Excite Entertainment Ltd: Management Accounting Report Analysis

VerifiedAdded on 2021/02/22

|15

|4030

|82

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application within Excite Entertainment Ltd, a UK-based event management company. The report differentiates between management and financial accounting, emphasizing the importance of management accounting for informed decision-making, cost control, and profitability. It explores various management accounting systems such as job costing, cost accounting, and inventory management, along with their benefits. The report also examines different methods of management accounting reporting, including budget reports, cost accounting reports, and inventory management reports. Furthermore, it compares marginal and absorption costing methods, providing income statements for Excite Entertainment Ltd based on each method. The report also discusses the advantages and disadvantages of different planning tools, such as zero-based budgeting and master budgeting, highlighting their roles in financial planning and control.

Management Accounting report

for Excite Entertainment Ltd

for Excite Entertainment Ltd

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Management Accounting and its different type of systems:..................................................3

P2 Different methods for management accounting reporting......................................................5

M1................................................................................................................................................5

D1................................................................................................................................................6

TASK 2............................................................................................................................................6

P3 & M2 Costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs:...........................................................................................6

D2................................................................................................................................................8

TASK 3............................................................................................................................................8

M3..............................................................................................................................................10

TASK 4..........................................................................................................................................10

P5...............................................................................................................................................10

b) Organisations adapt management accounting systems.........................................................10

Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1 Management Accounting and its different type of systems:..................................................3

P2 Different methods for management accounting reporting......................................................5

M1................................................................................................................................................5

D1................................................................................................................................................6

TASK 2............................................................................................................................................6

P3 & M2 Costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs:...........................................................................................6

D2................................................................................................................................................8

TASK 3............................................................................................................................................8

M3..............................................................................................................................................10

TASK 4..........................................................................................................................................10

P5...............................................................................................................................................10

b) Organisations adapt management accounting systems.........................................................10

Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is considered as an important function which is mainly used to

analyse the company’s data, for maximising profitability of business operations. This would help

in preparing the management reports which can be used to make short-term to manage

operational activities efficiently (Lavia López and Hiebl, 2014). An assignment is made to

analyse the importance of management accounting system in a company, by differentiating this

concept with financial accounting. For this purpose, Excite Entertainment Ltd is chosen that

deals in event industry of UK. In order to carry out various operations like budget planning,

responding towards financial crises and more, how this company can use management

accounting system is being discussed under the present report. For this purpose, various types of

reporting, planning tools with benefits and limitation are also analysed by comparing the

business strategy of chosen company with one of its competitor.

TASK 1

P1 Management Accounting and its different type of systems:

Management accounting refers to a process of preparing reports to provide statistical

information to a company, in order to take appropriate decisions of business on regular basis. It

helps a firm in making future plans by preparing managerial information, which includes entire

company’s data related to financial and non-financial activities (Leitner, 2013). Excite

Entertainment Ltd. deals in event management business, whose major activities includes

promotion of concerts and festivals at particular locations, in creative manner. To apply the

concept of management accounting in increasing profitability ratio and estimating different costs

required for completing a project, it becomes highly essential for this company what is main

difference between financial and management accounting, as explained beneath :-

Difference between management and financial accounting

Basis of comparison Management accounting Financial accounting

Objectives Provide entire information

of company to set goals,

mission and plan activities.

Disclose the end result or

financial state of a company on

a particular date.

Audience It is used by managers and

other authorities to take

Financial information is mainly

used by stakeholders, investors

Management accounting is considered as an important function which is mainly used to

analyse the company’s data, for maximising profitability of business operations. This would help

in preparing the management reports which can be used to make short-term to manage

operational activities efficiently (Lavia López and Hiebl, 2014). An assignment is made to

analyse the importance of management accounting system in a company, by differentiating this

concept with financial accounting. For this purpose, Excite Entertainment Ltd is chosen that

deals in event industry of UK. In order to carry out various operations like budget planning,

responding towards financial crises and more, how this company can use management

accounting system is being discussed under the present report. For this purpose, various types of

reporting, planning tools with benefits and limitation are also analysed by comparing the

business strategy of chosen company with one of its competitor.

TASK 1

P1 Management Accounting and its different type of systems:

Management accounting refers to a process of preparing reports to provide statistical

information to a company, in order to take appropriate decisions of business on regular basis. It

helps a firm in making future plans by preparing managerial information, which includes entire

company’s data related to financial and non-financial activities (Leitner, 2013). Excite

Entertainment Ltd. deals in event management business, whose major activities includes

promotion of concerts and festivals at particular locations, in creative manner. To apply the

concept of management accounting in increasing profitability ratio and estimating different costs

required for completing a project, it becomes highly essential for this company what is main

difference between financial and management accounting, as explained beneath :-

Difference between management and financial accounting

Basis of comparison Management accounting Financial accounting

Objectives Provide entire information

of company to set goals,

mission and plan activities.

Disclose the end result or

financial state of a company on

a particular date.

Audience It is used by managers and

other authorities to take

Financial information is mainly

used by stakeholders, investors

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

decisions for internal

activities of business

(Nielsen, Mitchell and

Nørreklit, 205).

and external parties of a firm.

Segment reporting Department wise Include overall information

Focus It concerns on estimating

future performance and

preparing records of

current data

In focuses on company’ past

records

Reporting, frequency and

distribution

Monthly, daily and weekly Yearly, semi-yearly and

quarterly

To increase the efficiencies of business operations, this company can utilise the concept of

management accounting system and its various applications in determining the number of human

resource needs for launching an event and planning other activities in desired way (Turban,

Volonino and Wood, 2015).

Job costing system – This costing method system is used to formulate costs required at

each level of production to complete the entire project. By identifying each job

separately, managers of Excite Entertainment Ltd. can analyse cost as per job, so that

major expenses can be reduced.

Cost accounting system – This system will help respective company in keeping an eye

over each transaction and cost required to complete each activity, for inventory valuation

and profitable analysis (Stein and et.al., 2015). It would also aid managers of Excite

Entertainment Ltd. to analyse which products or services prove profitable for business

and which are not, so that proper decisions can be made for improving the production. In

this regard, two main methods can be used as direct costing and standard costing. Hereby,

standard costing includes the comparison of efficient uses of resources to produce

services as per standard conditions. While direct costing helps in estimating the cost

which is attributed to production of certain services based on event formation for given

company. Both concepts will help in estimating the actual profitability of a specific

project, so that planning of event launch can be done in efficient way.

activities of business

(Nielsen, Mitchell and

Nørreklit, 205).

and external parties of a firm.

Segment reporting Department wise Include overall information

Focus It concerns on estimating

future performance and

preparing records of

current data

In focuses on company’ past

records

Reporting, frequency and

distribution

Monthly, daily and weekly Yearly, semi-yearly and

quarterly

To increase the efficiencies of business operations, this company can utilise the concept of

management accounting system and its various applications in determining the number of human

resource needs for launching an event and planning other activities in desired way (Turban,

Volonino and Wood, 2015).

Job costing system – This costing method system is used to formulate costs required at

each level of production to complete the entire project. By identifying each job

separately, managers of Excite Entertainment Ltd. can analyse cost as per job, so that

major expenses can be reduced.

Cost accounting system – This system will help respective company in keeping an eye

over each transaction and cost required to complete each activity, for inventory valuation

and profitable analysis (Stein and et.al., 2015). It would also aid managers of Excite

Entertainment Ltd. to analyse which products or services prove profitable for business

and which are not, so that proper decisions can be made for improving the production. In

this regard, two main methods can be used as direct costing and standard costing. Hereby,

standard costing includes the comparison of efficient uses of resources to produce

services as per standard conditions. While direct costing helps in estimating the cost

which is attributed to production of certain services based on event formation for given

company. Both concepts will help in estimating the actual profitability of a specific

project, so that planning of event launch can be done in efficient way.

Inventory management system – This system refers to be most effective in management

accounting that mainly focuses on managing inventories and making it available to cater

demand of customers within set period of time (Plumb and et.al., 2017). For tracking the

inventory orders, sales and deliverables, a number of method can be used, which includes

LIFO (Last in First out), FIFO (First in First out) and more, that may affect the bottom

lines of business in different manner. Hereby, respective company uses the concept of

ABC analysis for managing inventories.

P2 Different methods for management accounting reporting

For monitoring the current performance of business in order to improve the future state, a

company can use the concept of managerial accounting reports (Hilton and Platt, 2013). Through

analysing such performances of each department, decisions can be taken for improvement and

increase the same as well. In this regard, it is essential for managers of Excite Entertainment

Limited to concern on implementing following accounting reports –

Budget Report – To determine if current state of business is enough to meet present and

future requirement, budget report can be used by Excite Entertainment Ltd. This would also help

in estimating cost required to complete each phase of production, which further can be used to

prepare budget as well. It also gives support in analysing feasible ways for trimming costs.

Cost accounting reports: This report helps in estimating cost required for completing a

project and making budge plan accordingly. The given company can use this report to predict

how business expenses can be controlled by determining costs of products, process and more.

Inventory management report: To grow business successfully, it is essential for

preparing inventor report, by analysing different metrics (Senftlechner and Hiebl, 2015). It

includes item fill rate, inventory accuracy and stock turnover, analysing all these aspects,

managers of given company can make improvement plans, in order to increase the potential of

growth and success on business.

M1

Advantages of accounting system

Accounting management

system

Benefits of integrating this concept within Excite

Entertainment Ltd.

Inventory Management This technique helps respective company in increasing

accounting that mainly focuses on managing inventories and making it available to cater

demand of customers within set period of time (Plumb and et.al., 2017). For tracking the

inventory orders, sales and deliverables, a number of method can be used, which includes

LIFO (Last in First out), FIFO (First in First out) and more, that may affect the bottom

lines of business in different manner. Hereby, respective company uses the concept of

ABC analysis for managing inventories.

P2 Different methods for management accounting reporting

For monitoring the current performance of business in order to improve the future state, a

company can use the concept of managerial accounting reports (Hilton and Platt, 2013). Through

analysing such performances of each department, decisions can be taken for improvement and

increase the same as well. In this regard, it is essential for managers of Excite Entertainment

Limited to concern on implementing following accounting reports –

Budget Report – To determine if current state of business is enough to meet present and

future requirement, budget report can be used by Excite Entertainment Ltd. This would also help

in estimating cost required to complete each phase of production, which further can be used to

prepare budget as well. It also gives support in analysing feasible ways for trimming costs.

Cost accounting reports: This report helps in estimating cost required for completing a

project and making budge plan accordingly. The given company can use this report to predict

how business expenses can be controlled by determining costs of products, process and more.

Inventory management report: To grow business successfully, it is essential for

preparing inventor report, by analysing different metrics (Senftlechner and Hiebl, 2015). It

includes item fill rate, inventory accuracy and stock turnover, analysing all these aspects,

managers of given company can make improvement plans, in order to increase the potential of

growth and success on business.

M1

Advantages of accounting system

Accounting management

system

Benefits of integrating this concept within Excite

Entertainment Ltd.

Inventory Management This technique helps respective company in increasing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

System valuation of inventories and making plans to manage the

same as well.

Job Costing System

Predicting cost of each task for project completion helps in

analysing how cost of particular activity can be reduced.

Cost Accounting System

This system mostly helps in reducing the company’s

expenses for increasing profitability ratio.

D1

To increase the profitability and performance of business, it is essential for Excite

Entertainment Ltd. to integrate the concept of management accounting reports. This would help

in reducing any kind of wastage that affect budget of current year plans so that valuation of

business and its resources can be increased (Wickramasinghe and Alawattage, 2012). Hereby, by

evaluating the company’s data, inventory forecasting report can also be proposed to predict that

future state of business will be able to meet financial challenges.

TASK 2

P3 & M2 Costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs:

Marginal costing method: This concept is generally used for determining how much

cost is required if a company wants to increase additional quantities of products. This would also

help in analysing impact on increased unit or variable cost on business and total production

(Ward, 2012). In this regard, managers of Excite Entertainment Ltd. can use this costing method

to calculate cost required for producing a single unit of commodity to meet demand of

customers. For this purpose, marginal costing method calculate costs on the basis of changes in

variable costs.

Absorption costing method: This method considers both fixed and variable costs for

calculating the costs required to produce additional quantity of products. It also concerns on

calculating the direct material costs, labour price, variable and fixed overhead expenses, for the

same.

same as well.

Job Costing System

Predicting cost of each task for project completion helps in

analysing how cost of particular activity can be reduced.

Cost Accounting System

This system mostly helps in reducing the company’s

expenses for increasing profitability ratio.

D1

To increase the profitability and performance of business, it is essential for Excite

Entertainment Ltd. to integrate the concept of management accounting reports. This would help

in reducing any kind of wastage that affect budget of current year plans so that valuation of

business and its resources can be increased (Wickramasinghe and Alawattage, 2012). Hereby, by

evaluating the company’s data, inventory forecasting report can also be proposed to predict that

future state of business will be able to meet financial challenges.

TASK 2

P3 & M2 Costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs:

Marginal costing method: This concept is generally used for determining how much

cost is required if a company wants to increase additional quantities of products. This would also

help in analysing impact on increased unit or variable cost on business and total production

(Ward, 2012). In this regard, managers of Excite Entertainment Ltd. can use this costing method

to calculate cost required for producing a single unit of commodity to meet demand of

customers. For this purpose, marginal costing method calculate costs on the basis of changes in

variable costs.

Absorption costing method: This method considers both fixed and variable costs for

calculating the costs required to produce additional quantity of products. It also concerns on

calculating the direct material costs, labour price, variable and fixed overhead expenses, for the

same.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

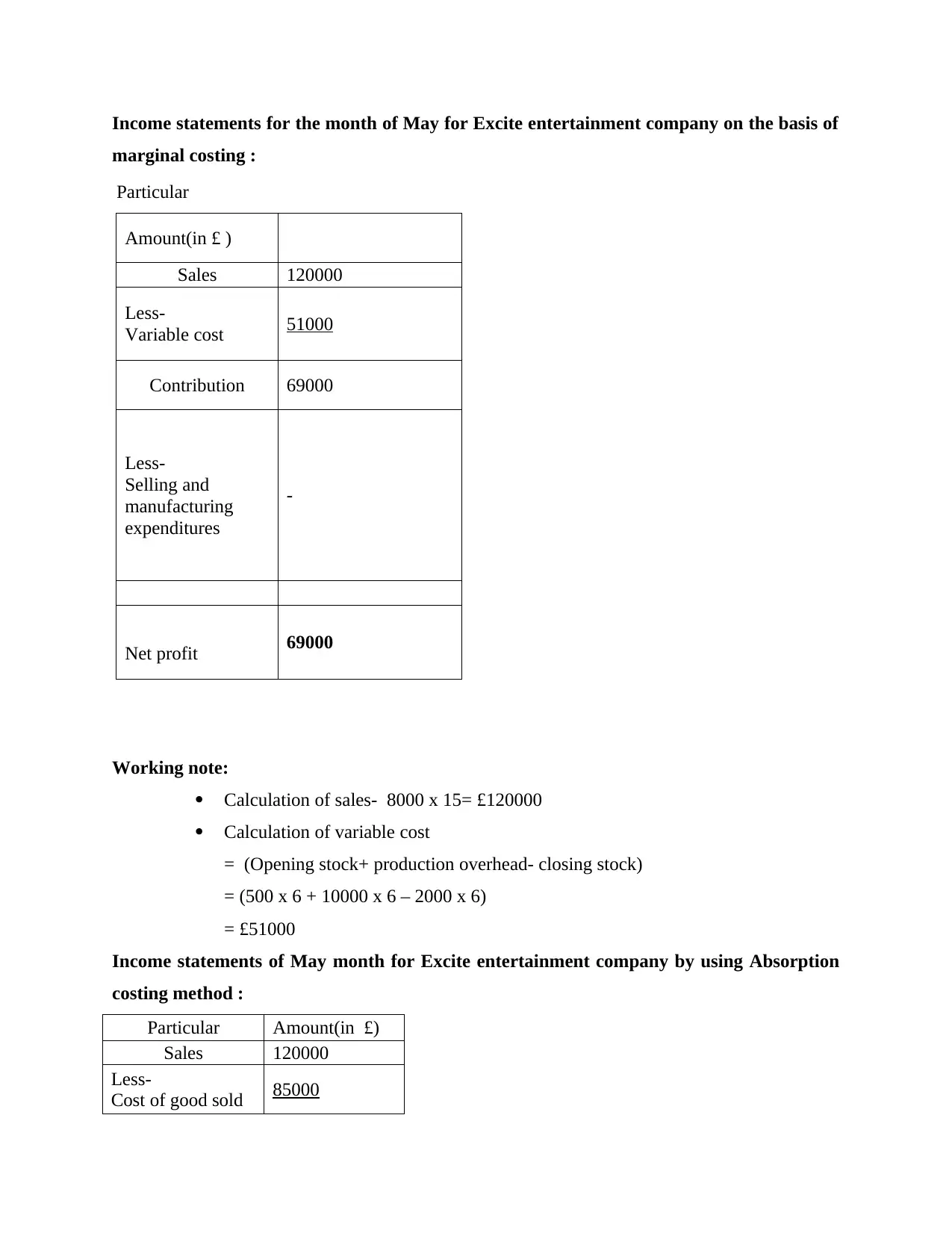

Income statements for the month of May for Excite entertainment company on the basis of

marginal costing :

Particular

Amount(in £ )

Sales 120000

Less-

Variable cost 51000

Contribution 69000

Less-

Selling and

manufacturing

expenditures

-

Net profit 69000

Working note:

Calculation of sales- 8000 x 15= £120000

Calculation of variable cost

= (Opening stock+ production overhead- closing stock)

= (500 x 6 + 10000 x 6 – 2000 x 6)

= £51000

Income statements of May month for Excite entertainment company by using Absorption

costing method :

Particular Amount(in £)

Sales 120000

Less-

Cost of good sold 85000

marginal costing :

Particular

Amount(in £ )

Sales 120000

Less-

Variable cost 51000

Contribution 69000

Less-

Selling and

manufacturing

expenditures

-

Net profit 69000

Working note:

Calculation of sales- 8000 x 15= £120000

Calculation of variable cost

= (Opening stock+ production overhead- closing stock)

= (500 x 6 + 10000 x 6 – 2000 x 6)

= £51000

Income statements of May month for Excite entertainment company by using Absorption

costing method :

Particular Amount(in £)

Sales 120000

Less-

Cost of good sold 85000

Gross profit 35000

Less-

Selling and

manufacturing

expenditures

-

Net profit 35000

Working note

Calculation of sales- 8000 x 15= 12000

Calculation of cost of good sold = (Opening stock + production overhead - closing stock)

= (500 x 10 + 10000 x 10 – 2000 x 10)

= £85000

D2

From the calculative data of income statements, it has been interpreted that using marginal

costing method, the cost required for producing addition single unit of service required £51k

while through absorption counting it will require £85k. So, in this regard, it is suggested to

Excite Entertainment Company to use absorption costing method because it focuses on every

expense that may affect by increasing single unit of production.

TASK 3

P4 Advantage and disadvantage of different types of planning tools

Budget can be defined as a plan under which a company estimate costs require for

completing each operation of business and some amount to meet future expenses (Hopper and

Bui, 2016). It can also be defined as a pre-determined statement of financial record of a

particular accounting period. In context with Excite Entertainment Ltd., its managers can

develop budget of every project related to launching an event so that wastages and other

expenses can be reduced. Budgetary control tools in this manner can help in making plans how

to cater future needs of business, in case of emergency (Maas, Schaltegger and Crutzen, 2016).

In this regard, different planning tools that help in formulating the specific budget plan are

described as below -

Zero based budget: It refers to an accounting practice that force management of a

company to analyse how to spent every single euro during a budgeting period. Zero-based

budget plan starts with initial stage where outstanding expenses usually avoided in current

Less-

Selling and

manufacturing

expenditures

-

Net profit 35000

Working note

Calculation of sales- 8000 x 15= 12000

Calculation of cost of good sold = (Opening stock + production overhead - closing stock)

= (500 x 10 + 10000 x 10 – 2000 x 10)

= £85000

D2

From the calculative data of income statements, it has been interpreted that using marginal

costing method, the cost required for producing addition single unit of service required £51k

while through absorption counting it will require £85k. So, in this regard, it is suggested to

Excite Entertainment Company to use absorption costing method because it focuses on every

expense that may affect by increasing single unit of production.

TASK 3

P4 Advantage and disadvantage of different types of planning tools

Budget can be defined as a plan under which a company estimate costs require for

completing each operation of business and some amount to meet future expenses (Hopper and

Bui, 2016). It can also be defined as a pre-determined statement of financial record of a

particular accounting period. In context with Excite Entertainment Ltd., its managers can

develop budget of every project related to launching an event so that wastages and other

expenses can be reduced. Budgetary control tools in this manner can help in making plans how

to cater future needs of business, in case of emergency (Maas, Schaltegger and Crutzen, 2016).

In this regard, different planning tools that help in formulating the specific budget plan are

described as below -

Zero based budget: It refers to an accounting practice that force management of a

company to analyse how to spent every single euro during a budgeting period. Zero-based

budget plan starts with initial stage where outstanding expenses usually avoided in current

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

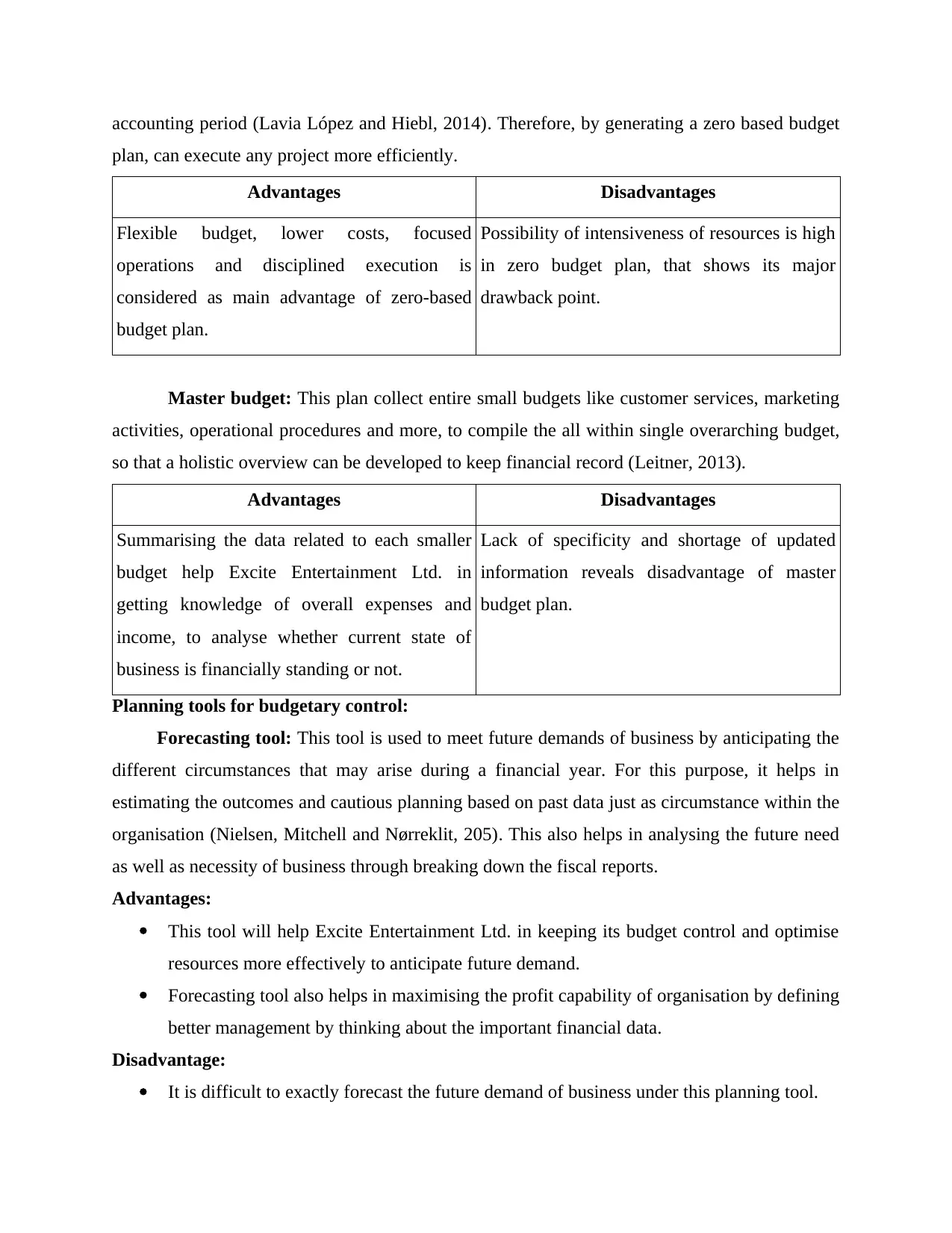

accounting period (Lavia López and Hiebl, 2014). Therefore, by generating a zero based budget

plan, can execute any project more efficiently.

Advantages Disadvantages

Flexible budget, lower costs, focused

operations and disciplined execution is

considered as main advantage of zero-based

budget plan.

Possibility of intensiveness of resources is high

in zero budget plan, that shows its major

drawback point.

Master budget: This plan collect entire small budgets like customer services, marketing

activities, operational procedures and more, to compile the all within single overarching budget,

so that a holistic overview can be developed to keep financial record (Leitner, 2013).

Advantages Disadvantages

Summarising the data related to each smaller

budget help Excite Entertainment Ltd. in

getting knowledge of overall expenses and

income, to analyse whether current state of

business is financially standing or not.

Lack of specificity and shortage of updated

information reveals disadvantage of master

budget plan.

Planning tools for budgetary control:

Forecasting tool: This tool is used to meet future demands of business by anticipating the

different circumstances that may arise during a financial year. For this purpose, it helps in

estimating the outcomes and cautious planning based on past data just as circumstance within the

organisation (Nielsen, Mitchell and Nørreklit, 205). This also helps in analysing the future need

as well as necessity of business through breaking down the fiscal reports.

Advantages:

This tool will help Excite Entertainment Ltd. in keeping its budget control and optimise

resources more effectively to anticipate future demand.

Forecasting tool also helps in maximising the profit capability of organisation by defining

better management by thinking about the important financial data.

Disadvantage:

It is difficult to exactly forecast the future demand of business under this planning tool.

plan, can execute any project more efficiently.

Advantages Disadvantages

Flexible budget, lower costs, focused

operations and disciplined execution is

considered as main advantage of zero-based

budget plan.

Possibility of intensiveness of resources is high

in zero budget plan, that shows its major

drawback point.

Master budget: This plan collect entire small budgets like customer services, marketing

activities, operational procedures and more, to compile the all within single overarching budget,

so that a holistic overview can be developed to keep financial record (Leitner, 2013).

Advantages Disadvantages

Summarising the data related to each smaller

budget help Excite Entertainment Ltd. in

getting knowledge of overall expenses and

income, to analyse whether current state of

business is financially standing or not.

Lack of specificity and shortage of updated

information reveals disadvantage of master

budget plan.

Planning tools for budgetary control:

Forecasting tool: This tool is used to meet future demands of business by anticipating the

different circumstances that may arise during a financial year. For this purpose, it helps in

estimating the outcomes and cautious planning based on past data just as circumstance within the

organisation (Nielsen, Mitchell and Nørreklit, 205). This also helps in analysing the future need

as well as necessity of business through breaking down the fiscal reports.

Advantages:

This tool will help Excite Entertainment Ltd. in keeping its budget control and optimise

resources more effectively to anticipate future demand.

Forecasting tool also helps in maximising the profit capability of organisation by defining

better management by thinking about the important financial data.

Disadvantage:

It is difficult to exactly forecast the future demand of business under this planning tool.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It may create issues to maintain performance and productivity of each department to

utilise resources for future demand.

Contingency tool: this tool refers to best planning technique in budgetary control that

helps in making back up plans to deal with uncertainties (Turban, Volonino and Wood, 2015).

By utilising contingency tool, Excite Entertainment Ltd. can make more effective plans for

keeping its business safe from vulnerable conditions, like natural calamities, project failure and

more.

Advantages

Making powerful back up plans to deal with vulnerable conditions is the best advantage

factor of contingency tool.

It provides remedial solutions to given company for facing the discrepancies.

Disadvantages:

Reinforcement or back up plans may create conflicts between stakeholders of this

company in managing the vulnerable conditions.

It requires lot of funds and resources to make such plans for anticipating the business

necessities.

M3

By integrating the forecasting and contingency type of planning tools, management of

Excite Entertainment Limited can develop more effective plans for budgetary control (Stein and

et.al., 2015). Hereby, by using master budget plan and forecasting tools, this company can also

streamline the entire aspects of business like sales and marketing, company’s assets, operating

expenses and more.

TASK 4

P5.

b) Organisations adapt management accounting systems

Calculation of contribution per unit-

Selling price per unit

Less- Variable cost per unit

40

10

utilise resources for future demand.

Contingency tool: this tool refers to best planning technique in budgetary control that

helps in making back up plans to deal with uncertainties (Turban, Volonino and Wood, 2015).

By utilising contingency tool, Excite Entertainment Ltd. can make more effective plans for

keeping its business safe from vulnerable conditions, like natural calamities, project failure and

more.

Advantages

Making powerful back up plans to deal with vulnerable conditions is the best advantage

factor of contingency tool.

It provides remedial solutions to given company for facing the discrepancies.

Disadvantages:

Reinforcement or back up plans may create conflicts between stakeholders of this

company in managing the vulnerable conditions.

It requires lot of funds and resources to make such plans for anticipating the business

necessities.

M3

By integrating the forecasting and contingency type of planning tools, management of

Excite Entertainment Limited can develop more effective plans for budgetary control (Stein and

et.al., 2015). Hereby, by using master budget plan and forecasting tools, this company can also

streamline the entire aspects of business like sales and marketing, company’s assets, operating

expenses and more.

TASK 4

P5.

b) Organisations adapt management accounting systems

Calculation of contribution per unit-

Selling price per unit

Less- Variable cost per unit

40

10

Contribution 30

Interpretation: from given data, it has been interpreted that selling price of Excite

Entertainment Limited is 40 Euro.

Calculation of break-even point = Fixed cost / contribution per unit

= 120000/30

= 4000 (in units)

Calculation of cost volume profit analysis = (Fixed cost + desirable profit) / contribution

= (120000+60000)/ 30

= 6000 units.

Profit at the sales of 4000 units-

Sales (4000*40)

Less- Variable cost (4000*10)

Contribution

Less- Fixed cost

Profit/ loss

160000

40000

120000

120000

0

Profit at the sales of 6000 units-

Sales (6000*40)

Less- Variable cost (6000*10)

Contribution

Less- Fixed cost

Profit

240000

60000

180000

120000

60000

Advice: In order to sale near about 6000 units for getting desirable profitability, it is

recommended to Excite Entertainment Limited to integrate following plans –

Problems of cash flow: Such kind of problems may generally arise in business when

there is a limited source of finance. Therefore, to resolve this issue, Excite Entertainment

Interpretation: from given data, it has been interpreted that selling price of Excite

Entertainment Limited is 40 Euro.

Calculation of break-even point = Fixed cost / contribution per unit

= 120000/30

= 4000 (in units)

Calculation of cost volume profit analysis = (Fixed cost + desirable profit) / contribution

= (120000+60000)/ 30

= 6000 units.

Profit at the sales of 4000 units-

Sales (4000*40)

Less- Variable cost (4000*10)

Contribution

Less- Fixed cost

Profit/ loss

160000

40000

120000

120000

0

Profit at the sales of 6000 units-

Sales (6000*40)

Less- Variable cost (6000*10)

Contribution

Less- Fixed cost

Profit

240000

60000

180000

120000

60000

Advice: In order to sale near about 6000 units for getting desirable profitability, it is

recommended to Excite Entertainment Limited to integrate following plans –

Problems of cash flow: Such kind of problems may generally arise in business when

there is a limited source of finance. Therefore, to resolve this issue, Excite Entertainment

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.