HND Business: Management Accounting Report, Ever Joy Enterprises (UK)

VerifiedAdded on 2020/12/10

|23

|5593

|325

Report

AI Summary

This report analyzes management accounting principles and their application to Ever Joy Enterprises (UK), a leisure and entertainment company. It begins by differentiating management accounting from financial accounting, then explores various cost accounting systems, including direct and standard costing, along with inventory management and job costing systems. The report also covers different types of management accounting reports and the importance of a sound accounting system. Furthermore, the report performs a break-even analysis to determine the number of tickets Ever Joy must sell to break even and achieve a profit target. It also evaluates the role of budgeting as a planning and problem-solving tool for the company's financial challenges and long-term success. The report provides recommendations for optimizing the company's financial performance and decision-making processes.

Management Accounting report for Ever

Joy Enterprises (UK)

1

Joy Enterprises (UK)

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction............................................................................................................................................................... 3

Task 1............................................................................................................................................................................ 3

Management Accounting systems............................................................................................................... 3

a. Differences between Management Accounting and Financial Accounting...........................5

b. Cost accounting systems (Direct Costs and Standard Costing)..................................................7

c. Inventory Management Systems..............................................................................................................7

d. Job costing systems........................................................................................................................................ 8

e. Different types management accounting reports............................................................................9

f. The need for a sound accounting system and the importance of the department

producing timely, accurate and relevant information.....................................................................10

Task 2......................................................................................................................................................................... 11

a. The number of tickets that must be sold to break even (i.e. the point at which there is

neither profit nor loss)...................................................................................................................................11

b. If we want to make a profit of £30,000.00, how many tickets should be sold? ..............12

c. What profit would result if 8,000 tickets were sold? ..................................................................13

Task 3......................................................................................................................................................................... 14

a. You are to evaluate how budgeting can be used by Ever Joy Enterprises as a planning

and problem-solving tool in dealing with financial problems, but also for leading the

organization to sustainable success.........................................................................................................14

Conclusion................................................................................................................................................................ 20

References................................................................................................................................................................ 21

2

Introduction............................................................................................................................................................... 3

Task 1............................................................................................................................................................................ 3

Management Accounting systems............................................................................................................... 3

a. Differences between Management Accounting and Financial Accounting...........................5

b. Cost accounting systems (Direct Costs and Standard Costing)..................................................7

c. Inventory Management Systems..............................................................................................................7

d. Job costing systems........................................................................................................................................ 8

e. Different types management accounting reports............................................................................9

f. The need for a sound accounting system and the importance of the department

producing timely, accurate and relevant information.....................................................................10

Task 2......................................................................................................................................................................... 11

a. The number of tickets that must be sold to break even (i.e. the point at which there is

neither profit nor loss)...................................................................................................................................11

b. If we want to make a profit of £30,000.00, how many tickets should be sold? ..............12

c. What profit would result if 8,000 tickets were sold? ..................................................................13

Task 3......................................................................................................................................................................... 14

a. You are to evaluate how budgeting can be used by Ever Joy Enterprises as a planning

and problem-solving tool in dealing with financial problems, but also for leading the

organization to sustainable success.........................................................................................................14

Conclusion................................................................................................................................................................ 20

References................................................................................................................................................................ 21

2

Introduction

Management accounting is an integral part of the enterprises which helps them to achieve their

goals and objectives in an effective and efficient manner. This report will be prepared to reflect

and discuss the concept of managerial or management accounting and write a reference in the

context for EVER JOY ENTERPRISES (UK) that operates its business operations in leisure

and entertainment industry in the UK. This report defines the concept of job costing systems,

cost accounting systems and inventory management systems and its usage in the enterprises.

This report will also solve the given problems to assist the Ever Joy Enterprise reviewing its

performance in Manchester region to determine its feasibility by using the break-event point

formula and which present the profits and BEP at which enterprises in the position of no profit

and no loss. This report also gives suitable advice to Ever Joy Enterprises on utilizing the

budgets as planning and problem-solving tools which solve the financial problems of the

enterprises.

Task 1

Management Accounting systems

Management Accounting is the accounting branch which basically deals with providing and

presenting accounting information to the manager in such an organized manner so that it can do

its managerial functions of planning, controlling and decision- making in an efficient and

effective manner. Management accounting acts as a decision-making support system to the

manager of an enterprises (Kaplan and Atkinson, 2015).

As per Certified Institute of Management Accountants (CIMA), United Kingdom,

“Management Accounting is an essential part of the company’s management concerned with

classifying, offering, and understanding information which is utilized for framing planning,

strategy and monitoring and governing activities or events, decision- making, optimal usage of

resources of an enterprise, disclosure to stakeholders and other external to the enterprises,

disclosure to workers or employees and assets safeguarding.

Objectives of Management Accounting

3

Management accounting is an integral part of the enterprises which helps them to achieve their

goals and objectives in an effective and efficient manner. This report will be prepared to reflect

and discuss the concept of managerial or management accounting and write a reference in the

context for EVER JOY ENTERPRISES (UK) that operates its business operations in leisure

and entertainment industry in the UK. This report defines the concept of job costing systems,

cost accounting systems and inventory management systems and its usage in the enterprises.

This report will also solve the given problems to assist the Ever Joy Enterprise reviewing its

performance in Manchester region to determine its feasibility by using the break-event point

formula and which present the profits and BEP at which enterprises in the position of no profit

and no loss. This report also gives suitable advice to Ever Joy Enterprises on utilizing the

budgets as planning and problem-solving tools which solve the financial problems of the

enterprises.

Task 1

Management Accounting systems

Management Accounting is the accounting branch which basically deals with providing and

presenting accounting information to the manager in such an organized manner so that it can do

its managerial functions of planning, controlling and decision- making in an efficient and

effective manner. Management accounting acts as a decision-making support system to the

manager of an enterprises (Kaplan and Atkinson, 2015).

As per Certified Institute of Management Accountants (CIMA), United Kingdom,

“Management Accounting is an essential part of the company’s management concerned with

classifying, offering, and understanding information which is utilized for framing planning,

strategy and monitoring and governing activities or events, decision- making, optimal usage of

resources of an enterprise, disclosure to stakeholders and other external to the enterprises,

disclosure to workers or employees and assets safeguarding.

Objectives of Management Accounting

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main objective of management accounting is to offer important information to the

management for an efficient and effective execution of managerial functions. Various

objectives of management accounting are enumerated as follows:

1. Planning and policy- making: Management Accounting provides or offers important and

accurate information to the management in the process of its policy- making and planning to

attain goals and objectives.

2. Controlling: Management: Accounting applies various essential techniques or methods

such as Budgetary control, Management Audit, Standard Costing, and Responsibility

Accounting to ensure an effective management control over the resources use of the enterprise.

3. Communicating: Appropriate communication of the performance of many departments of

an enterprise to different administration levels is necessary required for planning, decision-

making and controlling.

4. Analysis and interpretation of financial statements: Management Accounting gathers,

analyses and understands the important data from the results shown by the cost and financial

accounting system, and also offers important and appropriate information to the management in

a useful and systematic manner.

5. Decision- making: Management accounting offers important and accurate information to the

management in the process of its decision- making. The growth and success of management

highly and mostly depends upon a perfect decision- making.

6. Tax planning: Management accounting assists to the management in the process of tax

planning by availing various tax rebates and reliefs and, thus, minimizes the tax burden of the

enterprise on the whole.

Role and functions of Management Accounting

Management accounting plays very critical role in managing the operations of the

business. As specified management accounting is the key in any organisation which have the

4

management for an efficient and effective execution of managerial functions. Various

objectives of management accounting are enumerated as follows:

1. Planning and policy- making: Management Accounting provides or offers important and

accurate information to the management in the process of its policy- making and planning to

attain goals and objectives.

2. Controlling: Management: Accounting applies various essential techniques or methods

such as Budgetary control, Management Audit, Standard Costing, and Responsibility

Accounting to ensure an effective management control over the resources use of the enterprise.

3. Communicating: Appropriate communication of the performance of many departments of

an enterprise to different administration levels is necessary required for planning, decision-

making and controlling.

4. Analysis and interpretation of financial statements: Management Accounting gathers,

analyses and understands the important data from the results shown by the cost and financial

accounting system, and also offers important and appropriate information to the management in

a useful and systematic manner.

5. Decision- making: Management accounting offers important and accurate information to the

management in the process of its decision- making. The growth and success of management

highly and mostly depends upon a perfect decision- making.

6. Tax planning: Management accounting assists to the management in the process of tax

planning by availing various tax rebates and reliefs and, thus, minimizes the tax burden of the

enterprise on the whole.

Role and functions of Management Accounting

Management accounting plays very critical role in managing the operations of the

business. As specified management accounting is the key in any organisation which have the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

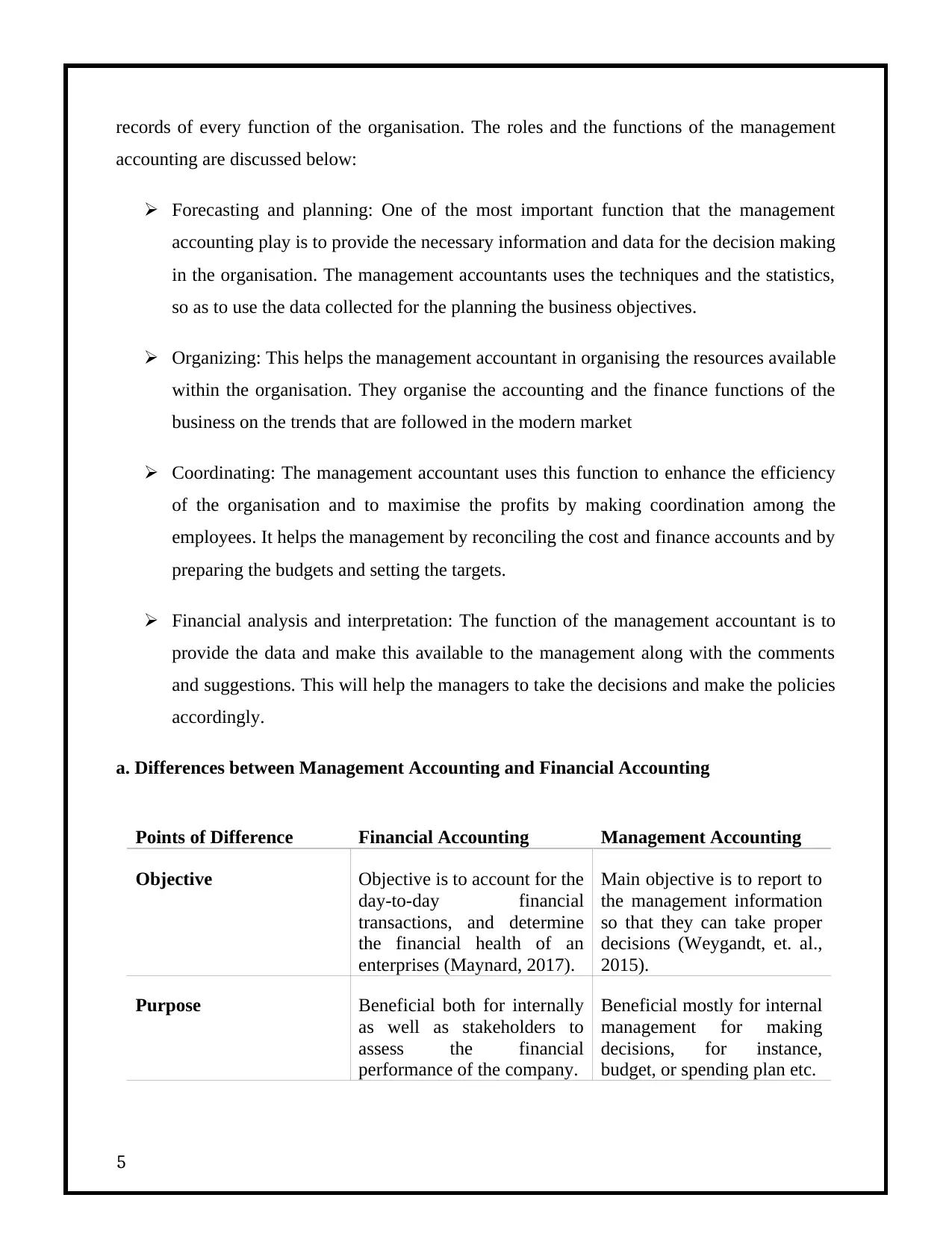

records of every function of the organisation. The roles and the functions of the management

accounting are discussed below:

Forecasting and planning: One of the most important function that the management

accounting play is to provide the necessary information and data for the decision making

in the organisation. The management accountants uses the techniques and the statistics,

so as to use the data collected for the planning the business objectives.

Organizing: This helps the management accountant in organising the resources available

within the organisation. They organise the accounting and the finance functions of the

business on the trends that are followed in the modern market

Coordinating: The management accountant uses this function to enhance the efficiency

of the organisation and to maximise the profits by making coordination among the

employees. It helps the management by reconciling the cost and finance accounts and by

preparing the budgets and setting the targets.

Financial analysis and interpretation: The function of the management accountant is to

provide the data and make this available to the management along with the comments

and suggestions. This will help the managers to take the decisions and make the policies

accordingly.

a. Differences between Management Accounting and Financial Accounting

Points of Difference Financial Accounting Management Accounting

Objective Objective is to account for the

day-to-day financial

transactions, and determine

the financial health of an

enterprises (Maynard, 2017).

Main objective is to report to

the management information

so that they can take proper

decisions (Weygandt, et. al.,

2015).

Purpose Beneficial both for internally

as well as stakeholders to

assess the financial

performance of the company.

Beneficial mostly for internal

management for making

decisions, for instance,

budget, or spending plan etc.

5

accounting are discussed below:

Forecasting and planning: One of the most important function that the management

accounting play is to provide the necessary information and data for the decision making

in the organisation. The management accountants uses the techniques and the statistics,

so as to use the data collected for the planning the business objectives.

Organizing: This helps the management accountant in organising the resources available

within the organisation. They organise the accounting and the finance functions of the

business on the trends that are followed in the modern market

Coordinating: The management accountant uses this function to enhance the efficiency

of the organisation and to maximise the profits by making coordination among the

employees. It helps the management by reconciling the cost and finance accounts and by

preparing the budgets and setting the targets.

Financial analysis and interpretation: The function of the management accountant is to

provide the data and make this available to the management along with the comments

and suggestions. This will help the managers to take the decisions and make the policies

accordingly.

a. Differences between Management Accounting and Financial Accounting

Points of Difference Financial Accounting Management Accounting

Objective Objective is to account for the

day-to-day financial

transactions, and determine

the financial health of an

enterprises (Maynard, 2017).

Main objective is to report to

the management information

so that they can take proper

decisions (Weygandt, et. al.,

2015).

Purpose Beneficial both for internally

as well as stakeholders to

assess the financial

performance of the company.

Beneficial mostly for internal

management for making

decisions, for instance,

budget, or spending plan etc.

5

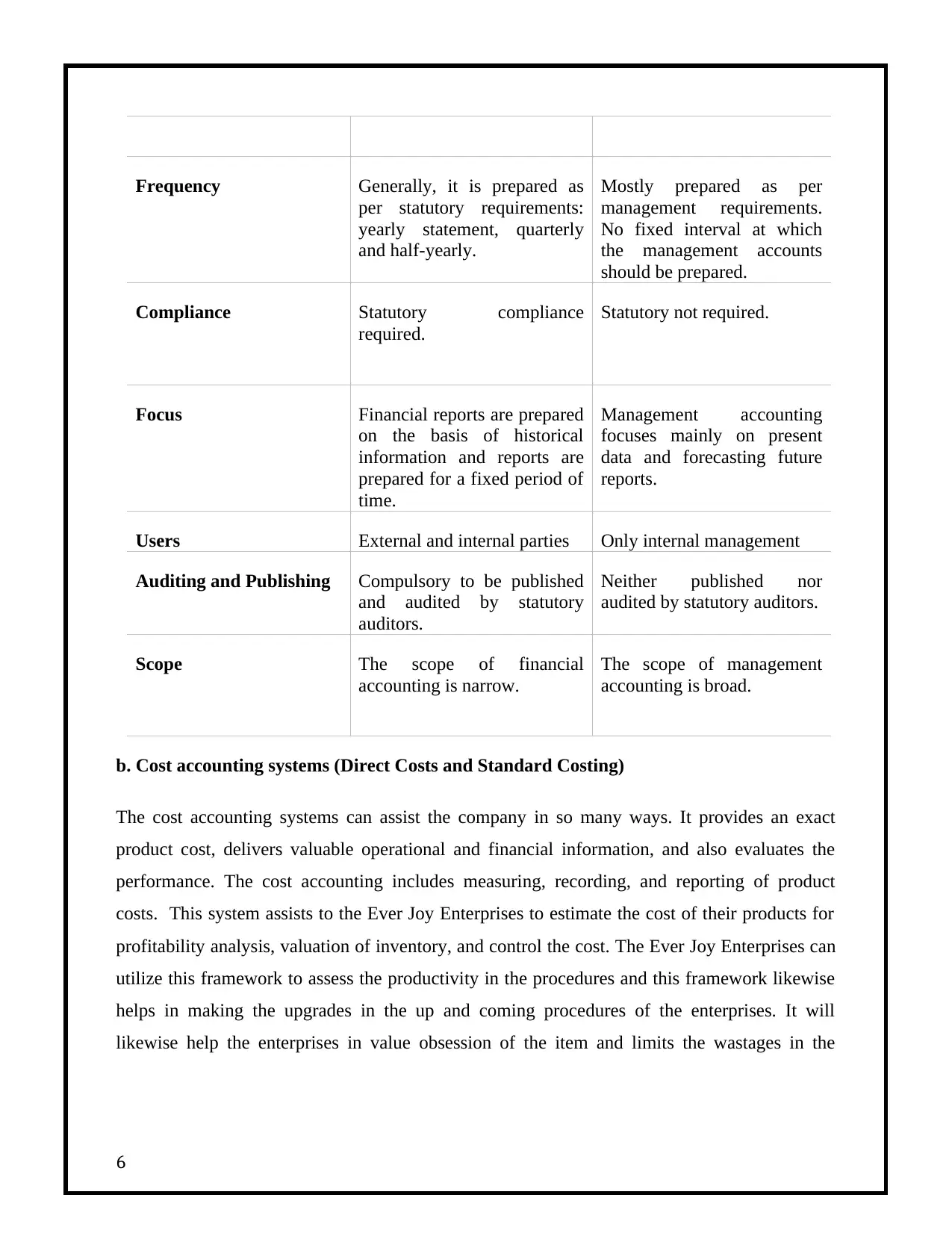

Frequency Generally, it is prepared as

per statutory requirements:

yearly statement, quarterly

and half-yearly.

Mostly prepared as per

management requirements.

No fixed interval at which

the management accounts

should be prepared.

Compliance Statutory compliance

required.

Statutory not required.

Focus Financial reports are prepared

on the basis of historical

information and reports are

prepared for a fixed period of

time.

Management accounting

focuses mainly on present

data and forecasting future

reports.

Users External and internal parties Only internal management

Auditing and Publishing Compulsory to be published

and audited by statutory

auditors.

Neither published nor

audited by statutory auditors.

Scope The scope of financial

accounting is narrow.

The scope of management

accounting is broad.

b. Cost accounting systems (Direct Costs and Standard Costing)

The cost accounting systems can assist the company in so many ways. It provides an exact

product cost, delivers valuable operational and financial information, and also evaluates the

performance. The cost accounting includes measuring, recording, and reporting of product

costs. This system assists to the Ever Joy Enterprises to estimate the cost of their products for

profitability analysis, valuation of inventory, and control the cost. The Ever Joy Enterprises can

utilize this framework to assess the productivity in the procedures and this framework likewise

helps in making the upgrades in the up and coming procedures of the enterprises. It will

likewise help the enterprises in value obsession of the item and limits the wastages in the

6

per statutory requirements:

yearly statement, quarterly

and half-yearly.

Mostly prepared as per

management requirements.

No fixed interval at which

the management accounts

should be prepared.

Compliance Statutory compliance

required.

Statutory not required.

Focus Financial reports are prepared

on the basis of historical

information and reports are

prepared for a fixed period of

time.

Management accounting

focuses mainly on present

data and forecasting future

reports.

Users External and internal parties Only internal management

Auditing and Publishing Compulsory to be published

and audited by statutory

auditors.

Neither published nor

audited by statutory auditors.

Scope The scope of financial

accounting is narrow.

The scope of management

accounting is broad.

b. Cost accounting systems (Direct Costs and Standard Costing)

The cost accounting systems can assist the company in so many ways. It provides an exact

product cost, delivers valuable operational and financial information, and also evaluates the

performance. The cost accounting includes measuring, recording, and reporting of product

costs. This system assists to the Ever Joy Enterprises to estimate the cost of their products for

profitability analysis, valuation of inventory, and control the cost. The Ever Joy Enterprises can

utilize this framework to assess the productivity in the procedures and this framework likewise

helps in making the upgrades in the up and coming procedures of the enterprises. It will

likewise help the enterprises in value obsession of the item and limits the wastages in the

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

assembling procedure (DRURY, 2013). It additionally gives helpful data to the administration

bookkeeper for the further arranging of the items.

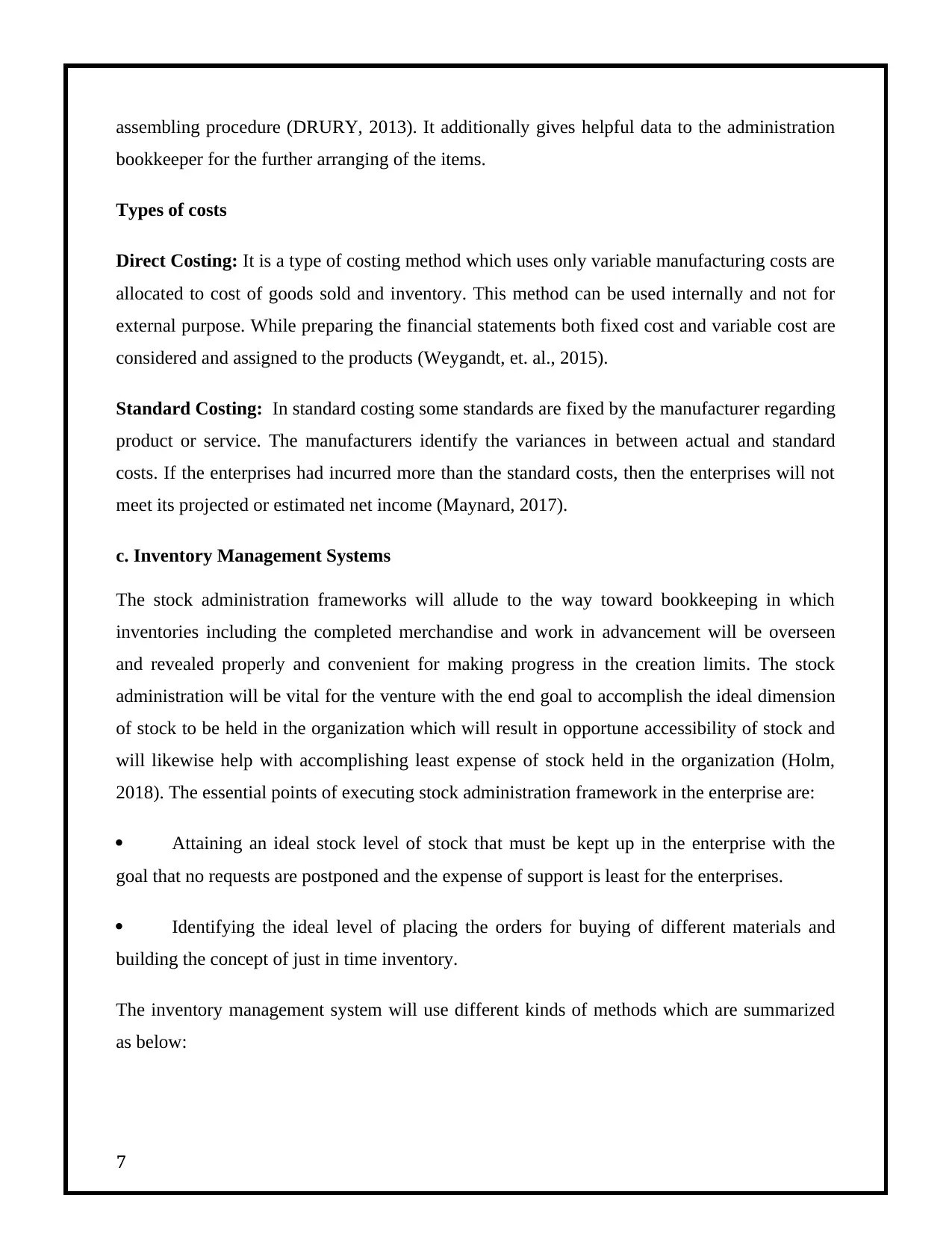

Types of costs

Direct Costing: It is a type of costing method which uses only variable manufacturing costs are

allocated to cost of goods sold and inventory. This method can be used internally and not for

external purpose. While preparing the financial statements both fixed cost and variable cost are

considered and assigned to the products (Weygandt, et. al., 2015).

Standard Costing: In standard costing some standards are fixed by the manufacturer regarding

product or service. The manufacturers identify the variances in between actual and standard

costs. If the enterprises had incurred more than the standard costs, then the enterprises will not

meet its projected or estimated net income (Maynard, 2017).

c. Inventory Management Systems

The stock administration frameworks will allude to the way toward bookkeeping in which

inventories including the completed merchandise and work in advancement will be overseen

and revealed properly and convenient for making progress in the creation limits. The stock

administration will be vital for the venture with the end goal to accomplish the ideal dimension

of stock to be held in the organization which will result in opportune accessibility of stock and

will likewise help with accomplishing least expense of stock held in the organization (Holm,

2018). The essential points of executing stock administration framework in the enterprise are:

Attaining an ideal stock level of stock that must be kept up in the enterprise with the

goal that no requests are postponed and the expense of support is least for the enterprises.

Identifying the ideal level of placing the orders for buying of different materials and

building the concept of just in time inventory.

The inventory management system will use different kinds of methods which are summarized

as below:

7

bookkeeper for the further arranging of the items.

Types of costs

Direct Costing: It is a type of costing method which uses only variable manufacturing costs are

allocated to cost of goods sold and inventory. This method can be used internally and not for

external purpose. While preparing the financial statements both fixed cost and variable cost are

considered and assigned to the products (Weygandt, et. al., 2015).

Standard Costing: In standard costing some standards are fixed by the manufacturer regarding

product or service. The manufacturers identify the variances in between actual and standard

costs. If the enterprises had incurred more than the standard costs, then the enterprises will not

meet its projected or estimated net income (Maynard, 2017).

c. Inventory Management Systems

The stock administration frameworks will allude to the way toward bookkeeping in which

inventories including the completed merchandise and work in advancement will be overseen

and revealed properly and convenient for making progress in the creation limits. The stock

administration will be vital for the venture with the end goal to accomplish the ideal dimension

of stock to be held in the organization which will result in opportune accessibility of stock and

will likewise help with accomplishing least expense of stock held in the organization (Holm,

2018). The essential points of executing stock administration framework in the enterprise are:

Attaining an ideal stock level of stock that must be kept up in the enterprise with the

goal that no requests are postponed and the expense of support is least for the enterprises.

Identifying the ideal level of placing the orders for buying of different materials and

building the concept of just in time inventory.

The inventory management system will use different kinds of methods which are summarized

as below:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

First in first out method: This is the method used by the organisation in which the

inventory that has came first is sold out first. This method is useful for the organisation that has

high ratio of turnover and the products are not durable. This will help the organisation in

maintaining the products expiry and removing the old stock first.

Last in first out method: In this method the stock that has came last in the store is sold

out first. This type of method is used in the industries which uses the market trends to sell their

product. As the organisation has to sell the products as per the current demand of the customers.

This will help the organisation in maintaining the stock and selling the products with the current

price trends.

d. Job costing systems

Job costing systems is a system for assigning the production or manufacturing costs to a specific

batches or products. Basically, this costing system is utilized only when the products produced

are different from each other. Job costing includes the accumulation materials, labor and

overhead costs for a particular job. For instance, a job costing is useful in the designing a

software program, manufacturing a small batch of products, constructing a custom machine

(DRURY, 2013). This costing system will help the Ever joy company in defining the prices of

the products of the company in useful manner. As the company is dealing in service sector so it

will help them to specify the cost of the task in the proper and efficient manner. The company

would be able to know the specific cost of the service and will be able to determine the price of

the different services that it provides.

In a job costing it includes the following activities which are listed below:

Materials

Labor

Overhead

Job costing assists to the Ever Joy Enterprises by providing useful information regarding

particular job in an accurate manner. The management easily accumulated the price of job and

8

inventory that has came first is sold out first. This method is useful for the organisation that has

high ratio of turnover and the products are not durable. This will help the organisation in

maintaining the products expiry and removing the old stock first.

Last in first out method: In this method the stock that has came last in the store is sold

out first. This type of method is used in the industries which uses the market trends to sell their

product. As the organisation has to sell the products as per the current demand of the customers.

This will help the organisation in maintaining the stock and selling the products with the current

price trends.

d. Job costing systems

Job costing systems is a system for assigning the production or manufacturing costs to a specific

batches or products. Basically, this costing system is utilized only when the products produced

are different from each other. Job costing includes the accumulation materials, labor and

overhead costs for a particular job. For instance, a job costing is useful in the designing a

software program, manufacturing a small batch of products, constructing a custom machine

(DRURY, 2013). This costing system will help the Ever joy company in defining the prices of

the products of the company in useful manner. As the company is dealing in service sector so it

will help them to specify the cost of the task in the proper and efficient manner. The company

would be able to know the specific cost of the service and will be able to determine the price of

the different services that it provides.

In a job costing it includes the following activities which are listed below:

Materials

Labor

Overhead

Job costing assists to the Ever Joy Enterprises by providing useful information regarding

particular job in an accurate manner. The management easily accumulated the price of job and

8

estimated how much cost involved in this job. The whole data are stored in the database of the

company which provides relevant information to the management and its customers.

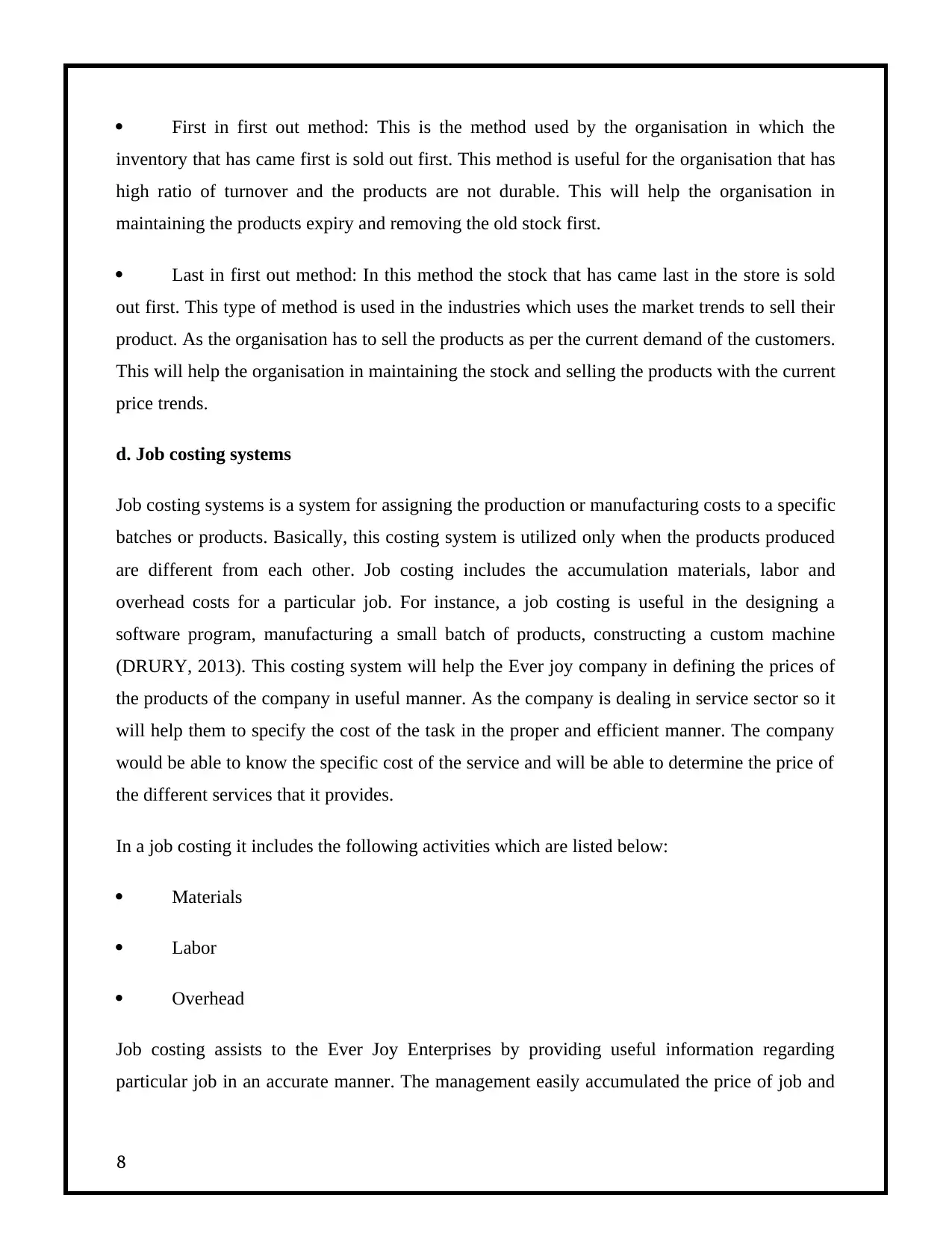

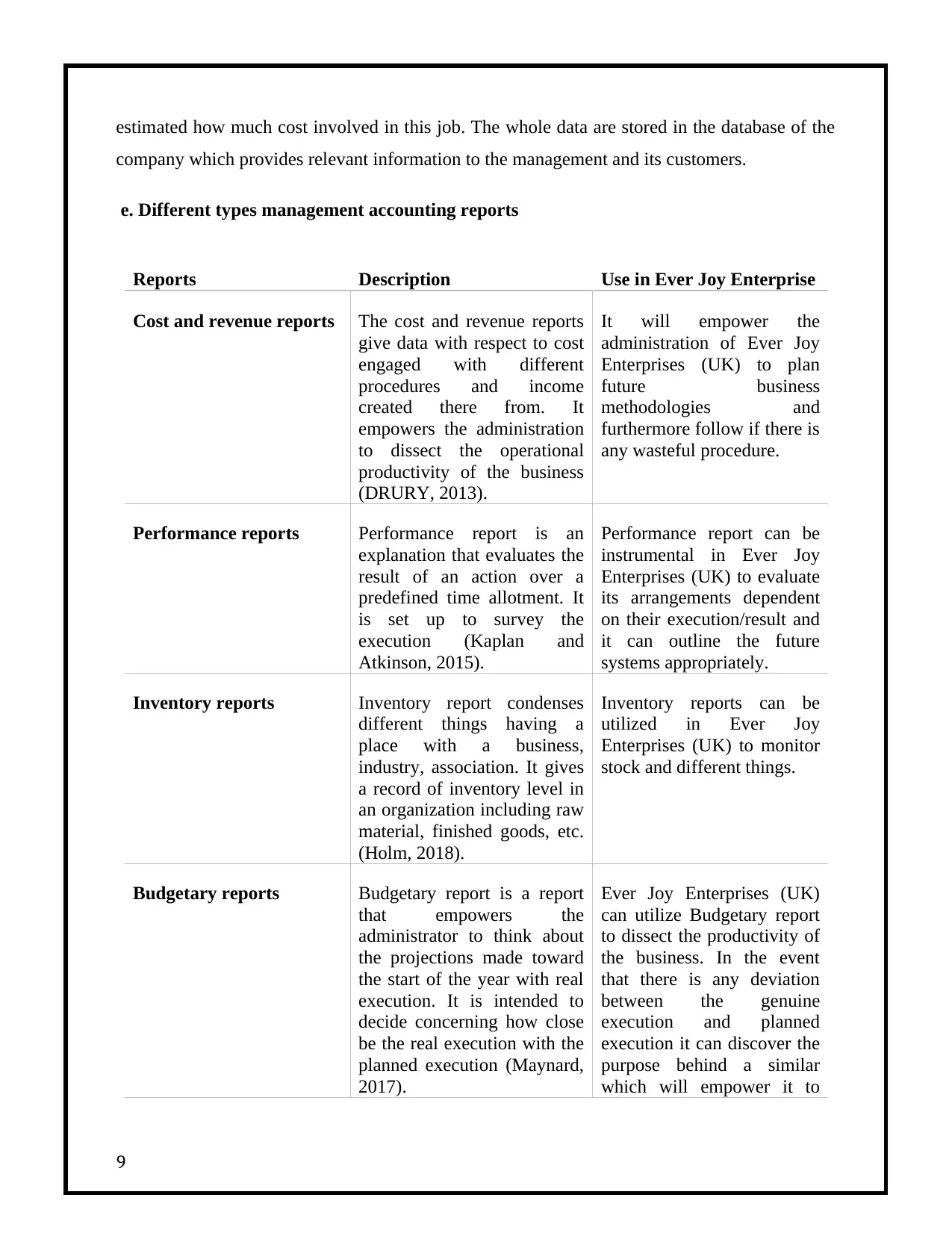

e. Different types management accounting reports

Reports Description Use in Ever Joy Enterprise

Cost and revenue reports The cost and revenue reports

give data with respect to cost

engaged with different

procedures and income

created there from. It

empowers the administration

to dissect the operational

productivity of the business

(DRURY, 2013).

It will empower the

administration of Ever Joy

Enterprises (UK) to plan

future business

methodologies and

furthermore follow if there is

any wasteful procedure.

Performance reports Performance report is an

explanation that evaluates the

result of an action over a

predefined time allotment. It

is set up to survey the

execution (Kaplan and

Atkinson, 2015).

Performance report can be

instrumental in Ever Joy

Enterprises (UK) to evaluate

its arrangements dependent

on their execution/result and

it can outline the future

systems appropriately.

Inventory reports Inventory report condenses

different things having a

place with a business,

industry, association. It gives

a record of inventory level in

an organization including raw

material, finished goods, etc.

(Holm, 2018).

Inventory reports can be

utilized in Ever Joy

Enterprises (UK) to monitor

stock and different things.

Budgetary reports Budgetary report is a report

that empowers the

administrator to think about

the projections made toward

the start of the year with real

execution. It is intended to

decide concerning how close

be the real execution with the

planned execution (Maynard,

2017).

Ever Joy Enterprises (UK)

can utilize Budgetary report

to dissect the productivity of

the business. In the event

that there is any deviation

between the genuine

execution and planned

execution it can discover the

purpose behind a similar

which will empower it to

9

company which provides relevant information to the management and its customers.

e. Different types management accounting reports

Reports Description Use in Ever Joy Enterprise

Cost and revenue reports The cost and revenue reports

give data with respect to cost

engaged with different

procedures and income

created there from. It

empowers the administration

to dissect the operational

productivity of the business

(DRURY, 2013).

It will empower the

administration of Ever Joy

Enterprises (UK) to plan

future business

methodologies and

furthermore follow if there is

any wasteful procedure.

Performance reports Performance report is an

explanation that evaluates the

result of an action over a

predefined time allotment. It

is set up to survey the

execution (Kaplan and

Atkinson, 2015).

Performance report can be

instrumental in Ever Joy

Enterprises (UK) to evaluate

its arrangements dependent

on their execution/result and

it can outline the future

systems appropriately.

Inventory reports Inventory report condenses

different things having a

place with a business,

industry, association. It gives

a record of inventory level in

an organization including raw

material, finished goods, etc.

(Holm, 2018).

Inventory reports can be

utilized in Ever Joy

Enterprises (UK) to monitor

stock and different things.

Budgetary reports Budgetary report is a report

that empowers the

administrator to think about

the projections made toward

the start of the year with real

execution. It is intended to

decide concerning how close

be the real execution with the

planned execution (Maynard,

2017).

Ever Joy Enterprises (UK)

can utilize Budgetary report

to dissect the productivity of

the business. In the event

that there is any deviation

between the genuine

execution and planned

execution it can discover the

purpose behind a similar

which will empower it to

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

frame better business

methodologies in future.

f. The need for a sound accounting system and the importance of the department

producing timely, accurate and relevant information.

A sound accounting system is a precise method for gathering and recording of the monetary

exchanges with the goal that it can empower every one of the partners to survey the execution

of the enterprise. Bookkeeping should be possible either physically or through mechanized

projects. However, a sound accounting system enhance the profits and efficiency of the

enterprise and also enhances the goodwill or reputation of the enterprises (Vanderbeck, 2012).

Following are benefits of a sound accounting system which are discussed as below:

Assists in decision making: A sound bookkeeping framework helps the administration to settle

on better choices for the business. Since the data given by the bookkeeping framework is

precise so it empowers the administration to painstakingly evaluate and examine every single

viewpoint and shape the future systems likewise.

Compatibility: It gives a system to the business to effectively share money related information.

Assume an organization buys another organization and the two are having a sound bookkeeping

framework set up then it would be anything but difficult to coordinate the records and would

spare part of time and exertion.

Improves the proficiency of a business: A sound bookkeeping framework annihilates any

odds of inconsistency and presents data convenient and precisely which thus builds the

profitability of the business. Presently days with the appearance of electronic bookkeeping

frameworks different reports can be produced with the dash of a catch which empowers the

administration to take the choices opportune that helps in the development of the business.

High level of accuracy: A sound bookkeeping gives a high level of precision in the

introduction of the last records. It limits the odds of any theft and uncovered the shortcoming

assuming any. Sound bookkeeping disposes of odds of blunders and introduces all the monetary

information definitely and precisely.

10

methodologies in future.

f. The need for a sound accounting system and the importance of the department

producing timely, accurate and relevant information.

A sound accounting system is a precise method for gathering and recording of the monetary

exchanges with the goal that it can empower every one of the partners to survey the execution

of the enterprise. Bookkeeping should be possible either physically or through mechanized

projects. However, a sound accounting system enhance the profits and efficiency of the

enterprise and also enhances the goodwill or reputation of the enterprises (Vanderbeck, 2012).

Following are benefits of a sound accounting system which are discussed as below:

Assists in decision making: A sound bookkeeping framework helps the administration to settle

on better choices for the business. Since the data given by the bookkeeping framework is

precise so it empowers the administration to painstakingly evaluate and examine every single

viewpoint and shape the future systems likewise.

Compatibility: It gives a system to the business to effectively share money related information.

Assume an organization buys another organization and the two are having a sound bookkeeping

framework set up then it would be anything but difficult to coordinate the records and would

spare part of time and exertion.

Improves the proficiency of a business: A sound bookkeeping framework annihilates any

odds of inconsistency and presents data convenient and precisely which thus builds the

profitability of the business. Presently days with the appearance of electronic bookkeeping

frameworks different reports can be produced with the dash of a catch which empowers the

administration to take the choices opportune that helps in the development of the business.

High level of accuracy: A sound bookkeeping gives a high level of precision in the

introduction of the last records. It limits the odds of any theft and uncovered the shortcoming

assuming any. Sound bookkeeping disposes of odds of blunders and introduces all the monetary

information definitely and precisely.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

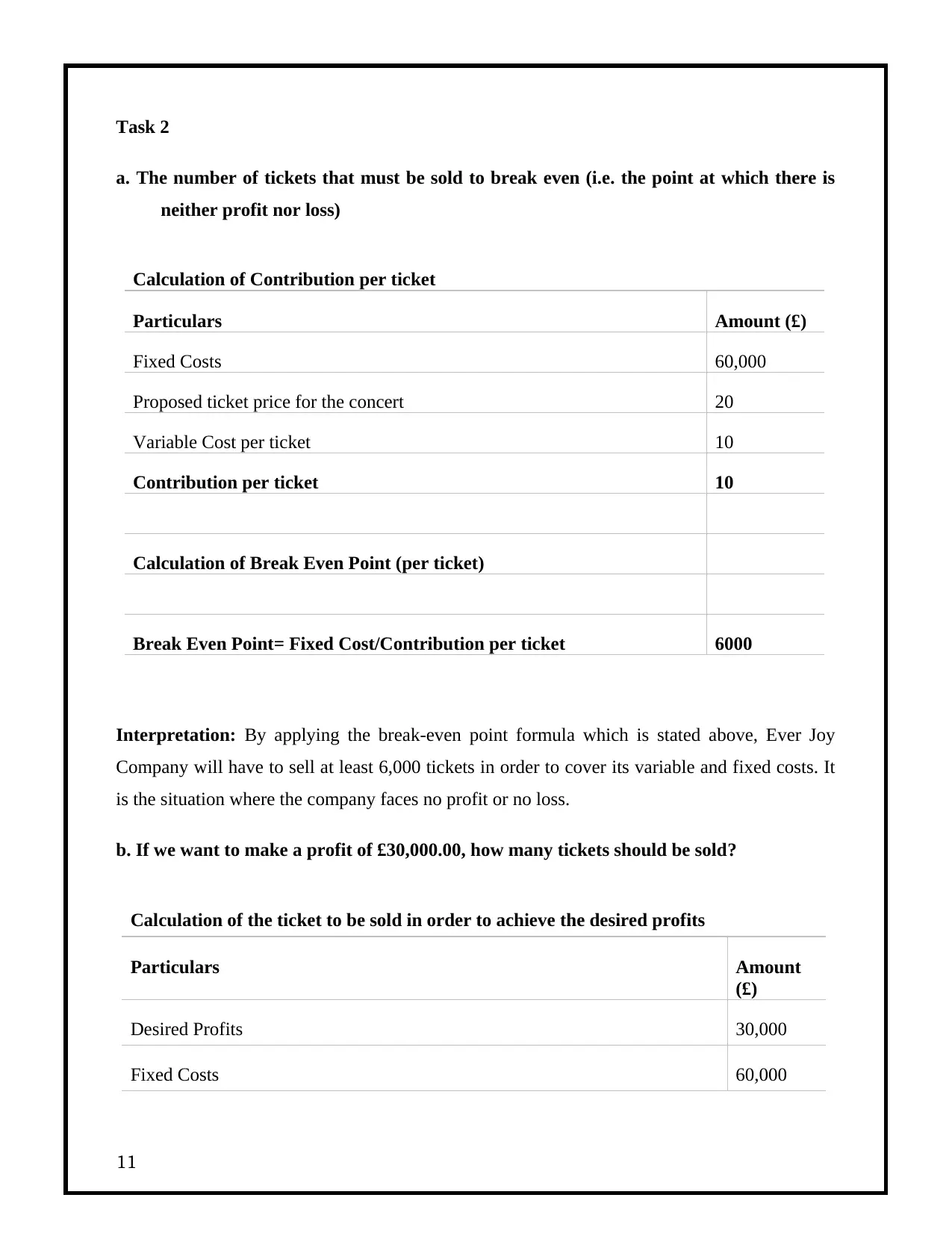

Task 2

a. The number of tickets that must be sold to break even (i.e. the point at which there is

neither profit nor loss)

Calculation of Contribution per ticket

Particulars Amount (£)

Fixed Costs 60,000

Proposed ticket price for the concert 20

Variable Cost per ticket 10

Contribution per ticket 10

Calculation of Break Even Point (per ticket)

Break Even Point= Fixed Cost/Contribution per ticket 6000

Interpretation: By applying the break-even point formula which is stated above, Ever Joy

Company will have to sell at least 6,000 tickets in order to cover its variable and fixed costs. It

is the situation where the company faces no profit or no loss.

b. If we want to make a profit of £30,000.00, how many tickets should be sold?

Calculation of the ticket to be sold in order to achieve the desired profits

Particulars Amount

(£)

Desired Profits 30,000

Fixed Costs 60,000

11

a. The number of tickets that must be sold to break even (i.e. the point at which there is

neither profit nor loss)

Calculation of Contribution per ticket

Particulars Amount (£)

Fixed Costs 60,000

Proposed ticket price for the concert 20

Variable Cost per ticket 10

Contribution per ticket 10

Calculation of Break Even Point (per ticket)

Break Even Point= Fixed Cost/Contribution per ticket 6000

Interpretation: By applying the break-even point formula which is stated above, Ever Joy

Company will have to sell at least 6,000 tickets in order to cover its variable and fixed costs. It

is the situation where the company faces no profit or no loss.

b. If we want to make a profit of £30,000.00, how many tickets should be sold?

Calculation of the ticket to be sold in order to achieve the desired profits

Particulars Amount

(£)

Desired Profits 30,000

Fixed Costs 60,000

11

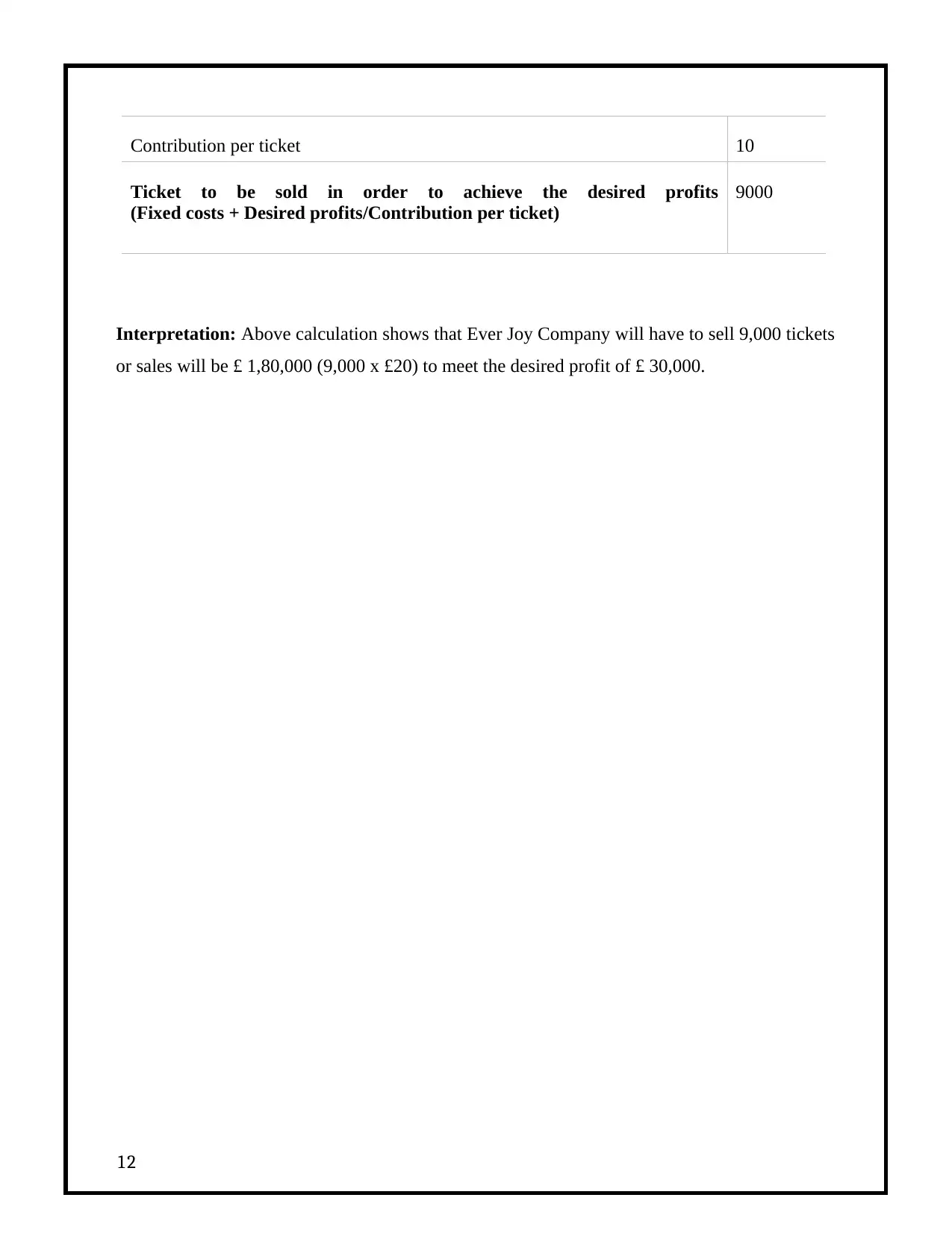

Contribution per ticket 10

Ticket to be sold in order to achieve the desired profits

(Fixed costs + Desired profits/Contribution per ticket)

9000

Interpretation: Above calculation shows that Ever Joy Company will have to sell 9,000 tickets

or sales will be £ 1,80,000 (9,000 x £20) to meet the desired profit of £ 30,000.

12

Ticket to be sold in order to achieve the desired profits

(Fixed costs + Desired profits/Contribution per ticket)

9000

Interpretation: Above calculation shows that Ever Joy Company will have to sell 9,000 tickets

or sales will be £ 1,80,000 (9,000 x £20) to meet the desired profit of £ 30,000.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.