Comprehensive Management Accounting Analysis for Tech (UK) Ltd.

VerifiedAdded on 2020/10/23

|16

|3973

|368

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application within Tech (UK) Ltd., a company specializing in mobile phone chargers and gadgets. The report begins by comparing management and financial accounting, emphasizing the importance of management accounting in providing valuable information for decision-making and planning. It then explores various accounting systems, including cost accounting (actual, standard, and normal costing), inventory management (LIFO, FIFO, AVCO), and job costing. The report further examines different types of accounting reporting systems, such as budgeting reports, accounts receivable reports, job cost reports, and inventory management reports, highlighting their significance in decision-making, loss reduction, and financial return enhancement. Task 2 delves into cost calculation, comparing marginal and absorption costing methods and presenting income statements based on each. The report also discusses the advantages and disadvantages of using planning tools in budgeting and concludes by outlining how management accounting systems contribute to addressing financial issues. This student assignment, available on Desklib, offers valuable insights into financial management practices.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION.................................................................................................................................3

TASK 1.................................................................................................................................................3

P1: Management accounting system and its essential requirements in Tech (UK) Ltd......................3

P2: Various types of accounting reporting system.............................................................................5

TASK 2.................................................................................................................................................7

P3: Calculation of cost and preparation of income statement............................................................7

TASK 3...............................................................................................................................................11

P4: Advantages and disadvantages of using planning tools use in budget.......................................11

TASK 4...............................................................................................................................................13

P5: Contribution of management accounting systems to respond financial issues...........................13

CONCLUSION...................................................................................................................................15

REFERENCES....................................................................................................................................16

INTRODUCTION.................................................................................................................................3

TASK 1.................................................................................................................................................3

P1: Management accounting system and its essential requirements in Tech (UK) Ltd......................3

P2: Various types of accounting reporting system.............................................................................5

TASK 2.................................................................................................................................................7

P3: Calculation of cost and preparation of income statement............................................................7

TASK 3...............................................................................................................................................11

P4: Advantages and disadvantages of using planning tools use in budget.......................................11

TASK 4...............................................................................................................................................13

P5: Contribution of management accounting systems to respond financial issues...........................13

CONCLUSION...................................................................................................................................15

REFERENCES....................................................................................................................................16

INTRODUCTION

Management accounting is an important function which are wholly liable to support

an organization by providing valuable information regarding financial or non-financial

transactions happened on daily basis. As there are various departments in an organisation

who are performed with an objective of achieving organisational goals thus they need to

provide support from accounting management in terms of providing them relevant data in

order to make profitable decision and suitable plans for the betterment of an organisation.

The present assignment report is based on Tech (UK) Ltd. which is exist in market to provide

special mobile telephone charger and other gadgets for retail outlets in the United Kingdom.

The project explains about the comparison between management and financial accounting

along with the essential need to management accounting in an organisation. The project also

includes various accounting and reporting systems along with advantages and disadvantages

of different types of budget. In addition with this, various financial tools to resolve financial

issues of company has been also discussed under this report (Abdel-Maksoud, 2011).

TASK 1

P1: Management accounting system and its essential requirements in Tech (UK) Ltd.

Management accounting:

It is form of management which is liable to provide valuable information to different

departments of an organization so as to make suitable decision and plans in order to achieve

desired goals and objectives within pre-determined time frame. They are helps responsible to

maintain financial reports which give true and fair information about financial position of

company to their shareholder and other interest parties.

Importance of management accounting

Management accounting are wholly responsible to record all financial as well as non-

financial transaction occurred on daily basis and prepare financial accounts on annual basis

so as to identify the actual financial position of company in market. Along with this, there are

other benefits as well which are received by Tech (UK) Ltd. such as:

Forecasting cash flows: With the help of different management accounting system,

the accounting managers are able to prepare different types of reports which help them in

estimating the inflow and outflow of cash within specified period of time. This will provide

Management accounting is an important function which are wholly liable to support

an organization by providing valuable information regarding financial or non-financial

transactions happened on daily basis. As there are various departments in an organisation

who are performed with an objective of achieving organisational goals thus they need to

provide support from accounting management in terms of providing them relevant data in

order to make profitable decision and suitable plans for the betterment of an organisation.

The present assignment report is based on Tech (UK) Ltd. which is exist in market to provide

special mobile telephone charger and other gadgets for retail outlets in the United Kingdom.

The project explains about the comparison between management and financial accounting

along with the essential need to management accounting in an organisation. The project also

includes various accounting and reporting systems along with advantages and disadvantages

of different types of budget. In addition with this, various financial tools to resolve financial

issues of company has been also discussed under this report (Abdel-Maksoud, 2011).

TASK 1

P1: Management accounting system and its essential requirements in Tech (UK) Ltd.

Management accounting:

It is form of management which is liable to provide valuable information to different

departments of an organization so as to make suitable decision and plans in order to achieve

desired goals and objectives within pre-determined time frame. They are helps responsible to

maintain financial reports which give true and fair information about financial position of

company to their shareholder and other interest parties.

Importance of management accounting

Management accounting are wholly responsible to record all financial as well as non-

financial transaction occurred on daily basis and prepare financial accounts on annual basis

so as to identify the actual financial position of company in market. Along with this, there are

other benefits as well which are received by Tech (UK) Ltd. such as:

Forecasting cash flows: With the help of different management accounting system,

the accounting managers are able to prepare different types of reports which help them in

estimating the inflow and outflow of cash within specified period of time. This will provide

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

an opportunity to management to execute business operations without fearing any shortage of

funds.

Appraisal of performances: Management accounting set standard for the employees

which are compulsorily required to achieve by the them after identifying their roles and

responsibilities. Analysing the performance of employees through comparing their actual

performance level with standard will bring motivation among employees to work hard and

achieve performance goals set by an organisation (Cheng, 2012).

Determination of rate of return: Management accounting recorded all business

transactions thus it help company in getting knowledge about the return they received in near

future on the amount they invested in particular business projects.

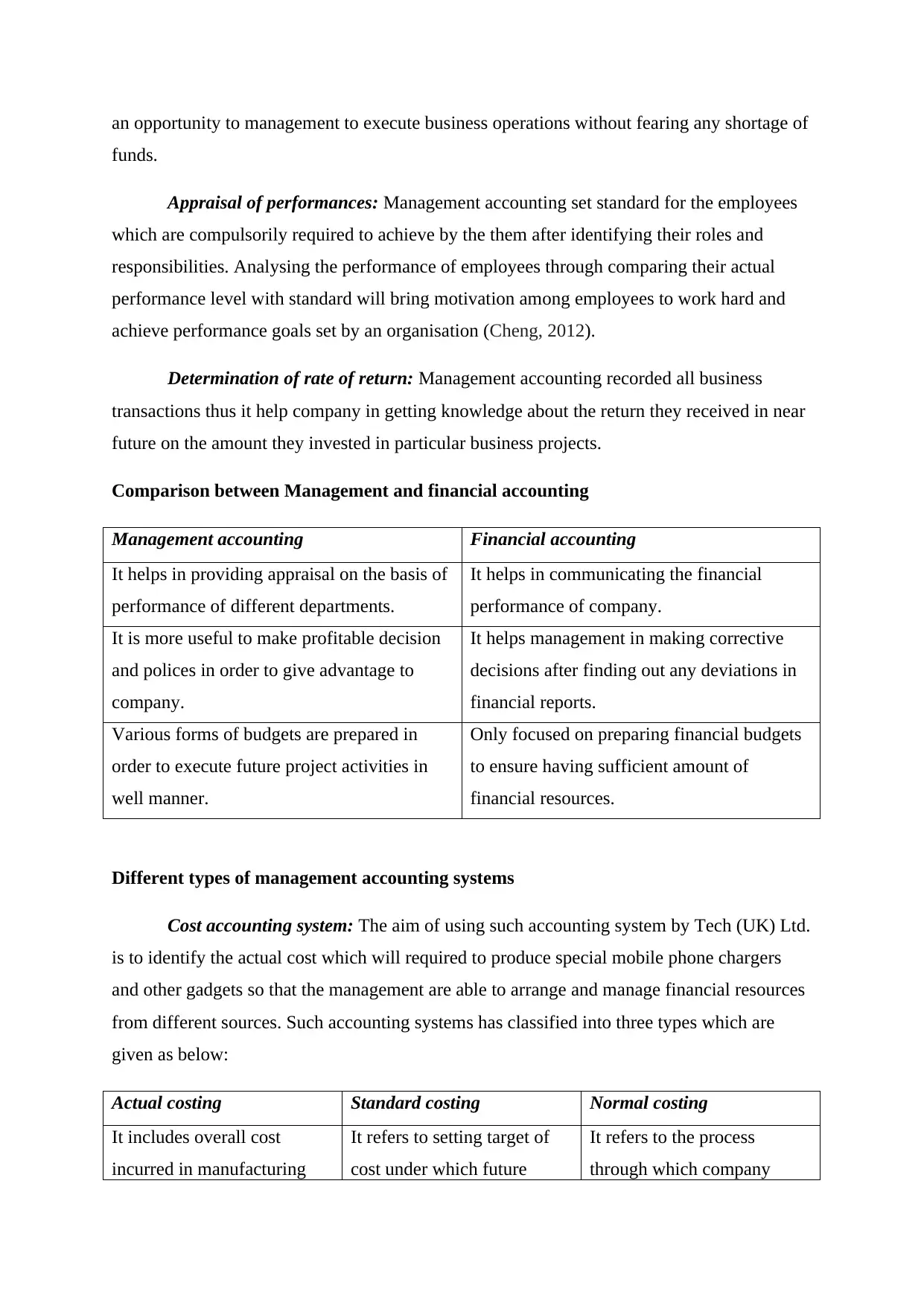

Comparison between Management and financial accounting

Management accounting Financial accounting

It helps in providing appraisal on the basis of

performance of different departments.

It helps in communicating the financial

performance of company.

It is more useful to make profitable decision

and polices in order to give advantage to

company.

It helps management in making corrective

decisions after finding out any deviations in

financial reports.

Various forms of budgets are prepared in

order to execute future project activities in

well manner.

Only focused on preparing financial budgets

to ensure having sufficient amount of

financial resources.

Different types of management accounting systems

Cost accounting system: The aim of using such accounting system by Tech (UK) Ltd.

is to identify the actual cost which will required to produce special mobile phone chargers

and other gadgets so that the management are able to arrange and manage financial resources

from different sources. Such accounting systems has classified into three types which are

given as below:

Actual costing Standard costing Normal costing

It includes overall cost

incurred in manufacturing

It refers to setting target of

cost under which future

It refers to the process

through which company

funds.

Appraisal of performances: Management accounting set standard for the employees

which are compulsorily required to achieve by the them after identifying their roles and

responsibilities. Analysing the performance of employees through comparing their actual

performance level with standard will bring motivation among employees to work hard and

achieve performance goals set by an organisation (Cheng, 2012).

Determination of rate of return: Management accounting recorded all business

transactions thus it help company in getting knowledge about the return they received in near

future on the amount they invested in particular business projects.

Comparison between Management and financial accounting

Management accounting Financial accounting

It helps in providing appraisal on the basis of

performance of different departments.

It helps in communicating the financial

performance of company.

It is more useful to make profitable decision

and polices in order to give advantage to

company.

It helps management in making corrective

decisions after finding out any deviations in

financial reports.

Various forms of budgets are prepared in

order to execute future project activities in

well manner.

Only focused on preparing financial budgets

to ensure having sufficient amount of

financial resources.

Different types of management accounting systems

Cost accounting system: The aim of using such accounting system by Tech (UK) Ltd.

is to identify the actual cost which will required to produce special mobile phone chargers

and other gadgets so that the management are able to arrange and manage financial resources

from different sources. Such accounting systems has classified into three types which are

given as below:

Actual costing Standard costing Normal costing

It includes overall cost

incurred in manufacturing

It refers to setting target of

cost under which future

It refers to the process

through which company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

process. Such cost includes

material, labour and

overhead.

business activities are

profitability executed. It is

done by management with an

objective to earn huge

profits.

identifying the amount

incurred in future production

activities.

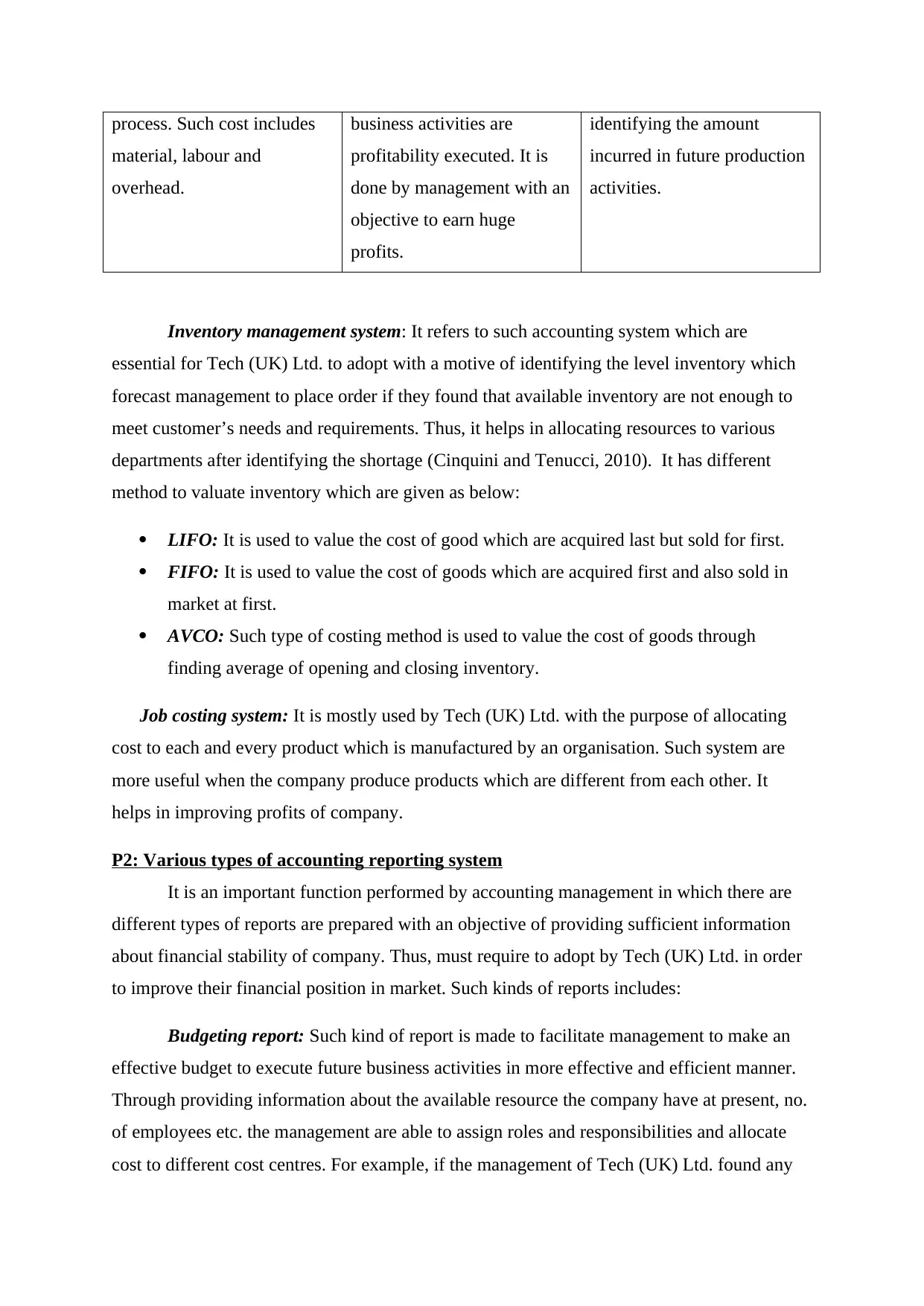

Inventory management system: It refers to such accounting system which are

essential for Tech (UK) Ltd. to adopt with a motive of identifying the level inventory which

forecast management to place order if they found that available inventory are not enough to

meet customer’s needs and requirements. Thus, it helps in allocating resources to various

departments after identifying the shortage (Cinquini and Tenucci, 2010). It has different

method to valuate inventory which are given as below:

LIFO: It is used to value the cost of good which are acquired last but sold for first.

FIFO: It is used to value the cost of goods which are acquired first and also sold in

market at first.

AVCO: Such type of costing method is used to value the cost of goods through

finding average of opening and closing inventory.

Job costing system: It is mostly used by Tech (UK) Ltd. with the purpose of allocating

cost to each and every product which is manufactured by an organisation. Such system are

more useful when the company produce products which are different from each other. It

helps in improving profits of company.

P2: Various types of accounting reporting system

It is an important function performed by accounting management in which there are

different types of reports are prepared with an objective of providing sufficient information

about financial stability of company. Thus, must require to adopt by Tech (UK) Ltd. in order

to improve their financial position in market. Such kinds of reports includes:

Budgeting report: Such kind of report is made to facilitate management to make an

effective budget to execute future business activities in more effective and efficient manner.

Through providing information about the available resource the company have at present, no.

of employees etc. the management are able to assign roles and responsibilities and allocate

cost to different cost centres. For example, if the management of Tech (UK) Ltd. found any

material, labour and

overhead.

business activities are

profitability executed. It is

done by management with an

objective to earn huge

profits.

identifying the amount

incurred in future production

activities.

Inventory management system: It refers to such accounting system which are

essential for Tech (UK) Ltd. to adopt with a motive of identifying the level inventory which

forecast management to place order if they found that available inventory are not enough to

meet customer’s needs and requirements. Thus, it helps in allocating resources to various

departments after identifying the shortage (Cinquini and Tenucci, 2010). It has different

method to valuate inventory which are given as below:

LIFO: It is used to value the cost of good which are acquired last but sold for first.

FIFO: It is used to value the cost of goods which are acquired first and also sold in

market at first.

AVCO: Such type of costing method is used to value the cost of goods through

finding average of opening and closing inventory.

Job costing system: It is mostly used by Tech (UK) Ltd. with the purpose of allocating

cost to each and every product which is manufactured by an organisation. Such system are

more useful when the company produce products which are different from each other. It

helps in improving profits of company.

P2: Various types of accounting reporting system

It is an important function performed by accounting management in which there are

different types of reports are prepared with an objective of providing sufficient information

about financial stability of company. Thus, must require to adopt by Tech (UK) Ltd. in order

to improve their financial position in market. Such kinds of reports includes:

Budgeting report: Such kind of report is made to facilitate management to make an

effective budget to execute future business activities in more effective and efficient manner.

Through providing information about the available resource the company have at present, no.

of employees etc. the management are able to assign roles and responsibilities and allocate

cost to different cost centres. For example, if the management of Tech (UK) Ltd. found any

shortage of financial resources then the management are in good position to raise funds from

different sources so as to fulfil the requirements (Harris and Mongiello, 2012).

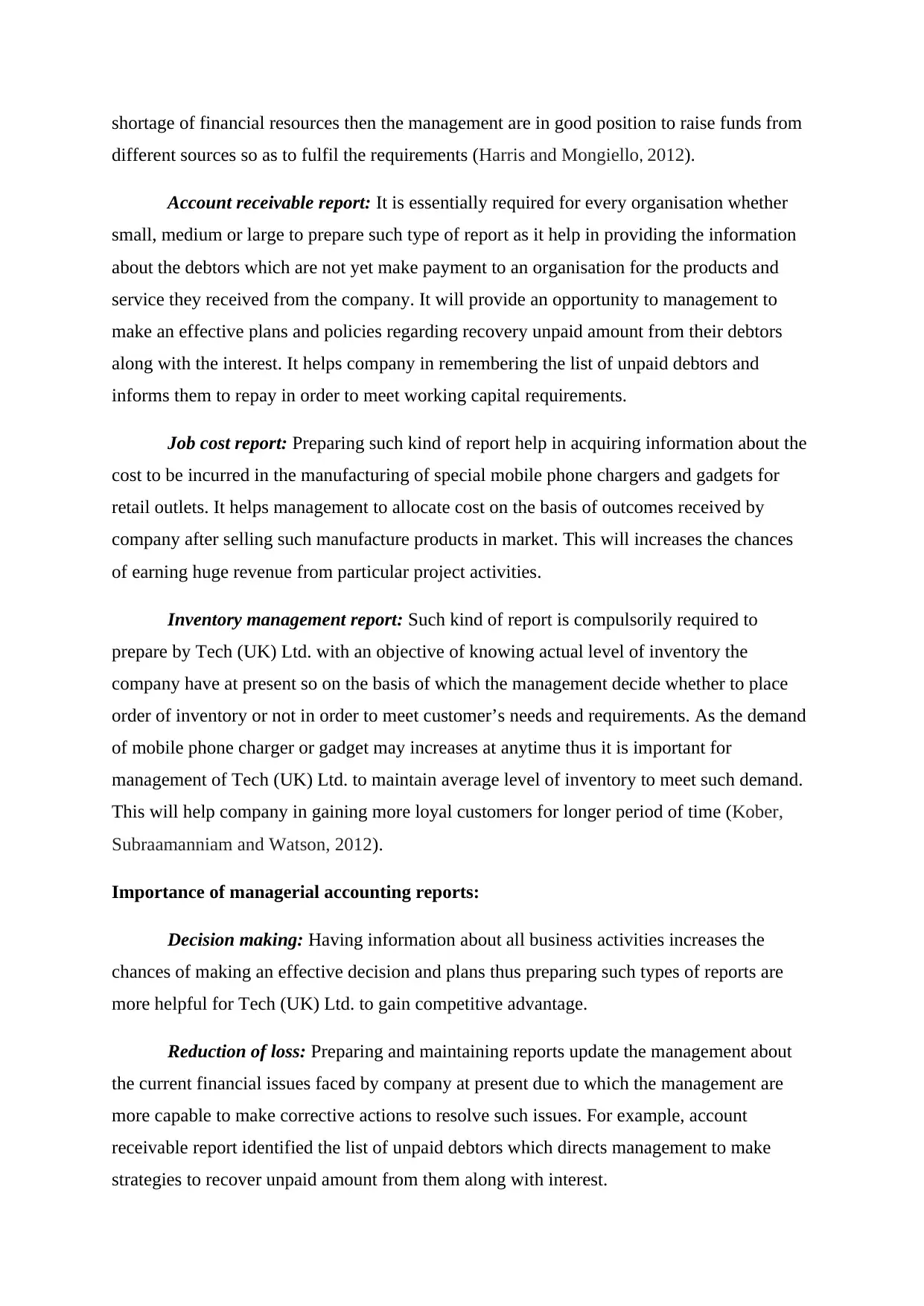

Account receivable report: It is essentially required for every organisation whether

small, medium or large to prepare such type of report as it help in providing the information

about the debtors which are not yet make payment to an organisation for the products and

service they received from the company. It will provide an opportunity to management to

make an effective plans and policies regarding recovery unpaid amount from their debtors

along with the interest. It helps company in remembering the list of unpaid debtors and

informs them to repay in order to meet working capital requirements.

Job cost report: Preparing such kind of report help in acquiring information about the

cost to be incurred in the manufacturing of special mobile phone chargers and gadgets for

retail outlets. It helps management to allocate cost on the basis of outcomes received by

company after selling such manufacture products in market. This will increases the chances

of earning huge revenue from particular project activities.

Inventory management report: Such kind of report is compulsorily required to

prepare by Tech (UK) Ltd. with an objective of knowing actual level of inventory the

company have at present so on the basis of which the management decide whether to place

order of inventory or not in order to meet customer’s needs and requirements. As the demand

of mobile phone charger or gadget may increases at anytime thus it is important for

management of Tech (UK) Ltd. to maintain average level of inventory to meet such demand.

This will help company in gaining more loyal customers for longer period of time (Kober,

Subraamanniam and Watson, 2012).

Importance of managerial accounting reports:

Decision making: Having information about all business activities increases the

chances of making an effective decision and plans thus preparing such types of reports are

more helpful for Tech (UK) Ltd. to gain competitive advantage.

Reduction of loss: Preparing and maintaining reports update the management about

the current financial issues faced by company at present due to which the management are

more capable to make corrective actions to resolve such issues. For example, account

receivable report identified the list of unpaid debtors which directs management to make

strategies to recover unpaid amount from them along with interest.

different sources so as to fulfil the requirements (Harris and Mongiello, 2012).

Account receivable report: It is essentially required for every organisation whether

small, medium or large to prepare such type of report as it help in providing the information

about the debtors which are not yet make payment to an organisation for the products and

service they received from the company. It will provide an opportunity to management to

make an effective plans and policies regarding recovery unpaid amount from their debtors

along with the interest. It helps company in remembering the list of unpaid debtors and

informs them to repay in order to meet working capital requirements.

Job cost report: Preparing such kind of report help in acquiring information about the

cost to be incurred in the manufacturing of special mobile phone chargers and gadgets for

retail outlets. It helps management to allocate cost on the basis of outcomes received by

company after selling such manufacture products in market. This will increases the chances

of earning huge revenue from particular project activities.

Inventory management report: Such kind of report is compulsorily required to

prepare by Tech (UK) Ltd. with an objective of knowing actual level of inventory the

company have at present so on the basis of which the management decide whether to place

order of inventory or not in order to meet customer’s needs and requirements. As the demand

of mobile phone charger or gadget may increases at anytime thus it is important for

management of Tech (UK) Ltd. to maintain average level of inventory to meet such demand.

This will help company in gaining more loyal customers for longer period of time (Kober,

Subraamanniam and Watson, 2012).

Importance of managerial accounting reports:

Decision making: Having information about all business activities increases the

chances of making an effective decision and plans thus preparing such types of reports are

more helpful for Tech (UK) Ltd. to gain competitive advantage.

Reduction of loss: Preparing and maintaining reports update the management about

the current financial issues faced by company at present due to which the management are

more capable to make corrective actions to resolve such issues. For example, account

receivable report identified the list of unpaid debtors which directs management to make

strategies to recover unpaid amount from them along with interest.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Increase financial returns: Preparing financial reports help in acquiring knowledge

about true and fair financial position of company which attracts lots of investors and

shareholder to invest capital in order to get maximum return in future. Thus, this increases the

financial position of company in market (Otley and Emmanuel, 2013).

TASK 2

P3: Calculation of cost and preparation of income statement

Cost: It refers to the amount which ate invested by company in order to produce

something new and valuable. It is required to execute business operations in more effective

and efficient manner. For example, labour cost, raw material cost and overhead expenses.

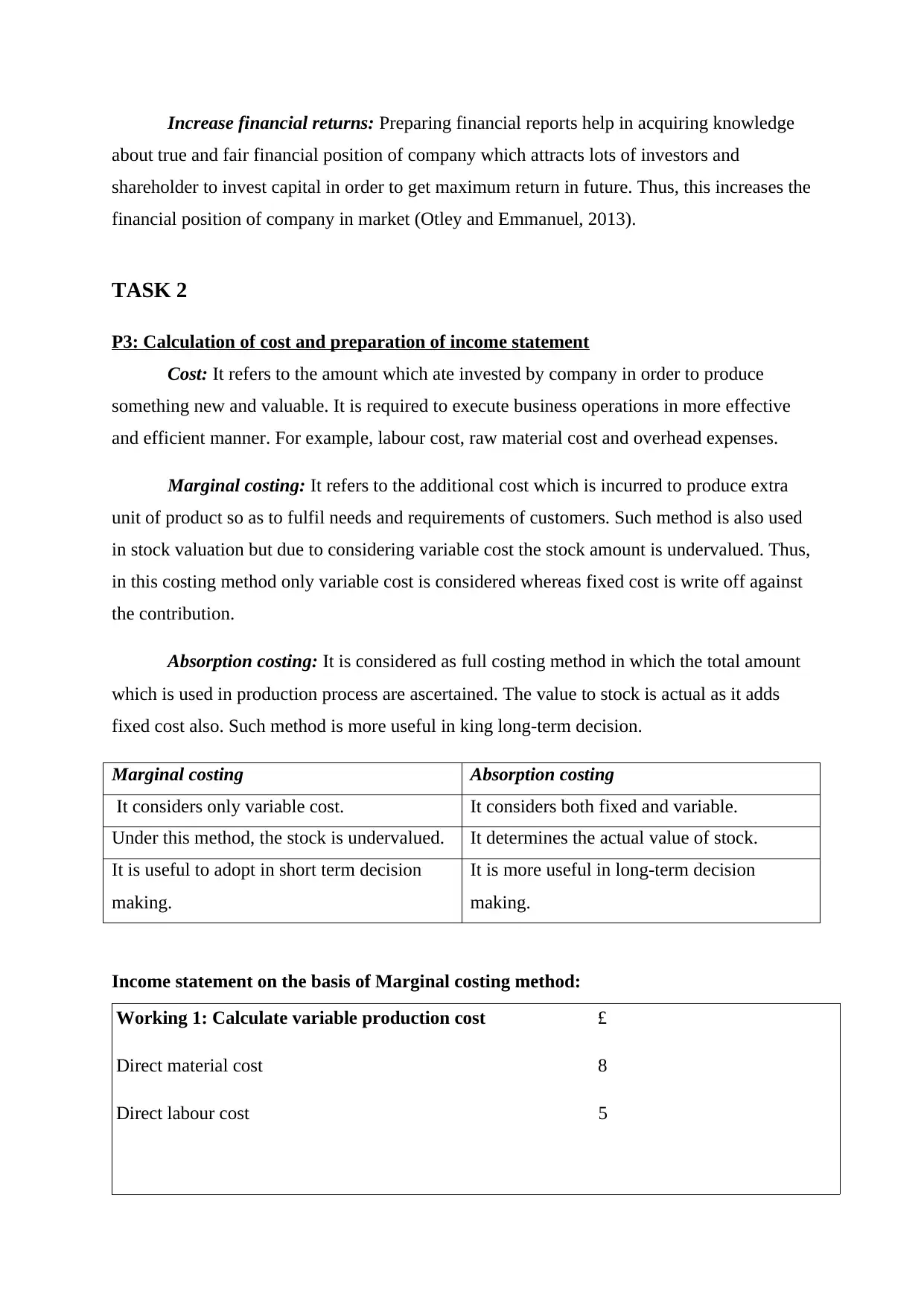

Marginal costing: It refers to the additional cost which is incurred to produce extra

unit of product so as to fulfil needs and requirements of customers. Such method is also used

in stock valuation but due to considering variable cost the stock amount is undervalued. Thus,

in this costing method only variable cost is considered whereas fixed cost is write off against

the contribution.

Absorption costing: It is considered as full costing method in which the total amount

which is used in production process are ascertained. The value to stock is actual as it adds

fixed cost also. Such method is more useful in king long-term decision.

Marginal costing Absorption costing

It considers only variable cost. It considers both fixed and variable.

Under this method, the stock is undervalued. It determines the actual value of stock.

It is useful to adopt in short term decision

making.

It is more useful in long-term decision

making.

Income statement on the basis of Marginal costing method:

Working 1: Calculate variable production cost £

Direct material cost 8

Direct labour cost 5

about true and fair financial position of company which attracts lots of investors and

shareholder to invest capital in order to get maximum return in future. Thus, this increases the

financial position of company in market (Otley and Emmanuel, 2013).

TASK 2

P3: Calculation of cost and preparation of income statement

Cost: It refers to the amount which ate invested by company in order to produce

something new and valuable. It is required to execute business operations in more effective

and efficient manner. For example, labour cost, raw material cost and overhead expenses.

Marginal costing: It refers to the additional cost which is incurred to produce extra

unit of product so as to fulfil needs and requirements of customers. Such method is also used

in stock valuation but due to considering variable cost the stock amount is undervalued. Thus,

in this costing method only variable cost is considered whereas fixed cost is write off against

the contribution.

Absorption costing: It is considered as full costing method in which the total amount

which is used in production process are ascertained. The value to stock is actual as it adds

fixed cost also. Such method is more useful in king long-term decision.

Marginal costing Absorption costing

It considers only variable cost. It considers both fixed and variable.

Under this method, the stock is undervalued. It determines the actual value of stock.

It is useful to adopt in short term decision

making.

It is more useful in long-term decision

making.

Income statement on the basis of Marginal costing method:

Working 1: Calculate variable production cost £

Direct material cost 8

Direct labour cost 5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable production O/h 2

Variable production cost 15

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*15 = 30000 500*15 = 7500

Net profit using marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Cost of production

Closing stock

Variable sales overheads

Contribution

Less Fixed costs:

Fixed Production overheads

Fixed Selling overheads

Net loss

0

30000

(7500)

15000

10000

52500

(22500)

(7875)

22125

(25000)

(2875)

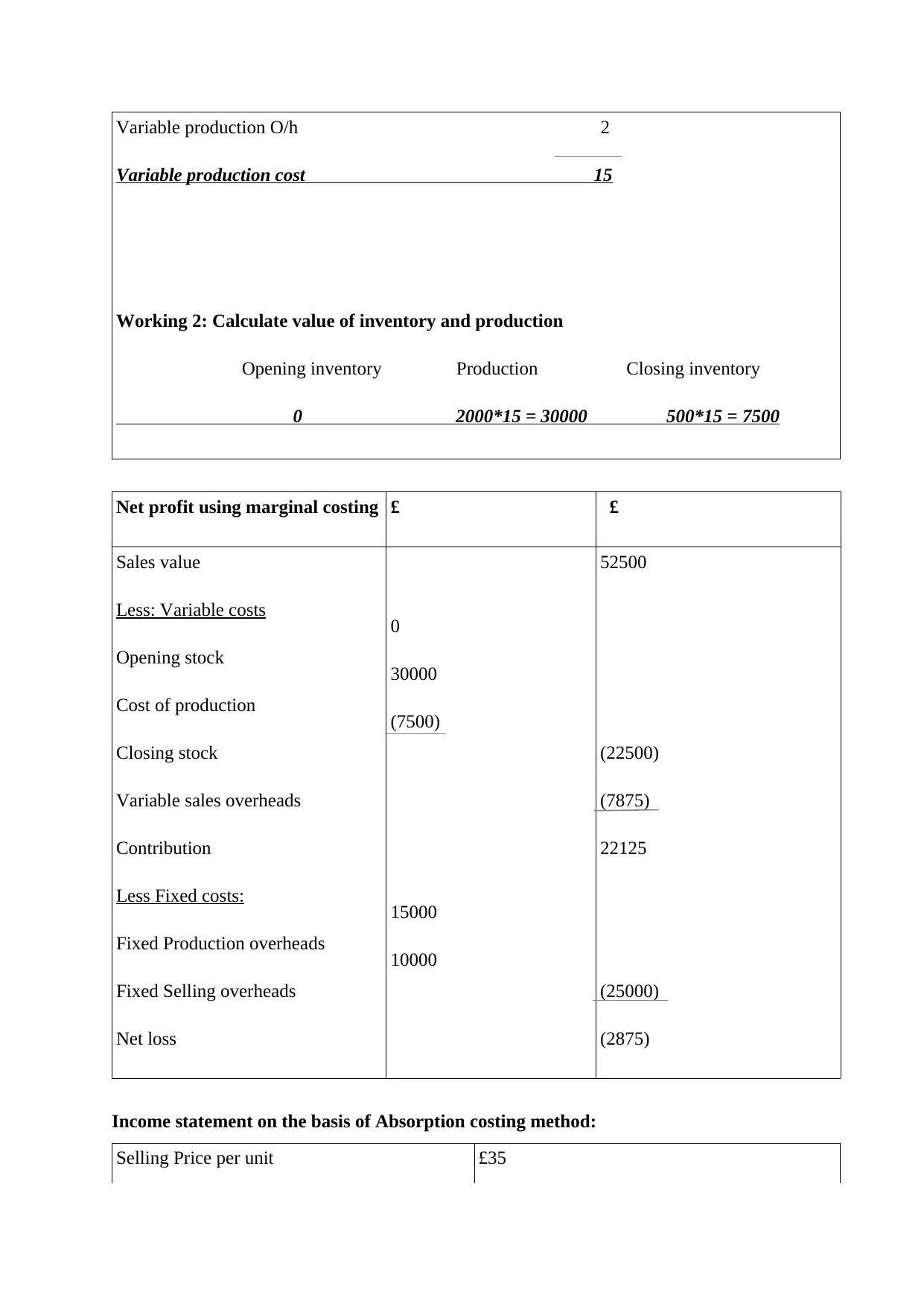

Income statement on the basis of Absorption costing method:

Selling Price per unit £35

Variable production cost 15

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 2000*15 = 30000 500*15 = 7500

Net profit using marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Cost of production

Closing stock

Variable sales overheads

Contribution

Less Fixed costs:

Fixed Production overheads

Fixed Selling overheads

Net loss

0

30000

(7500)

15000

10000

52500

(22500)

(7875)

22125

(25000)

(2875)

Income statement on the basis of Absorption costing method:

Selling Price per unit £35

Unit costs

Direct materials cost £8

Direct Labour cost £5

Variable Production overhead £2

Variable sales overhead £5.25

Budgeted production for the period is 3000

units

Fixed cost for a month:

Production overhead: In this budgeted cost is £15,000and Actual cost is £10,000

Selling cost: In this budgeted cost is £10,000and Actual cost is £7875

Absorption costing working notes

Working Note 1: Calculate full production cost

Direct material £8

Direct labour £5

Variable cost £2

Fixed cost £5

Total £20

Working Note 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 2,000*20 = £40000 500*20 = £10000

Working Note 3: under/ over absorbed fixed production overhead

Direct materials cost £8

Direct Labour cost £5

Variable Production overhead £2

Variable sales overhead £5.25

Budgeted production for the period is 3000

units

Fixed cost for a month:

Production overhead: In this budgeted cost is £15,000and Actual cost is £10,000

Selling cost: In this budgeted cost is £10,000and Actual cost is £7875

Absorption costing working notes

Working Note 1: Calculate full production cost

Direct material £8

Direct labour £5

Variable cost £2

Fixed cost £5

Total £20

Working Note 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 2,000*20 = £40000 500*20 = £10000

Working Note 3: under/ over absorbed fixed production overhead

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

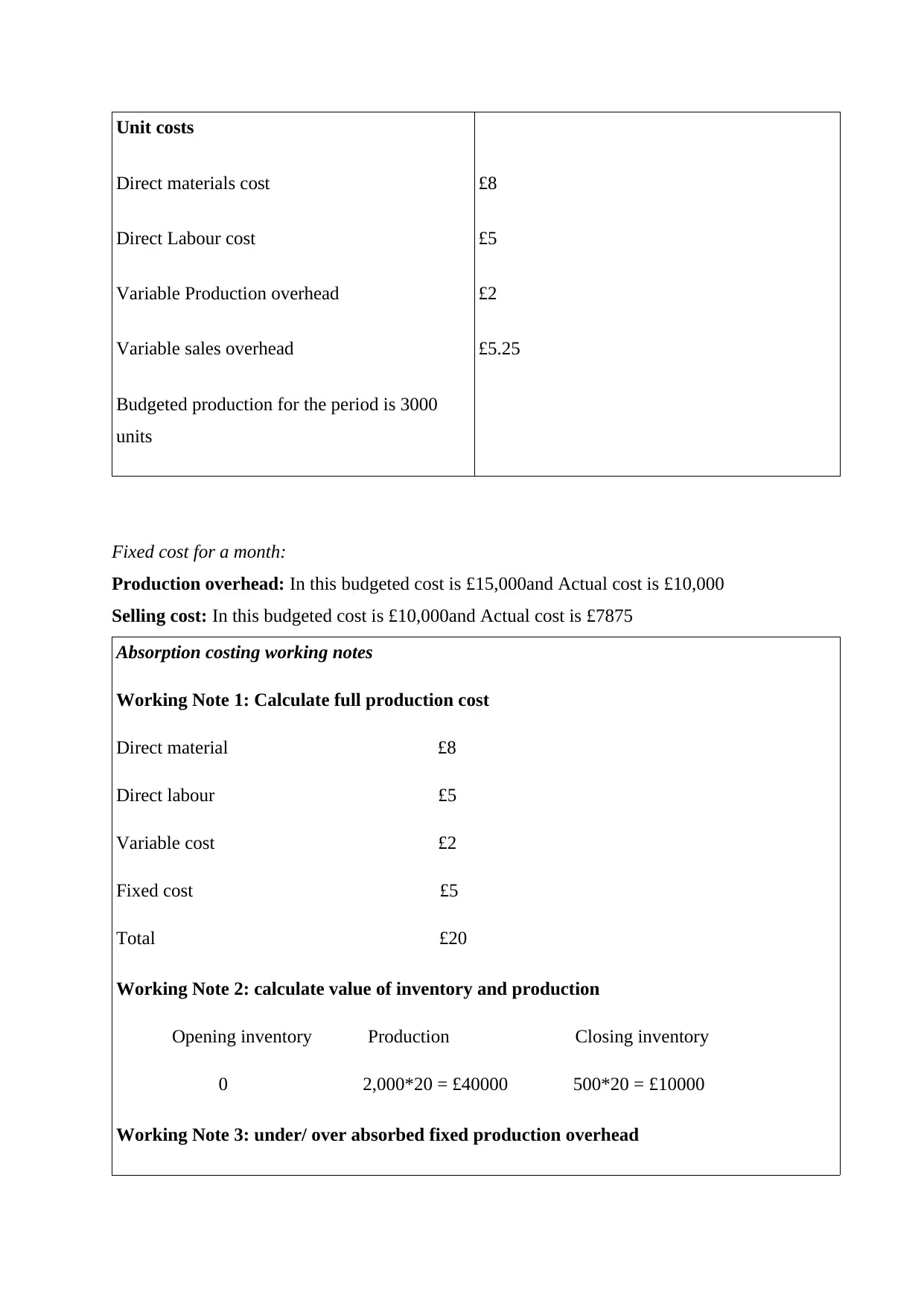

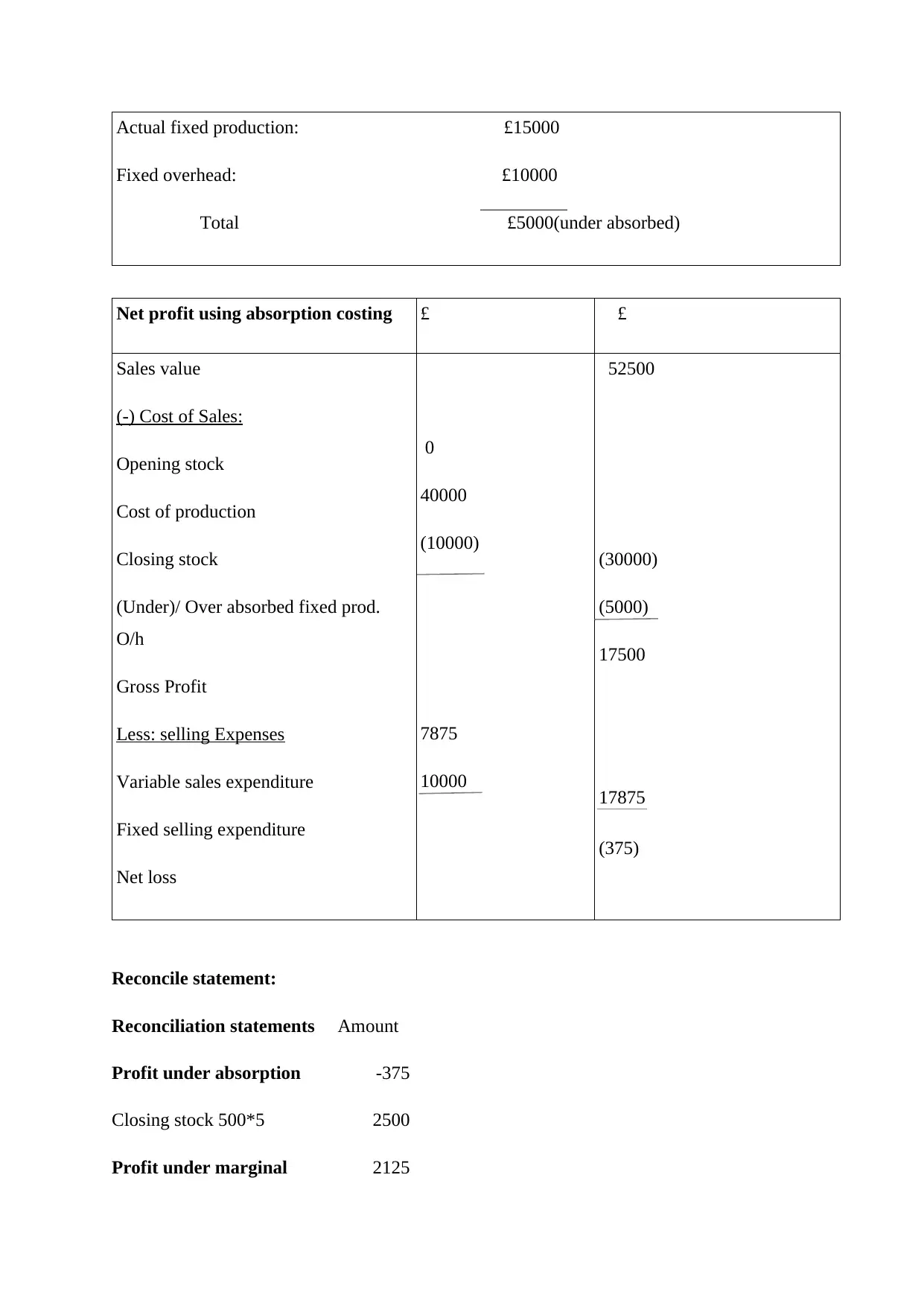

Actual fixed production: £15000

Fixed overhead: £10000

Total £5000(under absorbed)

Net profit using absorption costing £ £

Sales value

(-) Cost of Sales:

Opening stock

Cost of production

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less: selling Expenses

Variable sales expenditure

Fixed selling expenditure

Net loss

0

40000

(10000)

7875

10000

52500

(30000)

(5000)

17500

17875

(375)

Reconcile statement:

Reconciliation statements Amount

Profit under absorption -375

Closing stock 500*5 2500

Profit under marginal 2125

Fixed overhead: £10000

Total £5000(under absorbed)

Net profit using absorption costing £ £

Sales value

(-) Cost of Sales:

Opening stock

Cost of production

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less: selling Expenses

Variable sales expenditure

Fixed selling expenditure

Net loss

0

40000

(10000)

7875

10000

52500

(30000)

(5000)

17500

17875

(375)

Reconcile statement:

Reconciliation statements Amount

Profit under absorption -375

Closing stock 500*5 2500

Profit under marginal 2125

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The statement mentioned above clearly states that that after changing closing stock

valuation of 2500. The profit under marginal costing after making settlement of fixed cost it

comes as 2125.

TASK 3

P4: Advantages and disadvantages of using planning tools use in budget

There are different form of budget prepared by Tech (UK) Ltd. in order to execute

future business activities in more effective and efficient manner. Such types of budgets

includes master budget, cash flow budget, fixed budget and many more which are briefly

defined as below along with advantages and disadvantages:

Master budget: It is such type of budget which is prepared with an objective of

forecasting sales, level of production, capital required to be invested in execution of future

project activities etc. Such budget is interrelated with various budget of different bureau of

company (Otley and Emmanuel, 2013).

Advantage: It helps in providing overall cost to be incurred in the manufacturing

process of products and services.

Disadvantage: Preparation of such budget is not helpful for particular kind of activity

due to which the accuracies and reliability of information may decrease.

Cash flow budget: It is more useful to prepare such kind of budget as it help

management to ensure about cash inflow and outflow due to which the management should

able to make profitable plans and actions. There are various resources through which the

company can inflow cash within an organisation.

Advantage: It helps in knowing the inflow of cash which facilitate management to

execute future business operations in an effective and efficient manner.

Disadvantage: Sometimes it becomes difficult for manager to arrange and manage

cash inflow and outflow which increases the chances of wastage of funds.

Rolling budget: Such kind of budget is made after carefully analysing the new financial

place for nest accounting period which help in controlling business activities in an

appropriate manner.

valuation of 2500. The profit under marginal costing after making settlement of fixed cost it

comes as 2125.

TASK 3

P4: Advantages and disadvantages of using planning tools use in budget

There are different form of budget prepared by Tech (UK) Ltd. in order to execute

future business activities in more effective and efficient manner. Such types of budgets

includes master budget, cash flow budget, fixed budget and many more which are briefly

defined as below along with advantages and disadvantages:

Master budget: It is such type of budget which is prepared with an objective of

forecasting sales, level of production, capital required to be invested in execution of future

project activities etc. Such budget is interrelated with various budget of different bureau of

company (Otley and Emmanuel, 2013).

Advantage: It helps in providing overall cost to be incurred in the manufacturing

process of products and services.

Disadvantage: Preparation of such budget is not helpful for particular kind of activity

due to which the accuracies and reliability of information may decrease.

Cash flow budget: It is more useful to prepare such kind of budget as it help

management to ensure about cash inflow and outflow due to which the management should

able to make profitable plans and actions. There are various resources through which the

company can inflow cash within an organisation.

Advantage: It helps in knowing the inflow of cash which facilitate management to

execute future business operations in an effective and efficient manner.

Disadvantage: Sometimes it becomes difficult for manager to arrange and manage

cash inflow and outflow which increases the chances of wastage of funds.

Rolling budget: Such kind of budget is made after carefully analysing the new financial

place for nest accounting period which help in controlling business activities in an

appropriate manner.

Advantage: The management easily assumes to earn revenue in future period of time.

Disadvantage: Preparation of such kind of budget takes more time which increases its

complexity (Shah, Malik and Malik, 2011).

Flexible budget: Such kind of budget remain fined and cannot be changes with any

influencing factors thus all business activities are executed as decided earlier and are not

allowed to change financial plan as well.

Advantage: It helps in analysing the actual growth and success of small sixed

organisation.

Disadvantage: As such budget cannot be modified thus the chances of gaining

competitive opportunities will be less.

Flexible cost: Such kind of budget is opposite of fixed budget as the management make

changes in such budget after analysing the influencing factors.

Advantage: It helps management to make changes in their existing financial plan in

order to execute business operations in more effective and efficient manner.

Disadvantage: Sometimes the budget requires more funds due to which the

management may find difficulties in arranging funds within limited period of time.

Different pricing systems:

Price skimming: It is more useful pricing system in which an organisation increases

the prices of products at the time of launching product into market and thereafter slowly

decrease due to giving tough competitions to existing rivals in same market.

Economy pricing: In this, the firm lowering the price of products due to gaining

strong position is market as compared to their rivals. Through this, the company can achieve

huge customer strength as well.

Cost plus pricing: In this, the price of product are decided after analysing the total

cost incurred in production process. It includes about, material and overhead expenses.

Full cost pricing: In this, the prices have been fixed after analysing the total direct

cost incurred in manufacturing process.

Marginal cost pricing: In this, the cost which is incurred in pricing additional unit of

output is added to the price of product (Siverbo, 2014).

Disadvantage: Preparation of such kind of budget takes more time which increases its

complexity (Shah, Malik and Malik, 2011).

Flexible budget: Such kind of budget remain fined and cannot be changes with any

influencing factors thus all business activities are executed as decided earlier and are not

allowed to change financial plan as well.

Advantage: It helps in analysing the actual growth and success of small sixed

organisation.

Disadvantage: As such budget cannot be modified thus the chances of gaining

competitive opportunities will be less.

Flexible cost: Such kind of budget is opposite of fixed budget as the management make

changes in such budget after analysing the influencing factors.

Advantage: It helps management to make changes in their existing financial plan in

order to execute business operations in more effective and efficient manner.

Disadvantage: Sometimes the budget requires more funds due to which the

management may find difficulties in arranging funds within limited period of time.

Different pricing systems:

Price skimming: It is more useful pricing system in which an organisation increases

the prices of products at the time of launching product into market and thereafter slowly

decrease due to giving tough competitions to existing rivals in same market.

Economy pricing: In this, the firm lowering the price of products due to gaining

strong position is market as compared to their rivals. Through this, the company can achieve

huge customer strength as well.

Cost plus pricing: In this, the price of product are decided after analysing the total

cost incurred in production process. It includes about, material and overhead expenses.

Full cost pricing: In this, the prices have been fixed after analysing the total direct

cost incurred in manufacturing process.

Marginal cost pricing: In this, the cost which is incurred in pricing additional unit of

output is added to the price of product (Siverbo, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.