Management Accounting Practices at John Good Shipping, UK - Report

VerifiedAdded on 2023/06/15

|18

|5494

|465

Report

AI Summary

This report provides a detailed analysis of management accounting practices at John Good Shipping, a medium-sized logistics firm in the UK. It explores the principles and roles of management accounting, including cost accounting, job costing, inventory management, and price optimization systems. The report includes calculations for an income statement using both marginal and absorption costing methods, demonstrating their impact on profitability analysis. Different types of planning tools, such as zero-based budgeting, are discussed, highlighting their advantages and disadvantages in dealing with financial problems. Furthermore, the report evaluates the integration of management accounting within the organization, emphasizing the importance of budgeting reports, accounts receivable aging reports, and performance reports for effective financial decision-making. This analysis aims to provide insights into how management accounting supports strategic decision-making and financial stability at John Good Shipping.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

Principles of management accounting........................................................................................3

Role of management accounting and management accounting system......................................4

Calculations for an income statement using Marginal and Absorption costing..........................7

Evaluating how management accounting is integrated within the organization.........................9

CONCLUSION................................................................................................................................9

TASK 2..........................................................................................................................................11

Different types of Planning tools and its advantages and disadvantages..................................11

Effectiveness of management accounting in dealing with financial problems.........................13

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

Principles of management accounting........................................................................................3

Role of management accounting and management accounting system......................................4

Calculations for an income statement using Marginal and Absorption costing..........................7

Evaluating how management accounting is integrated within the organization.........................9

CONCLUSION................................................................................................................................9

TASK 2..........................................................................................................................................11

Different types of Planning tools and its advantages and disadvantages..................................11

Effectiveness of management accounting in dealing with financial problems.........................13

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting is the systematic process which is maintained by the company in

order to prepare reports about business transactions that help them to make strategic decisions.

The present study will provide detailed information about medium-sized organization, John

Good shipping, logistics firm in UK. The company allows their customers to interact directly

with its business system as they have invested in the upgraded shipping technology. In addition

to that, the report will provide information about principles of management account and its role.

Along with that, the study will calculate income statement using variable costing to support

business operations and its progress. Furthermore, the study will give information about benefits

of the function to the company and comparison analysis with the help of benchmarking and key

performance indicators to prevent financial problems. At last, the study will provide advantage

and disadvantages of various planning tools such as zero base budgeting and others.

TASK 1

Principles of management accounting

Management accounting plays a vital role in running business smoothly because it helps

managers of the company to track expenditures and income, provide detailed information about

business transaction so that they can make strategic decisions about business. Proper

management accounting is necessary to provide information to investors about business

transactions so that they can make decisions about financial transactions and investment

decisions.

The company used this method to find out the financial position so that managers and top

management team can make decisions on the basis of relevant data (Maheshwari, Maheshwari

and Maheshwari, 2021). The system of management accounting can provide different methods

and techniques to control the costs and budgets. The main objective and goal of the management

accounting is to avoid errors and mistakes which can be harmful for the company's performance.

1. Designing and compiling.

The principle of management accounting says that it is necessary for company to

maintain accounting reports, business transaction and other related information. It should be

designed in a proper way to meet organizational goals and deal with business issues. The

Management accounting is the systematic process which is maintained by the company in

order to prepare reports about business transactions that help them to make strategic decisions.

The present study will provide detailed information about medium-sized organization, John

Good shipping, logistics firm in UK. The company allows their customers to interact directly

with its business system as they have invested in the upgraded shipping technology. In addition

to that, the report will provide information about principles of management account and its role.

Along with that, the study will calculate income statement using variable costing to support

business operations and its progress. Furthermore, the study will give information about benefits

of the function to the company and comparison analysis with the help of benchmarking and key

performance indicators to prevent financial problems. At last, the study will provide advantage

and disadvantages of various planning tools such as zero base budgeting and others.

TASK 1

Principles of management accounting

Management accounting plays a vital role in running business smoothly because it helps

managers of the company to track expenditures and income, provide detailed information about

business transaction so that they can make strategic decisions about business. Proper

management accounting is necessary to provide information to investors about business

transactions so that they can make decisions about financial transactions and investment

decisions.

The company used this method to find out the financial position so that managers and top

management team can make decisions on the basis of relevant data (Maheshwari, Maheshwari

and Maheshwari, 2021). The system of management accounting can provide different methods

and techniques to control the costs and budgets. The main objective and goal of the management

accounting is to avoid errors and mistakes which can be harmful for the company's performance.

1. Designing and compiling.

The principle of management accounting says that it is necessary for company to

maintain accounting reports, business transaction and other related information. It should be

designed in a proper way to meet organizational goals and deal with business issues. The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management accounting system and approaches should be compiled very systematically with the

help of relevant data based on the previous information.

2. Control at source Accounting.

This system is helpful to control costs of products and services which are incurred during

the business transactions (Principles of management accounting, 2021). For example- detailed

information about materials, power, repairs and maintenance and others.

3. Accounting for inflation.

The principles of management accounting says that it is necessary to maintain capital

which is contributed by the owner of the company concern in terms of real money through the

revaluation accounting method (Weetman, 2019). So, the firm must take rate of inflation into

consideration in order to judge the progress of the business.

4. Management by Exception

When the manager of company present important information to top-level management

team, they can easily find out the deviations. In other words, budgetary control in the firm and

standard costing method are followed in the system. Therefore, in this way the actual

performance of the company is compared with the previous data. Also, if the things are going

wrong, the unfavourable deviations are being informed by the team to managers so that more

action can be taken if necessary.

Role of management accounting and management accounting system

The major role of management accounting is to keep record about business transactions

so that managers can make budgeting decisions, planning about business and other important

decisions such as investment, risk management and cost control (Abdusalomova, 2019). It will

help the management of the company to perform all its business functions such as organizing,

staffing, controlling and directing. The managers of john good shipping make important

decisions, with the help of management system such as recording of business transactions,

planning for future goals and risk management. For example- it will provide information about

relevant cost analysis and expenses so that managers can advice beneficial suggestions for future

business activities to their employees.

Different types of management accounting system

Cost accounting system- This is the method used by company in order to estimate the

product cost for profitability analysis. By adopting this framework the manager of the company

help of relevant data based on the previous information.

2. Control at source Accounting.

This system is helpful to control costs of products and services which are incurred during

the business transactions (Principles of management accounting, 2021). For example- detailed

information about materials, power, repairs and maintenance and others.

3. Accounting for inflation.

The principles of management accounting says that it is necessary to maintain capital

which is contributed by the owner of the company concern in terms of real money through the

revaluation accounting method (Weetman, 2019). So, the firm must take rate of inflation into

consideration in order to judge the progress of the business.

4. Management by Exception

When the manager of company present important information to top-level management

team, they can easily find out the deviations. In other words, budgetary control in the firm and

standard costing method are followed in the system. Therefore, in this way the actual

performance of the company is compared with the previous data. Also, if the things are going

wrong, the unfavourable deviations are being informed by the team to managers so that more

action can be taken if necessary.

Role of management accounting and management accounting system

The major role of management accounting is to keep record about business transactions

so that managers can make budgeting decisions, planning about business and other important

decisions such as investment, risk management and cost control (Abdusalomova, 2019). It will

help the management of the company to perform all its business functions such as organizing,

staffing, controlling and directing. The managers of john good shipping make important

decisions, with the help of management system such as recording of business transactions,

planning for future goals and risk management. For example- it will provide information about

relevant cost analysis and expenses so that managers can advice beneficial suggestions for future

business activities to their employees.

Different types of management accounting system

Cost accounting system- This is the method used by company in order to estimate the

product cost for profitability analysis. By adopting this framework the manager of the company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

can also estimate the cost control system and inventory valuation. It is the system which

comprises a controls and processes with respect to business that are designed by company to

report in order to manage cost.

Benefits- The major advantage of this method includes it helps the company to lower their

product cost by identifying the relevant items related to business. By adopting this method, the

company can achieve profit maximization which is beneficial for overall performance.

Drawbacks- The disadvantage of this method arise only if the management accounting system is

not applied with care. It is a very costly method because double set of books of accounts has to

be maintained which needs time and efforts both. While doing installation, this method required

good finance and sometimes results are misleading which can impact the efficiency of the

business.

Job costing system-It is the systematic process of providing information about the

product cost which is associated with a specific service job. This method must be able to keep

track on the cost of materials in the company that are being utilize during the job.

Benefits- By adopting this method, the firm can monitor the product cost throughout the

manufacturing process which can be beneficial for them to make important decisions. This

method provides analysis of overhead, labour and raw materials for each job. It will be helpful

because it can easily keep track on all expenses done by the firm on regular basis.

Drawbacks- this method can create conflict between employees because of overload paperwork

as the overheads cannot be controlled.

Inventory management system- The management accounting system says that this

method is used by company so that they can keep track on the goods throughout their entire

supply chain. This method gives detailed information about inventory, stock and other

approaches in the business operations (Pavlatos and Kostakis, 2018). The process provides areal

time view of the inventory across all the selling channels in the firm. John good shipping used

the effective method named as ERP method of inventory management which is also known as

enterprise resources planning. This method allows managers to manage all the business

transactions and activities such as logistics, financial transactions and planning of business

activities.

Benefits- The major benefit of using this method, it helps to manage multiple locations and

stocks outs. The method keeps a proper track on stocks in order to reduce risk of overselling and

comprises a controls and processes with respect to business that are designed by company to

report in order to manage cost.

Benefits- The major advantage of this method includes it helps the company to lower their

product cost by identifying the relevant items related to business. By adopting this method, the

company can achieve profit maximization which is beneficial for overall performance.

Drawbacks- The disadvantage of this method arise only if the management accounting system is

not applied with care. It is a very costly method because double set of books of accounts has to

be maintained which needs time and efforts both. While doing installation, this method required

good finance and sometimes results are misleading which can impact the efficiency of the

business.

Job costing system-It is the systematic process of providing information about the

product cost which is associated with a specific service job. This method must be able to keep

track on the cost of materials in the company that are being utilize during the job.

Benefits- By adopting this method, the firm can monitor the product cost throughout the

manufacturing process which can be beneficial for them to make important decisions. This

method provides analysis of overhead, labour and raw materials for each job. It will be helpful

because it can easily keep track on all expenses done by the firm on regular basis.

Drawbacks- this method can create conflict between employees because of overload paperwork

as the overheads cannot be controlled.

Inventory management system- The management accounting system says that this

method is used by company so that they can keep track on the goods throughout their entire

supply chain. This method gives detailed information about inventory, stock and other

approaches in the business operations (Pavlatos and Kostakis, 2018). The process provides areal

time view of the inventory across all the selling channels in the firm. John good shipping used

the effective method named as ERP method of inventory management which is also known as

enterprise resources planning. This method allows managers to manage all the business

transactions and activities such as logistics, financial transactions and planning of business

activities.

Benefits- The major benefit of using this method, it helps to manage multiple locations and

stocks outs. The method keeps a proper track on stocks in order to reduce risk of overselling and

to control unnecessary expenditure. This is the systematic method which is helpful to improve

business negotiation for cost savings while making inventory related important decisions. It is

helpful to minimize the stock outs and excess stock in order to simplify the inventory control

system .

Drawbacks – This method is expensive in nature and show limited elimination of risk in the

business activities.

Price optimization system- This method of management accounting gives detailed

understanding about how much business the firm obtain within profitability levels on the basis of

how sensitive their customers are to changes in product price. It is the mathematical process that

can be used by company to calculate about the demand of the goods at various prices (Bhimani,

2020). John Good shipping team combine the important data with inventory levels in order to

suggest the product price that will increase profitability.

Benefits- Nowadays, customers are more attracted towards products with reasonable price and

low cost. They pick up on products when they feel priced optimally so, the company use this

method to maximize the profits and sales., It will ultimately increase the revenue.

Drawbacks- This is the method which requires rapid reaction to alterations amongst the

competition, hence its is time exposure process.

Different methods used for management accounting Report

Cost accounting Report- This method includes information of provider such as data

utilization and cost by centre. It is helpful to keep customer informed and help them to control

costs. The company maintains this report to determine the cost per equivalent unit in the given

project. Unnecessary expenses and profit earning are estimated with the help of cost accounting

report.

Budgeting Report- Budget report play a vital role in management accounting because

this report helps business and managers of the company to understand the overall business

activities across different departments. By evaluating the expenses and income in previous years,

this report will help to estimate budgets for the following year. It will provide solution to cut

costs if necessary with respect to business. This report is also maintained to provide incentives to

employees , this step will motivate them to achieve success.

Accounts receivable Ageing report- This is one of the most important report for any

business as it provides an information about credit balances. With the help of this report

business negotiation for cost savings while making inventory related important decisions. It is

helpful to minimize the stock outs and excess stock in order to simplify the inventory control

system .

Drawbacks – This method is expensive in nature and show limited elimination of risk in the

business activities.

Price optimization system- This method of management accounting gives detailed

understanding about how much business the firm obtain within profitability levels on the basis of

how sensitive their customers are to changes in product price. It is the mathematical process that

can be used by company to calculate about the demand of the goods at various prices (Bhimani,

2020). John Good shipping team combine the important data with inventory levels in order to

suggest the product price that will increase profitability.

Benefits- Nowadays, customers are more attracted towards products with reasonable price and

low cost. They pick up on products when they feel priced optimally so, the company use this

method to maximize the profits and sales., It will ultimately increase the revenue.

Drawbacks- This is the method which requires rapid reaction to alterations amongst the

competition, hence its is time exposure process.

Different methods used for management accounting Report

Cost accounting Report- This method includes information of provider such as data

utilization and cost by centre. It is helpful to keep customer informed and help them to control

costs. The company maintains this report to determine the cost per equivalent unit in the given

project. Unnecessary expenses and profit earning are estimated with the help of cost accounting

report.

Budgeting Report- Budget report play a vital role in management accounting because

this report helps business and managers of the company to understand the overall business

activities across different departments. By evaluating the expenses and income in previous years,

this report will help to estimate budgets for the following year. It will provide solution to cut

costs if necessary with respect to business. This report is also maintained to provide incentives to

employees , this step will motivate them to achieve success.

Accounts receivable Ageing report- This is one of the most important report for any

business as it provides an information about credit balances. With the help of this report

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company can adjust credit policies to align them with clients payment capabilities. John good

shipping mangers maintains this report in order to find the invoice balance which is unpaid with

the time period. It keeps proper track on slow paying clients and used to attain detailed analysis

of problem associated with company's collection process.

Performance report- This report is maintained by the firm which shows overall

departmental reports to make strategic decisions. An organization keeps an accurate measure of

its financial strategy. In addition, this report will compare actual results to a budgetary statements

so that company can take action when there is an unfavourable situation. To attain the most

effective financial decision it is necessary to have authentic managerial accounting performance

report.

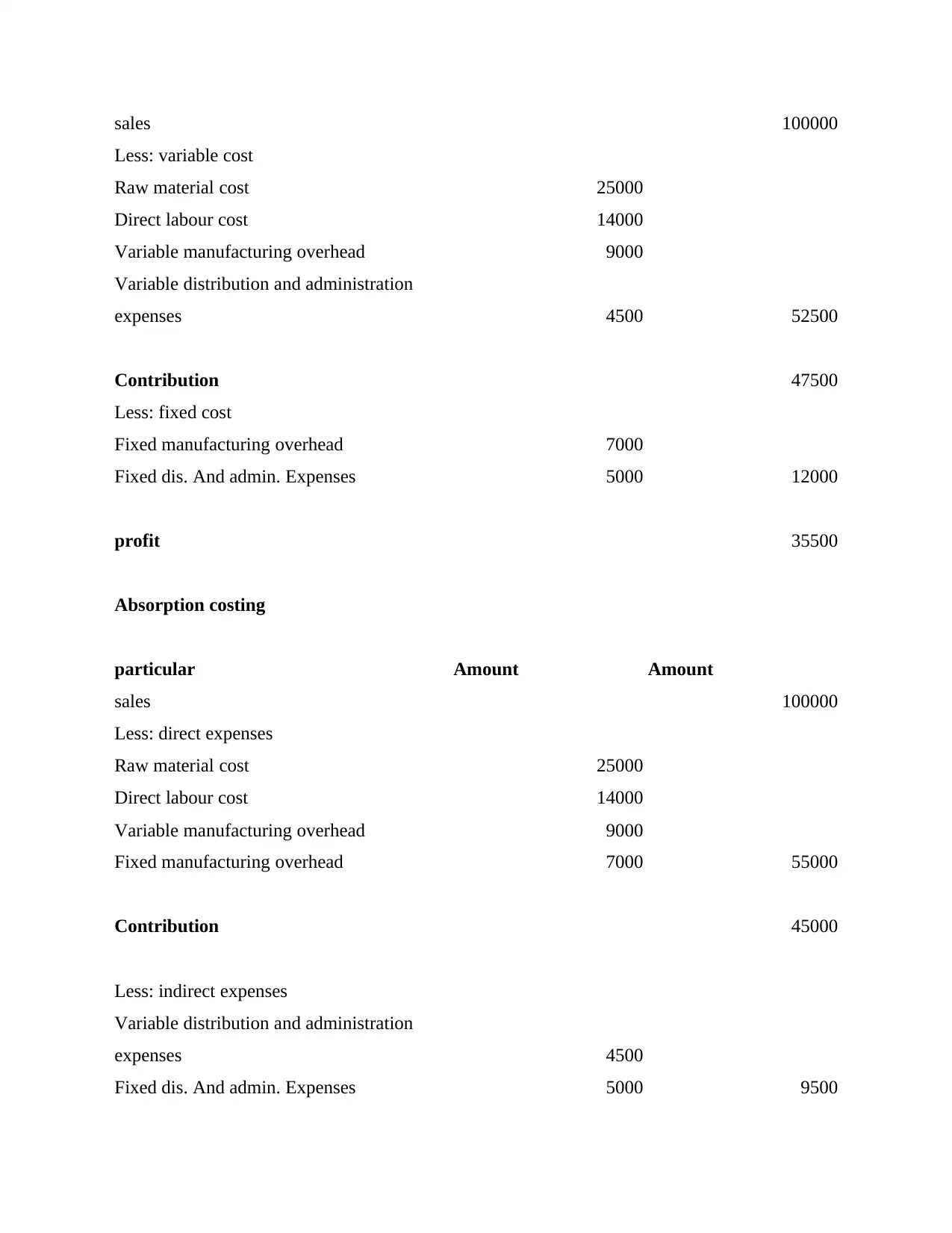

Calculations for an income statement using Marginal and Absorption costing

Marginal costing- when the fixed cost are considered as the cost of the period and

variable costs are considered as the product cost then it is known as marginal costing. The

treatment of fixed production overheads is the major reason behind the different profit figures

calculated under marginal and absorption costing. Here, the full amount of fixed production

overheads is being written off. This method is more useful in profit planning, which means if the

company wants to determine profitability at different level of sale then marginal costing is best.

A firm can make decision about selling price and buying decision.

Absorption costing- This is the method of management accounting for capturing all costs

of products or services associated with manufacturing a particular good. Indirect and direct costs

such as labor, raw material and insurance are accounted for by adopting this method. The major

advantages of using this method is to ensure more accurate accounting for inventory this is just

because the expenditure associated with ending inventory are directly linked to the full cost.

Marginal costing

particular Amount Amount

shipping mangers maintains this report in order to find the invoice balance which is unpaid with

the time period. It keeps proper track on slow paying clients and used to attain detailed analysis

of problem associated with company's collection process.

Performance report- This report is maintained by the firm which shows overall

departmental reports to make strategic decisions. An organization keeps an accurate measure of

its financial strategy. In addition, this report will compare actual results to a budgetary statements

so that company can take action when there is an unfavourable situation. To attain the most

effective financial decision it is necessary to have authentic managerial accounting performance

report.

Calculations for an income statement using Marginal and Absorption costing

Marginal costing- when the fixed cost are considered as the cost of the period and

variable costs are considered as the product cost then it is known as marginal costing. The

treatment of fixed production overheads is the major reason behind the different profit figures

calculated under marginal and absorption costing. Here, the full amount of fixed production

overheads is being written off. This method is more useful in profit planning, which means if the

company wants to determine profitability at different level of sale then marginal costing is best.

A firm can make decision about selling price and buying decision.

Absorption costing- This is the method of management accounting for capturing all costs

of products or services associated with manufacturing a particular good. Indirect and direct costs

such as labor, raw material and insurance are accounted for by adopting this method. The major

advantages of using this method is to ensure more accurate accounting for inventory this is just

because the expenditure associated with ending inventory are directly linked to the full cost.

Marginal costing

particular Amount Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sales 100000

Less: variable cost

Raw material cost 25000

Direct labour cost 14000

Variable manufacturing overhead 9000

Variable distribution and administration

expenses 4500 52500

Contribution 47500

Less: fixed cost

Fixed manufacturing overhead 7000

Fixed dis. And admin. Expenses 5000 12000

profit 35500

Absorption costing

particular Amount Amount

sales 100000

Less: direct expenses

Raw material cost 25000

Direct labour cost 14000

Variable manufacturing overhead 9000

Fixed manufacturing overhead 7000 55000

Contribution 45000

Less: indirect expenses

Variable distribution and administration

expenses 4500

Fixed dis. And admin. Expenses 5000 9500

Less: variable cost

Raw material cost 25000

Direct labour cost 14000

Variable manufacturing overhead 9000

Variable distribution and administration

expenses 4500 52500

Contribution 47500

Less: fixed cost

Fixed manufacturing overhead 7000

Fixed dis. And admin. Expenses 5000 12000

profit 35500

Absorption costing

particular Amount Amount

sales 100000

Less: direct expenses

Raw material cost 25000

Direct labour cost 14000

Variable manufacturing overhead 9000

Fixed manufacturing overhead 7000 55000

Contribution 45000

Less: indirect expenses

Variable distribution and administration

expenses 4500

Fixed dis. And admin. Expenses 5000 9500

profit 35500

From the above calculations the following rules can be made out such as:

The profit under marginal and absorption costing will be the same because there are no closing

and opening stocks. The above statement shows that the company make profit of 35500 and

make sales of 100000. As a matter of fact, the company contribution in marginal costing is

47500 while in absorption costing contribution shows the amount of 45000.

From the above discussion, it has been evaluated that absorption costing is a better method. But

if in case, the company is start up business and the major purpose is to take a look into

contribution per unit and break even analysis then marginal costing method will be helpful.

Evaluating how management accounting is integrated within the organization.

Management accounting is helpful for managers to make business related decisions with

the help of budgeting in order to reduce the unnecessary expenses. This system compare the

actual budget to actual expenses done by the firm in order to evaluate the financial information

(Azudin and Mansor, 2018). Managerial accountants in the firm support decision-making

process by providing and offering a financial information with the help of tools and software.

Manager of John good shipping use management accounting method so that they can

make short term and long term decisions which includes financial position and market place of

the firm (Why management accounting is important for decision-making, 2021). This system

helps them to make operational and investment related decisions in order to develop the

operational efficiency of the firm. To ensure the consistency once the process of management

accounting is adopted, hence it has to be attained as an organizational culture.

Management accounting system influences the operational decisions and thus can be

considered as one of the most important management aspects that shape the overall business and

entire firm. For example- In order to sustain the organizational culture of management

accounting, the managers or accountants have to attend strategic meetings in which planning and

policies can be made. The policies should cover all the important aspects such as management

accounting function and the scope, roles within the company. The management accounting

system provides detailed information about cash inflows-outflows, so that manager can evaluate

From the above calculations the following rules can be made out such as:

The profit under marginal and absorption costing will be the same because there are no closing

and opening stocks. The above statement shows that the company make profit of 35500 and

make sales of 100000. As a matter of fact, the company contribution in marginal costing is

47500 while in absorption costing contribution shows the amount of 45000.

From the above discussion, it has been evaluated that absorption costing is a better method. But

if in case, the company is start up business and the major purpose is to take a look into

contribution per unit and break even analysis then marginal costing method will be helpful.

Evaluating how management accounting is integrated within the organization.

Management accounting is helpful for managers to make business related decisions with

the help of budgeting in order to reduce the unnecessary expenses. This system compare the

actual budget to actual expenses done by the firm in order to evaluate the financial information

(Azudin and Mansor, 2018). Managerial accountants in the firm support decision-making

process by providing and offering a financial information with the help of tools and software.

Manager of John good shipping use management accounting method so that they can

make short term and long term decisions which includes financial position and market place of

the firm (Why management accounting is important for decision-making, 2021). This system

helps them to make operational and investment related decisions in order to develop the

operational efficiency of the firm. To ensure the consistency once the process of management

accounting is adopted, hence it has to be attained as an organizational culture.

Management accounting system influences the operational decisions and thus can be

considered as one of the most important management aspects that shape the overall business and

entire firm. For example- In order to sustain the organizational culture of management

accounting, the managers or accountants have to attend strategic meetings in which planning and

policies can be made. The policies should cover all the important aspects such as management

accounting function and the scope, roles within the company. The management accounting

system provides detailed information about cash inflows-outflows, so that manager can evaluate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the financial health of the company (Amara and Benelifa, 2017). This method measures what is

beneficial for the company and detect errors to form long term strategies to make effective

production and budget related decision.

CONCLUSION

To conclude, management accounting system is a decision-making method used by the

firm in order to increase the value by allowing its managers and top leaders to make operational

decisions based on costs evaluation and other performance related issues. By evaluating the

report it has been concluded that management accounting system mainly performed for internal

use so that effective decisions can be made.

Furthermore, it has summarized that company maintains cash flow statements, capital

statements and market research in brief in order to understand the financial health. Along with

this, the report concluded that management accounting reports such as cost accounting report,

performance report and budget report are being prepared for measuring the overall performance,

so that necessary changes can be done. At last, the report has provided information about

managerial accounting report which offers information regarding profitability, market factors

and overall performance include team performance.

beneficial for the company and detect errors to form long term strategies to make effective

production and budget related decision.

CONCLUSION

To conclude, management accounting system is a decision-making method used by the

firm in order to increase the value by allowing its managers and top leaders to make operational

decisions based on costs evaluation and other performance related issues. By evaluating the

report it has been concluded that management accounting system mainly performed for internal

use so that effective decisions can be made.

Furthermore, it has summarized that company maintains cash flow statements, capital

statements and market research in brief in order to understand the financial health. Along with

this, the report concluded that management accounting reports such as cost accounting report,

performance report and budget report are being prepared for measuring the overall performance,

so that necessary changes can be done. At last, the report has provided information about

managerial accounting report which offers information regarding profitability, market factors

and overall performance include team performance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

Different types of Planning tools and its advantages and disadvantages

Cash budget- The cash budget is one of the most important planning tools used by

company to make short term financial decision for cash inflows-outflows. It is the management

tool used by firm to manage cash so that managers can plan and control the use of money. With

the help of this tool, unnecessary expenses can be reduced which is beneficial for company's

profitability. There are different methods to prepare a cash budget which includes payment and

receipt method, balance sheet and cash flow statement.

Purpose- The major purpose of this budget is to assess any long term borrowing needs of the

business. Basically, it is well-known for the management decisions which is needed to make

short term business borrowing during operation cycle. It is noted that long term cash budgeting

requires more time and strategic planning. It will forecast ending cash balance and used by

company to plan things such as funds availability in order to invest.

Advantages- when the company is using a cash budget effectively, then they will become more

resourceful. It is possible that they might find various ways to save cash, which means they need

to eliminate all the unnecessary expenses or waste from budget (Kamau and Mungai, 2020). For

example- John good shipping team find that when they are watching every single penny spent

and earn by them or cash inflows-outflows they can easily control spending and find new

techniques of growth and development.

Another benefit of cash budget includes, when the company operates this budget, then

they can quickly determine if they have enough cash to meet the organizational goals. If not, then

it is necessary to make proper action and use effective techniques to ensure the budget estimates

can be met. Hence, it is said that cash budget can quickly identify potential deficits, if any issues

occur.

Disadvantages- Nowadays, people are more interested in online purchasing and have stopped

accepting cash for certain activities. For example- if the company only using cash budget and not

using online system then they may find it difficult to access some services which only requires

Different types of Planning tools and its advantages and disadvantages

Cash budget- The cash budget is one of the most important planning tools used by

company to make short term financial decision for cash inflows-outflows. It is the management

tool used by firm to manage cash so that managers can plan and control the use of money. With

the help of this tool, unnecessary expenses can be reduced which is beneficial for company's

profitability. There are different methods to prepare a cash budget which includes payment and

receipt method, balance sheet and cash flow statement.

Purpose- The major purpose of this budget is to assess any long term borrowing needs of the

business. Basically, it is well-known for the management decisions which is needed to make

short term business borrowing during operation cycle. It is noted that long term cash budgeting

requires more time and strategic planning. It will forecast ending cash balance and used by

company to plan things such as funds availability in order to invest.

Advantages- when the company is using a cash budget effectively, then they will become more

resourceful. It is possible that they might find various ways to save cash, which means they need

to eliminate all the unnecessary expenses or waste from budget (Kamau and Mungai, 2020). For

example- John good shipping team find that when they are watching every single penny spent

and earn by them or cash inflows-outflows they can easily control spending and find new

techniques of growth and development.

Another benefit of cash budget includes, when the company operates this budget, then

they can quickly determine if they have enough cash to meet the organizational goals. If not, then

it is necessary to make proper action and use effective techniques to ensure the budget estimates

can be met. Hence, it is said that cash budget can quickly identify potential deficits, if any issues

occur.

Disadvantages- Nowadays, people are more interested in online purchasing and have stopped

accepting cash for certain activities. For example- if the company only using cash budget and not

using online system then they may find it difficult to access some services which only requires

online payment. Hence, it is said that cash budget limits the spending power and impact overall

productivity.

Another drawback of cash budget includes, if people carry cash with them, there is a

chance they could misplace it or it can be stolen, therefore, it is said that cash is the easiest asset

to steal by someone. In other words, people cannot have access to it until they found it, hence,

losing cash will impact the budget. It is necessary to maintain cash budgeting properly so that

anyone can easily able to communicate financial position of the business.

Zero base budgeting- This method is used by company as a planning tool in which all

expenditure should be justified for each new period. In other words, the major purpose of zero

base budgeting is to eliminate unnecessary cost by looking at where expense can be cut down

(Hughes, 2020). For example- john good shipping used this budget in order to achieve strategic

goals which requires company to build their annual budget. This budget develops a new

approach every time that is starting from zero.

Purpose- one of the important aim of this budget is to justify expenses and money spent and also

aims to drive value for the company by optimizing the cost of any product or service.

Advantages- The major advantage of this budget includes managers of the company can justify

all operating expenses and shows which areas are generating revenue. Here, they think about

how money is spent and where the cost can be cut.

Disadvantages- one of the major drawback of this budgeting, it takes a lot of effort and time to

review and justify every element of budget very closely. Sometimes it can lead to culture change

in the company where there is reduced spirit of cooperation, as employees feel expendable.

Activity based budgeting- This budget is a systematic tool used by company in order to

research, record and analysing the business activities that lead to company's costs. Here, budgets

are developed and improved on the basis of results. For example- company's business activities

or operations are analysed to predict costs in other words every activity is recorded to arrive at

current year budget.

Purpose- This budgeting is being carried out to bring efficiency in the business activities,

therefore budgets are prepared after the justification of cost drivers.

Advantages- The major advantages of this budget includes, here the unnecessary and irrelevant

business activities are eliminated and only the relevant business activities form a practice. Hence,

productivity.

Another drawback of cash budget includes, if people carry cash with them, there is a

chance they could misplace it or it can be stolen, therefore, it is said that cash is the easiest asset

to steal by someone. In other words, people cannot have access to it until they found it, hence,

losing cash will impact the budget. It is necessary to maintain cash budgeting properly so that

anyone can easily able to communicate financial position of the business.

Zero base budgeting- This method is used by company as a planning tool in which all

expenditure should be justified for each new period. In other words, the major purpose of zero

base budgeting is to eliminate unnecessary cost by looking at where expense can be cut down

(Hughes, 2020). For example- john good shipping used this budget in order to achieve strategic

goals which requires company to build their annual budget. This budget develops a new

approach every time that is starting from zero.

Purpose- one of the important aim of this budget is to justify expenses and money spent and also

aims to drive value for the company by optimizing the cost of any product or service.

Advantages- The major advantage of this budget includes managers of the company can justify

all operating expenses and shows which areas are generating revenue. Here, they think about

how money is spent and where the cost can be cut.

Disadvantages- one of the major drawback of this budgeting, it takes a lot of effort and time to

review and justify every element of budget very closely. Sometimes it can lead to culture change

in the company where there is reduced spirit of cooperation, as employees feel expendable.

Activity based budgeting- This budget is a systematic tool used by company in order to

research, record and analysing the business activities that lead to company's costs. Here, budgets

are developed and improved on the basis of results. For example- company's business activities

or operations are analysed to predict costs in other words every activity is recorded to arrive at

current year budget.

Purpose- This budgeting is being carried out to bring efficiency in the business activities,

therefore budgets are prepared after the justification of cost drivers.

Advantages- The major advantages of this budget includes, here the unnecessary and irrelevant

business activities are eliminated and only the relevant business activities form a practice. Hence,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.