Case Study Analysis: Management Accounting, HI5017, Holmes Institute

VerifiedAdded on 2022/11/13

|19

|4289

|385

Case Study

AI Summary

This assignment analyzes a management accounting case study, focusing on cost concepts and their application in a service-based company. It identifies and explains fixed, variable, and sunk costs, providing examples from the case. The analysis evaluates the relevance of cost information in decision-making, particularly regarding purchasing appliances, and calculates costs for different options. Additionally, the assignment examines the impact of hiring additional employees on costs and revenue, offering recommendations based on the financial analysis. The document also includes a letter providing advice on space options, the number of children to accept, and the number of employees to hire. Finally, the assignment critiques a journal article on innovation management, discussing its components and relevance to real-world business scenarios.

MANAGEMENT ACCOUNTING 1

MANAGEMENT ACCOUNTING CASE STUDIES

By Student’s Name

Class

Professor

University

City, State

Date

MANAGEMENT ACCOUNTING CASE STUDIES

By Student’s Name

Class

Professor

University

City, State

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 2

Part A: Case Study Analysis

1. Three types of costs and specific examples for each

When accountants consider the behaviour of costs, various types of costs can be

identified from the case study in question. Fixed costs are those costs that do not change

regardless of the units of goods or services produced. An example of such a cost in the

childcare business is the annual license fee of $225. According to Weygandt, Kimmel and

Kieso (2015); Ainsworth & Deines (2019); Brewer, Garrison, and Noreen (2015), variable

costs involve those costs that change in total depending on the level of activity in the

business; they may vary proportionately or directly. An example of variable costs in this case

study is the total amount spent on snacks at $3.2 per child. It will change provided that the

number of children changes. Additionally, the mileage costs going at $0.56 per mile

constitutes a variable cost as it will change depending on the number of miles covered and so

does the total cost of the couple doing the laundry themselves at $8 per week as it varies

proportionately with the number of weeks in which the couple could have done laundry

activities.

Another type of cost identified in this case study is the sunk costs. These are costs that

have already been incurred, and they are irrecoverable (Kaplan and Atkinson, 2015). That

includes the amounts spent on the renovation activities in the firm, which is $79,500. There is

an additional sunk cost in the cost of old appliances totalling to $440.

2. Information relevant or irrelevant to the decision of purchasing appliances

When the Franks make their decisions, they must consider whether information on

individual costs is important. For them to consider purchasing costs, the Franks may need

to determine whether the decisions may be incurred because of future decisions or

whether the costs are differing from alternative costs that are available to them. If costs

can be incurred because of decisions the Franks may make in future or they are any

Part A: Case Study Analysis

1. Three types of costs and specific examples for each

When accountants consider the behaviour of costs, various types of costs can be

identified from the case study in question. Fixed costs are those costs that do not change

regardless of the units of goods or services produced. An example of such a cost in the

childcare business is the annual license fee of $225. According to Weygandt, Kimmel and

Kieso (2015); Ainsworth & Deines (2019); Brewer, Garrison, and Noreen (2015), variable

costs involve those costs that change in total depending on the level of activity in the

business; they may vary proportionately or directly. An example of variable costs in this case

study is the total amount spent on snacks at $3.2 per child. It will change provided that the

number of children changes. Additionally, the mileage costs going at $0.56 per mile

constitutes a variable cost as it will change depending on the number of miles covered and so

does the total cost of the couple doing the laundry themselves at $8 per week as it varies

proportionately with the number of weeks in which the couple could have done laundry

activities.

Another type of cost identified in this case study is the sunk costs. These are costs that

have already been incurred, and they are irrecoverable (Kaplan and Atkinson, 2015). That

includes the amounts spent on the renovation activities in the firm, which is $79,500. There is

an additional sunk cost in the cost of old appliances totalling to $440.

2. Information relevant or irrelevant to the decision of purchasing appliances

When the Franks make their decisions, they must consider whether information on

individual costs is important. For them to consider purchasing costs, the Franks may need

to determine whether the decisions may be incurred because of future decisions or

whether the costs are differing from alternative costs that are available to them. If costs

can be incurred because of decisions the Franks may make in future or they are any

MANAGEMENT ACCOUNTING 3

different from the available options, then they are relevant costs (Crosson and

Needles,2013). Therefore, information on the costs of new appliances, their installation

and any additional costs on utilities incurred by the Franks will be relevant to their

decisions on making purchases of new appliances. The opportunity cost of buying new

appliances is also a relevant cost as related with what van Baal, Meltzer, and Brouwer

(2016) note. In any project, the opportunity cost is used in the analysis because it

considers the cost of acquiring the equipment and the expected return of buying the

appliances. If the Franks decide to consider using another laundromat, the cost of pick-up

and delivery will be a relevant cost. Finally, a decision to do the laundry themselves would

make the cost of detergents significant for consideration.

In case the costs in consideration do not meet any of the two above discussed

criteria, they are considered to be irrelevant costs. For example, the sunk costs identified

in renovation and cost of old appliances are not pertinent to the decision-making at hand.

Sunk costs do not play a role in the decision (Roth, Robbert, and Straus, 2015). Secondly,

the future variable costs that may not differ under different courses of action by the

managers are irrelevant. The fixed cost of a yearly license fee ($225) is also irrelevant in

this case. The book value of the old equipment or its disposal thereof will be considered

irrelevant as they are sunk costs and that they contribute to the arising cashflow of the

current decisions respectively (Board of Studies the Institute of Chartered Accountants of

India, n.d). If the Franks do not choose to do the laundry themselves or transport it to

another laundry, then both transport cost incurred due to pick up and delivery of clothes,

and the cost of detergents will be irrelevant to the decision at hand.

different from the available options, then they are relevant costs (Crosson and

Needles,2013). Therefore, information on the costs of new appliances, their installation

and any additional costs on utilities incurred by the Franks will be relevant to their

decisions on making purchases of new appliances. The opportunity cost of buying new

appliances is also a relevant cost as related with what van Baal, Meltzer, and Brouwer

(2016) note. In any project, the opportunity cost is used in the analysis because it

considers the cost of acquiring the equipment and the expected return of buying the

appliances. If the Franks decide to consider using another laundromat, the cost of pick-up

and delivery will be a relevant cost. Finally, a decision to do the laundry themselves would

make the cost of detergents significant for consideration.

In case the costs in consideration do not meet any of the two above discussed

criteria, they are considered to be irrelevant costs. For example, the sunk costs identified

in renovation and cost of old appliances are not pertinent to the decision-making at hand.

Sunk costs do not play a role in the decision (Roth, Robbert, and Straus, 2015). Secondly,

the future variable costs that may not differ under different courses of action by the

managers are irrelevant. The fixed cost of a yearly license fee ($225) is also irrelevant in

this case. The book value of the old equipment or its disposal thereof will be considered

irrelevant as they are sunk costs and that they contribute to the arising cashflow of the

current decisions respectively (Board of Studies the Institute of Chartered Accountants of

India, n.d). If the Franks do not choose to do the laundry themselves or transport it to

another laundry, then both transport cost incurred due to pick up and delivery of clothes,

and the cost of detergents will be irrelevant to the decision at hand.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING 4

3. The cost of cloth laundering

There are three possible options to consider, depending on the relevance of the costs

considered above. Therefore, it proves crucial to consider the computation of the cost of

the Franks trying to launder the clothes by themselves, purchasing new equipment.

Alternatively, they may decide to deliver the children’s clothes to another laundromat.

The working for three options listed above are shown below:

Option 1: Purchasing appliances

Step 1

Compute the cost of appliances annually:

Sum the costs of:

The washer= $420, Dryer = $380, Installation = $43.72 Delivery = $35

The sum = 420+380+43.72+35= $878.2

However, appliances have an expected life of 8 years. Divide the sum by eight years

The resultant average annual appliance cost is $ 109.84

Step 2

Add an increase in energy costs

Find the annual cost of energy

Sum increases in costs due to washer and dryer (120+ 145) = $265

3. The cost of cloth laundering

There are three possible options to consider, depending on the relevance of the costs

considered above. Therefore, it proves crucial to consider the computation of the cost of

the Franks trying to launder the clothes by themselves, purchasing new equipment.

Alternatively, they may decide to deliver the children’s clothes to another laundromat.

The working for three options listed above are shown below:

Option 1: Purchasing appliances

Step 1

Compute the cost of appliances annually:

Sum the costs of:

The washer= $420, Dryer = $380, Installation = $43.72 Delivery = $35

The sum = 420+380+43.72+35= $878.2

However, appliances have an expected life of 8 years. Divide the sum by eight years

The resultant average annual appliance cost is $ 109.84

Step 2

Add an increase in energy costs

Find the annual cost of energy

Sum increases in costs due to washer and dryer (120+ 145) = $265

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

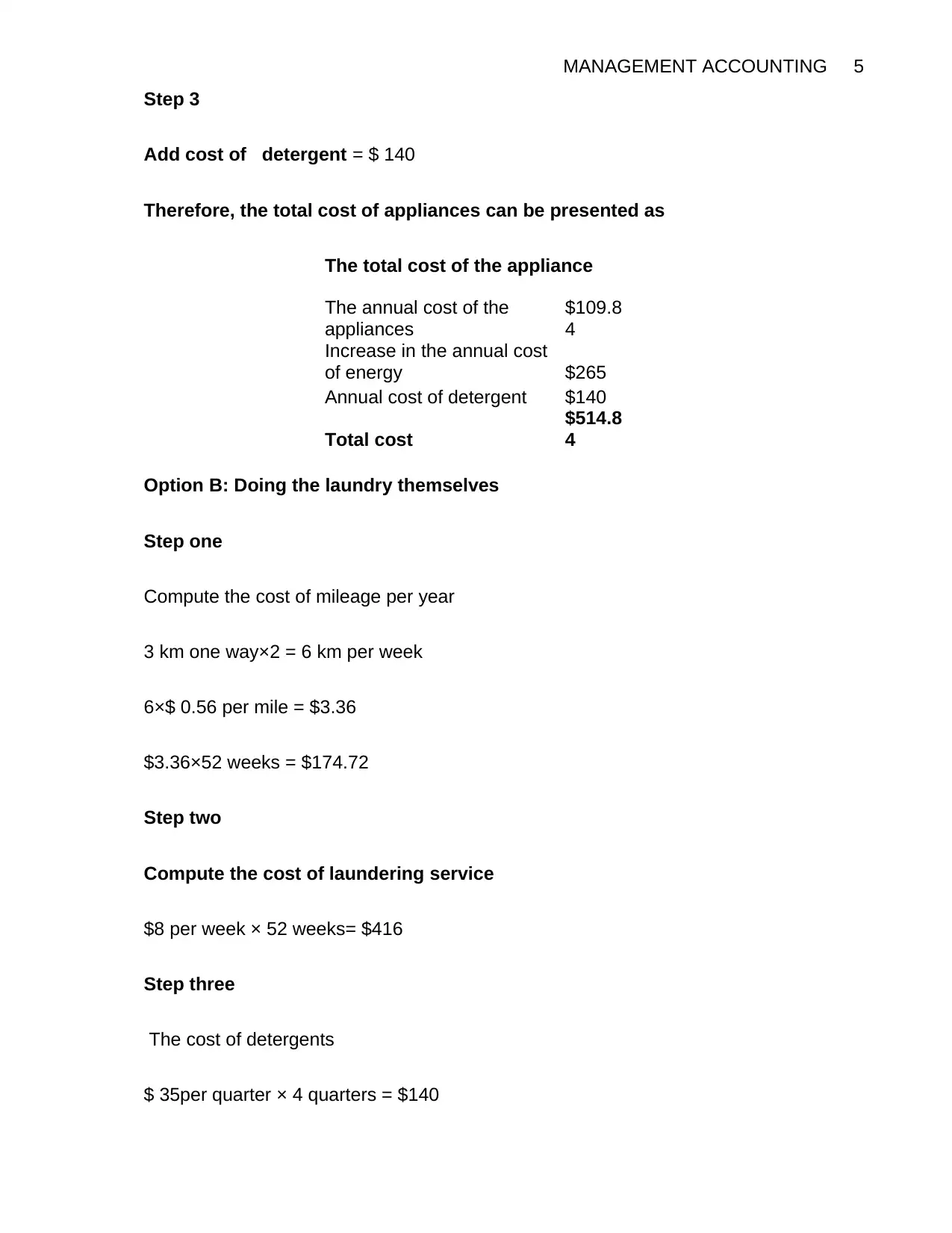

MANAGEMENT ACCOUNTING 5

Step 3

Add cost of detergent = $ 140

Therefore, the total cost of appliances can be presented as

The total cost of the appliance

The annual cost of the

appliances

$109.8

4

Increase in the annual cost

of energy $265

Annual cost of detergent $140

Total cost

$514.8

4

Option B: Doing the laundry themselves

Step one

Compute the cost of mileage per year

3 km one way×2 = 6 km per week

6×$ 0.56 per mile = $3.36

$3.36×52 weeks = $174.72

Step two

Compute the cost of laundering service

$8 per week × 52 weeks= $416

Step three

The cost of detergents

$ 35per quarter × 4 quarters = $140

Step 3

Add cost of detergent = $ 140

Therefore, the total cost of appliances can be presented as

The total cost of the appliance

The annual cost of the

appliances

$109.8

4

Increase in the annual cost

of energy $265

Annual cost of detergent $140

Total cost

$514.8

4

Option B: Doing the laundry themselves

Step one

Compute the cost of mileage per year

3 km one way×2 = 6 km per week

6×$ 0.56 per mile = $3.36

$3.36×52 weeks = $174.72

Step two

Compute the cost of laundering service

$8 per week × 52 weeks= $416

Step three

The cost of detergents

$ 35per quarter × 4 quarters = $140

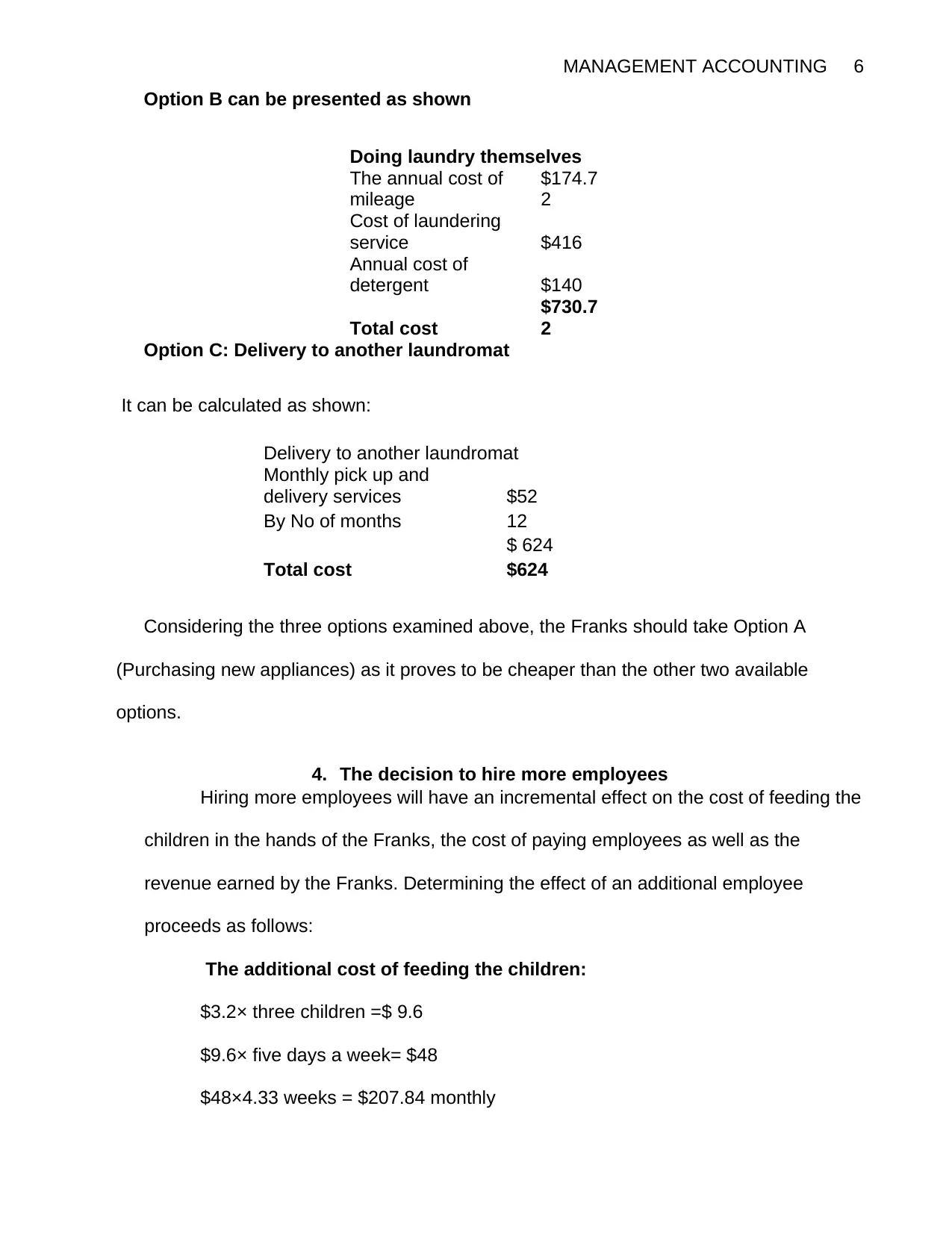

MANAGEMENT ACCOUNTING 6

Option B can be presented as shown

Doing laundry themselves

The annual cost of

mileage

$174.7

2

Cost of laundering

service $416

Annual cost of

detergent $140

Total cost

$730.7

2

Option C: Delivery to another laundromat

It can be calculated as shown:

Considering the three options examined above, the Franks should take Option A

(Purchasing new appliances) as it proves to be cheaper than the other two available

options.

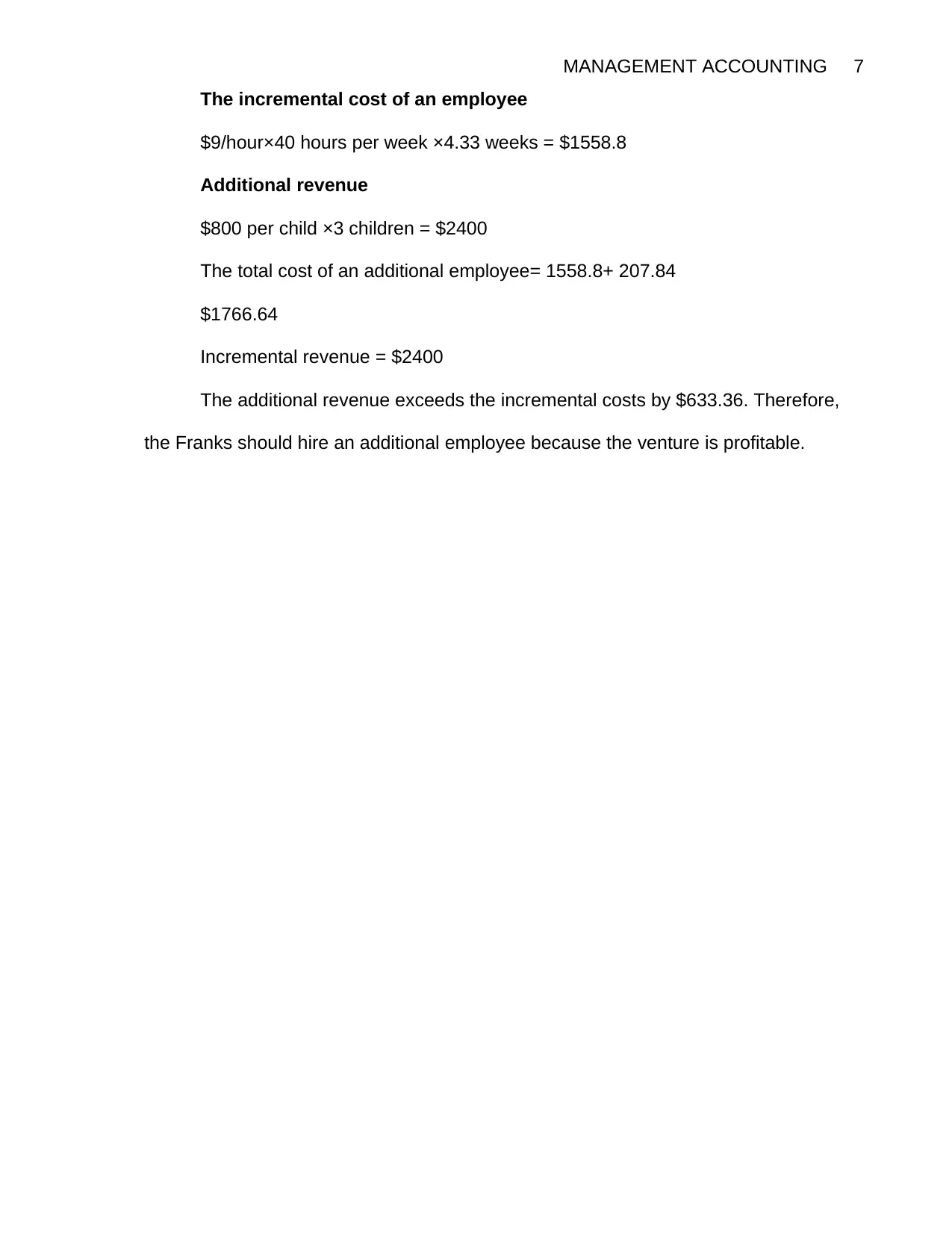

4. The decision to hire more employees

Hiring more employees will have an incremental effect on the cost of feeding the

children in the hands of the Franks, the cost of paying employees as well as the

revenue earned by the Franks. Determining the effect of an additional employee

proceeds as follows:

The additional cost of feeding the children:

$3.2× three children =$ 9.6

$9.6× five days a week= $48

$48×4.33 weeks = $207.84 monthly

Delivery to another laundromat

Monthly pick up and

delivery services $52

By No of months 12

$ 624

Total cost $624

Option B can be presented as shown

Doing laundry themselves

The annual cost of

mileage

$174.7

2

Cost of laundering

service $416

Annual cost of

detergent $140

Total cost

$730.7

2

Option C: Delivery to another laundromat

It can be calculated as shown:

Considering the three options examined above, the Franks should take Option A

(Purchasing new appliances) as it proves to be cheaper than the other two available

options.

4. The decision to hire more employees

Hiring more employees will have an incremental effect on the cost of feeding the

children in the hands of the Franks, the cost of paying employees as well as the

revenue earned by the Franks. Determining the effect of an additional employee

proceeds as follows:

The additional cost of feeding the children:

$3.2× three children =$ 9.6

$9.6× five days a week= $48

$48×4.33 weeks = $207.84 monthly

Delivery to another laundromat

Monthly pick up and

delivery services $52

By No of months 12

$ 624

Total cost $624

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING 7

The incremental cost of an employee

$9/hour×40 hours per week ×4.33 weeks = $1558.8

Additional revenue

$800 per child ×3 children = $2400

The total cost of an additional employee= 1558.8+ 207.84

$1766.64

Incremental revenue = $2400

The additional revenue exceeds the incremental costs by $633.36. Therefore,

the Franks should hire an additional employee because the venture is profitable.

The incremental cost of an employee

$9/hour×40 hours per week ×4.33 weeks = $1558.8

Additional revenue

$800 per child ×3 children = $2400

The total cost of an additional employee= 1558.8+ 207.84

$1766.64

Incremental revenue = $2400

The additional revenue exceeds the incremental costs by $633.36. Therefore,

the Franks should hire an additional employee because the venture is profitable.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 8

5. Letter on space options, number of children to accept and employees to hire

ODOO Accountants,

2018 Student Lane,

Melbourne.

+61 2 78982354

21/05/2019

The Manager,

The Franks Day-care Ltd,

2367 North F QLD

Dear sir/madam,

Re: ADVICE ON SPACE OPTIONS, NUMBER OF CHILDREN TO ACCEPT AND

EMPLOYEES TO HIRE

I write in response to your inquiries regarding possible room for expansion of your business

by moving to another rented space in town or operate at home, the possibility of extending the

capacity of the space to be used by allowing additional children and whether or not to hire

additional workers in your day care.

In addressing your concerns, I have prepared the possibilities for the new options to be

considered. The following analysis can be used to draw the right conclusion for your

enterprise’s decision.

5. Letter on space options, number of children to accept and employees to hire

ODOO Accountants,

2018 Student Lane,

Melbourne.

+61 2 78982354

21/05/2019

The Manager,

The Franks Day-care Ltd,

2367 North F QLD

Dear sir/madam,

Re: ADVICE ON SPACE OPTIONS, NUMBER OF CHILDREN TO ACCEPT AND

EMPLOYEES TO HIRE

I write in response to your inquiries regarding possible room for expansion of your business

by moving to another rented space in town or operate at home, the possibility of extending the

capacity of the space to be used by allowing additional children and whether or not to hire

additional workers in your day care.

In addressing your concerns, I have prepared the possibilities for the new options to be

considered. The following analysis can be used to draw the right conclusion for your

enterprise’s decision.

MANAGEMENT ACCOUNTING 9

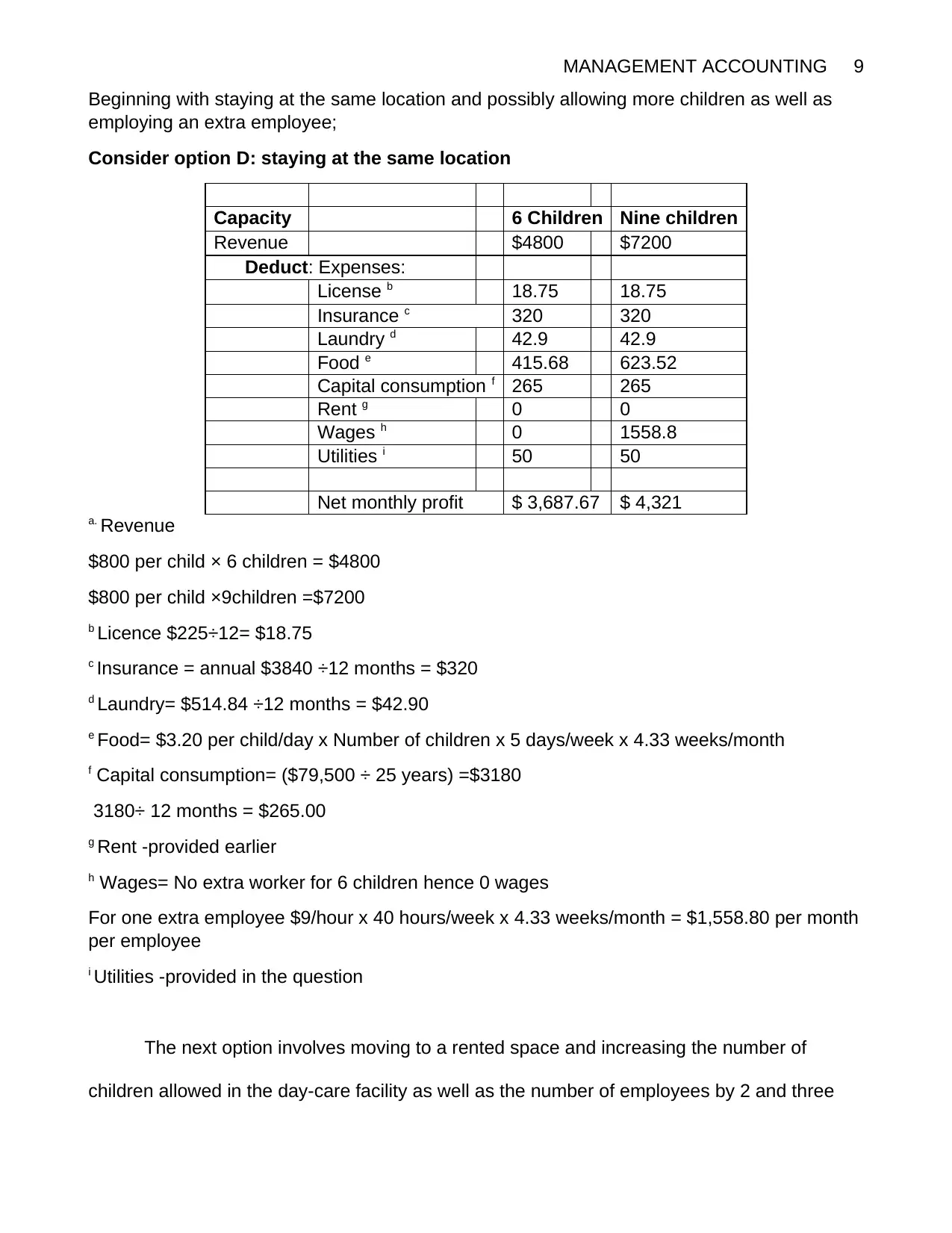

Beginning with staying at the same location and possibly allowing more children as well as

employing an extra employee;

Consider option D: staying at the same location

Capacity 6 Children Nine children

Revenue $4800 $7200

Deduct: Expenses:

License b 18.75 18.75

Insurance c 320 320

Laundry d 42.9 42.9

Food e 415.68 623.52

Capital consumption f 265 265

Rent g 0 0

Wages h 0 1558.8

Utilities i 50 50

Net monthly profit $ 3,687.67 $ 4,321

a. Revenue

$800 per child × 6 children = $4800

$800 per child ×9children =$7200

b Licence $225÷12= $18.75

c Insurance = annual $3840 ÷12 months = $320

d Laundry= $514.84 ÷12 months = $42.90

e Food= $3.20 per child/day x Number of children x 5 days/week x 4.33 weeks/month

f Capital consumption= ($79,500 ÷ 25 years) =$3180

3180÷ 12 months = $265.00

g Rent -provided earlier

h Wages= No extra worker for 6 children hence 0 wages

For one extra employee $9/hour x 40 hours/week x 4.33 weeks/month = $1,558.80 per month

per employee

i Utilities -provided in the question

The next option involves moving to a rented space and increasing the number of

children allowed in the day-care facility as well as the number of employees by 2 and three

Beginning with staying at the same location and possibly allowing more children as well as

employing an extra employee;

Consider option D: staying at the same location

Capacity 6 Children Nine children

Revenue $4800 $7200

Deduct: Expenses:

License b 18.75 18.75

Insurance c 320 320

Laundry d 42.9 42.9

Food e 415.68 623.52

Capital consumption f 265 265

Rent g 0 0

Wages h 0 1558.8

Utilities i 50 50

Net monthly profit $ 3,687.67 $ 4,321

a. Revenue

$800 per child × 6 children = $4800

$800 per child ×9children =$7200

b Licence $225÷12= $18.75

c Insurance = annual $3840 ÷12 months = $320

d Laundry= $514.84 ÷12 months = $42.90

e Food= $3.20 per child/day x Number of children x 5 days/week x 4.33 weeks/month

f Capital consumption= ($79,500 ÷ 25 years) =$3180

3180÷ 12 months = $265.00

g Rent -provided earlier

h Wages= No extra worker for 6 children hence 0 wages

For one extra employee $9/hour x 40 hours/week x 4.33 weeks/month = $1,558.80 per month

per employee

i Utilities -provided in the question

The next option involves moving to a rented space and increasing the number of

children allowed in the day-care facility as well as the number of employees by 2 and three

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT ACCOUNTING 10

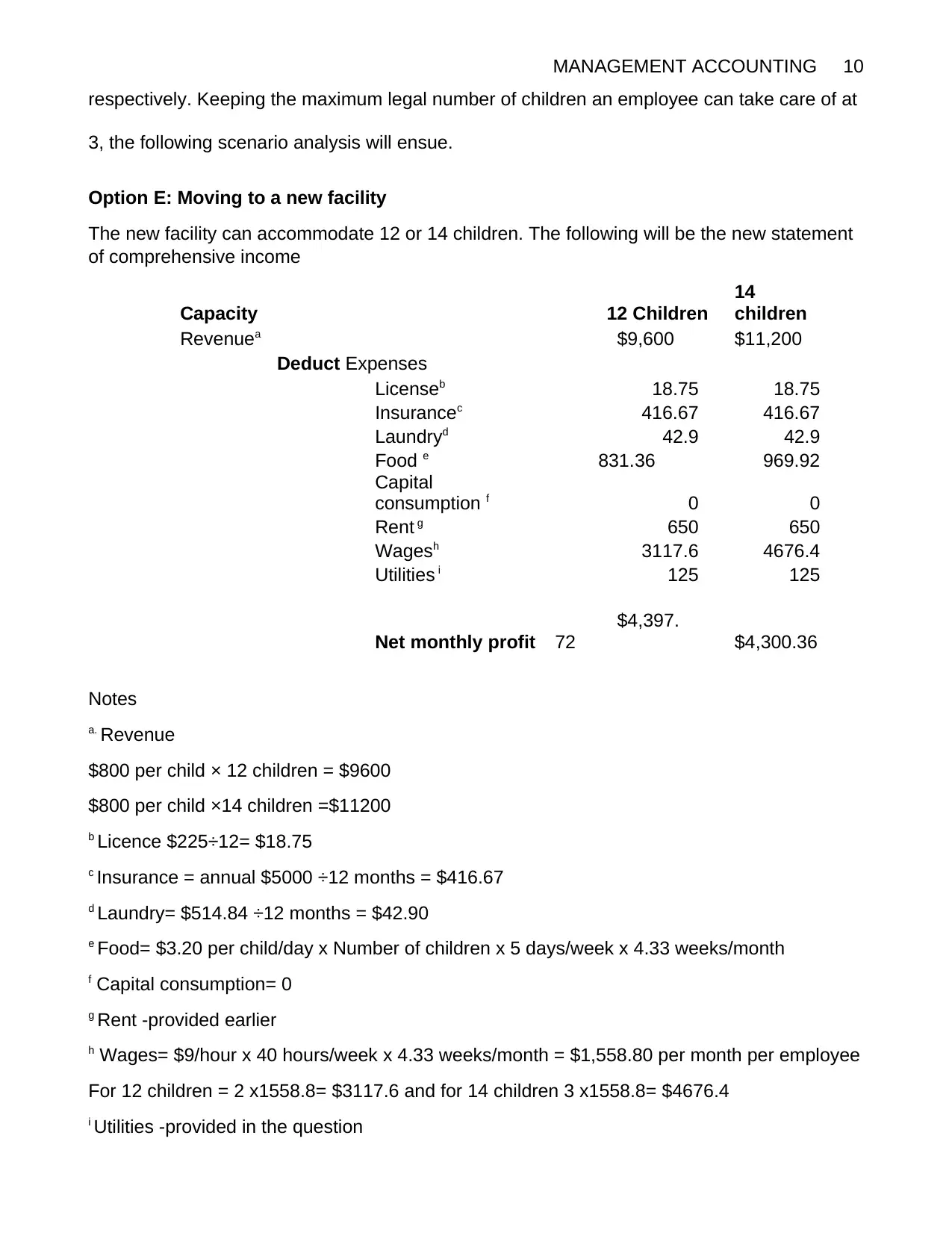

respectively. Keeping the maximum legal number of children an employee can take care of at

3, the following scenario analysis will ensue.

Option E: Moving to a new facility

The new facility can accommodate 12 or 14 children. The following will be the new statement

of comprehensive income

Capacity 12 Children

14

children

Revenuea $9,600 $11,200

Deduct Expenses

Licenseb 18.75 18.75

Insurancec 416.67 416.67

Laundryd 42.9 42.9

Food e 831.36 969.92

Capital

consumption f 0 0

Rent g 650 650

Wagesh 3117.6 4676.4

Utilities i 125 125

Net monthly profit

$4,397.

72 $4,300.36

Notes

a. Revenue

$800 per child × 12 children = $9600

$800 per child ×14 children =$11200

b Licence $225÷12= $18.75

c Insurance = annual $5000 ÷12 months = $416.67

d Laundry= $514.84 ÷12 months = $42.90

e Food= $3.20 per child/day x Number of children x 5 days/week x 4.33 weeks/month

f Capital consumption= 0

g Rent -provided earlier

h Wages= $9/hour x 40 hours/week x 4.33 weeks/month = $1,558.80 per month per employee

For 12 children = 2 x1558.8= $3117.6 and for 14 children 3 x1558.8= $4676.4

i Utilities -provided in the question

respectively. Keeping the maximum legal number of children an employee can take care of at

3, the following scenario analysis will ensue.

Option E: Moving to a new facility

The new facility can accommodate 12 or 14 children. The following will be the new statement

of comprehensive income

Capacity 12 Children

14

children

Revenuea $9,600 $11,200

Deduct Expenses

Licenseb 18.75 18.75

Insurancec 416.67 416.67

Laundryd 42.9 42.9

Food e 831.36 969.92

Capital

consumption f 0 0

Rent g 650 650

Wagesh 3117.6 4676.4

Utilities i 125 125

Net monthly profit

$4,397.

72 $4,300.36

Notes

a. Revenue

$800 per child × 12 children = $9600

$800 per child ×14 children =$11200

b Licence $225÷12= $18.75

c Insurance = annual $5000 ÷12 months = $416.67

d Laundry= $514.84 ÷12 months = $42.90

e Food= $3.20 per child/day x Number of children x 5 days/week x 4.33 weeks/month

f Capital consumption= 0

g Rent -provided earlier

h Wages= $9/hour x 40 hours/week x 4.33 weeks/month = $1,558.80 per month per employee

For 12 children = 2 x1558.8= $3117.6 and for 14 children 3 x1558.8= $4676.4

i Utilities -provided in the question

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT ACCOUNTING 11

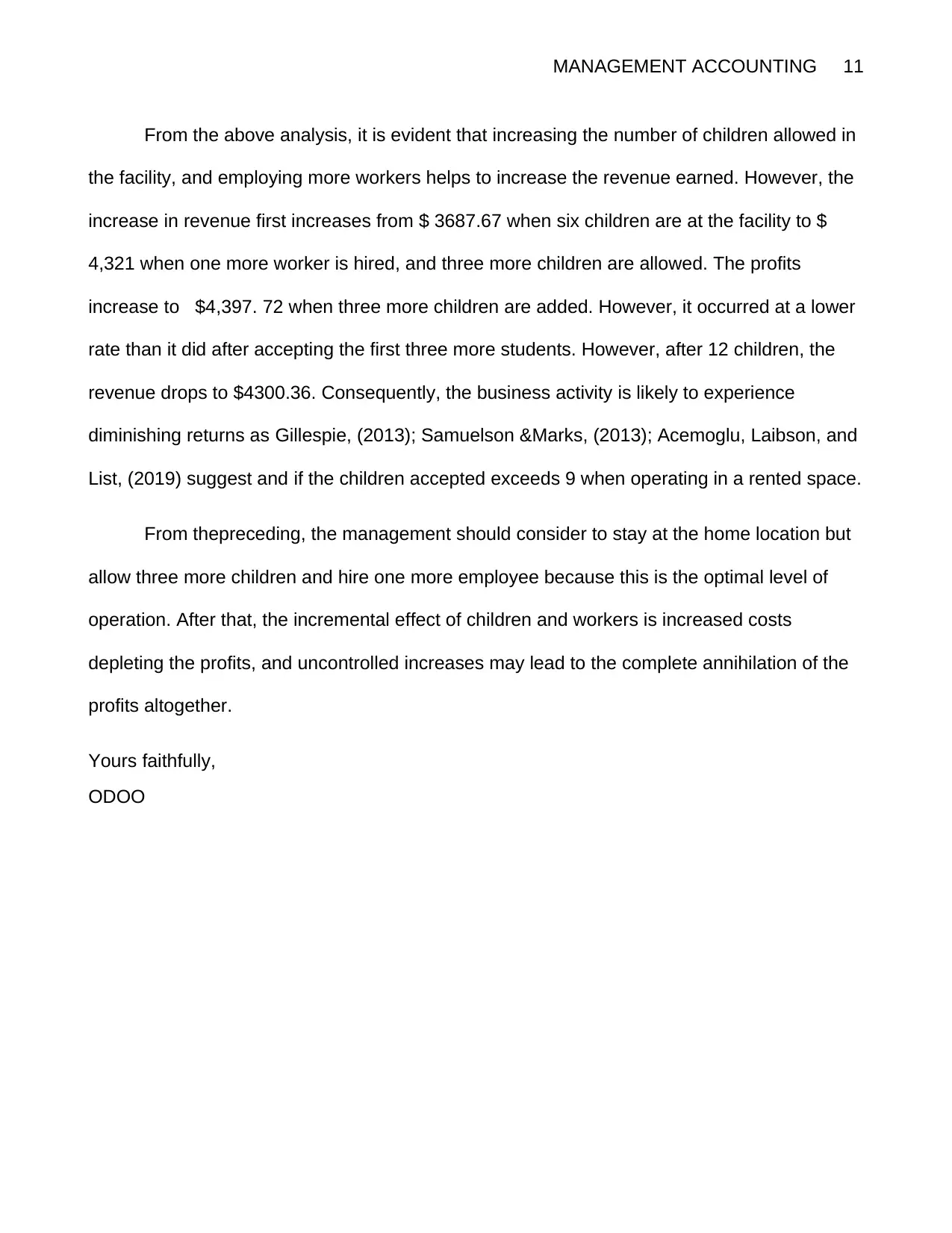

From the above analysis, it is evident that increasing the number of children allowed in

the facility, and employing more workers helps to increase the revenue earned. However, the

increase in revenue first increases from $ 3687.67 when six children are at the facility to $

4,321 when one more worker is hired, and three more children are allowed. The profits

increase to $4,397. 72 when three more children are added. However, it occurred at a lower

rate than it did after accepting the first three more students. However, after 12 children, the

revenue drops to $4300.36. Consequently, the business activity is likely to experience

diminishing returns as Gillespie, (2013); Samuelson &Marks, (2013); Acemoglu, Laibson, and

List, (2019) suggest and if the children accepted exceeds 9 when operating in a rented space.

From thepreceding, the management should consider to stay at the home location but

allow three more children and hire one more employee because this is the optimal level of

operation. After that, the incremental effect of children and workers is increased costs

depleting the profits, and uncontrolled increases may lead to the complete annihilation of the

profits altogether.

Yours faithfully,

ODOO

From the above analysis, it is evident that increasing the number of children allowed in

the facility, and employing more workers helps to increase the revenue earned. However, the

increase in revenue first increases from $ 3687.67 when six children are at the facility to $

4,321 when one more worker is hired, and three more children are allowed. The profits

increase to $4,397. 72 when three more children are added. However, it occurred at a lower

rate than it did after accepting the first three more students. However, after 12 children, the

revenue drops to $4300.36. Consequently, the business activity is likely to experience

diminishing returns as Gillespie, (2013); Samuelson &Marks, (2013); Acemoglu, Laibson, and

List, (2019) suggest and if the children accepted exceeds 9 when operating in a rented space.

From thepreceding, the management should consider to stay at the home location but

allow three more children and hire one more employee because this is the optimal level of

operation. After that, the incremental effect of children and workers is increased costs

depleting the profits, and uncontrolled increases may lead to the complete annihilation of the

profits altogether.

Yours faithfully,

ODOO

MANAGEMENT ACCOUNTING 12

Part B: Journal Article Critique

Components of management and their relevance.

A sound Management Accounting Information System (MAIS) should be a haven for

collection and processing of accounting information that is availed to the administrator for

planning, controlling and evaluation of decisions in a firm (Ha, Manh and Van Anh, 2017). In

the cases discussed in this text, both companies’ management accounting systems contain

various key components, including the data, people, procedures, and instruction. It is,

however, not clear whether the software part was developed since there were limited

comprised resources.

Data on the sizes, costs, and sales reports are available for both Cannon and Apple

managers. The data is essential for the analysis of the performance of the two companies

before they decided to venture into innovative activities discussed- creating the modified MC

for Cannon and the Mac for Apple Inc. Other data is used in cost targeting, as others are used

in informing purchase requisitions and other reports. Data, majorly stored in manual form, was

useful in providing correct and relevant production decisions.

People are a crucial element in the MAIS. They include the sales experts, marketing

team, the accountants, the engineers, managers, auditors, among others. In Apple, there

were trained engineers, self-taught hackers, as well as an artist. Cannon, on the other hand,

was composed of engineers, marketing experts, designers, among others. These are the

users of data collected in the MAIS. The coordination of members of this component helps to

design or redesign products. For instance, the design team at Cannon came up with the size

and desirable compactness of the MC while the sales and marketing and the accountants

arrived at a desired price for their product. The product champions also communicated to and

from the task force and the senior management hence coherence in decisions.

Part B: Journal Article Critique

Components of management and their relevance.

A sound Management Accounting Information System (MAIS) should be a haven for

collection and processing of accounting information that is availed to the administrator for

planning, controlling and evaluation of decisions in a firm (Ha, Manh and Van Anh, 2017). In

the cases discussed in this text, both companies’ management accounting systems contain

various key components, including the data, people, procedures, and instruction. It is,

however, not clear whether the software part was developed since there were limited

comprised resources.

Data on the sizes, costs, and sales reports are available for both Cannon and Apple

managers. The data is essential for the analysis of the performance of the two companies

before they decided to venture into innovative activities discussed- creating the modified MC

for Cannon and the Mac for Apple Inc. Other data is used in cost targeting, as others are used

in informing purchase requisitions and other reports. Data, majorly stored in manual form, was

useful in providing correct and relevant production decisions.

People are a crucial element in the MAIS. They include the sales experts, marketing

team, the accountants, the engineers, managers, auditors, among others. In Apple, there

were trained engineers, self-taught hackers, as well as an artist. Cannon, on the other hand,

was composed of engineers, marketing experts, designers, among others. These are the

users of data collected in the MAIS. The coordination of members of this component helps to

design or redesign products. For instance, the design team at Cannon came up with the size

and desirable compactness of the MC while the sales and marketing and the accountants

arrived at a desired price for their product. The product champions also communicated to and

from the task force and the senior management hence coherence in decisions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.