Evaluation of Management Accounting Systems and Reporting for Unilever

VerifiedAdded on 2021/02/19

|18

|5997

|264

Report

AI Summary

This report delves into the realm of management accounting, exploring various systems such as price optimization, cost accounting, inventory management, and job costing, and their significance in organizational contexts, particularly within Unilever. It outlines different techniques and methods of management accounting reporting, including variance analysis, budgeting, performance reports, activity-based costing, and standard costing. The report highlights the benefits of these systems, such as optimized resource utilization, cost reduction, and improved decision-making. Furthermore, it critically evaluates the integration of management accounting systems and reporting within a company, addressing how organizations adapt to financial challenges and leverage planning tools for problem-solving. The report uses Unilever as a case study to illustrate these concepts, analyzing how the company utilizes these tools to enhance its financial performance and achieve sustainable success.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

LO1 .................................................................................................................................................1

P1 Various kind of systems of management accounting.............................................................1

P2. Various kind of techniques and methods of management accounting reporting.................3

M1. Benefits of management accounting systems:......................................................................4

D1. Critically evaluation of management accounting system and reporting is integration with

company.......................................................................................................................................5

LO 2.................................................................................................................................................6

P3. Presentation of income statements to calculate net profit.....................................................6

Income statement under absorption costing method for month of May & June..........................6

M2. Using of techniques of management accounting and generate financial reporting

documents....................................................................................................................................7

D2. Financial reports prepared and data for a range of business activities..................................8

LO 3.................................................................................................................................................8

Use of planning tools used in management accounting...............................................................8

Uses of different planning tools in forecasting budget..............................................................10

LO 4...............................................................................................................................................10

Comparison of how organisations are adapting management accounting systems to respond to

financial problems......................................................................................................................10

M4: Management accounting in response to solve financial issue that can lead to the

sustainable success.....................................................................................................................14

D3: Planning tools to resolve the financial problems................................................................14

CONCLUSION.............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

LO1 .................................................................................................................................................1

P1 Various kind of systems of management accounting.............................................................1

P2. Various kind of techniques and methods of management accounting reporting.................3

M1. Benefits of management accounting systems:......................................................................4

D1. Critically evaluation of management accounting system and reporting is integration with

company.......................................................................................................................................5

LO 2.................................................................................................................................................6

P3. Presentation of income statements to calculate net profit.....................................................6

Income statement under absorption costing method for month of May & June..........................6

M2. Using of techniques of management accounting and generate financial reporting

documents....................................................................................................................................7

D2. Financial reports prepared and data for a range of business activities..................................8

LO 3.................................................................................................................................................8

Use of planning tools used in management accounting...............................................................8

Uses of different planning tools in forecasting budget..............................................................10

LO 4...............................................................................................................................................10

Comparison of how organisations are adapting management accounting systems to respond to

financial problems......................................................................................................................10

M4: Management accounting in response to solve financial issue that can lead to the

sustainable success.....................................................................................................................14

D3: Planning tools to resolve the financial problems................................................................14

CONCLUSION.............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting involves the use of professional understanding, expertise,

techniques and theories for systematically present accounting and economic data. It assists

business organization managers in creation of new policies/plans, controlling different

organizational functions, crucial decision-making, adequate use of organizational resources,

safeguarding economic resources and in reporting to senior leadership (Aksoylu and Aykan,

2013).This study shows an knowledge of management accounting schemes, various techniques

used to report management accounts. Advantages of and implementation of systems in

organizational context. Demerits and merits of numerous kind of tools of planning applied in

budgetary control. For evaluating all this report Unilever is taken which is UK's top retailer

company and selling consumer products. It has large range of consumer products such as house

hold products and personal and beauty care products, food or beverages.

This study report also discuss about practical use of cost techniques like marginal and

costing for assessing net income, ways by which systems and reporting are incorporated within

functions and process and detailed analysis of responding manner using planning tools.

LO1

P1 Various kind of systems of management accounting.

The management accounting system contains various kind of systems that play an

important role in the context of organisations. This is why because each accounting system has

own role for managing the internal functions of organisations. Financial and management

accounting are both different from one another such as:

Management accounting Financial accounting

This is related with analysing and organising

entire performance of company to the

responsible and crucial internal stakeholders.

It is related with forming of crucial statements

and reports that disclose the financial position

and strength of company during an accounting

year.

Manager are not bounded to follow any kind

of principles or framework so they prepare

reports accordingly to make favourable

While in financial accounting there is need to

effectively follow IFRS and accounting

standard that enable in proper formation of

Management accounting involves the use of professional understanding, expertise,

techniques and theories for systematically present accounting and economic data. It assists

business organization managers in creation of new policies/plans, controlling different

organizational functions, crucial decision-making, adequate use of organizational resources,

safeguarding economic resources and in reporting to senior leadership (Aksoylu and Aykan,

2013).This study shows an knowledge of management accounting schemes, various techniques

used to report management accounts. Advantages of and implementation of systems in

organizational context. Demerits and merits of numerous kind of tools of planning applied in

budgetary control. For evaluating all this report Unilever is taken which is UK's top retailer

company and selling consumer products. It has large range of consumer products such as house

hold products and personal and beauty care products, food or beverages.

This study report also discuss about practical use of cost techniques like marginal and

costing for assessing net income, ways by which systems and reporting are incorporated within

functions and process and detailed analysis of responding manner using planning tools.

LO1

P1 Various kind of systems of management accounting.

The management accounting system contains various kind of systems that play an

important role in the context of organisations. This is why because each accounting system has

own role for managing the internal functions of organisations. Financial and management

accounting are both different from one another such as:

Management accounting Financial accounting

This is related with analysing and organising

entire performance of company to the

responsible and crucial internal stakeholders.

It is related with forming of crucial statements

and reports that disclose the financial position

and strength of company during an accounting

year.

Manager are not bounded to follow any kind

of principles or framework so they prepare

reports accordingly to make favourable

While in financial accounting there is need to

effectively follow IFRS and accounting

standard that enable in proper formation of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

decision. reports and statements.

Herein, the context of Unilever company they adopt different kind of accounting systems for

purpose of internal decision making about their activities. Some types of management

accounting systems are mentioned below which are as follows:

Price optimisation system- It is a type of accounting system that is related to the

providing assistance to organisations so that they can determine the price of their

products and services at right level. Eventually, this is necessary for the companies to

assign the accurate price of their products and services at an accurate level so that

customers can be satisfied. As well as company may get the benefit from set level of

price. So overall the price optimisation system is essentially required by the companies to

set the price at an effective level. Along with determining the impact on the customers at

different level of price. For example in the aspect of Unilever company, they use this

accounting system for a purpose of setting the price of their beauty products. This system

assign the price by adding the profit in the cost of products and services.

Cost accounting system- This is a kind of accounting system that is aligned with the

determination of cost of different types of activities. Apart from it, this accounting system

is also useful in forecasting the future cost. On the basis of this accounting system,

companies can determine about efficiency of various activities. This is why because it

provides a framework for comparing the actual cost with the estimated cost. Eventually,

the cost accounting system is essentially required by the organisations to find out the cost

of various activities. Along with the estimating the cost of functions and activities. Same

as in the Unilever company, this accounting system is required by them to control and

minimise the cost of different products and services. Basically, they have wide portfolio

of products including about 400 brands so this accounting system helps them in

estimating and minimise the total cost as much as possible.

Inventory management system- This an accounting system that is associated with the

managing the stored inventories of companies in an effective manner (Boiral, 2016).

Apart from it, this accounting system tracks the quantity of raw material, finished

products that becomes a framework for taking decision about purchasing and selling of

inventories. The cost accounting system is essentially required by the organisations with

Herein, the context of Unilever company they adopt different kind of accounting systems for

purpose of internal decision making about their activities. Some types of management

accounting systems are mentioned below which are as follows:

Price optimisation system- It is a type of accounting system that is related to the

providing assistance to organisations so that they can determine the price of their

products and services at right level. Eventually, this is necessary for the companies to

assign the accurate price of their products and services at an accurate level so that

customers can be satisfied. As well as company may get the benefit from set level of

price. So overall the price optimisation system is essentially required by the companies to

set the price at an effective level. Along with determining the impact on the customers at

different level of price. For example in the aspect of Unilever company, they use this

accounting system for a purpose of setting the price of their beauty products. This system

assign the price by adding the profit in the cost of products and services.

Cost accounting system- This is a kind of accounting system that is aligned with the

determination of cost of different types of activities. Apart from it, this accounting system

is also useful in forecasting the future cost. On the basis of this accounting system,

companies can determine about efficiency of various activities. This is why because it

provides a framework for comparing the actual cost with the estimated cost. Eventually,

the cost accounting system is essentially required by the organisations to find out the cost

of various activities. Along with the estimating the cost of functions and activities. Same

as in the Unilever company, this accounting system is required by them to control and

minimise the cost of different products and services. Basically, they have wide portfolio

of products including about 400 brands so this accounting system helps them in

estimating and minimise the total cost as much as possible.

Inventory management system- This an accounting system that is associated with the

managing the stored inventories of companies in an effective manner (Boiral, 2016).

Apart from it, this accounting system tracks the quantity of raw material, finished

products that becomes a framework for taking decision about purchasing and selling of

inventories. The cost accounting system is essentially required by the organisations with

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

an objective to reduce the cost of inventories by providing detailed information about

quantity of inventory. Same as in the aspect of above mentioned company, Unilever they

are applying this accounting system for keeping the record of wide range of products.

Basically, this company has a wide range of products so it is essential for them to

implement the inventory management system. Otherwise in the absence of this

accounting system it will be difficult for them to make an appropriate relation between

the demand and supply of their products. Job costing system- This accounting system is one of the important system of

management accounting (Bromiley and et.al, 2015). It is associated with the proper

allocation of cost on various jobs which are associated to the different kind of activities.

Due to this companies can be able to evaluate about the cost of job of various functions.

Eventually, this accounting system is not limited to the providing the information about

the cost of job of various kind of activities but also it consists some other information

such as:

Direct material- The job accounting system provides the information about the cost of

direct material.

Direct labour- Along with it also contains the information regarding to the cost of direct

material.

Overheads- As well as the above accounting system is useful for giving the information

about various kind of overheads.

So these all above mentioned information is given by this accounting system. It is essentially

required by the companies to get detailed information about direct labour, material and

overheads. As well as about cost of job of different activities. Same as in the aspect of Unilever

company, they are using this accounting system which helps them in managing the cost of job.

P2. Various kind of techniques and methods of management accounting reporting.

There are various kind of techniques and methods of management accounting reporting

which are needed to be applied for presenting the reports. Such as the Unilever company uses

different kind of methods which are mentioned below:

Variance analysis- It is a kind of technique which is related to the identifying the

difference between the actual and estimated income and expenses (Malinić and Todorović,

2012). On the basis of it, companies can evaluate the needed changes in the plans and policies.

quantity of inventory. Same as in the aspect of above mentioned company, Unilever they

are applying this accounting system for keeping the record of wide range of products.

Basically, this company has a wide range of products so it is essential for them to

implement the inventory management system. Otherwise in the absence of this

accounting system it will be difficult for them to make an appropriate relation between

the demand and supply of their products. Job costing system- This accounting system is one of the important system of

management accounting (Bromiley and et.al, 2015). It is associated with the proper

allocation of cost on various jobs which are associated to the different kind of activities.

Due to this companies can be able to evaluate about the cost of job of various functions.

Eventually, this accounting system is not limited to the providing the information about

the cost of job of various kind of activities but also it consists some other information

such as:

Direct material- The job accounting system provides the information about the cost of

direct material.

Direct labour- Along with it also contains the information regarding to the cost of direct

material.

Overheads- As well as the above accounting system is useful for giving the information

about various kind of overheads.

So these all above mentioned information is given by this accounting system. It is essentially

required by the companies to get detailed information about direct labour, material and

overheads. As well as about cost of job of different activities. Same as in the aspect of Unilever

company, they are using this accounting system which helps them in managing the cost of job.

P2. Various kind of techniques and methods of management accounting reporting.

There are various kind of techniques and methods of management accounting reporting

which are needed to be applied for presenting the reports. Such as the Unilever company uses

different kind of methods which are mentioned below:

Variance analysis- It is a kind of technique which is related to the identifying the

difference between the actual and estimated income and expenses (Malinić and Todorović,

2012). On the basis of it, companies can evaluate the needed changes in the plans and policies.

Eventually, this technique helps in preparation of management accounting reports. As well as it

is being used by the above respective company.

Budgeting: This is the most common and generally accepted leadership audit analysis

method in which enterprise organization revenue and expenditure are estimated according to

previous record or patterns in preparing a forecast statement to face the organization's results in

the coming years. Budgeting may assist the managers of Unilever to analyse the further events

and aspects for better control and operation. Budget deficits are ready by managers according to

the demands of the organization, such as retail budgets. This method not only helps to determine

the effective aspects related to decision making.

Performance Report: This accounting method is used to analyze an organization's

graphical fidelity by considering the overall staff member's strength. These reports are

prepared periodically and helps in analysing the performance by examine the results form

previous reports. In large organizations such as Unilever, performance reports are prepared on

the basis of divisional basis. Managers prepare a structure for strategic decision-making by using

these reports. the employees of Unilever, usually rewarded for their vulnerable work and

consistent performance.

Activity based costing (ABC): Management defines and assigns distinct charges or

expenditures to cost sections under activity-based costing and then allocates them to distinct

costs. the indirect costs assigned to services and product are less prompt than other traditional

techniques. This reporting scheme defines the connection among different overhead costs,

expenses, features and services. By this method, some costs and expenditures are complicated to

allocate. Costs such as wages for employees, administrative expenses are a tuff of moment to

assign to a specific item. Mostly this technique is recognised in the manufacturing sector because

it improves data reliability. Unilever can initiate this costing to consolidate the divisional cost in

a particular section and reduces the possibilities for better management and control.

Standard costing: This costing also considered as normal costing. this kind of costs are

determined by managers based on their skills, variations in sector, past results, etc. It is a

accounting technique in which organization categorize an assessment of expenditure or cost

compared to real costs incurred over a given time period. Subsequently, managers compare real

and conventional costs to asses output or effectiveness. In Unilever leadership, sector trends or

is being used by the above respective company.

Budgeting: This is the most common and generally accepted leadership audit analysis

method in which enterprise organization revenue and expenditure are estimated according to

previous record or patterns in preparing a forecast statement to face the organization's results in

the coming years. Budgeting may assist the managers of Unilever to analyse the further events

and aspects for better control and operation. Budget deficits are ready by managers according to

the demands of the organization, such as retail budgets. This method not only helps to determine

the effective aspects related to decision making.

Performance Report: This accounting method is used to analyze an organization's

graphical fidelity by considering the overall staff member's strength. These reports are

prepared periodically and helps in analysing the performance by examine the results form

previous reports. In large organizations such as Unilever, performance reports are prepared on

the basis of divisional basis. Managers prepare a structure for strategic decision-making by using

these reports. the employees of Unilever, usually rewarded for their vulnerable work and

consistent performance.

Activity based costing (ABC): Management defines and assigns distinct charges or

expenditures to cost sections under activity-based costing and then allocates them to distinct

costs. the indirect costs assigned to services and product are less prompt than other traditional

techniques. This reporting scheme defines the connection among different overhead costs,

expenses, features and services. By this method, some costs and expenditures are complicated to

allocate. Costs such as wages for employees, administrative expenses are a tuff of moment to

assign to a specific item. Mostly this technique is recognised in the manufacturing sector because

it improves data reliability. Unilever can initiate this costing to consolidate the divisional cost in

a particular section and reduces the possibilities for better management and control.

Standard costing: This costing also considered as normal costing. this kind of costs are

determined by managers based on their skills, variations in sector, past results, etc. It is a

accounting technique in which organization categorize an assessment of expenditure or cost

compared to real costs incurred over a given time period. Subsequently, managers compare real

and conventional costs to asses output or effectiveness. In Unilever leadership, sector trends or

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

information from rivals are usually used to set normal costs. Managers evaluate the general

business efficiency by comparing normal costs with real costs.

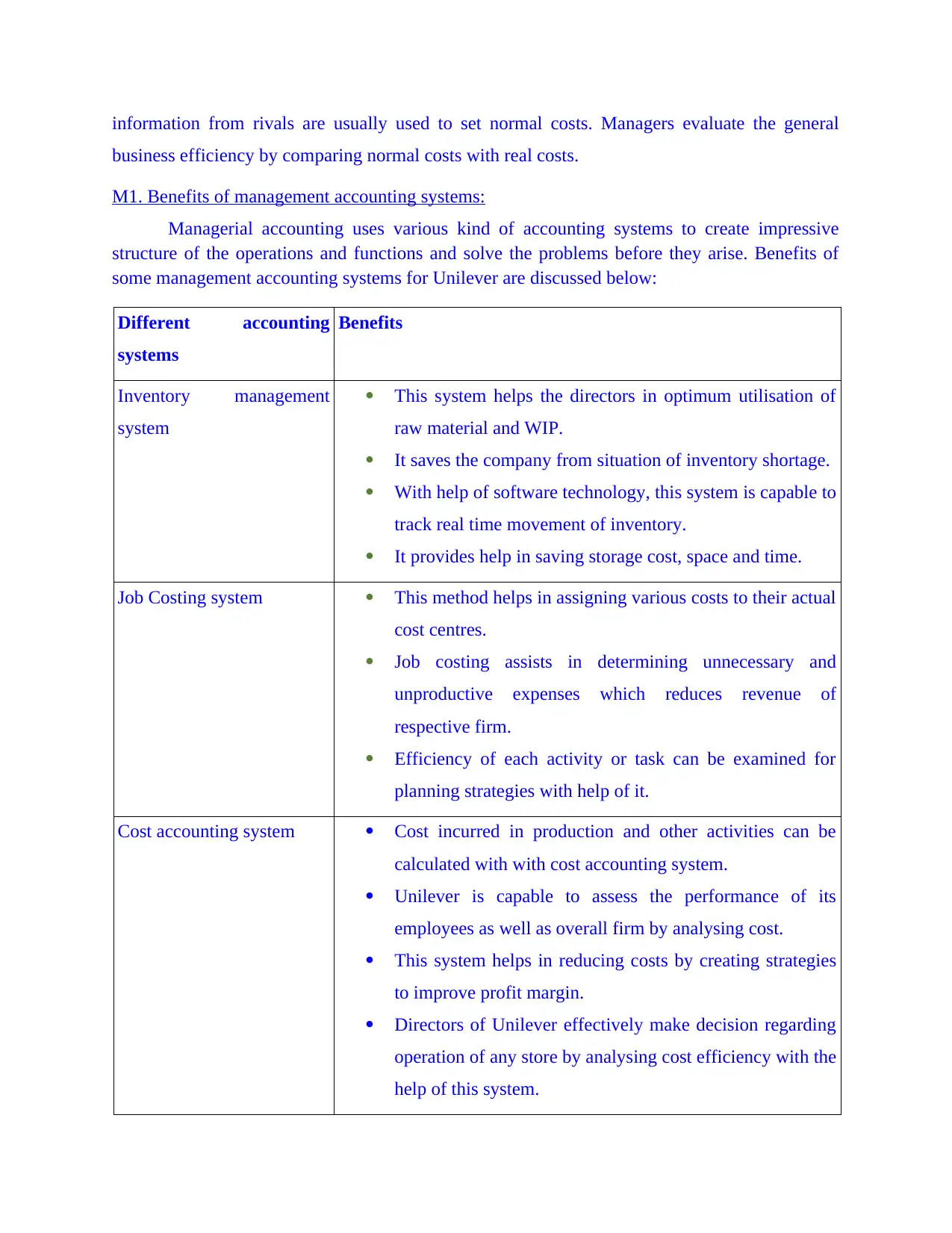

M1. Benefits of management accounting systems:

Managerial accounting uses various kind of accounting systems to create impressive

structure of the operations and functions and solve the problems before they arise. Benefits of

some management accounting systems for Unilever are discussed below:

Different accounting

systems

Benefits

Inventory management

system

This system helps the directors in optimum utilisation of

raw material and WIP.

It saves the company from situation of inventory shortage.

With help of software technology, this system is capable to

track real time movement of inventory.

It provides help in saving storage cost, space and time.

Job Costing system This method helps in assigning various costs to their actual

cost centres.

Job costing assists in determining unnecessary and

unproductive expenses which reduces revenue of

respective firm.

Efficiency of each activity or task can be examined for

planning strategies with help of it.

Cost accounting system Cost incurred in production and other activities can be

calculated with with cost accounting system.

Unilever is capable to assess the performance of its

employees as well as overall firm by analysing cost.

This system helps in reducing costs by creating strategies

to improve profit margin.

Directors of Unilever effectively make decision regarding

operation of any store by analysing cost efficiency with the

help of this system.

business efficiency by comparing normal costs with real costs.

M1. Benefits of management accounting systems:

Managerial accounting uses various kind of accounting systems to create impressive

structure of the operations and functions and solve the problems before they arise. Benefits of

some management accounting systems for Unilever are discussed below:

Different accounting

systems

Benefits

Inventory management

system

This system helps the directors in optimum utilisation of

raw material and WIP.

It saves the company from situation of inventory shortage.

With help of software technology, this system is capable to

track real time movement of inventory.

It provides help in saving storage cost, space and time.

Job Costing system This method helps in assigning various costs to their actual

cost centres.

Job costing assists in determining unnecessary and

unproductive expenses which reduces revenue of

respective firm.

Efficiency of each activity or task can be examined for

planning strategies with help of it.

Cost accounting system Cost incurred in production and other activities can be

calculated with with cost accounting system.

Unilever is capable to assess the performance of its

employees as well as overall firm by analysing cost.

This system helps in reducing costs by creating strategies

to improve profit margin.

Directors of Unilever effectively make decision regarding

operation of any store by analysing cost efficiency with the

help of this system.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Price optimization system It assists the managers to optimise the quality of products

with retaining same profit margin.

To win over the competitors, the firm can reduce the prices

of products.

D1. Critically evaluation of management accounting system and reporting is integration with

company.

At current scenarios of scenarios, each organization emphasizes managerial accounting

system that produces valuable reports and information that remain helpful for business in

making strategies and plans. Different management accounting systems supplies different reports

as inventory, performance and budget reports that provide fundamental data to form strategies

and plans in more effective manner (McLean, McGovern and Davie, 2015). Management of

Unilever must understand the internal reporting requirements and helps in managing the flow of

reporting form management accounting systems properly. In Unilever, various department and

store managers are produced to provide appropriate information for accounting and reporting

management in data management. Inventory and stock in the business are marinated through

different procedures that eventually help in efficient inventory management.

LO 2

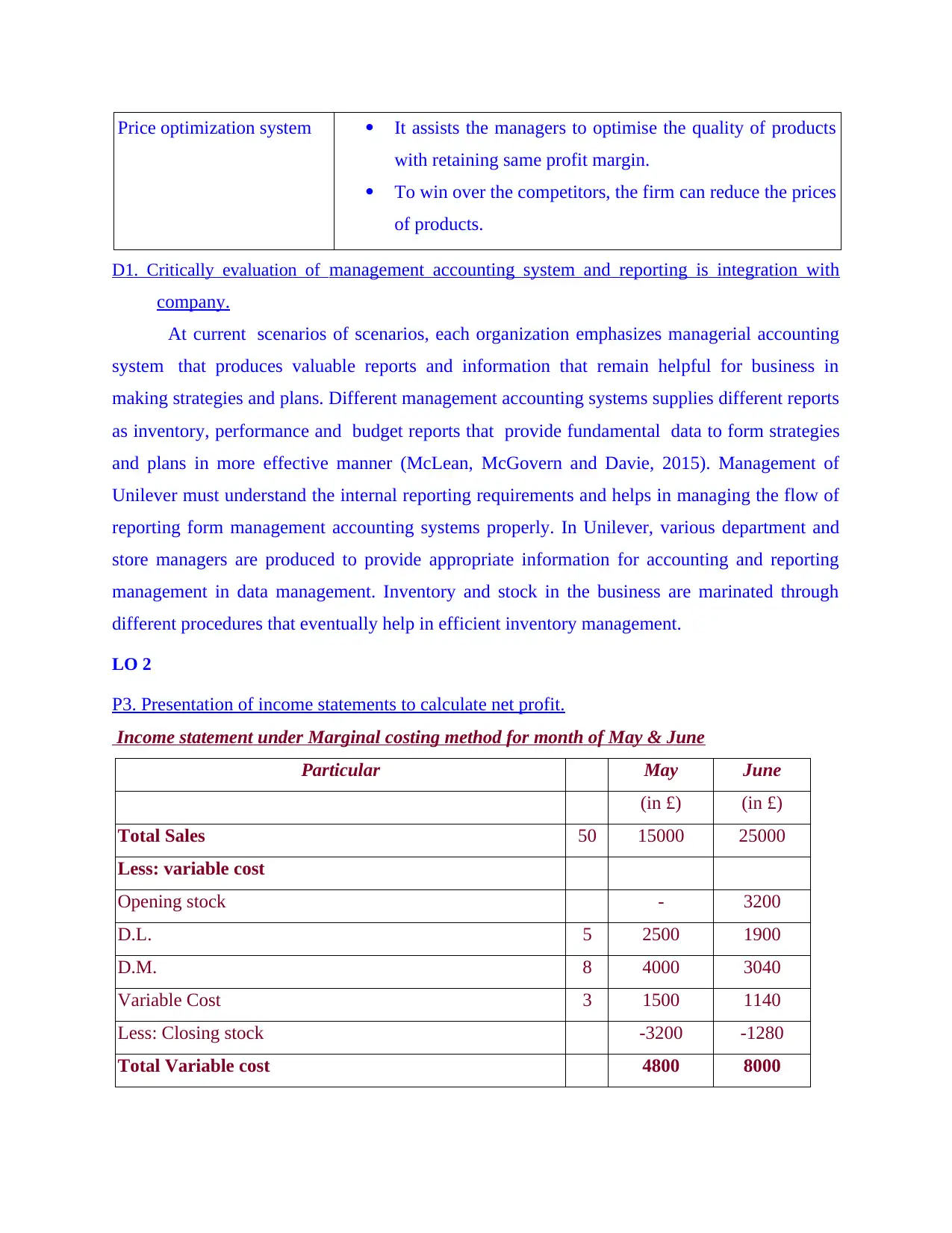

P3. Presentation of income statements to calculate net profit.

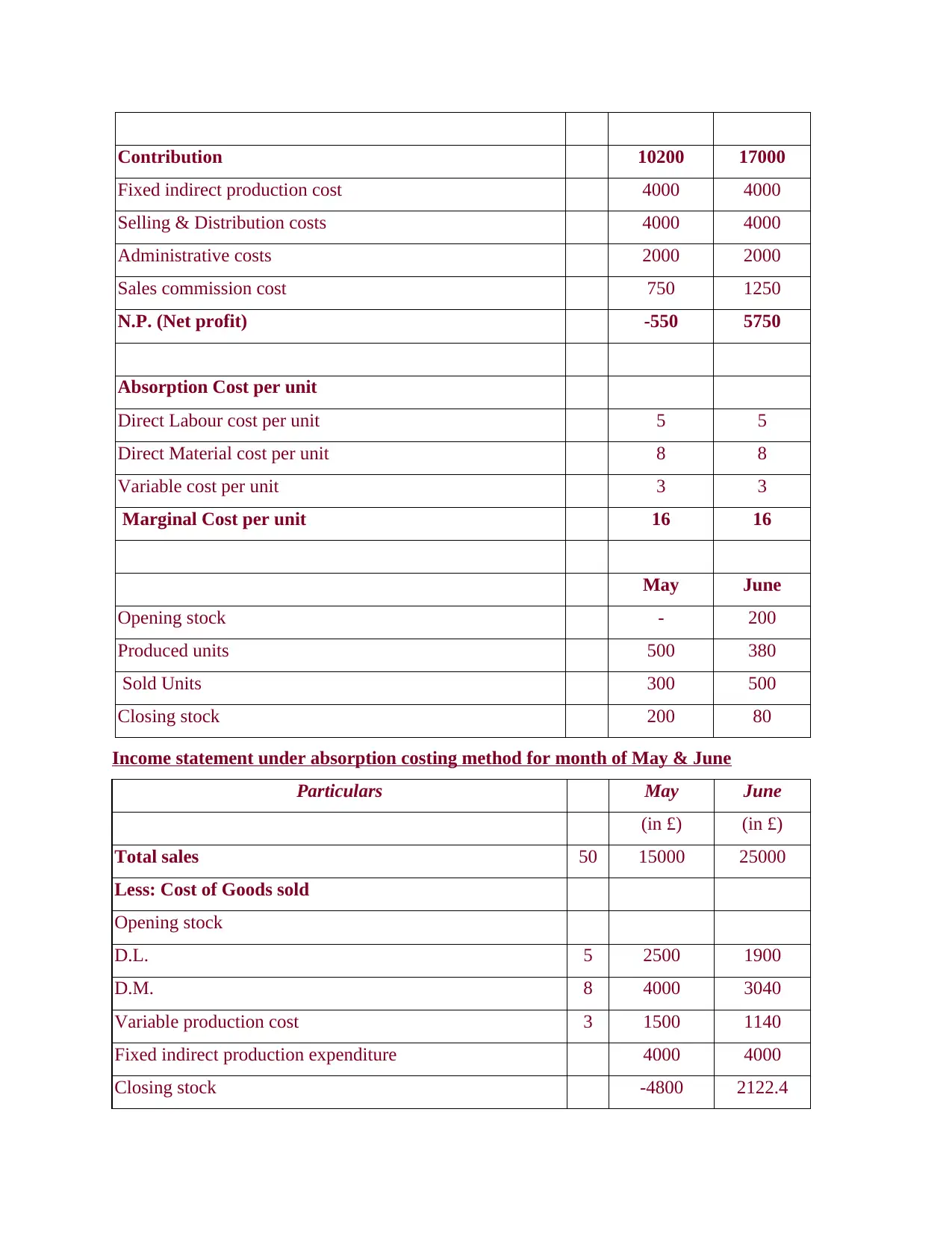

Income statement under Marginal costing method for month of May & June

Particular May June

(in £) (in £)

Total Sales 50 15000 25000

Less: variable cost

Opening stock - 3200

D.L. 5 2500 1900

D.M. 8 4000 3040

Variable Cost 3 1500 1140

Less: Closing stock -3200 -1280

Total Variable cost 4800 8000

with retaining same profit margin.

To win over the competitors, the firm can reduce the prices

of products.

D1. Critically evaluation of management accounting system and reporting is integration with

company.

At current scenarios of scenarios, each organization emphasizes managerial accounting

system that produces valuable reports and information that remain helpful for business in

making strategies and plans. Different management accounting systems supplies different reports

as inventory, performance and budget reports that provide fundamental data to form strategies

and plans in more effective manner (McLean, McGovern and Davie, 2015). Management of

Unilever must understand the internal reporting requirements and helps in managing the flow of

reporting form management accounting systems properly. In Unilever, various department and

store managers are produced to provide appropriate information for accounting and reporting

management in data management. Inventory and stock in the business are marinated through

different procedures that eventually help in efficient inventory management.

LO 2

P3. Presentation of income statements to calculate net profit.

Income statement under Marginal costing method for month of May & June

Particular May June

(in £) (in £)

Total Sales 50 15000 25000

Less: variable cost

Opening stock - 3200

D.L. 5 2500 1900

D.M. 8 4000 3040

Variable Cost 3 1500 1140

Less: Closing stock -3200 -1280

Total Variable cost 4800 8000

Contribution 10200 17000

Fixed indirect production cost 4000 4000

Selling & Distribution costs 4000 4000

Administrative costs 2000 2000

Sales commission cost 750 1250

N.P. (Net profit) -550 5750

Absorption Cost per unit

Direct Labour cost per unit 5 5

Direct Material cost per unit 8 8

Variable cost per unit 3 3

Marginal Cost per unit 16 16

May June

Opening stock - 200

Produced units 500 380

Sold Units 300 500

Closing stock 200 80

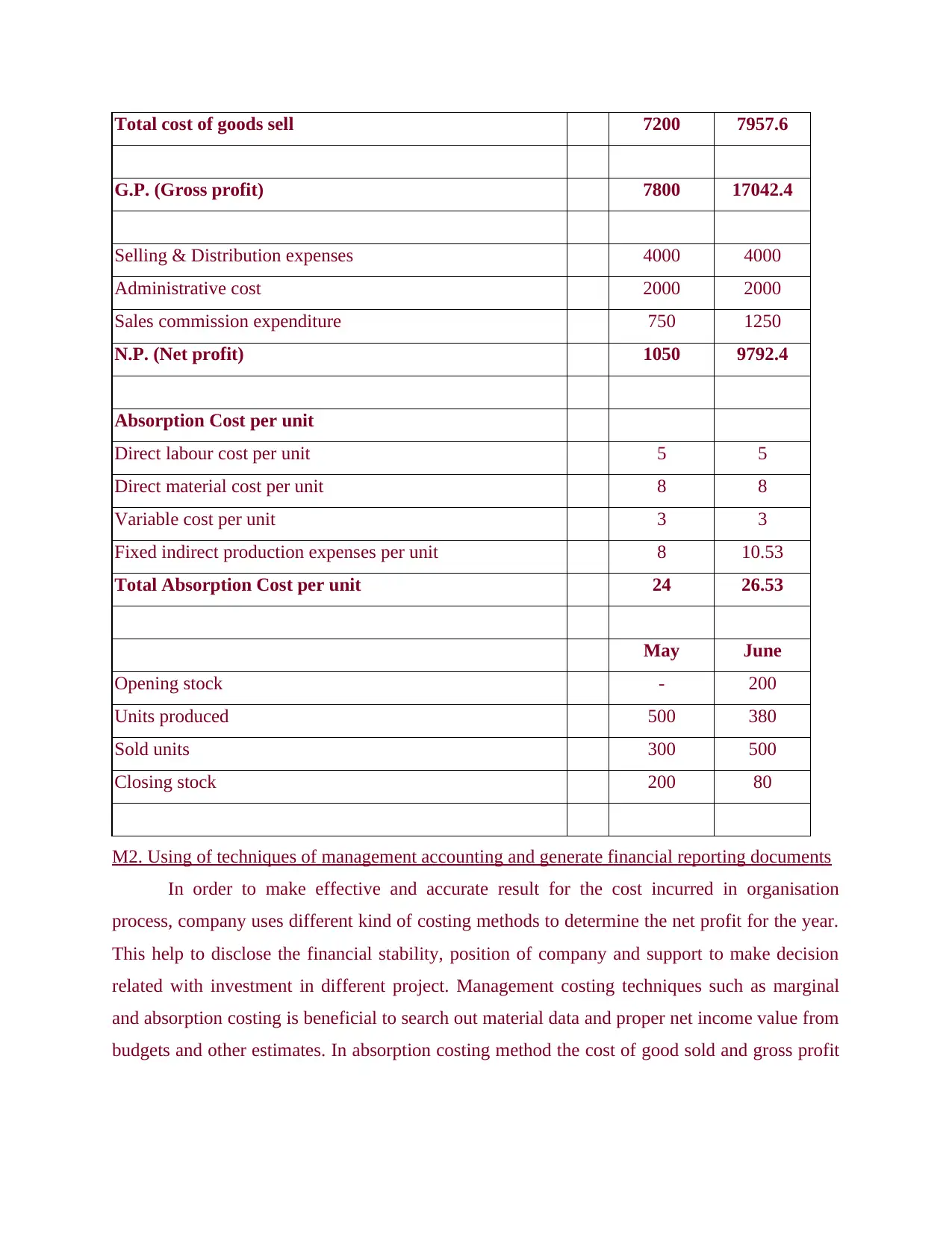

Income statement under absorption costing method for month of May & June

Particulars May June

(in £) (in £)

Total sales 50 15000 25000

Less: Cost of Goods sold

Opening stock

D.L. 5 2500 1900

D.M. 8 4000 3040

Variable production cost 3 1500 1140

Fixed indirect production expenditure 4000 4000

Closing stock -4800 2122.4

Fixed indirect production cost 4000 4000

Selling & Distribution costs 4000 4000

Administrative costs 2000 2000

Sales commission cost 750 1250

N.P. (Net profit) -550 5750

Absorption Cost per unit

Direct Labour cost per unit 5 5

Direct Material cost per unit 8 8

Variable cost per unit 3 3

Marginal Cost per unit 16 16

May June

Opening stock - 200

Produced units 500 380

Sold Units 300 500

Closing stock 200 80

Income statement under absorption costing method for month of May & June

Particulars May June

(in £) (in £)

Total sales 50 15000 25000

Less: Cost of Goods sold

Opening stock

D.L. 5 2500 1900

D.M. 8 4000 3040

Variable production cost 3 1500 1140

Fixed indirect production expenditure 4000 4000

Closing stock -4800 2122.4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total cost of goods sell 7200 7957.6

G.P. (Gross profit) 7800 17042.4

Selling & Distribution expenses 4000 4000

Administrative cost 2000 2000

Sales commission expenditure 750 1250

N.P. (Net profit) 1050 9792.4

Absorption Cost per unit

Direct labour cost per unit 5 5

Direct material cost per unit 8 8

Variable cost per unit 3 3

Fixed indirect production expenses per unit 8 10.53

Total Absorption Cost per unit 24 26.53

May June

Opening stock - 200

Units produced 500 380

Sold units 300 500

Closing stock 200 80

M2. Using of techniques of management accounting and generate financial reporting documents

In order to make effective and accurate result for the cost incurred in organisation

process, company uses different kind of costing methods to determine the net profit for the year.

This help to disclose the financial stability, position of company and support to make decision

related with investment in different project. Management costing techniques such as marginal

and absorption costing is beneficial to search out material data and proper net income value from

budgets and other estimates. In absorption costing method the cost of good sold and gross profit

G.P. (Gross profit) 7800 17042.4

Selling & Distribution expenses 4000 4000

Administrative cost 2000 2000

Sales commission expenditure 750 1250

N.P. (Net profit) 1050 9792.4

Absorption Cost per unit

Direct labour cost per unit 5 5

Direct material cost per unit 8 8

Variable cost per unit 3 3

Fixed indirect production expenses per unit 8 10.53

Total Absorption Cost per unit 24 26.53

May June

Opening stock - 200

Units produced 500 380

Sold units 300 500

Closing stock 200 80

M2. Using of techniques of management accounting and generate financial reporting documents

In order to make effective and accurate result for the cost incurred in organisation

process, company uses different kind of costing methods to determine the net profit for the year.

This help to disclose the financial stability, position of company and support to make decision

related with investment in different project. Management costing techniques such as marginal

and absorption costing is beneficial to search out material data and proper net income value from

budgets and other estimates. In absorption costing method the cost of good sold and gross profit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

is being calculated in order to fix the best price of product. With the help of marginal method net

income is being evaluated by considering fixed and variable cost.

D2. Financial reports prepared and data for a range of business activities

From the above income statements it has been identified that contribution for the may

10200 and June 17000 and net profit in these two month was (550) and 5750. By using

absorption costing the gross profit for the month of may is 7800 and 17042.2 and net profit in

may is equal to 1050 and in June it is 9792.2.

LO 3.

Use of planning tools used in management accounting

Budget: A comprehensive financial plan that is formulated by accountants by consulting

with managers for an accounting period. It encompasses planned liabilities, quantity of

resources, sales volumes, cash flows, revenues and many more. It reflects financial position of

any company in terms of future time period as well as acts as blue print or guider to direct

towards attaining financial objectives of any organisation. By analysing previous year budgets as

well as actual financial performances, current or future years budgets are formulated in effective

manner that indicates improvements along with modifications in the existing operations. In

reference to Unilever, financial professionals are responsible for the formulation of effective

budgetary statements and communicate the same to another departments or authorities with the

aim to implement strategies along with stated action plans (Thomas, 2016). Such budgetary

statements assists responsible authorities to solve issues in relevance to implementation of

planned strategies. It also helps in tracing revenues as well as another capital resources so that

further improvements can be made in achieving objectives along with financial position in the

competitive or dynamic international market.

Budgetary control: A controlling tool or system that is used to plan and control various

activities in order to get end results as per the budgeted statements is known as budgetary

control. It involves collecting, measuring, preparing reports, analysing as well as providing

feedbacks as per the budgetary performances. It is a technique that helps in managerial control

and is used by the managers of Unilever to evaluate performances of different departments in

context to budgeted goals. It is an ongoing process that is based on planning as well as

income is being evaluated by considering fixed and variable cost.

D2. Financial reports prepared and data for a range of business activities

From the above income statements it has been identified that contribution for the may

10200 and June 17000 and net profit in these two month was (550) and 5750. By using

absorption costing the gross profit for the month of may is 7800 and 17042.2 and net profit in

may is equal to 1050 and in June it is 9792.2.

LO 3.

Use of planning tools used in management accounting

Budget: A comprehensive financial plan that is formulated by accountants by consulting

with managers for an accounting period. It encompasses planned liabilities, quantity of

resources, sales volumes, cash flows, revenues and many more. It reflects financial position of

any company in terms of future time period as well as acts as blue print or guider to direct

towards attaining financial objectives of any organisation. By analysing previous year budgets as

well as actual financial performances, current or future years budgets are formulated in effective

manner that indicates improvements along with modifications in the existing operations. In

reference to Unilever, financial professionals are responsible for the formulation of effective

budgetary statements and communicate the same to another departments or authorities with the

aim to implement strategies along with stated action plans (Thomas, 2016). Such budgetary

statements assists responsible authorities to solve issues in relevance to implementation of

planned strategies. It also helps in tracing revenues as well as another capital resources so that

further improvements can be made in achieving objectives along with financial position in the

competitive or dynamic international market.

Budgetary control: A controlling tool or system that is used to plan and control various

activities in order to get end results as per the budgeted statements is known as budgetary

control. It involves collecting, measuring, preparing reports, analysing as well as providing

feedbacks as per the budgetary performances. It is a technique that helps in managerial control

and is used by the managers of Unilever to evaluate performances of different departments in

context to budgeted goals. It is an ongoing process that is based on planning as well as

coordinating various operations in order to get desired outcomes. The advantages along with

disadvantages of various planning are as follows:

Cash Budget: It is defined as the plan that is associated with receipts as well as

disbursements of cash in a financial period. It records transactions based on revenues collected,

loans payment and so on. It is prepared after sales, capital expenditures as well as purchase

activities by the accountants of Unilever. It helps in management of inflows as well as outflow of

cash and provides a brief picture related to the available cash as well as required cash to perfrom

daily operations in smooth ways.

Advantages: Such budget provides brief image of flow of cash during financial period. It

help managers of Unilever to manage all cash transactions in adequate manner in order to avoid

liquidity situations.

Disadvantages: Unilever also performs credit transactions and cash budget neglects credit

transactions due to which such budget does not provide fair image of profitability attained by

company.

Operating Budget

This is a useful scheduling instrument that provides a scheduled comprehensive

estimation of all expected revenue and spending over a given period based on projected revenues

or investment. It usually involves many post-budgets in Unilever, the most important of which is

the retail budget that is primed at first. This budget is prepared for short-term that only contains

regular or day to day expenses and cost. Capital expenditure of the organisation remain excluded

in terms of making operational budget.

Advantages: this budget helps in comprising the day to day income and expenditure of

business in very small structure.

Disadvantages: It contains lots of time duration that might lag the process of decision-

making and strategic planning.

Master budget

It is a concoction of different inter departmental budgets which finally leads to creation of

a master budget. It is a part of management's strategic vision for the future. Each and every facet

of operational areas of management are recorded in master budget. It helps in forecasting about

the future decisions and promulgating future strategic goals. Through a master budget an

organisation can develop accurate strategic intent for upcoming years to come. It helps in taking

disadvantages of various planning are as follows:

Cash Budget: It is defined as the plan that is associated with receipts as well as

disbursements of cash in a financial period. It records transactions based on revenues collected,

loans payment and so on. It is prepared after sales, capital expenditures as well as purchase

activities by the accountants of Unilever. It helps in management of inflows as well as outflow of

cash and provides a brief picture related to the available cash as well as required cash to perfrom

daily operations in smooth ways.

Advantages: Such budget provides brief image of flow of cash during financial period. It

help managers of Unilever to manage all cash transactions in adequate manner in order to avoid

liquidity situations.

Disadvantages: Unilever also performs credit transactions and cash budget neglects credit

transactions due to which such budget does not provide fair image of profitability attained by

company.

Operating Budget

This is a useful scheduling instrument that provides a scheduled comprehensive

estimation of all expected revenue and spending over a given period based on projected revenues

or investment. It usually involves many post-budgets in Unilever, the most important of which is

the retail budget that is primed at first. This budget is prepared for short-term that only contains

regular or day to day expenses and cost. Capital expenditure of the organisation remain excluded

in terms of making operational budget.

Advantages: this budget helps in comprising the day to day income and expenditure of

business in very small structure.

Disadvantages: It contains lots of time duration that might lag the process of decision-

making and strategic planning.

Master budget

It is a concoction of different inter departmental budgets which finally leads to creation of

a master budget. It is a part of management's strategic vision for the future. Each and every facet

of operational areas of management are recorded in master budget. It helps in forecasting about

the future decisions and promulgating future strategic goals. Through a master budget an

organisation can develop accurate strategic intent for upcoming years to come. It helps in taking

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.