Unit 5 Management Accounting Report: Costing Techniques and Reporting

VerifiedAdded on 2020/06/03

|17

|4362

|44

Report

AI Summary

This report, prepared for a General Manager (GM), delves into the principles of management accounting, emphasizing its importance for internal decision-making within an organization. It explores various management accounting systems and highlights the differences between financial and managerial accounting. The report examines different reporting methods, including job cost reports, inventory management reports, operating budget reports, and product/service profitability reports. It provides detailed calculations and comparisons of marginal and absorption costing techniques, including income statements for each method. Furthermore, it analyzes the advantages and disadvantages of planning tools used for budgetary control and discusses how organizations adapt management accounting systems to address financial challenges. The report concludes by summarizing key findings and providing a comprehensive overview of the topics discussed.

Unit 5

Management Accounting

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction...........................................................................................................................................3

P1: Explaining Management Accounting and Providing Essential Requirements of Different types

of Management Accounting System..................................................................................................4

P2: Explaining Different Methods Used for Management Accounting Reporting..............................5

Task 2.....................................................................................................................................................9

P3: Calculation of Costs Using Appropriate Techniques of Cost Analysis for Preparing an Income

Statement Using Marginal and Absorption Costs..............................................................................9

Task 3...................................................................................................................................................11

P4: Explaining the Advantages and Disadvantages of Different Types of Planning Tools Used for

Budgetary Control............................................................................................................................11

Task 4...................................................................................................................................................13

P5: Comparing How Organisations are Adapting Management Accounting Systems to Respond to

Financial Problems...........................................................................................................................13

Conclusion...........................................................................................................................................15

References...........................................................................................................................................16

REPORT

Introduction...........................................................................................................................................3

P1: Explaining Management Accounting and Providing Essential Requirements of Different types

of Management Accounting System..................................................................................................4

P2: Explaining Different Methods Used for Management Accounting Reporting..............................5

Task 2.....................................................................................................................................................9

P3: Calculation of Costs Using Appropriate Techniques of Cost Analysis for Preparing an Income

Statement Using Marginal and Absorption Costs..............................................................................9

Task 3...................................................................................................................................................11

P4: Explaining the Advantages and Disadvantages of Different Types of Planning Tools Used for

Budgetary Control............................................................................................................................11

Task 4...................................................................................................................................................13

P5: Comparing How Organisations are Adapting Management Accounting Systems to Respond to

Financial Problems...........................................................................................................................13

Conclusion...........................................................................................................................................15

References...........................................................................................................................................16

REPORT

From: MAO

To: GM

Subject: To write a report to GM covering management accounting and

management accounting system together with different costing techniques

and reporting to enable the organization implement them.

Introduction

In general that report is widely used across the world market which is known as financial

accounting. In any annual report of a certain company we can get financial statements of that

company, financial statements includes different five methods of performance those are

income statement, balance sheet, cash flow statement, changes in stockholder’s equity and

equity statement. Financial accounting is prepared for publishing in the public market, apart

from market publication there is an internal side. Managerial Accounting plays an important

role for internal stakeholders. Managerial accounting is the base ground of all financial

statements which determines the production volume and revenue of the entire company.

There are some advantages and disadvantages of different methods of management

accounting systems. Management can follow any of several tools for calculation of net profit

in the aspect of management accounting.

To: GM

Subject: To write a report to GM covering management accounting and

management accounting system together with different costing techniques

and reporting to enable the organization implement them.

Introduction

In general that report is widely used across the world market which is known as financial

accounting. In any annual report of a certain company we can get financial statements of that

company, financial statements includes different five methods of performance those are

income statement, balance sheet, cash flow statement, changes in stockholder’s equity and

equity statement. Financial accounting is prepared for publishing in the public market, apart

from market publication there is an internal side. Managerial Accounting plays an important

role for internal stakeholders. Managerial accounting is the base ground of all financial

statements which determines the production volume and revenue of the entire company.

There are some advantages and disadvantages of different methods of management

accounting systems. Management can follow any of several tools for calculation of net profit

in the aspect of management accounting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P1

Management Accounting:The aim of management accounting is to provide necessary

information and to help managers for taking day to day decisions. Basically management

accounting is prepared solely for internal purposes. The crucial difference between financial

accounting and management accounting is financial accounting is prepared for outside of the

organisation such as for shareholders, public and tax authority on the other hand managerial

accounting is prepared for internal organisation such as managers and employees. Financial

accounting follows formal procedures where managerial accounting doesn’t need to go

through the all steps of financial accounting; it only fulfils the some essential criteria.

Management accounting is too mandatory for operation managers; they are helpless without

management accounting. Operational managers take day to day decision from management

accounting. For example management accounting provides the information of how many

units need to be produced, what is the current margin, margin ratio, we can find out break-

even point by using the tools of managerial accounting (Britton and Waterston, 2013). After

producing in which level our production cost will compensate the total revenue and in which

stage variable cost is lowest. It is the process of identifying, measuring, analysing and

communicating all the essential information of organisation transaction. In this definition

identifying is generally known as journal, measuring is known to all as ledger, analysing

means to preparing trial balances and communicating indicates showing the outcomes in the

income statement and balance sheet. Management accounting accumulates the revenue, cash

flow, production unit, variable cost per unit and fixed cost of total production process.

Management accounting is too concerned about raw materials, sales revenue, production cost,

labour cost, manufacturing cost and other overhead cost (Christensen, Cottrell and Budd,

2016).

Management Accounting System: The goal of management accounting system is to provide

the best tools for the managers and to attain best performance for organisation. The system of

management accounting gives the path for solving day to day manufacturing related problems

and run the business activities easily. There is break down of management accounting such as

margin analysis, constraint analysis, capital budgeting, trend analysis and forecasting, product

valuation and costing and so on. Managers have some necessary responsibilities, among them

most important responsibilities are planning, directing and controlling. These are the role of

management accounting, planning, organising, controlling and decision taking. Managerial

accounting is viewed as internal accounting most of the times. Management accounting

system gathers different financial data from the operations like sales information; raw

materials data and inventory related data then analyse these sorts of data for preparing output

which help to make decision for better performances (Acikerisim.deu.edu.tr, 2017).

Managers who are responsible for managing the function of management accounting look

after the existing data of organisation and then start to analyse the previous shortcomings.

They give priorities on comparison between cost budget and actual budget. They prepare

different types of report and include several methodologies in those reports. Sales report,

Management Accounting:The aim of management accounting is to provide necessary

information and to help managers for taking day to day decisions. Basically management

accounting is prepared solely for internal purposes. The crucial difference between financial

accounting and management accounting is financial accounting is prepared for outside of the

organisation such as for shareholders, public and tax authority on the other hand managerial

accounting is prepared for internal organisation such as managers and employees. Financial

accounting follows formal procedures where managerial accounting doesn’t need to go

through the all steps of financial accounting; it only fulfils the some essential criteria.

Management accounting is too mandatory for operation managers; they are helpless without

management accounting. Operational managers take day to day decision from management

accounting. For example management accounting provides the information of how many

units need to be produced, what is the current margin, margin ratio, we can find out break-

even point by using the tools of managerial accounting (Britton and Waterston, 2013). After

producing in which level our production cost will compensate the total revenue and in which

stage variable cost is lowest. It is the process of identifying, measuring, analysing and

communicating all the essential information of organisation transaction. In this definition

identifying is generally known as journal, measuring is known to all as ledger, analysing

means to preparing trial balances and communicating indicates showing the outcomes in the

income statement and balance sheet. Management accounting accumulates the revenue, cash

flow, production unit, variable cost per unit and fixed cost of total production process.

Management accounting is too concerned about raw materials, sales revenue, production cost,

labour cost, manufacturing cost and other overhead cost (Christensen, Cottrell and Budd,

2016).

Management Accounting System: The goal of management accounting system is to provide

the best tools for the managers and to attain best performance for organisation. The system of

management accounting gives the path for solving day to day manufacturing related problems

and run the business activities easily. There is break down of management accounting such as

margin analysis, constraint analysis, capital budgeting, trend analysis and forecasting, product

valuation and costing and so on. Managers have some necessary responsibilities, among them

most important responsibilities are planning, directing and controlling. These are the role of

management accounting, planning, organising, controlling and decision taking. Managerial

accounting is viewed as internal accounting most of the times. Management accounting

system gathers different financial data from the operations like sales information; raw

materials data and inventory related data then analyse these sorts of data for preparing output

which help to make decision for better performances (Acikerisim.deu.edu.tr, 2017).

Managers who are responsible for managing the function of management accounting look

after the existing data of organisation and then start to analyse the previous shortcomings.

They give priorities on comparison between cost budget and actual budget. They prepare

different types of report and include several methodologies in those reports. Sales report,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

expense report and budget report are among them. They understand the real scenario when

they compare budgeted expenses and actual expenses (Crosson and Needles, 2014).

In this particular organisation management accounting will have its own benefits. As this

organisation is into production and produces different products so management accounting

will be beneficial in analysing the cost of production and also the margin that each product

yields. Further zero based budgeting techniques that are based on management accounting

principles would be beneficial for preparing the budgets. There are several products that are

being manufactured and therefore it is important to understand the contribution of each

product. Further, management accounting also ensures that the overhead costs are calculated

separately and as such the management can focus on lowering the overheads. Management

accounting will also be beneficial for analysing each product and products which are not

performing well can be modified or can be stopped. The profitability of the organisation will

enhance when management accounting principles are implemented within this organisation

P2

Management accounting uses various forms of reporting and in this section four such reports

will be discussed. The following are four types of reporting that are used for management

accounting reporting

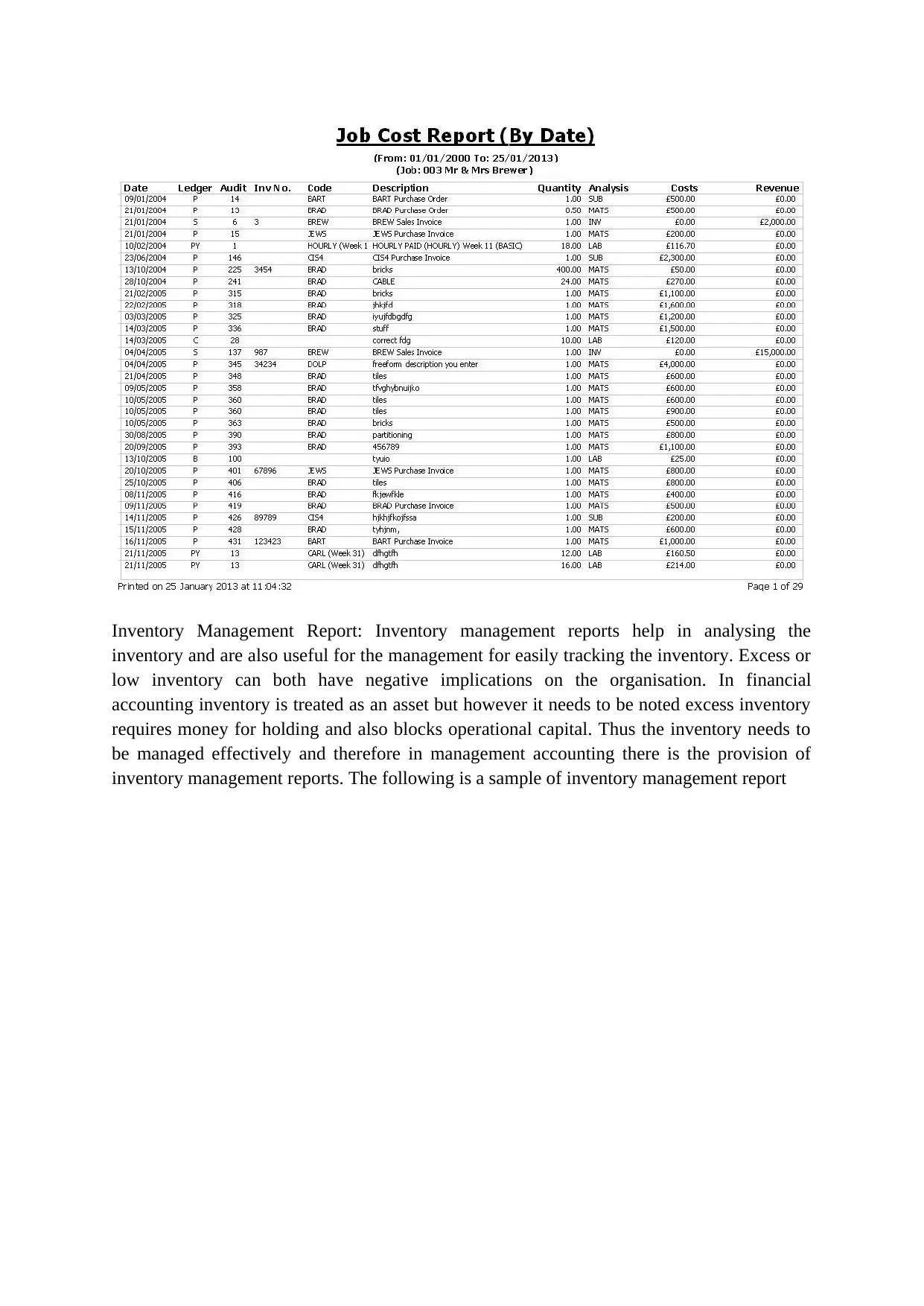

Job Cost Reports: Job cost report is used for job costing. In this report a job is defined and the

cost for that specific job is calculated. A job can be a specific project that is done for a

specific customer or it can be a single unit of product. The job costing method ensures

calculation of profitability based on single unit of production. In the manufacturing setting

the job cost report consists of direct expenses such as materials and labour and also indirect

expenses or the overheads for the job. The job cost report is almost like the profitability

report for the organisation but is specific to the job. The following is an example of a job cost

report

they compare budgeted expenses and actual expenses (Crosson and Needles, 2014).

In this particular organisation management accounting will have its own benefits. As this

organisation is into production and produces different products so management accounting

will be beneficial in analysing the cost of production and also the margin that each product

yields. Further zero based budgeting techniques that are based on management accounting

principles would be beneficial for preparing the budgets. There are several products that are

being manufactured and therefore it is important to understand the contribution of each

product. Further, management accounting also ensures that the overhead costs are calculated

separately and as such the management can focus on lowering the overheads. Management

accounting will also be beneficial for analysing each product and products which are not

performing well can be modified or can be stopped. The profitability of the organisation will

enhance when management accounting principles are implemented within this organisation

P2

Management accounting uses various forms of reporting and in this section four such reports

will be discussed. The following are four types of reporting that are used for management

accounting reporting

Job Cost Reports: Job cost report is used for job costing. In this report a job is defined and the

cost for that specific job is calculated. A job can be a specific project that is done for a

specific customer or it can be a single unit of product. The job costing method ensures

calculation of profitability based on single unit of production. In the manufacturing setting

the job cost report consists of direct expenses such as materials and labour and also indirect

expenses or the overheads for the job. The job cost report is almost like the profitability

report for the organisation but is specific to the job. The following is an example of a job cost

report

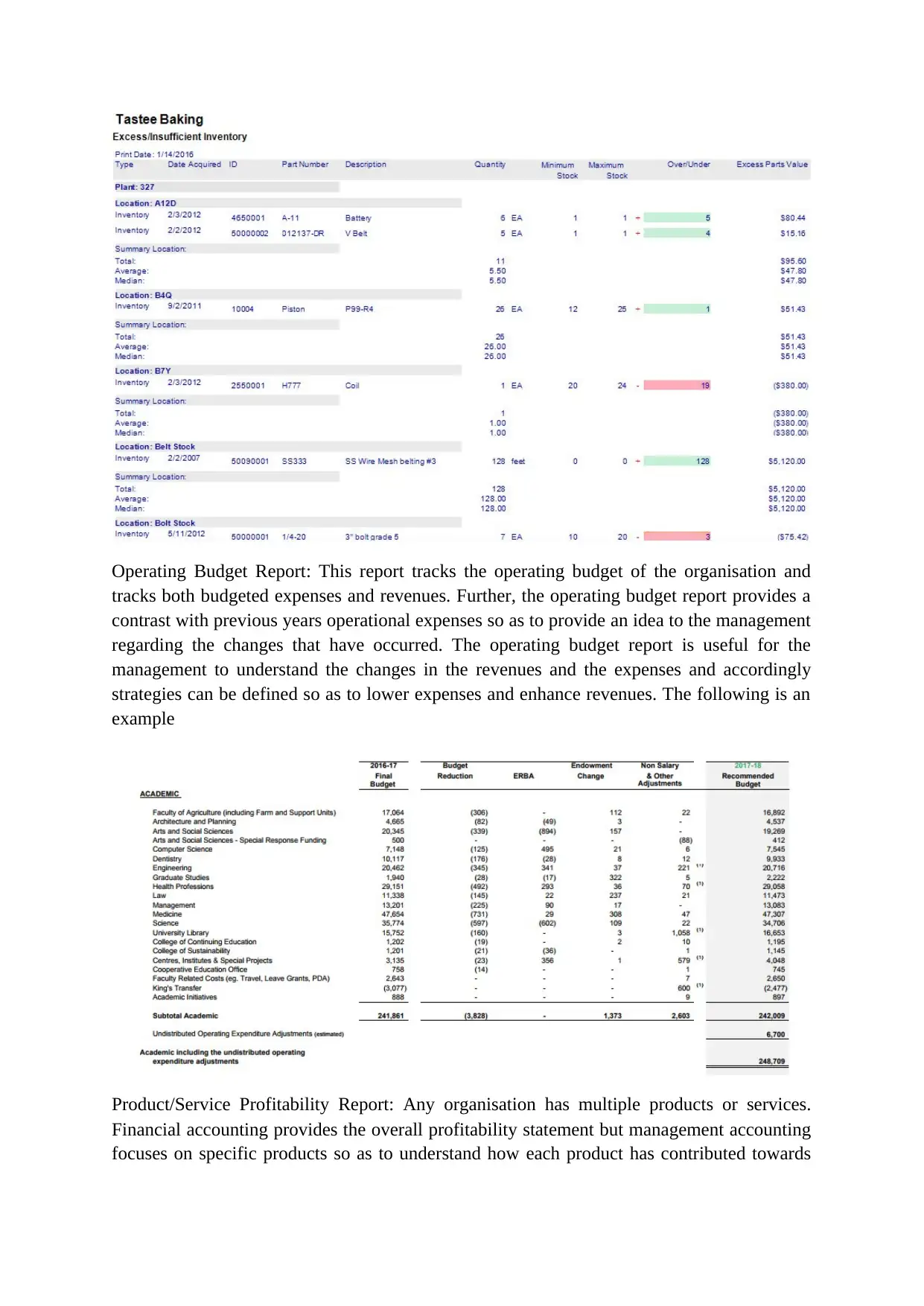

Inventory Management Report: Inventory management reports help in analysing the

inventory and are also useful for the management for easily tracking the inventory. Excess or

low inventory can both have negative implications on the organisation. In financial

accounting inventory is treated as an asset but however it needs to be noted excess inventory

requires money for holding and also blocks operational capital. Thus the inventory needs to

be managed effectively and therefore in management accounting there is the provision of

inventory management reports. The following is a sample of inventory management report

inventory and are also useful for the management for easily tracking the inventory. Excess or

low inventory can both have negative implications on the organisation. In financial

accounting inventory is treated as an asset but however it needs to be noted excess inventory

requires money for holding and also blocks operational capital. Thus the inventory needs to

be managed effectively and therefore in management accounting there is the provision of

inventory management reports. The following is a sample of inventory management report

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Operating Budget Report: This report tracks the operating budget of the organisation and

tracks both budgeted expenses and revenues. Further, the operating budget report provides a

contrast with previous years operational expenses so as to provide an idea to the management

regarding the changes that have occurred. The operating budget report is useful for the

management to understand the changes in the revenues and the expenses and accordingly

strategies can be defined so as to lower expenses and enhance revenues. The following is an

example

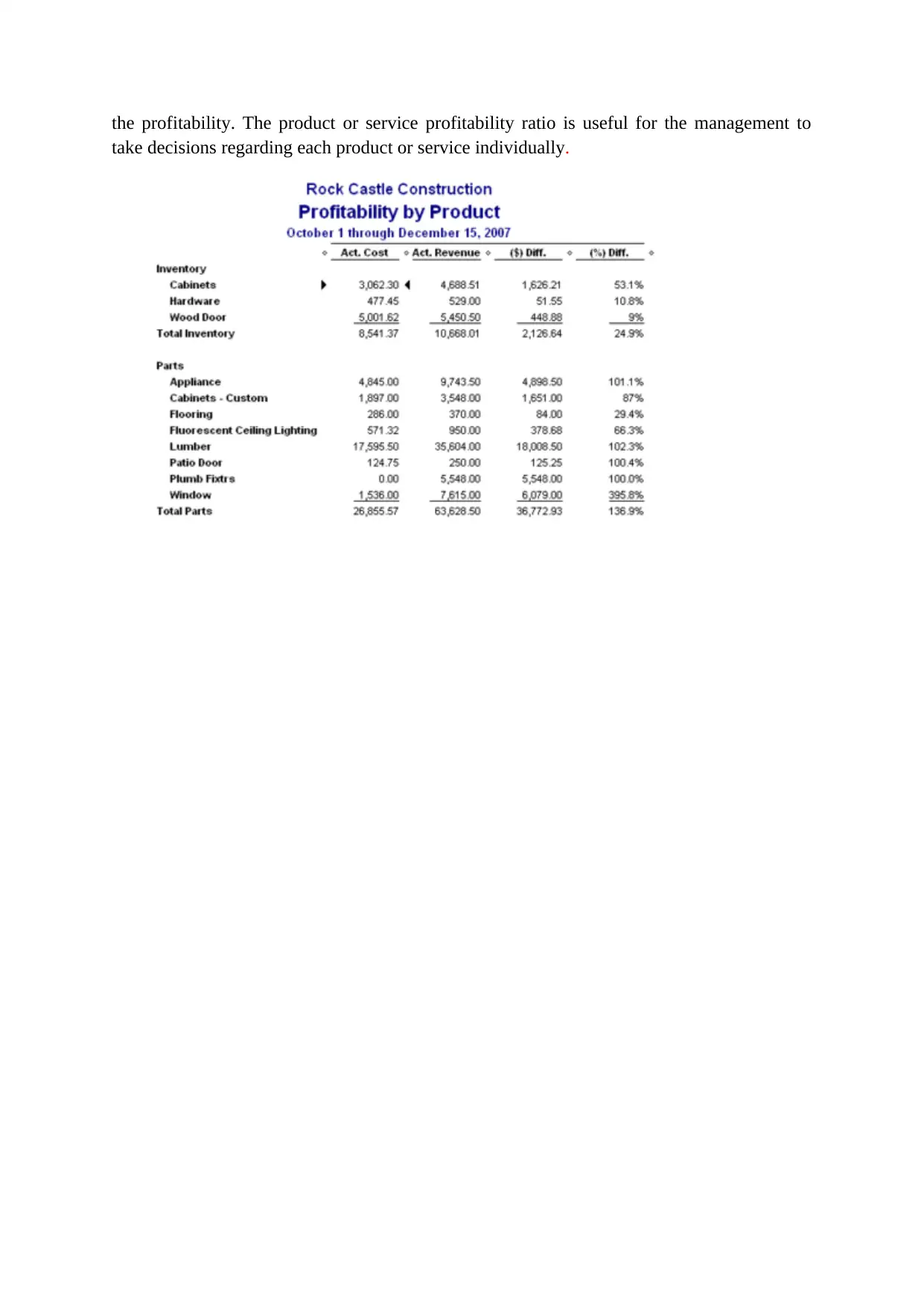

Product/Service Profitability Report: Any organisation has multiple products or services.

Financial accounting provides the overall profitability statement but management accounting

focuses on specific products so as to understand how each product has contributed towards

tracks both budgeted expenses and revenues. Further, the operating budget report provides a

contrast with previous years operational expenses so as to provide an idea to the management

regarding the changes that have occurred. The operating budget report is useful for the

management to understand the changes in the revenues and the expenses and accordingly

strategies can be defined so as to lower expenses and enhance revenues. The following is an

example

Product/Service Profitability Report: Any organisation has multiple products or services.

Financial accounting provides the overall profitability statement but management accounting

focuses on specific products so as to understand how each product has contributed towards

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the profitability. The product or service profitability ratio is useful for the management to

take decisions regarding each product or service individually.

take decisions regarding each product or service individually.

Task 2

P3

Calculation

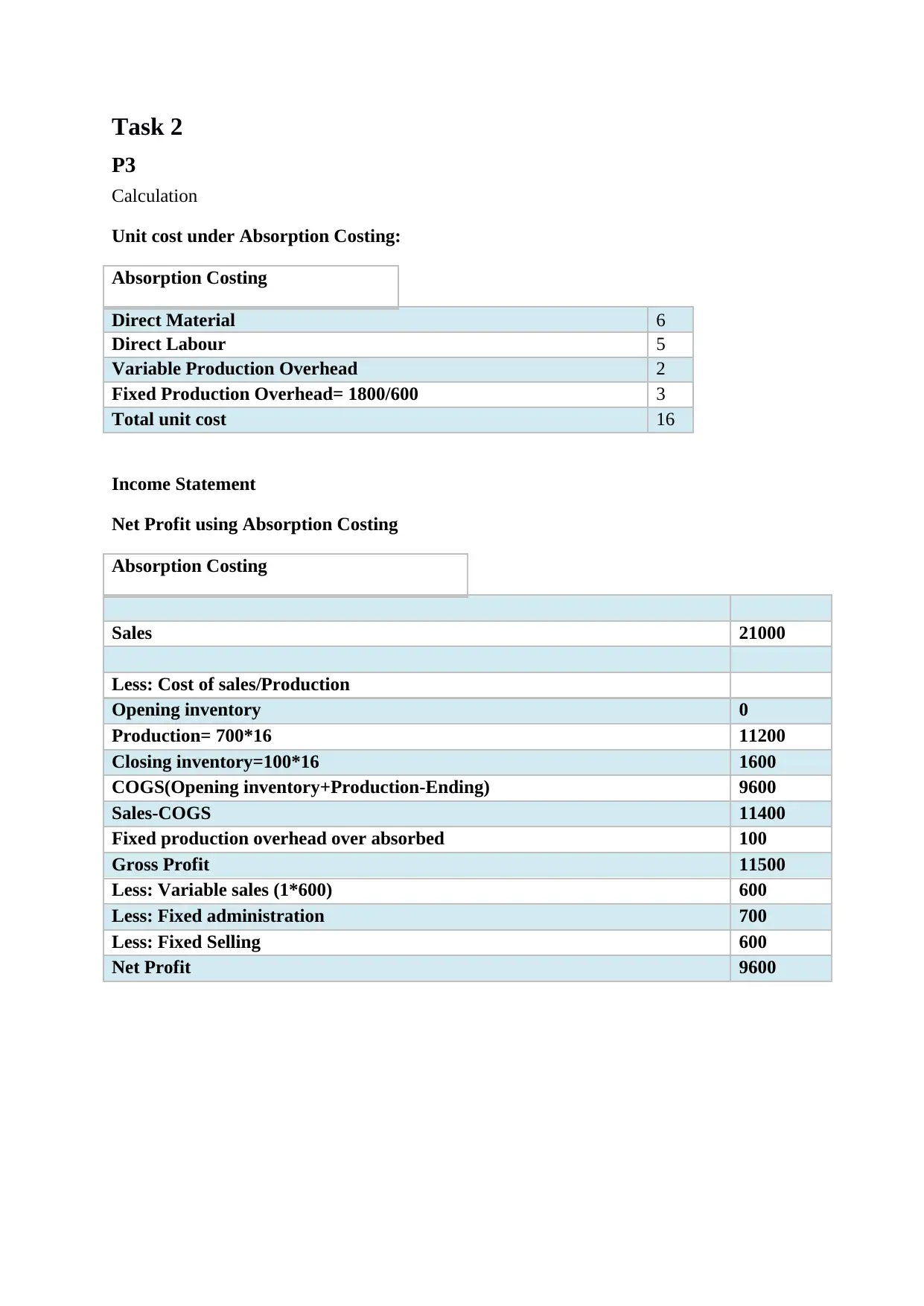

Unit cost under Absorption Costing:

Absorption Costing

Direct Material 6

Direct Labour 5

Variable Production Overhead 2

Fixed Production Overhead= 1800/600 3

Total unit cost 16

Income Statement

Net Profit using Absorption Costing

Absorption Costing

Sales 21000

Less: Cost of sales/Production

Opening inventory 0

Production= 700*16 11200

Closing inventory=100*16 1600

COGS(Opening inventory+Production-Ending) 9600

Sales-COGS 11400

Fixed production overhead over absorbed 100

Gross Profit 11500

Less: Variable sales (1*600) 600

Less: Fixed administration 700

Less: Fixed Selling 600

Net Profit 9600

P3

Calculation

Unit cost under Absorption Costing:

Absorption Costing

Direct Material 6

Direct Labour 5

Variable Production Overhead 2

Fixed Production Overhead= 1800/600 3

Total unit cost 16

Income Statement

Net Profit using Absorption Costing

Absorption Costing

Sales 21000

Less: Cost of sales/Production

Opening inventory 0

Production= 700*16 11200

Closing inventory=100*16 1600

COGS(Opening inventory+Production-Ending) 9600

Sales-COGS 11400

Fixed production overhead over absorbed 100

Gross Profit 11500

Less: Variable sales (1*600) 600

Less: Fixed administration 700

Less: Fixed Selling 600

Net Profit 9600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

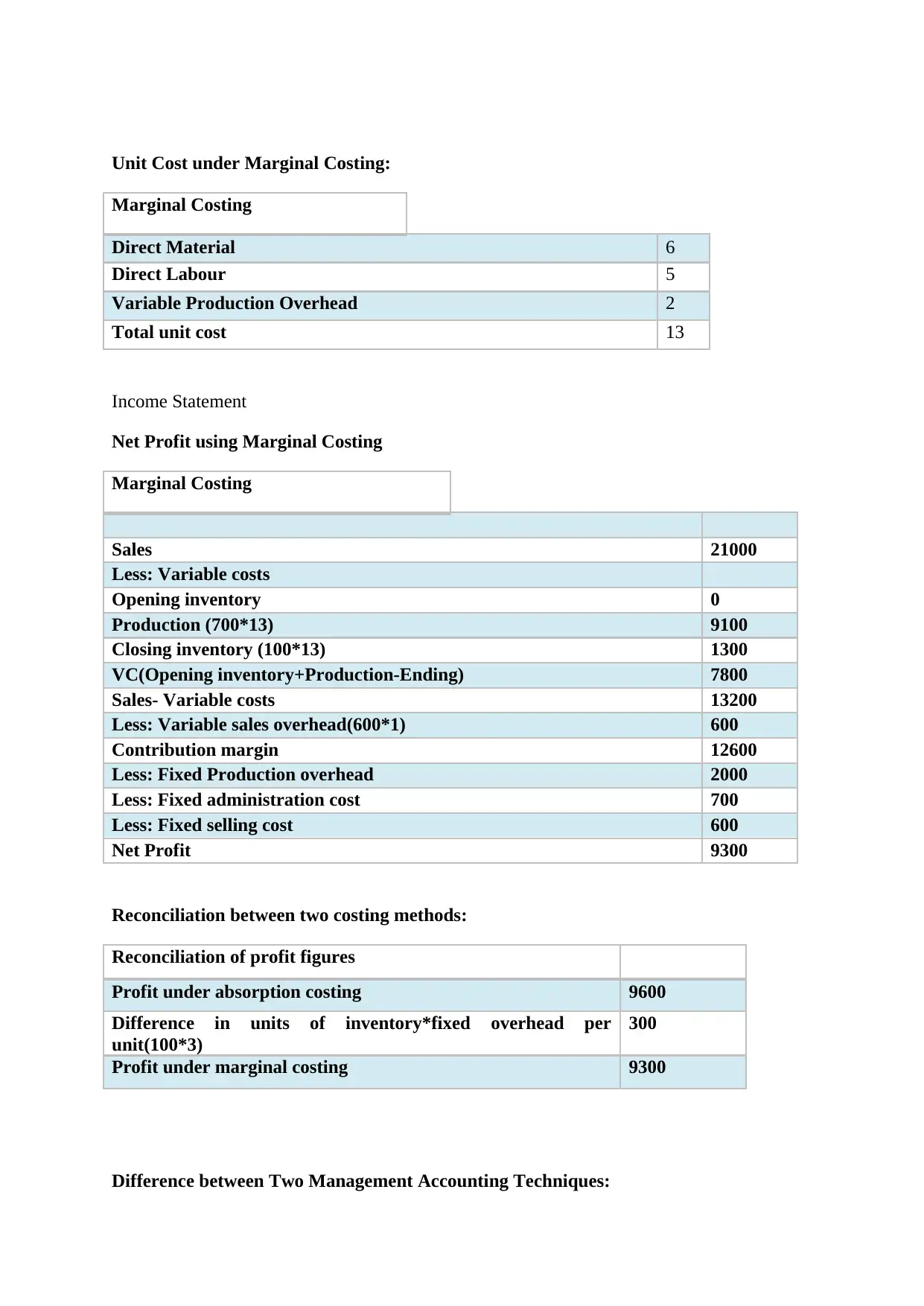

Unit Cost under Marginal Costing:

Marginal Costing

Direct Material 6

Direct Labour 5

Variable Production Overhead 2

Total unit cost 13

Income Statement

Net Profit using Marginal Costing

Marginal Costing

Sales 21000

Less: Variable costs

Opening inventory 0

Production (700*13) 9100

Closing inventory (100*13) 1300

VC(Opening inventory+Production-Ending) 7800

Sales- Variable costs 13200

Less: Variable sales overhead(600*1) 600

Contribution margin 12600

Less: Fixed Production overhead 2000

Less: Fixed administration cost 700

Less: Fixed selling cost 600

Net Profit 9300

Reconciliation between two costing methods:

Reconciliation of profit figures

Profit under absorption costing 9600

Difference in units of inventory*fixed overhead per

unit(100*3)

300

Profit under marginal costing 9300

Difference between Two Management Accounting Techniques:

Marginal Costing

Direct Material 6

Direct Labour 5

Variable Production Overhead 2

Total unit cost 13

Income Statement

Net Profit using Marginal Costing

Marginal Costing

Sales 21000

Less: Variable costs

Opening inventory 0

Production (700*13) 9100

Closing inventory (100*13) 1300

VC(Opening inventory+Production-Ending) 7800

Sales- Variable costs 13200

Less: Variable sales overhead(600*1) 600

Contribution margin 12600

Less: Fixed Production overhead 2000

Less: Fixed administration cost 700

Less: Fixed selling cost 600

Net Profit 9300

Reconciliation between two costing methods:

Reconciliation of profit figures

Profit under absorption costing 9600

Difference in units of inventory*fixed overhead per

unit(100*3)

300

Profit under marginal costing 9300

Difference between Two Management Accounting Techniques:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Here are presented key differences between Marginal Accounting techniques and absorption

accounting techniques.

In absorption costing both variable cost and fixed cost are counted as product costing in

inventory cost calculation on the other hand when it goes for marginal costing only the

variable costs is counted as product costing.

In case of marginal costing the higher the unit volume increases the higher the profit rises.

Production unit affects the revenue system in marginal costing. In case of absorption costing

similar thing doesn’t happen because here fixed cost also will be included in the cost system

that’s why it will affect the profitability.

The differences are few in nature between absorption cost and production cost. Because

direct material cost, direct labour cost and the manufacturing overhead cost are remained

same in both costing system. They put same influence in two methods.

In absorption costing the main highlighting point is net profit per unit. Net profit is crucial

matter for absorption costing on the opposite contribution margin per unit gets the more

importance when following marginal cost systems (Sedgwick, 2014).

When we run production procedure of a company there is created two parties automatically

those are lenders and borrowers. We have some lending and borrowing in the year end, it is

very natural in business market. So some inventories remain unsold in the end of the year and

some money remains in the hand of others and we have due also. In this case the variability

between opening balances and closing balances influences the absorption costing when

calculating cost per unit (Shim and Siegel, 2012). On the other hand this variability doesn’t

put any effects in case of marginal costing for cost per unit of output.

Task 3

P4

In order to focus upon the “planning and budget control” of a business organisation, it can be

said that effective utilization of tools being used for planning and controlling the budgetary

policies can be considered as beneficial for any business organisation. It can be helpful for

the organisation in evaluating and keeping control over the day- to- day financial operation in

accordance to the target, set up by the budget. The main objective of the budget control is to

enable the organisational management to execute the business operation especially the

financial performance in most effective and optimal manner. In order to keep effective

control over the budgetary policies of the business organisation, Planning is one of the most

important criteria. Planning can help the organisational management in evaluating and

identifying financial situation of the organisation, financial goals of the organisation and so

on.

Planning: budget generally provides an elaborate plan regarding the financial performance of

the business within a fixed period of time. Planning associated with the production

accounting techniques.

In absorption costing both variable cost and fixed cost are counted as product costing in

inventory cost calculation on the other hand when it goes for marginal costing only the

variable costs is counted as product costing.

In case of marginal costing the higher the unit volume increases the higher the profit rises.

Production unit affects the revenue system in marginal costing. In case of absorption costing

similar thing doesn’t happen because here fixed cost also will be included in the cost system

that’s why it will affect the profitability.

The differences are few in nature between absorption cost and production cost. Because

direct material cost, direct labour cost and the manufacturing overhead cost are remained

same in both costing system. They put same influence in two methods.

In absorption costing the main highlighting point is net profit per unit. Net profit is crucial

matter for absorption costing on the opposite contribution margin per unit gets the more

importance when following marginal cost systems (Sedgwick, 2014).

When we run production procedure of a company there is created two parties automatically

those are lenders and borrowers. We have some lending and borrowing in the year end, it is

very natural in business market. So some inventories remain unsold in the end of the year and

some money remains in the hand of others and we have due also. In this case the variability

between opening balances and closing balances influences the absorption costing when

calculating cost per unit (Shim and Siegel, 2012). On the other hand this variability doesn’t

put any effects in case of marginal costing for cost per unit of output.

Task 3

P4

In order to focus upon the “planning and budget control” of a business organisation, it can be

said that effective utilization of tools being used for planning and controlling the budgetary

policies can be considered as beneficial for any business organisation. It can be helpful for

the organisation in evaluating and keeping control over the day- to- day financial operation in

accordance to the target, set up by the budget. The main objective of the budget control is to

enable the organisational management to execute the business operation especially the

financial performance in most effective and optimal manner. In order to keep effective

control over the budgetary policies of the business organisation, Planning is one of the most

important criteria. Planning can help the organisational management in evaluating and

identifying financial situation of the organisation, financial goals of the organisation and so

on.

Planning: budget generally provides an elaborate plan regarding the financial performance of

the business within a fixed period of time. Planning associated with the production

procedures, sales promotion, optimal utilization of resources, advertisements, developmental

activities and so on that can generate the economical benefits for the organisation. Proper

planning can be effective way out for any business organisation by which any anticipated

condition can be created for avoiding business emergencies especially financial downfalls.

There are different types of budgetary control in the organisation which are master budget,

operating budget, cash flow budget, financial budget and static budget. Now let’s look the

key differences among them in the planning tools of budgetary control.

There are different types of budgetary control in the organisation which are master budget,

operating budget, cash flow budget, financial budget and static budget. Now let’s look the

key differences among them in the planning tools of budgetary control.

Budget for a business organisation can be classified in different types, like:

Cash budget: most important and effective budgetary tool for any business

organisation. By adopting such tool, an organisational management can focuses upon

the elaborated estimation of the money being receipt from every possible source and

the cash payments for several purposes. It also sheds light on the resultant or

remaining case balance all through the budget period. It also allows the organisational

management to keep effective control and coordination over the financial setup of the

organisation so that the organisation cannot face any economical downfall or

bankruptcy in the future.

Advantages- This helps in determining whether cash balances remain sufficient to full fill

regular obligations and its minimum liquidity and cash balance requirements. It also helps in

company to determine whether too much cash is retained that could be otherwise used in

production.

Disadvantages- They may cause distortions. Cash inflows do not rely to profit. Cash inflows

results from security deposits, fines, the sale of capital assets, non sustainability of funds.

Production cost budget: this budget focuses upon the estimated expenditure required

for the production purposes. The advantageous aspect of this budgetary tool is that, it

can shed light over the predictable cost or expenses required to execute the production

process of the organisation. It is beneficial as it can enable the organisational

management to provide maximum importance on the financial performance for

production process by which they can maintain the cost effectiveness of the

production expenditure. Apart from the advantageous it also have some basic

disadvantage, like: by maintain cost effectiveness of the production process, the

organisational management can negotiate with the quality of the raw materials being

used for the manufacturing process.

activities and so on that can generate the economical benefits for the organisation. Proper

planning can be effective way out for any business organisation by which any anticipated

condition can be created for avoiding business emergencies especially financial downfalls.

There are different types of budgetary control in the organisation which are master budget,

operating budget, cash flow budget, financial budget and static budget. Now let’s look the

key differences among them in the planning tools of budgetary control.

There are different types of budgetary control in the organisation which are master budget,

operating budget, cash flow budget, financial budget and static budget. Now let’s look the

key differences among them in the planning tools of budgetary control.

Budget for a business organisation can be classified in different types, like:

Cash budget: most important and effective budgetary tool for any business

organisation. By adopting such tool, an organisational management can focuses upon

the elaborated estimation of the money being receipt from every possible source and

the cash payments for several purposes. It also sheds light on the resultant or

remaining case balance all through the budget period. It also allows the organisational

management to keep effective control and coordination over the financial setup of the

organisation so that the organisation cannot face any economical downfall or

bankruptcy in the future.

Advantages- This helps in determining whether cash balances remain sufficient to full fill

regular obligations and its minimum liquidity and cash balance requirements. It also helps in

company to determine whether too much cash is retained that could be otherwise used in

production.

Disadvantages- They may cause distortions. Cash inflows do not rely to profit. Cash inflows

results from security deposits, fines, the sale of capital assets, non sustainability of funds.

Production cost budget: this budget focuses upon the estimated expenditure required

for the production purposes. The advantageous aspect of this budgetary tool is that, it

can shed light over the predictable cost or expenses required to execute the production

process of the organisation. It is beneficial as it can enable the organisational

management to provide maximum importance on the financial performance for

production process by which they can maintain the cost effectiveness of the

production expenditure. Apart from the advantageous it also have some basic

disadvantage, like: by maintain cost effectiveness of the production process, the

organisational management can negotiate with the quality of the raw materials being

used for the manufacturing process.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.