Management Accounting Report: Techniques and Analysis for Business

VerifiedAdded on 2021/02/20

|18

|5099

|34

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its role in organizational decision-making and financial management. It explores key concepts such as cost accounting systems, job costing systems, and price optimization methods, highlighting their advantages and disadvantages. The report analyzes various management accounting reporting methods, including budget reports, cost management accounting reports, and performance reports, emphasizing their importance in assessing organizational performance and controlling costs. Additionally, it examines how organizations adapt management accounting systems to address financial challenges. The report uses Unilever as a case study to demonstrate how the company uses these techniques. The report also includes an introduction outlining the significance of management accounting, a conclusion summarizing the key findings, and a list of references.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

Role of Management Accounting in an organisation..................................................................1

LO1..................................................................................................................................................4

P2 Methods of Management accounting reporting......................................................................4

LO2..................................................................................................................................................6

P3 Calculating costs using appropriate cost accounting techniques............................................6

......................................................................................................................................................7

LO4..................................................................................................................................................9

P4 Explaining the advantages and disadvantages of different types of planning tools used in

budgetary control.........................................................................................................................9

P5 Compare howorganizations are adapting management accounting systems to respond to

financial problems........................................................................................................................1

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

Role of Management Accounting in an organisation..................................................................1

LO1..................................................................................................................................................4

P2 Methods of Management accounting reporting......................................................................4

LO2..................................................................................................................................................6

P3 Calculating costs using appropriate cost accounting techniques............................................6

......................................................................................................................................................7

LO4..................................................................................................................................................9

P4 Explaining the advantages and disadvantages of different types of planning tools used in

budgetary control.........................................................................................................................9

P5 Compare howorganizations are adapting management accounting systems to respond to

financial problems........................................................................................................................1

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION

In management accounting or managerial accounting, managers use the provisions of

accounting information in order to better inform themselves before they decide matters within

their organizations, which aids their management and performance of control functions.

Management accounting helps the organization in managing the financial aspects accurately and

efficiently. Management accounting is one of the most reliable concept which can be used by

firm and organization. It aids managers to perform better the financial task. It helps managers in

decision making process and achieving goals and objectives(Ax and Greve, 2017). Report will

highlight basic concepts of management accounting. It will also lay emphasis on methods of

budgeting.

LO1

Role of Management Accounting in an organisation.

Management accounting in an organisation is for supporting the competitive decisions

making through collection, processing and communication of information that will help

management in planning controlling and elevating business processes & company strategies. For

surviving in competitive market, related to technological advancement , are required to use

advance methods for working over continuous improvement of quality control and reducing cost

of products. In these circumstances organisations are shifting towards modern information

system avoiding traditional system with long term move towards management accounting. Tools

of management accounting are following growing trend over recent years. For meeting the

economical advancement of companies management accounting has emerged with new

techniques and and systems helping the Unilever to manage its business. Management is helping

company to meet the needs of modern times business. New systems and techniques has helped

companies to manage its accounting needs and requirements (Bobryshev and et.al., 2015).

Business cannot run effectively without management accounting it includes various costing

method that companies adopt as per their businesses.

Types of Management Accounting System

Cost accounting system

Cost accounting systems refers to framework which is used by companies for estimating costs of

its products for analysing profitability , cost control and inventory valuation. It is critical to

estimate product's correct costs in profitable operations. Company must have knowledge about

1

In management accounting or managerial accounting, managers use the provisions of

accounting information in order to better inform themselves before they decide matters within

their organizations, which aids their management and performance of control functions.

Management accounting helps the organization in managing the financial aspects accurately and

efficiently. Management accounting is one of the most reliable concept which can be used by

firm and organization. It aids managers to perform better the financial task. It helps managers in

decision making process and achieving goals and objectives(Ax and Greve, 2017). Report will

highlight basic concepts of management accounting. It will also lay emphasis on methods of

budgeting.

LO1

Role of Management Accounting in an organisation.

Management accounting in an organisation is for supporting the competitive decisions

making through collection, processing and communication of information that will help

management in planning controlling and elevating business processes & company strategies. For

surviving in competitive market, related to technological advancement , are required to use

advance methods for working over continuous improvement of quality control and reducing cost

of products. In these circumstances organisations are shifting towards modern information

system avoiding traditional system with long term move towards management accounting. Tools

of management accounting are following growing trend over recent years. For meeting the

economical advancement of companies management accounting has emerged with new

techniques and and systems helping the Unilever to manage its business. Management is helping

company to meet the needs of modern times business. New systems and techniques has helped

companies to manage its accounting needs and requirements (Bobryshev and et.al., 2015).

Business cannot run effectively without management accounting it includes various costing

method that companies adopt as per their businesses.

Types of Management Accounting System

Cost accounting system

Cost accounting systems refers to framework which is used by companies for estimating costs of

its products for analysing profitability , cost control and inventory valuation. It is critical to

estimate product's correct costs in profitable operations. Company must have knowledge about

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

each product that is prepared by company which product is making profits and which are costing

much to company. This can be achieved when accurate cost of each product has been estimated

by company. Unilever is estimating cost of it closing inventory using cost accounting method.

Cost accounting system helps management of company to make business decisions. Corporate

accounting does not have to follow set standards that are flexible in meeting the management

needs unlike financial accounting that is required to provide financial information to external

users. Cost accounting helps Unilever in considering input costs of production that are both fixed

and variable.

Advantages

Cost accounting system help managers of Unilever to eliminate losses, wastes and

inefficiencies through standards. Standards set by company helps to reduce cost of

product.

Unilever is able to identify reason for increase or decrease in in profit. It help managers

to take remedial actions for maintaining the profitability of company.

When information of cost is available management is able to make decisions about

whether to purchase or not products from open market. Record of every product is

available with company in costing records (Bromwich and Scapens, 2016).

Cost accounting is appreciated by managers of Unilever as it is adaptable, can be tinkered

and implemented as per changing requirements of business. Cost accounting is used only

for accounting for internal purposes. Cost accounting is three dimensional which are accounting, calculations and reporting

that could be manipulated by different angles. It helps Unilever by guiding in price

determination, resource allocations and raising capital for meeting the production

requirement.

Disadvantages

Cost accounting department are available with only cost records where management is

making decisions for future that could be different as costs in previous yaear may not be

same as in succeeding year.

Accurate cost can be ascertained when only when full capacity is utlized it is not useful

for Unilever when there is partial utilization of capacity.

2

much to company. This can be achieved when accurate cost of each product has been estimated

by company. Unilever is estimating cost of it closing inventory using cost accounting method.

Cost accounting system helps management of company to make business decisions. Corporate

accounting does not have to follow set standards that are flexible in meeting the management

needs unlike financial accounting that is required to provide financial information to external

users. Cost accounting helps Unilever in considering input costs of production that are both fixed

and variable.

Advantages

Cost accounting system help managers of Unilever to eliminate losses, wastes and

inefficiencies through standards. Standards set by company helps to reduce cost of

product.

Unilever is able to identify reason for increase or decrease in in profit. It help managers

to take remedial actions for maintaining the profitability of company.

When information of cost is available management is able to make decisions about

whether to purchase or not products from open market. Record of every product is

available with company in costing records (Bromwich and Scapens, 2016).

Cost accounting is appreciated by managers of Unilever as it is adaptable, can be tinkered

and implemented as per changing requirements of business. Cost accounting is used only

for accounting for internal purposes. Cost accounting is three dimensional which are accounting, calculations and reporting

that could be manipulated by different angles. It helps Unilever by guiding in price

determination, resource allocations and raising capital for meeting the production

requirement.

Disadvantages

Cost accounting department are available with only cost records where management is

making decisions for future that could be different as costs in previous yaear may not be

same as in succeeding year.

Accurate cost can be ascertained when only when full capacity is utlized it is not useful

for Unilever when there is partial utilization of capacity.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial costs are not included when calculating the cost product therefore the correct

costs may not be calculated always.

Job costing system

Job costing system refers to system that assigns and accumulates manufacturing cost of

individual output unit. It is method to record cost of manufacturing job than of process. Job

costing system is useful when different items that are produced by company are different from

one another and are having significant costing. Job costing requires separate cost records for

items that are significantly varying from each other. Job records of Unilever are required to

report about the about direct material and labour costs which are actually used & assigned cost in

manufacturing overhead. With job costing Unilever is able to keep track over cost of every job,

to maintain data, that are relevant to operations of business (Chenhall and Moers, 2015). It is a

specific accounting method that helps Unilever in tracking the expense for creating unique

product. There are advantages and disadvantages of using job costing system.

Advantages /

Cost of products can be ascertained on completion of job giving scope for controlling the

cost of products taking suitable steps by Unilever. It helps in recognising profits

separately from each job.

On job completion every component of cost, profit and selling price are comparable with

estimates for controlling and reducing the costs for maximising the profits on every job in

job Costing of Unilever.

By using the past records of job costing company is able to estimate future costs. It

enables company to compare present and actual costs of every job and to prepare trend

analysis by compiling historical costs of jobs. Unilever is able to identify defects and spoilages arising in each job hence it helps

company to control it.

Disadvantages

Unilever is required to have effective supervision over job costing as there is no

standardization.

Company is required to maintain detailed information about job costing which involves

ample amount of clerical work.

3

costs may not be calculated always.

Job costing system

Job costing system refers to system that assigns and accumulates manufacturing cost of

individual output unit. It is method to record cost of manufacturing job than of process. Job

costing system is useful when different items that are produced by company are different from

one another and are having significant costing. Job costing requires separate cost records for

items that are significantly varying from each other. Job records of Unilever are required to

report about the about direct material and labour costs which are actually used & assigned cost in

manufacturing overhead. With job costing Unilever is able to keep track over cost of every job,

to maintain data, that are relevant to operations of business (Chenhall and Moers, 2015). It is a

specific accounting method that helps Unilever in tracking the expense for creating unique

product. There are advantages and disadvantages of using job costing system.

Advantages /

Cost of products can be ascertained on completion of job giving scope for controlling the

cost of products taking suitable steps by Unilever. It helps in recognising profits

separately from each job.

On job completion every component of cost, profit and selling price are comparable with

estimates for controlling and reducing the costs for maximising the profits on every job in

job Costing of Unilever.

By using the past records of job costing company is able to estimate future costs. It

enables company to compare present and actual costs of every job and to prepare trend

analysis by compiling historical costs of jobs. Unilever is able to identify defects and spoilages arising in each job hence it helps

company to control it.

Disadvantages

Unilever is required to have effective supervision over job costing as there is no

standardization.

Company is required to maintain detailed information about job costing which involves

ample amount of clerical work.

3

Costs cannot be controlled in job costing by the company as preventive steps are taken

after expenses are incurred in job costing.

Price optimisation system

Price optimization method refers to using mathematical analysis for determining the customer

responses over different prices of product and services over different channels. Price

optimization is widely used by organisations to describe prices of applications. Price

optimization issued by companies for enhancing its prices for effectively meeting the

organisations objectives. Price optimisation helps company to meet objective of company like

maximisation of operating profit. Price optimisation for calculating the variations in demand at

various price levels and combining data with details on inventory and costs levels for

recommending prices which will be improving profits (Chiarini and Vagnoni, 2015). Unilever is

using pricing optimisation method as strong profit lever that is often underdeveloped. Seeing the

complexity in pricing number of items over high dynamic conditions of market, modelling and

insights helps Unilever in forecasting demand, developing prices and promoting strategies,

controlling inventory levels and improving customer satisfaction.

Advantages

It helps Unilever to focus and analyse key areas like margin of sale & conversion

numbers. It helps in generating revenues that are noticeable & helps in expansion and

growth of business.

Requirement of manual work is reduced is reduced under price optimisation systems

because of which human errors are also reduced in company (Hall, 2016).

It helps Unilever to regularize its prices over channels in alignment with changing trends

of market, without redundancy. It also helps company to analyse the purchasing pattern of customer and their pricing

preferences, and it assists company in making better decisions.

Disadvantages

Price optimisation is costly processes that increases cost of company. It increases the

costing of product which is being manufactured by company.

It is time consuming process and involves technical experts, if the data is not accurately

prices of product will be mispriced.

4

after expenses are incurred in job costing.

Price optimisation system

Price optimization method refers to using mathematical analysis for determining the customer

responses over different prices of product and services over different channels. Price

optimization is widely used by organisations to describe prices of applications. Price

optimization issued by companies for enhancing its prices for effectively meeting the

organisations objectives. Price optimisation helps company to meet objective of company like

maximisation of operating profit. Price optimisation for calculating the variations in demand at

various price levels and combining data with details on inventory and costs levels for

recommending prices which will be improving profits (Chiarini and Vagnoni, 2015). Unilever is

using pricing optimisation method as strong profit lever that is often underdeveloped. Seeing the

complexity in pricing number of items over high dynamic conditions of market, modelling and

insights helps Unilever in forecasting demand, developing prices and promoting strategies,

controlling inventory levels and improving customer satisfaction.

Advantages

It helps Unilever to focus and analyse key areas like margin of sale & conversion

numbers. It helps in generating revenues that are noticeable & helps in expansion and

growth of business.

Requirement of manual work is reduced is reduced under price optimisation systems

because of which human errors are also reduced in company (Hall, 2016).

It helps Unilever to regularize its prices over channels in alignment with changing trends

of market, without redundancy. It also helps company to analyse the purchasing pattern of customer and their pricing

preferences, and it assists company in making better decisions.

Disadvantages

Price optimisation is costly processes that increases cost of company. It increases the

costing of product which is being manufactured by company.

It is time consuming process and involves technical experts, if the data is not accurately

prices of product will be mispriced.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO1

P2 Methods of Management accounting reporting

For every organisations it is important for businesses to keep record of each expenditure.

Management accounting report helps Unilever to trim costs of products and expenses, in

rewarding employees whose performances are high and investing in products that are giving

better financial returns to company. Financial reports are generated by company depending on

the project requirements and sensitivity of financial information. Management accounting reports

include (Jamil and et.al., 2015).

Budget Reports

Budgeting accounting report are used to measure performance of company and these report are

generated for large organisations departments wise. Unilever creates budget reports for

understanding the strategies of their business. Budget reports are prepared by organisations using

previous experiences related to the budgets. Budgets of company should be prepared keeping in

view estimates that are arising from previous circumstances. Budget reports contain all earning

sources and expenditures that help companies to carry out manufacturing processes accordingly.

Budgets are prepared by companies so that it is achieving its goals and objectives while being

within budgeted figures (Kaplan and Atkinson, 2015). These budgeted report guides manager of

Unilever in cutting costs that are excessive and are not productive. Company is able to allocate

its resources as per the budgeting reports to activities that are generating more profits for

company. It is essential for companies to make budgeted report that control over expenditure of

company can be maintained.

Cost Management Accounting Reports

Management accounting helps company in computing costs of product which are

manufactured by company. These report covers everything like material, overheads, labour and

other costs. Cost reports gives summarised form of all the information in manufacturing a

product. Cost report helps manager to analyse and capacity for realizing cost prices of different

items with selling prices. These reports help in estimating the profit margins as company is

having clear picture about every costs that are used for manufacturing the products or procuring

article. Cost report helps the managers of Unilever to compare cost of its products with the

budgeted figures. Cost reports are very essential for companies for pricing the product that are

5

P2 Methods of Management accounting reporting

For every organisations it is important for businesses to keep record of each expenditure.

Management accounting report helps Unilever to trim costs of products and expenses, in

rewarding employees whose performances are high and investing in products that are giving

better financial returns to company. Financial reports are generated by company depending on

the project requirements and sensitivity of financial information. Management accounting reports

include (Jamil and et.al., 2015).

Budget Reports

Budgeting accounting report are used to measure performance of company and these report are

generated for large organisations departments wise. Unilever creates budget reports for

understanding the strategies of their business. Budget reports are prepared by organisations using

previous experiences related to the budgets. Budgets of company should be prepared keeping in

view estimates that are arising from previous circumstances. Budget reports contain all earning

sources and expenditures that help companies to carry out manufacturing processes accordingly.

Budgets are prepared by companies so that it is achieving its goals and objectives while being

within budgeted figures (Kaplan and Atkinson, 2015). These budgeted report guides manager of

Unilever in cutting costs that are excessive and are not productive. Company is able to allocate

its resources as per the budgeting reports to activities that are generating more profits for

company. It is essential for companies to make budgeted report that control over expenditure of

company can be maintained.

Cost Management Accounting Reports

Management accounting helps company in computing costs of product which are

manufactured by company. These report covers everything like material, overheads, labour and

other costs. Cost reports gives summarised form of all the information in manufacturing a

product. Cost report helps manager to analyse and capacity for realizing cost prices of different

items with selling prices. These reports help in estimating the profit margins as company is

having clear picture about every costs that are used for manufacturing the products or procuring

article. Cost report helps the managers of Unilever to compare cost of its products with the

budgeted figures. Cost reports are very essential for companies for pricing the product that are

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

manufactured by company (Malina, 2017). These reports are important as they gives the

estimates of the cost of products.

Performance Reports

Performance reports are essential as they help company to review their performances.

Performance reports are prepared for evaluating the performance of business as well as

employees of company. Performance reports may be generated department wise, product wise,

or even for processes. These may be generated quarterly, monthly or yearly as per the

requirement of organisations. These performance reports help manger of company in making in

making critical strategic decision relate to future of organisation. It helps company to lay focus

over the underperforming production processes. Performances of management accounting gives

deep insights about working of company. Performance reports helps the company to analyse the

flaws existing in the processes and procedures. (Nielsen, Mitchell and Nørreklit, 2015)

Performance reports are essential for company for measuring its performances of the strategies

laid by them for their mission. Performance reports asses the difference between the budgeted

and actual figures. After carrying out the differences managers tend to formulate strategies to

remove the differences in the budgeted system. Performance reports give the clear picture about

the success of the product performance. Companies than prepare policies and strategies for

enhancing the performance of the compnay so that it can achieve it desired objectives within the

given time frames. Managers and owner review to know how far the strategic that framed for

particular product or service are effective and whether any modification are required.

Managerial Accounting Reports

information reports helps company to analyse the accounting of the various cost and

expenditures of the projects. These reports are generated internally within organisation and

outsourced to professionals who are having skills and experience for carrying out the task

appropriately. They are generating profits as managers are preparing report based on

transactions. These reports are helping the organisation to carry out the best practices which will

be helping it to grow in the market. Managerial accounting are prepared by organisation after

recording all the costs and expenditures related to the product and services. This report help

company to prepare reports containing the differences and the estimated cost of accounting .

Therefore it is very essential for companies to prepare accounting reports containing the records

of each and every project that is undertaken by company. These reports are prepared by

6

estimates of the cost of products.

Performance Reports

Performance reports are essential as they help company to review their performances.

Performance reports are prepared for evaluating the performance of business as well as

employees of company. Performance reports may be generated department wise, product wise,

or even for processes. These may be generated quarterly, monthly or yearly as per the

requirement of organisations. These performance reports help manger of company in making in

making critical strategic decision relate to future of organisation. It helps company to lay focus

over the underperforming production processes. Performances of management accounting gives

deep insights about working of company. Performance reports helps the company to analyse the

flaws existing in the processes and procedures. (Nielsen, Mitchell and Nørreklit, 2015)

Performance reports are essential for company for measuring its performances of the strategies

laid by them for their mission. Performance reports asses the difference between the budgeted

and actual figures. After carrying out the differences managers tend to formulate strategies to

remove the differences in the budgeted system. Performance reports give the clear picture about

the success of the product performance. Companies than prepare policies and strategies for

enhancing the performance of the compnay so that it can achieve it desired objectives within the

given time frames. Managers and owner review to know how far the strategic that framed for

particular product or service are effective and whether any modification are required.

Managerial Accounting Reports

information reports helps company to analyse the accounting of the various cost and

expenditures of the projects. These reports are generated internally within organisation and

outsourced to professionals who are having skills and experience for carrying out the task

appropriately. They are generating profits as managers are preparing report based on

transactions. These reports are helping the organisation to carry out the best practices which will

be helping it to grow in the market. Managerial accounting are prepared by organisation after

recording all the costs and expenditures related to the product and services. This report help

company to prepare reports containing the differences and the estimated cost of accounting .

Therefore it is very essential for companies to prepare accounting reports containing the records

of each and every project that is undertaken by company. These reports are prepared by

6

companies so that it can have the records of all the projects that are used by companies in future

for making budgeted reports. Managerial accounting report helps company to make comparison

between the cost of manufacturing the different products by company (Otley, 2016).

LO2

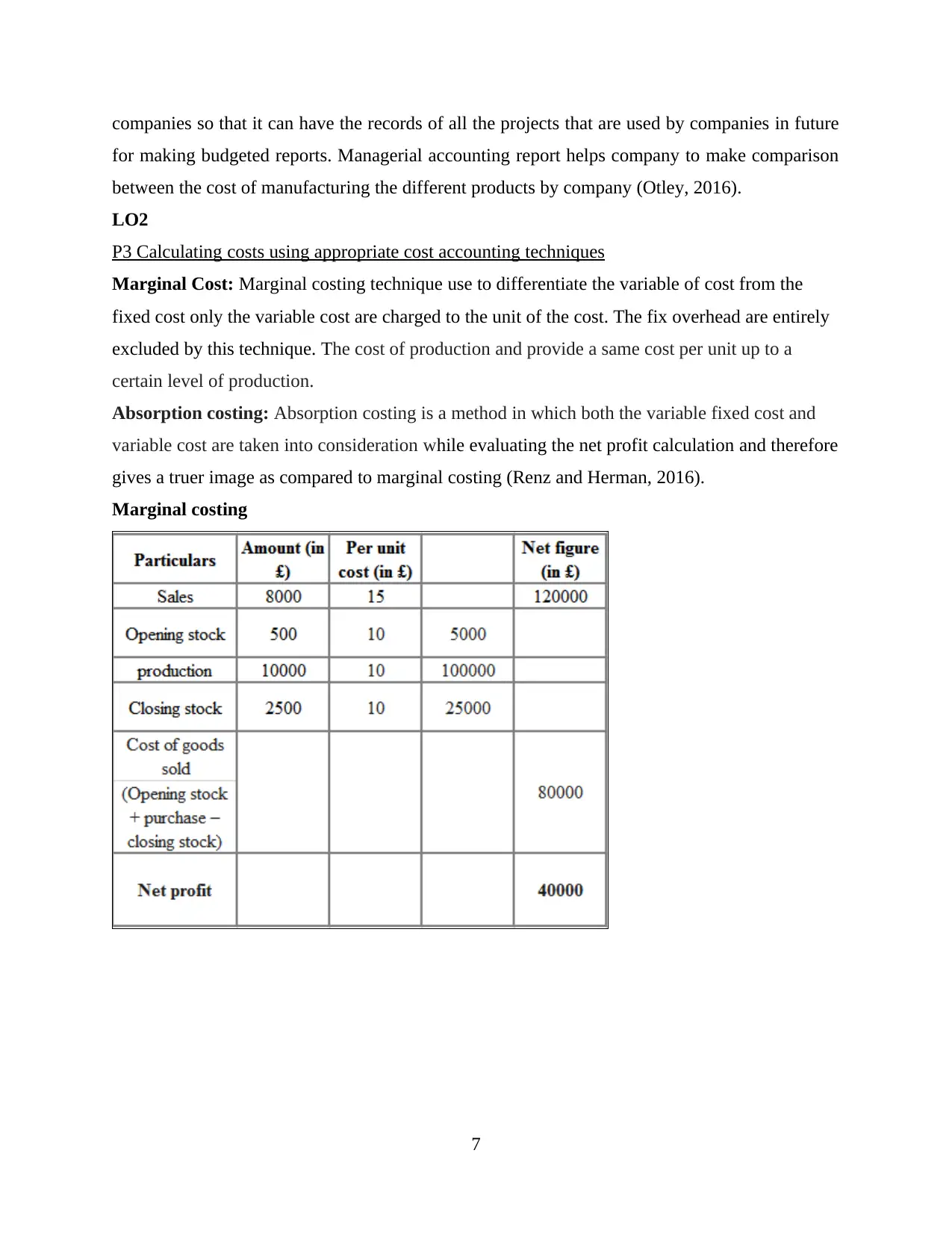

P3 Calculating costs using appropriate cost accounting techniques

Marginal Cost: Marginal costing technique use to differentiate the variable of cost from the

fixed cost only the variable cost are charged to the unit of the cost. The fix overhead are entirely

excluded by this technique. The cost of production and provide a same cost per unit up to a

certain level of production.

Absorption costing: Absorption costing is a method in which both the variable fixed cost and

variable cost are taken into consideration while evaluating the net profit calculation and therefore

gives a truer image as compared to marginal costing (Renz and Herman, 2016).

Marginal costing

7

for making budgeted reports. Managerial accounting report helps company to make comparison

between the cost of manufacturing the different products by company (Otley, 2016).

LO2

P3 Calculating costs using appropriate cost accounting techniques

Marginal Cost: Marginal costing technique use to differentiate the variable of cost from the

fixed cost only the variable cost are charged to the unit of the cost. The fix overhead are entirely

excluded by this technique. The cost of production and provide a same cost per unit up to a

certain level of production.

Absorption costing: Absorption costing is a method in which both the variable fixed cost and

variable cost are taken into consideration while evaluating the net profit calculation and therefore

gives a truer image as compared to marginal costing (Renz and Herman, 2016).

Marginal costing

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

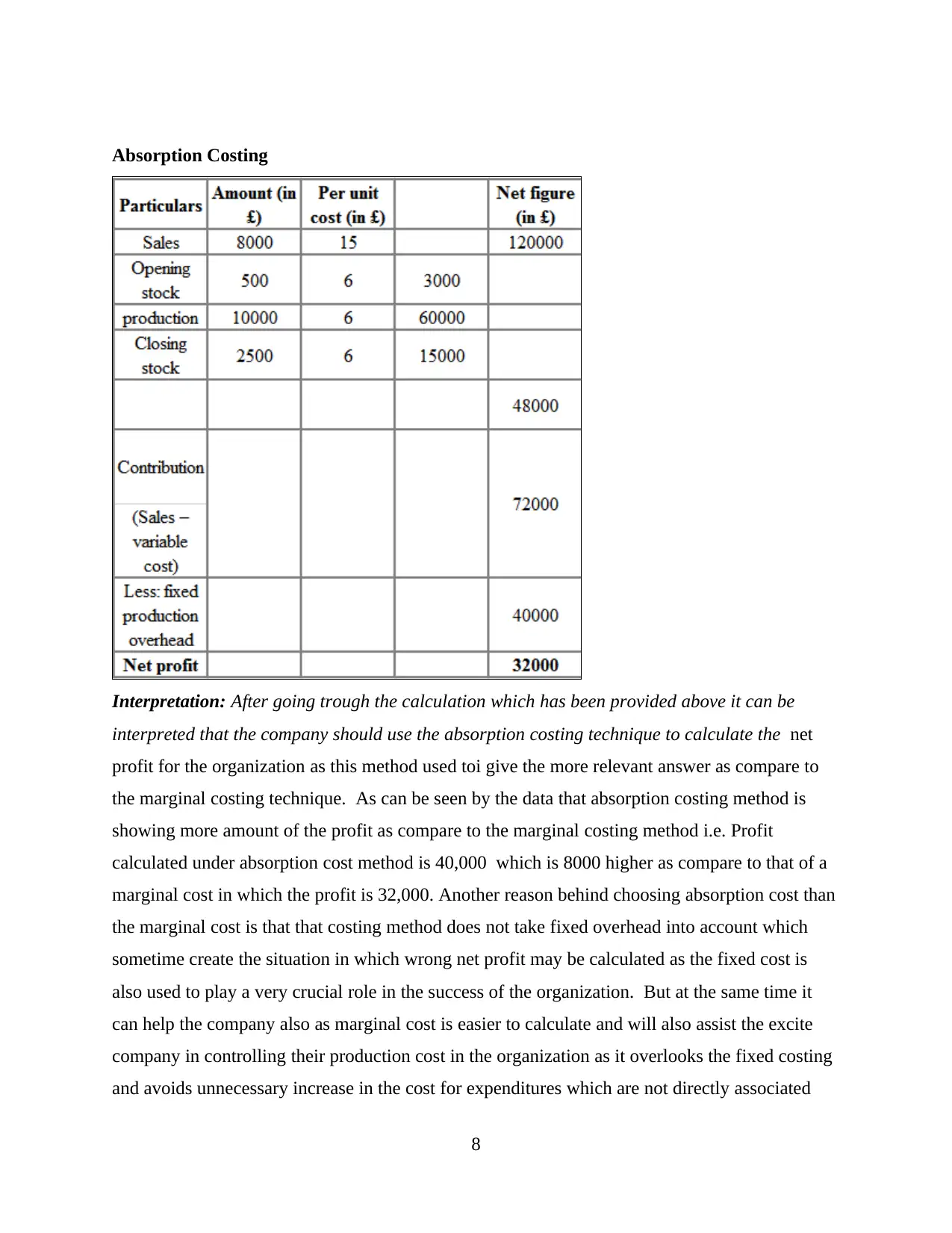

Absorption Costing

Interpretation: After going trough the calculation which has been provided above it can be

interpreted that the company should use the absorption costing technique to calculate the net

profit for the organization as this method used toi give the more relevant answer as compare to

the marginal costing technique. As can be seen by the data that absorption costing method is

showing more amount of the profit as compare to the marginal costing method i.e. Profit

calculated under absorption cost method is 40,000 which is 8000 higher as compare to that of a

marginal cost in which the profit is 32,000. Another reason behind choosing absorption cost than

the marginal cost is that that costing method does not take fixed overhead into account which

sometime create the situation in which wrong net profit may be calculated as the fixed cost is

also used to play a very crucial role in the success of the organization. But at the same time it

can help the company also as marginal cost is easier to calculate and will also assist the excite

company in controlling their production cost in the organization as it overlooks the fixed costing

and avoids unnecessary increase in the cost for expenditures which are not directly associated

8

Interpretation: After going trough the calculation which has been provided above it can be

interpreted that the company should use the absorption costing technique to calculate the net

profit for the organization as this method used toi give the more relevant answer as compare to

the marginal costing technique. As can be seen by the data that absorption costing method is

showing more amount of the profit as compare to the marginal costing method i.e. Profit

calculated under absorption cost method is 40,000 which is 8000 higher as compare to that of a

marginal cost in which the profit is 32,000. Another reason behind choosing absorption cost than

the marginal cost is that that costing method does not take fixed overhead into account which

sometime create the situation in which wrong net profit may be calculated as the fixed cost is

also used to play a very crucial role in the success of the organization. But at the same time it

can help the company also as marginal cost is easier to calculate and will also assist the excite

company in controlling their production cost in the organization as it overlooks the fixed costing

and avoids unnecessary increase in the cost for expenditures which are not directly associated

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

with the product. In the end it can be said that the marginal cost can give the faulty decision

when compiling the long term profit of the company. Marginal costing technique is also not

compile with GAAP standard and cannot be used for external reporting since it distorts the net

profit that is responded to the stakeholder.

In order to support the suggest that the organization should use the Absorption costing

system, it can be said that under absorption cost both variable and fixed cost is taken into

consideration by the technique while evaluating the net profit will help the company in finding

out the best and the relevant outcome as fixed cost is very important part of the organization.

However their are many disadvantages also of the absorption costing that is skewing the

profitability of the company. It also proves to be redundant to use for the purpose of comparing

the different line of the product together. But when comparing it with the marginal cost than it

can be said that it is better technique. Also as absorption costing technique is approved by GAAP

it can be said that it can be used for external reporting as well.

LO4

P4 Explaining the advantages and disadvantages of different types of planning tools used in

budgetary control.

Budgetary control may be defined as a technique which is undertaken by the firm for

assessing deviations by doing comparison of actual performance in against to the standards.

Further, budget implies for the monetary framework which contains both cash inflow and

outflows pertaining to specific time period. In this regard, there are several planning tools which

can be used by ABC such as:

Zero based budgeting: Under such budgeting technique, business starts with zero as a base. In

this, emphasis is placed on justifying all the expenditures and income associated with new

period. Hence, in ZBB, amount is assigned to each activity after doing analysis of its needs and

costs (Sands, and Gunarathne, 2015). Thus, using this technique ABC can develop competent

financial framework for the upcoming time period.

Advantages

ZBB facilitates optimal utilization of resources as it focuses on removing non-productive

activities from operations

Assists in promoting operational efficiency through optimal financial plan

9

when compiling the long term profit of the company. Marginal costing technique is also not

compile with GAAP standard and cannot be used for external reporting since it distorts the net

profit that is responded to the stakeholder.

In order to support the suggest that the organization should use the Absorption costing

system, it can be said that under absorption cost both variable and fixed cost is taken into

consideration by the technique while evaluating the net profit will help the company in finding

out the best and the relevant outcome as fixed cost is very important part of the organization.

However their are many disadvantages also of the absorption costing that is skewing the

profitability of the company. It also proves to be redundant to use for the purpose of comparing

the different line of the product together. But when comparing it with the marginal cost than it

can be said that it is better technique. Also as absorption costing technique is approved by GAAP

it can be said that it can be used for external reporting as well.

LO4

P4 Explaining the advantages and disadvantages of different types of planning tools used in

budgetary control.

Budgetary control may be defined as a technique which is undertaken by the firm for

assessing deviations by doing comparison of actual performance in against to the standards.

Further, budget implies for the monetary framework which contains both cash inflow and

outflows pertaining to specific time period. In this regard, there are several planning tools which

can be used by ABC such as:

Zero based budgeting: Under such budgeting technique, business starts with zero as a base. In

this, emphasis is placed on justifying all the expenditures and income associated with new

period. Hence, in ZBB, amount is assigned to each activity after doing analysis of its needs and

costs (Sands, and Gunarathne, 2015). Thus, using this technique ABC can develop competent

financial framework for the upcoming time period.

Advantages

ZBB facilitates optimal utilization of resources as it focuses on removing non-productive

activities from operations

Assists in promoting operational efficiency through optimal financial plan

9

Disadvantages

Time intensive exercise as it includes detailed evaluation of every item of plan

Highly expensive because for ZBB number of decision packages need to be prepared

Activity based budgeting

This budgeting method can be used by ABC for recording and analysing activities which

in turn leads cost to business. Such modern technique of budgeting is highly effectual which

emphasizes on distributing cost as per the activities carried out by the firm. In this, resource

consumption and cost origination are considered as base for cost determination as well as

allocation (Schaltegger and Burritt, 2017).

Advantages

Assists in reducing cost by offering meaningful information about cost aspects or

activities

Helps in improving business process by identifying and removing non-value added

activities from operations

Disadvantages

It is complex process that is not understood by all the employees of company.

It requires companies to spend extra time over the activities of accompany and is a time

consuming process.

Cash Budget

Cash budgets helps organisations to prepare the cash budgets of business. This budget is

prepared by company so that it can control the cost of company to manufacture the products.

These budgets are helping the organisation to have control over the businesses (van Helden and

Uddin, 2016).

Advantages

Cash budget helps company to avoid the over costing of its products.

These budgets help the company monitor and control its cash inflows and outflows

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems

Management accounting has helped in solving financial problems through:

10

Disadvantages

Time intensive exercise as it includes detailed evaluation of every item of plan

Highly expensive because for ZBB number of decision packages need to be prepared

Activity based budgeting

This budgeting method can be used by ABC for recording and analysing activities which

in turn leads cost to business. Such modern technique of budgeting is highly effectual which

emphasizes on distributing cost as per the activities carried out by the firm. In this, resource

consumption and cost origination are considered as base for cost determination as well as

allocation (Schaltegger and Burritt, 2017).

Advantages

Assists in reducing cost by offering meaningful information about cost aspects or

activities

Helps in improving business process by identifying and removing non-value added

activities from operations

Disadvantages

It is complex process that is not understood by all the employees of company.

It requires companies to spend extra time over the activities of accompany and is a time

consuming process.

Cash Budget

Cash budgets helps organisations to prepare the cash budgets of business. This budget is

prepared by company so that it can control the cost of company to manufacture the products.

These budgets are helping the organisation to have control over the businesses (van Helden and

Uddin, 2016).

Advantages

Cash budget helps company to avoid the over costing of its products.

These budgets help the company monitor and control its cash inflows and outflows

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems

Management accounting has helped in solving financial problems through:

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.