Analyzing Management Accounting Systems at Excite Entertainment

VerifiedAdded on 2023/01/19

|17

|4584

|21

Report

AI Summary

This report provides an overview of management accounting principles and their application within Excite Entertainment Ltd, a UK-based leisure and entertainment company. It differentiates management accounting from financial accounting, outlines various management accounting systems such as cost accounting, inventory management (LIFO & FIFO), and job costing. The report highlights the benefits of integrated management accounting for planning, controlling, and coordinating business activities. It also explores different management accounting reporting methods, including budget reports, accounts receivable aging reports, job cost reports, and inventory/manufacturing reports. The importance of accurate, relevant, and reliable information in management accounting is emphasized, focusing on its role in control, problem assessment, and cost calculation. The report touches upon marginal costing techniques and the significance of budgetary control tools. Furthermore, it briefly compares different management accounting systems, offering a comprehensive view of how organizations can leverage these systems to address financial challenges. Desklib offers this and many other solved assignments for students.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Management accounting is a process which provides the financial information or

data to the manager so that on the basis of that manager can make decision

accordingly in the organization.. It helps the management of a company in monitoring

the current process and controlling the operational activities. In the current report, the

concept and importance of management accounting has been discussed along with

discussion of various types of accounting. Excite Entertainment Ltd operates in leisure

and entertainment industry in the UK. After that the report goes on to explain the

various methods is used for accounting management reporting and a variety of costs

utilizing different techniques will be detailed in this report. Further, in this report, concept

of absorption and marginal costing will be discussed along with advantages as well as

disadvantages of various budgetary control tools that can be used. Lastly, in this report,

a comparison will be made between the different management accounting systems

which is implemented by organizations in order to solve the financial problems or crisis.

MAIN BODY

Management accounting and different types of management accounting systems

Management Accounting

Process based accounting which provides the financial information or data to the

manager so that on the basis of that manager can make decision accordingly in the

organization. This is the type of accounting which is only used by the internal

management in the organization. As in this process the management of the organization

used to use the financial report and report also invoice financial balance statement (Ax

and Greve, 2017). In simple words, It can be said that in this accounting is the process

of using statistical data to take better decision in the organization. There is no

prescribed structure or the format in which management accounting in the organization

used to take place.

Management accounting and financial accounting is two different type of the accounting

system which is used by the organization.

Basis Management Accounting Financial Accounting

Legal Requirement Management accounting is It is legally mandatory to

1

Management accounting is a process which provides the financial information or

data to the manager so that on the basis of that manager can make decision

accordingly in the organization.. It helps the management of a company in monitoring

the current process and controlling the operational activities. In the current report, the

concept and importance of management accounting has been discussed along with

discussion of various types of accounting. Excite Entertainment Ltd operates in leisure

and entertainment industry in the UK. After that the report goes on to explain the

various methods is used for accounting management reporting and a variety of costs

utilizing different techniques will be detailed in this report. Further, in this report, concept

of absorption and marginal costing will be discussed along with advantages as well as

disadvantages of various budgetary control tools that can be used. Lastly, in this report,

a comparison will be made between the different management accounting systems

which is implemented by organizations in order to solve the financial problems or crisis.

MAIN BODY

Management accounting and different types of management accounting systems

Management Accounting

Process based accounting which provides the financial information or data to the

manager so that on the basis of that manager can make decision accordingly in the

organization. This is the type of accounting which is only used by the internal

management in the organization. As in this process the management of the organization

used to use the financial report and report also invoice financial balance statement (Ax

and Greve, 2017). In simple words, It can be said that in this accounting is the process

of using statistical data to take better decision in the organization. There is no

prescribed structure or the format in which management accounting in the organization

used to take place.

Management accounting and financial accounting is two different type of the accounting

system which is used by the organization.

Basis Management Accounting Financial Accounting

Legal Requirement Management accounting is It is legally mandatory to

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

not mandatory to for the

organization to have.

have financial accounting

for all the company.

Format of presentation There is no specific format

for presenting the

information and data in

management accounting.

Financial accounting used

to have the specific format

to present and record the

information.

Area of coverage within

organization

Management Accounting is

only used by the internal

team of the organization.

Financial Accounting is

used by both internal and

external stakeholders of the

organization.

Type of data used Management accounting

used to use both

quantitative and qualitative

data to measure the grid in

the organization.

Financial accounting only

uses the quantitative idea to

measure the grid in the

organization.

Different type of management accounting system

Cost Accounting System:

Cost Accounting system is the accounting system which looks at the cost factor

of the organization. As cost accounting system is the framework used by the

organization to uncerta the cost is critical for the organizational profit (Chenhall and

Moers, 2015). Excite Entertainment should have the proper idea about which service of

the organization is profitable and which one is not profitable. It can be interpreted with

the help of the cost accounting system only.

Importance

Dis closer of profitable and unprofitable activity

Help in making future policy

Inventory Management Systems:

As the name of the system suggest, it is the type of the management accounting

tool which used to look at the management of the inventory in an organization. This

2

organization to have.

have financial accounting

for all the company.

Format of presentation There is no specific format

for presenting the

information and data in

management accounting.

Financial accounting used

to have the specific format

to present and record the

information.

Area of coverage within

organization

Management Accounting is

only used by the internal

team of the organization.

Financial Accounting is

used by both internal and

external stakeholders of the

organization.

Type of data used Management accounting

used to use both

quantitative and qualitative

data to measure the grid in

the organization.

Financial accounting only

uses the quantitative idea to

measure the grid in the

organization.

Different type of management accounting system

Cost Accounting System:

Cost Accounting system is the accounting system which looks at the cost factor

of the organization. As cost accounting system is the framework used by the

organization to uncerta the cost is critical for the organizational profit (Chenhall and

Moers, 2015). Excite Entertainment should have the proper idea about which service of

the organization is profitable and which one is not profitable. It can be interpreted with

the help of the cost accounting system only.

Importance

Dis closer of profitable and unprofitable activity

Help in making future policy

Inventory Management Systems:

As the name of the system suggest, it is the type of the management accounting

tool which used to look at the management of the inventory in an organization. This

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

system used to have a combination of technology and process in the organization which

looks at monitoring and maintenance of stocked product. Products can be the company

assets, raw material or the product which are ready or in process. The essential

requirement for this management system is that it helps the Excite entertairment in

building the correlation between the organization product at different locations. Their are

two type of inventory management system.

LIFO: It is the accounting system in which the last item which is produced are

assumed as sold first.

FIFO: It is the accounting system in which oldest inventory item are recorded as

sold first.

Importance

Improve efficiency and productivity

Reduce inventory cost and maximize the sale

Job Costing System:

It is the another accounting tool in which manager used to delegate the cost

related to the manufacturing of individual unit of the output (Honggowati and et.al.,

2017). It is generally used when there is a big number of the product line of the

company.

Importance

Accuracy in profitability report

Employee performance benchmarksin the amount which is incurred to produce

the product of the organization. The reason behind using cost accounting as a

management accounting tool is that estimating the cost is critical for the organizational

profit (Chenhall and Moers, 2015). Excite Entertainment should have the proper idea

about which service of the organization is profitable and which one is not profitable. It

can be interpreted with the help of the cost accounting system only.

Importance

Dis closer of profitable and unprofitable activity

Help in making future policy

Inventory Management Systems:

3

looks at monitoring and maintenance of stocked product. Products can be the company

assets, raw material or the product which are ready or in process. The essential

requirement for this management system is that it helps the Excite entertairment in

building the correlation between the organization product at different locations. Their are

two type of inventory management system.

LIFO: It is the accounting system in which the last item which is produced are

assumed as sold first.

FIFO: It is the accounting system in which oldest inventory item are recorded as

sold first.

Importance

Improve efficiency and productivity

Reduce inventory cost and maximize the sale

Job Costing System:

It is the another accounting tool in which manager used to delegate the cost

related to the manufacturing of individual unit of the output (Honggowati and et.al.,

2017). It is generally used when there is a big number of the product line of the

company.

Importance

Accuracy in profitability report

Employee performance benchmarksin the amount which is incurred to produce

the product of the organization. The reason behind using cost accounting as a

management accounting tool is that estimating the cost is critical for the organizational

profit (Chenhall and Moers, 2015). Excite Entertainment should have the proper idea

about which service of the organization is profitable and which one is not profitable. It

can be interpreted with the help of the cost accounting system only.

Importance

Dis closer of profitable and unprofitable activity

Help in making future policy

Inventory Management Systems:

3

As the name of the system suggest, it is the type of the management accounting

tool which used to look at the management of the inventory in an organization. This

system used to have a combination of technology and process in the organization which

looks at monitoring and maintenance of stocked product. Products can be the company

assets, raw material or the product which are ready or in process. The essential

requirement for this management system is that it helps the Excite entertairment in

building the correlation between the organization product at different locations. Their are

two type of inventory management system.

LIFO: It is the accounting system in which the last item which is produced are

assumed as sold first.

FIFO: It is the accounting system in which oldest inventory item are recorded as

sold first.

Importance

Improve efficiency and productivity

Reduce inventory cost and maximize the sale

Job Costing System:

It is the another accounting tool in which manager used to delegate the cost

related to the manufacturing of individual unit of the output (Honggowati and et.al.,

2017). It is generally used when there is a big number of the product line of the

company.

Importance

Accuracy in profitability report

Employee performance benchmarks

Benefits of Integrated Management Accounting

Planning: Integrated Management accounting provides the basis for the

management of Excite Entertainment in preparing plan as with the help of the

management accounting the management of the organization is able to get different

aspect information which are used by the different department in their working.

Controlling and Coordinating: Management accounting used to provide the

information to the management of Excite Entertainment about what are the hurdles

which are faced by the organization in their on the basis of that the management of the

4

tool which used to look at the management of the inventory in an organization. This

system used to have a combination of technology and process in the organization which

looks at monitoring and maintenance of stocked product. Products can be the company

assets, raw material or the product which are ready or in process. The essential

requirement for this management system is that it helps the Excite entertairment in

building the correlation between the organization product at different locations. Their are

two type of inventory management system.

LIFO: It is the accounting system in which the last item which is produced are

assumed as sold first.

FIFO: It is the accounting system in which oldest inventory item are recorded as

sold first.

Importance

Improve efficiency and productivity

Reduce inventory cost and maximize the sale

Job Costing System:

It is the another accounting tool in which manager used to delegate the cost

related to the manufacturing of individual unit of the output (Honggowati and et.al.,

2017). It is generally used when there is a big number of the product line of the

company.

Importance

Accuracy in profitability report

Employee performance benchmarks

Benefits of Integrated Management Accounting

Planning: Integrated Management accounting provides the basis for the

management of Excite Entertainment in preparing plan as with the help of the

management accounting the management of the organization is able to get different

aspect information which are used by the different department in their working.

Controlling and Coordinating: Management accounting used to provide the

information to the management of Excite Entertainment about what are the hurdles

which are faced by the organization in their on the basis of that the management of the

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company used to take the corrective decision to control the operation and fixed the co

ordination between different department.

Different methods used for management accounting reporting

There are many type of management accounting reports which can be used by the

manager in the organization. Some of the common management accounting reports are

as follows:

Budget report is an internal report which is used in the management accounting

in which the management of the organization used measure difference between budget

and actual performance of business. In simple word budget report are made to find out

the deviation between the actual performance and estimated budget.

Importance There are two big Importance for the sake of which the budget report is

made in the Excite Entertainment. The first and most important Importance of budget

report is to correct the deficiency which is occurring in the operation of the business as

almost. As after getting the knowledge of the deviation, manager used to take the

decision to correct the same.

Other Importance is to relate the realistic and accuracy of the estimation which

was made by the management in the past.

Accounts Receivable Aging is another type of the management accounting

report which is based on the periodic report which is more concerned about the time. As

this report used to see company accounts receivable according to the time of invoice

has been outstanding. Generally, this report used to see the financial strength of Excite

Entertainment. This report used to manage and control the cash flow in the organization

as this tool used to extent the credit limit of the potential customer (Jansen, 2018).

Manager generally uses this type of the report to manage the collection process of the

company. This report helps the manager in having the total idea of the credit allocated

to the customer and on the basis of same manger used to take the corrective action to

tighten the policy of the organization.

Job cost report is the another form of the report in management accounting

which is used by the manager to analyses all the expense related to one specific

project. This is the report in which the manager used to find the deviation between the

revenue which was in real incurred and the revenue which was estimated in the past.

5

ordination between different department.

Different methods used for management accounting reporting

There are many type of management accounting reports which can be used by the

manager in the organization. Some of the common management accounting reports are

as follows:

Budget report is an internal report which is used in the management accounting

in which the management of the organization used measure difference between budget

and actual performance of business. In simple word budget report are made to find out

the deviation between the actual performance and estimated budget.

Importance There are two big Importance for the sake of which the budget report is

made in the Excite Entertainment. The first and most important Importance of budget

report is to correct the deficiency which is occurring in the operation of the business as

almost. As after getting the knowledge of the deviation, manager used to take the

decision to correct the same.

Other Importance is to relate the realistic and accuracy of the estimation which

was made by the management in the past.

Accounts Receivable Aging is another type of the management accounting

report which is based on the periodic report which is more concerned about the time. As

this report used to see company accounts receivable according to the time of invoice

has been outstanding. Generally, this report used to see the financial strength of Excite

Entertainment. This report used to manage and control the cash flow in the organization

as this tool used to extent the credit limit of the potential customer (Jansen, 2018).

Manager generally uses this type of the report to manage the collection process of the

company. This report helps the manager in having the total idea of the credit allocated

to the customer and on the basis of same manger used to take the corrective action to

tighten the policy of the organization.

Job cost report is the another form of the report in management accounting

which is used by the manager to analyses all the expense related to one specific

project. This is the report in which the manager used to find the deviation between the

revenue which was in real incurred and the revenue which was estimated in the past.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

After finding the deviation manager used to put the effort to reduce the deviation and

improve the performance of the organization.

Inventory and manufacturing report is the another report which is made in the

organization to support the management accounting in the organization. This report of

the organization used to look at the amount of the equipment left in the organization and

the reorder time of the equipment this help the business in managing the inventory in

efficient way. This report also includes the information regarding the waste, labor cost

and overhead cost. This information helps Excite entertainment manager in getting the

perfect knowledge about the position of the business on the basis of that manager used

to plan different activity in an organization.

At the same time, it is also very important for the organization to check the

reliability and accuracy of the information which has been used to prepare the

management accounting. The biggest reason for the same is it may have laid to the

wrong decision making in the organization as outcome of the management accounting

is over depended on the accuracy of the information which has been collected (Khan

and Jain, 2018). Organization also has to make sure that the data on which the

accounting function in the organization has taken place are updated one as data used

to change on the regular time interval for the organization. Management accounting

done on the outdated data may create the situation in the organization where manager

used to implement the decision based on the previous problem which will overlook the

issue faced by the company in today's scenario.

Importance of presenting accurate, relevant and reliable information

Accurate, relevant and reliable information management accounting will bring the

variety of the benefit for the organization and the stakeholder of the company. Some of

the benefit are as follow:

Control: This is the biggest benefit which is enjoyed by the owner and the

stakeholder of the organization that they will be having the proper knowledge of the

current situation of the organization. It will help them in having the proper control over

the functioning of the organization and can take the different action depending upon the

information.

6

improve the performance of the organization.

Inventory and manufacturing report is the another report which is made in the

organization to support the management accounting in the organization. This report of

the organization used to look at the amount of the equipment left in the organization and

the reorder time of the equipment this help the business in managing the inventory in

efficient way. This report also includes the information regarding the waste, labor cost

and overhead cost. This information helps Excite entertainment manager in getting the

perfect knowledge about the position of the business on the basis of that manager used

to plan different activity in an organization.

At the same time, it is also very important for the organization to check the

reliability and accuracy of the information which has been used to prepare the

management accounting. The biggest reason for the same is it may have laid to the

wrong decision making in the organization as outcome of the management accounting

is over depended on the accuracy of the information which has been collected (Khan

and Jain, 2018). Organization also has to make sure that the data on which the

accounting function in the organization has taken place are updated one as data used

to change on the regular time interval for the organization. Management accounting

done on the outdated data may create the situation in the organization where manager

used to implement the decision based on the previous problem which will overlook the

issue faced by the company in today's scenario.

Importance of presenting accurate, relevant and reliable information

Accurate, relevant and reliable information management accounting will bring the

variety of the benefit for the organization and the stakeholder of the company. Some of

the benefit are as follow:

Control: This is the biggest benefit which is enjoyed by the owner and the

stakeholder of the organization that they will be having the proper knowledge of the

current situation of the organization. It will help them in having the proper control over

the functioning of the organization and can take the different action depending upon the

information.

6

Assessing the Problem: Accounting done with the help of Accurate, relevant and

reliable information information will help the company in assessing the solution of the

problem on time. As by comparing the management accounting report of two time

interval manager can easily uncertain the deviation and the issue which is faced by the

organization in the past on the basis of same manager or shareholder can take the

corrective action in the organization.

Cost Calculation

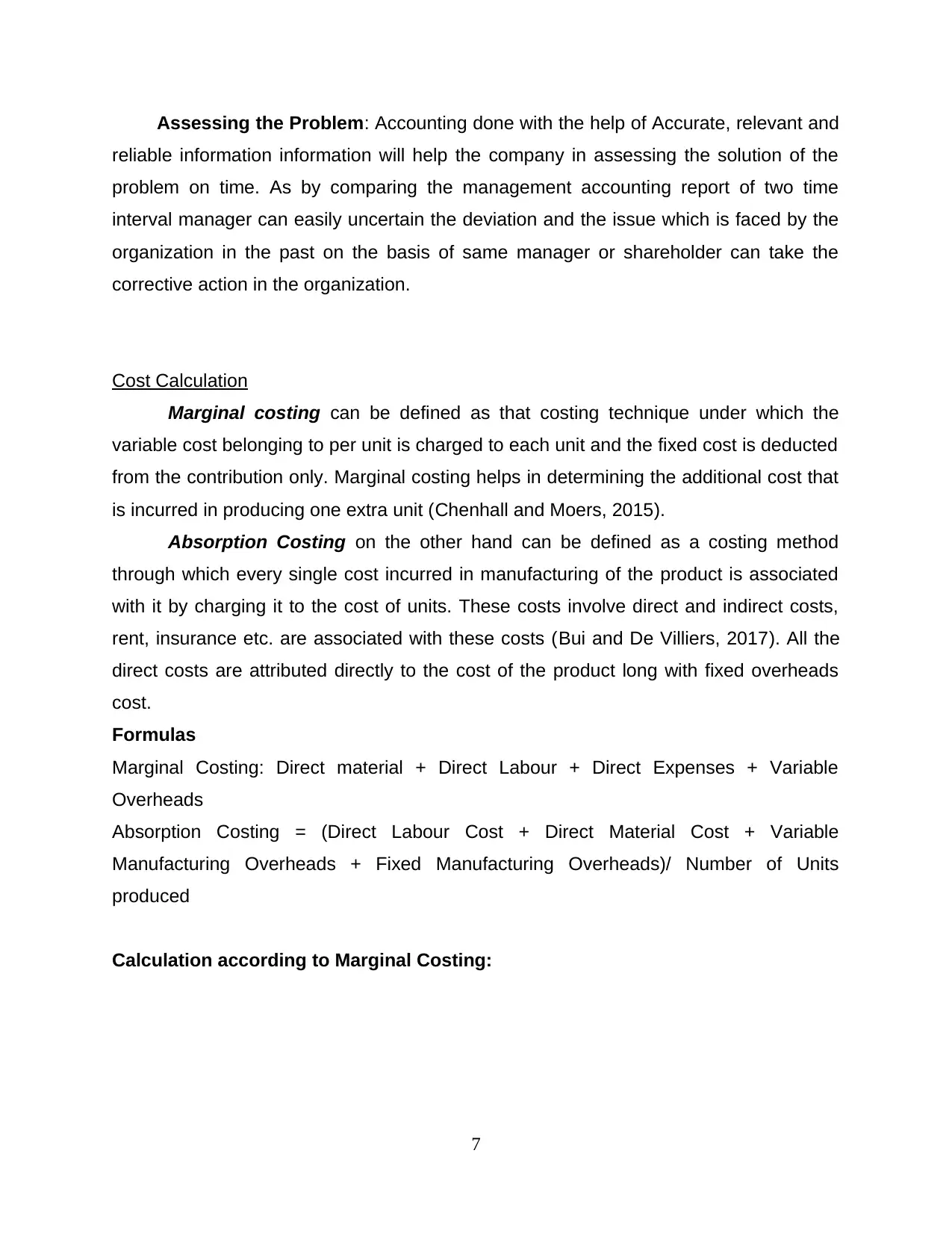

Marginal costing can be defined as that costing technique under which the

variable cost belonging to per unit is charged to each unit and the fixed cost is deducted

from the contribution only. Marginal costing helps in determining the additional cost that

is incurred in producing one extra unit (Chenhall and Moers, 2015).

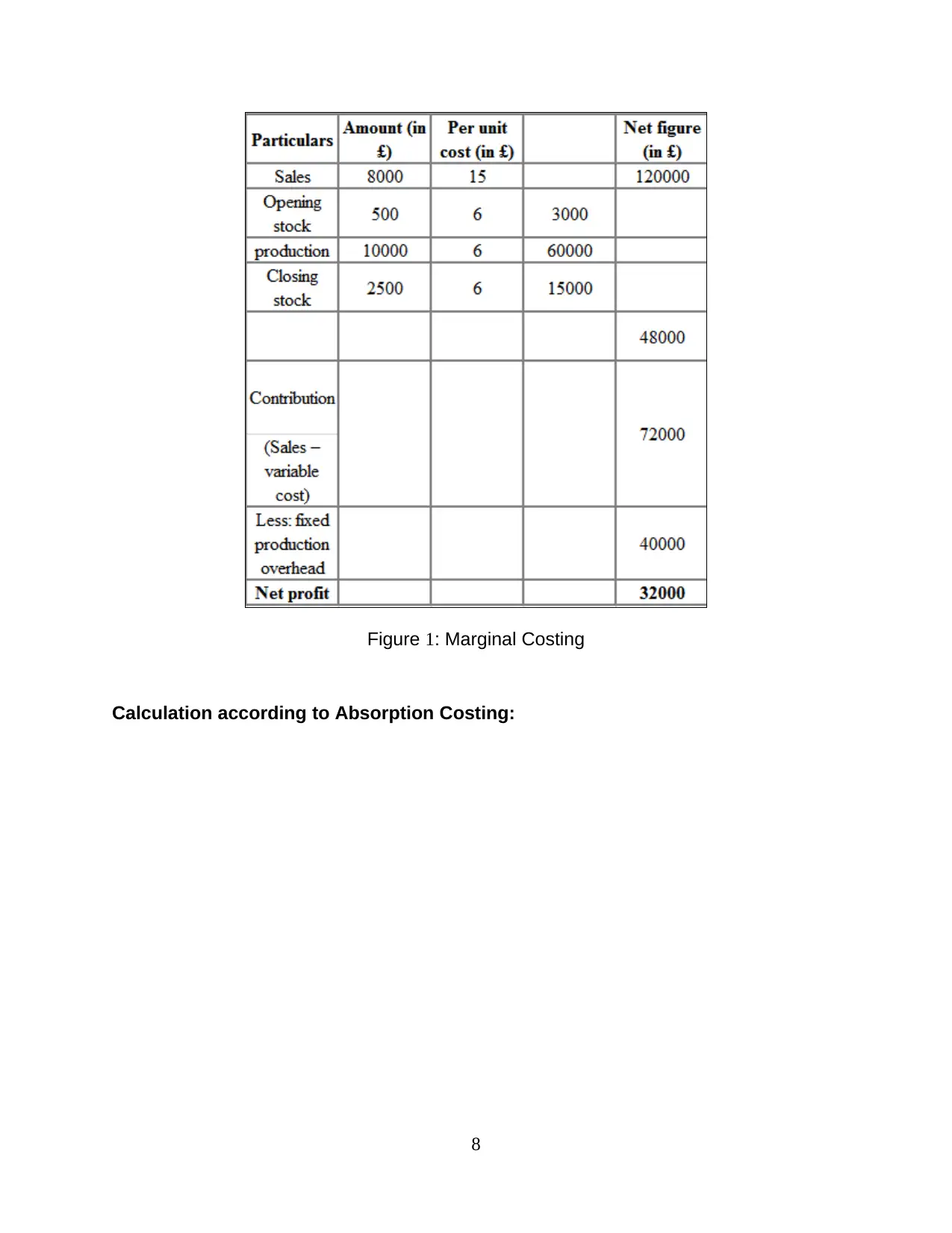

Absorption Costing on the other hand can be defined as a costing method

through which every single cost incurred in manufacturing of the product is associated

with it by charging it to the cost of units. These costs involve direct and indirect costs,

rent, insurance etc. are associated with these costs (Bui and De Villiers, 2017). All the

direct costs are attributed directly to the cost of the product long with fixed overheads

cost.

Formulas

Marginal Costing: Direct material + Direct Labour + Direct Expenses + Variable

Overheads

Absorption Costing = (Direct Labour Cost + Direct Material Cost + Variable

Manufacturing Overheads + Fixed Manufacturing Overheads)/ Number of Units

produced

Calculation according to Marginal Costing:

7

reliable information information will help the company in assessing the solution of the

problem on time. As by comparing the management accounting report of two time

interval manager can easily uncertain the deviation and the issue which is faced by the

organization in the past on the basis of same manager or shareholder can take the

corrective action in the organization.

Cost Calculation

Marginal costing can be defined as that costing technique under which the

variable cost belonging to per unit is charged to each unit and the fixed cost is deducted

from the contribution only. Marginal costing helps in determining the additional cost that

is incurred in producing one extra unit (Chenhall and Moers, 2015).

Absorption Costing on the other hand can be defined as a costing method

through which every single cost incurred in manufacturing of the product is associated

with it by charging it to the cost of units. These costs involve direct and indirect costs,

rent, insurance etc. are associated with these costs (Bui and De Villiers, 2017). All the

direct costs are attributed directly to the cost of the product long with fixed overheads

cost.

Formulas

Marginal Costing: Direct material + Direct Labour + Direct Expenses + Variable

Overheads

Absorption Costing = (Direct Labour Cost + Direct Material Cost + Variable

Manufacturing Overheads + Fixed Manufacturing Overheads)/ Number of Units

produced

Calculation according to Marginal Costing:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Figure 1: Marginal Costing

Calculation according to Absorption Costing:

8

Calculation according to Absorption Costing:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 2: Absorption Costing

Interpretation: In both the calculations made above, profit statement has been

made using absorption and marginal costing methods for the Excite Entertainment

Limited. It can be clearly interpreted that the profit under absorption costing is more as

compared to the profit under marginal costing i.e. of the company adopts absorption

costing the profit would be £40000 and under marginal costing it is only £32000.

Therefore, in order to calculate their profits and distribute profits accordingly, the

company should adopt absorption costing rather than marginal costing method.

Absorption costing method is in compliance with the GAAP Standards and further it

takes into account the fixed overhead cost which is attributed to the products

manufactured and therefore it depicts truer image of profitability rather than skewing it

unnecessarily thus depicting a truer image as compared to the marginal costing method

(Agrawal and Cooper, 2017).

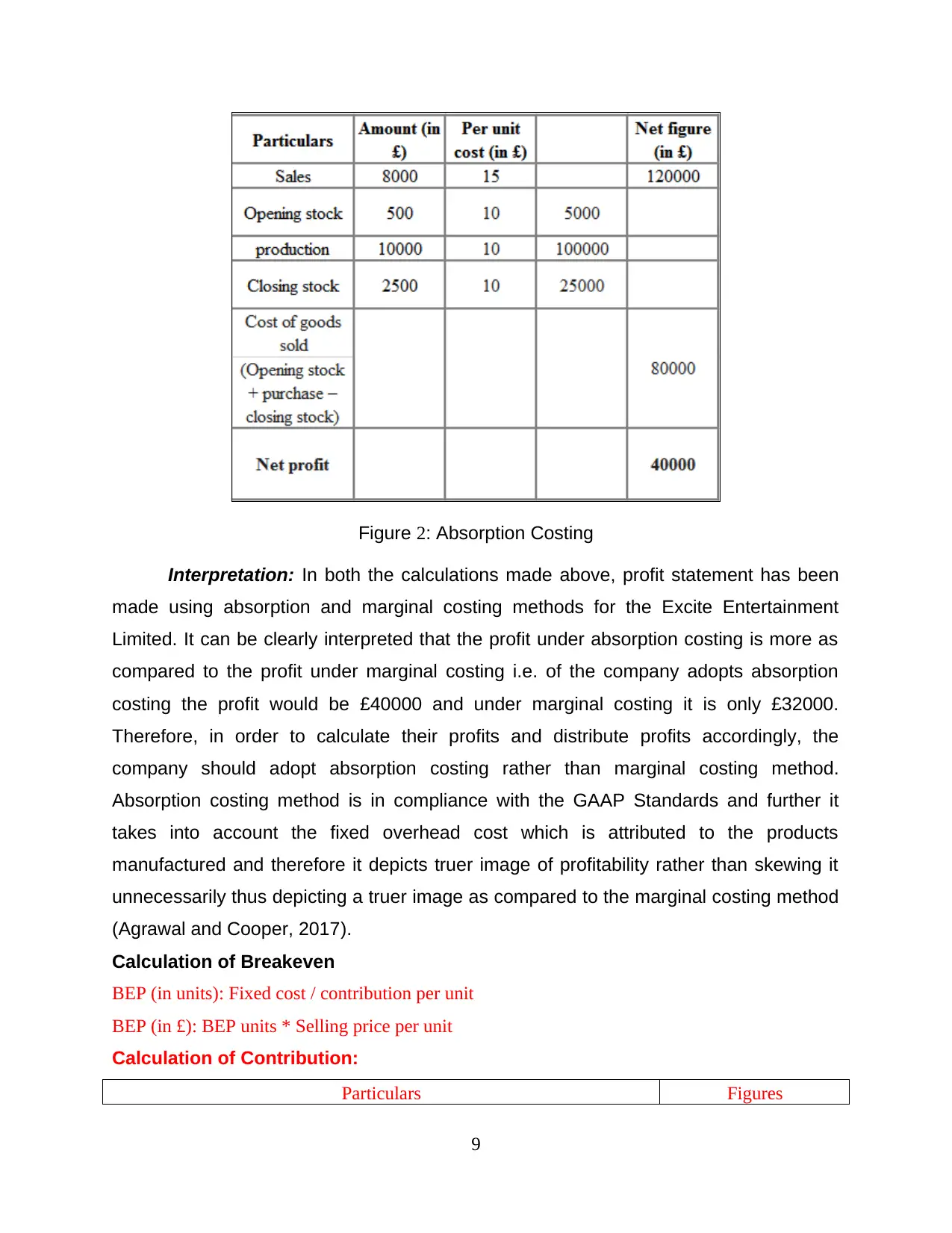

Calculation of Breakeven

BEP (in units): Fixed cost / contribution per unit

BEP (in £): BEP units * Selling price per unit

Calculation of Contribution:

Particulars Figures

9

Interpretation: In both the calculations made above, profit statement has been

made using absorption and marginal costing methods for the Excite Entertainment

Limited. It can be clearly interpreted that the profit under absorption costing is more as

compared to the profit under marginal costing i.e. of the company adopts absorption

costing the profit would be £40000 and under marginal costing it is only £32000.

Therefore, in order to calculate their profits and distribute profits accordingly, the

company should adopt absorption costing rather than marginal costing method.

Absorption costing method is in compliance with the GAAP Standards and further it

takes into account the fixed overhead cost which is attributed to the products

manufactured and therefore it depicts truer image of profitability rather than skewing it

unnecessarily thus depicting a truer image as compared to the marginal costing method

(Agrawal and Cooper, 2017).

Calculation of Breakeven

BEP (in units): Fixed cost / contribution per unit

BEP (in £): BEP units * Selling price per unit

Calculation of Contribution:

Particulars Figures

9

Selling price per unit (SPU) 40

Variable cost per unit (VCPU) 10

Contribution per unit (SPU – VCPU) 30

Fixed cost 120000

BEP (in units) 120000 / 30 = 4000

BEP (in £) 4000 * 40 = 160000

This concludes that at this point that 4000 tickets can be sold i.e. the revenue incurred

will be 160000 at which point the revenue incurred matches with the expenses made by

the company.

It can be clearly interpreted for the contribution calculation made above that per

unit contribution for each ticket is only £30 per ticket. Contribution i.e. the profit is

calculated by deducting variable cost per unit form the selling price per unit.

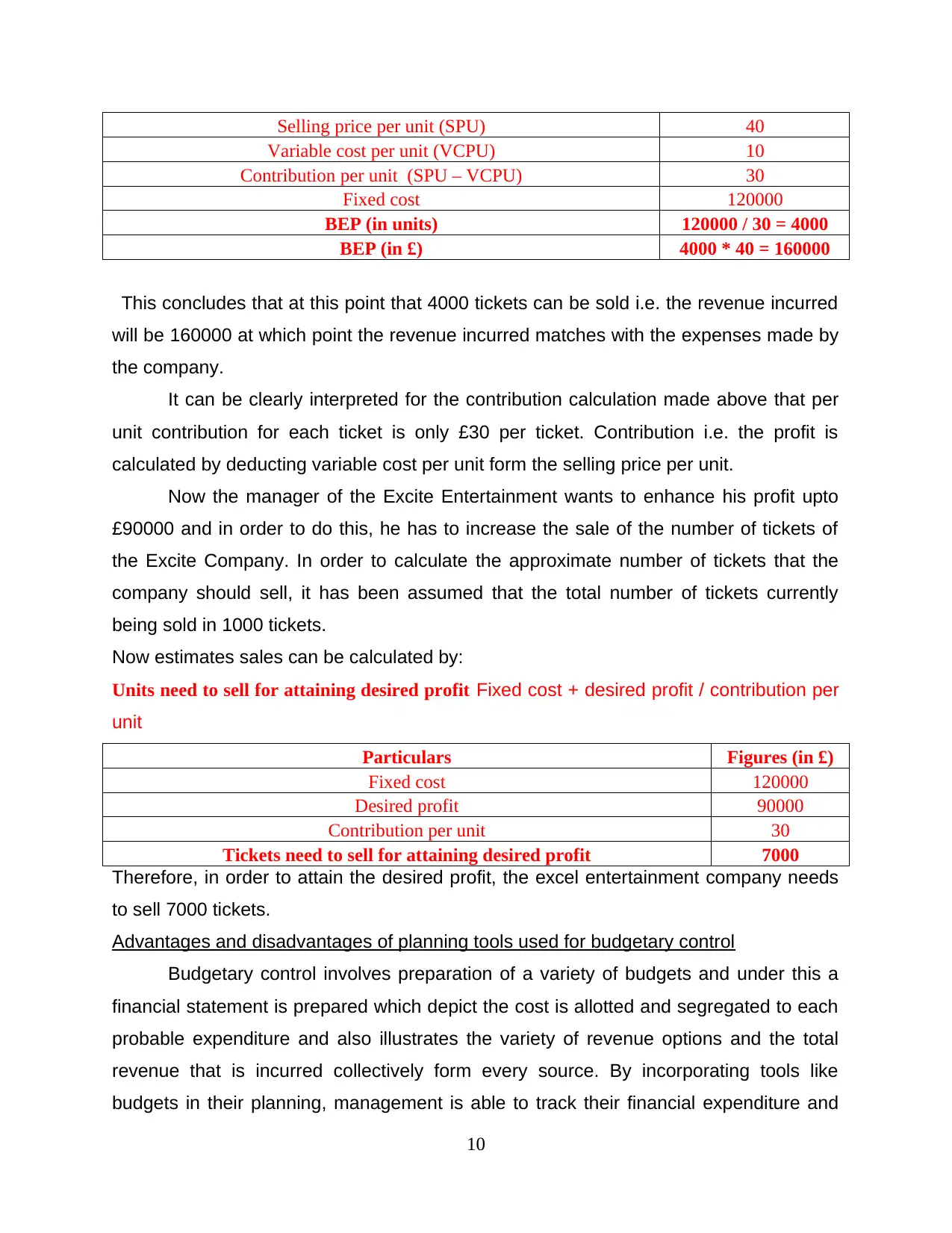

Now the manager of the Excite Entertainment wants to enhance his profit upto

£90000 and in order to do this, he has to increase the sale of the number of tickets of

the Excite Company. In order to calculate the approximate number of tickets that the

company should sell, it has been assumed that the total number of tickets currently

being sold in 1000 tickets.

Now estimates sales can be calculated by:

Units need to sell for attaining desired profit Fixed cost + desired profit / contribution per

unit

Particulars Figures (in £)

Fixed cost 120000

Desired profit 90000

Contribution per unit 30

Tickets need to sell for attaining desired profit 7000

Therefore, in order to attain the desired profit, the excel entertainment company needs

to sell 7000 tickets.

Advantages and disadvantages of planning tools used for budgetary control

Budgetary control involves preparation of a variety of budgets and under this a

financial statement is prepared which depict the cost is allotted and segregated to each

probable expenditure and also illustrates the variety of revenue options and the total

revenue that is incurred collectively form every source. By incorporating tools like

budgets in their planning, management is able to track their financial expenditure and

10

Variable cost per unit (VCPU) 10

Contribution per unit (SPU – VCPU) 30

Fixed cost 120000

BEP (in units) 120000 / 30 = 4000

BEP (in £) 4000 * 40 = 160000

This concludes that at this point that 4000 tickets can be sold i.e. the revenue incurred

will be 160000 at which point the revenue incurred matches with the expenses made by

the company.

It can be clearly interpreted for the contribution calculation made above that per

unit contribution for each ticket is only £30 per ticket. Contribution i.e. the profit is

calculated by deducting variable cost per unit form the selling price per unit.

Now the manager of the Excite Entertainment wants to enhance his profit upto

£90000 and in order to do this, he has to increase the sale of the number of tickets of

the Excite Company. In order to calculate the approximate number of tickets that the

company should sell, it has been assumed that the total number of tickets currently

being sold in 1000 tickets.

Now estimates sales can be calculated by:

Units need to sell for attaining desired profit Fixed cost + desired profit / contribution per

unit

Particulars Figures (in £)

Fixed cost 120000

Desired profit 90000

Contribution per unit 30

Tickets need to sell for attaining desired profit 7000

Therefore, in order to attain the desired profit, the excel entertainment company needs

to sell 7000 tickets.

Advantages and disadvantages of planning tools used for budgetary control

Budgetary control involves preparation of a variety of budgets and under this a

financial statement is prepared which depict the cost is allotted and segregated to each

probable expenditure and also illustrates the variety of revenue options and the total

revenue that is incurred collectively form every source. By incorporating tools like

budgets in their planning, management is able to track their financial expenditure and

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.