Management Accounting System Techniques and Reports for Jupiter Plc

VerifiedAdded on 2021/01/02

|22

|3877

|276

Report

AI Summary

This report provides a comprehensive analysis of management accounting, focusing on various techniques and their applications within Jupiter Plc. It begins with an introduction to management accounting, differentiating it from financial accounting and outlining essential requirements for different systems like job costing and inventory management. The report then delves into the methods of management accounting reporting, including cost reporting, budgets, and performance reports. It explores the benefits of management accounting systems, such as cost reduction and waste elimination, along with their specific applications within Jupiter Plc. The report also covers the integration of management accounting systems and reports, emphasizing their interrelation in aiding decision-making. Furthermore, the report examines marginal costing, absorption costing, and planning tools used in budgetary control, including their advantages and disadvantages. Finally, it discusses the adoption of management accounting systems to address financial problems and the use of planning tools for budget preparation and forecasting, concluding with a summary of the key findings and recommendations.

Management

Accounting

Feedback

Accounting

Feedback

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1 ...........................................................................................................................................1

1. Understanding of management accounting system................................................................1

2. Methods of management counting reporting..........................................................................2

3.Benefits of management accounting system and theirs application in Jupiter plc...................3

4. Integration of Managing accounting system and management accounting of reporting........5

TASK 2 ...........................................................................................................................................5

a) Marginal costing.....................................................................................................................5

b)Absorption costing...................................................................................................................5

TASK 3............................................................................................................................................6

1. Advantages and disadvantages of planning tools used in budgetary control..........................6

2. Use of different planning tools and their application in for preparation and forecasting

budget..........................................................................................................................................7

TASK 4............................................................................................................................................8

1.Adoption of management accounting system to respond to financial problems.....................8

2. Use of planning tools to respond and solve financial problems..............................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

REFERENCES................................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1 ...........................................................................................................................................1

1. Understanding of management accounting system................................................................1

2. Methods of management counting reporting..........................................................................2

3.Benefits of management accounting system and theirs application in Jupiter plc...................3

4. Integration of Managing accounting system and management accounting of reporting........5

TASK 2 ...........................................................................................................................................5

a) Marginal costing.....................................................................................................................5

b)Absorption costing...................................................................................................................5

TASK 3............................................................................................................................................6

1. Advantages and disadvantages of planning tools used in budgetary control..........................6

2. Use of different planning tools and their application in for preparation and forecasting

budget..........................................................................................................................................7

TASK 4............................................................................................................................................8

1.Adoption of management accounting system to respond to financial problems.....................8

2. Use of planning tools to respond and solve financial problems..............................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................12

REFERENCES................................................................................................................................2

INTRODUCTION

Management accounting can be defined as tat branch of account in an organisation

which deal with presenting information to aid managers in the decision making processes. It

takes into consideration both financial information as well data related with other activities

occurred in business. With taking into consideration all these information reports are prepared

by which assist the decision making process of the organisation. In the present report an

application of different management accounting system techniques and reports are applied along

with their advantages and disadvantages for Jupiter Plc.

TASK 1

1. Understanding of management accounting system

Accounting: this can be defined as language of the business through which the

organisation speaks about its growth and profitability. This is a process of summarizing,

analysing and reporting of transactions to determine profits and to evaluate taxation liability of

the business.

Financials accounting: Under this a comprehensive record of financial transaction

pertaining to a financial year are kept which include both monitory and accrual transaction to

determined actual profits earned by the organisation.

Management accounting: This can be defined as preparation and providing on time

financial and statistical information to the management of Jupiter PLC to assize them in decision

making process. The decision are generally short term in nature. This is different from

financial accounting as in it financial reports are presented to internal stakeholders of the Jupiter

Plc as opposed to external stakeholder. The result of this system can be undertaken as

formulation of reports of the company, its different departments, mangers and CEO.

Essential requirements of different types of management accounting system:

Job costing: this is a method under which manufacturing cost related to a particular job

carried out in Jupiter Plc is recorded. With job costing system a project manager keeps track of

the cost related with every job. This aids them in evaluation of working capital requirement as

well as the amount that is spent on a particular job. Eg:

Inventory management system: this is a mathematical analytical tool which is used by

the management of the organisation for determination of how consumer will respond to different

1

Management accounting can be defined as tat branch of account in an organisation

which deal with presenting information to aid managers in the decision making processes. It

takes into consideration both financial information as well data related with other activities

occurred in business. With taking into consideration all these information reports are prepared

by which assist the decision making process of the organisation. In the present report an

application of different management accounting system techniques and reports are applied along

with their advantages and disadvantages for Jupiter Plc.

TASK 1

1. Understanding of management accounting system

Accounting: this can be defined as language of the business through which the

organisation speaks about its growth and profitability. This is a process of summarizing,

analysing and reporting of transactions to determine profits and to evaluate taxation liability of

the business.

Financials accounting: Under this a comprehensive record of financial transaction

pertaining to a financial year are kept which include both monitory and accrual transaction to

determined actual profits earned by the organisation.

Management accounting: This can be defined as preparation and providing on time

financial and statistical information to the management of Jupiter PLC to assize them in decision

making process. The decision are generally short term in nature. This is different from

financial accounting as in it financial reports are presented to internal stakeholders of the Jupiter

Plc as opposed to external stakeholder. The result of this system can be undertaken as

formulation of reports of the company, its different departments, mangers and CEO.

Essential requirements of different types of management accounting system:

Job costing: this is a method under which manufacturing cost related to a particular job

carried out in Jupiter Plc is recorded. With job costing system a project manager keeps track of

the cost related with every job. This aids them in evaluation of working capital requirement as

well as the amount that is spent on a particular job. Eg:

Inventory management system: this is a mathematical analytical tool which is used by

the management of the organisation for determination of how consumer will respond to different

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

price of their products and services which are distributed through different channels. Under this

a price band is selected so that a price can be offered to consumer which is acceptable to them.

Inventory management: this can be defined as supervision of non capitalized assets and

stoke items that are used in production of articles in Jupiter Plc under this then the flow of raw

material from warehouse to production unit is supervised along with determination of future

requirement to produce estimate budgets units. Inventory method used in business are LIFO-

last in first out this method is banned by HMRC. Another method used id FIFO first in first out,

this means inventory winch came first shall be issues first in production line over the

inventories which comers at later dates.

Cost accounting: this can be defined as a frame work which is used by Jupiter plc to

estimate the cost of production of its article. This estimation aids the management in analysing

the profitability, inventory valuation and cost control of the organisation. Accurate estimation of

the cost related with production of a unit is a sign of profitable organisations.

Actual costing: This can be defined as recording the cost of product which is actually incurred

on its production. Such as actual cost of labour, material and overhead incurred in production.

Standard costing: Standard costing is an accounting technique that some manufacturers used to

identify the differences or variances between 1) the actual costs of the goods that were produced,

and 2) the costs that should have occurred for those goods

Normal costing: this is used for valuation of manufactured products with the actual material,

labour and overhead cost which is based on a predetermined rate.

2. Methods of management counting reporting

Management accounting reports are based on the information need of the management

and these are prepared by taking in to financial as well as statistical data from all the departments

of the Jupiter Plc. The reports prepared are very useful for the management of the organisation as

this helps them in deciding future action plan for the business (Van Helden and Uddin, 2016).

Different types of reports prepared under this system is:

Cost reporting: under this, profits margins are estimated and with this it is evaluated that

what is the actual cost that has been incurred on production and procurement of a unit of article.

Under this material expenses, labour cost, overhead cost and expenses related with each activity

undertaken in the organisation.

2

a price band is selected so that a price can be offered to consumer which is acceptable to them.

Inventory management: this can be defined as supervision of non capitalized assets and

stoke items that are used in production of articles in Jupiter Plc under this then the flow of raw

material from warehouse to production unit is supervised along with determination of future

requirement to produce estimate budgets units. Inventory method used in business are LIFO-

last in first out this method is banned by HMRC. Another method used id FIFO first in first out,

this means inventory winch came first shall be issues first in production line over the

inventories which comers at later dates.

Cost accounting: this can be defined as a frame work which is used by Jupiter plc to

estimate the cost of production of its article. This estimation aids the management in analysing

the profitability, inventory valuation and cost control of the organisation. Accurate estimation of

the cost related with production of a unit is a sign of profitable organisations.

Actual costing: This can be defined as recording the cost of product which is actually incurred

on its production. Such as actual cost of labour, material and overhead incurred in production.

Standard costing: Standard costing is an accounting technique that some manufacturers used to

identify the differences or variances between 1) the actual costs of the goods that were produced,

and 2) the costs that should have occurred for those goods

Normal costing: this is used for valuation of manufactured products with the actual material,

labour and overhead cost which is based on a predetermined rate.

2. Methods of management counting reporting

Management accounting reports are based on the information need of the management

and these are prepared by taking in to financial as well as statistical data from all the departments

of the Jupiter Plc. The reports prepared are very useful for the management of the organisation as

this helps them in deciding future action plan for the business (Van Helden and Uddin, 2016).

Different types of reports prepared under this system is:

Cost reporting: under this, profits margins are estimated and with this it is evaluated that

what is the actual cost that has been incurred on production and procurement of a unit of article.

Under this material expenses, labour cost, overhead cost and expenses related with each activity

undertaken in the organisation.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Budgets: these are prepared for a particular period and under these sales, purchase,

expenses etc are forecasted for future period. These are set as targets for the organisation which

it must have to accomplish with given budget and in stipulated time. Budgets are prepared for

almost every activity performed in organisation and is considered as important tool for

managerial control.

Performance report: this can be referred as performance evaluation of all the activities

as well as human resource of the Jupiter Plc. Under this actual performances is compared with

budgets or forecasted and the degree of deviation is determined and sections are taken to correct

the deviation to reach the actual results which were estimated before time.

Inventory management report:

3. Benefits of management accounting system and theirs application in Jupiter plc

Cost accounting system:

Advantages:

Elimination of waste, losses and inefficiency from the production and management.

Reduction in cost of production.

Identification of reason for profit and loss in the organisation,

Significant advice on make and buy decision as what will be more beneficial for the company

with to make the article or to buy the same from outside.

Disadvantages:

Consideration of past performance for making report on the basis of which future

decision are taken.

Previous year cost ado not remain dame in subsequent years so coat data are not so

useful.

Cost estimation is done on full utilization capacity and data for partiality used capacity

cannot be used in its true sense.

Job costing methodologies:

Advantages:

Calculation of the profits earned on each job performed in the organisation.

Provide manager detailed information on production statistics of individual departments.

3

expenses etc are forecasted for future period. These are set as targets for the organisation which

it must have to accomplish with given budget and in stipulated time. Budgets are prepared for

almost every activity performed in organisation and is considered as important tool for

managerial control.

Performance report: this can be referred as performance evaluation of all the activities

as well as human resource of the Jupiter Plc. Under this actual performances is compared with

budgets or forecasted and the degree of deviation is determined and sections are taken to correct

the deviation to reach the actual results which were estimated before time.

Inventory management report:

3. Benefits of management accounting system and theirs application in Jupiter plc

Cost accounting system:

Advantages:

Elimination of waste, losses and inefficiency from the production and management.

Reduction in cost of production.

Identification of reason for profit and loss in the organisation,

Significant advice on make and buy decision as what will be more beneficial for the company

with to make the article or to buy the same from outside.

Disadvantages:

Consideration of past performance for making report on the basis of which future

decision are taken.

Previous year cost ado not remain dame in subsequent years so coat data are not so

useful.

Cost estimation is done on full utilization capacity and data for partiality used capacity

cannot be used in its true sense.

Job costing methodologies:

Advantages:

Calculation of the profits earned on each job performed in the organisation.

Provide manager detailed information on production statistics of individual departments.

3

Individual and team performance can be tracked and evaluated in terms of cost control

and efficiency.

Disadvantages:

Detailed records related with labour and material used must be kept on order to assist in

calculations and determination of statistical data and actual output.

A close watch on records must be kept in order to determine actual cost and expenses

incurred on specific job and activity related with production.

Inventory management system:

Advantages:

Keeps a record of the available inventory in the stock.

Estimation of the future need of raw material require which is based on budgeted

production.

Evaluation of the stock which s used by each department separately which is determined

as the items issued to particular department.

Disadvantages:

Records cannot be kept for same inventories units such as nut, bolt etc.

using different method gives different results, and a change in the method of inventory

keeping in between an accounting periods can not give correct results.

Price optimisation:

Advantages:

this helps in determination of rate of return as with optimization of price cost is

controlled hence profits are enhanced.

Helps in controlling the cost.

This help in forecasting the cash flows and fund flows.

Disadvantages:

Difficult to determine the reaction that will be given by consumers on the prices of

products of the organisation.

Selectivity of consumers to price fluctuation can not betaken as a major factor to

determine the price.

4

and efficiency.

Disadvantages:

Detailed records related with labour and material used must be kept on order to assist in

calculations and determination of statistical data and actual output.

A close watch on records must be kept in order to determine actual cost and expenses

incurred on specific job and activity related with production.

Inventory management system:

Advantages:

Keeps a record of the available inventory in the stock.

Estimation of the future need of raw material require which is based on budgeted

production.

Evaluation of the stock which s used by each department separately which is determined

as the items issued to particular department.

Disadvantages:

Records cannot be kept for same inventories units such as nut, bolt etc.

using different method gives different results, and a change in the method of inventory

keeping in between an accounting periods can not give correct results.

Price optimisation:

Advantages:

this helps in determination of rate of return as with optimization of price cost is

controlled hence profits are enhanced.

Helps in controlling the cost.

This help in forecasting the cash flows and fund flows.

Disadvantages:

Difficult to determine the reaction that will be given by consumers on the prices of

products of the organisation.

Selectivity of consumers to price fluctuation can not betaken as a major factor to

determine the price.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4. Integration of Managing accounting system and management accounting of reporting

Both management accounting system and management accounting reports are interrelated

with each other and it can be stated that both care non separable as with the use of different

methods of accounting system and assistance in reporting is taken. In preparation of the budgets

present and past data from the job and costing is taken and a future forecast and estimation is

prepared (Otley, 2016). With the accounting tools price of the product is estimated along with

analysing of data and information of production and related activities.

With the techniques of management accounting cost and expenses related with a

particular job and specific activities aid determine and this helps in preparation of costing report

as this taken into consideration expenses allocated and done by each department in Jupiter plc.

The organisation cab use both accounting system and report techniques to produces data and

information that can help the management in development of accurate plans and assist them in

taking short as well as long term decision.

TASK 2

Application of manageable accounting techniques

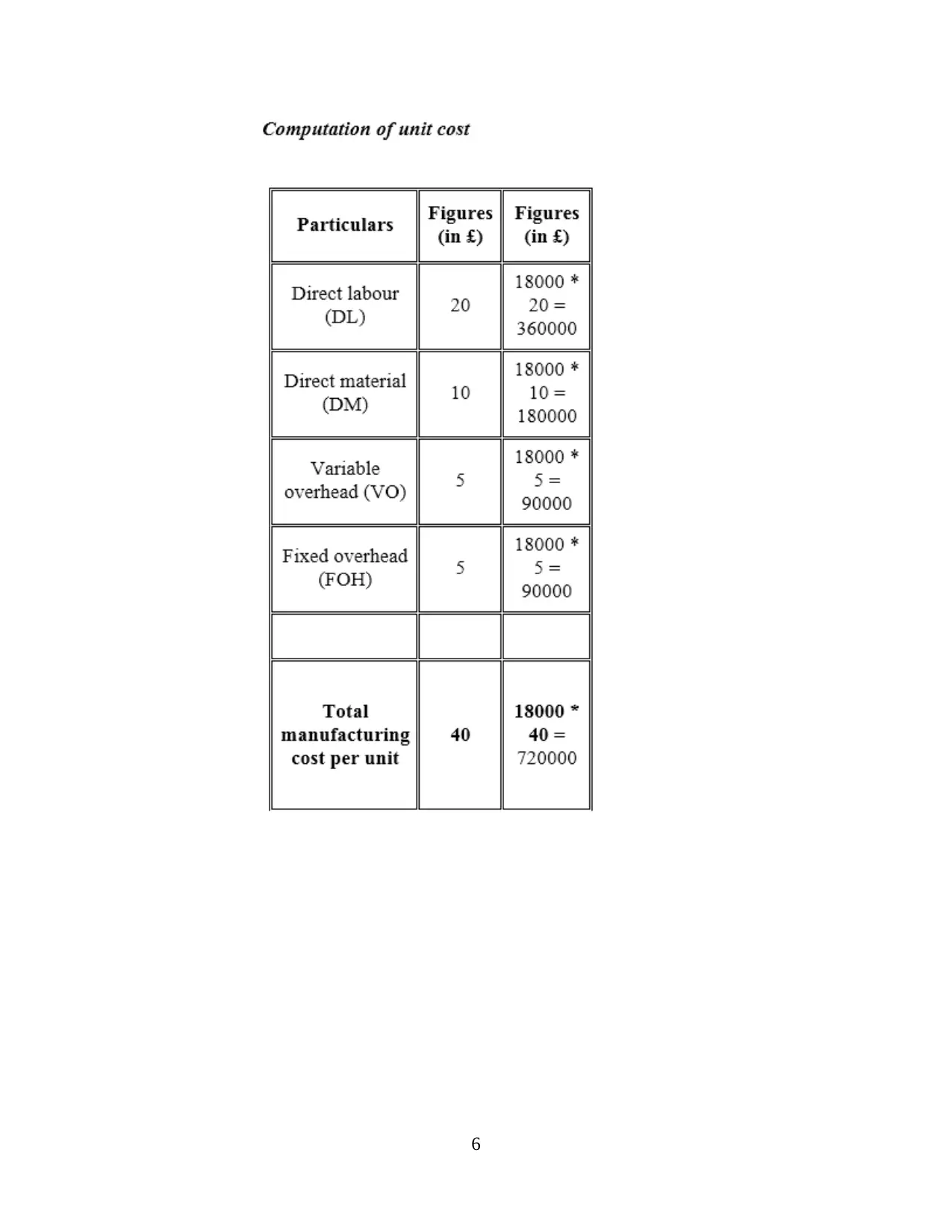

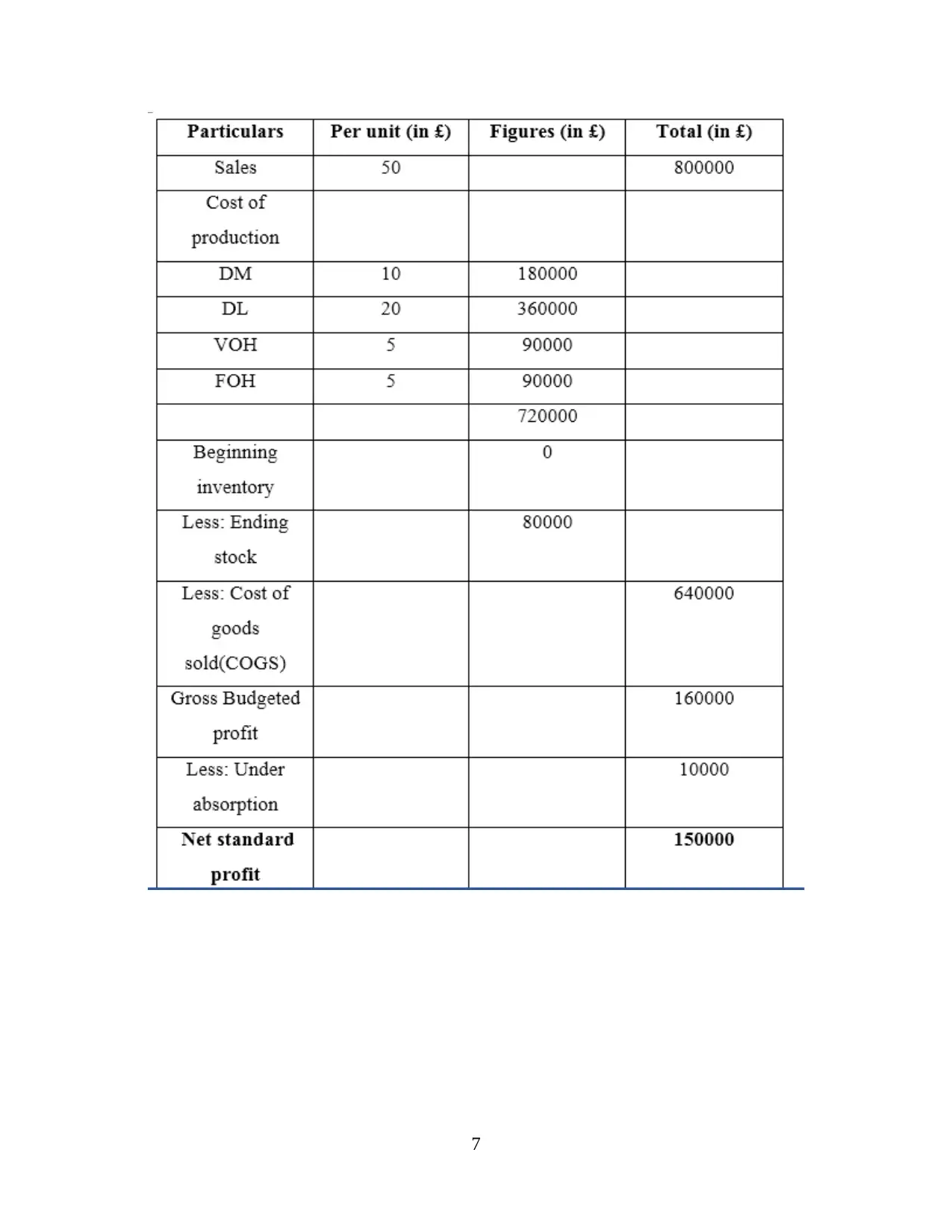

a) Marginal costing

This is a method of accounting in which variable cost are charged to cost of production and all

fixed whether administrative or other overhead in period cost. Fixed cost is written off in ful

against contribution.

Marginal costing:

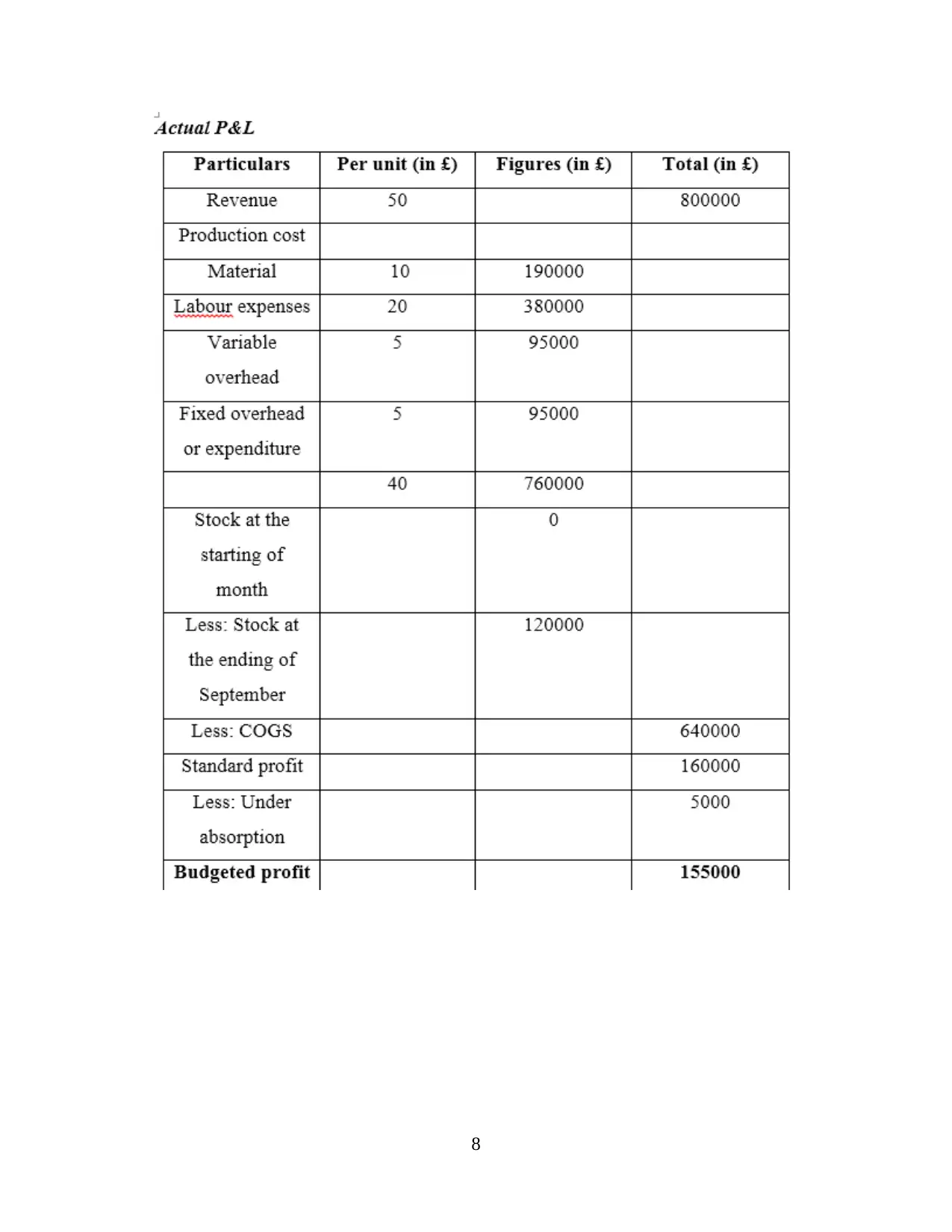

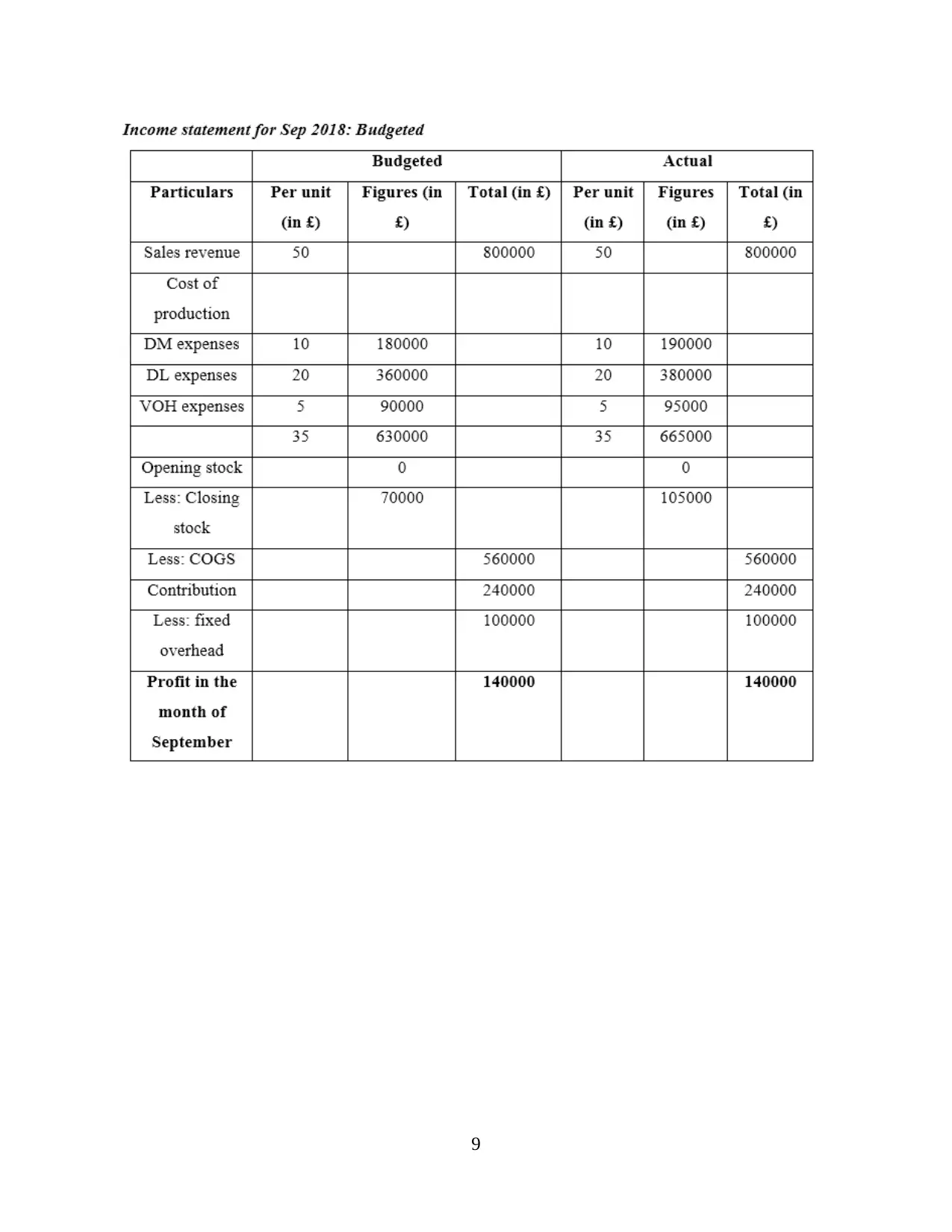

b)Absorption costing

Absorption costing: this can be defined as that method of costing which takes into

consideration all coast associated with manufacturing and production of a product. Under this

fixed overhead charges are take as part of production cots.

5

Both management accounting system and management accounting reports are interrelated

with each other and it can be stated that both care non separable as with the use of different

methods of accounting system and assistance in reporting is taken. In preparation of the budgets

present and past data from the job and costing is taken and a future forecast and estimation is

prepared (Otley, 2016). With the accounting tools price of the product is estimated along with

analysing of data and information of production and related activities.

With the techniques of management accounting cost and expenses related with a

particular job and specific activities aid determine and this helps in preparation of costing report

as this taken into consideration expenses allocated and done by each department in Jupiter plc.

The organisation cab use both accounting system and report techniques to produces data and

information that can help the management in development of accurate plans and assist them in

taking short as well as long term decision.

TASK 2

Application of manageable accounting techniques

a) Marginal costing

This is a method of accounting in which variable cost are charged to cost of production and all

fixed whether administrative or other overhead in period cost. Fixed cost is written off in ful

against contribution.

Marginal costing:

b)Absorption costing

Absorption costing: this can be defined as that method of costing which takes into

consideration all coast associated with manufacturing and production of a product. Under this

fixed overhead charges are take as part of production cots.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

9

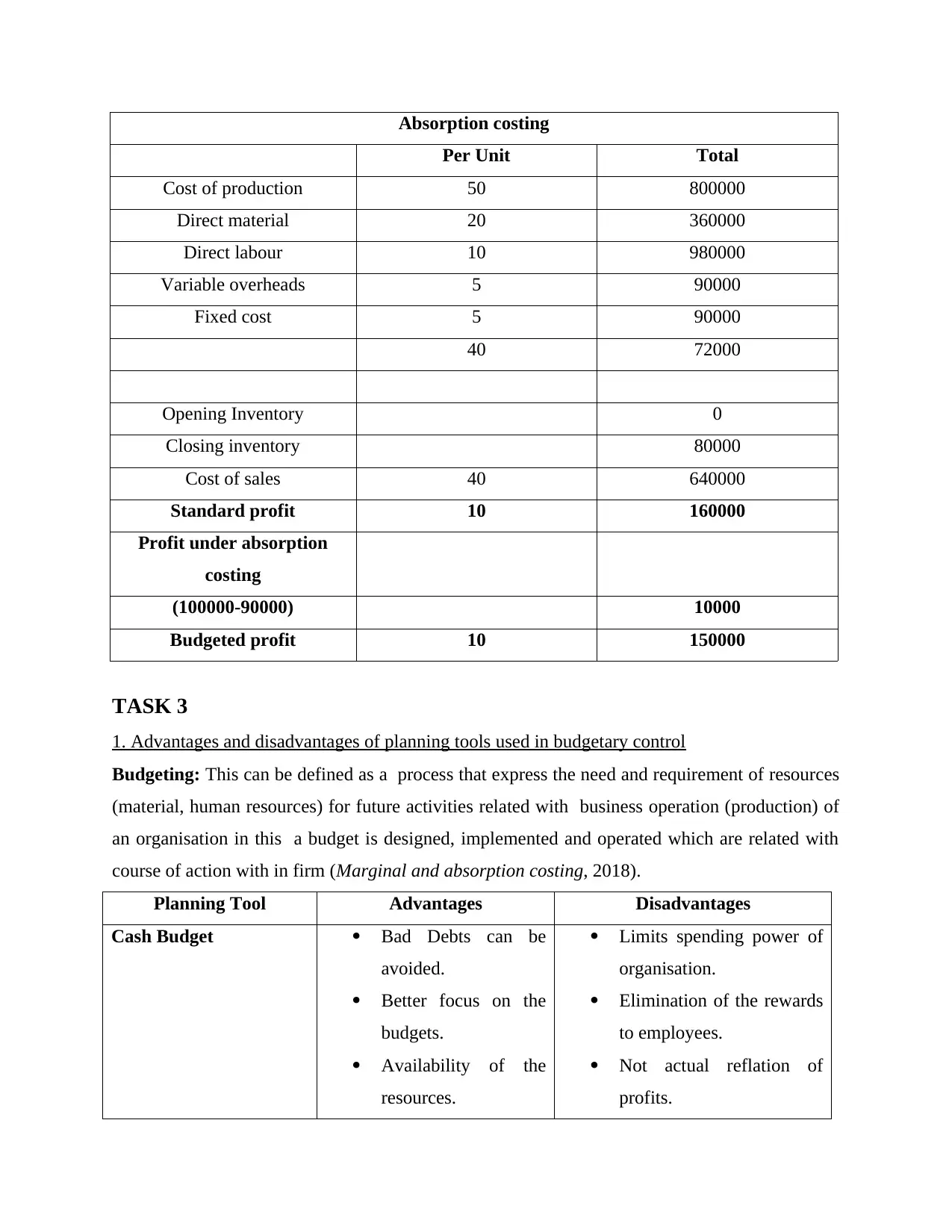

Absorption costing

Per Unit Total

Cost of production 50 800000

Direct material 20 360000

Direct labour 10 980000

Variable overheads 5 90000

Fixed cost 5 90000

40 72000

Opening Inventory 0

Closing inventory 80000

Cost of sales 40 640000

Standard profit 10 160000

Profit under absorption

costing

(100000-90000) 10000

Budgeted profit 10 150000

TASK 3

1. Advantages and disadvantages of planning tools used in budgetary control

Budgeting: This can be defined as a process that express the need and requirement of resources

(material, human resources) for future activities related with business operation (production) of

an organisation in this a budget is designed, implemented and operated which are related with

course of action with in firm (Marginal and absorption costing, 2018).

Planning Tool Advantages Disadvantages

Cash Budget Bad Debts can be

avoided.

Better focus on the

budgets.

Availability of the

resources.

Limits spending power of

organisation.

Elimination of the rewards

to employees.

Not actual reflation of

profits.

Per Unit Total

Cost of production 50 800000

Direct material 20 360000

Direct labour 10 980000

Variable overheads 5 90000

Fixed cost 5 90000

40 72000

Opening Inventory 0

Closing inventory 80000

Cost of sales 40 640000

Standard profit 10 160000

Profit under absorption

costing

(100000-90000) 10000

Budgeted profit 10 150000

TASK 3

1. Advantages and disadvantages of planning tools used in budgetary control

Budgeting: This can be defined as a process that express the need and requirement of resources

(material, human resources) for future activities related with business operation (production) of

an organisation in this a budget is designed, implemented and operated which are related with

course of action with in firm (Marginal and absorption costing, 2018).

Planning Tool Advantages Disadvantages

Cash Budget Bad Debts can be

avoided.

Better focus on the

budgets.

Availability of the

resources.

Limits spending power of

organisation.

Elimination of the rewards

to employees.

Not actual reflation of

profits.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.