Management Accounting Report: Analysis of Sollatek Company Operations

VerifiedAdded on 2020/06/06

|16

|5311

|72

Report

AI Summary

This report provides a comprehensive analysis of Sollatek's management accounting practices. It begins with an introduction to management accounting and its essential needs within the company. The report then delves into the various techniques used for management accounting reporting, including operational budget reporting, inventory management reporting, job costing reporting, and performance reporting. It highlights the advantages of a robust management accounting system and critically evaluates the reporting systems in place. The report further explores the use of different costing methods in evaluating net profit, including discussions on various accounting methods. It examines the advantages and disadvantages of using planning tools, critically analyzing their role in overcoming financial problems. The report concludes with an evaluation of financial issues and how management accounting can be used to resolve them. The report uses Sollatek as a case study to demonstrate how these techniques can be applied to manage business operations, optimize financial performance, and make informed decisions.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................2

P1. Essential needs of management accounting system..............................................................2

P2. Techniques used for MA reporting.......................................................................................3

M1: Advantages of MA..............................................................................................................5

D1: Critical evaluation of reporting system................................................................................5

TASK 2............................................................................................................................................5

P3: Use of costing methods in evaluation of net profit...............................................................5

M2: Various accounting methods...............................................................................................7

D2: Evaluation of profit and loss statements..............................................................................7

TASK 3............................................................................................................................................8

P4: Advantages and disadvantage of using planning tools.........................................................8

M3: Critically analysis of planning tools..................................................................................10

D3: Use of tools to overcome financial problems.....................................................................10

TASK 4..........................................................................................................................................11

P5 to resolve financial issue with the use of MA .....................................................................11

M4: Evaluation of financial issues............................................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................2

P1. Essential needs of management accounting system..............................................................2

P2. Techniques used for MA reporting.......................................................................................3

M1: Advantages of MA..............................................................................................................5

D1: Critical evaluation of reporting system................................................................................5

TASK 2............................................................................................................................................5

P3: Use of costing methods in evaluation of net profit...............................................................5

M2: Various accounting methods...............................................................................................7

D2: Evaluation of profit and loss statements..............................................................................7

TASK 3............................................................................................................................................8

P4: Advantages and disadvantage of using planning tools.........................................................8

M3: Critically analysis of planning tools..................................................................................10

D3: Use of tools to overcome financial problems.....................................................................10

TASK 4..........................................................................................................................................11

P5 to resolve financial issue with the use of MA .....................................................................11

M4: Evaluation of financial issues............................................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Accounting is the systematic process of data collection, summarising and recording of

financial transaction which is related with the business operations. While, management is

responsible for providing proper planning, controlling and maintaining effective records and

balance in company’s financial statements. Combination of both can help company to attain its

long and short term goals and objectives (Ahmad and Kamilah, 2013). It is considered as one of

the important aspects of business entity in order to regulate its day to day financial transactions.

In this project report, “Sollatek” company uses various accounting techniques and

methods to control and maintain their operations. Firm has appointed a account office to prepare

a well organise report that can provide necessary information regarding accounting system in the

business organisation. This report involves various analysis of costing and reporting methods

that can help them to calculate good or bad outcomes. Also, different planning tools which are

used by Sollatek in order to manage their operating expenses and cash-flows are explained here.

The performance of two companies is compare at the end of this report.

1

Accounting is the systematic process of data collection, summarising and recording of

financial transaction which is related with the business operations. While, management is

responsible for providing proper planning, controlling and maintaining effective records and

balance in company’s financial statements. Combination of both can help company to attain its

long and short term goals and objectives (Ahmad and Kamilah, 2013). It is considered as one of

the important aspects of business entity in order to regulate its day to day financial transactions.

In this project report, “Sollatek” company uses various accounting techniques and

methods to control and maintain their operations. Firm has appointed a account office to prepare

a well organise report that can provide necessary information regarding accounting system in the

business organisation. This report involves various analysis of costing and reporting methods

that can help them to calculate good or bad outcomes. Also, different planning tools which are

used by Sollatek in order to manage their operating expenses and cash-flows are explained here.

The performance of two companies is compare at the end of this report.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 1

P1. Essential needs of management accounting system

Accounting system is the concern with sourcing, analysis and communication of various

decisions which are associated with the relevant financial and non-financial data. It is based on

the positive impact of decision for transformation of administration. Management accounting

plays an important role in guiding right direction the manager and company as well. Crucial

decisions which are helpful for the growth, performance and modification are based on type of

accounting system used by Sollatek (Bodie, 2013). It has been determined that scope and

significance of management accounting are highly essential for making effective financial

decision. It consists of several types of accounting data which are associated with financial

reporting like costing, inventory analysis and many more. The results are effective if company is

using more accurate and reliable information.

In order words, all irrelevant data can affect the profitability of the cited company. The

manager needs to plan perfect strategies according to the set standards so that desired outcomes

can be attained. The interest of shareholders is required to be considered by the account

managers because they are responsible for providing right direction to company. The major

aspects of any business concern is to generate as much profit so that long term and short term

objectives can be meet out. The resources of company can be utilised by applying proper

accounting system so that less chances of wastage can occur. Accounting system helps managers

to estimate the total cost incurred by firm over the production of goods and services. It is one of

the most accountable aspects that are required to be kept as a part of planning process because

overall decision of future plan is based on the financial position of company.

All are determined by using information from various accounting statements which are

prepared by the managers during year. Prime motive of managers is to increase maximum

revenue by using least cost over the expenses. As, they know that resource are in very limited

and that can be used through applying right techniques and methods which can help them to

minimise wastage. During the procedures of new project, sollatek incurs heavy capital over its

set up and necessary requirements that all are managed and control by accounting system

(DRURY, 2013). The department of finance is responsible for evaluating total cost and losses

which are going to be invested during starting of new venture with the use of various MA

systems. As a account officer, it is my sole responsibility to use perfect accounting system so that

2

P1. Essential needs of management accounting system

Accounting system is the concern with sourcing, analysis and communication of various

decisions which are associated with the relevant financial and non-financial data. It is based on

the positive impact of decision for transformation of administration. Management accounting

plays an important role in guiding right direction the manager and company as well. Crucial

decisions which are helpful for the growth, performance and modification are based on type of

accounting system used by Sollatek (Bodie, 2013). It has been determined that scope and

significance of management accounting are highly essential for making effective financial

decision. It consists of several types of accounting data which are associated with financial

reporting like costing, inventory analysis and many more. The results are effective if company is

using more accurate and reliable information.

In order words, all irrelevant data can affect the profitability of the cited company. The

manager needs to plan perfect strategies according to the set standards so that desired outcomes

can be attained. The interest of shareholders is required to be considered by the account

managers because they are responsible for providing right direction to company. The major

aspects of any business concern is to generate as much profit so that long term and short term

objectives can be meet out. The resources of company can be utilised by applying proper

accounting system so that less chances of wastage can occur. Accounting system helps managers

to estimate the total cost incurred by firm over the production of goods and services. It is one of

the most accountable aspects that are required to be kept as a part of planning process because

overall decision of future plan is based on the financial position of company.

All are determined by using information from various accounting statements which are

prepared by the managers during year. Prime motive of managers is to increase maximum

revenue by using least cost over the expenses. As, they know that resource are in very limited

and that can be used through applying right techniques and methods which can help them to

minimise wastage. During the procedures of new project, sollatek incurs heavy capital over its

set up and necessary requirements that all are managed and control by accounting system

(DRURY, 2013). The department of finance is responsible for evaluating total cost and losses

which are going to be invested during starting of new venture with the use of various MA

systems. As a account officer, it is my sole responsibility to use perfect accounting system so that

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

more positive outcome can be generate in coming future. Some of the accounting systems are

discussed these are: It is generally related with the procedures of gathering of data, summarising

it, recording into the concern books and analyse them by using right techniques before posting it

to financial statements. Because, these are considered as that costs which are incur by the

company during the production of product and services. During that process certain costing are

need to be considered such as normal, standard and actual costing. Inventory accounting system

is referred as a systematic record of stock information that is related with company’s production

process. It is used to manage, relocate and control various stock material that are going to be

implemented in the production process. Main purpose of this system is to track stock level,

summary related with order and analyse report of deliveries. Price optimisation system is the

numerical data used by managers of Sollatek to determine how clients will respond to different

prices for products and services through other channels. Focus of company is to estimate the

price that will fulfil the needs like maximising operating cost for the year. Job costing system is

concerned with the procedures by which determination of assigned cost that are related on a

specific lot size of activities under which both individual and organisation is related with. In this

system, analysis is done by observing products which are relatively different from each other.

Management accounting is known as a dynamic process that mainly targets on effective

accounting policies which are related with company. It is mostly associated with the strategic

development and effective decision making system.

P2. Techniques used for MA reporting

In every business concern, management accounting reporting is considered as one of the

important systems which can help company to analyse financial transactions. It is organised by

using right reporting system that provides more accurate results in the near future. The

transactions which are collected from operations are firstly analysed before posting it into

accounting books of accounts. It is done so because most of the major decision are taken on the

basis of those entries made by accounts managers (Gates and et. al., 2011). MA is responsible for

the interaction all department which is working for common objectives. They are mostly related

with all those factors which are affecting the performance of administration such as internal and

external. The social and cultural aspects are need to be considered while making a well planned

reporting. All those data which are related with Sollatek business operation are recorded into

3

discussed these are: It is generally related with the procedures of gathering of data, summarising

it, recording into the concern books and analyse them by using right techniques before posting it

to financial statements. Because, these are considered as that costs which are incur by the

company during the production of product and services. During that process certain costing are

need to be considered such as normal, standard and actual costing. Inventory accounting system

is referred as a systematic record of stock information that is related with company’s production

process. It is used to manage, relocate and control various stock material that are going to be

implemented in the production process. Main purpose of this system is to track stock level,

summary related with order and analyse report of deliveries. Price optimisation system is the

numerical data used by managers of Sollatek to determine how clients will respond to different

prices for products and services through other channels. Focus of company is to estimate the

price that will fulfil the needs like maximising operating cost for the year. Job costing system is

concerned with the procedures by which determination of assigned cost that are related on a

specific lot size of activities under which both individual and organisation is related with. In this

system, analysis is done by observing products which are relatively different from each other.

Management accounting is known as a dynamic process that mainly targets on effective

accounting policies which are related with company. It is mostly associated with the strategic

development and effective decision making system.

P2. Techniques used for MA reporting

In every business concern, management accounting reporting is considered as one of the

important systems which can help company to analyse financial transactions. It is organised by

using right reporting system that provides more accurate results in the near future. The

transactions which are collected from operations are firstly analysed before posting it into

accounting books of accounts. It is done so because most of the major decision are taken on the

basis of those entries made by accounts managers (Gates and et. al., 2011). MA is responsible for

the interaction all department which is working for common objectives. They are mostly related

with all those factors which are affecting the performance of administration such as internal and

external. The social and cultural aspects are need to be considered while making a well planned

reporting. All those data which are related with Sollatek business operation are recorded into

3

management accounting system. Before discussing various reporting techniques we should first

know about few things.

Report: It is known as an account provided for a specific matter, particularly in the form

of an official statements or document, after consult with proper investigation and approval of the

top management.

Reporting of financial statements: A reporting concern is an entity or business that

formulate financial reports. By taking necessary information from various sources. It consists of

company' performance, growth position and total investments. The accounts department look-

after all the valuable data by taking help of activities, various situations and important

investments which are essential for the development of business. In other ways, it is known as

techniques of providing necessary information to the higher authority. It also provides right

direction to other expertise those carries important skills and capabilities to frame well and

accurate accounting reports. It is prepared by using past and current year performances. It is done

to gain positive and innovative ideas for future investment those are made by outside

stakeholders. It will be more helpful for the management to draw a perfect plan that can guide

the company to achieve it set objectives. Reporting gives management necessary information

regarding Sollatek current year performance by analysing costs incurred over production of

products and services. It also presents how expenses can be managed in order to earn future

profits. It also provides information about what is the major cause of less profit in previous year

and make corrective steps to overcome these issues. In accordance to manage the financial

changes and reactions in the company they need to go through various reporting systems. Some

of the reporting system that are useful for Sollatek are as follows: Operational budget reporting

reporting system is used to get information about the expenditure which are done by the

company during the year on the production of goods and services. It helps accounts managers to

determine actual costs incur by sollatek. It consists of various sub units such as sales budgets,

variables budgets and other manufacturing budgets. Inventory management reporting is related

with management and control of inventory position in the company. Different types of physical

stocks those are used by Sollatek are used by mangers to prepare report. It will guide them to

check the level of inventory. There are various methods which can helpful for stock control such

as EOQ and ABC analysis.

4

know about few things.

Report: It is known as an account provided for a specific matter, particularly in the form

of an official statements or document, after consult with proper investigation and approval of the

top management.

Reporting of financial statements: A reporting concern is an entity or business that

formulate financial reports. By taking necessary information from various sources. It consists of

company' performance, growth position and total investments. The accounts department look-

after all the valuable data by taking help of activities, various situations and important

investments which are essential for the development of business. In other ways, it is known as

techniques of providing necessary information to the higher authority. It also provides right

direction to other expertise those carries important skills and capabilities to frame well and

accurate accounting reports. It is prepared by using past and current year performances. It is done

to gain positive and innovative ideas for future investment those are made by outside

stakeholders. It will be more helpful for the management to draw a perfect plan that can guide

the company to achieve it set objectives. Reporting gives management necessary information

regarding Sollatek current year performance by analysing costs incurred over production of

products and services. It also presents how expenses can be managed in order to earn future

profits. It also provides information about what is the major cause of less profit in previous year

and make corrective steps to overcome these issues. In accordance to manage the financial

changes and reactions in the company they need to go through various reporting systems. Some

of the reporting system that are useful for Sollatek are as follows: Operational budget reporting

reporting system is used to get information about the expenditure which are done by the

company during the year on the production of goods and services. It helps accounts managers to

determine actual costs incur by sollatek. It consists of various sub units such as sales budgets,

variables budgets and other manufacturing budgets. Inventory management reporting is related

with management and control of inventory position in the company. Different types of physical

stocks those are used by Sollatek are used by mangers to prepare report. It will guide them to

check the level of inventory. There are various methods which can helpful for stock control such

as EOQ and ABC analysis.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job costing reporting costs which is associated with manufacturing of goods in a set lot

size are considered under this reports. As, this will help to determine the sequence, timing and

date of manufacturing. It will also provide information about total profit generated by each

activities in a year. Performance report reporting can be more drastically help the accounts

department to analyse current year performances of the cited company (Kotas, 2014). It is done

with comparing data from past year with current. It provides motivation to the employees as

well as organisation in order to attain its objectives. Account receivable report particular reports

are based on the data which are recorded by using cash information. Those cash transactions

which is deal in credit or cash are target and recorded to know that exact time of recovery.

M1: Advantages of MA

In an organisation such as Sollatek, they require a well organisation management

accounting system which can record and analyse its daily business transactions. It will be more

helpful for them to reach at their necessary destination. There is various system available with

the managers from which they can select either of them to get more accurate results. The main

advantages of MA are to increase efficiency foe company with the available resources. Some

other are related with profitability and future sustainability of company existence.

D1: Critical evaluation of reporting system

In Sollatek company, they need to analyse their financial data by using right accounting

report. It will be collected by using necessary information from various departments those are

responsible for essential management of financial stability. On the basis of their reporting, top

management will take future decision. Some of the available reporting system are job costing

which provide information about each activities as how much time they are taking to complete a

project. Other are inventory system and performance report which guide managers to maintain

proper balance among each department. Future, this will help to estimate total costs and losses

which are affecting the performance of the company.

TASK 2

P3: Use of costing methods in evaluation of net profit

Costing is a term which is used by an organization to estimate data assembling and

analysis of key elements of costs which are incurred to attain set objectives. These are simply

related with production costs that is used by managers to produce maximum units with the

5

size are considered under this reports. As, this will help to determine the sequence, timing and

date of manufacturing. It will also provide information about total profit generated by each

activities in a year. Performance report reporting can be more drastically help the accounts

department to analyse current year performances of the cited company (Kotas, 2014). It is done

with comparing data from past year with current. It provides motivation to the employees as

well as organisation in order to attain its objectives. Account receivable report particular reports

are based on the data which are recorded by using cash information. Those cash transactions

which is deal in credit or cash are target and recorded to know that exact time of recovery.

M1: Advantages of MA

In an organisation such as Sollatek, they require a well organisation management

accounting system which can record and analyse its daily business transactions. It will be more

helpful for them to reach at their necessary destination. There is various system available with

the managers from which they can select either of them to get more accurate results. The main

advantages of MA are to increase efficiency foe company with the available resources. Some

other are related with profitability and future sustainability of company existence.

D1: Critical evaluation of reporting system

In Sollatek company, they need to analyse their financial data by using right accounting

report. It will be collected by using necessary information from various departments those are

responsible for essential management of financial stability. On the basis of their reporting, top

management will take future decision. Some of the available reporting system are job costing

which provide information about each activities as how much time they are taking to complete a

project. Other are inventory system and performance report which guide managers to maintain

proper balance among each department. Future, this will help to estimate total costs and losses

which are affecting the performance of the company.

TASK 2

P3: Use of costing methods in evaluation of net profit

Costing is a term which is used by an organization to estimate data assembling and

analysis of key elements of costs which are incurred to attain set objectives. These are simply

related with production costs that is used by managers to produce maximum units with the

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

available resources (Hopwood and et. al.,2010). Costing includes various costs such as variable,

fixed or semi-variable costs. On the other hands, such amounts which is shown with the billing

charts as costs. It is further used in preparation financial statements. The Sollatek may use

various costing techniques in order to attain accurate net profit information. Some of them are:

Absorption costing is said to be that methods in which overheads are inter-changed

between a costs of other product and services and current values. Few costs are absorbed with

extra unit of production. It will be related with direct material, labour and other overhead

charges. It consists fixed overhead.

Marginal costing refers as those costs which are used by company in production of one

extra unit of product. Under this procedures, it may be directly impact with total number of

production costs incur by Sollatek company (Merchant and Kenneth, 2012). The other name of

this costs are prime cost, but it does not consider fixed costs. It represents relationship between

profit and volume.

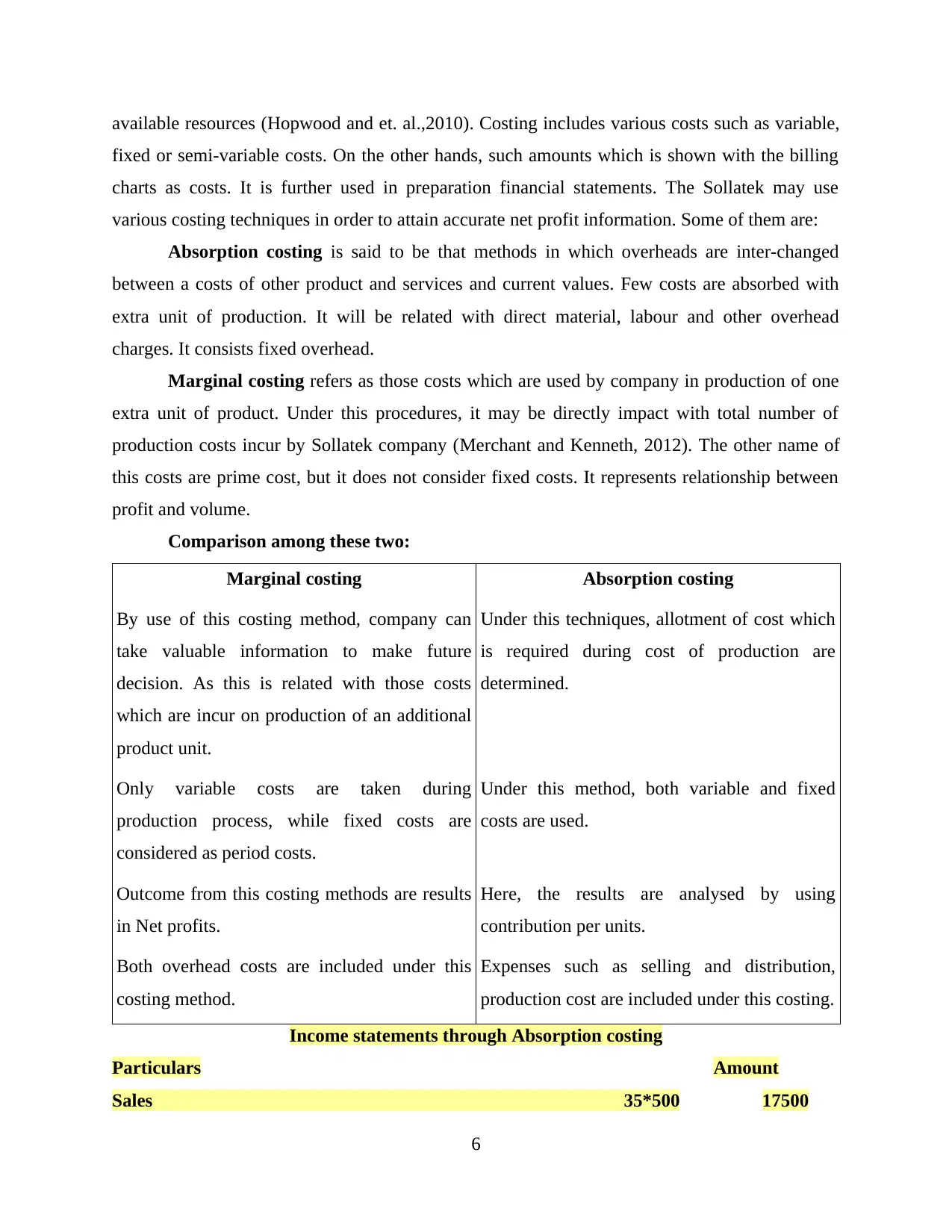

Comparison among these two:

Marginal costing Absorption costing

By use of this costing method, company can

take valuable information to make future

decision. As this is related with those costs

which are incur on production of an additional

product unit.

Under this techniques, allotment of cost which

is required during cost of production are

determined.

Only variable costs are taken during

production process, while fixed costs are

considered as period costs.

Under this method, both variable and fixed

costs are used.

Outcome from this costing methods are results

in Net profits.

Here, the results are analysed by using

contribution per units.

Both overhead costs are included under this

costing method.

Expenses such as selling and distribution,

production cost are included under this costing.

Income statements through Absorption costing

Particulars Amount

Sales 35*500 17500

6

fixed or semi-variable costs. On the other hands, such amounts which is shown with the billing

charts as costs. It is further used in preparation financial statements. The Sollatek may use

various costing techniques in order to attain accurate net profit information. Some of them are:

Absorption costing is said to be that methods in which overheads are inter-changed

between a costs of other product and services and current values. Few costs are absorbed with

extra unit of production. It will be related with direct material, labour and other overhead

charges. It consists fixed overhead.

Marginal costing refers as those costs which are used by company in production of one

extra unit of product. Under this procedures, it may be directly impact with total number of

production costs incur by Sollatek company (Merchant and Kenneth, 2012). The other name of

this costs are prime cost, but it does not consider fixed costs. It represents relationship between

profit and volume.

Comparison among these two:

Marginal costing Absorption costing

By use of this costing method, company can

take valuable information to make future

decision. As this is related with those costs

which are incur on production of an additional

product unit.

Under this techniques, allotment of cost which

is required during cost of production are

determined.

Only variable costs are taken during

production process, while fixed costs are

considered as period costs.

Under this method, both variable and fixed

costs are used.

Outcome from this costing methods are results

in Net profits.

Here, the results are analysed by using

contribution per units.

Both overhead costs are included under this

costing method.

Expenses such as selling and distribution,

production cost are included under this costing.

Income statements through Absorption costing

Particulars Amount

Sales 35*500 17500

6

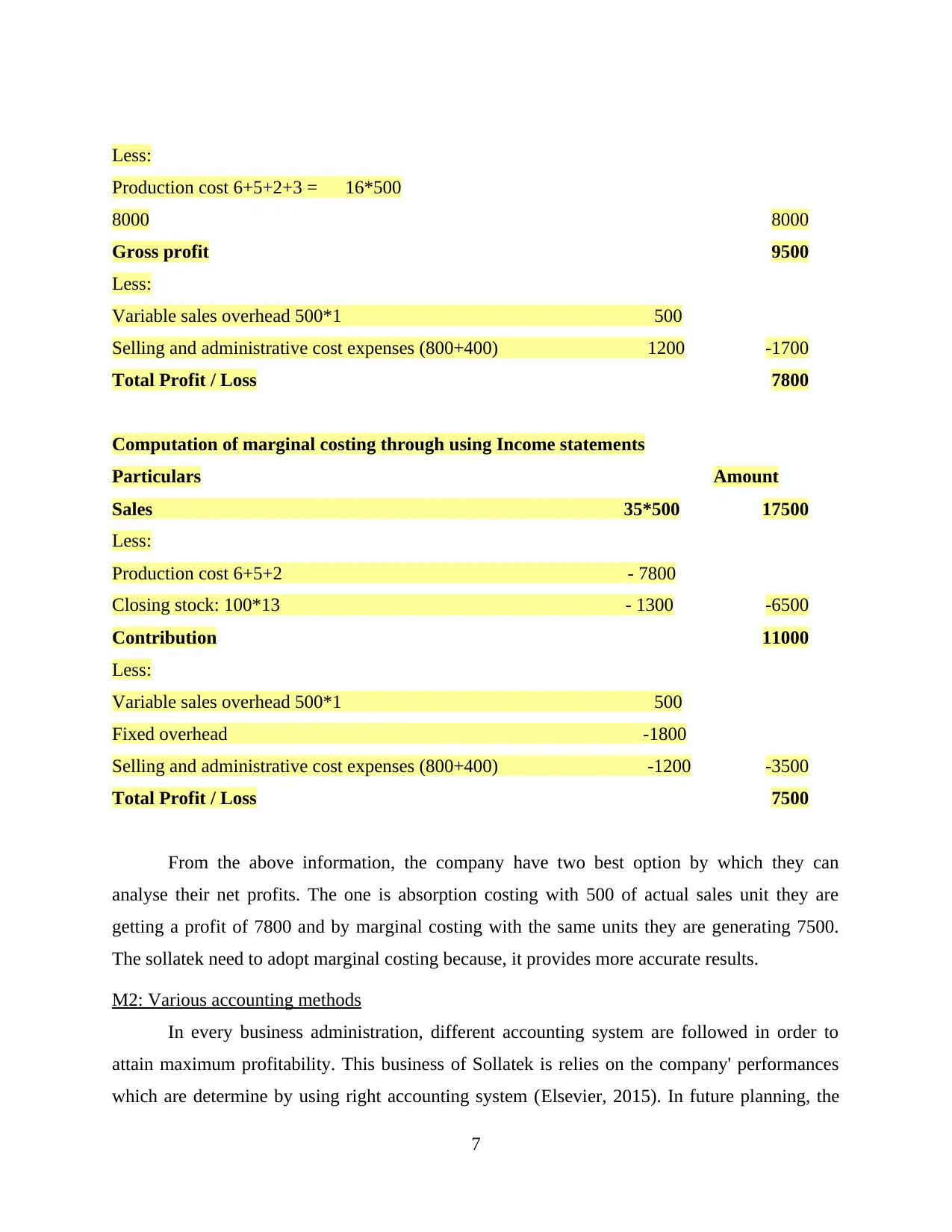

Less:

Production cost 6+5+2+3 = 16*500

8000 8000

Gross profit 9500

Less:

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

Computation of marginal costing through using Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

Contribution 11000

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

From the above information, the company have two best option by which they can

analyse their net profits. The one is absorption costing with 500 of actual sales unit they are

getting a profit of 7800 and by marginal costing with the same units they are generating 7500.

The sollatek need to adopt marginal costing because, it provides more accurate results.

M2: Various accounting methods

In every business administration, different accounting system are followed in order to

attain maximum profitability. This business of Sollatek is relies on the company' performances

which are determine by using right accounting system (Elsevier, 2015). In future planning, the

7

Production cost 6+5+2+3 = 16*500

8000 8000

Gross profit 9500

Less:

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

Computation of marginal costing through using Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

Contribution 11000

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

From the above information, the company have two best option by which they can

analyse their net profits. The one is absorption costing with 500 of actual sales unit they are

getting a profit of 7800 and by marginal costing with the same units they are generating 7500.

The sollatek need to adopt marginal costing because, it provides more accurate results.

M2: Various accounting methods

In every business administration, different accounting system are followed in order to

attain maximum profitability. This business of Sollatek is relies on the company' performances

which are determine by using right accounting system (Elsevier, 2015). In future planning, the

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

above discussed accounting techniques are more effectively used in achieving future goals. It is

used to analyse future and actual and standard cost balances. Techniques such as goals

transparency and provide consistent feedback. Provide regular training and development for the

account managers.

D2: Evaluation of profit and loss statements

As per the above mentioned information, company can use either of the methods that

would provide more relevant profit. In order to earn maximum profit both costing methods are

effective. Because, if they are going with marginal costing they incur 7800 net profit with 500

units of actual sales. While, if they are going with absorption costing they are receiving 7500 of

net profits with the same units. Difference of 300 units as net earning is collected from this

research.

TASK 3

P4: Advantages and disadvantage of using planning tools

Budget refers as future estimation of total cost and expenses which are incur by company

with its limited resources. The prime objectives of budget preparation are to estimate the future

costs that are going to be utilised by an organisation. It is known as detailed financial plan of

action. It consists of total lists of revenues and expenses for declared period of time. Budgeting

control simply imply measuring, reporting, examine and providing necessary suggestion on the

basis of budget performances. All those planning and controlling of various aspects of

production process is determined under this process. It is considered as personal responsibilities

of a managers in regards to establishing various effective measure in relation to attain its aims

and objectives (Kotas and Richard, 2014). The major purpose of Sollatek is to control and

maintain effective balance among regular operations of company's data. It is mainly based on

perfect control system that assist the departments to formulate its business targets.

Procedures of budgetary control:

Future estimation of budget needs stages, managers required to make appropriate plan to

manage their daily activities through using effective ideas from the development of each

departments. With the use of perfect strategies company can assists to earn huge profit by

investing minimum cost over production expenses. It is related with various internal and external

aspects which are affecting profitability during the years. Actual costs are need to be considered

8

used to analyse future and actual and standard cost balances. Techniques such as goals

transparency and provide consistent feedback. Provide regular training and development for the

account managers.

D2: Evaluation of profit and loss statements

As per the above mentioned information, company can use either of the methods that

would provide more relevant profit. In order to earn maximum profit both costing methods are

effective. Because, if they are going with marginal costing they incur 7800 net profit with 500

units of actual sales. While, if they are going with absorption costing they are receiving 7500 of

net profits with the same units. Difference of 300 units as net earning is collected from this

research.

TASK 3

P4: Advantages and disadvantage of using planning tools

Budget refers as future estimation of total cost and expenses which are incur by company

with its limited resources. The prime objectives of budget preparation are to estimate the future

costs that are going to be utilised by an organisation. It is known as detailed financial plan of

action. It consists of total lists of revenues and expenses for declared period of time. Budgeting

control simply imply measuring, reporting, examine and providing necessary suggestion on the

basis of budget performances. All those planning and controlling of various aspects of

production process is determined under this process. It is considered as personal responsibilities

of a managers in regards to establishing various effective measure in relation to attain its aims

and objectives (Kotas and Richard, 2014). The major purpose of Sollatek is to control and

maintain effective balance among regular operations of company's data. It is mainly based on

perfect control system that assist the departments to formulate its business targets.

Procedures of budgetary control:

Future estimation of budget needs stages, managers required to make appropriate plan to

manage their daily activities through using effective ideas from the development of each

departments. With the use of perfect strategies company can assists to earn huge profit by

investing minimum cost over production expenses. It is related with various internal and external

aspects which are affecting profitability during the years. Actual costs are need to be considered

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

major decisions are based on type of costs company are using during the production process. It

determines actual cost and performances that are regulated in current years. By the use of this,

managers can develop two reactions such as favourable and unfavourable. The one which is

more accurate are need to be taken into consideration and adverse are transfer for further

analysis. Evaluation among actual and standard costs: In this steps, budgets are prepared by

using actual cost figures.

In the budgetary control process, it is considered as one of the important phase in which

necessary decision are taken into consideration (Nixon and Burns, 2012). The variances among

variable costs, budgets costs sales are evaluated under this process. The results are generated by

using values by comparing actual costs or standard costs. The outcome from this will be more

effective if information is accurate and correct. Review phase is considered as last phase in

budget control process. Under this, various suggestion and feedbacks are analysed. The

appointed managers are given responsibility to determine various mistakes and essential

requirements from every department (Caglio and Ditillo, 2012). In this report of mangers, they

need to present various facts that consists of valuable information about budget that whether this

budgets are going to fulfil the needs of company. Is the cost are reduced by using appropriate

techniques. If all goes in well planned manner, then management will approve budgets for

further existences.

Some important planning tools are:

Operating budgets: It is related with those budgets which are used in order to manage

their expenses that are incur by the company while, manufacturing process (Callahan, Stetz and

Brooks, 2011). It is also known as annual budgets of an activity that represent various terms in

which budgets may be classified. It consists of reimbursable tasks and services for other

departments. It can be determined by using various budget such as sales, variance etc.

Advantages of this approach Regular maintains of record can help the company to attain

maximum profitability. Fur sustainability can be achieving by using right cost estimation

techniques on weekly, monthly or yearly basis. On the other hand, disadvantage in managers are

having limited information this budget won't be applicable.

Cash budget is related with that information which is related with cash transaction that

are done from various activities such investing, financing and operating. It is used to determine

total cash invested by company in each activities (Burritt, Schaltegger and Zvezdov, 2011).

9

determines actual cost and performances that are regulated in current years. By the use of this,

managers can develop two reactions such as favourable and unfavourable. The one which is

more accurate are need to be taken into consideration and adverse are transfer for further

analysis. Evaluation among actual and standard costs: In this steps, budgets are prepared by

using actual cost figures.

In the budgetary control process, it is considered as one of the important phase in which

necessary decision are taken into consideration (Nixon and Burns, 2012). The variances among

variable costs, budgets costs sales are evaluated under this process. The results are generated by

using values by comparing actual costs or standard costs. The outcome from this will be more

effective if information is accurate and correct. Review phase is considered as last phase in

budget control process. Under this, various suggestion and feedbacks are analysed. The

appointed managers are given responsibility to determine various mistakes and essential

requirements from every department (Caglio and Ditillo, 2012). In this report of mangers, they

need to present various facts that consists of valuable information about budget that whether this

budgets are going to fulfil the needs of company. Is the cost are reduced by using appropriate

techniques. If all goes in well planned manner, then management will approve budgets for

further existences.

Some important planning tools are:

Operating budgets: It is related with those budgets which are used in order to manage

their expenses that are incur by the company while, manufacturing process (Callahan, Stetz and

Brooks, 2011). It is also known as annual budgets of an activity that represent various terms in

which budgets may be classified. It consists of reimbursable tasks and services for other

departments. It can be determined by using various budget such as sales, variance etc.

Advantages of this approach Regular maintains of record can help the company to attain

maximum profitability. Fur sustainability can be achieving by using right cost estimation

techniques on weekly, monthly or yearly basis. On the other hand, disadvantage in managers are

having limited information this budget won't be applicable.

Cash budget is related with that information which is related with cash transaction that

are done from various activities such investing, financing and operating. It is used to determine

total cash invested by company in each activities (Burritt, Schaltegger and Zvezdov, 2011).

9

Positive and accurate information of cash inflows and outflows are analysed with the use of this

budgets. If payback period is competed, then cash flows are ignoring. It is not used to measure

profitability of the company.

Static budget is those budgets which cannot changes with the changes in volume (What

Are the Advantages and Disadvantages of Using a Static Budget, 2017). It anticipates amounts

about inputs and outputs that are received before the time of situation begins. The results are

always varying from the actual outcome as because they are only used while planning of future

activities. Its benefits is formulate under various term and situations under which values are

based on assumption basis.

Forecasting tool: It is said to be an important tools which is used to estimate future cost and

expenditure that are a company is going to incurred during the period of time. It also analyse

future value of growth procedures for chosen time frame.

Advantages: It used to guide business with necessary information regarding use to make

decision regarding future of an organisation.

Disadvantage: The main demerit of forecasting is similar as that of any kind of

techniques of estimating the future because no one can sure about upcoming implications.

Contingency Tool: It is an effective planning assessment that effect as per the market changes or

business disruption which can have on company. It allow management to pressure-test strategies

and risk assessment.

Advantages: It perceived future uncertainty that are based on administration past

experiences. It can easily be helpful to control risk factors that are present in an organisation.

Disadvantage: It often requires businesses to have plenty of resources to back up their

contingency strategies.

M3: Critically analysis of planning tools

In the estimation of better results companies are using various planning tools which can

provide them positive results. The main purpose of using such kind of tools is to control extra

costs and get maximum profitability (van der Steen, 2011). With the use of necessary tools

company can target to earn as much revenue as they can to cover its long term debts. Few of

them are operating budget which is more effective tools of company to control its expenses

because on that basis financial position can be estimated.

10

budgets. If payback period is competed, then cash flows are ignoring. It is not used to measure

profitability of the company.

Static budget is those budgets which cannot changes with the changes in volume (What

Are the Advantages and Disadvantages of Using a Static Budget, 2017). It anticipates amounts

about inputs and outputs that are received before the time of situation begins. The results are

always varying from the actual outcome as because they are only used while planning of future

activities. Its benefits is formulate under various term and situations under which values are

based on assumption basis.

Forecasting tool: It is said to be an important tools which is used to estimate future cost and

expenditure that are a company is going to incurred during the period of time. It also analyse

future value of growth procedures for chosen time frame.

Advantages: It used to guide business with necessary information regarding use to make

decision regarding future of an organisation.

Disadvantage: The main demerit of forecasting is similar as that of any kind of

techniques of estimating the future because no one can sure about upcoming implications.

Contingency Tool: It is an effective planning assessment that effect as per the market changes or

business disruption which can have on company. It allow management to pressure-test strategies

and risk assessment.

Advantages: It perceived future uncertainty that are based on administration past

experiences. It can easily be helpful to control risk factors that are present in an organisation.

Disadvantage: It often requires businesses to have plenty of resources to back up their

contingency strategies.

M3: Critically analysis of planning tools

In the estimation of better results companies are using various planning tools which can

provide them positive results. The main purpose of using such kind of tools is to control extra

costs and get maximum profitability (van der Steen, 2011). With the use of necessary tools

company can target to earn as much revenue as they can to cover its long term debts. Few of

them are operating budget which is more effective tools of company to control its expenses

because on that basis financial position can be estimated.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.