Management Accounting Application & Financial Report for Tech UK

VerifiedAdded on 2024/06/05

|25

|4688

|173

Report

AI Summary

This report provides a detailed analysis of management accounting principles and their application within Tech UK. It covers essential requirements of a management accounting system, including cost accounting, job costing, and price optimizing systems. The report presents financial information, evaluates the benefits of management accounting systems, and critically evaluates their integration within organizational processes. It includes cost calculations using marginal and absorption costing techniques to prepare an income statement. Different kinds of budgets and the budget preparation process are discussed, emphasizing the importance of budgeting for planning and control. The report also explains how the Balanced Scorecard approach can be used to respond to financial problems and compares it to other management accounting approaches. The analysis aims to demonstrate how management accounting can lead organizations to sustainable success by effectively responding to financial challenges.

Management accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................4

Task 1...............................................................................................................................................5

a) Explanation of management accounting and the essential requirements of management

accounting system........................................................................................................................5

b) Presenting financial information.............................................................................................7

M1 Evaluate the benefits of management accounting systems and their application within an

organizational context..................................................................................................................9

D1 Critically evaluates how management accounting systems and management accounting

reporting is integrated within organizational processes.............................................................10

Task 2.............................................................................................................................................11

a) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs..........................................................................................11

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents...................................................................................................13

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.....................................................................................................................................14

Task 3:...........................................................................................................................................15

a) Different kinds of budgets and their advantages and disadvantages.....................................15

b) The budget preparation process including determination of pricing and different costing

systems that can be used............................................................................................................16

c) The importance of budget as a tool for planning and control purposes................................17

2

Introduction......................................................................................................................................4

Task 1...............................................................................................................................................5

a) Explanation of management accounting and the essential requirements of management

accounting system........................................................................................................................5

b) Presenting financial information.............................................................................................7

M1 Evaluate the benefits of management accounting systems and their application within an

organizational context..................................................................................................................9

D1 Critically evaluates how management accounting systems and management accounting

reporting is integrated within organizational processes.............................................................10

Task 2.............................................................................................................................................11

a) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs..........................................................................................11

M2 Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents...................................................................................................13

D2 Produce financial reports that accurately apply and interpret data for a range of business

activities.....................................................................................................................................14

Task 3:...........................................................................................................................................15

a) Different kinds of budgets and their advantages and disadvantages.....................................15

b) The budget preparation process including determination of pricing and different costing

systems that can be used............................................................................................................16

c) The importance of budget as a tool for planning and control purposes................................17

2

M3 You will need to analyze the use of the different planning tools and their application for

preparing and forecasting budgets.............................................................................................18

Task 4:...........................................................................................................................................19

Explain ways to which the Balanced Scorecard approach suggested by the auditors can be

used to respond its financial problem and compare this approach to another management

accounting approach used in another organization of your choice............................................19

M4 Analyse how, in responding to financial problems, management accounting can lead

organizations to sustainable success..........................................................................................20

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead to sustainable success.....................................................................................21

Conclusion.....................................................................................................................................22

References......................................................................................................................................23

3

preparing and forecasting budgets.............................................................................................18

Task 4:...........................................................................................................................................19

Explain ways to which the Balanced Scorecard approach suggested by the auditors can be

used to respond its financial problem and compare this approach to another management

accounting approach used in another organization of your choice............................................19

M4 Analyse how, in responding to financial problems, management accounting can lead

organizations to sustainable success..........................................................................................20

D3 Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead to sustainable success.....................................................................................21

Conclusion.....................................................................................................................................22

References......................................................................................................................................23

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

In the business there is the need to perform all of the operations in the most effective manner and

for that proper information and plan will be required. This will be carried with the help of

management accounting as there are systems which can be used for this purpose. There will be

use of various tools and techniques by which it will be possible for Tech UK to make the

required decisions in most effective manner. The planning will be done and also the income

statement in relation to the company will be prepared in the report. All of the issues will be

undertaken with the help of the approaches and techniques available by bringing them in use and

all this will be discussed below.

4

In the business there is the need to perform all of the operations in the most effective manner and

for that proper information and plan will be required. This will be carried with the help of

management accounting as there are systems which can be used for this purpose. There will be

use of various tools and techniques by which it will be possible for Tech UK to make the

required decisions in most effective manner. The planning will be done and also the income

statement in relation to the company will be prepared in the report. All of the issues will be

undertaken with the help of the approaches and techniques available by bringing them in use and

all this will be discussed below.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 1

a) Explanation of management accounting and the essential requirements of management

accounting system.

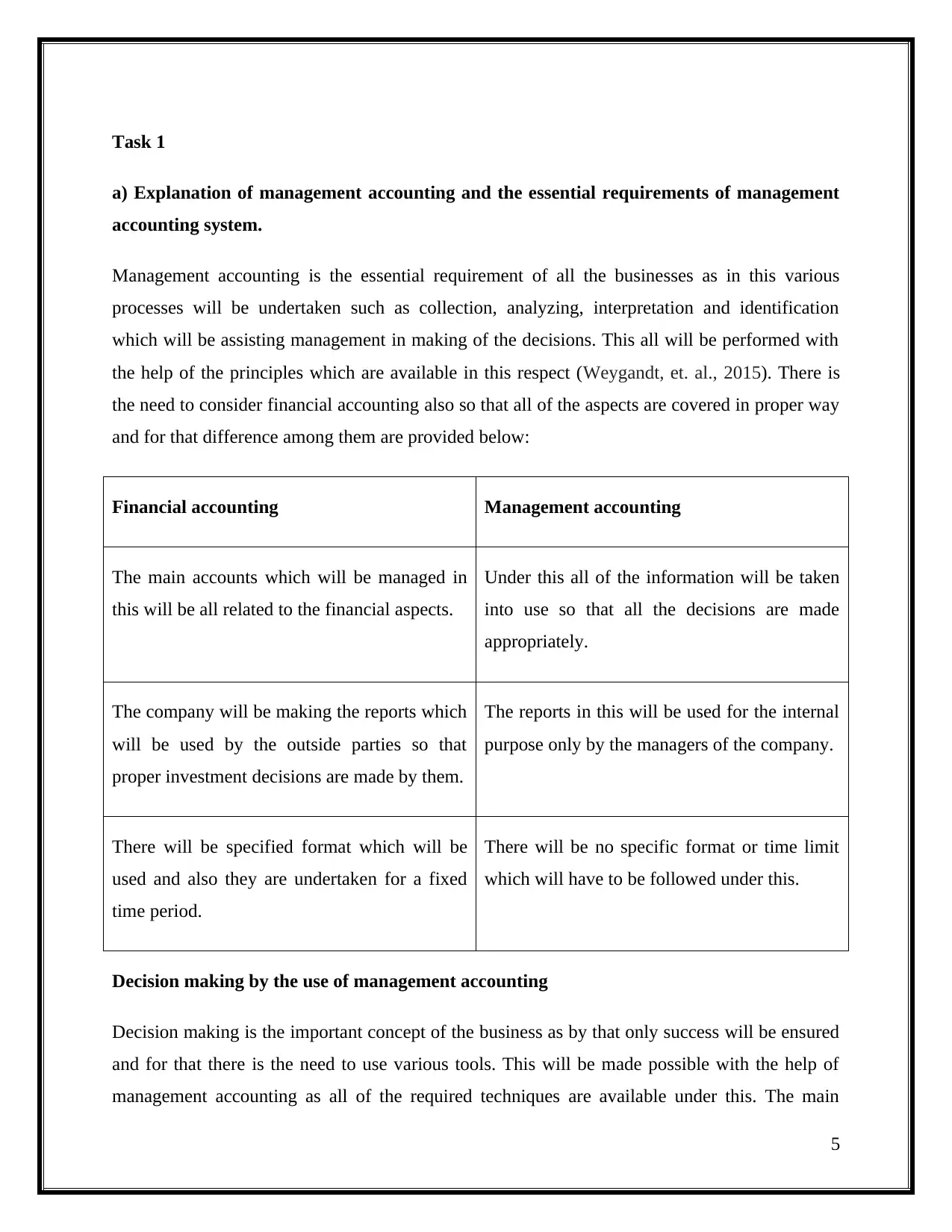

Management accounting is the essential requirement of all the businesses as in this various

processes will be undertaken such as collection, analyzing, interpretation and identification

which will be assisting management in making of the decisions. This all will be performed with

the help of the principles which are available in this respect (Weygandt, et. al., 2015). There is

the need to consider financial accounting also so that all of the aspects are covered in proper way

and for that difference among them are provided below:

Financial accounting Management accounting

The main accounts which will be managed in

this will be all related to the financial aspects.

Under this all of the information will be taken

into use so that all the decisions are made

appropriately.

The company will be making the reports which

will be used by the outside parties so that

proper investment decisions are made by them.

The reports in this will be used for the internal

purpose only by the managers of the company.

There will be specified format which will be

used and also they are undertaken for a fixed

time period.

There will be no specific format or time limit

which will have to be followed under this.

Decision making by the use of management accounting

Decision making is the important concept of the business as by that only success will be ensured

and for that there is the need to use various tools. This will be made possible with the help of

management accounting as all of the required techniques are available under this. The main

5

a) Explanation of management accounting and the essential requirements of management

accounting system.

Management accounting is the essential requirement of all the businesses as in this various

processes will be undertaken such as collection, analyzing, interpretation and identification

which will be assisting management in making of the decisions. This all will be performed with

the help of the principles which are available in this respect (Weygandt, et. al., 2015). There is

the need to consider financial accounting also so that all of the aspects are covered in proper way

and for that difference among them are provided below:

Financial accounting Management accounting

The main accounts which will be managed in

this will be all related to the financial aspects.

Under this all of the information will be taken

into use so that all the decisions are made

appropriately.

The company will be making the reports which

will be used by the outside parties so that

proper investment decisions are made by them.

The reports in this will be used for the internal

purpose only by the managers of the company.

There will be specified format which will be

used and also they are undertaken for a fixed

time period.

There will be no specific format or time limit

which will have to be followed under this.

Decision making by the use of management accounting

Decision making is the important concept of the business as by that only success will be ensured

and for that there is the need to use various tools. This will be made possible with the help of

management accounting as all of the required techniques are available under this. The main

5

aspects is the cost which will be covered and for that information will be collected so that it can

be used in the approaches such as target costing, activity based costing and standard costing

(Dong, et. al., 2014). This will then be further utilized in the ascertainment of the best price

which will be providing the company with the required profitability. There are several methods

for this under management accounting such as penetration pricing, cost plus pricing and price

skimming. The budgets will be made which proves to be the plan which can be followed for the

attainment of targets. The company is required to make the improvements and for those

decisions will have to be made and they can be made possible with the help of variance analysis

in which the deviations together with the reason for same are identified and they will be used in

the further process (Ada & Ghaffarzadeh, 2015). All of the above mentioned actions will be

undertaken by the help of the information which will have to be collected by the management by

the use of the various systems which are there and an understanding of the same will be gained

below:

Cost accounting system: The data in relation to cost is most essential and that will be collected

by the help of this system. In this all the aspects which are to be noted in this respect will be

considered and for that various methods are there which will be taken into use. By the help of

them accurate cost will be determined by the company. Tech UK can undertake actual costing if

they believe in realistic accounting as all of the actual values will be used under this. The targets

are required to be achieved and this will be made possible when the cost will be ascertained by

the use of the standards that is performed in standard costing. A combination of both is covered

in normal costing in which direct expenses are taken in actual terms and the overheads will be

incorporated by the help of standards.

Job costing: The Company will be required to calculate the cost in relation to various jobs which

are undertaken in the business. There are several methods which can be used under it and this

will be including the process costing in which all of the processes which are performed will be

considered and the cost will be calculated. The contracts which are made by the company will be

valued by the use of contract costing in which all the activities which will be undertaken in the

contract will be covered (Zaleha Abdul Rashid, et. al., 2014). The company carries the

production in batches and for that batch costing will be taken into consideration so that the

identified cost can be allocated among all the units which are produced under that batch.

6

be used in the approaches such as target costing, activity based costing and standard costing

(Dong, et. al., 2014). This will then be further utilized in the ascertainment of the best price

which will be providing the company with the required profitability. There are several methods

for this under management accounting such as penetration pricing, cost plus pricing and price

skimming. The budgets will be made which proves to be the plan which can be followed for the

attainment of targets. The company is required to make the improvements and for those

decisions will have to be made and they can be made possible with the help of variance analysis

in which the deviations together with the reason for same are identified and they will be used in

the further process (Ada & Ghaffarzadeh, 2015). All of the above mentioned actions will be

undertaken by the help of the information which will have to be collected by the management by

the use of the various systems which are there and an understanding of the same will be gained

below:

Cost accounting system: The data in relation to cost is most essential and that will be collected

by the help of this system. In this all the aspects which are to be noted in this respect will be

considered and for that various methods are there which will be taken into use. By the help of

them accurate cost will be determined by the company. Tech UK can undertake actual costing if

they believe in realistic accounting as all of the actual values will be used under this. The targets

are required to be achieved and this will be made possible when the cost will be ascertained by

the use of the standards that is performed in standard costing. A combination of both is covered

in normal costing in which direct expenses are taken in actual terms and the overheads will be

incorporated by the help of standards.

Job costing: The Company will be required to calculate the cost in relation to various jobs which

are undertaken in the business. There are several methods which can be used under it and this

will be including the process costing in which all of the processes which are performed will be

considered and the cost will be calculated. The contracts which are made by the company will be

valued by the use of contract costing in which all the activities which will be undertaken in the

contract will be covered (Zaleha Abdul Rashid, et. al., 2014). The company carries the

production in batches and for that batch costing will be taken into consideration so that the

identified cost can be allocated among all the units which are produced under that batch.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Price optimizing system: The profitability of the company is required to be maintained in

appropriate manner and for that the price will have to be set at the best level. There will use of

the several factors under this. One of them is cost which will be used and then certain profit will

be added on that and this will be performed in cost plus pricing. In addition to this there are

several other techniques also which will be used and in them all the market conditions will be

considered. This will be including the skimming and penetration pricing.

b) Presenting financial information.

The company will be required to use all of the data which has been collected in the further

processes and for that it will be required that it shall be reported in the proper manner so that it

can be understood in appropriate manner (Legaspi, 2014). There will be need to make the entries

of the same in the easy manner by which it will be possible for to use it in the best manner. The

main reports that are required to be prepared are as follow:

Various types of reports:

Cost reports: This is required to be prepared in proper manner as the cost related information

will be collected in this and that will be essential in the making of the cost decisions. The cost

will be calculated and the components which are involved in them will be reported under this. By

this it will be possible to make such decisions by which the cost of the business will be reduced.

Budget report: There is the need to make the estimates of the cost and other matters so that

proper operations are performed. This report is prepared as all the estimates are made in this and

they will be provided to all the departments who will be using it in the maintenance of all the

cost and the incomes so that proper results are attained (Amirya, et. al., 2014). All of the

information which is collected will be used in this so that there is no default which is made in the

business.

Variance report: the actual amounts which are there will have to be considered and then they

will be compared with the targets which have been set and by that variations which exist among

them will be determined. There will be the reason which is responsible for the same which will

also be ascertained with the help of this. They all will be considered by the company in the

7

appropriate manner and for that the price will have to be set at the best level. There will use of

the several factors under this. One of them is cost which will be used and then certain profit will

be added on that and this will be performed in cost plus pricing. In addition to this there are

several other techniques also which will be used and in them all the market conditions will be

considered. This will be including the skimming and penetration pricing.

b) Presenting financial information.

The company will be required to use all of the data which has been collected in the further

processes and for that it will be required that it shall be reported in the proper manner so that it

can be understood in appropriate manner (Legaspi, 2014). There will be need to make the entries

of the same in the easy manner by which it will be possible for to use it in the best manner. The

main reports that are required to be prepared are as follow:

Various types of reports:

Cost reports: This is required to be prepared in proper manner as the cost related information

will be collected in this and that will be essential in the making of the cost decisions. The cost

will be calculated and the components which are involved in them will be reported under this. By

this it will be possible to make such decisions by which the cost of the business will be reduced.

Budget report: There is the need to make the estimates of the cost and other matters so that

proper operations are performed. This report is prepared as all the estimates are made in this and

they will be provided to all the departments who will be using it in the maintenance of all the

cost and the incomes so that proper results are attained (Amirya, et. al., 2014). All of the

information which is collected will be used in this so that there is no default which is made in the

business.

Variance report: the actual amounts which are there will have to be considered and then they

will be compared with the targets which have been set and by that variations which exist among

them will be determined. There will be the reason which is responsible for the same which will

also be ascertained with the help of this. They all will be considered by the company in the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

making of the budget in the future period by considering them so that the same does not occur

again and there are proper results which will be attained.

Reason to present information in an understandable manner:

The information which has been collected in the above part by the help of the system will be

used by the management of the company in various purposes and for that it will be needed that it

is presented in proper manner. This is because then only the managers will be able to use that in

the required manner. They will be presented in understandable and easy manner so that no

specific need of the skills arises. If the complex process will be used then it will be difficult to

use that in the business and it will not be providing the company with any advantage as they will

not be able to take the appropriate decisions which are very essential.

8

again and there are proper results which will be attained.

Reason to present information in an understandable manner:

The information which has been collected in the above part by the help of the system will be

used by the management of the company in various purposes and for that it will be needed that it

is presented in proper manner. This is because then only the managers will be able to use that in

the required manner. They will be presented in understandable and easy manner so that no

specific need of the skills arises. If the complex process will be used then it will be difficult to

use that in the business and it will not be providing the company with any advantage as they will

not be able to take the appropriate decisions which are very essential.

8

M1 Evaluate the benefits of management accounting systems and their application within

an organizational context.

The management accounting is taken into use in the business as there are various benefits which

will be obtained with the help of them. The company will be able to improve the performance as

all of the information needs will be satisfied in proper manner (Edmonds, et. al., 2016). There

will be better decisions making which will be possible and this will help in achieving the targets

and aims which are specified. The company will be able to achieve the increase in profitability as

the overall cost which is incurred in business is reduced.

9

an organizational context.

The management accounting is taken into use in the business as there are various benefits which

will be obtained with the help of them. The company will be able to improve the performance as

all of the information needs will be satisfied in proper manner (Edmonds, et. al., 2016). There

will be better decisions making which will be possible and this will help in achieving the targets

and aims which are specified. The company will be able to achieve the increase in profitability as

the overall cost which is incurred in business is reduced.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

D1 Critically evaluates how management accounting systems and management accounting

reporting is integrated within organizational processes.

Tech UK is using the systems and the reports both in the process of management accounting and

this is because they are integrated and will have to be used in combined manner. The use of one

will not be possible without considering the other one. The process of report making will need

the information to be presented and that will be collected by the use of the systems. The

departments of the business will be responsible for providing the required information as they all

will be used so it can be considered that they all are related as the processes which are performed

by them are interrelated and this makes them integrated in company.

10

reporting is integrated within organizational processes.

Tech UK is using the systems and the reports both in the process of management accounting and

this is because they are integrated and will have to be used in combined manner. The use of one

will not be possible without considering the other one. The process of report making will need

the information to be presented and that will be collected by the use of the systems. The

departments of the business will be responsible for providing the required information as they all

will be used so it can be considered that they all are related as the processes which are performed

by them are interrelated and this makes them integrated in company.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 2

a) Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs.

Microeconomic technique:

In the business there are various costs which are incurred and it is require that they are classified

in an appropriate manner so that they can be treated in accordance with same. There will be

direct and indirect cost which will be included in this and that will be taken into account whole

the total cost of the product will be calculated. The fixed variable elements of the cost will be

ascertained in which the amount which will be constant is fixed and others are variable (Aurora,

2013). The variances which are there will be ascertained by the help of variance analysis.

The techniques which the Tech UK will be using in the process of calculation of the cost are as

follows:

Marginal costing: This is the method in which cost will be calculated by the consideration of

the variable component of the cost. They will be taken into use and contribution will be

ascertained and then to identify the profit, fixed cost will be included.

Absorption costing: the allocation of all the costs are carried out under this and by that fixed

expenses are also considered for the units which are related to the current year and this gives rise

to the under or over absorption which is required to be adjusted.

Product costing:

The product cost is to be calculated by considering all the expenses which are incurred in relation

to it. For that there are various approaches which can be used such as standard costing and target

costing. Another is activity based costing in which the cost will be ascertained by considering the

activities which are performed in the business (Hemmer and Labor, 2016). They will be

identified and then allocation is made in accordance with them.

11

a) Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs.

Microeconomic technique:

In the business there are various costs which are incurred and it is require that they are classified

in an appropriate manner so that they can be treated in accordance with same. There will be

direct and indirect cost which will be included in this and that will be taken into account whole

the total cost of the product will be calculated. The fixed variable elements of the cost will be

ascertained in which the amount which will be constant is fixed and others are variable (Aurora,

2013). The variances which are there will be ascertained by the help of variance analysis.

The techniques which the Tech UK will be using in the process of calculation of the cost are as

follows:

Marginal costing: This is the method in which cost will be calculated by the consideration of

the variable component of the cost. They will be taken into use and contribution will be

ascertained and then to identify the profit, fixed cost will be included.

Absorption costing: the allocation of all the costs are carried out under this and by that fixed

expenses are also considered for the units which are related to the current year and this gives rise

to the under or over absorption which is required to be adjusted.

Product costing:

The product cost is to be calculated by considering all the expenses which are incurred in relation

to it. For that there are various approaches which can be used such as standard costing and target

costing. Another is activity based costing in which the cost will be ascertained by considering the

activities which are performed in the business (Hemmer and Labor, 2016). They will be

identified and then allocation is made in accordance with them.

11

Cost of inventory:

The inventory of the business is required to be valued in the proper manner and for tat all of the

costs which are incurred on them will be identified. Then the proper method will be used which

can make the stock to be valued appropriately. There are several tools and they included

weighted average, FIFO and LIFO and by that all of the stock which is present will be

considered.

12

The inventory of the business is required to be valued in the proper manner and for tat all of the

costs which are incurred on them will be identified. Then the proper method will be used which

can make the stock to be valued appropriately. There are several tools and they included

weighted average, FIFO and LIFO and by that all of the stock which is present will be

considered.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.