Management Accounting Systems and Reporting: Airdri Case Study Report

VerifiedAdded on 2021/02/19

|17

|5507

|82

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and practices, using the case of Airdri, a hand dryer manufacturing company. It begins with an introduction to management accounting, its essential requirements, and various system types like financial, cost, and tax accounting. The report then delves into different management accounting reporting methods, including trading and profit & loss accounts, balance sheets, and cash flow statements, alongside inventory management and job-costing systems. Furthermore, it explores cost analysis techniques, such as fixed and variable costs, absorption costing, and marginal costing, with an example income statement using marginal costing. The report also discusses the advantages and disadvantages of different planning tools and how organizations adapt management accounting systems to respond to financial problems. The conclusion summarizes the key findings, emphasizing the importance of management accounting in decision-making and performance improvement.

Management

Accounting

1

Accounting

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

P1 management accounting and give the essential requirements of different types of...............3

management accounting systems...............................................................................................3

P2: Explain different methods used for management accounting reporting...............................5

TASK 2............................................................................................................................................6

P3: Calculate costs using appropriate techniques of cost analysis..............................................6

P4. Advantages and disadvantages of different types of planning tools.....................................9

P5: Compare how organizations are adapting management accounting systems to respond to

...................................................................................................................................................13

Financial problems...................................................................................................................13

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

2

TASK 1............................................................................................................................................3

P1 management accounting and give the essential requirements of different types of...............3

management accounting systems...............................................................................................3

P2: Explain different methods used for management accounting reporting...............................5

TASK 2............................................................................................................................................6

P3: Calculate costs using appropriate techniques of cost analysis..............................................6

P4. Advantages and disadvantages of different types of planning tools.....................................9

P5: Compare how organizations are adapting management accounting systems to respond to

...................................................................................................................................................13

Financial problems...................................................................................................................13

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

2

INTRODUCTION

In business context, the concepts of gathering, analysing, posting, measuring and

evaluating internal financial information into useful accounts is knows as management

accounting (Aksoylu and Aykan, 2013). Cost accounting or managerial accounting is a

systematic process of presenting meaningful financial data that help internal manager to

formulate various policies, take respective decision and control different function and operation

within company to increase total productivity and profitability. This report is based on Airdri,

which is a small hand dryer manufacturing company in UK.

In this report, demonstration of various types of management accounting system and

reports have been discussed. In addition proper explanation and application of different kind of

accounting techniques are used to prepare income statements and different types of planning tool

that help in proper planning are discussed. Apart from this the use of management accounting in

respond to various financial problem are defined in this project.

TASK 1

P1 management accounting and give the essential requirements of different types of

management accounting systems.

The defined procedure of maintaining accurate management accounts and reports which

provide authentic and yearly financial information which is essential required by management of

company in order to make take day to day important decision is known as management

accounting (About Management accounting, 2019). It also supports in preparing budgets and

provide strength to planning process to evaluate and measure the company performance during a

time frame. The main elements of subjectivity in management accounting are:

To make effective use of resources to grow and maximise profit.

To create strategies and methods that support to reach the desired goals of company.

There are different types of management accounting system that are used by management

of Airdri for different purpose in order to increase the productivity and overall performance.

These systems have various crucial functions such as:

Provide and modify data: In business context, data is useful information that helps in

making valuable decision. Different types of system like cost accounting system helps to provide

accurate data related to total cost included in production process (Boiral, 2016). These systems

3

In business context, the concepts of gathering, analysing, posting, measuring and

evaluating internal financial information into useful accounts is knows as management

accounting (Aksoylu and Aykan, 2013). Cost accounting or managerial accounting is a

systematic process of presenting meaningful financial data that help internal manager to

formulate various policies, take respective decision and control different function and operation

within company to increase total productivity and profitability. This report is based on Airdri,

which is a small hand dryer manufacturing company in UK.

In this report, demonstration of various types of management accounting system and

reports have been discussed. In addition proper explanation and application of different kind of

accounting techniques are used to prepare income statements and different types of planning tool

that help in proper planning are discussed. Apart from this the use of management accounting in

respond to various financial problem are defined in this project.

TASK 1

P1 management accounting and give the essential requirements of different types of

management accounting systems.

The defined procedure of maintaining accurate management accounts and reports which

provide authentic and yearly financial information which is essential required by management of

company in order to make take day to day important decision is known as management

accounting (About Management accounting, 2019). It also supports in preparing budgets and

provide strength to planning process to evaluate and measure the company performance during a

time frame. The main elements of subjectivity in management accounting are:

To make effective use of resources to grow and maximise profit.

To create strategies and methods that support to reach the desired goals of company.

There are different types of management accounting system that are used by management

of Airdri for different purpose in order to increase the productivity and overall performance.

These systems have various crucial functions such as:

Provide and modify data: In business context, data is useful information that helps in

making valuable decision. Different types of system like cost accounting system helps to provide

accurate data related to total cost included in production process (Boiral, 2016). These systems

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

also support to make effective modification in total expenses of a specific period so that profit

margin can be increased in future.

Serves as a mean of communication: Different systems of management accounting are

beneficial for company as they act as best mean of communication among different department

within an organisation. Inventory management system is used by internal management of Airdri

to record total stock available in warehouses and this information is provided to production team

in order to manufacture number of hand dryer in specific time frame.

There are various types of management accounting system which are used in Airdri that

provide authenticity, accuracy and appropriative to the different function. Some of this system is

discussed underneath:

Financial accounting system: This system mainly helps to provide the proper guidelines

to manager of Airdri to prepare final accounts concerning following assets, liabilities and

operating results. All those system that hold the information related to financial records is known

as accounting system such as in Airdri receivable accounts record the traction of customer, sales

to record any type of sales done in system etc. these accounts are mapped to take meaningful

decision (Bromiley and et.al, 2015).

Cost accounting system: The manager of Airdri use to asses and measure the exact

detail to total cost that are incurred at each level of producing and selling hand dryer. There are

two types of costing method such as product costing and activity based costing that are used by

respective company to record the total expenses during a time frame. Product costing is used

determine the total expenses such as worker wages, purchases and transportation cost etc.

pertaining the development of Hand dryer. They use this costing to streamline production cost in

order to maximise profit. Activity based costing helps to ascertain and assigns the total costs to

overheads operation and then assigns these costs to valuable hand dryer.

Management accounting system: This system help to use the company financial

information and prepare authentic reports that are confidentiality used by internal manager of

Airdri. The main advantage of this system is to have proper control within company so that

unprofitable activity can be eliminating from the company (Malinić and Todorović, 2012). These

internal reports ease the process of decision making and determine the ways to increase the

efficiency and productivity of manufacture process. Manager of company use to analyse the

4

margin can be increased in future.

Serves as a mean of communication: Different systems of management accounting are

beneficial for company as they act as best mean of communication among different department

within an organisation. Inventory management system is used by internal management of Airdri

to record total stock available in warehouses and this information is provided to production team

in order to manufacture number of hand dryer in specific time frame.

There are various types of management accounting system which are used in Airdri that

provide authenticity, accuracy and appropriative to the different function. Some of this system is

discussed underneath:

Financial accounting system: This system mainly helps to provide the proper guidelines

to manager of Airdri to prepare final accounts concerning following assets, liabilities and

operating results. All those system that hold the information related to financial records is known

as accounting system such as in Airdri receivable accounts record the traction of customer, sales

to record any type of sales done in system etc. these accounts are mapped to take meaningful

decision (Bromiley and et.al, 2015).

Cost accounting system: The manager of Airdri use to asses and measure the exact

detail to total cost that are incurred at each level of producing and selling hand dryer. There are

two types of costing method such as product costing and activity based costing that are used by

respective company to record the total expenses during a time frame. Product costing is used

determine the total expenses such as worker wages, purchases and transportation cost etc.

pertaining the development of Hand dryer. They use this costing to streamline production cost in

order to maximise profit. Activity based costing helps to ascertain and assigns the total costs to

overheads operation and then assigns these costs to valuable hand dryer.

Management accounting system: This system help to use the company financial

information and prepare authentic reports that are confidentiality used by internal manager of

Airdri. The main advantage of this system is to have proper control within company so that

unprofitable activity can be eliminating from the company (Malinić and Todorović, 2012). These

internal reports ease the process of decision making and determine the ways to increase the

efficiency and productivity of manufacture process. Manager of company use to analyse the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

trend lines to forecast future sales and prepare budgets in order to increase the profit in an

accounting year.

Tax accounting system: It is a system that is mainly meant for the tax purposes and

dictates the particular rule which must be followed by each company and individual firms when

preparing annual tax return. In Airdri, this system focuses solely on particular item like income,

investment losses or gains and other business transaction that influence the individual tax burden.

P2: Explain different methods used for management accounting reporting.

In small sized organisation such as Airdri, there is a need of recording each and every

dealing of business so that regular decision is made for future improvement. To maintain a

systematic record of entire business dealing and financial happening in accurate format different

types of accounting reports are prepared. Some of these methods are discussed underneath:

Trading and profit and loss accounts: The main purpose of preparing this reports is to

calculated and measure the total profit made by Airdri over a period of time. Manager of Airdri

use to determine the gross profit or gross loss attained by producing and selling designer hand

dryer. This statement give the detail about Airdri capability to generate profit by driving revenue,

cutting cost and detail of revenue and expenses that includes net sales, COGS and selling and

Administration expenses (McLean, McGovern and Davie, 2015).

Balance sheet: It is consider being valuable financial report or statements that discloses

the total worth of a company at a given point of time. This report is mainly prepared by the

internal management of Airdri to provide an elaborated idea about actual and current financial

position. It shows the total of asset that is owns, total of liabilities that is owes by company as

well as actual amount invested by Airdri in business. The main use of balance sheet is to

determine the working capital is enough to sustain its operation, calculate the net worth so that

possible issuance of dividend can be made from retained earnings.

Cash flow statements: This report basically helps to determine the main and primary

cash flows happening during the specific period of time (Takeda and Boyns, 2014). As cash flow

statements are depended on the cash basis of accounting therefore it is very significant in order to

evaluate and measure the cash position of a company. In Airdri, this financial report is prepared

to determine the upcoming cash position so that they can plan and coordinate its total financial

operation in respectful manner. It also help to determine the total cash that will be generated

from operation and total money required to run basis production operations.

5

accounting year.

Tax accounting system: It is a system that is mainly meant for the tax purposes and

dictates the particular rule which must be followed by each company and individual firms when

preparing annual tax return. In Airdri, this system focuses solely on particular item like income,

investment losses or gains and other business transaction that influence the individual tax burden.

P2: Explain different methods used for management accounting reporting.

In small sized organisation such as Airdri, there is a need of recording each and every

dealing of business so that regular decision is made for future improvement. To maintain a

systematic record of entire business dealing and financial happening in accurate format different

types of accounting reports are prepared. Some of these methods are discussed underneath:

Trading and profit and loss accounts: The main purpose of preparing this reports is to

calculated and measure the total profit made by Airdri over a period of time. Manager of Airdri

use to determine the gross profit or gross loss attained by producing and selling designer hand

dryer. This statement give the detail about Airdri capability to generate profit by driving revenue,

cutting cost and detail of revenue and expenses that includes net sales, COGS and selling and

Administration expenses (McLean, McGovern and Davie, 2015).

Balance sheet: It is consider being valuable financial report or statements that discloses

the total worth of a company at a given point of time. This report is mainly prepared by the

internal management of Airdri to provide an elaborated idea about actual and current financial

position. It shows the total of asset that is owns, total of liabilities that is owes by company as

well as actual amount invested by Airdri in business. The main use of balance sheet is to

determine the working capital is enough to sustain its operation, calculate the net worth so that

possible issuance of dividend can be made from retained earnings.

Cash flow statements: This report basically helps to determine the main and primary

cash flows happening during the specific period of time (Takeda and Boyns, 2014). As cash flow

statements are depended on the cash basis of accounting therefore it is very significant in order to

evaluate and measure the cash position of a company. In Airdri, this financial report is prepared

to determine the upcoming cash position so that they can plan and coordinate its total financial

operation in respectful manner. It also help to determine the total cash that will be generated

from operation and total money required to run basis production operations.

5

Important system of management accounting in relation to preparation of authentic

reports is defined below:

Inventory management systems: This system assist to manage the available inventory

in warehouses that provide support to the entire supply chain of Airdri in order to grow profit. By

using this system internal manager of company keeps a valid record of total finished hand dryer

ready for sales, quantity of goods in transit and actual raw material that can be used in producing

goods.

Job-costing systems: This system is mainly helpful for Airdri to estimate the beneficial

and related information with cost of specific job or task. The system merely highlights on cost or

expenses acquired for or related with all and each work and assign them to such job. In

respective firm job costing system is mainly used at lower band at which different cost are

classified according to the nature and then these cost are categorized by bookkeeper of company

as per system to decrease difficulty in exploration of total performance of several operations.

Price-optimising systems: By implementing this system manager of Airdri uses to fix

the prices of hand dryer as per the need of customer so that profitability of business can be

increased. Thus it is stated that by implementing the concepts of price system valuable decision

related to pricing are made to ensure profit margin. Therefore, with the help of this system

respective company is able to sell hand dryer at lower prices than their competitors by analysing

the trends and business scenarios.

TASK 2

P3: Calculate costs using appropriate techniques of cost analysis

In business context, the outlay spent by an organisation to buy essential requirement of

business in known as cost. In simple term, an amount that is incurred or spent by user in order to

receive something is known as costs. Expenses or cost are mainly the monetary valuation of

material, resources, efforts, time and utilities consumed and opportunities involved in

manufacture and delivery of goods and services. It is stated that all expenses are consider as cost

but all cost are defined as expenses. There are various kind of costs and costing methods that are

useful in setting prices for Airdri with the main motive to increase profitability.

6

reports is defined below:

Inventory management systems: This system assist to manage the available inventory

in warehouses that provide support to the entire supply chain of Airdri in order to grow profit. By

using this system internal manager of company keeps a valid record of total finished hand dryer

ready for sales, quantity of goods in transit and actual raw material that can be used in producing

goods.

Job-costing systems: This system is mainly helpful for Airdri to estimate the beneficial

and related information with cost of specific job or task. The system merely highlights on cost or

expenses acquired for or related with all and each work and assign them to such job. In

respective firm job costing system is mainly used at lower band at which different cost are

classified according to the nature and then these cost are categorized by bookkeeper of company

as per system to decrease difficulty in exploration of total performance of several operations.

Price-optimising systems: By implementing this system manager of Airdri uses to fix

the prices of hand dryer as per the need of customer so that profitability of business can be

increased. Thus it is stated that by implementing the concepts of price system valuable decision

related to pricing are made to ensure profit margin. Therefore, with the help of this system

respective company is able to sell hand dryer at lower prices than their competitors by analysing

the trends and business scenarios.

TASK 2

P3: Calculate costs using appropriate techniques of cost analysis

In business context, the outlay spent by an organisation to buy essential requirement of

business in known as cost. In simple term, an amount that is incurred or spent by user in order to

receive something is known as costs. Expenses or cost are mainly the monetary valuation of

material, resources, efforts, time and utilities consumed and opportunities involved in

manufacture and delivery of goods and services. It is stated that all expenses are consider as cost

but all cost are defined as expenses. There are various kind of costs and costing methods that are

useful in setting prices for Airdri with the main motive to increase profitability.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Fixed cost: This kind of cost does not change with the changes in level of production and

are also referred as overheads costs. They are recorded as same in case if Airdri produces 100

hand dryer or 1000, such as rents, salary, depreciation etc.

Variable cost: On the other side this costs keeps on changing with the fluctuation in total

unit of outputs. In case if volume of producing hand dryer increase in Airdri, then variable cost

related with labour, material usually gets increased.

Absorption costing: This costing is also known as full costing that includes fixed

overheads charges that are included while producing total unit of Hand dryer in Airdri during a

specific time period. In other term, absorption costing is the total cost of a finished good that

mainly includes the cost of direct labour, material, variable overhead and fixed overhead.

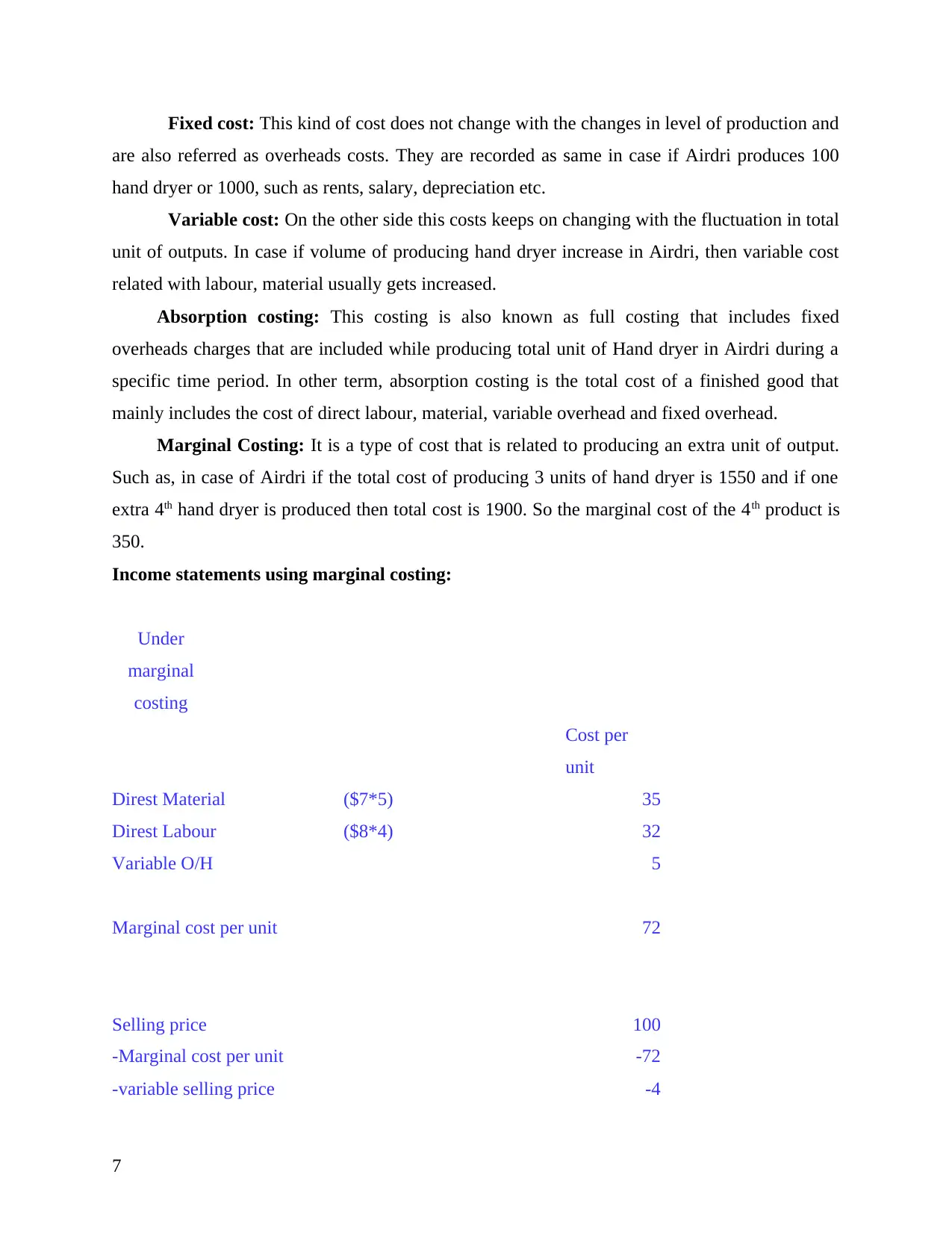

Marginal Costing: It is a type of cost that is related to producing an extra unit of output.

Such as, in case of Airdri if the total cost of producing 3 units of hand dryer is 1550 and if one

extra 4th hand dryer is produced then total cost is 1900. So the marginal cost of the 4th product is

350.

Income statements using marginal costing:

Under

marginal

costing

Cost per

unit

Direst Material ($7*5) 35

Direst Labour ($8*4) 32

Variable O/H 5

Marginal cost per unit 72

Selling price 100

-Marginal cost per unit -72

-variable selling price -4

7

are also referred as overheads costs. They are recorded as same in case if Airdri produces 100

hand dryer or 1000, such as rents, salary, depreciation etc.

Variable cost: On the other side this costs keeps on changing with the fluctuation in total

unit of outputs. In case if volume of producing hand dryer increase in Airdri, then variable cost

related with labour, material usually gets increased.

Absorption costing: This costing is also known as full costing that includes fixed

overheads charges that are included while producing total unit of Hand dryer in Airdri during a

specific time period. In other term, absorption costing is the total cost of a finished good that

mainly includes the cost of direct labour, material, variable overhead and fixed overhead.

Marginal Costing: It is a type of cost that is related to producing an extra unit of output.

Such as, in case of Airdri if the total cost of producing 3 units of hand dryer is 1550 and if one

extra 4th hand dryer is produced then total cost is 1900. So the marginal cost of the 4th product is

350.

Income statements using marginal costing:

Under

marginal

costing

Cost per

unit

Direst Material ($7*5) 35

Direst Labour ($8*4) 32

Variable O/H 5

Marginal cost per unit 72

Selling price 100

-Marginal cost per unit -72

-variable selling price -4

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

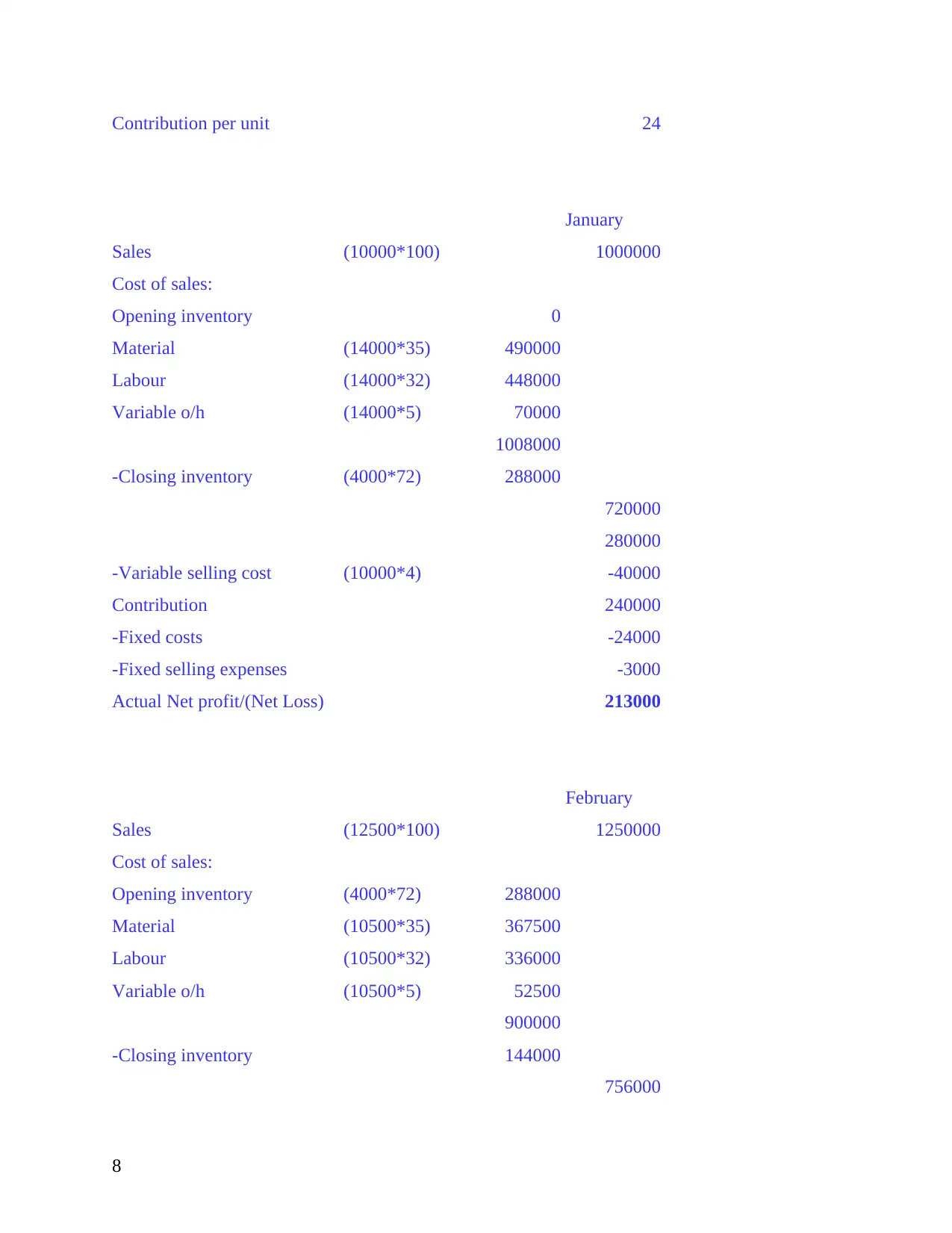

Contribution per unit 24

January

Sales (10000*100) 1000000

Cost of sales:

Opening inventory 0

Material (14000*35) 490000

Labour (14000*32) 448000

Variable o/h (14000*5) 70000

1008000

-Closing inventory (4000*72) 288000

720000

280000

-Variable selling cost (10000*4) -40000

Contribution 240000

-Fixed costs -24000

-Fixed selling expenses -3000

Actual Net profit/(Net Loss) 213000

February

Sales (12500*100) 1250000

Cost of sales:

Opening inventory (4000*72) 288000

Material (10500*35) 367500

Labour (10500*32) 336000

Variable o/h (10500*5) 52500

900000

-Closing inventory 144000

756000

8

January

Sales (10000*100) 1000000

Cost of sales:

Opening inventory 0

Material (14000*35) 490000

Labour (14000*32) 448000

Variable o/h (14000*5) 70000

1008000

-Closing inventory (4000*72) 288000

720000

280000

-Variable selling cost (10000*4) -40000

Contribution 240000

-Fixed costs -24000

-Fixed selling expenses -3000

Actual Net profit/(Net Loss) 213000

February

Sales (12500*100) 1250000

Cost of sales:

Opening inventory (4000*72) 288000

Material (10500*35) 367500

Labour (10500*32) 336000

Variable o/h (10500*5) 52500

900000

-Closing inventory 144000

756000

8

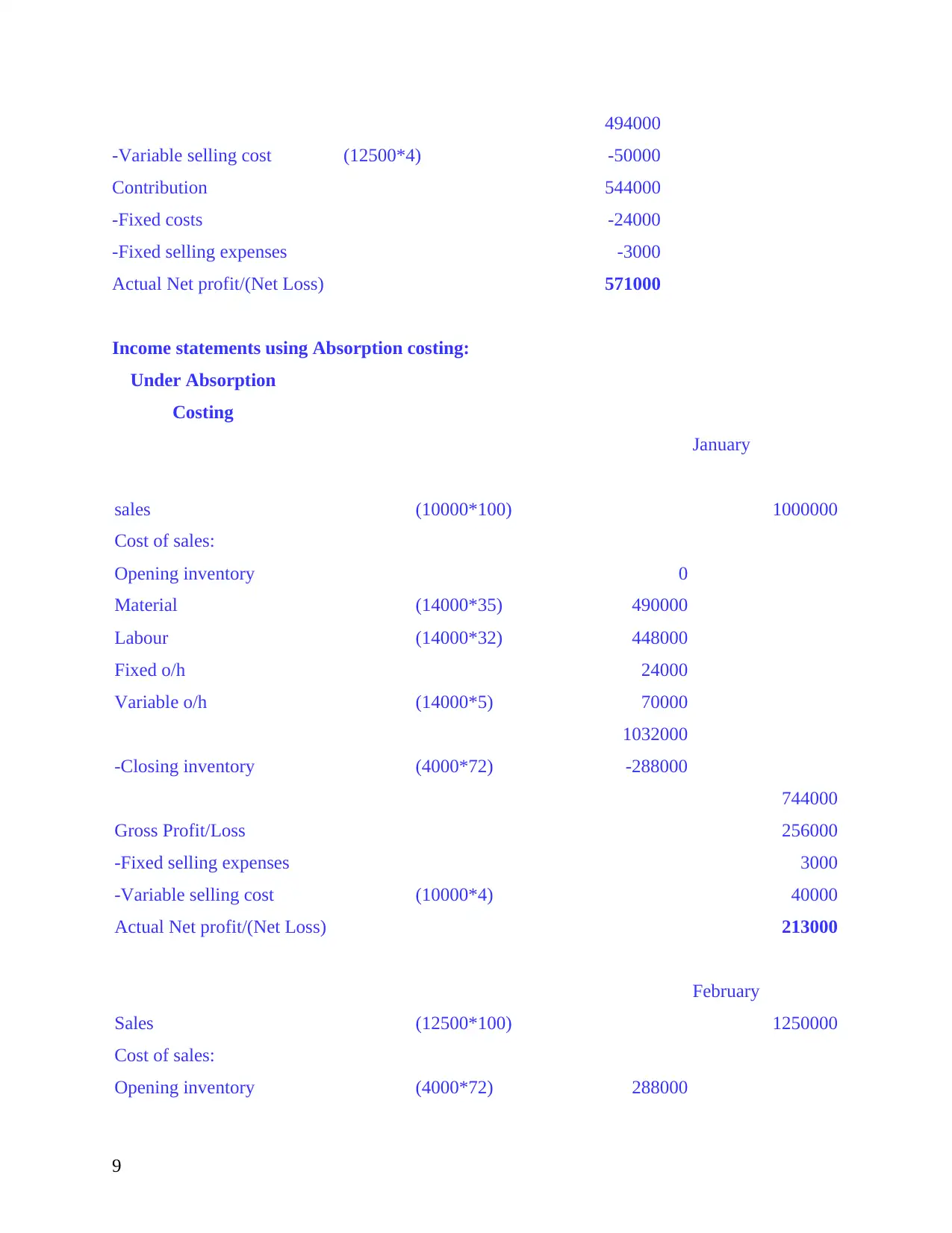

494000

-Variable selling cost (12500*4) -50000

Contribution 544000

-Fixed costs -24000

-Fixed selling expenses -3000

Actual Net profit/(Net Loss) 571000

Income statements using Absorption costing:

Under Absorption

Costing

January

sales (10000*100) 1000000

Cost of sales:

Opening inventory 0

Material (14000*35) 490000

Labour (14000*32) 448000

Fixed o/h 24000

Variable o/h (14000*5) 70000

1032000

-Closing inventory (4000*72) -288000

744000

Gross Profit/Loss 256000

-Fixed selling expenses 3000

-Variable selling cost (10000*4) 40000

Actual Net profit/(Net Loss) 213000

February

Sales (12500*100) 1250000

Cost of sales:

Opening inventory (4000*72) 288000

9

-Variable selling cost (12500*4) -50000

Contribution 544000

-Fixed costs -24000

-Fixed selling expenses -3000

Actual Net profit/(Net Loss) 571000

Income statements using Absorption costing:

Under Absorption

Costing

January

sales (10000*100) 1000000

Cost of sales:

Opening inventory 0

Material (14000*35) 490000

Labour (14000*32) 448000

Fixed o/h 24000

Variable o/h (14000*5) 70000

1032000

-Closing inventory (4000*72) -288000

744000

Gross Profit/Loss 256000

-Fixed selling expenses 3000

-Variable selling cost (10000*4) 40000

Actual Net profit/(Net Loss) 213000

February

Sales (12500*100) 1250000

Cost of sales:

Opening inventory (4000*72) 288000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

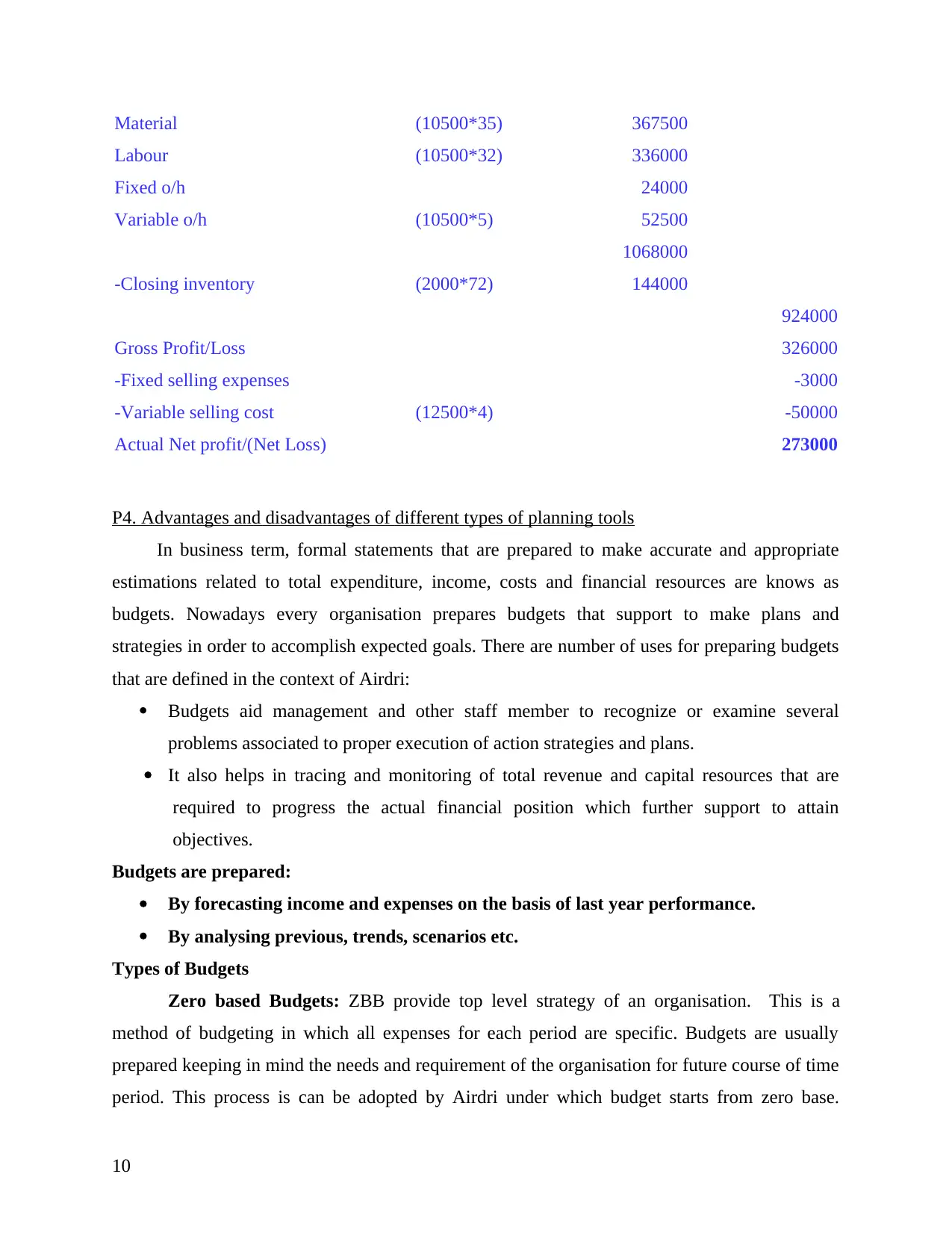

Material (10500*35) 367500

Labour (10500*32) 336000

Fixed o/h 24000

Variable o/h (10500*5) 52500

1068000

-Closing inventory (2000*72) 144000

924000

Gross Profit/Loss 326000

-Fixed selling expenses -3000

-Variable selling cost (12500*4) -50000

Actual Net profit/(Net Loss) 273000

P4. Advantages and disadvantages of different types of planning tools

In business term, formal statements that are prepared to make accurate and appropriate

estimations related to total expenditure, income, costs and financial resources are knows as

budgets. Nowadays every organisation prepares budgets that support to make plans and

strategies in order to accomplish expected goals. There are number of uses for preparing budgets

that are defined in the context of Airdri:

Budgets aid management and other staff member to recognize or examine several

problems associated to proper execution of action strategies and plans.

It also helps in tracing and monitoring of total revenue and capital resources that are

required to progress the actual financial position which further support to attain

objectives.

Budgets are prepared:

By forecasting income and expenses on the basis of last year performance.

By analysing previous, trends, scenarios etc.

Types of Budgets

Zero based Budgets: ZBB provide top level strategy of an organisation. This is a

method of budgeting in which all expenses for each period are specific. Budgets are usually

prepared keeping in mind the needs and requirement of the organisation for future course of time

period. This process is can be adopted by Airdri under which budget starts from zero base.

10

Labour (10500*32) 336000

Fixed o/h 24000

Variable o/h (10500*5) 52500

1068000

-Closing inventory (2000*72) 144000

924000

Gross Profit/Loss 326000

-Fixed selling expenses -3000

-Variable selling cost (12500*4) -50000

Actual Net profit/(Net Loss) 273000

P4. Advantages and disadvantages of different types of planning tools

In business term, formal statements that are prepared to make accurate and appropriate

estimations related to total expenditure, income, costs and financial resources are knows as

budgets. Nowadays every organisation prepares budgets that support to make plans and

strategies in order to accomplish expected goals. There are number of uses for preparing budgets

that are defined in the context of Airdri:

Budgets aid management and other staff member to recognize or examine several

problems associated to proper execution of action strategies and plans.

It also helps in tracing and monitoring of total revenue and capital resources that are

required to progress the actual financial position which further support to attain

objectives.

Budgets are prepared:

By forecasting income and expenses on the basis of last year performance.

By analysing previous, trends, scenarios etc.

Types of Budgets

Zero based Budgets: ZBB provide top level strategy of an organisation. This is a

method of budgeting in which all expenses for each period are specific. Budgets are usually

prepared keeping in mind the needs and requirement of the organisation for future course of time

period. This process is can be adopted by Airdri under which budget starts from zero base.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Furthermore the needs of the company are analysed. Airdri budget should be made regardless of

the previous years. This budgeting can help Airdri in lower costs for organisation by avoiding

increase or decrease to its prior period's budget.

Advantages: In Airdri ZBB is helpful to make a valid track of current movement of cash

inflows and outflows within specific year. That further support to accomplish cash affectivity in

order to reduce any kind of opposing liquidity situation.

Disadvantages: In particular time within organisation like Airdri, it is not easy to assess the

actual cash position due to credit sales and purchase in that cases ZBB totally fails and can

impact business performance (Thomas, 2016).

Incremental Budget: This is a vital part of management accounting. Under this budget

for the current fiscal year base for working is allocated under upcoming years. It is a budget

prepared using previous and actual performance of an organisation. This method can be used by

Airdri because it is simple in nature that helps the company in dealing with various departments

with consistence. Furthermore continuity of funding will help Airdri in achieve target with

efficiency. Incremental budgeting can be suitable for Airdri because funding are fixed with little

requirement. It can also help company to ensure stability of budget in upcoming year.

Advantages: This budget is mainly used by management of Airdri to categorize the problems of

last year and effectively plans for future period. In company incremental budget also support to

ascertain the specific subdivision which is spending outside its limits so that valuable decision

are made.

Disadvantages: The major disadvantage of incremental budgets is that it lacks specificity. In

Airdri the dollar amounts and figures are a collective amount of all section's expenditures and

earnings. Due to some future contingencies it is not easy to predict accurately about future.

Operating Budget: It primarily consists of several sub-budgets. The most being sales

budget which usually the first to be prepared (Yazdifar and et.al., 2012). Operating Budget

basically includes details of all income and expenses that are estimated by an organisation. It is

prepared in advance for a particular that a firm expects to achieve in future. Airdri can use

operating budget that will help company in getting short-term budget in which capital outlays is

excluded because it is a long-term cost. Operating Budget helps the entire business to track the

financial activities with efficiency. Furthermore this budget indicates both money the

organisation spends and money that is projected to come.

11

the previous years. This budgeting can help Airdri in lower costs for organisation by avoiding

increase or decrease to its prior period's budget.

Advantages: In Airdri ZBB is helpful to make a valid track of current movement of cash

inflows and outflows within specific year. That further support to accomplish cash affectivity in

order to reduce any kind of opposing liquidity situation.

Disadvantages: In particular time within organisation like Airdri, it is not easy to assess the

actual cash position due to credit sales and purchase in that cases ZBB totally fails and can

impact business performance (Thomas, 2016).

Incremental Budget: This is a vital part of management accounting. Under this budget

for the current fiscal year base for working is allocated under upcoming years. It is a budget

prepared using previous and actual performance of an organisation. This method can be used by

Airdri because it is simple in nature that helps the company in dealing with various departments

with consistence. Furthermore continuity of funding will help Airdri in achieve target with

efficiency. Incremental budgeting can be suitable for Airdri because funding are fixed with little

requirement. It can also help company to ensure stability of budget in upcoming year.

Advantages: This budget is mainly used by management of Airdri to categorize the problems of

last year and effectively plans for future period. In company incremental budget also support to

ascertain the specific subdivision which is spending outside its limits so that valuable decision

are made.

Disadvantages: The major disadvantage of incremental budgets is that it lacks specificity. In

Airdri the dollar amounts and figures are a collective amount of all section's expenditures and

earnings. Due to some future contingencies it is not easy to predict accurately about future.

Operating Budget: It primarily consists of several sub-budgets. The most being sales

budget which usually the first to be prepared (Yazdifar and et.al., 2012). Operating Budget

basically includes details of all income and expenses that are estimated by an organisation. It is

prepared in advance for a particular that a firm expects to achieve in future. Airdri can use

operating budget that will help company in getting short-term budget in which capital outlays is

excluded because it is a long-term cost. Operating Budget helps the entire business to track the

financial activities with efficiency. Furthermore this budget indicates both money the

organisation spends and money that is projected to come.

11

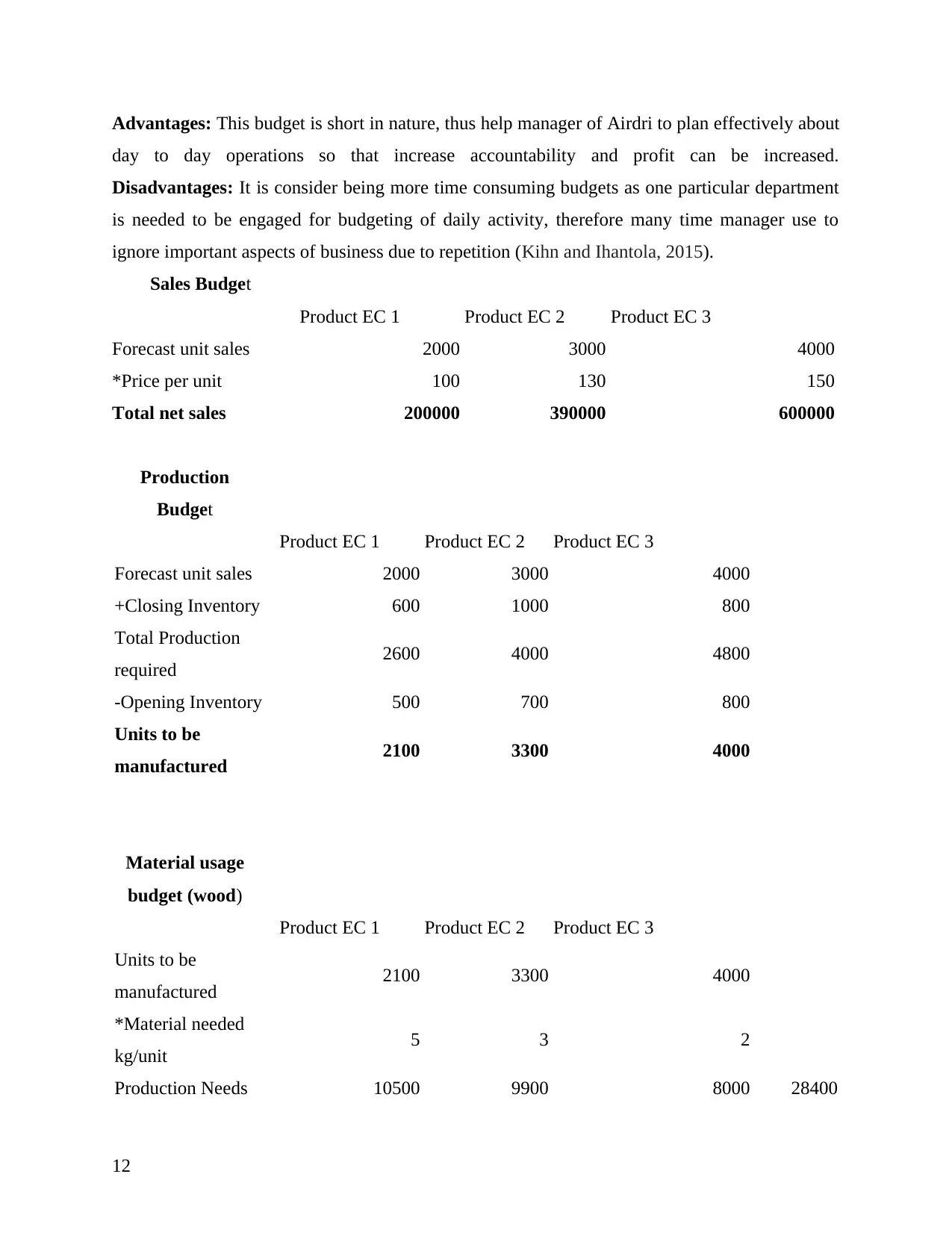

Advantages: This budget is short in nature, thus help manager of Airdri to plan effectively about

day to day operations so that increase accountability and profit can be increased.

Disadvantages: It is consider being more time consuming budgets as one particular department

is needed to be engaged for budgeting of daily activity, therefore many time manager use to

ignore important aspects of business due to repetition (Kihn and Ihantola, 2015).

Sales Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

*Price per unit 100 130 150

Total net sales 200000 390000 600000

Production

Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

+Closing Inventory 600 1000 800

Total Production

required 2600 4000 4800

-Opening Inventory 500 700 800

Units to be

manufactured 2100 3300 4000

Material usage

budget (wood)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 5 3 2

Production Needs 10500 9900 8000 28400

12

day to day operations so that increase accountability and profit can be increased.

Disadvantages: It is consider being more time consuming budgets as one particular department

is needed to be engaged for budgeting of daily activity, therefore many time manager use to

ignore important aspects of business due to repetition (Kihn and Ihantola, 2015).

Sales Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

*Price per unit 100 130 150

Total net sales 200000 390000 600000

Production

Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

+Closing Inventory 600 1000 800

Total Production

required 2600 4000 4800

-Opening Inventory 500 700 800

Units to be

manufactured 2100 3300 4000

Material usage

budget (wood)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 5 3 2

Production Needs 10500 9900 8000 28400

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.