BTEC Higher National Diploma Management Accounting Report - Unit 5

VerifiedAdded on 2022/12/29

|24

|5855

|2

Report

AI Summary

This report provides a comprehensive overview of management accounting, its tools, and techniques, with a focus on their practical application within organizations, specifically Connect Catering Services. The report begins by defining management accounting and outlining its essential requirements, emphasizing its role in evaluating organizational performance, resource allocation, and financial statement presentation. It then explores various management accounting reporting methods, including budgeting, cost schedules, and variance analysis. The report evaluates the benefits of management accounting systems, such as improved decision-making, efficient resource utilization, and enhanced communication, while also examining how these systems integrate within organizational processes. The analysis extends to cost calculation using marginal and absorption costing techniques, including the preparation of income statements. The report provides a detailed analysis of financial reporting documents and their application. The report also uses financial data to perform calculations and create financial statements for Connect Catering Services. The report concludes by critically evaluating how management accounting systems and reporting are integrated within organizational processes, emphasizing the importance of these systems for effective financial management and decision-making.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

This report is based on the Management accounting system their tools and techniques and

applicability in the working of the organisation. It is the branch of accounting that evaluates the

performance of the organisation and is only for the internal use by the management only. It also

comprises of the income statement computation using two ways of costing, i.e., absorption

costing and marginal costing. It is prepared with the professional skills and focuses on the fully

and effectively utilizing the resources, safeguarding them and enhancing operational efficiency

(Armitage, 2020). It helps in evaluation of the key areas that are have huge impact on the

organisation’s performance.

This report is concerned with the Connect Catering Services, which is the one of the best

organisations of UK. It has the headquarters in Oxfordshire, and started its operations in 1989, by

John Herring. A comparison is made with the similar organisation in using the accounting

system for solving the financial problems faced by them.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting is also termed as managerial accounting that deals with the

public and private enterprises that helps the organisation to achieve its objectives and goals by

classifying, measuring, illuminating and communicating commercial information at internal

terms. It is the clear view of statistical data and its information and activities that refers the

finance and business policies that assist the planning and controlling operations of the enterprise.

Measurement of presentation: It assist the enterprise in evaluating the workers

completion and their level of efficiency that compiles the acute and standardized

presentation which fits the divergence by it essential plan of actions can be implemented

(Bakhtiari, 2020). It may also formulate the policies that evolves that worker performance

as compare to other individuals in the organisation.

Categorisation of risk: Another advantage of management accounting or managerial

accounting is recognising the risk element in the organisation by which it can be reduce

This report is based on the Management accounting system their tools and techniques and

applicability in the working of the organisation. It is the branch of accounting that evaluates the

performance of the organisation and is only for the internal use by the management only. It also

comprises of the income statement computation using two ways of costing, i.e., absorption

costing and marginal costing. It is prepared with the professional skills and focuses on the fully

and effectively utilizing the resources, safeguarding them and enhancing operational efficiency

(Armitage, 2020). It helps in evaluation of the key areas that are have huge impact on the

organisation’s performance.

This report is concerned with the Connect Catering Services, which is the one of the best

organisations of UK. It has the headquarters in Oxfordshire, and started its operations in 1989, by

John Herring. A comparison is made with the similar organisation in using the accounting

system for solving the financial problems faced by them.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting is also termed as managerial accounting that deals with the

public and private enterprises that helps the organisation to achieve its objectives and goals by

classifying, measuring, illuminating and communicating commercial information at internal

terms. It is the clear view of statistical data and its information and activities that refers the

finance and business policies that assist the planning and controlling operations of the enterprise.

Measurement of presentation: It assist the enterprise in evaluating the workers

completion and their level of efficiency that compiles the acute and standardized

presentation which fits the divergence by it essential plan of actions can be implemented

(Bakhtiari, 2020). It may also formulate the policies that evolves that worker performance

as compare to other individuals in the organisation.

Categorisation of risk: Another advantage of management accounting or managerial

accounting is recognising the risk element in the organisation by which it can be reduce

the organisational risk handling practices that dominate the employee presentation.

Accounting

Allotment of resources: Enterprise is sufficiently capable to achieve the utilisation of

resources with efficiency that helps the various sections to have the distinct point of view

for every section and figures in the organisation (Farazdaghi, 2020). It also includes the

summarizing, analysing and coverage the resources that supervise the financial

information.

Financial statement presentation: Management accounting submits the accurate

presentation of the business financial position that helps the statistical statements in

regards with information and data. The various factors that affect cost and financial

activities to overlooked it more reliably in the organization as for fundamental decision

making.

P2 Explain different methods used for management accounting reporting.

Management accounting is the method of communicating the sources of statistical

statements and information that serves the changes in the organizational complexities to make it

more specialized factors that indicates the proper accounting and audit.

Budget: A budget is the total calculation of cost and income as it is a microeconomics

concept for particular time interval that follows the administrative body, governing body,

group of individuals, a business, and the list will continue. The process starts with set up

the assumptions for the future coming budget outcome in the financial year as it is a

financial program for particular interval that generally raise the occurrence of commercial

project.

Cost Schedules: A cost schedule is the overall production of cost at various levels of

product and by which average cost and marginal cost can be measured and the curve of

cost schedule will draw. It is assumed that the organisation has prepare the short run cost

schedule and long run cost schedule individually (Gray, 2020). According to the

organisation it can assumed that the production with the out-dated or obsoleted

technology and methods surely involves the high monetary value.

Variance analysis: It is the part of fund control activity in which a budget for income,

revenue and expenses is differentiate with the actual report of the enterprise and the

Accounting

Allotment of resources: Enterprise is sufficiently capable to achieve the utilisation of

resources with efficiency that helps the various sections to have the distinct point of view

for every section and figures in the organisation (Farazdaghi, 2020). It also includes the

summarizing, analysing and coverage the resources that supervise the financial

information.

Financial statement presentation: Management accounting submits the accurate

presentation of the business financial position that helps the statistical statements in

regards with information and data. The various factors that affect cost and financial

activities to overlooked it more reliably in the organization as for fundamental decision

making.

P2 Explain different methods used for management accounting reporting.

Management accounting is the method of communicating the sources of statistical

statements and information that serves the changes in the organizational complexities to make it

more specialized factors that indicates the proper accounting and audit.

Budget: A budget is the total calculation of cost and income as it is a microeconomics

concept for particular time interval that follows the administrative body, governing body,

group of individuals, a business, and the list will continue. The process starts with set up

the assumptions for the future coming budget outcome in the financial year as it is a

financial program for particular interval that generally raise the occurrence of commercial

project.

Cost Schedules: A cost schedule is the overall production of cost at various levels of

product and by which average cost and marginal cost can be measured and the curve of

cost schedule will draw. It is assumed that the organisation has prepare the short run cost

schedule and long run cost schedule individually (Gray, 2020). According to the

organisation it can assumed that the production with the out-dated or obsoleted

technology and methods surely involves the high monetary value.

Variance analysis: It is the part of fund control activity in which a budget for income,

revenue and expenses is differentiate with the actual report of the enterprise and the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

statement usually carry forward to classify the enterprise presentation in respect of the

plan and policies that ensures by the management.

M1 Evaluate the benefits of management accounting systems and their application within an

organizational context.

Management accounting is a process to determine, examine and conveys all important

information to managers which is helpful to make decisions and having knowledge about the

cost of accounting to achieve goals of organization in effective manner. Management accounting

is beneficial for every organization to plan all activities sequentially for effective operations.

There are various type budgets and accounts are prepared which are divided in various form such

as department and product. Actual performance is compared with standard set and if there are

some variances raised mangers find out reasons behind and take actions to solve them.

Management accounting explains responsibilities of executives and their area of working so

there is no confusion regarding work; everything is done in well-organized manner (Haslam,

2020). It Manages and coordinate all finance, production, and personal activities of an

organization to achieve objectives. It also removes all wastage and unnecessary activities which

saves time to perform activities and also improves efficiency of organization.

There is two-way communication in preparation management accounting like if there

some modifications are required in accounts than these information send to top management

which helps them to take decision and responsibilities of work and their assignment

communicate to lower level for their smooth working. Data provided by these accounts is quite

accurate and reliable which is helpful in maximization of profit. In an organization various

application are implemented such as measuring performance and efficiency of employees by

comparing their estimated and actual performance; if there is some deviation exist necessary

steps would be taken to correct them. Resources are allocated in all level of department and

divisions of an organization by the help of management accounting so employees can use these

resources optimally (Indrani, 2020). It gives exact financial position of an enterprise with

important data which helps managers to make policies and take effective and profitable decisions

for organization.

plan and policies that ensures by the management.

M1 Evaluate the benefits of management accounting systems and their application within an

organizational context.

Management accounting is a process to determine, examine and conveys all important

information to managers which is helpful to make decisions and having knowledge about the

cost of accounting to achieve goals of organization in effective manner. Management accounting

is beneficial for every organization to plan all activities sequentially for effective operations.

There are various type budgets and accounts are prepared which are divided in various form such

as department and product. Actual performance is compared with standard set and if there are

some variances raised mangers find out reasons behind and take actions to solve them.

Management accounting explains responsibilities of executives and their area of working so

there is no confusion regarding work; everything is done in well-organized manner (Haslam,

2020). It Manages and coordinate all finance, production, and personal activities of an

organization to achieve objectives. It also removes all wastage and unnecessary activities which

saves time to perform activities and also improves efficiency of organization.

There is two-way communication in preparation management accounting like if there

some modifications are required in accounts than these information send to top management

which helps them to take decision and responsibilities of work and their assignment

communicate to lower level for their smooth working. Data provided by these accounts is quite

accurate and reliable which is helpful in maximization of profit. In an organization various

application are implemented such as measuring performance and efficiency of employees by

comparing their estimated and actual performance; if there is some deviation exist necessary

steps would be taken to correct them. Resources are allocated in all level of department and

divisions of an organization by the help of management accounting so employees can use these

resources optimally (Indrani, 2020). It gives exact financial position of an enterprise with

important data which helps managers to make policies and take effective and profitable decisions

for organization.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1 Critically evaluate how management accounting systems and management accounting

reporting is integrated within organizational processes.

Management accounting is the process of finding, quantifying and interpreting the results

for evaluating the performance of the organization. It plays a vital role in the decision-making

process of an organization and has a growing expectation over the period of time. It provides the

organization the information related to its financial and operational efficiency in compliance to

the project undertaken. It comprises of the processes undertaken for installing control and

planning operations that supports an effective decision-making process. It helps the organization

in constantly measuring its performance and taking appropriate actions for increasing the

operational efficiency and enhance productivity (Javadian and Kootanaee, 2020). It also focuses

on providing quality products and services to the customers of the organization. The continuous

improvements done in the operational processes facilitates in simplification of the process,

eliminating waste of both time and resources and improving productivity at an optimum level.

The cost management done by the organization plays an important role in improving the

processes on a regular basis. A record of all the transactions including the receipts and payments

associated to a particular project are recorded at a place for evaluating the profitability of the

company and to minimize the costs resulting in higher returns. It also judges the effectiveness of

all major projects including the new activities taken up by the organization to ensues potential

returns.

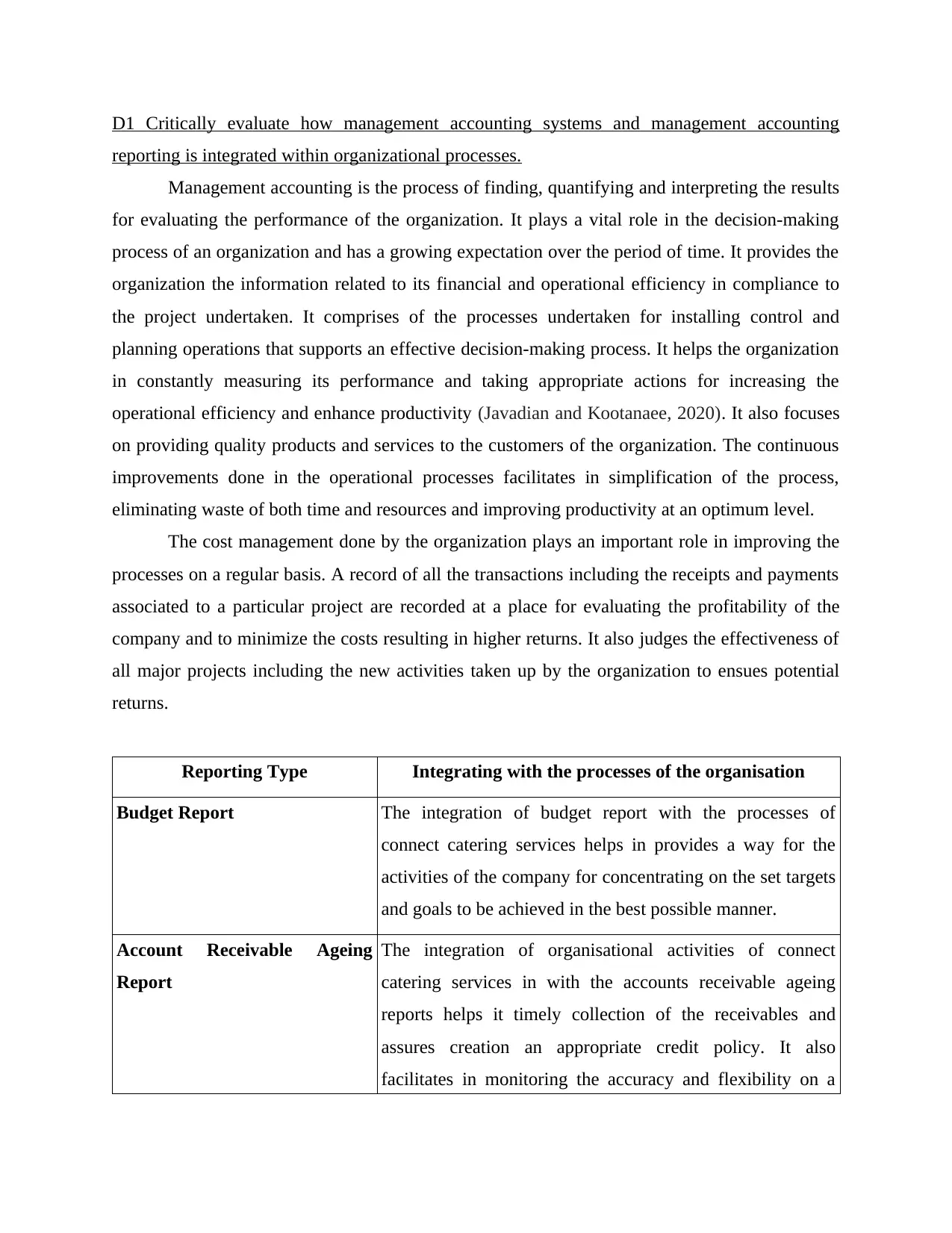

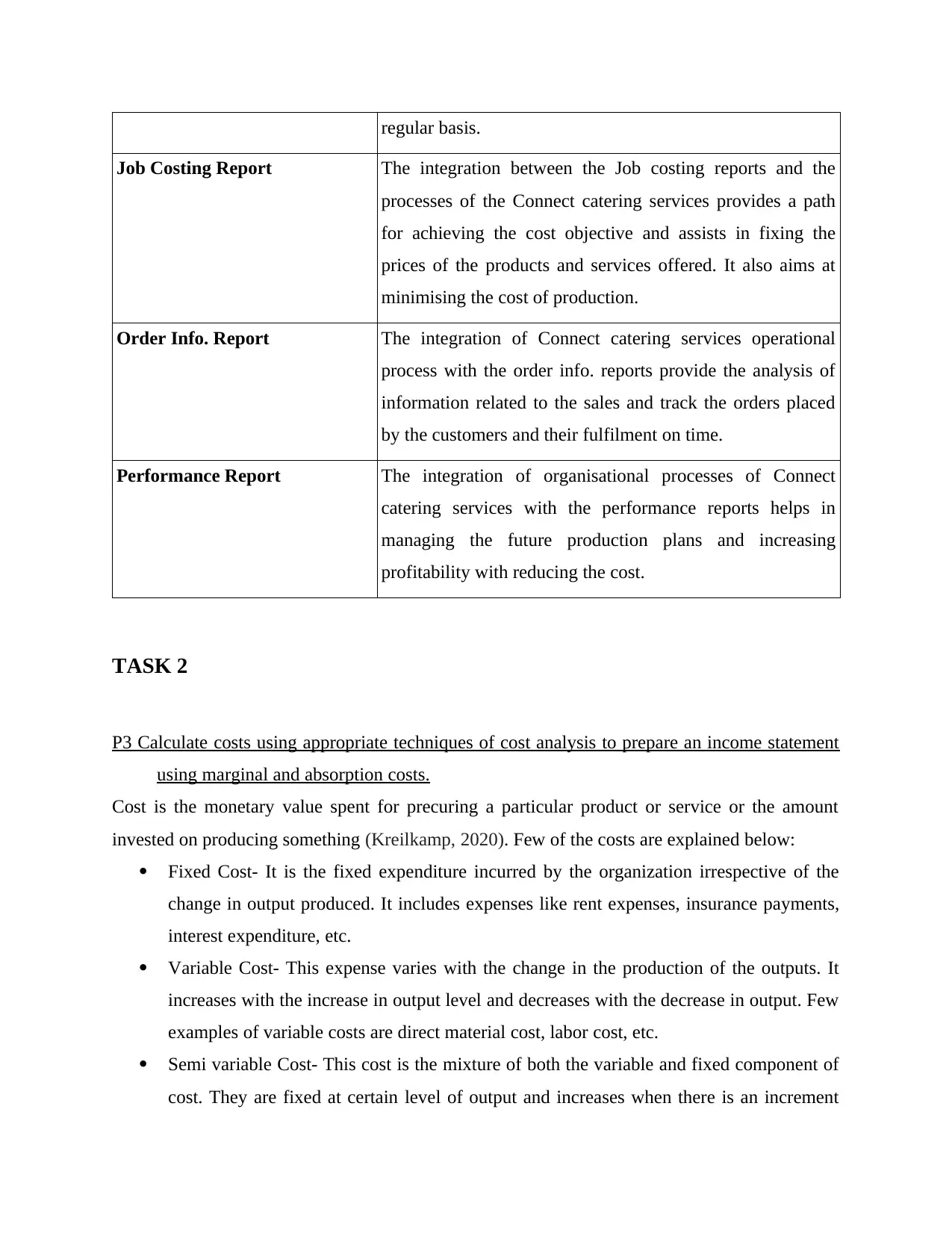

Reporting Type Integrating with the processes of the organisation

Budget Report The integration of budget report with the processes of

connect catering services helps in provides a way for the

activities of the company for concentrating on the set targets

and goals to be achieved in the best possible manner.

Account Receivable Ageing

Report

The integration of organisational activities of connect

catering services in with the accounts receivable ageing

reports helps it timely collection of the receivables and

assures creation an appropriate credit policy. It also

facilitates in monitoring the accuracy and flexibility on a

reporting is integrated within organizational processes.

Management accounting is the process of finding, quantifying and interpreting the results

for evaluating the performance of the organization. It plays a vital role in the decision-making

process of an organization and has a growing expectation over the period of time. It provides the

organization the information related to its financial and operational efficiency in compliance to

the project undertaken. It comprises of the processes undertaken for installing control and

planning operations that supports an effective decision-making process. It helps the organization

in constantly measuring its performance and taking appropriate actions for increasing the

operational efficiency and enhance productivity (Javadian and Kootanaee, 2020). It also focuses

on providing quality products and services to the customers of the organization. The continuous

improvements done in the operational processes facilitates in simplification of the process,

eliminating waste of both time and resources and improving productivity at an optimum level.

The cost management done by the organization plays an important role in improving the

processes on a regular basis. A record of all the transactions including the receipts and payments

associated to a particular project are recorded at a place for evaluating the profitability of the

company and to minimize the costs resulting in higher returns. It also judges the effectiveness of

all major projects including the new activities taken up by the organization to ensues potential

returns.

Reporting Type Integrating with the processes of the organisation

Budget Report The integration of budget report with the processes of

connect catering services helps in provides a way for the

activities of the company for concentrating on the set targets

and goals to be achieved in the best possible manner.

Account Receivable Ageing

Report

The integration of organisational activities of connect

catering services in with the accounts receivable ageing

reports helps it timely collection of the receivables and

assures creation an appropriate credit policy. It also

facilitates in monitoring the accuracy and flexibility on a

regular basis.

Job Costing Report The integration between the Job costing reports and the

processes of the Connect catering services provides a path

for achieving the cost objective and assists in fixing the

prices of the products and services offered. It also aims at

minimising the cost of production.

Order Info. Report The integration of Connect catering services operational

process with the order info. reports provide the analysis of

information related to the sales and track the orders placed

by the customers and their fulfilment on time.

Performance Report The integration of organisational processes of Connect

catering services with the performance reports helps in

managing the future production plans and increasing

profitability with reducing the cost.

TASK 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

Cost is the monetary value spent for precuring a particular product or service or the amount

invested on producing something (Kreilkamp, 2020). Few of the costs are explained below:

Fixed Cost- It is the fixed expenditure incurred by the organization irrespective of the

change in output produced. It includes expenses like rent expenses, insurance payments,

interest expenditure, etc.

Variable Cost- This expense varies with the change in the production of the outputs. It

increases with the increase in output level and decreases with the decrease in output. Few

examples of variable costs are direct material cost, labor cost, etc.

Semi variable Cost- This cost is the mixture of both the variable and fixed component of

cost. They are fixed at certain level of output and increases when there is an increment

Job Costing Report The integration between the Job costing reports and the

processes of the Connect catering services provides a path

for achieving the cost objective and assists in fixing the

prices of the products and services offered. It also aims at

minimising the cost of production.

Order Info. Report The integration of Connect catering services operational

process with the order info. reports provide the analysis of

information related to the sales and track the orders placed

by the customers and their fulfilment on time.

Performance Report The integration of organisational processes of Connect

catering services with the performance reports helps in

managing the future production plans and increasing

profitability with reducing the cost.

TASK 2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

Cost is the monetary value spent for precuring a particular product or service or the amount

invested on producing something (Kreilkamp, 2020). Few of the costs are explained below:

Fixed Cost- It is the fixed expenditure incurred by the organization irrespective of the

change in output produced. It includes expenses like rent expenses, insurance payments,

interest expenditure, etc.

Variable Cost- This expense varies with the change in the production of the outputs. It

increases with the increase in output level and decreases with the decrease in output. Few

examples of variable costs are direct material cost, labor cost, etc.

Semi variable Cost- This cost is the mixture of both the variable and fixed component of

cost. They are fixed at certain level of output and increases when there is an increment

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

done above the certain limit. The example of such cost are electricity expenses, telephone

charges, etc.

Opportunity Cost- It is the cost of forgiven benefit that an organization could have earned

by not investing in the other available option. In simple words, it is referred as the return

that can be earned from the next best opportunity available while a company is making a

decision for undertaking a particular product.

There are two major techniques used by organization for calculation of the cost and helps in

preparation of the income statement, they are Marginal Cost and Absorption Cost. Marginal

costing is the technique used for calculation of the cost incurred for producing an extra unit of

product that is referred as marginal cost (Kurdestani, 2020). It is a simple tool that helps in

identifying the impact of change in the units produced on the profitability. It relates to the

variable cost of production. Whereas, Absorption costing is associated to the fixed overheads

incurred in the production process. It relates to the manufacturing cost for producing a particular

production. Few examples of this costing are direct material, rental expenses, insurance

expenses, and other such costs.

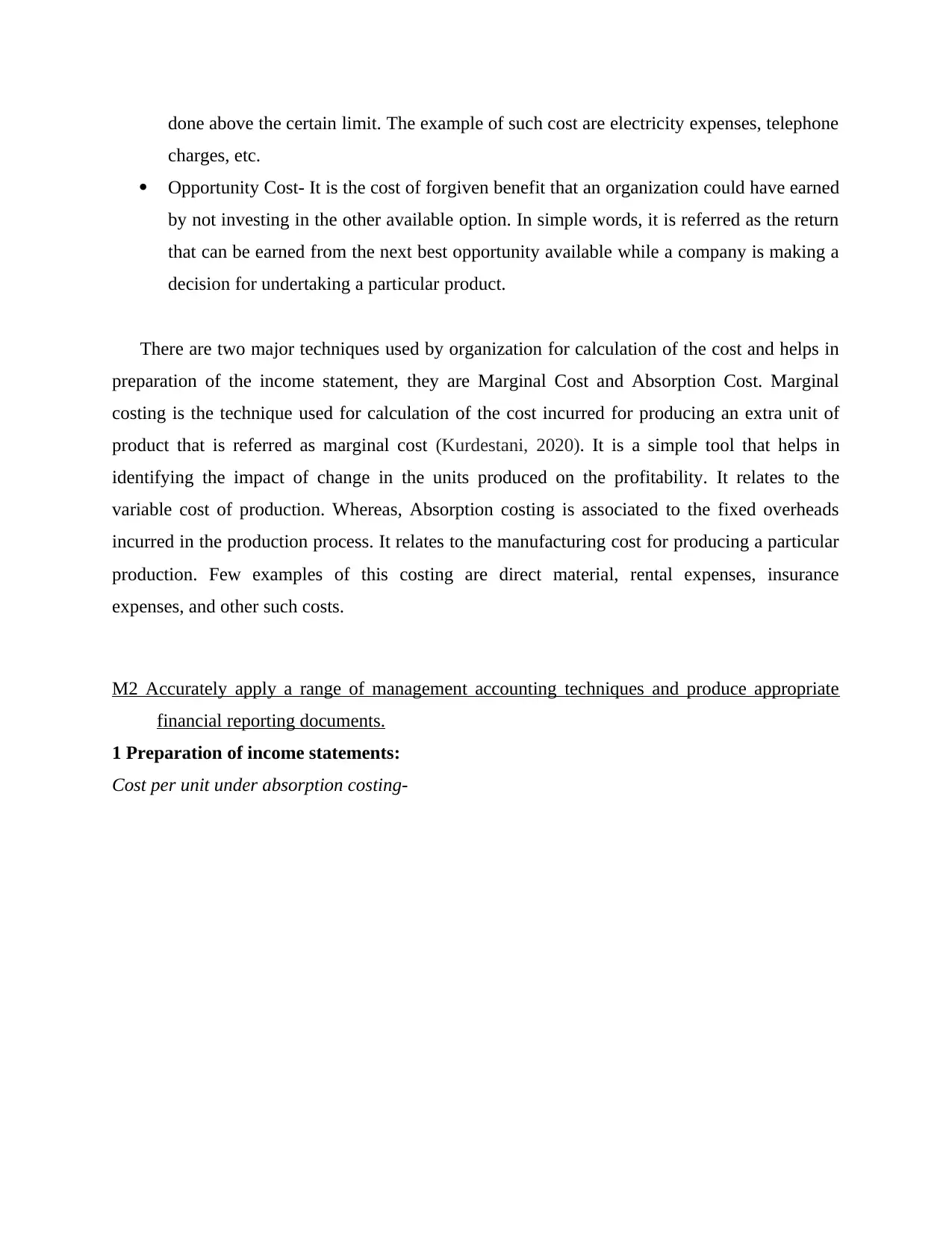

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

1 Preparation of income statements:

Cost per unit under absorption costing-

charges, etc.

Opportunity Cost- It is the cost of forgiven benefit that an organization could have earned

by not investing in the other available option. In simple words, it is referred as the return

that can be earned from the next best opportunity available while a company is making a

decision for undertaking a particular product.

There are two major techniques used by organization for calculation of the cost and helps in

preparation of the income statement, they are Marginal Cost and Absorption Cost. Marginal

costing is the technique used for calculation of the cost incurred for producing an extra unit of

product that is referred as marginal cost (Kurdestani, 2020). It is a simple tool that helps in

identifying the impact of change in the units produced on the profitability. It relates to the

variable cost of production. Whereas, Absorption costing is associated to the fixed overheads

incurred in the production process. It relates to the manufacturing cost for producing a particular

production. Few examples of this costing are direct material, rental expenses, insurance

expenses, and other such costs.

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

1 Preparation of income statements:

Cost per unit under absorption costing-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.

1 Preparation of income statements:

Cost per unit under absorption costing-

Preparation of income statements:

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per unit 6 (15000/2500) 5(15000/3000)

10 9

Connect Catering Services

Income statement under absorption costing

Particulars April may

Sales(2000*8) (2000*8) 16000 16000

Less: Cost of sales (2000*10) (2000*9) 20000 18000

Fixed Manufacturing Overhead 15000 15000

Variable Manufacturing cost (2500*4) (3000*4) 10000 12000

Closing stock (500*10) (1500*9) 5000 13500

Opening stock (500*9) 0 4500

Gross loss(16000-20000)(16000-18000) -4000 -2000

Less: Fixed Non-Manufacturing Cost -4000 -4000

Net loss -8000 -6000

Cost per unit under marginal costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Connect Catering Services

Income statement under marginal costing

financial reporting documents.

1 Preparation of income statements:

Cost per unit under absorption costing-

Preparation of income statements:

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per unit 6 (15000/2500) 5(15000/3000)

10 9

Connect Catering Services

Income statement under absorption costing

Particulars April may

Sales(2000*8) (2000*8) 16000 16000

Less: Cost of sales (2000*10) (2000*9) 20000 18000

Fixed Manufacturing Overhead 15000 15000

Variable Manufacturing cost (2500*4) (3000*4) 10000 12000

Closing stock (500*10) (1500*9) 5000 13500

Opening stock (500*9) 0 4500

Gross loss(16000-20000)(16000-18000) -4000 -2000

Less: Fixed Non-Manufacturing Cost -4000 -4000

Net loss -8000 -6000

Cost per unit under marginal costing-

Activity April May

Variable Manufacturing cost per unit 4 4

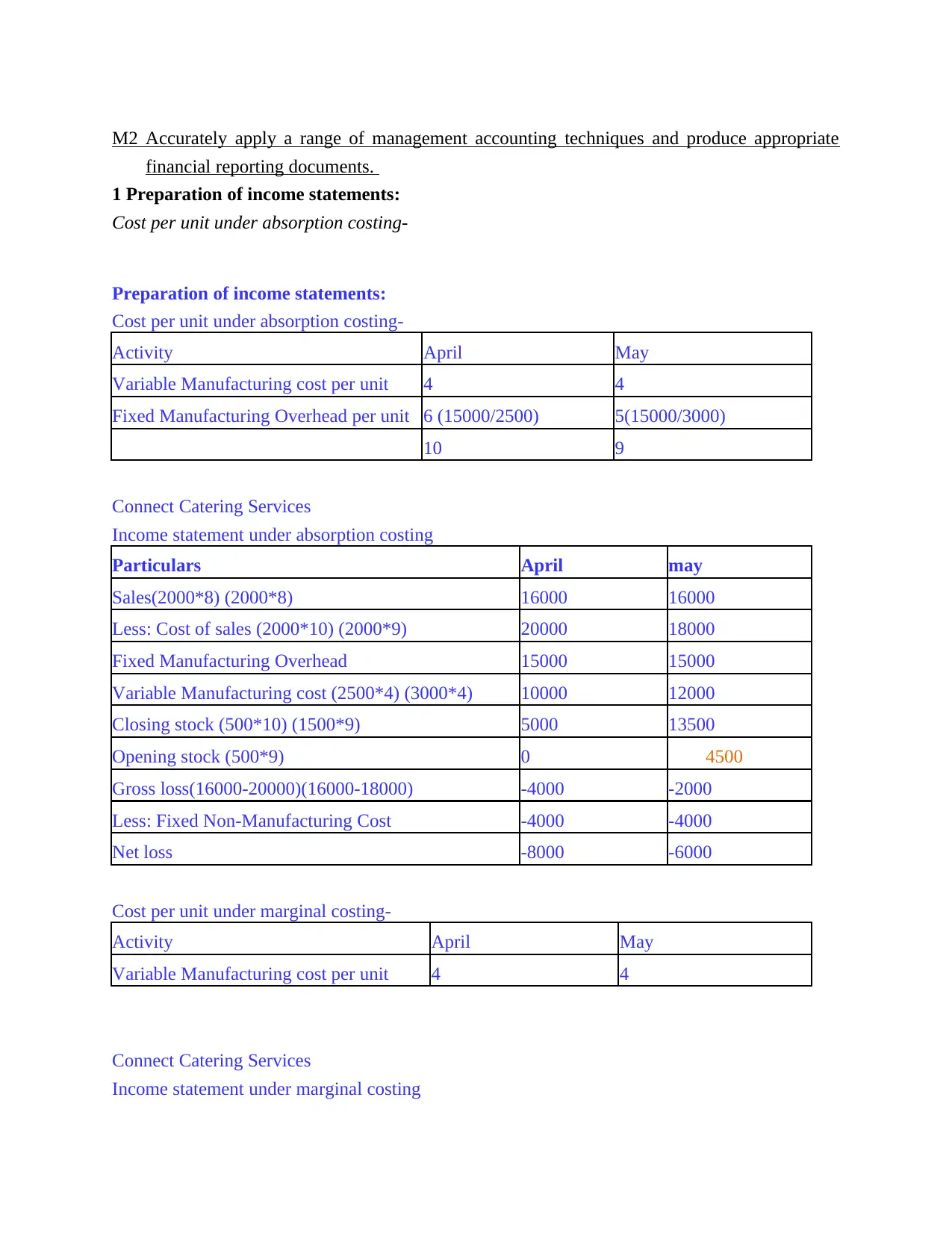

Connect Catering Services

Income statement under marginal costing

Particulars April May

Sales 16000 16000

Less: Marginal cost of sales 8000 8000

Variable Manufacturing cost (2500*4) (3000*4) 10000 12000

Closing stock (500*4) (1500*4) 2000 6000

Opening stock(500*4) 0 2000

Contribution(Note 1) 8000 8000

Less: Fixed Manufacturing Overhead 15000 15000

Less: Fixed Non-Manufacturing Cost 4000 4000

Net loss -11000 -11000

Reconciliation statement:

Particulars April May

Net loss under absorption costing -8000 -6000

Less: Closing stock -3000 -5000

Net loss under marginal costing -11000 -11000

Working Notes

Note1.

Marginal Cost of sales

Particulars April may

Opening Inventory 0 2000

Add: Cost of production 10000 12000

Less: Closing inventory 2000 6000

8000 8000

2 a)

1. Fixed and variable costs

Fixed costs:

Activity Amount

Sales 16000 16000

Less: Marginal cost of sales 8000 8000

Variable Manufacturing cost (2500*4) (3000*4) 10000 12000

Closing stock (500*4) (1500*4) 2000 6000

Opening stock(500*4) 0 2000

Contribution(Note 1) 8000 8000

Less: Fixed Manufacturing Overhead 15000 15000

Less: Fixed Non-Manufacturing Cost 4000 4000

Net loss -11000 -11000

Reconciliation statement:

Particulars April May

Net loss under absorption costing -8000 -6000

Less: Closing stock -3000 -5000

Net loss under marginal costing -11000 -11000

Working Notes

Note1.

Marginal Cost of sales

Particulars April may

Opening Inventory 0 2000

Add: Cost of production 10000 12000

Less: Closing inventory 2000 6000

8000 8000

2 a)

1. Fixed and variable costs

Fixed costs:

Activity Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

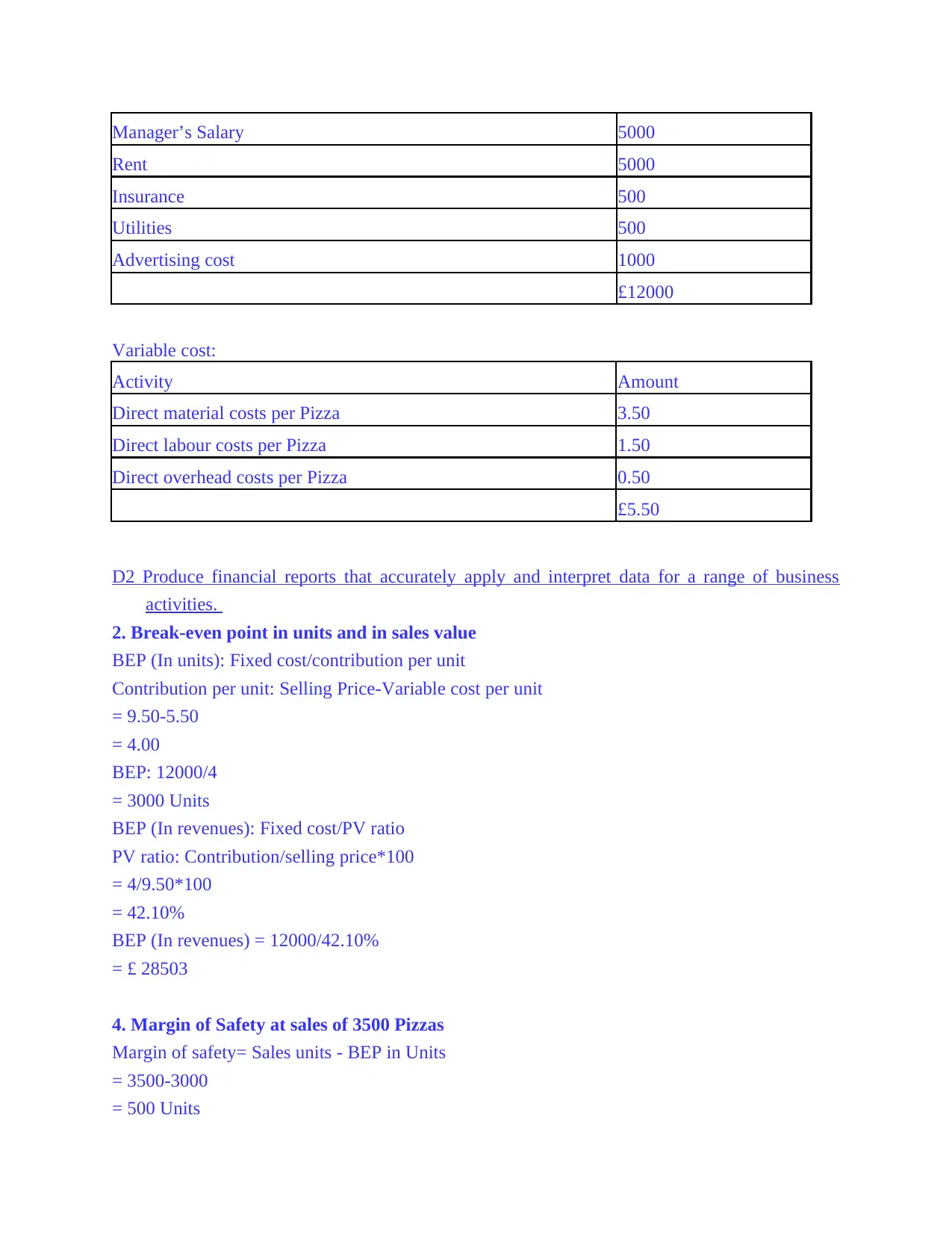

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

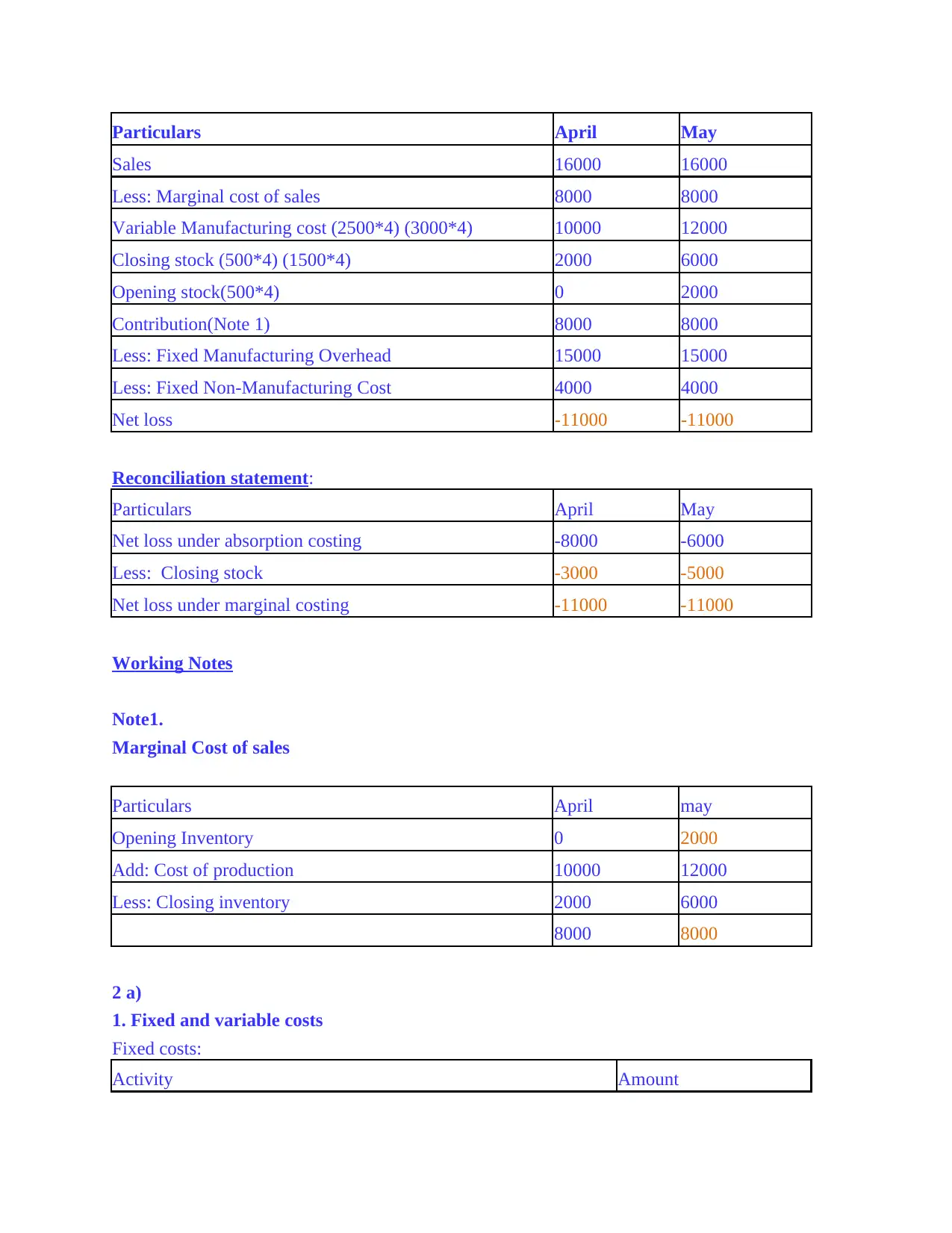

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.

2. Break-even point in units and in sales value

BEP (In units): Fixed cost/contribution per unit

Contribution per unit: Selling Price-Variable cost per unit

= 9.50-5.50

= 4.00

BEP: 12000/4

= 3000 Units

BEP (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/selling price*100

= 4/9.50*100

= 42.10%

BEP (In revenues) = 12000/42.10%

= £ 28503

4. Margin of Safety at sales of 3500 Pizzas

Margin of safety= Sales units - BEP in Units

= 3500-3000

= 500 Units

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.

2. Break-even point in units and in sales value

BEP (In units): Fixed cost/contribution per unit

Contribution per unit: Selling Price-Variable cost per unit

= 9.50-5.50

= 4.00

BEP: 12000/4

= 3000 Units

BEP (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/selling price*100

= 4/9.50*100

= 42.10%

BEP (In revenues) = 12000/42.10%

= £ 28503

4. Margin of Safety at sales of 3500 Pizzas

Margin of safety= Sales units - BEP in Units

= 3500-3000

= 500 Units

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

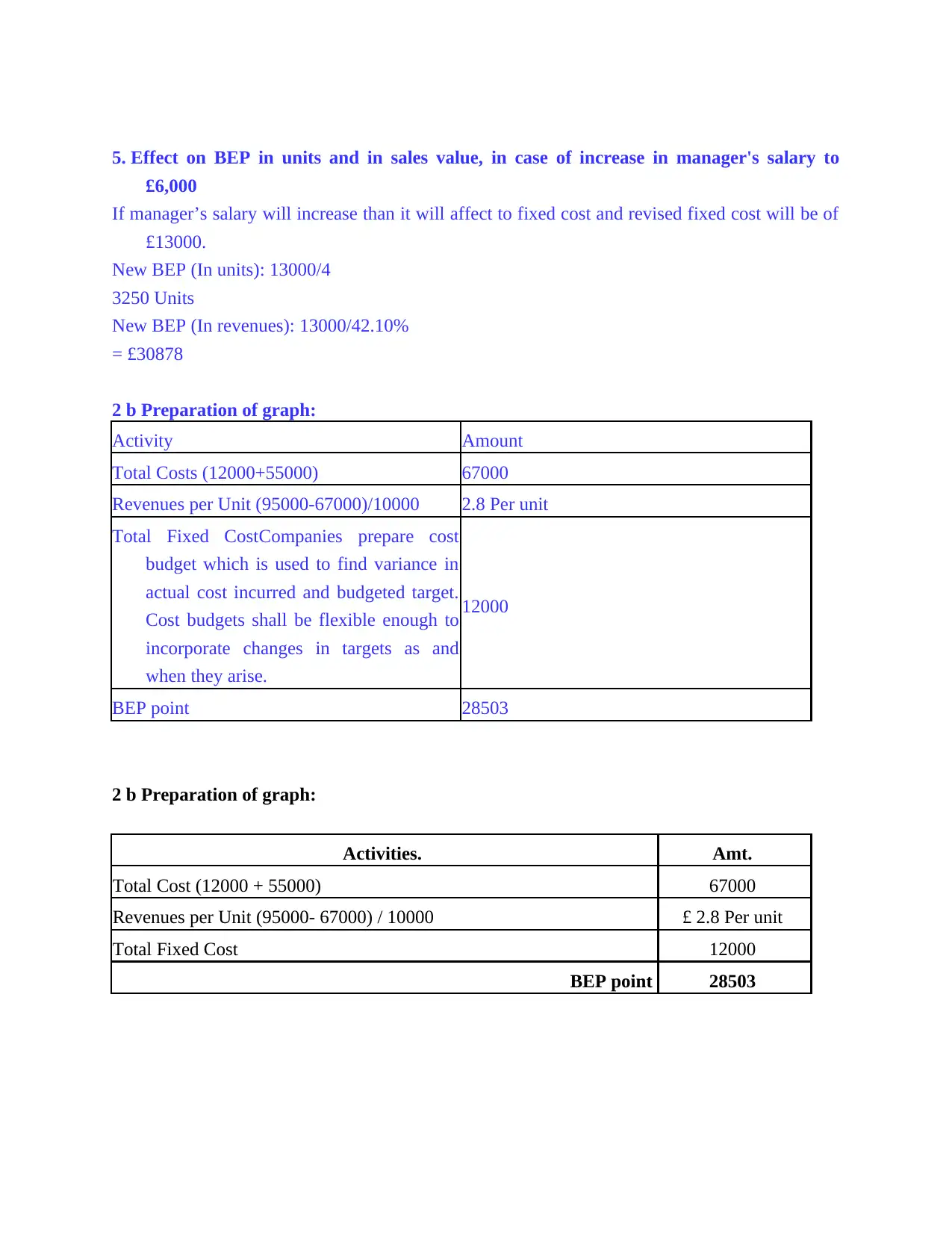

5. Effect on BEP in units and in sales value, in case of increase in manager's salary to

£6,000

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

2 b Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed CostCompanies prepare cost

budget which is used to find variance in

actual cost incurred and budgeted target.

Cost budgets shall be flexible enough to

incorporate changes in targets as and

when they arise.

12000

BEP point 28503

2 b Preparation of graph:

Activities. Amt.

Total Cost (12000 + 55000) 67000

Revenues per Unit (95000- 67000) / 10000 £ 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

£6,000

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

2 b Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed CostCompanies prepare cost

budget which is used to find variance in

actual cost incurred and budgeted target.

Cost budgets shall be flexible enough to

incorporate changes in targets as and

when they arise.

12000

BEP point 28503

2 b Preparation of graph:

Activities. Amt.

Total Cost (12000 + 55000) 67000

Revenues per Unit (95000- 67000) / 10000 £ 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

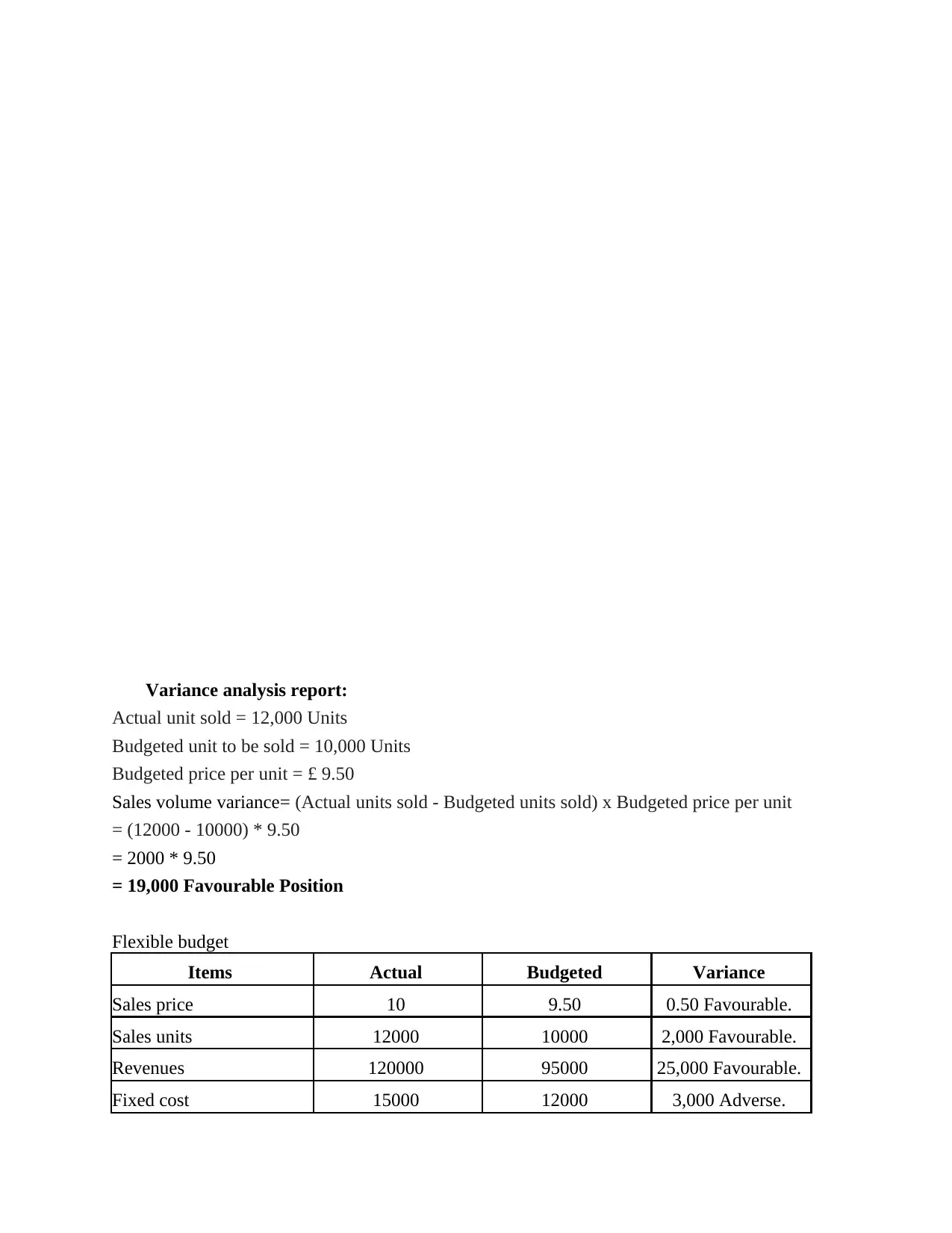

Variance analysis report:

Actual unit sold = 12,000 Units

Budgeted unit to be sold = 10,000 Units

Budgeted price per unit = £ 9.50

Sales volume variance= (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000 - 10000) * 9.50

= 2000 * 9.50

= 19,000 Favourable Position

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 0.50 Favourable.

Sales units 12000 10000 2,000 Favourable.

Revenues 120000 95000 25,000 Favourable.

Fixed cost 15000 12000 3,000 Adverse.

Actual unit sold = 12,000 Units

Budgeted unit to be sold = 10,000 Units

Budgeted price per unit = £ 9.50

Sales volume variance= (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000 - 10000) * 9.50

= 2000 * 9.50

= 19,000 Favourable Position

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 0.50 Favourable.

Sales units 12000 10000 2,000 Favourable.

Revenues 120000 95000 25,000 Favourable.

Fixed cost 15000 12000 3,000 Adverse.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.