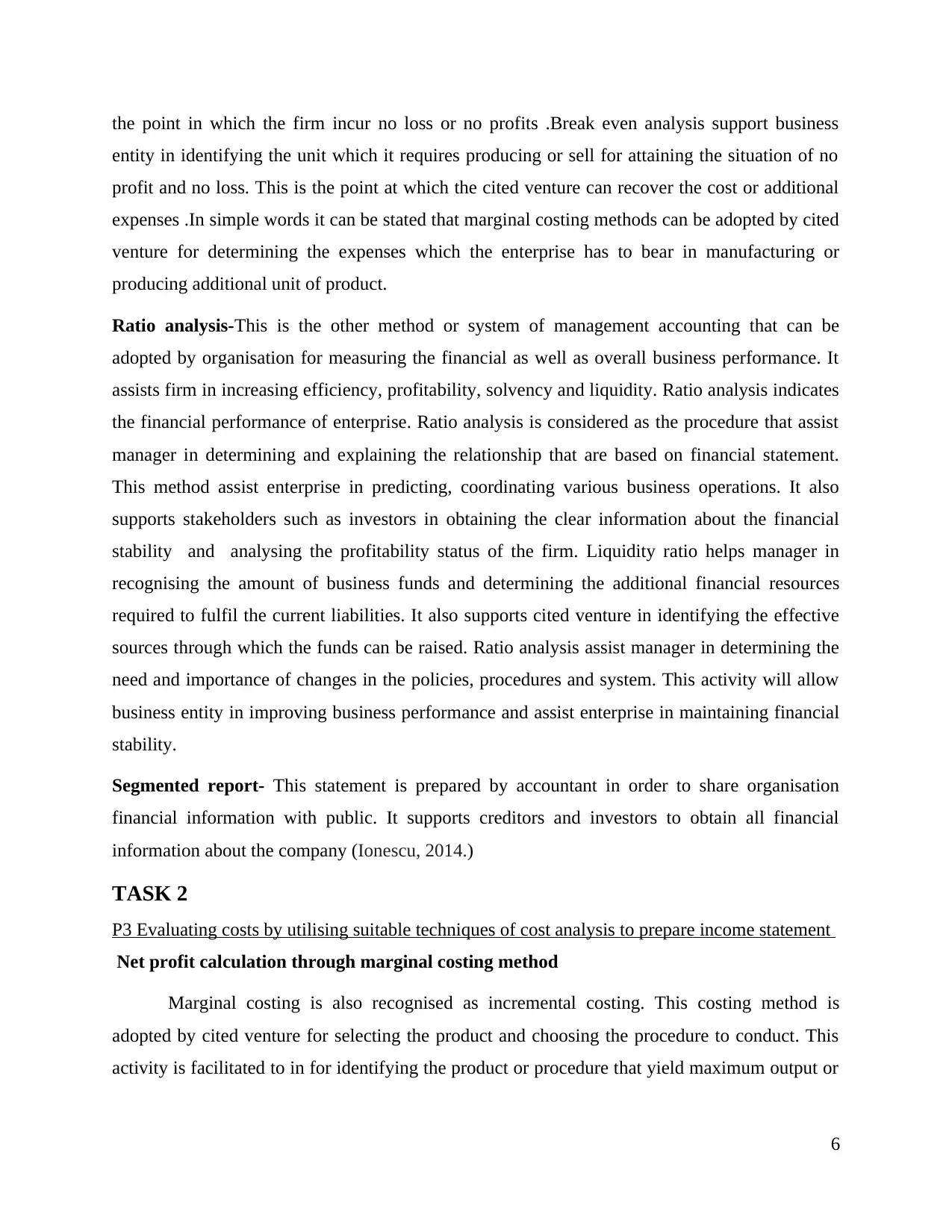

Income statement by absorption costing methods

Absorption costing technique-It is defined as a method of evaluating the cost of goods by

considering the indirect expenses as well as direct costs. Absorption costing technique is also

considered as managerial accounting cost method that can be used for determining all the

expenses or cost that are related to manufacturing of specific product. Absorption costing refers

to the manufacturing expenses that are absorbed by the unit of particular item produced. The

cost of completed unit of product that are kept as inventory involves direct labour, material, fixed

as well as variables manufacturing expenses.

In absorption costing method all the operations as well as evaluation are conducted on the

basis of manufacturing procedure.

8

an opportunity to attract more customers. The utilisation of better quality of raw material in the

production procedure assists enterprise in saving cost. It also aids business entity in minimising

the wastage of resources and reduction of short term losses.

Income statement by absorption costing methods

Absorption costing technique-It is defined as a method of evaluating the cost of goods by

considering the indirect expenses as well as direct costs. Absorption costing technique is also

considered as managerial accounting cost method that can be used for determining all the

expenses or cost that are related to manufacturing of specific product. Absorption costing refers

to the manufacturing expenses that are absorbed by the unit of particular item produced. The

cost of completed unit of product that are kept as inventory involves direct labour, material, fixed

as well as variables manufacturing expenses.

In absorption costing method all the operations as well as evaluation are conducted on the

basis of manufacturing procedure.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation- It can be interpret from the above calculation that increase in production cost has

direct impact on the product prices and quality of goods as well as services. The table has

presented that the variable expenses is 1800 that which is normal but it ad value to the overall

expenses that can have great impact on the profit margin and on the pricers of goods or services.

The manager in cited venture need to develop effective strategies in order to control the fixed

expenses .As this activity will help organisation in maintaining financial stability and minimising

risk or uncertainties in the future (Ismail and King, 2014)

Comparison between two management accounting techniques

9

direct impact on the product prices and quality of goods as well as services. The table has

presented that the variable expenses is 1800 that which is normal but it ad value to the overall

expenses that can have great impact on the profit margin and on the pricers of goods or services.

The manager in cited venture need to develop effective strategies in order to control the fixed

expenses .As this activity will help organisation in maintaining financial stability and minimising

risk or uncertainties in the future (Ismail and King, 2014)

Comparison between two management accounting techniques

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

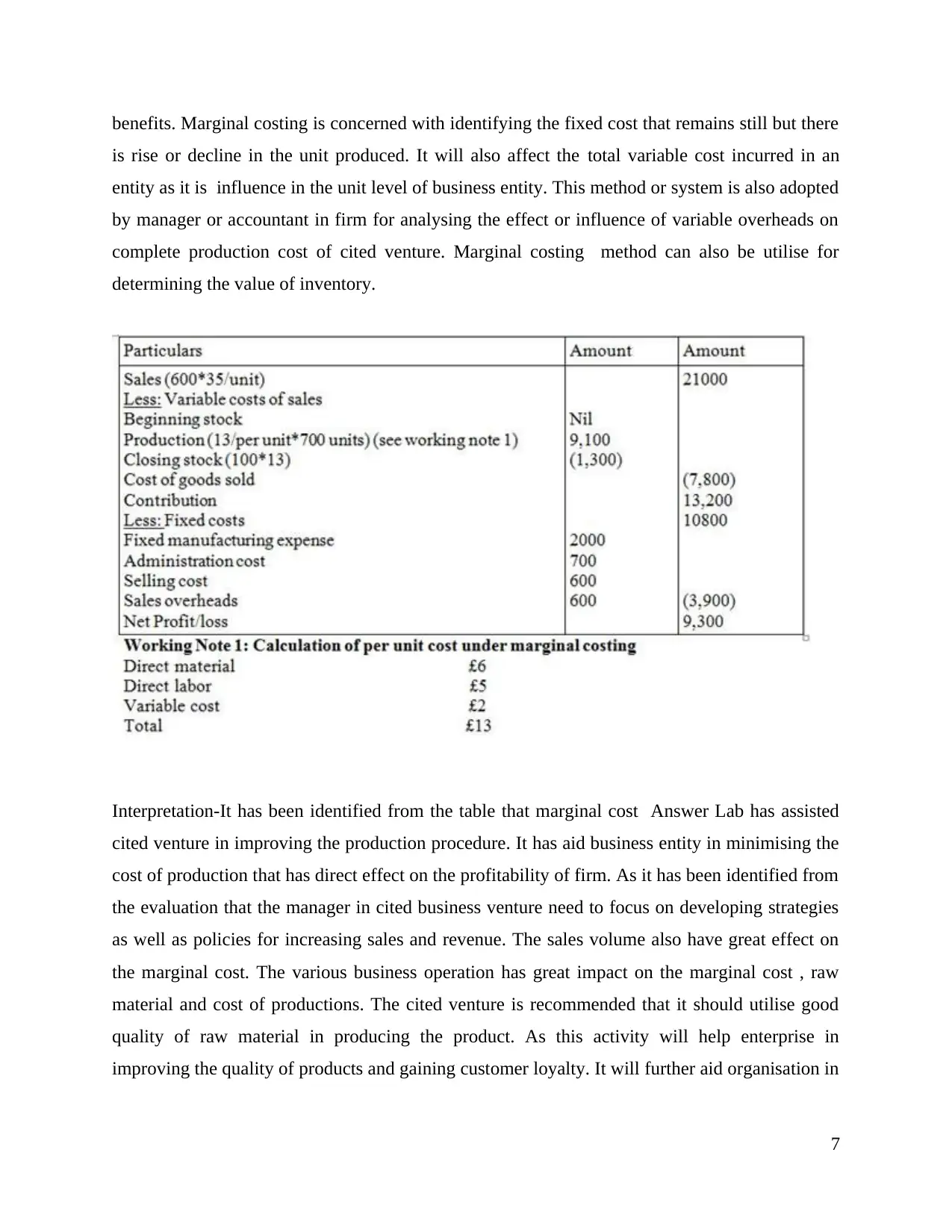

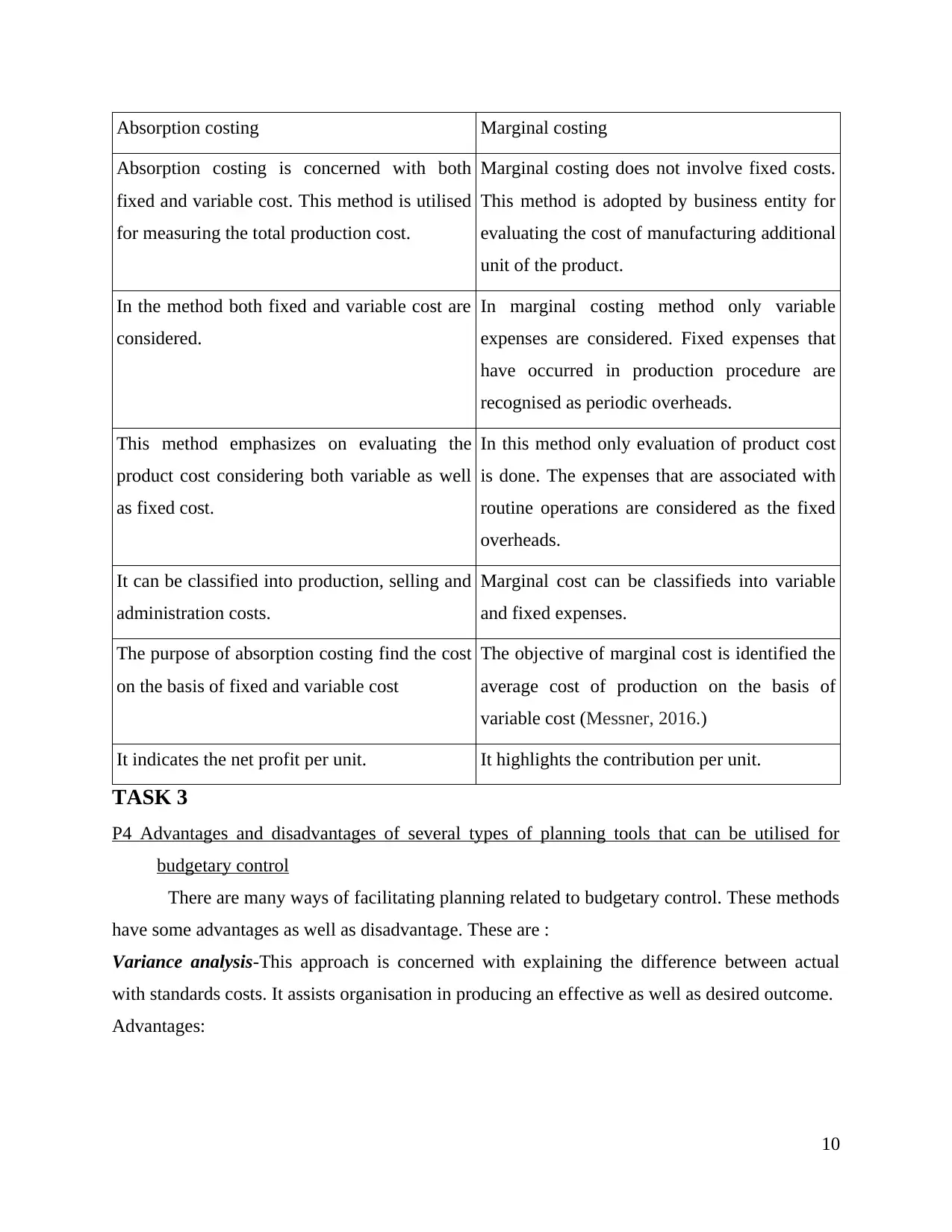

Absorption costing Marginal costing

Absorption costing is concerned with both

fixed and variable cost. This method is utilised

for measuring the total production cost.

Marginal costing does not involve fixed costs.

This method is adopted by business entity for

evaluating the cost of manufacturing additional

unit of the product.

In the method both fixed and variable cost are

considered.

In marginal costing method only variable

expenses are considered. Fixed expenses that

have occurred in production procedure are

recognised as periodic overheads.

This method emphasizes on evaluating the

product cost considering both variable as well

as fixed cost.

In this method only evaluation of product cost

is done. The expenses that are associated with

routine operations are considered as the fixed

overheads.

It can be classified into production, selling and

administration costs.

Marginal cost can be classifieds into variable

and fixed expenses.

The purpose of absorption costing find the cost

on the basis of fixed and variable cost

The objective of marginal cost is identified the

average cost of production on the basis of

variable cost (Messner, 2016.)

It indicates the net profit per unit. It highlights the contribution per unit.

TASK 3

P4 Advantages and disadvantages of several types of planning tools that can be utilised for

budgetary control

There are many ways of facilitating planning related to budgetary control. These methods

have some advantages as well as disadvantage. These are :

Variance analysis-This approach is concerned with explaining the difference between actual

with standards costs. It assists organisation in producing an effective as well as desired outcome.

Advantages:

10

Absorption costing is concerned with both

fixed and variable cost. This method is utilised

for measuring the total production cost.

Marginal costing does not involve fixed costs.

This method is adopted by business entity for

evaluating the cost of manufacturing additional

unit of the product.

In the method both fixed and variable cost are

considered.

In marginal costing method only variable

expenses are considered. Fixed expenses that

have occurred in production procedure are

recognised as periodic overheads.

This method emphasizes on evaluating the

product cost considering both variable as well

as fixed cost.

In this method only evaluation of product cost

is done. The expenses that are associated with

routine operations are considered as the fixed

overheads.

It can be classified into production, selling and

administration costs.

Marginal cost can be classifieds into variable

and fixed expenses.

The purpose of absorption costing find the cost

on the basis of fixed and variable cost

The objective of marginal cost is identified the

average cost of production on the basis of

variable cost (Messner, 2016.)

It indicates the net profit per unit. It highlights the contribution per unit.

TASK 3

P4 Advantages and disadvantages of several types of planning tools that can be utilised for

budgetary control

There are many ways of facilitating planning related to budgetary control. These methods

have some advantages as well as disadvantage. These are :

Variance analysis-This approach is concerned with explaining the difference between actual

with standards costs. It assists organisation in producing an effective as well as desired outcome.

Advantages:

10

The objective of variance analysis is to identify the gap between costs. It supports

manager in identifying the effective solution for reducing the expenses and managing

cash flows.

Variance analysis assist manager or accountant in developing the relationship between

several variables that can aide organisation in minimising the risk and uncertainties.

The variance analysis method support firm in identifying the performance gaps .It

provides manager an opportunity to compare actual performance with standard.

It assists management in analysing that whether the variance is favourable or

unfavourable.

This is the effective tool to evaluate manager performance

Variance analysis methods assists manager in making suitable decisions.

It also aids manager in identifying the resources or assets that are not utilized

completely .

Disadvantages

Variance analysis is very time consuming process as compared to other methods .

The organisation is required to appoint experts in order to conducts this procedure which

leads to additional costs.

If in case this method presents the negative deviations then in such situation , it becomes

difficult for organisation to achieve desired outcome or accomplish its goals.

A wrong measurement or assumption may lead to additional cost that may have great

effect on the business performance

Responsibility accounting-This is other tool that describes the way manager in the business unit

are held responsible for the activities they conduct. Organisation consists of various functional

department in which departmental head or managers are liable for the efficient and effective

utilisation of resources. In responsibility accounting method, variance analysis is conducted on

the basis of functional unit (Ngugi, 2015)

Advantages:

It becomes easier for top level management to identify the person accountable for

deviation or variation in material.

11

manager in identifying the effective solution for reducing the expenses and managing

cash flows.

Variance analysis assist manager or accountant in developing the relationship between

several variables that can aide organisation in minimising the risk and uncertainties.

The variance analysis method support firm in identifying the performance gaps .It

provides manager an opportunity to compare actual performance with standard.

It assists management in analysing that whether the variance is favourable or

unfavourable.

This is the effective tool to evaluate manager performance

Variance analysis methods assists manager in making suitable decisions.

It also aids manager in identifying the resources or assets that are not utilized

completely .

Disadvantages

Variance analysis is very time consuming process as compared to other methods .

The organisation is required to appoint experts in order to conducts this procedure which

leads to additional costs.

If in case this method presents the negative deviations then in such situation , it becomes

difficult for organisation to achieve desired outcome or accomplish its goals.

A wrong measurement or assumption may lead to additional cost that may have great

effect on the business performance

Responsibility accounting-This is other tool that describes the way manager in the business unit

are held responsible for the activities they conduct. Organisation consists of various functional

department in which departmental head or managers are liable for the efficient and effective

utilisation of resources. In responsibility accounting method, variance analysis is conducted on

the basis of functional unit (Ngugi, 2015)

Advantages:

It becomes easier for top level management to identify the person accountable for

deviation or variation in material.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.