Management Accounting Systems, Reporting, and Budgetary Control

VerifiedAdded on 2019/12/18

|22

|5368

|137

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices at AS Diverse Limited, a UK-based service sector company in the dancing industry. The report begins by defining management accounting and its essential requirements, detailing various systems such as cost accounting, inventory management, price optimization, job costing, transfer pricing, process costing, and activity-based costing. It then explores the reporting methods used by AS Diverse Limited, including account receivables reports, operating budget reports, inventory management reports, departmental reports, payroll reports, expense reports, and revenue reports. The report highlights the importance of these methods in assessing financial performance, making strategic decisions, and controlling costs. Finally, the report delves into the calculation of cost and profit, and planning tools and methods beneficial for budgetary control, providing a complete overview of management accounting's role in the company's financial management.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Accounting is a process which is used by every kind of business entity in order to

manage, diversify, interpret, prepare, explain etc. to financial data and informations in effectual

manner. When the financial data are to be manage in appropriate way then the company is easily

able to fulfil and meet different financial goals and objectives. Further, with the help of

management accounting business organisation is highly able to control over the expenses and

enhance level of sales and revenue at the financial years ending. In order to explain about the

management accounting there is a AS Diverse Limited company is chosen which is a small

business and UK based. Further, it is a private limited firm and operates in the service sector i.e.

dancing industry (AS Diverse limited, 2016). The study helps to analyse about different systems

of management accounting and their essential requirements at the workplace. It shows different

methods and ways which are used by the AS Diverse Limited for reporting management

accounts. In addition to this, the study describes calculation of net income using absorption and

marginal costing. At the end of report, it focuses on planning tools and methods which are

helpful for AS Diverse limited in budgetary control.

TASK 1

P1 Defining management accounting and its important requirements of various kinds for its

approaches or systems

Business Report

To,

General Manager,

AS Diverse Limited

Date: 4th October 2017

Subject: Management accounting systems

In the business world, every company has key motive is that to maximize level of profit

by controlling costs and expenses. Higher the costs lead to reduce net profit at the end of year

and hampers overall financial performance. The aspect by which AS Diverse limited highly

able to know lack of problems in the firm regarding finance department is identified as a

management accounting. In the accounting scenario, there are very broad tools and methods are

1

Accounting is a process which is used by every kind of business entity in order to

manage, diversify, interpret, prepare, explain etc. to financial data and informations in effectual

manner. When the financial data are to be manage in appropriate way then the company is easily

able to fulfil and meet different financial goals and objectives. Further, with the help of

management accounting business organisation is highly able to control over the expenses and

enhance level of sales and revenue at the financial years ending. In order to explain about the

management accounting there is a AS Diverse Limited company is chosen which is a small

business and UK based. Further, it is a private limited firm and operates in the service sector i.e.

dancing industry (AS Diverse limited, 2016). The study helps to analyse about different systems

of management accounting and their essential requirements at the workplace. It shows different

methods and ways which are used by the AS Diverse Limited for reporting management

accounts. In addition to this, the study describes calculation of net income using absorption and

marginal costing. At the end of report, it focuses on planning tools and methods which are

helpful for AS Diverse limited in budgetary control.

TASK 1

P1 Defining management accounting and its important requirements of various kinds for its

approaches or systems

Business Report

To,

General Manager,

AS Diverse Limited

Date: 4th October 2017

Subject: Management accounting systems

In the business world, every company has key motive is that to maximize level of profit

by controlling costs and expenses. Higher the costs lead to reduce net profit at the end of year

and hampers overall financial performance. The aspect by which AS Diverse limited highly

able to know lack of problems in the firm regarding finance department is identified as a

management accounting. In the accounting scenario, there are very broad tools and methods are

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

included. Furthermore, by applying such kinds of techniques and approaches the As Diverse

Limited is able to achieve different financial targets and objectives in effectual manner. Apart

from this, the respective aspect the firm able to determine data regarding finance and accounts

for the present and future as well (Burritt and et.al., 2011). Various systems of the management

accounting along with their requirements for AS Diverse limited are delineated as below:

Cost accounting system: Key approach of management accounting is related to cost

which is very sensitive aspect of business process. By using such kinds of system, the

AS Diverse limited is able to determine different kinds of expenses such as direct,

indirect, fixed, variable, overhead costs etc. After adding all such expenses, it calculated

total cost or production and on the basis of it determine selling prices. Hence, the

essential requirement of the cost accounting is to determine cost of total production as

well as each unit. When it knows that how much cost is to incurred for producing one

unit then it able to calculate selling price and sale to customers.

Inventory management system: The system by which management can know level of

stock or inventory which is available at the AS Diverse limited. When there are higher

inventory remains with firm then it reduces profitability and performance of company

and hamper smooth functioning as well (Kaplan and Atkinson, 2015). Key requirement

to use respective accounting system is to control over and stock and utilize it in effective

way by which AS Diverse limited able to generate higher amount of sales. Hence, it can

become highly financially sound and create better image across the industry where it

operates in UK.

Price Optimisation: The system where product prices are analysed and fixed by the

management of AS Diverse Limited company is known as the price optimisation. In

general, each and every business entity selling its products and services after changing

in the selling prices. Further, a specific price level where more customers purchasing

goods then using this method profitable price can be determined.

Job costing: As per this system, cost and expenses incurred in each job of the company

are analysed and taken into account by the managers. Within workplace of AS Diverse

Limited, different product range are manufactured. For assessing and deriving cost

2

Limited is able to achieve different financial targets and objectives in effectual manner. Apart

from this, the respective aspect the firm able to determine data regarding finance and accounts

for the present and future as well (Burritt and et.al., 2011). Various systems of the management

accounting along with their requirements for AS Diverse limited are delineated as below:

Cost accounting system: Key approach of management accounting is related to cost

which is very sensitive aspect of business process. By using such kinds of system, the

AS Diverse limited is able to determine different kinds of expenses such as direct,

indirect, fixed, variable, overhead costs etc. After adding all such expenses, it calculated

total cost or production and on the basis of it determine selling prices. Hence, the

essential requirement of the cost accounting is to determine cost of total production as

well as each unit. When it knows that how much cost is to incurred for producing one

unit then it able to calculate selling price and sale to customers.

Inventory management system: The system by which management can know level of

stock or inventory which is available at the AS Diverse limited. When there are higher

inventory remains with firm then it reduces profitability and performance of company

and hamper smooth functioning as well (Kaplan and Atkinson, 2015). Key requirement

to use respective accounting system is to control over and stock and utilize it in effective

way by which AS Diverse limited able to generate higher amount of sales. Hence, it can

become highly financially sound and create better image across the industry where it

operates in UK.

Price Optimisation: The system where product prices are analysed and fixed by the

management of AS Diverse Limited company is known as the price optimisation. In

general, each and every business entity selling its products and services after changing

in the selling prices. Further, a specific price level where more customers purchasing

goods then using this method profitable price can be determined.

Job costing: As per this system, cost and expenses incurred in each job of the company

are analysed and taken into account by the managers. Within workplace of AS Diverse

Limited, different product range are manufactured. For assessing and deriving cost

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

comes into consideration at each job level, this system is required by the firm.

Transfer pricing: As per the method, the company AS Diverse limited purchases

different raw materials and services from large and parent organisation which provide at

lower charges compare to market rate. When the AS Diverse limited uses respective

type of management accounting systems then easily able to reduce total cost of

production and selling prices as well. Essential requirement to employ transfer price is

to decline level of total cost which is incurred in the production and operation process

(Håkansson, Kraus and Lind, 2010). Further, when cost of every unit reduces then prices

also by which more number of buyers attracts and helps to enhance financial

performance in the dancing industry of UK.

Process costing: Another method is process costing which is used by AS Diverse

limited and helps to determine cost of each process in better way. When it able to known

that expenses incurred in particular business process such as manufacturing, production,

accounting etc. By using such kind of approach of management accounting the AS

Diverse limited is highly able to become financially sound in the overall industry.

Reason to employ the process costing in the firm is to analyses different costs and

expenses of each process which are comes into consideration at the workplace. It can be

said that, the process costing is effective and integral part of the business entity and

helps to take decisions related to different processes.

Activity based costing (ABC): Other approach of manage accounts is activity based

costing method which shows costs of each and every activity of different processes.

Here the AS Diverse limited requires to collect every financial transaction related to

each activity of a process. It is widely used method by several firms because it can know

that which activity incurring higher expenses at to produce products and services. On the

basis of expenditures of every cost it able to know that overall production process

incurred how many costs.

P2 Explaining various management accounting reporting methods used by AS Diverse Limited

Business Report

3

Transfer pricing: As per the method, the company AS Diverse limited purchases

different raw materials and services from large and parent organisation which provide at

lower charges compare to market rate. When the AS Diverse limited uses respective

type of management accounting systems then easily able to reduce total cost of

production and selling prices as well. Essential requirement to employ transfer price is

to decline level of total cost which is incurred in the production and operation process

(Håkansson, Kraus and Lind, 2010). Further, when cost of every unit reduces then prices

also by which more number of buyers attracts and helps to enhance financial

performance in the dancing industry of UK.

Process costing: Another method is process costing which is used by AS Diverse

limited and helps to determine cost of each process in better way. When it able to known

that expenses incurred in particular business process such as manufacturing, production,

accounting etc. By using such kind of approach of management accounting the AS

Diverse limited is highly able to become financially sound in the overall industry.

Reason to employ the process costing in the firm is to analyses different costs and

expenses of each process which are comes into consideration at the workplace. It can be

said that, the process costing is effective and integral part of the business entity and

helps to take decisions related to different processes.

Activity based costing (ABC): Other approach of manage accounts is activity based

costing method which shows costs of each and every activity of different processes.

Here the AS Diverse limited requires to collect every financial transaction related to

each activity of a process. It is widely used method by several firms because it can know

that which activity incurring higher expenses at to produce products and services. On the

basis of expenditures of every cost it able to know that overall production process

incurred how many costs.

P2 Explaining various management accounting reporting methods used by AS Diverse Limited

Business Report

3

To,

General Manager,

AS Diverse Limited

Date: 4th October 2017

Subject: Reporting methods of management accounting systems

In the company, different kinds of reports are prepared by the management which helps

to analyse various aspects of the business process. When the firm prepare effective reports of

each and every financial transaction then able to determine that in which order AS Diverse

limited is generating profit. Along with this by using reporting methods it can derive

performance in the dancing industry of UK and can make business strategies as well decisions.

(Andor, Mohanty and Toth, 2015) Different method which are employed by AS Diverse limited

for reposting different management accounts are analysed as below:

Account receivables report: Moreover, method of reporting in which various

receivables in terms of cash are recorded and analysed is known as report of account

receivables. By this management of AS Diverse limited is highly able to know that how

much cash is received from internal and external environment in one financial year.

When the company receives amount from various debtors is to be transacted in the such

report. Higher the debtors are not better for the firm because it reduces cash collection

efficiency within a year. Apart from this, products and services which are selling at the

credit rather than cash then credit amount is also recorded in the accounts receivables

report. Such kind of report requires for the company in order to know that how much

amount is to be receive at the accounting year ending (Islam and Hu, 2012).

Operating budget report: The approach of reporting which shows various inflows as

well as outflows of business and helps to determine future financial data is identified as

budget. In this, various kind of future information’s are to be predicted and make proper

strategies according to that which is highly profitable for AS Diverse limited. Apart

from this it helps to make comparison between actual results as well as budgeted data

estimated through budget report. By comparing this, it able to know business

performance at the closure of a financial year. Different kinds of financial data are

4

General Manager,

AS Diverse Limited

Date: 4th October 2017

Subject: Reporting methods of management accounting systems

In the company, different kinds of reports are prepared by the management which helps

to analyse various aspects of the business process. When the firm prepare effective reports of

each and every financial transaction then able to determine that in which order AS Diverse

limited is generating profit. Along with this by using reporting methods it can derive

performance in the dancing industry of UK and can make business strategies as well decisions.

(Andor, Mohanty and Toth, 2015) Different method which are employed by AS Diverse limited

for reposting different management accounts are analysed as below:

Account receivables report: Moreover, method of reporting in which various

receivables in terms of cash are recorded and analysed is known as report of account

receivables. By this management of AS Diverse limited is highly able to know that how

much cash is received from internal and external environment in one financial year.

When the company receives amount from various debtors is to be transacted in the such

report. Higher the debtors are not better for the firm because it reduces cash collection

efficiency within a year. Apart from this, products and services which are selling at the

credit rather than cash then credit amount is also recorded in the accounts receivables

report. Such kind of report requires for the company in order to know that how much

amount is to be receive at the accounting year ending (Islam and Hu, 2012).

Operating budget report: The approach of reporting which shows various inflows as

well as outflows of business and helps to determine future financial data is identified as

budget. In this, various kind of future information’s are to be predicted and make proper

strategies according to that which is highly profitable for AS Diverse limited. Apart

from this it helps to make comparison between actual results as well as budgeted data

estimated through budget report. By comparing this, it able to know business

performance at the closure of a financial year. Different kinds of financial data are

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

derived by adopting budgeting at AS Diverse limited which are like as cash, sales,

turnover, level of production, required material, labour costs etc.

Inventory management report: A method of reporting in which overall information

about the stock in the workplace is transacted. When value of total stock is higher at the

end of an accounting period then leads to decline total revenue of the firm. The reason is

that, employees unable to utilise inventory level in an optimum direction. Further, in this

basic two values are included like closing and opening stock. Total of inventory

management report treated in the assets side of balance sheet.

Departmental report: Another method in which cost, revenue, sales or any other kind

of financial data recorded on the basis of functions is known as the departmental report.

After considering total of this particular report AS Diverse Limited easily able to assess

that which of the department performing well in the industry.

Report of payroll: The method of reporting by which AS Diverse limited able to record

various financial transactions which are related to the employees and members of

organisation. It includes those expenses and some of money which is given the workers

such as wages, salary, compensation, allowances, monetary appreciation and rewards

etc. After doing summation of all such expenses of employees it making treatment in

books of profit and loss account. All the companies prepared the respective report which

helps to determine total expenditures incurred for employees.

Report of expenses: Another kind of report is related to expenses where all the

disposals are to be recorded. By using the report management of AS Diverse limited can

derive that how many expenditures are incurred in the business in within specific period

of time. If it founds that expenses are higher as compare to the incomes then take

corrective actions in order to control over costs (Jacobs and Cuganesan, 2014). Further.

The report shows about all the disposals related to employees, production, direct and

indirect, fixed and variable overheads etc. These all the expenses are treated in the profit

and loss account in the expenditures side.

Report of revenue or turnover: As per the revenue report, those amounts which are

generated and come in the firm from selling products and services is to be transacted

5

turnover, level of production, required material, labour costs etc.

Inventory management report: A method of reporting in which overall information

about the stock in the workplace is transacted. When value of total stock is higher at the

end of an accounting period then leads to decline total revenue of the firm. The reason is

that, employees unable to utilise inventory level in an optimum direction. Further, in this

basic two values are included like closing and opening stock. Total of inventory

management report treated in the assets side of balance sheet.

Departmental report: Another method in which cost, revenue, sales or any other kind

of financial data recorded on the basis of functions is known as the departmental report.

After considering total of this particular report AS Diverse Limited easily able to assess

that which of the department performing well in the industry.

Report of payroll: The method of reporting by which AS Diverse limited able to record

various financial transactions which are related to the employees and members of

organisation. It includes those expenses and some of money which is given the workers

such as wages, salary, compensation, allowances, monetary appreciation and rewards

etc. After doing summation of all such expenses of employees it making treatment in

books of profit and loss account. All the companies prepared the respective report which

helps to determine total expenditures incurred for employees.

Report of expenses: Another kind of report is related to expenses where all the

disposals are to be recorded. By using the report management of AS Diverse limited can

derive that how many expenditures are incurred in the business in within specific period

of time. If it founds that expenses are higher as compare to the incomes then take

corrective actions in order to control over costs (Jacobs and Cuganesan, 2014). Further.

The report shows about all the disposals related to employees, production, direct and

indirect, fixed and variable overheads etc. These all the expenses are treated in the profit

and loss account in the expenditures side.

Report of revenue or turnover: As per the revenue report, those amounts which are

generated and come in the firm from selling products and services is to be transacted

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Hammad, Jusoh and Yen Nee Oon, 2010). Every business expects that level of turnover

or sales at the end of year will be higher which lead to increase profit of entity. AS

Diverse limited make such report for determine that it is how much efficient to attract

consumers and sale its dancing services in the country UK. Higher the amount of

turnover is profitable for the company.

TASK 2

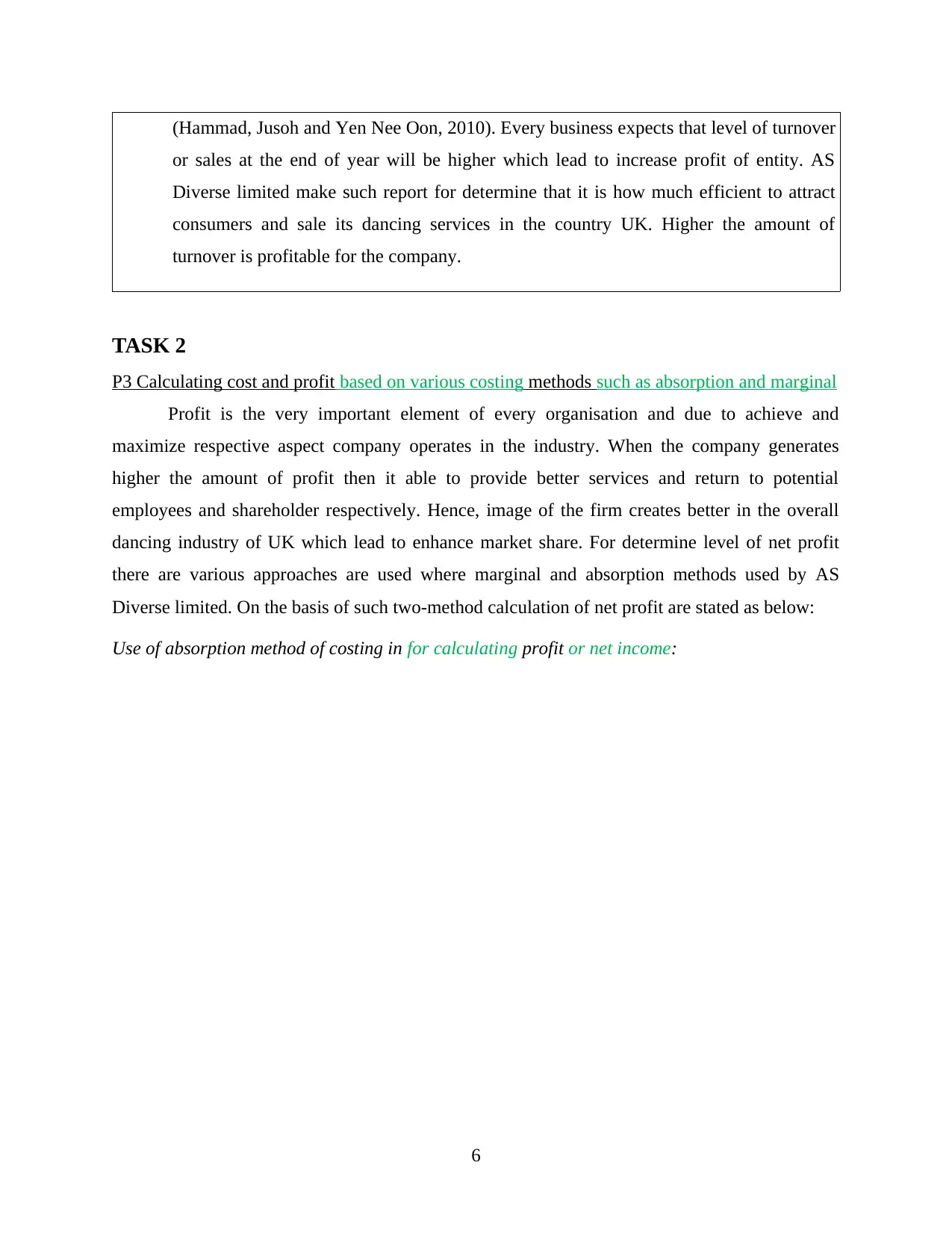

P3 Calculating cost and profit based on various costing methods such as absorption and marginal

Profit is the very important element of every organisation and due to achieve and

maximize respective aspect company operates in the industry. When the company generates

higher the amount of profit then it able to provide better services and return to potential

employees and shareholder respectively. Hence, image of the firm creates better in the overall

dancing industry of UK which lead to enhance market share. For determine level of net profit

there are various approaches are used where marginal and absorption methods used by AS

Diverse limited. On the basis of such two-method calculation of net profit are stated as below:

Use of absorption method of costing in for calculating profit or net income:

6

or sales at the end of year will be higher which lead to increase profit of entity. AS

Diverse limited make such report for determine that it is how much efficient to attract

consumers and sale its dancing services in the country UK. Higher the amount of

turnover is profitable for the company.

TASK 2

P3 Calculating cost and profit based on various costing methods such as absorption and marginal

Profit is the very important element of every organisation and due to achieve and

maximize respective aspect company operates in the industry. When the company generates

higher the amount of profit then it able to provide better services and return to potential

employees and shareholder respectively. Hence, image of the firm creates better in the overall

dancing industry of UK which lead to enhance market share. For determine level of net profit

there are various approaches are used where marginal and absorption methods used by AS

Diverse limited. On the basis of such two-method calculation of net profit are stated as below:

Use of absorption method of costing in for calculating profit or net income:

6

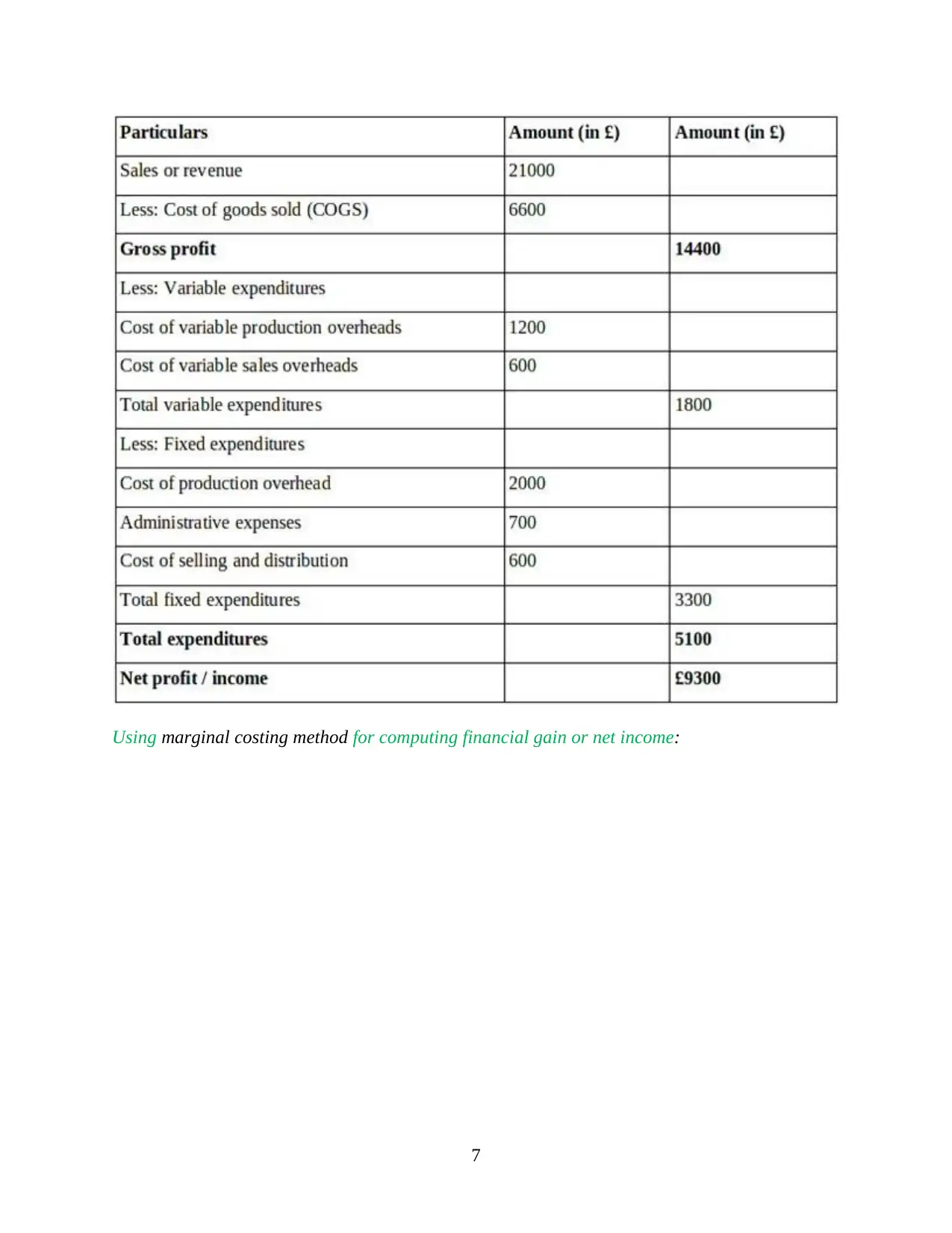

Using marginal costing method for computing financial gain or net income:

7

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation

From the above computed net profit, it can be assessed that, while calculating profit and

cost on the basis of marginal and absorption costing values are differs. When level of net profit is

to be determined using absorption costing method then net profit is coming out worth of 9300

GBP. On the other side, when AS Diverse limited uses another method of costing i.e. marginal

net profit is generated worth of 12600 GBP. There is huge difference between net yield

generated by the company at the end of year. If talking about the level of expenditures and costs

it can be visualised that in terms of marginal method total expenses are worth of 1800 GBP and

in the absorption costing it is worth of 5100 GBP. For occurring such difference reason is that

both methods consider different amount of costs and then calculate net profit (ullen and et.al.,

2013). Marginal or variable method of costing include only direct and variable expenditures for

determine net profit at the end.

Furthermore, another method such as absorption costing uses all the costs and

expenditures which are comes into consideration are the workplace of AS Diverse limited. Here

all the direct, indirect, variable and fixed overheads and miscellaneous expenses and added and

then derive net yield. Most of the firms use absorption method because it helps to recover all the

expenses and then charge price from consumers of the dancing services provided by it.

8

From the above computed net profit, it can be assessed that, while calculating profit and

cost on the basis of marginal and absorption costing values are differs. When level of net profit is

to be determined using absorption costing method then net profit is coming out worth of 9300

GBP. On the other side, when AS Diverse limited uses another method of costing i.e. marginal

net profit is generated worth of 12600 GBP. There is huge difference between net yield

generated by the company at the end of year. If talking about the level of expenditures and costs

it can be visualised that in terms of marginal method total expenses are worth of 1800 GBP and

in the absorption costing it is worth of 5100 GBP. For occurring such difference reason is that

both methods consider different amount of costs and then calculate net profit (ullen and et.al.,

2013). Marginal or variable method of costing include only direct and variable expenditures for

determine net profit at the end.

Furthermore, another method such as absorption costing uses all the costs and

expenditures which are comes into consideration are the workplace of AS Diverse limited. Here

all the direct, indirect, variable and fixed overheads and miscellaneous expenses and added and

then derive net yield. Most of the firms use absorption method because it helps to recover all the

expenses and then charge price from consumers of the dancing services provided by it.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

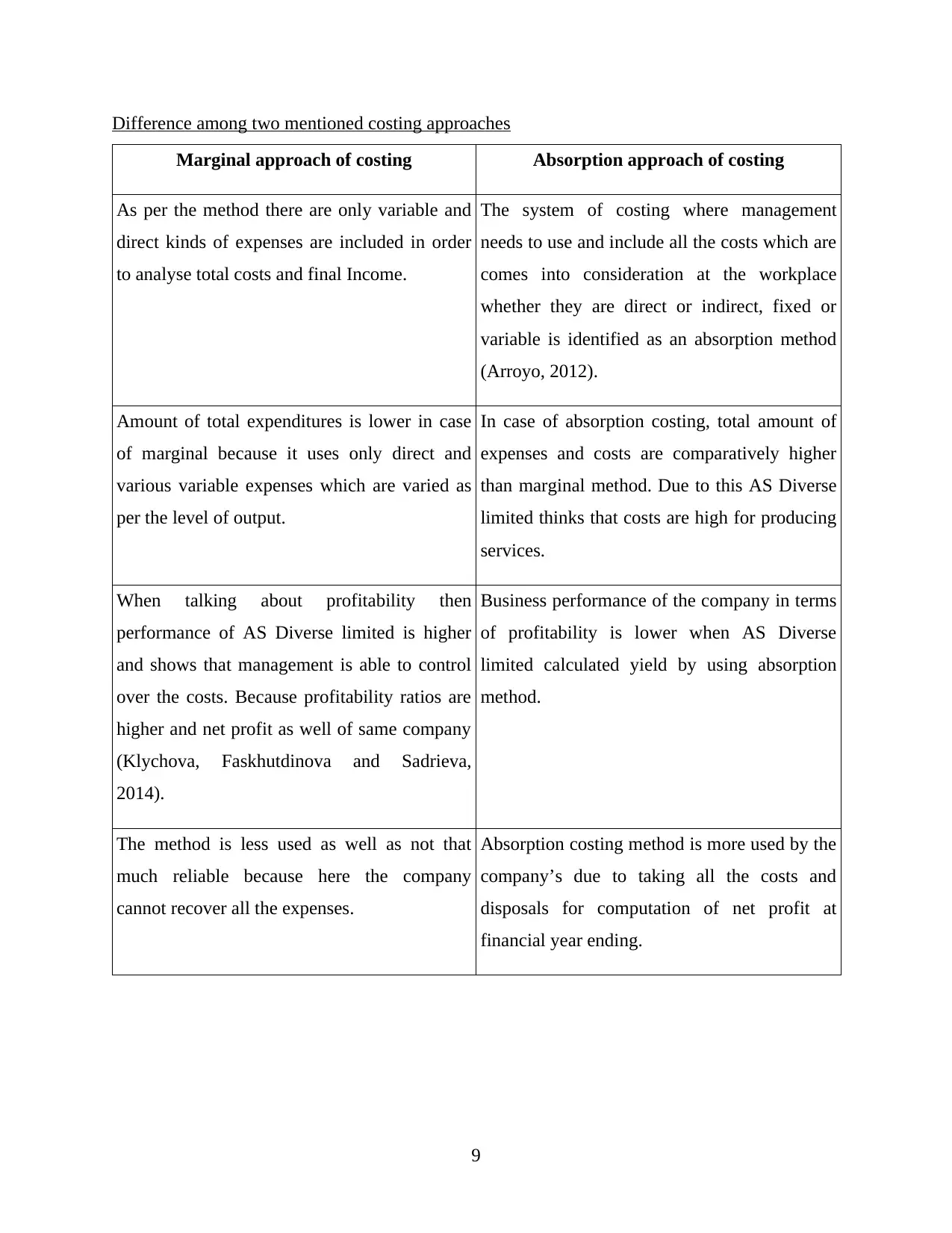

Difference among two mentioned costing approaches

Marginal approach of costing Absorption approach of costing

As per the method there are only variable and

direct kinds of expenses are included in order

to analyse total costs and final Income.

The system of costing where management

needs to use and include all the costs which are

comes into consideration at the workplace

whether they are direct or indirect, fixed or

variable is identified as an absorption method

(Arroyo, 2012).

Amount of total expenditures is lower in case

of marginal because it uses only direct and

various variable expenses which are varied as

per the level of output.

In case of absorption costing, total amount of

expenses and costs are comparatively higher

than marginal method. Due to this AS Diverse

limited thinks that costs are high for producing

services.

When talking about profitability then

performance of AS Diverse limited is higher

and shows that management is able to control

over the costs. Because profitability ratios are

higher and net profit as well of same company

(Klychova, Faskhutdinova and Sadrieva,

2014).

Business performance of the company in terms

of profitability is lower when AS Diverse

limited calculated yield by using absorption

method.

The method is less used as well as not that

much reliable because here the company

cannot recover all the expenses.

Absorption costing method is more used by the

company’s due to taking all the costs and

disposals for computation of net profit at

financial year ending.

9

Marginal approach of costing Absorption approach of costing

As per the method there are only variable and

direct kinds of expenses are included in order

to analyse total costs and final Income.

The system of costing where management

needs to use and include all the costs which are

comes into consideration at the workplace

whether they are direct or indirect, fixed or

variable is identified as an absorption method

(Arroyo, 2012).

Amount of total expenditures is lower in case

of marginal because it uses only direct and

various variable expenses which are varied as

per the level of output.

In case of absorption costing, total amount of

expenses and costs are comparatively higher

than marginal method. Due to this AS Diverse

limited thinks that costs are high for producing

services.

When talking about profitability then

performance of AS Diverse limited is higher

and shows that management is able to control

over the costs. Because profitability ratios are

higher and net profit as well of same company

(Klychova, Faskhutdinova and Sadrieva,

2014).

Business performance of the company in terms

of profitability is lower when AS Diverse

limited calculated yield by using absorption

method.

The method is less used as well as not that

much reliable because here the company

cannot recover all the expenses.

Absorption costing method is more used by the

company’s due to taking all the costs and

disposals for computation of net profit at

financial year ending.

9

TASK 3

P4 Merits and demerits of different types of planning tools used by AS Diverse limited

Planning is very important aspect of every business firm which helps in smooth

functioning and make it profitable. In context to this, various types of tools and methods are to

be adopted by the AS Diverse limited in order to prepare highly effective plan. Tools for making

effectual plan are described as below:

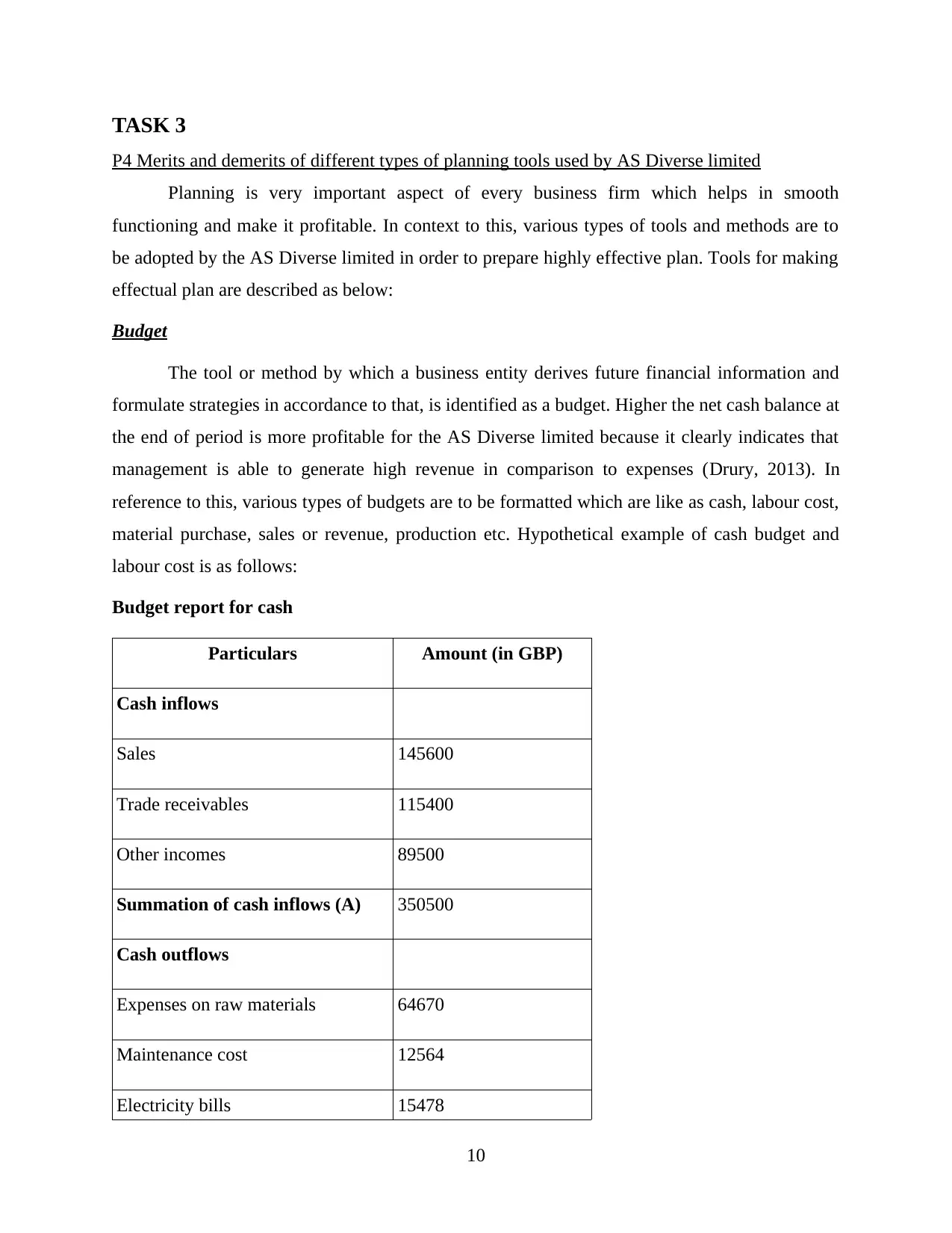

Budget

The tool or method by which a business entity derives future financial information and

formulate strategies in accordance to that, is identified as a budget. Higher the net cash balance at

the end of period is more profitable for the AS Diverse limited because it clearly indicates that

management is able to generate high revenue in comparison to expenses (Drury, 2013). In

reference to this, various types of budgets are to be formatted which are like as cash, labour cost,

material purchase, sales or revenue, production etc. Hypothetical example of cash budget and

labour cost is as follows:

Budget report for cash

Particulars Amount (in GBP)

Cash inflows

Sales 145600

Trade receivables 115400

Other incomes 89500

Summation of cash inflows (A) 350500

Cash outflows

Expenses on raw materials 64670

Maintenance cost 12564

Electricity bills 15478

10

P4 Merits and demerits of different types of planning tools used by AS Diverse limited

Planning is very important aspect of every business firm which helps in smooth

functioning and make it profitable. In context to this, various types of tools and methods are to

be adopted by the AS Diverse limited in order to prepare highly effective plan. Tools for making

effectual plan are described as below:

Budget

The tool or method by which a business entity derives future financial information and

formulate strategies in accordance to that, is identified as a budget. Higher the net cash balance at

the end of period is more profitable for the AS Diverse limited because it clearly indicates that

management is able to generate high revenue in comparison to expenses (Drury, 2013). In

reference to this, various types of budgets are to be formatted which are like as cash, labour cost,

material purchase, sales or revenue, production etc. Hypothetical example of cash budget and

labour cost is as follows:

Budget report for cash

Particulars Amount (in GBP)

Cash inflows

Sales 145600

Trade receivables 115400

Other incomes 89500

Summation of cash inflows (A) 350500

Cash outflows

Expenses on raw materials 64670

Maintenance cost 12564

Electricity bills 15478

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.