Comprehensive Management Accounting Report: Analysis and Strategies

VerifiedAdded on 2020/01/07

|14

|4274

|191

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its functions, different types of management accounting systems, and application to Imda Tech Limited. It explores the functions of management accounting, including planning, organizing, controlling, and decision-making. The report delves into various costing systems like actual costing, standard costing, and inventory management systems. Furthermore, it analyzes marginal costing and absorption costing, providing detailed calculations and comparisons. The report also discusses the advantages and disadvantages of different budgeting methods, including incremental and zero-based budgeting, and explores pricing strategies. Finally, it examines the Balance Score Card approach as a tool for performance measurement and strategic alignment within the company. The report offers insights into the importance of management accounting for effective decision-making and financial control within a manufacturing context.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

A) Functions of management accounting.....................................................................................3

B) Different types of management accounting system................................................................5

Task 2...............................................................................................................................................5

1. Marginal costing.......................................................................................................................5

2. Absorption costing....................................................................................................................6

Task 3..............................................................................................................................................7

A) Advantage and Disadvantage of different types of budget.....................................................7

B) Process of preparing budget....................................................................................................8

C) Pricing strategies.....................................................................................................................9

Task 4.............................................................................................................................................10

A) Balance Score Card...............................................................................................................10

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

A) Functions of management accounting.....................................................................................3

B) Different types of management accounting system................................................................5

Task 2...............................................................................................................................................5

1. Marginal costing.......................................................................................................................5

2. Absorption costing....................................................................................................................6

Task 3..............................................................................................................................................7

A) Advantage and Disadvantage of different types of budget.....................................................7

B) Process of preparing budget....................................................................................................8

C) Pricing strategies.....................................................................................................................9

Task 4.............................................................................................................................................10

A) Balance Score Card...............................................................................................................10

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

Introduction

A cost accounting system is a system of accounting used by the manufacturers to account

for manufacturing activities carried by the manufacturer under perpetual inventory system. Thus

it can be said as the accounting system designed for the manufacturers to record the flow of

inventory through various stages of production (Gullifer and Payne, 2015). A typical cost

accounting system records the inflow and outflow of the materials at each stages of the

production. Whether it be in work-in-progress it should be properly accounted for. Present report

is based on Imda tech limited which produces mobile charger and other gadgets for retail outlets

in UK (Hecht, 2016). Current assignment will discuss the function of management accounting. It

will explain cost accounting system, inventory management system. It will calculate the

Absorption cost and marginal cost. In addition, report will describe the balance score card

approach.

Task 1

A) Functions of management accounting

Management accounting is the domain that is used to do cost related calculations in terms

of product and services by the business firms. There is a huge difference between both financial

accounting and management accounting. One of the main difference between both is that in case

of financial accounting and other one is that in former one data related to cost of production in

terms of individual values are not taken in to consideration. Whereas, in management accounting

entire accounting is done on computing cost of product. The other main difference between both

is that in management accounting performance of the firm in terms of cost is measured. On other

hand, in financial management firm overall performance in different areas is measured. Hence, it

can be said that there is difference between financial and management accounting.

Management accounting whole process depends on 4 basic function of Management like

1. Planning, 2. organisations, 3. Controlling and 4. Decision Making. Explaining in details

function of Management accounting they are:

1. Planning: Planning is preparation done in advance before execution to achieve some specific

goal (Horngren and et.al, 2010). It may be short term or long term. A budget planning is type of

financial planning shows how scarce resources to be maximal utilised over specific period of

A cost accounting system is a system of accounting used by the manufacturers to account

for manufacturing activities carried by the manufacturer under perpetual inventory system. Thus

it can be said as the accounting system designed for the manufacturers to record the flow of

inventory through various stages of production (Gullifer and Payne, 2015). A typical cost

accounting system records the inflow and outflow of the materials at each stages of the

production. Whether it be in work-in-progress it should be properly accounted for. Present report

is based on Imda tech limited which produces mobile charger and other gadgets for retail outlets

in UK (Hecht, 2016). Current assignment will discuss the function of management accounting. It

will explain cost accounting system, inventory management system. It will calculate the

Absorption cost and marginal cost. In addition, report will describe the balance score card

approach.

Task 1

A) Functions of management accounting

Management accounting is the domain that is used to do cost related calculations in terms

of product and services by the business firms. There is a huge difference between both financial

accounting and management accounting. One of the main difference between both is that in case

of financial accounting and other one is that in former one data related to cost of production in

terms of individual values are not taken in to consideration. Whereas, in management accounting

entire accounting is done on computing cost of product. The other main difference between both

is that in management accounting performance of the firm in terms of cost is measured. On other

hand, in financial management firm overall performance in different areas is measured. Hence, it

can be said that there is difference between financial and management accounting.

Management accounting whole process depends on 4 basic function of Management like

1. Planning, 2. organisations, 3. Controlling and 4. Decision Making. Explaining in details

function of Management accounting they are:

1. Planning: Planning is preparation done in advance before execution to achieve some specific

goal (Horngren and et.al, 2010). It may be short term or long term. A budget planning is type of

financial planning shows how scarce resources to be maximal utilised over specific period of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

time. Management accounting is interconnected in financial management and budgetary system

as whole because budgeting control depends on developing of financial reports which helps in

providing information to manager to take decision in financial controlling. Planning reports help

manager to estimate the effect of alternative options available on firms ability to achieve desirer

goal (Kaplan and Atkinson, 2015). If business enterprises target specific profit in one financial

year they they should also determine how they can achieve them.

2. Organising: It is process of establishing organisational framework and assigning

responsibility to the people working in organisation for achieving business goals and objective.

Organisational structure differs from business to business or an enterprise to enterprises. In

business different department can be assigned to by setting up divisions, departments, sections

and branches (Quattrone, 2016).

3. Controlling: It is a process of monitoring, measuring, evaluating and correcting the actual

results to ensure that a business enterprise goal and planning is achieved or going to be achieved

or not (Saladrigues and Tena, 2017). Controlling is accomplished with feedback, feedback is

process to take corrective measures been taken to evaluate or correct steps while implementing

plan.

4. Decision Making: Decision making is process of choosing best alternative among various

ones. Decision Making is inherent in all three functions of management like Planning, organising

and controlling (Weygandt, Kimmel and Kieso, 2015). A manager cannot plan without decision

making and have to choose among different alternative the best one which meet goals as early as

possible. Following are process of decision making:

Identifying a problem requiring managerial actions.

Specifying the objective or goals to be achieved.

Choosing alternative coerce of action.

gathering the information about sequence of Each alternatives (Zimmerman and Yahya-

Zadeh, 2011).

Importance of management accounting

Management accounting is very important for decision making. It assist in

determine the selling process of the goods. It examines the cost and try to ignore unnecessary

as whole because budgeting control depends on developing of financial reports which helps in

providing information to manager to take decision in financial controlling. Planning reports help

manager to estimate the effect of alternative options available on firms ability to achieve desirer

goal (Kaplan and Atkinson, 2015). If business enterprises target specific profit in one financial

year they they should also determine how they can achieve them.

2. Organising: It is process of establishing organisational framework and assigning

responsibility to the people working in organisation for achieving business goals and objective.

Organisational structure differs from business to business or an enterprise to enterprises. In

business different department can be assigned to by setting up divisions, departments, sections

and branches (Quattrone, 2016).

3. Controlling: It is a process of monitoring, measuring, evaluating and correcting the actual

results to ensure that a business enterprise goal and planning is achieved or going to be achieved

or not (Saladrigues and Tena, 2017). Controlling is accomplished with feedback, feedback is

process to take corrective measures been taken to evaluate or correct steps while implementing

plan.

4. Decision Making: Decision making is process of choosing best alternative among various

ones. Decision Making is inherent in all three functions of management like Planning, organising

and controlling (Weygandt, Kimmel and Kieso, 2015). A manager cannot plan without decision

making and have to choose among different alternative the best one which meet goals as early as

possible. Following are process of decision making:

Identifying a problem requiring managerial actions.

Specifying the objective or goals to be achieved.

Choosing alternative coerce of action.

gathering the information about sequence of Each alternatives (Zimmerman and Yahya-

Zadeh, 2011).

Importance of management accounting

Management accounting is very important for decision making. It assist in

determine the selling process of the goods. It examines the cost and try to ignore unnecessary

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

expenditure of the organization so that company can make effective control over the costs. It

determining the activities required for the production (Carlsson-Wall Kraus and Lind, 2015).

Management accounting is very important that helps in determine the production activities. With

the help of this company like Imda can make effective decision and can make profit to great

extent. It is the great tool that assists in reducing cost of the organization. Budget is the major

part of any business. With the help of management accounting Imda ltd can improve its cash

flow to great extent. That is the great technique that assists in getting effective financial returns.

With the help of this companies can forecast demand and supply and can make production

accordingly (Alyousef and Mickan, 2016).

B) Different types of management accounting system

Actual Costing : Actual cost accounting is the recording of the products cost at different factors

enable for it. Be it actual cost of material, actual cost of labour, actual overheads cost occurred,

allocated according to the actual quantity of product (Gul, 2014).

Standard Costing : Standard cost accounting system is the process of substituting actual cost

with the estimated cost and then identifying the difference between the actual costs and estimated

costs and then identifying the variances (Tucker and Parker, 2014).

Normal Costing : It is the method of tracking production costs on the basis of the estimated

prices of the inputs multiplied by the actual quantity of the inputs used.

Inventory Management Systems

Inventory management system is a continuous system of moving parts and products in and out of

the organisations premises (Ismail, Ramli. and Darus, 2014). Organisation's inventory is

managed on a daily basis as they shipped out their products to their users or customers and also

place new orders for the products. Thus that is called Inventory Management Systems.

Job Costing Systems

Job costing system is a process of accumulating costs which are been associated with a specific

production or a specific service (Cescon, Costantini and Rossi, 2013). The information provided

in job costing system should be accurate as the information provided their in and prices quoted

for different products should allow for a reasonable profit.

Price Optimising Systems

Price optimising system is a system where there is use of mathematical analysis by a company to

determine how the users of the products react on the different prices of it's products and through

determining the activities required for the production (Carlsson-Wall Kraus and Lind, 2015).

Management accounting is very important that helps in determine the production activities. With

the help of this company like Imda can make effective decision and can make profit to great

extent. It is the great tool that assists in reducing cost of the organization. Budget is the major

part of any business. With the help of management accounting Imda ltd can improve its cash

flow to great extent. That is the great technique that assists in getting effective financial returns.

With the help of this companies can forecast demand and supply and can make production

accordingly (Alyousef and Mickan, 2016).

B) Different types of management accounting system

Actual Costing : Actual cost accounting is the recording of the products cost at different factors

enable for it. Be it actual cost of material, actual cost of labour, actual overheads cost occurred,

allocated according to the actual quantity of product (Gul, 2014).

Standard Costing : Standard cost accounting system is the process of substituting actual cost

with the estimated cost and then identifying the difference between the actual costs and estimated

costs and then identifying the variances (Tucker and Parker, 2014).

Normal Costing : It is the method of tracking production costs on the basis of the estimated

prices of the inputs multiplied by the actual quantity of the inputs used.

Inventory Management Systems

Inventory management system is a continuous system of moving parts and products in and out of

the organisations premises (Ismail, Ramli. and Darus, 2014). Organisation's inventory is

managed on a daily basis as they shipped out their products to their users or customers and also

place new orders for the products. Thus that is called Inventory Management Systems.

Job Costing Systems

Job costing system is a process of accumulating costs which are been associated with a specific

production or a specific service (Cescon, Costantini and Rossi, 2013). The information provided

in job costing system should be accurate as the information provided their in and prices quoted

for different products should allow for a reasonable profit.

Price Optimising Systems

Price optimising system is a system where there is use of mathematical analysis by a company to

determine how the users of the products react on the different prices of it's products and through

different channels (Zimmerman and Yahya-Zadeh, 2011).

Task 2

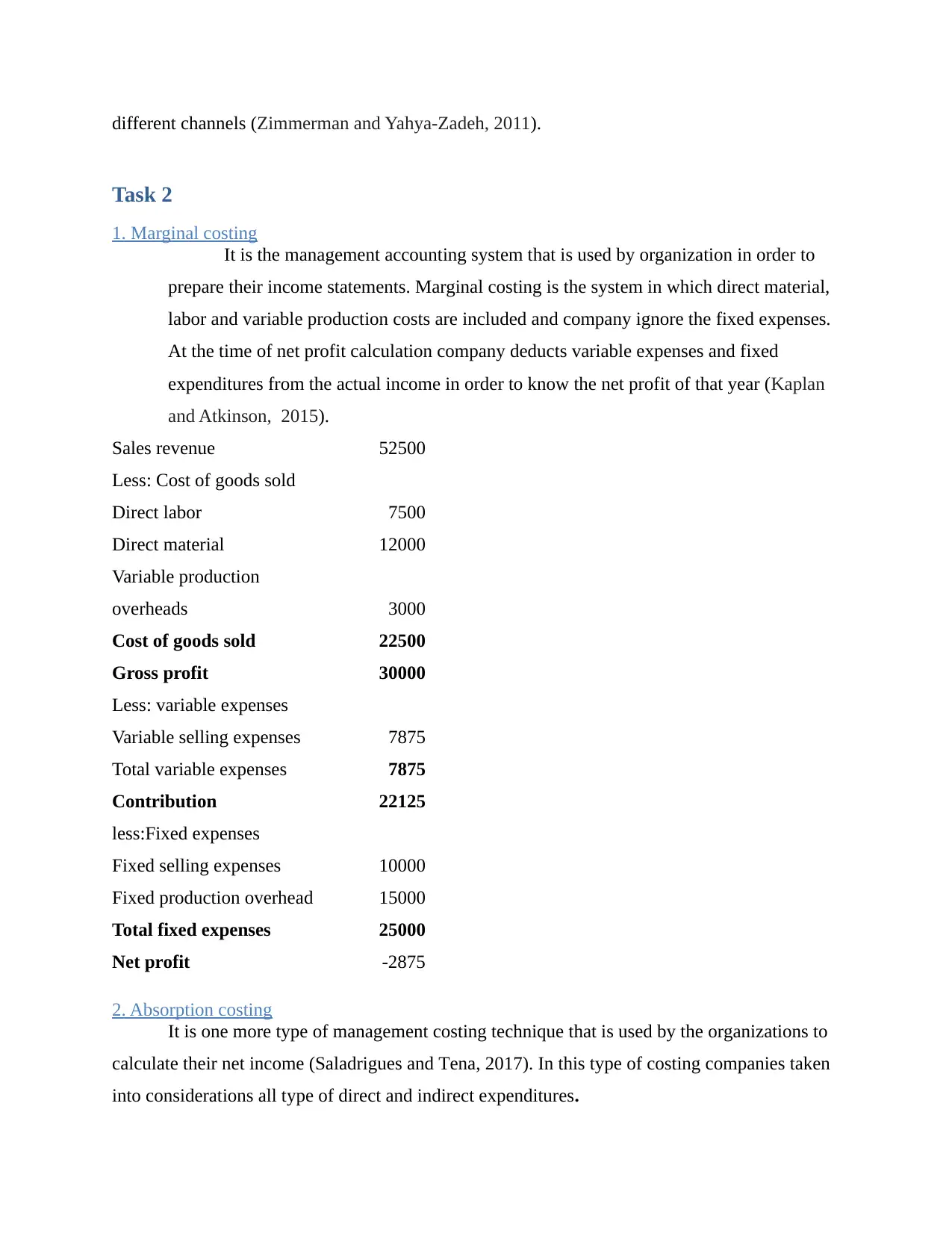

1. Marginal costing

It is the management accounting system that is used by organization in order to

prepare their income statements. Marginal costing is the system in which direct material,

labor and variable production costs are included and company ignore the fixed expenses.

At the time of net profit calculation company deducts variable expenses and fixed

expenditures from the actual income in order to know the net profit of that year (Kaplan

and Atkinson, 2015).

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Cost of goods sold 22500

Gross profit 30000

Less: variable expenses

Variable selling expenses 7875

Total variable expenses 7875

Contribution 22125

less:Fixed expenses

Fixed selling expenses 10000

Fixed production overhead 15000

Total fixed expenses 25000

Net profit -2875

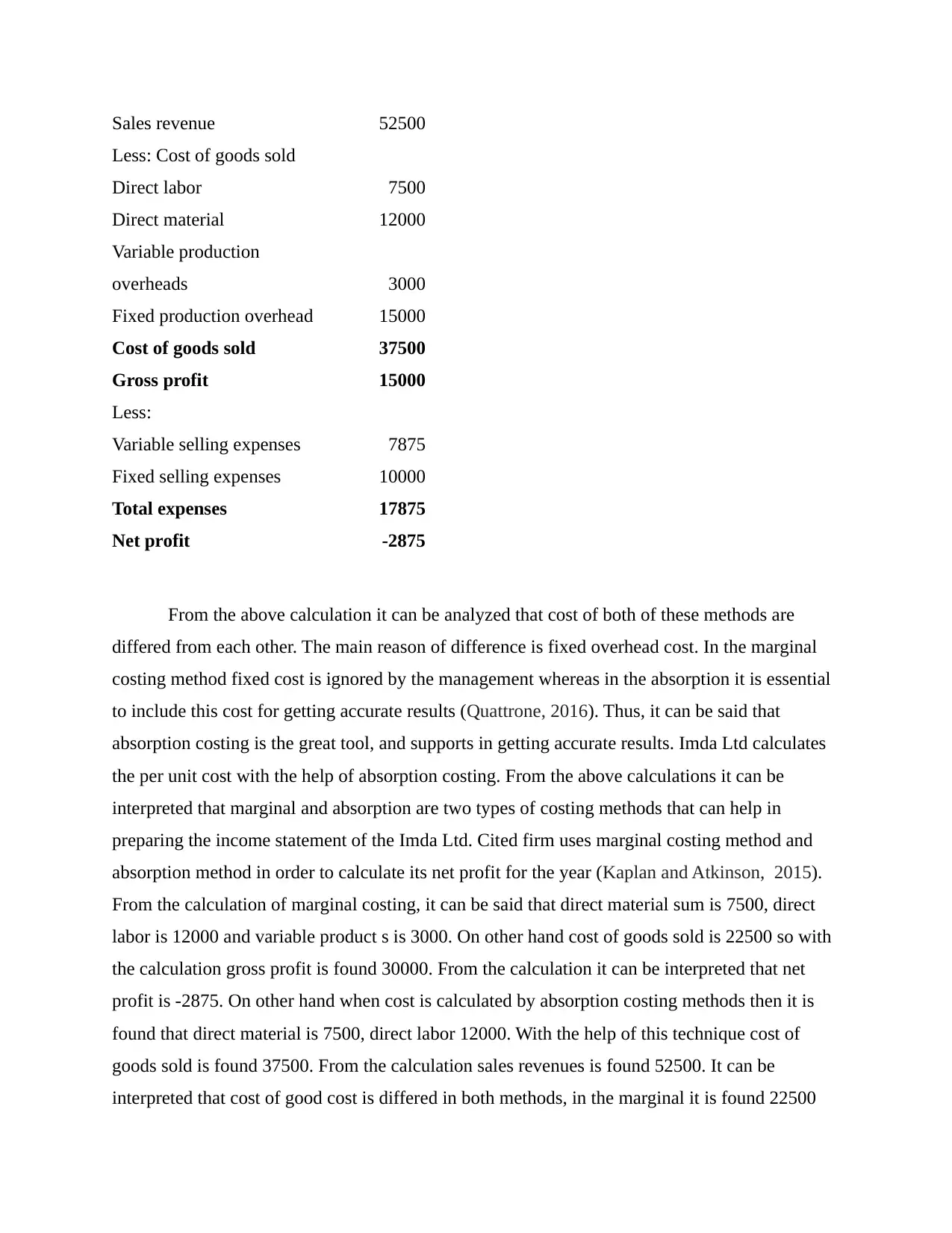

2. Absorption costing

It is one more type of management costing technique that is used by the organizations to

calculate their net income (Saladrigues and Tena, 2017). In this type of costing companies taken

into considerations all type of direct and indirect expenditures.

Task 2

1. Marginal costing

It is the management accounting system that is used by organization in order to

prepare their income statements. Marginal costing is the system in which direct material,

labor and variable production costs are included and company ignore the fixed expenses.

At the time of net profit calculation company deducts variable expenses and fixed

expenditures from the actual income in order to know the net profit of that year (Kaplan

and Atkinson, 2015).

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Cost of goods sold 22500

Gross profit 30000

Less: variable expenses

Variable selling expenses 7875

Total variable expenses 7875

Contribution 22125

less:Fixed expenses

Fixed selling expenses 10000

Fixed production overhead 15000

Total fixed expenses 25000

Net profit -2875

2. Absorption costing

It is one more type of management costing technique that is used by the organizations to

calculate their net income (Saladrigues and Tena, 2017). In this type of costing companies taken

into considerations all type of direct and indirect expenditures.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sales revenue 52500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Fixed production overhead 15000

Cost of goods sold 37500

Gross profit 15000

Less:

Variable selling expenses 7875

Fixed selling expenses 10000

Total expenses 17875

Net profit -2875

From the above calculation it can be analyzed that cost of both of these methods are

differed from each other. The main reason of difference is fixed overhead cost. In the marginal

costing method fixed cost is ignored by the management whereas in the absorption it is essential

to include this cost for getting accurate results (Quattrone, 2016). Thus, it can be said that

absorption costing is the great tool, and supports in getting accurate results. Imda Ltd calculates

the per unit cost with the help of absorption costing. From the above calculations it can be

interpreted that marginal and absorption are two types of costing methods that can help in

preparing the income statement of the Imda Ltd. Cited firm uses marginal costing method and

absorption method in order to calculate its net profit for the year (Kaplan and Atkinson, 2015).

From the calculation of marginal costing, it can be said that direct material sum is 7500, direct

labor is 12000 and variable product s is 3000. On other hand cost of goods sold is 22500 so with

the calculation gross profit is found 30000. From the calculation it can be interpreted that net

profit is -2875. On other hand when cost is calculated by absorption costing methods then it is

found that direct material is 7500, direct labor 12000. With the help of this technique cost of

goods sold is found 37500. From the calculation sales revenues is found 52500. It can be

interpreted that cost of good cost is differed in both methods, in the marginal it is found 22500

Less: Cost of goods sold

Direct labor 7500

Direct material 12000

Variable production

overheads 3000

Fixed production overhead 15000

Cost of goods sold 37500

Gross profit 15000

Less:

Variable selling expenses 7875

Fixed selling expenses 10000

Total expenses 17875

Net profit -2875

From the above calculation it can be analyzed that cost of both of these methods are

differed from each other. The main reason of difference is fixed overhead cost. In the marginal

costing method fixed cost is ignored by the management whereas in the absorption it is essential

to include this cost for getting accurate results (Quattrone, 2016). Thus, it can be said that

absorption costing is the great tool, and supports in getting accurate results. Imda Ltd calculates

the per unit cost with the help of absorption costing. From the above calculations it can be

interpreted that marginal and absorption are two types of costing methods that can help in

preparing the income statement of the Imda Ltd. Cited firm uses marginal costing method and

absorption method in order to calculate its net profit for the year (Kaplan and Atkinson, 2015).

From the calculation of marginal costing, it can be said that direct material sum is 7500, direct

labor is 12000 and variable product s is 3000. On other hand cost of goods sold is 22500 so with

the calculation gross profit is found 30000. From the calculation it can be interpreted that net

profit is -2875. On other hand when cost is calculated by absorption costing methods then it is

found that direct material is 7500, direct labor 12000. With the help of this technique cost of

goods sold is found 37500. From the calculation sales revenues is found 52500. It can be

interpreted that cost of good cost is differed in both methods, in the marginal it is found 22500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

where in absorption it is found 37500 (Carlsson-Wall, Kraus and Lind, 2015). The reason of

difference is that in the marginal only variable expenditures are being taken into account whereas

in the absorption costing method fixed and variable both expenditures are taken into account by

the management.

Task 3

A) Advantage and Disadvantage of different types of budget

Budget is one of the most important part of business, that helps in making effective

decisions for the well fare of organization. It assist in creating the strong business ideas and helps

in forecasting the future situation. According the give scenario Imda ltd wants to improve its

economic position for that company has to prepare the budget so that it can look upon its

expenditures and can minimize unnecessary expenditures of the workplace (Ismail, Ramli and

Darus, 2014). It is beneficial tool that supports in systematic planning.

Incremental budgeting

It is one of the essential tool in which Imda can make small changes in its already

available budget in order to prepare a new budget. In such type of method incremental amount

adds by the management.

Advantage:

The main advantage of this budget system is that it makes sure little deviation in the

actual planning (Ismail, Ramli and Darus, 2014). W

ith the help of this equality will be remain in all department of Imda Ltd.

Disadvantage:

It is not good for the cited firm because there is no incentive format for making control

over unnecessary costs. Perpetual allocation of resources is another drawback of this budgeting system.

Zero based budgeting

It is another type of budgeting system in which zero is kept as base. In this proper market

research is done by the management and accordingly it allocate resources. It looks upon the real

market situation and accordingly run operations.

Advantage:

The main advantage of this type of tool is that it is based on real figures thus, decisions

difference is that in the marginal only variable expenditures are being taken into account whereas

in the absorption costing method fixed and variable both expenditures are taken into account by

the management.

Task 3

A) Advantage and Disadvantage of different types of budget

Budget is one of the most important part of business, that helps in making effective

decisions for the well fare of organization. It assist in creating the strong business ideas and helps

in forecasting the future situation. According the give scenario Imda ltd wants to improve its

economic position for that company has to prepare the budget so that it can look upon its

expenditures and can minimize unnecessary expenditures of the workplace (Ismail, Ramli and

Darus, 2014). It is beneficial tool that supports in systematic planning.

Incremental budgeting

It is one of the essential tool in which Imda can make small changes in its already

available budget in order to prepare a new budget. In such type of method incremental amount

adds by the management.

Advantage:

The main advantage of this budget system is that it makes sure little deviation in the

actual planning (Ismail, Ramli and Darus, 2014). W

ith the help of this equality will be remain in all department of Imda Ltd.

Disadvantage:

It is not good for the cited firm because there is no incentive format for making control

over unnecessary costs. Perpetual allocation of resources is another drawback of this budgeting system.

Zero based budgeting

It is another type of budgeting system in which zero is kept as base. In this proper market

research is done by the management and accordingly it allocate resources. It looks upon the real

market situation and accordingly run operations.

Advantage:

The main advantage of this type of tool is that it is based on real figures thus, decisions

can be made accurate.

Cost curtailment is another benefit of this tool (Gul, 2014).

Disadvantgae:

But it is time consuming process and management requires lots of fund for preparing the

final budget. Apart from that if Imda Ltd follows this budgeting system then it is necessary that cited

firm hires skilled employees those who can deal with the budget effectively.

Fixed budgeting

It is another type of budgeting system in which Imda has to analyses the business

performance and accordingly cited firm has to prepare fixed planning strategies so that it can

accomplish its objectives significantly (Ismail, Ramli and Darus, 2014). Accordingly

management can make planning and can take strategies decision which can support in

development of the company y to great extent. But this cannot be altered that is the drawback of

this technique.

Advantgae:

It is beneficial tool by this way company performance can be measured.

It tries to keep cost level minimum.

Disadvanatge:

It does not compare results.

It is fixed so ca not be changed if any souirces get changed.

B) Process of preparing budget

Budget is prepared by the organization by following systematic process, in the absence of

proper process good budget can not be prepared by the entities. It is as following :

Update budget assumption: It is necessary to identify the current performance and

analyze assumptions. Company has to update budget assumptions in order to create

further operations.

Review bottlenecks: It is the next phase in which capabilities of imda Ltd is identified

and accordingly investment decisions are taken by the cited firm (Kaplan and Atkinson,

2015).

Available funding: After reviewing the bottlenecks organization has to look upon the

available funds. By this way they will be able to observe what else is required more.

Cost curtailment is another benefit of this tool (Gul, 2014).

Disadvantgae:

But it is time consuming process and management requires lots of fund for preparing the

final budget. Apart from that if Imda Ltd follows this budgeting system then it is necessary that cited

firm hires skilled employees those who can deal with the budget effectively.

Fixed budgeting

It is another type of budgeting system in which Imda has to analyses the business

performance and accordingly cited firm has to prepare fixed planning strategies so that it can

accomplish its objectives significantly (Ismail, Ramli and Darus, 2014). Accordingly

management can make planning and can take strategies decision which can support in

development of the company y to great extent. But this cannot be altered that is the drawback of

this technique.

Advantgae:

It is beneficial tool by this way company performance can be measured.

It tries to keep cost level minimum.

Disadvanatge:

It does not compare results.

It is fixed so ca not be changed if any souirces get changed.

B) Process of preparing budget

Budget is prepared by the organization by following systematic process, in the absence of

proper process good budget can not be prepared by the entities. It is as following :

Update budget assumption: It is necessary to identify the current performance and

analyze assumptions. Company has to update budget assumptions in order to create

further operations.

Review bottlenecks: It is the next phase in which capabilities of imda Ltd is identified

and accordingly investment decisions are taken by the cited firm (Kaplan and Atkinson,

2015).

Available funding: After reviewing the bottlenecks organization has to look upon the

available funds. By this way they will be able to observe what else is required more.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Step costing point: In this stage company has to look upon the costing point and they

have to define what amount will incurred for particular activity.

Create budget package: In this cited firm has to update the entire budget package so that

decisions can be made related to allocation of resources.

Issue budget package: once all information are gathered then they have to issue package

of final budget (Saladrigues and Tena, 2017).

Obtain revenue forecast: It is essential for Imda Ltd is to obtain revenue forecast so that

future income can be identified and accordingly necessary changes can be made in the

budget.

Obtain department budget: It is the next step in which company has to obtain department

budget and adjustment is required to be made.

Obtain capital budget request: In this stage budget is send to senior level managers for

making updation (Weygandt, Kimmel and Kieso, 2015). .

Update budget model: Higher authorities make changes and update the budget.

Review the budget: Now Imda Ltd has to review the budget carefully so that mistakes

can be identified.

Process budget iterations: Now it is the phase in which iterations are developed.

Load the final budget: After all steps final budget is being prepared by the company and it

is presented in front of all stakeholders (Saladrigues and Tena, 2017).

C) Pricing strategies

Imda Ltd has to set its prices, for that they have to look upon the several factors such as

market demand, competition and product value. Pricing strategies of cited firm is interrelated

with the cost planning. Cited firm is using cost plus pricing strategy in which it includes all cost

and add its profit percentage in this. After that final prices is gained which is kept for the

products of the company (Quattrone, 2016). Price is set by the firm in order to gain high profit.

There are several pricing strategies such as premium, market penetration, economy, price

skimming, psychology and bundle pricing strategies. Cited firm includes all cost which are

incurred in the production and manufacturing. It is beneficial strategy and can support in

allocating funds to all departments. Imda Ltd makes changes in its prices as per market demand,

market position (Gullifer and Payne, 2015). These forces impact on the business performance ,

productivity and profit earning capacity of the organization to great extent. Correct pricing

have to define what amount will incurred for particular activity.

Create budget package: In this cited firm has to update the entire budget package so that

decisions can be made related to allocation of resources.

Issue budget package: once all information are gathered then they have to issue package

of final budget (Saladrigues and Tena, 2017).

Obtain revenue forecast: It is essential for Imda Ltd is to obtain revenue forecast so that

future income can be identified and accordingly necessary changes can be made in the

budget.

Obtain department budget: It is the next step in which company has to obtain department

budget and adjustment is required to be made.

Obtain capital budget request: In this stage budget is send to senior level managers for

making updation (Weygandt, Kimmel and Kieso, 2015). .

Update budget model: Higher authorities make changes and update the budget.

Review the budget: Now Imda Ltd has to review the budget carefully so that mistakes

can be identified.

Process budget iterations: Now it is the phase in which iterations are developed.

Load the final budget: After all steps final budget is being prepared by the company and it

is presented in front of all stakeholders (Saladrigues and Tena, 2017).

C) Pricing strategies

Imda Ltd has to set its prices, for that they have to look upon the several factors such as

market demand, competition and product value. Pricing strategies of cited firm is interrelated

with the cost planning. Cited firm is using cost plus pricing strategy in which it includes all cost

and add its profit percentage in this. After that final prices is gained which is kept for the

products of the company (Quattrone, 2016). Price is set by the firm in order to gain high profit.

There are several pricing strategies such as premium, market penetration, economy, price

skimming, psychology and bundle pricing strategies. Cited firm includes all cost which are

incurred in the production and manufacturing. It is beneficial strategy and can support in

allocating funds to all departments. Imda Ltd makes changes in its prices as per market demand,

market position (Gullifer and Payne, 2015). These forces impact on the business performance ,

productivity and profit earning capacity of the organization to great extent. Correct pricing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

strategy assist in gaining competitive advantage because it will attract t more people towards the

firm and they will buy the products of the entity. That would help in sustaining in the market for

longer duration. Apart from this pricing strategies assist in increasing profitability of the

organization to great extent.

Task 4

A) Balance Score Card

It is used extensively in business and in industry, government and non government

organisation to develop all business activities around vision and strategy of organisation,

helps in improving internal and external communication of business and monitoring

organisational performance against strategic goals (Hecht, 2016). It is strategic planning

and management system used in helping and monitoring organisational performance.

In this balance score card strategy is centric point based on organisational goal and

Financial, Customers, Learning and growth and internal process are four framework.

Balance score card is majorly used by government, non profit and big organizations. That

supports in increasing level of performance of the companies and develops their internal and

external communication to great extent. Imda Ltd takes support of balance score card in order to

minimize economic problems. It is the great tool that supports in improving business

performance of the cited firm (Weygandt, Kimmel and Kieso, 2015). From the financial

perspective it is very important. With the assistance of this method company can identify return

on their investments and can find out value of shareholders in the organization. It looks upon the

all areas and make effective strategies so that upcoming uncertainties can be avoided by the

entity. It makes relationship between various corporate programs. By this way quality of

products and customer service can be improved. That would support the Imda Ltyd in improving

its sales volume thus, it will support in resolving economic problems (Zimmerman and Yahya-

Zadeh, 2011). It supports in gaining competitive advantage and improving business decision of

the company. Thus cited firm can provide excellent services to its clients and they will be

satisfied. That would be beneficial for the organization and by this way Imda Ltd will be able to

give response to the financial problems. Balance score cards look upon the internal and external

position of the entity and try to find out the drawback. With the help of this cited firm will be

able to develop new strategies that can help in improving business performance of the

firm and they will buy the products of the entity. That would help in sustaining in the market for

longer duration. Apart from this pricing strategies assist in increasing profitability of the

organization to great extent.

Task 4

A) Balance Score Card

It is used extensively in business and in industry, government and non government

organisation to develop all business activities around vision and strategy of organisation,

helps in improving internal and external communication of business and monitoring

organisational performance against strategic goals (Hecht, 2016). It is strategic planning

and management system used in helping and monitoring organisational performance.

In this balance score card strategy is centric point based on organisational goal and

Financial, Customers, Learning and growth and internal process are four framework.

Balance score card is majorly used by government, non profit and big organizations. That

supports in increasing level of performance of the companies and develops their internal and

external communication to great extent. Imda Ltd takes support of balance score card in order to

minimize economic problems. It is the great tool that supports in improving business

performance of the cited firm (Weygandt, Kimmel and Kieso, 2015). From the financial

perspective it is very important. With the assistance of this method company can identify return

on their investments and can find out value of shareholders in the organization. It looks upon the

all areas and make effective strategies so that upcoming uncertainties can be avoided by the

entity. It makes relationship between various corporate programs. By this way quality of

products and customer service can be improved. That would support the Imda Ltyd in improving

its sales volume thus, it will support in resolving economic problems (Zimmerman and Yahya-

Zadeh, 2011). It supports in gaining competitive advantage and improving business decision of

the company. Thus cited firm can provide excellent services to its clients and they will be

satisfied. That would be beneficial for the organization and by this way Imda Ltd will be able to

give response to the financial problems. Balance score cards look upon the internal and external

position of the entity and try to find out the drawback. With the help of this cited firm will be

able to develop new strategies that can help in improving business performance of the

organization to great extent (Alyousef and Mickan, 2016). It is the disciplined way that translate

strategic intent of an entity into actionable programs. By this way Imda Ltd will be able to offer

consumers satisfactory products as per their demand. That would make them positive towards the

brand and thus, overall financial position of the cited firm will get strong.

Balance score card is the effective tool that supports in identifying the issues in the

finance department and provide ways to resolve it. In this company can focuis on needs of

consumers and can produce products according to ttheir requiremnts. Marketing manager can

offer attractive discounts to the consumers so that promotion can be done effectively.

Performance of the employees needs to be r eviewed time to time so that their level of standard

can be improved. This tool supports organization in making control over activities so that

mistakes can be minimized and cited firm can resolve their financial problems.

Conclusion

From the above report it can be concluded that management accounting is an essential

part of business that supports in managing overall business operations in an effective manner.

Absorption and marginal are two types of costing that can support in preparing the income

statement of the company. Organizations have to use correct technique so that it can measure its

income and performance of the entity. Budget is one of the most important parts of management

accounting. By preparing effective budget firm can make effective control over its unnecessary

expenditures and can improve its profitability to great extent.

strategic intent of an entity into actionable programs. By this way Imda Ltd will be able to offer

consumers satisfactory products as per their demand. That would make them positive towards the

brand and thus, overall financial position of the cited firm will get strong.

Balance score card is the effective tool that supports in identifying the issues in the

finance department and provide ways to resolve it. In this company can focuis on needs of

consumers and can produce products according to ttheir requiremnts. Marketing manager can

offer attractive discounts to the consumers so that promotion can be done effectively.

Performance of the employees needs to be r eviewed time to time so that their level of standard

can be improved. This tool supports organization in making control over activities so that

mistakes can be minimized and cited firm can resolve their financial problems.

Conclusion

From the above report it can be concluded that management accounting is an essential

part of business that supports in managing overall business operations in an effective manner.

Absorption and marginal are two types of costing that can support in preparing the income

statement of the company. Organizations have to use correct technique so that it can measure its

income and performance of the entity. Budget is one of the most important parts of management

accounting. By preparing effective budget firm can make effective control over its unnecessary

expenditures and can improve its profitability to great extent.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.