Management Accounting for Cost & Control Assignment, University Name

VerifiedAdded on 2019/10/30

|14

|880

|219

Homework Assignment

AI Summary

This assignment solution addresses key concepts in Management Accounting for Cost & Control, covering topics such as traditional vs. modern cost accounting methods, computation of equivalent units, joint production costs allocation, and variance analysis. The document provides detailed answers to specific questions, including calculations, explanations, and comparisons. It explores practical applications of cost management techniques, including budgeting and its relationship to government policies. The assignment also includes references to relevant academic sources, offering a comprehensive understanding of the subject matter and its practical implications within a business context.

Running head: MANAGEMENT ACCOUNTING FOR COST & CONTROL

Management Accounting for Cost & Control

Name of the University

Name of the student

Authors note

Management Accounting for Cost & Control

Name of the University

Name of the student

Authors note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING FOR COST & CONTROL

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement B:......................................................................................................................3

Answer to Question 2:................................................................................................................3

Answer to Question 3:................................................................................................................6

Requirement a:.......................................................................................................................6

Requirement b:.......................................................................................................................6

Answer to Question 4:................................................................................................................7

Requirement a:.......................................................................................................................7

Requirement b:.......................................................................................................................9

Answer to Question 5:..............................................................................................................10

Requirement A:....................................................................................................................10

Requirement B:....................................................................................................................11

References:...............................................................................................................................13

Table of Contents

Answer to Question 1:................................................................................................................2

Requirement a:.......................................................................................................................2

Requirement B:......................................................................................................................3

Answer to Question 2:................................................................................................................3

Answer to Question 3:................................................................................................................6

Requirement a:.......................................................................................................................6

Requirement b:.......................................................................................................................6

Answer to Question 4:................................................................................................................7

Requirement a:.......................................................................................................................7

Requirement b:.......................................................................................................................9

Answer to Question 5:..............................................................................................................10

Requirement A:....................................................................................................................10

Requirement B:....................................................................................................................11

References:...............................................................................................................................13

2MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question 1:

Requirement a:

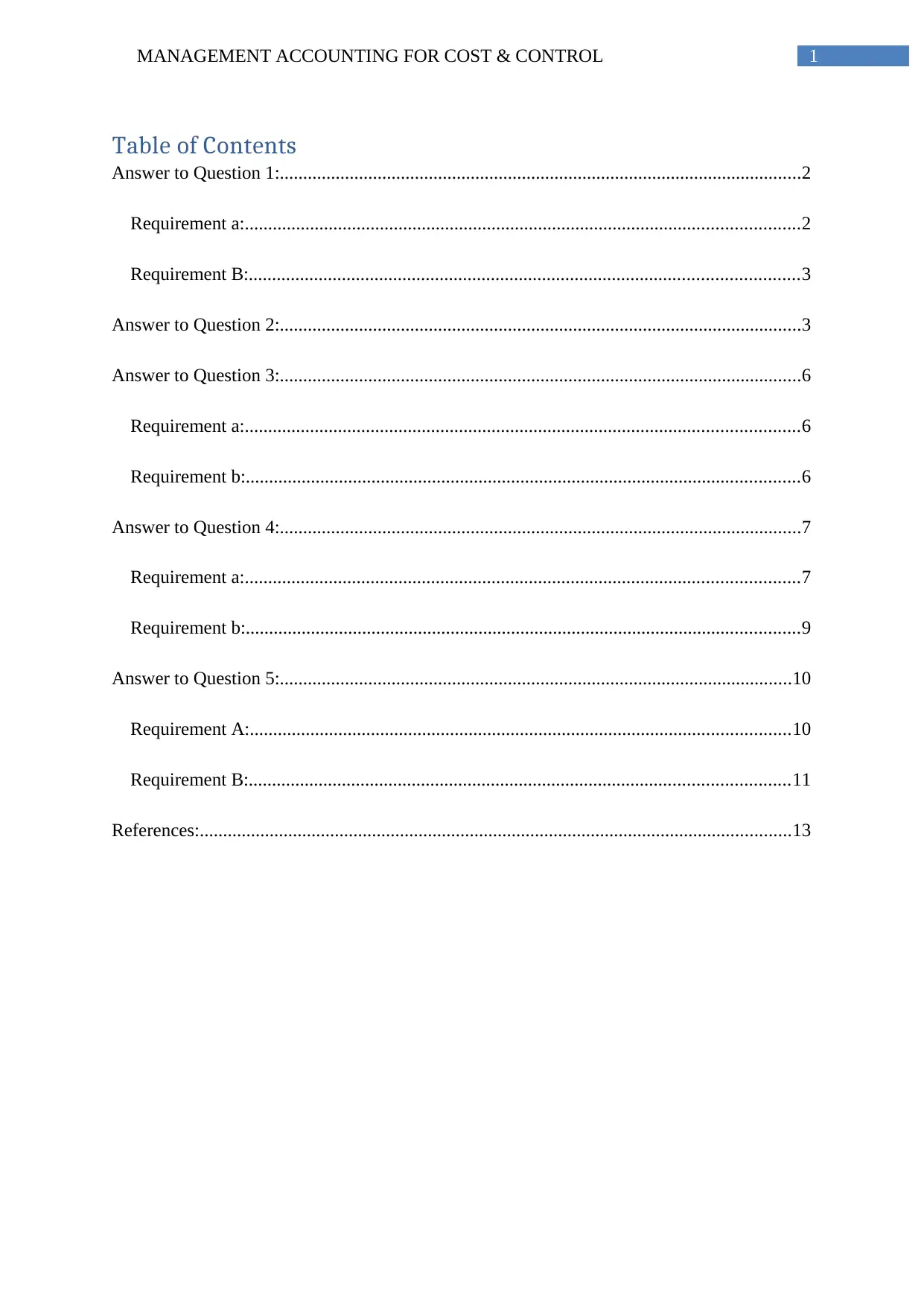

DR. CR.

Date Particulars Amount Date Particulars Amount

To, Balance b/d. 24855 31/8/14 By, Work-in-Process A/c. 6010

To, Accounts Payable A/c. 6155 By, Balance c/d 25000

31010 31010

DR. CR.

Date Particulars Amount Date Particulars Amount

1/8/X4 To, Balance b/d 8790 31/8/X4 By, Cost of Goods Sold A/c. 30000

31/8/X4 To, Work-in-Process A/c. 30110 By,Balance c/d 8900

38900 38900

DR. CR.

Date Particulars Amount Date Particulars Amount

31/8/X4 To, Finished Goods A/c. 30000 31/8/X4 By, Profit & Loss A/c. 32800

To, Manufacturing

Overhead A/c. 2800

32800 32800

Direct Material Account

Finished Goods

Cost of Goods Sold

Answer to Question 1:

Requirement a:

DR. CR.

Date Particulars Amount Date Particulars Amount

To, Balance b/d. 24855 31/8/14 By, Work-in-Process A/c. 6010

To, Accounts Payable A/c. 6155 By, Balance c/d 25000

31010 31010

DR. CR.

Date Particulars Amount Date Particulars Amount

1/8/X4 To, Balance b/d 8790 31/8/X4 By, Cost of Goods Sold A/c. 30000

31/8/X4 To, Work-in-Process A/c. 30110 By,Balance c/d 8900

38900 38900

DR. CR.

Date Particulars Amount Date Particulars Amount

31/8/X4 To, Finished Goods A/c. 30000 31/8/X4 By, Profit & Loss A/c. 32800

To, Manufacturing

Overhead A/c. 2800

32800 32800

Direct Material Account

Finished Goods

Cost of Goods Sold

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING FOR COST & CONTROL

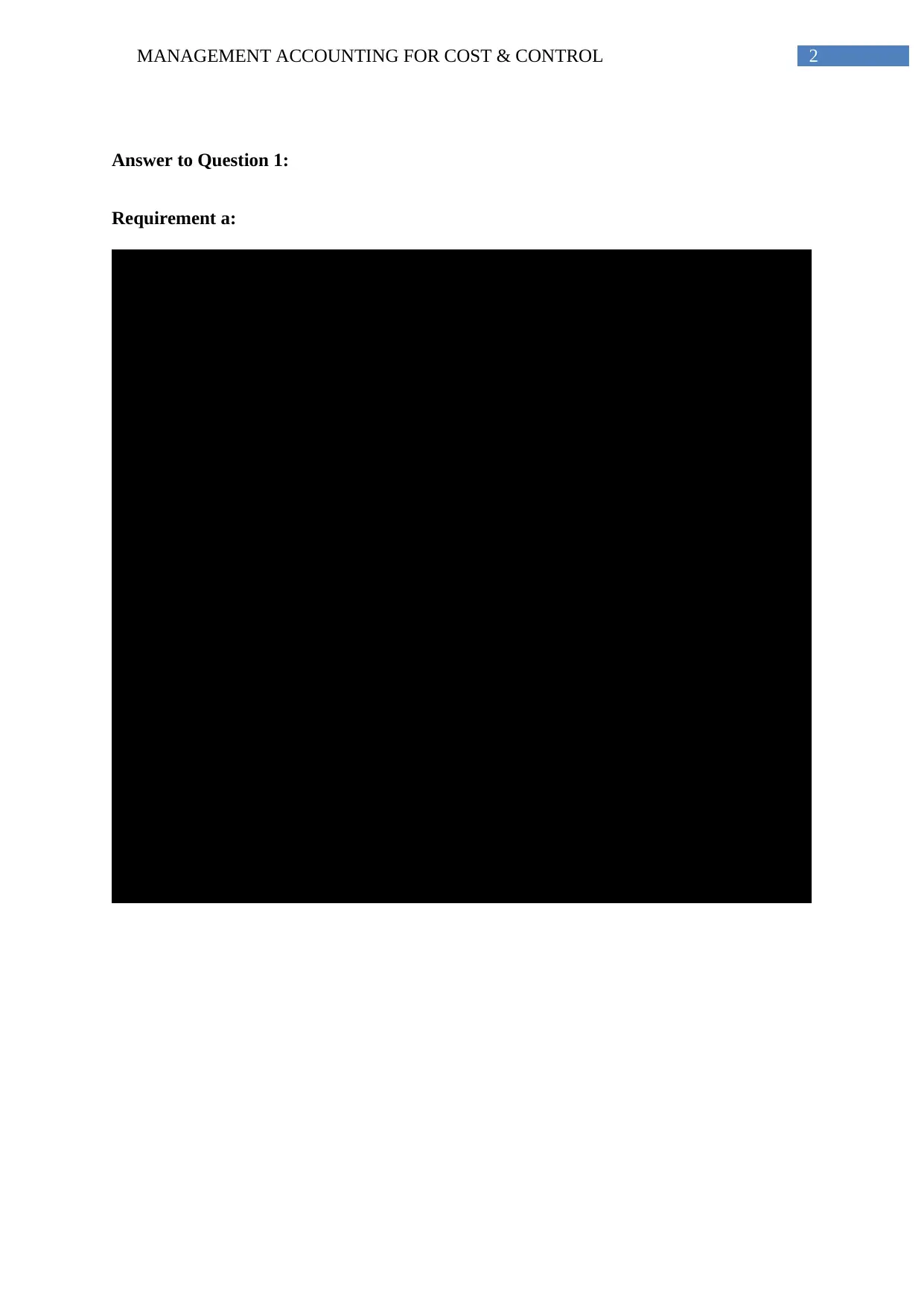

DR. CR.

Date Particulars Amount Date Particulars Amount

1/8/X4 To, Balance b/d 6700 31/8/X4 By, Finished Goods A/c. 30110

To, Direct Labor A/c. 14800 By, Balance c/d 9400

To, Manufacturing Overhead A/c. 12000

To, Direct Material A/c. 6010

39510 39510

DR. CR.

Date Particulars Amount Date Particulars Amount

31/8/X4 To, Bank A/c. 6700 1/8/X4 By, Balance b/d 2345

31/8/X4 To, Balance c/d 1800 By, Direct Material A/c. 6155

8500 8500

Work-in-Process

Accounts Payable

Requirement B:

The cost accounting format used for constructing the great pyramid of Giza 4500

years ago and its construction now has wide differences. Pyramid was constructed then using

the traditional approach involving stages of planning, initiating, executing, designing and

closing. However, there were some constraint faced in the pyramid construction and the

application of modern cost management accounting would involve different techniques of

construction. Using the modern concept, processed cost accounting would be considered

appropriate for the construction of great pyramid of Giza. The construction cost would be

managed by segregation of cost and where cost of each unit of products is assumed to be

same of other (Fullerton et al. 2013). Actual production cost can be easily assigned using the

modern techniques.

Answer to Question 2:

Computation of Equivalent Units:

DR. CR.

Date Particulars Amount Date Particulars Amount

1/8/X4 To, Balance b/d 6700 31/8/X4 By, Finished Goods A/c. 30110

To, Direct Labor A/c. 14800 By, Balance c/d 9400

To, Manufacturing Overhead A/c. 12000

To, Direct Material A/c. 6010

39510 39510

DR. CR.

Date Particulars Amount Date Particulars Amount

31/8/X4 To, Bank A/c. 6700 1/8/X4 By, Balance b/d 2345

31/8/X4 To, Balance c/d 1800 By, Direct Material A/c. 6155

8500 8500

Work-in-Process

Accounts Payable

Requirement B:

The cost accounting format used for constructing the great pyramid of Giza 4500

years ago and its construction now has wide differences. Pyramid was constructed then using

the traditional approach involving stages of planning, initiating, executing, designing and

closing. However, there were some constraint faced in the pyramid construction and the

application of modern cost management accounting would involve different techniques of

construction. Using the modern concept, processed cost accounting would be considered

appropriate for the construction of great pyramid of Giza. The construction cost would be

managed by segregation of cost and where cost of each unit of products is assumed to be

same of other (Fullerton et al. 2013). Actual production cost can be easily assigned using the

modern techniques.

Answer to Question 2:

Computation of Equivalent Units:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING FOR COST & CONTROL

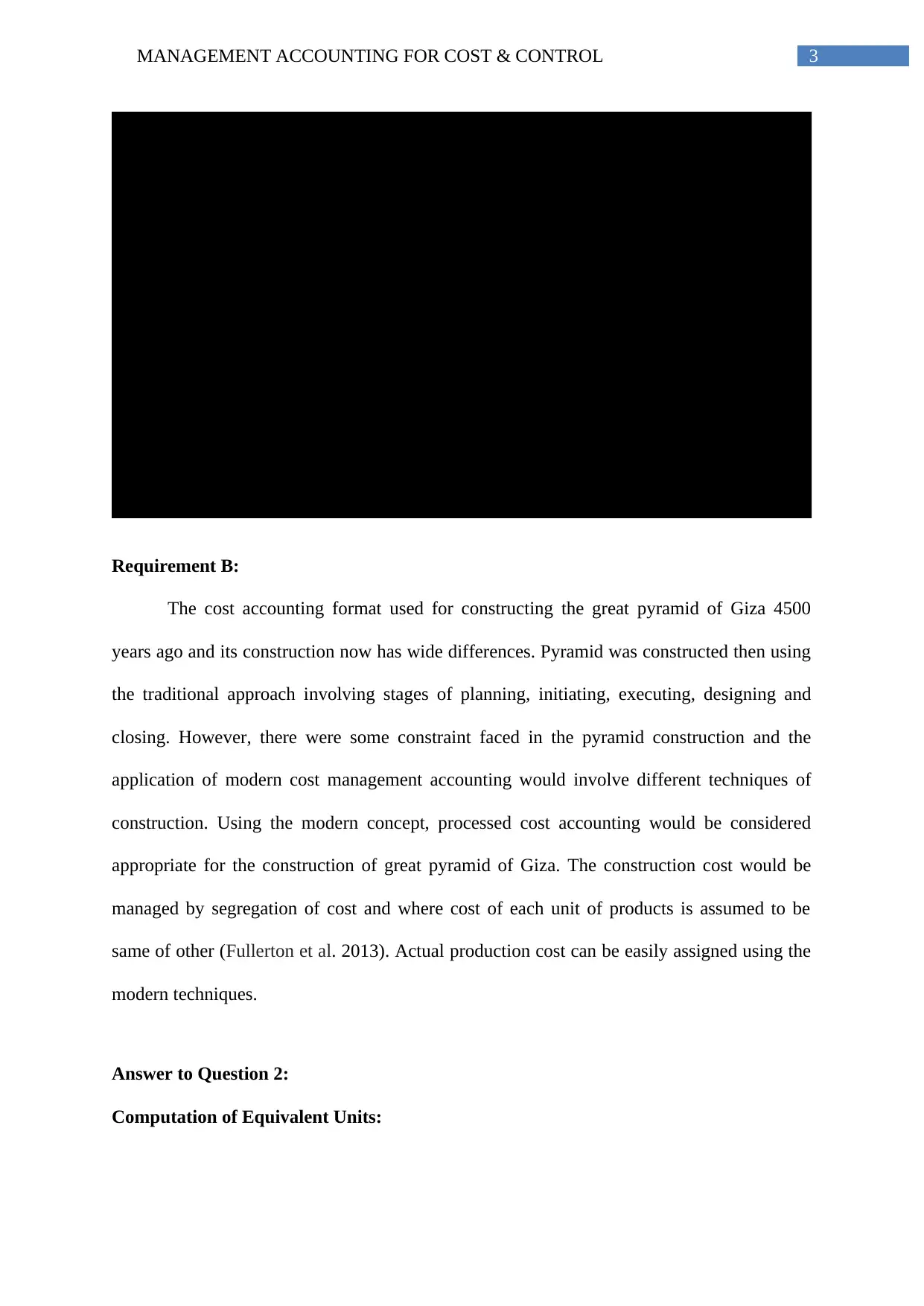

Process 1 Physical Flow

Material Conversion

O/WIP 2000 0 1400

Started in May 6000

Total Production 8000

Completed in Process 7000 7000 7000

C/WIP 1000 1000 500

Total Equivalent Units 8000 7500

Process 2 Physical Flow

Material Conversion

O/WIP 1000 0 500

Started in May 7000

Total Production 8000

C/WIP 750 0 225

Completed I Process 7250 7250 7250

Total Equivalent Units 7250 7975

Equivalent Units

Equivalent Units

Cost per Equivalent Units:

Process 1 Physical Flow

Material Conversion

O/WIP 2000 0 1400

Started in May 6000

Total Production 8000

Completed in Process 7000 7000 7000

C/WIP 1000 1000 500

Total Equivalent Units 8000 7500

Process 2 Physical Flow

Material Conversion

O/WIP 1000 0 500

Started in May 7000

Total Production 8000

C/WIP 750 0 225

Completed I Process 7250 7250 7250

Total Equivalent Units 7250 7975

Equivalent Units

Equivalent Units

Cost per Equivalent Units:

5MANAGEMENT ACCOUNTING FOR COST & CONTROL

Particulars Material Coversion Transferred-in Total

Process 1:

O/WIP Cost $3,000 $2,000 $5,000

Current Cost $30,000 $60,000 $90,000

Total Production Cost of Process 1 $33,000 $62,000 $95,000

Total Equivalent Units 8000 7500

Cost per Equivalent Units of Process 1 $4.13 $8.27 $12.39

Process 2:

O/WIP Cost $3,000 $4,000 $8,000 $15,000

Current Cost $35,000 $45,000 $86,742 $166,742

Total Production Cost of Process 2 $38,000 $49,000 $94,742 $181,742

Total Equivalent Units 7250 7975 7000

Cost per Equivalent Units of Process 2 $5.24 $6.14 $13.53 $25

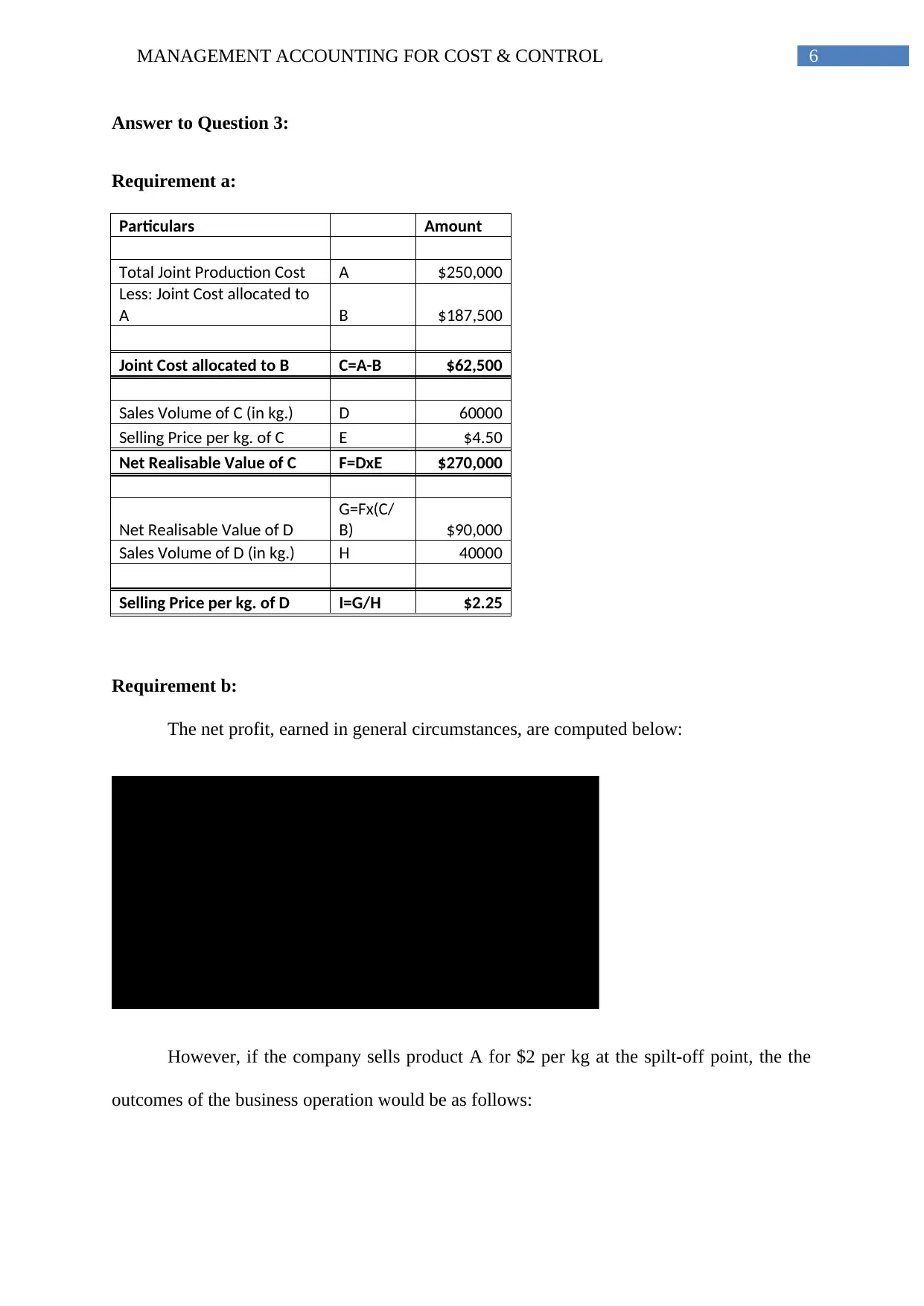

Cost of Finished Goods and Closing Stock:

Particulars Amount

Finished Goods Completed during May 7250

Cost per Equivalent Units $25

Cost of Finished Goods Completed $180,671

Closing Stock in Process 1 1000

Cost per Equivalent Units for Process 1 $12.39

Cost of Closing Stock in Process 1 $12,391.67

Closing Stock in Process 2 750

Cost per Equivalent Units for Process 1 $24.92

Cost of Closing Stock in Process 2 $18,690.08

Particulars Material Coversion Transferred-in Total

Process 1:

O/WIP Cost $3,000 $2,000 $5,000

Current Cost $30,000 $60,000 $90,000

Total Production Cost of Process 1 $33,000 $62,000 $95,000

Total Equivalent Units 8000 7500

Cost per Equivalent Units of Process 1 $4.13 $8.27 $12.39

Process 2:

O/WIP Cost $3,000 $4,000 $8,000 $15,000

Current Cost $35,000 $45,000 $86,742 $166,742

Total Production Cost of Process 2 $38,000 $49,000 $94,742 $181,742

Total Equivalent Units 7250 7975 7000

Cost per Equivalent Units of Process 2 $5.24 $6.14 $13.53 $25

Cost of Finished Goods and Closing Stock:

Particulars Amount

Finished Goods Completed during May 7250

Cost per Equivalent Units $25

Cost of Finished Goods Completed $180,671

Closing Stock in Process 1 1000

Cost per Equivalent Units for Process 1 $12.39

Cost of Closing Stock in Process 1 $12,391.67

Closing Stock in Process 2 750

Cost per Equivalent Units for Process 1 $24.92

Cost of Closing Stock in Process 2 $18,690.08

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING FOR COST & CONTROL

Answer to Question 3:

Requirement a:

Particulars Amount

Total Joint Production Cost A $250,000

Less: Joint Cost allocated to

A B $187,500

Joint Cost allocated to B C=A-B $62,500

Sales Volume of C (in kg.) D 60000

Selling Price per kg. of C E $4.50

Net Realisable Value of C F=DxE $270,000

Net Realisable Value of D

G=Fx(C/

B) $90,000

Sales Volume of D (in kg.) H 40000

Selling Price per kg. of D I=G/H $2.25

Requirement b:

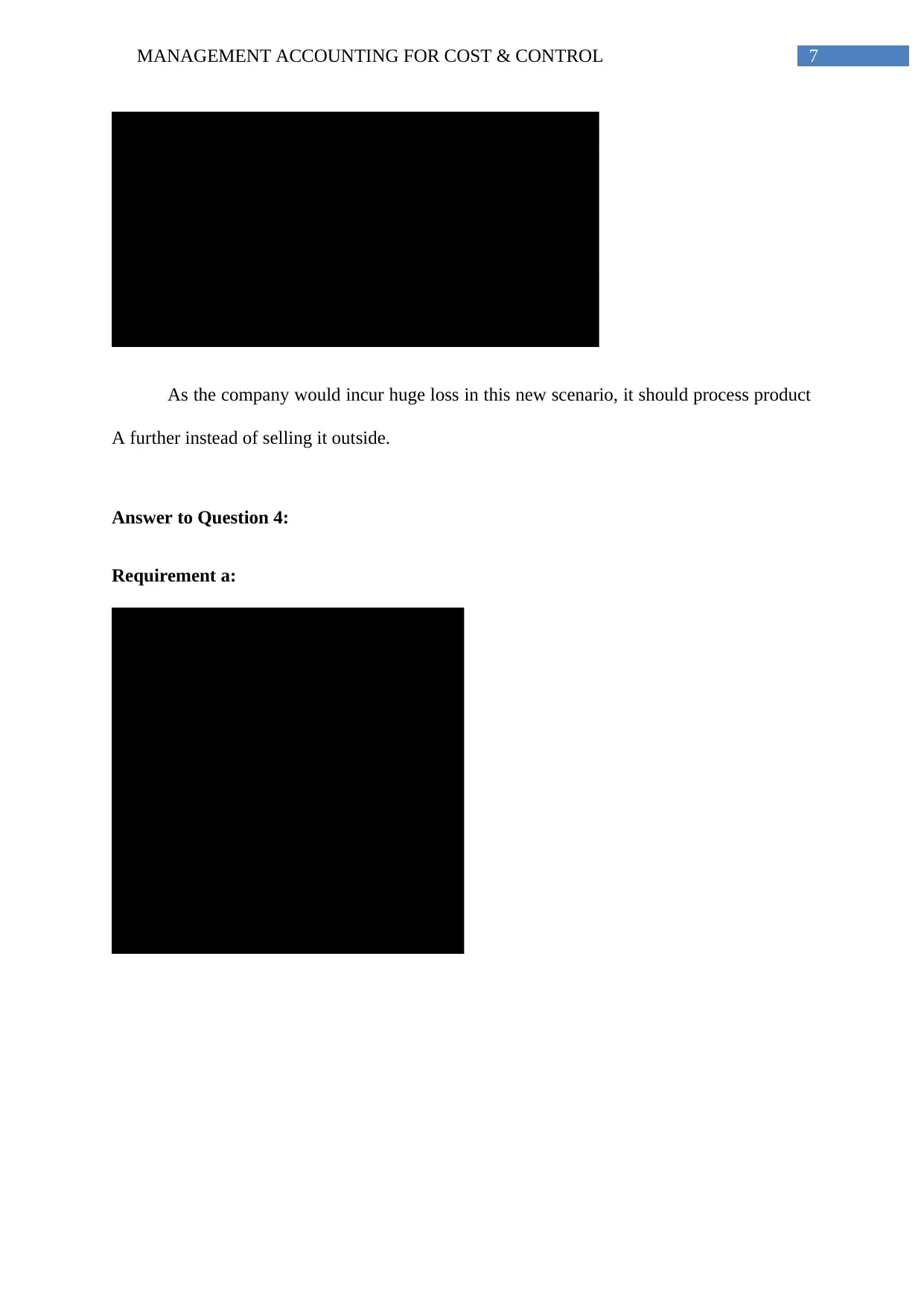

The net profit, earned in general circumstances, are computed below:

Particulars A B Total

Selling Price per unit $4.50 $2.25

Sales Volume 60000 40000 100000

Total Sale Revenue $270,000 $90,000 $360,000

Joint Cost Allocation ($187,500) ($62,500) ($250,000)

Further Processing Cost ($45,000) ($25,000) ($70,000)

Net Profit $37,500 $2,500 $40,000

However, if the company sells product A for $2 per kg at the spilt-off point, the the

outcomes of the business operation would be as follows:

Answer to Question 3:

Requirement a:

Particulars Amount

Total Joint Production Cost A $250,000

Less: Joint Cost allocated to

A B $187,500

Joint Cost allocated to B C=A-B $62,500

Sales Volume of C (in kg.) D 60000

Selling Price per kg. of C E $4.50

Net Realisable Value of C F=DxE $270,000

Net Realisable Value of D

G=Fx(C/

B) $90,000

Sales Volume of D (in kg.) H 40000

Selling Price per kg. of D I=G/H $2.25

Requirement b:

The net profit, earned in general circumstances, are computed below:

Particulars A B Total

Selling Price per unit $4.50 $2.25

Sales Volume 60000 40000 100000

Total Sale Revenue $270,000 $90,000 $360,000

Joint Cost Allocation ($187,500) ($62,500) ($250,000)

Further Processing Cost ($45,000) ($25,000) ($70,000)

Net Profit $37,500 $2,500 $40,000

However, if the company sells product A for $2 per kg at the spilt-off point, the the

outcomes of the business operation would be as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING FOR COST & CONTROL

Particulars A B Total

Selling Price per unit $2.00 $2.25

Sales Volume 60000 40000 100000

Total Sale Revenue $120,000 $90,000 $210,000

Joint Cost Allocation ($142,857) ($107,143) ($250,000)

Further Processing Cost ($25,000) ($25,000)

Net Profit ($22,857) ($42,143) ($65,000)

As the company would incur huge loss in this new scenario, it should process product

A further instead of selling it outside.

Answer to Question 4:

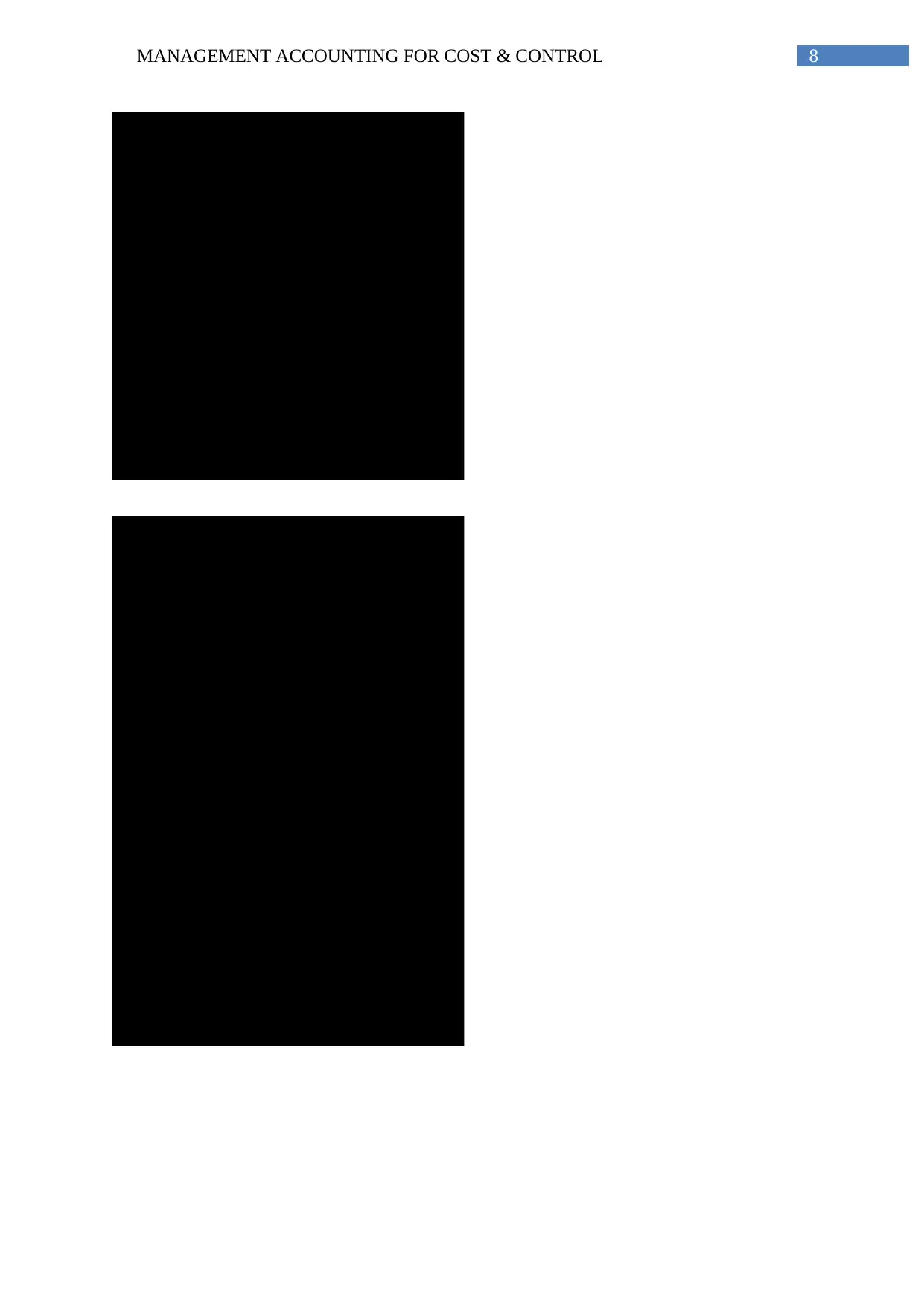

Requirement a:

Particulars Amount

Material Purchased (in units) 220000

Standard Price per kg $6

Standard Cost for Actual Material

Purchased $1,320,000

Actual Cost of Actual Material

Purchased $1,364,000

Material Price Variance ($44,000)

Remarks Unfavorable

Material Price Variance:

Particulars A B Total

Selling Price per unit $2.00 $2.25

Sales Volume 60000 40000 100000

Total Sale Revenue $120,000 $90,000 $210,000

Joint Cost Allocation ($142,857) ($107,143) ($250,000)

Further Processing Cost ($25,000) ($25,000)

Net Profit ($22,857) ($42,143) ($65,000)

As the company would incur huge loss in this new scenario, it should process product

A further instead of selling it outside.

Answer to Question 4:

Requirement a:

Particulars Amount

Material Purchased (in units) 220000

Standard Price per kg $6

Standard Cost for Actual Material

Purchased $1,320,000

Actual Cost of Actual Material

Purchased $1,364,000

Material Price Variance ($44,000)

Remarks Unfavorable

Material Price Variance:

8MANAGEMENT ACCOUNTING FOR COST & CONTROL

Particulars Amount

Units Produced 19500

Standard Usage per unit of

production 11

Standard Usage for Actual

Production 214500

Actual Material Usage 197000

Standard price per kg. $6

Material Usage Variance $105,000

Remarks Favorable

Material Usage Variance:

Particulars Amount

Actual Production 19500

Standard Labor hour per unit 2

Standard Labor Hour for Actual

Production 39000

Actual Labor Hours 40000

Standard Labor Rate per hour $20

Direct Labor Efficiency Variance ($20,000)

Total Direct Labor Variance ($1,650)

Direct Labor Rate Variace $18,350

Standard Labor Cost for Actual

Labor Hours $800,000

Actual Labor Cost $781,650

Actual Direct Labor Rate per hour $19.54

Actual Direct Labor Rate per hour:

Particulars Amount

Units Produced 19500

Standard Usage per unit of

production 11

Standard Usage for Actual

Production 214500

Actual Material Usage 197000

Standard price per kg. $6

Material Usage Variance $105,000

Remarks Favorable

Material Usage Variance:

Particulars Amount

Actual Production 19500

Standard Labor hour per unit 2

Standard Labor Hour for Actual

Production 39000

Actual Labor Hours 40000

Standard Labor Rate per hour $20

Direct Labor Efficiency Variance ($20,000)

Total Direct Labor Variance ($1,650)

Direct Labor Rate Variace $18,350

Standard Labor Cost for Actual

Labor Hours $800,000

Actual Labor Cost $781,650

Actual Direct Labor Rate per hour $19.54

Actual Direct Labor Rate per hour:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGEMENT ACCOUNTING FOR COST & CONTROL

Dr. Cr.

Date Amount Amount

Direct Material A/c. Dr. $1,364,000

To, Accounts Payable A/c. $1,364,000

Work-in-Progress A/c. Dr. 1287000

To, Direct Material A/c. 1287000

Material Price Variance A/c. Dr. $44,000

To, Direct Material A/c. $44,000

Direct Material A/c. Dr. $105,000

To, Material Usage Variance A/c. $105,000

Direct Labor Cost A/c. Dr. $781,650

To, Accrued Payroll A/c. $781,650

Work-in-Progress A/c. Dr. 780000

To, Direct Labor Cost A/c. 780000

Direct Labor Cost A/c. Dr. $18,350

To, Direct Labor Rate Variance A/c. $18,350

Direct Labor Efficiency Variance A/c. Dr. $20,000

To, Direct Labor Cost A/c. $20,000

Material Usage Variance A/c. Dr. $105,000

Direct Labor Rate Variance A/c. Dr. $18,350

To, Cost of Goods Sold A/c. $59,350

To, Direct Labor Efficiency Variance A/c. $20,000

To, Material Price Variance A/c. $44,000

Particulars

Requirement b:

One of the most crucial tools in the business management is the analysis of variance

that helps in analysing the cause of deviation between the actual cost and estimated cost. The

actual and planned expenses of any project can be effectively monitored using the variance

analysis application. Variance analysis helps in identification of fluctuation in any accounting

budget (Lanen, 2016).

Some of other areas where tool of variance analysis can hold importance are

organizational behaviour and human resource department. Performance of human resource

Dr. Cr.

Date Amount Amount

Direct Material A/c. Dr. $1,364,000

To, Accounts Payable A/c. $1,364,000

Work-in-Progress A/c. Dr. 1287000

To, Direct Material A/c. 1287000

Material Price Variance A/c. Dr. $44,000

To, Direct Material A/c. $44,000

Direct Material A/c. Dr. $105,000

To, Material Usage Variance A/c. $105,000

Direct Labor Cost A/c. Dr. $781,650

To, Accrued Payroll A/c. $781,650

Work-in-Progress A/c. Dr. 780000

To, Direct Labor Cost A/c. 780000

Direct Labor Cost A/c. Dr. $18,350

To, Direct Labor Rate Variance A/c. $18,350

Direct Labor Efficiency Variance A/c. Dr. $20,000

To, Direct Labor Cost A/c. $20,000

Material Usage Variance A/c. Dr. $105,000

Direct Labor Rate Variance A/c. Dr. $18,350

To, Cost of Goods Sold A/c. $59,350

To, Direct Labor Efficiency Variance A/c. $20,000

To, Material Price Variance A/c. $44,000

Particulars

Requirement b:

One of the most crucial tools in the business management is the analysis of variance

that helps in analysing the cause of deviation between the actual cost and estimated cost. The

actual and planned expenses of any project can be effectively monitored using the variance

analysis application. Variance analysis helps in identification of fluctuation in any accounting

budget (Lanen, 2016).

Some of other areas where tool of variance analysis can hold importance are

organizational behaviour and human resource department. Performance of human resource

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT ACCOUNTING FOR COST & CONTROL

department is related with the financial outcome and using the variance analysis helps in

establishing relationship between departments of organization (Stretton, 2014).

Answer to Question 5:

Requirement A:

Particulars 20X2 20X3 20X4 20X5 20X6

Sales Volume 32400 34992 37791 40000 40000

Selling Price per unit $6.63 $6.97 $7.38 $8.13 $8.78

Total Sales Revenue $214,812 $243,824 $279,051 $325,080 $351,000

Cost of Goods Sold ($164,520) ($186,192) ($212,841) ($238,760) ($257,120)

Gross Profit $50,292 $57,632 $66,210 $86,320 $93,880

General & Administrative

Expenses ($30,074) ($34,135) ($39,067) ($45,511) ($49,140)

Net Profit before Tax $20,218 $23,496 $27,143 $40,809 $44,740

Less: Income Tax @40% ($8,087) ($9,399) ($10,857) ($16,324) ($17,896)

Net Profit after Tax $12,131 $14,098 $16,286 $24,485 $26,844

Particulars 20X2 20X3 20X4 20X5 20X6

Opening Balance of Retained

Earnings $3,500 $3,780 $4,082 $4,409 $4,762

Net Profit for the period $12,131 $14,098 $16,286 $24,485 $26,844

$15,631 $17,878 $20,368 $28,894 $31,606

Less: Dividends Payable ($7,885) ($9,164) ($10,586) ($15,915) ($17,449)

Closing Balance of Retained

Earnings $3,780 $8,714 $9,782 $12,979 $14,157

Budgeted Income Statement:

Budgeted Statement of Retained Earnings:

Workings:

department is related with the financial outcome and using the variance analysis helps in

establishing relationship between departments of organization (Stretton, 2014).

Answer to Question 5:

Requirement A:

Particulars 20X2 20X3 20X4 20X5 20X6

Sales Volume 32400 34992 37791 40000 40000

Selling Price per unit $6.63 $6.97 $7.38 $8.13 $8.78

Total Sales Revenue $214,812 $243,824 $279,051 $325,080 $351,000

Cost of Goods Sold ($164,520) ($186,192) ($212,841) ($238,760) ($257,120)

Gross Profit $50,292 $57,632 $66,210 $86,320 $93,880

General & Administrative

Expenses ($30,074) ($34,135) ($39,067) ($45,511) ($49,140)

Net Profit before Tax $20,218 $23,496 $27,143 $40,809 $44,740

Less: Income Tax @40% ($8,087) ($9,399) ($10,857) ($16,324) ($17,896)

Net Profit after Tax $12,131 $14,098 $16,286 $24,485 $26,844

Particulars 20X2 20X3 20X4 20X5 20X6

Opening Balance of Retained

Earnings $3,500 $3,780 $4,082 $4,409 $4,762

Net Profit for the period $12,131 $14,098 $16,286 $24,485 $26,844

$15,631 $17,878 $20,368 $28,894 $31,606

Less: Dividends Payable ($7,885) ($9,164) ($10,586) ($15,915) ($17,449)

Closing Balance of Retained

Earnings $3,780 $8,714 $9,782 $12,979 $14,157

Budgeted Income Statement:

Budgeted Statement of Retained Earnings:

Workings:

11MANAGEMENT ACCOUNTING FOR COST & CONTROL

Particulars 20X1 20X2 20X3 20X4 20X5 20X6 20X7

Sales 30000 32400 34992 37791 40000 40000 40000

Add: Closing Stock 3600 5249 5669 6000 6000 6000

37649 40661 43791 46000 46000

Less: Opening Stock 3600 5249 5669 6000 6000

Total Purchase 34049 35412 38123 40000 40000

Units Purchase Cost $5.10 $5.36 $5.68 $6.02 $6.50

Total Purchase Cost $173,649 $189,808 $216,537 $240,800 $260,000

Add: Opening Stock Value $17,640 $26,769 $30,384 $34,080 $36,120

$191,289 $216,577 $246,921 $274,880 $296,120

Less: Closing Stock Value $26,769 $30,384 $34,080 $36,120 $39,000

Total Cost of Goods Sold $164,520 $186,192 $212,841 $238,760 $257,120

Cost of Goods Sold Schedule:

Requirement B:

Preparation of budget within the organization should be aligned with the government

policies and priorities. Controlling the expenditures aggregately along with strategic

allocation of resources is incorporated in the budget. The linkage between the budgetary

policies and expenditures for improving revenue forecasted is exerted by political pressure

(Otley & Emmanuel, 2013).

Particulars 20X1 20X2 20X3 20X4 20X5 20X6 20X7

Sales 30000 32400 34992 37791 40000 40000 40000

Add: Closing Stock 3600 5249 5669 6000 6000 6000

37649 40661 43791 46000 46000

Less: Opening Stock 3600 5249 5669 6000 6000

Total Purchase 34049 35412 38123 40000 40000

Units Purchase Cost $5.10 $5.36 $5.68 $6.02 $6.50

Total Purchase Cost $173,649 $189,808 $216,537 $240,800 $260,000

Add: Opening Stock Value $17,640 $26,769 $30,384 $34,080 $36,120

$191,289 $216,577 $246,921 $274,880 $296,120

Less: Closing Stock Value $26,769 $30,384 $34,080 $36,120 $39,000

Total Cost of Goods Sold $164,520 $186,192 $212,841 $238,760 $257,120

Cost of Goods Sold Schedule:

Requirement B:

Preparation of budget within the organization should be aligned with the government

policies and priorities. Controlling the expenditures aggregately along with strategic

allocation of resources is incorporated in the budget. The linkage between the budgetary

policies and expenditures for improving revenue forecasted is exerted by political pressure

(Otley & Emmanuel, 2013).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.