Management Accounting Project: UCK Furniture Case Study and Analysis

VerifiedAdded on 2020/07/22

|19

|6072

|34

Project

AI Summary

This management accounting project analyzes the application of various accounting techniques and systems within UCK Furniture, a manufacturing company dealing with tables and drawers. The project covers the concept of management accounting, its requirements, and different reporting methods such as job costing, inventory, and operational budget reports. It explores the benefits of management accounting systems, including improved decision-making, resource allocation, and risk assessment. The project also examines the integration of management accounting reports with organizational processes, emphasizing the importance of aligning financial data with production, inventory management, and operational benchmarks. The analysis includes cost analysis techniques, financial reporting, and an overview of planning tools used for budgetary control and cash budgeting, concluding with recommendations for improving financial performance through effective planning and management accounting systems. The project also explores the merits and demerits of marginal and absorption costing.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

PROJECT 1......................................................................................................................................3

INTRODUCTION...........................................................................................................................3

TASK ..............................................................................................................................................3

1.1 Concept of management accounting and their requirement in organisation....................3

1.2 Different management accounting reports.......................................................................5

1.3 Benefits of management accounting systems...................................................................6

1.4 Integration of management accounting reports with organisational process...................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

Project 2 ........................................................................................................................................10

INTRODUCTION.........................................................................................................................10

TASK 1..........................................................................................................................................10

1.1 Application of cost analysis techniques for formulation of income statement..............10

1.2 Application of management accounting techniques regarding financial reporting .......12

1.3 Merits and Demerits of Marginal and Absorption costing.............................................12

TASK 2..........................................................................................................................................13

2.1 Advantages and disadvantages of different planning tools used for budgetary control.13

2.2 Estimation of expenses if change in number of hours....................................................14

2.3 Preparation of cash budget.............................................................................................14

TASK 3..........................................................................................................................................15

3.1 Application of different management accounting systems to respond financial issues 15

3.2 Contribution of management accounting to improve financial performance.................16

3.3 Application of planning tools to reduce financial issues to achieve success.................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

.......................................................................................................................................................19

PROJECT 1......................................................................................................................................3

INTRODUCTION...........................................................................................................................3

TASK ..............................................................................................................................................3

1.1 Concept of management accounting and their requirement in organisation....................3

1.2 Different management accounting reports.......................................................................5

1.3 Benefits of management accounting systems...................................................................6

1.4 Integration of management accounting reports with organisational process...................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

Project 2 ........................................................................................................................................10

INTRODUCTION.........................................................................................................................10

TASK 1..........................................................................................................................................10

1.1 Application of cost analysis techniques for formulation of income statement..............10

1.2 Application of management accounting techniques regarding financial reporting .......12

1.3 Merits and Demerits of Marginal and Absorption costing.............................................12

TASK 2..........................................................................................................................................13

2.1 Advantages and disadvantages of different planning tools used for budgetary control.13

2.2 Estimation of expenses if change in number of hours....................................................14

2.3 Preparation of cash budget.............................................................................................14

TASK 3..........................................................................................................................................15

3.1 Application of different management accounting systems to respond financial issues 15

3.2 Contribution of management accounting to improve financial performance.................16

3.3 Application of planning tools to reduce financial issues to achieve success.................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

.......................................................................................................................................................19

PROJECT 1

INTRODUCTION

Management accounting includes different kind of tools and techniques like budgeting,

marginal costing, risk analysis, standard costing, value analysis, cost volume profit analysis etc.

All such techniques provides statistical and functional information to the executives of

organisation for planning, decision-making and selection of most profitable project which

provides higher return. Through application of such systems, management of organisation

become expert in financial reporting and managing working capital requirements to perform day

to day functions. UCK Furniture deals in table and drawer division (Christ and Burritt, 2013).

In the present report explain about, essential requirements of different management

accounting systems and methods which are used by UCK Furniture for reporting. Also,

application of accounting systems in organisation and benefits of individual management

accounting systems and integration of reports with organisational functions.

TASK

1.1 Concept of management accounting and their requirement in organisation

UCK furniture is manufacturing organisation which deals in two products Table and

Drawer. It is understand by the management of organisation that large number of benefits are

gathered through implementation of management accounting systems. Accounting officer of

UCK decided to prepare training programmes for their interns which helps them to gather

knowledge about different accounting systems and their important in organisational respect.

Concept of management accounting: It is wide concept which includes the provisions

of different costing and managerial techniques. Different tools which are used regarding

collection and interpretation of information are named as responsibility accounting, value

analysis, marginal costing, standard costing, marginal costing, budgetary control etc. Through

use of all such tools accounting officer of UCK Furniture gather financial and statistical

information which helps in forecasting and preparation of effective strategies. Each and every

accounting system have their different role and benefits in organisation. It enhance the decision

making power of manager which helps in short and long term decision-making. The main

objectives for which the management of UCK Furniture adopts such different accounting

systems are defined below:

INTRODUCTION

Management accounting includes different kind of tools and techniques like budgeting,

marginal costing, risk analysis, standard costing, value analysis, cost volume profit analysis etc.

All such techniques provides statistical and functional information to the executives of

organisation for planning, decision-making and selection of most profitable project which

provides higher return. Through application of such systems, management of organisation

become expert in financial reporting and managing working capital requirements to perform day

to day functions. UCK Furniture deals in table and drawer division (Christ and Burritt, 2013).

In the present report explain about, essential requirements of different management

accounting systems and methods which are used by UCK Furniture for reporting. Also,

application of accounting systems in organisation and benefits of individual management

accounting systems and integration of reports with organisational functions.

TASK

1.1 Concept of management accounting and their requirement in organisation

UCK furniture is manufacturing organisation which deals in two products Table and

Drawer. It is understand by the management of organisation that large number of benefits are

gathered through implementation of management accounting systems. Accounting officer of

UCK decided to prepare training programmes for their interns which helps them to gather

knowledge about different accounting systems and their important in organisational respect.

Concept of management accounting: It is wide concept which includes the provisions

of different costing and managerial techniques. Different tools which are used regarding

collection and interpretation of information are named as responsibility accounting, value

analysis, marginal costing, standard costing, marginal costing, budgetary control etc. Through

use of all such tools accounting officer of UCK Furniture gather financial and statistical

information which helps in forecasting and preparation of effective strategies. Each and every

accounting system have their different role and benefits in organisation. It enhance the decision

making power of manager which helps in short and long term decision-making. The main

objectives for which the management of UCK Furniture adopts such different accounting

systems are defined below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Improvement of communication and effective disbursement of roles and responsibilities

Improved decision-making

Higher coordination among different departmental functions

Helps in evaluation of the effectiveness of strategies and policies

Evaluation and the interpretation of financial statements

Contributes in planning and formulation of policies

Essential requirements of different management accounting systems

Presentation of financial position: Application of different accounting systems provides

the data which depicts the financial position of organisation. Collection of such costing

and financial data helps in preparation of effective financial reports which improves

decision making of internal parties (Macintosh and Quattrone, 2010).

Allocation of resources: Effective implementation of inventory systems helps in

maintenance of stocks within organisation. EOQ model provides the information

regarding the time period about reordering of their stocks. It provides the opportunity to

the manger of UCK Furniture about effective allocation of resources to different

departments for their optimum utilisation. It contributes in accomplishment

organisational objectives for attainment of long term sustainability.

Assessment of risk: Budgetary control in one of the important process which helps in

identification of the future risks which are associated with project. Such early

identification of uncertainties helps in preparation of contingency provisions and risk is

minimised through effective management.

Different types of management accounting systems

Job costing system: It helps in assigning manufacturing cost to each products which are

produced by UCK Furniture. It is considered as one of the important cost controlling

method. This method helps in tracking of their actual expenses. This method is used only

when different types of goods are manufactured by organisation. The procedure which is

followed during use of this accounting system is mentioned below:

- Receiving enquiry: It includes the process of receiving the views of customers about quality,

price and time period of completion.

- Estimation of price: It can be done on the basis of tastes and preferences of customers.

- Order receiving: Orders are placed after assurance of customer about prices.

Improved decision-making

Higher coordination among different departmental functions

Helps in evaluation of the effectiveness of strategies and policies

Evaluation and the interpretation of financial statements

Contributes in planning and formulation of policies

Essential requirements of different management accounting systems

Presentation of financial position: Application of different accounting systems provides

the data which depicts the financial position of organisation. Collection of such costing

and financial data helps in preparation of effective financial reports which improves

decision making of internal parties (Macintosh and Quattrone, 2010).

Allocation of resources: Effective implementation of inventory systems helps in

maintenance of stocks within organisation. EOQ model provides the information

regarding the time period about reordering of their stocks. It provides the opportunity to

the manger of UCK Furniture about effective allocation of resources to different

departments for their optimum utilisation. It contributes in accomplishment

organisational objectives for attainment of long term sustainability.

Assessment of risk: Budgetary control in one of the important process which helps in

identification of the future risks which are associated with project. Such early

identification of uncertainties helps in preparation of contingency provisions and risk is

minimised through effective management.

Different types of management accounting systems

Job costing system: It helps in assigning manufacturing cost to each products which are

produced by UCK Furniture. It is considered as one of the important cost controlling

method. This method helps in tracking of their actual expenses. This method is used only

when different types of goods are manufactured by organisation. The procedure which is

followed during use of this accounting system is mentioned below:

- Receiving enquiry: It includes the process of receiving the views of customers about quality,

price and time period of completion.

- Estimation of price: It can be done on the basis of tastes and preferences of customers.

- Order receiving: Orders are placed after assurance of customer about prices.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

- Production order: It is placed in the beginning of production process.

- Cost recording: Recording each and every cost which is incurred during production process.

- Completion of job: Report is provided to accountant for final costing and its comparison with

estimated.

Price optimisation system: It is considered as mathematical analysis done by the

management of company for determination of the change in the behaviour of customers

at different levels of price of their products and services. It helps in formulation of

effective pricing strategies and improve their sales figure.

Inventory management system: This system helps in supervision of the stocks and

assets of organisation. It ensures the effective floe of the raw material to the production

department for development of their efficiency. This system includes the adoption of

effective software's for tracking level of inventories, orders, sales and deliveries (Nandan,

2010).

1.2 Different management accounting reports

UCK Furniture is manufacturing organisation. To attain sustainability in their operations

management of organisation need to implement organised reporting system. It contributes to

keep record of different transactions performed by departments in systematic manner. Manager

of UCK Furniture has the duty to analyse such facts and issues which present in reports to make

their decisions more accurate and reliable. Different kind of reports which are prepared by

organisation are known as job costing, inventory, performance, budgeting etc. Different reports

includes different financial and non financial information to attain proper control over the

functions of different departments.

Different benefits are gathered by UCK Furniture like better understanding between the

employees, reduction in duplication of functions, better coordination, effective communication

channels, appraisal of performance of employees etc. The overall impact of reporting system is

upon organisational capabilities which provides the opportunity to accomplish their targets

within stipulated period of time. These reports not only beneficial for internal parties of

organisation but also used by the external stakeholder to enhance their decision making about

their investments in organisation. It fulfils dual concept regarding ascertainment of the trust and

loyalty of employees and external parties.

Different types of management accounting reports

- Cost recording: Recording each and every cost which is incurred during production process.

- Completion of job: Report is provided to accountant for final costing and its comparison with

estimated.

Price optimisation system: It is considered as mathematical analysis done by the

management of company for determination of the change in the behaviour of customers

at different levels of price of their products and services. It helps in formulation of

effective pricing strategies and improve their sales figure.

Inventory management system: This system helps in supervision of the stocks and

assets of organisation. It ensures the effective floe of the raw material to the production

department for development of their efficiency. This system includes the adoption of

effective software's for tracking level of inventories, orders, sales and deliveries (Nandan,

2010).

1.2 Different management accounting reports

UCK Furniture is manufacturing organisation. To attain sustainability in their operations

management of organisation need to implement organised reporting system. It contributes to

keep record of different transactions performed by departments in systematic manner. Manager

of UCK Furniture has the duty to analyse such facts and issues which present in reports to make

their decisions more accurate and reliable. Different kind of reports which are prepared by

organisation are known as job costing, inventory, performance, budgeting etc. Different reports

includes different financial and non financial information to attain proper control over the

functions of different departments.

Different benefits are gathered by UCK Furniture like better understanding between the

employees, reduction in duplication of functions, better coordination, effective communication

channels, appraisal of performance of employees etc. The overall impact of reporting system is

upon organisational capabilities which provides the opportunity to accomplish their targets

within stipulated period of time. These reports not only beneficial for internal parties of

organisation but also used by the external stakeholder to enhance their decision making about

their investments in organisation. It fulfils dual concept regarding ascertainment of the trust and

loyalty of employees and external parties.

Different types of management accounting reports

Operational budget reports: This report contains the plan which helps in analysis of the

actual performance of different departments by comparison with such set standards. This

report also assist the manger of organisation to pay adequate incentives to their

employees as per their actual performance. Such incentives will proved as motivating

factor for other employees to work hard and get appreciation from their superiors.

Accounts receivable ageing report: This report helps in segregation of accounts

receivable of organisation on the basis of the time an invoice has been outstanding.

According to this report management of UCK Furniture identifies the financial health of

their customers. If collection process of an outstanding amount is slower than normal

then need to change their credit policies. It provides the opportunity to organisation to

establish effective system which helps in collection of debts within stipulated period of

time and effectively run their day to day activities.

Inventory and manufacturing reports: Accounting officer of UCK Furniture uses this

report to improve their manufacturing and inventory process more efficient. Information

which is provided by this reports includes actual wastages in their stocks, labour cost,

overhead cost. Such information is compared by organisation with different assembly

lines to grab opportunities (Burritt and et. al., 2011).

Job cost report: This report is used by the management of UCK Furniture to track the

cost and revenue which they achieved from production of their two division products

Table and Drawer. It provides opportunity to earn large number of profits through

controlling of their unnecessary expenses. Through application of this costing system

profitable jobs are identified so, they can give more emphasis on jobs to earn large

number of profits.

1.3 Benefits of management accounting systems

Management accounting system enable in taking beneficial judgement on the basis of

short period consideration. It is really important to understand such facts and things which reflect

by the MAS so that effectiveness and efficiency could be maintain. Every management

accounting system have several benefits which need to evaluate in appropriate and suitable

frame. Following are several benefits which need to underpin by UKC Furnitures so that better

and appropriate working could be promoted:

actual performance of different departments by comparison with such set standards. This

report also assist the manger of organisation to pay adequate incentives to their

employees as per their actual performance. Such incentives will proved as motivating

factor for other employees to work hard and get appreciation from their superiors.

Accounts receivable ageing report: This report helps in segregation of accounts

receivable of organisation on the basis of the time an invoice has been outstanding.

According to this report management of UCK Furniture identifies the financial health of

their customers. If collection process of an outstanding amount is slower than normal

then need to change their credit policies. It provides the opportunity to organisation to

establish effective system which helps in collection of debts within stipulated period of

time and effectively run their day to day activities.

Inventory and manufacturing reports: Accounting officer of UCK Furniture uses this

report to improve their manufacturing and inventory process more efficient. Information

which is provided by this reports includes actual wastages in their stocks, labour cost,

overhead cost. Such information is compared by organisation with different assembly

lines to grab opportunities (Burritt and et. al., 2011).

Job cost report: This report is used by the management of UCK Furniture to track the

cost and revenue which they achieved from production of their two division products

Table and Drawer. It provides opportunity to earn large number of profits through

controlling of their unnecessary expenses. Through application of this costing system

profitable jobs are identified so, they can give more emphasis on jobs to earn large

number of profits.

1.3 Benefits of management accounting systems

Management accounting system enable in taking beneficial judgement on the basis of

short period consideration. It is really important to understand such facts and things which reflect

by the MAS so that effectiveness and efficiency could be maintain. Every management

accounting system have several benefits which need to evaluate in appropriate and suitable

frame. Following are several benefits which need to underpin by UKC Furnitures so that better

and appropriate working could be promoted:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job costing system: A major benefit which could be gain through implementing

appropriate job costing system is that individual and separately profit margin could be

assess with high frequency accuracy in various operations of business. It also support in

crafting employees benchmarking so that better and effective outcome could be drawn in

working towards effective manufacturing. It is flexible in nature which derive another

benefit which further suppose to enable in evaluating particular indirect cost or

manufacturing process cost. Hence, effective production and manufacturing will lead to

take place under such stances.

Inventory management system: Inventory and stock need to manage at manufacturing

place properly so that efficacy in operations could be manage and maintain properly. One

of a most appropriate benefits which could be drawn by managing inventory is that it will

support an association to become successful by minimising the cost and wastage as well.

Along with this, this section will lead to improved cash flow of a company so that profit

could be generated in better associated manner. This benefits in manufacturing such

products and services only which highly demanded so that appropriate and optimal level

of inventory could be manage and maintain in order to gain better suited results.

These benefits required to underpin and estimated by UKC Furnitures so that better and

suitable working get promoted which further assist in deriving appropriate and suitable outcome.

As it will also reflect to generate and enhance profit and revenue of a company so that

appropriate and sufficient working operations get done (Chen and et. al., 2011).

1.4 Integration of management accounting reports with organisational process

Integration and combination of two aspects make things correct and appropriate in nature

so that better and suitable outcome could be enforce in gaining effective and absolute results.

Management accounting reports provide regular basis consideration of operations which assist in

gaining and making better results. Such reports need to merge with organisational process and

operations so that beneficial results options could be estimated in better frame. Following are the

management accounting reporting whose relationship with organisational process is essential for

facilitating better and supported working. UKC Furniture required to integrate their management

accounting report with organisational process for assigning suitable outcome and better

productivity:

appropriate job costing system is that individual and separately profit margin could be

assess with high frequency accuracy in various operations of business. It also support in

crafting employees benchmarking so that better and effective outcome could be drawn in

working towards effective manufacturing. It is flexible in nature which derive another

benefit which further suppose to enable in evaluating particular indirect cost or

manufacturing process cost. Hence, effective production and manufacturing will lead to

take place under such stances.

Inventory management system: Inventory and stock need to manage at manufacturing

place properly so that efficacy in operations could be manage and maintain properly. One

of a most appropriate benefits which could be drawn by managing inventory is that it will

support an association to become successful by minimising the cost and wastage as well.

Along with this, this section will lead to improved cash flow of a company so that profit

could be generated in better associated manner. This benefits in manufacturing such

products and services only which highly demanded so that appropriate and optimal level

of inventory could be manage and maintain in order to gain better suited results.

These benefits required to underpin and estimated by UKC Furnitures so that better and

suitable working get promoted which further assist in deriving appropriate and suitable outcome.

As it will also reflect to generate and enhance profit and revenue of a company so that

appropriate and sufficient working operations get done (Chen and et. al., 2011).

1.4 Integration of management accounting reports with organisational process

Integration and combination of two aspects make things correct and appropriate in nature

so that better and suitable outcome could be enforce in gaining effective and absolute results.

Management accounting reports provide regular basis consideration of operations which assist in

gaining and making better results. Such reports need to merge with organisational process and

operations so that beneficial results options could be estimated in better frame. Following are the

management accounting reporting whose relationship with organisational process is essential for

facilitating better and supported working. UKC Furniture required to integrate their management

accounting report with organisational process for assigning suitable outcome and better

productivity:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory and manufacturing reports enable in preparing such records of production

which need to take place on regular basis. It is really important to maintain appropriate

relationship with such aspects. This could be interlinked with organisational process of

production department whom need to produce only such quantity which demanded from

market world. This will assist in utilising all resources properly so that effective gains

and beneficial outcome possibility get enhance in order to maximise appropriateness in

working and operations with target accomplishment (Goyal, 2014).

Another integration of organisational process and management accounting report concern

with operational budget report under which there is a need to set some benchmark related

with performance of various employees so that better and suitable operation and target

accomplishment get done. This will enable in gaining better outcome as well as better

associated frame could be sustain. Hence, with meeting of budget requirement

association become able to sustain into keen competitive world for more and better way.

Integration such process with reports is essential so that effective operations could take

place. This will assist them to grow and move towards positive direction in order to gain

effectiveness.

CONCLUSION

It has been concluded from the above report that, large number of benefits are gathered

by the management of UCK Furniture through adopting accounting systems. It helps them to

create more understanding among their different departments. Price optimisation system helps in

influencing the behaviour of customers through fixing of effective prices of their different

products. Ultimately, it helps in improvement of their productivity and profitability. Through

application of accounting and reporting systems essential requirements like determination of

goals, risk assessment, improved judgement, better coordination among functions etc. are

fulfilled which contributes in accomplishment of organisational common goals.

which need to take place on regular basis. It is really important to maintain appropriate

relationship with such aspects. This could be interlinked with organisational process of

production department whom need to produce only such quantity which demanded from

market world. This will assist in utilising all resources properly so that effective gains

and beneficial outcome possibility get enhance in order to maximise appropriateness in

working and operations with target accomplishment (Goyal, 2014).

Another integration of organisational process and management accounting report concern

with operational budget report under which there is a need to set some benchmark related

with performance of various employees so that better and suitable operation and target

accomplishment get done. This will enable in gaining better outcome as well as better

associated frame could be sustain. Hence, with meeting of budget requirement

association become able to sustain into keen competitive world for more and better way.

Integration such process with reports is essential so that effective operations could take

place. This will assist them to grow and move towards positive direction in order to gain

effectiveness.

CONCLUSION

It has been concluded from the above report that, large number of benefits are gathered

by the management of UCK Furniture through adopting accounting systems. It helps them to

create more understanding among their different departments. Price optimisation system helps in

influencing the behaviour of customers through fixing of effective prices of their different

products. Ultimately, it helps in improvement of their productivity and profitability. Through

application of accounting and reporting systems essential requirements like determination of

goals, risk assessment, improved judgement, better coordination among functions etc. are

fulfilled which contributes in accomplishment of organisational common goals.

REFERENCES

Books and Journals

Christ, K.L. and Burritt, R.L., 2013. Environmental management accounting: the significance of

contingent variables for adoption. Journal of Cleaner Production. 41. pp.163-173.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Nandan, R., 2010. Management accounting needs of SMEs and the role of professional

accountants: A renewed research agenda. Journal of applied management accounting

research. 8(1). p.65.

Burritt, R.L., and et. al., 2011. Environmental MA and supply chain management (Vol. 27).

Springer Science & Business Media.

Chen, H., and et. al., 2011. Effects of audit quality on earnings management and cost of equity

capital: Evidence from China. Contemporary Accounting Research. 28(3). pp.892-925.

Goyal, D.P., 2014. Management Information Systems: Managerial Perspectives. Vikas

Publishing House.

Van der Stede, W.A., 2011. Management accounting research in the wake of the crisis: some

reflections. European Accounting Review. 20(4). pp.605-623.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Ward, K., 2012. Strategic management accounting. Routledge.

Albelda, E., 2011. The role of management accounting practices as facilitators of the

environmental management: Evidence from EMAS organisations. Sustainability

Accounting, Management and Policy Journal. 2(1). pp.76-100.

Zang, A.Y., 2011. Evidence on the trade-off between real activities manipulation and accrual-

based earnings management. The Accounting Review. 87(2). pp.675-703.

Qian, W., Burritt, R. and Monroe, G., 2011. Environmental management accounting in local

government: A case of waste management. Accounting, Auditing & Accountability

Journal.24(1). pp.93-128.

Online

Management Accounting. 2017.[Online]. Available Through: <https://www.imanet.org/insights-

and-trends/management-accounting-quarterly?ssopc=1>.

Books and Journals

Christ, K.L. and Burritt, R.L., 2013. Environmental management accounting: the significance of

contingent variables for adoption. Journal of Cleaner Production. 41. pp.163-173.

Macintosh, N.B. and Quattrone, P., 2010. Management accounting and control systems: An

organizational and sociological approach. John Wiley & Sons.

Nandan, R., 2010. Management accounting needs of SMEs and the role of professional

accountants: A renewed research agenda. Journal of applied management accounting

research. 8(1). p.65.

Burritt, R.L., and et. al., 2011. Environmental MA and supply chain management (Vol. 27).

Springer Science & Business Media.

Chen, H., and et. al., 2011. Effects of audit quality on earnings management and cost of equity

capital: Evidence from China. Contemporary Accounting Research. 28(3). pp.892-925.

Goyal, D.P., 2014. Management Information Systems: Managerial Perspectives. Vikas

Publishing House.

Van der Stede, W.A., 2011. Management accounting research in the wake of the crisis: some

reflections. European Accounting Review. 20(4). pp.605-623.

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between theory

and practice in management accounting. Management Accounting Research. 21(2).

pp.79-82.

Ward, K., 2012. Strategic management accounting. Routledge.

Albelda, E., 2011. The role of management accounting practices as facilitators of the

environmental management: Evidence from EMAS organisations. Sustainability

Accounting, Management and Policy Journal. 2(1). pp.76-100.

Zang, A.Y., 2011. Evidence on the trade-off between real activities manipulation and accrual-

based earnings management. The Accounting Review. 87(2). pp.675-703.

Qian, W., Burritt, R. and Monroe, G., 2011. Environmental management accounting in local

government: A case of waste management. Accounting, Auditing & Accountability

Journal.24(1). pp.93-128.

Online

Management Accounting. 2017.[Online]. Available Through: <https://www.imanet.org/insights-

and-trends/management-accounting-quarterly?ssopc=1>.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Project 2

INTRODUCTION

Principles of management accounting are used by the manager of organisation to drive

success in their business operations. This data which is gathered from different accounting

systems assists manager in business decision making and control. Different benefits which are

achieved through implementation of accounting systems are analysis of cost and revenue,

provides insight into business performance, work of cost reduction projects, helps in variance

analysis and strategic planning. This system consists different planning tools which is used for

forecasting future actions and accomplishment of desired targets. UCK Furniture is

manufacturing organisation provides tables and drawers (Christ and Burritt, 2013).

In the present report explain about, application of different cost analysis techniques,

merits and demerits of marginal and absorption costing, advantages and disadvantage of

planning tools. Also, adaptation of management accounting systems to respond financial issues

and use of planning tools to achieve success.

TASK 1

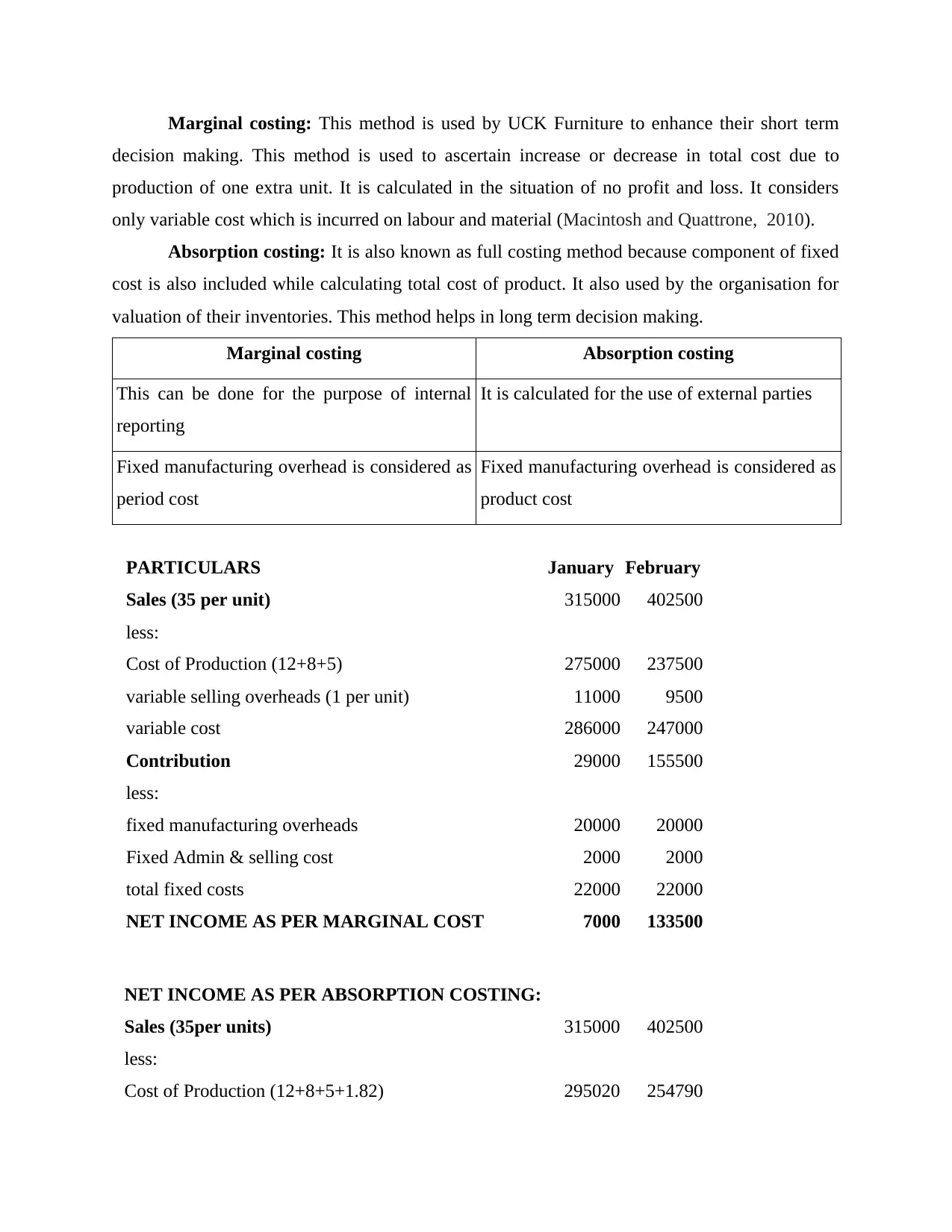

1.1 Application of cost analysis techniques for formulation of income statement

Cost: It is the monetary value which is paid by the management of UCK Furniture

regarding production of tables and drawers. While calculating the actual cost different aspects

which are considered includes efforts, resources, time and utilities, opportunity foregone etc.

There are different types of cost which are defined below:

Fixed and variable cost: Fixed cost remains constant and not fluctuated with the change

in production units. This cost will decrease with the increase in the number of units of

production. On other hand, variable cost means which is incurred by organisation regarding

production of products. This cost is directly related to production of number of units.

Opportunity and outlay costs: Outlay costs are considered as actual expenses which is

incurred by organisation on plant and machinery, labour, material etc. On the other hand,

opportunity cost means the cost in terms of earning which is foregone due to selection of next

alternative.

Difference between marginal and absorption costing

INTRODUCTION

Principles of management accounting are used by the manager of organisation to drive

success in their business operations. This data which is gathered from different accounting

systems assists manager in business decision making and control. Different benefits which are

achieved through implementation of accounting systems are analysis of cost and revenue,

provides insight into business performance, work of cost reduction projects, helps in variance

analysis and strategic planning. This system consists different planning tools which is used for

forecasting future actions and accomplishment of desired targets. UCK Furniture is

manufacturing organisation provides tables and drawers (Christ and Burritt, 2013).

In the present report explain about, application of different cost analysis techniques,

merits and demerits of marginal and absorption costing, advantages and disadvantage of

planning tools. Also, adaptation of management accounting systems to respond financial issues

and use of planning tools to achieve success.

TASK 1

1.1 Application of cost analysis techniques for formulation of income statement

Cost: It is the monetary value which is paid by the management of UCK Furniture

regarding production of tables and drawers. While calculating the actual cost different aspects

which are considered includes efforts, resources, time and utilities, opportunity foregone etc.

There are different types of cost which are defined below:

Fixed and variable cost: Fixed cost remains constant and not fluctuated with the change

in production units. This cost will decrease with the increase in the number of units of

production. On other hand, variable cost means which is incurred by organisation regarding

production of products. This cost is directly related to production of number of units.

Opportunity and outlay costs: Outlay costs are considered as actual expenses which is

incurred by organisation on plant and machinery, labour, material etc. On the other hand,

opportunity cost means the cost in terms of earning which is foregone due to selection of next

alternative.

Difference between marginal and absorption costing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Marginal costing: This method is used by UCK Furniture to enhance their short term

decision making. This method is used to ascertain increase or decrease in total cost due to

production of one extra unit. It is calculated in the situation of no profit and loss. It considers

only variable cost which is incurred on labour and material (Macintosh and Quattrone, 2010).

Absorption costing: It is also known as full costing method because component of fixed

cost is also included while calculating total cost of product. It also used by the organisation for

valuation of their inventories. This method helps in long term decision making.

Marginal costing Absorption costing

This can be done for the purpose of internal

reporting

It is calculated for the use of external parties

Fixed manufacturing overhead is considered as

period cost

Fixed manufacturing overhead is considered as

product cost

PARTICULARS January February

Sales (35 per unit) 315000 402500

less:

Cost of Production (12+8+5) 275000 237500

variable selling overheads (1 per unit) 11000 9500

variable cost 286000 247000

Contribution 29000 155500

less:

fixed manufacturing overheads 20000 20000

Fixed Admin & selling cost 2000 2000

total fixed costs 22000 22000

NET INCOME AS PER MARGINAL COST 7000 133500

NET INCOME AS PER ABSORPTION COSTING:

Sales (35per units) 315000 402500

less:

Cost of Production (12+8+5+1.82) 295020 254790

decision making. This method is used to ascertain increase or decrease in total cost due to

production of one extra unit. It is calculated in the situation of no profit and loss. It considers

only variable cost which is incurred on labour and material (Macintosh and Quattrone, 2010).

Absorption costing: It is also known as full costing method because component of fixed

cost is also included while calculating total cost of product. It also used by the organisation for

valuation of their inventories. This method helps in long term decision making.

Marginal costing Absorption costing

This can be done for the purpose of internal

reporting

It is calculated for the use of external parties

Fixed manufacturing overhead is considered as

period cost

Fixed manufacturing overhead is considered as

product cost

PARTICULARS January February

Sales (35 per unit) 315000 402500

less:

Cost of Production (12+8+5) 275000 237500

variable selling overheads (1 per unit) 11000 9500

variable cost 286000 247000

Contribution 29000 155500

less:

fixed manufacturing overheads 20000 20000

Fixed Admin & selling cost 2000 2000

total fixed costs 22000 22000

NET INCOME AS PER MARGINAL COST 7000 133500

NET INCOME AS PER ABSORPTION COSTING:

Sales (35per units) 315000 402500

less:

Cost of Production (12+8+5+1.82) 295020 254790

Gross Profit 19980 147710

LESS:

Fixed and variable cost:

variable sales overheads (1 per unit) 9000 11500

Fixed selling cost 2000 2000

Total costs 11000 13500

NET INCOME AS PER ABSORPTION COSTING: 8980 134210

1.2 Application of management accounting techniques regarding financial reporting

The two different cost techniques are used regarding production of financial reports. As

per marginal costing method, it is observed that in month of January and February the net

income which is earned by UCK Furniture is 7000 and 133500. On other hand, by use of

Absorption costing method, the net income of January and February month is ascertained as

8980 and 134210 (Nandan, 2010).

1.3 Merits and Demerits of Marginal and Absorption costing

Marginal costing

Merits

It provides the information about relationship between cost, price and volume.

The valuation of stock is not get affected due to present year fixed costs

Impact of production and sales policies is clearly visible and understood with the helps of

marginal costing technique

Demerits

The major limitation of this method that it uses past data and decisions are taken for

future period of time

It is not effective method for long term decision making

It ignores the component of fixed cost

Absorption costing

Merits

It fulfils the requirements of GAAP Compliant and helps in reporting to internal revenue

services

It considers all cost which are incurred during production means both fixed and variable

Demerits

LESS:

Fixed and variable cost:

variable sales overheads (1 per unit) 9000 11500

Fixed selling cost 2000 2000

Total costs 11000 13500

NET INCOME AS PER ABSORPTION COSTING: 8980 134210

1.2 Application of management accounting techniques regarding financial reporting

The two different cost techniques are used regarding production of financial reports. As

per marginal costing method, it is observed that in month of January and February the net

income which is earned by UCK Furniture is 7000 and 133500. On other hand, by use of

Absorption costing method, the net income of January and February month is ascertained as

8980 and 134210 (Nandan, 2010).

1.3 Merits and Demerits of Marginal and Absorption costing

Marginal costing

Merits

It provides the information about relationship between cost, price and volume.

The valuation of stock is not get affected due to present year fixed costs

Impact of production and sales policies is clearly visible and understood with the helps of

marginal costing technique

Demerits

The major limitation of this method that it uses past data and decisions are taken for

future period of time

It is not effective method for long term decision making

It ignores the component of fixed cost

Absorption costing

Merits

It fulfils the requirements of GAAP Compliant and helps in reporting to internal revenue

services

It considers all cost which are incurred during production means both fixed and variable

Demerits

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.