Management Accounting Report: C&S Builder Merchants LTD Analysis

VerifiedAdded on 2020/10/22

|18

|5303

|370

Report

AI Summary

This report delves into the principles of management accounting, emphasizing its role in providing critical information to business managers for effective decision-making. Focusing on C&S Builder Merchants LTD, the report explores various management accounting techniques, including job costing, price optimization, and cost accounting systems. It examines the calculation of income statements using marginal costing and absorption costing, and analyzes the benefits of management accounting systems. Furthermore, the report assesses different planning tools used for budgetary control, evaluating their advantages and disadvantages. It also examines the integration of management accounting within an organization and its response to financial problems, highlighting organizational sustainability through these accounting methods. The report concludes with a comprehensive overview of management accounting's impact on organizational performance and its role in strategic planning.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and its essential requirements...................................................1

P2 methods of management accounting report......................................................................3

M1 Benefits of management accounting system....................................................................4

D1 Management accounting report integrated within organisational....................................4

TASK 2............................................................................................................................................5

P3 Calculation of an income statement.................................................................................5

M2 Management accounting techniques................................................................................8

D2 Analysis and interpretation of data ..................................................................................8

TASK 3............................................................................................................................................8

P4 Analyse advantages and disadvantages of different planning tools used for budgetary control.

..........................................................................................................................................................8

M3 Analyse the use of different planning tools for preparing and forecasting budgets......10

TASK 4..........................................................................................................................................10

P5 management accounting systems and its response to financial problems.......................10

M4 Organisational sustainability through management accounting....................................12

CONCLUSION .............................................................................................................................13

REFERENCE.................................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and its essential requirements...................................................1

P2 methods of management accounting report......................................................................3

M1 Benefits of management accounting system....................................................................4

D1 Management accounting report integrated within organisational....................................4

TASK 2............................................................................................................................................5

P3 Calculation of an income statement.................................................................................5

M2 Management accounting techniques................................................................................8

D2 Analysis and interpretation of data ..................................................................................8

TASK 3............................................................................................................................................8

P4 Analyse advantages and disadvantages of different planning tools used for budgetary control.

..........................................................................................................................................................8

M3 Analyse the use of different planning tools for preparing and forecasting budgets......10

TASK 4..........................................................................................................................................10

P5 management accounting systems and its response to financial problems.......................10

M4 Organisational sustainability through management accounting....................................12

CONCLUSION .............................................................................................................................13

REFERENCE.................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is a term used to describe an accounting methods, system and

techniques which provides information to business managers. This would help in making

decisions related to day-to-day operation of a business. With regards to small organization, this

concept aid them to monitor performance of business in regular manner. This report is carried on

C&S Builder Merchants LTD to discus concept of management accounting and to understand

different planning tools impacts an organization (Fullerton, 2014). Apart from this, report will

keep its focus over Planning tools of budgetary control, different techniques of cost analysis, use

of planning tools and adaptability of management accounting in an organization. Lastly,

assessment will put light on usage of management accounting and understanding of different

techniques of cost analysis and control.

TASK 1

P1 Management accounting and its essential requirements

Management accounting is the process of preparing reports. In this accounting

information goes through several steps such as interpretation, analysis, identification and at last

presentation. The overall information is obtained with a help of financial and cost accounting.

These type of information which are required by a manager for making daily task preparation

and to make short term decision for an organisation. There are different uses of management

accounting in every field and their application are as follows: It is used to measure performance

of employee and identifying of risk possibility, it is also used in allocation of resources in an

optimised way as C&S Builder Merchants LTD can use different techniques to allocate the

resources so where the resources are needed first should supply there first. It helps organisation

to achieve the long term goal and to sustain for the longer period (Renz, 2016). The management

accounting used to provide the proper presentation of the position of organisation in terms of

finance, Which helps to prepare the financial reports,used in decision-making for future.

C&S Builder Merchants LTD is a manufacturing company which supplies the natural

and man-made stones, concrete, bricks, tiles, and woods like thing for making designer garden.

C&S Builder Merchants LTD uses inventory control management and budgeting control

techniques for handling the the accounts in efficient and effective way.

There are various types of management accounting system which are as follows;

1

Management accounting is a term used to describe an accounting methods, system and

techniques which provides information to business managers. This would help in making

decisions related to day-to-day operation of a business. With regards to small organization, this

concept aid them to monitor performance of business in regular manner. This report is carried on

C&S Builder Merchants LTD to discus concept of management accounting and to understand

different planning tools impacts an organization (Fullerton, 2014). Apart from this, report will

keep its focus over Planning tools of budgetary control, different techniques of cost analysis, use

of planning tools and adaptability of management accounting in an organization. Lastly,

assessment will put light on usage of management accounting and understanding of different

techniques of cost analysis and control.

TASK 1

P1 Management accounting and its essential requirements

Management accounting is the process of preparing reports. In this accounting

information goes through several steps such as interpretation, analysis, identification and at last

presentation. The overall information is obtained with a help of financial and cost accounting.

These type of information which are required by a manager for making daily task preparation

and to make short term decision for an organisation. There are different uses of management

accounting in every field and their application are as follows: It is used to measure performance

of employee and identifying of risk possibility, it is also used in allocation of resources in an

optimised way as C&S Builder Merchants LTD can use different techniques to allocate the

resources so where the resources are needed first should supply there first. It helps organisation

to achieve the long term goal and to sustain for the longer period (Renz, 2016). The management

accounting used to provide the proper presentation of the position of organisation in terms of

finance, Which helps to prepare the financial reports,used in decision-making for future.

C&S Builder Merchants LTD is a manufacturing company which supplies the natural

and man-made stones, concrete, bricks, tiles, and woods like thing for making designer garden.

C&S Builder Merchants LTD uses inventory control management and budgeting control

techniques for handling the the accounts in efficient and effective way.

There are various types of management accounting system which are as follows;

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

JOB COSTING SYSTEM

Job costing process involves total cost of material, labour and overhead for the particular

task. This system keeps tracks each and every record and monitor it accurately. It is used to

gather the information at small unit level. For example job costing is used for determine the cost

of the construction,which is the basic function of C&S Builder Merchants LTD. The following

accounting activities which involves in job costing such as labour ,material and over head. Raw

Material used to convert into finished goods,while labour does the given job in the specific time.

Overhead are those expenses which are associated with business for running it effectively.

The process of job costing has a particular procedure consist of enquiry, In which the

consumer is always concerned about the overall quality of raw material,which are required to

make the finished product (Otley, 2016).

Then estimate costing of job is done so that estimated cost could be obtained in mind of the

accountant. Order is placed if consumer is satisfied with the raw material and the cost of material

per unit is fixed before delivery it. Then the final activity are performed which includes the

completion of job,hence raw material are converted into finished product,and payments of bills

are prepared. The company uses Job costing is assigning the fair rate of cost in daily,hourly and

monthly bases , also uses it to distribute the actual cost of each project during process of

manufacturing.

PRICE OPTIMISING SYSTEM

This system is used to control the pricing of each and every resources used in the

company. And keep pricing minimum so that cost price of the product per unit can be

minimised, which helps in making finished product more profitable at time of selling. This

system have been also been utilised to identify the response of consumers towards the fluctuating

price. Hence C&S Builder Merchants LTD can use different price optimization technique. The

company C&S Builder Merchants LTD can use their system to cut down the prices of different

segment for their customer according to the responses (Lavia Lopez., 2014). This system helps in

determining the pricing structure for the activities in the organisation so that it leads to availing

higher profitability for business. The growth,maturity and the declined stage of of the product

determines the pricing of the product.

2

Job costing process involves total cost of material, labour and overhead for the particular

task. This system keeps tracks each and every record and monitor it accurately. It is used to

gather the information at small unit level. For example job costing is used for determine the cost

of the construction,which is the basic function of C&S Builder Merchants LTD. The following

accounting activities which involves in job costing such as labour ,material and over head. Raw

Material used to convert into finished goods,while labour does the given job in the specific time.

Overhead are those expenses which are associated with business for running it effectively.

The process of job costing has a particular procedure consist of enquiry, In which the

consumer is always concerned about the overall quality of raw material,which are required to

make the finished product (Otley, 2016).

Then estimate costing of job is done so that estimated cost could be obtained in mind of the

accountant. Order is placed if consumer is satisfied with the raw material and the cost of material

per unit is fixed before delivery it. Then the final activity are performed which includes the

completion of job,hence raw material are converted into finished product,and payments of bills

are prepared. The company uses Job costing is assigning the fair rate of cost in daily,hourly and

monthly bases , also uses it to distribute the actual cost of each project during process of

manufacturing.

PRICE OPTIMISING SYSTEM

This system is used to control the pricing of each and every resources used in the

company. And keep pricing minimum so that cost price of the product per unit can be

minimised, which helps in making finished product more profitable at time of selling. This

system have been also been utilised to identify the response of consumers towards the fluctuating

price. Hence C&S Builder Merchants LTD can use different price optimization technique. The

company C&S Builder Merchants LTD can use their system to cut down the prices of different

segment for their customer according to the responses (Lavia Lopez., 2014). This system helps in

determining the pricing structure for the activities in the organisation so that it leads to availing

higher profitability for business. The growth,maturity and the declined stage of of the product

determines the pricing of the product.

2

COST ACCOUNTING SYSTEM

The cost accounting system helps in finding cost estimate of the product. There are two

types of cost accounting system first one is job order costing ,which gathers the information of

manufacturing cost for each and every job separately. While the other one is Process costing,

which gathers the manufacturing cost separate for each process (Hiebl, 2014). It can be suitable

for company like C&S Builder Merchants LTD because it has developed a process involving

different department and cost flows from one to another department. It is essential to determine

the cost accounting in company to take the construction company to next level of success.

P2 methods of management accounting report

Management accounting is an important part of organisation, it gives clear and complete

picture of company's actual performance. Enterprise prepare these reports quarterly or annually

and these reports are only used for internal use. It is focused on different segments of business

and analyse performance of each segment. Management reports helps organisation in decision

making as they have all information about company performance. C&S Builder is a medium size

organisation, which deals in providing construction materials and products to individuals and

companies. It assist businesses in forecasting future decisions. It is very crucial part for small and

medium organisations to identify their strengths and weaknesses to be competitive in market

place. These reports helps in smooth functioning of operations. The following are some

management accounting reports prepared by organisations:

Budgeting Reports: These reports assist small and medium organisations to identify

their performance. It helps in preparing budget to determine estimated cost and revenues related

to the projects. Budget is prepared on basis of actual expenses of previous years. In C&S

Builder, managers use this report to provide bonus to its employees for achieving desired goals.

Budgets are prepared separately for each department (Cooper, 2017). It also helps enterprise in

cost controlling by identifying areas of wastages and analysing actual performance with

standards.

Inventory and manufacturing Reports: This kind of reports are prepared by

manufacturing concerns who produce physical products. It includes all costs related to

production of products and helps in making efficient process of manufacturing and inventory.

C&S Builder is a manufacturing organisation, these reports will help them to maintain enough

3

The cost accounting system helps in finding cost estimate of the product. There are two

types of cost accounting system first one is job order costing ,which gathers the information of

manufacturing cost for each and every job separately. While the other one is Process costing,

which gathers the manufacturing cost separate for each process (Hiebl, 2014). It can be suitable

for company like C&S Builder Merchants LTD because it has developed a process involving

different department and cost flows from one to another department. It is essential to determine

the cost accounting in company to take the construction company to next level of success.

P2 methods of management accounting report

Management accounting is an important part of organisation, it gives clear and complete

picture of company's actual performance. Enterprise prepare these reports quarterly or annually

and these reports are only used for internal use. It is focused on different segments of business

and analyse performance of each segment. Management reports helps organisation in decision

making as they have all information about company performance. C&S Builder is a medium size

organisation, which deals in providing construction materials and products to individuals and

companies. It assist businesses in forecasting future decisions. It is very crucial part for small and

medium organisations to identify their strengths and weaknesses to be competitive in market

place. These reports helps in smooth functioning of operations. The following are some

management accounting reports prepared by organisations:

Budgeting Reports: These reports assist small and medium organisations to identify

their performance. It helps in preparing budget to determine estimated cost and revenues related

to the projects. Budget is prepared on basis of actual expenses of previous years. In C&S

Builder, managers use this report to provide bonus to its employees for achieving desired goals.

Budgets are prepared separately for each department (Cooper, 2017). It also helps enterprise in

cost controlling by identifying areas of wastages and analysing actual performance with

standards.

Inventory and manufacturing Reports: This kind of reports are prepared by

manufacturing concerns who produce physical products. It includes all costs related to

production of products and helps in making efficient process of manufacturing and inventory.

C&S Builder is a manufacturing organisation, these reports will help them to maintain enough

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

inventory of stock to complete demands of their customers on time. It helps in improving

assembly line process and to analyse opportunities for various departments.

Job costing Reports: It is prepared to identify related expenses and revenues of a

particular project. It helps in evaluating profitability of project. It helps in identifying areas of

profitability, so that managers can increase productivity and profitability of business. In case of

C&S Builder, these reports assist in determining profitableness of particular task (Tappura,

2015). It identifies areas where company need to put extra efforts in order to enhance efficiency

and effectiveness. Profit margins are forecasted through this report as they have estimated cost

prices of production.

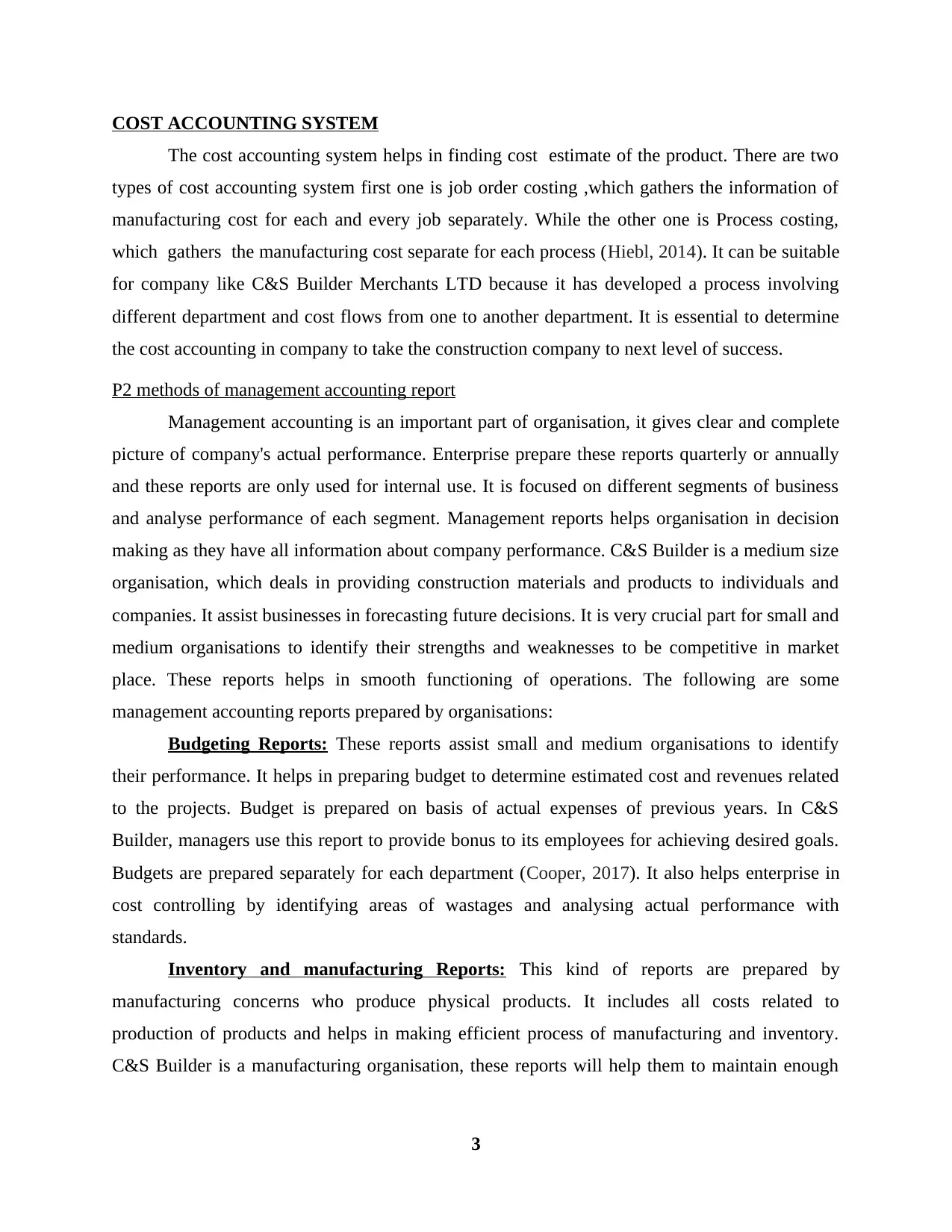

M1 Benefits of management accounting system

System Benefits

Price Optimization

System

For C&S Builder, it will help in cost control and setting prices for

products. This system determine demand fluctuation at different levels

of prices.

Job Costing system It will help C&S Builder in identifying per order cost and determine

operation expenses. It provides necessary information to measure

performance of individual in terms of effectiveness, productivity and

efficiency.

Cost accounting

system

It is helpful for C&S Builder for estimating product cost and control

material, labour and other costs relate to production. It will be helpful in

planing the budget and setting standards for measuring efficiency of

management (Senftlechner, 2015).

Inventory

management system

C&S Builder is a manufacturing business, this system will help in

supervising stock and assets of company. It is beneficial in delivering

customers demand in the right manner.

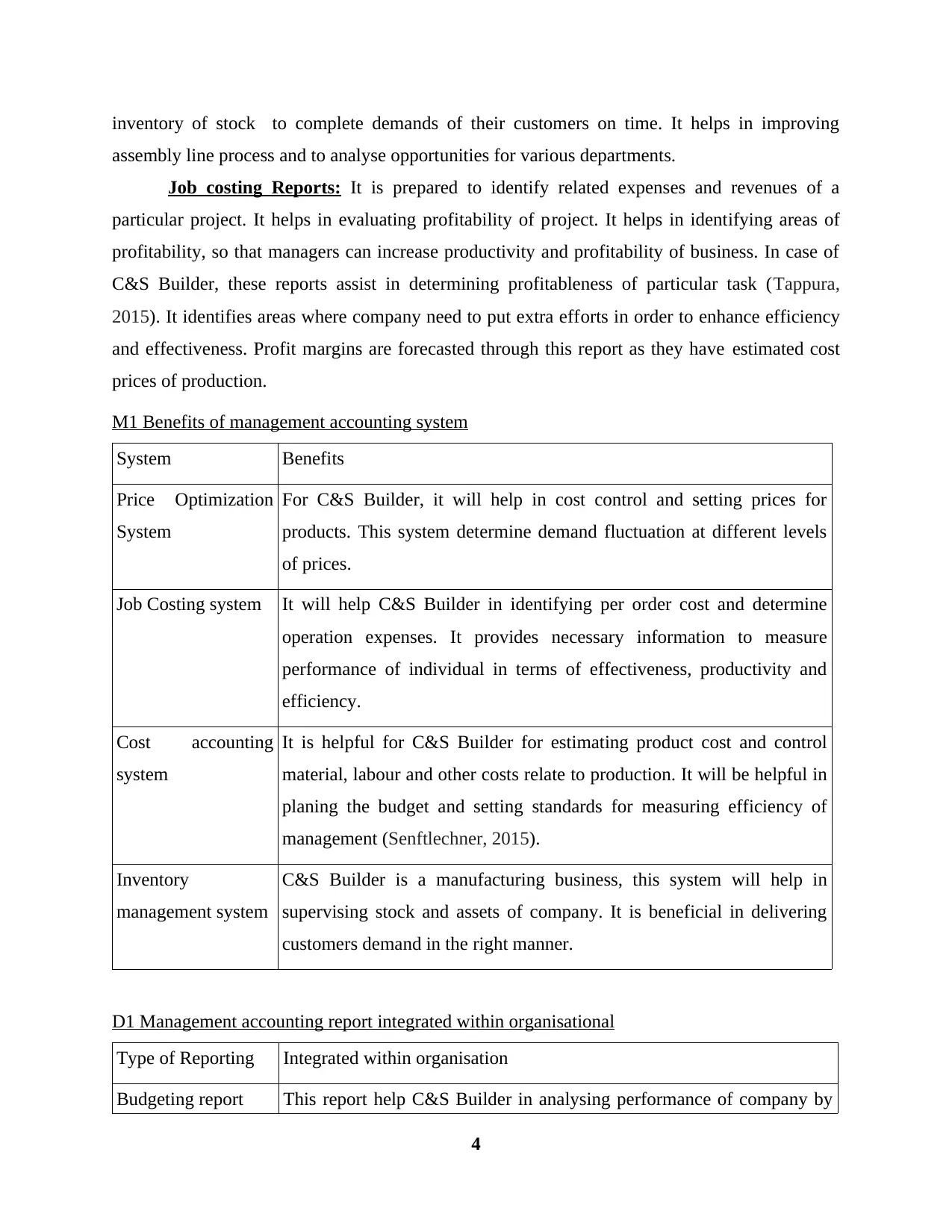

D1 Management accounting report integrated within organisational

Type of Reporting Integrated within organisation

Budgeting report This report help C&S Builder in analysing performance of company by

4

assembly line process and to analyse opportunities for various departments.

Job costing Reports: It is prepared to identify related expenses and revenues of a

particular project. It helps in evaluating profitability of project. It helps in identifying areas of

profitability, so that managers can increase productivity and profitability of business. In case of

C&S Builder, these reports assist in determining profitableness of particular task (Tappura,

2015). It identifies areas where company need to put extra efforts in order to enhance efficiency

and effectiveness. Profit margins are forecasted through this report as they have estimated cost

prices of production.

M1 Benefits of management accounting system

System Benefits

Price Optimization

System

For C&S Builder, it will help in cost control and setting prices for

products. This system determine demand fluctuation at different levels

of prices.

Job Costing system It will help C&S Builder in identifying per order cost and determine

operation expenses. It provides necessary information to measure

performance of individual in terms of effectiveness, productivity and

efficiency.

Cost accounting

system

It is helpful for C&S Builder for estimating product cost and control

material, labour and other costs relate to production. It will be helpful in

planing the budget and setting standards for measuring efficiency of

management (Senftlechner, 2015).

Inventory

management system

C&S Builder is a manufacturing business, this system will help in

supervising stock and assets of company. It is beneficial in delivering

customers demand in the right manner.

D1 Management accounting report integrated within organisational

Type of Reporting Integrated within organisation

Budgeting report This report help C&S Builder in analysing performance of company by

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

setting standards and comparing those standards with actual

performance. This assist in improvement of productivity.

Job Cost report Through this report C&S Builder can identify areas where management

needs to make efforts to increase efficiency.

Inventory and

Manufacturing

report

It will assist C&S Builder in improving inventory orders, increase sales

and improve delivery process of products.

TASK 2

P3 Calculation of an income statement

Cost - It is a real or actual amount of money that include all payments and contractual

obligation on an organisation which is need to be paid to prescribed parties before a particular

period of time. In business, two types of costs are considered: Fixed cost and variable cost.

Fixed cost is a cost or expense which remain constant during particular period of time. It

is an expense that does not varies with change in level of output. Building rent, machinery and

plant are examples of fixed cost (Bovens, 2014). On the other hand, Variable is a cost that

change with change in level of an output and depends on entire production output. Wages,

materials, utilities are common examples of variable cost.

Absorption costing - It is a cost accounting method for valuing inventory. This includes

all the costs of manufacturing a product including both fixed and variable costs. All cost means

direct material costs and indirect cost like overhead cost are included in the price of inventory.

There are four components of absorption costing: Direct material, direct labour, variable

manufacturing overhead and fixed manufacturing overhead.

Marginal costing is a additional cost incurred for a production of an additional unit of an

output. It indicates a rate at which total cost of a product changes as production increases by one

unit. It happens because fixed cost do not change based on number of products produced, the

marginal cost is influenced only by variations in the variable costs.

Working Notes:

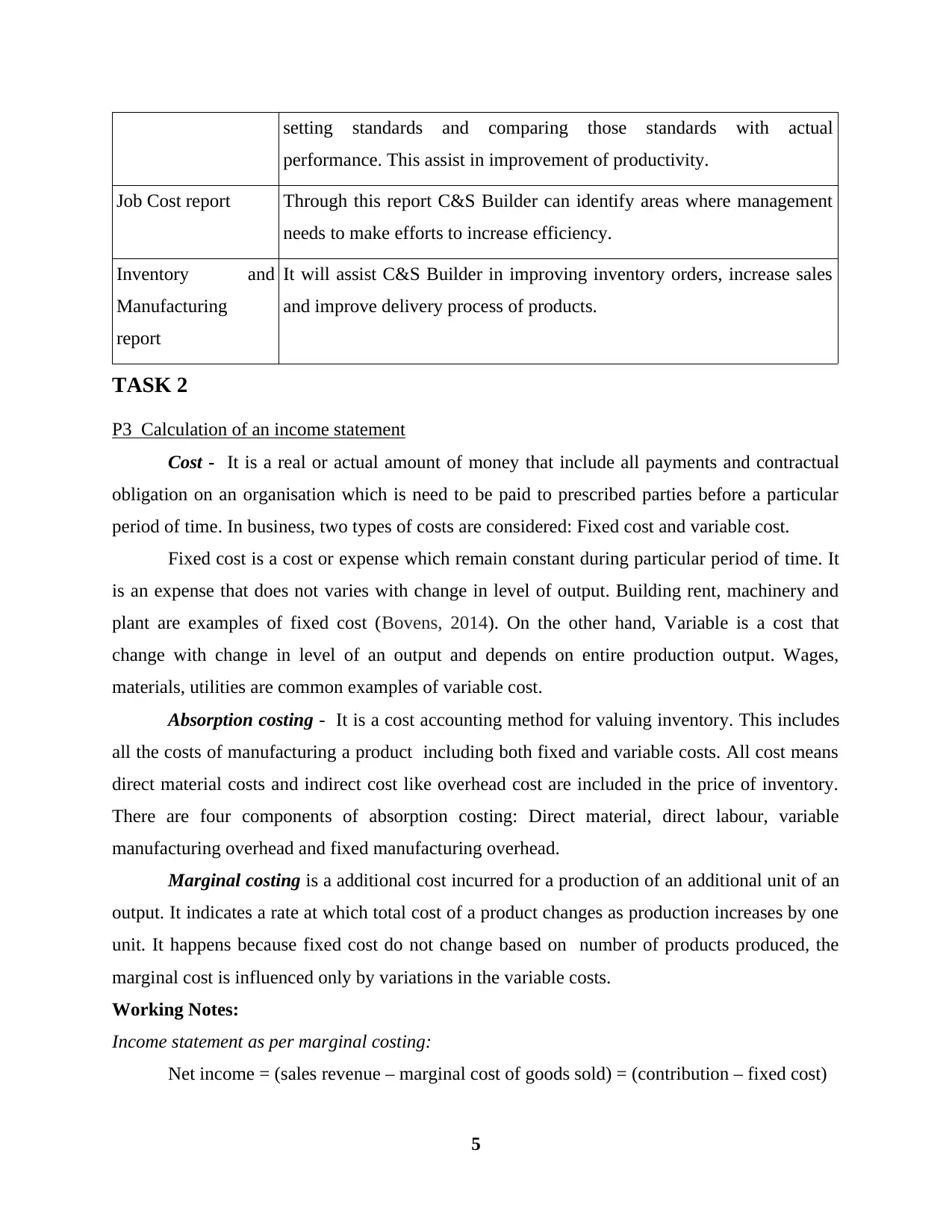

Income statement as per marginal costing:

Net income = (sales revenue – marginal cost of goods sold) = (contribution – fixed cost)

5

performance. This assist in improvement of productivity.

Job Cost report Through this report C&S Builder can identify areas where management

needs to make efforts to increase efficiency.

Inventory and

Manufacturing

report

It will assist C&S Builder in improving inventory orders, increase sales

and improve delivery process of products.

TASK 2

P3 Calculation of an income statement

Cost - It is a real or actual amount of money that include all payments and contractual

obligation on an organisation which is need to be paid to prescribed parties before a particular

period of time. In business, two types of costs are considered: Fixed cost and variable cost.

Fixed cost is a cost or expense which remain constant during particular period of time. It

is an expense that does not varies with change in level of output. Building rent, machinery and

plant are examples of fixed cost (Bovens, 2014). On the other hand, Variable is a cost that

change with change in level of an output and depends on entire production output. Wages,

materials, utilities are common examples of variable cost.

Absorption costing - It is a cost accounting method for valuing inventory. This includes

all the costs of manufacturing a product including both fixed and variable costs. All cost means

direct material costs and indirect cost like overhead cost are included in the price of inventory.

There are four components of absorption costing: Direct material, direct labour, variable

manufacturing overhead and fixed manufacturing overhead.

Marginal costing is a additional cost incurred for a production of an additional unit of an

output. It indicates a rate at which total cost of a product changes as production increases by one

unit. It happens because fixed cost do not change based on number of products produced, the

marginal cost is influenced only by variations in the variable costs.

Working Notes:

Income statement as per marginal costing:

Net income = (sales revenue – marginal cost of goods sold) = (contribution – fixed cost)

5

Particulars Amount

Sales revenue = (no. of units sold x selling price of each = 600 x 55) £33000

Marginal Cost of products sold: £9600

Production = (units produced x marginal cost per unit = 800 x 16) 12800

closing stock = (closing stock units x marginal cost per unit = 200 x

16) 3200

Contribution £23400

Fixed cost ( 3200+1200+1500 ) £5900

Net profit £17500

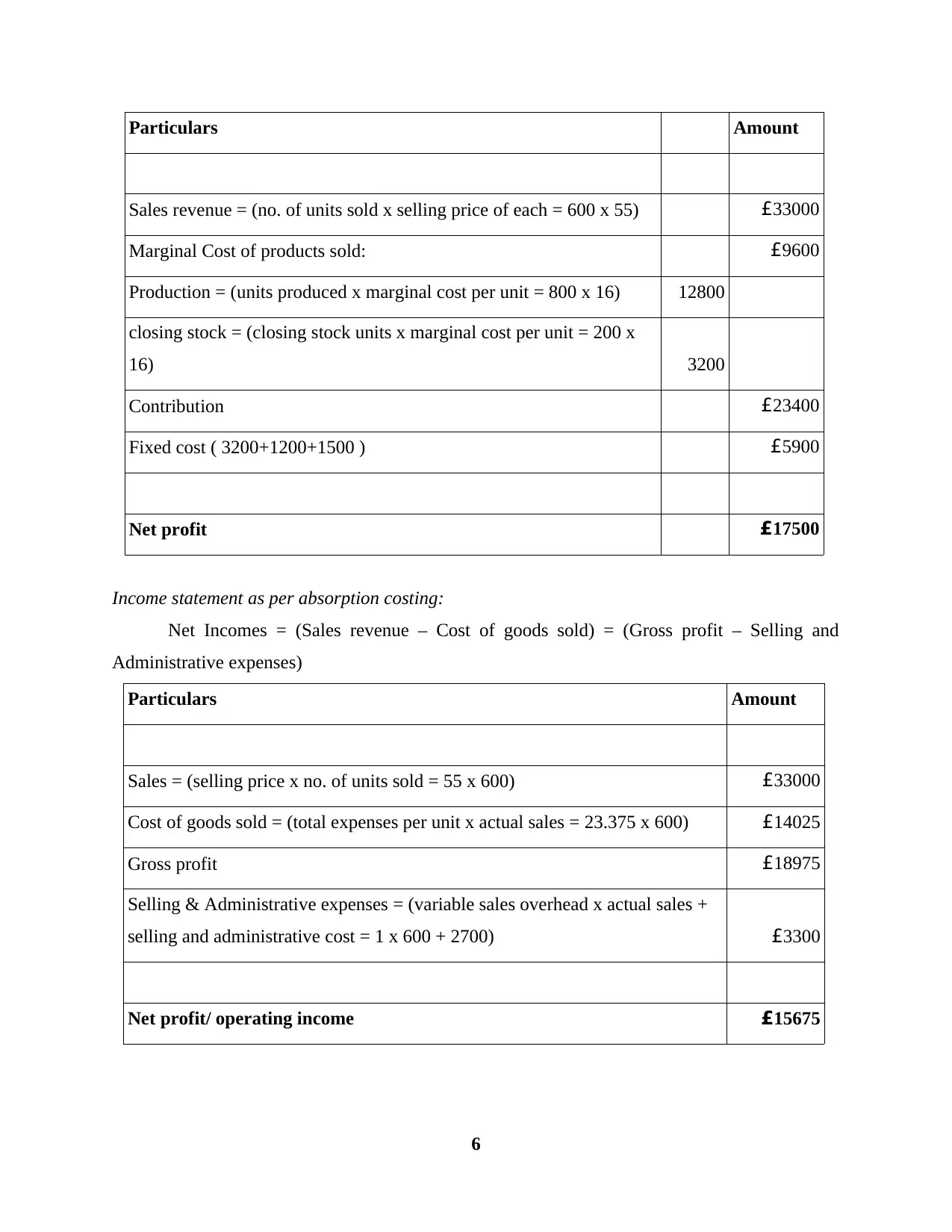

Income statement as per absorption costing:

Net Incomes = (Sales revenue – Cost of goods sold) = (Gross profit – Selling and

Administrative expenses)

Particulars Amount

Sales = (selling price x no. of units sold = 55 x 600) £33000

Cost of goods sold = (total expenses per unit x actual sales = 23.375 x 600) £14025

Gross profit £18975

Selling & Administrative expenses = (variable sales overhead x actual sales +

selling and administrative cost = 1 x 600 + 2700) £3300

Net profit/ operating income £15675

6

Sales revenue = (no. of units sold x selling price of each = 600 x 55) £33000

Marginal Cost of products sold: £9600

Production = (units produced x marginal cost per unit = 800 x 16) 12800

closing stock = (closing stock units x marginal cost per unit = 200 x

16) 3200

Contribution £23400

Fixed cost ( 3200+1200+1500 ) £5900

Net profit £17500

Income statement as per absorption costing:

Net Incomes = (Sales revenue – Cost of goods sold) = (Gross profit – Selling and

Administrative expenses)

Particulars Amount

Sales = (selling price x no. of units sold = 55 x 600) £33000

Cost of goods sold = (total expenses per unit x actual sales = 23.375 x 600) £14025

Gross profit £18975

Selling & Administrative expenses = (variable sales overhead x actual sales +

selling and administrative cost = 1 x 600 + 2700) £3300

Net profit/ operating income £15675

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

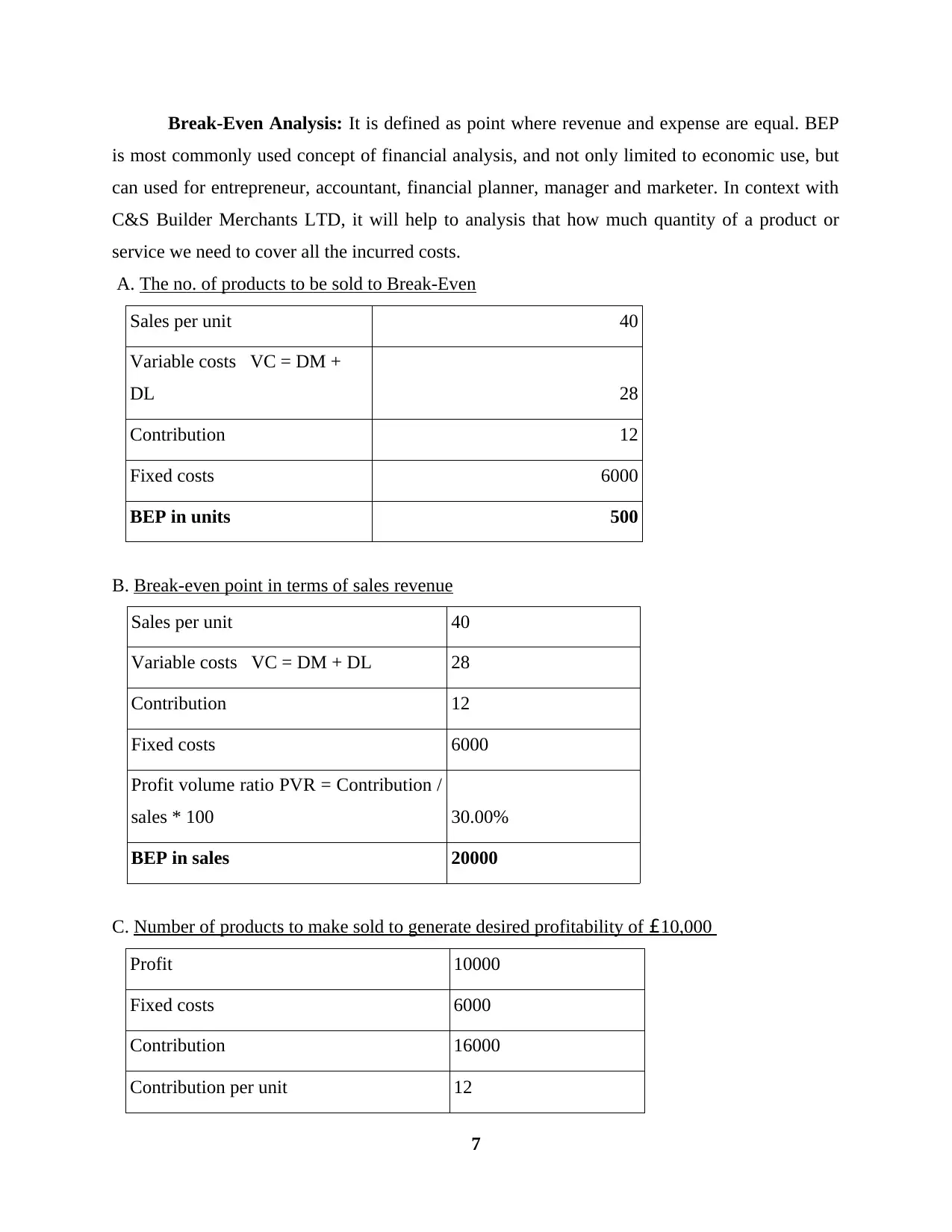

Break-Even Analysis: It is defined as point where revenue and expense are equal. BEP

is most commonly used concept of financial analysis, and not only limited to economic use, but

can used for entrepreneur, accountant, financial planner, manager and marketer. In context with

C&S Builder Merchants LTD, it will help to analysis that how much quantity of a product or

service we need to cover all the incurred costs.

A. The no. of products to be sold to Break-Even

Sales per unit 40

Variable costs VC = DM +

DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

B. Break-even point in terms of sales revenue

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution /

sales * 100 30.00%

BEP in sales 20000

C. Number of products to make sold to generate desired profitability of £10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

7

is most commonly used concept of financial analysis, and not only limited to economic use, but

can used for entrepreneur, accountant, financial planner, manager and marketer. In context with

C&S Builder Merchants LTD, it will help to analysis that how much quantity of a product or

service we need to cover all the incurred costs.

A. The no. of products to be sold to Break-Even

Sales per unit 40

Variable costs VC = DM +

DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

B. Break-even point in terms of sales revenue

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution /

sales * 100 30.00%

BEP in sales 20000

C. Number of products to make sold to generate desired profitability of £10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sales 1333.33

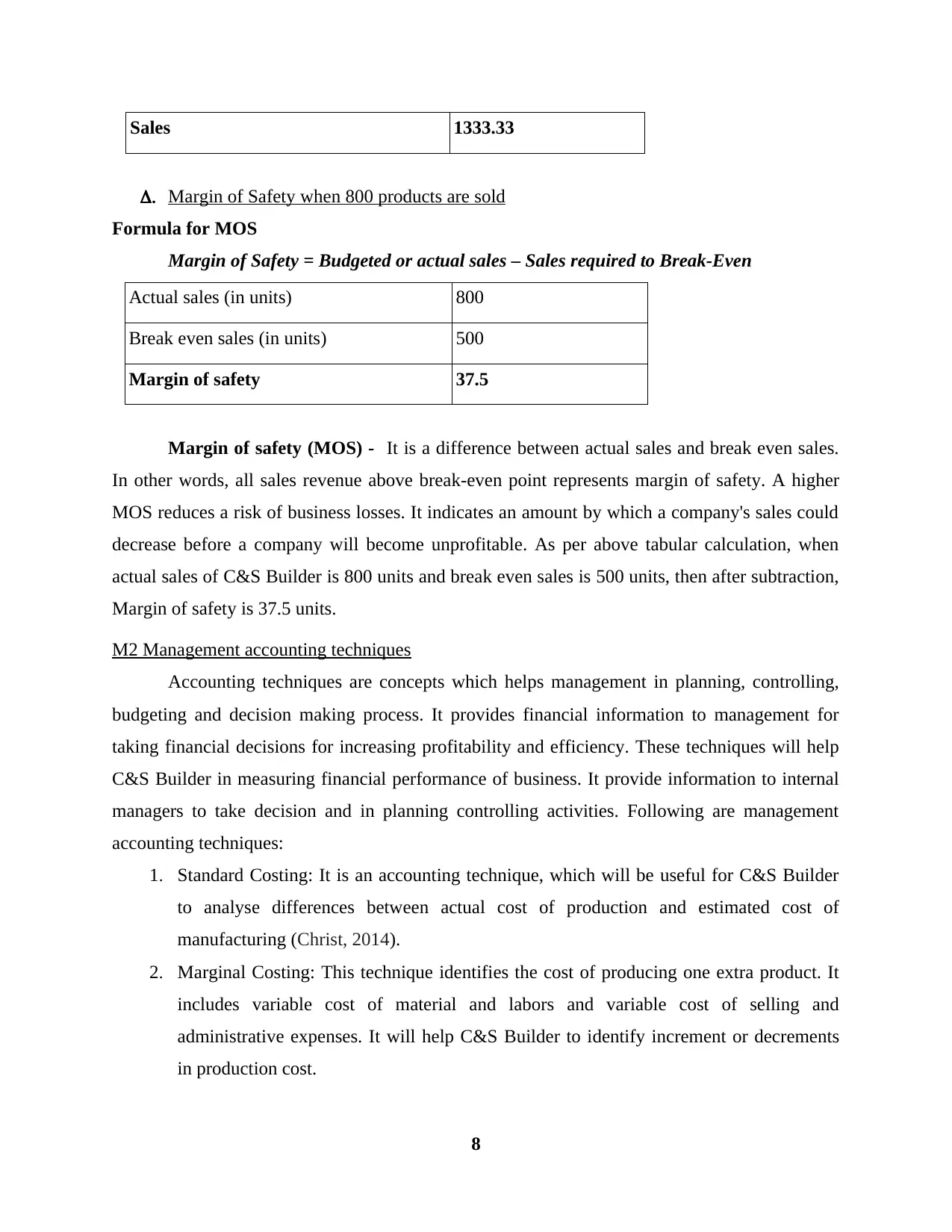

D. Margin of Safety when 800 products are sold

Formula for MOS

Margin of Safety = Budgeted or actual sales – Sales required to Break-Even

Actual sales (in units) 800

Break even sales (in units) 500

Margin of safety 37.5

Margin of safety (MOS) - It is a difference between actual sales and break even sales.

In other words, all sales revenue above break-even point represents margin of safety. A higher

MOS reduces a risk of business losses. It indicates an amount by which a company's sales could

decrease before a company will become unprofitable. As per above tabular calculation, when

actual sales of C&S Builder is 800 units and break even sales is 500 units, then after subtraction,

Margin of safety is 37.5 units.

M2 Management accounting techniques

Accounting techniques are concepts which helps management in planning, controlling,

budgeting and decision making process. It provides financial information to management for

taking financial decisions for increasing profitability and efficiency. These techniques will help

C&S Builder in measuring financial performance of business. It provide information to internal

managers to take decision and in planning controlling activities. Following are management

accounting techniques:

1. Standard Costing: It is an accounting technique, which will be useful for C&S Builder

to analyse differences between actual cost of production and estimated cost of

manufacturing (Christ, 2014).

2. Marginal Costing: This technique identifies the cost of producing one extra product. It

includes variable cost of material and labors and variable cost of selling and

administrative expenses. It will help C&S Builder to identify increment or decrements

in production cost.

8

D. Margin of Safety when 800 products are sold

Formula for MOS

Margin of Safety = Budgeted or actual sales – Sales required to Break-Even

Actual sales (in units) 800

Break even sales (in units) 500

Margin of safety 37.5

Margin of safety (MOS) - It is a difference between actual sales and break even sales.

In other words, all sales revenue above break-even point represents margin of safety. A higher

MOS reduces a risk of business losses. It indicates an amount by which a company's sales could

decrease before a company will become unprofitable. As per above tabular calculation, when

actual sales of C&S Builder is 800 units and break even sales is 500 units, then after subtraction,

Margin of safety is 37.5 units.

M2 Management accounting techniques

Accounting techniques are concepts which helps management in planning, controlling,

budgeting and decision making process. It provides financial information to management for

taking financial decisions for increasing profitability and efficiency. These techniques will help

C&S Builder in measuring financial performance of business. It provide information to internal

managers to take decision and in planning controlling activities. Following are management

accounting techniques:

1. Standard Costing: It is an accounting technique, which will be useful for C&S Builder

to analyse differences between actual cost of production and estimated cost of

manufacturing (Christ, 2014).

2. Marginal Costing: This technique identifies the cost of producing one extra product. It

includes variable cost of material and labors and variable cost of selling and

administrative expenses. It will help C&S Builder to identify increment or decrements

in production cost.

8

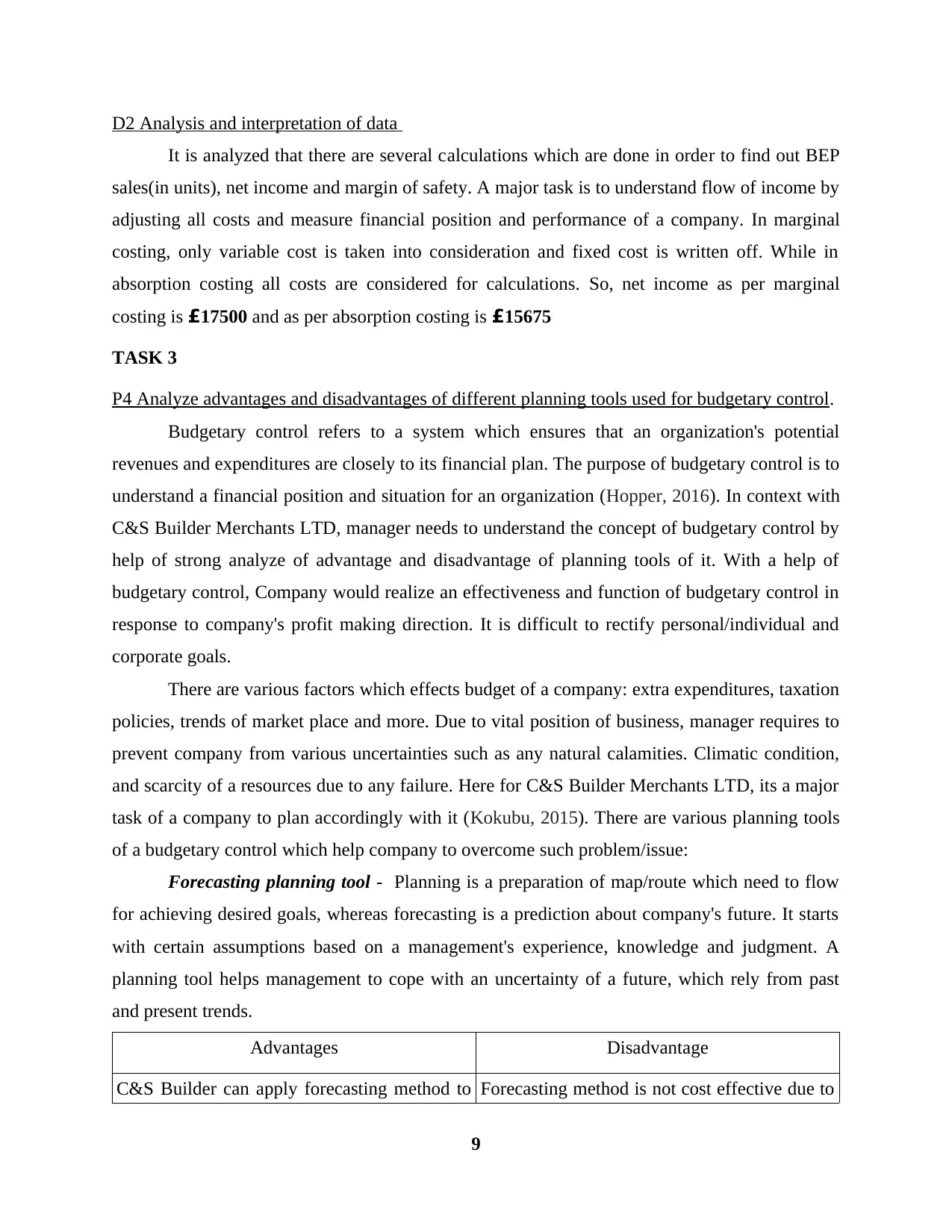

D2 Analysis and interpretation of data

It is analyzed that there are several calculations which are done in order to find out BEP

sales(in units), net income and margin of safety. A major task is to understand flow of income by

adjusting all costs and measure financial position and performance of a company. In marginal

costing, only variable cost is taken into consideration and fixed cost is written off. While in

absorption costing all costs are considered for calculations. So, net income as per marginal

costing is £17500 and as per absorption costing is £15675

TASK 3

P4 Analyze advantages and disadvantages of different planning tools used for budgetary control.

Budgetary control refers to a system which ensures that an organization's potential

revenues and expenditures are closely to its financial plan. The purpose of budgetary control is to

understand a financial position and situation for an organization (Hopper, 2016). In context with

C&S Builder Merchants LTD, manager needs to understand the concept of budgetary control by

help of strong analyze of advantage and disadvantage of planning tools of it. With a help of

budgetary control, Company would realize an effectiveness and function of budgetary control in

response to company's profit making direction. It is difficult to rectify personal/individual and

corporate goals.

There are various factors which effects budget of a company: extra expenditures, taxation

policies, trends of market place and more. Due to vital position of business, manager requires to

prevent company from various uncertainties such as any natural calamities. Climatic condition,

and scarcity of a resources due to any failure. Here for C&S Builder Merchants LTD, its a major

task of a company to plan accordingly with it (Kokubu, 2015). There are various planning tools

of a budgetary control which help company to overcome such problem/issue:

Forecasting planning tool - Planning is a preparation of map/route which need to flow

for achieving desired goals, whereas forecasting is a prediction about company's future. It starts

with certain assumptions based on a management's experience, knowledge and judgment. A

planning tool helps management to cope with an uncertainty of a future, which rely from past

and present trends.

Advantages Disadvantage

C&S Builder can apply forecasting method to Forecasting method is not cost effective due to

9

It is analyzed that there are several calculations which are done in order to find out BEP

sales(in units), net income and margin of safety. A major task is to understand flow of income by

adjusting all costs and measure financial position and performance of a company. In marginal

costing, only variable cost is taken into consideration and fixed cost is written off. While in

absorption costing all costs are considered for calculations. So, net income as per marginal

costing is £17500 and as per absorption costing is £15675

TASK 3

P4 Analyze advantages and disadvantages of different planning tools used for budgetary control.

Budgetary control refers to a system which ensures that an organization's potential

revenues and expenditures are closely to its financial plan. The purpose of budgetary control is to

understand a financial position and situation for an organization (Hopper, 2016). In context with

C&S Builder Merchants LTD, manager needs to understand the concept of budgetary control by

help of strong analyze of advantage and disadvantage of planning tools of it. With a help of

budgetary control, Company would realize an effectiveness and function of budgetary control in

response to company's profit making direction. It is difficult to rectify personal/individual and

corporate goals.

There are various factors which effects budget of a company: extra expenditures, taxation

policies, trends of market place and more. Due to vital position of business, manager requires to

prevent company from various uncertainties such as any natural calamities. Climatic condition,

and scarcity of a resources due to any failure. Here for C&S Builder Merchants LTD, its a major

task of a company to plan accordingly with it (Kokubu, 2015). There are various planning tools

of a budgetary control which help company to overcome such problem/issue:

Forecasting planning tool - Planning is a preparation of map/route which need to flow

for achieving desired goals, whereas forecasting is a prediction about company's future. It starts

with certain assumptions based on a management's experience, knowledge and judgment. A

planning tool helps management to cope with an uncertainty of a future, which rely from past

and present trends.

Advantages Disadvantage

C&S Builder can apply forecasting method to Forecasting method is not cost effective due to

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.