Comprehensive Analysis of Management Accounting for Oshodi Plc Report

VerifiedAdded on 2021/02/20

|18

|5376

|36

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices, using Oshodi Plc, a manufacturing company, as a case study. It begins with an introduction to management accounting and its essential requirements, including inventory management, cost accounting, price optimization, and job order costing systems. The report then explains different methods used for accounting reporting, such as budget reports, accounts receivable aging reports, inventory and manufacturing reports, and cost accounting reports. A comparative analysis of the benefits and applications of various management accounting systems is presented, followed by a critical evaluation of the integration between management accounting systems and accounting reporting within Oshodi Plc. The report further explores income statements using marginal and absorption costing, the application of management accounting techniques, and financial reporting documents. It also discusses different types of planning tools for budgetary control, the use of planning tools and their applications, and the adoption of management accounting systems for responding to financial problems. The conclusion summarizes the key findings and insights regarding management accounting within the context of Oshodi Plc.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Task 1...............................................................................................................................................3

P1 Management accounting and its essential requirement..........................................................3

P2 Explain different method that is used by industry for reporting.............................................4

M1 Benefits of Management accounting system and its application..........................................6

D1 Critically evaluation of integration between management accounting system and

accounting reporting ...................................................................................................................7

TASK 2............................................................................................................................................8

P3 Income statement by using marginal costing and absorption costing....................................8

....................................................................................................................................................10

....................................................................................................................................................10

M2 Application of management accounting technique and financial reporting document ......10

D2 Financial reports that apply and data interpretation.............................................................11

TASK 3..........................................................................................................................................11

P4 Different types of planning tools can be used for budgetary control...................................11

M3 Uses of planning tools and its application...........................................................................13

Task 4.............................................................................................................................................13

P5 Adoption of management accounting system for responding financial problems...............13

M4 Management accounting leads to sustainable success........................................................15

D3 Planning tools for accounting respond.................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCE.................................................................................................................................17

INTRODUCTION...........................................................................................................................3

Task 1...............................................................................................................................................3

P1 Management accounting and its essential requirement..........................................................3

P2 Explain different method that is used by industry for reporting.............................................4

M1 Benefits of Management accounting system and its application..........................................6

D1 Critically evaluation of integration between management accounting system and

accounting reporting ...................................................................................................................7

TASK 2............................................................................................................................................8

P3 Income statement by using marginal costing and absorption costing....................................8

....................................................................................................................................................10

....................................................................................................................................................10

M2 Application of management accounting technique and financial reporting document ......10

D2 Financial reports that apply and data interpretation.............................................................11

TASK 3..........................................................................................................................................11

P4 Different types of planning tools can be used for budgetary control...................................11

M3 Uses of planning tools and its application...........................................................................13

Task 4.............................................................................................................................................13

P5 Adoption of management accounting system for responding financial problems...............13

M4 Management accounting leads to sustainable success........................................................15

D3 Planning tools for accounting respond.................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCE.................................................................................................................................17

INTRODUCTION

In management accounting managers of all organization uses different types of

accounting for the purpose of maintaining profit. Managers of business organization make

business decision regarding financial and non financial performance. It is important for

organization to manage the accounts properly by collecting accounting information and make

corrective business decisions (Peysakhova and Anyushenkova, 2018). To know about

management accounting and its importance Oshodi Plc has been taken that is a manufacturing

company which manufacturers JOJO fruit juice to customers. The management of such

organization management accounting for the purpose of getting profits. System of management

accounting, accounting reports and different kinds of planning tools will cover in this report that

helps to collect and analysis the accounting information within organization. Moreover, these

system helps to find out the problems and provide solution for the purpose of making profits.

Task 1

P1 Management accounting and its essential requirement

Management accounting are consider as collection of information and data that helps to

make day to day and short term management decision. It is a practice which is used by

organization to grow business continuously and increase profitability. Management accounting

system consider as internal system that helps to make business profits by applying different types

of management accounting system. System are the policies which helps business enterprises to

run a business successfully and it control business information that leads to organizational

objectives. In Oshodi Plc, mangers use different types of management accounting system that are

essential for organization as it helps to maintain the business information and work accordingly

(Granlund and Lukka, 2017). The different types of management accounting system are as

follows:

Inventory management system - This system is a combination of technology that

involves processes and procedure for maintaining or tracking the stock. By using this system

Oshodi Plc can manage stock that helps to place order accordingly. It required within

organization to manage the stock and monitor them affectively. It is used by all organization

where number of products are prepared and need to track inventory. Inventory is tracking by a

In management accounting managers of all organization uses different types of

accounting for the purpose of maintaining profit. Managers of business organization make

business decision regarding financial and non financial performance. It is important for

organization to manage the accounts properly by collecting accounting information and make

corrective business decisions (Peysakhova and Anyushenkova, 2018). To know about

management accounting and its importance Oshodi Plc has been taken that is a manufacturing

company which manufacturers JOJO fruit juice to customers. The management of such

organization management accounting for the purpose of getting profits. System of management

accounting, accounting reports and different kinds of planning tools will cover in this report that

helps to collect and analysis the accounting information within organization. Moreover, these

system helps to find out the problems and provide solution for the purpose of making profits.

Task 1

P1 Management accounting and its essential requirement

Management accounting are consider as collection of information and data that helps to

make day to day and short term management decision. It is a practice which is used by

organization to grow business continuously and increase profitability. Management accounting

system consider as internal system that helps to make business profits by applying different types

of management accounting system. System are the policies which helps business enterprises to

run a business successfully and it control business information that leads to organizational

objectives. In Oshodi Plc, mangers use different types of management accounting system that are

essential for organization as it helps to maintain the business information and work accordingly

(Granlund and Lukka, 2017). The different types of management accounting system are as

follows:

Inventory management system - This system is a combination of technology that

involves processes and procedure for maintaining or tracking the stock. By using this system

Oshodi Plc can manage stock that helps to place order accordingly. It required within

organization to manage the stock and monitor them affectively. It is used by all organization

where number of products are prepared and need to track inventory. Inventory is tracking by a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

system which is used by company to maintain the a fixed limit of stock and make profits for

organization. It considers different methods which are as defined:

FIFO: This method is used to sold the inventory which is ordered firstly.

LIFO: It is used by organization to sold good which is purchased recently.

AVCO: This particular method is also used by organization to sold the goods at average

cost.

From the above methods Oshodi Plc is using LIFO method beacause of getting lower

taxable income and higher return than FIFO.

Cost accounting system - This system is useful for organization as it helps to get the cost

of business activities and other expenses which are incurred by organization. It required in

Oshodi Plc company to get cost information about manufacturing of JOJO fruit juice. It helps to

decide the cost of fruit juice accordingly by analysing the all expenses. Accountant of Oshodi Plc

records, classify, summarize and analysis the cost of product and services that helps to maintain

profitability. Moreover, it required to control the budgetary cost in which limited resources of

particular projects are considered and it helps to get cost of organization (Gibassier, Rodrigue

and Arjaliès, 2018).

Price optimization system - Every organization wanted to set the prices of products and

services which is render by themselves. According to management, prices of product and

services should be reasonable that can cover all cost of manufacturing product and services and

should be optimum for customers. It required for Oshodi Plc in order to set the prices of JOJO

fruit juice that helps to earn profits. Therefore, this system is helpful for organization to set the

prices of products and services and maintain profitability. The management of selected company

attracts customers by deciding the prices of JOJO fruit juice that helps to get more profits.

Job order costing - To allocate the cost with specific batch of products are involve in job

order costing system. The main purpose of such system is accumulation of cost in particular

batch which are different from other batches. This make sure that incurred cost of products and

services is reasonable while comparing from cost of other products. It is required for JOJO fruit

juice company to divide the cost in to specific batches and maintain profits. Therefore,

management of JOJO fruit juice assign the cost of juice in to specific batch and earn higher

profits (Berger, 2018).

organization. It considers different methods which are as defined:

FIFO: This method is used to sold the inventory which is ordered firstly.

LIFO: It is used by organization to sold good which is purchased recently.

AVCO: This particular method is also used by organization to sold the goods at average

cost.

From the above methods Oshodi Plc is using LIFO method beacause of getting lower

taxable income and higher return than FIFO.

Cost accounting system - This system is useful for organization as it helps to get the cost

of business activities and other expenses which are incurred by organization. It required in

Oshodi Plc company to get cost information about manufacturing of JOJO fruit juice. It helps to

decide the cost of fruit juice accordingly by analysing the all expenses. Accountant of Oshodi Plc

records, classify, summarize and analysis the cost of product and services that helps to maintain

profitability. Moreover, it required to control the budgetary cost in which limited resources of

particular projects are considered and it helps to get cost of organization (Gibassier, Rodrigue

and Arjaliès, 2018).

Price optimization system - Every organization wanted to set the prices of products and

services which is render by themselves. According to management, prices of product and

services should be reasonable that can cover all cost of manufacturing product and services and

should be optimum for customers. It required for Oshodi Plc in order to set the prices of JOJO

fruit juice that helps to earn profits. Therefore, this system is helpful for organization to set the

prices of products and services and maintain profitability. The management of selected company

attracts customers by deciding the prices of JOJO fruit juice that helps to get more profits.

Job order costing - To allocate the cost with specific batch of products are involve in job

order costing system. The main purpose of such system is accumulation of cost in particular

batch which are different from other batches. This make sure that incurred cost of products and

services is reasonable while comparing from cost of other products. It is required for JOJO fruit

juice company to divide the cost in to specific batches and maintain profits. Therefore,

management of JOJO fruit juice assign the cost of juice in to specific batch and earn higher

profits (Berger, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

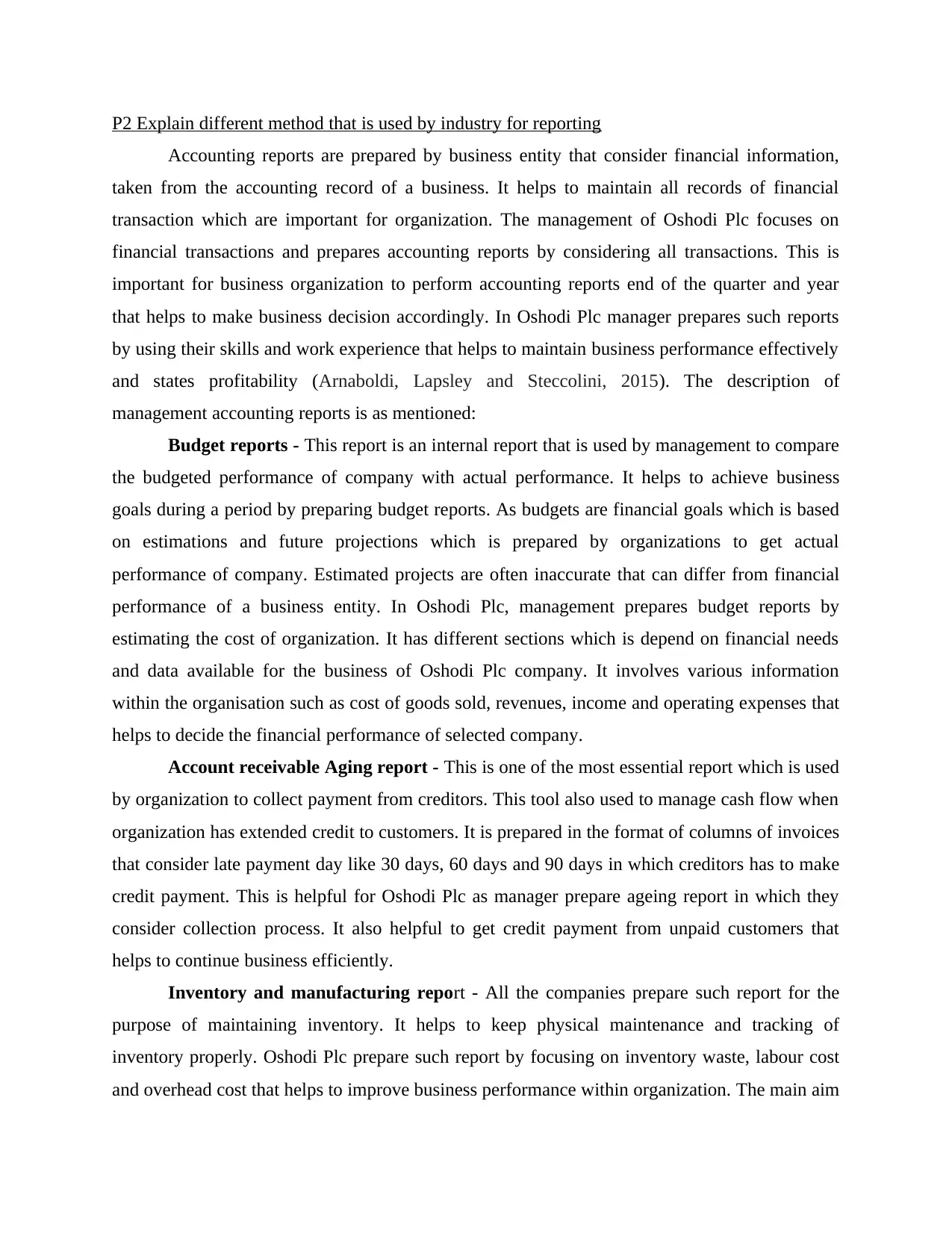

P2 Explain different method that is used by industry for reporting

Accounting reports are prepared by business entity that consider financial information,

taken from the accounting record of a business. It helps to maintain all records of financial

transaction which are important for organization. The management of Oshodi Plc focuses on

financial transactions and prepares accounting reports by considering all transactions. This is

important for business organization to perform accounting reports end of the quarter and year

that helps to make business decision accordingly. In Oshodi Plc manager prepares such reports

by using their skills and work experience that helps to maintain business performance effectively

and states profitability (Arnaboldi, Lapsley and Steccolini, 2015). The description of

management accounting reports is as mentioned:

Budget reports - This report is an internal report that is used by management to compare

the budgeted performance of company with actual performance. It helps to achieve business

goals during a period by preparing budget reports. As budgets are financial goals which is based

on estimations and future projections which is prepared by organizations to get actual

performance of company. Estimated projects are often inaccurate that can differ from financial

performance of a business entity. In Oshodi Plc, management prepares budget reports by

estimating the cost of organization. It has different sections which is depend on financial needs

and data available for the business of Oshodi Plc company. It involves various information

within the organisation such as cost of goods sold, revenues, income and operating expenses that

helps to decide the financial performance of selected company.

Account receivable Aging report - This is one of the most essential report which is used

by organization to collect payment from creditors. This tool also used to manage cash flow when

organization has extended credit to customers. It is prepared in the format of columns of invoices

that consider late payment day like 30 days, 60 days and 90 days in which creditors has to make

credit payment. This is helpful for Oshodi Plc as manager prepare ageing report in which they

consider collection process. It also helpful to get credit payment from unpaid customers that

helps to continue business efficiently.

Inventory and manufacturing report - All the companies prepare such report for the

purpose of maintaining inventory. It helps to keep physical maintenance and tracking of

inventory properly. Oshodi Plc prepare such report by focusing on inventory waste, labour cost

and overhead cost that helps to improve business performance within organization. The main aim

Accounting reports are prepared by business entity that consider financial information,

taken from the accounting record of a business. It helps to maintain all records of financial

transaction which are important for organization. The management of Oshodi Plc focuses on

financial transactions and prepares accounting reports by considering all transactions. This is

important for business organization to perform accounting reports end of the quarter and year

that helps to make business decision accordingly. In Oshodi Plc manager prepares such reports

by using their skills and work experience that helps to maintain business performance effectively

and states profitability (Arnaboldi, Lapsley and Steccolini, 2015). The description of

management accounting reports is as mentioned:

Budget reports - This report is an internal report that is used by management to compare

the budgeted performance of company with actual performance. It helps to achieve business

goals during a period by preparing budget reports. As budgets are financial goals which is based

on estimations and future projections which is prepared by organizations to get actual

performance of company. Estimated projects are often inaccurate that can differ from financial

performance of a business entity. In Oshodi Plc, management prepares budget reports by

estimating the cost of organization. It has different sections which is depend on financial needs

and data available for the business of Oshodi Plc company. It involves various information

within the organisation such as cost of goods sold, revenues, income and operating expenses that

helps to decide the financial performance of selected company.

Account receivable Aging report - This is one of the most essential report which is used

by organization to collect payment from creditors. This tool also used to manage cash flow when

organization has extended credit to customers. It is prepared in the format of columns of invoices

that consider late payment day like 30 days, 60 days and 90 days in which creditors has to make

credit payment. This is helpful for Oshodi Plc as manager prepare ageing report in which they

consider collection process. It also helpful to get credit payment from unpaid customers that

helps to continue business efficiently.

Inventory and manufacturing report - All the companies prepare such report for the

purpose of maintaining inventory. It helps to keep physical maintenance and tracking of

inventory properly. Oshodi Plc prepare such report by focusing on inventory waste, labour cost

and overhead cost that helps to improve business performance within organization. The main aim

of such report is to manage stock which is used to prepare fruit juice and prepare a report of all

expenses and material that helps to achieve business goals. Therefore, inventory report is useful

for business organization to maintain the records of all stock and increase profitability (Jollands,

Akroyd and Sawabe, 2018).

Cost accounting reports - This report is essential for organization that provides side by

side view of total cost that occurred within organization. It considers all cost of products and

services which is provided by organization to maintain the business at up position. In Oshodi Plc

manager prepares cost accounting report due to manufacturing the JOJO fruit juice. It helps

business organization to improve the profitability by maintaining the cost of products. If

organization does not prepare such report, then it cannot get actual cost of product while

producing products and services. As result they cannot make correct business decision due to

lack of cost accounting reports. The management of Oshodi Plc gather financial information,

gather them and make correct financial business decision by preparing cost accounting reports.

Therefore, this report is helpful for firms to maintain cost of each products and services for the

purpose of earning profits (Braam and Peeters, 2018).

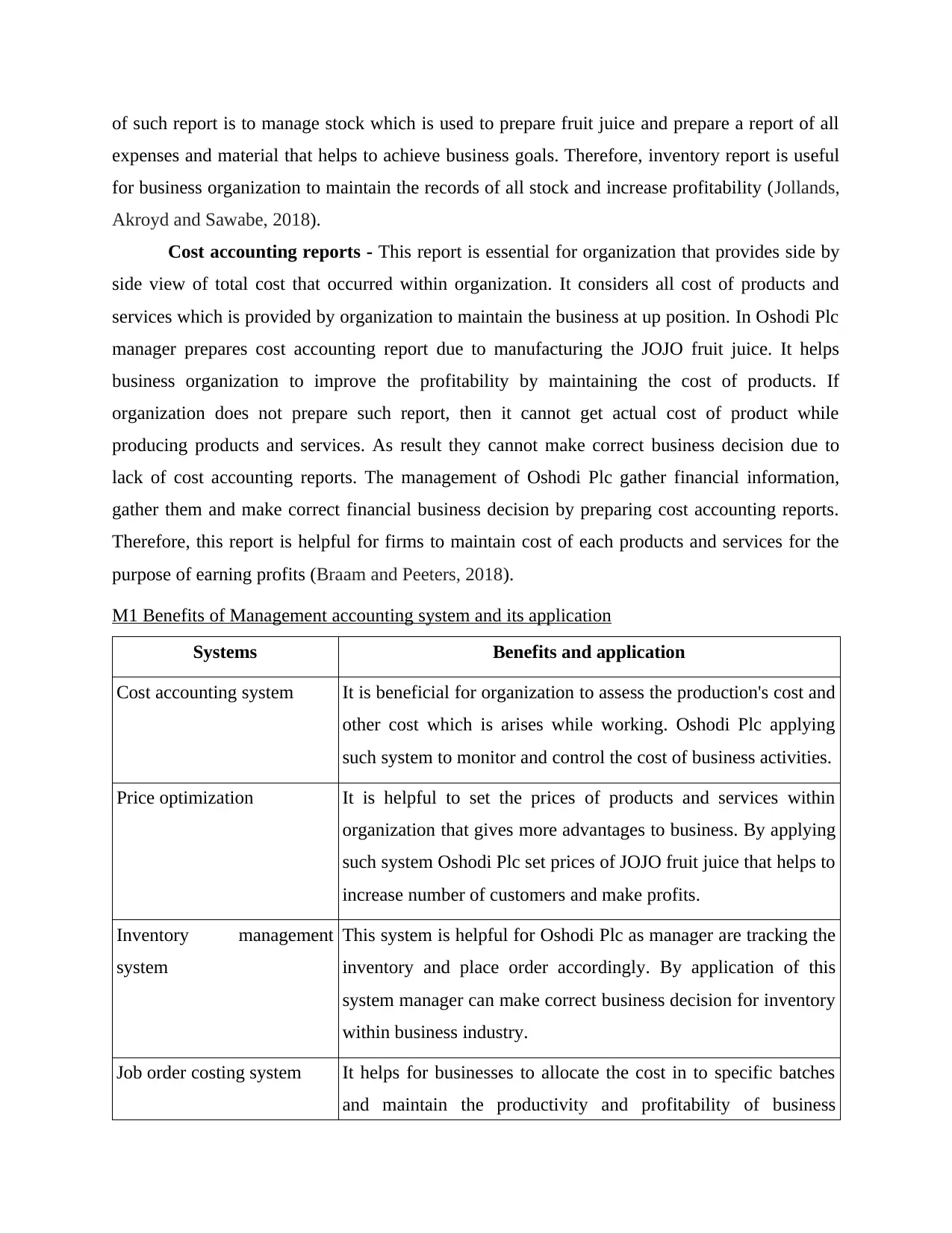

M1 Benefits of Management accounting system and its application

Systems Benefits and application

Cost accounting system It is beneficial for organization to assess the production's cost and

other cost which is arises while working. Oshodi Plc applying

such system to monitor and control the cost of business activities.

Price optimization It is helpful to set the prices of products and services within

organization that gives more advantages to business. By applying

such system Oshodi Plc set prices of JOJO fruit juice that helps to

increase number of customers and make profits.

Inventory management

system

This system is helpful for Oshodi Plc as manager are tracking the

inventory and place order accordingly. By application of this

system manager can make correct business decision for inventory

within business industry.

Job order costing system It helps for businesses to allocate the cost in to specific batches

and maintain the productivity and profitability of business

expenses and material that helps to achieve business goals. Therefore, inventory report is useful

for business organization to maintain the records of all stock and increase profitability (Jollands,

Akroyd and Sawabe, 2018).

Cost accounting reports - This report is essential for organization that provides side by

side view of total cost that occurred within organization. It considers all cost of products and

services which is provided by organization to maintain the business at up position. In Oshodi Plc

manager prepares cost accounting report due to manufacturing the JOJO fruit juice. It helps

business organization to improve the profitability by maintaining the cost of products. If

organization does not prepare such report, then it cannot get actual cost of product while

producing products and services. As result they cannot make correct business decision due to

lack of cost accounting reports. The management of Oshodi Plc gather financial information,

gather them and make correct financial business decision by preparing cost accounting reports.

Therefore, this report is helpful for firms to maintain cost of each products and services for the

purpose of earning profits (Braam and Peeters, 2018).

M1 Benefits of Management accounting system and its application

Systems Benefits and application

Cost accounting system It is beneficial for organization to assess the production's cost and

other cost which is arises while working. Oshodi Plc applying

such system to monitor and control the cost of business activities.

Price optimization It is helpful to set the prices of products and services within

organization that gives more advantages to business. By applying

such system Oshodi Plc set prices of JOJO fruit juice that helps to

increase number of customers and make profits.

Inventory management

system

This system is helpful for Oshodi Plc as manager are tracking the

inventory and place order accordingly. By application of this

system manager can make correct business decision for inventory

within business industry.

Job order costing system It helps for businesses to allocate the cost in to specific batches

and maintain the productivity and profitability of business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organization. By using this system manager of Oshodi Plc

allocate cost according to special batches that helps to achieve

business goals.

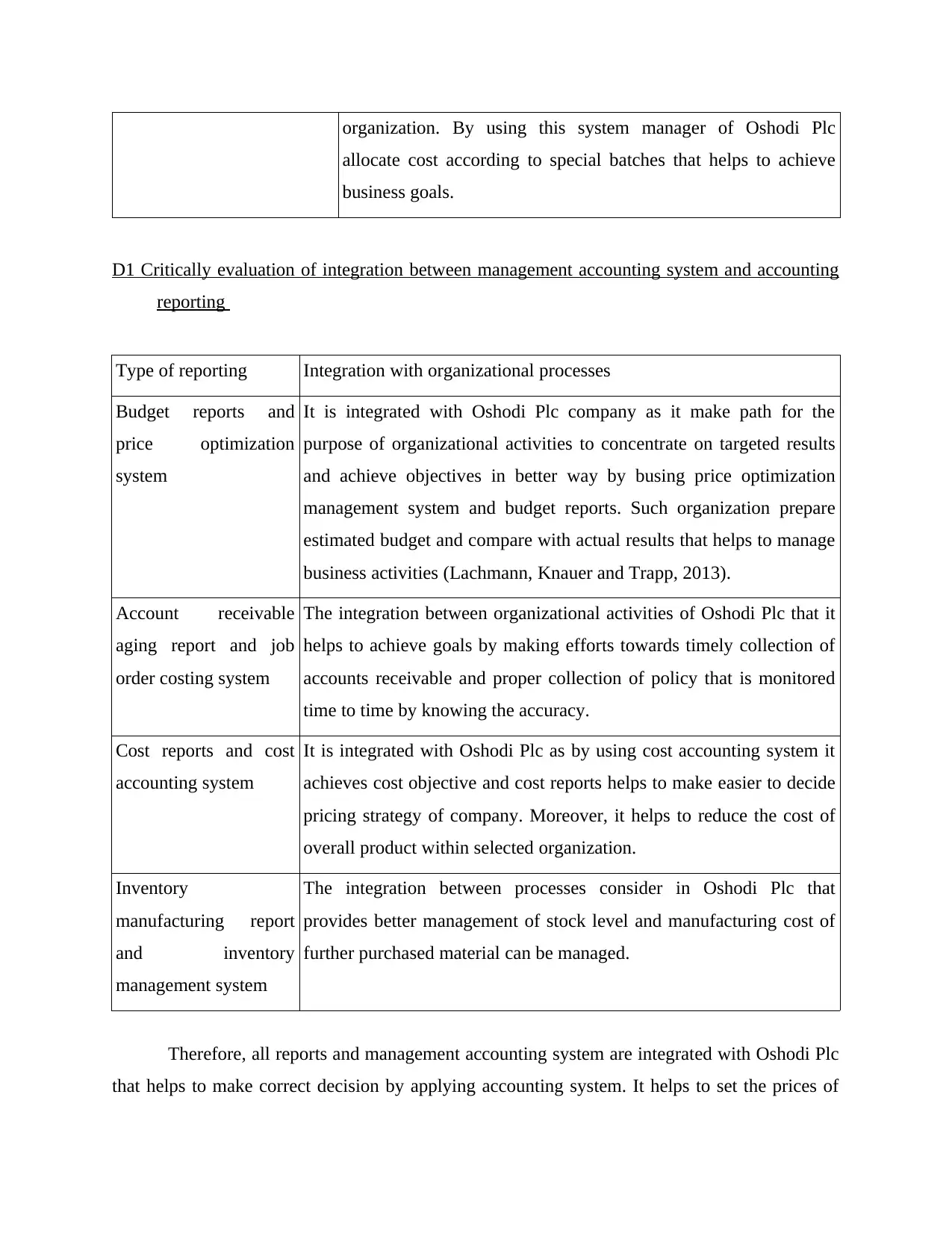

D1 Critically evaluation of integration between management accounting system and accounting

reporting

Type of reporting Integration with organizational processes

Budget reports and

price optimization

system

It is integrated with Oshodi Plc company as it make path for the

purpose of organizational activities to concentrate on targeted results

and achieve objectives in better way by busing price optimization

management system and budget reports. Such organization prepare

estimated budget and compare with actual results that helps to manage

business activities (Lachmann, Knauer and Trapp, 2013).

Account receivable

aging report and job

order costing system

The integration between organizational activities of Oshodi Plc that it

helps to achieve goals by making efforts towards timely collection of

accounts receivable and proper collection of policy that is monitored

time to time by knowing the accuracy.

Cost reports and cost

accounting system

It is integrated with Oshodi Plc as by using cost accounting system it

achieves cost objective and cost reports helps to make easier to decide

pricing strategy of company. Moreover, it helps to reduce the cost of

overall product within selected organization.

Inventory

manufacturing report

and inventory

management system

The integration between processes consider in Oshodi Plc that

provides better management of stock level and manufacturing cost of

further purchased material can be managed.

Therefore, all reports and management accounting system are integrated with Oshodi Plc

that helps to make correct decision by applying accounting system. It helps to set the prices of

allocate cost according to special batches that helps to achieve

business goals.

D1 Critically evaluation of integration between management accounting system and accounting

reporting

Type of reporting Integration with organizational processes

Budget reports and

price optimization

system

It is integrated with Oshodi Plc company as it make path for the

purpose of organizational activities to concentrate on targeted results

and achieve objectives in better way by busing price optimization

management system and budget reports. Such organization prepare

estimated budget and compare with actual results that helps to manage

business activities (Lachmann, Knauer and Trapp, 2013).

Account receivable

aging report and job

order costing system

The integration between organizational activities of Oshodi Plc that it

helps to achieve goals by making efforts towards timely collection of

accounts receivable and proper collection of policy that is monitored

time to time by knowing the accuracy.

Cost reports and cost

accounting system

It is integrated with Oshodi Plc as by using cost accounting system it

achieves cost objective and cost reports helps to make easier to decide

pricing strategy of company. Moreover, it helps to reduce the cost of

overall product within selected organization.

Inventory

manufacturing report

and inventory

management system

The integration between processes consider in Oshodi Plc that

provides better management of stock level and manufacturing cost of

further purchased material can be managed.

Therefore, all reports and management accounting system are integrated with Oshodi Plc

that helps to make correct decision by applying accounting system. It helps to set the prices of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

products, cost of products and gives information about material which are available within

organization. If organization use all accounting system and prepare reports then it can achieve

business objectives easily.

TASK 2

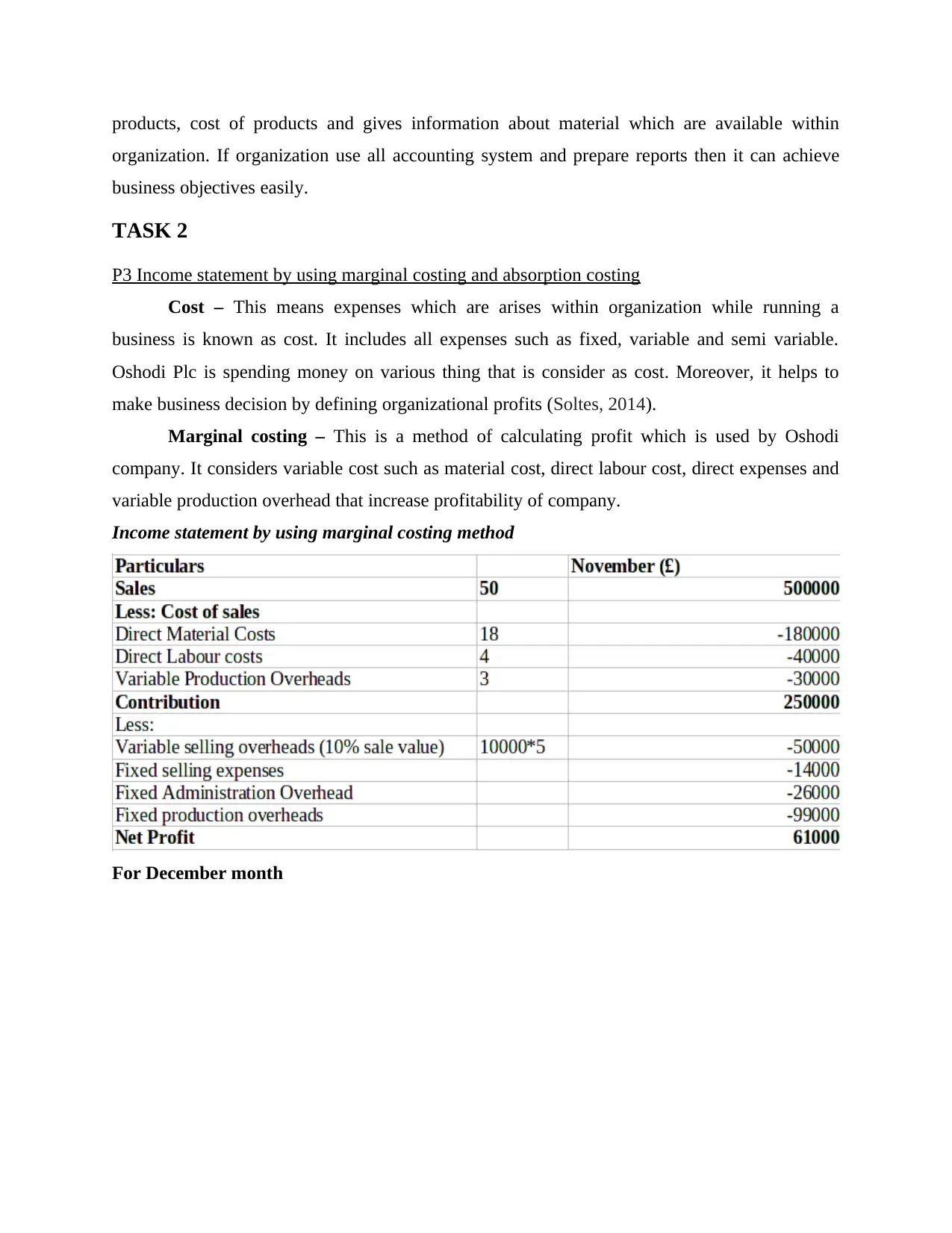

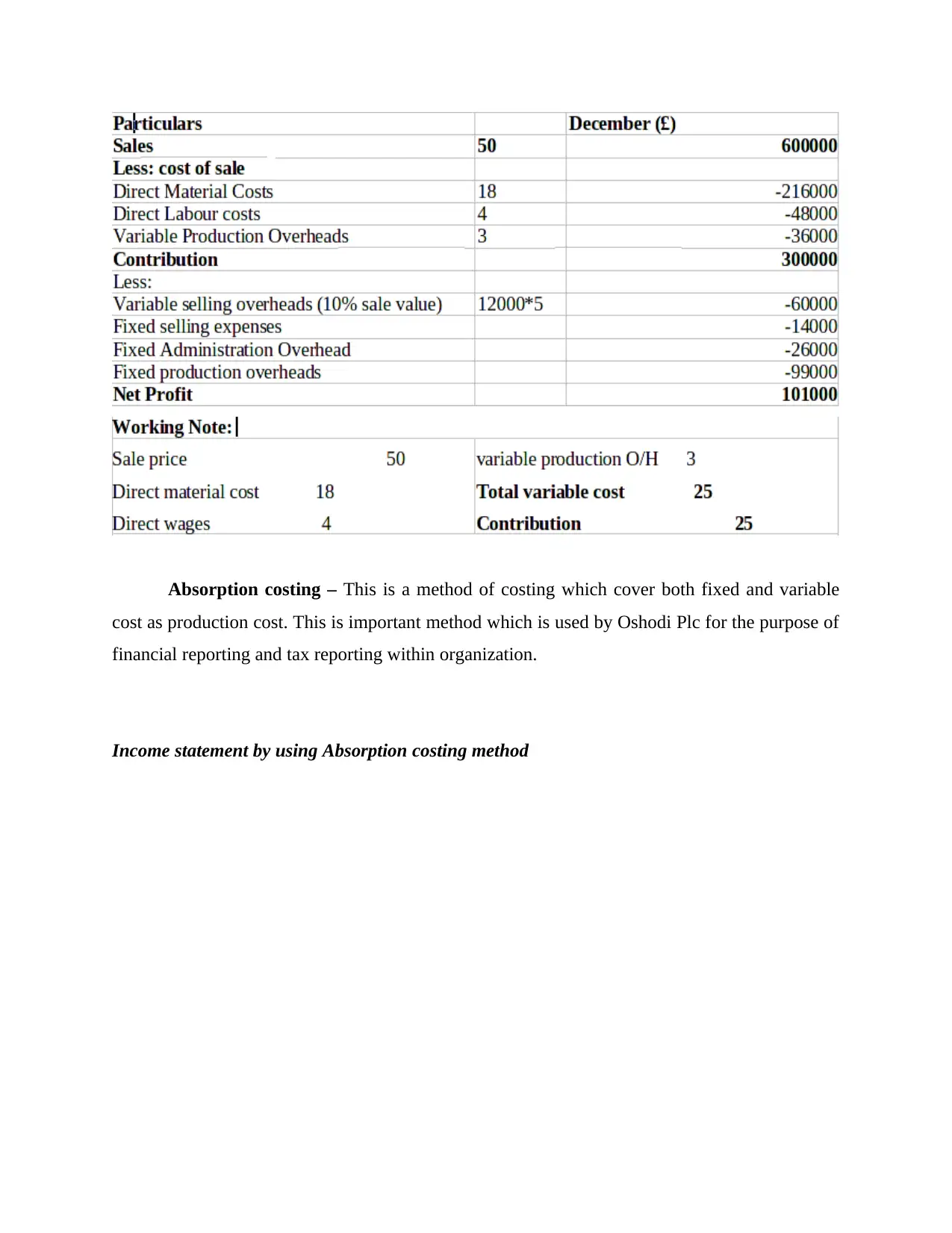

P3 Income statement by using marginal costing and absorption costing

Cost – This means expenses which are arises within organization while running a

business is known as cost. It includes all expenses such as fixed, variable and semi variable.

Oshodi Plc is spending money on various thing that is consider as cost. Moreover, it helps to

make business decision by defining organizational profits (Soltes, 2014).

Marginal costing – This is a method of calculating profit which is used by Oshodi

company. It considers variable cost such as material cost, direct labour cost, direct expenses and

variable production overhead that increase profitability of company.

Income statement by using marginal costing method

For December month

organization. If organization use all accounting system and prepare reports then it can achieve

business objectives easily.

TASK 2

P3 Income statement by using marginal costing and absorption costing

Cost – This means expenses which are arises within organization while running a

business is known as cost. It includes all expenses such as fixed, variable and semi variable.

Oshodi Plc is spending money on various thing that is consider as cost. Moreover, it helps to

make business decision by defining organizational profits (Soltes, 2014).

Marginal costing – This is a method of calculating profit which is used by Oshodi

company. It considers variable cost such as material cost, direct labour cost, direct expenses and

variable production overhead that increase profitability of company.

Income statement by using marginal costing method

For December month

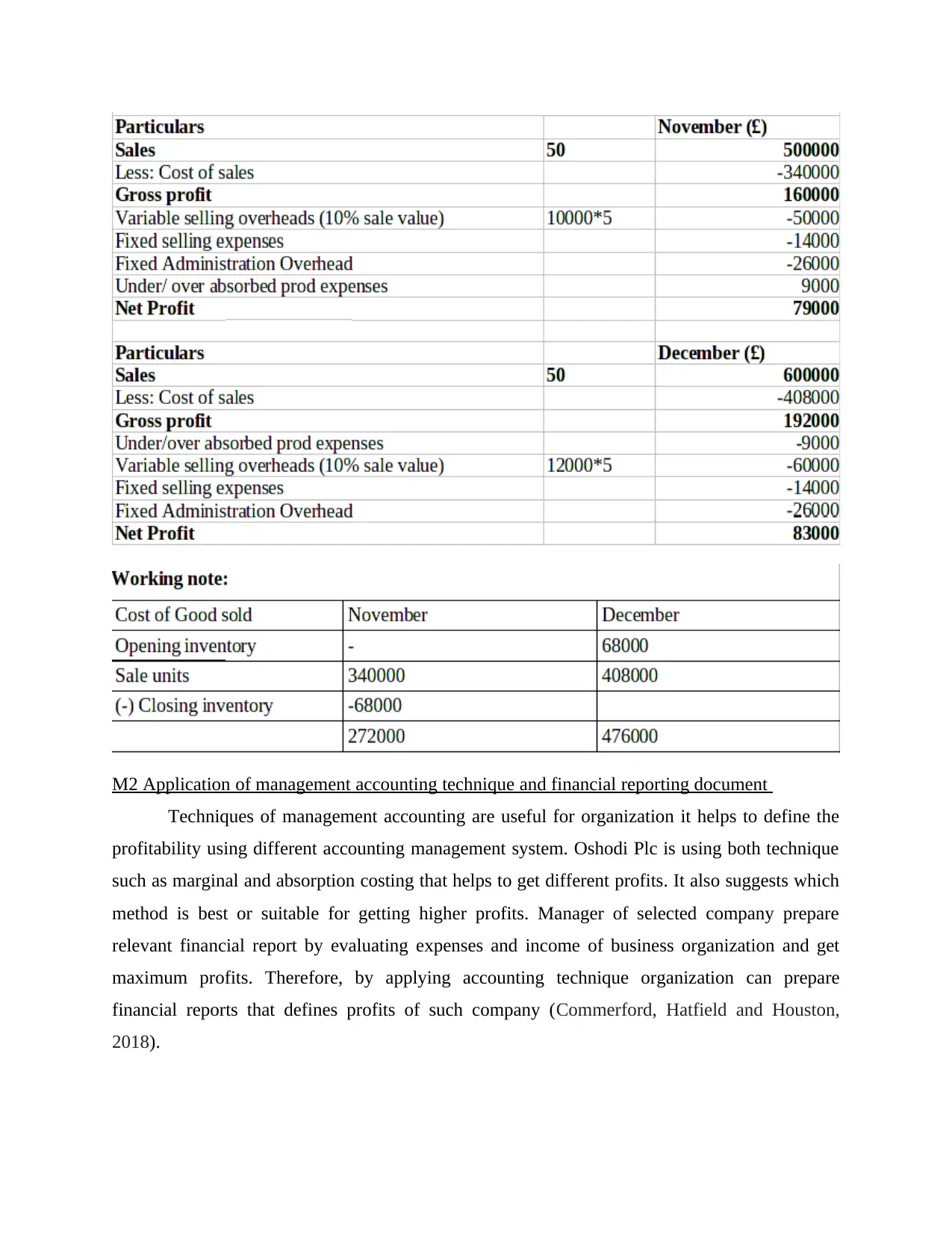

Absorption costing – This is a method of costing which cover both fixed and variable

cost as production cost. This is important method which is used by Oshodi Plc for the purpose of

financial reporting and tax reporting within organization.

Income statement by using Absorption costing method

cost as production cost. This is important method which is used by Oshodi Plc for the purpose of

financial reporting and tax reporting within organization.

Income statement by using Absorption costing method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

M2 Application of management accounting technique and financial reporting document

Techniques of management accounting are useful for organization it helps to define the

profitability using different accounting management system. Oshodi Plc is using both technique

such as marginal and absorption costing that helps to get different profits. It also suggests which

method is best or suitable for getting higher profits. Manager of selected company prepare

relevant financial report by evaluating expenses and income of business organization and get

maximum profits. Therefore, by applying accounting technique organization can prepare

financial reports that defines profits of such company (Commerford, Hatfield and Houston,

2018).

Techniques of management accounting are useful for organization it helps to define the

profitability using different accounting management system. Oshodi Plc is using both technique

such as marginal and absorption costing that helps to get different profits. It also suggests which

method is best or suitable for getting higher profits. Manager of selected company prepare

relevant financial report by evaluating expenses and income of business organization and get

maximum profits. Therefore, by applying accounting technique organization can prepare

financial reports that defines profits of such company (Commerford, Hatfield and Houston,

2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D2 Financial reports that apply and data interpretation

An annual report that consider all information regarding income and expenses of

company and prepares a main document is consider as financial report. It is prepared by

managers at end of the year in order to know profitability. Oshodi Plc preparing JOJO fruit juice

and accountant of such organization prepare financial reports that shows profits. By using

absorption costing technique Oshodi Plc is getting 79000 profit in November month and in

December it is getting higher profit that is 83000. And marginal costing states 61000 as profit in

the November month and in December it earned 101000 as profit which is higher than prior

month (Kober, Subraamanniam and Watson, 2012).

TASK 3

P4 Different types of planning tools can be used for budgetary control

Estimation of income and expenses under a fixed period of time is consider as budget.

This budget helps business organization to take corrective actions by setting the goals. It is pre

estimation of income and expenses which can occur in company while running a business. In

other words, this is a process of creating a plan to spend the money and make sounding decision

for the purpose of achieving business objectives. Such as, manager of Oshodi Plc analysis

business information and set a budget for their business activities that helps to accomplish

business objectives. On the other side, budget is a planning source that helps business

organization to develop a financial plan that defines various operations during fixed period of

time.

Planning tool is a technique that is used by company to know the budget and control such

budget. If budget of any business activities is excess, then manager can adjust with other

activities where is needed. In Oshodi Plc, accountant set a budget and control the excessive

budgets by using different types of planning tools.

Different types of planning tools and their merits and demerits are as follows:

Capital budget: It contains capital receipts and payments which is used by company to

know the capital profits. In this budget, managers allocate money for the purpose of maintaining

long term or fixed assets like land, machinery, building etc. Manager of Oshodi Plc prepare such

report by focusing on juice machine, building and other fixed assets that helps to give long term

An annual report that consider all information regarding income and expenses of

company and prepares a main document is consider as financial report. It is prepared by

managers at end of the year in order to know profitability. Oshodi Plc preparing JOJO fruit juice

and accountant of such organization prepare financial reports that shows profits. By using

absorption costing technique Oshodi Plc is getting 79000 profit in November month and in

December it is getting higher profit that is 83000. And marginal costing states 61000 as profit in

the November month and in December it earned 101000 as profit which is higher than prior

month (Kober, Subraamanniam and Watson, 2012).

TASK 3

P4 Different types of planning tools can be used for budgetary control

Estimation of income and expenses under a fixed period of time is consider as budget.

This budget helps business organization to take corrective actions by setting the goals. It is pre

estimation of income and expenses which can occur in company while running a business. In

other words, this is a process of creating a plan to spend the money and make sounding decision

for the purpose of achieving business objectives. Such as, manager of Oshodi Plc analysis

business information and set a budget for their business activities that helps to accomplish

business objectives. On the other side, budget is a planning source that helps business

organization to develop a financial plan that defines various operations during fixed period of

time.

Planning tool is a technique that is used by company to know the budget and control such

budget. If budget of any business activities is excess, then manager can adjust with other

activities where is needed. In Oshodi Plc, accountant set a budget and control the excessive

budgets by using different types of planning tools.

Different types of planning tools and their merits and demerits are as follows:

Capital budget: It contains capital receipts and payments which is used by company to

know the capital profits. In this budget, managers allocate money for the purpose of maintaining

long term or fixed assets like land, machinery, building etc. Manager of Oshodi Plc prepare such

report by focusing on juice machine, building and other fixed assets that helps to give long term

profits. In Oshodi Plc manager can control the expenditure which can affect long term business

decision and also provides strategic direction to such industry.

Merits – It helps to make capital budget decision by focusing on long term assets that

determines risk while running business activities. Moreover, it helps to generate investment

opportunities for Oshodi Plc. It increases wealth of shareholders in Oshodi Plc and create a large

business market that helps to increase sale of corporate industry (Apostolou and et. al., 2018).

Demerits – Long term decision may be irreversible within business firm that can reduce

profits. Techniques which are used for preparing such budget are basis on assumptions not real.

Moreover, it take time much to prepare such budget and not easy for company to consider all

long term assets.

Operating budget: This budget contains operating activities of business organization

that involves company expenses, expected income and expected cost for definite period. In case

Oshodi Plc budgets focuses on operational activities of business entity that ensure day to day

business activities. Costs are related to maintenance expenses, sales cost and running a business

that helps to decide the day to day business performance. Manager of selected company uses

operating budget to perform day to day business activities in effective manner and complete

targets.

Merits: This budget helps small business to allocate money in to short term for achieving

business goals. It is helpful for Oshodi Plc as it is flexible that can accept changes for improving

the business performance. It focuses on routine transactions that helps to create more business

opportunities and accomplish day to day targets.

Demerits: This is time required budget that takes more time to prepare this budget.

Therefore, it may be difficult for Oshodi Plc to prepare operating budget on daily basis and get

profitability of such organization.

Master budget: This is sum total of all divisional budgets which is prepared by all

department within organization. It consider as major tool within corporate sector that helps to

make financial planning, cash flow forecast, balance sheet and profit and loss account of

business entity. Manager of Oshodi Plc prepare master budget for a year and reach at a level in a

particular period. With the help of master budget chosen company make financial plan and work

accordingly for the purpose of expanding business in fixed amounts (About master budget,

2019).

decision and also provides strategic direction to such industry.

Merits – It helps to make capital budget decision by focusing on long term assets that

determines risk while running business activities. Moreover, it helps to generate investment

opportunities for Oshodi Plc. It increases wealth of shareholders in Oshodi Plc and create a large

business market that helps to increase sale of corporate industry (Apostolou and et. al., 2018).

Demerits – Long term decision may be irreversible within business firm that can reduce

profits. Techniques which are used for preparing such budget are basis on assumptions not real.

Moreover, it take time much to prepare such budget and not easy for company to consider all

long term assets.

Operating budget: This budget contains operating activities of business organization

that involves company expenses, expected income and expected cost for definite period. In case

Oshodi Plc budgets focuses on operational activities of business entity that ensure day to day

business activities. Costs are related to maintenance expenses, sales cost and running a business

that helps to decide the day to day business performance. Manager of selected company uses

operating budget to perform day to day business activities in effective manner and complete

targets.

Merits: This budget helps small business to allocate money in to short term for achieving

business goals. It is helpful for Oshodi Plc as it is flexible that can accept changes for improving

the business performance. It focuses on routine transactions that helps to create more business

opportunities and accomplish day to day targets.

Demerits: This is time required budget that takes more time to prepare this budget.

Therefore, it may be difficult for Oshodi Plc to prepare operating budget on daily basis and get

profitability of such organization.

Master budget: This is sum total of all divisional budgets which is prepared by all

department within organization. It consider as major tool within corporate sector that helps to

make financial planning, cash flow forecast, balance sheet and profit and loss account of

business entity. Manager of Oshodi Plc prepare master budget for a year and reach at a level in a

particular period. With the help of master budget chosen company make financial plan and work

accordingly for the purpose of expanding business in fixed amounts (About master budget,

2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.