Management Accounting Report for EverJoy Enterprises (UK)

VerifiedAdded on 2021/01/02

|32

|5866

|208

Report

AI Summary

This report serves as a comprehensive management accounting analysis for EverJoy Enterprises, a UK-based leisure and entertainment company. It delves into the core concepts of management accounting, differentiating it from financial accounting and exploring various cost accounting systems, including direct costs and standard costing. The report examines inventory management systems, job costing systems, and different types of management accounting reports. It also includes a numerical problem-solving section that calculates the break-even point and profit projections for a concert event, offering insights into profitability. Furthermore, the report evaluates the role of budgeting as a planning and problem-solving tool, and assesses the importance of strong financial governance in preventing financial issues, offering recommendations for sustainable success. The report includes references and appendices to support its findings and recommendations, providing valuable information for EverJoy Enterprises.

Management Accounting report for EverJoy

Enterprises

1

Enterprises

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction....................................................................................................................................2

Task – (LO1)..................................................................................................................................3

Management Accounting.............................................................................................................3

a. Differences between Management Accounting and Financial Accounting.............................5

b. Cost accounting systems (Direct Costs and Standard Costing)...............................................7

c. Inventory Management Systems............................................................................................10

d. Job Costing Systems..............................................................................................................12

e. Different types management accounting reports....................................................................14

f. The need for a sound accounting system and the importance of the department producing

timely, accurate and relevant information..................................................................................17

Task 2 – (LO2).............................................................................................................................19

a. The number of tickets that must be sold to break even (i.e. the point at which there is neither

profit nor loss)............................................................................................................................19

b. If we want to make a profit of £30,000.00, how many tickets should be sold?.....................20

c. What profit would result if 8,000 tickets were sold?.............................................................21

Task 3 – (LO3 & 4)......................................................................................................................22

a. You are to evaluate how budgeting can be used by Ever Joy Enterprises as a planning and

problem-solving tool in dealing with financial problems, but also for leading the organization

to sustainable success.................................................................................................................22

b. You are to also evaluate how strong financial governance can help to pre-empt or prevent

financial problems for Ever Joy Enterprises and the means by which management accounting

systems can contribute...............................................................................................................25

Conclusion....................................................................................................................................28

References.....................................................................................................................................29

Appendix.......................................................................................................................................31

2

Introduction....................................................................................................................................2

Task – (LO1)..................................................................................................................................3

Management Accounting.............................................................................................................3

a. Differences between Management Accounting and Financial Accounting.............................5

b. Cost accounting systems (Direct Costs and Standard Costing)...............................................7

c. Inventory Management Systems............................................................................................10

d. Job Costing Systems..............................................................................................................12

e. Different types management accounting reports....................................................................14

f. The need for a sound accounting system and the importance of the department producing

timely, accurate and relevant information..................................................................................17

Task 2 – (LO2).............................................................................................................................19

a. The number of tickets that must be sold to break even (i.e. the point at which there is neither

profit nor loss)............................................................................................................................19

b. If we want to make a profit of £30,000.00, how many tickets should be sold?.....................20

c. What profit would result if 8,000 tickets were sold?.............................................................21

Task 3 – (LO3 & 4)......................................................................................................................22

a. You are to evaluate how budgeting can be used by Ever Joy Enterprises as a planning and

problem-solving tool in dealing with financial problems, but also for leading the organization

to sustainable success.................................................................................................................22

b. You are to also evaluate how strong financial governance can help to pre-empt or prevent

financial problems for Ever Joy Enterprises and the means by which management accounting

systems can contribute...............................................................................................................25

Conclusion....................................................................................................................................28

References.....................................................................................................................................29

Appendix.......................................................................................................................................31

2

Introduction

This report will be prepared to discuss the concept of management accounting and write a

reference manual for Ever Joy Enterprises (UK) that operates in leisure and entertainment

industry in the UK. This report delineates the concept of cost accounting systems, job costing

systems, and Inventory Management systems; differentiate between management accounting and

financial accounting. This report will also solve a numerical problem to help Ever Joy

Enterprises (UK) reviewing its concert event in Manchester region to ascertain its viability by

calculating break-even point (i.e. the point at which there is neither profit nor loss) and other

profitability related requirement. This report will also advise Ever Joy Enterprises (UK) on using

budgeting as a pillar for planning purposes within the organization.

3

This report will be prepared to discuss the concept of management accounting and write a

reference manual for Ever Joy Enterprises (UK) that operates in leisure and entertainment

industry in the UK. This report delineates the concept of cost accounting systems, job costing

systems, and Inventory Management systems; differentiate between management accounting and

financial accounting. This report will also solve a numerical problem to help Ever Joy

Enterprises (UK) reviewing its concert event in Manchester region to ascertain its viability by

calculating break-even point (i.e. the point at which there is neither profit nor loss) and other

profitability related requirement. This report will also advise Ever Joy Enterprises (UK) on using

budgeting as a pillar for planning purposes within the organization.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Task – (LO1)

Management Accounting

Management accounting is the presentation of accounting information in such a way as to assist

management in the formulation of policy and the day-to-day operation of an enterprise. The

management accounting collected the accounting data with the help of financial accounting and

cost accounting for the purpose of policy planning, formulation, decision making and control for

the enterprises. Management accounting is the vital branch of accounting which assists to the

management in the preparation of various reports and strategies for their departments which

enhance their productivity and efficiency. Various management accounting tools and techniques

assist to the enterprises to achieve their goals and objectives on a systematic manner. In other

words, management accounting is an important decision-making tool and technique used

internally by the management. Tools and techniques like cost-volume-profit analysis, variance

analysis, budgeting, break even analysis are some of the prominent tools and techniques used in

the management accounting (Edmonds, et. al., 2016).

Objectives of management accounting

Helps to the management of an enterprises in planning and formulation of policies for future

Helps to the management in an interpretation of financial information

Helps in coordinating operations

Helps in evaluating the efficiency and effectiveness of policies

Helps in controlling performance

Main tools and techniques used in management accounting are listed below:

Cost accounting

Absorption and marginal costing

Fund flow analysis

Cash flow analysis

Standard costing

Budgetary control

4

Management Accounting

Management accounting is the presentation of accounting information in such a way as to assist

management in the formulation of policy and the day-to-day operation of an enterprise. The

management accounting collected the accounting data with the help of financial accounting and

cost accounting for the purpose of policy planning, formulation, decision making and control for

the enterprises. Management accounting is the vital branch of accounting which assists to the

management in the preparation of various reports and strategies for their departments which

enhance their productivity and efficiency. Various management accounting tools and techniques

assist to the enterprises to achieve their goals and objectives on a systematic manner. In other

words, management accounting is an important decision-making tool and technique used

internally by the management. Tools and techniques like cost-volume-profit analysis, variance

analysis, budgeting, break even analysis are some of the prominent tools and techniques used in

the management accounting (Edmonds, et. al., 2016).

Objectives of management accounting

Helps to the management of an enterprises in planning and formulation of policies for future

Helps to the management in an interpretation of financial information

Helps in coordinating operations

Helps in evaluating the efficiency and effectiveness of policies

Helps in controlling performance

Main tools and techniques used in management accounting are listed below:

Cost accounting

Absorption and marginal costing

Fund flow analysis

Cash flow analysis

Standard costing

Budgetary control

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advantages Disadvantages

Increases efficiency of the enterprises Biased interpretation

Simplifies the decision making in

financial statements

Lack of knowledge

Cost transparency Impracticable in nature

Assist in goal completion Preferences depends upon experience and

intuition

Flexibility and freedom Lack of objectivity

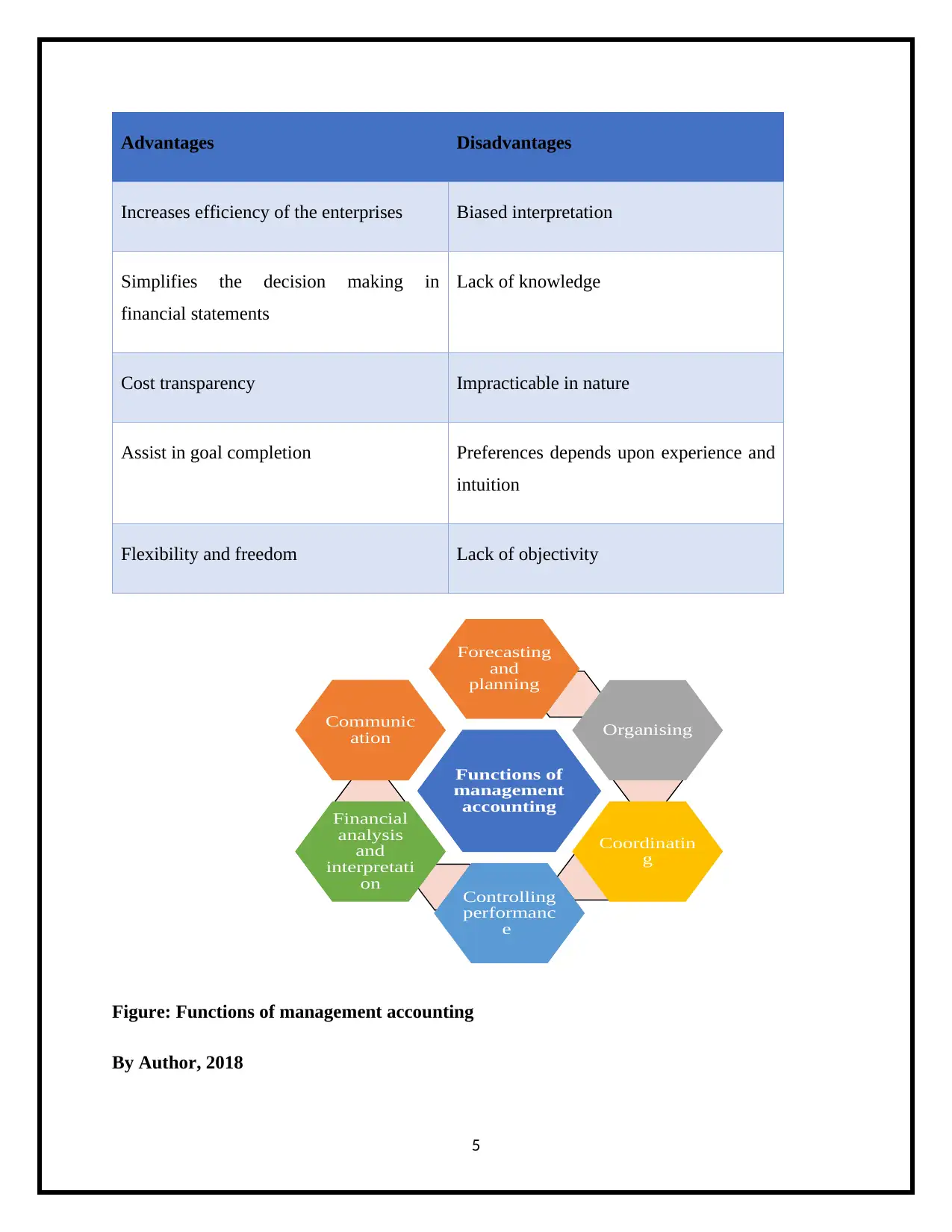

Figure: Functions of management accounting

By Author, 2018

5

Functions of

management

accounting

Forecasting

and

planning

Organising

Coordinatin

g

Controlling

performanc

e

Financial

analysis

and

interpretati

on

Communic

ation

Increases efficiency of the enterprises Biased interpretation

Simplifies the decision making in

financial statements

Lack of knowledge

Cost transparency Impracticable in nature

Assist in goal completion Preferences depends upon experience and

intuition

Flexibility and freedom Lack of objectivity

Figure: Functions of management accounting

By Author, 2018

5

Functions of

management

accounting

Forecasting

and

planning

Organising

Coordinatin

g

Controlling

performanc

e

Financial

analysis

and

interpretati

on

Communic

ation

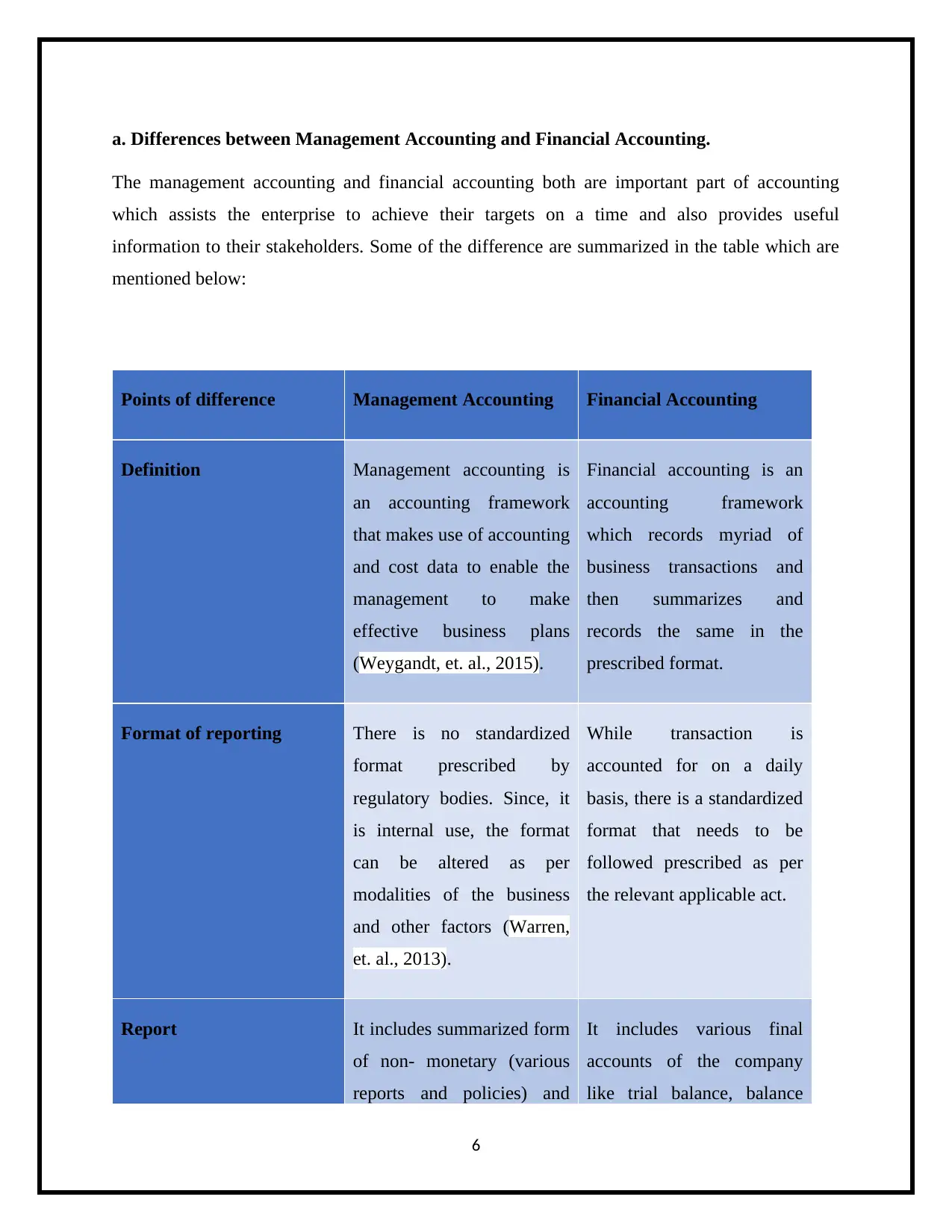

a. Differences between Management Accounting and Financial Accounting.

The management accounting and financial accounting both are important part of accounting

which assists the enterprise to achieve their targets on a time and also provides useful

information to their stakeholders. Some of the difference are summarized in the table which are

mentioned below:

Points of difference Management Accounting Financial Accounting

Definition Management accounting is

an accounting framework

that makes use of accounting

and cost data to enable the

management to make

effective business plans

(Weygandt, et. al., 2015).

Financial accounting is an

accounting framework

which records myriad of

business transactions and

then summarizes and

records the same in the

prescribed format.

Format of reporting There is no standardized

format prescribed by

regulatory bodies. Since, it

is internal use, the format

can be altered as per

modalities of the business

and other factors (Warren,

et. al., 2013).

While transaction is

accounted for on a daily

basis, there is a standardized

format that needs to be

followed prescribed as per

the relevant applicable act.

Report It includes summarized form

of non- monetary (various

reports and policies) and

It includes various final

accounts of the company

like trial balance, balance

6

The management accounting and financial accounting both are important part of accounting

which assists the enterprise to achieve their targets on a time and also provides useful

information to their stakeholders. Some of the difference are summarized in the table which are

mentioned below:

Points of difference Management Accounting Financial Accounting

Definition Management accounting is

an accounting framework

that makes use of accounting

and cost data to enable the

management to make

effective business plans

(Weygandt, et. al., 2015).

Financial accounting is an

accounting framework

which records myriad of

business transactions and

then summarizes and

records the same in the

prescribed format.

Format of reporting There is no standardized

format prescribed by

regulatory bodies. Since, it

is internal use, the format

can be altered as per

modalities of the business

and other factors (Warren,

et. al., 2013).

While transaction is

accounted for on a daily

basis, there is a standardized

format that needs to be

followed prescribed as per

the relevant applicable act.

Report It includes summarized form

of non- monetary (various

reports and policies) and

It includes various final

accounts of the company

like trial balance, balance

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

monetary (balance sheet,

profit and loss) transactions.

sheet, cash flow statement,

trading & profit and loss

account.

Statutory requirement It is the statutory

requirement to get the books

of accounts audited.

There is no such statutory

requirement as the

information is used by the

management.

Purpose The management accounting

is used for internal purpose.

The financial accounting is

used for external purpose.

The above points show some difference in between management accounting and financial

accounting. The management accounting assists to the management in preparation of financial

accounting for the enterprise in every financial year. The management accounting has a wider

scope than the financial accounting. It involves financial accounting and cost accounting which

assists to the management in preparation of plans and policies (Weygandt, et. al., 2015).

7

profit and loss) transactions.

sheet, cash flow statement,

trading & profit and loss

account.

Statutory requirement It is the statutory

requirement to get the books

of accounts audited.

There is no such statutory

requirement as the

information is used by the

management.

Purpose The management accounting

is used for internal purpose.

The financial accounting is

used for external purpose.

The above points show some difference in between management accounting and financial

accounting. The management accounting assists to the management in preparation of financial

accounting for the enterprise in every financial year. The management accounting has a wider

scope than the financial accounting. It involves financial accounting and cost accounting which

assists to the management in preparation of plans and policies (Weygandt, et. al., 2015).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

b. Cost accounting systems (Direct Costs and Standard Costing)

Cost accounting is an accounting mechanism in which all costs incurred are collected, classified

and recorded. Cost accounting helps in allocating cost incurred on producing various products by

segregating it into direct cost, indirect cost and fixed cost. Cost accounting computes the unit

cost of a product which enables to ascertain cost of stock at the end of the year and cost of goods

sold during the year. It analyses the cost structure of the business. Cost accounting helps the

management in determining where a business is gaining or losing money. Cost accounting helps

the management in determining how the business earns and make use of them. It can be used as a

tool to minimize the cost of production by eliminating any unnecessary expenses/losses incurred

while producing a product. It provides necessary cost information for planning, implementing

and controlling. It is instrumental in assessing the profitability of various products which can be

utilized by various banks and financial institutions to provide loans. Ever Joy Enterprises can

integrate the cost accounting system with their organizational processes to reduce the costs and

expenses and also eliminate the wastages in the manufacturing system of the enterprises

(Warren, et. al., 2013).

Figure: Types or Techniques of costing

By Author, 2018

8

Types or

Techniques

of costing

Uniform

costing

Marginal

costing

Standard

costing

Absorption

costing

Direct

costing

Historical

costing

Cost accounting is an accounting mechanism in which all costs incurred are collected, classified

and recorded. Cost accounting helps in allocating cost incurred on producing various products by

segregating it into direct cost, indirect cost and fixed cost. Cost accounting computes the unit

cost of a product which enables to ascertain cost of stock at the end of the year and cost of goods

sold during the year. It analyses the cost structure of the business. Cost accounting helps the

management in determining where a business is gaining or losing money. Cost accounting helps

the management in determining how the business earns and make use of them. It can be used as a

tool to minimize the cost of production by eliminating any unnecessary expenses/losses incurred

while producing a product. It provides necessary cost information for planning, implementing

and controlling. It is instrumental in assessing the profitability of various products which can be

utilized by various banks and financial institutions to provide loans. Ever Joy Enterprises can

integrate the cost accounting system with their organizational processes to reduce the costs and

expenses and also eliminate the wastages in the manufacturing system of the enterprises

(Warren, et. al., 2013).

Figure: Types or Techniques of costing

By Author, 2018

8

Types or

Techniques

of costing

Uniform

costing

Marginal

costing

Standard

costing

Absorption

costing

Direct

costing

Historical

costing

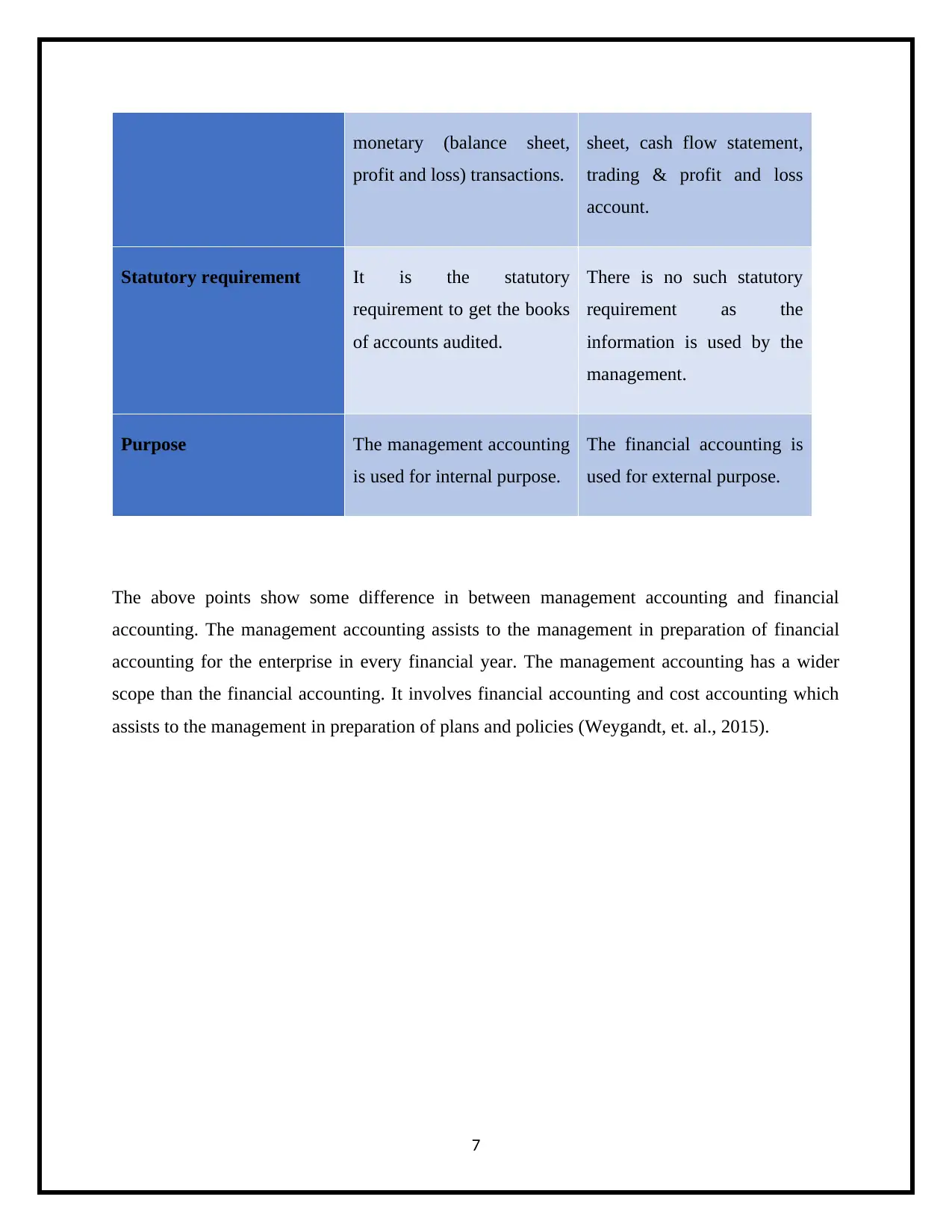

Following are the main types or techniques of costing for ascertaining costs:

Marginal costing: Marginal costing is a costing technique in which the variable cost, i.e.,

marginal cost is charged to units of cost, while the fixed cost for the period is totally written off

against the contribution (Kren, 2018). It can be calculated as:

Marginal cost = Direct Material + Direct Labor + Direct Expenses + Variable Overheads

Figure: Characteristics of Marginal Costing

By Author, 2018

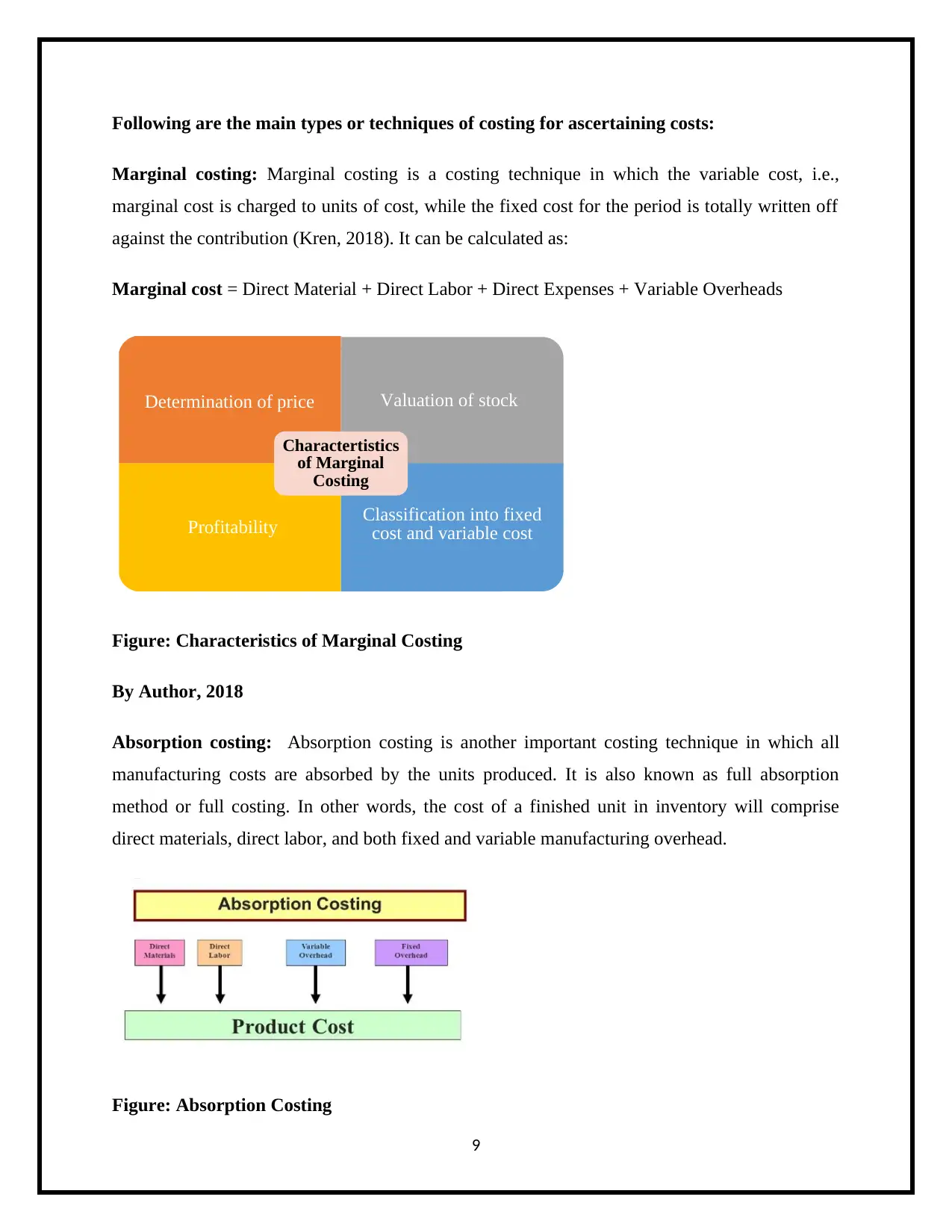

Absorption costing: Absorption costing is another important costing technique in which all

manufacturing costs are absorbed by the units produced. It is also known as full absorption

method or full costing. In other words, the cost of a finished unit in inventory will comprise

direct materials, direct labor, and both fixed and variable manufacturing overhead.

Figure: Absorption Costing

9

Determination of price Valuation of stock

Profitability Classification into fixed

cost and variable cost

Charactertistics

of Marginal

Costing

Marginal costing: Marginal costing is a costing technique in which the variable cost, i.e.,

marginal cost is charged to units of cost, while the fixed cost for the period is totally written off

against the contribution (Kren, 2018). It can be calculated as:

Marginal cost = Direct Material + Direct Labor + Direct Expenses + Variable Overheads

Figure: Characteristics of Marginal Costing

By Author, 2018

Absorption costing: Absorption costing is another important costing technique in which all

manufacturing costs are absorbed by the units produced. It is also known as full absorption

method or full costing. In other words, the cost of a finished unit in inventory will comprise

direct materials, direct labor, and both fixed and variable manufacturing overhead.

Figure: Absorption Costing

9

Determination of price Valuation of stock

Profitability Classification into fixed

cost and variable cost

Charactertistics

of Marginal

Costing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By Author, 2018

Standard costing: Standard costing is a technique of costing in which manufacturers or

producers use it to identify the variances or differences in between the costs that should occurred

for those goods and the actual costs of the goods that were manufactured.

Figure: Standard costs

By Author, 2018

Uniform costing: Uniform costing is the usage of the same costing and accounting principles

and standards or methods uniformly by various undertakings in the same industry. In this costing

the cost statements and reports are prepared on a uniform basis and the period of accounting is

common for all units’ member.

Direct costing: Direct costing is a specialized form of cost analysis that uses variable costs only

to make decisions. This costing does not consider fixed costs and useful in short- term decisions

making in the company. Direct costing is not useful in long- term decision making because it not

considered all costs which are necessary in long- term decision making.

Historical costing: Historical costing is ascertainment of costs after they have been incurred.

This costing considered past work done by the manufacturing undertakings and comparisons

done by using past data of the enterprises (Kren, 2018).

10

Standard costing: Standard costing is a technique of costing in which manufacturers or

producers use it to identify the variances or differences in between the costs that should occurred

for those goods and the actual costs of the goods that were manufactured.

Figure: Standard costs

By Author, 2018

Uniform costing: Uniform costing is the usage of the same costing and accounting principles

and standards or methods uniformly by various undertakings in the same industry. In this costing

the cost statements and reports are prepared on a uniform basis and the period of accounting is

common for all units’ member.

Direct costing: Direct costing is a specialized form of cost analysis that uses variable costs only

to make decisions. This costing does not consider fixed costs and useful in short- term decisions

making in the company. Direct costing is not useful in long- term decision making because it not

considered all costs which are necessary in long- term decision making.

Historical costing: Historical costing is ascertainment of costs after they have been incurred.

This costing considered past work done by the manufacturing undertakings and comparisons

done by using past data of the enterprises (Kren, 2018).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

c. Inventory Management Systems

Inventory management system is a mechanism through which a business can track all the moving

parts of its operations. This covers everything from production of a product to retail stores and

from warehouse to shipping the product, all the movements of stock are traded in the inventory

management system. In this process system finished goods and work in progress are

systematically managed so that optimal use of available resources can be made. Ever Joy

Enterprises can integrate its system with inventory management system in which enterprises can

use technology to track the inventory level in its business operations (Goddard and Simm, 2017).

Figure: Inventory Management

By Author, 2018

11

Inventory

Managem

ent

Product

Inventory

Product

Purchase

Products

Sales

Product

Inventory

ATP &

CTP

Suppliers

Manager

Accounting

Manager

Inventory

Status

Reports

Inventory management system is a mechanism through which a business can track all the moving

parts of its operations. This covers everything from production of a product to retail stores and

from warehouse to shipping the product, all the movements of stock are traded in the inventory

management system. In this process system finished goods and work in progress are

systematically managed so that optimal use of available resources can be made. Ever Joy

Enterprises can integrate its system with inventory management system in which enterprises can

use technology to track the inventory level in its business operations (Goddard and Simm, 2017).

Figure: Inventory Management

By Author, 2018

11

Inventory

Managem

ent

Product

Inventory

Product

Purchase

Products

Sales

Product

Inventory

ATP &

CTP

Suppliers

Manager

Accounting

Manager

Inventory

Status

Reports

Benefits of inventory management systems to the Ever Joy Enterprises are listed below:

It minimized cost of labor and other expenses

Reduced dead stock problems in the enterprises

Transparency improved in the whole system

It minimized costs of handling or storage

Enhanced partner relationship, vendor and supplier

There are three types of inventory: work-in-progress, finished goods and raw materials. The

enterprises can use inventory control models like ABC (Activity Based Costing), EOQ

(Economic Order Quantity), and JIT (Just in time) model to maximize the profits and minimize

the inventory expenses. The Ever Joy Enterprises can use this model of inventory to eliminate

the wastages and enhance their productivity in entire manufacturing system. Inventory

accounting method include FIFO (First in, first out), LIFO (Last in, first out) and other methods

can be used by the enterprises to calculate the level of inventory in the manufacturing system

(Kren, 2018).

Inventory management also means sustaining the efficient and effective internal controls over

stock or inventory which includes safeguarding the inventory from theft and damage, to track

inventory movement in the system by using a purchase orders, frequently comparing physical

inventory counts with amounts recorded, and maintaining an inventory ledger. The effective

inventory management system assists to the Ever Joy Enterprises to track the record of level of

inventory in their business operations and helpful to the enterprises to reduce the expenditures

which is related to the stock and dead stock in the manufacturing system (Warren, et. al., 2013).

12

It minimized cost of labor and other expenses

Reduced dead stock problems in the enterprises

Transparency improved in the whole system

It minimized costs of handling or storage

Enhanced partner relationship, vendor and supplier

There are three types of inventory: work-in-progress, finished goods and raw materials. The

enterprises can use inventory control models like ABC (Activity Based Costing), EOQ

(Economic Order Quantity), and JIT (Just in time) model to maximize the profits and minimize

the inventory expenses. The Ever Joy Enterprises can use this model of inventory to eliminate

the wastages and enhance their productivity in entire manufacturing system. Inventory

accounting method include FIFO (First in, first out), LIFO (Last in, first out) and other methods

can be used by the enterprises to calculate the level of inventory in the manufacturing system

(Kren, 2018).

Inventory management also means sustaining the efficient and effective internal controls over

stock or inventory which includes safeguarding the inventory from theft and damage, to track

inventory movement in the system by using a purchase orders, frequently comparing physical

inventory counts with amounts recorded, and maintaining an inventory ledger. The effective

inventory management system assists to the Ever Joy Enterprises to track the record of level of

inventory in their business operations and helpful to the enterprises to reduce the expenditures

which is related to the stock and dead stock in the manufacturing system (Warren, et. al., 2013).

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 32

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.