Management Accounting: Cost Analysis, Budgetary Control & Planning

VerifiedAdded on 2024/05/20

|19

|3904

|209

Report

AI Summary

This report provides an overview of management accounting, focusing on cost analysis, budgetary control, and financial reporting. It explains different management accounting systems like cost accounting, job accounting, inventory management, and pricing systems. Various methods of management accounting reporting, including sales reports, budget reports, inventory management reports, and cost reports, are discussed. The report evaluates the benefits of management accounting systems, such as improved profitability and reduced costing, within an organizational context. It also calculates costs using marginal and absorption costing techniques to prepare an income statement, explaining the advantages and disadvantages of different planning tools used in budgetary control. Furthermore, the report analyzes how organizations adapt management accounting systems to respond to financial problems and achieve sustainable success.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction......................................................................................................................................3

P1 Explain management accounting and give the essential requirements for different types of

management accounting..................................................................................................................4

P2 Explain different methods used for management accounting reporting.....................................6

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context......................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costing............................................................................................8

M2 Apply a range of management accounting techniques and produce appropriate financial

reporting documents......................................................................................................................11

P4 Explain the advantages and disadvantages of different types of planning tools used in the

budgetary control...........................................................................................................................12

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets........................................................................................................................14

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.........................................................................................................................15

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success..............................................................................................16

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

2

Introduction......................................................................................................................................3

P1 Explain management accounting and give the essential requirements for different types of

management accounting..................................................................................................................4

P2 Explain different methods used for management accounting reporting.....................................6

M1 Evaluate the benefits of management accounting systems and their application within an

organisational context......................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costing............................................................................................8

M2 Apply a range of management accounting techniques and produce appropriate financial

reporting documents......................................................................................................................11

P4 Explain the advantages and disadvantages of different types of planning tools used in the

budgetary control...........................................................................................................................12

M3 Analyse the use of different planning tools and their application for preparing and

forecasting budgets........................................................................................................................14

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.........................................................................................................................15

M4 Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success..............................................................................................16

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction:

Zyalla is an international organisation and is going through some organisational restructuring and

changes. This report is prepared to consider the changes in the management accounting systems

and management accounting tools and techniques and the process for resolving financial issues.

Every organisation need to make changes in costing and management systems with a view to

response the ever-changing organisational need. Management accountings systems are designed

formulated software programmes which require data and further interpret for user's requirement.

This report will throw light over the number of management accounting systems such as job

costing systems, pricing systems, costing systems, process costing etc. and the budgetary tools

and techniques for responding towards financial problems.

4

Zyalla is an international organisation and is going through some organisational restructuring and

changes. This report is prepared to consider the changes in the management accounting systems

and management accounting tools and techniques and the process for resolving financial issues.

Every organisation need to make changes in costing and management systems with a view to

response the ever-changing organisational need. Management accountings systems are designed

formulated software programmes which require data and further interpret for user's requirement.

This report will throw light over the number of management accounting systems such as job

costing systems, pricing systems, costing systems, process costing etc. and the budgetary tools

and techniques for responding towards financial problems.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

P1 Explain management accounting and give the essential requirements for different types

of management accounting.

The concept of management accounting was developed in eighteen century and since, and then

the number of developers evaluated the concept of management devices. Management

accounting is a mechanism which involves the partnership with management accounting systems

and management accounting reporting. There are different types of management accounting

systems, namely cost accounting system, job accounting system, inventory management system,

pricing system (Guga, & Musa, 2015). Each system is formulated for fulfilling different

organisations intentions and is discussed as below:

Cost accounting system: This system maintains costing of products manufactured.

Costing is necessary for estimating a price of per unit. It major essential is to examine the

expenditure made for each unit of product and for further analysing profitability,

inventory assessment and controlling costs (Guga, & Musa, 2015)

Inventory management system: This system is installed for making inventory valuation.

In a manufacturing unit, inventory of raw materials, work in progress and finished goods

are required and it also involves the significant amount of investment. This system in

measuring terms like EOQ, inventory re-order level, a maximum level of inventory,

5

Inventory

management

system

Pricing

system

Job

accountin

g system

of management accounting.

The concept of management accounting was developed in eighteen century and since, and then

the number of developers evaluated the concept of management devices. Management

accounting is a mechanism which involves the partnership with management accounting systems

and management accounting reporting. There are different types of management accounting

systems, namely cost accounting system, job accounting system, inventory management system,

pricing system (Guga, & Musa, 2015). Each system is formulated for fulfilling different

organisations intentions and is discussed as below:

Cost accounting system: This system maintains costing of products manufactured.

Costing is necessary for estimating a price of per unit. It major essential is to examine the

expenditure made for each unit of product and for further analysing profitability,

inventory assessment and controlling costs (Guga, & Musa, 2015)

Inventory management system: This system is installed for making inventory valuation.

In a manufacturing unit, inventory of raw materials, work in progress and finished goods

are required and it also involves the significant amount of investment. This system in

measuring terms like EOQ, inventory re-order level, a maximum level of inventory,

5

Inventory

management

system

Pricing

system

Job

accountin

g system

minimum level and aids in eliminating any duplication or shortage of inventory (Guga, &

Musa, 2015)

Job accounting system: This system is formulated for assessing the costs of specific or

particular job. Certain industries like servicing industry, construction units make a single

job and ascertain its costs. Its major essentials are that it controls cost, measures

profitability from the single project, inventory valuation etc. hence, it is an essential

system.

Pricing system: pricing of products is essentially an important process for ascertaining

profitability from a single project. This system is useful for ascertaining customer’s

reactions at different prices and selects the most optimum pricing strategy for an

organisation. This is an essential system so as to select a pricing strategy which makes

revenues and profits as well for the company (Guga, & Musa, 2015).

6

Musa, 2015)

Job accounting system: This system is formulated for assessing the costs of specific or

particular job. Certain industries like servicing industry, construction units make a single

job and ascertain its costs. Its major essentials are that it controls cost, measures

profitability from the single project, inventory valuation etc. hence, it is an essential

system.

Pricing system: pricing of products is essentially an important process for ascertaining

profitability from a single project. This system is useful for ascertaining customer’s

reactions at different prices and selects the most optimum pricing strategy for an

organisation. This is an essential system so as to select a pricing strategy which makes

revenues and profits as well for the company (Guga, & Musa, 2015).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P2 Explain different methods used for management accounting reporting.

Management accounting reporting are formed in varied methods to resolve different queries of

an organisation. A manager might require information related to sales, production, estimation,

cash expenses and such like and need to formulate policies for future purpose. These measured

are reviewed through different reports. The reports are formulated at different period of time

considering manager’s requirement (Lessmann, et. al., 2015). The period can be monthly,

quarterly, half-yearly and yearly. Some of them are discussed below:

Sales report: Sales report is formulated with a view to measuring the number of units sold and

the fluctuations in the selling pricing. It makes the thorough analysis about the increase or

decrease in the sales number. This report is further used for forecasting sales for next specific

period through trend line and other operational tools.

Budget report: Budgets are the statements which forecast in numerical figures regarding costing

and sales, production units, liquidity etc. These forecasting factors act as the measure for

controlling figures. The major essential of a budget report is that it is used for variance analysis,

further aid in future planning, and act as a controller factor for current actual figures. In variance

analysis, the actual figures are measured against budgeted one and measures for variances are

implemented (Lessmann, et. al., 2015).

Inventory management report: For a manufacturing concern, making the considerable

investment in inventory is essential. Inventory requires considerable monitoring so as to

eliminate duplication of activities and wastage of money. This report makes analyses of

production capacity, inventory requirement.

Cost reports: Costs reports are formulated for measuring expenditures for products

manufactured. Since products costing are subject to fluctuations and require constant

monitoring. Since, costing has the effect over many another factor such as prices, administration

expenses etc. This report is formulated frequently (Lessmann, et. al., 2015).

7

Management accounting reporting are formed in varied methods to resolve different queries of

an organisation. A manager might require information related to sales, production, estimation,

cash expenses and such like and need to formulate policies for future purpose. These measured

are reviewed through different reports. The reports are formulated at different period of time

considering manager’s requirement (Lessmann, et. al., 2015). The period can be monthly,

quarterly, half-yearly and yearly. Some of them are discussed below:

Sales report: Sales report is formulated with a view to measuring the number of units sold and

the fluctuations in the selling pricing. It makes the thorough analysis about the increase or

decrease in the sales number. This report is further used for forecasting sales for next specific

period through trend line and other operational tools.

Budget report: Budgets are the statements which forecast in numerical figures regarding costing

and sales, production units, liquidity etc. These forecasting factors act as the measure for

controlling figures. The major essential of a budget report is that it is used for variance analysis,

further aid in future planning, and act as a controller factor for current actual figures. In variance

analysis, the actual figures are measured against budgeted one and measures for variances are

implemented (Lessmann, et. al., 2015).

Inventory management report: For a manufacturing concern, making the considerable

investment in inventory is essential. Inventory requires considerable monitoring so as to

eliminate duplication of activities and wastage of money. This report makes analyses of

production capacity, inventory requirement.

Cost reports: Costs reports are formulated for measuring expenditures for products

manufactured. Since products costing are subject to fluctuations and require constant

monitoring. Since, costing has the effect over many another factor such as prices, administration

expenses etc. This report is formulated frequently (Lessmann, et. al., 2015).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M1 Evaluate the benefits of management accounting systems and their application within

an organisational context.

The evolution of management accounting systems has been realised long back. The evolution has

been made for enhancing managerial decisions and effective management. These systems have

large benefits such as follows:

Improves profitability: Management systems are implemented in order to improves

decision making and overall improves profits for the organisation. These systems are

made for orderly assessment and interpretation of data.

Reduces costing: One of the major motives of organisation is to reduce costs of

manufacturing/ servicing. An organisation incurs direct and indirect costs and strives to

work in the efficient manner through which costing can be reduced.

An effective decision-making mechanism for futuristic stabilisation: Systems are

implemented to aid managers in making decisions. In the competitive scenario, there are

many numbers of firms with large technological advancement and hence, decisions play

the key role in surviving into the intense scenario (Strelnik, et. al., 2015).

In the context of an organisation, Zyalla is going through financial restructuring and expansion

process and is striving towards increased production capacity and increased revenues. It must

implement systems such as job costing, process costing and inventory systems and takes up large

benefits. It will aid in reducing expenses, and management of organisational processes (Bodnar,

and Hopwood, 2012).

8

an organisational context.

The evolution of management accounting systems has been realised long back. The evolution has

been made for enhancing managerial decisions and effective management. These systems have

large benefits such as follows:

Improves profitability: Management systems are implemented in order to improves

decision making and overall improves profits for the organisation. These systems are

made for orderly assessment and interpretation of data.

Reduces costing: One of the major motives of organisation is to reduce costs of

manufacturing/ servicing. An organisation incurs direct and indirect costs and strives to

work in the efficient manner through which costing can be reduced.

An effective decision-making mechanism for futuristic stabilisation: Systems are

implemented to aid managers in making decisions. In the competitive scenario, there are

many numbers of firms with large technological advancement and hence, decisions play

the key role in surviving into the intense scenario (Strelnik, et. al., 2015).

In the context of an organisation, Zyalla is going through financial restructuring and expansion

process and is striving towards increased production capacity and increased revenues. It must

implement systems such as job costing, process costing and inventory systems and takes up large

benefits. It will aid in reducing expenses, and management of organisational processes (Bodnar,

and Hopwood, 2012).

8

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costing.

Costs refer to the expenditure made by an organisation for producing per unit. There are different

types of cost and are classified on the basis nature, behaviour etc. Following are few costs which

are used in cost:

Direct and indirect cost: The costs which are directly linked to the manufacturing of a

product is known as direct costs such as direct material cost, direct labour costs, overhead

costs etc. Further, the cost which is indirectly linked and does not necessarily incurred for

manufacturing of a product is known as indirect costs such as administrative expense,

utility expense etc. (Hilton, and Platt, 2013).

Product cost: These are the costs which are incurred for producing a product and include

direct costs only.

Period costs: Period costs are those costs which are incurred in a specific period of time

of organisational productivity. These include all types of costs such as the cost of goods

sold, indirect costs incurred for total revenues earned in a specific period.

The above are different nature of costs which are incurred and organisation uses different

techniques for measuring cost and profitability (Hilton, and Platt, 2013). The two techniques are

marginal costing and absorption costing:

Marginal costing: Marginal costing is a technique whereby per unit cost of a product is

ascertained through variable costing and the fixed costs are deducted overall by contribution. The

inventory valuation is done through variable costs only and hence, the profits are higher but

subject to over or under absorption of fixed production overheads (Hilton, and Platt, 2013).

Absorption costing: In this costing technique, products costs are calculated by analysing both

variable and fixed costs elements. It analyses costs per unit till it has absorbed costs. In this

technique, inventory valuation is done through both fixed and variable costs and hence,

inventory valuation is higher which reduces profitability margin (Aruomoaghe, &Agbo, 2013).

9

statement using marginal and absorption costing.

Costs refer to the expenditure made by an organisation for producing per unit. There are different

types of cost and are classified on the basis nature, behaviour etc. Following are few costs which

are used in cost:

Direct and indirect cost: The costs which are directly linked to the manufacturing of a

product is known as direct costs such as direct material cost, direct labour costs, overhead

costs etc. Further, the cost which is indirectly linked and does not necessarily incurred for

manufacturing of a product is known as indirect costs such as administrative expense,

utility expense etc. (Hilton, and Platt, 2013).

Product cost: These are the costs which are incurred for producing a product and include

direct costs only.

Period costs: Period costs are those costs which are incurred in a specific period of time

of organisational productivity. These include all types of costs such as the cost of goods

sold, indirect costs incurred for total revenues earned in a specific period.

The above are different nature of costs which are incurred and organisation uses different

techniques for measuring cost and profitability (Hilton, and Platt, 2013). The two techniques are

marginal costing and absorption costing:

Marginal costing: Marginal costing is a technique whereby per unit cost of a product is

ascertained through variable costing and the fixed costs are deducted overall by contribution. The

inventory valuation is done through variable costs only and hence, the profits are higher but

subject to over or under absorption of fixed production overheads (Hilton, and Platt, 2013).

Absorption costing: In this costing technique, products costs are calculated by analysing both

variable and fixed costs elements. It analyses costs per unit till it has absorbed costs. In this

technique, inventory valuation is done through both fixed and variable costs and hence,

inventory valuation is higher which reduces profitability margin (Aruomoaghe, &Agbo, 2013).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

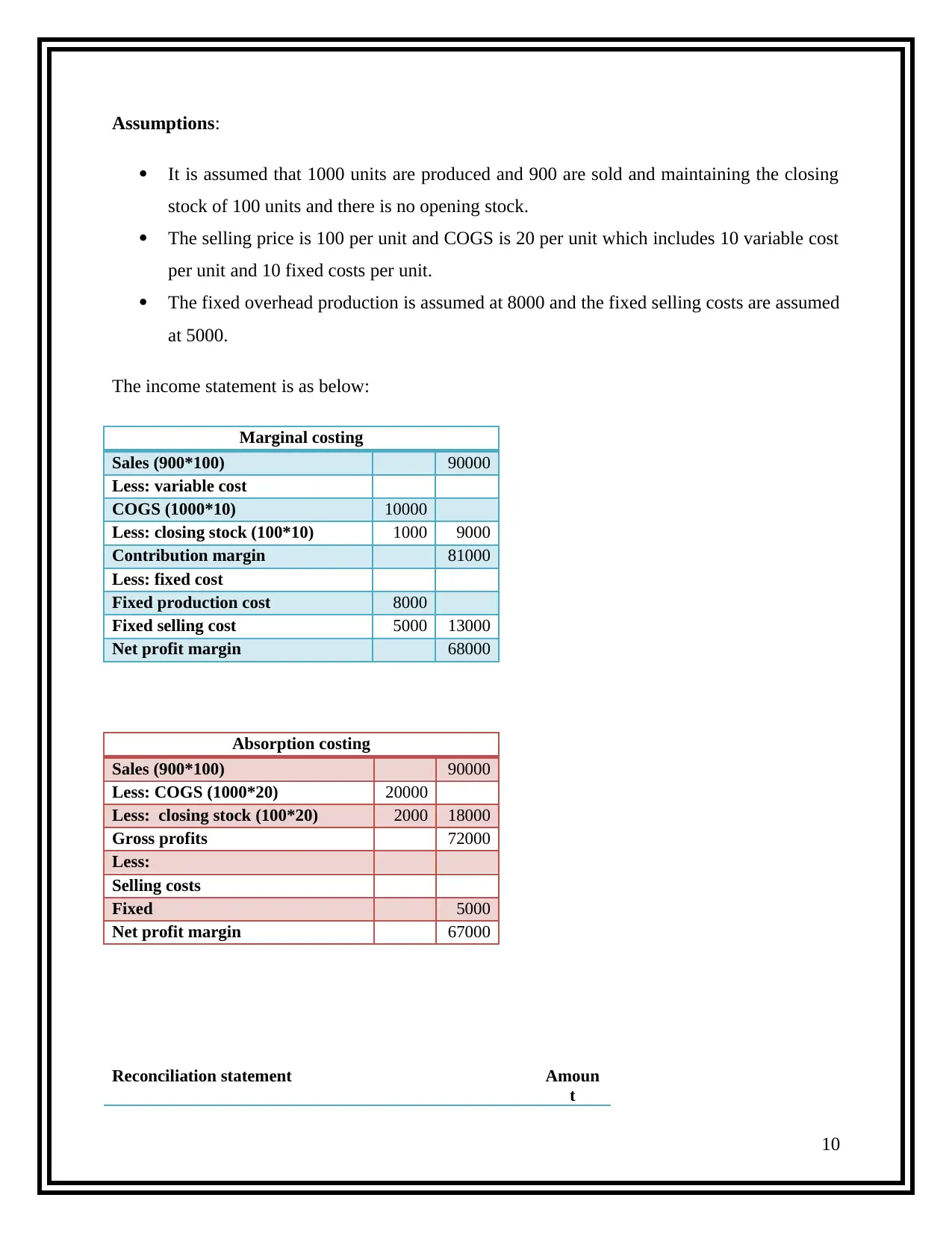

Assumptions:

It is assumed that 1000 units are produced and 900 are sold and maintaining the closing

stock of 100 units and there is no opening stock.

The selling price is 100 per unit and COGS is 20 per unit which includes 10 variable cost

per unit and 10 fixed costs per unit.

The fixed overhead production is assumed at 8000 and the fixed selling costs are assumed

at 5000.

The income statement is as below:

Marginal costing

Sales (900*100) 90000

Less: variable cost

COGS (1000*10) 10000

Less: closing stock (100*10) 1000 9000

Contribution margin 81000

Less: fixed cost

Fixed production cost 8000

Fixed selling cost 5000 13000

Net profit margin 68000

Absorption costing

Sales (900*100) 90000

Less: COGS (1000*20) 20000

Less: closing stock (100*20) 2000 18000

Gross profits 72000

Less:

Selling costs

Fixed 5000

Net profit margin 67000

Reconciliation statement Amoun

t

10

It is assumed that 1000 units are produced and 900 are sold and maintaining the closing

stock of 100 units and there is no opening stock.

The selling price is 100 per unit and COGS is 20 per unit which includes 10 variable cost

per unit and 10 fixed costs per unit.

The fixed overhead production is assumed at 8000 and the fixed selling costs are assumed

at 5000.

The income statement is as below:

Marginal costing

Sales (900*100) 90000

Less: variable cost

COGS (1000*10) 10000

Less: closing stock (100*10) 1000 9000

Contribution margin 81000

Less: fixed cost

Fixed production cost 8000

Fixed selling cost 5000 13000

Net profit margin 68000

Absorption costing

Sales (900*100) 90000

Less: COGS (1000*20) 20000

Less: closing stock (100*20) 2000 18000

Gross profits 72000

Less:

Selling costs

Fixed 5000

Net profit margin 67000

Reconciliation statement Amoun

t

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

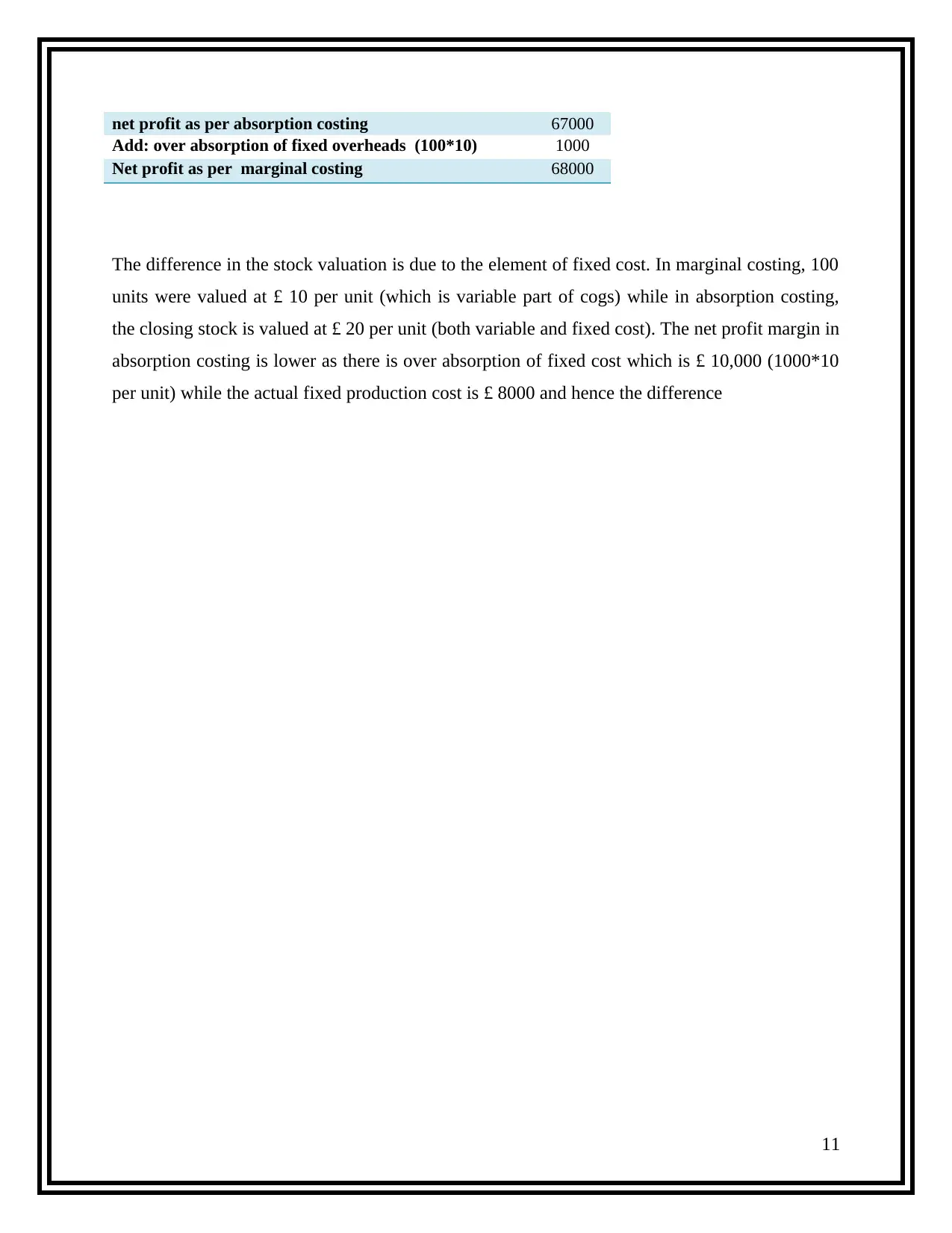

net profit as per absorption costing 67000

Add: over absorption of fixed overheads (100*10) 1000

Net profit as per marginal costing 68000

The difference in the stock valuation is due to the element of fixed cost. In marginal costing, 100

units were valued at £ 10 per unit (which is variable part of cogs) while in absorption costing,

the closing stock is valued at £ 20 per unit (both variable and fixed cost). The net profit margin in

absorption costing is lower as there is over absorption of fixed cost which is £ 10,000 (1000*10

per unit) while the actual fixed production cost is £ 8000 and hence the difference

11

Add: over absorption of fixed overheads (100*10) 1000

Net profit as per marginal costing 68000

The difference in the stock valuation is due to the element of fixed cost. In marginal costing, 100

units were valued at £ 10 per unit (which is variable part of cogs) while in absorption costing,

the closing stock is valued at £ 20 per unit (both variable and fixed cost). The net profit margin in

absorption costing is lower as there is over absorption of fixed cost which is £ 10,000 (1000*10

per unit) while the actual fixed production cost is £ 8000 and hence the difference

11

M2 Apply a range of management accounting techniques and produce appropriate

financial reporting documents.

The techniques applied over here are marginal costing and absorption costing. The income

statement is presented as above.

The difference in the inventory valuation is due to the fixed cost element. The inventory

in marginal cost consists only of variable portion and hence, it is valued at £ 9000 only

while in the absorption costing, the inventory valued at 18000 which is due to fixed cost

overheads.

The difference in the net profit margin is due to over-absorption of fixed costs. The actual

fixed costs amount to £ 8000 but in absorption costing £ 9000 (900 units*10 per unit

fixed overhead) was considered and hence, there arises a difference of £ 1000.

12

financial reporting documents.

The techniques applied over here are marginal costing and absorption costing. The income

statement is presented as above.

The difference in the inventory valuation is due to the fixed cost element. The inventory

in marginal cost consists only of variable portion and hence, it is valued at £ 9000 only

while in the absorption costing, the inventory valued at 18000 which is due to fixed cost

overheads.

The difference in the net profit margin is due to over-absorption of fixed costs. The actual

fixed costs amount to £ 8000 but in absorption costing £ 9000 (900 units*10 per unit

fixed overhead) was considered and hence, there arises a difference of £ 1000.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.