Management Accounting Report: Chair Manufacturing & Financial Problems

VerifiedAdded on 2020/11/23

|16

|3280

|169

Report

AI Summary

This report delves into the realm of management accounting, examining the application of marginal and absorption costing methods through income statements of a chair manufacturing company over three years. It provides a detailed analysis of various planning tools used for budgetary control, including fixed, flexible, incremental, and zero-based budgets, along with the significance of variance analysis. The report further explores how organizations leverage management accounting systems to address financial challenges, highlighting the importance of benchmarking, key performance indicators, and ratio analysis. The content covers practical applications of these concepts, offering insights into how management accounting contributes to effective decision-making and financial strategy formulation within an organization. It provides a comprehensive overview of the role of management accounting in optimizing financial performance.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

Contents

INTRODUCTION...........................................................................................................................3

P3. Income statement of chair manufacturing company of three years using marginal costing

and absorption costing.................................................................................................................3

P4. Advantages and disadvantages of planning tools used for budgetary control.......................8

P5.Organizatiins are adapting Management accounting system to solve their financial

problems.....................................................................................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

Contents

INTRODUCTION...........................................................................................................................3

P3. Income statement of chair manufacturing company of three years using marginal costing

and absorption costing.................................................................................................................3

P4. Advantages and disadvantages of planning tools used for budgetary control.......................8

P5.Organizatiins are adapting Management accounting system to solve their financial

problems.....................................................................................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

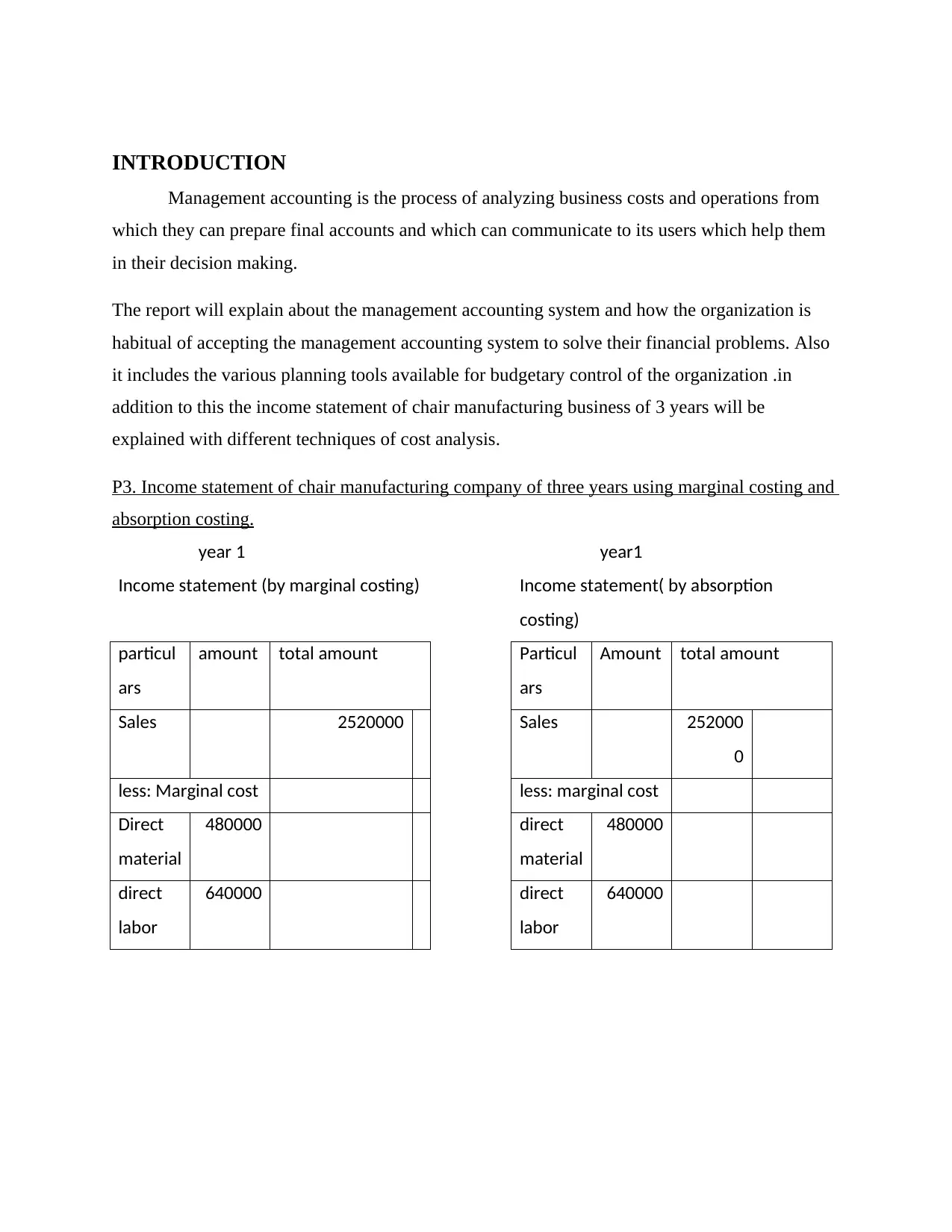

INTRODUCTION

Management accounting is the process of analyzing business costs and operations from

which they can prepare final accounts and which can communicate to its users which help them

in their decision making.

The report will explain about the management accounting system and how the organization is

habitual of accepting the management accounting system to solve their financial problems. Also

it includes the various planning tools available for budgetary control of the organization .in

addition to this the income statement of chair manufacturing business of 3 years will be

explained with different techniques of cost analysis.

P3. Income statement of chair manufacturing company of three years using marginal costing and

absorption costing.

year 1 year1

Income statement (by marginal costing) Income statement( by absorption

costing)

particul

ars

amount total amount Particul

ars

Amount total amount

Sales 2520000 Sales 252000

0

less: Marginal cost less: marginal cost

Direct

material

480000 direct

material

480000

direct

labor

640000 direct

labor

640000

Management accounting is the process of analyzing business costs and operations from

which they can prepare final accounts and which can communicate to its users which help them

in their decision making.

The report will explain about the management accounting system and how the organization is

habitual of accepting the management accounting system to solve their financial problems. Also

it includes the various planning tools available for budgetary control of the organization .in

addition to this the income statement of chair manufacturing business of 3 years will be

explained with different techniques of cost analysis.

P3. Income statement of chair manufacturing company of three years using marginal costing and

absorption costing.

year 1 year1

Income statement (by marginal costing) Income statement( by absorption

costing)

particul

ars

amount total amount Particul

ars

Amount total amount

Sales 2520000 Sales 252000

0

less: Marginal cost less: marginal cost

Direct

material

480000 direct

material

480000

direct

labor

640000 direct

labor

640000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

variable

manufa

cturing

overhea

ds

800000 variable

manufa

cturing

overhea

d

800000

variable

selling

and

adminis

tration

overhea

d

10000 fixed

manufa

cturing

overhea

d

64000

closing

stock

4000 1926000 closing

stock

4000 198000

0

Contribution 594000 gross profit 540000

Less:selling&

distribution

overhead

10000

Less

administration

overheads

15000

less:

interest

expense

1000 less: selling and administrative

overhead

profit 568000 Variable 10000

Fixed 15000

interest

expense

1000 26000

year 2 net 514000

manufa

cturing

overhea

ds

800000 variable

manufa

cturing

overhea

d

800000

variable

selling

and

adminis

tration

overhea

d

10000 fixed

manufa

cturing

overhea

d

64000

closing

stock

4000 1926000 closing

stock

4000 198000

0

Contribution 594000 gross profit 540000

Less:selling&

distribution

overhead

10000

Less

administration

overheads

15000

less:

interest

expense

1000 less: selling and administrative

overhead

profit 568000 Variable 10000

Fixed 15000

interest

expense

1000 26000

year 2 net 514000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profit

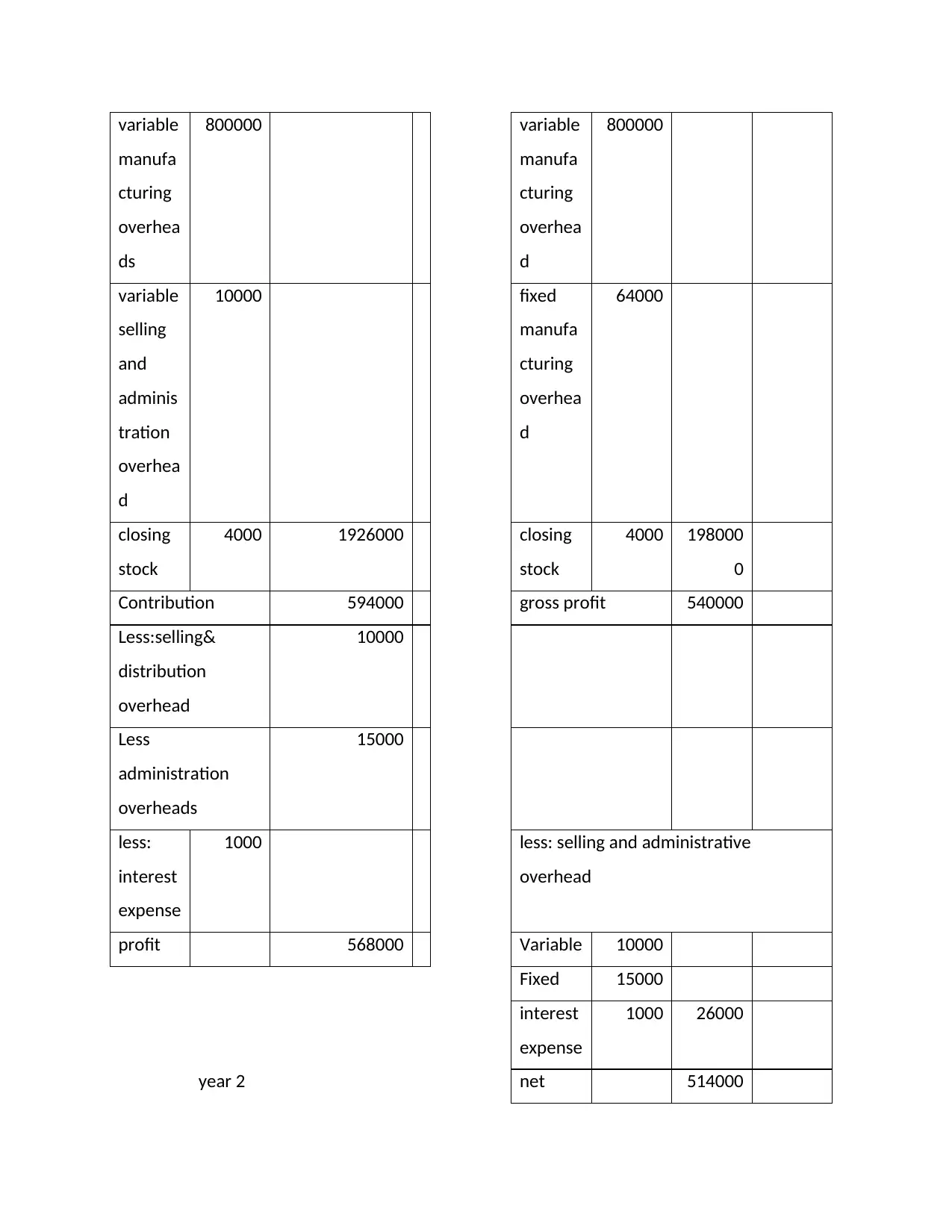

Income statement (by marginal costing)

particul

ars

amount total amount year 2

Sales 2800000 Income statement (by absorption

costing)

less: Marginal cost Particul

ars

Amount total amount

Direct

material

576000 Sales 280000

0

direct

labour

768000 less: marginal cost

variable

manufa

cturing

overhea

ds

960000 direct

material

576000

variable

selling

and

adminis

tration

overhea

d

10500 direct

labour

768000

closing

stock

12000 2302500 variable

manufa

cturing

overhea

d

960000

Income statement (by marginal costing)

particul

ars

amount total amount year 2

Sales 2800000 Income statement (by absorption

costing)

less: Marginal cost Particul

ars

Amount total amount

Direct

material

576000 Sales 280000

0

direct

labour

768000 less: marginal cost

variable

manufa

cturing

overhea

ds

960000 direct

material

576000

variable

selling

and

adminis

tration

overhea

d

10500 direct

labour

768000

closing

stock

12000 2302500 variable

manufa

cturing

overhea

d

960000

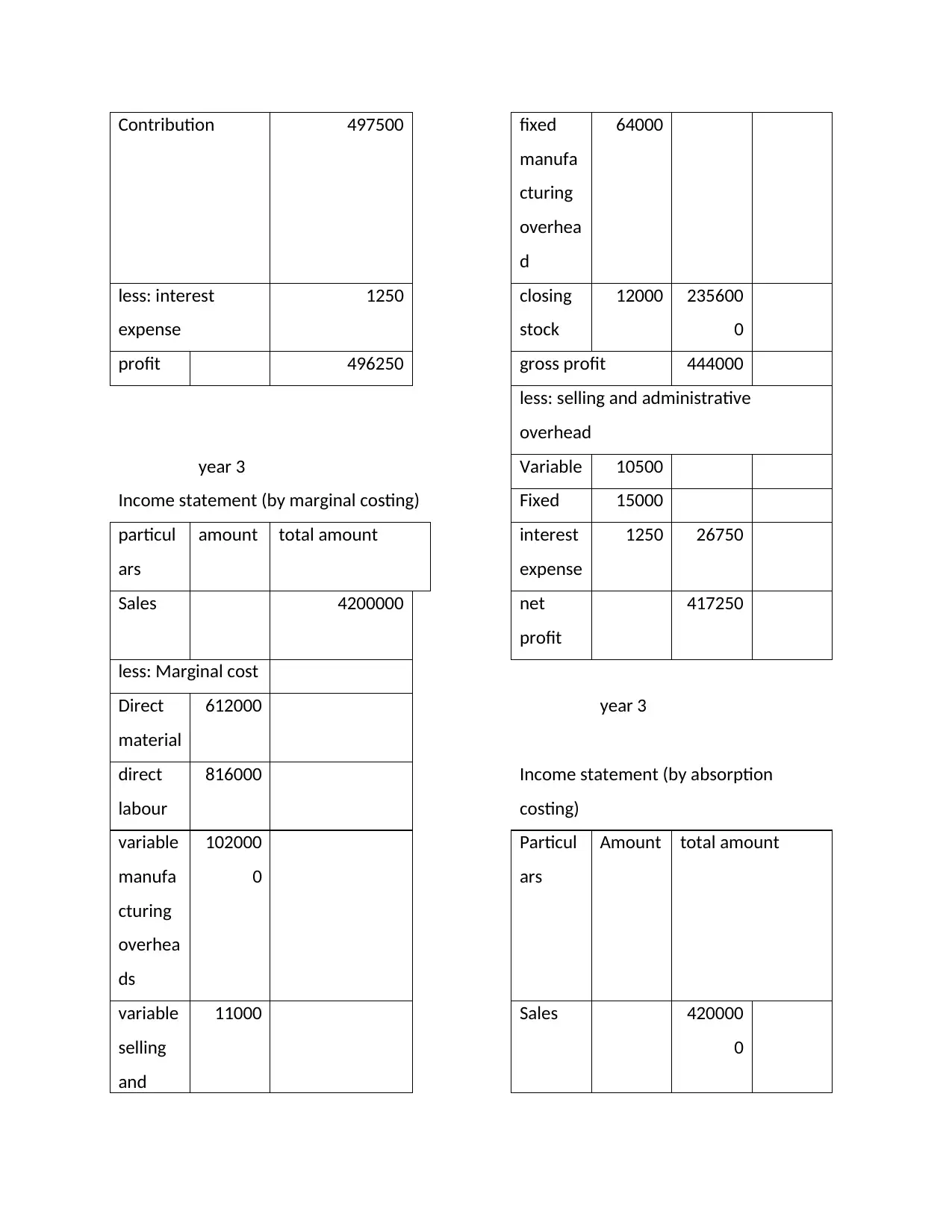

Contribution 497500 fixed

manufa

cturing

overhea

d

64000

less: interest

expense

1250 closing

stock

12000 235600

0

profit 496250 gross profit 444000

less: selling and administrative

overhead

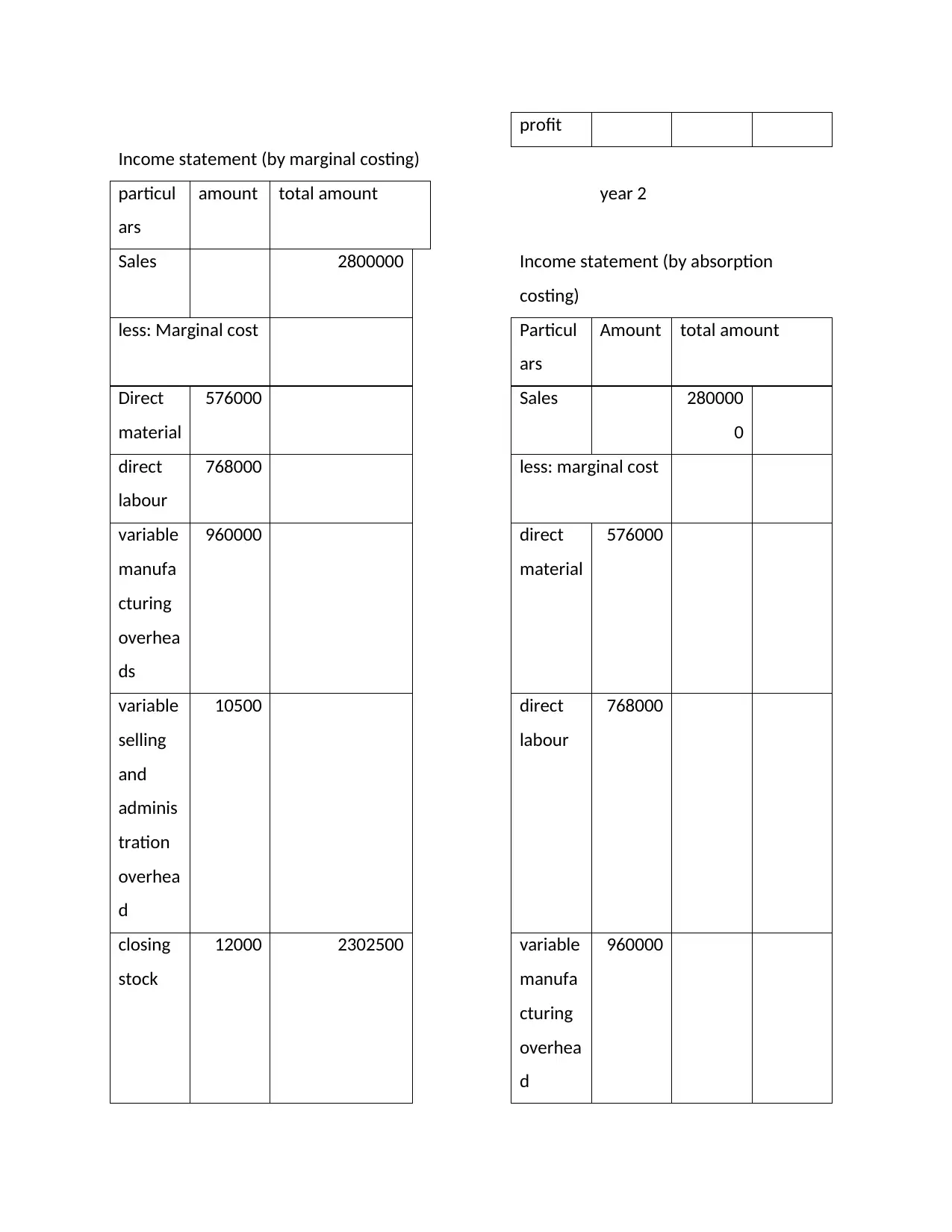

year 3 Variable 10500

Income statement (by marginal costing) Fixed 15000

particul

ars

amount total amount interest

expense

1250 26750

Sales 4200000 net

profit

417250

less: Marginal cost

Direct

material

612000 year 3

direct

labour

816000 Income statement (by absorption

costing)

variable

manufa

cturing

overhea

ds

102000

0

Particul

ars

Amount total amount

variable

selling

and

11000 Sales 420000

0

manufa

cturing

overhea

d

64000

less: interest

expense

1250 closing

stock

12000 235600

0

profit 496250 gross profit 444000

less: selling and administrative

overhead

year 3 Variable 10500

Income statement (by marginal costing) Fixed 15000

particul

ars

amount total amount interest

expense

1250 26750

Sales 4200000 net

profit

417250

less: Marginal cost

Direct

material

612000 year 3

direct

labour

816000 Income statement (by absorption

costing)

variable

manufa

cturing

overhea

ds

102000

0

Particul

ars

Amount total amount

variable

selling

and

11000 Sales 420000

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

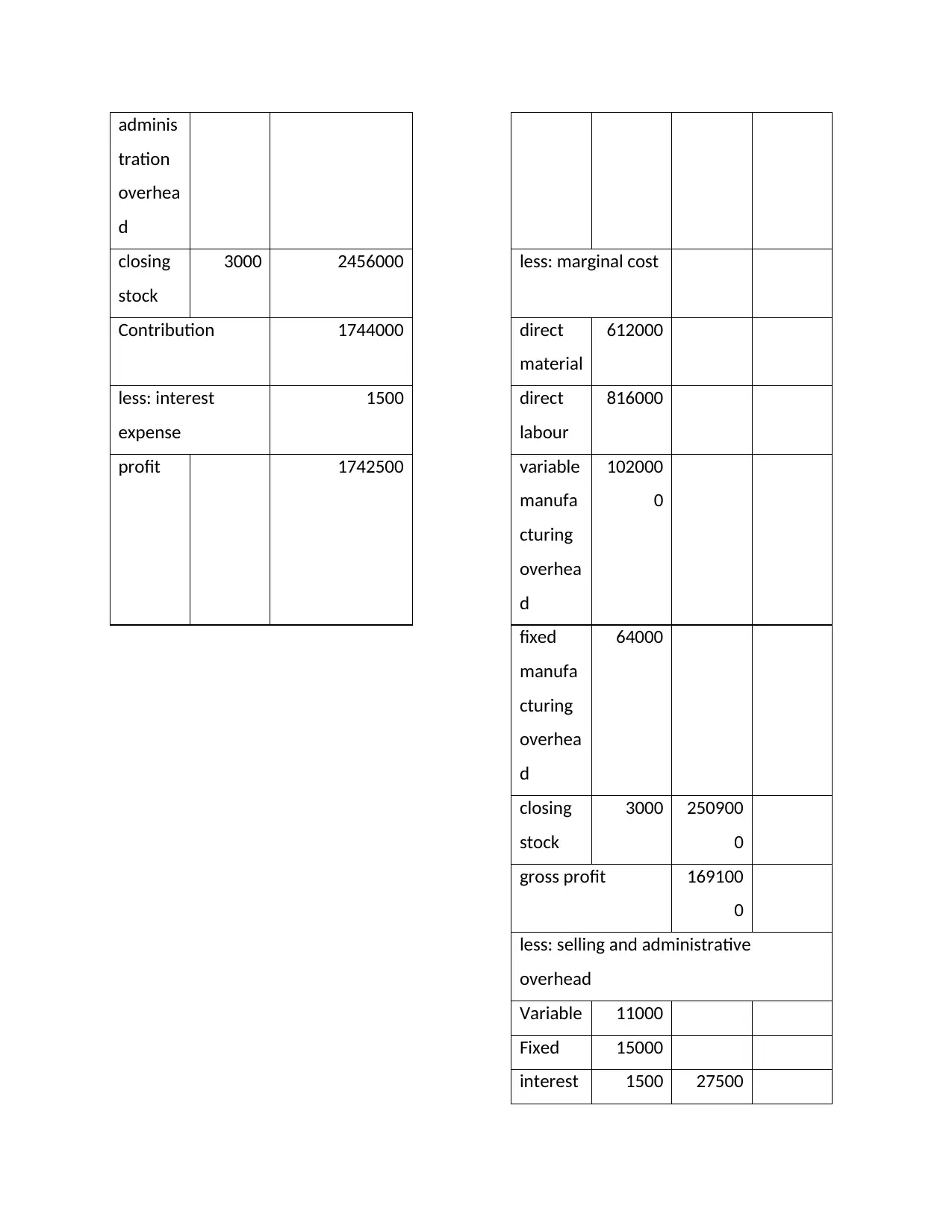

adminis

tration

overhea

d

closing

stock

3000 2456000 less: marginal cost

Contribution 1744000 direct

material

612000

less: interest

expense

1500 direct

labour

816000

profit 1742500 variable

manufa

cturing

overhea

d

102000

0

fixed

manufa

cturing

overhea

d

64000

closing

stock

3000 250900

0

gross profit 169100

0

less: selling and administrative

overhead

Variable 11000

Fixed 15000

interest 1500 27500

tration

overhea

d

closing

stock

3000 2456000 less: marginal cost

Contribution 1744000 direct

material

612000

less: interest

expense

1500 direct

labour

816000

profit 1742500 variable

manufa

cturing

overhea

d

102000

0

fixed

manufa

cturing

overhea

d

64000

closing

stock

3000 250900

0

gross profit 169100

0

less: selling and administrative

overhead

Variable 11000

Fixed 15000

interest 1500 27500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

expense

net

profit

166350

0

Working note

Sales-marginal cost(direct material, direct labor, variable expenses,)-fixed expenses-overheads-

closing stock= gross profit.

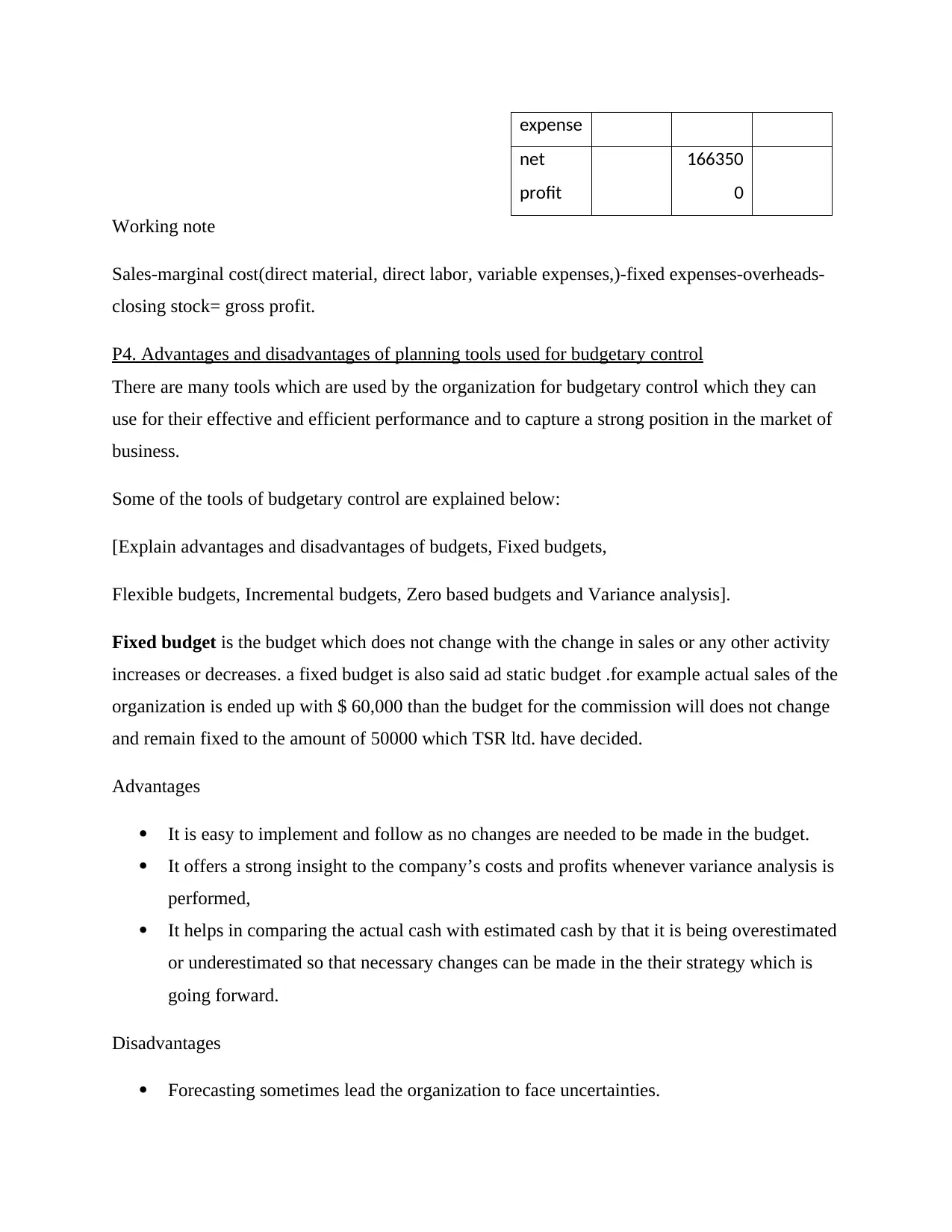

P4. Advantages and disadvantages of planning tools used for budgetary control

There are many tools which are used by the organization for budgetary control which they can

use for their effective and efficient performance and to capture a strong position in the market of

business.

Some of the tools of budgetary control are explained below:

[Explain advantages and disadvantages of budgets, Fixed budgets,

Flexible budgets, Incremental budgets, Zero based budgets and Variance analysis].

Fixed budget is the budget which does not change with the change in sales or any other activity

increases or decreases. a fixed budget is also said ad static budget .for example actual sales of the

organization is ended up with $ 60,000 than the budget for the commission will does not change

and remain fixed to the amount of 50000 which TSR ltd. have decided.

Advantages

It is easy to implement and follow as no changes are needed to be made in the budget.

It offers a strong insight to the company’s costs and profits whenever variance analysis is

performed,

It helps in comparing the actual cash with estimated cash by that it is being overestimated

or underestimated so that necessary changes can be made in the their strategy which is

going forward.

Disadvantages

Forecasting sometimes lead the organization to face uncertainties.

net

profit

166350

0

Working note

Sales-marginal cost(direct material, direct labor, variable expenses,)-fixed expenses-overheads-

closing stock= gross profit.

P4. Advantages and disadvantages of planning tools used for budgetary control

There are many tools which are used by the organization for budgetary control which they can

use for their effective and efficient performance and to capture a strong position in the market of

business.

Some of the tools of budgetary control are explained below:

[Explain advantages and disadvantages of budgets, Fixed budgets,

Flexible budgets, Incremental budgets, Zero based budgets and Variance analysis].

Fixed budget is the budget which does not change with the change in sales or any other activity

increases or decreases. a fixed budget is also said ad static budget .for example actual sales of the

organization is ended up with $ 60,000 than the budget for the commission will does not change

and remain fixed to the amount of 50000 which TSR ltd. have decided.

Advantages

It is easy to implement and follow as no changes are needed to be made in the budget.

It offers a strong insight to the company’s costs and profits whenever variance analysis is

performed,

It helps in comparing the actual cash with estimated cash by that it is being overestimated

or underestimated so that necessary changes can be made in the their strategy which is

going forward.

Disadvantages

Forecasting sometimes lead the organization to face uncertainties.

The biggest disadvantage of fixed budget is lack of flexibility as company needs to make

changes in their budget according to change in their situations.

These budgets are based on historical data so if the company have flexible trend of sales

and profits than these budgets does not provide the necessary information to the company

as company follows flexible trend.

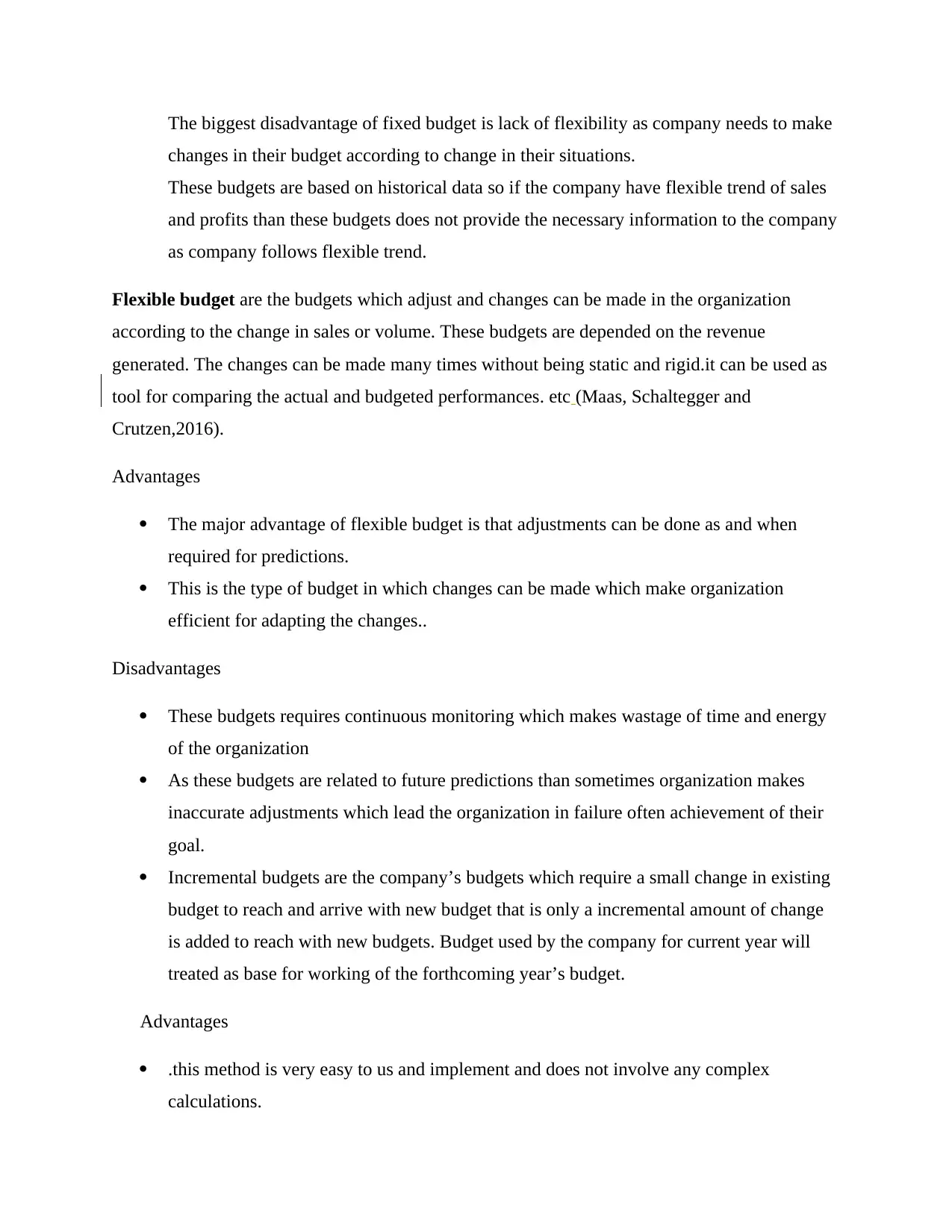

Flexible budget are the budgets which adjust and changes can be made in the organization

according to the change in sales or volume. These budgets are depended on the revenue

generated. The changes can be made many times without being static and rigid.it can be used as

tool for comparing the actual and budgeted performances. etc (Maas, Schaltegger and

Crutzen,2016).

Advantages

The major advantage of flexible budget is that adjustments can be done as and when

required for predictions.

This is the type of budget in which changes can be made which make organization

efficient for adapting the changes..

Disadvantages

These budgets requires continuous monitoring which makes wastage of time and energy

of the organization

As these budgets are related to future predictions than sometimes organization makes

inaccurate adjustments which lead the organization in failure often achievement of their

goal.

Incremental budgets are the company’s budgets which require a small change in existing

budget to reach and arrive with new budget that is only a incremental amount of change

is added to reach with new budgets. Budget used by the company for current year will

treated as base for working of the forthcoming year’s budget.

Advantages

.this method is very easy to us and implement and does not involve any complex

calculations.

changes in their budget according to change in their situations.

These budgets are based on historical data so if the company have flexible trend of sales

and profits than these budgets does not provide the necessary information to the company

as company follows flexible trend.

Flexible budget are the budgets which adjust and changes can be made in the organization

according to the change in sales or volume. These budgets are depended on the revenue

generated. The changes can be made many times without being static and rigid.it can be used as

tool for comparing the actual and budgeted performances. etc (Maas, Schaltegger and

Crutzen,2016).

Advantages

The major advantage of flexible budget is that adjustments can be done as and when

required for predictions.

This is the type of budget in which changes can be made which make organization

efficient for adapting the changes..

Disadvantages

These budgets requires continuous monitoring which makes wastage of time and energy

of the organization

As these budgets are related to future predictions than sometimes organization makes

inaccurate adjustments which lead the organization in failure often achievement of their

goal.

Incremental budgets are the company’s budgets which require a small change in existing

budget to reach and arrive with new budget that is only a incremental amount of change

is added to reach with new budgets. Budget used by the company for current year will

treated as base for working of the forthcoming year’s budget.

Advantages

.this method is very easy to us and implement and does not involve any complex

calculations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This budget ensures the continuity of funding for various departments without doing

much analysis regarding the funding requirements.

The impact of any changes can be seen immediately.

It ensures no large deviations in the budget of year and after years.

Disadvantages

Incremental budget generally leads to extra spending as each department tries to get more

and more funds which is required to fund their operations as departments will try to

spend more money as possible as they can to get similar amount for the next budget

which is wastage of financial resources.

It does not consider the changes as this approach assumes that every element of the

budget remains same as last year as it fails to take minimum changes into the

consideration.

Using of this budgets by managers will leads to growth with little revenue but with more

expenses as they do this budgeting to ensure that their organization always get the

favorable changes.

Zero base budgeting is the budgeting process which starts from zero base and ensures that

every function of the organization is being analyzed for its cost and needs. This is the method

of budgeting in which each and every expenses are justified for each new period and then

budget is made according to the requirements of the next period irrespective of the budget

that it is higher or lower with the previous budgets

Advantages:-

These budget ensures that every managers needs to specify and justify for all the

operating This budget helps b in keeping the legacy expenses in check on timely basis.

It ensures the careful planning of future expense and revenue.

It encourages the executive management at all levels for the active participation in

complete budget process.

Zero base budgeting ensures the careful planning.

It helps in promoting operational efficiency expenses they spent for every period.

As it is not based on incremental approach.

much analysis regarding the funding requirements.

The impact of any changes can be seen immediately.

It ensures no large deviations in the budget of year and after years.

Disadvantages

Incremental budget generally leads to extra spending as each department tries to get more

and more funds which is required to fund their operations as departments will try to

spend more money as possible as they can to get similar amount for the next budget

which is wastage of financial resources.

It does not consider the changes as this approach assumes that every element of the

budget remains same as last year as it fails to take minimum changes into the

consideration.

Using of this budgets by managers will leads to growth with little revenue but with more

expenses as they do this budgeting to ensure that their organization always get the

favorable changes.

Zero base budgeting is the budgeting process which starts from zero base and ensures that

every function of the organization is being analyzed for its cost and needs. This is the method

of budgeting in which each and every expenses are justified for each new period and then

budget is made according to the requirements of the next period irrespective of the budget

that it is higher or lower with the previous budgets

Advantages:-

These budget ensures that every managers needs to specify and justify for all the

operating This budget helps b in keeping the legacy expenses in check on timely basis.

It ensures the careful planning of future expense and revenue.

It encourages the executive management at all levels for the active participation in

complete budget process.

Zero base budgeting ensures the careful planning.

It helps in promoting operational efficiency expenses they spent for every period.

As it is not based on incremental approach.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Disadvantages

Zero base budgeting is basically a resource intensive that is it takes a lot of time and

effort of the manager to review the budget closely and justify each and every expenses of

the budget rather modifying the existing budget.

This budget involves more paper work in the preparation of zero base budgeting.

Administration and communication of zero base budget creates many critical poblems.in

the case of large organizations many number of decision packages are prepared it

includes more expenses.

Variance analysis is the process of computing the cause of variance between the actual costs

and estimated costs. Which also includes two phases that is computation if individual variances

and determining the cause for each variance.

Advantages

The advantage of variance analysis that the reason for all the variances can be easily

evaluated and company can take remedial actions.

The subdivision of variance helps in disclosing the relationship between the different

variances.

It helps in fixing the responsibilities of every individual or department for each variance

separately.

It can also be used for controlling the costs.

It helps in highlighting all the inefficient performance so that they can be eliminated from

complete process or steps can be taken to make it effective.

P5.Organizatiins are adapting Management accounting system to solve their financial problems

Management accounting systems play the crucial role in the organization as these systems helps

mangers to plan accordingly and help them to solve their financial problems by offering and

performing various functions. These systems are made to provide such information to the

organization which helps management in aiming the good decisions (Otley,2016). The focus of

management accounting system is to provide the information to internal users so that they can

make good and sound decisions. Mangers are using these accounting systems for planning

functions and budgeting .budgets are made to compare the actual expense with estimate expenses

Zero base budgeting is basically a resource intensive that is it takes a lot of time and

effort of the manager to review the budget closely and justify each and every expenses of

the budget rather modifying the existing budget.

This budget involves more paper work in the preparation of zero base budgeting.

Administration and communication of zero base budget creates many critical poblems.in

the case of large organizations many number of decision packages are prepared it

includes more expenses.

Variance analysis is the process of computing the cause of variance between the actual costs

and estimated costs. Which also includes two phases that is computation if individual variances

and determining the cause for each variance.

Advantages

The advantage of variance analysis that the reason for all the variances can be easily

evaluated and company can take remedial actions.

The subdivision of variance helps in disclosing the relationship between the different

variances.

It helps in fixing the responsibilities of every individual or department for each variance

separately.

It can also be used for controlling the costs.

It helps in highlighting all the inefficient performance so that they can be eliminated from

complete process or steps can be taken to make it effective.

P5.Organizatiins are adapting Management accounting system to solve their financial problems

Management accounting systems play the crucial role in the organization as these systems helps

mangers to plan accordingly and help them to solve their financial problems by offering and

performing various functions. These systems are made to provide such information to the

organization which helps management in aiming the good decisions (Otley,2016). The focus of

management accounting system is to provide the information to internal users so that they can

make good and sound decisions. Mangers are using these accounting systems for planning

functions and budgeting .budgets are made to compare the actual expense with estimate expenses

so that corrective actions ad decisions can be taken to correct the deviations if any occurs.

Management accounting system reaches in almost all departments of the organization including

IT, marketing, Human resource, finance, production, sales etc. The management accounting

system helps in formulating the financial strategies such as sales forecasting, budgets etc. they

also incorporate the data’s from final accounts of the organization to develop the strategies which

can improve the organization’s future performance. Through the system of management

accounting it help mangers to create static, flexible and rolling budges which help them to

monitor the expenses of the organization and this is important for any organization a sit directly

affects the bottom line profit. There are various tools through which managers can maintain

profitability of the organization including using of breakeven analysis.as to this point company is

able to k now its break even where they are in situation of that production level where they in no

profit no loss point. This helps in managing company’s production levels, their sales objective,

and various other factors which impact profitability of the organization Some of the major

function performed by these systems is:-

Benchmarking

It is the process through which TSR ltd is able to measure their performance of products,

services against of the other company (Duport Company’s) services and product which is

considered to be best in the industry and market. This helps TSR ltd to analyses and find out

their financial problems by continuously identifying, understanding and adopting the outstanding

practices which can be found inside and outside of eth organization. Through benchmarking

organization can recognize for their exemplary operational performances. In the company

benchmarked performances can be measured though using financial ratios, productivity ratios,

operating results etc.

Key performance indicators

It is a s et of quantifiable measures which company uses to compare their performance in terms

of meeting their strategic and operational goals .key performance indicators varies between the

companies depending on the priorities and their criteria of performance. These are directly linked

to goals of the company which help them to identify that in which key areas they are lacking by

measuring them through KPI”s as they measure and track the specific business goals .after

Management accounting system reaches in almost all departments of the organization including

IT, marketing, Human resource, finance, production, sales etc. The management accounting

system helps in formulating the financial strategies such as sales forecasting, budgets etc. they

also incorporate the data’s from final accounts of the organization to develop the strategies which

can improve the organization’s future performance. Through the system of management

accounting it help mangers to create static, flexible and rolling budges which help them to

monitor the expenses of the organization and this is important for any organization a sit directly

affects the bottom line profit. There are various tools through which managers can maintain

profitability of the organization including using of breakeven analysis.as to this point company is

able to k now its break even where they are in situation of that production level where they in no

profit no loss point. This helps in managing company’s production levels, their sales objective,

and various other factors which impact profitability of the organization Some of the major

function performed by these systems is:-

Benchmarking

It is the process through which TSR ltd is able to measure their performance of products,

services against of the other company (Duport Company’s) services and product which is

considered to be best in the industry and market. This helps TSR ltd to analyses and find out

their financial problems by continuously identifying, understanding and adopting the outstanding

practices which can be found inside and outside of eth organization. Through benchmarking

organization can recognize for their exemplary operational performances. In the company

benchmarked performances can be measured though using financial ratios, productivity ratios,

operating results etc.

Key performance indicators

It is a s et of quantifiable measures which company uses to compare their performance in terms

of meeting their strategic and operational goals .key performance indicators varies between the

companies depending on the priorities and their criteria of performance. These are directly linked

to goals of the company which help them to identify that in which key areas they are lacking by

measuring them through KPI”s as they measure and track the specific business goals .after

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.