Detailed Report on Management Accounting Systems at Harrods Limited

VerifiedAdded on 2020/06/06

|18

|4512

|59

Report

AI Summary

This report provides a detailed analysis of management accounting systems implemented at Harrods Limited, a retail business in the United Kingdom. The report begins by explaining various systems such as cost accounting, inventory management, job costing, and price optimization. It then delves into different methods used for management accounting reporting, including cost reports, sales reports, payroll reports, and account receivables reports. Furthermore, the report includes the preparation of income statements using both marginal and absorption costing methods, demonstrating how these techniques impact the financial outcomes of the business. The assignment highlights the significance of management accounting in internal decision-making and financial statement preparation, offering insights into how Harrods Limited utilizes these systems to manage its operations and financial performance. The report emphasizes the importance of cost allocation, financial reporting, and the use of various accounting methods to assess the profitability and financial health of the business.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION

A concept of knowledge in which financial plans are schedules, applied at the workplace,

analysed and evaluated is known as management accounting (MA). Businesses consider this

particular aspect within working environment for making those kinds of decisions which are

related to internal criteria (Hiebl, 2014). Any kind of external business judgements are needed to

make then MA not works at that condition. For creating broad understanding about MA, Harrods

Limited organisation is taken into consideration. It is one kind of small business enterprise and

operates in retail sector of United Kingdom. The present assignment shows various systems and

methods which are used to take several decisions and complete process of MA reporting.

Therefore, management easily able to prepare financial statements for the accounting period

ending. In additional to this, profit and loss accounts formulated in the project by using two MA

techniques i.e. marginal as well as absorption costing. Further, some planning tools which

applied by Harrods Limited in budgetary control systems are explained. At the end of current

study, systems which are used to resolve various financial problems in easy at the workplace are

described.

TASK 1

P1 Explaining several systems of ma which are used by Harrods limited

Business Report

From: Management accounting Officer

To: General Manager

Harrods Limited

Subject: Systems of management accounting

Date: 24th November 2017

Introduction : These reports will be considers as Harrods Limited has been used for system of

1

A concept of knowledge in which financial plans are schedules, applied at the workplace,

analysed and evaluated is known as management accounting (MA). Businesses consider this

particular aspect within working environment for making those kinds of decisions which are

related to internal criteria (Hiebl, 2014). Any kind of external business judgements are needed to

make then MA not works at that condition. For creating broad understanding about MA, Harrods

Limited organisation is taken into consideration. It is one kind of small business enterprise and

operates in retail sector of United Kingdom. The present assignment shows various systems and

methods which are used to take several decisions and complete process of MA reporting.

Therefore, management easily able to prepare financial statements for the accounting period

ending. In additional to this, profit and loss accounts formulated in the project by using two MA

techniques i.e. marginal as well as absorption costing. Further, some planning tools which

applied by Harrods Limited in budgetary control systems are explained. At the end of current

study, systems which are used to resolve various financial problems in easy at the workplace are

described.

TASK 1

P1 Explaining several systems of ma which are used by Harrods limited

Business Report

From: Management accounting Officer

To: General Manager

Harrods Limited

Subject: Systems of management accounting

Date: 24th November 2017

Introduction : These reports will be considers as Harrods Limited has been used for system of

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management accounting such as how cost accounting should be used to more effectively and

efficiently as well as inventory management to help and control the flow of goods form

manufacture to warehoused and facilitate to point of sale, and require the job costing to maintain

the data which is more relevant often operation of the business and price optimisation relates to

B2B and B2C.

Systems Cost accounting: The process of the systematic recording and analysis of the cost of

material, to improve the utilisation of resources such as manpower, plant and machinery

and cash etc. Expenditure is committed or incurred the process of produces of its goods

relationship with cost centres and cost units. Every job order, service and contract

include the ascertainment of the cost will appreciate. The cost of production to deals

with distribution and selling the goods (DRURY, 2013). Cost accounting relating to the

various elements of cost to control and help classification, and ascertainment of cost. In

cost accounting the income and expenditure relates the production of goods and services

to be recorded. The process of costing consists of routine of ascertaining cost by

historical or conventional costing, marginal costing and standard costing. Further,

implementing a system of cost control for labour heads, materials to represent the source

of economy. Every different department the audit system was organised to make

effective and efficiently working. Inventory management: In inventory management to guide the flow of goods form

manufactured to go-downs and reflect the point of sale and its is a component of supply

chain management. Its refers to the process of storing, ordering and using a company

inventory such as raw materials, components, and finished product (Inventory

Management, 2013). This is such type of asset which will be disposed of in future in the

ordinary course of the Harrods Limited. Buyers must also determine whether each

product purchased will be a basic store item or specially buy. When stock level is

required to manage within workplace then company goes for determining value of total

inventory. For this particular aspect, basically three kinds of methods available with

Harrods Limited which are like LIFO, weighted average as well as FIFO. The concept of

inventory stock it has been manufacturing system to visualize the all work with the

2

efficiently as well as inventory management to help and control the flow of goods form

manufacture to warehoused and facilitate to point of sale, and require the job costing to maintain

the data which is more relevant often operation of the business and price optimisation relates to

B2B and B2C.

Systems Cost accounting: The process of the systematic recording and analysis of the cost of

material, to improve the utilisation of resources such as manpower, plant and machinery

and cash etc. Expenditure is committed or incurred the process of produces of its goods

relationship with cost centres and cost units. Every job order, service and contract

include the ascertainment of the cost will appreciate. The cost of production to deals

with distribution and selling the goods (DRURY, 2013). Cost accounting relating to the

various elements of cost to control and help classification, and ascertainment of cost. In

cost accounting the income and expenditure relates the production of goods and services

to be recorded. The process of costing consists of routine of ascertaining cost by

historical or conventional costing, marginal costing and standard costing. Further,

implementing a system of cost control for labour heads, materials to represent the source

of economy. Every different department the audit system was organised to make

effective and efficiently working. Inventory management: In inventory management to guide the flow of goods form

manufactured to go-downs and reflect the point of sale and its is a component of supply

chain management. Its refers to the process of storing, ordering and using a company

inventory such as raw materials, components, and finished product (Inventory

Management, 2013). This is such type of asset which will be disposed of in future in the

ordinary course of the Harrods Limited. Buyers must also determine whether each

product purchased will be a basic store item or specially buy. When stock level is

required to manage within workplace then company goes for determining value of total

inventory. For this particular aspect, basically three kinds of methods available with

Harrods Limited which are like LIFO, weighted average as well as FIFO. The concept of

inventory stock it has been manufacturing system to visualize the all work with the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

support of projects and business services at the time of process of production and it has

occurred prior to the completion of the project. Consider the services, the inventory

management the process of information has been partially and the period of work is

completed to the priority to sale in Harrods Limited. In the external environment the

requirements of inventory level has been competing the challenges and through the

going process as the business needs. Job costing:According to Job Costing, in manufacturing job the method of recording a

manager can keep tracking the cost of each job and maintaining the data which is more

relevant to operate the business or firms Harrods Limited. The techniques should be used

for customer specifications whether in situation every different department has

different job has to be performed. (Cooper, Ezzamel and Qu, 2017). A job is specific

order for work usually carried out within a factory or workshops and moves through

activities and operations and continuously indefinable unit. It is a cost unit which

consist of a single order or contract. Price optimisation: The product and service of the organisation to sell the market

through the medium of different channels and to verify the customer respond will affect

the different prices and to analysis the mathematical terms. To determine that the price

of company determine the best meet is objective such as maximizing operating profit.

Harrods Limited is widely used in the pricing field to describe application that set prices.

There are two prices business to business or business to consumer, in B2C by a large

demand volumes, each transaction, representing a very small proportion of total revenue.

In B2B relatively small transaction volume as per transaction require different analytic

process.

Conclusion: At the end, the cost accounting will be required to classifying and summarizing

various alternative course of action, so the production of goods will be record income and

revenue by time to time, so it will be impact on production, selling and distribution, and the

inventory management supervise the flow of goods and facilitate to point of sale. The

organisation has set the data and selected a more relevant which is used for the operating time

so the business run smoothly and price optimisation helps to Harrods Limited to determine the

price of products and maximize the profit.

3

occurred prior to the completion of the project. Consider the services, the inventory

management the process of information has been partially and the period of work is

completed to the priority to sale in Harrods Limited. In the external environment the

requirements of inventory level has been competing the challenges and through the

going process as the business needs. Job costing:According to Job Costing, in manufacturing job the method of recording a

manager can keep tracking the cost of each job and maintaining the data which is more

relevant to operate the business or firms Harrods Limited. The techniques should be used

for customer specifications whether in situation every different department has

different job has to be performed. (Cooper, Ezzamel and Qu, 2017). A job is specific

order for work usually carried out within a factory or workshops and moves through

activities and operations and continuously indefinable unit. It is a cost unit which

consist of a single order or contract. Price optimisation: The product and service of the organisation to sell the market

through the medium of different channels and to verify the customer respond will affect

the different prices and to analysis the mathematical terms. To determine that the price

of company determine the best meet is objective such as maximizing operating profit.

Harrods Limited is widely used in the pricing field to describe application that set prices.

There are two prices business to business or business to consumer, in B2C by a large

demand volumes, each transaction, representing a very small proportion of total revenue.

In B2B relatively small transaction volume as per transaction require different analytic

process.

Conclusion: At the end, the cost accounting will be required to classifying and summarizing

various alternative course of action, so the production of goods will be record income and

revenue by time to time, so it will be impact on production, selling and distribution, and the

inventory management supervise the flow of goods and facilitate to point of sale. The

organisation has set the data and selected a more relevant which is used for the operating time

so the business run smoothly and price optimisation helps to Harrods Limited to determine the

price of products and maximize the profit.

3

P2 Different methods used for reporting of management accounting.

From: Management accounting Officer

To: General Manager

Harrods Limited

Subject: Management accounting report.

Date: 24th November 2017

Allocation of cost is essential for every small business enterprise in order to analyse the

expenses which are made to develop the products and services. For tracking the cost, various

accounting systems have been analysed which are used to identify the cost which is associated

with goods and services provided by firm to its customers (Zimmerman and Yahya-Zadeh,

2011). It also involves application of some important systems to develop financial reports at

end of financial year. In present context, there are also some effective accounting methods have

been identified, which should be used by HARRODS LTD to develop appropriate management

accounting reports and determined the cost incurred on goods and services. There are some

products and services are also analysed which are considered as more profitable for firm. There

is a major importance of these accounting reports such as:

Provides information about various levels of management.

It also helps in selection appropriate information from alternatives.

It is considered as helpful in accomplishment of profitable operations.

Supports in achievement of objectives.

Usually follows the principles of management by execution.

In addition to this, there are some important reports have been analysed which are described

below:

Cost report: It is process in which is used to analyse the information related to cost

related information that helps in minimizing and controlling the cost in the future. It is

also considered as cost in which the management will provide information internal

report system and it also useful for analysing the cost that is incurred on products of

4

From: Management accounting Officer

To: General Manager

Harrods Limited

Subject: Management accounting report.

Date: 24th November 2017

Allocation of cost is essential for every small business enterprise in order to analyse the

expenses which are made to develop the products and services. For tracking the cost, various

accounting systems have been analysed which are used to identify the cost which is associated

with goods and services provided by firm to its customers (Zimmerman and Yahya-Zadeh,

2011). It also involves application of some important systems to develop financial reports at

end of financial year. In present context, there are also some effective accounting methods have

been identified, which should be used by HARRODS LTD to develop appropriate management

accounting reports and determined the cost incurred on goods and services. There are some

products and services are also analysed which are considered as more profitable for firm. There

is a major importance of these accounting reports such as:

Provides information about various levels of management.

It also helps in selection appropriate information from alternatives.

It is considered as helpful in accomplishment of profitable operations.

Supports in achievement of objectives.

Usually follows the principles of management by execution.

In addition to this, there are some important reports have been analysed which are described

below:

Cost report: It is process in which is used to analyse the information related to cost

related information that helps in minimizing and controlling the cost in the future. It is

also considered as cost in which the management will provide information internal

report system and it also useful for analysing the cost that is incurred on products of

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

single unit of products (Baldvinsdottir, Mitchell and Nørreklit, 2010). Futher the

organization will support to analyse the price of products and balance of enterprise as

making entry of cost of good sold on profit and loss account. Hence, this accounting

system will support HARRODS Ltd by providing transfer pricing, variance analysis,

standard costing and activity based costing.

Sales report: It is also an important accounting report that indicates rise or decrease in

sales that support the management to know those areas where there is market

opportunity to rise the profitability and sales (Ward, 2012). It is also considered as

report that shows the company's actual sale which it has made over specific time

duration. It is required by management to know the buying behaviour of customers that

relates to products and services as they don't have an information about turnover of

organisation but also discount offers for customers.

Payroll report: This report of management accounting is related to calculation of

compensation paid to employees in order to analyse the financial position of

organization. It clearly identifies the company 's reputation and it is useful for managers

to analyse the performance of individuals through increasing the amount bonus and

incentives. In HARRODS Ltd, these reports are usually generates from software which

are updated with important changes to reduce the cost long time duration of

organisation.

Account receivables report: It is analysed as critical tool which is used to manage the

flow of cash for companies that provide credits to their potentials buyers. It usually

breaks down customers balances by time in which they have been owed and it also

includes separate columns for invoices which are received after 30 days, 60 and 90 days

late from time duration (Parker, 2012). These are considered as useful for manager

HARRODS Ltd to identify the problems with the process of collection of enterprise.

Job costing report: As per the research, these report is usually considered as

accumulation of major expenses which are led by enterprise on raw material, overhead

and labour for development or purchase of some specific product and service in order to

increase the profitability.

5

organization will support to analyse the price of products and balance of enterprise as

making entry of cost of good sold on profit and loss account. Hence, this accounting

system will support HARRODS Ltd by providing transfer pricing, variance analysis,

standard costing and activity based costing.

Sales report: It is also an important accounting report that indicates rise or decrease in

sales that support the management to know those areas where there is market

opportunity to rise the profitability and sales (Ward, 2012). It is also considered as

report that shows the company's actual sale which it has made over specific time

duration. It is required by management to know the buying behaviour of customers that

relates to products and services as they don't have an information about turnover of

organisation but also discount offers for customers.

Payroll report: This report of management accounting is related to calculation of

compensation paid to employees in order to analyse the financial position of

organization. It clearly identifies the company 's reputation and it is useful for managers

to analyse the performance of individuals through increasing the amount bonus and

incentives. In HARRODS Ltd, these reports are usually generates from software which

are updated with important changes to reduce the cost long time duration of

organisation.

Account receivables report: It is analysed as critical tool which is used to manage the

flow of cash for companies that provide credits to their potentials buyers. It usually

breaks down customers balances by time in which they have been owed and it also

includes separate columns for invoices which are received after 30 days, 60 and 90 days

late from time duration (Parker, 2012). These are considered as useful for manager

HARRODS Ltd to identify the problems with the process of collection of enterprise.

Job costing report: As per the research, these report is usually considered as

accumulation of major expenses which are led by enterprise on raw material, overhead

and labour for development or purchase of some specific product and service in order to

increase the profitability.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

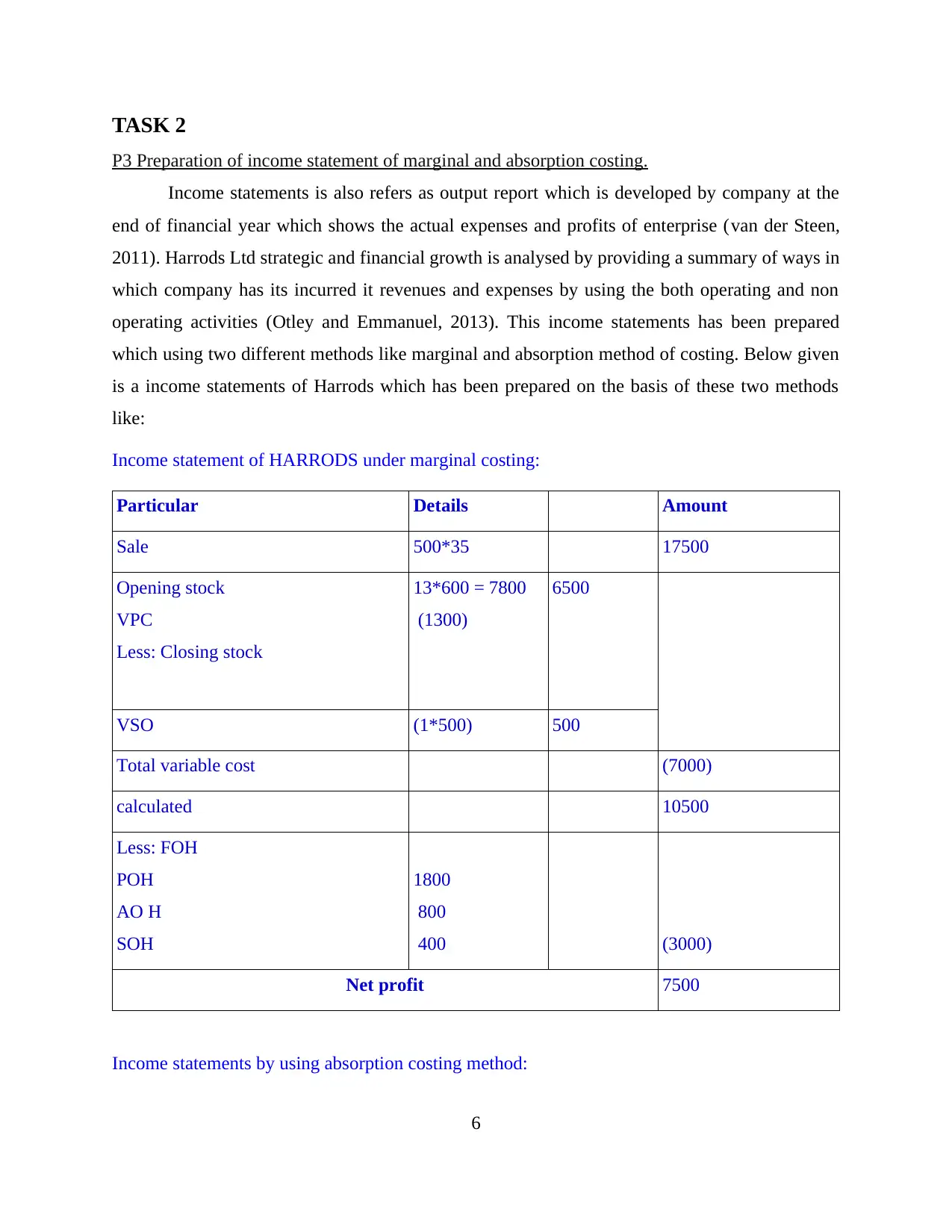

P3 Preparation of income statement of marginal and absorption costing.

Income statements is also refers as output report which is developed by company at the

end of financial year which shows the actual expenses and profits of enterprise (van der Steen,

2011). Harrods Ltd strategic and financial growth is analysed by providing a summary of ways in

which company has its incurred it revenues and expenses by using the both operating and non

operating activities (Otley and Emmanuel, 2013). This income statements has been prepared

which using two different methods like marginal and absorption method of costing. Below given

is a income statements of Harrods which has been prepared on the basis of these two methods

like:

Income statement of HARRODS under marginal costing:

Particular Details Amount

Sale 500*35 17500

Opening stock

VPC

Less: Closing stock

13*600 = 7800

(1300)

6500

VSO (1*500) 500

Total variable cost (7000)

calculated 10500

Less: FOH

POH

AO H

SOH

1800

800

400 (3000)

Net profit 7500

Income statements by using absorption costing method:

6

P3 Preparation of income statement of marginal and absorption costing.

Income statements is also refers as output report which is developed by company at the

end of financial year which shows the actual expenses and profits of enterprise (van der Steen,

2011). Harrods Ltd strategic and financial growth is analysed by providing a summary of ways in

which company has its incurred it revenues and expenses by using the both operating and non

operating activities (Otley and Emmanuel, 2013). This income statements has been prepared

which using two different methods like marginal and absorption method of costing. Below given

is a income statements of Harrods which has been prepared on the basis of these two methods

like:

Income statement of HARRODS under marginal costing:

Particular Details Amount

Sale 500*35 17500

Opening stock

VPC

Less: Closing stock

13*600 = 7800

(1300)

6500

VSO (1*500) 500

Total variable cost (7000)

calculated 10500

Less: FOH

POH

AO H

SOH

1800

800

400 (3000)

Net profit 7500

Income statements by using absorption costing method:

6

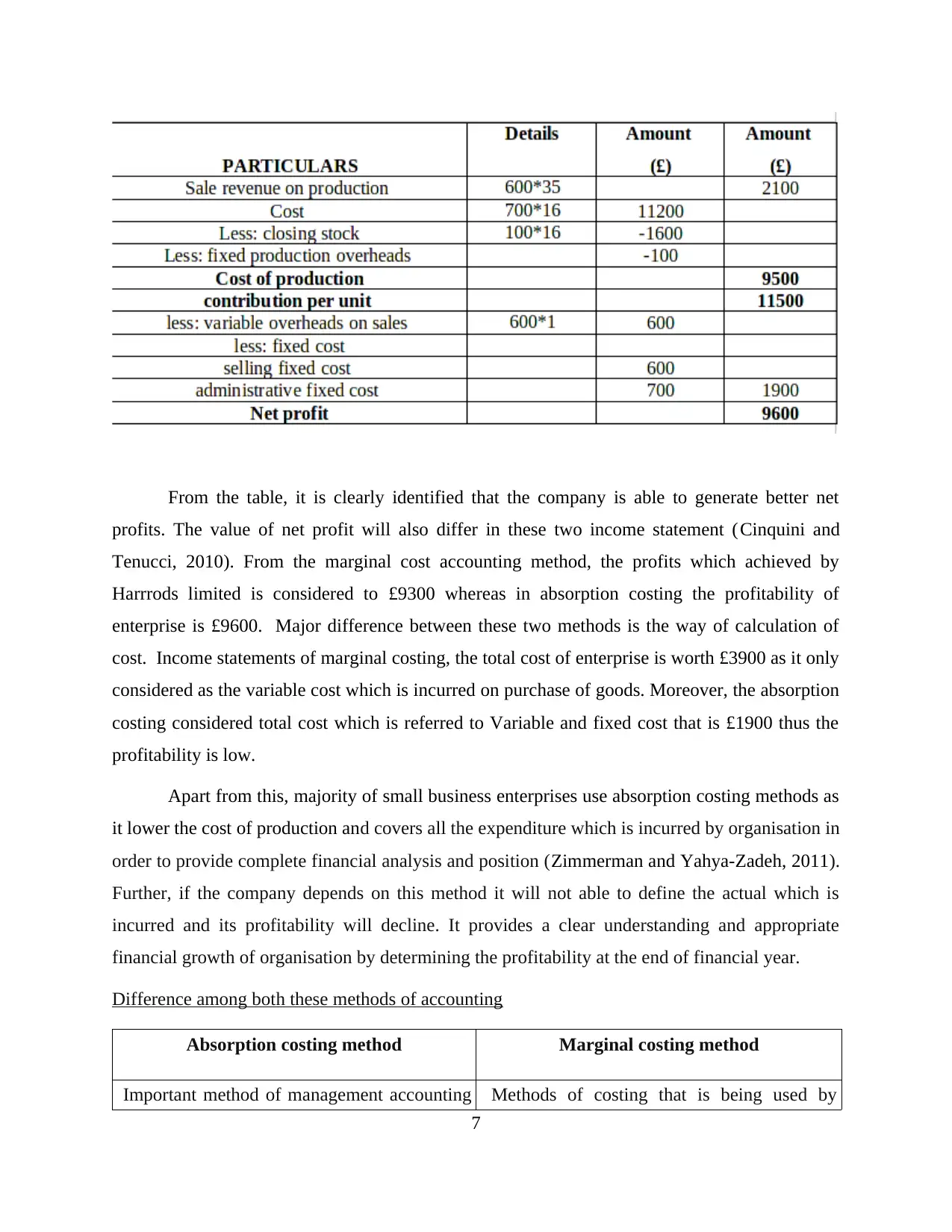

From the table, it is clearly identified that the company is able to generate better net

profits. The value of net profit will also differ in these two income statement (Cinquini and

Tenucci, 2010). From the marginal cost accounting method, the profits which achieved by

Harrrods limited is considered to £9300 whereas in absorption costing the profitability of

enterprise is £9600. Major difference between these two methods is the way of calculation of

cost. Income statements of marginal costing, the total cost of enterprise is worth £3900 as it only

considered as the variable cost which is incurred on purchase of goods. Moreover, the absorption

costing considered total cost which is referred to Variable and fixed cost that is £1900 thus the

profitability is low.

Apart from this, majority of small business enterprises use absorption costing methods as

it lower the cost of production and covers all the expenditure which is incurred by organisation in

order to provide complete financial analysis and position (Zimmerman and Yahya-Zadeh, 2011).

Further, if the company depends on this method it will not able to define the actual which is

incurred and its profitability will decline. It provides a clear understanding and appropriate

financial growth of organisation by determining the profitability at the end of financial year.

Difference among both these methods of accounting

Absorption costing method Marginal costing method

Important method of management accounting Methods of costing that is being used by

7

profits. The value of net profit will also differ in these two income statement (Cinquini and

Tenucci, 2010). From the marginal cost accounting method, the profits which achieved by

Harrrods limited is considered to £9300 whereas in absorption costing the profitability of

enterprise is £9600. Major difference between these two methods is the way of calculation of

cost. Income statements of marginal costing, the total cost of enterprise is worth £3900 as it only

considered as the variable cost which is incurred on purchase of goods. Moreover, the absorption

costing considered total cost which is referred to Variable and fixed cost that is £1900 thus the

profitability is low.

Apart from this, majority of small business enterprises use absorption costing methods as

it lower the cost of production and covers all the expenditure which is incurred by organisation in

order to provide complete financial analysis and position (Zimmerman and Yahya-Zadeh, 2011).

Further, if the company depends on this method it will not able to define the actual which is

incurred and its profitability will decline. It provides a clear understanding and appropriate

financial growth of organisation by determining the profitability at the end of financial year.

Difference among both these methods of accounting

Absorption costing method Marginal costing method

Important method of management accounting Methods of costing that is being used by

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in which the organization will use both

variable and management accounting in order

to provide a actual financial position of

HARRODS through profitability.

organization to calculate the additional

expenses which are made by organization on

purchase of goods and services (Fullerton,

Kennedy and Widener, 2013). It is not

considered as effective as it only considers the

Variable cost and does not provide an actual

financial position of enterprise.

In marginal costing the amount of stock

remaining at the end of year is considered as

overall variable expenses which is analysed as

cost of production. Therefore, they are not

analysed in next year 's income statements.

In this, the amount of closing stock which is

calculated at the end of year should be carry

forward in next accounting year. It also

considered in total cost of production or

purchase in specific time duration.

In this company is also capable to gain

formulate better decision for business

operations which is done on the basis of

international standards of accounting.

This method is being used by managers to

formulate and implement better and effective

business decisions.

It is used by management for the reason on

external system of management accounting.

It is mainly used by organisation for the

purpose of internal reporting system.

TASK 3

P4 Merits and demerits some important tools and methods of planning.

In present scenario, some important planning tools are identified which is required

management accounting system to make the control over the disposals. By these tools, the firms

will get support to greater extent in budgetary control systems (Van der Stede, 2011). In present

scenario, HARRODS Ltd also use various planning tools to achieve high amount of gains at end

of financial year in retail industry. Apart from various tools and techniques, there are mainly

three methods which is budget methods as well as ratio analysis. Benefits and limitations of such

tools are describes as below:

Budgeting: Considered as effective significant techniques that is used within Harrods in

order to manage the cost, accounts and resources (Cuganesan, Dunford and Palmer, 2012). From

the perspective of Budget, the HARRODS enterprise is able to understand its future

8

variable and management accounting in order

to provide a actual financial position of

HARRODS through profitability.

organization to calculate the additional

expenses which are made by organization on

purchase of goods and services (Fullerton,

Kennedy and Widener, 2013). It is not

considered as effective as it only considers the

Variable cost and does not provide an actual

financial position of enterprise.

In marginal costing the amount of stock

remaining at the end of year is considered as

overall variable expenses which is analysed as

cost of production. Therefore, they are not

analysed in next year 's income statements.

In this, the amount of closing stock which is

calculated at the end of year should be carry

forward in next accounting year. It also

considered in total cost of production or

purchase in specific time duration.

In this company is also capable to gain

formulate better decision for business

operations which is done on the basis of

international standards of accounting.

This method is being used by managers to

formulate and implement better and effective

business decisions.

It is used by management for the reason on

external system of management accounting.

It is mainly used by organisation for the

purpose of internal reporting system.

TASK 3

P4 Merits and demerits some important tools and methods of planning.

In present scenario, some important planning tools are identified which is required

management accounting system to make the control over the disposals. By these tools, the firms

will get support to greater extent in budgetary control systems (Van der Stede, 2011). In present

scenario, HARRODS Ltd also use various planning tools to achieve high amount of gains at end

of financial year in retail industry. Apart from various tools and techniques, there are mainly

three methods which is budget methods as well as ratio analysis. Benefits and limitations of such

tools are describes as below:

Budgeting: Considered as effective significant techniques that is used within Harrods in

order to manage the cost, accounts and resources (Cuganesan, Dunford and Palmer, 2012). From

the perspective of Budget, the HARRODS enterprise is able to understand its future

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

management accounting and expected financial position or performance in retail sector of

furniture. In this, the company allocate appropriate funds for each task which is needed to be

completed in specific time period. Other than this, there are various types of budgets have been

prepared by Harrods in order to manage its cost in market. Through application of this

methodology of development of effective budgets for each and every task and project,

management of Harrods will be able to decrease their cost of operations and also enable the

organisation to earn its desired profitability.

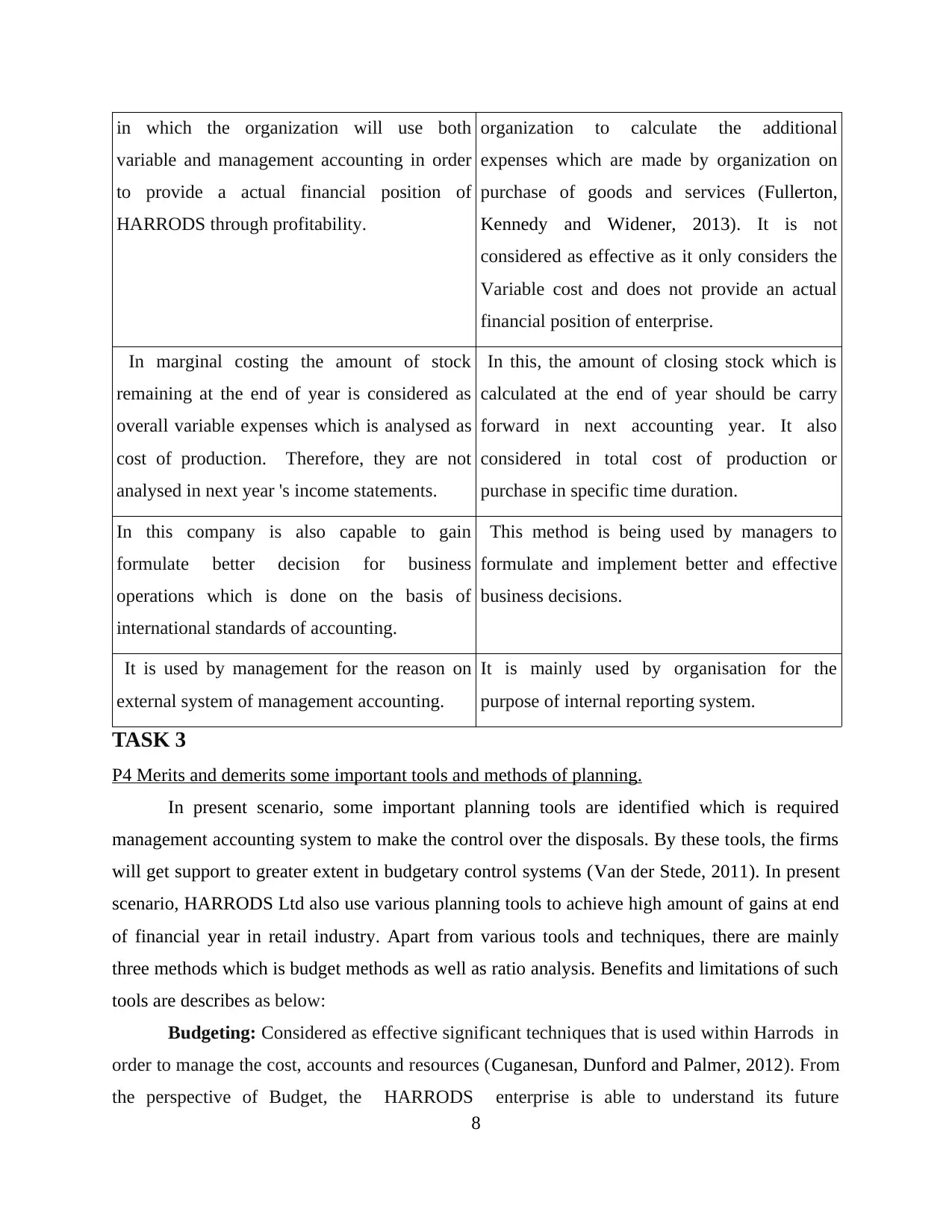

Cash Budget:

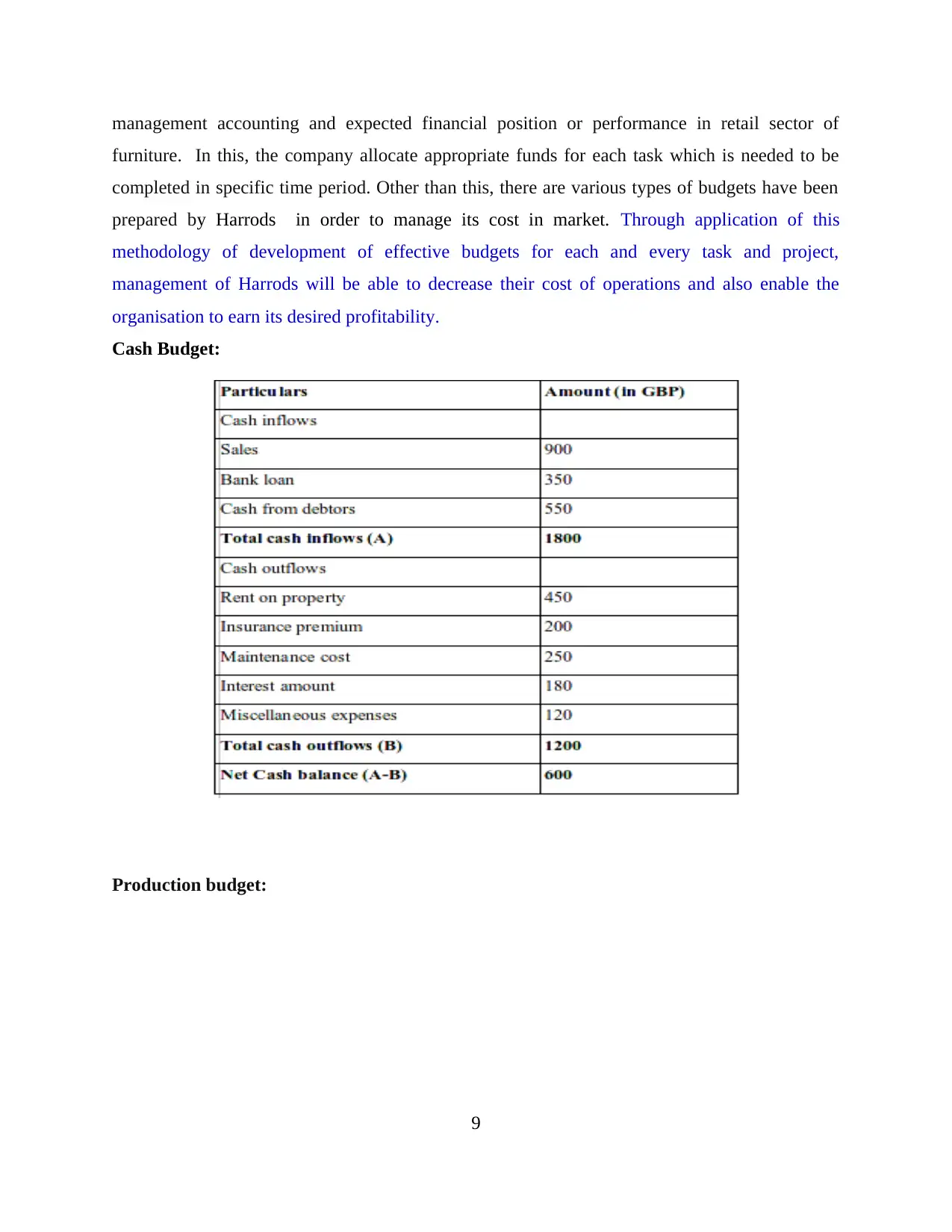

Production budget:

9

furniture. In this, the company allocate appropriate funds for each task which is needed to be

completed in specific time period. Other than this, there are various types of budgets have been

prepared by Harrods in order to manage its cost in market. Through application of this

methodology of development of effective budgets for each and every task and project,

management of Harrods will be able to decrease their cost of operations and also enable the

organisation to earn its desired profitability.

Cash Budget:

Production budget:

9

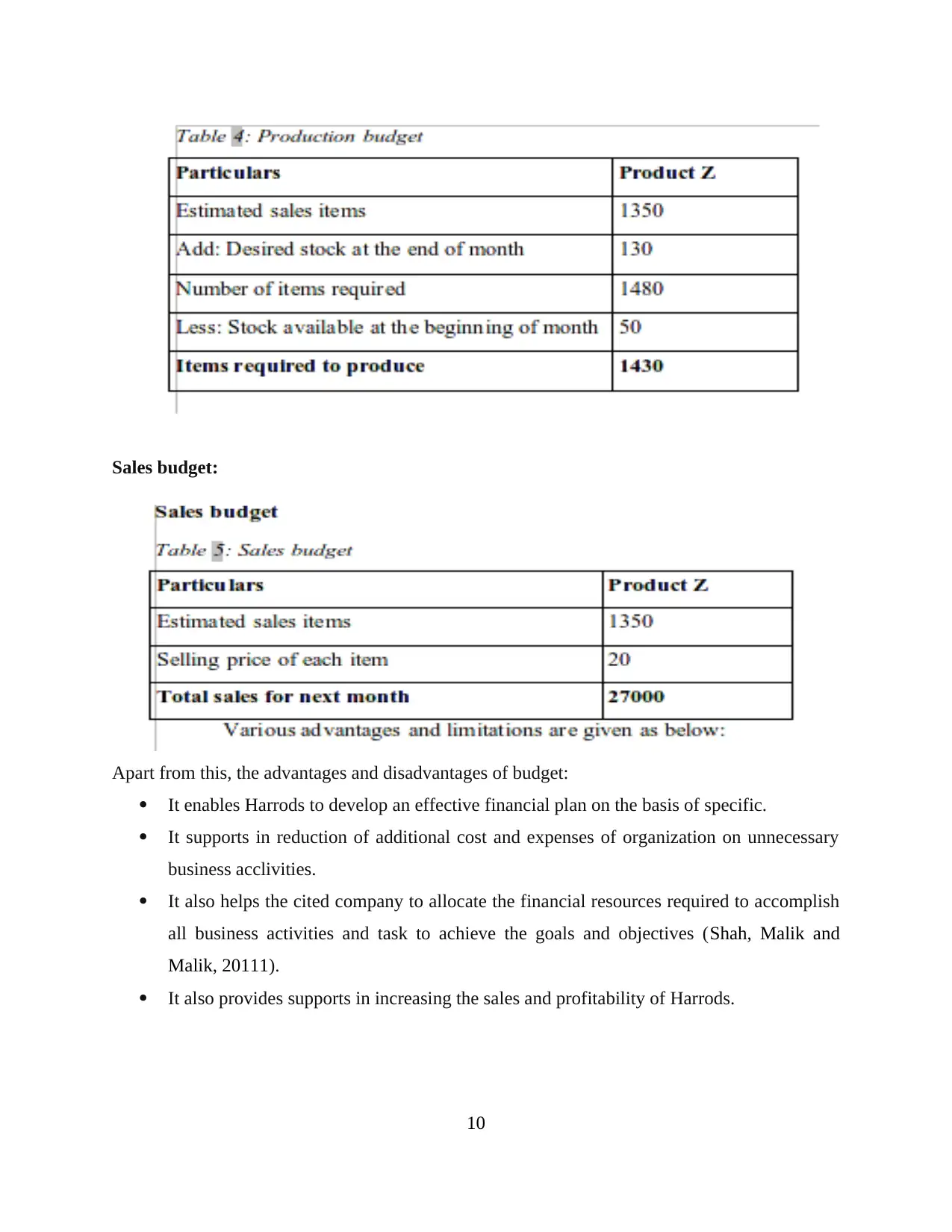

Sales budget:

Apart from this, the advantages and disadvantages of budget:

It enables Harrods to develop an effective financial plan on the basis of specific.

It supports in reduction of additional cost and expenses of organization on unnecessary

business acclivities.

It also helps the cited company to allocate the financial resources required to accomplish

all business activities and task to achieve the goals and objectives (Shah, Malik and

Malik, 20111).

It also provides supports in increasing the sales and profitability of Harrods.

10

Apart from this, the advantages and disadvantages of budget:

It enables Harrods to develop an effective financial plan on the basis of specific.

It supports in reduction of additional cost and expenses of organization on unnecessary

business acclivities.

It also helps the cited company to allocate the financial resources required to accomplish

all business activities and task to achieve the goals and objectives (Shah, Malik and

Malik, 20111).

It also provides supports in increasing the sales and profitability of Harrods.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.