Management Accounting Report: Imda Tech's Financial Strategies

VerifiedAdded on 2020/02/17

|16

|5394

|113

Report

AI Summary

This report examines the fundamentals of management accounting, focusing on its application within Imda Tech, a manufacturing organization specializing in mobile chargers. The report begins by defining managerial accounting and differentiating it from financial accounting, emphasizing its role in internal decision-making and strategic planning. It then explores various types of management accounting systems, such as cost accounting and inventory management, and how these systems can be utilized by different departments within Imda Tech. The report includes calculations of net profit using both marginal and absorption costing techniques. It further delves into budgeting, covering different types of budgets, the budget preparation process, and pricing strategies. Additionally, the report explains the balance scorecard and its implementation for performance measurement. The report aims to provide Imda Tech's divisional managers with the necessary tools to make informed decisions, improve operational efficiency, and achieve sustainable growth. The report also includes an introduction, conclusion, and references.

MANAGEMENT ACCOUNTING

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................3

TASK 1.................................................................................................................................................3

(A). (i). Managerial accounting, definition and distinguish between management and financial

accounting........................................................................................................................................3

(ii) Significance of management accounting information as a decision-making tool....................4

(B) Explaining different types of management accounting system & its use by various

departments......................................................................................................................................5

TASK2..................................................................................................................................................8

Calculation of net profit by adopting marginal and absorption costing techniques........................8

TASK 3...............................................................................................................................................10

P4) (a) Various types of budget and its characteristics/limitations................................................10

b) Process of preparing budget......................................................................................................11

c) Pricing strategies........................................................................................................................12

Task 4..................................................................................................................................................12

a) Explanation of balance scorecard and how it can be implemented can deliver a range of

performance measure.....................................................................................................................12

CONCLUSION..................................................................................................................................13

REFERENCES...................................................................................................................................15

2

INTRODUCTION................................................................................................................................3

TASK 1.................................................................................................................................................3

(A). (i). Managerial accounting, definition and distinguish between management and financial

accounting........................................................................................................................................3

(ii) Significance of management accounting information as a decision-making tool....................4

(B) Explaining different types of management accounting system & its use by various

departments......................................................................................................................................5

TASK2..................................................................................................................................................8

Calculation of net profit by adopting marginal and absorption costing techniques........................8

TASK 3...............................................................................................................................................10

P4) (a) Various types of budget and its characteristics/limitations................................................10

b) Process of preparing budget......................................................................................................11

c) Pricing strategies........................................................................................................................12

Task 4..................................................................................................................................................12

a) Explanation of balance scorecard and how it can be implemented can deliver a range of

performance measure.....................................................................................................................12

CONCLUSION..................................................................................................................................13

REFERENCES...................................................................................................................................15

2

INTRODUCTION

The process of analysis, examination, interpretation & presenting accounting based

information that has been measured through the preparation of financial accounting, reports and

others is called managerial accounting. It aids in business decisions for creating a right policies,

daily operational management plans and others for the purpose of successful business. It helps in

measuring organizational purpose, assessing business risk, resource allocation decisions and other

plans for the sustainable success. Imda Tech is a manufacturing organization that is involved in

preparing special chargers for the mobile and gadgets for the British retailers. In the recent meeting,

different departmental managers have complained for the lack of monetary information in order to

improve their decision-making process. Thus, the proposed report herewith emphasizes on

understanding and assessing the managerial accounting fundamentals i.e. financial accounting,

budgeting, balance score card and costing techniques as well. With the help of this, Imda Tech’s

divisional managers will be able to make smarter decisions for achieving a long-run success.

TASK 1

(A). (i). Managerial accounting, definition and distinguish between management and financial

accounting

To: Imdal, Line Manager

From: Management Accounting Officer

Date: 9th April 2017

Subject: Management accounting meaning and its difference from the financial accounting

Management accounting is regarded as a process which provides time-dated and accurate

financial & statistical information to the managers for making regular short-term decisions. Unlike

financial accounting which targeted at making annual corporate accounts to report external

stakeholders, MA focuses on generating weekly or monthly reports and informs the internal

audiences of the Imda Tech i.e. executives, departmental managers and others (Nuhu, Baird and

Appuhami, 2016). The reports express the available cash balance, sales revenue, outstanding

receivables & payables, inventory & other required statistical information. The main objective of it

is to enhance the business efficiency and thereby reach the organizational goals successfully.

Difference between financial and managerial accounting

Differences Managerial accounting (MA) Financial accounting (FA)

Aim The target aim of the MA is to provide

essential information to the internal

Unlike MA, it aims at delivering

required information to the

3

The process of analysis, examination, interpretation & presenting accounting based

information that has been measured through the preparation of financial accounting, reports and

others is called managerial accounting. It aids in business decisions for creating a right policies,

daily operational management plans and others for the purpose of successful business. It helps in

measuring organizational purpose, assessing business risk, resource allocation decisions and other

plans for the sustainable success. Imda Tech is a manufacturing organization that is involved in

preparing special chargers for the mobile and gadgets for the British retailers. In the recent meeting,

different departmental managers have complained for the lack of monetary information in order to

improve their decision-making process. Thus, the proposed report herewith emphasizes on

understanding and assessing the managerial accounting fundamentals i.e. financial accounting,

budgeting, balance score card and costing techniques as well. With the help of this, Imda Tech’s

divisional managers will be able to make smarter decisions for achieving a long-run success.

TASK 1

(A). (i). Managerial accounting, definition and distinguish between management and financial

accounting

To: Imdal, Line Manager

From: Management Accounting Officer

Date: 9th April 2017

Subject: Management accounting meaning and its difference from the financial accounting

Management accounting is regarded as a process which provides time-dated and accurate

financial & statistical information to the managers for making regular short-term decisions. Unlike

financial accounting which targeted at making annual corporate accounts to report external

stakeholders, MA focuses on generating weekly or monthly reports and informs the internal

audiences of the Imda Tech i.e. executives, departmental managers and others (Nuhu, Baird and

Appuhami, 2016). The reports express the available cash balance, sales revenue, outstanding

receivables & payables, inventory & other required statistical information. The main objective of it

is to enhance the business efficiency and thereby reach the organizational goals successfully.

Difference between financial and managerial accounting

Differences Managerial accounting (MA) Financial accounting (FA)

Aim The target aim of the MA is to provide

essential information to the internal

Unlike MA, it aims at delivering

required information to the

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

users, i.e. departmental managers,

executives, directors and others for

taking informed organizational

decisions.

outsiders and external users i.e.

shareholders, creditors, lenders

and others to assist their

decisions-making process

(Schroeder, Clark and Cathey,

2016).

Mandatory

requirement

It totally depends upon the manager’s

choices and decisions without any

mandatory regulatory requirement

(Nuhu, Baird and Appuhami, 2016).

Imda Tech Ltd owes mandatory

obligation to prepare their income

statement, balance sheet and

others following accounting

standards and company law.

Governing

principles

Reports are prepared without any

standard base and can be constructed in

any format as per the choice of

management team.

In UK, GAAP has been designed

which all the entities needs to

adhere with while making their

annual accounts.

Time horizon Imda Tech’s managers not only needs to

prepare past reports also have to forecast

the future by making budgets.

It is prepared for the historical

accounting year.

Audit There is no need for the business to audit

their reports by an independent audit to

verify the truthfulness of it.

Unlike MA, Imda Tech is legally

accountable to audit their annual

reports by CPA to verify its

trustworthiness and truthfulness

(Picker and et.al., 2016).

Confidentiality The reports prepared by the managers

keep fully confidential as they are

available for the managerial use only.

SOCI, SOFP and SOCF are

publicly published in order to

report the financial success to the

external audiences, thus,

confidentiality is not maintained.

(ii) Significance of management accounting information as a decision-making tool

It is important for the Imda Tech’s managers to get assistance of the strategic management

accounting in order to make planning & decisions regarding the resource allocation, higher

organizational efficiency, exceeding sales performance and better short-term as well as long-term

4

executives, directors and others for

taking informed organizational

decisions.

outsiders and external users i.e.

shareholders, creditors, lenders

and others to assist their

decisions-making process

(Schroeder, Clark and Cathey,

2016).

Mandatory

requirement

It totally depends upon the manager’s

choices and decisions without any

mandatory regulatory requirement

(Nuhu, Baird and Appuhami, 2016).

Imda Tech Ltd owes mandatory

obligation to prepare their income

statement, balance sheet and

others following accounting

standards and company law.

Governing

principles

Reports are prepared without any

standard base and can be constructed in

any format as per the choice of

management team.

In UK, GAAP has been designed

which all the entities needs to

adhere with while making their

annual accounts.

Time horizon Imda Tech’s managers not only needs to

prepare past reports also have to forecast

the future by making budgets.

It is prepared for the historical

accounting year.

Audit There is no need for the business to audit

their reports by an independent audit to

verify the truthfulness of it.

Unlike MA, Imda Tech is legally

accountable to audit their annual

reports by CPA to verify its

trustworthiness and truthfulness

(Picker and et.al., 2016).

Confidentiality The reports prepared by the managers

keep fully confidential as they are

available for the managerial use only.

SOCI, SOFP and SOCF are

publicly published in order to

report the financial success to the

external audiences, thus,

confidentiality is not maintained.

(ii) Significance of management accounting information as a decision-making tool

It is important for the Imda Tech’s managers to get assistance of the strategic management

accounting in order to make planning & decisions regarding the resource allocation, higher

organizational efficiency, exceeding sales performance and better short-term as well as long-term

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

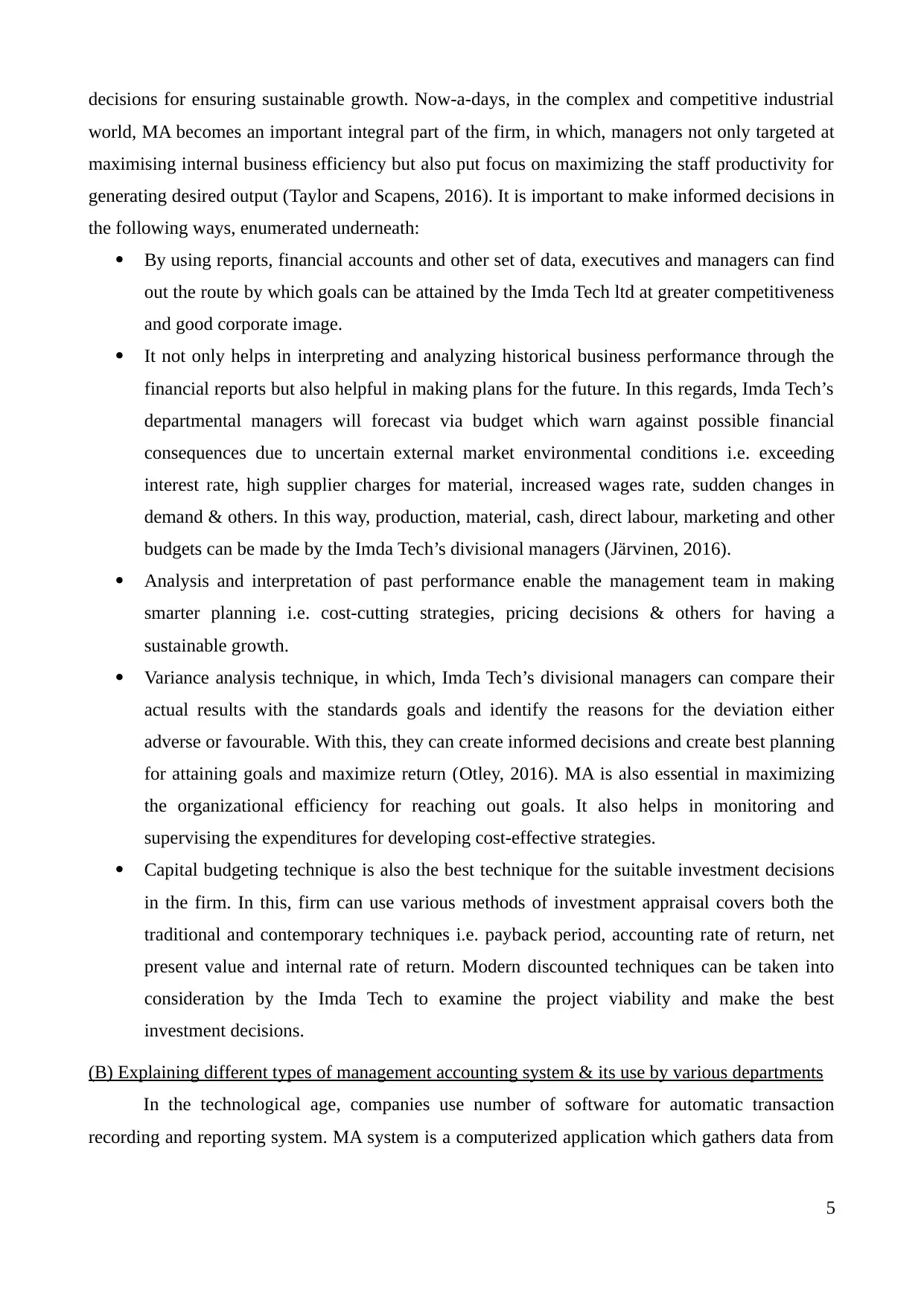

decisions for ensuring sustainable growth. Now-a-days, in the complex and competitive industrial

world, MA becomes an important integral part of the firm, in which, managers not only targeted at

maximising internal business efficiency but also put focus on maximizing the staff productivity for

generating desired output (Taylor and Scapens, 2016). It is important to make informed decisions in

the following ways, enumerated underneath:

By using reports, financial accounts and other set of data, executives and managers can find

out the route by which goals can be attained by the Imda Tech ltd at greater competitiveness

and good corporate image.

It not only helps in interpreting and analyzing historical business performance through the

financial reports but also helpful in making plans for the future. In this regards, Imda Tech’s

departmental managers will forecast via budget which warn against possible financial

consequences due to uncertain external market environmental conditions i.e. exceeding

interest rate, high supplier charges for material, increased wages rate, sudden changes in

demand & others. In this way, production, material, cash, direct labour, marketing and other

budgets can be made by the Imda Tech’s divisional managers (Järvinen, 2016).

Analysis and interpretation of past performance enable the management team in making

smarter planning i.e. cost-cutting strategies, pricing decisions & others for having a

sustainable growth.

Variance analysis technique, in which, Imda Tech’s divisional managers can compare their

actual results with the standards goals and identify the reasons for the deviation either

adverse or favourable. With this, they can create informed decisions and create best planning

for attaining goals and maximize return (Otley, 2016). MA is also essential in maximizing

the organizational efficiency for reaching out goals. It also helps in monitoring and

supervising the expenditures for developing cost-effective strategies.

Capital budgeting technique is also the best technique for the suitable investment decisions

in the firm. In this, firm can use various methods of investment appraisal covers both the

traditional and contemporary techniques i.e. payback period, accounting rate of return, net

present value and internal rate of return. Modern discounted techniques can be taken into

consideration by the Imda Tech to examine the project viability and make the best

investment decisions.

(B) Explaining different types of management accounting system & its use by various departments

In the technological age, companies use number of software for automatic transaction

recording and reporting system. MA system is a computerized application which gathers data from

5

world, MA becomes an important integral part of the firm, in which, managers not only targeted at

maximising internal business efficiency but also put focus on maximizing the staff productivity for

generating desired output (Taylor and Scapens, 2016). It is important to make informed decisions in

the following ways, enumerated underneath:

By using reports, financial accounts and other set of data, executives and managers can find

out the route by which goals can be attained by the Imda Tech ltd at greater competitiveness

and good corporate image.

It not only helps in interpreting and analyzing historical business performance through the

financial reports but also helpful in making plans for the future. In this regards, Imda Tech’s

departmental managers will forecast via budget which warn against possible financial

consequences due to uncertain external market environmental conditions i.e. exceeding

interest rate, high supplier charges for material, increased wages rate, sudden changes in

demand & others. In this way, production, material, cash, direct labour, marketing and other

budgets can be made by the Imda Tech’s divisional managers (Järvinen, 2016).

Analysis and interpretation of past performance enable the management team in making

smarter planning i.e. cost-cutting strategies, pricing decisions & others for having a

sustainable growth.

Variance analysis technique, in which, Imda Tech’s divisional managers can compare their

actual results with the standards goals and identify the reasons for the deviation either

adverse or favourable. With this, they can create informed decisions and create best planning

for attaining goals and maximize return (Otley, 2016). MA is also essential in maximizing

the organizational efficiency for reaching out goals. It also helps in monitoring and

supervising the expenditures for developing cost-effective strategies.

Capital budgeting technique is also the best technique for the suitable investment decisions

in the firm. In this, firm can use various methods of investment appraisal covers both the

traditional and contemporary techniques i.e. payback period, accounting rate of return, net

present value and internal rate of return. Modern discounted techniques can be taken into

consideration by the Imda Tech to examine the project viability and make the best

investment decisions.

(B) Explaining different types of management accounting system & its use by various departments

In the technological age, companies use number of software for automatic transaction

recording and reporting system. MA system is a computerized application which gathers data from

5

wider set of operations i.e. sales, cost of material, labor’s wages rate, inventory and others and

transform and process it into meaningful manner by generating reports (Guinea, 2016). There are

number of MA system available which Imda Tech’s various business departments can use for the

measuring business performance and bringing continuous improvement in the goods delivery

system for achieving the defined targets. The system provides the information about regular

operations like sales, purchase, cost, comparison between target & actual data and others which

enable Imda Tech’s managerial team in creating excellent plans for the growth in profitability. Some

of the important MA systems that are helpful in generating informative business reports are

enumerated underneath:

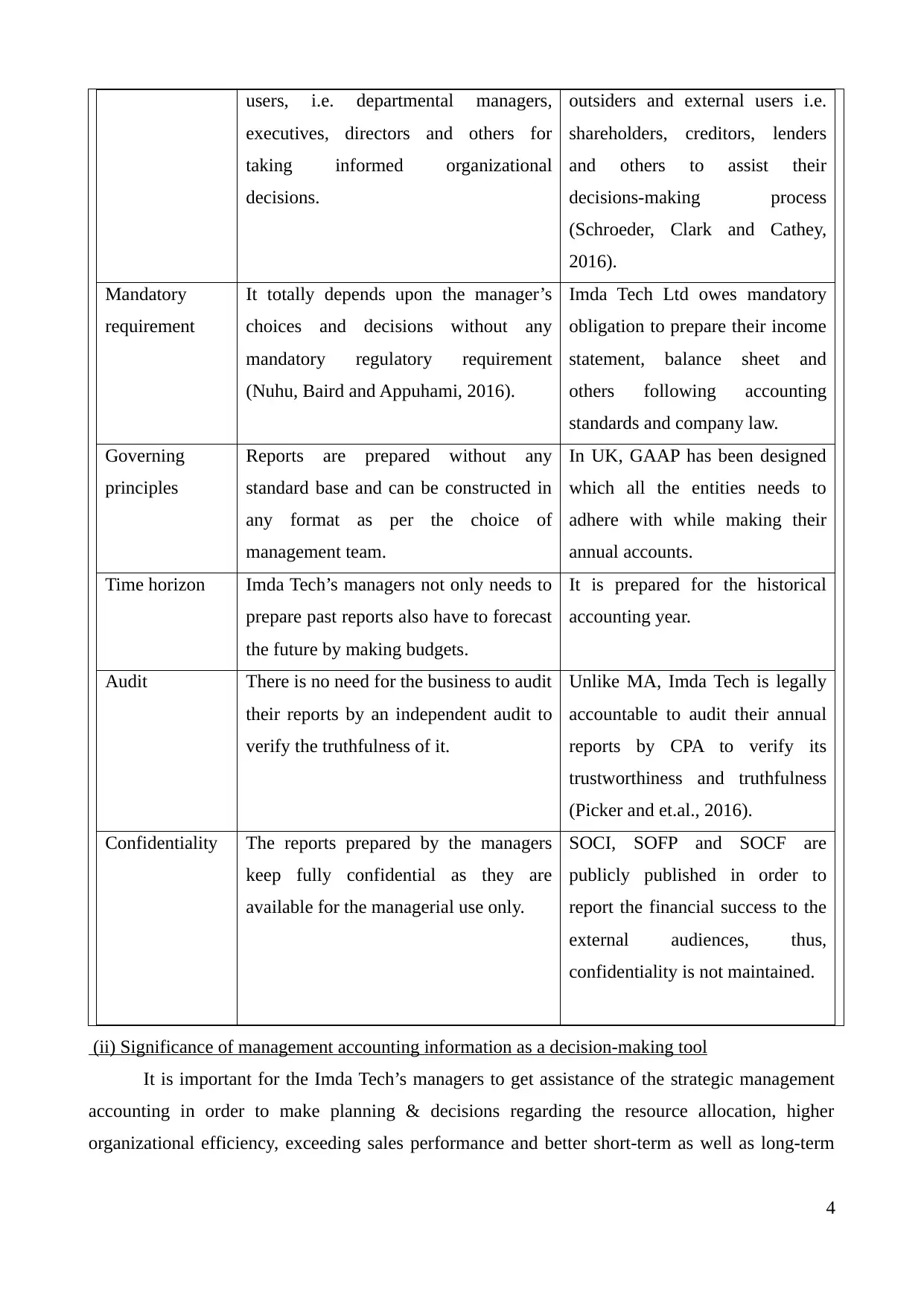

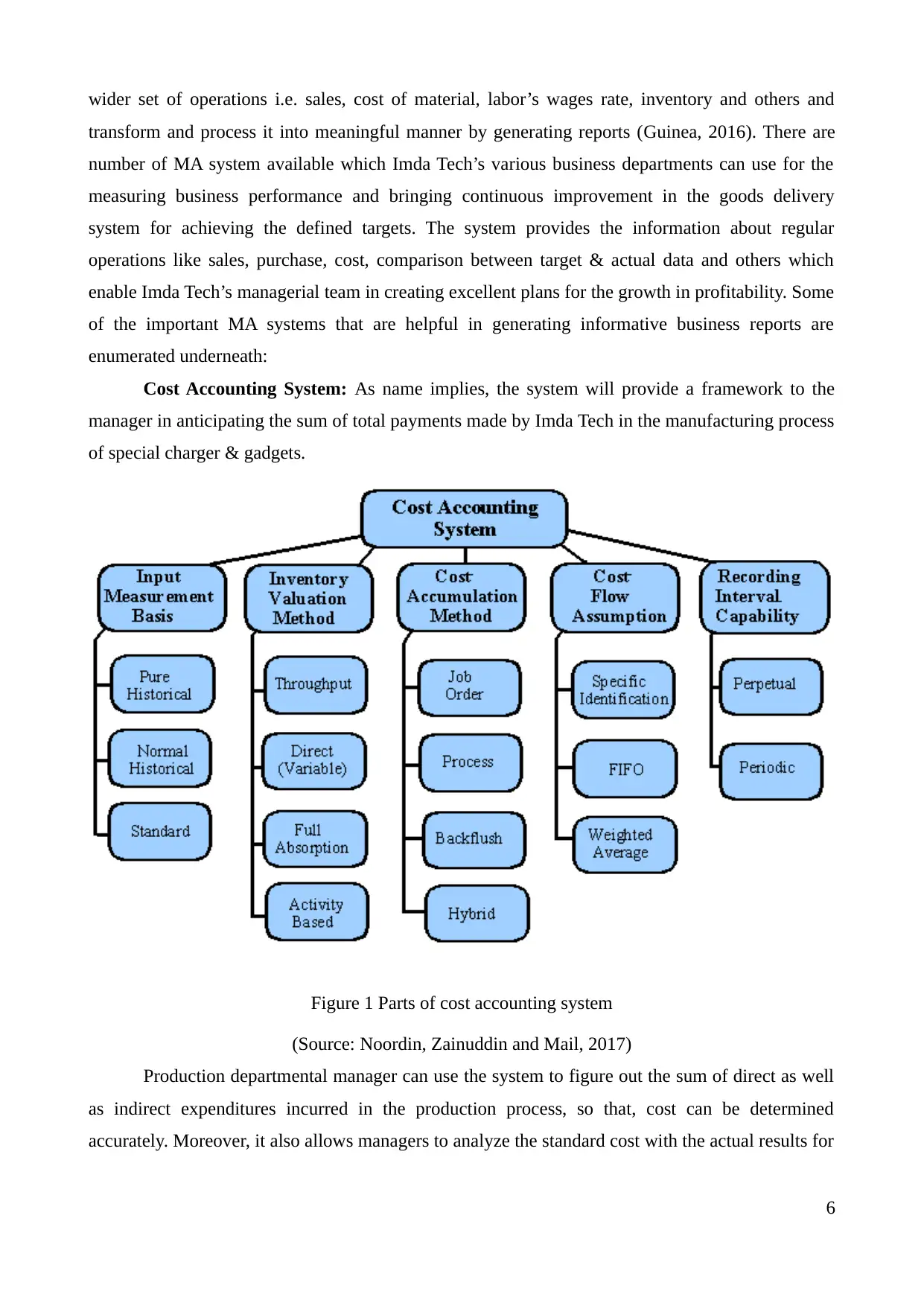

Cost Accounting System: As name implies, the system will provide a framework to the

manager in anticipating the sum of total payments made by Imda Tech in the manufacturing process

of special charger & gadgets.

Figure 1 Parts of cost accounting system

(Source: Noordin, Zainuddin and Mail, 2017)

Production departmental manager can use the system to figure out the sum of direct as well

as indirect expenditures incurred in the production process, so that, cost can be determined

accurately. Moreover, it also allows managers to analyze the standard cost with the actual results for

6

transform and process it into meaningful manner by generating reports (Guinea, 2016). There are

number of MA system available which Imda Tech’s various business departments can use for the

measuring business performance and bringing continuous improvement in the goods delivery

system for achieving the defined targets. The system provides the information about regular

operations like sales, purchase, cost, comparison between target & actual data and others which

enable Imda Tech’s managerial team in creating excellent plans for the growth in profitability. Some

of the important MA systems that are helpful in generating informative business reports are

enumerated underneath:

Cost Accounting System: As name implies, the system will provide a framework to the

manager in anticipating the sum of total payments made by Imda Tech in the manufacturing process

of special charger & gadgets.

Figure 1 Parts of cost accounting system

(Source: Noordin, Zainuddin and Mail, 2017)

Production departmental manager can use the system to figure out the sum of direct as well

as indirect expenditures incurred in the production process, so that, cost can be determined

accurately. Moreover, it also allows managers to analyze the standard cost with the actual results for

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the evaluation of deviations and thereby compute the total manufacturing/work cost (Noordin,

Zainuddin and Mail, 2017). With the help of this, right decisions can be made by the Imda Tech’s

production manager for right cost allocation, waste reduction and efficient resource utilization for

the minimal cost.

Inventory Management System: It is a computerized software which is beneficial for the

inventory tracking because it provides essential information regarding the order placed, sales order

deliveries and adjust the stock items accordingly. Being a manufacturing concern, Imda Tech Ltd

can use the system for creating orders, material bills and other documentation for the production

function. With this, manager can value accurately the closing stock and avoid any possibility of

overstocking and danger level by managing it accordingly in line with the market demand.

Job Costing System: Job order costing system enable corporate managers to assign the

manufacturing overheads to an individual unit or a production batch. Imda Tech’s manufacturing,

and purchase department can use it to figure out the total cost (material, labour, fixed and variable

production overheads) incurred on a specific batch or consumer order received by it and helps to

quote prices for the orders placed by the customers and retail outlets for chargers and gadgets (Uyar

and Kuzey, 2016).

Price optimisation system: Selling department of the Imda tech Ltd can use this system to

find out the responsiveness of the customers at distinctive prices charged by it for the goods

produced. It will assist the firm in making analytics-based prices that is reasonable for both the

organization and customer (Taleizadeh and et.al., 2017). It is because; users will be ready to pay the

rates willingly for getting the product whereas company can receive good return on the total

turnover.

7

Zainuddin and Mail, 2017). With the help of this, right decisions can be made by the Imda Tech’s

production manager for right cost allocation, waste reduction and efficient resource utilization for

the minimal cost.

Inventory Management System: It is a computerized software which is beneficial for the

inventory tracking because it provides essential information regarding the order placed, sales order

deliveries and adjust the stock items accordingly. Being a manufacturing concern, Imda Tech Ltd

can use the system for creating orders, material bills and other documentation for the production

function. With this, manager can value accurately the closing stock and avoid any possibility of

overstocking and danger level by managing it accordingly in line with the market demand.

Job Costing System: Job order costing system enable corporate managers to assign the

manufacturing overheads to an individual unit or a production batch. Imda Tech’s manufacturing,

and purchase department can use it to figure out the total cost (material, labour, fixed and variable

production overheads) incurred on a specific batch or consumer order received by it and helps to

quote prices for the orders placed by the customers and retail outlets for chargers and gadgets (Uyar

and Kuzey, 2016).

Price optimisation system: Selling department of the Imda tech Ltd can use this system to

find out the responsiveness of the customers at distinctive prices charged by it for the goods

produced. It will assist the firm in making analytics-based prices that is reasonable for both the

organization and customer (Taleizadeh and et.al., 2017). It is because; users will be ready to pay the

rates willingly for getting the product whereas company can receive good return on the total

turnover.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK2

Calculation of net profit by adopting marginal and absorption costing techniques

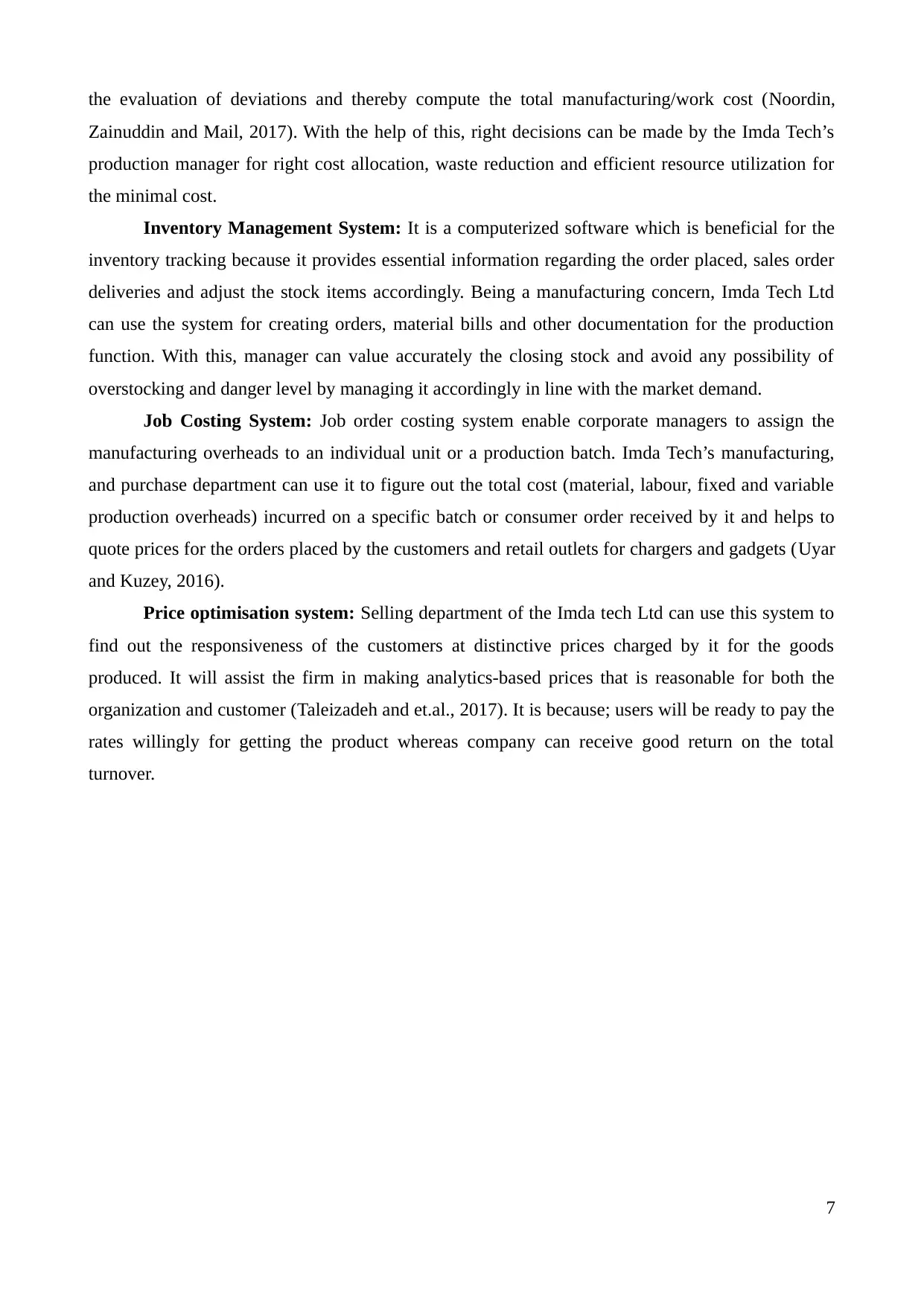

I:Marginal costing- It is a management costing method that can be used by the company for the

purpose of preparing the income statement in the financial year. Thus, it can be define in terms of

management accounting is that there is an increment and decrement in an opportunity cost of a firm

when there is an extra unit of cost produce at each production level. Furthermore, the calculation

under this marginal costing in which the management accountant take only direct material, direct

labor and variable production and ignore fixed expenses. Thereafter, at the time of calculating net

profit it deduct variable expenses as well as fixed expenses from the gross profit.

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Cost of goods sold 22500

Gross profit 30000

Less: variable expenses

Variable selling expenses 7875

Total variable expenses 7875

Contribution 22125

less:Fixed expenses

Fixed selling expenses 10000

Fixed production overhead 15000

Total fixed expenses 25000

Net profit -2875

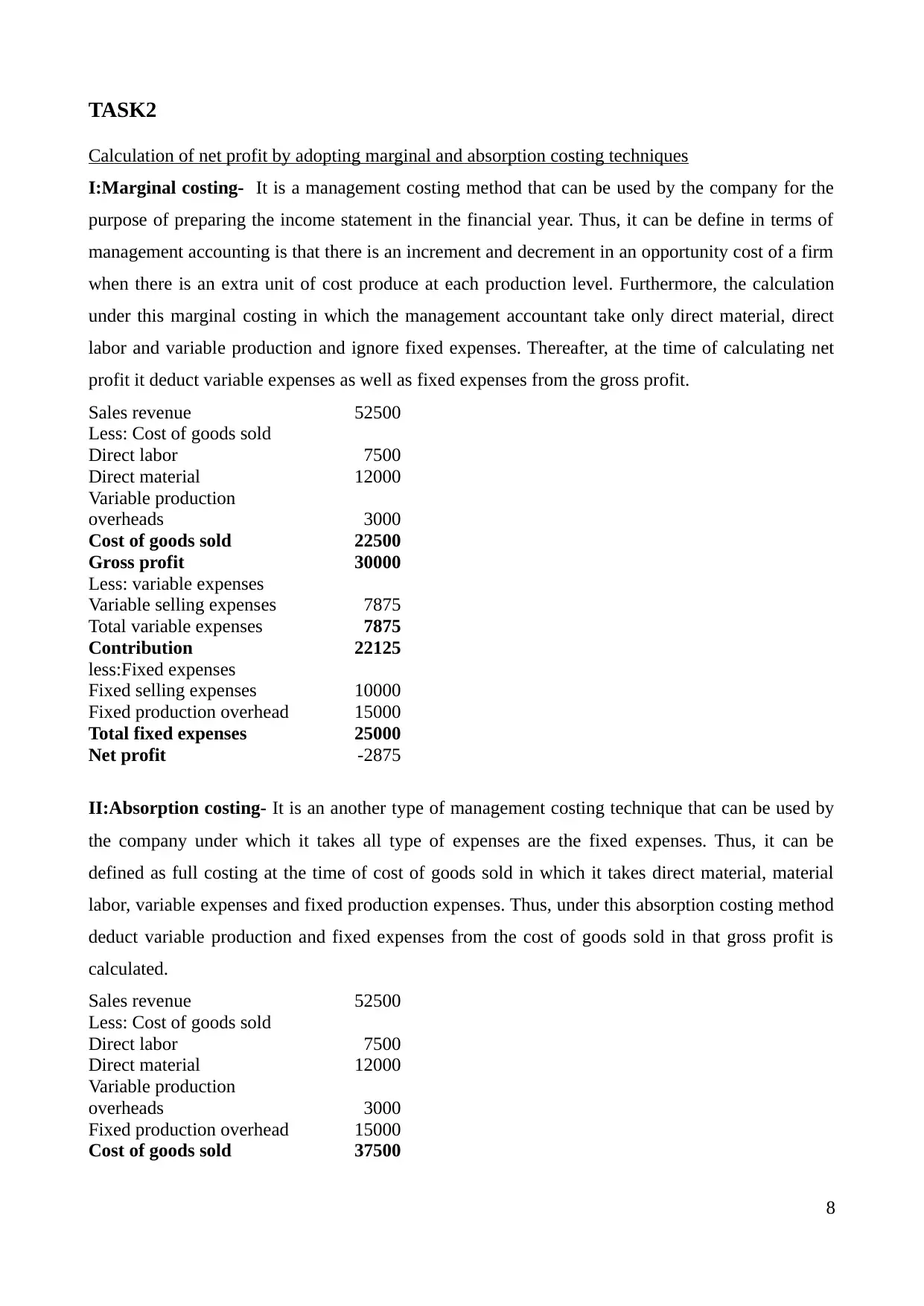

II:Absorption costing- It is an another type of management costing technique that can be used by

the company under which it takes all type of expenses are the fixed expenses. Thus, it can be

defined as full costing at the time of cost of goods sold in which it takes direct material, material

labor, variable expenses and fixed production expenses. Thus, under this absorption costing method

deduct variable production and fixed expenses from the cost of goods sold in that gross profit is

calculated.

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Fixed production overhead 15000

Cost of goods sold 37500

8

Calculation of net profit by adopting marginal and absorption costing techniques

I:Marginal costing- It is a management costing method that can be used by the company for the

purpose of preparing the income statement in the financial year. Thus, it can be define in terms of

management accounting is that there is an increment and decrement in an opportunity cost of a firm

when there is an extra unit of cost produce at each production level. Furthermore, the calculation

under this marginal costing in which the management accountant take only direct material, direct

labor and variable production and ignore fixed expenses. Thereafter, at the time of calculating net

profit it deduct variable expenses as well as fixed expenses from the gross profit.

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Cost of goods sold 22500

Gross profit 30000

Less: variable expenses

Variable selling expenses 7875

Total variable expenses 7875

Contribution 22125

less:Fixed expenses

Fixed selling expenses 10000

Fixed production overhead 15000

Total fixed expenses 25000

Net profit -2875

II:Absorption costing- It is an another type of management costing technique that can be used by

the company under which it takes all type of expenses are the fixed expenses. Thus, it can be

defined as full costing at the time of cost of goods sold in which it takes direct material, material

labor, variable expenses and fixed production expenses. Thus, under this absorption costing method

deduct variable production and fixed expenses from the cost of goods sold in that gross profit is

calculated.

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Fixed production overhead 15000

Cost of goods sold 37500

8

Gross profit 15000

Less:

Variable selling expenses 7875

Fixed selling expenses 10000

Total expenses 17875

Net profit -2875

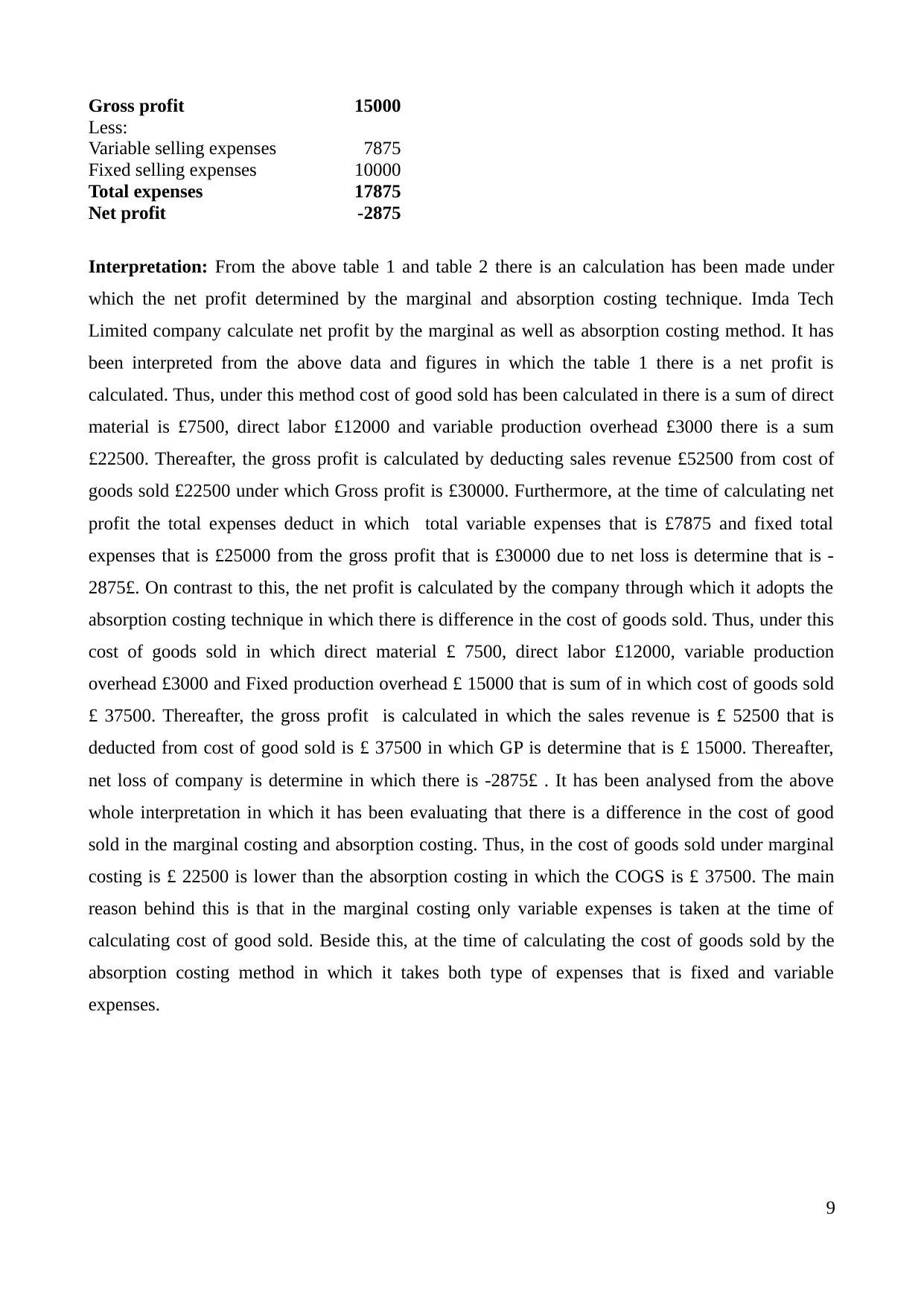

Interpretation: From the above table 1 and table 2 there is an calculation has been made under

which the net profit determined by the marginal and absorption costing technique. Imda Tech

Limited company calculate net profit by the marginal as well as absorption costing method. It has

been interpreted from the above data and figures in which the table 1 there is a net profit is

calculated. Thus, under this method cost of good sold has been calculated in there is a sum of direct

material is £7500, direct labor £12000 and variable production overhead £3000 there is a sum

£22500. Thereafter, the gross profit is calculated by deducting sales revenue £52500 from cost of

goods sold £22500 under which Gross profit is £30000. Furthermore, at the time of calculating net

profit the total expenses deduct in which total variable expenses that is £7875 and fixed total

expenses that is £25000 from the gross profit that is £30000 due to net loss is determine that is -

2875£. On contrast to this, the net profit is calculated by the company through which it adopts the

absorption costing technique in which there is difference in the cost of goods sold. Thus, under this

cost of goods sold in which direct material £ 7500, direct labor £12000, variable production

overhead £3000 and Fixed production overhead £ 15000 that is sum of in which cost of goods sold

£ 37500. Thereafter, the gross profit is calculated in which the sales revenue is £ 52500 that is

deducted from cost of good sold is £ 37500 in which GP is determine that is £ 15000. Thereafter,

net loss of company is determine in which there is -2875£ . It has been analysed from the above

whole interpretation in which it has been evaluating that there is a difference in the cost of good

sold in the marginal costing and absorption costing. Thus, in the cost of goods sold under marginal

costing is £ 22500 is lower than the absorption costing in which the COGS is £ 37500. The main

reason behind this is that in the marginal costing only variable expenses is taken at the time of

calculating cost of good sold. Beside this, at the time of calculating the cost of goods sold by the

absorption costing method in which it takes both type of expenses that is fixed and variable

expenses.

9

Less:

Variable selling expenses 7875

Fixed selling expenses 10000

Total expenses 17875

Net profit -2875

Interpretation: From the above table 1 and table 2 there is an calculation has been made under

which the net profit determined by the marginal and absorption costing technique. Imda Tech

Limited company calculate net profit by the marginal as well as absorption costing method. It has

been interpreted from the above data and figures in which the table 1 there is a net profit is

calculated. Thus, under this method cost of good sold has been calculated in there is a sum of direct

material is £7500, direct labor £12000 and variable production overhead £3000 there is a sum

£22500. Thereafter, the gross profit is calculated by deducting sales revenue £52500 from cost of

goods sold £22500 under which Gross profit is £30000. Furthermore, at the time of calculating net

profit the total expenses deduct in which total variable expenses that is £7875 and fixed total

expenses that is £25000 from the gross profit that is £30000 due to net loss is determine that is -

2875£. On contrast to this, the net profit is calculated by the company through which it adopts the

absorption costing technique in which there is difference in the cost of goods sold. Thus, under this

cost of goods sold in which direct material £ 7500, direct labor £12000, variable production

overhead £3000 and Fixed production overhead £ 15000 that is sum of in which cost of goods sold

£ 37500. Thereafter, the gross profit is calculated in which the sales revenue is £ 52500 that is

deducted from cost of good sold is £ 37500 in which GP is determine that is £ 15000. Thereafter,

net loss of company is determine in which there is -2875£ . It has been analysed from the above

whole interpretation in which it has been evaluating that there is a difference in the cost of good

sold in the marginal costing and absorption costing. Thus, in the cost of goods sold under marginal

costing is £ 22500 is lower than the absorption costing in which the COGS is £ 37500. The main

reason behind this is that in the marginal costing only variable expenses is taken at the time of

calculating cost of good sold. Beside this, at the time of calculating the cost of goods sold by the

absorption costing method in which it takes both type of expenses that is fixed and variable

expenses.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

P4) (a) Various types of budget and its characteristics/limitations

Budget is an approach for forecasting and decision making process related to further

business operations. It creates several ideas for effectiveness of organization(Ax and Greve, 2016).

As per the given case scenario, Imda Limited sets target to improve its financial position therefore

budget is prepared for systematic planning procedure to be followed on. There are different kinds of

budget prepared that can be expressed as below:- Fixed budget:- Under this system, management accountant of organization analyzes current

business performance and further prepare fixed planning strategies to be implemented in

further months (Brown and et.al., 2016). Therefore, a certain idea is applied for further

months. For example; if company sets target to invest 2% more than current performance for

production and distribution of goods. Then, for next 2 further months, this target will be

constant. It is time consuming and effective for determining on focused goal and

implementing similar strategies at large scale.

Flexible budget:- It is different form fixed budget because of dynamics in planning

strategies. In this process, management accountant of entity analyzes all months

performance and further makes decisions differently (Daskalakis, Devanur and Weinberg,

2015). However, changes in strategic plan is occurred through this system. It affects

productivity and profitability of firm for next further months. For instance; due to continues

fluctuations in production and distribution of goods, various planning procedures are

obtained for following on strategies. In this regard, flexible budget is related to preparing

action plans in different ways.

Advantages of budget:- It is useful to present current business performance as per which

several ideas are created for decision making to operate business activities in future time. In

addition to this, it is best tool for optimum utilization of resources and fund. Moreover, productivity

and profitability of firm can be enhanced efficiently through using this approach (Giri and Sharma,

2014). However, a good relationship between employee and employer can be established by

preparing budget that is helpful for effective performance management. Thus, budget is considered

as one of the most essential tool for allocating fund for Imda Limited adequately.

Drawbacks of budget:- Wrong predictions over planning procedure is unable to formulate

and implement strategies for further years. However, it is difficult to analyze all business activities

and preparing planning strategies according to current business performance. Including this, budget

processing is costly and remains difficult to gain coordination of each employee of firm for working

10

P4) (a) Various types of budget and its characteristics/limitations

Budget is an approach for forecasting and decision making process related to further

business operations. It creates several ideas for effectiveness of organization(Ax and Greve, 2016).

As per the given case scenario, Imda Limited sets target to improve its financial position therefore

budget is prepared for systematic planning procedure to be followed on. There are different kinds of

budget prepared that can be expressed as below:- Fixed budget:- Under this system, management accountant of organization analyzes current

business performance and further prepare fixed planning strategies to be implemented in

further months (Brown and et.al., 2016). Therefore, a certain idea is applied for further

months. For example; if company sets target to invest 2% more than current performance for

production and distribution of goods. Then, for next 2 further months, this target will be

constant. It is time consuming and effective for determining on focused goal and

implementing similar strategies at large scale.

Flexible budget:- It is different form fixed budget because of dynamics in planning

strategies. In this process, management accountant of entity analyzes all months

performance and further makes decisions differently (Daskalakis, Devanur and Weinberg,

2015). However, changes in strategic plan is occurred through this system. It affects

productivity and profitability of firm for next further months. For instance; due to continues

fluctuations in production and distribution of goods, various planning procedures are

obtained for following on strategies. In this regard, flexible budget is related to preparing

action plans in different ways.

Advantages of budget:- It is useful to present current business performance as per which

several ideas are created for decision making to operate business activities in future time. In

addition to this, it is best tool for optimum utilization of resources and fund. Moreover, productivity

and profitability of firm can be enhanced efficiently through using this approach (Giri and Sharma,

2014). However, a good relationship between employee and employer can be established by

preparing budget that is helpful for effective performance management. Thus, budget is considered

as one of the most essential tool for allocating fund for Imda Limited adequately.

Drawbacks of budget:- Wrong predictions over planning procedure is unable to formulate

and implement strategies for further years. However, it is difficult to analyze all business activities

and preparing planning strategies according to current business performance. Including this, budget

processing is costly and remains difficult to gain coordination of each employee of firm for working

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

in team (Johnson, 2013). Moreover, there are uncertain changes occurs at workplace that disturbs

set planning procedures. Including this, wrong prediction for future business operations is tough

task for achieving effectiveness of organization. In this regard, budget is unplanned procedure for

creating ideas for various kinds of functional departments. Therefore, it is required for management

accountant to recognize all business operations and further preparing strategies more efficiently. In

accordance to this, effective budget planning procedure is meaningful for increasing its efficiency at

high level.

b) Process of preparing budget

Management accountant of Imda Limited prepares budget to allocate fund for effectiveness

of entity systematically (Klemstine and Maher, 2014). In this regard, it is presented in a managed

stepping by recognizing current planning to implementing as well evaluating further business

operations. However, process for preparing budget can be described as below:-(A)Update budget assumptions:- Under this system, management accountant of Imda Limited,

analyzes assumptions as well recognizes current business performance (Thai, Varghese and

Barker, 2015). As per which, identified data are updated and further assumptions are

acquired. Therefore, ideas are created for further business operations.

(B) Review bottlenecks:- In this process, maximum achievement is analyzed according to

which all effectiveness of organization is reviewed. In this regard, capability of

organization is obtained for investment and implementing action plans regarding enhancing

profitability of firm.(C) Available funding:- After reviewing all business operations and budget assumptions,

available net funding is observed including incurred expenses and gained revenue (Brown

and et.al., 2016). Thereby, in this process, effective fund is analyzed for operating further

business activities.(D) Creating budget package:- In this process, overall expenses and revenue is obtained for

adequate production and distribution of services provided by Imda limited. Therefore,

proper budget is prepared for effectiveness of organization and enhancing its efficiency at

high level.

(E) Obtain revenue forecast and department budget:- After creating budget package, revenue

and department functions are foretasted. On the basis of this, decisions are made for further

implementation (Giri and Sharma, 2014). However, estimated income and department

performance is forecast-ed for further implementation. In accordance to this, prepared

action plans are stepped forwarded that is useful for resources and fund allocation.

11

set planning procedures. Including this, wrong prediction for future business operations is tough

task for achieving effectiveness of organization. In this regard, budget is unplanned procedure for

creating ideas for various kinds of functional departments. Therefore, it is required for management

accountant to recognize all business operations and further preparing strategies more efficiently. In

accordance to this, effective budget planning procedure is meaningful for increasing its efficiency at

high level.

b) Process of preparing budget

Management accountant of Imda Limited prepares budget to allocate fund for effectiveness

of entity systematically (Klemstine and Maher, 2014). In this regard, it is presented in a managed

stepping by recognizing current planning to implementing as well evaluating further business

operations. However, process for preparing budget can be described as below:-(A)Update budget assumptions:- Under this system, management accountant of Imda Limited,

analyzes assumptions as well recognizes current business performance (Thai, Varghese and

Barker, 2015). As per which, identified data are updated and further assumptions are

acquired. Therefore, ideas are created for further business operations.

(B) Review bottlenecks:- In this process, maximum achievement is analyzed according to

which all effectiveness of organization is reviewed. In this regard, capability of

organization is obtained for investment and implementing action plans regarding enhancing

profitability of firm.(C) Available funding:- After reviewing all business operations and budget assumptions,

available net funding is observed including incurred expenses and gained revenue (Brown

and et.al., 2016). Thereby, in this process, effective fund is analyzed for operating further

business activities.(D) Creating budget package:- In this process, overall expenses and revenue is obtained for

adequate production and distribution of services provided by Imda limited. Therefore,

proper budget is prepared for effectiveness of organization and enhancing its efficiency at

high level.

(E) Obtain revenue forecast and department budget:- After creating budget package, revenue

and department functions are foretasted. On the basis of this, decisions are made for further

implementation (Giri and Sharma, 2014). However, estimated income and department

performance is forecast-ed for further implementation. In accordance to this, prepared

action plans are stepped forwarded that is useful for resources and fund allocation.

11

Above mentioned process is benefited for forecasting and decision making regarding

business operations in future time. However, estimated decision making is proceed for increasing

efficiency and proper management of entire business operations that impacts on productivity and

profitability of firm.

c) Pricing strategies

Management accountant of Imda limited sets price of product for production and

distribution system. In this process, costs are decided as per various factors as market demand,

competition and product value. Therefore, pricing strategies is interrelated with preparing planning

for cost. Including this, various determinants are recognized as material used in manufacturing and

production of goods. However, this kind of strategy is beneficial for financial management as well

fund allocation. Under this system, as per market position of products and changes in demand for

goods, prices are changes (Klemstine and Maher, 2014). It affects productivity and profit earning

capacity of firm. In accordance to this, various tools and techniques are used for setting price and

effective pricing as per which proper strategies are implemented and evaluated. Thus, pricing

strategies are of different kinds to set costs of product and making decisions for attraction of

customers towards product qualities. It influences market position and competitive strategies to set

cost according to consumer's affordability. In this regard, pricing strategies plays crucial role to

present financial position of entity as well enhancing profit earning capability to sustain product

value in market for long term sustainability effectively. Hence, pricing strategies are useful for

systematic management and enhancing profitability at high level (Ax and Greve, 2016).

TASK 4

a) Explanation of balance scorecard and how it can be implemented can deliver a range of

performance measure

It is that type of approach under which there is a management system and strategic planning

that are majorly used by the government, non-profit organisation, industry and business. Thus, it

can effectively align the firm activities that enhance the external and internal communication. The

Imda tech company adopts balance scorecard approach that is a framework of financial and non-

financial (Uyar and Kuzey,2016 ). Thus, under this approach in which there is a financial measures

that majorly includes the investment in suppliers, process, technology, innovation and employees

etc. It has been categorised into two parts that are financial and non-financial perspective that are

as described below-

Non- financial Prespectives

Learning and growth perspective- It is that type of perspective under which it majorly

12

business operations in future time. However, estimated decision making is proceed for increasing

efficiency and proper management of entire business operations that impacts on productivity and

profitability of firm.

c) Pricing strategies

Management accountant of Imda limited sets price of product for production and

distribution system. In this process, costs are decided as per various factors as market demand,

competition and product value. Therefore, pricing strategies is interrelated with preparing planning

for cost. Including this, various determinants are recognized as material used in manufacturing and

production of goods. However, this kind of strategy is beneficial for financial management as well

fund allocation. Under this system, as per market position of products and changes in demand for

goods, prices are changes (Klemstine and Maher, 2014). It affects productivity and profit earning

capacity of firm. In accordance to this, various tools and techniques are used for setting price and

effective pricing as per which proper strategies are implemented and evaluated. Thus, pricing

strategies are of different kinds to set costs of product and making decisions for attraction of

customers towards product qualities. It influences market position and competitive strategies to set

cost according to consumer's affordability. In this regard, pricing strategies plays crucial role to

present financial position of entity as well enhancing profit earning capability to sustain product

value in market for long term sustainability effectively. Hence, pricing strategies are useful for

systematic management and enhancing profitability at high level (Ax and Greve, 2016).

TASK 4

a) Explanation of balance scorecard and how it can be implemented can deliver a range of

performance measure

It is that type of approach under which there is a management system and strategic planning

that are majorly used by the government, non-profit organisation, industry and business. Thus, it

can effectively align the firm activities that enhance the external and internal communication. The

Imda tech company adopts balance scorecard approach that is a framework of financial and non-

financial (Uyar and Kuzey,2016 ). Thus, under this approach in which there is a financial measures

that majorly includes the investment in suppliers, process, technology, innovation and employees

etc. It has been categorised into two parts that are financial and non-financial perspective that are

as described below-

Non- financial Prespectives

Learning and growth perspective- It is that type of perspective under which it majorly

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.