Management Accounting Report: Costing and Reporting for LM Engineering

VerifiedAdded on 2021/02/19

|17

|4855

|41

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application within LM Engineering Ltd., a civil engineering and planning services company. It begins by defining management accounting and its role in organizational success, differentiating it from financial accounting. The report then examines various accounting systems, including cost accounting, price optimization, job costing, and inventory management, highlighting their benefits. It explores different types of management reports, such as performance reports, budget reports, accounts receivable, and cost managerial accounting reports. The report also discusses the benefits of management accounting systems, like improved cost control and customer satisfaction. Furthermore, the report delves into costing methods, comparing marginal and absorption costing and their impact on net profitability, using calculations and examples to illustrate the concepts. Finally, it emphasizes the integration of management reporting and accounting systems for effective decision-making within the organization.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

INTRODUCTION

Management accounting is an important part for an organisation which assist them in

driving towards achievement of its desired goals and objectives within pre-determined time

period. It performs several functions such as analysing and summarising accounting reports such

as Income statement, Balance sheet, Cash flow statement etc. These reports facilitate managers

in framing an effective strategies and suitable policies for the beneficial of company such as

using management accounting and reporting systems, preparing of budget and different

techniques to monitor unnecessary expenses etc. LM Engineering Ltd. company a civil

engineering and planning services company having headquarter in London, United Kingdom and

offers to the people of northern British Columbia. The report discusses the concept of

management accounting and its various types with their benefits to company. In addition with

this, various reporting systems such as performance report, inventory management report etc. are

briefly discussed under this report with the context of selected organisation. Apart from this,

types of costing methods and its uses in calculation of net profitability, concept of budget and its

tools to control expenses, uses of management accounting systems and techniques to resolve

financial related issues which are faced by an organisation.

TASK 1

P1:

The process of recording, summarising, and presenting financial records of an

organisation is known as management accounting. For this different types of books are maintain

by the financial department of company such as profits and loss account, cash flow statement

and balance sheet for an organisation (Chapman, 2011). The concept of management accounting

is directly related with estimating cost that will be bear by organisation to operate business its

operations. Along with this it helps an department to manage the funds by removing or

eliminating the waste.

LM Engineering limited uses different types of accounting softwares or systems by which

they maintain financial records as it helps them to formulate the strategy that helps company to

achieve their expected results. Some accounting system that are implemented by organisation is

mention as follow:

1

Management accounting is an important part for an organisation which assist them in

driving towards achievement of its desired goals and objectives within pre-determined time

period. It performs several functions such as analysing and summarising accounting reports such

as Income statement, Balance sheet, Cash flow statement etc. These reports facilitate managers

in framing an effective strategies and suitable policies for the beneficial of company such as

using management accounting and reporting systems, preparing of budget and different

techniques to monitor unnecessary expenses etc. LM Engineering Ltd. company a civil

engineering and planning services company having headquarter in London, United Kingdom and

offers to the people of northern British Columbia. The report discusses the concept of

management accounting and its various types with their benefits to company. In addition with

this, various reporting systems such as performance report, inventory management report etc. are

briefly discussed under this report with the context of selected organisation. Apart from this,

types of costing methods and its uses in calculation of net profitability, concept of budget and its

tools to control expenses, uses of management accounting systems and techniques to resolve

financial related issues which are faced by an organisation.

TASK 1

P1:

The process of recording, summarising, and presenting financial records of an

organisation is known as management accounting. For this different types of books are maintain

by the financial department of company such as profits and loss account, cash flow statement

and balance sheet for an organisation (Chapman, 2011). The concept of management accounting

is directly related with estimating cost that will be bear by organisation to operate business its

operations. Along with this it helps an department to manage the funds by removing or

eliminating the waste.

LM Engineering limited uses different types of accounting softwares or systems by which

they maintain financial records as it helps them to formulate the strategy that helps company to

achieve their expected results. Some accounting system that are implemented by organisation is

mention as follow:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting system:. This helps an organisation to analysis, predicts and calculates

all types of cost such as fixed cost, variable cost etc. To maintain and calculate the financial

records helps an organisation to calculate proper cost that is invested by company and helps to

generate more profits in future. LM Engineering Ltd. update their financial system that helps to

analysing price of different products and services as it helps to find cost along with their added

margin. Along with this it helps an organisation to analysis the future profitability of firm (Cost

accounting systems, 2013).

Price optimisation system:. With the execution of price optimisation system LM

Engineering Ltd identify the perception of its customers which help them to decide the price that

ensure future profitability as price effects on buying and selling of its customers. For this

financial department needs effective employees’ that helps to research in market. As they

provide essential information to an organisation that relates with satisfaction level of its targeted

customers it is related with price factor of company. This helps an organisation to decide that

they follow with current policy or modify changes according to market demands (Christ and

Burritt, 2013).

Job costing system- It refers to the system by which an organisation total cost of its

operating activities are calculated by company. This provides various range of its products and

services that help an organisation to allocate financial service individually. For this it is the most

suitable to adopt by organisation as they provide different products and services with wide range

of its products. LM Engineering Ltd use such system to make estimate cost for each units

separately. Along with this it helps organisation to calculate its expenses and revenues

individually.

Inventory management system- These helps an organisation to manage and track the

status of its inventory. This helps an organisation to meet with the expectations of customer

which helps to generate faith in customers through delivering demanded products on time. LM

Engineering Ltd uses this system to ensure the availability of company products and their

services. Example- organisation wants to track the status of its conveyance system then this

system help organisation to check the productivity of their services (Garrison and et. al., 2010).

Difference between management and financial accounting

2

all types of cost such as fixed cost, variable cost etc. To maintain and calculate the financial

records helps an organisation to calculate proper cost that is invested by company and helps to

generate more profits in future. LM Engineering Ltd. update their financial system that helps to

analysing price of different products and services as it helps to find cost along with their added

margin. Along with this it helps an organisation to analysis the future profitability of firm (Cost

accounting systems, 2013).

Price optimisation system:. With the execution of price optimisation system LM

Engineering Ltd identify the perception of its customers which help them to decide the price that

ensure future profitability as price effects on buying and selling of its customers. For this

financial department needs effective employees’ that helps to research in market. As they

provide essential information to an organisation that relates with satisfaction level of its targeted

customers it is related with price factor of company. This helps an organisation to decide that

they follow with current policy or modify changes according to market demands (Christ and

Burritt, 2013).

Job costing system- It refers to the system by which an organisation total cost of its

operating activities are calculated by company. This provides various range of its products and

services that help an organisation to allocate financial service individually. For this it is the most

suitable to adopt by organisation as they provide different products and services with wide range

of its products. LM Engineering Ltd use such system to make estimate cost for each units

separately. Along with this it helps organisation to calculate its expenses and revenues

individually.

Inventory management system- These helps an organisation to manage and track the

status of its inventory. This helps an organisation to meet with the expectations of customer

which helps to generate faith in customers through delivering demanded products on time. LM

Engineering Ltd uses this system to ensure the availability of company products and their

services. Example- organisation wants to track the status of its conveyance system then this

system help organisation to check the productivity of their services (Garrison and et. al., 2010).

Difference between management and financial accounting

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting- This accounting system help an organisation to provide

necessary and relevant details that directly helps financial department to formulate effective

policy and plans for the project.

Internal department are whole sole controllers of business it includes managers,

employees, management etc. as they has authority to make plans and monitor the operations that

are performed by organisation. As they are developed to gains the future benefits by reducing the

cost of different activities that operates by organisation. For this all rules and regulations,

policies are developed within inside the organisations.

Financial accounting- With the help of financial accounting an organisation prepare and

records financial transaction or statements. For this financial department create profit & loss

account, balance sheet etc. It helps an organisation to ensure their financial position in industry.

External parties that involve investors, banks, financial institution etc. are the persons

which are major factors as they impact on financial decision of an organisation. For an effective

decision that relates with monetary decisions are developed through historical perspective such

as past data records, last year balances sheet etc. To manage effective accounts organisation has

to follow particular formats (Goetsch and Davis, 2014).

P2

There are several accounting system of management which are useful for the higher

authorities of the organisation in determining their actual financial positions in present times.

This helps to identify and prepare their effective plans or policies as it increases the chances of

achieving higher goals and expected results for an organisation. With this it is possible for

management to make productive result within decided time period. As this report includes

information, data and records for monetary and non-monetary terms that helps to make effective

decisions. Some reports that are prepared by LM Engineering Ltd is as follow:

Performance report- This report is prepares with the purpose of assessing and measuring

the performance of an organisation and its employees. As it provides reliable and useful

information that relates with current performance of the employees that work for the

organisation. With this it is easy for organisation identify and developed issues that create barrier

in the performance of employees. This helps the management of LM Engineering Ltd. o

formulate corrective decisions as it helps organisation to take corrective decisions that are for the

3

necessary and relevant details that directly helps financial department to formulate effective

policy and plans for the project.

Internal department are whole sole controllers of business it includes managers,

employees, management etc. as they has authority to make plans and monitor the operations that

are performed by organisation. As they are developed to gains the future benefits by reducing the

cost of different activities that operates by organisation. For this all rules and regulations,

policies are developed within inside the organisations.

Financial accounting- With the help of financial accounting an organisation prepare and

records financial transaction or statements. For this financial department create profit & loss

account, balance sheet etc. It helps an organisation to ensure their financial position in industry.

External parties that involve investors, banks, financial institution etc. are the persons

which are major factors as they impact on financial decision of an organisation. For an effective

decision that relates with monetary decisions are developed through historical perspective such

as past data records, last year balances sheet etc. To manage effective accounts organisation has

to follow particular formats (Goetsch and Davis, 2014).

P2

There are several accounting system of management which are useful for the higher

authorities of the organisation in determining their actual financial positions in present times.

This helps to identify and prepare their effective plans or policies as it increases the chances of

achieving higher goals and expected results for an organisation. With this it is possible for

management to make productive result within decided time period. As this report includes

information, data and records for monetary and non-monetary terms that helps to make effective

decisions. Some reports that are prepared by LM Engineering Ltd is as follow:

Performance report- This report is prepares with the purpose of assessing and measuring

the performance of an organisation and its employees. As it provides reliable and useful

information that relates with current performance of the employees that work for the

organisation. With this it is easy for organisation identify and developed issues that create barrier

in the performance of employees. This helps the management of LM Engineering Ltd. o

formulate corrective decisions as it helps organisation to take corrective decisions that are for the

3

welfare of employees because they improve their skills and productivity (Lavia López and Hiebl,

2014).

Budget report- With the preparation of budget organisation decides the estimate cost for

each activity of the organisation. As separate functions and activities are already decided or

formulated by the management that are perform by different departments of an organisation. LM

Engineering Ltd use this report to utilize optimum resources of the organisation by reducing the

number of unnecessary activities that is performed by the organisation.

Accounts receivable or debtors- This report explain and contain the information about

unpaid debtors or due amount that is earned by organisation but not paid by customers. It is

important for LM Engineering Limited to maintain the records of accounts receivable as they

highly impact on the profitability of an organisation. This is mainly related with the credit

facility of an organisation it is the responsibility of financial department of an organisation to

record unpaid amount so that they recover amounts which helps to gain high profits of an

organisation. Apart from this it helps an organisation to update their credits policy to overcome

from bad-debts (Linoff and Berry, 2011).

Cost managerial accounting report- It may be defined as the report which indicates the

information about the overall cost incurred in process of production and other business activities.

Using such report by LM Engineering Ltd. Help in identifying and analysing the actual cost

which makes easy for their managers to frame an effective pricing strategies for their products

and services offered in market. This will help in retaining loyal customers as well as generate

huge profitability. Through this report the organisation provide the full details of about money

that is invested for the execution of its business operations. This leads the administration of LM

Engineering Ltd. to calculate the expenses before selling of products and outcome or income that

is received by sale of its products when they are deliver to its customers. Along with this it helps

an organisation to control unnecessary cost which reduces the profits of the organisation (Lukka

and Vinnari, 2014).

M1

Each accounting system has separate benefits which brings positive results for the

company. If an organisation uses such system then it helps to accomplish goals and objective

easily. Some benefits of management accounting system is as follow:

4

2014).

Budget report- With the preparation of budget organisation decides the estimate cost for

each activity of the organisation. As separate functions and activities are already decided or

formulated by the management that are perform by different departments of an organisation. LM

Engineering Ltd use this report to utilize optimum resources of the organisation by reducing the

number of unnecessary activities that is performed by the organisation.

Accounts receivable or debtors- This report explain and contain the information about

unpaid debtors or due amount that is earned by organisation but not paid by customers. It is

important for LM Engineering Limited to maintain the records of accounts receivable as they

highly impact on the profitability of an organisation. This is mainly related with the credit

facility of an organisation it is the responsibility of financial department of an organisation to

record unpaid amount so that they recover amounts which helps to gain high profits of an

organisation. Apart from this it helps an organisation to update their credits policy to overcome

from bad-debts (Linoff and Berry, 2011).

Cost managerial accounting report- It may be defined as the report which indicates the

information about the overall cost incurred in process of production and other business activities.

Using such report by LM Engineering Ltd. Help in identifying and analysing the actual cost

which makes easy for their managers to frame an effective pricing strategies for their products

and services offered in market. This will help in retaining loyal customers as well as generate

huge profitability. Through this report the organisation provide the full details of about money

that is invested for the execution of its business operations. This leads the administration of LM

Engineering Ltd. to calculate the expenses before selling of products and outcome or income that

is received by sale of its products when they are deliver to its customers. Along with this it helps

an organisation to control unnecessary cost which reduces the profits of the organisation (Lukka

and Vinnari, 2014).

M1

Each accounting system has separate benefits which brings positive results for the

company. If an organisation uses such system then it helps to accomplish goals and objective

easily. Some benefits of management accounting system is as follow:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting system is beneficial for management as it help to set the price of

products through analysing the cost that is invested for the manufacture of products

and service.

With execution of cost accounting system an organisation determines the unnecessary

cost that increases the price of products.

The effective use of inventory management system helps an organisation to meet with

its loyal customers by fulfilling their demand and needs on time.

Inventory management system manage the stock of products and reduce extra cost that

burden on company to make products. Like with effective inventory system

organisation find current position of stock which create balances between demand and

supply of stocks.

D1

To provide the favour of LM Engineering Ltd. it is necessary for organisation to integrate

between management report and accounting system as both of this concept helps to create

effective decisions and plans that help to achieve organisational goal and objective with

efficiency & effectiveness. So management combine both of this activities to increase the value

in their products or services.

TASK 2

P3:

It is the amount on the basis of which the company charged for the services rendered and

products sold to the customers. To evaluate cost, it is important for manager to check books of

accounts under which all transactions related with producing and selling products and services

are accurately recorded. There are two costing methods which includes marginal as well as

absorption which are briefly explained as under:

Marginal costing: It is most adoptable costing method by small and medium sized

organisation as it assist in presenting more profitability in financial statements. It increases

profits due to including only variable cost and ignoring fixed cost. Thus, it also known as

variable costing method as well.

Absorption costing: It is another technique to calculate net profitability which includes

both variable and fixed costs (Absorption costing, 2018). It provides accurate information

5

products through analysing the cost that is invested for the manufacture of products

and service.

With execution of cost accounting system an organisation determines the unnecessary

cost that increases the price of products.

The effective use of inventory management system helps an organisation to meet with

its loyal customers by fulfilling their demand and needs on time.

Inventory management system manage the stock of products and reduce extra cost that

burden on company to make products. Like with effective inventory system

organisation find current position of stock which create balances between demand and

supply of stocks.

D1

To provide the favour of LM Engineering Ltd. it is necessary for organisation to integrate

between management report and accounting system as both of this concept helps to create

effective decisions and plans that help to achieve organisational goal and objective with

efficiency & effectiveness. So management combine both of this activities to increase the value

in their products or services.

TASK 2

P3:

It is the amount on the basis of which the company charged for the services rendered and

products sold to the customers. To evaluate cost, it is important for manager to check books of

accounts under which all transactions related with producing and selling products and services

are accurately recorded. There are two costing methods which includes marginal as well as

absorption which are briefly explained as under:

Marginal costing: It is most adoptable costing method by small and medium sized

organisation as it assist in presenting more profitability in financial statements. It increases

profits due to including only variable cost and ignoring fixed cost. Thus, it also known as

variable costing method as well.

Absorption costing: It is another technique to calculate net profitability which includes

both variable and fixed costs (Absorption costing, 2018). It provides accurate information

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

regarding profitability of company to their shareholders due to inclusion of fixed cost which is

not done in marginal costing method. It increases credibility of shareholder towards company

due to which they may increase their amount in existing investment and enhance financial

position of company.

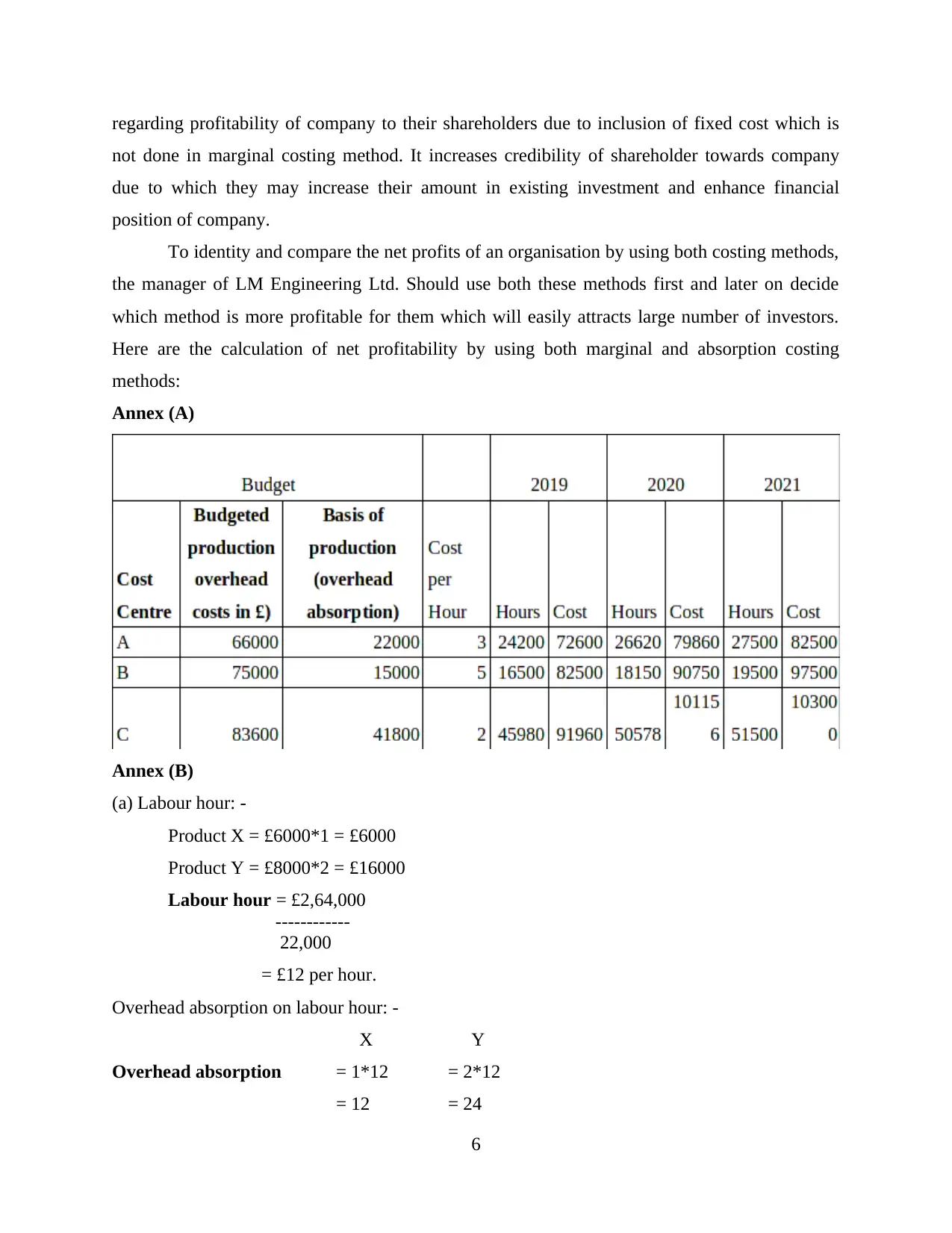

To identity and compare the net profits of an organisation by using both costing methods,

the manager of LM Engineering Ltd. Should use both these methods first and later on decide

which method is more profitable for them which will easily attracts large number of investors.

Here are the calculation of net profitability by using both marginal and absorption costing

methods:

Annex (A)

Annex (B)

(a) Labour hour: -

Product X = £6000*1 = £6000

Product Y = £8000*2 = £16000

Labour hour = £2,64,000

------------

22,000

= £12 per hour.

Overhead absorption on labour hour: -

X Y

Overhead absorption = 1*12 = 2*12

= 12 = 24

6

not done in marginal costing method. It increases credibility of shareholder towards company

due to which they may increase their amount in existing investment and enhance financial

position of company.

To identity and compare the net profits of an organisation by using both costing methods,

the manager of LM Engineering Ltd. Should use both these methods first and later on decide

which method is more profitable for them which will easily attracts large number of investors.

Here are the calculation of net profitability by using both marginal and absorption costing

methods:

Annex (A)

Annex (B)

(a) Labour hour: -

Product X = £6000*1 = £6000

Product Y = £8000*2 = £16000

Labour hour = £2,64,000

------------

22,000

= £12 per hour.

Overhead absorption on labour hour: -

X Y

Overhead absorption = 1*12 = 2*12

= 12 = 24

6

Total Overheads = £6000*12 = £8000*24

= £72,000 = £192,000

(b) Using ABC approach: -

Machine hour per period:

Product X = £6000*4 = £24,000

Product Y = £8000*2 = £16,000

Cost driven rate: -

Production set up = £179,000 = 2893 per set up.

60

Order handling = £30,000 = 416.666 = 417 per order

72

Machine cost = £55,000 = 1.375 per order

40,000

Overhead using ABC approach: -

X

Set up = 15*2983 = 44,745

Order = 12*417 = 5004

Machine cost = 24000*1.375 = 33,000

Total 82749

Y

Set up = 45*2983 = 134,235

Order = 60*417 = 25,020

Machine cost = 16000*1.375 = 22,000

Total 181,255

Annex (c)

7

= £72,000 = £192,000

(b) Using ABC approach: -

Machine hour per period:

Product X = £6000*4 = £24,000

Product Y = £8000*2 = £16,000

Cost driven rate: -

Production set up = £179,000 = 2893 per set up.

60

Order handling = £30,000 = 416.666 = 417 per order

72

Machine cost = £55,000 = 1.375 per order

40,000

Overhead using ABC approach: -

X

Set up = 15*2983 = 44,745

Order = 12*417 = 5004

Machine cost = 24000*1.375 = 33,000

Total 82749

Y

Set up = 45*2983 = 134,235

Order = 60*417 = 25,020

Machine cost = 16000*1.375 = 22,000

Total 181,255

Annex (c)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

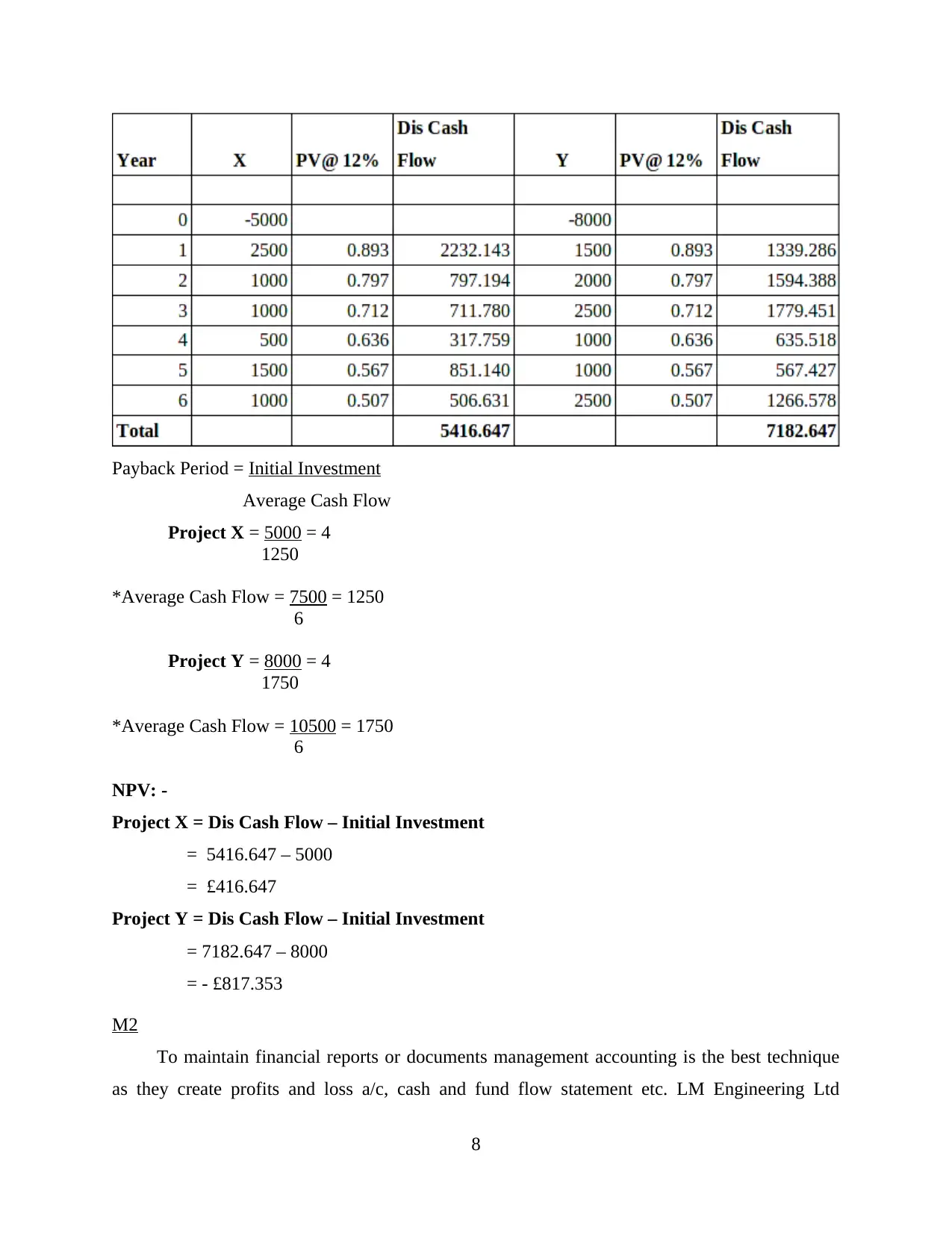

Payback Period = Initial Investment

Average Cash Flow

Project X = 5000 = 4

1250

*Average Cash Flow = 7500 = 1250

6

Project Y = 8000 = 4

1750

*Average Cash Flow = 10500 = 1750

6

NPV: -

Project X = Dis Cash Flow – Initial Investment

= 5416.647 – 5000

= £416.647

Project Y = Dis Cash Flow – Initial Investment

= 7182.647 – 8000

= - £817.353

M2

To maintain financial reports or documents management accounting is the best technique

as they create profits and loss a/c, cash and fund flow statement etc. LM Engineering Ltd

8

Average Cash Flow

Project X = 5000 = 4

1250

*Average Cash Flow = 7500 = 1250

6

Project Y = 8000 = 4

1750

*Average Cash Flow = 10500 = 1750

6

NPV: -

Project X = Dis Cash Flow – Initial Investment

= 5416.647 – 5000

= £416.647

Project Y = Dis Cash Flow – Initial Investment

= 7182.647 – 8000

= - £817.353

M2

To maintain financial reports or documents management accounting is the best technique

as they create profits and loss a/c, cash and fund flow statement etc. LM Engineering Ltd

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

evaluate its financial position by using accounting tools and techniques that involve cost

accounting system and analysis of financial statement of company.

D2

It is essential for every company to make financial reports of whole year or quarter

through this it is easy for organisation to analyse their current financial position. For this the first

task that is require to done by financial department is to interpret the transactions that take places

during different business activities. Along with an organisation calculate actual amount that is

invested in each activity of organisation.

TASK 3

P4

Budget- Budget is an internal tool that is used by company which helps them to analysis

and find out estimated cost for the upcoming year. This is divided by management of company

into quarterly and half yearly basis. As it helps the organisation to evaluate their output result

with expected results of management (Pavlatos and Kostakis, 2015). Usually budgets are made

for anything but specifically they are used to calculate money that is earn and spend by

government or organisation it help them to complete its activities with minimum cost.

Types of budget

Cash flow budget- These types of budget helps an organisation to record the transaction

from where cash come in and where it is spend or expense by management. Along with this it

helps an organisation to manage sufficient amount of funds by which they creates launch or start

new project. Like small companies are the major clients of LM Engineering Ltd that creates

budget from them.

Financial budget- The financial budget help the company to manage their finance or

money for the whole year. These includes income statement, profits and loss a/c etc. effective

financial budget help the company to show their financial strength in market or its stakeholders.

Management of LM Engineering Ltd. formulate effective financial budget through which they

monitor their expenses (Renz, 2016).

Static budget- The static budget is developed by management as they are stable and

cannot be changed easily. In this changes are developed only sales or profits of company are

increased. Like fixed cost it bear by every organisation either they operate its activities or not.

9

accounting system and analysis of financial statement of company.

D2

It is essential for every company to make financial reports of whole year or quarter

through this it is easy for organisation to analyse their current financial position. For this the first

task that is require to done by financial department is to interpret the transactions that take places

during different business activities. Along with an organisation calculate actual amount that is

invested in each activity of organisation.

TASK 3

P4

Budget- Budget is an internal tool that is used by company which helps them to analysis

and find out estimated cost for the upcoming year. This is divided by management of company

into quarterly and half yearly basis. As it helps the organisation to evaluate their output result

with expected results of management (Pavlatos and Kostakis, 2015). Usually budgets are made

for anything but specifically they are used to calculate money that is earn and spend by

government or organisation it help them to complete its activities with minimum cost.

Types of budget

Cash flow budget- These types of budget helps an organisation to record the transaction

from where cash come in and where it is spend or expense by management. Along with this it

helps an organisation to manage sufficient amount of funds by which they creates launch or start

new project. Like small companies are the major clients of LM Engineering Ltd that creates

budget from them.

Financial budget- The financial budget help the company to manage their finance or

money for the whole year. These includes income statement, profits and loss a/c etc. effective

financial budget help the company to show their financial strength in market or its stakeholders.

Management of LM Engineering Ltd. formulate effective financial budget through which they

monitor their expenses (Renz, 2016).

Static budget- The static budget is developed by management as they are stable and

cannot be changed easily. In this changes are developed only sales or profits of company are

increased. Like fixed cost it bear by every organisation either they operate its activities or not.

9

Budgetary control- In simple words budgetary control helps an organisation to achieve

their specific goals in a pre-determined budget. Example- LM Engineering Ltd. helps small

industry to make their budget through which they increased their sales or profits,

Contingency tool- Each organisation has to face negative or difficult situation that create

negative impact on company. For this LM Engineering Ltd. prepare contingency budget which

helps to face this complex situation.

Benefits of contingency tool

Stability- Unexpected events are beyond the control of organisation so in this context

contingency tool provides sufficient funds through which an company maintain their current

position.

Responsibility- In difficult times contingency tool help the organisation to find out

reasons and persons who are responsible for bad situation.

Limitations of contingency plans

Complex- Contingency plans are difficult to create as it is difficult to understand the

future because uncertainties are beyond the control of an organisation.

Response- these plans work and create reactive action for organisation while to face

unexpected proactive plans are more beneficial for organisation.

Flexible Budget- It is the simplest form to develop a budget. This includes those factors

that directly effect on the revenue of company. If there is change in market the income is

increased and decreased of the organisation (Suomala and Lyly-Yrjänäinen, 2012).

Merits of flexible budget

Flexible budgets are useful in those organisations in which price of products is changes

frequently. LM Engineering Ltd. develops budget for small firms as well as for industry

also.

With the help of flexible budget it is easy for organisation to update and adopt the

changes that are required by company as it increase benefits for organisation.

De-merits of flexible budget

In case of flexible budget it is difficult for organisation to differentiate between flexible

and variable cost. So this create problems for LM engineering ltd. as they has to change

the whole budget for organisation.

10

their specific goals in a pre-determined budget. Example- LM Engineering Ltd. helps small

industry to make their budget through which they increased their sales or profits,

Contingency tool- Each organisation has to face negative or difficult situation that create

negative impact on company. For this LM Engineering Ltd. prepare contingency budget which

helps to face this complex situation.

Benefits of contingency tool

Stability- Unexpected events are beyond the control of organisation so in this context

contingency tool provides sufficient funds through which an company maintain their current

position.

Responsibility- In difficult times contingency tool help the organisation to find out

reasons and persons who are responsible for bad situation.

Limitations of contingency plans

Complex- Contingency plans are difficult to create as it is difficult to understand the

future because uncertainties are beyond the control of an organisation.

Response- these plans work and create reactive action for organisation while to face

unexpected proactive plans are more beneficial for organisation.

Flexible Budget- It is the simplest form to develop a budget. This includes those factors

that directly effect on the revenue of company. If there is change in market the income is

increased and decreased of the organisation (Suomala and Lyly-Yrjänäinen, 2012).

Merits of flexible budget

Flexible budgets are useful in those organisations in which price of products is changes

frequently. LM Engineering Ltd. develops budget for small firms as well as for industry

also.

With the help of flexible budget it is easy for organisation to update and adopt the

changes that are required by company as it increase benefits for organisation.

De-merits of flexible budget

In case of flexible budget it is difficult for organisation to differentiate between flexible

and variable cost. So this create problems for LM engineering ltd. as they has to change

the whole budget for organisation.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.