Detailed Management Accounting Report for Unit 5: Systems and Analysis

VerifiedAdded on 2021/02/19

|21

|4770

|39

Report

AI Summary

This report delves into the core concepts of management accounting, exploring essential requirements and various systems such as cost accounting, inventory management, job costing, and price optimization. It explains reporting methods like budget reports, accounts receivable reports, performance reports, and cost reports. The report further evaluates the advantages and applications of these systems within an organization, analyzing their benefits and limitations. Cost calculation techniques, including marginal and absorption costing, are discussed. Additionally, the report assesses different planning tools, their advantages and disadvantages, and compares organizations adapting to various management accounting systems. The analysis extends to resolving financial problems within management accounting and its impact on organizational growth, concluding with a critical evaluation of planning tools.

UNIT 5 Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

LO1..................................................................................................................................................3

P1. Explaining the concept of management accounting and essential requirements of its

various system........................................................................................................................3

P2. Explaining various methods of management accounting that are used for reporting......5

M1. Evaluating the advantages and the application of the management accounting system

within the organization...........................................................................................................6

D1. Evaluating the integration between the system and the reporting of the management

accounting...............................................................................................................................7

LO 2.................................................................................................................................................7

P. 3 Calculating the cost using various appropriate techniques............................................7

.......................................................................................................................................................10

LO 3...............................................................................................................................................10

P. 4 Assessment of advantages and disadvantages of different planning tools....................10

M. 3 Analysing use of different planning tools...................................................................13

LO 4...............................................................................................................................................13

P. 4 Comparing organizations which are adapting to various management accounting system.

..............................................................................................................................................13

M. 4 Analysing how resolving to financial problems in management accounting helps in

further growth and success...................................................................................................16

D. 2 Critical evaluation of the planning tools for accounting.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

LO1..................................................................................................................................................3

P1. Explaining the concept of management accounting and essential requirements of its

various system........................................................................................................................3

P2. Explaining various methods of management accounting that are used for reporting......5

M1. Evaluating the advantages and the application of the management accounting system

within the organization...........................................................................................................6

D1. Evaluating the integration between the system and the reporting of the management

accounting...............................................................................................................................7

LO 2.................................................................................................................................................7

P. 3 Calculating the cost using various appropriate techniques............................................7

.......................................................................................................................................................10

LO 3...............................................................................................................................................10

P. 4 Assessment of advantages and disadvantages of different planning tools....................10

M. 3 Analysing use of different planning tools...................................................................13

LO 4...............................................................................................................................................13

P. 4 Comparing organizations which are adapting to various management accounting system.

..............................................................................................................................................13

M. 4 Analysing how resolving to financial problems in management accounting helps in

further growth and success...................................................................................................16

D. 2 Critical evaluation of the planning tools for accounting.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is an effective process of preparing accounts and reports in an

accurate and efficient manner. Management accounting helps in planning, organizing, staffing,

directing, controlling and monitoring the activities of the organization which helps in effective

decision making. Management accounting effectively helps in forecasting, margin analysis,

constraint analysis, forecasting, valuation, variance analysis, profitability, break even analysis,

new product analysis, etc. It helps in managing and analysing the cost of the business by

effectively preparing internal financial reports. This helps managers in decision making for long

term growth of the business.

This study will highlight, different types of management accounting systems. This study

will also calculate the cost using various appropriate techniques which helps in preparing income

statement by using absorption and marginal cost. Furthermore, this study will include various

planning tools which are used for budgetary control. This study will also compare organizations

which are adapting to various management accounting system, which eventually helps in

resolving various financial problems.

LO1.

P1. Explaining the concept of management accounting and essential requirements of its various

system

Management accounting refers to the representation of the accounting information in

respect of formulating the policies that are been adopted by management and enables Arcadia

group in managing their routine activities (Thomas, 2016). MA helps the company in performing

the managerial functions that involve planning, directing, organising, controlling and staffing.

Unlike financial accounting, management accounting facilitates useful information to the internal

staff within Arcadia group and not for the outsiders. MA aims for providing both qualitative and

the quantitative information which helps the managers of Arcadia group in making suitable

decisions and seeks for the opportunities that generates larger profits.

Management accounting is very useful for internal stakeholders of the company and does

not have top comply with any rules and regulations. It is not compulsory to carry out

management accounting reports. On the contrary, financial accounting is performed based on

certain set of rules and regulations. Financial statements are compulsory to prepare every

Management accounting is an effective process of preparing accounts and reports in an

accurate and efficient manner. Management accounting helps in planning, organizing, staffing,

directing, controlling and monitoring the activities of the organization which helps in effective

decision making. Management accounting effectively helps in forecasting, margin analysis,

constraint analysis, forecasting, valuation, variance analysis, profitability, break even analysis,

new product analysis, etc. It helps in managing and analysing the cost of the business by

effectively preparing internal financial reports. This helps managers in decision making for long

term growth of the business.

This study will highlight, different types of management accounting systems. This study

will also calculate the cost using various appropriate techniques which helps in preparing income

statement by using absorption and marginal cost. Furthermore, this study will include various

planning tools which are used for budgetary control. This study will also compare organizations

which are adapting to various management accounting system, which eventually helps in

resolving various financial problems.

LO1.

P1. Explaining the concept of management accounting and essential requirements of its various

system

Management accounting refers to the representation of the accounting information in

respect of formulating the policies that are been adopted by management and enables Arcadia

group in managing their routine activities (Thomas, 2016). MA helps the company in performing

the managerial functions that involve planning, directing, organising, controlling and staffing.

Unlike financial accounting, management accounting facilitates useful information to the internal

staff within Arcadia group and not for the outsiders. MA aims for providing both qualitative and

the quantitative information which helps the managers of Arcadia group in making suitable

decisions and seeks for the opportunities that generates larger profits.

Management accounting is very useful for internal stakeholders of the company and does

not have top comply with any rules and regulations. It is not compulsory to carry out

management accounting reports. On the contrary, financial accounting is performed based on

certain set of rules and regulations. Financial statements are compulsory to prepare every

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

financial year ending. Theses financial reports are distributed to both internal and external

stakeholders which helps in strategic decision making.

There are various systems of management accounting which plays a significant role in efficient

functioning of Arcadia group business that are as follows-

Cost accounting system- It is the system that presents the information for analysing and

classifying the expenditure that is involved in producing the product. It provides systematic

record of the cost ascertained in purchasing the raw material and the labour used in respect of the

production process. The major objective of this system is to evaluate the cost, ensuring proper

controlling and the planning of the cost and assessing the cost for making managerial decisions.

This system is adopted by Arcadia group in order to estimate product cost for making

profitability analysis, cost control and the valuation of the inventory.

Inventory management system- It refers to the system that tracks the goods through

entire management of the supply chain and the portion in which the business operates (Ismail,

Isa, and Mia, 2018). It covers all the things that begins from the production to the retail,

warehousing to the shipping and other aspects like movement of the stock and in between the

parts. This system helps in proper management of the supply chain and assist the managers in

developing focus to other critical parts of the business. Inventory management system plays an

essential role in managing the stock items of Arcadia group and consistently tracing its delivery

to its ultimate customers. It also helps in analysing the requirement of the inventory and creating

automated ordering. It enables the organization in understanding its assets and in making

optimum use of the asset so that business operation could be improved and larger profitability

can be gained.

Job costing system- It is the method of recoding cost that is been incurred in the job of

manufacturing the product of Arcadia group. Through this system, manager of the company

could be able to track the cost for each job and in maintaining the data that is relevant for the

business operations (Nguyen, 2018). It is very important for the company as appropriate

evaluation of the costing results in better estimation of the project, management decisions and

the financial reporting. It helps the business owners in determining the true cost that is attached

to every job or the service within its organization.

Price optimization system- It is the mathematical tool that is been applied by Arcadia

group in order to assess the response of tits customers towards different price level of its

stakeholders which helps in strategic decision making.

There are various systems of management accounting which plays a significant role in efficient

functioning of Arcadia group business that are as follows-

Cost accounting system- It is the system that presents the information for analysing and

classifying the expenditure that is involved in producing the product. It provides systematic

record of the cost ascertained in purchasing the raw material and the labour used in respect of the

production process. The major objective of this system is to evaluate the cost, ensuring proper

controlling and the planning of the cost and assessing the cost for making managerial decisions.

This system is adopted by Arcadia group in order to estimate product cost for making

profitability analysis, cost control and the valuation of the inventory.

Inventory management system- It refers to the system that tracks the goods through

entire management of the supply chain and the portion in which the business operates (Ismail,

Isa, and Mia, 2018). It covers all the things that begins from the production to the retail,

warehousing to the shipping and other aspects like movement of the stock and in between the

parts. This system helps in proper management of the supply chain and assist the managers in

developing focus to other critical parts of the business. Inventory management system plays an

essential role in managing the stock items of Arcadia group and consistently tracing its delivery

to its ultimate customers. It also helps in analysing the requirement of the inventory and creating

automated ordering. It enables the organization in understanding its assets and in making

optimum use of the asset so that business operation could be improved and larger profitability

can be gained.

Job costing system- It is the method of recoding cost that is been incurred in the job of

manufacturing the product of Arcadia group. Through this system, manager of the company

could be able to track the cost for each job and in maintaining the data that is relevant for the

business operations (Nguyen, 2018). It is very important for the company as appropriate

evaluation of the costing results in better estimation of the project, management decisions and

the financial reporting. It helps the business owners in determining the true cost that is attached

to every job or the service within its organization.

Price optimization system- It is the mathematical tool that is been applied by Arcadia

group in order to assess the response of tits customers towards different price level of its

products and the services. This system is essential because it helps in determining demand and

fixing the best price so that sales of the company could be increased with larger customer base.

Fixing the most suitable prices enables the organization in meeting its various objectives like

profit maximization and reaching the sales target (Latan and et.al., 2018). This process helps in

setting up the adequate retail value of the product that is affordable and reasonable for the

customers.

P2. Explaining various methods of management accounting that are used for reporting

Budget report- This report refers the estimations of various aspects of the business such

as sales budget, purchase budget etc. Budget report helps in analysing the performance of the

business and assist the mangers of Arcadia group in keeping proper control over the cost or

spending so that profit margin increases. The anticipations made in this report are based on the

actual expenses from previous years. Budget reports are useful for Arcadia group in providing

the incentives to its employees.

Accounts receivable report- This report relates with keeping the track on the receivables

that are to be collected from the debtors of Arcadia group. Preparing this report is critical for the

enterprise in order to maintain its cash flow that is timely collection of dues helps in meeting the

cash expenses in the future. It prevents the collection department from overlooking of the old

debts and in managing the present dues (Quinn and et.al., 2018). Manager of Arcadia group uses

this report in finding out the problems if present in the collection process of the company.

Account receivable report provides for tightening the credit policies so that average collection

period does not result in longer period. This in turn helps in maintaining the cash liquidity of the

firm.

Performance report- It is created by Arcadia group for reviewing its overall performance

and also the performance of its employees at the end of the period. Departmental performance

reports are also been formulated which helps in making the analysis of each department which in

turn helps in performance management appraisal of the employees. Managers uses this report for

making strategic decisions relating to the future prospects of its business. On the basis of this

report individuals are been rewarded against their commitment and the under performers are

been given proper training. Performance report helps in identifying the flaws if any present in the

operation of Arcadia group and it plays a crucial role in keeping the accurate measure of the

strategy developed by an entity in achieving their mission.

fixing the best price so that sales of the company could be increased with larger customer base.

Fixing the most suitable prices enables the organization in meeting its various objectives like

profit maximization and reaching the sales target (Latan and et.al., 2018). This process helps in

setting up the adequate retail value of the product that is affordable and reasonable for the

customers.

P2. Explaining various methods of management accounting that are used for reporting

Budget report- This report refers the estimations of various aspects of the business such

as sales budget, purchase budget etc. Budget report helps in analysing the performance of the

business and assist the mangers of Arcadia group in keeping proper control over the cost or

spending so that profit margin increases. The anticipations made in this report are based on the

actual expenses from previous years. Budget reports are useful for Arcadia group in providing

the incentives to its employees.

Accounts receivable report- This report relates with keeping the track on the receivables

that are to be collected from the debtors of Arcadia group. Preparing this report is critical for the

enterprise in order to maintain its cash flow that is timely collection of dues helps in meeting the

cash expenses in the future. It prevents the collection department from overlooking of the old

debts and in managing the present dues (Quinn and et.al., 2018). Manager of Arcadia group uses

this report in finding out the problems if present in the collection process of the company.

Account receivable report provides for tightening the credit policies so that average collection

period does not result in longer period. This in turn helps in maintaining the cash liquidity of the

firm.

Performance report- It is created by Arcadia group for reviewing its overall performance

and also the performance of its employees at the end of the period. Departmental performance

reports are also been formulated which helps in making the analysis of each department which in

turn helps in performance management appraisal of the employees. Managers uses this report for

making strategic decisions relating to the future prospects of its business. On the basis of this

report individuals are been rewarded against their commitment and the under performers are

been given proper training. Performance report helps in identifying the flaws if any present in the

operation of Arcadia group and it plays a crucial role in keeping the accurate measure of the

strategy developed by an entity in achieving their mission.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost report- It refers to that management accounting report which records the cost

associated with the specific project so that proper planning can be achieved with low cost and

maximum profits. This report helps in identifying the areas that are incurring higher cost so that

corrective measures can be taken by the managers of Arcadia group (Cooper, Ezzamel and

Robson, 2019). It ensures controlling on the expenses with optimum utilization of the company's

resources which in turn leads to efficient working and effective achievement of the

organizational goals.

Other managerial report- This includes information reports, competitors analysis,

project reports etc. that are very vital for organization for achieving the growing success in the

long run. For attaining the most from the decisions, it helps the managers in reaching towards the

credible and the authentic conduct of the business activities.

M1. Evaluating the advantages and the application of the management accounting system within

the organization

Cost Accounting System- This management system is applied in all organisations with

the purpose of determining cost incurred during manufacturing process of products & services.

Thus, this system play a significant role in profitability analysis of Arcadia group Ltd (Otley,

2016).

Advantage

Provide effective utilisation of resources in order to set high profit margin on products &

services offered by Arcadia group Ltd.

This helps Arcadia group Ltd. In identifying different types of financials issues and

provide solution for resolving those problems.

Disadvantages

There is a lack of uniform procedure which may lead to different results and outcomes.

Inventory Management System- Internal managers of Arcadia group Ltd implement

this system in organisation to determine availability of inventory and to calculate value of

available inventory so that company can easily carry out its manufacturing process. This system

is also beneficial in managing output level and sales volume.

Advantage

associated with the specific project so that proper planning can be achieved with low cost and

maximum profits. This report helps in identifying the areas that are incurring higher cost so that

corrective measures can be taken by the managers of Arcadia group (Cooper, Ezzamel and

Robson, 2019). It ensures controlling on the expenses with optimum utilization of the company's

resources which in turn leads to efficient working and effective achievement of the

organizational goals.

Other managerial report- This includes information reports, competitors analysis,

project reports etc. that are very vital for organization for achieving the growing success in the

long run. For attaining the most from the decisions, it helps the managers in reaching towards the

credible and the authentic conduct of the business activities.

M1. Evaluating the advantages and the application of the management accounting system within

the organization

Cost Accounting System- This management system is applied in all organisations with

the purpose of determining cost incurred during manufacturing process of products & services.

Thus, this system play a significant role in profitability analysis of Arcadia group Ltd (Otley,

2016).

Advantage

Provide effective utilisation of resources in order to set high profit margin on products &

services offered by Arcadia group Ltd.

This helps Arcadia group Ltd. In identifying different types of financials issues and

provide solution for resolving those problems.

Disadvantages

There is a lack of uniform procedure which may lead to different results and outcomes.

Inventory Management System- Internal managers of Arcadia group Ltd implement

this system in organisation to determine availability of inventory and to calculate value of

available inventory so that company can easily carry out its manufacturing process. This system

is also beneficial in managing output level and sales volume.

Advantage

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This system provides monetary benefits to a company as with these Managers of Arcadia

group Ltd take decision of adapting a inventory management method.

This enhances customers loyalty and Inventory turnover of Arcadia group Ltd (Ofosu,

2018).

Disadvantages

It is an expensive and complex approach. It is very difficult to traxck the level of

inventory needed at the particular time.

Job costing System- This is applicable in a company which is offering unique and

different types of products such as Interior Designing Company and Event Management

Companies. This system is useful as it provides detailed information of cost associated in each

job.

Advantage

This system facilitate waste management in Arcadia group Ltd which in turn enhances

profitability of company.

Disadvantages

The overhead of the company cannot be controlled while using this method and it may

lead to rise in the conflict of the organization. It is an expensive and complex system.

Price optimization system: This system is essential because it helps in determining

demand and fixing the best price so that sales of the company could be increased with larger

customer base.

Advantage

This system helps in setting a price which a consumer is willing to pay. It helps in

increasing the demand of the products which eventually leads to higher profitability and

performance for the company.

Disadvantages

Dynamic price affect the demand of the company which leads to lower profitability and

performance for the company.

group Ltd take decision of adapting a inventory management method.

This enhances customers loyalty and Inventory turnover of Arcadia group Ltd (Ofosu,

2018).

Disadvantages

It is an expensive and complex approach. It is very difficult to traxck the level of

inventory needed at the particular time.

Job costing System- This is applicable in a company which is offering unique and

different types of products such as Interior Designing Company and Event Management

Companies. This system is useful as it provides detailed information of cost associated in each

job.

Advantage

This system facilitate waste management in Arcadia group Ltd which in turn enhances

profitability of company.

Disadvantages

The overhead of the company cannot be controlled while using this method and it may

lead to rise in the conflict of the organization. It is an expensive and complex system.

Price optimization system: This system is essential because it helps in determining

demand and fixing the best price so that sales of the company could be increased with larger

customer base.

Advantage

This system helps in setting a price which a consumer is willing to pay. It helps in

increasing the demand of the products which eventually leads to higher profitability and

performance for the company.

Disadvantages

Dynamic price affect the demand of the company which leads to lower profitability and

performance for the company.

D1. Evaluating the integration between the system and the reporting of the management

accounting

Both management accounting systems and reporting are an integral part of a business

organisation. With management accounting reports Arcadia group Ltd is able to evaluate

performance of company, variance in actual & estimated cost with cost accounting report and

organise production process by analysing different reports. Whereas management accounting

system helps company in managing inefficiency evaluated from reports. Moreover, both reports

are inter-dependent on each other (Renz, 2016).

LO 2

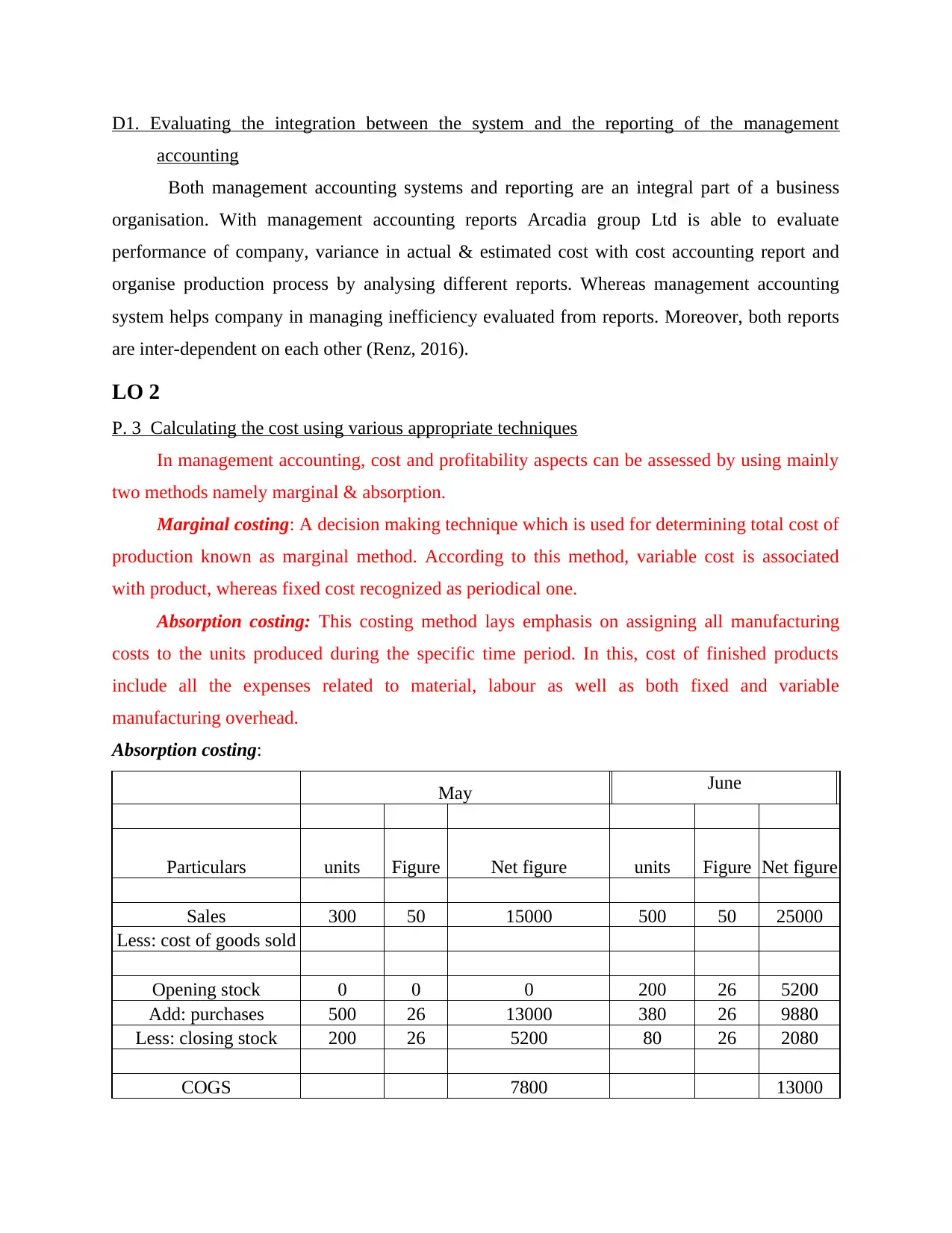

P. 3 Calculating the cost using various appropriate techniques

In management accounting, cost and profitability aspects can be assessed by using mainly

two methods namely marginal & absorption.

Marginal costing: A decision making technique which is used for determining total cost of

production known as marginal method. According to this method, variable cost is associated

with product, whereas fixed cost recognized as periodical one.

Absorption costing: This costing method lays emphasis on assigning all manufacturing

costs to the units produced during the specific time period. In this, cost of finished products

include all the expenses related to material, labour as well as both fixed and variable

manufacturing overhead.

Absorption costing:

May June

Particulars units Figure Net figure units Figure Net figure

Sales 300 50 15000 500 50 25000

Less: cost of goods sold

Opening stock 0 0 0 200 26 5200

Add: purchases 500 26 13000 380 26 9880

Less: closing stock 200 26 5200 80 26 2080

COGS 7800 13000

accounting

Both management accounting systems and reporting are an integral part of a business

organisation. With management accounting reports Arcadia group Ltd is able to evaluate

performance of company, variance in actual & estimated cost with cost accounting report and

organise production process by analysing different reports. Whereas management accounting

system helps company in managing inefficiency evaluated from reports. Moreover, both reports

are inter-dependent on each other (Renz, 2016).

LO 2

P. 3 Calculating the cost using various appropriate techniques

In management accounting, cost and profitability aspects can be assessed by using mainly

two methods namely marginal & absorption.

Marginal costing: A decision making technique which is used for determining total cost of

production known as marginal method. According to this method, variable cost is associated

with product, whereas fixed cost recognized as periodical one.

Absorption costing: This costing method lays emphasis on assigning all manufacturing

costs to the units produced during the specific time period. In this, cost of finished products

include all the expenses related to material, labour as well as both fixed and variable

manufacturing overhead.

Absorption costing:

May June

Particulars units Figure Net figure units Figure Net figure

Sales 300 50 15000 500 50 25000

Less: cost of goods sold

Opening stock 0 0 0 200 26 5200

Add: purchases 500 26 13000 380 26 9880

Less: closing stock 200 26 5200 80 26 2080

COGS 7800 13000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Gross profit 7200 12000

Less:

Fixed selling 4000 4000

Fixed Administration 2000 2000

Commission 750 1250

Total indirect expenses 6750 7250

NP 450 4750

Interpretation: Absorption costing is an effective method which takes into consideration

all the direct and indirect expenses. The net profit of the company for the month of May is 450

and for the month of June it is 4750.

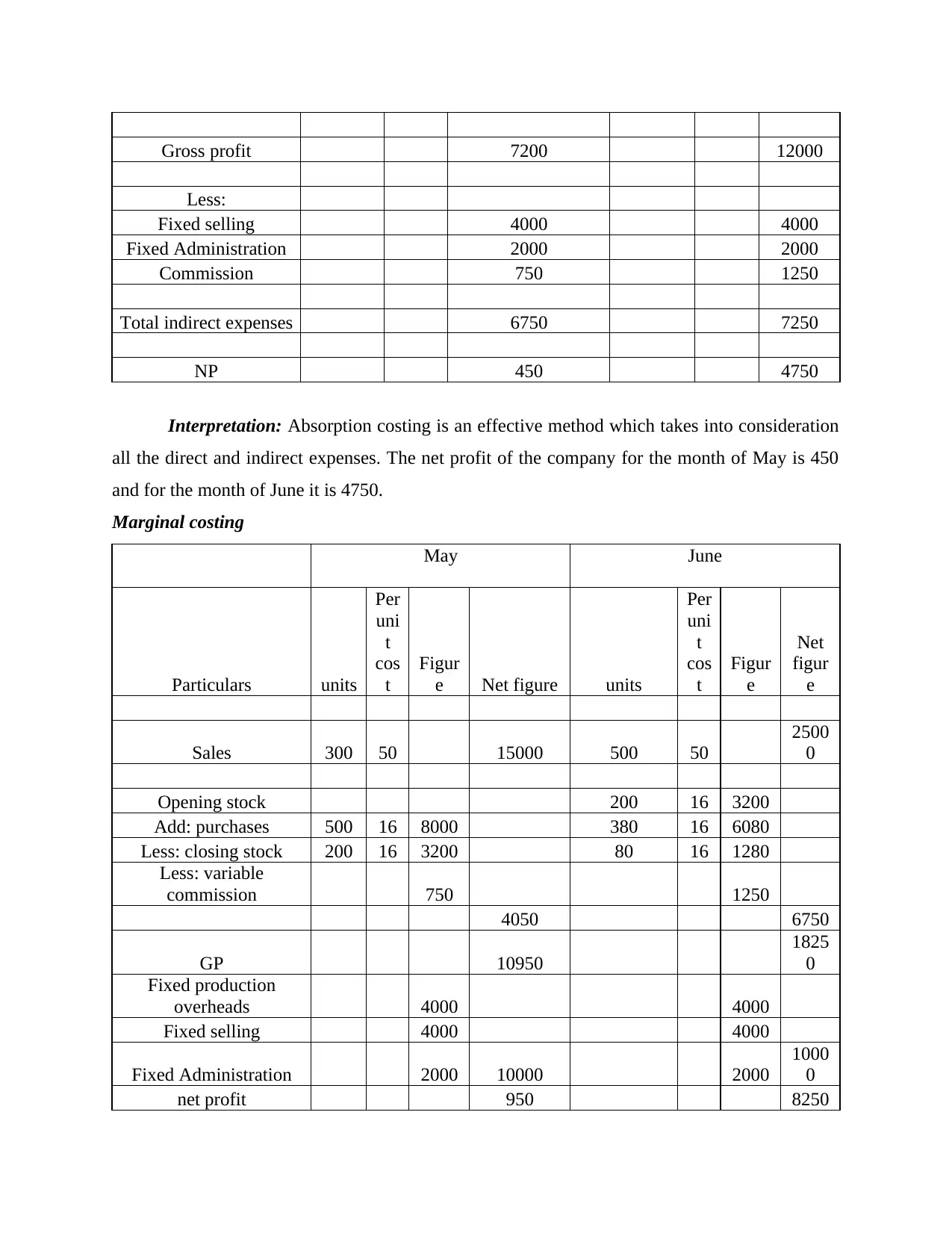

Marginal costing

May June

Particulars units

Per

uni

t

cos

t

Figur

e Net figure units

Per

uni

t

cos

t

Figur

e

Net

figur

e

Sales 300 50 15000 500 50

2500

0

Opening stock 200 16 3200

Add: purchases 500 16 8000 380 16 6080

Less: closing stock 200 16 3200 80 16 1280

Less: variable

commission 750 1250

4050 6750

GP 10950

1825

0

Fixed production

overheads 4000 4000

Fixed selling 4000 4000

Fixed Administration 2000 10000 2000

1000

0

net profit 950 8250

Less:

Fixed selling 4000 4000

Fixed Administration 2000 2000

Commission 750 1250

Total indirect expenses 6750 7250

NP 450 4750

Interpretation: Absorption costing is an effective method which takes into consideration

all the direct and indirect expenses. The net profit of the company for the month of May is 450

and for the month of June it is 4750.

Marginal costing

May June

Particulars units

Per

uni

t

cos

t

Figur

e Net figure units

Per

uni

t

cos

t

Figur

e

Net

figur

e

Sales 300 50 15000 500 50

2500

0

Opening stock 200 16 3200

Add: purchases 500 16 8000 380 16 6080

Less: closing stock 200 16 3200 80 16 1280

Less: variable

commission 750 1250

4050 6750

GP 10950

1825

0

Fixed production

overheads 4000 4000

Fixed selling 4000 4000

Fixed Administration 2000 10000 2000

1000

0

net profit 950 8250

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: Marginal costing is an effective management accounting method which

helps in evaluating the cost of producing of one additional unit in the level of production. The net

profit of the company for the month of May is 950 and for the month of June it is 8250.

Hence, Absorption costing is an effective method as it takes into account all the cost at

the time of manufacturing particular product. Absorption costing gives accurate results which

helps in higher operational efficiency.

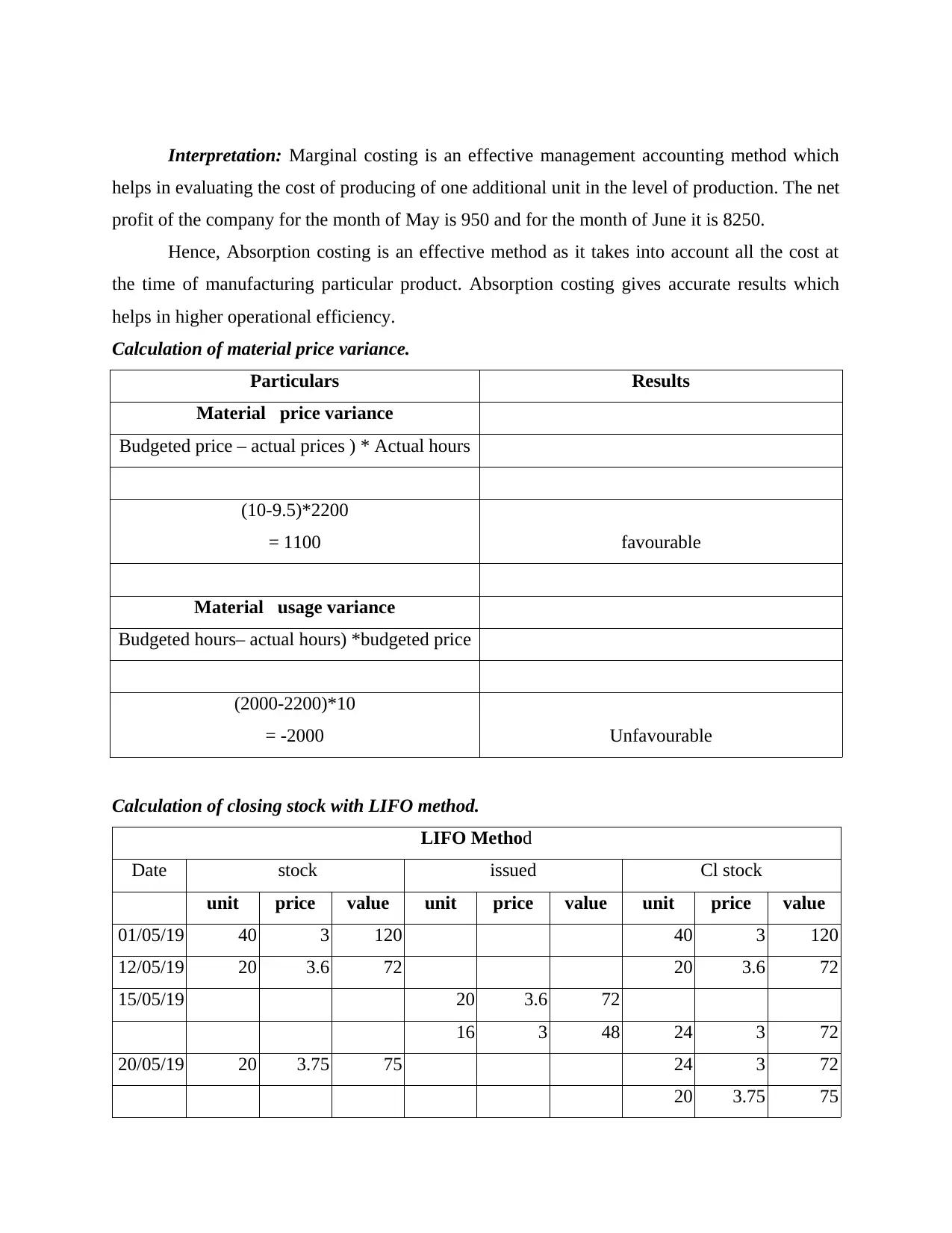

Calculation of material price variance.

Particulars Results

Material price variance

Budgeted price – actual prices ) * Actual hours

(10-9.5)*2200

= 1100 favourable

Material usage variance

Budgeted hours– actual hours) *budgeted price

(2000-2200)*10

= -2000 Unfavourable

Calculation of closing stock with LIFO method.

LIFO Method

Date stock issued Cl stock

unit price value unit price value unit price value

01/05/19 40 3 120 40 3 120

12/05/19 20 3.6 72 20 3.6 72

15/05/19 20 3.6 72

16 3 48 24 3 72

20/05/19 20 3.75 75 24 3 72

20 3.75 75

helps in evaluating the cost of producing of one additional unit in the level of production. The net

profit of the company for the month of May is 950 and for the month of June it is 8250.

Hence, Absorption costing is an effective method as it takes into account all the cost at

the time of manufacturing particular product. Absorption costing gives accurate results which

helps in higher operational efficiency.

Calculation of material price variance.

Particulars Results

Material price variance

Budgeted price – actual prices ) * Actual hours

(10-9.5)*2200

= 1100 favourable

Material usage variance

Budgeted hours– actual hours) *budgeted price

(2000-2200)*10

= -2000 Unfavourable

Calculation of closing stock with LIFO method.

LIFO Method

Date stock issued Cl stock

unit price value unit price value unit price value

01/05/19 40 3 120 40 3 120

12/05/19 20 3.6 72 20 3.6 72

15/05/19 20 3.6 72

16 3 48 24 3 72

20/05/19 20 3.75 75 24 3 72

20 3.75 75

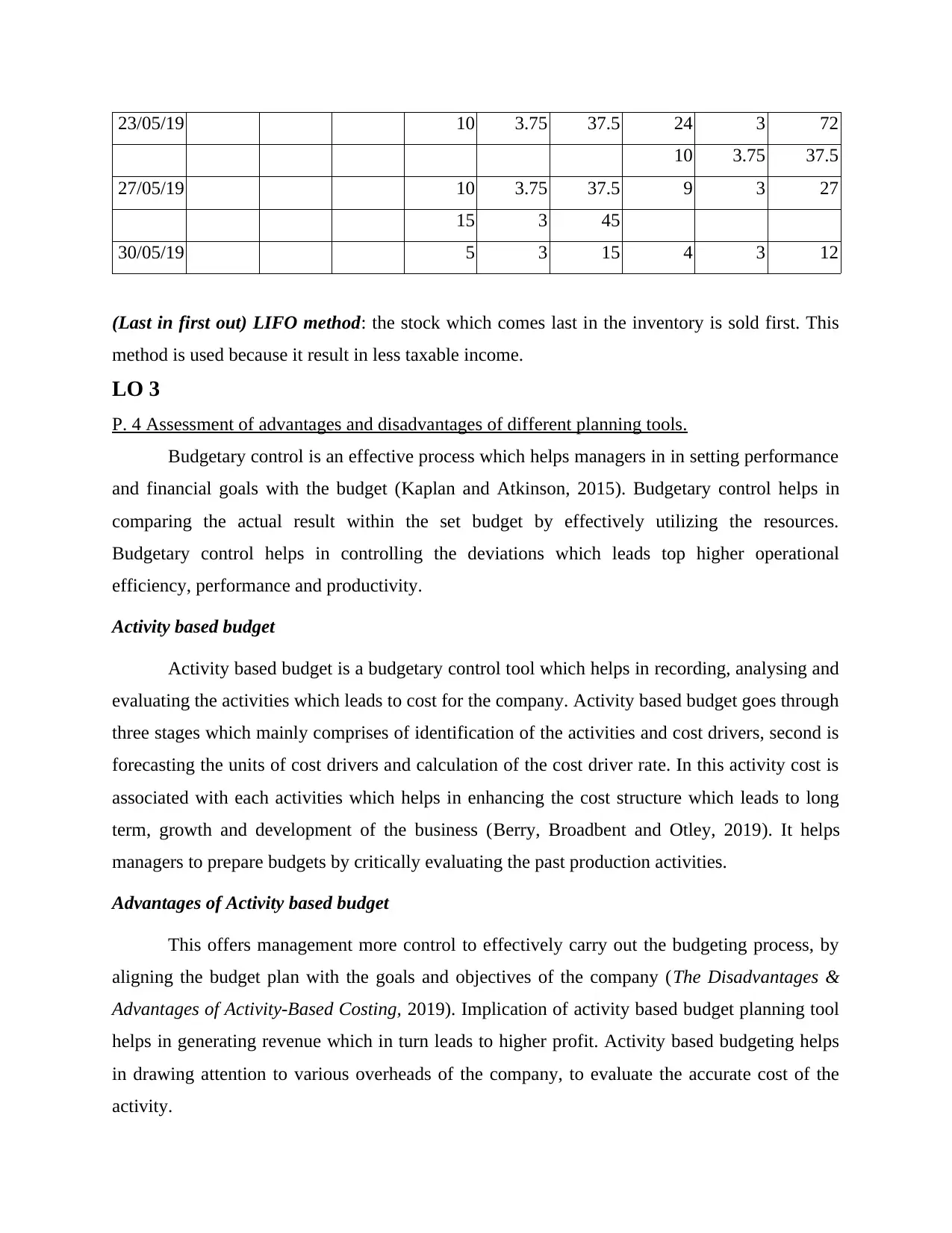

23/05/19 10 3.75 37.5 24 3 72

10 3.75 37.5

27/05/19 10 3.75 37.5 9 3 27

15 3 45

30/05/19 5 3 15 4 3 12

(Last in first out) LIFO method: the stock which comes last in the inventory is sold first. This

method is used because it result in less taxable income.

LO 3

P. 4 Assessment of advantages and disadvantages of different planning tools.

Budgetary control is an effective process which helps managers in in setting performance

and financial goals with the budget (Kaplan and Atkinson, 2015). Budgetary control helps in

comparing the actual result within the set budget by effectively utilizing the resources.

Budgetary control helps in controlling the deviations which leads top higher operational

efficiency, performance and productivity.

Activity based budget

Activity based budget is a budgetary control tool which helps in recording, analysing and

evaluating the activities which leads to cost for the company. Activity based budget goes through

three stages which mainly comprises of identification of the activities and cost drivers, second is

forecasting the units of cost drivers and calculation of the cost driver rate. In this activity cost is

associated with each activities which helps in enhancing the cost structure which leads to long

term, growth and development of the business (Berry, Broadbent and Otley, 2019). It helps

managers to prepare budgets by critically evaluating the past production activities.

Advantages of Activity based budget

This offers management more control to effectively carry out the budgeting process, by

aligning the budget plan with the goals and objectives of the company (The Disadvantages &

Advantages of Activity-Based Costing, 2019). Implication of activity based budget planning tool

helps in generating revenue which in turn leads to higher profit. Activity based budgeting helps

in drawing attention to various overheads of the company, to evaluate the accurate cost of the

activity.

10 3.75 37.5

27/05/19 10 3.75 37.5 9 3 27

15 3 45

30/05/19 5 3 15 4 3 12

(Last in first out) LIFO method: the stock which comes last in the inventory is sold first. This

method is used because it result in less taxable income.

LO 3

P. 4 Assessment of advantages and disadvantages of different planning tools.

Budgetary control is an effective process which helps managers in in setting performance

and financial goals with the budget (Kaplan and Atkinson, 2015). Budgetary control helps in

comparing the actual result within the set budget by effectively utilizing the resources.

Budgetary control helps in controlling the deviations which leads top higher operational

efficiency, performance and productivity.

Activity based budget

Activity based budget is a budgetary control tool which helps in recording, analysing and

evaluating the activities which leads to cost for the company. Activity based budget goes through

three stages which mainly comprises of identification of the activities and cost drivers, second is

forecasting the units of cost drivers and calculation of the cost driver rate. In this activity cost is

associated with each activities which helps in enhancing the cost structure which leads to long

term, growth and development of the business (Berry, Broadbent and Otley, 2019). It helps

managers to prepare budgets by critically evaluating the past production activities.

Advantages of Activity based budget

This offers management more control to effectively carry out the budgeting process, by

aligning the budget plan with the goals and objectives of the company (The Disadvantages &

Advantages of Activity-Based Costing, 2019). Implication of activity based budget planning tool

helps in generating revenue which in turn leads to higher profit. Activity based budgeting helps

in drawing attention to various overheads of the company, to evaluate the accurate cost of the

activity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.