Management Accounting Report: Cost Analysis and Ethical Issues

VerifiedAdded on 2023/01/05

|16

|2831

|53

Report

AI Summary

This report offers a comprehensive analysis of management accounting, encompassing various aspects such as cost allocation, job costing, process costing, and Cost-Volume-Profit (CVP) analysis. It delves into different cost allocation methods including direct, step-down, and reciprocal methods, and applies these to practical scenarios. The report also explores process costing using both weighted-average and FIFO methods, and performs break-even analysis. Furthermore, the report examines ethical conflicts within the context of operational budgeting, specifically the challenges a sales manager faces when providing sales estimates. The report includes calculations, theoretical concepts, and a case study to review ethical issues in the field of management accounting.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The report summarize about management accounting and its practical knowledge. Under the

report different kinds of calculation are done in accordance of given data set and requirement of

brief. Apart from the calculations some theoretical concepts are also covered in report such as

ethical conflict, break even analysis and many more.

The report summarize about management accounting and its practical knowledge. Under the

report different kinds of calculation are done in accordance of given data set and requirement of

brief. Apart from the calculations some theoretical concepts are also covered in report such as

ethical conflict, break even analysis and many more.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Question 1: Support Department cost allocation........................................................................4

Question 2: Support Department Cost allocation and Job Costing.............................................6

Question 3: Process Costing........................................................................................................7

Question 4: Cost Volume and Profit (CVP) Analysis.................................................................8

Question 5: Planning: Operational Budgets..............................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Question 1: Support Department cost allocation........................................................................4

Question 2: Support Department Cost allocation and Job Costing.............................................6

Question 3: Process Costing........................................................................................................7

Question 4: Cost Volume and Profit (CVP) Analysis.................................................................8

Question 5: Planning: Operational Budgets..............................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is the process of defining, evaluating, assessing, interpreting and

transmitting financial reports to managers in order to meet the aims of the company. It differs

from cost reporting and the goal of management accounting is to enable users inside the

organization to make well-informed business choices (Pelz, 2019). The report is based on

different kinds of theoretical and practical framework of management accounting. Most of the

calculations are based on cost analysis, breakeven analysis and many more. In the last part of

report, a case has been analyzed in order to review ethical issues.

MAIN BODY

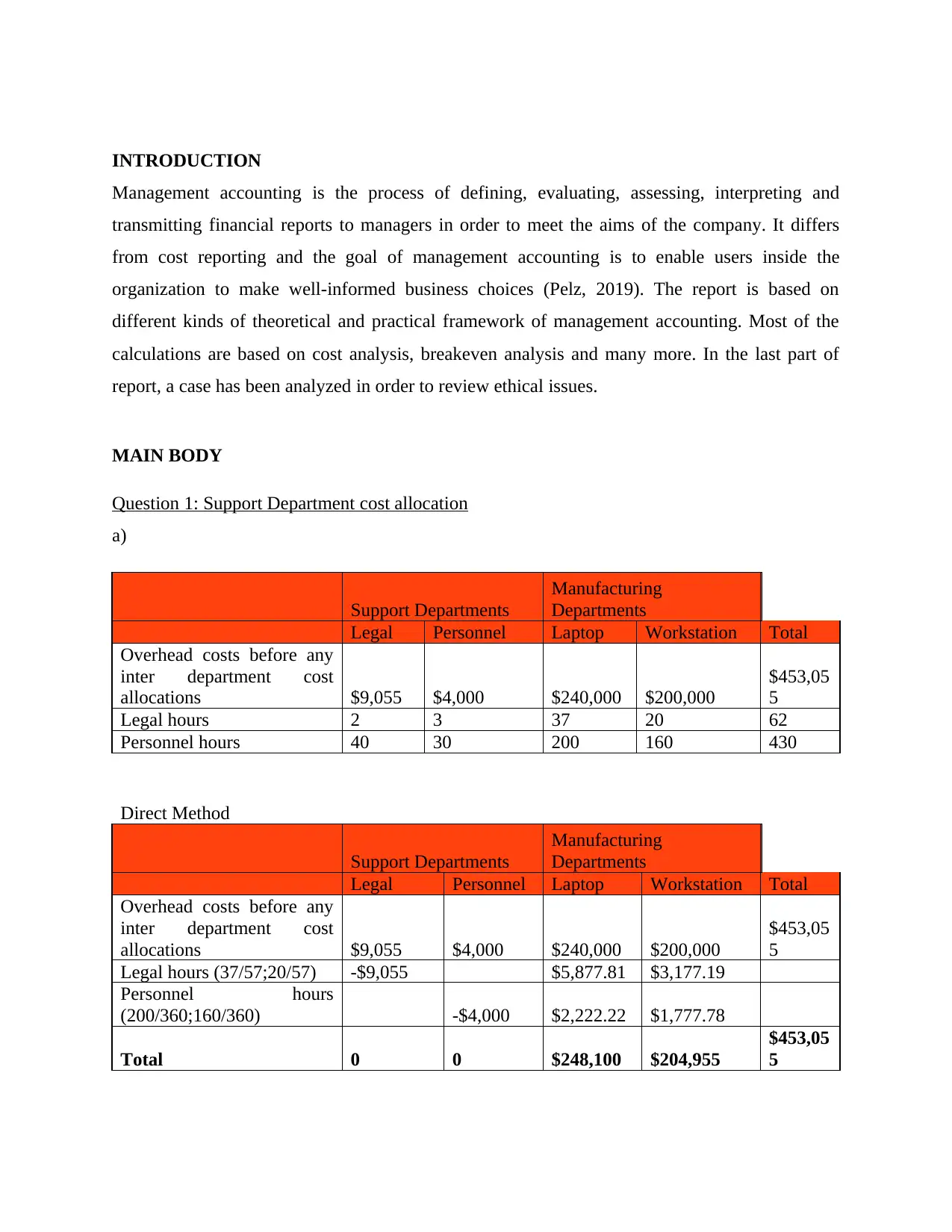

Question 1: Support Department cost allocation

a)

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours 2 3 37 20 62

Personnel hours 40 30 200 160 430

Direct Method

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours (37/57;20/57) -$9,055 $5,877.81 $3,177.19

Personnel hours

(200/360;160/360) -$4,000 $2,222.22 $1,777.78

Total 0 0 $248,100 $204,955

$453,05

5

Management accounting is the process of defining, evaluating, assessing, interpreting and

transmitting financial reports to managers in order to meet the aims of the company. It differs

from cost reporting and the goal of management accounting is to enable users inside the

organization to make well-informed business choices (Pelz, 2019). The report is based on

different kinds of theoretical and practical framework of management accounting. Most of the

calculations are based on cost analysis, breakeven analysis and many more. In the last part of

report, a case has been analyzed in order to review ethical issues.

MAIN BODY

Question 1: Support Department cost allocation

a)

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours 2 3 37 20 62

Personnel hours 40 30 200 160 430

Direct Method

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours (37/57;20/57) -$9,055 $5,877.81 $3,177.19

Personnel hours

(200/360;160/360) -$4,000 $2,222.22 $1,777.78

Total 0 0 $248,100 $204,955

$453,05

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

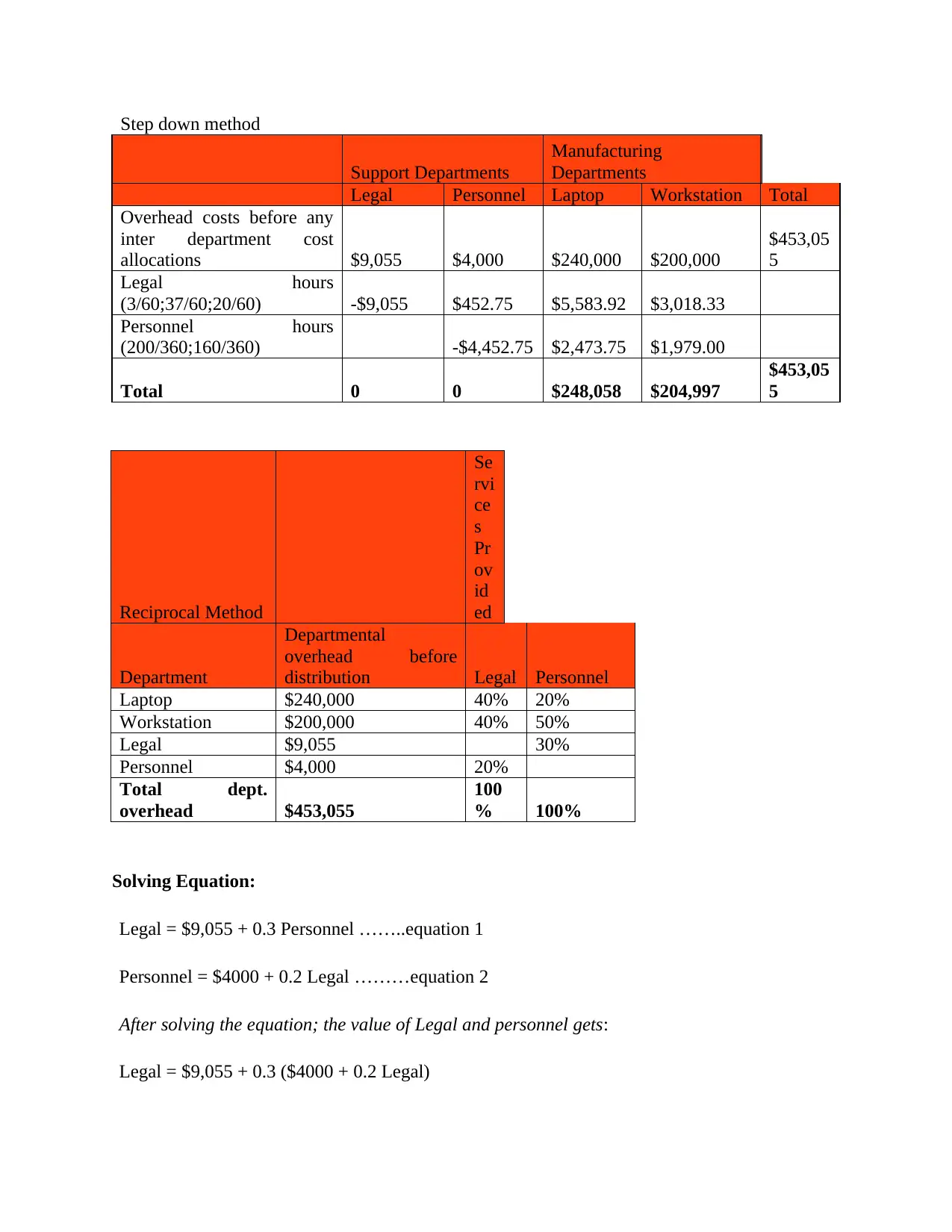

Step down method

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours

(3/60;37/60;20/60) -$9,055 $452.75 $5,583.92 $3,018.33

Personnel hours

(200/360;160/360) -$4,452.75 $2,473.75 $1,979.00

Total 0 0 $248,058 $204,997

$453,05

5

Reciprocal Method

Se

rvi

ce

s

Pr

ov

id

ed

Department

Departmental

overhead before

distribution Legal Personnel

Laptop $240,000 40% 20%

Workstation $200,000 40% 50%

Legal $9,055 30%

Personnel $4,000 20%

Total dept.

overhead $453,055

100

% 100%

Solving Equation:

Legal = $9,055 + 0.3 Personnel ……..equation 1

Personnel = $4000 + 0.2 Legal ………equation 2

After solving the equation; the value of Legal and personnel gets:

Legal = $9,055 + 0.3 ($4000 + 0.2 Legal)

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours

(3/60;37/60;20/60) -$9,055 $452.75 $5,583.92 $3,018.33

Personnel hours

(200/360;160/360) -$4,452.75 $2,473.75 $1,979.00

Total 0 0 $248,058 $204,997

$453,05

5

Reciprocal Method

Se

rvi

ce

s

Pr

ov

id

ed

Department

Departmental

overhead before

distribution Legal Personnel

Laptop $240,000 40% 20%

Workstation $200,000 40% 50%

Legal $9,055 30%

Personnel $4,000 20%

Total dept.

overhead $453,055

100

% 100%

Solving Equation:

Legal = $9,055 + 0.3 Personnel ……..equation 1

Personnel = $4000 + 0.2 Legal ………equation 2

After solving the equation; the value of Legal and personnel gets:

Legal = $9,055 + 0.3 ($4000 + 0.2 Legal)

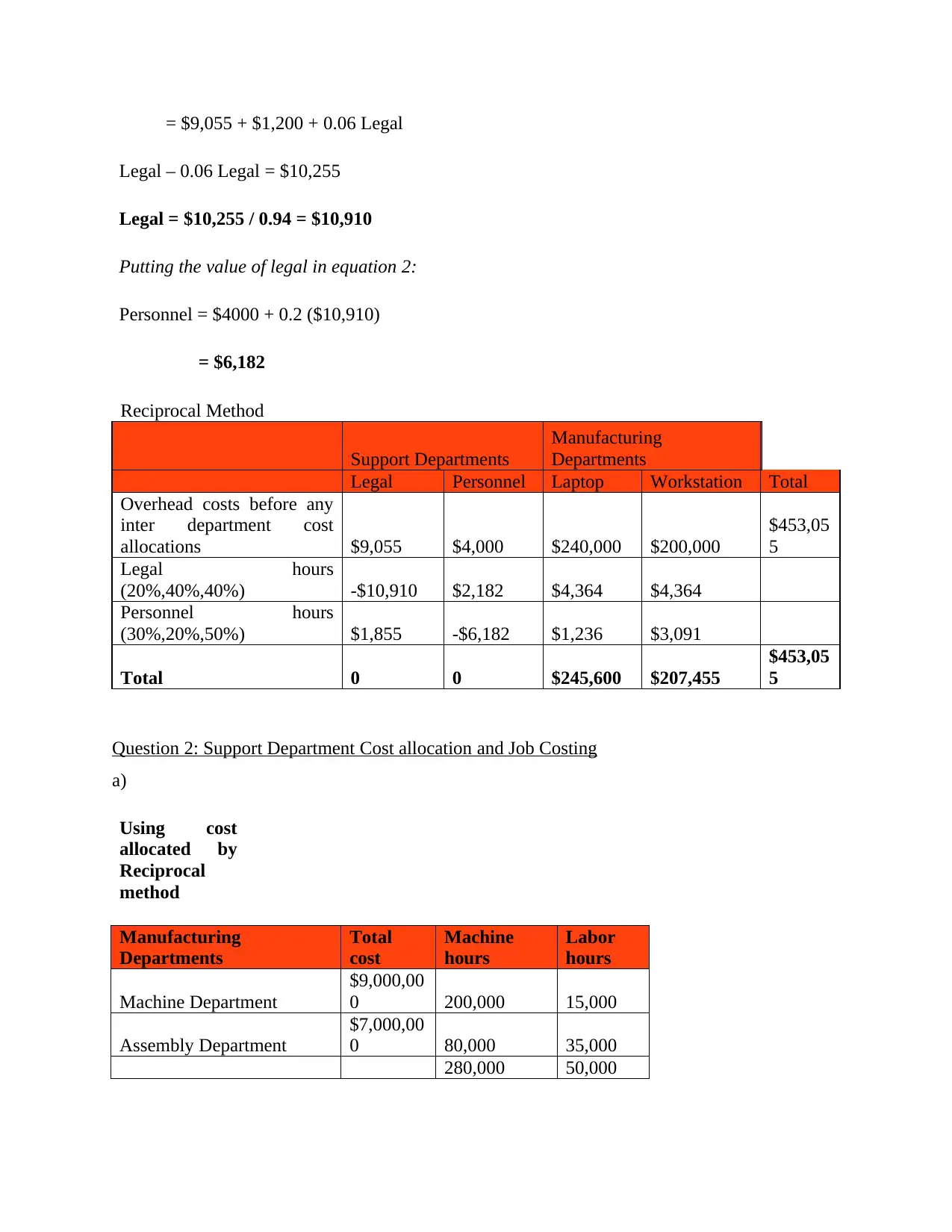

= $9,055 + $1,200 + 0.06 Legal

Legal – 0.06 Legal = $10,255

Legal = $10,255 / 0.94 = $10,910

Putting the value of legal in equation 2:

Personnel = $4000 + 0.2 ($10,910)

= $6,182

Reciprocal Method

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours

(20%,40%,40%) -$10,910 $2,182 $4,364 $4,364

Personnel hours

(30%,20%,50%) $1,855 -$6,182 $1,236 $3,091

Total 0 0 $245,600 $207,455

$453,05

5

Question 2: Support Department Cost allocation and Job Costing

a)

Using cost

allocated by

Reciprocal

method

Manufacturing

Departments

Total

cost

Machine

hours

Labor

hours

Machine Department

$9,000,00

0 200,000 15,000

Assembly Department

$7,000,00

0 80,000 35,000

280,000 50,000

Legal – 0.06 Legal = $10,255

Legal = $10,255 / 0.94 = $10,910

Putting the value of legal in equation 2:

Personnel = $4000 + 0.2 ($10,910)

= $6,182

Reciprocal Method

Support Departments

Manufacturing

Departments

Legal Personnel Laptop Workstation Total

Overhead costs before any

inter department cost

allocations $9,055 $4,000 $240,000 $200,000

$453,05

5

Legal hours

(20%,40%,40%) -$10,910 $2,182 $4,364 $4,364

Personnel hours

(30%,20%,50%) $1,855 -$6,182 $1,236 $3,091

Total 0 0 $245,600 $207,455

$453,05

5

Question 2: Support Department Cost allocation and Job Costing

a)

Using cost

allocated by

Reciprocal

method

Manufacturing

Departments

Total

cost

Machine

hours

Labor

hours

Machine Department

$9,000,00

0 200,000 15,000

Assembly Department

$7,000,00

0 80,000 35,000

280,000 50,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost per Unit

Machine cost per unit (Machine

department cost / Machine hours) $32.14

Labor cost per unit (Labor department

cost / Labor hours) $140

Total Cost of Job MT27

Job no. MT27

Machinin

g Assembly

Direct materials $36,000 $6,710

Direct labor cost $1,550 $1,650

Labor overhead cost $6,300 $9,800

Machine overhead cost $6,750 $643

Total Job cost $50,600 $18,803

b) Among different cost allocation methods, Reciprocal Method will be suitable. It's the most

reliable, the most complex. The connection between the service divisions is understood in the

reciprocal process (Cescon, Costantin and Grassetti, 2019). This means that the expenses of the

service department are transferred to and from the various service departments. The allocation of

service tech costs is insufficient if the system used for the distribution of funds lacks or fails to

provide legal approval to cross - departmental program. Inter - departmental services are

provided that several or more divisions offer to each other. Remember, for instance, the situation

whereby service tech A offers services to service tech B and, in exchange, department B offers

services to system A.

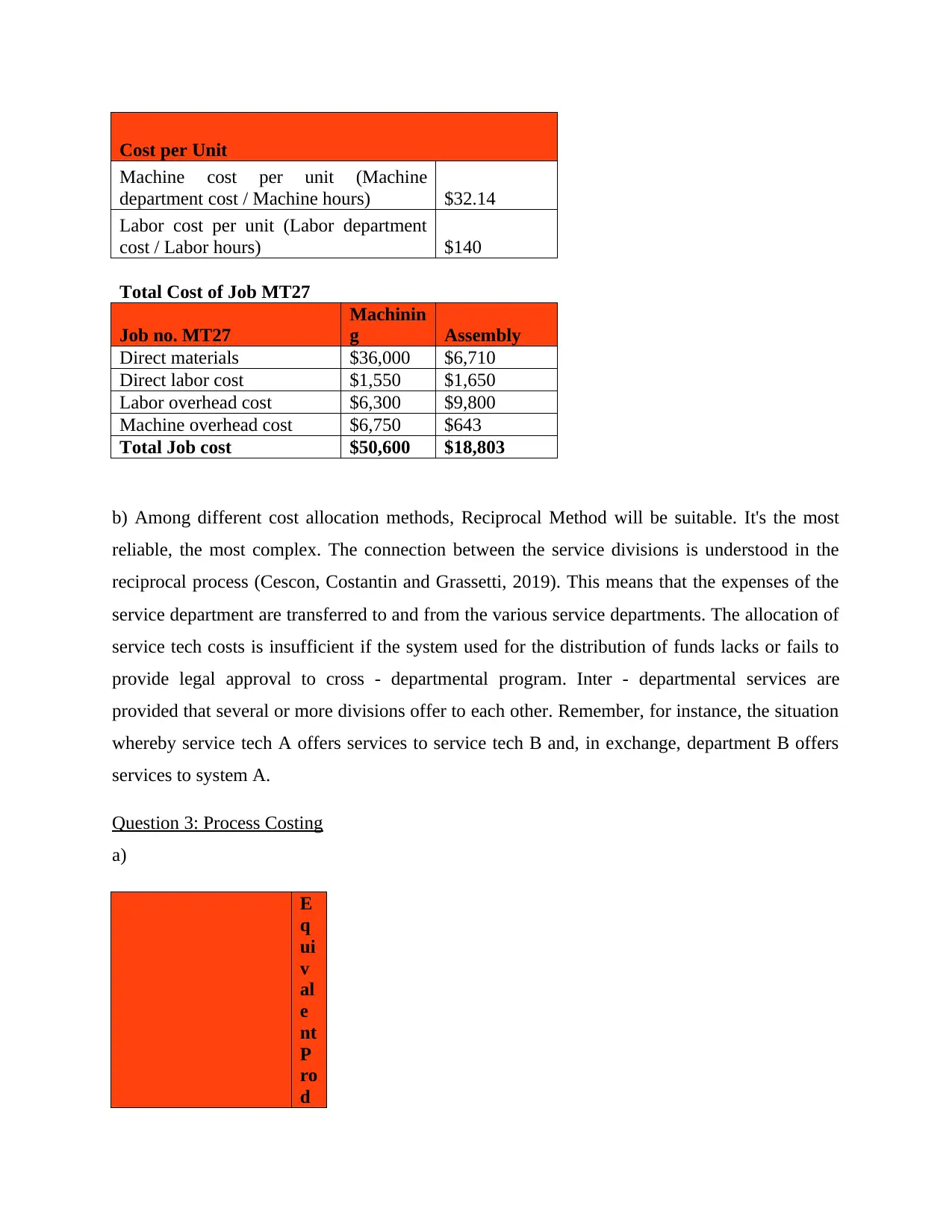

Question 3: Process Costing

a)

E

q

ui

v

al

e

nt

P

ro

d

Machine cost per unit (Machine

department cost / Machine hours) $32.14

Labor cost per unit (Labor department

cost / Labor hours) $140

Total Cost of Job MT27

Job no. MT27

Machinin

g Assembly

Direct materials $36,000 $6,710

Direct labor cost $1,550 $1,650

Labor overhead cost $6,300 $9,800

Machine overhead cost $6,750 $643

Total Job cost $50,600 $18,803

b) Among different cost allocation methods, Reciprocal Method will be suitable. It's the most

reliable, the most complex. The connection between the service divisions is understood in the

reciprocal process (Cescon, Costantin and Grassetti, 2019). This means that the expenses of the

service department are transferred to and from the various service departments. The allocation of

service tech costs is insufficient if the system used for the distribution of funds lacks or fails to

provide legal approval to cross - departmental program. Inter - departmental services are

provided that several or more divisions offer to each other. Remember, for instance, the situation

whereby service tech A offers services to service tech B and, in exchange, department B offers

services to system A.

Question 3: Process Costing

a)

E

q

ui

v

al

e

nt

P

ro

d

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

u

ct

io

n

Material

Production data Output Units % Units % Units

Opening WIP 70,000 70% 49,000 40% 28,000

Units transferred out 380,000 100% 380,000 100% 380,000

Ending WIP 80,000 75% 60,000 25% 20,000

530,000 489,000 428,000

Statement

of cost

Item Amount

Equivalent

Production

Cost per

unit

Material $391,850 489,000 $0.80

Conversion $287,300 428,000 $0.67

Total cost

per unit $1.47

i. Weighted-Average method

Process

A/c FIFO

Method

Weighted-

Average

method

Units

Amoun

t Units

Amou

nt

Beginning

WIP 70,000 $50,050 Process transferred

450,00

0

$662,6

66

Materials

460,00

0

$391,85

0 Ending WIP (Balance) 80,000

$66,53

4

Conversion

$287,30

0

530,00

0

$729,20

0

530,00

0

$729,2

00

ii. FIFO method

ct

io

n

Material

Production data Output Units % Units % Units

Opening WIP 70,000 70% 49,000 40% 28,000

Units transferred out 380,000 100% 380,000 100% 380,000

Ending WIP 80,000 75% 60,000 25% 20,000

530,000 489,000 428,000

Statement

of cost

Item Amount

Equivalent

Production

Cost per

unit

Material $391,850 489,000 $0.80

Conversion $287,300 428,000 $0.67

Total cost

per unit $1.47

i. Weighted-Average method

Process

A/c FIFO

Method

Weighted-

Average

method

Units

Amoun

t Units

Amou

nt

Beginning

WIP 70,000 $50,050 Process transferred

450,00

0

$662,6

66

Materials

460,00

0

$391,85

0 Ending WIP (Balance) 80,000

$66,53

4

Conversion

$287,30

0

530,00

0

$729,20

0

530,00

0

$729,2

00

ii. FIFO method

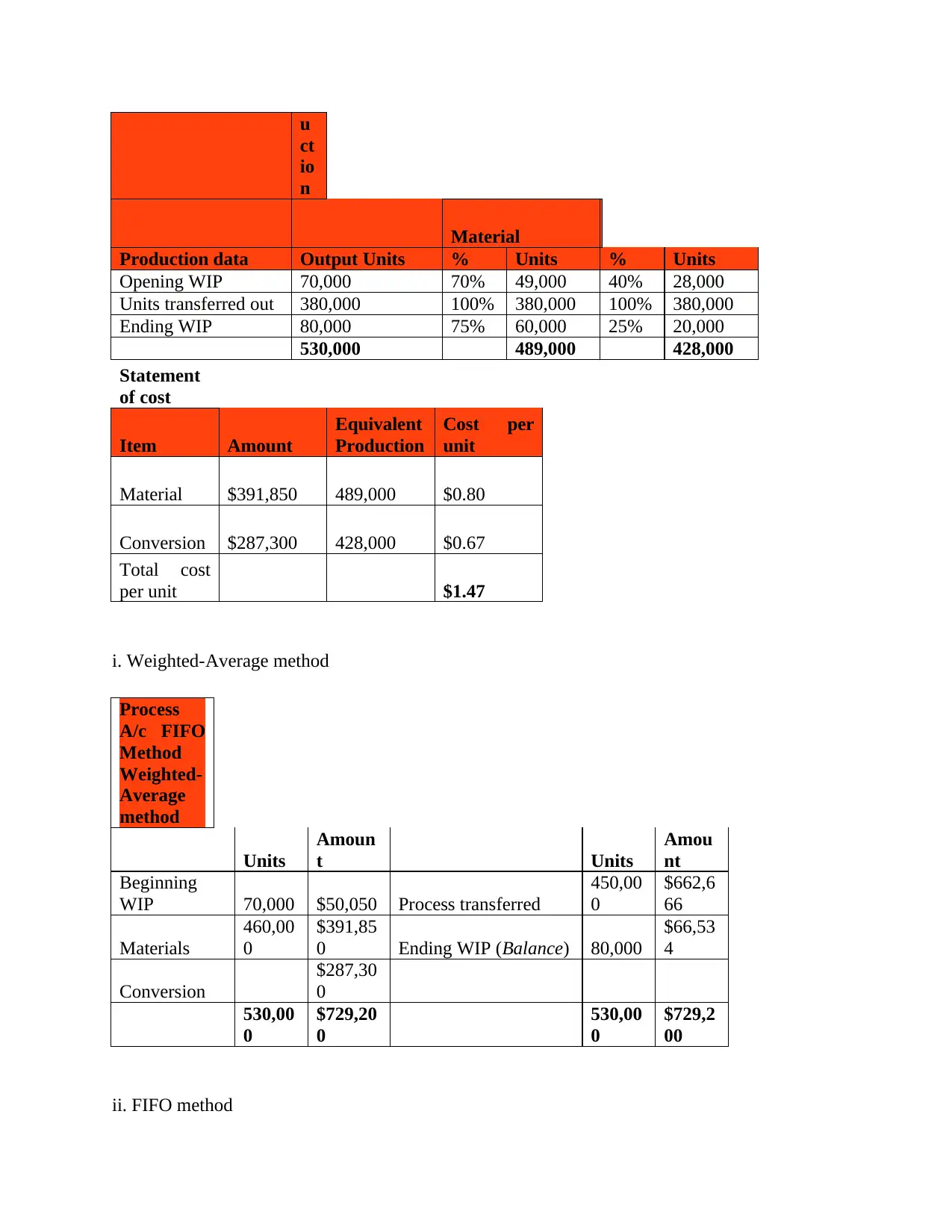

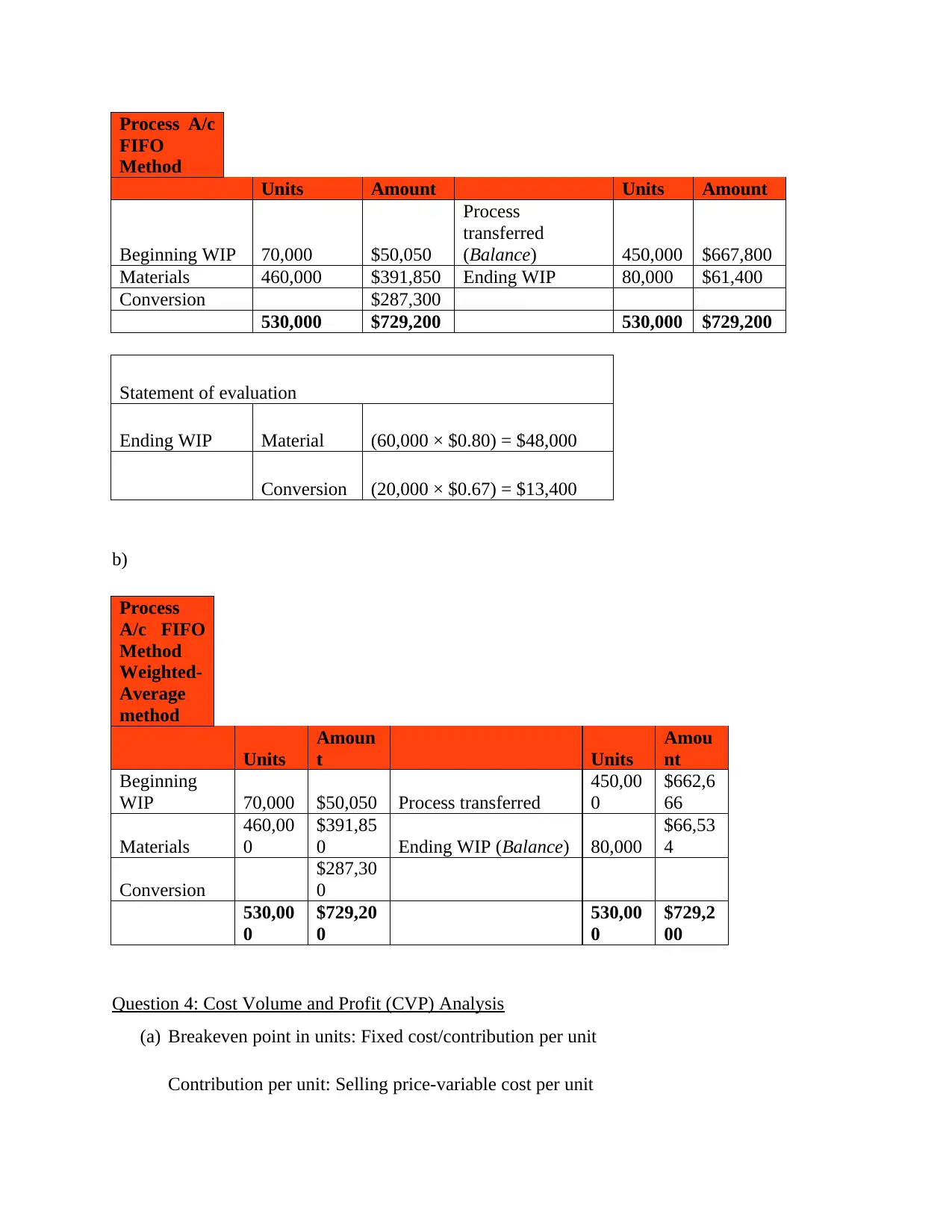

Process A/c

FIFO

Method

Units Amount Units Amount

Beginning WIP 70,000 $50,050

Process

transferred

(Balance) 450,000 $667,800

Materials 460,000 $391,850 Ending WIP 80,000 $61,400

Conversion $287,300

530,000 $729,200 530,000 $729,200

Statement of evaluation

Ending WIP Material (60,000 × $0.80) = $48,000

Conversion (20,000 × $0.67) = $13,400

b)

Process

A/c FIFO

Method

Weighted-

Average

method

Units

Amoun

t Units

Amou

nt

Beginning

WIP 70,000 $50,050 Process transferred

450,00

0

$662,6

66

Materials

460,00

0

$391,85

0 Ending WIP (Balance) 80,000

$66,53

4

Conversion

$287,30

0

530,00

0

$729,20

0

530,00

0

$729,2

00

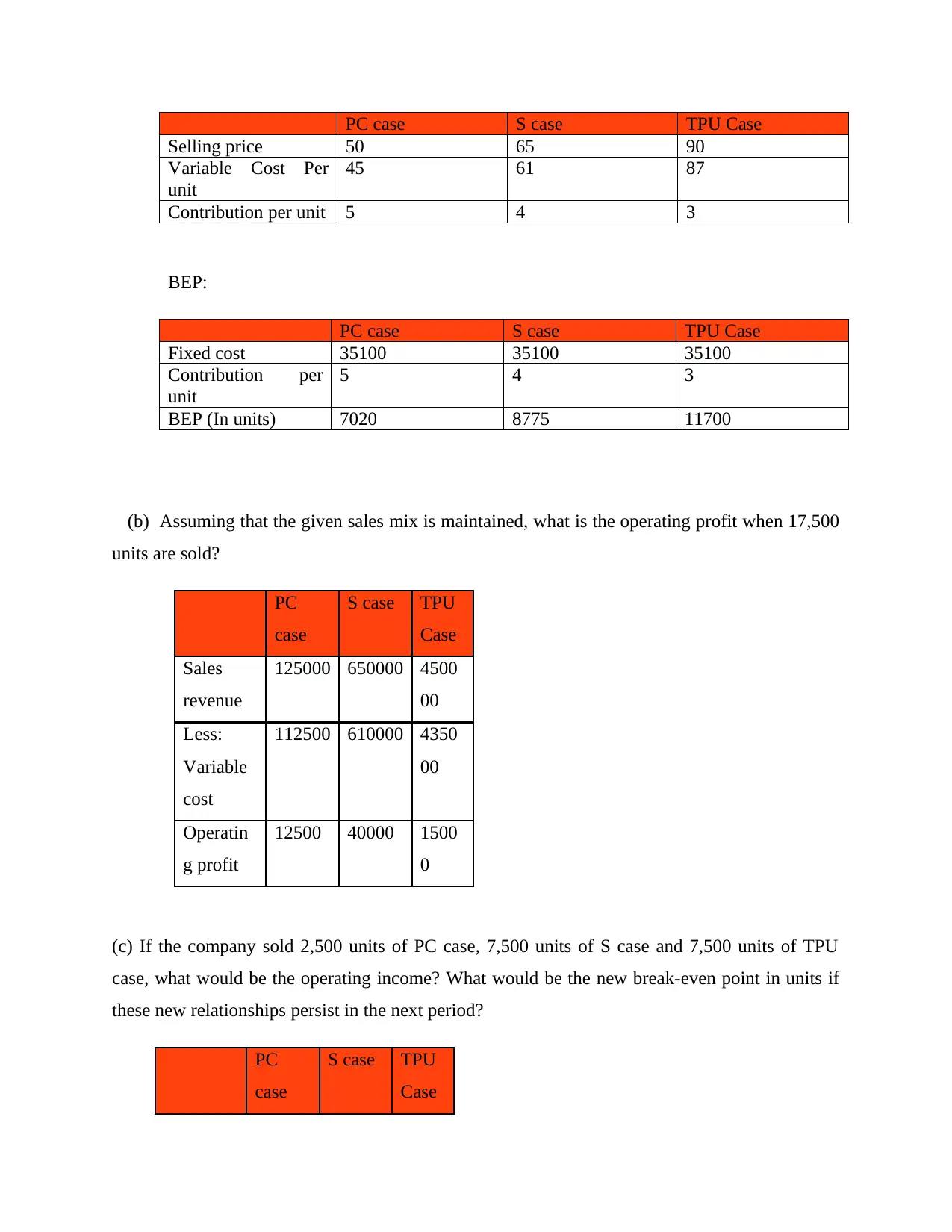

Question 4: Cost Volume and Profit (CVP) Analysis

(a) Breakeven point in units: Fixed cost/contribution per unit

Contribution per unit: Selling price-variable cost per unit

FIFO

Method

Units Amount Units Amount

Beginning WIP 70,000 $50,050

Process

transferred

(Balance) 450,000 $667,800

Materials 460,000 $391,850 Ending WIP 80,000 $61,400

Conversion $287,300

530,000 $729,200 530,000 $729,200

Statement of evaluation

Ending WIP Material (60,000 × $0.80) = $48,000

Conversion (20,000 × $0.67) = $13,400

b)

Process

A/c FIFO

Method

Weighted-

Average

method

Units

Amoun

t Units

Amou

nt

Beginning

WIP 70,000 $50,050 Process transferred

450,00

0

$662,6

66

Materials

460,00

0

$391,85

0 Ending WIP (Balance) 80,000

$66,53

4

Conversion

$287,30

0

530,00

0

$729,20

0

530,00

0

$729,2

00

Question 4: Cost Volume and Profit (CVP) Analysis

(a) Breakeven point in units: Fixed cost/contribution per unit

Contribution per unit: Selling price-variable cost per unit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PC case S case TPU Case

Selling price 50 65 90

Variable Cost Per

unit

45 61 87

Contribution per unit 5 4 3

BEP:

PC case S case TPU Case

Fixed cost 35100 35100 35100

Contribution per

unit

5 4 3

BEP (In units) 7020 8775 11700

(b) Assuming that the given sales mix is maintained, what is the operating profit when 17,500

units are sold?

PC

case

S case TPU

Case

Sales

revenue

125000 650000 4500

00

Less:

Variable

cost

112500 610000 4350

00

Operatin

g profit

12500 40000 1500

0

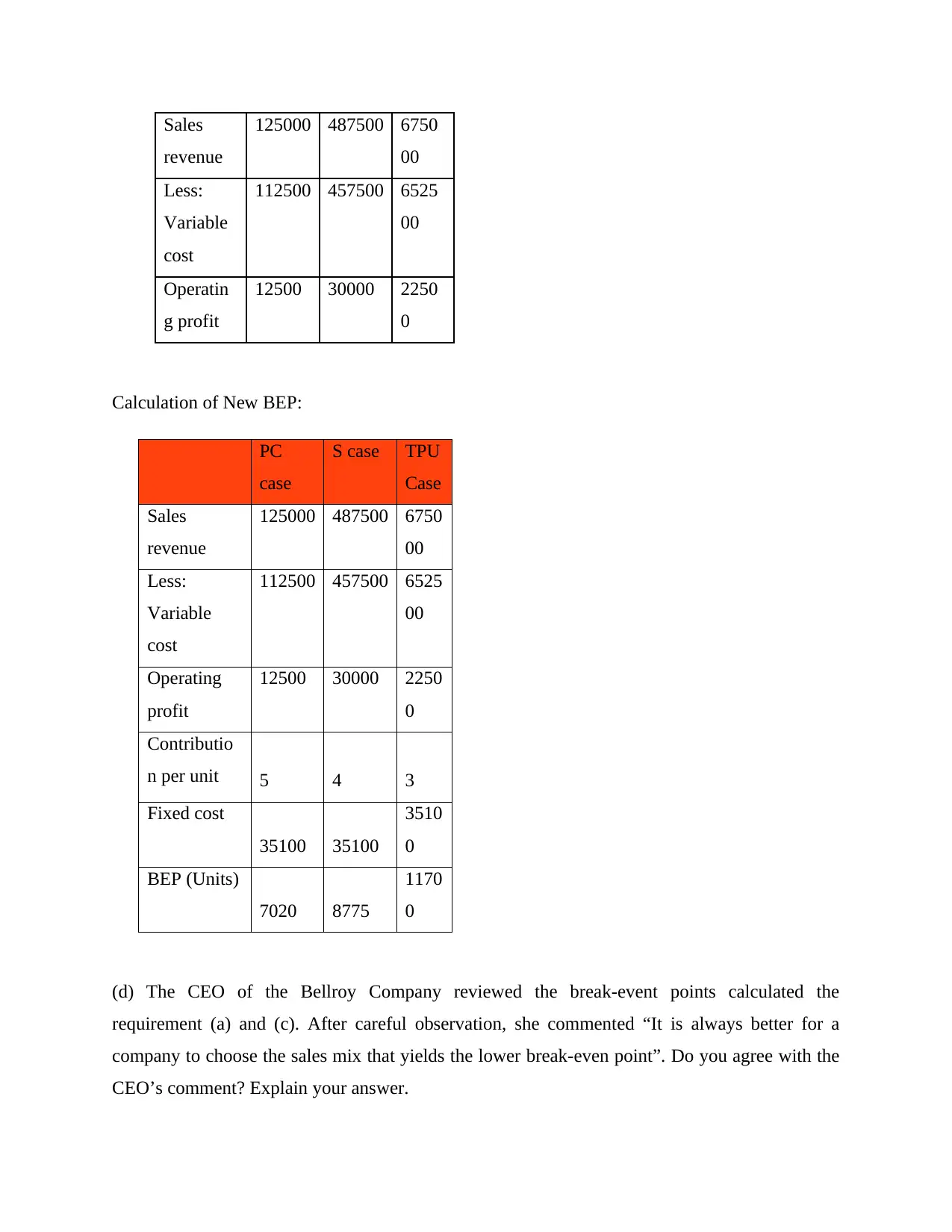

(c) If the company sold 2,500 units of PC case, 7,500 units of S case and 7,500 units of TPU

case, what would be the operating income? What would be the new break-even point in units if

these new relationships persist in the next period?

PC

case

S case TPU

Case

Selling price 50 65 90

Variable Cost Per

unit

45 61 87

Contribution per unit 5 4 3

BEP:

PC case S case TPU Case

Fixed cost 35100 35100 35100

Contribution per

unit

5 4 3

BEP (In units) 7020 8775 11700

(b) Assuming that the given sales mix is maintained, what is the operating profit when 17,500

units are sold?

PC

case

S case TPU

Case

Sales

revenue

125000 650000 4500

00

Less:

Variable

cost

112500 610000 4350

00

Operatin

g profit

12500 40000 1500

0

(c) If the company sold 2,500 units of PC case, 7,500 units of S case and 7,500 units of TPU

case, what would be the operating income? What would be the new break-even point in units if

these new relationships persist in the next period?

PC

case

S case TPU

Case

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales

revenue

125000 487500 6750

00

Less:

Variable

cost

112500 457500 6525

00

Operatin

g profit

12500 30000 2250

0

Calculation of New BEP:

PC

case

S case TPU

Case

Sales

revenue

125000 487500 6750

00

Less:

Variable

cost

112500 457500 6525

00

Operating

profit

12500 30000 2250

0

Contributio

n per unit 5 4 3

Fixed cost

35100 35100

3510

0

BEP (Units)

7020 8775

1170

0

(d) The CEO of the Bellroy Company reviewed the break-event points calculated the

requirement (a) and (c). After careful observation, she commented “It is always better for a

company to choose the sales mix that yields the lower break-even point”. Do you agree with the

CEO’s comment? Explain your answer.

revenue

125000 487500 6750

00

Less:

Variable

cost

112500 457500 6525

00

Operatin

g profit

12500 30000 2250

0

Calculation of New BEP:

PC

case

S case TPU

Case

Sales

revenue

125000 487500 6750

00

Less:

Variable

cost

112500 457500 6525

00

Operating

profit

12500 30000 2250

0

Contributio

n per unit 5 4 3

Fixed cost

35100 35100

3510

0

BEP (Units)

7020 8775

1170

0

(d) The CEO of the Bellroy Company reviewed the break-event points calculated the

requirement (a) and (c). After careful observation, she commented “It is always better for a

company to choose the sales mix that yields the lower break-even point”. Do you agree with the

CEO’s comment? Explain your answer.

Yes, I am agreeing with CEO’s comment. It is so because corporation is not necessarily free to

sell any amount of units of a commodity that produces the largest profit of the company. Since

the sale depends on a variety of external influences, including the demand of the customer for the

goods, the availability of raw materials, the manufacturing capability of the firm, restrictions

made by the government, etc. Since revenues depend on certain uncontrollable causes, the

ultimate aim of the businesses is to find a sales mix that will produce the highest benefit for them

(Fleischman and McLean, 2020). Generally, different goods have different purchase rates,

variable costs and contribution margins. Consequently, any change in the percentage wherein the

goods are sold has a substantial effect on the break-even rate. This shift is known as 'change in

sales mix' or 'change in market mix.'

Question 5: Planning: Operational Budgets

(a) Describe the ethical conflict that John is facing when asked to provide estimated sales

for next year?

Ethical conflict- Ethical disputes occur as people are faced with a disagreement between

the general frameworks of belief in morals, ethics or justice and their own particular

circumstances (Doktoralina and Apollo, 2019). Right and wrong are not necessarily

entirely straightforward, and certain cases include deciding between two "evils" where,

maybe, ethical decisions could result in physical or professional harm, or where an

individual may benefit from an ethical issue. Such disputes could take place on an

individual, technical or cultural scale.

Overview of case- As per the given information in brief this can be inferred that John is a

sales manager and due to COVID 19 situations have been changed. In this context, John

was asked to estimate sales for upcoming time period by CFO. Though, John is sales

manager and it is not possible for him to forecast accurately. As well as reason due to

sell any amount of units of a commodity that produces the largest profit of the company. Since

the sale depends on a variety of external influences, including the demand of the customer for the

goods, the availability of raw materials, the manufacturing capability of the firm, restrictions

made by the government, etc. Since revenues depend on certain uncontrollable causes, the

ultimate aim of the businesses is to find a sales mix that will produce the highest benefit for them

(Fleischman and McLean, 2020). Generally, different goods have different purchase rates,

variable costs and contribution margins. Consequently, any change in the percentage wherein the

goods are sold has a substantial effect on the break-even rate. This shift is known as 'change in

sales mix' or 'change in market mix.'

Question 5: Planning: Operational Budgets

(a) Describe the ethical conflict that John is facing when asked to provide estimated sales

for next year?

Ethical conflict- Ethical disputes occur as people are faced with a disagreement between

the general frameworks of belief in morals, ethics or justice and their own particular

circumstances (Doktoralina and Apollo, 2019). Right and wrong are not necessarily

entirely straightforward, and certain cases include deciding between two "evils" where,

maybe, ethical decisions could result in physical or professional harm, or where an

individual may benefit from an ethical issue. Such disputes could take place on an

individual, technical or cultural scale.

Overview of case- As per the given information in brief this can be inferred that John is a

sales manager and due to COVID 19 situations have been changed. In this context, John

was asked to estimate sales for upcoming time period by CFO. Though, John is sales

manager and it is not possible for him to forecast accurately. As well as reason due to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.