Management Accounting Report: R.L. Maynard Case Study Analysis

VerifiedAdded on 2020/02/05

|17

|5600

|34

Report

AI Summary

This report examines management accounting practices, focusing on the case of R.L. Maynard, a small to medium-sized enterprise (SME). The report begins with an introduction to management accounting and its importance, differentiating it from financial accounting. It explores various management accounting systems, including traditional cost accounting, cost accounting systems, job costing, batch costing, inventory management, price optimization, lean accounting, throughput accounting, and transfer pricing. The report then details different management accounting reporting methods such as job cost reports, budgeting reports, and sales reports. Furthermore, the report delves into cost accounting techniques, including marginal and absorption costing. It also discusses budgetary control, planning tools, and the adaptation of management accounting systems to address financial problems, concluding with a summary of the findings and references.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1) Management accounting and essential requirements of different types of management

accounting systems.................................................................................................................3

P2Explain different methods that are used in management accounting reporting.................6

TASK 2............................................................................................................................................7

P3Calculate unit cost and also describe the difference among the marginal and absorption

costing technique....................................................................................................................7

TASK 3............................................................................................................................................9

P4) Advantages and disadvantages of different types of planning tools for budgetary control

................................................................................................................................................9

P5 Compare how organisation should adapt management accounting system to respond the

financial problems................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1) Management accounting and essential requirements of different types of management

accounting systems.................................................................................................................3

P2Explain different methods that are used in management accounting reporting.................6

TASK 2............................................................................................................................................7

P3Calculate unit cost and also describe the difference among the marginal and absorption

costing technique....................................................................................................................7

TASK 3............................................................................................................................................9

P4) Advantages and disadvantages of different types of planning tools for budgetary control

................................................................................................................................................9

P5 Compare how organisation should adapt management accounting system to respond the

financial problems................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting plays a very significant role in the organisation as they are the

integral part within the management. Therefore, management accountant plays a great role in

providing the proper guidance and advises that assist them to run the business activities

smoothly. It also assists in enhancing the efficiency level in both management as well as staff

workers. Management accounting is totally different from the financial accounting as they are

always looking forwards rather than take historical based data. Therefore, it mainly consists of

the information regard to statistical and financial due to which managers make their day to day

decisions regard to business activities. The research project in context to the R.L. Maynard is

small size medium enterprises in that are only 50 employees are working and the annual net

turnover is less than £500,000. There is a discussion on the management accounting and

there necessary requirement of different types of management accounting system (Scapens and

Bromwich, 2010). Furthermore, there is an also study on the various methods which are mainly

use in the management accounting reporting. Thereafter, income statement has been prepared by

the company by adopting two different techniques are the marginal and absorption costing

techniques. Further, there is an also study on the budgetary control and its various types of

planning tools. Along with that, there is an also description on management accounting system

that are responding the financial problems.

TASK 1

P1) Management accounting and essential requirements of different types of management

accounting systems

Management Accounting:

Managers have to keep a track of different activities which take place in the organisation

for which they are working. R L Maynard is an organisation that has to maintain its flow of

information and accounts so that finances and resources are well managed. The term

management accounting or managerial accounting is based on the specific provisions of

accounting information for getting better perception about the financial or non-financial situation

and make effective decisions (Ward, 2012). This practise is applicable in three wide areas i.e.

strategic management, performance management and risk management. Company can get better

strategies and organisational heads will be able to make effective decisions through these

Management accounting plays a very significant role in the organisation as they are the

integral part within the management. Therefore, management accountant plays a great role in

providing the proper guidance and advises that assist them to run the business activities

smoothly. It also assists in enhancing the efficiency level in both management as well as staff

workers. Management accounting is totally different from the financial accounting as they are

always looking forwards rather than take historical based data. Therefore, it mainly consists of

the information regard to statistical and financial due to which managers make their day to day

decisions regard to business activities. The research project in context to the R.L. Maynard is

small size medium enterprises in that are only 50 employees are working and the annual net

turnover is less than £500,000. There is a discussion on the management accounting and

there necessary requirement of different types of management accounting system (Scapens and

Bromwich, 2010). Furthermore, there is an also study on the various methods which are mainly

use in the management accounting reporting. Thereafter, income statement has been prepared by

the company by adopting two different techniques are the marginal and absorption costing

techniques. Further, there is an also study on the budgetary control and its various types of

planning tools. Along with that, there is an also description on management accounting system

that are responding the financial problems.

TASK 1

P1) Management accounting and essential requirements of different types of management

accounting systems

Management Accounting:

Managers have to keep a track of different activities which take place in the organisation

for which they are working. R L Maynard is an organisation that has to maintain its flow of

information and accounts so that finances and resources are well managed. The term

management accounting or managerial accounting is based on the specific provisions of

accounting information for getting better perception about the financial or non-financial situation

and make effective decisions (Ward, 2012). This practise is applicable in three wide areas i.e.

strategic management, performance management and risk management. Company can get better

strategies and organisational heads will be able to make effective decisions through these

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

aspects. Financial statements are presented with better evaluation when management accounting

practises are incorporated. Analysis, interpretation and presentation of the data is very efficiently

done (Parker, 2012).

Often management accounting and financial accounting are confused with each other.

But these two terminologies are quite different and have a separate meaning and application

(Fullerton, Kennedy and Widener, 2013). Financial accounting is preparation of reports which

are formed on the basis of past performances. However, management accounting is totally based

on the collection of data from revenues, outstanding debt requirements which are further utilised

for managing everyday operations and business decisions (Bebbington and Thomson, 2013).

Different types of management accounting systems:

Traditional cost accounting: Company’s overhead manufacturing costs when allocated

effectively then traditional cost accounting method is said to be initiated (DRURY, 2013). Also

referred as conventional technique of cost accounting, the indirect costs associated with goods

which are to be manufactured by R L Maynardare depicted and allocated in this system. The

major attributes which were included in this system are labour hours which are directly

applicable on production, machine hours, and volumes of units produced in a particular time slot,

etc. Earlier business organisations faced a lot of issues and problems because of external

expenses depicted in the financial statements (Li and et. al., 2012). The uniformity in products

was demanded by customers but this lead to serious complications in manufacturing and

production due to lesser technologies. Hence, there is a need to gain estimates of the pricing

which is considered as overhead costs. This was performed under traditional cost accounting.

Cost accounting system: This type of management accounting system is also known as

product costing system. The entire framework is developed by businesses to get an estimate

regarding the costs associated with products and followed by their analysis of profitability. Other

functions involved in this system are cost control and inventory valuation. R L Maynard will be

able to understand the estimate and realise the products that are profitable and the ones that are

not generating any sort of profit.

Job costing system: Under the cost accounting system, job order costing or job costing is

also involved. According to this system, the cost of manufacturing on every job of the company

(R L Maynard) is estimated separately. The production of specialised services and products

which are unique in qualities is controlled through job costing system. The appropriateness of

practises are incorporated. Analysis, interpretation and presentation of the data is very efficiently

done (Parker, 2012).

Often management accounting and financial accounting are confused with each other.

But these two terminologies are quite different and have a separate meaning and application

(Fullerton, Kennedy and Widener, 2013). Financial accounting is preparation of reports which

are formed on the basis of past performances. However, management accounting is totally based

on the collection of data from revenues, outstanding debt requirements which are further utilised

for managing everyday operations and business decisions (Bebbington and Thomson, 2013).

Different types of management accounting systems:

Traditional cost accounting: Company’s overhead manufacturing costs when allocated

effectively then traditional cost accounting method is said to be initiated (DRURY, 2013). Also

referred as conventional technique of cost accounting, the indirect costs associated with goods

which are to be manufactured by R L Maynardare depicted and allocated in this system. The

major attributes which were included in this system are labour hours which are directly

applicable on production, machine hours, and volumes of units produced in a particular time slot,

etc. Earlier business organisations faced a lot of issues and problems because of external

expenses depicted in the financial statements (Li and et. al., 2012). The uniformity in products

was demanded by customers but this lead to serious complications in manufacturing and

production due to lesser technologies. Hence, there is a need to gain estimates of the pricing

which is considered as overhead costs. This was performed under traditional cost accounting.

Cost accounting system: This type of management accounting system is also known as

product costing system. The entire framework is developed by businesses to get an estimate

regarding the costs associated with products and followed by their analysis of profitability. Other

functions involved in this system are cost control and inventory valuation. R L Maynard will be

able to understand the estimate and realise the products that are profitable and the ones that are

not generating any sort of profit.

Job costing system: Under the cost accounting system, job order costing or job costing is

also involved. According to this system, the cost of manufacturing on every job of the company

(R L Maynard) is estimated separately. The production of specialised services and products

which are unique in qualities is controlled through job costing system. The appropriateness of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

this costing system is quite less for R L Maynard as compared to the organisations that have

continuous involvement of production of unique products and services.

Batch costing system: The accounting system which involves specific order is known as

batch costing system. There are large similarities between job costing and batch costing. The

only difference is that instead of estimating the cost involved per job, here the cost of production

of each batch is estimated and specific control measures are developed. Once, the estimation of

cost for a batch is gained, the company can then opt for finding the estimate cost of production

for every item.

Inventory management system: R L Maynard has inventory in the form of products.

According to demand proposed in the market, necessary supply is provided. If there is no

inventory management system applied in the company then a disproportionate figure is acquired

in the flow of supply and demand. The number of orders, sales and deliveries that are tackling

place are systematically arranged and tracked so that decisions regarding further production can

be made.

Price optimisation system: Often companies face trouble in gaining profits and managing

their expenses. The price optimisation system is analytical tool which helps organisations like R

L Maynard to estimate the reactions or response of customers when variable prices are defined

for products and services at several working channels. This helps in selecting the best suited

mode of operations and the attribute of maximised profits is gained through this system.

Lean accounting: Business strategies are incomplete without proper financial assistance

and functioning (ter Bogt and van Helden, 2012). The lean accounting system was developed for

assisting the business strategies and plans of lean enterprises. R L Maynard can experience

greater productivity and profitability if this principle system is applied. The purpose of this

accounting system was largely inspired by lean manufacturing which was based on total quality

management and improvements on a continuous basis (Bouten and Hoozée, 2013.). Entire

accounting, control and measurement processes which have been employed in the organisation

have to be guided by lean processes that reduce commitment of errors, defects and makes the

functioning much more fruitful and benefactor.

R L Maynard can experience reduction in wastage of resources and funds when lean

accounting system is applied. There is a significant use of this system in cost reduction and

efficiency increment. If resources are correctly utilised and less number of errors are made then it

continuous involvement of production of unique products and services.

Batch costing system: The accounting system which involves specific order is known as

batch costing system. There are large similarities between job costing and batch costing. The

only difference is that instead of estimating the cost involved per job, here the cost of production

of each batch is estimated and specific control measures are developed. Once, the estimation of

cost for a batch is gained, the company can then opt for finding the estimate cost of production

for every item.

Inventory management system: R L Maynard has inventory in the form of products.

According to demand proposed in the market, necessary supply is provided. If there is no

inventory management system applied in the company then a disproportionate figure is acquired

in the flow of supply and demand. The number of orders, sales and deliveries that are tackling

place are systematically arranged and tracked so that decisions regarding further production can

be made.

Price optimisation system: Often companies face trouble in gaining profits and managing

their expenses. The price optimisation system is analytical tool which helps organisations like R

L Maynard to estimate the reactions or response of customers when variable prices are defined

for products and services at several working channels. This helps in selecting the best suited

mode of operations and the attribute of maximised profits is gained through this system.

Lean accounting: Business strategies are incomplete without proper financial assistance

and functioning (ter Bogt and van Helden, 2012). The lean accounting system was developed for

assisting the business strategies and plans of lean enterprises. R L Maynard can experience

greater productivity and profitability if this principle system is applied. The purpose of this

accounting system was largely inspired by lean manufacturing which was based on total quality

management and improvements on a continuous basis (Bouten and Hoozée, 2013.). Entire

accounting, control and measurement processes which have been employed in the organisation

have to be guided by lean processes that reduce commitment of errors, defects and makes the

functioning much more fruitful and benefactor.

R L Maynard can experience reduction in wastage of resources and funds when lean

accounting system is applied. There is a significant use of this system in cost reduction and

efficiency increment. If resources are correctly utilised and less number of errors are made then it

becomes easier for reaching customer satisfaction levels (DRURY, 2013). Financial position in

the strategic markets is easily estimated and deeper understanding is created. As a result,

managers are able to take decisions which are more favourable and act as controller of financial

losses. Sales, production and improvements in organisational growth can be witnessed through

this accounting system (Li, Sawhney and Ramasamy, 2012.).

Throughput accounting system: Enterprises have managers that perform the financial

analysis and other accounting operations for providing information which will further be helpful

in improving the profitability of the company (Ward, 2012). R L Maynard can experience this

growth through Throughput accounting system which is based on principle based management

accounting. This system is also referred as TA. Organisational goals and objectives can be

achieved when TA is initialised. This system helps in identifying the limits or core competencies

which take forward the company towards goals. Once this limit is reached, simplified measures

are taken for driving entire business operations towards the same (Ward, 2012). TA doesn’t

allocate costs but it has focused cash which involved neither cost accounting nor costing. Major

aim of this system is maximise profits and opportunities of growth for organisation without

incurring much heavier costs and improvements.

Being an internal reporting tool, this management accounting system has to be helpful in

enforcing efficiency with greater effectiveness. It not only enhances shareholder wealth but

improves the profit performance of R L Maynard. This attribute automatically becomes helpful

in solving the major satisfactory issues of different stakeholders. The major advantage of this

system is its wider applicability (Parker, 2012). The entire financial management is diverted for

non-profit or voluntary organisations also.

Transfer pricing: Businesses have to deal with internal and external transactions. Internal

ones occur between different departments say suppliers and the manufacturers, etc. This kind of

transfer of money internally is considered as transfer pricing. The trade which exists between

different entities inside the large firm uses this management accounting system for measuring

and managing the finances (Fullerton, Kennedy and Widener, 2013). Every individual

department has its own share of profit when considering the entire product or service which is to

be delivered to customers. It may be possible that ineffective management can lead to significant

conflicts and clashes inter-departmentally. Henceforth, R L Maynard has to devise an efficient

management accounting system like transfer pricing for maintaining a balance and equality when

the strategic markets is easily estimated and deeper understanding is created. As a result,

managers are able to take decisions which are more favourable and act as controller of financial

losses. Sales, production and improvements in organisational growth can be witnessed through

this accounting system (Li, Sawhney and Ramasamy, 2012.).

Throughput accounting system: Enterprises have managers that perform the financial

analysis and other accounting operations for providing information which will further be helpful

in improving the profitability of the company (Ward, 2012). R L Maynard can experience this

growth through Throughput accounting system which is based on principle based management

accounting. This system is also referred as TA. Organisational goals and objectives can be

achieved when TA is initialised. This system helps in identifying the limits or core competencies

which take forward the company towards goals. Once this limit is reached, simplified measures

are taken for driving entire business operations towards the same (Ward, 2012). TA doesn’t

allocate costs but it has focused cash which involved neither cost accounting nor costing. Major

aim of this system is maximise profits and opportunities of growth for organisation without

incurring much heavier costs and improvements.

Being an internal reporting tool, this management accounting system has to be helpful in

enforcing efficiency with greater effectiveness. It not only enhances shareholder wealth but

improves the profit performance of R L Maynard. This attribute automatically becomes helpful

in solving the major satisfactory issues of different stakeholders. The major advantage of this

system is its wider applicability (Parker, 2012). The entire financial management is diverted for

non-profit or voluntary organisations also.

Transfer pricing: Businesses have to deal with internal and external transactions. Internal

ones occur between different departments say suppliers and the manufacturers, etc. This kind of

transfer of money internally is considered as transfer pricing. The trade which exists between

different entities inside the large firm uses this management accounting system for measuring

and managing the finances (Fullerton, Kennedy and Widener, 2013). Every individual

department has its own share of profit when considering the entire product or service which is to

be delivered to customers. It may be possible that ineffective management can lead to significant

conflicts and clashes inter-departmentally. Henceforth, R L Maynard has to devise an efficient

management accounting system like transfer pricing for maintaining a balance and equality when

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

it comes to sharing of profits and losses. The rules and regulations which have been devised

under this system have to be followed by each and every department while making a transaction

from one entity to another (Bebbington and Thomson, 2013).

P2. Explain different methods that are used in management accounting reporting

There various different types of methods that are used by R.L. Maynard in the management

accounting reporting which are describe as follows-

Job cost reports- It is the most important for the firm in which it mainly consist of crucial

information that are provided within the organisation. It is mainly regard to the recent job

status which assists the firm to determining the how job is to be completed in respective of

revenues and cost (Pitkänen and Lukka, 2011). The main advantage of job costing is that it

assist the management accountant under they can effectively allocating the cost that are

directly relating to the job. It also helps the Company to effectively control cost before it

starts under control by the management accountant.

Budgeting reports- R.L.Maynard used the budgeting reports in which the management

accountant used the budgeted reports. It assist the firm to evaluate the financial performance

by make comparison among the budgeted projection and actual number in an accounting

period. Therefore, these budgeted reports are majorly includes in which there is a detailed

information that are regard to budget and accounting information. It is majorly based upon

on the accrual basis that are used in accounting. Main purpose of budgetary report is that to

show the compliance with the laws and also provide an extra information regard to revenues

and expenses which are not presenting in the CAFR.

Sales reports- It is that type of report under which there is a detailed information regard to

sales activities that are carried out by the sales team and it assist the sales manager to

measure the performance of these team members (Englund and Gerdin, 2011). Apart from

this, it also shows the selling of company’s products or services to the customers at specific

time period. Thus, it also assists the management of R.L. Maynard to finding out the sales

profits that are made under the particular time bound. Therefore, the main benefits from the

sales reports is that the Company can estimated their financial position by make comparison

among sales figure of current year with the previous year figures.

under this system have to be followed by each and every department while making a transaction

from one entity to another (Bebbington and Thomson, 2013).

P2. Explain different methods that are used in management accounting reporting

There various different types of methods that are used by R.L. Maynard in the management

accounting reporting which are describe as follows-

Job cost reports- It is the most important for the firm in which it mainly consist of crucial

information that are provided within the organisation. It is mainly regard to the recent job

status which assists the firm to determining the how job is to be completed in respective of

revenues and cost (Pitkänen and Lukka, 2011). The main advantage of job costing is that it

assist the management accountant under they can effectively allocating the cost that are

directly relating to the job. It also helps the Company to effectively control cost before it

starts under control by the management accountant.

Budgeting reports- R.L.Maynard used the budgeting reports in which the management

accountant used the budgeted reports. It assist the firm to evaluate the financial performance

by make comparison among the budgeted projection and actual number in an accounting

period. Therefore, these budgeted reports are majorly includes in which there is a detailed

information that are regard to budget and accounting information. It is majorly based upon

on the accrual basis that are used in accounting. Main purpose of budgetary report is that to

show the compliance with the laws and also provide an extra information regard to revenues

and expenses which are not presenting in the CAFR.

Sales reports- It is that type of report under which there is a detailed information regard to

sales activities that are carried out by the sales team and it assist the sales manager to

measure the performance of these team members (Englund and Gerdin, 2011). Apart from

this, it also shows the selling of company’s products or services to the customers at specific

time period. Thus, it also assists the management of R.L. Maynard to finding out the sales

profits that are made under the particular time bound. Therefore, the main benefits from the

sales reports is that the Company can estimated their financial position by make comparison

among sales figure of current year with the previous year figures.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

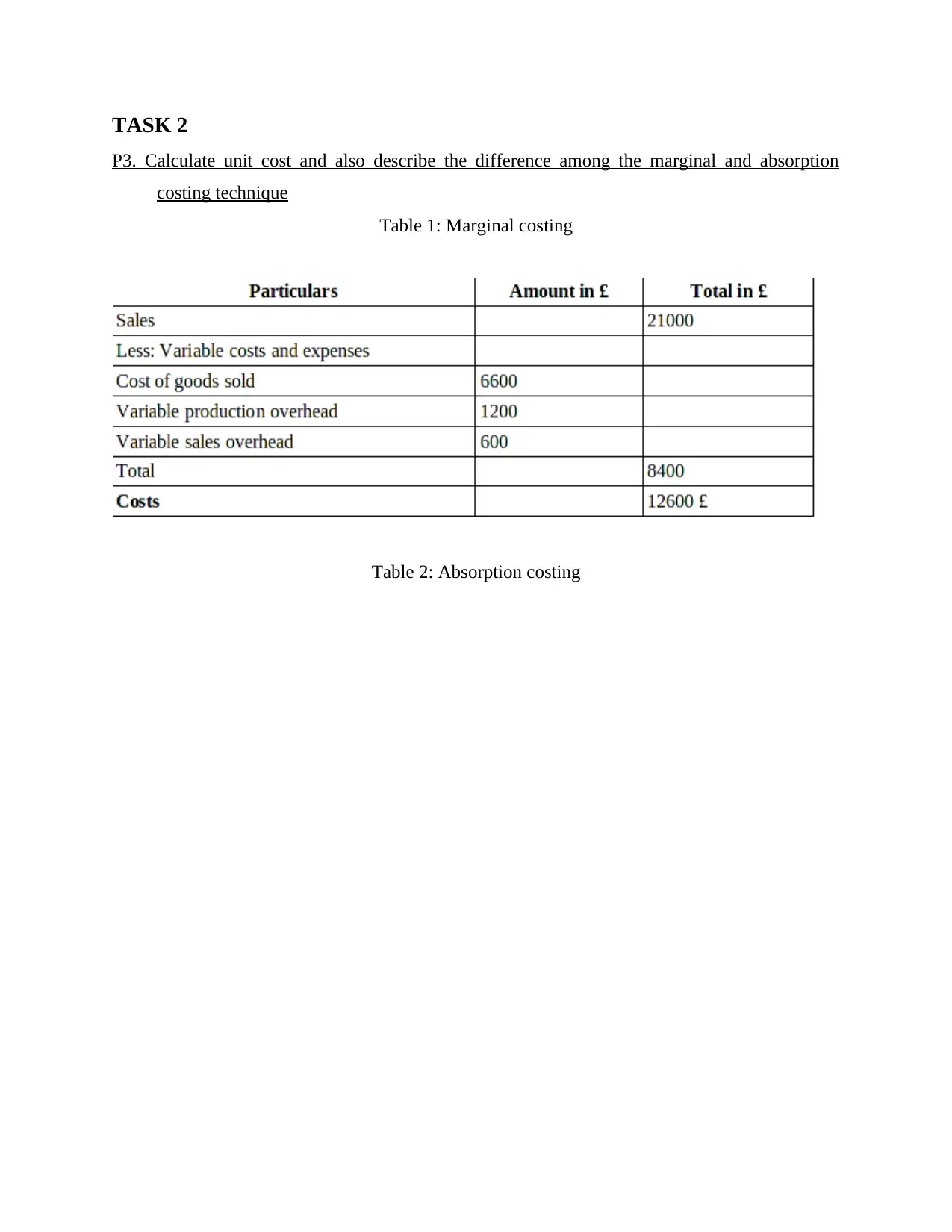

P3. Calculate unit cost and also describe the difference among the marginal and absorption

costing technique

Table 1: Marginal costing

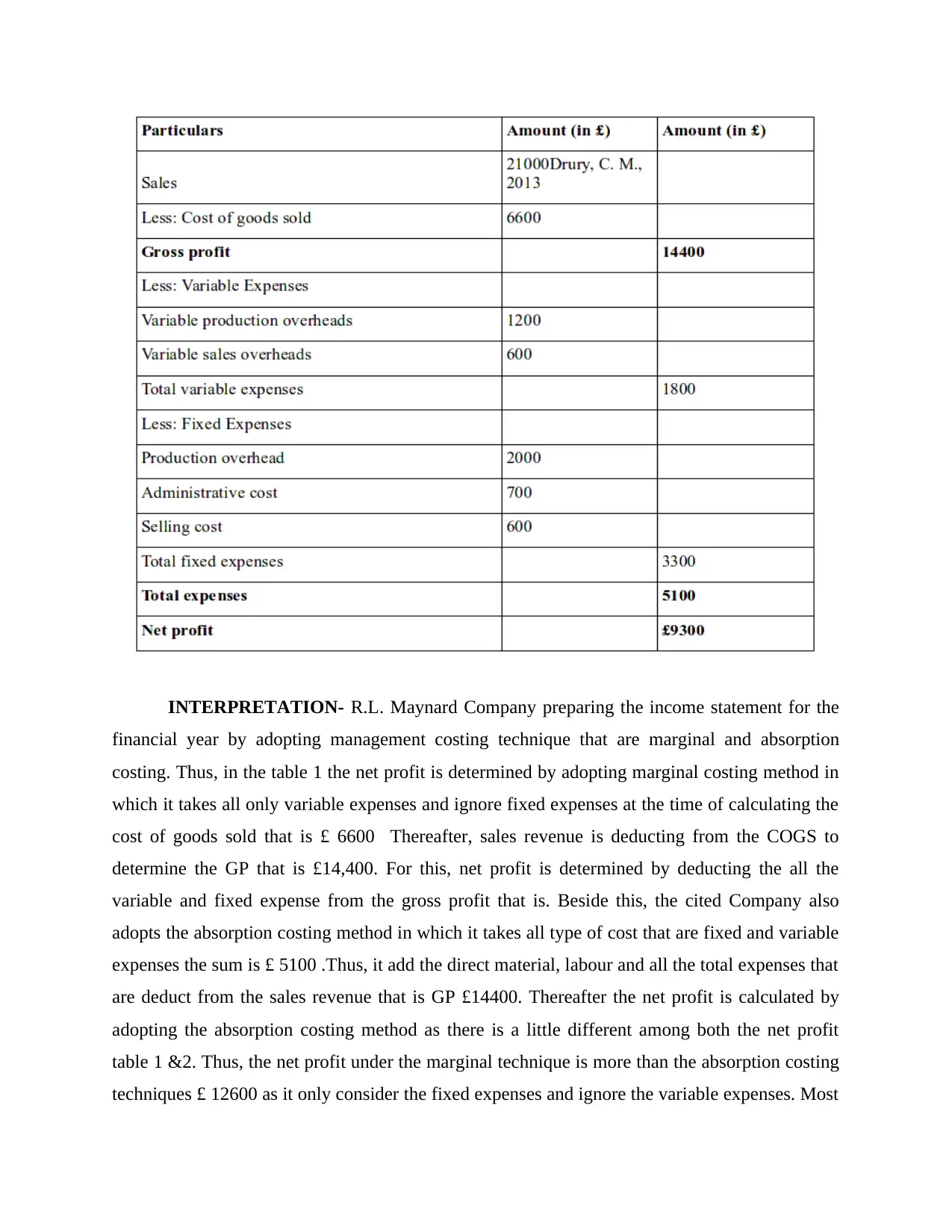

Table 2: Absorption costing

P3. Calculate unit cost and also describe the difference among the marginal and absorption

costing technique

Table 1: Marginal costing

Table 2: Absorption costing

INTERPRETATION- R.L. Maynard Company preparing the income statement for the

financial year by adopting management costing technique that are marginal and absorption

costing. Thus, in the table 1 the net profit is determined by adopting marginal costing method in

which it takes all only variable expenses and ignore fixed expenses at the time of calculating the

cost of goods sold that is £ 6600 Thereafter, sales revenue is deducting from the COGS to

determine the GP that is £14,400. For this, net profit is determined by deducting the all the

variable and fixed expense from the gross profit that is. Beside this, the cited Company also

adopts the absorption costing method in which it takes all type of cost that are fixed and variable

expenses the sum is £ 5100 .Thus, it add the direct material, labour and all the total expenses that

are deduct from the sales revenue that is GP £14400. Thereafter the net profit is calculated by

adopting the absorption costing method as there is a little different among both the net profit

table 1 &2. Thus, the net profit under the marginal technique is more than the absorption costing

techniques £ 12600 as it only consider the fixed expenses and ignore the variable expenses. Most

financial year by adopting management costing technique that are marginal and absorption

costing. Thus, in the table 1 the net profit is determined by adopting marginal costing method in

which it takes all only variable expenses and ignore fixed expenses at the time of calculating the

cost of goods sold that is £ 6600 Thereafter, sales revenue is deducting from the COGS to

determine the GP that is £14,400. For this, net profit is determined by deducting the all the

variable and fixed expense from the gross profit that is. Beside this, the cited Company also

adopts the absorption costing method in which it takes all type of cost that are fixed and variable

expenses the sum is £ 5100 .Thus, it add the direct material, labour and all the total expenses that

are deduct from the sales revenue that is GP £14400. Thereafter the net profit is calculated by

adopting the absorption costing method as there is a little different among both the net profit

table 1 &2. Thus, the net profit under the marginal technique is more than the absorption costing

techniques £ 12600 as it only consider the fixed expenses and ignore the variable expenses. Most

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of the scholar said that the absorption costing techniques are the most appropriate techniques.

The main reason behind this is that it will considering all type of cost that measure the

Company’s financial position in effective manner.

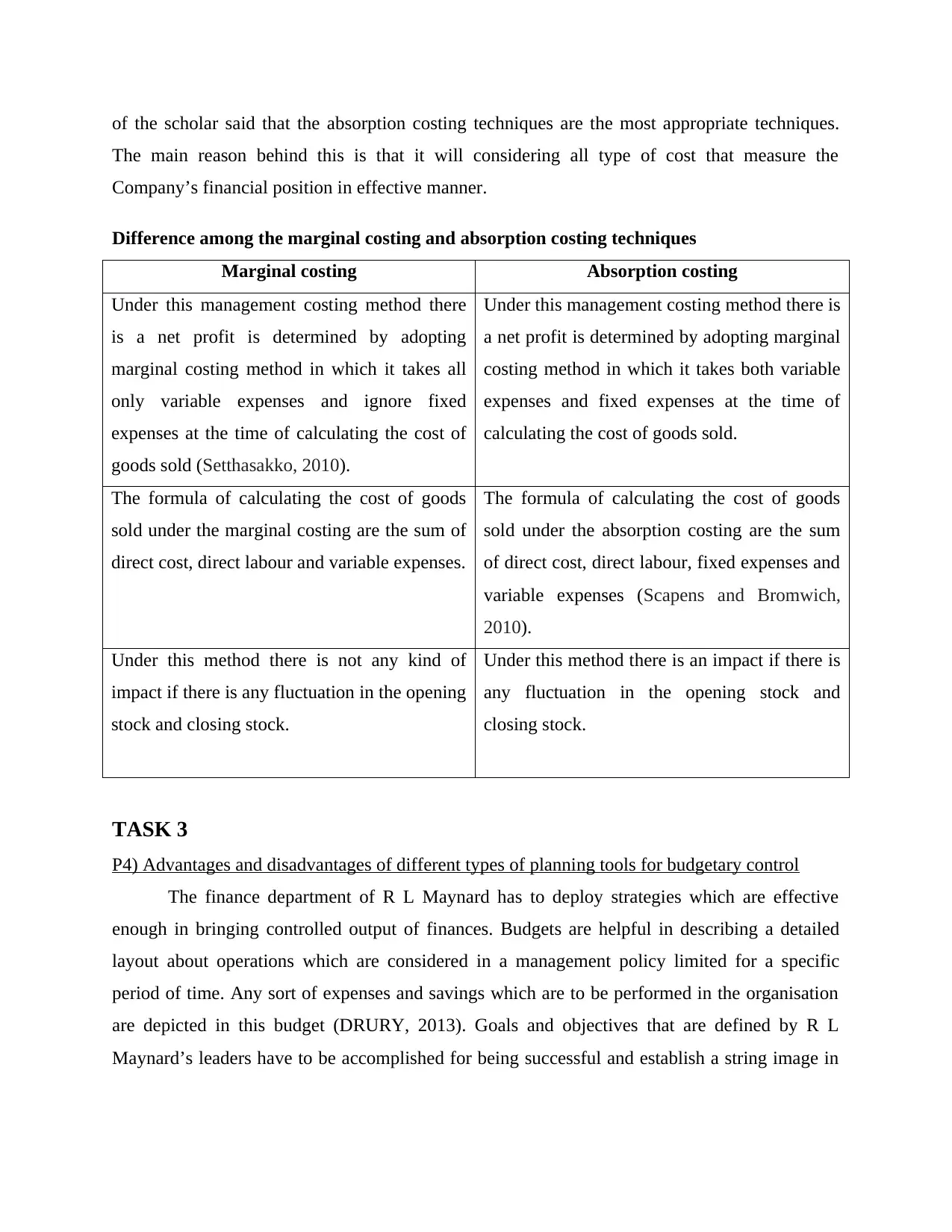

Difference among the marginal costing and absorption costing techniques

Marginal costing Absorption costing

Under this management costing method there

is a net profit is determined by adopting

marginal costing method in which it takes all

only variable expenses and ignore fixed

expenses at the time of calculating the cost of

goods sold (Setthasakko, 2010).

Under this management costing method there is

a net profit is determined by adopting marginal

costing method in which it takes both variable

expenses and fixed expenses at the time of

calculating the cost of goods sold.

The formula of calculating the cost of goods

sold under the marginal costing are the sum of

direct cost, direct labour and variable expenses.

The formula of calculating the cost of goods

sold under the absorption costing are the sum

of direct cost, direct labour, fixed expenses and

variable expenses (Scapens and Bromwich,

2010).

Under this method there is not any kind of

impact if there is any fluctuation in the opening

stock and closing stock.

Under this method there is an impact if there is

any fluctuation in the opening stock and

closing stock.

TASK 3

P4) Advantages and disadvantages of different types of planning tools for budgetary control

The finance department of R L Maynard has to deploy strategies which are effective

enough in bringing controlled output of finances. Budgets are helpful in describing a detailed

layout about operations which are considered in a management policy limited for a specific

period of time. Any sort of expenses and savings which are to be performed in the organisation

are depicted in this budget (DRURY, 2013). Goals and objectives that are defined by R L

Maynard’s leaders have to be accomplished for being successful and establish a string image in

The main reason behind this is that it will considering all type of cost that measure the

Company’s financial position in effective manner.

Difference among the marginal costing and absorption costing techniques

Marginal costing Absorption costing

Under this management costing method there

is a net profit is determined by adopting

marginal costing method in which it takes all

only variable expenses and ignore fixed

expenses at the time of calculating the cost of

goods sold (Setthasakko, 2010).

Under this management costing method there is

a net profit is determined by adopting marginal

costing method in which it takes both variable

expenses and fixed expenses at the time of

calculating the cost of goods sold.

The formula of calculating the cost of goods

sold under the marginal costing are the sum of

direct cost, direct labour and variable expenses.

The formula of calculating the cost of goods

sold under the absorption costing are the sum

of direct cost, direct labour, fixed expenses and

variable expenses (Scapens and Bromwich,

2010).

Under this method there is not any kind of

impact if there is any fluctuation in the opening

stock and closing stock.

Under this method there is an impact if there is

any fluctuation in the opening stock and

closing stock.

TASK 3

P4) Advantages and disadvantages of different types of planning tools for budgetary control

The finance department of R L Maynard has to deploy strategies which are effective

enough in bringing controlled output of finances. Budgets are helpful in describing a detailed

layout about operations which are considered in a management policy limited for a specific

period of time. Any sort of expenses and savings which are to be performed in the organisation

are depicted in this budget (DRURY, 2013). Goals and objectives that are defined by R L

Maynard’s leaders have to be accomplished for being successful and establish a string image in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the market. Preparing a budget without proper planning and analysis doesn’t support

organisational goals and objectives.

Budget reports are prepared and implemented in such a way that performance evaluation

is acquired simultaneously. All the responsibilities and duties which have to be fulfilled by

respective individuals are also defined in these reports. Following are the advantages and

disadvantages of budgetary control:

Advantages:

Clear declaration of responsibilities is produced in budgetary control reports. When this

attribute is achieved by organizational heads then aims and objectives are more

effectively met (DRURY, 2013).

Performance evaluation helps in analyzing the defects and flaws which hinder or block

effective working. A comparison is made between past performances and present

functioning and related deviations are gathered. This further helps in efficient budgeting

and making remedial measures.

Organizational goals and objectives can be improvised and defined with better efficiency

through these reports. Precision and accuracy is obtained and overall business reaches a

new height and competition is better handled (Fullerton, Kennedy and Widener, 2013).

Coordination is promoted and improved because centralization of company activities is

achieved. Management helps in reducing confusion and increasing responsibility of

respective authorities. If different functional activities are defined clearly then employees are guided by a

dignified path. This helps in encouraging them or boosts their morale for working more

effectively and achieving the goals without exceeding budgets (Bebbington and

Thomson, 2013). Despite of being a challenging task, there is more scope of innovation

and greater support for preparation of the best competencies.

Disadvantages:

A great drawback which has been experienced by R L Maynard with budgetary control is

major dependency on future estimates. There are situations in which large amount of

risks and losses can be faced by the company. If specific allocations are not made for

these kind of instances then budgetary control turns out to be ineffective and goals and

objectives are not met (Ward, 2012).

organisational goals and objectives.

Budget reports are prepared and implemented in such a way that performance evaluation

is acquired simultaneously. All the responsibilities and duties which have to be fulfilled by

respective individuals are also defined in these reports. Following are the advantages and

disadvantages of budgetary control:

Advantages:

Clear declaration of responsibilities is produced in budgetary control reports. When this

attribute is achieved by organizational heads then aims and objectives are more

effectively met (DRURY, 2013).

Performance evaluation helps in analyzing the defects and flaws which hinder or block

effective working. A comparison is made between past performances and present

functioning and related deviations are gathered. This further helps in efficient budgeting

and making remedial measures.

Organizational goals and objectives can be improvised and defined with better efficiency

through these reports. Precision and accuracy is obtained and overall business reaches a

new height and competition is better handled (Fullerton, Kennedy and Widener, 2013).

Coordination is promoted and improved because centralization of company activities is

achieved. Management helps in reducing confusion and increasing responsibility of

respective authorities. If different functional activities are defined clearly then employees are guided by a

dignified path. This helps in encouraging them or boosts their morale for working more

effectively and achieving the goals without exceeding budgets (Bebbington and

Thomson, 2013). Despite of being a challenging task, there is more scope of innovation

and greater support for preparation of the best competencies.

Disadvantages:

A great drawback which has been experienced by R L Maynard with budgetary control is

major dependency on future estimates. There are situations in which large amount of

risks and losses can be faced by the company. If specific allocations are not made for

these kind of instances then budgetary control turns out to be ineffective and goals and

objectives are not met (Ward, 2012).

Often organizational stability is lost due to lack of coordination and improper motivation.

Individuals may or may not be satisfied with budgets and estimations. Their satisfaction

level reflects in motivation which further affects coordination in executing different

business operations.

The planning, analysis and interpretation process is quite expensive and large amount of

costs are involved. Entire system requires proper supervision and monitoring which

makes it ineffective in terms of costs during introduction and application (Parker, 2012).

When outcomes of the budget have to be implemented and applied in the dynamics of

company then budgetary control measures are adapted. Following tools are largely used for

planning budgetary controls:

1. Responsibility accounting

2. Variance analysis

3. Zero base budgeting

4. Fund adjustments

Variance Analysis: The process of analysing and interpreting the difference which is

obtained within actual results and those which had been planned, expected or aimed by the

company is considered as variance analysis. It is one of the most convenient options in planning

budgetary controls because it deals with present and past performances of the organisation.

Merits and Demerits:

When overall values are achieved by the company in terms of variance then effective

remedies or precautionary measures are quickly taken for reducing the impact of losses.

Any sort of negligence or inefficiency portrayed by any function of the organization is

accurately determined through this tool (Fullerton, Kennedy and Widener, 2013).

Despite of such great advantages, this tool requires large amount of investments in terms

of time and resources because lot of analysis has to be performed.

Managers have to perform planning but there is strict requirement of experts which again

calls for increased costs and more time for training or adhering these experts with

organizational functioning.

Responsibility Accounting: A reporting system which collates the revenues, costs and

profits with help of managers who are themselves directly accountable for the same is

Individuals may or may not be satisfied with budgets and estimations. Their satisfaction

level reflects in motivation which further affects coordination in executing different

business operations.

The planning, analysis and interpretation process is quite expensive and large amount of

costs are involved. Entire system requires proper supervision and monitoring which

makes it ineffective in terms of costs during introduction and application (Parker, 2012).

When outcomes of the budget have to be implemented and applied in the dynamics of

company then budgetary control measures are adapted. Following tools are largely used for

planning budgetary controls:

1. Responsibility accounting

2. Variance analysis

3. Zero base budgeting

4. Fund adjustments

Variance Analysis: The process of analysing and interpreting the difference which is

obtained within actual results and those which had been planned, expected or aimed by the

company is considered as variance analysis. It is one of the most convenient options in planning

budgetary controls because it deals with present and past performances of the organisation.

Merits and Demerits:

When overall values are achieved by the company in terms of variance then effective

remedies or precautionary measures are quickly taken for reducing the impact of losses.

Any sort of negligence or inefficiency portrayed by any function of the organization is

accurately determined through this tool (Fullerton, Kennedy and Widener, 2013).

Despite of such great advantages, this tool requires large amount of investments in terms

of time and resources because lot of analysis has to be performed.

Managers have to perform planning but there is strict requirement of experts which again

calls for increased costs and more time for training or adhering these experts with

organizational functioning.

Responsibility Accounting: A reporting system which collates the revenues, costs and

profits with help of managers who are themselves directly accountable for the same is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.