Management Accounting Systems, Methods, and Costing Report

VerifiedAdded on 2020/12/30

|20

|5091

|207

Report

AI Summary

This report provides an in-depth analysis of management accounting principles, focusing on their application within Merlin Finance Consultancy. It explores various management accounting systems, including inventory management and cost accounting, and details different methods of management accounting reports, such as budget reports and performance reports. The report also differentiates between management and financial accounting, highlighting the benefits and applications of management accounting systems within an organization. Additionally, it includes calculations of costs using marginal and absorption costing methods, along with income statements for each. The report concludes by evaluating the link between management accounting systems, reports, and the overall organizational processes, emphasizing their importance in achieving business goals and objectives. This report is a comprehensive resource for understanding how management accounting supports financial planning, decision-making, and performance evaluation within a business context.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Management accounting involve the information regarding financial or statistical which

help the manager to manager all the organisational work. It will include the process of analysis,

measuring, communicate with the members or interpret the information to their internal as well

as external users. It further help the business to take important decision to achieve their goals &

objectives (Ax and Greve, 2017). Management accounting use for the internal analysis so

manager of the company maintain professional accounting information which required for the

growth of organisation. To be understand better, this report choose Merlin Finance Consultant

which is medium size company consultancy company and it is established in the year 1988.

Company provide the information regarding financial planning, to protect assets and increase the

standard of living of their clients. This report include different types of management accounting

system and methods of management accounting report. Along with this, it will include the

managerial & cost accounting techniques to prepare income statement for the organisation. In

addition, advantage & disadvantage of planning tools which is used to control budget and how

organisations deal with various financial problems nu using different management accounting

system (Helden and Uddin, 2016).

P1 Management accounting and essential requirement of different type of management

accounting system

It is used for the internal analysis or it's main objective to provide effective decision in

respect of achieving business goals & vision. It will help the manager to evaluate or measure the

financial information of the Merlin Finance Consultancy and help to manage operational

activities (Bennett and James, 2017). Management accounting help the organisation to perform

their task effectively which improve the productivity as well as profitability and it further help

the manger in their decision making process.

Every organisation use different management accounting system for the better

performance or fulfil the requirement of their business. These systems help the manager to

develop different strategies in respect of achieving their objectives & goals. Manger of Merlin

Finance Consultancy follow various this system to measure the performance of employees and

corporation whether it is beneficial or not.

1

Management accounting involve the information regarding financial or statistical which

help the manager to manager all the organisational work. It will include the process of analysis,

measuring, communicate with the members or interpret the information to their internal as well

as external users. It further help the business to take important decision to achieve their goals &

objectives (Ax and Greve, 2017). Management accounting use for the internal analysis so

manager of the company maintain professional accounting information which required for the

growth of organisation. To be understand better, this report choose Merlin Finance Consultant

which is medium size company consultancy company and it is established in the year 1988.

Company provide the information regarding financial planning, to protect assets and increase the

standard of living of their clients. This report include different types of management accounting

system and methods of management accounting report. Along with this, it will include the

managerial & cost accounting techniques to prepare income statement for the organisation. In

addition, advantage & disadvantage of planning tools which is used to control budget and how

organisations deal with various financial problems nu using different management accounting

system (Helden and Uddin, 2016).

P1 Management accounting and essential requirement of different type of management

accounting system

It is used for the internal analysis or it's main objective to provide effective decision in

respect of achieving business goals & vision. It will help the manager to evaluate or measure the

financial information of the Merlin Finance Consultancy and help to manage operational

activities (Bennett and James, 2017). Management accounting help the organisation to perform

their task effectively which improve the productivity as well as profitability and it further help

the manger in their decision making process.

Every organisation use different management accounting system for the better

performance or fulfil the requirement of their business. These systems help the manager to

develop different strategies in respect of achieving their objectives & goals. Manger of Merlin

Finance Consultancy follow various this system to measure the performance of employees and

corporation whether it is beneficial or not.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory management software: It is a system or software which is used by the

organisations to measure their inventory level on regular basis. It include the all functional

activities such as transportation of stock, so this system record the data regarding each

transaction. In the service sector organisation company keep the record of their clients on the

regular basis. In the Merlin Finance Consultancy, manger adopt this system to record their

customers data in their database (Boučková, 2015). Which help the business to identify their

clients or they have to satisfy them through various activities. Such as, if number of client reduce

for the regular period then it's manager's responsibility to identity the reason. So this information

available through inventory management system or software that why it is required in the

organisation to measure the inventory on continue basis.

Cost accounting system: This system help the business to identify their product cost

which is related to their operational activities. Cost accounting system used for the identification

of exact amount spend on their product & service provided by the organisation to their

consumers. In Merlin Finance Consultancy, manger follow this system to identity the cost of

their services which provided to their clients to satisfy them. It will include the time or money

spend by their advisor at the time of providing financial services to their customers. It will

provide the idea to set the price of their services which help the organisation increase their

profitability or make them able to achieve their business goals & objectives (Chiarini and

Vagnoni,, 2015). Cost accounting system required for the further help of manager in their

decision making process. On the basis of cost analysis, manger build effective strategies which

help to increase their consultancy services among the clients.

Price optimisation system: It is the price analysis model which help the business to

identify the consumer's reaction on different price range of product & services. This system also

help the organisation to determine the price of their product & services that will meet with

company's objectives to increase profitability. Manager of Merlin Finance Consultancy adopt

this system to fix the rate of their services which is charged by them from their clients. Company

fix the rate of their services which can cover the overall cost or provide the decent profit margin

to the Merlin Finance Consultancy. Price optimisation system required to follow by the manager

to determine the reaction of client toward their price range. So it will help to build their strategies

according to it and take effective decision.

2

organisations to measure their inventory level on regular basis. It include the all functional

activities such as transportation of stock, so this system record the data regarding each

transaction. In the service sector organisation company keep the record of their clients on the

regular basis. In the Merlin Finance Consultancy, manger adopt this system to record their

customers data in their database (Boučková, 2015). Which help the business to identify their

clients or they have to satisfy them through various activities. Such as, if number of client reduce

for the regular period then it's manager's responsibility to identity the reason. So this information

available through inventory management system or software that why it is required in the

organisation to measure the inventory on continue basis.

Cost accounting system: This system help the business to identify their product cost

which is related to their operational activities. Cost accounting system used for the identification

of exact amount spend on their product & service provided by the organisation to their

consumers. In Merlin Finance Consultancy, manger follow this system to identity the cost of

their services which provided to their clients to satisfy them. It will include the time or money

spend by their advisor at the time of providing financial services to their customers. It will

provide the idea to set the price of their services which help the organisation increase their

profitability or make them able to achieve their business goals & objectives (Chiarini and

Vagnoni,, 2015). Cost accounting system required for the further help of manager in their

decision making process. On the basis of cost analysis, manger build effective strategies which

help to increase their consultancy services among the clients.

Price optimisation system: It is the price analysis model which help the business to

identify the consumer's reaction on different price range of product & services. This system also

help the organisation to determine the price of their product & services that will meet with

company's objectives to increase profitability. Manager of Merlin Finance Consultancy adopt

this system to fix the rate of their services which is charged by them from their clients. Company

fix the rate of their services which can cover the overall cost or provide the decent profit margin

to the Merlin Finance Consultancy. Price optimisation system required to follow by the manager

to determine the reaction of client toward their price range. So it will help to build their strategies

according to it and take effective decision.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

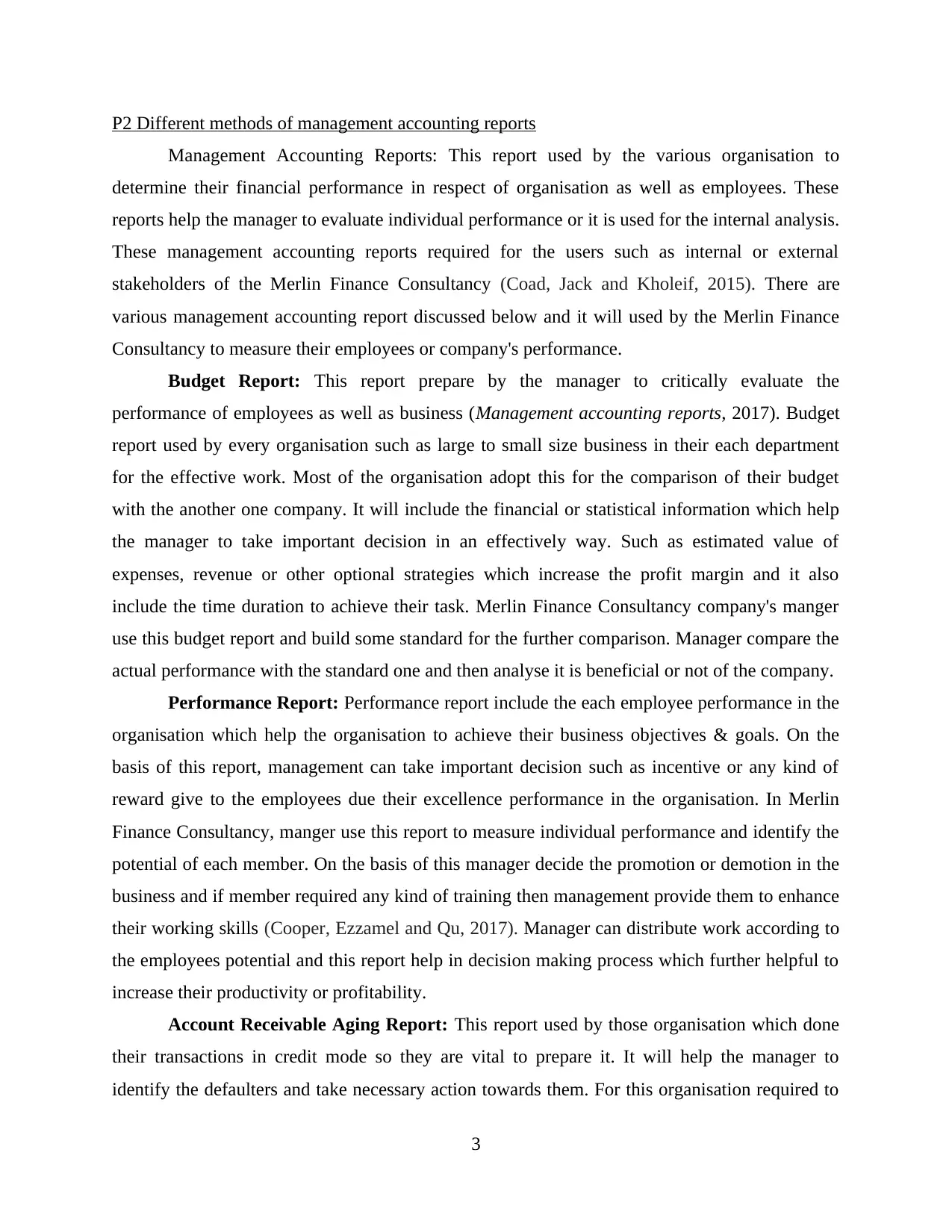

P2 Different methods of management accounting reports

Management Accounting Reports: This report used by the various organisation to

determine their financial performance in respect of organisation as well as employees. These

reports help the manager to evaluate individual performance or it is used for the internal analysis.

These management accounting reports required for the users such as internal or external

stakeholders of the Merlin Finance Consultancy (Coad, Jack and Kholeif, 2015). There are

various management accounting report discussed below and it will used by the Merlin Finance

Consultancy to measure their employees or company's performance.

Budget Report: This report prepare by the manager to critically evaluate the

performance of employees as well as business (Management accounting reports, 2017). Budget

report used by every organisation such as large to small size business in their each department

for the effective work. Most of the organisation adopt this for the comparison of their budget

with the another one company. It will include the financial or statistical information which help

the manager to take important decision in an effectively way. Such as estimated value of

expenses, revenue or other optional strategies which increase the profit margin and it also

include the time duration to achieve their task. Merlin Finance Consultancy company's manger

use this budget report and build some standard for the further comparison. Manager compare the

actual performance with the standard one and then analyse it is beneficial or not of the company.

Performance Report: Performance report include the each employee performance in the

organisation which help the organisation to achieve their business objectives & goals. On the

basis of this report, management can take important decision such as incentive or any kind of

reward give to the employees due their excellence performance in the organisation. In Merlin

Finance Consultancy, manger use this report to measure individual performance and identify the

potential of each member. On the basis of this manager decide the promotion or demotion in the

business and if member required any kind of training then management provide them to enhance

their working skills (Cooper, Ezzamel and Qu, 2017). Manager can distribute work according to

the employees potential and this report help in decision making process which further helpful to

increase their productivity or profitability.

Account Receivable Aging Report: This report used by those organisation which done

their transactions in credit mode so they are vital to prepare it. It will help the manager to

identify the defaulters and take necessary action towards them. For this organisation required to

3

Management Accounting Reports: This report used by the various organisation to

determine their financial performance in respect of organisation as well as employees. These

reports help the manager to evaluate individual performance or it is used for the internal analysis.

These management accounting reports required for the users such as internal or external

stakeholders of the Merlin Finance Consultancy (Coad, Jack and Kholeif, 2015). There are

various management accounting report discussed below and it will used by the Merlin Finance

Consultancy to measure their employees or company's performance.

Budget Report: This report prepare by the manager to critically evaluate the

performance of employees as well as business (Management accounting reports, 2017). Budget

report used by every organisation such as large to small size business in their each department

for the effective work. Most of the organisation adopt this for the comparison of their budget

with the another one company. It will include the financial or statistical information which help

the manager to take important decision in an effectively way. Such as estimated value of

expenses, revenue or other optional strategies which increase the profit margin and it also

include the time duration to achieve their task. Merlin Finance Consultancy company's manger

use this budget report and build some standard for the further comparison. Manager compare the

actual performance with the standard one and then analyse it is beneficial or not of the company.

Performance Report: Performance report include the each employee performance in the

organisation which help the organisation to achieve their business objectives & goals. On the

basis of this report, management can take important decision such as incentive or any kind of

reward give to the employees due their excellence performance in the organisation. In Merlin

Finance Consultancy, manger use this report to measure individual performance and identify the

potential of each member. On the basis of this manager decide the promotion or demotion in the

business and if member required any kind of training then management provide them to enhance

their working skills (Cooper, Ezzamel and Qu, 2017). Manager can distribute work according to

the employees potential and this report help in decision making process which further helpful to

increase their productivity or profitability.

Account Receivable Aging Report: This report used by those organisation which done

their transactions in credit mode so they are vital to prepare it. It will help the manager to

identify the defaulters and take necessary action towards them. For this organisation required to

3

maintain account receivable aging report and this report basically prepare by the medium to large

sector organisation. Because it is not easy to recall each defaulter without any records that why

manger prepare this report for the future help to recover their money. Manager of Merlin Finance

Consultancy use this report because they provide financial services to their clients and they have

to maintain records regarding their clients payment. With the help of this, manager can easily

identify the person who doing default and it will increase the efficiency of their work or increase

the profitability or reduce the number of non- payment clients.

Cost Managerial Accounting Report: This report include the all element which is

related to the cost of product & services. It provide the overall summery of these element such as

variable, fixed or overhead cost. It will help the manager of Merlin Finance Consultancy to

determine the cost of their services which help business to fix their consultancy charges and it

beneficial at the time of estimating profit margin (Hall, 2016). This report include the detailed

information regarding their expenses such as manpower cost, infrastructure, maintenance charges

and other expenses. This report help the Merlin Finance Consultancy company to manager their

cost in respect of increasing their profitability which lead to achieve their business goals &

objectives.

Difference between management & financial accounting:

Management Accounting Financial Accounting

It required relevant information, so

manger can develop various policies

and strategies.

Manager take important decision on the

basis of financial statements.

This accounting only focuses on

preparing financial statement.

It is compulsory to prepare and

required monetary information.

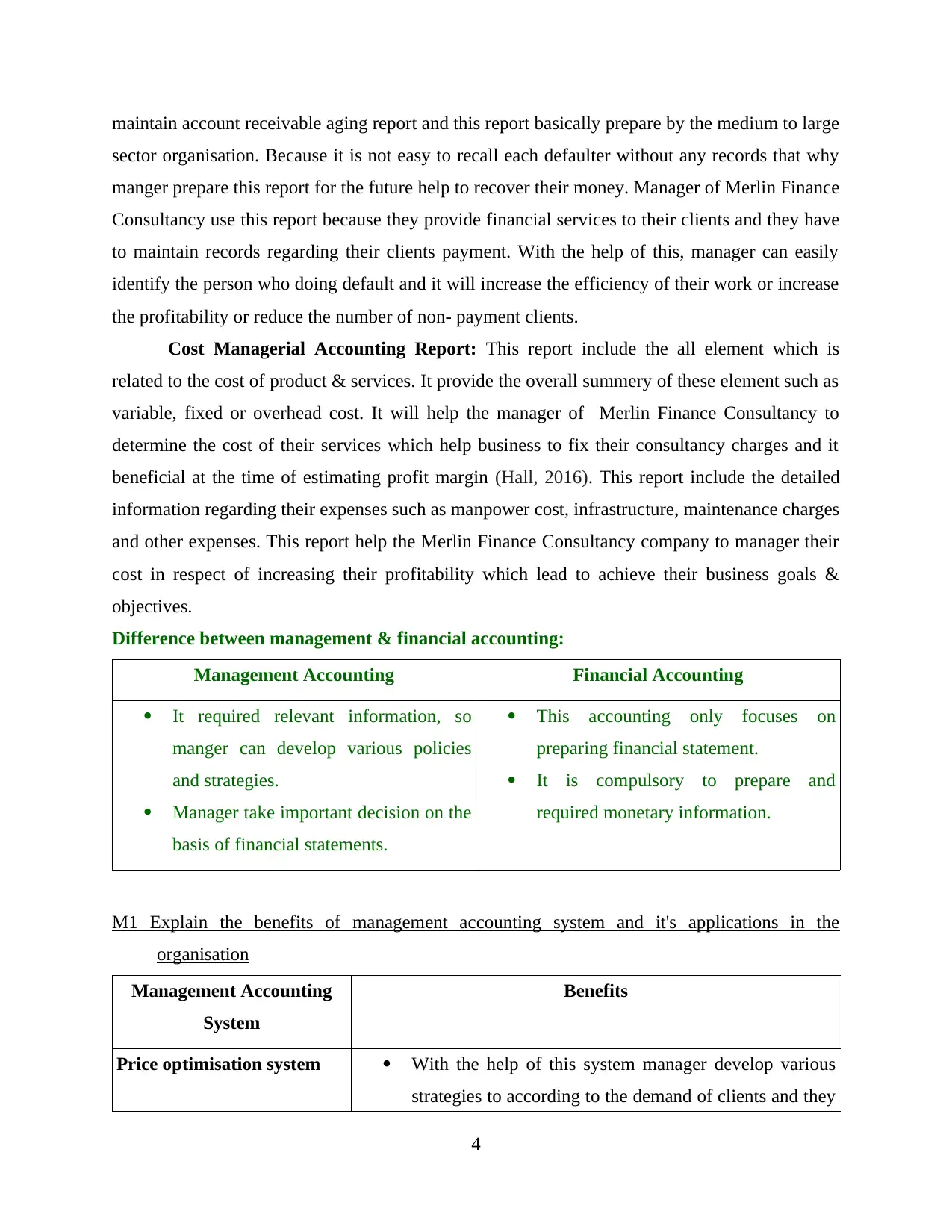

M1 Explain the benefits of management accounting system and it's applications in the

organisation

Management Accounting

System

Benefits

Price optimisation system With the help of this system manager develop various

strategies to according to the demand of clients and they

4

sector organisation. Because it is not easy to recall each defaulter without any records that why

manger prepare this report for the future help to recover their money. Manager of Merlin Finance

Consultancy use this report because they provide financial services to their clients and they have

to maintain records regarding their clients payment. With the help of this, manager can easily

identify the person who doing default and it will increase the efficiency of their work or increase

the profitability or reduce the number of non- payment clients.

Cost Managerial Accounting Report: This report include the all element which is

related to the cost of product & services. It provide the overall summery of these element such as

variable, fixed or overhead cost. It will help the manager of Merlin Finance Consultancy to

determine the cost of their services which help business to fix their consultancy charges and it

beneficial at the time of estimating profit margin (Hall, 2016). This report include the detailed

information regarding their expenses such as manpower cost, infrastructure, maintenance charges

and other expenses. This report help the Merlin Finance Consultancy company to manager their

cost in respect of increasing their profitability which lead to achieve their business goals &

objectives.

Difference between management & financial accounting:

Management Accounting Financial Accounting

It required relevant information, so

manger can develop various policies

and strategies.

Manager take important decision on the

basis of financial statements.

This accounting only focuses on

preparing financial statement.

It is compulsory to prepare and

required monetary information.

M1 Explain the benefits of management accounting system and it's applications in the

organisation

Management Accounting

System

Benefits

Price optimisation system With the help of this system manager develop various

strategies to according to the demand of clients and they

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

also compare their competitors price policy regarding

same services.

It will help the manager to identify the consumers who

can pay for their services and also analyse the behaviour

of clients towards their price policy.

Cost accounting system It is beneficial for the organisation to control their cost

for the period when company provide the financial

services to their clients.

This system help to reduce the cost of their services

which further increase the profit margin as well as

efficiency of their employees.

Inventory management

system

It provide updated information regarding their clients

which is helpful for the manager to build strategies

according to available data.

Inventory management system save the time as well as

money of the Merlin Finance Consultancy company.

D1 Critically evaluate the link between management accounting system or management account

report with the organisational process

Every business required management accounting system or reports to complete their

organisational process. Because this process include the various activities which can be done

through different strategies and it also involve the decision which taken by the manger for the

benefit of business. For this, Merlin Finance Consultancy have to follow accounting systems or

reports because they provide the budget or performance repost which required at the time of

decision. Cost accounting system or inventory management system help the manager to build

effective strategies in respect of reducing cost or increase the profitability. Integration of systems

or report in the organisational process help to achieve business goals & objectives (Maas,

Schaltegger and Crutzen, 2016).

5

same services.

It will help the manager to identify the consumers who

can pay for their services and also analyse the behaviour

of clients towards their price policy.

Cost accounting system It is beneficial for the organisation to control their cost

for the period when company provide the financial

services to their clients.

This system help to reduce the cost of their services

which further increase the profit margin as well as

efficiency of their employees.

Inventory management

system

It provide updated information regarding their clients

which is helpful for the manager to build strategies

according to available data.

Inventory management system save the time as well as

money of the Merlin Finance Consultancy company.

D1 Critically evaluate the link between management accounting system or management account

report with the organisational process

Every business required management accounting system or reports to complete their

organisational process. Because this process include the various activities which can be done

through different strategies and it also involve the decision which taken by the manger for the

benefit of business. For this, Merlin Finance Consultancy have to follow accounting systems or

reports because they provide the budget or performance repost which required at the time of

decision. Cost accounting system or inventory management system help the manager to build

effective strategies in respect of reducing cost or increase the profitability. Integration of systems

or report in the organisational process help to achieve business goals & objectives (Maas,

Schaltegger and Crutzen, 2016).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

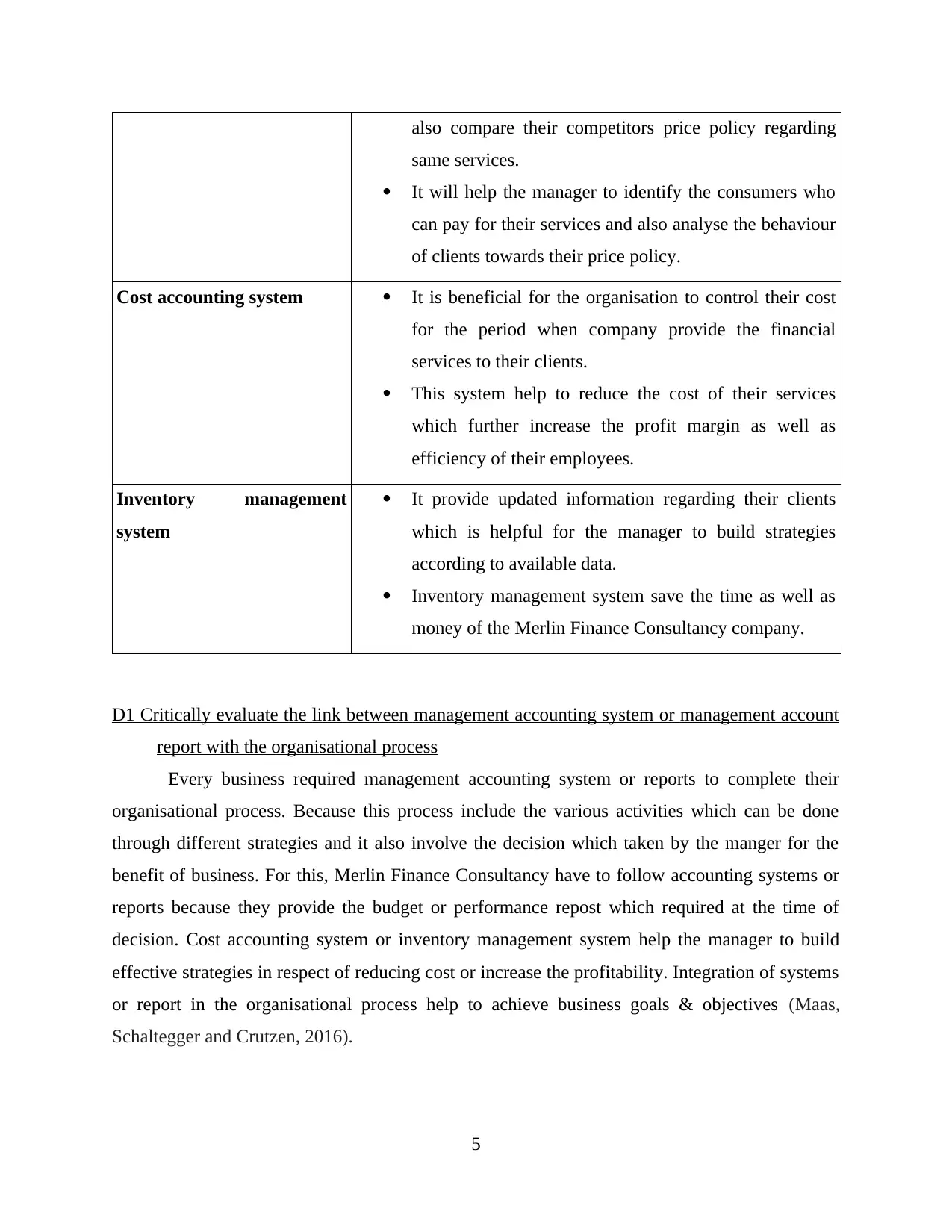

P3 Calculate cost by using marginal or absorption costing methods

Absorption Costing: - This costing method help the organisation to calculate total cost of

production which help the manager to identify the cost of each unite. It is also called full costing

method.

Marginal costing: - It is the change of per unit at the time of producing each single unit over the

period of production. Purpose of this costing is to achieve economics of sale.

Income statement by Absorption Costing:

Particular Amount

Sale(10000*25) 250000

Less: - Cost of goods sold

Material Cost 50000

Labour Cost 30000

Variable Cost 20000

Fixed manufacturing overheads 40000

110000

Less: - Selling & Administration Expenses 60000

Income 50000

*Working Notes: -

Selling & Administration Expenses = ( Fixed + Variable)

= (30000 + 30000)

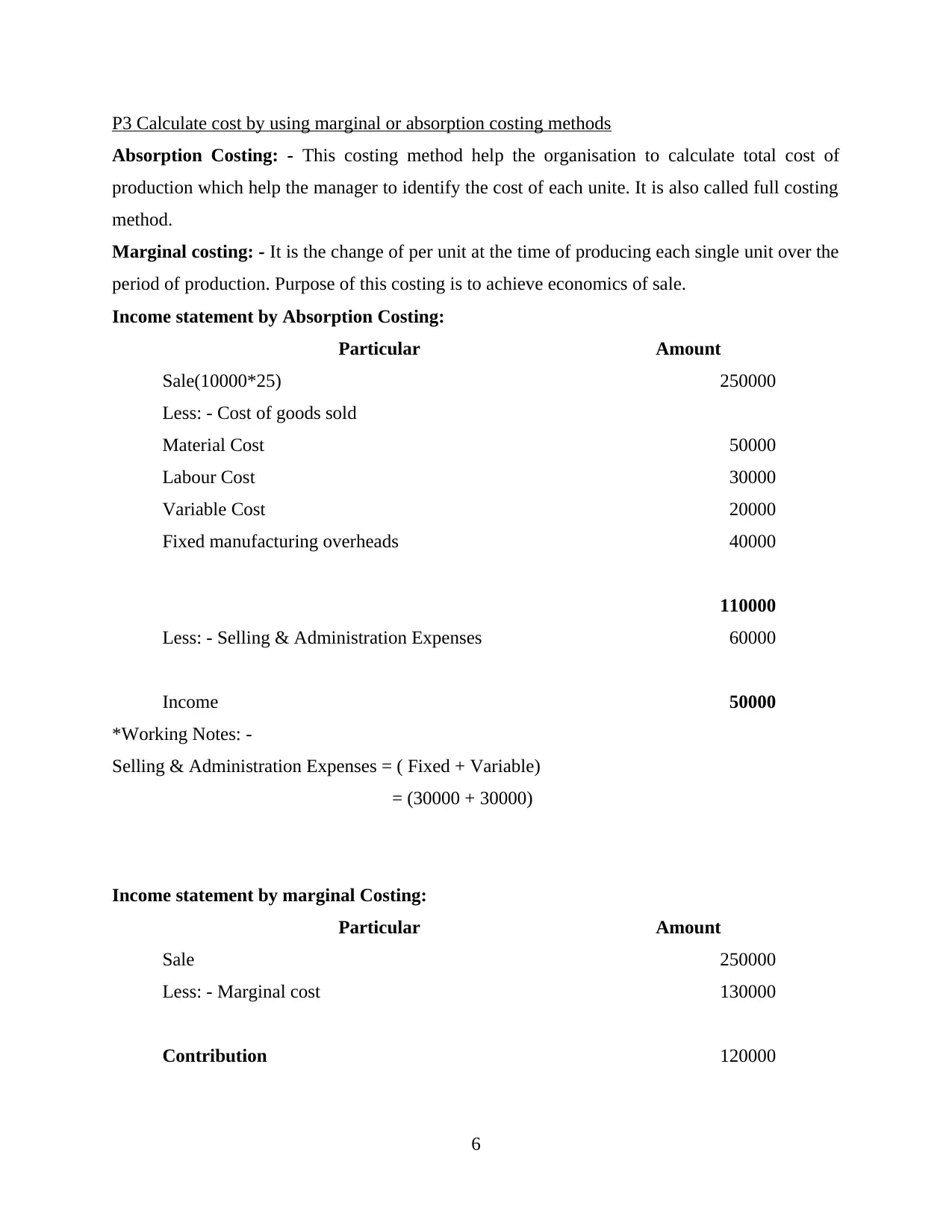

Income statement by marginal Costing:

Particular Amount

Sale 250000

Less: - Marginal cost 130000

Contribution 120000

6

Absorption Costing: - This costing method help the organisation to calculate total cost of

production which help the manager to identify the cost of each unite. It is also called full costing

method.

Marginal costing: - It is the change of per unit at the time of producing each single unit over the

period of production. Purpose of this costing is to achieve economics of sale.

Income statement by Absorption Costing:

Particular Amount

Sale(10000*25) 250000

Less: - Cost of goods sold

Material Cost 50000

Labour Cost 30000

Variable Cost 20000

Fixed manufacturing overheads 40000

110000

Less: - Selling & Administration Expenses 60000

Income 50000

*Working Notes: -

Selling & Administration Expenses = ( Fixed + Variable)

= (30000 + 30000)

Income statement by marginal Costing:

Particular Amount

Sale 250000

Less: - Marginal cost 130000

Contribution 120000

6

Less: - Fixed Cost 70000

Income 50000

*Working Notes

Marginal cost = Direct material+ Direct labour+ Variable manufacturing overhead+ Variable

Selling and Administrative Expenses

= 50000+30000+20000+30000

= 130000

Fixed Cost = 40000+30000

= 70000

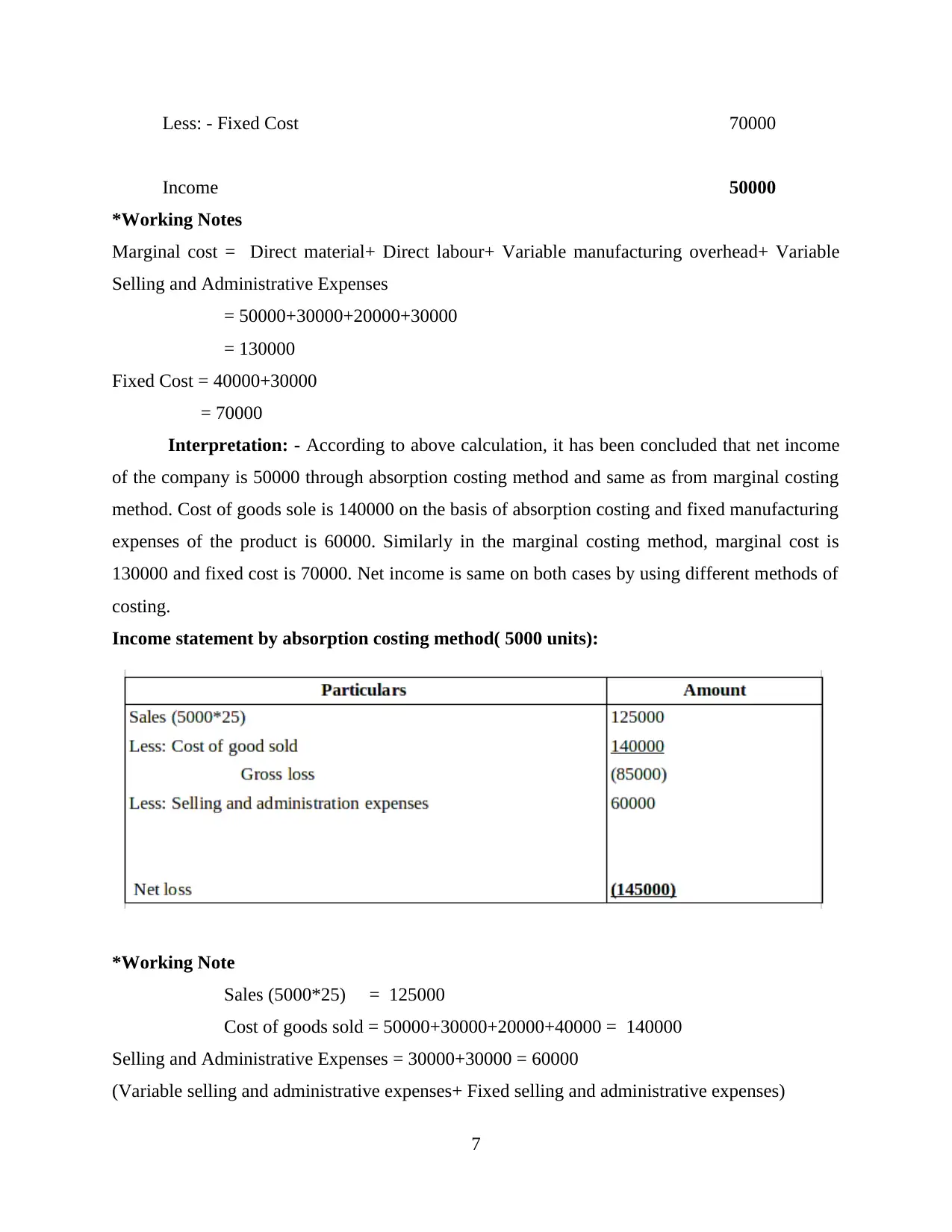

Interpretation: - According to above calculation, it has been concluded that net income

of the company is 50000 through absorption costing method and same as from marginal costing

method. Cost of goods sole is 140000 on the basis of absorption costing and fixed manufacturing

expenses of the product is 60000. Similarly in the marginal costing method, marginal cost is

130000 and fixed cost is 70000. Net income is same on both cases by using different methods of

costing.

Income statement by absorption costing method( 5000 units):

*Working Note

Sales (5000*25) = 125000

Cost of goods sold = 50000+30000+20000+40000 = 140000

Selling and Administrative Expenses = 30000+30000 = 60000

(Variable selling and administrative expenses+ Fixed selling and administrative expenses)

7

Income 50000

*Working Notes

Marginal cost = Direct material+ Direct labour+ Variable manufacturing overhead+ Variable

Selling and Administrative Expenses

= 50000+30000+20000+30000

= 130000

Fixed Cost = 40000+30000

= 70000

Interpretation: - According to above calculation, it has been concluded that net income

of the company is 50000 through absorption costing method and same as from marginal costing

method. Cost of goods sole is 140000 on the basis of absorption costing and fixed manufacturing

expenses of the product is 60000. Similarly in the marginal costing method, marginal cost is

130000 and fixed cost is 70000. Net income is same on both cases by using different methods of

costing.

Income statement by absorption costing method( 5000 units):

*Working Note

Sales (5000*25) = 125000

Cost of goods sold = 50000+30000+20000+40000 = 140000

Selling and Administrative Expenses = 30000+30000 = 60000

(Variable selling and administrative expenses+ Fixed selling and administrative expenses)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

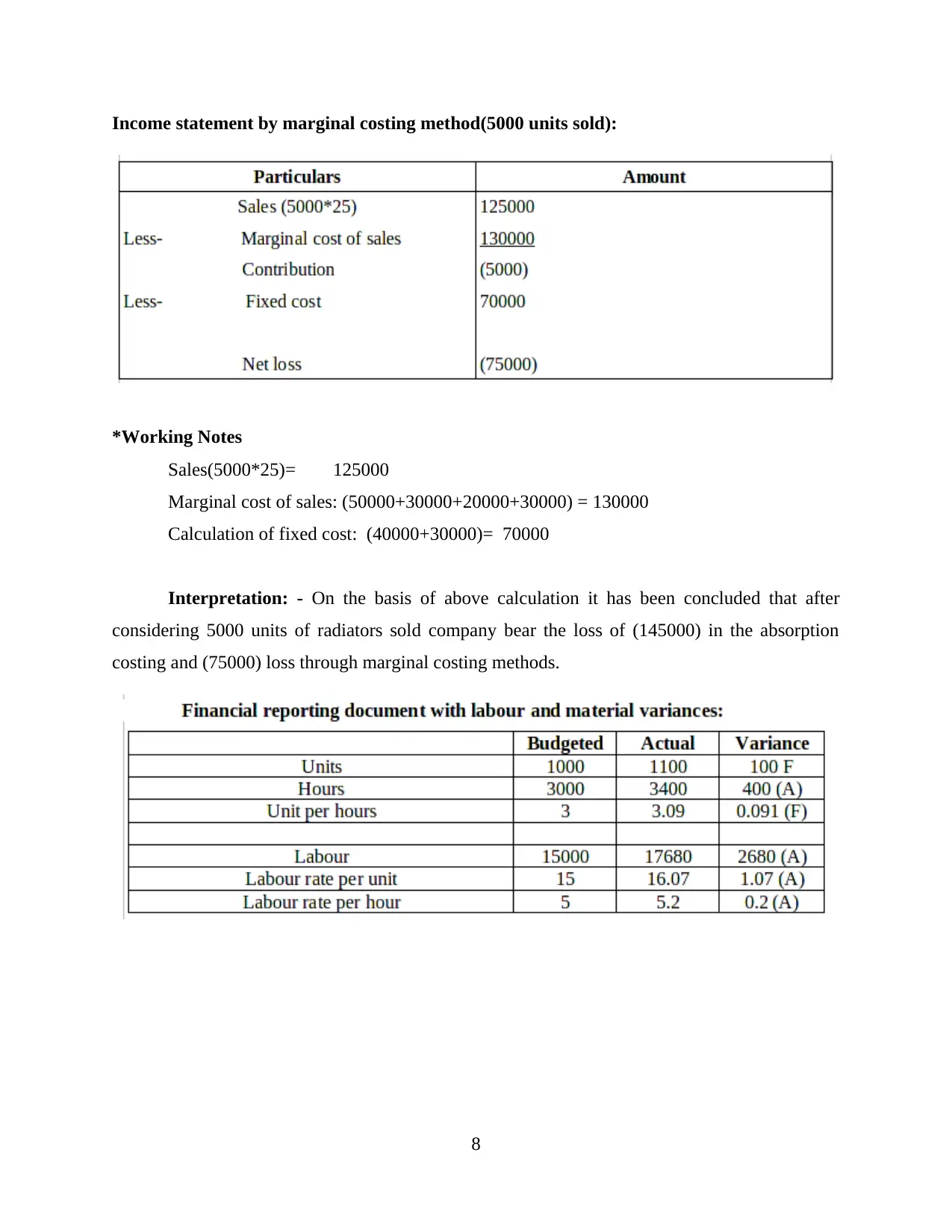

Income statement by marginal costing method(5000 units sold):

*Working Notes

Sales(5000*25)= 125000

Marginal cost of sales: (50000+30000+20000+30000) = 130000

Calculation of fixed cost: (40000+30000)= 70000

Interpretation: - On the basis of above calculation it has been concluded that after

considering 5000 units of radiators sold company bear the loss of (145000) in the absorption

costing and (75000) loss through marginal costing methods.

8

*Working Notes

Sales(5000*25)= 125000

Marginal cost of sales: (50000+30000+20000+30000) = 130000

Calculation of fixed cost: (40000+30000)= 70000

Interpretation: - On the basis of above calculation it has been concluded that after

considering 5000 units of radiators sold company bear the loss of (145000) in the absorption

costing and (75000) loss through marginal costing methods.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

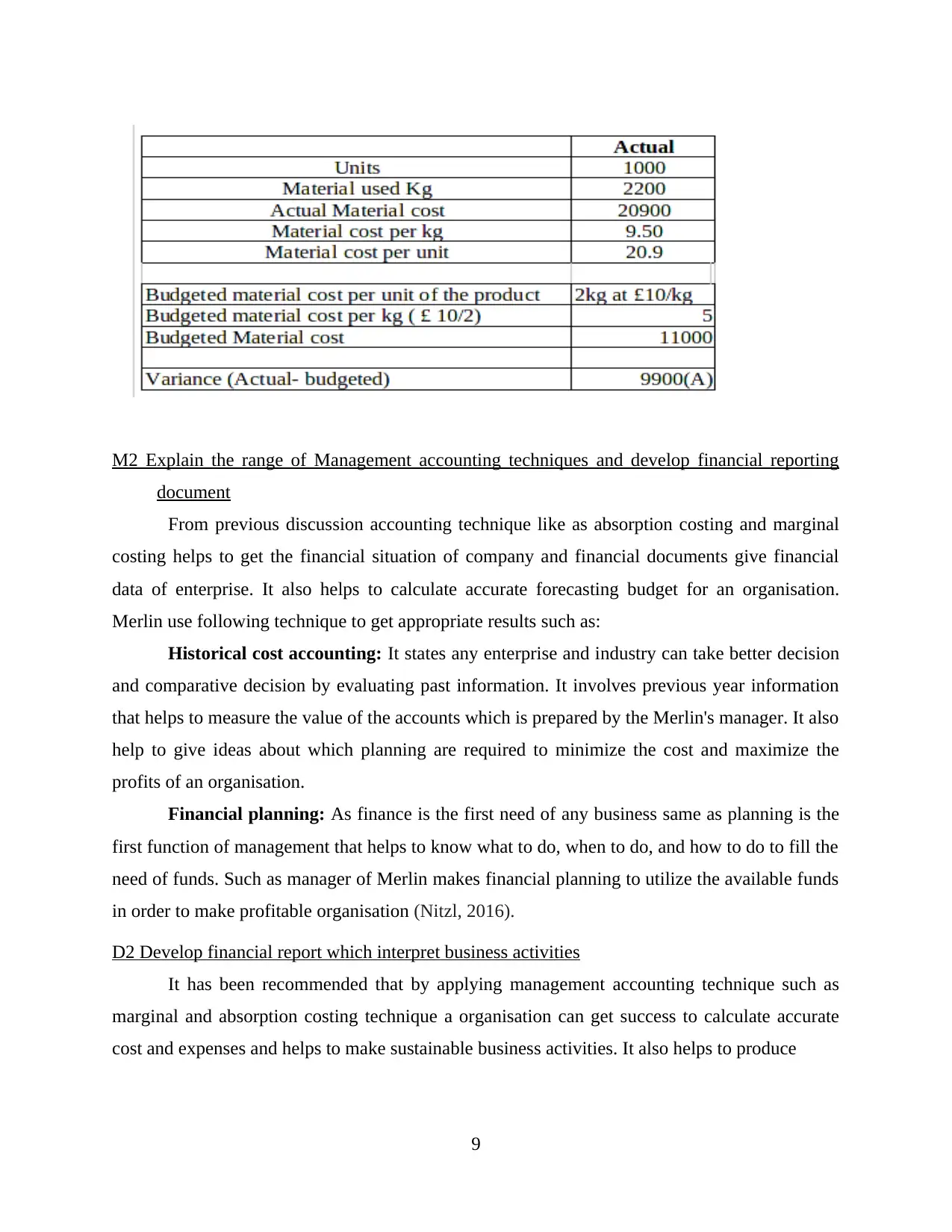

M2 Explain the range of Management accounting techniques and develop financial reporting

document

From previous discussion accounting technique like as absorption costing and marginal

costing helps to get the financial situation of company and financial documents give financial

data of enterprise. It also helps to calculate accurate forecasting budget for an organisation.

Merlin use following technique to get appropriate results such as:

Historical cost accounting: It states any enterprise and industry can take better decision

and comparative decision by evaluating past information. It involves previous year information

that helps to measure the value of the accounts which is prepared by the Merlin's manager. It also

help to give ideas about which planning are required to minimize the cost and maximize the

profits of an organisation.

Financial planning: As finance is the first need of any business same as planning is the

first function of management that helps to know what to do, when to do, and how to do to fill the

need of funds. Such as manager of Merlin makes financial planning to utilize the available funds

in order to make profitable organisation (Nitzl, 2016).

D2 Develop financial report which interpret business activities

It has been recommended that by applying management accounting technique such as

marginal and absorption costing technique a organisation can get success to calculate accurate

cost and expenses and helps to make sustainable business activities. It also helps to produce

9

document

From previous discussion accounting technique like as absorption costing and marginal

costing helps to get the financial situation of company and financial documents give financial

data of enterprise. It also helps to calculate accurate forecasting budget for an organisation.

Merlin use following technique to get appropriate results such as:

Historical cost accounting: It states any enterprise and industry can take better decision

and comparative decision by evaluating past information. It involves previous year information

that helps to measure the value of the accounts which is prepared by the Merlin's manager. It also

help to give ideas about which planning are required to minimize the cost and maximize the

profits of an organisation.

Financial planning: As finance is the first need of any business same as planning is the

first function of management that helps to know what to do, when to do, and how to do to fill the

need of funds. Such as manager of Merlin makes financial planning to utilize the available funds

in order to make profitable organisation (Nitzl, 2016).

D2 Develop financial report which interpret business activities

It has been recommended that by applying management accounting technique such as

marginal and absorption costing technique a organisation can get success to calculate accurate

cost and expenses and helps to make sustainable business activities. It also helps to produce

9

financial reporting documents that gives proper records of financial transaction and incurred cost

in an enterprise. Manager of Merlin prepares financial reports every year that is useful to

understand the data and take effective business decisions.

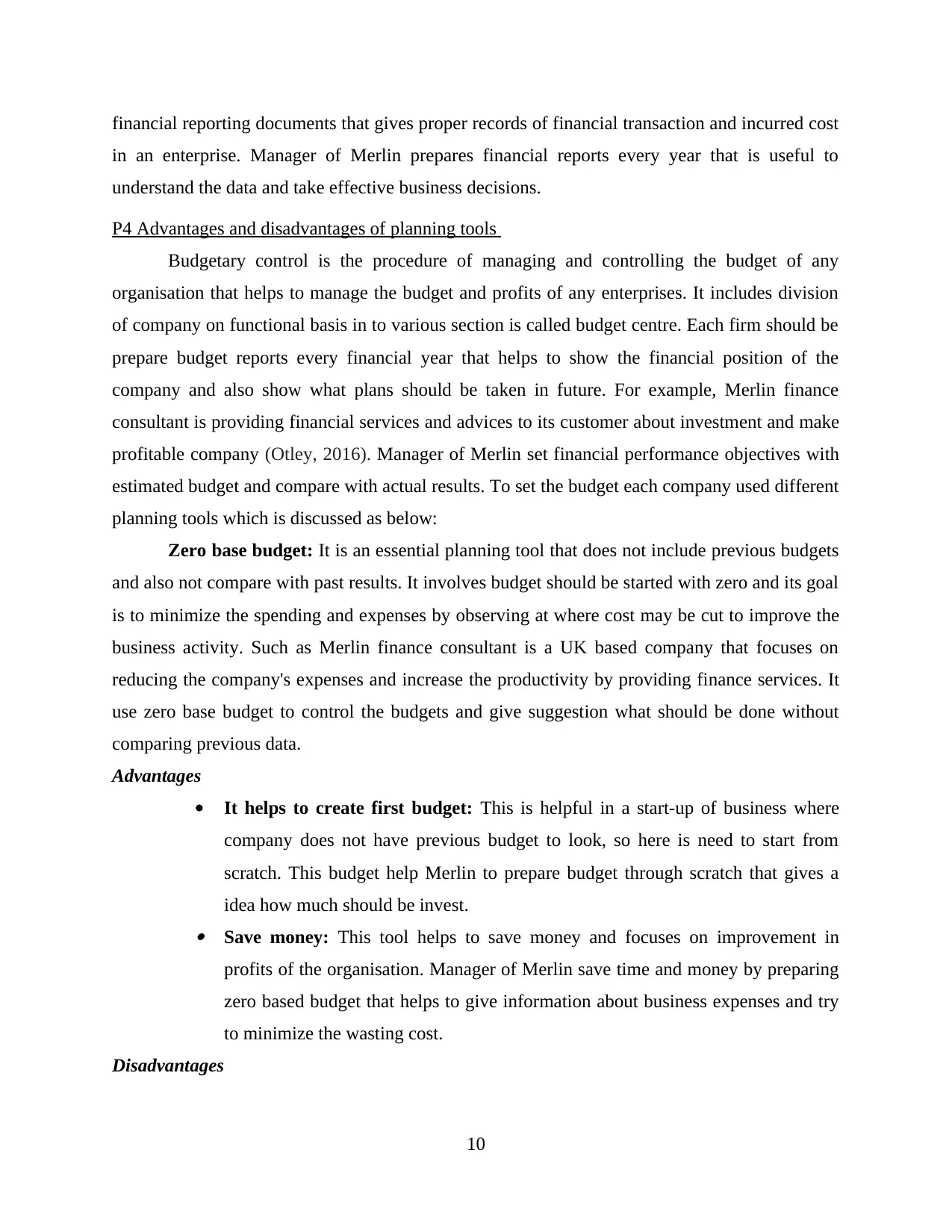

P4 Advantages and disadvantages of planning tools

Budgetary control is the procedure of managing and controlling the budget of any

organisation that helps to manage the budget and profits of any enterprises. It includes division

of company on functional basis in to various section is called budget centre. Each firm should be

prepare budget reports every financial year that helps to show the financial position of the

company and also show what plans should be taken in future. For example, Merlin finance

consultant is providing financial services and advices to its customer about investment and make

profitable company (Otley, 2016). Manager of Merlin set financial performance objectives with

estimated budget and compare with actual results. To set the budget each company used different

planning tools which is discussed as below:

Zero base budget: It is an essential planning tool that does not include previous budgets

and also not compare with past results. It involves budget should be started with zero and its goal

is to minimize the spending and expenses by observing at where cost may be cut to improve the

business activity. Such as Merlin finance consultant is a UK based company that focuses on

reducing the company's expenses and increase the productivity by providing finance services. It

use zero base budget to control the budgets and give suggestion what should be done without

comparing previous data.

Advantages

It helps to create first budget: This is helpful in a start-up of business where

company does not have previous budget to look, so here is need to start from

scratch. This budget help Merlin to prepare budget through scratch that gives a

idea how much should be invest.

Save money: This tool helps to save money and focuses on improvement in

profits of the organisation. Manager of Merlin save time and money by preparing

zero based budget that helps to give information about business expenses and try

to minimize the wasting cost.

Disadvantages

10

in an enterprise. Manager of Merlin prepares financial reports every year that is useful to

understand the data and take effective business decisions.

P4 Advantages and disadvantages of planning tools

Budgetary control is the procedure of managing and controlling the budget of any

organisation that helps to manage the budget and profits of any enterprises. It includes division

of company on functional basis in to various section is called budget centre. Each firm should be

prepare budget reports every financial year that helps to show the financial position of the

company and also show what plans should be taken in future. For example, Merlin finance

consultant is providing financial services and advices to its customer about investment and make

profitable company (Otley, 2016). Manager of Merlin set financial performance objectives with

estimated budget and compare with actual results. To set the budget each company used different

planning tools which is discussed as below:

Zero base budget: It is an essential planning tool that does not include previous budgets

and also not compare with past results. It involves budget should be started with zero and its goal

is to minimize the spending and expenses by observing at where cost may be cut to improve the

business activity. Such as Merlin finance consultant is a UK based company that focuses on

reducing the company's expenses and increase the productivity by providing finance services. It

use zero base budget to control the budgets and give suggestion what should be done without

comparing previous data.

Advantages

It helps to create first budget: This is helpful in a start-up of business where

company does not have previous budget to look, so here is need to start from

scratch. This budget help Merlin to prepare budget through scratch that gives a

idea how much should be invest.

Save money: This tool helps to save money and focuses on improvement in

profits of the organisation. Manager of Merlin save time and money by preparing

zero based budget that helps to give information about business expenses and try

to minimize the wasting cost.

Disadvantages

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.