Financial Analysis: Management Accounting Report for Jupiter PLC

VerifiedAdded on 2020/12/09

|18

|5245

|210

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its application within the context of Jupiter PLC, a medium-sized manufacturing company. The report begins with an introduction to management accounting, defining its role in providing financial data to aid in managerial decision-making, planning, and control. It outlines different management accounting systems such as job costing, inventory management, cost accounting, and price optimization, detailing their functions and benefits. The report then explores various management accounting reporting methods, including budget reports, accounts receivable aging, and job cost reports. It evaluates the benefits and disadvantages of these systems, particularly within the context of Jupiter PLC. The report further examines the integration of management accounting systems and reporting with organizational processes, emphasizing their role in planning, goal setting, and performance measurement. Additionally, it delves into a range of management accounting techniques, including absorption costing and marginal costing, providing illustrative examples. Finally, the report addresses budgetary control, analyzing the advantages and disadvantages of different planning tools and their application in budget preparation and forecasting. The report concludes by assessing how management accounting can contribute to an organization's sustainable success by addressing financial problems and evaluating the effectiveness of planning tools. This report is an insightful resource for students studying finance and accounting, offering practical insights into the application of management accounting principles within a real-world business scenario.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Management accounting and different system ...........................................................................1

Different methods used for management accounting reporting ..................................................2

Benefits of management accounting system and its application to Jupiter PLC.........................3

Management accounting system and reporting are integrated with organization processes.......5

TASK 2............................................................................................................................................5

Range of management accounting techniques.............................................................................5

TASK 3............................................................................................................................................8

Advantages and disadvantages of different planning tools used in Budgetary control ..............8

Use of different planning tools and their application for preparing and forecasting budget.....10

TASK 4..........................................................................................................................................11

Management accounting systems for responding to financial problems...................................11

Management accounting can lead organization to sustainable success by responding to

financial problems ....................................................................................................................12

Evaluate planning tools for accounting to solve the financial problem to lead organization to

sustainable success ....................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Management accounting and different system ...........................................................................1

Different methods used for management accounting reporting ..................................................2

Benefits of management accounting system and its application to Jupiter PLC.........................3

Management accounting system and reporting are integrated with organization processes.......5

TASK 2............................................................................................................................................5

Range of management accounting techniques.............................................................................5

TASK 3............................................................................................................................................8

Advantages and disadvantages of different planning tools used in Budgetary control ..............8

Use of different planning tools and their application for preparing and forecasting budget.....10

TASK 4..........................................................................................................................................11

Management accounting systems for responding to financial problems...................................11

Management accounting can lead organization to sustainable success by responding to

financial problems ....................................................................................................................12

Evaluate planning tools for accounting to solve the financial problem to lead organization to

sustainable success ....................................................................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting utilizes provisions of accounting data in order to better inform

themselves before they make decision matters within their company that assists their

management and execution of control operation. The aim of management accounting is to

provide requirement of administration by existing relevant data, so that business conducted in an

effective manner. It deals with the forecast about the future(Kaplan and Atkinson, 2015). It

assists administration to take decision and to make plans for future instructions of action. The

objective of management accounting is to define accounting data to the administration. It helps

in administration in communicating the fiscal data about company. It aids administration in

coordinating the functions of the organization.

This case study is based on Jupiter PLC. It is medium sized manufacturing company This

report will explain meaning of management accounting and its different system. It will state

different methods used for management accounting reporting. It will evaluate benefits of

management accounting system and their application within organization. It will apply range of

management accounting techniques. Furthermore, report will explain advantages and

disadvantages of various types of planning tools utilized in budgetary control. It will analysis use

of different planning tools and their application for preparing and forecasting budgets.

TASK 1

Management accounting and different system

Management Accounting:

Management accounting is involvement with accounting data that is helpful to

management. It is the term utilized to draw accounting techniques, systems and methods that

with particular knowledge and skills help administration in its project of increasing profits and

reducing losses. It is the execution of accounting data in relation to develop policies to be

followed by direction and help it daily operations (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

The primary conception of management accounting are related to calculation and following

costs. It is job that includes partnering in management decisions making, devising planning and

execution management system and giving expertness in fiscal reporting and relation to help

administration in the data and apply of strategy of company.

Management accounting utilizes provisions of accounting data in order to better inform

themselves before they make decision matters within their company that assists their

management and execution of control operation. The aim of management accounting is to

provide requirement of administration by existing relevant data, so that business conducted in an

effective manner. It deals with the forecast about the future(Kaplan and Atkinson, 2015). It

assists administration to take decision and to make plans for future instructions of action. The

objective of management accounting is to define accounting data to the administration. It helps

in administration in communicating the fiscal data about company. It aids administration in

coordinating the functions of the organization.

This case study is based on Jupiter PLC. It is medium sized manufacturing company This

report will explain meaning of management accounting and its different system. It will state

different methods used for management accounting reporting. It will evaluate benefits of

management accounting system and their application within organization. It will apply range of

management accounting techniques. Furthermore, report will explain advantages and

disadvantages of various types of planning tools utilized in budgetary control. It will analysis use

of different planning tools and their application for preparing and forecasting budgets.

TASK 1

Management accounting and different system

Management Accounting:

Management accounting is involvement with accounting data that is helpful to

management. It is the term utilized to draw accounting techniques, systems and methods that

with particular knowledge and skills help administration in its project of increasing profits and

reducing losses. It is the execution of accounting data in relation to develop policies to be

followed by direction and help it daily operations (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

The primary conception of management accounting are related to calculation and following

costs. It is job that includes partnering in management decisions making, devising planning and

execution management system and giving expertness in fiscal reporting and relation to help

administration in the data and apply of strategy of company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Different type of management accounting system:

There are mainly four types of management accounting system that is job costing,

inventory management, cost accounting and price optimization use within in Jupiter PLC.

Job Costing: It is accounting that paths costs and revenues by job and allow standardized

reporting of profitability by job. Job costing helps in management accounting system that enable

numbers to be allotted to single items if expenditure and revenues. It measures all costs includes

in structure job or in the fabrication of products done in separate collection.

Cost accounting: It is procedure of recording, categorizing, evaluating and assigning

costs connected with process and then developing different courses of activity to control the

prices. This purpose is to advise the administration on way to optimize business practices and

procedures based on cost efficiency and capacity(Langfield-Smith and et.al., 2017).

Inventory management: Inventory is product and material that holds by company for

ultimate goal of resale. Inventory management is discipline mainly about particular shape and

placement of stocked with products. The scope of it involve balance among refilling lead time,

carrying costs of inventory and asset management. Company utilise LIFO and FIFO for

valuation of inventory in Jupiter PLC.

Different methods used for management accounting reporting

Management accounting reporting are prepared by organization to have information

about the various operation of the firm. This reports are prepared by management in which

information about the operating activities is included. There are various management accounting

reports that consist of : Budget report : These reports is prepared by management to have measure the

performance of organization on the basis of the budget prepared which consist of

estimated expenses and incomes which are compared with the budgeted expenses and

incomes. Budget reports provide information to management about the deviation in the

performance which affect the Jupiter PLC to take corrective action to improve the

performance of firm (Kaplan and Atkinson, 2015). Budget report is prepared by Jupiter

PLC to measure its performance to take necessary action ton improve its performance

and profitability.

2

There are mainly four types of management accounting system that is job costing,

inventory management, cost accounting and price optimization use within in Jupiter PLC.

Job Costing: It is accounting that paths costs and revenues by job and allow standardized

reporting of profitability by job. Job costing helps in management accounting system that enable

numbers to be allotted to single items if expenditure and revenues. It measures all costs includes

in structure job or in the fabrication of products done in separate collection.

Cost accounting: It is procedure of recording, categorizing, evaluating and assigning

costs connected with process and then developing different courses of activity to control the

prices. This purpose is to advise the administration on way to optimize business practices and

procedures based on cost efficiency and capacity(Langfield-Smith and et.al., 2017).

Inventory management: Inventory is product and material that holds by company for

ultimate goal of resale. Inventory management is discipline mainly about particular shape and

placement of stocked with products. The scope of it involve balance among refilling lead time,

carrying costs of inventory and asset management. Company utilise LIFO and FIFO for

valuation of inventory in Jupiter PLC.

Different methods used for management accounting reporting

Management accounting reporting are prepared by organization to have information

about the various operation of the firm. This reports are prepared by management in which

information about the operating activities is included. There are various management accounting

reports that consist of : Budget report : These reports is prepared by management to have measure the

performance of organization on the basis of the budget prepared which consist of

estimated expenses and incomes which are compared with the budgeted expenses and

incomes. Budget reports provide information to management about the deviation in the

performance which affect the Jupiter PLC to take corrective action to improve the

performance of firm (Kaplan and Atkinson, 2015). Budget report is prepared by Jupiter

PLC to measure its performance to take necessary action ton improve its performance

and profitability.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Account receivable aging : This report is prepared by management to have information

about its customers that have not paid the amount. This report helps in identifying the

bad debts of organization (Latan and et.al., 2018). Account receivable aging report

prepared by management assist in modifying the credit policy of Jupiter PLC. Account

receivable aging reports helps the Jupiter PLC in identifying which customers have not

paid the amount for its product.

Job cost report : It is a report prepared by management to allocate the cost of its product

to each job. This report estimates the cost of product to compare with the actual cost

incurred by organization (Managerial Accounting Reports , 2017). Job cost report assist

in controlling the cost of each job by measuring the variation in cost report. Jupiter PLC

use this reporting system to identify the cost of each job and helps in controlling expenses

to increase its profitability.

Benefits of management accounting system and its application to Jupiter PLC

Management accounting provide various advantages which helps the organization in

improving their performance and profitability (Wouters and Kirchberger, 2015). Benefits of

Management accounting system such as:

Benefit of cost accounting system

This system helps the Jupiter Plc in reducing the cost allocated to the products this

support firm in increasing their profitability by reducing expenses.

This system helps the Jupiter PLC in planning for future production to improve its

performance and profitability in the future to increase its market share.

Cost accounting system assist Jupiter PLC fixing price of its product to increase its

profitability and also helps in increasing efficiency of the firm to achieve its targeted

goals.

This system is helpful for Jupiter Plc as it helps in utilizing the resources in the efficient

way to reduce wastage and cost.

Disadvantages of Cost accounting system :

This system is expensive due to which many organizations are not able to afford the

system.

The result shown according to cost accounting system are different from financial result

thus this system does not provide accurate information.

3

about its customers that have not paid the amount. This report helps in identifying the

bad debts of organization (Latan and et.al., 2018). Account receivable aging report

prepared by management assist in modifying the credit policy of Jupiter PLC. Account

receivable aging reports helps the Jupiter PLC in identifying which customers have not

paid the amount for its product.

Job cost report : It is a report prepared by management to allocate the cost of its product

to each job. This report estimates the cost of product to compare with the actual cost

incurred by organization (Managerial Accounting Reports , 2017). Job cost report assist

in controlling the cost of each job by measuring the variation in cost report. Jupiter PLC

use this reporting system to identify the cost of each job and helps in controlling expenses

to increase its profitability.

Benefits of management accounting system and its application to Jupiter PLC

Management accounting provide various advantages which helps the organization in

improving their performance and profitability (Wouters and Kirchberger, 2015). Benefits of

Management accounting system such as:

Benefit of cost accounting system

This system helps the Jupiter Plc in reducing the cost allocated to the products this

support firm in increasing their profitability by reducing expenses.

This system helps the Jupiter PLC in planning for future production to improve its

performance and profitability in the future to increase its market share.

Cost accounting system assist Jupiter PLC fixing price of its product to increase its

profitability and also helps in increasing efficiency of the firm to achieve its targeted

goals.

This system is helpful for Jupiter Plc as it helps in utilizing the resources in the efficient

way to reduce wastage and cost.

Disadvantages of Cost accounting system :

This system is expensive due to which many organizations are not able to afford the

system.

The result shown according to cost accounting system are different from financial result

thus this system does not provide accurate information.

3

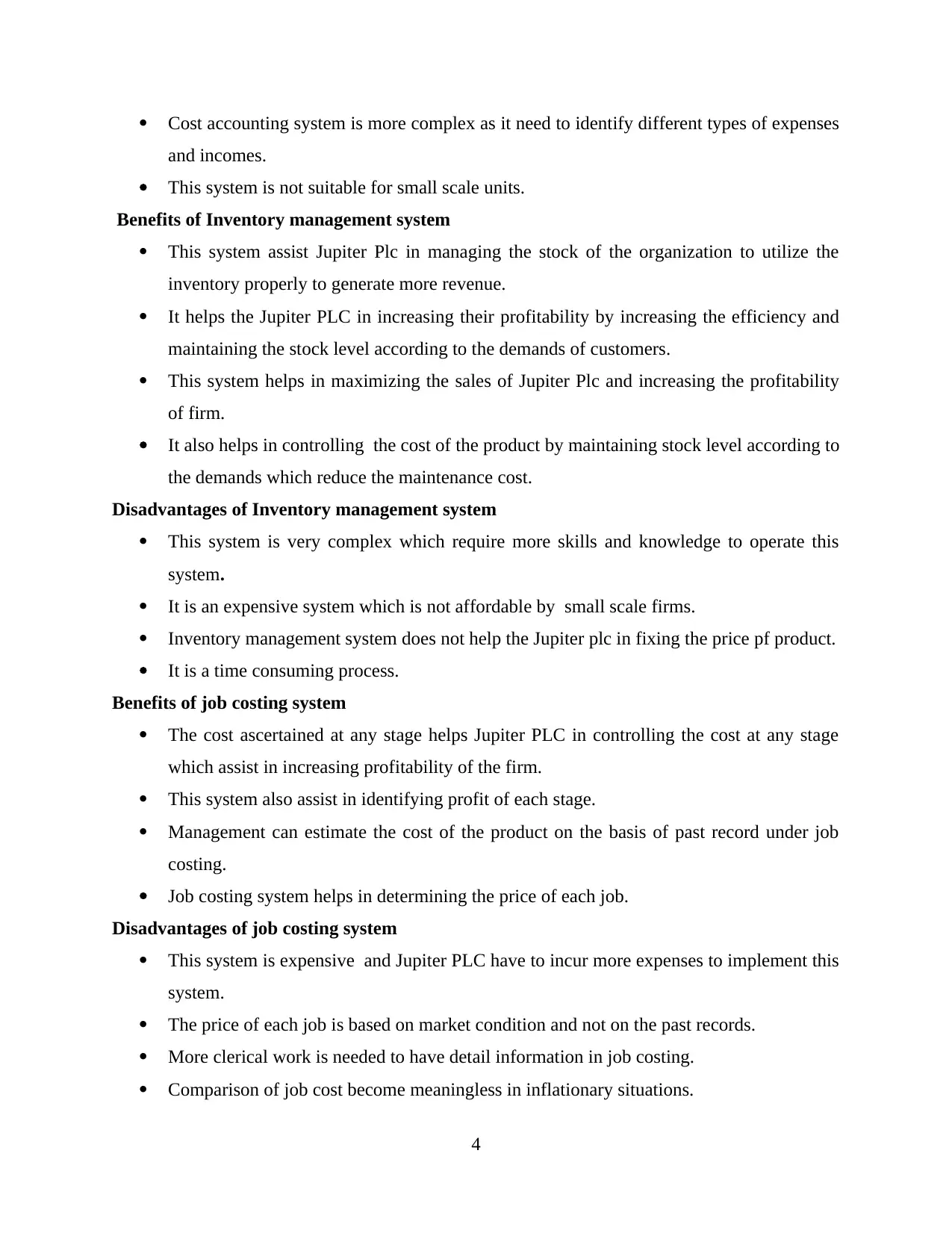

Cost accounting system is more complex as it need to identify different types of expenses

and incomes.

This system is not suitable for small scale units.

Benefits of Inventory management system

This system assist Jupiter Plc in managing the stock of the organization to utilize the

inventory properly to generate more revenue.

It helps the Jupiter PLC in increasing their profitability by increasing the efficiency and

maintaining the stock level according to the demands of customers.

This system helps in maximizing the sales of Jupiter Plc and increasing the profitability

of firm.

It also helps in controlling the cost of the product by maintaining stock level according to

the demands which reduce the maintenance cost.

Disadvantages of Inventory management system

This system is very complex which require more skills and knowledge to operate this

system.

It is an expensive system which is not affordable by small scale firms.

Inventory management system does not help the Jupiter plc in fixing the price pf product.

It is a time consuming process.

Benefits of job costing system

The cost ascertained at any stage helps Jupiter PLC in controlling the cost at any stage

which assist in increasing profitability of the firm.

This system also assist in identifying profit of each stage.

Management can estimate the cost of the product on the basis of past record under job

costing.

Job costing system helps in determining the price of each job.

Disadvantages of job costing system

This system is expensive and Jupiter PLC have to incur more expenses to implement this

system.

The price of each job is based on market condition and not on the past records.

More clerical work is needed to have detail information in job costing.

Comparison of job cost become meaningless in inflationary situations.

4

and incomes.

This system is not suitable for small scale units.

Benefits of Inventory management system

This system assist Jupiter Plc in managing the stock of the organization to utilize the

inventory properly to generate more revenue.

It helps the Jupiter PLC in increasing their profitability by increasing the efficiency and

maintaining the stock level according to the demands of customers.

This system helps in maximizing the sales of Jupiter Plc and increasing the profitability

of firm.

It also helps in controlling the cost of the product by maintaining stock level according to

the demands which reduce the maintenance cost.

Disadvantages of Inventory management system

This system is very complex which require more skills and knowledge to operate this

system.

It is an expensive system which is not affordable by small scale firms.

Inventory management system does not help the Jupiter plc in fixing the price pf product.

It is a time consuming process.

Benefits of job costing system

The cost ascertained at any stage helps Jupiter PLC in controlling the cost at any stage

which assist in increasing profitability of the firm.

This system also assist in identifying profit of each stage.

Management can estimate the cost of the product on the basis of past record under job

costing.

Job costing system helps in determining the price of each job.

Disadvantages of job costing system

This system is expensive and Jupiter PLC have to incur more expenses to implement this

system.

The price of each job is based on market condition and not on the past records.

More clerical work is needed to have detail information in job costing.

Comparison of job cost become meaningless in inflationary situations.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

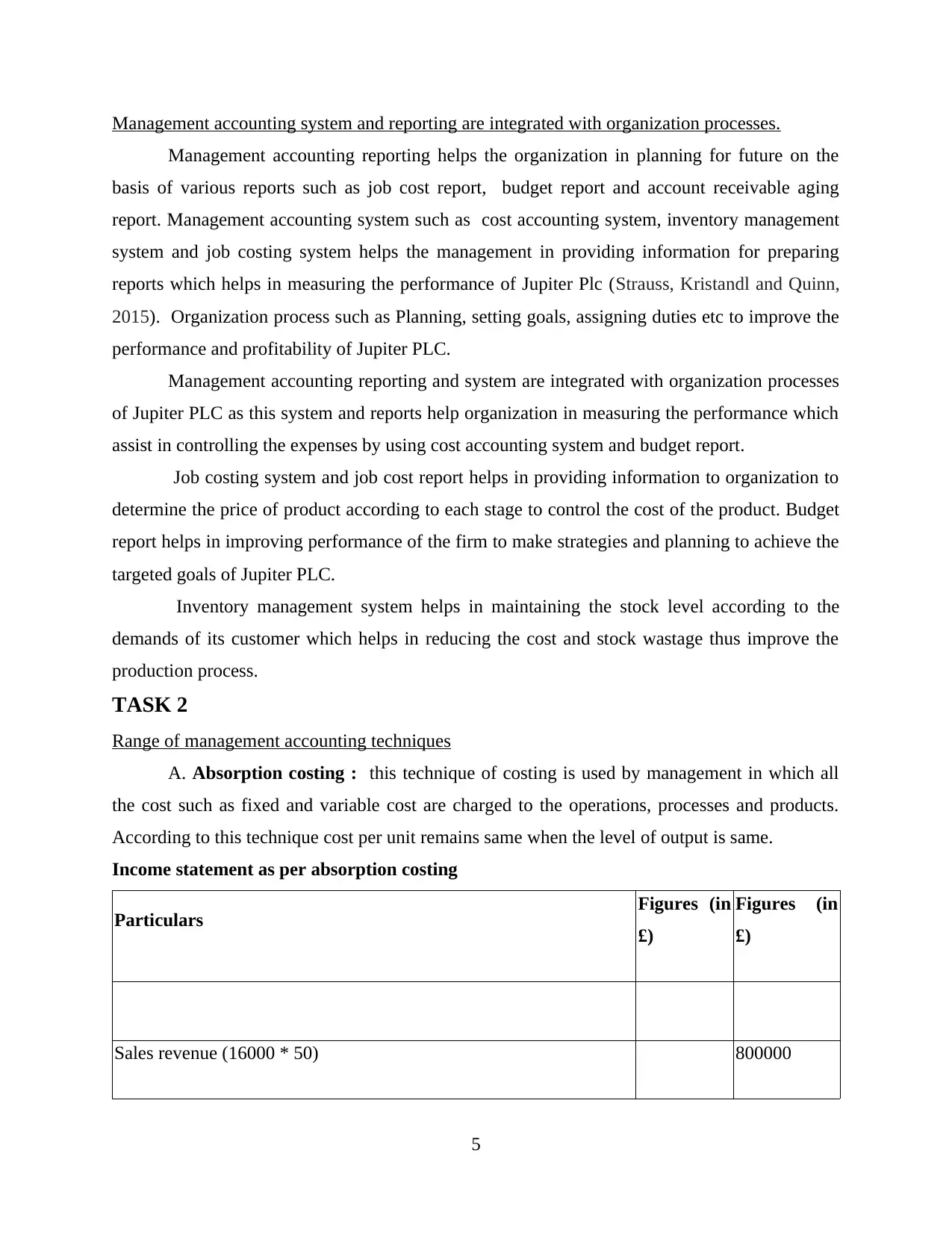

Management accounting system and reporting are integrated with organization processes.

Management accounting reporting helps the organization in planning for future on the

basis of various reports such as job cost report, budget report and account receivable aging

report. Management accounting system such as cost accounting system, inventory management

system and job costing system helps the management in providing information for preparing

reports which helps in measuring the performance of Jupiter Plc (Strauss, Kristandl and Quinn,

2015). Organization process such as Planning, setting goals, assigning duties etc to improve the

performance and profitability of Jupiter PLC.

Management accounting reporting and system are integrated with organization processes

of Jupiter PLC as this system and reports help organization in measuring the performance which

assist in controlling the expenses by using cost accounting system and budget report.

Job costing system and job cost report helps in providing information to organization to

determine the price of product according to each stage to control the cost of the product. Budget

report helps in improving performance of the firm to make strategies and planning to achieve the

targeted goals of Jupiter PLC.

Inventory management system helps in maintaining the stock level according to the

demands of its customer which helps in reducing the cost and stock wastage thus improve the

production process.

TASK 2

Range of management accounting techniques

A. Absorption costing : this technique of costing is used by management in which all

the cost such as fixed and variable cost are charged to the operations, processes and products.

According to this technique cost per unit remains same when the level of output is same.

Income statement as per absorption costing

Particulars Figures (in

£)

Figures (in

£)

Sales revenue (16000 * 50) 800000

5

Management accounting reporting helps the organization in planning for future on the

basis of various reports such as job cost report, budget report and account receivable aging

report. Management accounting system such as cost accounting system, inventory management

system and job costing system helps the management in providing information for preparing

reports which helps in measuring the performance of Jupiter Plc (Strauss, Kristandl and Quinn,

2015). Organization process such as Planning, setting goals, assigning duties etc to improve the

performance and profitability of Jupiter PLC.

Management accounting reporting and system are integrated with organization processes

of Jupiter PLC as this system and reports help organization in measuring the performance which

assist in controlling the expenses by using cost accounting system and budget report.

Job costing system and job cost report helps in providing information to organization to

determine the price of product according to each stage to control the cost of the product. Budget

report helps in improving performance of the firm to make strategies and planning to achieve the

targeted goals of Jupiter PLC.

Inventory management system helps in maintaining the stock level according to the

demands of its customer which helps in reducing the cost and stock wastage thus improve the

production process.

TASK 2

Range of management accounting techniques

A. Absorption costing : this technique of costing is used by management in which all

the cost such as fixed and variable cost are charged to the operations, processes and products.

According to this technique cost per unit remains same when the level of output is same.

Income statement as per absorption costing

Particulars Figures (in

£)

Figures (in

£)

Sales revenue (16000 * 50) 800000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

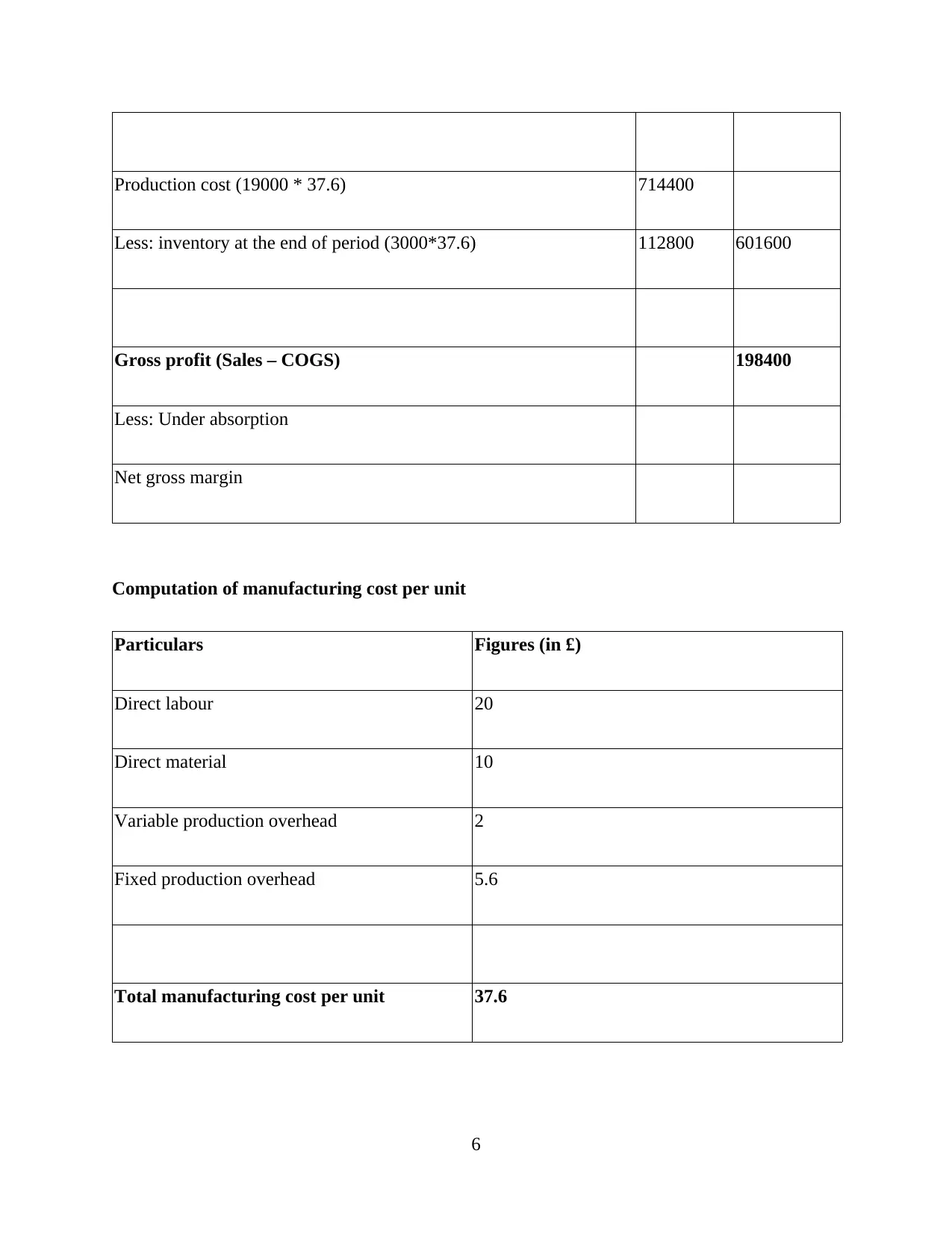

Production cost (19000 * 37.6) 714400

Less: inventory at the end of period (3000*37.6) 112800 601600

Gross profit (Sales – COGS) 198400

Less: Under absorption

Net gross margin

Computation of manufacturing cost per unit

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

6

Less: inventory at the end of period (3000*37.6) 112800 601600

Gross profit (Sales – COGS) 198400

Less: Under absorption

Net gross margin

Computation of manufacturing cost per unit

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

6

On the basis of above computation it can be interpreted that manufacturing cost per unit

as per absorption costing calculated by adding the direct labour, direct material, variable

production overhead and fixed production overhead which provided the result 37.6 as

manufacturing cost per unit. Also, gross profit according to the income statement as per

absorption costing is 198400 which is computed by subtracting cost of good sold by sales.

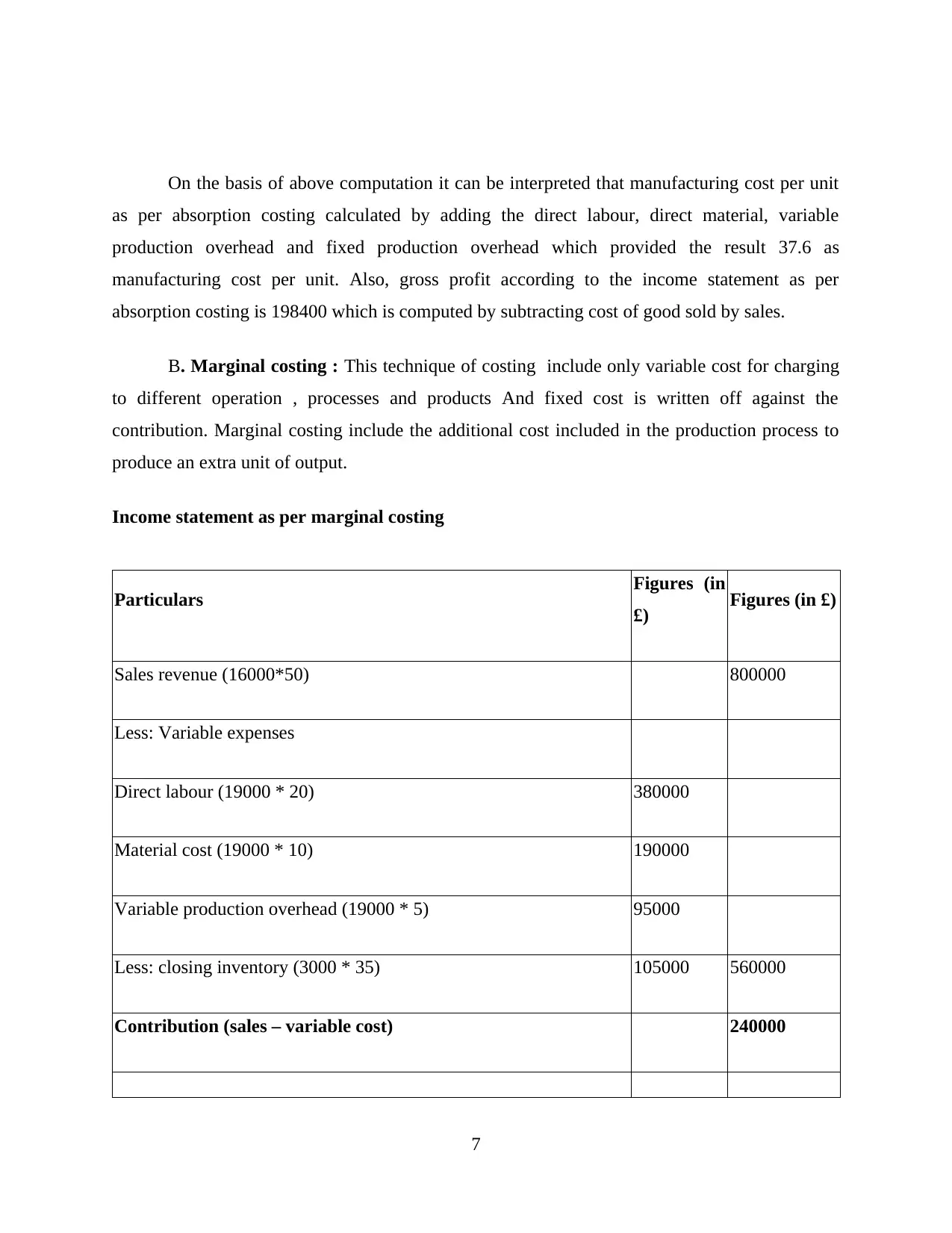

B. Marginal costing : This technique of costing include only variable cost for charging

to different operation , processes and products And fixed cost is written off against the

contribution. Marginal costing include the additional cost included in the production process to

produce an extra unit of output.

Income statement as per marginal costing

Particulars Figures (in

£) Figures (in £)

Sales revenue (16000*50) 800000

Less: Variable expenses

Direct labour (19000 * 20) 380000

Material cost (19000 * 10) 190000

Variable production overhead (19000 * 5) 95000

Less: closing inventory (3000 * 35) 105000 560000

Contribution (sales – variable cost) 240000

7

as per absorption costing calculated by adding the direct labour, direct material, variable

production overhead and fixed production overhead which provided the result 37.6 as

manufacturing cost per unit. Also, gross profit according to the income statement as per

absorption costing is 198400 which is computed by subtracting cost of good sold by sales.

B. Marginal costing : This technique of costing include only variable cost for charging

to different operation , processes and products And fixed cost is written off against the

contribution. Marginal costing include the additional cost included in the production process to

produce an extra unit of output.

Income statement as per marginal costing

Particulars Figures (in

£) Figures (in £)

Sales revenue (16000*50) 800000

Less: Variable expenses

Direct labour (19000 * 20) 380000

Material cost (19000 * 10) 190000

Variable production overhead (19000 * 5) 95000

Less: closing inventory (3000 * 35) 105000 560000

Contribution (sales – variable cost) 240000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

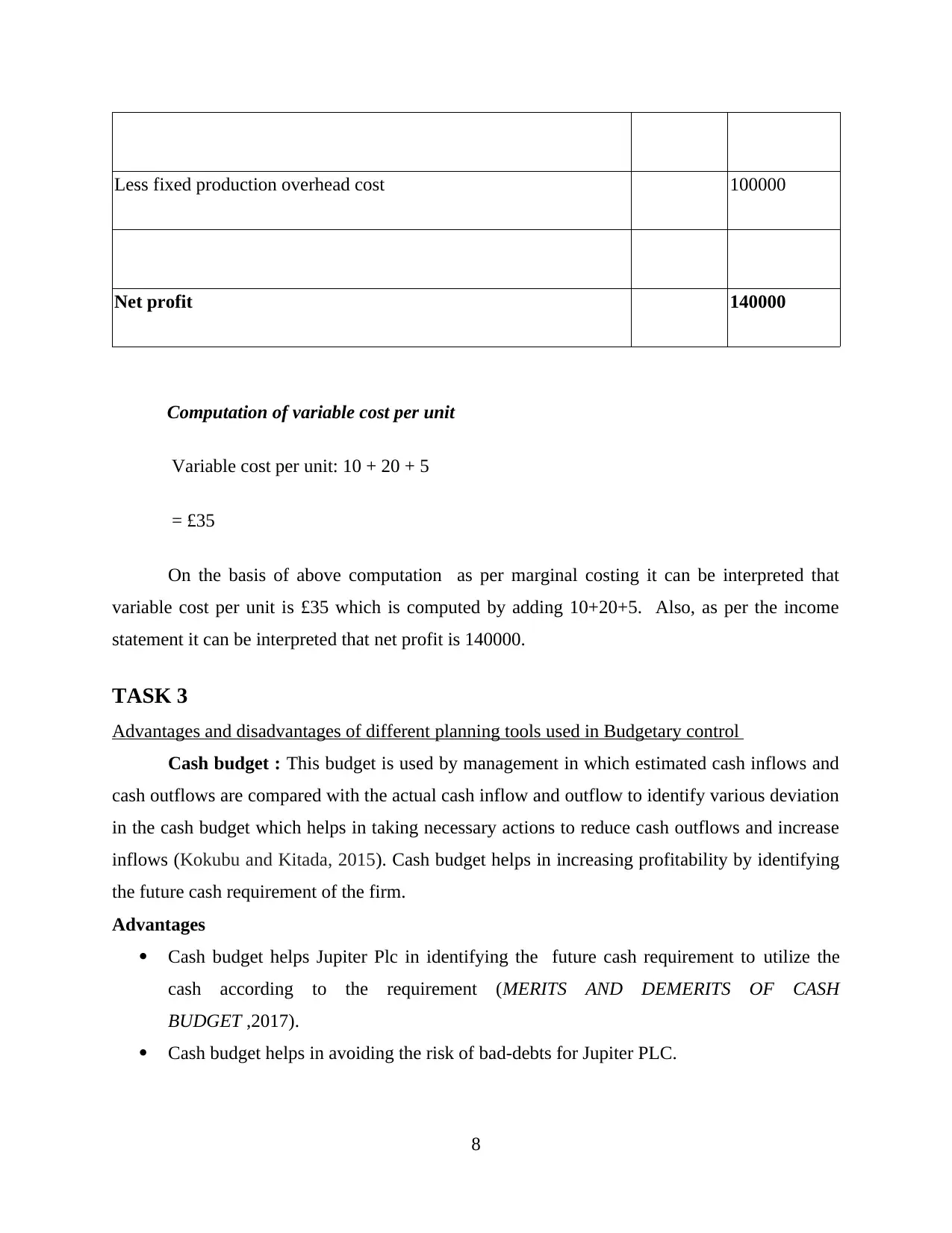

Less fixed production overhead cost 100000

Net profit 140000

Computation of variable cost per unit

Variable cost per unit: 10 + 20 + 5

= £35

On the basis of above computation as per marginal costing it can be interpreted that

variable cost per unit is £35 which is computed by adding 10+20+5. Also, as per the income

statement it can be interpreted that net profit is 140000.

TASK 3

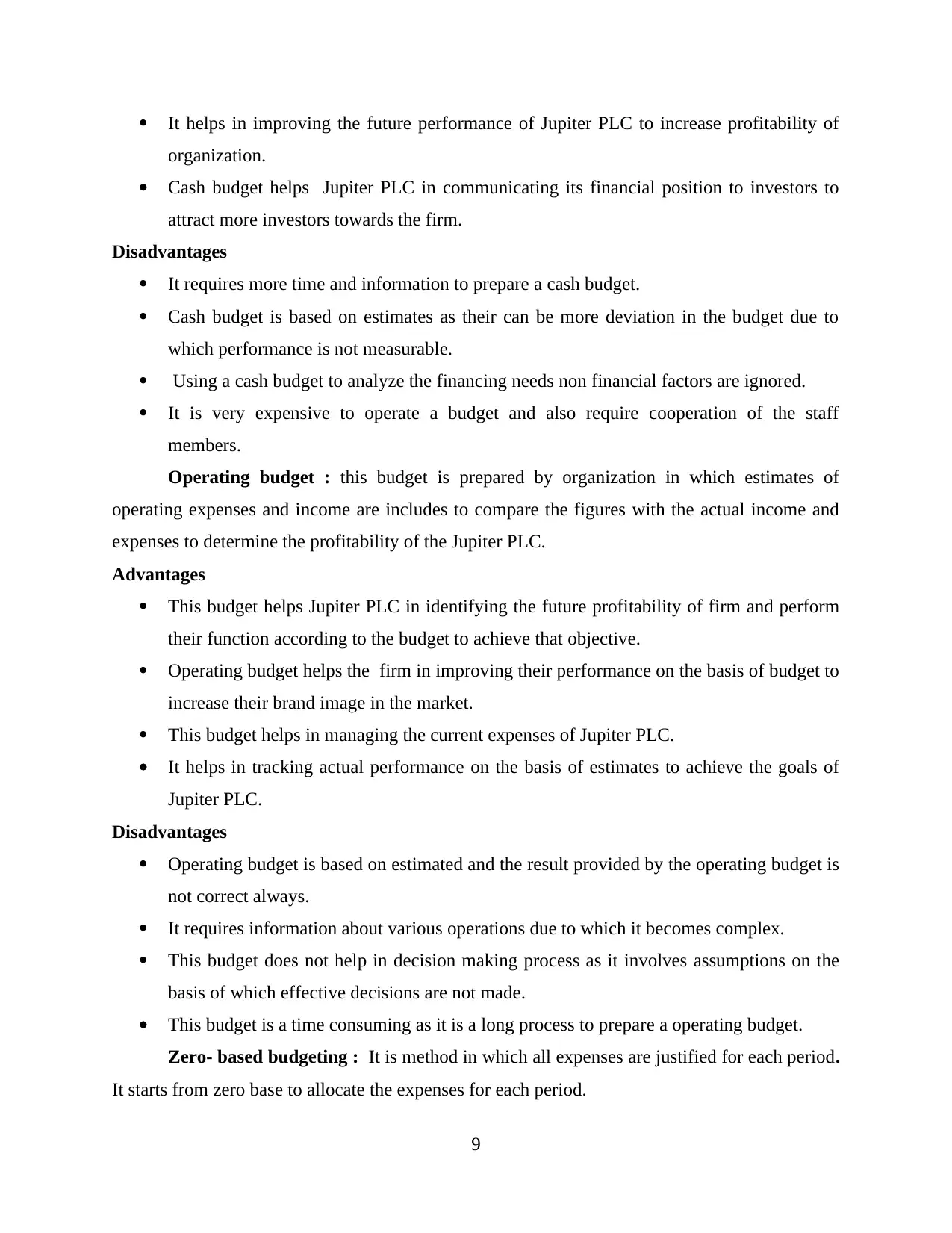

Advantages and disadvantages of different planning tools used in Budgetary control

Cash budget : This budget is used by management in which estimated cash inflows and

cash outflows are compared with the actual cash inflow and outflow to identify various deviation

in the cash budget which helps in taking necessary actions to reduce cash outflows and increase

inflows (Kokubu and Kitada, 2015). Cash budget helps in increasing profitability by identifying

the future cash requirement of the firm.

Advantages

Cash budget helps Jupiter Plc in identifying the future cash requirement to utilize the

cash according to the requirement (MERITS AND DEMERITS OF CASH

BUDGET ,2017).

Cash budget helps in avoiding the risk of bad-debts for Jupiter PLC.

8

Net profit 140000

Computation of variable cost per unit

Variable cost per unit: 10 + 20 + 5

= £35

On the basis of above computation as per marginal costing it can be interpreted that

variable cost per unit is £35 which is computed by adding 10+20+5. Also, as per the income

statement it can be interpreted that net profit is 140000.

TASK 3

Advantages and disadvantages of different planning tools used in Budgetary control

Cash budget : This budget is used by management in which estimated cash inflows and

cash outflows are compared with the actual cash inflow and outflow to identify various deviation

in the cash budget which helps in taking necessary actions to reduce cash outflows and increase

inflows (Kokubu and Kitada, 2015). Cash budget helps in increasing profitability by identifying

the future cash requirement of the firm.

Advantages

Cash budget helps Jupiter Plc in identifying the future cash requirement to utilize the

cash according to the requirement (MERITS AND DEMERITS OF CASH

BUDGET ,2017).

Cash budget helps in avoiding the risk of bad-debts for Jupiter PLC.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It helps in improving the future performance of Jupiter PLC to increase profitability of

organization.

Cash budget helps Jupiter PLC in communicating its financial position to investors to

attract more investors towards the firm.

Disadvantages

It requires more time and information to prepare a cash budget.

Cash budget is based on estimates as their can be more deviation in the budget due to

which performance is not measurable.

Using a cash budget to analyze the financing needs non financial factors are ignored.

It is very expensive to operate a budget and also require cooperation of the staff

members.

Operating budget : this budget is prepared by organization in which estimates of

operating expenses and income are includes to compare the figures with the actual income and

expenses to determine the profitability of the Jupiter PLC.

Advantages

This budget helps Jupiter PLC in identifying the future profitability of firm and perform

their function according to the budget to achieve that objective.

Operating budget helps the firm in improving their performance on the basis of budget to

increase their brand image in the market.

This budget helps in managing the current expenses of Jupiter PLC.

It helps in tracking actual performance on the basis of estimates to achieve the goals of

Jupiter PLC.

Disadvantages

Operating budget is based on estimated and the result provided by the operating budget is

not correct always.

It requires information about various operations due to which it becomes complex.

This budget does not help in decision making process as it involves assumptions on the

basis of which effective decisions are not made.

This budget is a time consuming as it is a long process to prepare a operating budget.

Zero- based budgeting : It is method in which all expenses are justified for each period.

It starts from zero base to allocate the expenses for each period.

9

organization.

Cash budget helps Jupiter PLC in communicating its financial position to investors to

attract more investors towards the firm.

Disadvantages

It requires more time and information to prepare a cash budget.

Cash budget is based on estimates as their can be more deviation in the budget due to

which performance is not measurable.

Using a cash budget to analyze the financing needs non financial factors are ignored.

It is very expensive to operate a budget and also require cooperation of the staff

members.

Operating budget : this budget is prepared by organization in which estimates of

operating expenses and income are includes to compare the figures with the actual income and

expenses to determine the profitability of the Jupiter PLC.

Advantages

This budget helps Jupiter PLC in identifying the future profitability of firm and perform

their function according to the budget to achieve that objective.

Operating budget helps the firm in improving their performance on the basis of budget to

increase their brand image in the market.

This budget helps in managing the current expenses of Jupiter PLC.

It helps in tracking actual performance on the basis of estimates to achieve the goals of

Jupiter PLC.

Disadvantages

Operating budget is based on estimated and the result provided by the operating budget is

not correct always.

It requires information about various operations due to which it becomes complex.

This budget does not help in decision making process as it involves assumptions on the

basis of which effective decisions are not made.

This budget is a time consuming as it is a long process to prepare a operating budget.

Zero- based budgeting : It is method in which all expenses are justified for each period.

It starts from zero base to allocate the expenses for each period.

9

Advantages

Cost is saved in inefficient operations.

Resources are allocated on cost benefit terms, there is better utilization of resources.

It helps in planning for future.

It helps in operational efficiency as it is not based on incremental approach.

Disadvantages

It is time consuming process.

Zero – based budgeting require more paper work.

There is personal bias in ranking of decision- packages.

Administration and communication of zero – based budgeting may create many critical

problems.

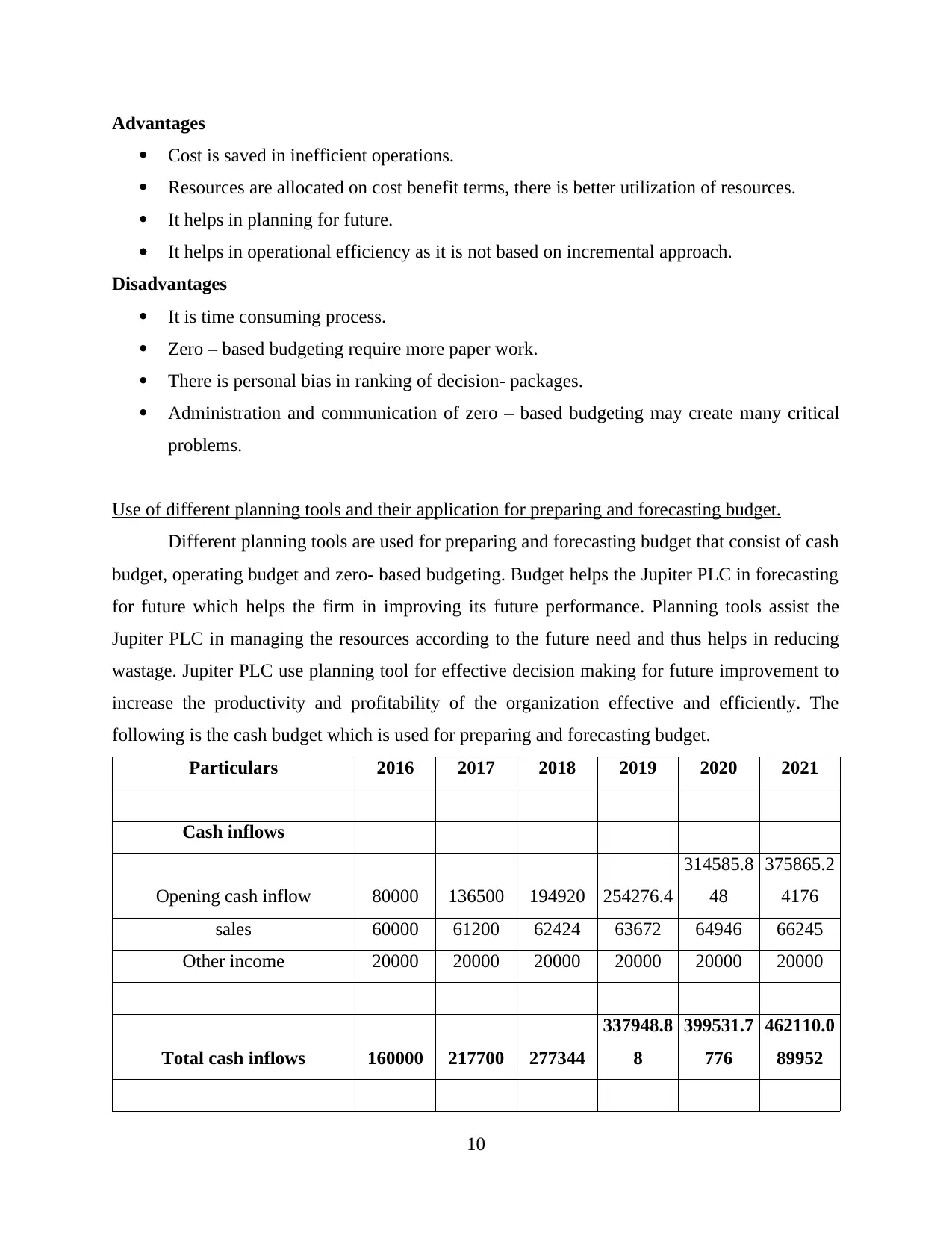

Use of different planning tools and their application for preparing and forecasting budget.

Different planning tools are used for preparing and forecasting budget that consist of cash

budget, operating budget and zero- based budgeting. Budget helps the Jupiter PLC in forecasting

for future which helps the firm in improving its future performance. Planning tools assist the

Jupiter PLC in managing the resources according to the future need and thus helps in reducing

wastage. Jupiter PLC use planning tool for effective decision making for future improvement to

increase the productivity and profitability of the organization effective and efficiently. The

following is the cash budget which is used for preparing and forecasting budget.

Particulars 2016 2017 2018 2019 2020 2021

Cash inflows

Opening cash inflow 80000 136500 194920 254276.4

314585.8

48

375865.2

4176

sales 60000 61200 62424 63672 64946 66245

Other income 20000 20000 20000 20000 20000 20000

Total cash inflows 160000 217700 277344

337948.8

8

399531.7

776

462110.0

89952

10

Cost is saved in inefficient operations.

Resources are allocated on cost benefit terms, there is better utilization of resources.

It helps in planning for future.

It helps in operational efficiency as it is not based on incremental approach.

Disadvantages

It is time consuming process.

Zero – based budgeting require more paper work.

There is personal bias in ranking of decision- packages.

Administration and communication of zero – based budgeting may create many critical

problems.

Use of different planning tools and their application for preparing and forecasting budget.

Different planning tools are used for preparing and forecasting budget that consist of cash

budget, operating budget and zero- based budgeting. Budget helps the Jupiter PLC in forecasting

for future which helps the firm in improving its future performance. Planning tools assist the

Jupiter PLC in managing the resources according to the future need and thus helps in reducing

wastage. Jupiter PLC use planning tool for effective decision making for future improvement to

increase the productivity and profitability of the organization effective and efficiently. The

following is the cash budget which is used for preparing and forecasting budget.

Particulars 2016 2017 2018 2019 2020 2021

Cash inflows

Opening cash inflow 80000 136500 194920 254276.4

314585.8

48

375865.2

4176

sales 60000 61200 62424 63672 64946 66245

Other income 20000 20000 20000 20000 20000 20000

Total cash inflows 160000 217700 277344

337948.8

8

399531.7

776

462110.0

89952

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.