Management Accounting Report: Performance Analysis of Unicorn Company

VerifiedAdded on 2020/10/04

|19

|5612

|270

Report

AI Summary

This management accounting report focuses on Unicorn Company, a financial services provider, and its internal accounting practices. The report begins with an introduction to management accounting, emphasizing its role in internal decision-making, strategic planning, and performance management. It then details the essential types of management accounting systems employed by the company, including job costing, cost accounting, price optimization, and inventory management, highlighting the advantages and disadvantages of each. Furthermore, the report examines the various management accounting reports prepared by Unicorn, such as budget reports, accounts receivable aging reports, job cost reports, and inventory and manufacturing reports, explaining their significance in evaluating performance and making informed decisions. The report also explores the application of marginal costing and absorption costing for income statement preparation and discusses the advantages and disadvantages of budgetary control. Finally, it analyzes how the management accounting system helps Unicorn respond to financial problems, concluding with a summary of the key findings and recommendations for improving financial management practices.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................1

LO 1- ...............................................................................................................................................1

Management accounting and its essential type of management accounting system and

different methods used in management accounting report .......................................................1

Lo 2..................................................................................................................................................6

calculate cost using appropriate techniques of cost analysis for preparing income statement. . .6

Project y.........................................................................................................................................11

Explaining advantages and disadvantage of different types of planning tools of budgetary

control.......................................................................................................................................11

LO 4 ..............................................................................................................................................14

Analysing how management accounting system helps in responding to financial problems.. 14

Conclusion.....................................................................................................................................15

References......................................................................................................................................17

Introduction......................................................................................................................................1

LO 1- ...............................................................................................................................................1

Management accounting and its essential type of management accounting system and

different methods used in management accounting report .......................................................1

Lo 2..................................................................................................................................................6

calculate cost using appropriate techniques of cost analysis for preparing income statement. . .6

Project y.........................................................................................................................................11

Explaining advantages and disadvantage of different types of planning tools of budgetary

control.......................................................................................................................................11

LO 4 ..............................................................................................................................................14

Analysing how management accounting system helps in responding to financial problems.. 14

Conclusion.....................................................................................................................................15

References......................................................................................................................................17

Introduction

Management accounting is the significant part of accounting which usually used for

internal purpose of the organisation. This accounting provides necessary information to manager

which used to determine the aim of the company . Managerial accounting essential to prepare

planning , strategies which used to accomplish the goals and objectives of the company within

the specified time. Manager need not to be follow rules and regulation to prepare managerial

accounting .It use to take decision making and increase efficiency that helps to increase

profitability and growth of the company. manager need not require any audit process because it

prepare for accomplish the internal purpose (Maas, Schaltegger and Crutzen, 2016). Manger

focus on risk management , strategic management , performance management that helps to

accomplish the goals.

Present report based on Unicorn company is the privately held which provide financial

services to people. This report will define management accounting and essential types of

management accounting system . It also explaining about the managerial accounting report

prepare by company. Further , company adopt marginal costing and absorption costing for

preparing income statement. Company adopt essential planning tools of budgetary control and

its advantage and disadvantages. This report will also explain that organisation adopt

management accounting system to respond financial problems.

LO 1-

Management accounting and its essential type of management accounting system and different

methods used in management accounting report

Management accounting- It is the integral part of the accounting which provide necessary

information to manager for formulate strategies and planning that helps to determine long term

goals. Managerial accounting focus on monetary and non monetary data which use to take

decision for achieving the long term goals and short term goals of the company. Unicorn

company adopt this accounting because it is mandatory to analyse break even point , forecasting

the business profitability and sales, new product analysis and capital requirement that leads to

increase profitability , sustainable growth of the company. manager can solve the problem with

the effective manner with the help of management accounting (Adler, 2018). It focuses on three

area such as-

1

Management accounting is the significant part of accounting which usually used for

internal purpose of the organisation. This accounting provides necessary information to manager

which used to determine the aim of the company . Managerial accounting essential to prepare

planning , strategies which used to accomplish the goals and objectives of the company within

the specified time. Manager need not to be follow rules and regulation to prepare managerial

accounting .It use to take decision making and increase efficiency that helps to increase

profitability and growth of the company. manager need not require any audit process because it

prepare for accomplish the internal purpose (Maas, Schaltegger and Crutzen, 2016). Manger

focus on risk management , strategic management , performance management that helps to

accomplish the goals.

Present report based on Unicorn company is the privately held which provide financial

services to people. This report will define management accounting and essential types of

management accounting system . It also explaining about the managerial accounting report

prepare by company. Further , company adopt marginal costing and absorption costing for

preparing income statement. Company adopt essential planning tools of budgetary control and

its advantage and disadvantages. This report will also explain that organisation adopt

management accounting system to respond financial problems.

LO 1-

Management accounting and its essential type of management accounting system and different

methods used in management accounting report

Management accounting- It is the integral part of the accounting which provide necessary

information to manager for formulate strategies and planning that helps to determine long term

goals. Managerial accounting focus on monetary and non monetary data which use to take

decision for achieving the long term goals and short term goals of the company. Unicorn

company adopt this accounting because it is mandatory to analyse break even point , forecasting

the business profitability and sales, new product analysis and capital requirement that leads to

increase profitability , sustainable growth of the company. manager can solve the problem with

the effective manner with the help of management accounting (Adler, 2018). It focuses on three

area such as-

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Performance management - manager of the Unicorn can develop and manage business

practices which used as to improve performance of the company that helps to reduce unnecessary

cost and achieve goals. Performance management also helps to increase efficiency , morale of

the employees.

Strategic management - management accounting is significant to formulating rational

strategies that ultimately helps to accomplish the overall goals and objective of the company at

the point of time.

Risk management- Management accounting useful for identifying ,measuring and

controlling the risk. Manager can determine capital structure also determine the amount

investment that need to eliminate the future risk . it helps to accomplish the goals and objective

of the company.

management accounting is differ from financial accounting because management accounting

provide information to manager for internal purpose but financial accounting provide necessary

information to shareholders. Further management accounting helps to prepare strategy for

achieving the goals and objective whereas financial accounting represent the financial position of

the company.

Essential requirement of management accounting system

Unicorn company adopt various types of management accounting system such as job

costing , cost accounting , price optimisation and inventory management which play crucial role

in management accounting because it helps to determine the cost and quality of the product

(Messner,2016). Company can providing quality goods and services to the customer at the

affordable price that helps to increase profitability , reputation and sustainable growth of the

company.

Job costing - It is the fundamental costing of management account which track records

of cost and revenues associated with particular job. This accounting system ascertain the labour

cost , material cost , overheads to determine cost of the job. It also provides useful cost

information to customers under the contract. unicorn company can adopt job costing because it

helps to quote price and profits in the separate job specification which receive from customers

order. job costing use as to comparing previous year job costing and recent cost costing that

helps to take corrective action to reducing the cost on the suitable job. This costing system is

required for Company because can eliminate the excessive cost on job which need to provide

2

practices which used as to improve performance of the company that helps to reduce unnecessary

cost and achieve goals. Performance management also helps to increase efficiency , morale of

the employees.

Strategic management - management accounting is significant to formulating rational

strategies that ultimately helps to accomplish the overall goals and objective of the company at

the point of time.

Risk management- Management accounting useful for identifying ,measuring and

controlling the risk. Manager can determine capital structure also determine the amount

investment that need to eliminate the future risk . it helps to accomplish the goals and objective

of the company.

management accounting is differ from financial accounting because management accounting

provide information to manager for internal purpose but financial accounting provide necessary

information to shareholders. Further management accounting helps to prepare strategy for

achieving the goals and objective whereas financial accounting represent the financial position of

the company.

Essential requirement of management accounting system

Unicorn company adopt various types of management accounting system such as job

costing , cost accounting , price optimisation and inventory management which play crucial role

in management accounting because it helps to determine the cost and quality of the product

(Messner,2016). Company can providing quality goods and services to the customer at the

affordable price that helps to increase profitability , reputation and sustainable growth of the

company.

Job costing - It is the fundamental costing of management account which track records

of cost and revenues associated with particular job. This accounting system ascertain the labour

cost , material cost , overheads to determine cost of the job. It also provides useful cost

information to customers under the contract. unicorn company can adopt job costing because it

helps to quote price and profits in the separate job specification which receive from customers

order. job costing use as to comparing previous year job costing and recent cost costing that

helps to take corrective action to reducing the cost on the suitable job. This costing system is

required for Company because can eliminate the excessive cost on job which need to provide

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

serveries at the lower cost that helps to increase profitability , customer loyalty and growth of the

company.

Pros-

Management of the company can analysis the material , labour cost and overhead cost on

the particular job that helps to accomplish the profitability target.

Manager can use job costing for preparing future budgets which helps to achieve goals

and objective of the company.

cons-

Job costing is more expensive because it required supervisor to determine the cost.

It is more critical work and includes historical data so there is lot of chance of errors.

Cost accounting - Unicorn adopting this system of management accounting which deals

in collection, analysing, organising and controlling the cost. Cost accountant of the company

adopt cost accounting system which represent the revenue and cost of the process . cost

accounting includes direct cost such as direct material, direct labour and direct expenses & also

includes indirect cost such as selling and administration expanses , advertisement expanses and

all overheads which helps to ascertain the cost. Cost accounting is required for company because

it provide all cost information that helps to controlling the cost and also check the accuracy of

financial account. Company can compare the cost with historical data that helps to reducing the

cost of production , increase profitability and improve financial position.

Pros -

Cost accountant eliminate the non profitable activities and enhance the profitable

activities that helps to achieve goals of the company.

Unicorn can control the cost by comparing previous year data and current year data.

cons -

Unicorn company can't analysis the futuristic situation of the company that limpact on

increasing cost due to changing in external factors.

Price optimisation - Unicorn adopt this accounting system which used to determine such

price which customer willing to pay against the product (Kastberg and Siverbo, 2016).

Customers demand varies at different price level so company use this system for calculating the

price. It is required because it helps to provide quality product at the reasonable price that helps

3

company.

Pros-

Management of the company can analysis the material , labour cost and overhead cost on

the particular job that helps to accomplish the profitability target.

Manager can use job costing for preparing future budgets which helps to achieve goals

and objective of the company.

cons-

Job costing is more expensive because it required supervisor to determine the cost.

It is more critical work and includes historical data so there is lot of chance of errors.

Cost accounting - Unicorn adopting this system of management accounting which deals

in collection, analysing, organising and controlling the cost. Cost accountant of the company

adopt cost accounting system which represent the revenue and cost of the process . cost

accounting includes direct cost such as direct material, direct labour and direct expenses & also

includes indirect cost such as selling and administration expanses , advertisement expanses and

all overheads which helps to ascertain the cost. Cost accounting is required for company because

it provide all cost information that helps to controlling the cost and also check the accuracy of

financial account. Company can compare the cost with historical data that helps to reducing the

cost of production , increase profitability and improve financial position.

Pros -

Cost accountant eliminate the non profitable activities and enhance the profitable

activities that helps to achieve goals of the company.

Unicorn can control the cost by comparing previous year data and current year data.

cons -

Unicorn company can't analysis the futuristic situation of the company that limpact on

increasing cost due to changing in external factors.

Price optimisation - Unicorn adopt this accounting system which used to determine such

price which customer willing to pay against the product (Kastberg and Siverbo, 2016).

Customers demand varies at different price level so company use this system for calculating the

price. It is required because it helps to provide quality product at the reasonable price that helps

3

to increase loyal customers, increase profitability of the company. price optimisation use to

ascertain the cost of the product so company can gain attractive profits .

Pros -

Company can enhancing their selling growth by providing goods and services at the

reasonable price.

Price optimisation helps to take decision regarding controlling the cost that helps to

increase profitability and sustainable growth of the company.

cons-

Unicorn not able to accurate price of product because customers needs and preference

changes.

Inventory management - Unicorn adopt this management accounting system because it is

essential to manage the flow of the goods and services which helps meet out the customer

demand. inventory management focus on balancing among the replenishment lead time ,

carrying cost , shortage cost , inventory forecasting which is helpful to reducing the unnecessary

cost. Company can manage the production level which provides quality product at the

reasonable price that helps to increase customer satisfaction. Inventory management is important

to reducing the cost such as carrying cost , handling cost , shortage cost. It is require for

achieving efficiency and productivity level and reducing the cost that helps to accomplish the

target like sales target , profit target , customer target (Messner, 2016).

Pros-

Unicorn company can meet out the customer needs and preference at the time of demand

that helps to achieve the profitability of the company.

It is significant system of management accounting which use to reduce the unnecessary

cost like handing cost , shortage cost. company can deliver product to customers at the

reasonable price that helps to maximising the profits.

Cons-

Unicorn can't determine the production level and cost because customers needs and

preferences changes according to trends.

Organisation adopts different type of management accounting report -

Unicorn company prepare management accounting report which helps to formulate

effective strategy for enhancing the performance. Management accounting report rep[rent the

4

ascertain the cost of the product so company can gain attractive profits .

Pros -

Company can enhancing their selling growth by providing goods and services at the

reasonable price.

Price optimisation helps to take decision regarding controlling the cost that helps to

increase profitability and sustainable growth of the company.

cons-

Unicorn not able to accurate price of product because customers needs and preference

changes.

Inventory management - Unicorn adopt this management accounting system because it is

essential to manage the flow of the goods and services which helps meet out the customer

demand. inventory management focus on balancing among the replenishment lead time ,

carrying cost , shortage cost , inventory forecasting which is helpful to reducing the unnecessary

cost. Company can manage the production level which provides quality product at the

reasonable price that helps to increase customer satisfaction. Inventory management is important

to reducing the cost such as carrying cost , handling cost , shortage cost. It is require for

achieving efficiency and productivity level and reducing the cost that helps to accomplish the

target like sales target , profit target , customer target (Messner, 2016).

Pros-

Unicorn company can meet out the customer needs and preference at the time of demand

that helps to achieve the profitability of the company.

It is significant system of management accounting which use to reduce the unnecessary

cost like handing cost , shortage cost. company can deliver product to customers at the

reasonable price that helps to maximising the profits.

Cons-

Unicorn can't determine the production level and cost because customers needs and

preferences changes according to trends.

Organisation adopts different type of management accounting report -

Unicorn company prepare management accounting report which helps to formulate

effective strategy for enhancing the performance. Management accounting report rep[rent the

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

clear picture or health of the company. This report use to monetary and non monetary benefit

to good performer what helps to boost the employee's morale and motivation. managerial

accounting report need to take decision regarding invest money into the goods and services that

helps to increase profitability. Manager prepare budgetary report , account receivable report ,

job costing report , inventory and manufacturing report, performance report etc that can be

prepare on monthly , quarterly and annually basis.

Budget report - Unicorn prepare budget report which analyse the performance of the

company. manager can compare previous year budget report and current year budget. If , any

deviation found then corrective action taken for accomplish the goals and objective of the

company. Unicorn can enhance the efficiency of the business by improving the cost and

controlling the cost. Manager can provide monetary benefits to employees for boost the morale

and motivation that helps to increase productivity level. manager can take appropriate decision

without any delay that help[s to achieve goals and objective of the company . It is essential

because company can take competitive advantage and grab future opportunities which improve

business performance. It also contributes to build image by improving performance that helps to

maximise the profitability and growth of the company (Van der Stede, 2015).

Account receivable ageing report - Unicorn prepare this report because it represents the

cash inflow and outflow within the year. If company deliver goods and services on credit then

they have to include separate column for invoice that are thirty days , sixty days and ninety days.

This report helps to find out the collection of the company . This report understand their ability .

if company's ability is strong they can provide goods and services on credit that helps to increase

loyal customers and profitability. If company ability is weakness they not able to provide

services on the credit which effect to customer base. Unicorn can take corrective action when

customers not able to pay their amount so they can recover the amount. If cash flow inflow is

higher than outflow that repent that company able to pay debt. Account receivable account use to

manage cash flow that helps to improve financial position and build image in the market .

ultimately it helps to accomplish the goals and objective of the company such as profit

maximization , sustainable growth etc.

Job cost report - This report represent the cost or expenses occur for particular project. it

helps to determine the cost should be charge on particular job that helps to formulate strategy for

increase the profitability of the company. This management report to enhance the profitability

5

to good performer what helps to boost the employee's morale and motivation. managerial

accounting report need to take decision regarding invest money into the goods and services that

helps to increase profitability. Manager prepare budgetary report , account receivable report ,

job costing report , inventory and manufacturing report, performance report etc that can be

prepare on monthly , quarterly and annually basis.

Budget report - Unicorn prepare budget report which analyse the performance of the

company. manager can compare previous year budget report and current year budget. If , any

deviation found then corrective action taken for accomplish the goals and objective of the

company. Unicorn can enhance the efficiency of the business by improving the cost and

controlling the cost. Manager can provide monetary benefits to employees for boost the morale

and motivation that helps to increase productivity level. manager can take appropriate decision

without any delay that help[s to achieve goals and objective of the company . It is essential

because company can take competitive advantage and grab future opportunities which improve

business performance. It also contributes to build image by improving performance that helps to

maximise the profitability and growth of the company (Van der Stede, 2015).

Account receivable ageing report - Unicorn prepare this report because it represents the

cash inflow and outflow within the year. If company deliver goods and services on credit then

they have to include separate column for invoice that are thirty days , sixty days and ninety days.

This report helps to find out the collection of the company . This report understand their ability .

if company's ability is strong they can provide goods and services on credit that helps to increase

loyal customers and profitability. If company ability is weakness they not able to provide

services on the credit which effect to customer base. Unicorn can take corrective action when

customers not able to pay their amount so they can recover the amount. If cash flow inflow is

higher than outflow that repent that company able to pay debt. Account receivable account use to

manage cash flow that helps to improve financial position and build image in the market .

ultimately it helps to accomplish the goals and objective of the company such as profit

maximization , sustainable growth etc.

Job cost report - This report represent the cost or expenses occur for particular project. it

helps to determine the cost should be charge on particular job that helps to formulate strategy for

increase the profitability of the company. This management report to enhance the profitability

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

activities that helps to achieve the goals and objective . manager can eliminate the non

profitability activities that helps to reduce wastage of material , cost and time which leads to

increase profit margins of the company. Thy can providing services at the lower cost that leads to

increase customer base, profitability and growth of the company (Messner, 2016).

Inventory and manufacturing report- it is the part of management accounting report

which would increase efficiency of manufacturing activities. this report use to analysis the

quantity of production and cost of the product. Inventory and manufacturing report helps to

reduce the carrying cost , handing cost , cost of the particular product. Company can provide

goods and services to customers at the suitable price and meet out their need on the time of

demand . It is useful for increasing the sales growth . profitability and image of the company.

Performance report - manager of the Unicorn company prepare performance report which

represent the performance of the functional department and employee's performance. This report

is important which use to prepare effective strategies for improving the performance of the

company that helps to achieve goals and objective of the company. Manager can plan , organise

and controlling the activities that helps to increase efficiency of the employees . main objective

of prepare this report that is formulated the accurate strategy for achieving the mission and vision

of the company. This report helps to reduce labour turnover coast and increase profitability .

Other report - Unicorn company also prepare project report , production report and other

information report which also work for achieving the goals and objective of the company.

manager must have assess to authenticate accounting report which is essential to take appropriate

decision to accomplish the mission of the company at the specific time .

Lo 2

calculate cost using appropriate techniques of cost analysis for preparing income statement

Appendix A

Question 2

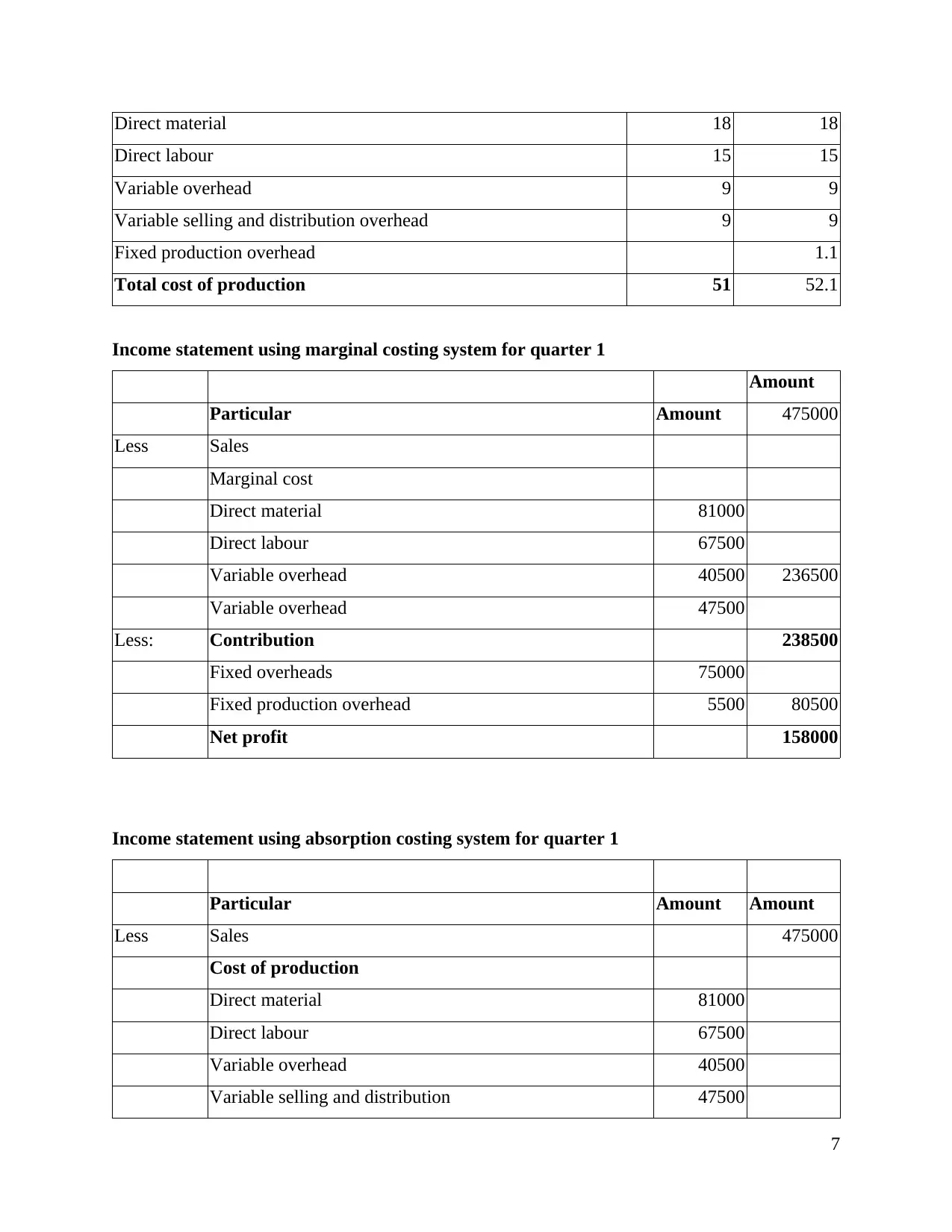

Calculation of cost of production for marginal costing for quarter 1

Particular Marginal Absorption

6

profitability activities that helps to reduce wastage of material , cost and time which leads to

increase profit margins of the company. Thy can providing services at the lower cost that leads to

increase customer base, profitability and growth of the company (Messner, 2016).

Inventory and manufacturing report- it is the part of management accounting report

which would increase efficiency of manufacturing activities. this report use to analysis the

quantity of production and cost of the product. Inventory and manufacturing report helps to

reduce the carrying cost , handing cost , cost of the particular product. Company can provide

goods and services to customers at the suitable price and meet out their need on the time of

demand . It is useful for increasing the sales growth . profitability and image of the company.

Performance report - manager of the Unicorn company prepare performance report which

represent the performance of the functional department and employee's performance. This report

is important which use to prepare effective strategies for improving the performance of the

company that helps to achieve goals and objective of the company. Manager can plan , organise

and controlling the activities that helps to increase efficiency of the employees . main objective

of prepare this report that is formulated the accurate strategy for achieving the mission and vision

of the company. This report helps to reduce labour turnover coast and increase profitability .

Other report - Unicorn company also prepare project report , production report and other

information report which also work for achieving the goals and objective of the company.

manager must have assess to authenticate accounting report which is essential to take appropriate

decision to accomplish the mission of the company at the specific time .

Lo 2

calculate cost using appropriate techniques of cost analysis for preparing income statement

Appendix A

Question 2

Calculation of cost of production for marginal costing for quarter 1

Particular Marginal Absorption

6

Direct material 18 18

Direct labour 15 15

Variable overhead 9 9

Variable selling and distribution overhead 9 9

Fixed production overhead 1.1

Total cost of production 51 52.1

Income statement using marginal costing system for quarter 1

Amount

Particular Amount 475000

Less Sales

Marginal cost

Direct material 81000

Direct labour 67500

Variable overhead 40500 236500

Variable overhead 47500

Less: Contribution 238500

Fixed overheads 75000

Fixed production overhead 5500 80500

Net profit 158000

Income statement using absorption costing system for quarter 1

Particular Amount Amount

Less Sales 475000

Cost of production

Direct material 81000

Direct labour 67500

Variable overhead 40500

Variable selling and distribution 47500

7

Direct labour 15 15

Variable overhead 9 9

Variable selling and distribution overhead 9 9

Fixed production overhead 1.1

Total cost of production 51 52.1

Income statement using marginal costing system for quarter 1

Amount

Particular Amount 475000

Less Sales

Marginal cost

Direct material 81000

Direct labour 67500

Variable overhead 40500 236500

Variable overhead 47500

Less: Contribution 238500

Fixed overheads 75000

Fixed production overhead 5500 80500

Net profit 158000

Income statement using absorption costing system for quarter 1

Particular Amount Amount

Less Sales 475000

Cost of production

Direct material 81000

Direct labour 67500

Variable overhead 40500

Variable selling and distribution 47500

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

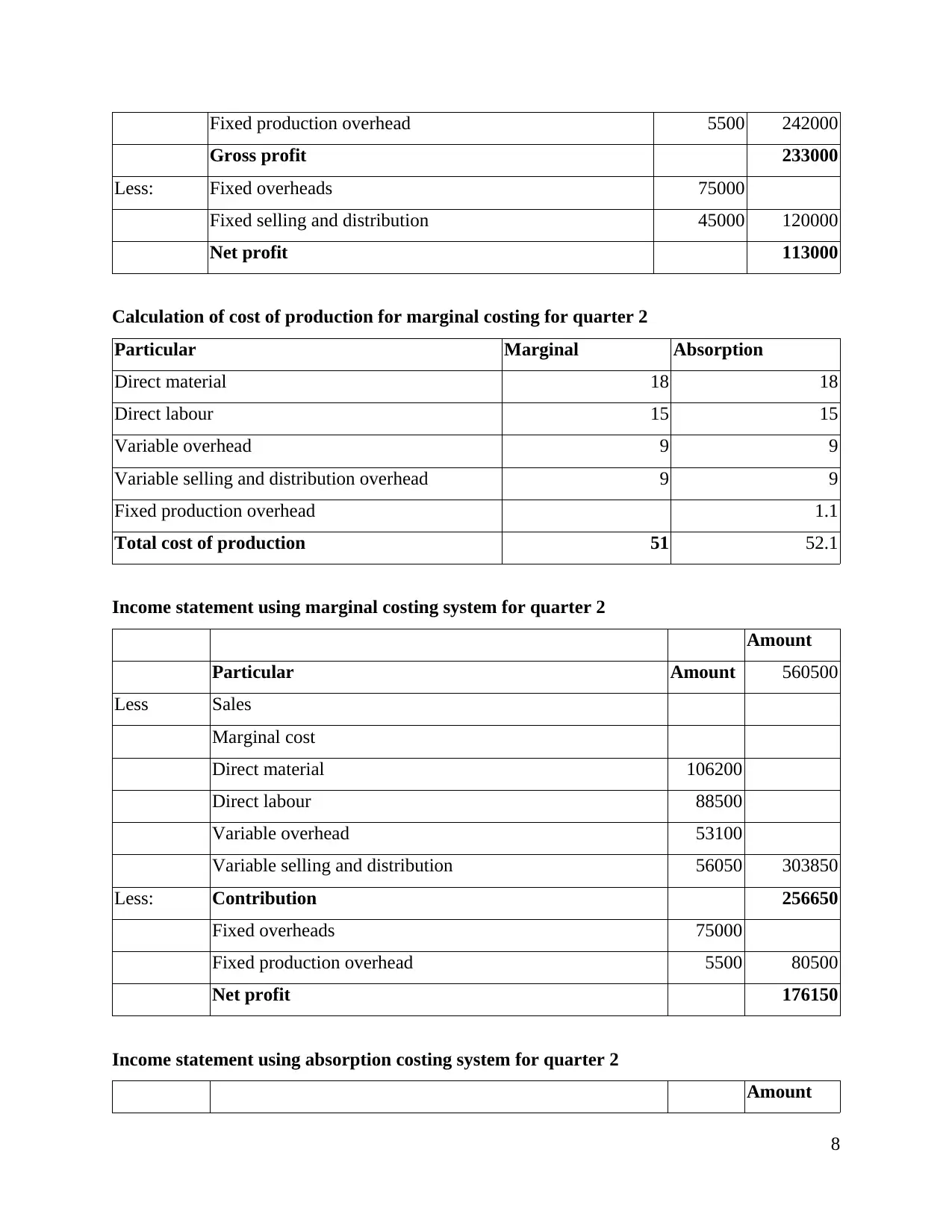

Fixed production overhead 5500 242000

Gross profit 233000

Less: Fixed overheads 75000

Fixed selling and distribution 45000 120000

Net profit 113000

Calculation of cost of production for marginal costing for quarter 2

Particular Marginal Absorption

Direct material 18 18

Direct labour 15 15

Variable overhead 9 9

Variable selling and distribution overhead 9 9

Fixed production overhead 1.1

Total cost of production 51 52.1

Income statement using marginal costing system for quarter 2

Amount

Particular Amount 560500

Less Sales

Marginal cost

Direct material 106200

Direct labour 88500

Variable overhead 53100

Variable selling and distribution 56050 303850

Less: Contribution 256650

Fixed overheads 75000

Fixed production overhead 5500 80500

Net profit 176150

Income statement using absorption costing system for quarter 2

Amount

8

Gross profit 233000

Less: Fixed overheads 75000

Fixed selling and distribution 45000 120000

Net profit 113000

Calculation of cost of production for marginal costing for quarter 2

Particular Marginal Absorption

Direct material 18 18

Direct labour 15 15

Variable overhead 9 9

Variable selling and distribution overhead 9 9

Fixed production overhead 1.1

Total cost of production 51 52.1

Income statement using marginal costing system for quarter 2

Amount

Particular Amount 560500

Less Sales

Marginal cost

Direct material 106200

Direct labour 88500

Variable overhead 53100

Variable selling and distribution 56050 303850

Less: Contribution 256650

Fixed overheads 75000

Fixed production overhead 5500 80500

Net profit 176150

Income statement using absorption costing system for quarter 2

Amount

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

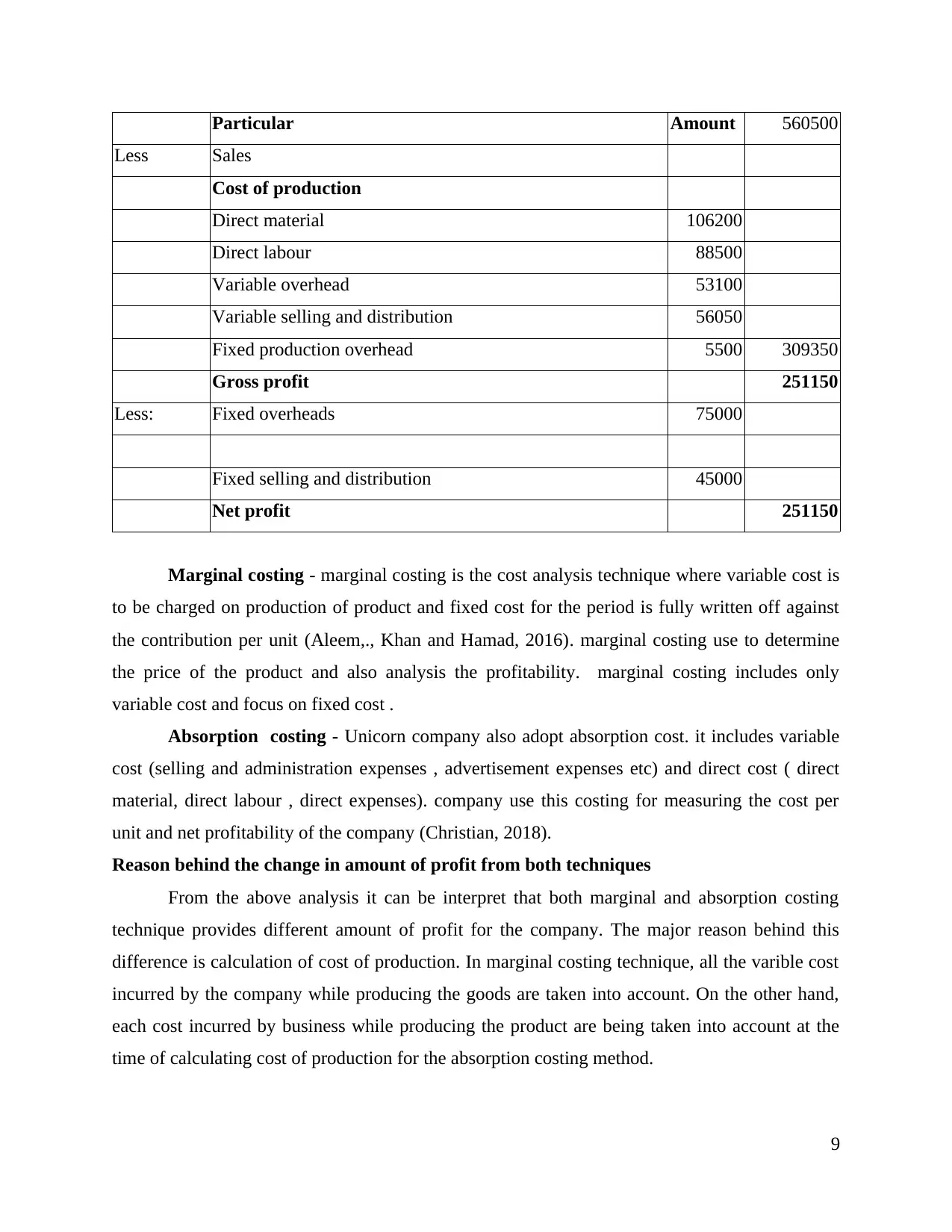

Particular Amount 560500

Less Sales

Cost of production

Direct material 106200

Direct labour 88500

Variable overhead 53100

Variable selling and distribution 56050

Fixed production overhead 5500 309350

Gross profit 251150

Less: Fixed overheads 75000

Fixed selling and distribution 45000

Net profit 251150

Marginal costing - marginal costing is the cost analysis technique where variable cost is

to be charged on production of product and fixed cost for the period is fully written off against

the contribution per unit (Aleem,., Khan and Hamad, 2016). marginal costing use to determine

the price of the product and also analysis the profitability. marginal costing includes only

variable cost and focus on fixed cost .

Absorption costing - Unicorn company also adopt absorption cost. it includes variable

cost (selling and administration expenses , advertisement expenses etc) and direct cost ( direct

material, direct labour , direct expenses). company use this costing for measuring the cost per

unit and net profitability of the company (Christian, 2018).

Reason behind the change in amount of profit from both techniques

From the above analysis it can be interpret that both marginal and absorption costing

technique provides different amount of profit for the company. The major reason behind this

difference is calculation of cost of production. In marginal costing technique, all the varible cost

incurred by the company while producing the goods are taken into account. On the other hand,

each cost incurred by business while producing the product are being taken into account at the

time of calculating cost of production for the absorption costing method.

9

Less Sales

Cost of production

Direct material 106200

Direct labour 88500

Variable overhead 53100

Variable selling and distribution 56050

Fixed production overhead 5500 309350

Gross profit 251150

Less: Fixed overheads 75000

Fixed selling and distribution 45000

Net profit 251150

Marginal costing - marginal costing is the cost analysis technique where variable cost is

to be charged on production of product and fixed cost for the period is fully written off against

the contribution per unit (Aleem,., Khan and Hamad, 2016). marginal costing use to determine

the price of the product and also analysis the profitability. marginal costing includes only

variable cost and focus on fixed cost .

Absorption costing - Unicorn company also adopt absorption cost. it includes variable

cost (selling and administration expenses , advertisement expenses etc) and direct cost ( direct

material, direct labour , direct expenses). company use this costing for measuring the cost per

unit and net profitability of the company (Christian, 2018).

Reason behind the change in amount of profit from both techniques

From the above analysis it can be interpret that both marginal and absorption costing

technique provides different amount of profit for the company. The major reason behind this

difference is calculation of cost of production. In marginal costing technique, all the varible cost

incurred by the company while producing the goods are taken into account. On the other hand,

each cost incurred by business while producing the product are being taken into account at the

time of calculating cost of production for the absorption costing method.

9

Further, the difference between profit in these techniques also incurs because in the

marginal costing, the fixed administration and selling overheads are not taken into account.

Whereas, in the absorption costing method, each cost are being taken into account by the firm.

Appendix B

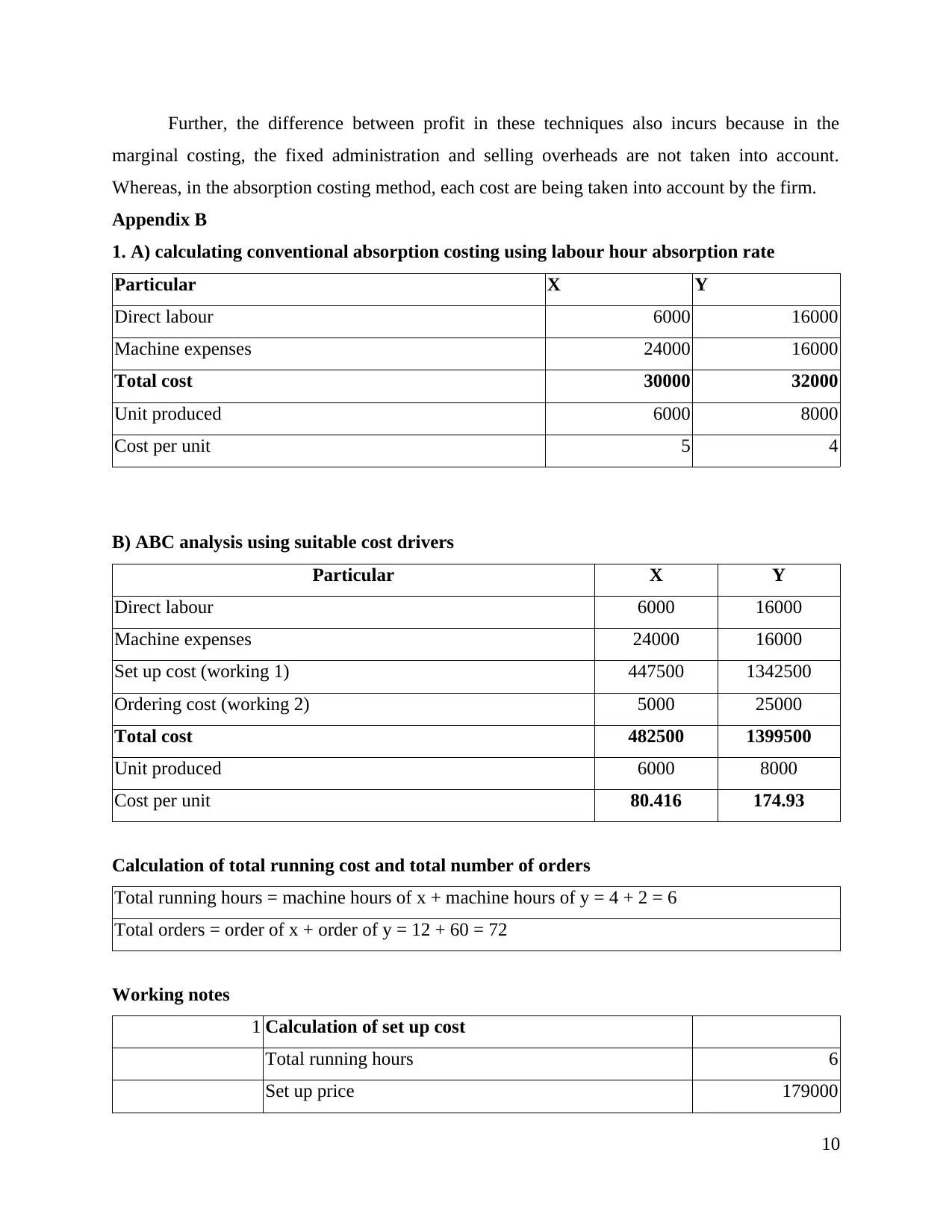

1. A) calculating conventional absorption costing using labour hour absorption rate

Particular X Y

Direct labour 6000 16000

Machine expenses 24000 16000

Total cost 30000 32000

Unit produced 6000 8000

Cost per unit 5 4

B) ABC analysis using suitable cost drivers

Particular X Y

Direct labour 6000 16000

Machine expenses 24000 16000

Set up cost (working 1) 447500 1342500

Ordering cost (working 2) 5000 25000

Total cost 482500 1399500

Unit produced 6000 8000

Cost per unit 80.416 174.93

Calculation of total running cost and total number of orders

Total running hours = machine hours of x + machine hours of y = 4 + 2 = 6

Total orders = order of x + order of y = 12 + 60 = 72

Working notes

1 Calculation of set up cost

Total running hours 6

Set up price 179000

10

marginal costing, the fixed administration and selling overheads are not taken into account.

Whereas, in the absorption costing method, each cost are being taken into account by the firm.

Appendix B

1. A) calculating conventional absorption costing using labour hour absorption rate

Particular X Y

Direct labour 6000 16000

Machine expenses 24000 16000

Total cost 30000 32000

Unit produced 6000 8000

Cost per unit 5 4

B) ABC analysis using suitable cost drivers

Particular X Y

Direct labour 6000 16000

Machine expenses 24000 16000

Set up cost (working 1) 447500 1342500

Ordering cost (working 2) 5000 25000

Total cost 482500 1399500

Unit produced 6000 8000

Cost per unit 80.416 174.93

Calculation of total running cost and total number of orders

Total running hours = machine hours of x + machine hours of y = 4 + 2 = 6

Total orders = order of x + order of y = 12 + 60 = 72

Working notes

1 Calculation of set up cost

Total running hours 6

Set up price 179000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.