Management Accounting Report: Rent-A-Car Financial Analysis

VerifiedAdded on 2020/11/12

|18

|5393

|478

Report

AI Summary

This report provides a detailed analysis of management accounting principles, focusing on the Rent-A-Car industry as a case study. It covers essential requirements of various management accounting systems, including cost accounting, inventory management, and job costing. The report explores different methods of management accounting reporting, such as cost reports, job costing reports, budget reports, and performance reports. Furthermore, it delves into cost analysis techniques, specifically marginal costing and absorption costing, and demonstrates how to prepare an income statement using these methods. The report also examines various planning tools used in budgetary control and discusses how management accounting systems can be utilized to respond to financial problems. The analysis includes practical examples and formulas to illustrate the concepts, providing a comprehensive understanding of management accounting practices and their application in a real-world business context.

MANAGEMENT ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems...........................................................................................1

P2 Explain different methods used for management accounting reporting...........................3

P3 Calculate costs using appropriate techniques of costs analysis to prepare an income

statement using marginal and absorption costs......................................................................5

P4. Types of planning tools used in budgetary control:..................................................10

P5 management accounting systems to respond to financial problems...............................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems...........................................................................................1

P2 Explain different methods used for management accounting reporting...........................3

P3 Calculate costs using appropriate techniques of costs analysis to prepare an income

statement using marginal and absorption costs......................................................................5

P4. Types of planning tools used in budgetary control:..................................................10

P5 management accounting systems to respond to financial problems...............................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting is a process of collecting previous data, analysing and measuring them,

making plans for achieving organisational goals accordingly. It is a process used for decision

making process. Rent-A-Car industry is an american company which was established in 1957 by

St. Louis, Missouri. The company rents the car and also it oversees commercial fleet

management, sales used car, lorry, etc. This study will disclose different management accounting

reports, different management accounting tools, management accounting techniques,

determination of costs of the organisation. This assignment will also cover the marginal costing

and absorption costing with their examples, different budgetary planning tools along with their

advantages and disadvantages. This study will also suggest how management accounting system

responds to different financial problems.

LO 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting is an accounting system is application of knowledge and skills to

prepare and present financial and other information related to decision making in such a way so

that they could help them in decision making, planning and organising operation of

industry(Kaplan and Atkinson, 2015.).

Management accounting is a process of looking forward and taking decision which could

help them to create a better future of the organisation. Management accountants are also known

as value-creators as they work for creating more value of the organisation in future than its

historical values.

essential requirements of different types of management accounting system:

Knowledge and skills related to management accounting of Rant-A-Car can be experienced from

different fields and functions of the organisation like pricing, valuation, efficiency auditing,

marketing etc.

some essential requirements of management accounting system are as follows:

11 Cost accounting system: cost accounting system of the industry is the very important

gathered by managerial accountant of Rent-A-Car. It shows the cost company incurred by

1

Management accounting is a process of collecting previous data, analysing and measuring them,

making plans for achieving organisational goals accordingly. It is a process used for decision

making process. Rent-A-Car industry is an american company which was established in 1957 by

St. Louis, Missouri. The company rents the car and also it oversees commercial fleet

management, sales used car, lorry, etc. This study will disclose different management accounting

reports, different management accounting tools, management accounting techniques,

determination of costs of the organisation. This assignment will also cover the marginal costing

and absorption costing with their examples, different budgetary planning tools along with their

advantages and disadvantages. This study will also suggest how management accounting system

responds to different financial problems.

LO 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems.

Management accounting is an accounting system is application of knowledge and skills to

prepare and present financial and other information related to decision making in such a way so

that they could help them in decision making, planning and organising operation of

industry(Kaplan and Atkinson, 2015.).

Management accounting is a process of looking forward and taking decision which could

help them to create a better future of the organisation. Management accountants are also known

as value-creators as they work for creating more value of the organisation in future than its

historical values.

essential requirements of different types of management accounting system:

Knowledge and skills related to management accounting of Rant-A-Car can be experienced from

different fields and functions of the organisation like pricing, valuation, efficiency auditing,

marketing etc.

some essential requirements of management accounting system are as follows:

11 Cost accounting system: cost accounting system of the industry is the very important

gathered by managerial accountant of Rent-A-Car. It shows the cost company incurred by

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the organisation with a view to get cost associated with the product or service provided

by the industry to its customer(Quattrone, 2016.)..

11 Accounting related to cost of the company can be gathered through its cost

recordings, cost analysing, cost reports, vouchers, etc. a management accountant

needs to gather a detailed information relating to cost through various factors so that

he can get the actual cost of the product or service and can make plans to reduce its

cost and get maximum returns.

Benefits

This system is helpful for the company to be cost effective.

Management can make effective decisions in order to make the company cost effective

and enhace its profitability.

It also enables company to utilize its resources more efficiently and effectively.

11 Inventory management system: inventory management system enables the company to

use its inventories efficiently in order to reduce inventory cost to the company. This

system shows how Rent-A-Car can properly reduce its use of its inventory along with

maintaining same stock level to fulfil customer's needs and demands. It helps the

company to control misappropriation of stock. For appropriate using the inventory

company can use different methods like LIFO, FIFO. Weighted average inventory

system, etc.

Benefits

it helps the company to have control overuse of inventory in the organisation.

It enables Rent-A-Car to track its inventory level in the organisation.

It also helps the company to increase profitability of Rent-A-Car.

11 Job costing system: this system is being used by the company where the job is being

performed by the company in different process. It enables Rent-A-Car to find out cost of

specific job to the company. It shows the cost of direct material, direct labour, overheads

etc. direct material and direct labour are those who are used at the time of producing the

product. Whereas overheads are operating cost to the company.

2

by the industry to its customer(Quattrone, 2016.)..

11 Accounting related to cost of the company can be gathered through its cost

recordings, cost analysing, cost reports, vouchers, etc. a management accountant

needs to gather a detailed information relating to cost through various factors so that

he can get the actual cost of the product or service and can make plans to reduce its

cost and get maximum returns.

Benefits

This system is helpful for the company to be cost effective.

Management can make effective decisions in order to make the company cost effective

and enhace its profitability.

It also enables company to utilize its resources more efficiently and effectively.

11 Inventory management system: inventory management system enables the company to

use its inventories efficiently in order to reduce inventory cost to the company. This

system shows how Rent-A-Car can properly reduce its use of its inventory along with

maintaining same stock level to fulfil customer's needs and demands. It helps the

company to control misappropriation of stock. For appropriate using the inventory

company can use different methods like LIFO, FIFO. Weighted average inventory

system, etc.

Benefits

it helps the company to have control overuse of inventory in the organisation.

It enables Rent-A-Car to track its inventory level in the organisation.

It also helps the company to increase profitability of Rent-A-Car.

11 Job costing system: this system is being used by the company where the job is being

performed by the company in different process. It enables Rent-A-Car to find out cost of

specific job to the company. It shows the cost of direct material, direct labour, overheads

etc. direct material and direct labour are those who are used at the time of producing the

product. Whereas overheads are operating cost to the company.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefits

through this system Rent-A-Car can know the cost of each job performed by the company

it helps the management get to know the wastage of cost at each level of business through

which company can become more cost effective.

It helps the company to reduce the cost in order to increase its profit.

P2 Explain different methods used for management accounting reporting.

Management accounting concerns with receiving financial accounting data through its past

records and making decisions for its better growth. On the other hand management accounting

reporting refers to preparation of reports for the decision making process. For the purpose of

performing management accounting tasks, there are some methods that can be follows:

1. Cost reports : cost reports are prepared for evaluating product cost of the organisation.

This report contains cost incurred by the company in the past, reviews on the past cost

accounting system and ideas to improve it as well. Product cost means cost of product

manufactured. Which includes raw material cost, overheads, labour, etc. cost reports

shows the actual cost which is used to compare it with selling price and get the profit

margin of the industry(Malmi, 2016).

Managerial accountant of Rent-A-Car prepares cost reports to get the knowledge

about hourly labour cost of labour, overheads, car maintenance cost, work cost etc. this report

shows the actual costs incurred by the company in last few years in detail which helps the

managerial accountant to analyse the cost and find some way to minimise the cost and control

the wastage of cost.

2. Job costing report : in job costing report, Rent-A-Car prepares a cost report of each

process performed in the business. Job costing report includes cost to each department of

the company along with estimated revenue from that department in order to detrmone

profitability of the company. With the help of budgetory report manager sees the

estimated cost of each department. After comparing it with the job costing report,

manager get to know the point of inefficiency of the business through which the company

becomes more cost effective.

3

through this system Rent-A-Car can know the cost of each job performed by the company

it helps the management get to know the wastage of cost at each level of business through

which company can become more cost effective.

It helps the company to reduce the cost in order to increase its profit.

P2 Explain different methods used for management accounting reporting.

Management accounting concerns with receiving financial accounting data through its past

records and making decisions for its better growth. On the other hand management accounting

reporting refers to preparation of reports for the decision making process. For the purpose of

performing management accounting tasks, there are some methods that can be follows:

1. Cost reports : cost reports are prepared for evaluating product cost of the organisation.

This report contains cost incurred by the company in the past, reviews on the past cost

accounting system and ideas to improve it as well. Product cost means cost of product

manufactured. Which includes raw material cost, overheads, labour, etc. cost reports

shows the actual cost which is used to compare it with selling price and get the profit

margin of the industry(Malmi, 2016).

Managerial accountant of Rent-A-Car prepares cost reports to get the knowledge

about hourly labour cost of labour, overheads, car maintenance cost, work cost etc. this report

shows the actual costs incurred by the company in last few years in detail which helps the

managerial accountant to analyse the cost and find some way to minimise the cost and control

the wastage of cost.

2. Job costing report : in job costing report, Rent-A-Car prepares a cost report of each

process performed in the business. Job costing report includes cost to each department of

the company along with estimated revenue from that department in order to detrmone

profitability of the company. With the help of budgetory report manager sees the

estimated cost of each department. After comparing it with the job costing report,

manager get to know the point of inefficiency of the business through which the company

becomes more cost effective.

3

3. Budget report : budget reports plays a very important role in measuring company's

actual performance. Small companies prepares their cost budget as a whole whereas

budget of large industries could be prepared department wise. However, these companies

need to compile all the budgets of its different department and prepare a single report to

get overall performance of the company.

Rent-A-Car prepares its budget frequently. Budget reports give an idea about company's future

expenses. These are prepared on the basis of past experinces of the company. In order to

minimize the cost, it is essential for the company to prepare its budget. Company will go towards

efficiently achieving the goals if it is working accordance with the set budgets.

4. Account receivable ageing reports : this report is essential for those companies which

are who relieses account receivable heavily. Through these reports manager of the

industry can get information about average time in which credit could be reliesed from

the clients, average amount of defaults over the period, and identifying the defaulters of

the company as well. To control the defaults in account receivable, company can make

the some rigid policies for account receivable process(Tappura and et.al.,2015).

Through these reports industry can estimate the amount of bad debts which can be incurred

during the whole year. It can help to maintain a balanced amount of provision for bad debts and

also to find some ways to minimize them.

5. Performance reports : These reports shows the performance of the employees of the

company as a whole at the end of terms. These reports are used by the managerial

persons to view the performance of the employees. Generally these reports are of use for

human resource manager of the company. These reports are used by the managers key

factor to be considered while decision making regarding human resources i.e. employees

of the company.

Theses reports are helpful for taking decisions related to performance appraisal, salary

increments, etc. these report contains a deep detailed description about the performance of the

employees(Bui and De Villiers, 2017). 6Financial reports: as the name says it all, financial

reports are reports which includes financial statements of the company of last few years.

4

actual performance. Small companies prepares their cost budget as a whole whereas

budget of large industries could be prepared department wise. However, these companies

need to compile all the budgets of its different department and prepare a single report to

get overall performance of the company.

Rent-A-Car prepares its budget frequently. Budget reports give an idea about company's future

expenses. These are prepared on the basis of past experinces of the company. In order to

minimize the cost, it is essential for the company to prepare its budget. Company will go towards

efficiently achieving the goals if it is working accordance with the set budgets.

4. Account receivable ageing reports : this report is essential for those companies which

are who relieses account receivable heavily. Through these reports manager of the

industry can get information about average time in which credit could be reliesed from

the clients, average amount of defaults over the period, and identifying the defaulters of

the company as well. To control the defaults in account receivable, company can make

the some rigid policies for account receivable process(Tappura and et.al.,2015).

Through these reports industry can estimate the amount of bad debts which can be incurred

during the whole year. It can help to maintain a balanced amount of provision for bad debts and

also to find some ways to minimize them.

5. Performance reports : These reports shows the performance of the employees of the

company as a whole at the end of terms. These reports are used by the managerial

persons to view the performance of the employees. Generally these reports are of use for

human resource manager of the company. These reports are used by the managers key

factor to be considered while decision making regarding human resources i.e. employees

of the company.

Theses reports are helpful for taking decisions related to performance appraisal, salary

increments, etc. these report contains a deep detailed description about the performance of the

employees(Bui and De Villiers, 2017). 6Financial reports: as the name says it all, financial

reports are reports which includes financial statements of the company of last few years.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6. 6. Financial reports financial report concerns with putting together data related to

financial accounting of different years and comparing them with each other in order to

measure the actual performance of the industry over the period of time.

RENT-A-CAR prepares financial reports of the company every year in order to get actual

performance and actual variation in position of the industy every. On this way management can

be able make best decision for the company.

7. Other reports : along with the above stated reports, Rent-A-Car industry prepares some

other reports like competitor's analysis, order information reports, consumer behaviour

reports, etc. these all reports are helpful for the organisation in their decision making. All

the reports of the company related to the management accounting, are prepared for

helping the managers of organisation in different ways. Every report needs to be analysed

in detailed carefully for the purpose of decision making. And making the decisions more

efficiently for the company's growth in the market(Bromwich and Scapens, 2016).

All the managerial reports are prepared by Rent-A-Car industry for the sake of enhancing the

performance of the company in future compared to its historical performance.

P3 Calculate costs using appropriate techniques of costs analysis to prepare an income statement

using marginal and absorption costs

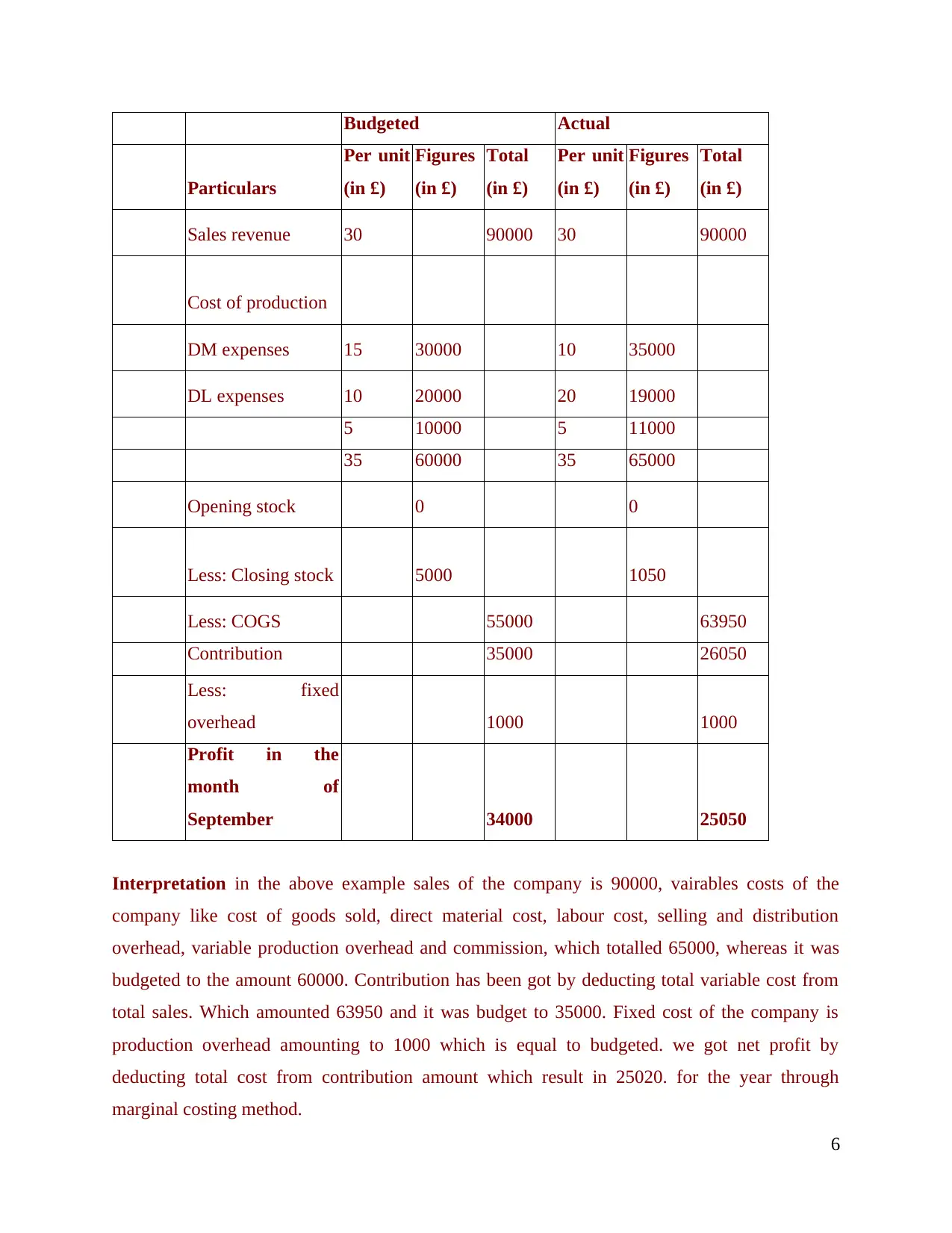

Marginal costing: marginal costing is a process of costing which shows the variation in total

cost of the company over the year. Total cost of the industry may vary due to variation in the cost

of inputs, increase or decrease in quantity of the product, etc.

Marginal costing have various advantages like as it is the most simple method of costing top be

understand, there is no problem in calculating fixed overheads, it provides facilities to have

control over variable cost by as it is charged against the contribution(Hall, 2016).

However, there are also some disadvantages of this method of costing for example, there

is of no use where there is no separation of expenses into fixed and variable, due to technological

development, there is an increase in fixed costs of the company and if we calculate net profit

from this method, we can even get negative results.

Marginal costing formula - sales- variable cost = fixed cost + profit

Marginal statement

5

financial accounting of different years and comparing them with each other in order to

measure the actual performance of the industry over the period of time.

RENT-A-CAR prepares financial reports of the company every year in order to get actual

performance and actual variation in position of the industy every. On this way management can

be able make best decision for the company.

7. Other reports : along with the above stated reports, Rent-A-Car industry prepares some

other reports like competitor's analysis, order information reports, consumer behaviour

reports, etc. these all reports are helpful for the organisation in their decision making. All

the reports of the company related to the management accounting, are prepared for

helping the managers of organisation in different ways. Every report needs to be analysed

in detailed carefully for the purpose of decision making. And making the decisions more

efficiently for the company's growth in the market(Bromwich and Scapens, 2016).

All the managerial reports are prepared by Rent-A-Car industry for the sake of enhancing the

performance of the company in future compared to its historical performance.

P3 Calculate costs using appropriate techniques of costs analysis to prepare an income statement

using marginal and absorption costs

Marginal costing: marginal costing is a process of costing which shows the variation in total

cost of the company over the year. Total cost of the industry may vary due to variation in the cost

of inputs, increase or decrease in quantity of the product, etc.

Marginal costing have various advantages like as it is the most simple method of costing top be

understand, there is no problem in calculating fixed overheads, it provides facilities to have

control over variable cost by as it is charged against the contribution(Hall, 2016).

However, there are also some disadvantages of this method of costing for example, there

is of no use where there is no separation of expenses into fixed and variable, due to technological

development, there is an increase in fixed costs of the company and if we calculate net profit

from this method, we can even get negative results.

Marginal costing formula - sales- variable cost = fixed cost + profit

Marginal statement

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Budgeted Actual

Particulars

Per unit

(in £)

Figures

(in £)

Total

(in £)

Per unit

(in £)

Figures

(in £)

Total

(in £)

Sales revenue 30 90000 30 90000

Cost of production

DM expenses 15 30000 10 35000

DL expenses 10 20000 20 19000

5 10000 5 11000

35 60000 35 65000

Opening stock 0 0

Less: Closing stock 5000 1050

Less: COGS 55000 63950

Contribution 35000 26050

Less: fixed

overhead 1000 1000

Profit in the

month of

September 34000 25050

Interpretation in the above example sales of the company is 90000, vairables costs of the

company like cost of goods sold, direct material cost, labour cost, selling and distribution

overhead, variable production overhead and commission, which totalled 65000, whereas it was

budgeted to the amount 60000. Contribution has been got by deducting total variable cost from

total sales. Which amounted 63950 and it was budget to 35000. Fixed cost of the company is

production overhead amounting to 1000 which is equal to budgeted. we got net profit by

deducting total cost from contribution amount which result in 25020. for the year through

marginal costing method.

6

Particulars

Per unit

(in £)

Figures

(in £)

Total

(in £)

Per unit

(in £)

Figures

(in £)

Total

(in £)

Sales revenue 30 90000 30 90000

Cost of production

DM expenses 15 30000 10 35000

DL expenses 10 20000 20 19000

5 10000 5 11000

35 60000 35 65000

Opening stock 0 0

Less: Closing stock 5000 1050

Less: COGS 55000 63950

Contribution 35000 26050

Less: fixed

overhead 1000 1000

Profit in the

month of

September 34000 25050

Interpretation in the above example sales of the company is 90000, vairables costs of the

company like cost of goods sold, direct material cost, labour cost, selling and distribution

overhead, variable production overhead and commission, which totalled 65000, whereas it was

budgeted to the amount 60000. Contribution has been got by deducting total variable cost from

total sales. Which amounted 63950 and it was budget to 35000. Fixed cost of the company is

production overhead amounting to 1000 which is equal to budgeted. we got net profit by

deducting total cost from contribution amount which result in 25020. for the year through

marginal costing method.

6

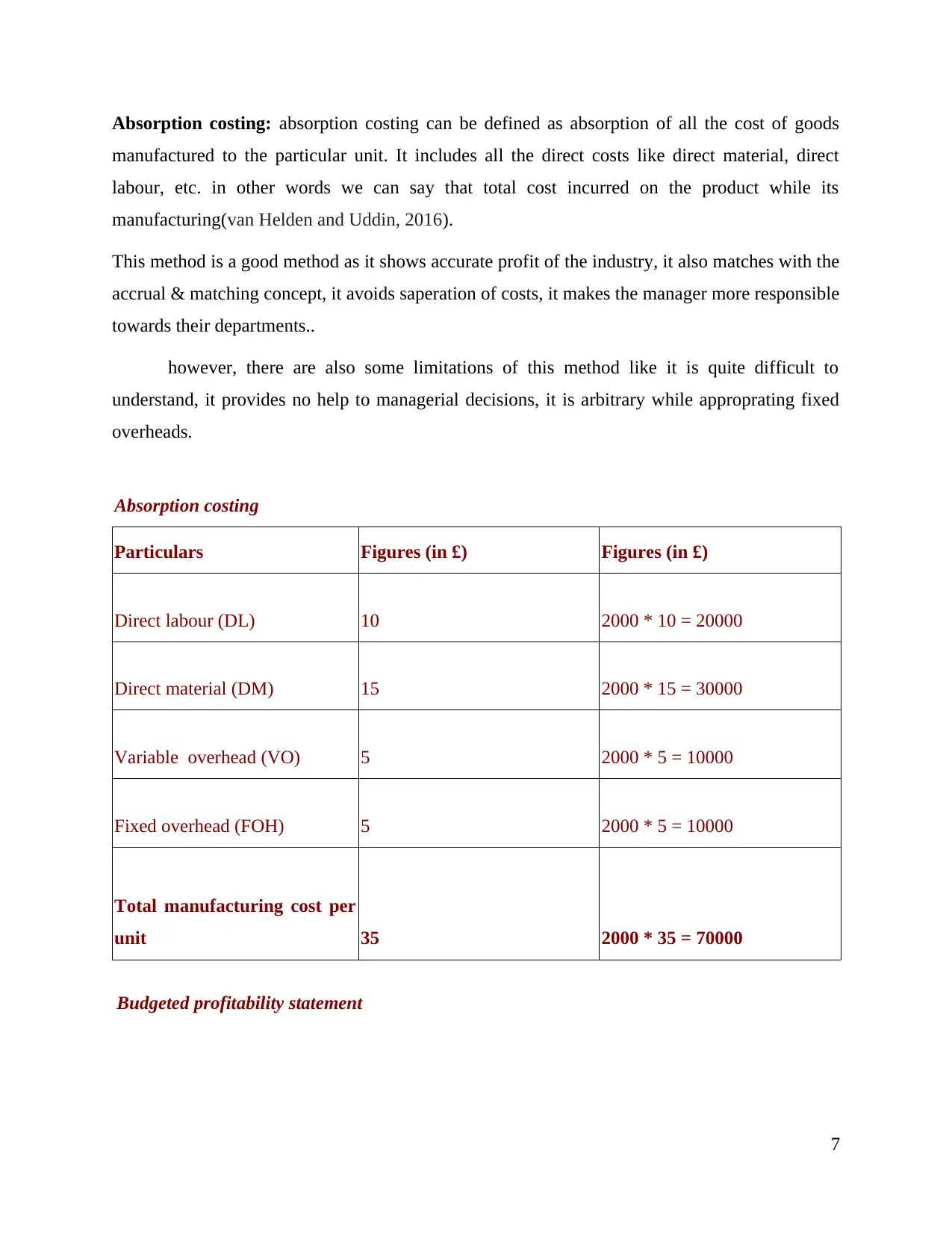

Absorption costing: absorption costing can be defined as absorption of all the cost of goods

manufactured to the particular unit. It includes all the direct costs like direct material, direct

labour, etc. in other words we can say that total cost incurred on the product while its

manufacturing(van Helden and Uddin, 2016).

This method is a good method as it shows accurate profit of the industry, it also matches with the

accrual & matching concept, it avoids saperation of costs, it makes the manager more responsible

towards their departments..

however, there are also some limitations of this method like it is quite difficult to

understand, it provides no help to managerial decisions, it is arbitrary while approprating fixed

overheads.

Absorption costing

Particulars Figures (in £) Figures (in £)

Direct labour (DL) 10 2000 * 10 = 20000

Direct material (DM) 15 2000 * 15 = 30000

Variable overhead (VO) 5 2000 * 5 = 10000

Fixed overhead (FOH) 5 2000 * 5 = 10000

Total manufacturing cost per

unit 35 2000 * 35 = 70000

Budgeted profitability statement

7

manufactured to the particular unit. It includes all the direct costs like direct material, direct

labour, etc. in other words we can say that total cost incurred on the product while its

manufacturing(van Helden and Uddin, 2016).

This method is a good method as it shows accurate profit of the industry, it also matches with the

accrual & matching concept, it avoids saperation of costs, it makes the manager more responsible

towards their departments..

however, there are also some limitations of this method like it is quite difficult to

understand, it provides no help to managerial decisions, it is arbitrary while approprating fixed

overheads.

Absorption costing

Particulars Figures (in £) Figures (in £)

Direct labour (DL) 10 2000 * 10 = 20000

Direct material (DM) 15 2000 * 15 = 30000

Variable overhead (VO) 5 2000 * 5 = 10000

Fixed overhead (FOH) 5 2000 * 5 = 10000

Total manufacturing cost per

unit 35 2000 * 35 = 70000

Budgeted profitability statement

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

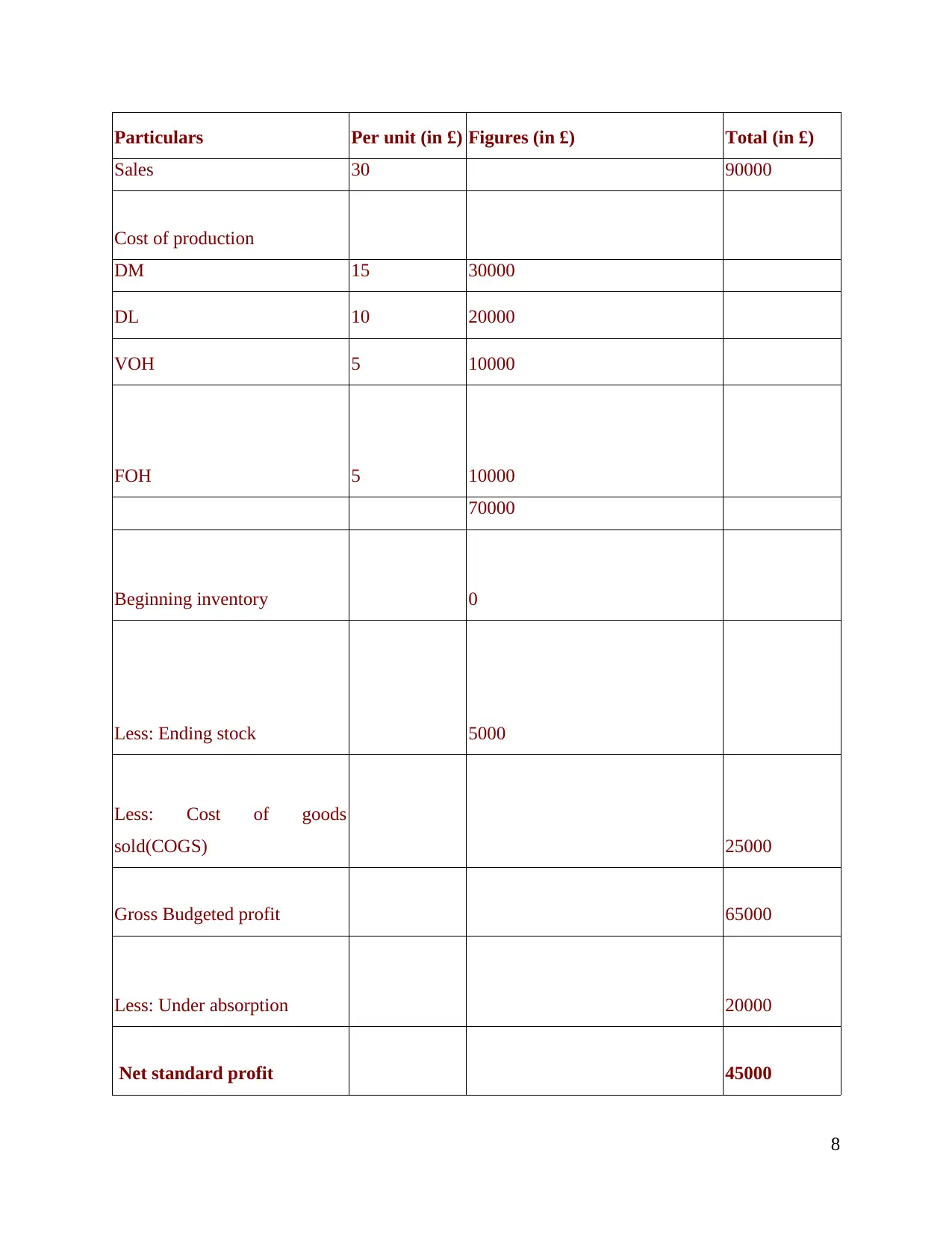

Particulars Per unit (in £) Figures (in £) Total (in £)

Sales 30 90000

Cost of production

DM 15 30000

DL 10 20000

VOH 5 10000

FOH 5 10000

70000

Beginning inventory 0

Less: Ending stock 5000

Less: Cost of goods

sold(COGS) 25000

Gross Budgeted profit 65000

Less: Under absorption 20000

Net standard profit 45000

8

Sales 30 90000

Cost of production

DM 15 30000

DL 10 20000

VOH 5 10000

FOH 5 10000

70000

Beginning inventory 0

Less: Ending stock 5000

Less: Cost of goods

sold(COGS) 25000

Gross Budgeted profit 65000

Less: Under absorption 20000

Net standard profit 45000

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

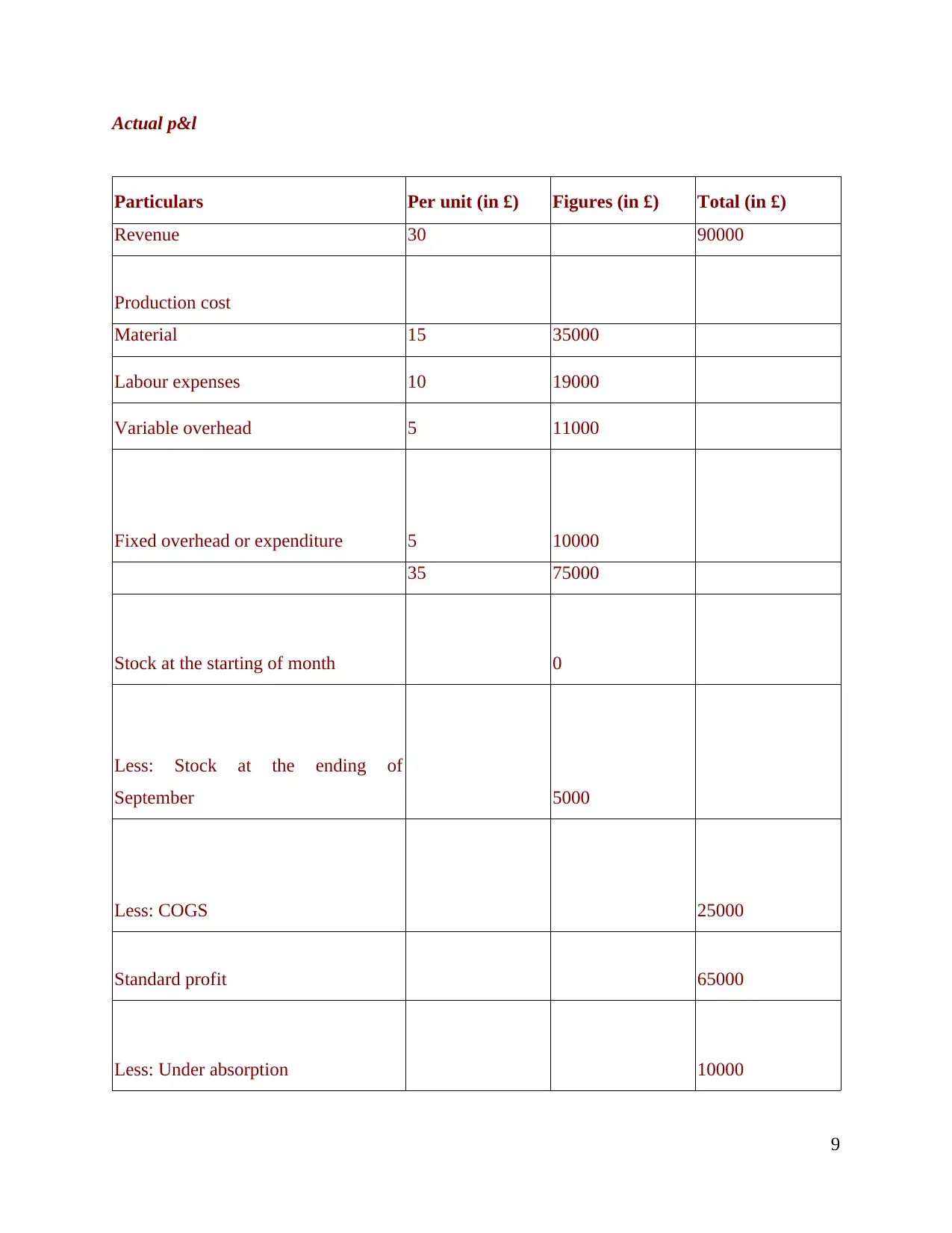

Actual p&l

Particulars Per unit (in £) Figures (in £) Total (in £)

Revenue 30 90000

Production cost

Material 15 35000

Labour expenses 10 19000

Variable overhead 5 11000

Fixed overhead or expenditure 5 10000

35 75000

Stock at the starting of month 0

Less: Stock at the ending of

September 5000

Less: COGS 25000

Standard profit 65000

Less: Under absorption 10000

9

Particulars Per unit (in £) Figures (in £) Total (in £)

Revenue 30 90000

Production cost

Material 15 35000

Labour expenses 10 19000

Variable overhead 5 11000

Fixed overhead or expenditure 5 10000

35 75000

Stock at the starting of month 0

Less: Stock at the ending of

September 5000

Less: COGS 25000

Standard profit 65000

Less: Under absorption 10000

9

Budgeted profit 55000

Interpretation: in the above example, we are calculating net profit through absorption costing

method. We have sale of 90000, cost of manufacture is 70000. which has be calculated by

adding material cost 30000, labour cost 20000, total variable overhead 10000 and fixed overhead

equal to 10000. Gross profit of the company has been absorbed by deducting cost of sales from

sales. Company has incurred , total variable and fixed cost 20000. With these data, we got net

profit 37500 by deducting total cost from the gross profit. Whereas the budgeted profit of the

company was 55000 hence, company has gained an under absorbed profit by 17500.

Comparison:

AS it can be seen that we have calculated net profit through marginal costing method and

absorption costing method from same set of data. But we got different results from both the

methods. The difference arrived because we don't include commission and amortisation cost in

absorption costing method. Rent-A-Car got more profit from absorption costing method in

comparison to marginal costing method(Van der Stede, 2016).

Hence, we can say that absorption costing is the best method to be used for calculation of

net profit. As it results in more net profit generation from absorption costing method.

P4. Types of planning tools used in budgetary control:

Budgetary control is a management activity in which actual income and expense in

compared with standard or planned income and expenses. To make this compare Rent A Car first

set the standard result by taking help of financial planning tools and techniques than it calculate

the degree and amount of variation so that budgetary control tools can be used to minimise the

variation. Planning is long termed concept than budgetary. Budgetary planning is the process of

set standard and benchmark for every activity practice in organisation . Rent A Car use these

benchmarks to compare actual performance with expected outcome. If manager find high

variation in wanted and actual result, then corrective action are taken by company. If manager

find low gap in result, then appreciation , rewards are given to employee for their efficient work

and cost cutting efforts(Bui. and De Villiers, 2017)

10

Interpretation: in the above example, we are calculating net profit through absorption costing

method. We have sale of 90000, cost of manufacture is 70000. which has be calculated by

adding material cost 30000, labour cost 20000, total variable overhead 10000 and fixed overhead

equal to 10000. Gross profit of the company has been absorbed by deducting cost of sales from

sales. Company has incurred , total variable and fixed cost 20000. With these data, we got net

profit 37500 by deducting total cost from the gross profit. Whereas the budgeted profit of the

company was 55000 hence, company has gained an under absorbed profit by 17500.

Comparison:

AS it can be seen that we have calculated net profit through marginal costing method and

absorption costing method from same set of data. But we got different results from both the

methods. The difference arrived because we don't include commission and amortisation cost in

absorption costing method. Rent-A-Car got more profit from absorption costing method in

comparison to marginal costing method(Van der Stede, 2016).

Hence, we can say that absorption costing is the best method to be used for calculation of

net profit. As it results in more net profit generation from absorption costing method.

P4. Types of planning tools used in budgetary control:

Budgetary control is a management activity in which actual income and expense in

compared with standard or planned income and expenses. To make this compare Rent A Car first

set the standard result by taking help of financial planning tools and techniques than it calculate

the degree and amount of variation so that budgetary control tools can be used to minimise the

variation. Planning is long termed concept than budgetary. Budgetary planning is the process of

set standard and benchmark for every activity practice in organisation . Rent A Car use these

benchmarks to compare actual performance with expected outcome. If manager find high

variation in wanted and actual result, then corrective action are taken by company. If manager

find low gap in result, then appreciation , rewards are given to employee for their efficient work

and cost cutting efforts(Bui. and De Villiers, 2017)

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.