Management Accounting Report: Financial Analysis of Q Clothing

VerifiedAdded on 2023/01/19

|21

|3797

|40

Report

AI Summary

This management accounting report provides a comprehensive overview of key concepts and applications within the field. It begins with an introduction to management accounting, differentiating it from financial accounting and outlining its various types and functions. The report then explores different management accounting reporting methods, including cost accounting, inventory, and accounts receivable aging reports. A case study of Q clothing company is used throughout the report. The report delves into income statements under both absorption and marginal costing, providing detailed calculations and comparisons. It also examines the advantages and disadvantages of various planning tools used for budgetary control, such as cash and capital budgets. Finally, the report includes a reconciliation statement between absorption and marginal costing and a comparison of organizations to resolve financial issues using management accounting systems. The report aims to enhance understanding of financial accounting and its use in business decision-making.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and its types..................................................................................1

P2. Different methods used for management accounting reporting............................................2

TASK 2............................................................................................................................................2

P3 Income statement under absorption and marginal costing.....................................................2

TASK 3............................................................................................................................................2

P4. Advantages and disadvantages of different types of planning tools used for budgetary

control.........................................................................................................................................2

TASK 4............................................................................................................................................2

P5. Comparison of organisation in order to sort out financial issues by help of management

accounting system.......................................................................................................................2

CONCLUSION ...............................................................................................................................2

REFERENCES................................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and its types..................................................................................1

P2. Different methods used for management accounting reporting............................................2

TASK 2............................................................................................................................................2

P3 Income statement under absorption and marginal costing.....................................................2

TASK 3............................................................................................................................................2

P4. Advantages and disadvantages of different types of planning tools used for budgetary

control.........................................................................................................................................2

TASK 4............................................................................................................................................2

P5. Comparison of organisation in order to sort out financial issues by help of management

accounting system.......................................................................................................................2

CONCLUSION ...............................................................................................................................2

REFERENCES................................................................................................................................2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is a way of recording company's monetary and non monetary

transactions in an effective manner with an objective of management of internal aspects

(Fullerton, Kennedy and Widener, 2013). Under this accounting internal reports are produced for

managers so that they can take suitable actions in the direction of achieving company's goals and

objectives. Basically, the main objective of this project report is to describing and understanding

term management accounting in a detailed way. For better understanding of different task of

project report a business is selected which is Q clothing company. This company is located in

London, United Kingdom and operates in manufacturing of cloths. The project report covers

about vital range of accounting systems, MA reports, income statements as well as role of MAS

in order to assess financial issues.

TASK 1

P1. Management accounting and its types.

The management accounting is broad term which starts with process of collecting

monetary and non monetary outcomes of companies and ends with preparation of internal

reports. This accounting consists a vital range of functions which are mentioned below such as :

Provide data – This is a main function of MA which consists information about

quantitative and qualitative transaction about company.

Modify data – Another function of MA is to analysing and modifying collected data so

that it can be utilised for further use (Kihn and Ihantola, 2015).

Analyse and interpret data – As well as MA is linked with analysing and interpretation of

data so that managers can aware about financial position.

Quantitative and qualitative – This is the main function of MA which states that under it

both kind of information is gathered including financial and non financial transaction.

Types of accounting system:

Financial accounting system – This can be defined as a kind of accounting system

which is applied in companies for collecting and analysing financial information. It is

formulated financial system which are being represented to both stakeholder internal and

external. Within this, it is crucial to perform auditing of whole developed financial

1

Management accounting is a way of recording company's monetary and non monetary

transactions in an effective manner with an objective of management of internal aspects

(Fullerton, Kennedy and Widener, 2013). Under this accounting internal reports are produced for

managers so that they can take suitable actions in the direction of achieving company's goals and

objectives. Basically, the main objective of this project report is to describing and understanding

term management accounting in a detailed way. For better understanding of different task of

project report a business is selected which is Q clothing company. This company is located in

London, United Kingdom and operates in manufacturing of cloths. The project report covers

about vital range of accounting systems, MA reports, income statements as well as role of MAS

in order to assess financial issues.

TASK 1

P1. Management accounting and its types.

The management accounting is broad term which starts with process of collecting

monetary and non monetary outcomes of companies and ends with preparation of internal

reports. This accounting consists a vital range of functions which are mentioned below such as :

Provide data – This is a main function of MA which consists information about

quantitative and qualitative transaction about company.

Modify data – Another function of MA is to analysing and modifying collected data so

that it can be utilised for further use (Kihn and Ihantola, 2015).

Analyse and interpret data – As well as MA is linked with analysing and interpretation of

data so that managers can aware about financial position.

Quantitative and qualitative – This is the main function of MA which states that under it

both kind of information is gathered including financial and non financial transaction.

Types of accounting system:

Financial accounting system – This can be defined as a kind of accounting system

which is applied in companies for collecting and analysing financial information. It is

formulated financial system which are being represented to both stakeholder internal and

external. Within this, it is crucial to perform auditing of whole developed financial

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

statements in order to evaluate effectiveness. For example: Q clothing company

formulate the income statement for evaluating its profit as well as loss at the year end.

Cost accounting system: This system includes procedures of projecting future cost as

well as assigning funds consequently. It is essential system within firm as they required

this for effective utilisation of available financial resources. Therefore, this is

significantly required in organisation for minimising as well as controlling total cost of

several activities. For example: Q clothing company are applying this system for

reducing the whole activities and operations cost of manufacturing cloths.

Management accounting system: It is the system which aids firms monetary

information as well as prepare reports for managers to make decisions (Kihn and

Ihantola, 2015). Mainly, this system is significant to making effectual decisions as this

reports includes financial and non financial data which are required through managers. Q

clothing company use this system to take decision regarding various activities as well as

operations associated to clothing production. For example: Utilisation of price

optimisation system leads towards effectual setting of price.

Tax accounting system: This is also considered as the kind of accounting system. Its

main aim is to manage whole taxation activities. Herein, firms have to company given

regulations as well as rules while calculating tax return. For example: there are global

taxation rules that are crucial for organisation to utilise into procedures of computing tax

rate. So, Q clothing company can calculate tax at the end of the year through assistance

of this accounting system.

P2. Different methods used for management accounting reporting.

Management accounting reporting can be considered as the procedures of formulating

internal reports for helping broad of directors into decision making. Few kinds of management

accounting reporting are discussed below:

Cost accounting report: Within this particular report, data about whole cost of activities is

involved. Through utilising this report, organisations can approximate the future time

periods. Also, this become simple to evaluate those activities that outcomes in higher cost

in compare to last accounting duration. Q clothing company accountants prepare this

report in order to aware whole expenses within accounting period.

2

formulate the income statement for evaluating its profit as well as loss at the year end.

Cost accounting system: This system includes procedures of projecting future cost as

well as assigning funds consequently. It is essential system within firm as they required

this for effective utilisation of available financial resources. Therefore, this is

significantly required in organisation for minimising as well as controlling total cost of

several activities. For example: Q clothing company are applying this system for

reducing the whole activities and operations cost of manufacturing cloths.

Management accounting system: It is the system which aids firms monetary

information as well as prepare reports for managers to make decisions (Kihn and

Ihantola, 2015). Mainly, this system is significant to making effectual decisions as this

reports includes financial and non financial data which are required through managers. Q

clothing company use this system to take decision regarding various activities as well as

operations associated to clothing production. For example: Utilisation of price

optimisation system leads towards effectual setting of price.

Tax accounting system: This is also considered as the kind of accounting system. Its

main aim is to manage whole taxation activities. Herein, firms have to company given

regulations as well as rules while calculating tax return. For example: there are global

taxation rules that are crucial for organisation to utilise into procedures of computing tax

rate. So, Q clothing company can calculate tax at the end of the year through assistance

of this accounting system.

P2. Different methods used for management accounting reporting.

Management accounting reporting can be considered as the procedures of formulating

internal reports for helping broad of directors into decision making. Few kinds of management

accounting reporting are discussed below:

Cost accounting report: Within this particular report, data about whole cost of activities is

involved. Through utilising this report, organisations can approximate the future time

periods. Also, this become simple to evaluate those activities that outcomes in higher cost

in compare to last accounting duration. Q clothing company accountants prepare this

report in order to aware whole expenses within accounting period.

2

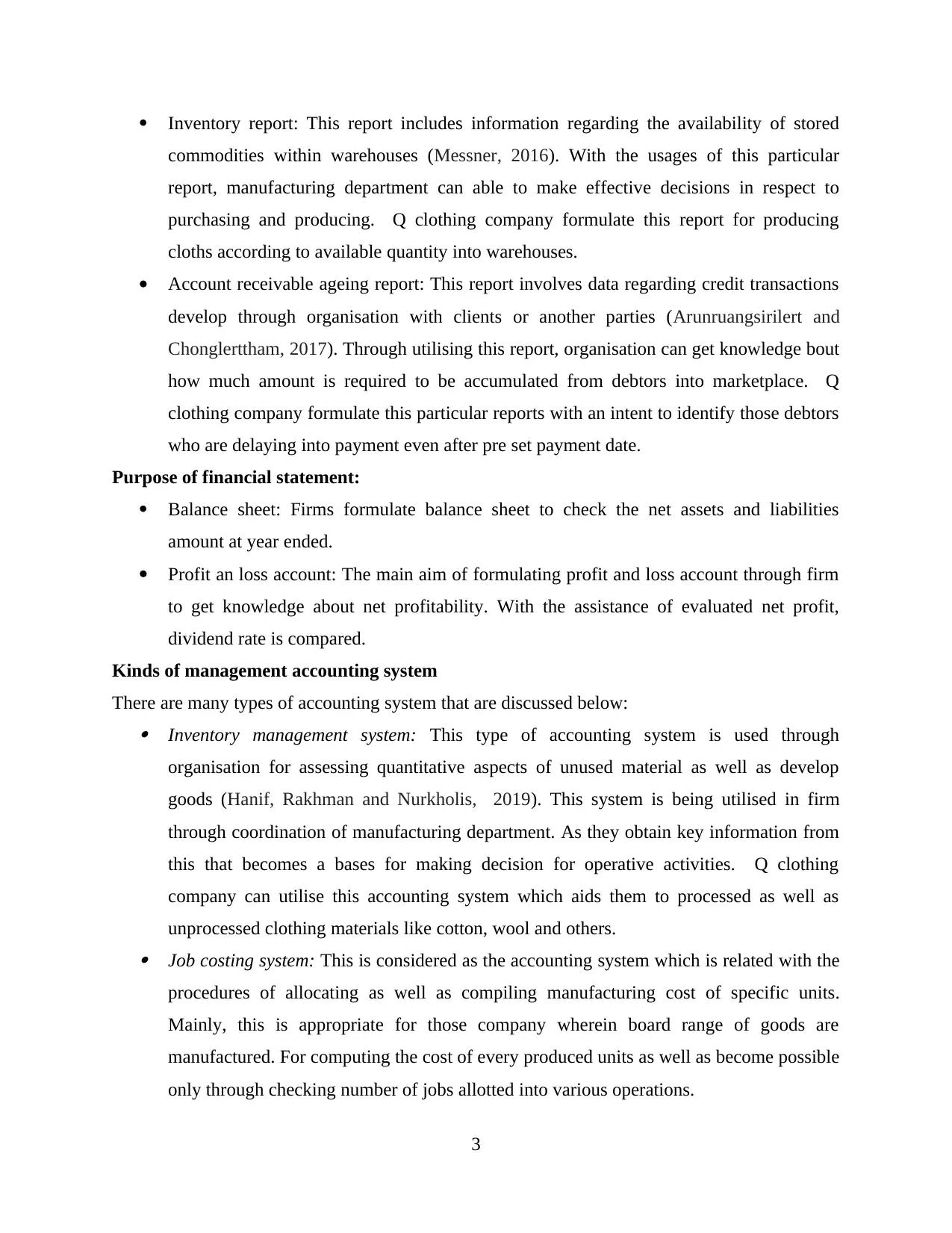

Inventory report: This report includes information regarding the availability of stored

commodities within warehouses (Messner, 2016). With the usages of this particular

report, manufacturing department can able to make effective decisions in respect to

purchasing and producing. Q clothing company formulate this report for producing

cloths according to available quantity into warehouses.

Account receivable ageing report: This report involves data regarding credit transactions

develop through organisation with clients or another parties (Arunruangsirilert and

Chonglerttham, 2017). Through utilising this report, organisation can get knowledge bout

how much amount is required to be accumulated from debtors into marketplace. Q

clothing company formulate this particular reports with an intent to identify those debtors

who are delaying into payment even after pre set payment date.

Purpose of financial statement:

Balance sheet: Firms formulate balance sheet to check the net assets and liabilities

amount at year ended.

Profit an loss account: The main aim of formulating profit and loss account through firm

to get knowledge about net profitability. With the assistance of evaluated net profit,

dividend rate is compared.

Kinds of management accounting system

There are many types of accounting system that are discussed below: Inventory management system: This type of accounting system is used through

organisation for assessing quantitative aspects of unused material as well as develop

goods (Hanif, Rakhman and Nurkholis, 2019). This system is being utilised in firm

through coordination of manufacturing department. As they obtain key information from

this that becomes a bases for making decision for operative activities. Q clothing

company can utilise this accounting system which aids them to processed as well as

unprocessed clothing materials like cotton, wool and others. Job costing system: This is considered as the accounting system which is related with the

procedures of allocating as well as compiling manufacturing cost of specific units.

Mainly, this is appropriate for those company wherein board range of goods are

manufactured. For computing the cost of every produced units as well as become possible

only through checking number of jobs allotted into various operations.

3

commodities within warehouses (Messner, 2016). With the usages of this particular

report, manufacturing department can able to make effective decisions in respect to

purchasing and producing. Q clothing company formulate this report for producing

cloths according to available quantity into warehouses.

Account receivable ageing report: This report involves data regarding credit transactions

develop through organisation with clients or another parties (Arunruangsirilert and

Chonglerttham, 2017). Through utilising this report, organisation can get knowledge bout

how much amount is required to be accumulated from debtors into marketplace. Q

clothing company formulate this particular reports with an intent to identify those debtors

who are delaying into payment even after pre set payment date.

Purpose of financial statement:

Balance sheet: Firms formulate balance sheet to check the net assets and liabilities

amount at year ended.

Profit an loss account: The main aim of formulating profit and loss account through firm

to get knowledge about net profitability. With the assistance of evaluated net profit,

dividend rate is compared.

Kinds of management accounting system

There are many types of accounting system that are discussed below: Inventory management system: This type of accounting system is used through

organisation for assessing quantitative aspects of unused material as well as develop

goods (Hanif, Rakhman and Nurkholis, 2019). This system is being utilised in firm

through coordination of manufacturing department. As they obtain key information from

this that becomes a bases for making decision for operative activities. Q clothing

company can utilise this accounting system which aids them to processed as well as

unprocessed clothing materials like cotton, wool and others. Job costing system: This is considered as the accounting system which is related with the

procedures of allocating as well as compiling manufacturing cost of specific units.

Mainly, this is appropriate for those company wherein board range of goods are

manufactured. For computing the cost of every produced units as well as become possible

only through checking number of jobs allotted into various operations.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

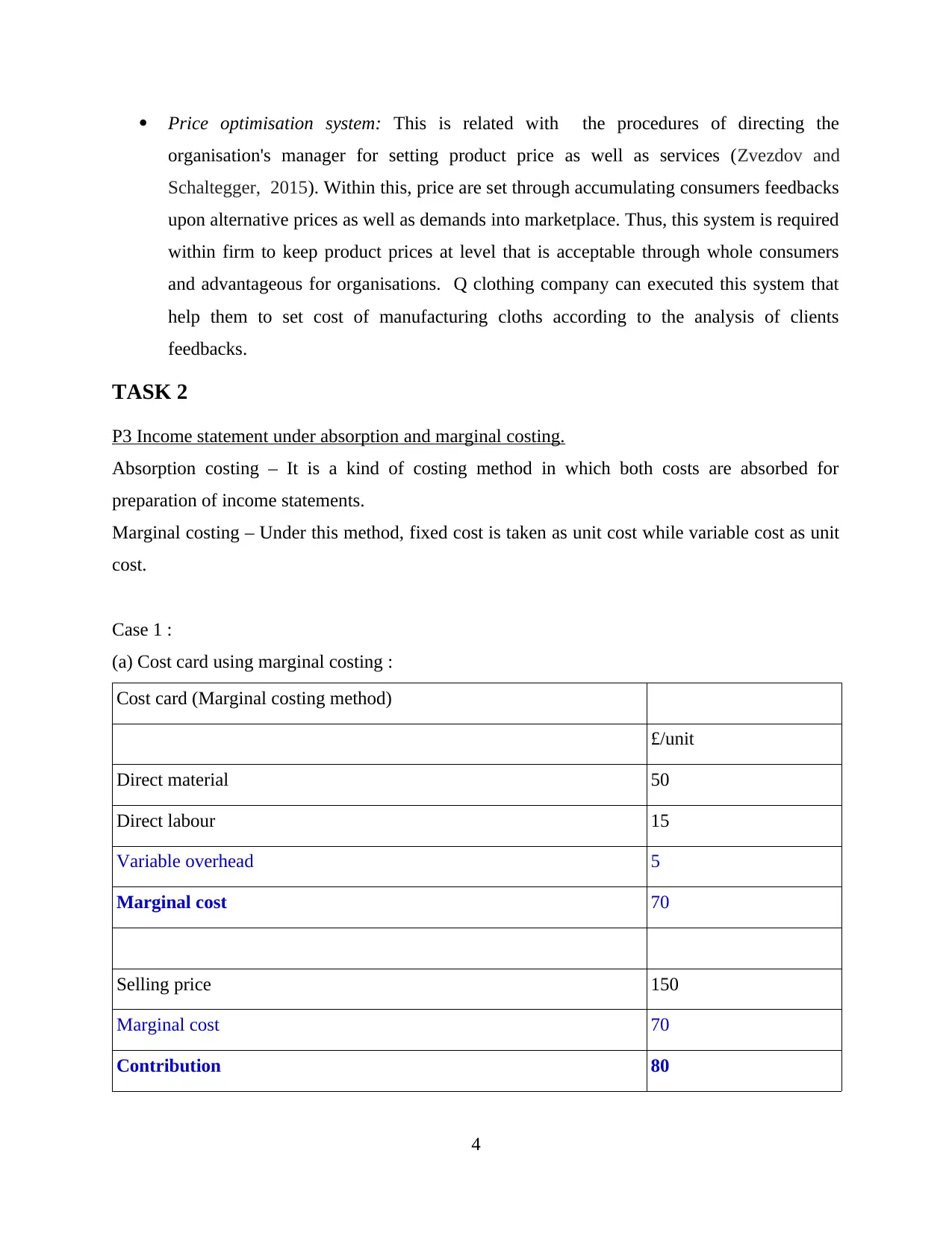

Price optimisation system: This is related with the procedures of directing the

organisation's manager for setting product price as well as services (Zvezdov and

Schaltegger, 2015). Within this, price are set through accumulating consumers feedbacks

upon alternative prices as well as demands into marketplace. Thus, this system is required

within firm to keep product prices at level that is acceptable through whole consumers

and advantageous for organisations. Q clothing company can executed this system that

help them to set cost of manufacturing cloths according to the analysis of clients

feedbacks.

TASK 2

P3 Income statement under absorption and marginal costing.

Absorption costing – It is a kind of costing method in which both costs are absorbed for

preparation of income statements.

Marginal costing – Under this method, fixed cost is taken as unit cost while variable cost as unit

cost.

Case 1 :

(a) Cost card using marginal costing :

Cost card (Marginal costing method)

£/unit

Direct material 50

Direct labour 15

Variable overhead 5

Marginal cost 70

Selling price 150

Marginal cost 70

Contribution 80

4

organisation's manager for setting product price as well as services (Zvezdov and

Schaltegger, 2015). Within this, price are set through accumulating consumers feedbacks

upon alternative prices as well as demands into marketplace. Thus, this system is required

within firm to keep product prices at level that is acceptable through whole consumers

and advantageous for organisations. Q clothing company can executed this system that

help them to set cost of manufacturing cloths according to the analysis of clients

feedbacks.

TASK 2

P3 Income statement under absorption and marginal costing.

Absorption costing – It is a kind of costing method in which both costs are absorbed for

preparation of income statements.

Marginal costing – Under this method, fixed cost is taken as unit cost while variable cost as unit

cost.

Case 1 :

(a) Cost card using marginal costing :

Cost card (Marginal costing method)

£/unit

Direct material 50

Direct labour 15

Variable overhead 5

Marginal cost 70

Selling price 150

Marginal cost 70

Contribution 80

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(b) Profit and loss account:

Profit and loss statement for month of January:

Particulars DR CR

Sales revenue (12000 * 150) 1800000

Direct material (15000*50) 750000

Direct labour (15000*15) 225000

Variable cost (15000*5) 75000

Fixed production overhead 30000

Less : Closing stock (3000*70) 210000

Less: Cost of sales 870000

Profit 930000

Profit and loss statement for month of February

Particulars DR CR

Sales revenue (14000 * 150) 2100000

Direct material (12000*50) 600000

Direct labour (12000*15) 180000

Variable cost (12000*5) 60000

Add : Opening stock (3000*70) 210000

Fixed production overhead 24000

Less- Closing stock (1000*70) 70000

Less: Cost of sales 1004000

Profit 1096000

5

Profit and loss statement for month of January:

Particulars DR CR

Sales revenue (12000 * 150) 1800000

Direct material (15000*50) 750000

Direct labour (15000*15) 225000

Variable cost (15000*5) 75000

Fixed production overhead 30000

Less : Closing stock (3000*70) 210000

Less: Cost of sales 870000

Profit 930000

Profit and loss statement for month of February

Particulars DR CR

Sales revenue (14000 * 150) 2100000

Direct material (12000*50) 600000

Direct labour (12000*15) 180000

Variable cost (12000*5) 60000

Add : Opening stock (3000*70) 210000

Fixed production overhead 24000

Less- Closing stock (1000*70) 70000

Less: Cost of sales 1004000

Profit 1096000

5

Profit and loss statement for month of March

Particulars DR CR

Sales revenue (11000 * 150) 1650000

Direct material (10000*50) 500000

Direct labour (10000*15) 150000

Variable cost (10000*5) 50000

Add : Opening stock (1000*70) 70000

Fixed production overhead 20000

Less: Cost of sales 790000

Profit 860000

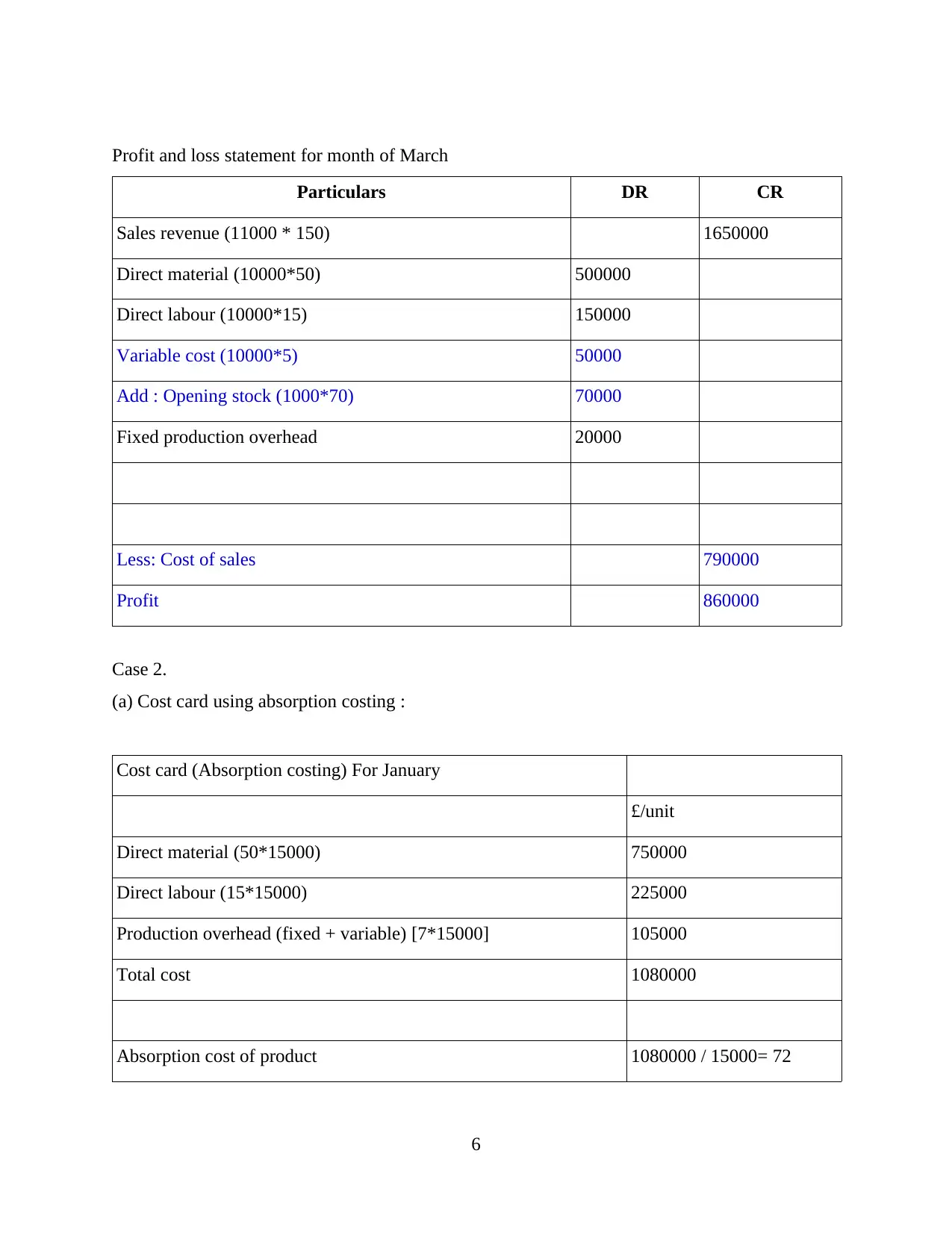

Case 2.

(a) Cost card using absorption costing :

Cost card (Absorption costing) For January

£/unit

Direct material (50*15000) 750000

Direct labour (15*15000) 225000

Production overhead (fixed + variable) [7*15000] 105000

Total cost 1080000

Absorption cost of product 1080000 / 15000= 72

6

Particulars DR CR

Sales revenue (11000 * 150) 1650000

Direct material (10000*50) 500000

Direct labour (10000*15) 150000

Variable cost (10000*5) 50000

Add : Opening stock (1000*70) 70000

Fixed production overhead 20000

Less: Cost of sales 790000

Profit 860000

Case 2.

(a) Cost card using absorption costing :

Cost card (Absorption costing) For January

£/unit

Direct material (50*15000) 750000

Direct labour (15*15000) 225000

Production overhead (fixed + variable) [7*15000] 105000

Total cost 1080000

Absorption cost of product 1080000 / 15000= 72

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Selling price 150

Less- Total cost 72

Profit 78

(b) Profit and loss account for month of January:

Particulars DR CR

Sales revenue (12000*150) 1800000

Variable cost:

Direct material (15000*50) 750000

Direct labour (15000*15) 225000

Less- Closing stock (3000*70) 210000

Fixed production cost (30000+3000) 33000

Less: cost of sales 798000

Profit 1002000

Cost card (Absorption costing) For February

£/unit

Direct material (50*12000) 600000

Direct labour (15*12000) 180000

Production overhead (fixed + variable) [7*12000] 84000

7

Less- Total cost 72

Profit 78

(b) Profit and loss account for month of January:

Particulars DR CR

Sales revenue (12000*150) 1800000

Variable cost:

Direct material (15000*50) 750000

Direct labour (15000*15) 225000

Less- Closing stock (3000*70) 210000

Fixed production cost (30000+3000) 33000

Less: cost of sales 798000

Profit 1002000

Cost card (Absorption costing) For February

£/unit

Direct material (50*12000) 600000

Direct labour (15*12000) 180000

Production overhead (fixed + variable) [7*12000] 84000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

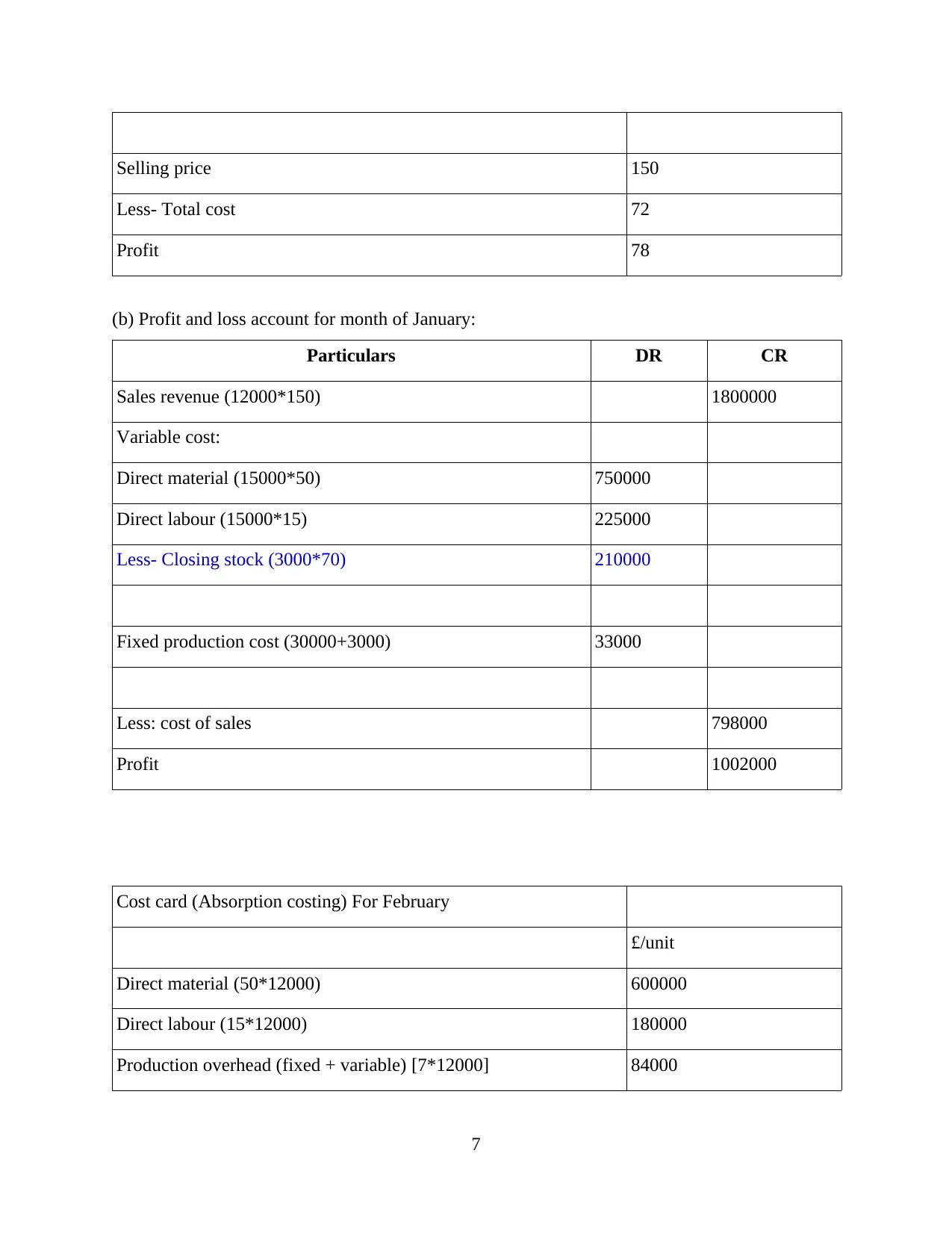

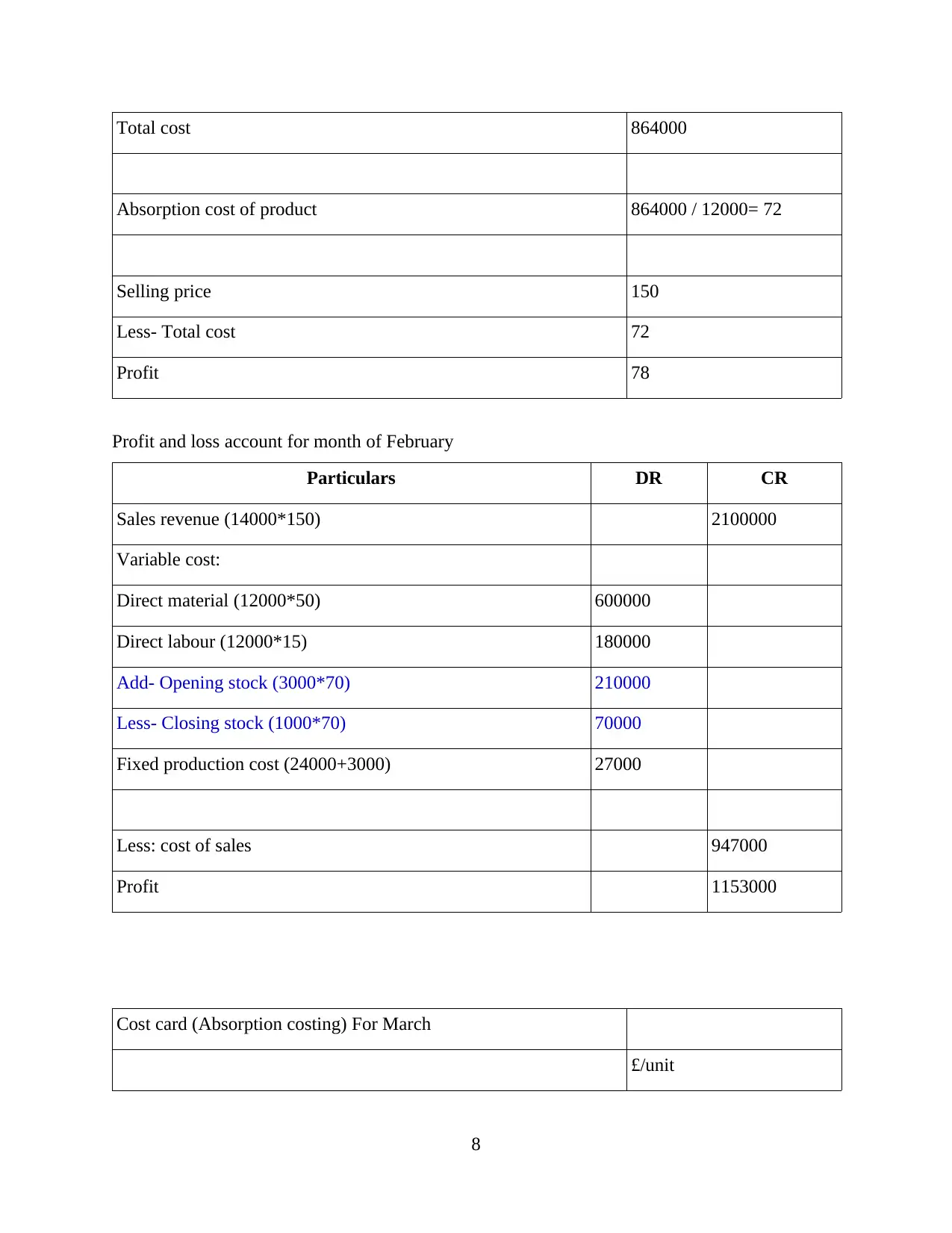

Total cost 864000

Absorption cost of product 864000 / 12000= 72

Selling price 150

Less- Total cost 72

Profit 78

Profit and loss account for month of February

Particulars DR CR

Sales revenue (14000*150) 2100000

Variable cost:

Direct material (12000*50) 600000

Direct labour (12000*15) 180000

Add- Opening stock (3000*70) 210000

Less- Closing stock (1000*70) 70000

Fixed production cost (24000+3000) 27000

Less: cost of sales 947000

Profit 1153000

Cost card (Absorption costing) For March

£/unit

8

Absorption cost of product 864000 / 12000= 72

Selling price 150

Less- Total cost 72

Profit 78

Profit and loss account for month of February

Particulars DR CR

Sales revenue (14000*150) 2100000

Variable cost:

Direct material (12000*50) 600000

Direct labour (12000*15) 180000

Add- Opening stock (3000*70) 210000

Less- Closing stock (1000*70) 70000

Fixed production cost (24000+3000) 27000

Less: cost of sales 947000

Profit 1153000

Cost card (Absorption costing) For March

£/unit

8

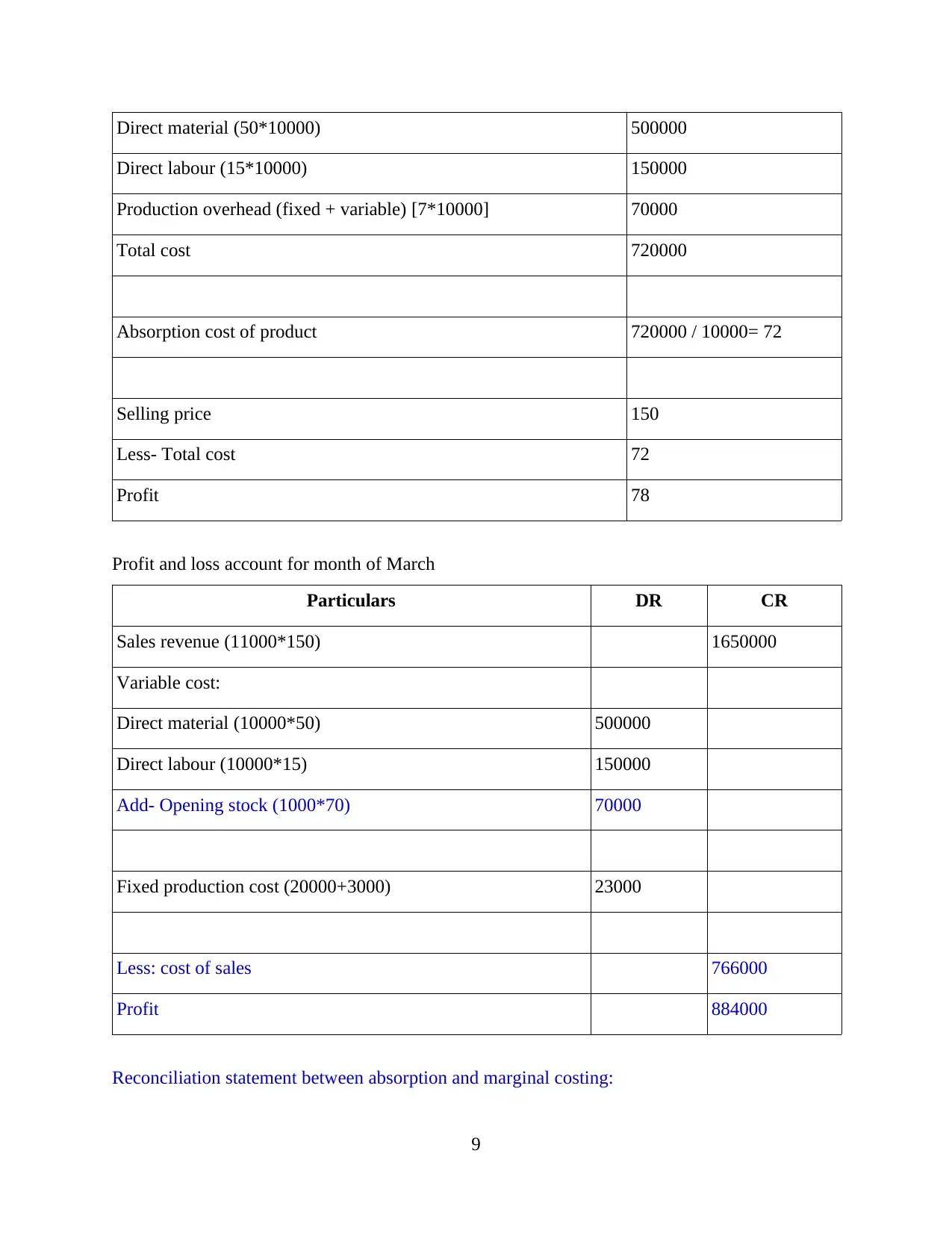

Direct material (50*10000) 500000

Direct labour (15*10000) 150000

Production overhead (fixed + variable) [7*10000] 70000

Total cost 720000

Absorption cost of product 720000 / 10000= 72

Selling price 150

Less- Total cost 72

Profit 78

Profit and loss account for month of March

Particulars DR CR

Sales revenue (11000*150) 1650000

Variable cost:

Direct material (10000*50) 500000

Direct labour (10000*15) 150000

Add- Opening stock (1000*70) 70000

Fixed production cost (20000+3000) 23000

Less: cost of sales 766000

Profit 884000

Reconciliation statement between absorption and marginal costing:

9

Direct labour (15*10000) 150000

Production overhead (fixed + variable) [7*10000] 70000

Total cost 720000

Absorption cost of product 720000 / 10000= 72

Selling price 150

Less- Total cost 72

Profit 78

Profit and loss account for month of March

Particulars DR CR

Sales revenue (11000*150) 1650000

Variable cost:

Direct material (10000*50) 500000

Direct labour (10000*15) 150000

Add- Opening stock (1000*70) 70000

Fixed production cost (20000+3000) 23000

Less: cost of sales 766000

Profit 884000

Reconciliation statement between absorption and marginal costing:

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.