Detailed Management Accounting Report for Swing Patrol

VerifiedAdded on 2019/12/18

|16

|4896

|222

Report

AI Summary

This report provides a detailed analysis of management accounting practices, focusing on the context of Swing Patrol, a small-scale dance class operating in the UK. The report begins with an introduction to management accounting, highlighting its importance in cost-related decision-making. It explores various management accounting systems, including cost accounting, job order costing, process costing, throughput accounting, inventory management, and price optimization systems, outlining their essential requirements and applications. The report further examines different methods used in management accounting reporting, such as budget reporting, accounts receivable aging, and job cost reports, discussing their significance in assessing firm performance and making informed business decisions. Additionally, the report delves into the benefits and drawbacks of different planning techniques and compares various management accounting systems, culminating in a conclusion that summarizes the key findings and insights. References are provided to support the analysis.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

P1. Explaining management accounting and essential requirements of different types of

management accounting systems.................................................................................................3

P2. Different methods used by the business firms for management accounting reporting.........5

TASK 2............................................................................................................................................7

P3. Calculation of net income with the help of marginal and absorption costing method..........7

TASK 3..........................................................................................................................................10

P4 Benefits and drawbacks of different kinds of planning techniques......................................10

P5 Comparing different management accounting systems........................................................14

CONCLUSION..............................................................................................................................14

REFERNCES.................................................................................................................................16

INTRODUCTION...........................................................................................................................3

P1. Explaining management accounting and essential requirements of different types of

management accounting systems.................................................................................................3

P2. Different methods used by the business firms for management accounting reporting.........5

TASK 2............................................................................................................................................7

P3. Calculation of net income with the help of marginal and absorption costing method..........7

TASK 3..........................................................................................................................................10

P4 Benefits and drawbacks of different kinds of planning techniques......................................10

P5 Comparing different management accounting systems........................................................14

CONCLUSION..............................................................................................................................14

REFERNCES.................................................................................................................................16

INTRODUCTION

Management accounting is the one of the important discipline that is used by the managers

to make cost related business decisions. In the current report, varied management accounting

systems are described in context of Swing patrol. Mentioned firm is operating a dance class in

the UK and comes in the category of small scale firm. In the report different management

reporting and planning tools are also discussed in detail. At end of the report, applications of

planning tools is revealed and comparison of different MAS is made.

P1. Systems of MA and their requiements

To

The General manager of Swing Patrol Date: 11/9/2017

Sub: Management accounting systems and their types

Management accounting is the one of the most important domain under which accounting

of cost is done and same is computed for varied product lines as well as deviation is same is

identified. There are number of advantage of management accounting for firms. Main merit of

management accounting is that it help management in tracking cost of project. Thus, by taking

action on time firm manage cost of its product. Main objective behind using management

accounting is to keep detail record of expenses that are incurred in the business and to take

relevant business decisions. Business firms aim at earning maximum amount of profit at any

cost. Numerous factor impede growth rate of revenue in the specific financial year. Cost is one of

the factors that affect the overall profitability of business firm. Thus, Swing Patrol aims at

reducing the cost of production and distribution as well as inventory storage so that stiff control

can be maintained on the overall cost that is beard by the business firm to produce goods at

workplace. Tracking of the cost is inevitable to maintain cost value up to certain level in business

(Burritt and et.,al., 2011). For this purpose, management accounting is used by the business

firms. Management accounting is the discipline under which cost is recorded and different

accounts are prepared to evaluate cost time to time. In this regard, some of the important tools

like variance analysis and budget are used by the business firms. In the variance analysis, actual

cost that is generated in the business of Swing Patrol is compared with the parameters and on

that basis, firm’s performance is accessed by the management accountant. Budget is another

important tool under which maximum limit is ascertained up to which business firm can make

Management accounting is the one of the important discipline that is used by the managers

to make cost related business decisions. In the current report, varied management accounting

systems are described in context of Swing patrol. Mentioned firm is operating a dance class in

the UK and comes in the category of small scale firm. In the report different management

reporting and planning tools are also discussed in detail. At end of the report, applications of

planning tools is revealed and comparison of different MAS is made.

P1. Systems of MA and their requiements

To

The General manager of Swing Patrol Date: 11/9/2017

Sub: Management accounting systems and their types

Management accounting is the one of the most important domain under which accounting

of cost is done and same is computed for varied product lines as well as deviation is same is

identified. There are number of advantage of management accounting for firms. Main merit of

management accounting is that it help management in tracking cost of project. Thus, by taking

action on time firm manage cost of its product. Main objective behind using management

accounting is to keep detail record of expenses that are incurred in the business and to take

relevant business decisions. Business firms aim at earning maximum amount of profit at any

cost. Numerous factor impede growth rate of revenue in the specific financial year. Cost is one of

the factors that affect the overall profitability of business firm. Thus, Swing Patrol aims at

reducing the cost of production and distribution as well as inventory storage so that stiff control

can be maintained on the overall cost that is beard by the business firm to produce goods at

workplace. Tracking of the cost is inevitable to maintain cost value up to certain level in business

(Burritt and et.,al., 2011). For this purpose, management accounting is used by the business

firms. Management accounting is the discipline under which cost is recorded and different

accounts are prepared to evaluate cost time to time. In this regard, some of the important tools

like variance analysis and budget are used by the business firms. In the variance analysis, actual

cost that is generated in the business of Swing Patrol is compared with the parameters and on

that basis, firm’s performance is accessed by the management accountant. Budget is another

important tool under which maximum limit is ascertained up to which business firm can make

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

expenditure in its business. Budget may be prepared on quarterly basis and to control cost on

monthly basis, follow up is done. In case it is estimated that determined level may be breached

then in that situation, in starting stage, corrective actions are taken by firm to control the cost

(Burritt and Schaltegger, 2010). In break-even analysis method, fixed and variable cost are taken

in to account along with the sales price. Thus, by using output of the break even analysis method

Swing Patrol is determining the extent to which it must produce units so that cost can be covered

and sufficient amount of profit can be earned in the business. It can be said that there are

multiple benefits of management accounting for the business firms. Management accounting

system refers to the way that is followed to record costs that are related to business. According to

business requirements varied cost accounting systerms are developed. Some of the essential

requirements of management accounting systems are given as below:

Cost accounting: Cost accounting management accounting system is used by the firms.

Under this accounting system all sort of expenses are recorded by the business firms. Cost

accounting is required to make estimation about the likely amount of expenses that can be made

by the business firm in the upcoming time period (Cuganesan, Dunford and Palmer, 2012). Thus,

projections are made about the cost on the basis of cost accounting system. Under mentioned

management accounting systems all sort of expenses are classified separately. Thus, it can be

said that clear division of cost is done in the management accounting system. Managers of the

most business firms use data that is recorded under mentioned system to make business

decisions. Example: Cost accounting is followed by Toyota because it is making single sort of

product in its business.

Job order: Job order is the other accounting system which is often used by the firms that

are producing multiple products. In many firms different sort of products are produced on the

basis of order that is place by the client. Under job order accounting system cost data related to

different product lines or batch is required to be prepared. On daily basis all expenditures that are

related to specific batch are recorded in the accounting system under separate document as per

requirements. Through mentioned accounting system one easily identify the product line whose

cost is very high or skyrocketing at fast pace. By developing suitable strategy cost can be

encapsulate up to specific limit by the managers. Job order is the costing system that is widely

used by the firms especially in the manufacturing sector. Those firms that are operating in the

service sector also use mentioned approach because they offered wide variety of services to the

monthly basis, follow up is done. In case it is estimated that determined level may be breached

then in that situation, in starting stage, corrective actions are taken by firm to control the cost

(Burritt and Schaltegger, 2010). In break-even analysis method, fixed and variable cost are taken

in to account along with the sales price. Thus, by using output of the break even analysis method

Swing Patrol is determining the extent to which it must produce units so that cost can be covered

and sufficient amount of profit can be earned in the business. It can be said that there are

multiple benefits of management accounting for the business firms. Management accounting

system refers to the way that is followed to record costs that are related to business. According to

business requirements varied cost accounting systerms are developed. Some of the essential

requirements of management accounting systems are given as below:

Cost accounting: Cost accounting management accounting system is used by the firms.

Under this accounting system all sort of expenses are recorded by the business firms. Cost

accounting is required to make estimation about the likely amount of expenses that can be made

by the business firm in the upcoming time period (Cuganesan, Dunford and Palmer, 2012). Thus,

projections are made about the cost on the basis of cost accounting system. Under mentioned

management accounting systems all sort of expenses are classified separately. Thus, it can be

said that clear division of cost is done in the management accounting system. Managers of the

most business firms use data that is recorded under mentioned system to make business

decisions. Example: Cost accounting is followed by Toyota because it is making single sort of

product in its business.

Job order: Job order is the other accounting system which is often used by the firms that

are producing multiple products. In many firms different sort of products are produced on the

basis of order that is place by the client. Under job order accounting system cost data related to

different product lines or batch is required to be prepared. On daily basis all expenditures that are

related to specific batch are recorded in the accounting system under separate document as per

requirements. Through mentioned accounting system one easily identify the product line whose

cost is very high or skyrocketing at fast pace. By developing suitable strategy cost can be

encapsulate up to specific limit by the managers. Job order is the costing system that is widely

used by the firms especially in the manufacturing sector. Those firms that are operating in the

service sector also use mentioned approach because they offered wide variety of services to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

customers and due to this reason it is very important to do costing separately of these product

lines so that an accurate overview can be obtained about cost of each product line individually.

FMCG firms like P&G are best example of mentioned costing system which prepare wide

variety of products and they use job order costing to keep record of costing of each product

separately.

Process costing: Process costing give better picture of the overall cost of production in

respect to the firms whose business operations are very complex (Cadez and Guilding, 2012). It

must be noted that in any business firm for producing specific product different stages are

performed. Cost of these stages of production is different from each other. In the process costing

approach data related to different stages of manufacturing is required to be gathered so that

managers can obtain an overview cost of each stage of production. This approach of recording of

expenses make process costing different from other management accounting systems. So, it can

be said that in order to record expenditures in process costing business firm require to employee

different employees for different stages of production. These employees will record relevant

data. Then gathered data will be compiled to compute overall cost of production. Glaxo Smith

Kline is the one of best example of firm which is using process costing at its manufacturing

plant.

Throughput accounting: It is the accounting system that is newly developed by an Israel

business man. Under this accounting system, main focus is on cost control in the business. In the

throughput accounting system, old one is converted in to modern accounting system. Stress is

laid down on the constraints that lead to elevation in cost (Morales and Lambert, 2013). On the

basis of calculation that is done in throughput accounting system, strategies are prepared that can

be followed to reduce the cost and for maximizing profit in business.

Inventory management system: Inventory management system is one under which

detailed record of inventory is maintained in respect to different products that are manufactured

by firm in its plant. Up to date record help firm is making prudent inventory purchase and

storage related decisions.

Price optimization system: It is a system under which information related to price and cost

that are related to specific products is maintained. By analyzing changes that happened in costs

of different items cost control decisions are made by the managers to optimize price of product.

lines so that an accurate overview can be obtained about cost of each product line individually.

FMCG firms like P&G are best example of mentioned costing system which prepare wide

variety of products and they use job order costing to keep record of costing of each product

separately.

Process costing: Process costing give better picture of the overall cost of production in

respect to the firms whose business operations are very complex (Cadez and Guilding, 2012). It

must be noted that in any business firm for producing specific product different stages are

performed. Cost of these stages of production is different from each other. In the process costing

approach data related to different stages of manufacturing is required to be gathered so that

managers can obtain an overview cost of each stage of production. This approach of recording of

expenses make process costing different from other management accounting systems. So, it can

be said that in order to record expenditures in process costing business firm require to employee

different employees for different stages of production. These employees will record relevant

data. Then gathered data will be compiled to compute overall cost of production. Glaxo Smith

Kline is the one of best example of firm which is using process costing at its manufacturing

plant.

Throughput accounting: It is the accounting system that is newly developed by an Israel

business man. Under this accounting system, main focus is on cost control in the business. In the

throughput accounting system, old one is converted in to modern accounting system. Stress is

laid down on the constraints that lead to elevation in cost (Morales and Lambert, 2013). On the

basis of calculation that is done in throughput accounting system, strategies are prepared that can

be followed to reduce the cost and for maximizing profit in business.

Inventory management system: Inventory management system is one under which

detailed record of inventory is maintained in respect to different products that are manufactured

by firm in its plant. Up to date record help firm is making prudent inventory purchase and

storage related decisions.

Price optimization system: It is a system under which information related to price and cost

that are related to specific products is maintained. By analyzing changes that happened in costs

of different items cost control decisions are made by the managers to optimize price of product.

P2. Different methods used by the business firms for management accounting reporting

In the management accounting, there are different tools and methods that are used for

analysis of data. On the application of these tools and methods, varied results are obtained and

same are reported in the reports that are prepared for the business managers. Some of the

important methods that are commonly used by firms for management accounting reporting are as

follows:

Budget reporting: Budget reporting is done by the managers of Swing Patrol to its top

managers. Budget reporting is used by all the firms that come in large, medium and small sized

category. Under this report, all expenditures that come in the category of fixed, variable and semi

variable, direct and indirect expenses are listed separately. Standard values for these expenditures

are recorded in the budget report and both standard and actual values are compared with each

other. On the basis of positive and negative variance, performance of the firm is accessed and it

is identified whether firm perform will well or not. In budget report, comments are given on the

expenditures separately with respect to enhancement or reduction in the value of same. In the

report, role that business environment plays in elevation of expenses in business is clearly

communicated to the top managers. Apart from this, inefficient performance of employees on job

is also considered as a reason for poor performance of business. It can be said that budget

reporting helps managers in identifying the area where they need to work in order to improve

firm’s performance (Richardson, 2012). By preparing strategy on right time further, erosion of

firm’s performance is prevented and same is brought on the growth track again.

Accounts receivable ageing: Accounts receivable refer to the debt amount that debtor has

to pay to business firm within specific time period. Cash management of Swing Patrol and

accounts receivable are closely interlinked to each other. There are many business firms that

generate more sale on credit basis in order to compete with rival firms in the market. Due to this

reason, less amount of cash is received in the business and huge fund remain blocked in the

unsold sales. In the account receivable reports, detailed information is made available about the

receivables that are related to different entities (Bouten and Hoozée, 2013). These receivables are

classified into different categories like bad debt and probable individuals in same category. On

the basis of relevant classification, managers come to know about the receivables on which they

seriously need to work and the extent to which they must give debt to any business firm so that

liquidity would not get reduced substantially in the business

In the management accounting, there are different tools and methods that are used for

analysis of data. On the application of these tools and methods, varied results are obtained and

same are reported in the reports that are prepared for the business managers. Some of the

important methods that are commonly used by firms for management accounting reporting are as

follows:

Budget reporting: Budget reporting is done by the managers of Swing Patrol to its top

managers. Budget reporting is used by all the firms that come in large, medium and small sized

category. Under this report, all expenditures that come in the category of fixed, variable and semi

variable, direct and indirect expenses are listed separately. Standard values for these expenditures

are recorded in the budget report and both standard and actual values are compared with each

other. On the basis of positive and negative variance, performance of the firm is accessed and it

is identified whether firm perform will well or not. In budget report, comments are given on the

expenditures separately with respect to enhancement or reduction in the value of same. In the

report, role that business environment plays in elevation of expenses in business is clearly

communicated to the top managers. Apart from this, inefficient performance of employees on job

is also considered as a reason for poor performance of business. It can be said that budget

reporting helps managers in identifying the area where they need to work in order to improve

firm’s performance (Richardson, 2012). By preparing strategy on right time further, erosion of

firm’s performance is prevented and same is brought on the growth track again.

Accounts receivable ageing: Accounts receivable refer to the debt amount that debtor has

to pay to business firm within specific time period. Cash management of Swing Patrol and

accounts receivable are closely interlinked to each other. There are many business firms that

generate more sale on credit basis in order to compete with rival firms in the market. Due to this

reason, less amount of cash is received in the business and huge fund remain blocked in the

unsold sales. In the account receivable reports, detailed information is made available about the

receivables that are related to different entities (Bouten and Hoozée, 2013). These receivables are

classified into different categories like bad debt and probable individuals in same category. On

the basis of relevant classification, managers come to know about the receivables on which they

seriously need to work and the extent to which they must give debt to any business firm so that

liquidity would not get reduced substantially in the business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job cost report: In the mentioned report cost of different product lines is mentioned.

Through review of the job cost, report managers come to know about the cost that is incurred in

different product lines by business firm. On the basis of evaluation of facts and figures, managers

come to know about the product lines whose cost is so high. They also come to know about the

return that is made on specific product line whose cost is so high. Thus, by comparing the cost

and return profile of product line, managers make business decisions. It can be said that there is

high significance of the job cost report for managers. Better decisions are made by the managers

with respect to whether further investment must be made on the specific product line or not. It

can be said that job cost report has high importance for the business firms.

Inventory and manufacturing: Inventory and manufacturing reports are prepared on large

scale by Swing Patrol and under this, in the report inventory that is in the warehouse is reported.

Past year inventory figures are compared with the current year’s values in order to access firm’s

performance and efficiency as well as accuracy of business decisions. Comments are made in the

report about reasons due to which excessive inventory is observed in the warehouse and amount

of money that is blocked in the unsold goods of business (Papaspyropoulos and et.al., 2012). It

can be said that inventory report helps managers in formulating a strategy that can be followed to

improve the cash management in business. Value of inventory that remains in the business is

taken into consideration in order to determine the number of units that must be further produced

so that demand can be met on time and less elevation will be observed in the inventory value. It

can be said that there is due importance of inventory and manufacturing report for the business

firm. Mentioned reports must be taken into account to make the business decisions.

.

TASK 2

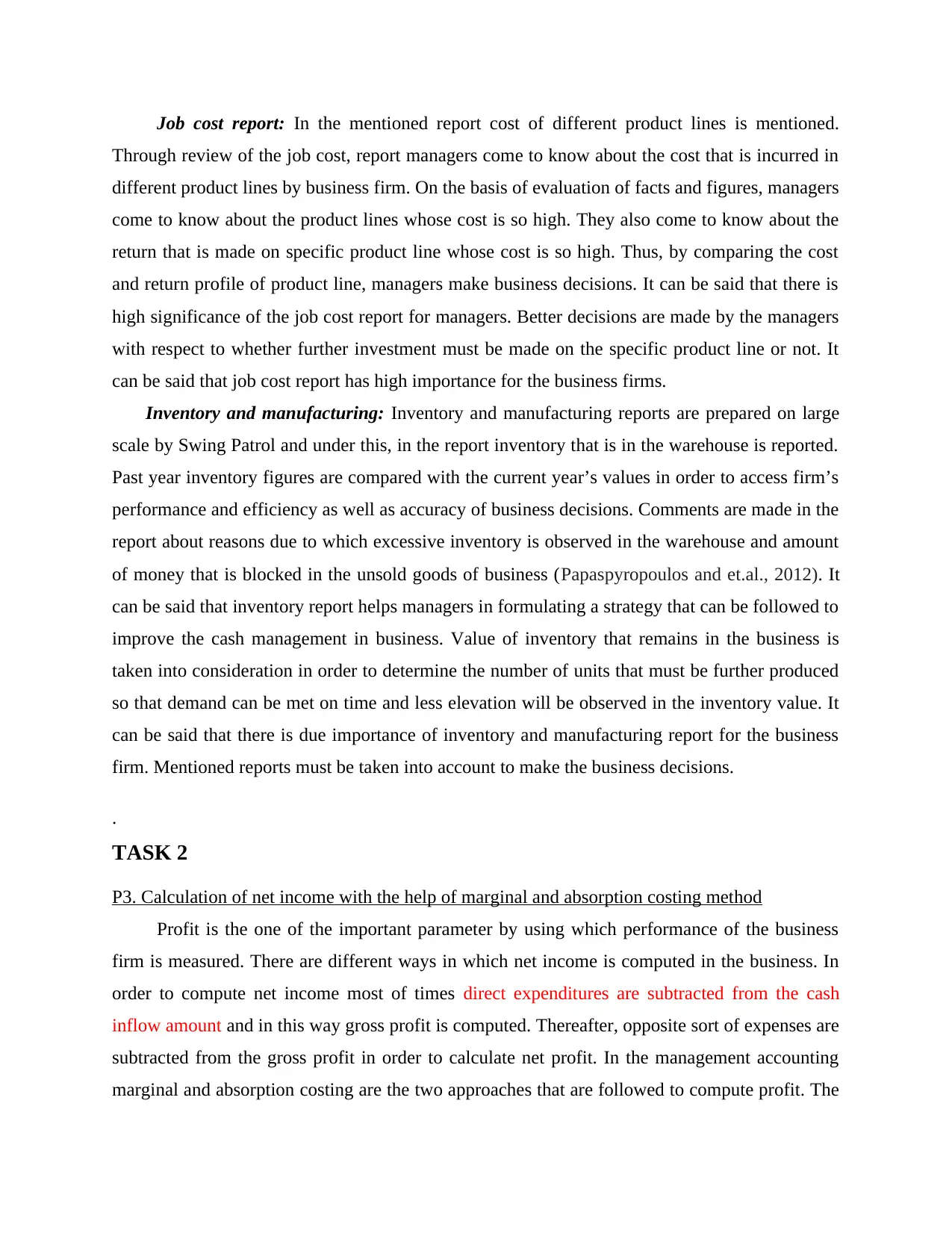

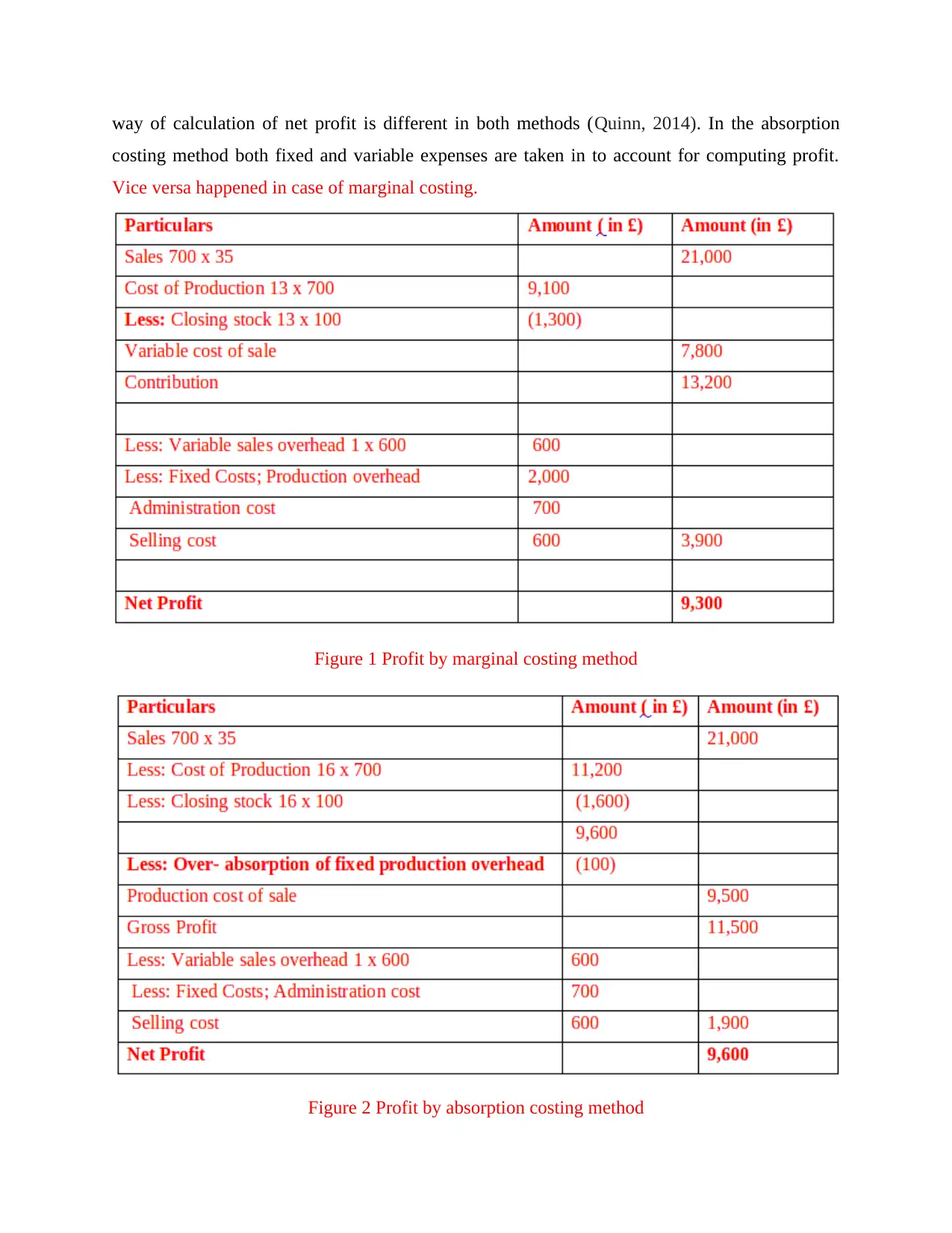

P3. Calculation of net income with the help of marginal and absorption costing method

Profit is the one of the important parameter by using which performance of the business

firm is measured. There are different ways in which net income is computed in the business. In

order to compute net income most of times direct expenditures are subtracted from the cash

inflow amount and in this way gross profit is computed. Thereafter, opposite sort of expenses are

subtracted from the gross profit in order to calculate net profit. In the management accounting

marginal and absorption costing are the two approaches that are followed to compute profit. The

Through review of the job cost, report managers come to know about the cost that is incurred in

different product lines by business firm. On the basis of evaluation of facts and figures, managers

come to know about the product lines whose cost is so high. They also come to know about the

return that is made on specific product line whose cost is so high. Thus, by comparing the cost

and return profile of product line, managers make business decisions. It can be said that there is

high significance of the job cost report for managers. Better decisions are made by the managers

with respect to whether further investment must be made on the specific product line or not. It

can be said that job cost report has high importance for the business firms.

Inventory and manufacturing: Inventory and manufacturing reports are prepared on large

scale by Swing Patrol and under this, in the report inventory that is in the warehouse is reported.

Past year inventory figures are compared with the current year’s values in order to access firm’s

performance and efficiency as well as accuracy of business decisions. Comments are made in the

report about reasons due to which excessive inventory is observed in the warehouse and amount

of money that is blocked in the unsold goods of business (Papaspyropoulos and et.al., 2012). It

can be said that inventory report helps managers in formulating a strategy that can be followed to

improve the cash management in business. Value of inventory that remains in the business is

taken into consideration in order to determine the number of units that must be further produced

so that demand can be met on time and less elevation will be observed in the inventory value. It

can be said that there is due importance of inventory and manufacturing report for the business

firm. Mentioned reports must be taken into account to make the business decisions.

.

TASK 2

P3. Calculation of net income with the help of marginal and absorption costing method

Profit is the one of the important parameter by using which performance of the business

firm is measured. There are different ways in which net income is computed in the business. In

order to compute net income most of times direct expenditures are subtracted from the cash

inflow amount and in this way gross profit is computed. Thereafter, opposite sort of expenses are

subtracted from the gross profit in order to calculate net profit. In the management accounting

marginal and absorption costing are the two approaches that are followed to compute profit. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

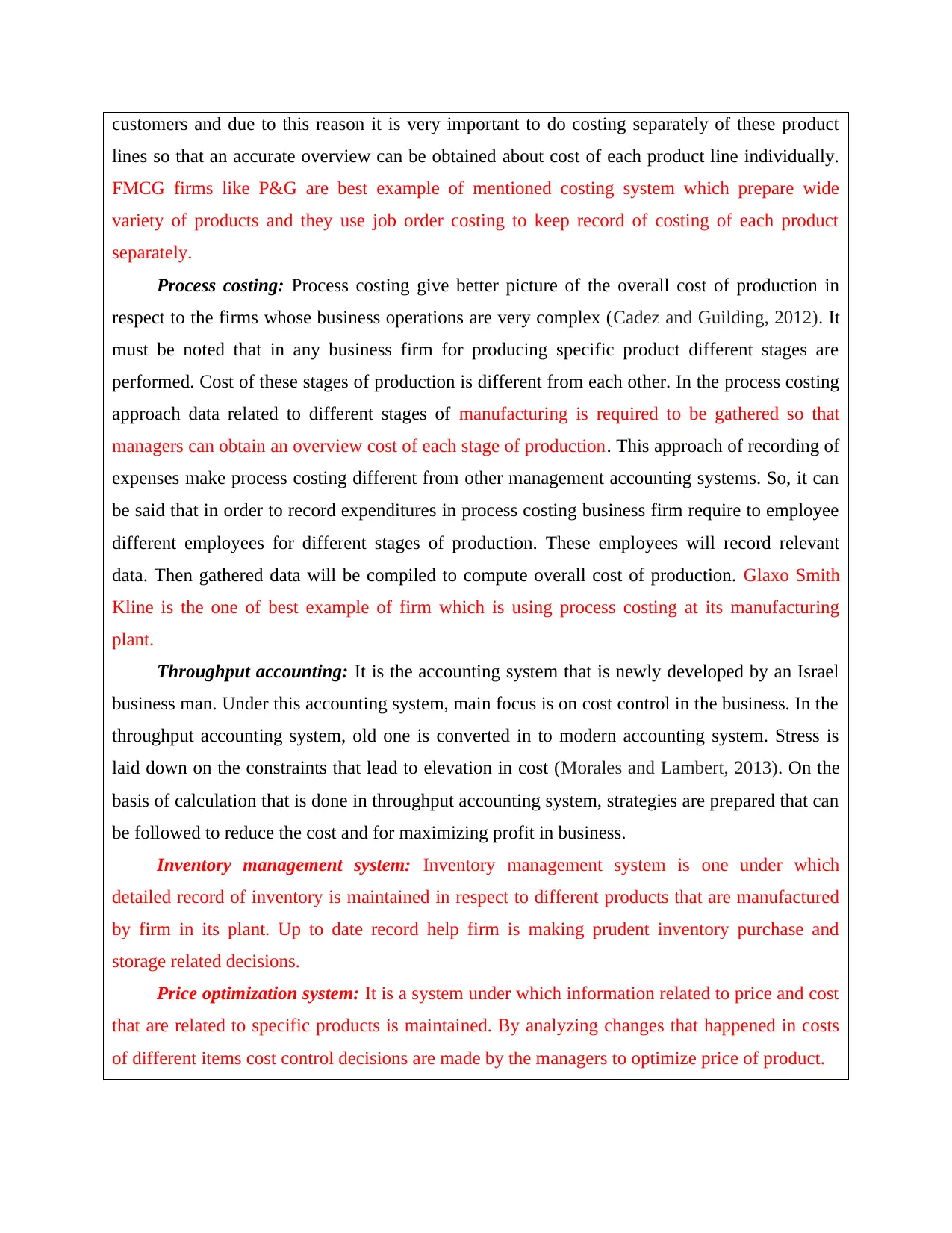

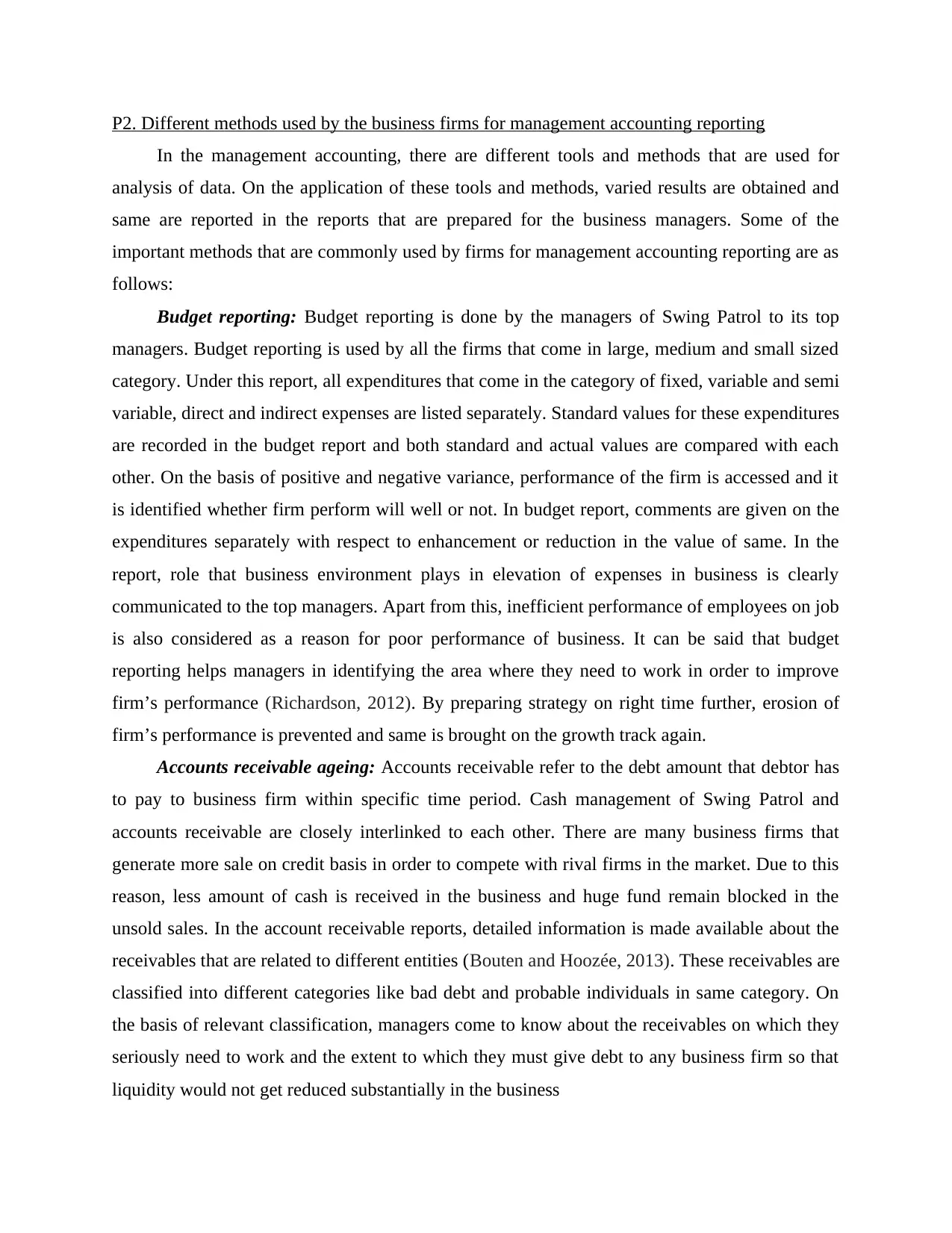

way of calculation of net profit is different in both methods (Quinn, 2014). In the absorption

costing method both fixed and variable expenses are taken in to account for computing profit.

Vice versa happened in case of marginal costing.

Figure 1 Profit by marginal costing method

Figure 2 Profit by absorption costing method

costing method both fixed and variable expenses are taken in to account for computing profit.

Vice versa happened in case of marginal costing.

Figure 1 Profit by marginal costing method

Figure 2 Profit by absorption costing method

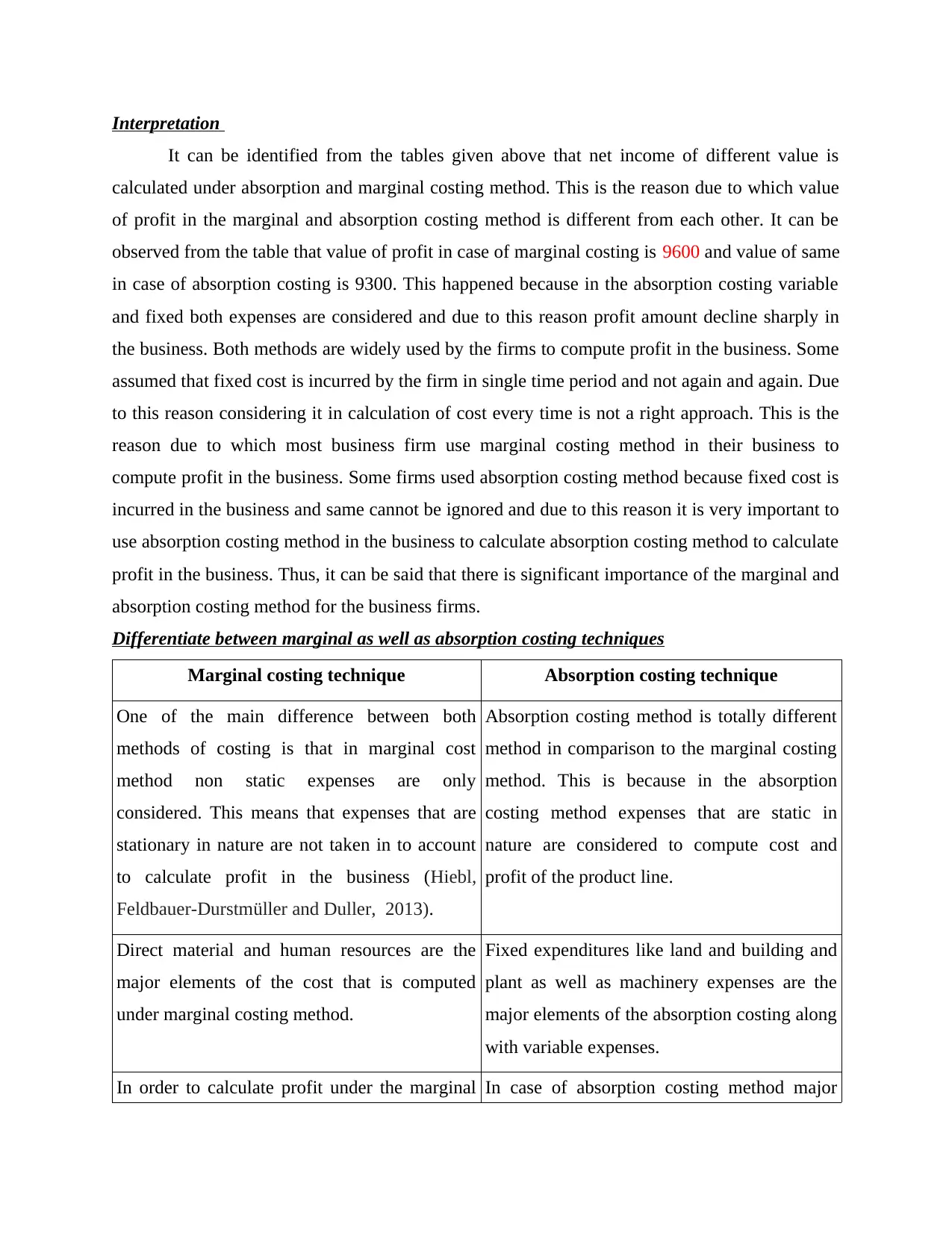

Interpretation

It can be identified from the tables given above that net income of different value is

calculated under absorption and marginal costing method. This is the reason due to which value

of profit in the marginal and absorption costing method is different from each other. It can be

observed from the table that value of profit in case of marginal costing is 9600 and value of same

in case of absorption costing is 9300. This happened because in the absorption costing variable

and fixed both expenses are considered and due to this reason profit amount decline sharply in

the business. Both methods are widely used by the firms to compute profit in the business. Some

assumed that fixed cost is incurred by the firm in single time period and not again and again. Due

to this reason considering it in calculation of cost every time is not a right approach. This is the

reason due to which most business firm use marginal costing method in their business to

compute profit in the business. Some firms used absorption costing method because fixed cost is

incurred in the business and same cannot be ignored and due to this reason it is very important to

use absorption costing method in the business to calculate absorption costing method to calculate

profit in the business. Thus, it can be said that there is significant importance of the marginal and

absorption costing method for the business firms.

Differentiate between marginal as well as absorption costing techniques

Marginal costing technique Absorption costing technique

One of the main difference between both

methods of costing is that in marginal cost

method non static expenses are only

considered. This means that expenses that are

stationary in nature are not taken in to account

to calculate profit in the business (Hiebl,

Feldbauer-Durstmüller and Duller, 2013).

Absorption costing method is totally different

method in comparison to the marginal costing

method. This is because in the absorption

costing method expenses that are static in

nature are considered to compute cost and

profit of the product line.

Direct material and human resources are the

major elements of the cost that is computed

under marginal costing method.

Fixed expenditures like land and building and

plant as well as machinery expenses are the

major elements of the absorption costing along

with variable expenses.

In order to calculate profit under the marginal In case of absorption costing method major

It can be identified from the tables given above that net income of different value is

calculated under absorption and marginal costing method. This is the reason due to which value

of profit in the marginal and absorption costing method is different from each other. It can be

observed from the table that value of profit in case of marginal costing is 9600 and value of same

in case of absorption costing is 9300. This happened because in the absorption costing variable

and fixed both expenses are considered and due to this reason profit amount decline sharply in

the business. Both methods are widely used by the firms to compute profit in the business. Some

assumed that fixed cost is incurred by the firm in single time period and not again and again. Due

to this reason considering it in calculation of cost every time is not a right approach. This is the

reason due to which most business firm use marginal costing method in their business to

compute profit in the business. Some firms used absorption costing method because fixed cost is

incurred in the business and same cannot be ignored and due to this reason it is very important to

use absorption costing method in the business to calculate absorption costing method to calculate

profit in the business. Thus, it can be said that there is significant importance of the marginal and

absorption costing method for the business firms.

Differentiate between marginal as well as absorption costing techniques

Marginal costing technique Absorption costing technique

One of the main difference between both

methods of costing is that in marginal cost

method non static expenses are only

considered. This means that expenses that are

stationary in nature are not taken in to account

to calculate profit in the business (Hiebl,

Feldbauer-Durstmüller and Duller, 2013).

Absorption costing method is totally different

method in comparison to the marginal costing

method. This is because in the absorption

costing method expenses that are static in

nature are considered to compute cost and

profit of the product line.

Direct material and human resources are the

major elements of the cost that is computed

under marginal costing method.

Fixed expenditures like land and building and

plant as well as machinery expenses are the

major elements of the absorption costing along

with variable expenses.

In order to calculate profit under the marginal In case of absorption costing method major

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

costing method profit volume ratio is take in to

consideration by the managers.

elements are variable expenses and fixed cost

like purchase of land and building.

Inventory that is valued in the last year is not

again recorded in the present year accounting

statements.

In case of the absorption costing method

opposite is done and last year stock value is

added in the present year financial statements.

TASK 3

P4 Benefits and drawbacks of different kinds of planning techniques

Planning in context of management accounting refers to the situation where specific

actions are determined that will be taken to handle specific situation. On other hand, budgetary

control refers to the situation in which standards and actual performance are compared with each

other to determine performance.

There are different type of planning tools that are used by the Swing Patrol in its business.

Some of the important planning tools are budget, project evaluation methods and ratio analysis.

There is a significance importance of these methods for the business firms (Malmi, 2010). Merits

and demerits of the mentioned methods are explained below.

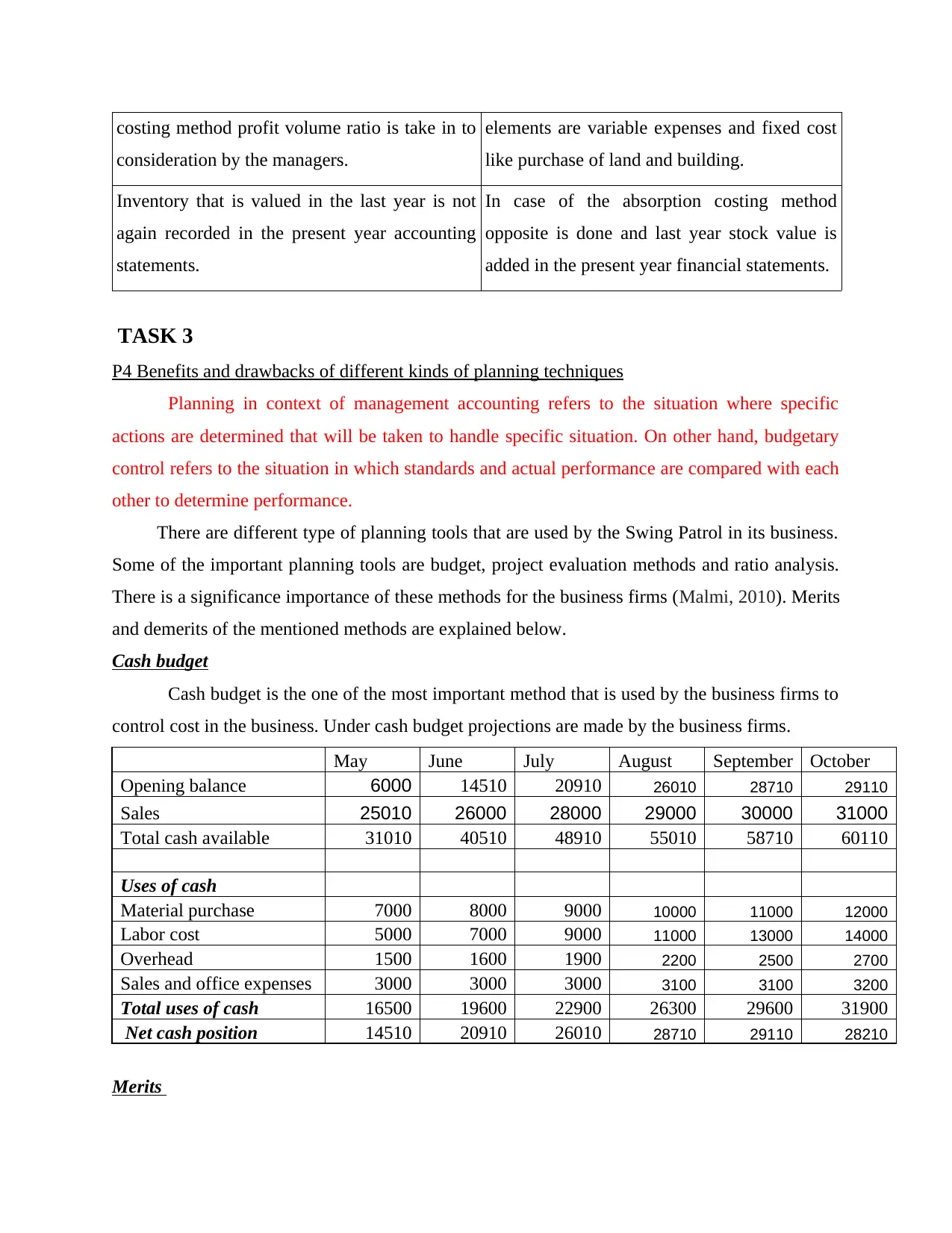

Cash budget

Cash budget is the one of the most important method that is used by the business firms to

control cost in the business. Under cash budget projections are made by the business firms.

May June July August September October

Opening balance 6000 14510 20910 26010 28710 29110

Sales 25010 26000 28000 29000 30000 31000

Total cash available 31010 40510 48910 55010 58710 60110

Uses of cash

Material purchase 7000 8000 9000 10000 11000 12000

Labor cost 5000 7000 9000 11000 13000 14000

Overhead 1500 1600 1900 2200 2500 2700

Sales and office expenses 3000 3000 3000 3100 3100 3200

Total uses of cash 16500 19600 22900 26300 29600 31900

Net cash position 14510 20910 26010 28710 29110 28210

Merits

consideration by the managers.

elements are variable expenses and fixed cost

like purchase of land and building.

Inventory that is valued in the last year is not

again recorded in the present year accounting

statements.

In case of the absorption costing method

opposite is done and last year stock value is

added in the present year financial statements.

TASK 3

P4 Benefits and drawbacks of different kinds of planning techniques

Planning in context of management accounting refers to the situation where specific

actions are determined that will be taken to handle specific situation. On other hand, budgetary

control refers to the situation in which standards and actual performance are compared with each

other to determine performance.

There are different type of planning tools that are used by the Swing Patrol in its business.

Some of the important planning tools are budget, project evaluation methods and ratio analysis.

There is a significance importance of these methods for the business firms (Malmi, 2010). Merits

and demerits of the mentioned methods are explained below.

Cash budget

Cash budget is the one of the most important method that is used by the business firms to

control cost in the business. Under cash budget projections are made by the business firms.

May June July August September October

Opening balance 6000 14510 20910 26010 28710 29110

Sales 25010 26000 28000 29000 30000 31000

Total cash available 31010 40510 48910 55010 58710 60110

Uses of cash

Material purchase 7000 8000 9000 10000 11000 12000

Labor cost 5000 7000 9000 11000 13000 14000

Overhead 1500 1600 1900 2200 2500 2700

Sales and office expenses 3000 3000 3000 3100 3100 3200

Total uses of cash 16500 19600 22900 26300 29600 31900

Net cash position 14510 20910 26010 28710 29110 28210

Merits

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

One of the main merit of the budget is that in this parameters are determined up to which

cost must be controlled in the business. Thus, there is a target in front of the managers

which they have to achieve at any cost for welfare of the organization. Budget ensured

that management will successfully maintain stiff control on the cost.

Budget motivate employees to work hard for benefit of the Swing patrol. As mentioned

above in the budget targets are set for the employees (Hopwood, Unerman. and Fries,

2010). They strive to achieve same and this thing motivate them to work hard. Thus, it

can be said that by using budget effective use of human resources can be made in the

business.

Budget ensured that resources will be effectively used in the business. Analysis of

business environment is done in order to make prediction about the variables of the

budget. Thus, according to estimation about the likely business conditions resources are

allocated effectively among varied business activities and by doing so effective use of

resources is done in the business.

Demerits

Main demerit of the budget is that it is very difficult to make prediction in the budget.

This is because it is very difficult to make prediction about the future time period. If

prediction is wrong then in that case wrong values will be determined in the budget (Cash

budgets, 2017). Thus, wrong decisions will be made on the basis of budget. This is the

major limitation of the budget.

In the budget in order to make prediction past year figures are taken in to account. It is

not necessary that past will repeat itself. Hence, if same thing will really happened then in

that case wrong prediction will be made in the budget and decisions made on the basis of

budget will also be wrong.

In case of budget it is observed that business firms does not have skilled employees.

Relevant employees make wrong prediction and there is a very high probability of

happening of same. Thus, if wrong estimation will be made then wrong decisions can be

taken on the basis of budget.

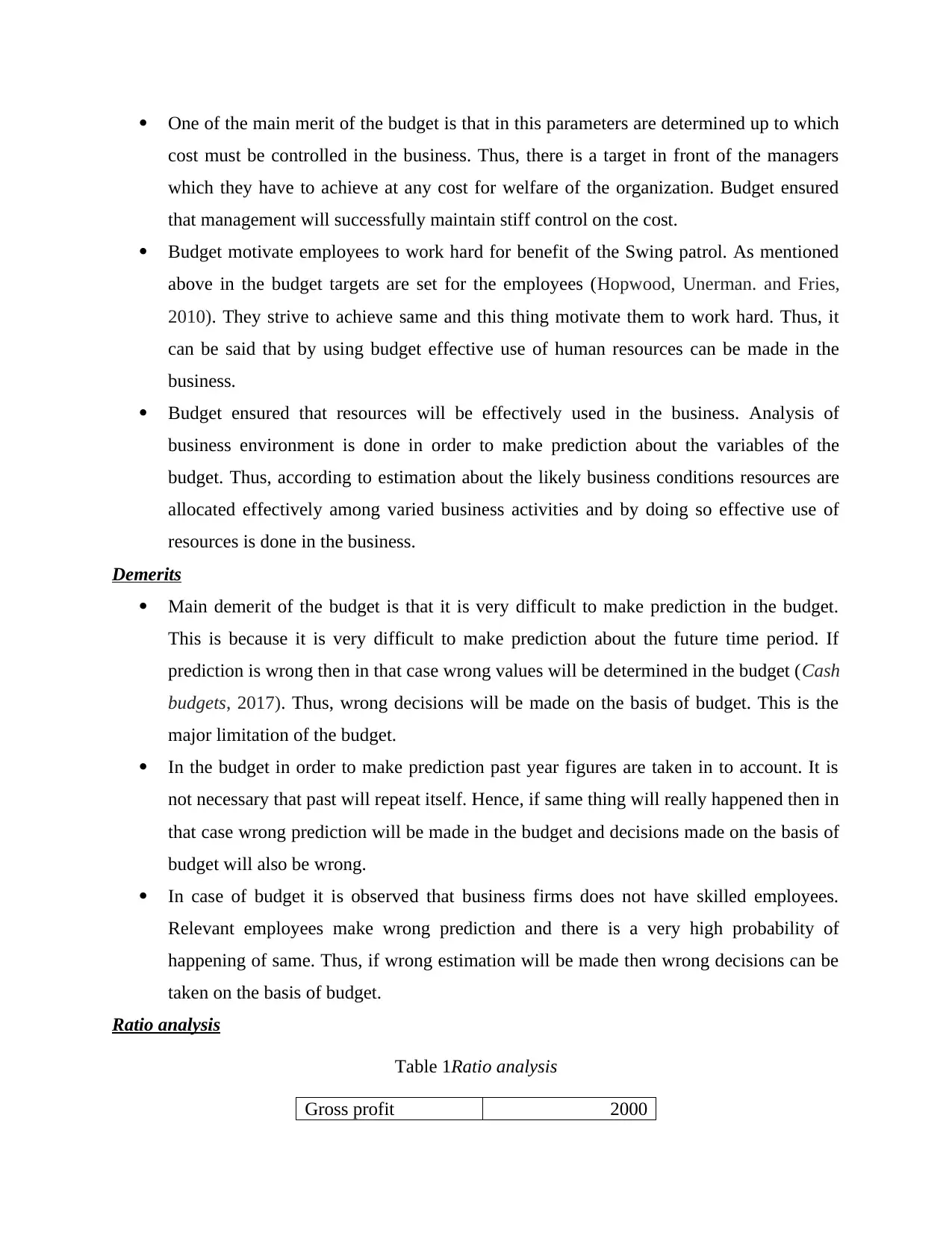

Ratio analysis

Table 1Ratio analysis

Gross profit 2000

cost must be controlled in the business. Thus, there is a target in front of the managers

which they have to achieve at any cost for welfare of the organization. Budget ensured

that management will successfully maintain stiff control on the cost.

Budget motivate employees to work hard for benefit of the Swing patrol. As mentioned

above in the budget targets are set for the employees (Hopwood, Unerman. and Fries,

2010). They strive to achieve same and this thing motivate them to work hard. Thus, it

can be said that by using budget effective use of human resources can be made in the

business.

Budget ensured that resources will be effectively used in the business. Analysis of

business environment is done in order to make prediction about the variables of the

budget. Thus, according to estimation about the likely business conditions resources are

allocated effectively among varied business activities and by doing so effective use of

resources is done in the business.

Demerits

Main demerit of the budget is that it is very difficult to make prediction in the budget.

This is because it is very difficult to make prediction about the future time period. If

prediction is wrong then in that case wrong values will be determined in the budget (Cash

budgets, 2017). Thus, wrong decisions will be made on the basis of budget. This is the

major limitation of the budget.

In the budget in order to make prediction past year figures are taken in to account. It is

not necessary that past will repeat itself. Hence, if same thing will really happened then in

that case wrong prediction will be made in the budget and decisions made on the basis of

budget will also be wrong.

In case of budget it is observed that business firms does not have skilled employees.

Relevant employees make wrong prediction and there is a very high probability of

happening of same. Thus, if wrong estimation will be made then wrong decisions can be

taken on the basis of budget.

Ratio analysis

Table 1Ratio analysis

Gross profit 2000

Sales revenue 25000

Gross profit ratio 8.00%

Net profit 1000

Sales revenue 25000

Net profit ratio 4.00%

Current assets 2000

Current liability 4000

Current ratio 0.50

Total assets 7000

Sales 25000

Total assets turnover

ratio 0.28

Debt 4000

Equity 2000

Debt equity ratio 2.00

Merits

There are some merits of the ratio analysis and evaluation of the firm performance is one

of them. By determining target percentage of gross and net profit sales and expenses

amount in budget can be determined and in this way budgetary control can be performed

in the organization. There are different ways in which performance of the Swing patrol

can be measured and ratio analysis is one of them. By using ratio analysis performance of

the business firm can be measured easily.

Ratio analysis is the technique that can be used by any person. There are not complex

process that one need to follow in order to do calculation (Merchant, 2012). Thus, easy to

use feature of the ratio analysis is the one of the major strong point of this method.

Risk management strategy in respect to budget can be prepared on time by using ratio

analysis method. Current ratio reflects the liquidity position of the business firm. If

current ratio is below 1:1 there is alarming signal for the firm that its liquidity position is

not good. Accordingly firm can determine value of short term loan in its relevant budget.

Thus, it can be said that ratio analysis help in budgetary control. In such situation by

taking actions immediately firm can prevent itself from facing problem of liquidity

crunch.

Demerits

Gross profit ratio 8.00%

Net profit 1000

Sales revenue 25000

Net profit ratio 4.00%

Current assets 2000

Current liability 4000

Current ratio 0.50

Total assets 7000

Sales 25000

Total assets turnover

ratio 0.28

Debt 4000

Equity 2000

Debt equity ratio 2.00

Merits

There are some merits of the ratio analysis and evaluation of the firm performance is one

of them. By determining target percentage of gross and net profit sales and expenses

amount in budget can be determined and in this way budgetary control can be performed

in the organization. There are different ways in which performance of the Swing patrol

can be measured and ratio analysis is one of them. By using ratio analysis performance of

the business firm can be measured easily.

Ratio analysis is the technique that can be used by any person. There are not complex

process that one need to follow in order to do calculation (Merchant, 2012). Thus, easy to

use feature of the ratio analysis is the one of the major strong point of this method.

Risk management strategy in respect to budget can be prepared on time by using ratio

analysis method. Current ratio reflects the liquidity position of the business firm. If

current ratio is below 1:1 there is alarming signal for the firm that its liquidity position is

not good. Accordingly firm can determine value of short term loan in its relevant budget.

Thus, it can be said that ratio analysis help in budgetary control. In such situation by

taking actions immediately firm can prevent itself from facing problem of liquidity

crunch.

Demerits

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.