Management Accounting Report: Financial Analysis of a Company

VerifiedAdded on 2021/02/21

|19

|5413

|18

Report

AI Summary

This report delves into the realm of management accounting, examining its critical role in analyzing, monitoring, and controlling organizational performance. It focuses on the application of management accounting principles within Equilibrium Asset Management and its client, Cambridge Manufacturing Company Ltd. The report covers essential aspects such as management accounting systems, including cost accounting, inventory management, and price optimization. It also explores different management accounting reporting methods like performance reports, budget reports, and inventory management reports. Furthermore, the report analyzes various costing techniques and planning tools used for budgetary control, comparing organizations and their approaches to solving financial problems through management accounting. The report also includes a critical evaluation of accounting system reporting, benefits of management accounting systems, and use of planning tools for preparing and forecasting budgets. The report concludes by highlighting the importance of management accounting in achieving sustainable success for organizations.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirements of its systems.......................................1

P2 Different methods used for management accounting reporting.............................................3

M1 Benefits of management accounting systems:.......................................................................1

D1: Critical evaluation of accounting system reporting..............................................................1

TASK 2............................................................................................................................................3

P3 Different costing techniques that are used .............................................................................3

M2 Various techniques of management accounting system .......................................................7

D2 Interpret data for a range of business activities......................................................................7

TASK 3............................................................................................................................................7

P4 Planning tools used for budgetary control:.............................................................................7

M3 Use of planning tools and their application for preparing and forecasting budgets:.............9

TASK 4............................................................................................................................................9

P5 Comparison of organisations to solve the financial problem with the use of management

accounting system........................................................................................................................9

M4 Management accounting in response to financial problem can lead organisations to

sustainable success ....................................................................................................................11

D3 Planning tools used to resolve financial problems:..............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirements of its systems.......................................1

P2 Different methods used for management accounting reporting.............................................3

M1 Benefits of management accounting systems:.......................................................................1

D1: Critical evaluation of accounting system reporting..............................................................1

TASK 2............................................................................................................................................3

P3 Different costing techniques that are used .............................................................................3

M2 Various techniques of management accounting system .......................................................7

D2 Interpret data for a range of business activities......................................................................7

TASK 3............................................................................................................................................7

P4 Planning tools used for budgetary control:.............................................................................7

M3 Use of planning tools and their application for preparing and forecasting budgets:.............9

TASK 4............................................................................................................................................9

P5 Comparison of organisations to solve the financial problem with the use of management

accounting system........................................................................................................................9

M4 Management accounting in response to financial problem can lead organisations to

sustainable success ....................................................................................................................11

D3 Planning tools used to resolve financial problems:..............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Management accounting can be defined as the process which is followed by top level

executives of business entities for the purpose of analysing, monitoring, measuring and

controlling organisational performance. With the help of it internal stakeholders formulate

strategic decisions for the betterment of company (Wickramasinghe and Alawattage, 2012).

Main aim of this project is to determine importance of management accounting, its systems and

reports for enterprises to manage operations and respond to financial problems. The organisation

which is selected for this report is Equilibrium Asset Management which is a financial consultant

and have various clients such as Cambridge Manufacturing Company Ltd. which is mainly

established in UK. This report covers various topics such as management accounting, different

system and reports, use of various costing techniques to calculate profits etc. Along with this,

different planning tools used in budgetary control and the way in which organisations are using

management accounting systems are also covered under this assignment.

TASK 1

P1 Management accounting and essential requirements of its systems

Management accounting: It is the process of analysing performance of so that strategic

decision could be formulated to enhance it and reach to the long term business goals. With the

help of it stakeholders analyse that the company is generating profit or facing losses. In

Cambridge Manufacturing Company Ltd. managers conduct management accounting on regular

basis so that detailed information regarding current status of enterprise can be kept. It guides

them to take appropriate actions that can help to critical situations such as continuous decrement

in profits etc.

Management accounting system: It can be defined as the system which is used by

managers of different organisations for the purpose of analysing that business is performing well

or not. It helps managers of Cambridge Manufacturing Company Ltd. to share accurate

information of enterprise with stakeholders so that their interest within the company can be

maintained (Zoni, Dossi and Morelli, 2012).

Different management accounting systems: There are various management accounting

systems that are used by managers of business entities in order to make sure that predetermined

1

Management accounting can be defined as the process which is followed by top level

executives of business entities for the purpose of analysing, monitoring, measuring and

controlling organisational performance. With the help of it internal stakeholders formulate

strategic decisions for the betterment of company (Wickramasinghe and Alawattage, 2012).

Main aim of this project is to determine importance of management accounting, its systems and

reports for enterprises to manage operations and respond to financial problems. The organisation

which is selected for this report is Equilibrium Asset Management which is a financial consultant

and have various clients such as Cambridge Manufacturing Company Ltd. which is mainly

established in UK. This report covers various topics such as management accounting, different

system and reports, use of various costing techniques to calculate profits etc. Along with this,

different planning tools used in budgetary control and the way in which organisations are using

management accounting systems are also covered under this assignment.

TASK 1

P1 Management accounting and essential requirements of its systems

Management accounting: It is the process of analysing performance of so that strategic

decision could be formulated to enhance it and reach to the long term business goals. With the

help of it stakeholders analyse that the company is generating profit or facing losses. In

Cambridge Manufacturing Company Ltd. managers conduct management accounting on regular

basis so that detailed information regarding current status of enterprise can be kept. It guides

them to take appropriate actions that can help to critical situations such as continuous decrement

in profits etc.

Management accounting system: It can be defined as the system which is used by

managers of different organisations for the purpose of analysing that business is performing well

or not. It helps managers of Cambridge Manufacturing Company Ltd. to share accurate

information of enterprise with stakeholders so that their interest within the company can be

maintained (Zoni, Dossi and Morelli, 2012).

Different management accounting systems: There are various management accounting

systems that are used by managers of business entities in order to make sure that predetermined

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

objectives are achieved or not. Some of them which are used by management of Cambridge

Manufacturing Company Ltd. are discussed below:

Cost accounting system: It is a system which is used in most of the manufacturing

companies for the purpose of keeping track record of costs which is related to production

activities. Managers in Cambridge Manufacturing Company Ltd. use it for the purpose of

analysing all the expenses related to products manufactured by enterprise in order to allot funds

to all the functional departments according to their requirements. It is required for the

organisation because it helps management to estimate cost and evaluate ability of Cambridge

Manufacturing Company Ltd. to generate profits.

Inventory management system: It is used by different business entities to keep a track

record of stock which is used for production activities so that all the projects that are undertaken

by company can be completed within the specific time limit. In Cambridge Manufacturing

Company Ltd. managers use it for the purpose of analysing that organisation is having sufficient

stock to manufacture all the products. There are three different types of inventory management

system which are discussed below:

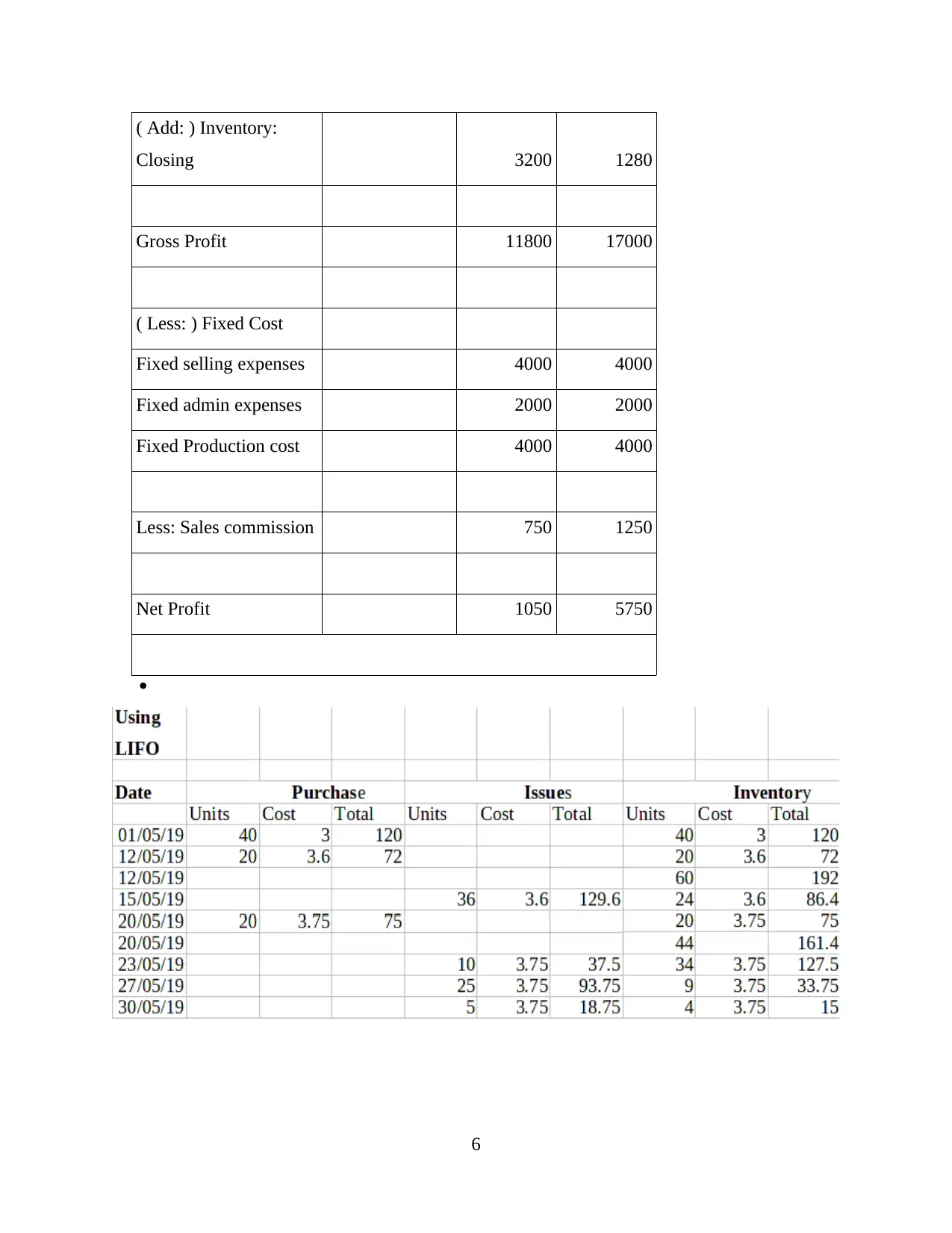

LIFO (Last In First Out): In this method of inventory management currently bought

goods are used to product products.

FIFO (First In First Out): In FIFO earlier acquired goods are used for product

manufacturing activities.

AVCO (Average cost): In this method, inventory is used on average basis of average

cost to conduct production activities.

From all the above described methods of inventory management FIFO is used by

managers of Cambridge Manufacturing Company Ltd. to manufacture different products. It is

required by the organisation as it helps to analyse that sufficient amount of stock is available in

warehouses for production or not (Liang, 2013).

Price optimization system: It is a system which is used by business entities to set

appropriate prices for the products so that expectation of client could be matched. In Cambridge

Manufacturing Company Ltd. managers use this system to set best suitable prices for all the

manufactured units in order to meet long term business objectives and enhance overall

profitability. It is required for enterprise as it helps to monitor response of customers on different

prices that are set by managers for products. While using this system managers determine

2

Manufacturing Company Ltd. are discussed below:

Cost accounting system: It is a system which is used in most of the manufacturing

companies for the purpose of keeping track record of costs which is related to production

activities. Managers in Cambridge Manufacturing Company Ltd. use it for the purpose of

analysing all the expenses related to products manufactured by enterprise in order to allot funds

to all the functional departments according to their requirements. It is required for the

organisation because it helps management to estimate cost and evaluate ability of Cambridge

Manufacturing Company Ltd. to generate profits.

Inventory management system: It is used by different business entities to keep a track

record of stock which is used for production activities so that all the projects that are undertaken

by company can be completed within the specific time limit. In Cambridge Manufacturing

Company Ltd. managers use it for the purpose of analysing that organisation is having sufficient

stock to manufacture all the products. There are three different types of inventory management

system which are discussed below:

LIFO (Last In First Out): In this method of inventory management currently bought

goods are used to product products.

FIFO (First In First Out): In FIFO earlier acquired goods are used for product

manufacturing activities.

AVCO (Average cost): In this method, inventory is used on average basis of average

cost to conduct production activities.

From all the above described methods of inventory management FIFO is used by

managers of Cambridge Manufacturing Company Ltd. to manufacture different products. It is

required by the organisation as it helps to analyse that sufficient amount of stock is available in

warehouses for production or not (Liang, 2013).

Price optimization system: It is a system which is used by business entities to set

appropriate prices for the products so that expectation of client could be matched. In Cambridge

Manufacturing Company Ltd. managers use this system to set best suitable prices for all the

manufactured units in order to meet long term business objectives and enhance overall

profitability. It is required for enterprise as it helps to monitor response of customers on different

prices that are set by managers for products. While using this system managers determine

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

expectations of clients regarding price and then decide a best rate for each item so that large

market share can be acquired.

Job order costing system: It is used by organisations to identify cost of all the jobs that

are performed to conduct business activities. Managers in Cambridge Manufacturing Company

Ltd. use this system for the purpose of analysing the expenses that are related to different

activities that are performed according to specifications of clients. It is required by the enterprise

because with the help of it cost of each and every job can be analysed to measure profitability. It

also guides top level executives to assess ability of all the activities to generate profits for

betterment of organisation.

All the above described systems are used by managers in Cambridge Manufacturing

Company Ltd. in order to analyse position of enterprise. The information which is gathered with

the help of all of them is used by management of entity to form strategic decisions for betterment

of organisation.

P2 Different methods used for management accounting reporting

Management accounting reporting: It can be defined as the process of generating

reports in which information regarding organisation's performance, ability to generate profits etc.

All the management accounting reports are presented in front of stakeholders in order to provide

information regarding actual status of enterprise. In Cambridge Manufacturing Company Ltd.

managers focus on it for the purpose of formulating strategic decisions for betterment of

enterprise (Maas, Schaltegger and Crutzen, 2016).

Different methods of management accounting reporting: There are various methods

that are used to formulate management reports and help top level executives to assess that

organisation is performing well or not. All of them that are used by managers of Cambridge

Manufacturing Company Ltd. are described below:

Performance report: In this method of reporting performance of organisation and

employees is analysed and reported in a report for the purpose of keeping a track record of it. In

Cambridge Manufacturing Company Ltd. It is formulated by managers in order to analyse that

the activities performed by enterprise are beneficial or not. This report is advantages for the

entity because it help management to provide rewards to staff members according to their

performance and motivate them. Distribution of bonus and rewards is done on the basis of it as it

guides managers to analyse efforts of all workers to accomplish business goals.

3

market share can be acquired.

Job order costing system: It is used by organisations to identify cost of all the jobs that

are performed to conduct business activities. Managers in Cambridge Manufacturing Company

Ltd. use this system for the purpose of analysing the expenses that are related to different

activities that are performed according to specifications of clients. It is required by the enterprise

because with the help of it cost of each and every job can be analysed to measure profitability. It

also guides top level executives to assess ability of all the activities to generate profits for

betterment of organisation.

All the above described systems are used by managers in Cambridge Manufacturing

Company Ltd. in order to analyse position of enterprise. The information which is gathered with

the help of all of them is used by management of entity to form strategic decisions for betterment

of organisation.

P2 Different methods used for management accounting reporting

Management accounting reporting: It can be defined as the process of generating

reports in which information regarding organisation's performance, ability to generate profits etc.

All the management accounting reports are presented in front of stakeholders in order to provide

information regarding actual status of enterprise. In Cambridge Manufacturing Company Ltd.

managers focus on it for the purpose of formulating strategic decisions for betterment of

enterprise (Maas, Schaltegger and Crutzen, 2016).

Different methods of management accounting reporting: There are various methods

that are used to formulate management reports and help top level executives to assess that

organisation is performing well or not. All of them that are used by managers of Cambridge

Manufacturing Company Ltd. are described below:

Performance report: In this method of reporting performance of organisation and

employees is analysed and reported in a report for the purpose of keeping a track record of it. In

Cambridge Manufacturing Company Ltd. It is formulated by managers in order to analyse that

the activities performed by enterprise are beneficial or not. This report is advantages for the

entity because it help management to provide rewards to staff members according to their

performance and motivate them. Distribution of bonus and rewards is done on the basis of it as it

guides managers to analyse efforts of all workers to accomplish business goals.

3

Budget report: It is an internal report which is generated by managers in order to keep a

record of different incomes and expenses that are related to a specific period of time. The

information which is recorded in this report is used by management of Cambridge

Manufacturing Company Ltd. to allot sufficient amount of funds to different functional

departments of organisation so that they can perform operations appropriately. It is beneficial for

the enterprise because it helps to execute all the business activities in limited monetary resources.

This report is also used to make comparison between actual and budgeted expenses and incomes.

Inventory management report: In manufacturing companies it is generated by

managers in order to keep an eye on inventory which is used for production activities. In

Cambridge Manufacturing Company Ltd. it is created by management so that they can analyse

actual status of goods that are used to manufacture products. With the help of it managers order

stock before warehouses became out of stock. It is beneficial for businesses because it helps to

assess that a company is having sufficient inventory to conduct operational activities.

Account receivable aging report: All the companies that are offering credit to their

clients generate such types of reports. When customers are not able to pay whole amount of

product at the time of purchase then they ask seller to allow them credit and they promise to pay

the due amount after a certain period of time. In this type of situation managers of Cambridge

Manufacturing Company Ltd. generate account receivable report so that information regarding

owed amount of clients can be recorded. When customers fails to pay the outstanding amount at

due date then managers analyse it and gather information regarding the due amount of them and

ask to pay the same. It is beneficial for the enterprise because it can help to tighten credit policies

in order to ignore the situation of late payments from buyers (Michalski, 2012).

All the above described reports are generated by managers in Cambridge Manufacturing

Company Ltd. In order to keep detailed information of different activities performed by it. With

the help of all of them managers determine actual position of company and then formulate

strategic decisions to enhance it.

4

record of different incomes and expenses that are related to a specific period of time. The

information which is recorded in this report is used by management of Cambridge

Manufacturing Company Ltd. to allot sufficient amount of funds to different functional

departments of organisation so that they can perform operations appropriately. It is beneficial for

the enterprise because it helps to execute all the business activities in limited monetary resources.

This report is also used to make comparison between actual and budgeted expenses and incomes.

Inventory management report: In manufacturing companies it is generated by

managers in order to keep an eye on inventory which is used for production activities. In

Cambridge Manufacturing Company Ltd. it is created by management so that they can analyse

actual status of goods that are used to manufacture products. With the help of it managers order

stock before warehouses became out of stock. It is beneficial for businesses because it helps to

assess that a company is having sufficient inventory to conduct operational activities.

Account receivable aging report: All the companies that are offering credit to their

clients generate such types of reports. When customers are not able to pay whole amount of

product at the time of purchase then they ask seller to allow them credit and they promise to pay

the due amount after a certain period of time. In this type of situation managers of Cambridge

Manufacturing Company Ltd. generate account receivable report so that information regarding

owed amount of clients can be recorded. When customers fails to pay the outstanding amount at

due date then managers analyse it and gather information regarding the due amount of them and

ask to pay the same. It is beneficial for the enterprise because it can help to tighten credit policies

in order to ignore the situation of late payments from buyers (Michalski, 2012).

All the above described reports are generated by managers in Cambridge Manufacturing

Company Ltd. In order to keep detailed information of different activities performed by it. With

the help of all of them managers determine actual position of company and then formulate

strategic decisions to enhance it.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

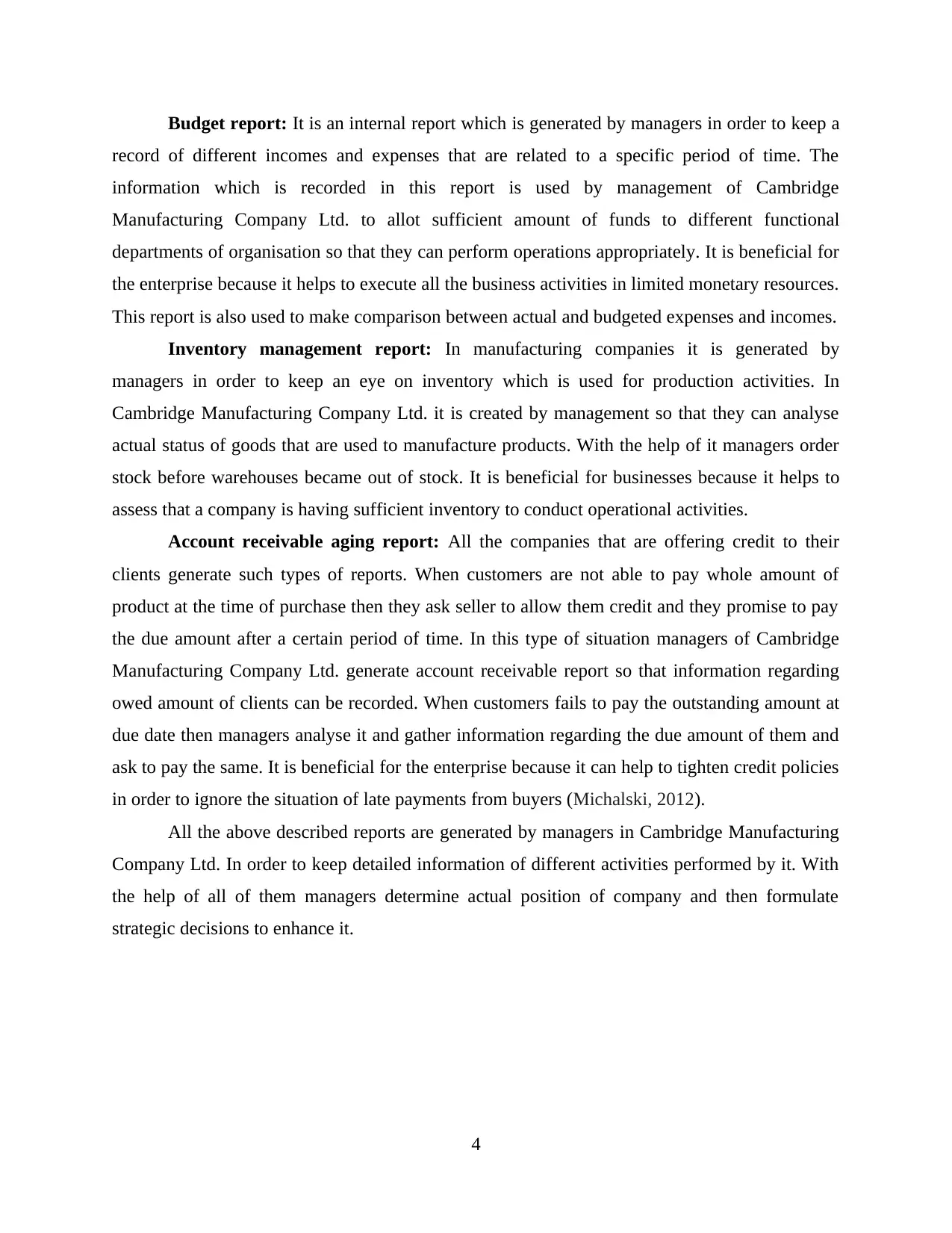

M1 Benefits of management accounting systems:

Management

systems

Benefits & organisational context

Inventory

management

It ensures that optimal inventory levels are present at the warehouse

by maintaining stock sheets.

Cambridge Manufacturing Company Ltd. uses inventory

management system to order goods from the suppliers to avoid any

stock-outs.

Cost accounting It guides managers at reducing prices for company's product &

service by estimating income and expenses for the period.

This system acts as being profitable for Cambridge Manufacturing

Company Ltd. as it eliminates any loss arising in the period and

consider those activities that generate revenue for products.

Price

optimisation

Price optimisation system help the managers in setting price of

products.

This system aids Cambridge Manufacturing Company Ltd. in

maximising customer satisfaction (Mahesha and Akash, 2013).

Job costing It is used by companies for providing jobs to the workers as per their

skill and requirement.

Cambridge Manufacturing Company Ltd. uses job costing system to

appoint right people for right jobs.

D1: Critical evaluation of accounting system reporting

From the elaborated discussion of different crucial reports it has been critically evaluated

that all important feature for acquisition maximum results for Cambridge manufacturing

company LTD. If manager make proper use of these report then they will be able to generate

more reliable and accurate decision within a specific period of time so that profitability can be

increased. The primary objective of preparing different reports to accomplish actuals aims that

Management

systems

Benefits & organisational context

Inventory

management

It ensures that optimal inventory levels are present at the warehouse

by maintaining stock sheets.

Cambridge Manufacturing Company Ltd. uses inventory

management system to order goods from the suppliers to avoid any

stock-outs.

Cost accounting It guides managers at reducing prices for company's product &

service by estimating income and expenses for the period.

This system acts as being profitable for Cambridge Manufacturing

Company Ltd. as it eliminates any loss arising in the period and

consider those activities that generate revenue for products.

Price

optimisation

Price optimisation system help the managers in setting price of

products.

This system aids Cambridge Manufacturing Company Ltd. in

maximising customer satisfaction (Mahesha and Akash, 2013).

Job costing It is used by companies for providing jobs to the workers as per their

skill and requirement.

Cambridge Manufacturing Company Ltd. uses job costing system to

appoint right people for right jobs.

D1: Critical evaluation of accounting system reporting

From the elaborated discussion of different crucial reports it has been critically evaluated

that all important feature for acquisition maximum results for Cambridge manufacturing

company LTD. If manager make proper use of these report then they will be able to generate

more reliable and accurate decision within a specific period of time so that profitability can be

increased. The primary objective of preparing different reports to accomplish actuals aims that

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

are being fixed by manager of company. In accordance with this, performance report is one of

the most beneficial report which provide more impressive structure and detail substance related

to financial position can easily be examine in appropriate manner. It has been ascertain that with

the support to accounts receivable reports manager are able to provide strength to credit policy

and increase sales figure.

2

the most beneficial report which provide more impressive structure and detail substance related

to financial position can easily be examine in appropriate manner. It has been ascertain that with

the support to accounts receivable reports manager are able to provide strength to credit policy

and increase sales figure.

2

TASK 2

P3 Different costing techniques that are used

Cost is termed as the monetary amount that is being charged by seller for buyer at the

time of selling crucial product of company (Ruiz-de-Arbulo-Lopez, Fortuny-Santos and

Cuatrecasas-Arbós, 2013). There can be different types of cost that are directly or indirectly

associated with production process that aid to increase the overall productivity of company. In

business there are different kind of costing techniques that are effectively used in respective

company to prepare the financial statement and ascertain the net profit for an accounting year.

These are discussed below:

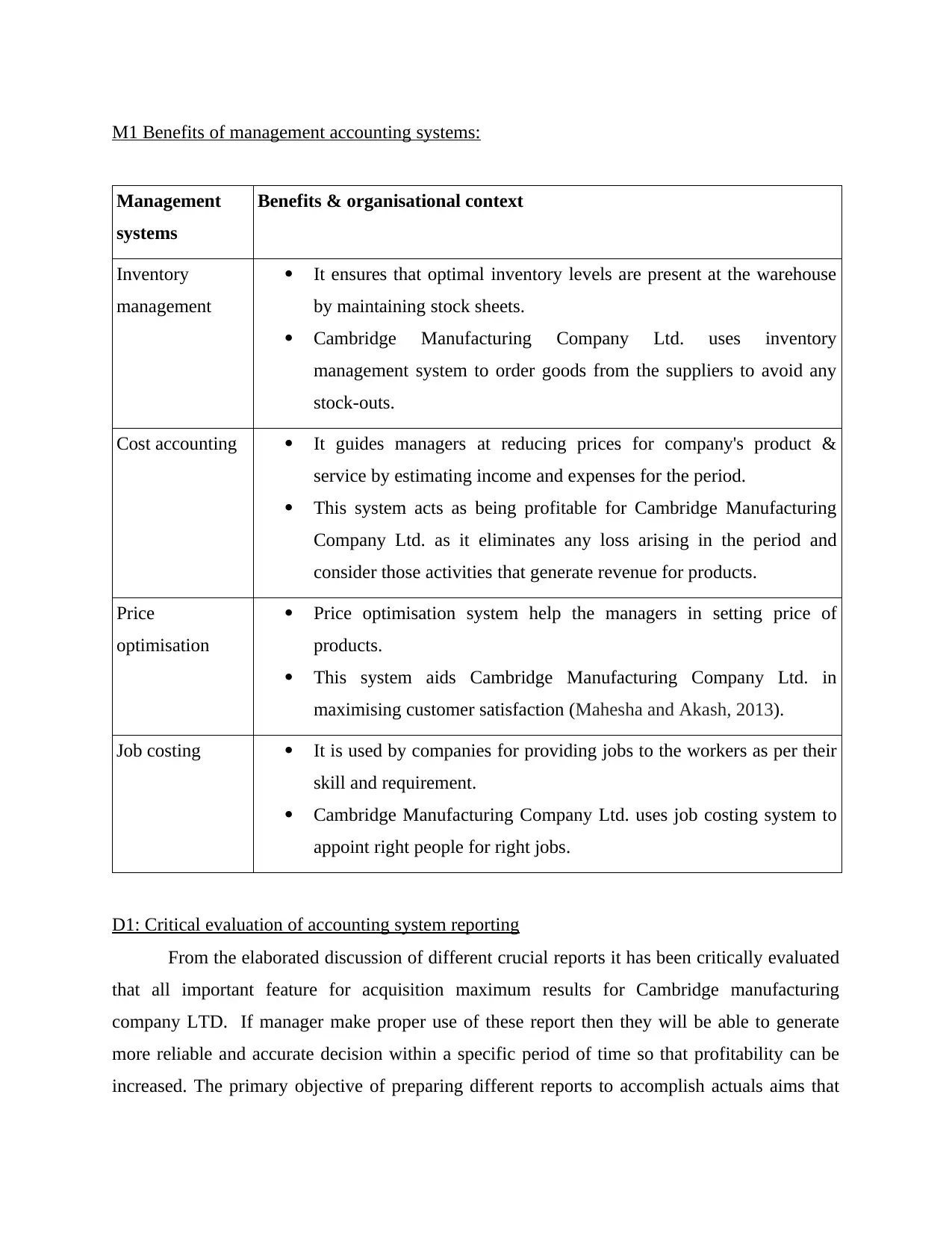

Absorption costing: This method of costing is related with all overheads that are

incurred in production and are irrespective in nature which are charged to each unit cost of

product. There is no assortment of expenditure within fixed or variable as it includes every cost

while producing valuable goods. Thus it is also consider one of the most important costing

techniques that instantly connected with manufacture of products and services. These includes

both variable and fixed cost during the same point of time therefore it is also known as full

costing method.

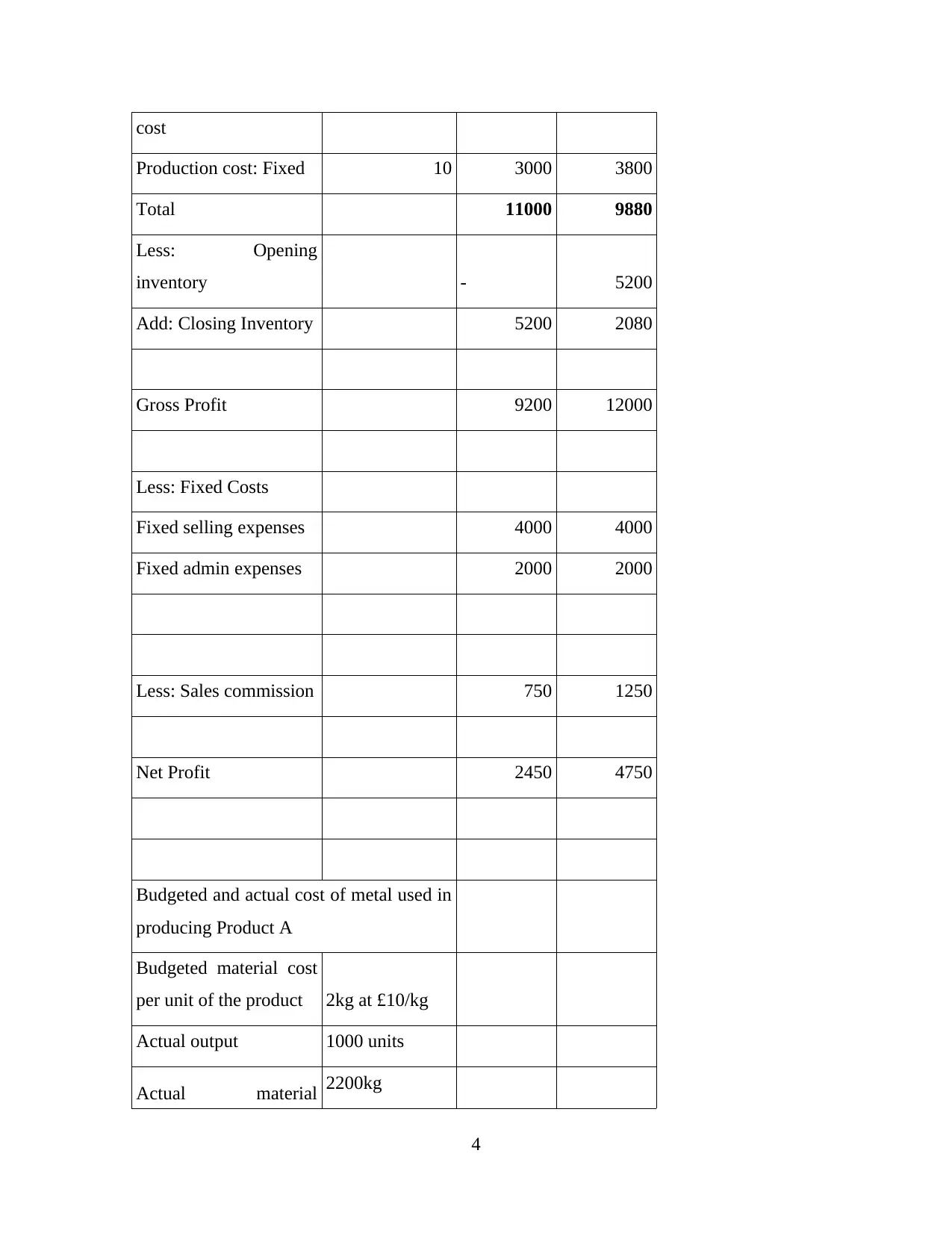

Absorption Costing:

May June

Selling Price 50 15000 25000

Less: Absorption Costs

Per unit Direct

materials cost 8 4000 3040

Per unit Direct labour

cost 5 2500 1900

Per unit variable

production overheads

3 1500 1140

3

P3 Different costing techniques that are used

Cost is termed as the monetary amount that is being charged by seller for buyer at the

time of selling crucial product of company (Ruiz-de-Arbulo-Lopez, Fortuny-Santos and

Cuatrecasas-Arbós, 2013). There can be different types of cost that are directly or indirectly

associated with production process that aid to increase the overall productivity of company. In

business there are different kind of costing techniques that are effectively used in respective

company to prepare the financial statement and ascertain the net profit for an accounting year.

These are discussed below:

Absorption costing: This method of costing is related with all overheads that are

incurred in production and are irrespective in nature which are charged to each unit cost of

product. There is no assortment of expenditure within fixed or variable as it includes every cost

while producing valuable goods. Thus it is also consider one of the most important costing

techniques that instantly connected with manufacture of products and services. These includes

both variable and fixed cost during the same point of time therefore it is also known as full

costing method.

Absorption Costing:

May June

Selling Price 50 15000 25000

Less: Absorption Costs

Per unit Direct

materials cost 8 4000 3040

Per unit Direct labour

cost 5 2500 1900

Per unit variable

production overheads

3 1500 1140

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cost

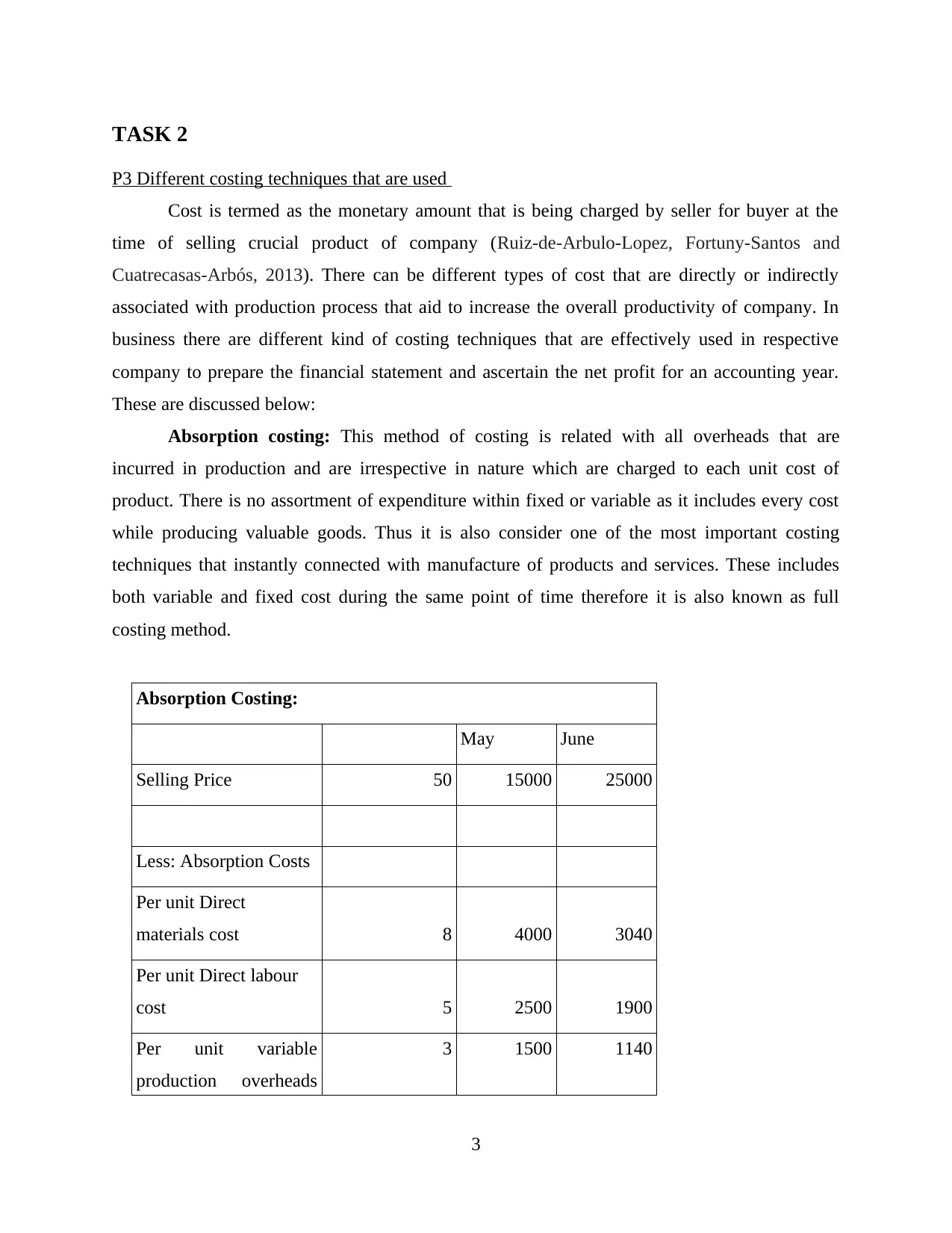

Production cost: Fixed 10 3000 3800

Total 11000 9880

Less: Opening

inventory - 5200

Add: Closing Inventory 5200 2080

Gross Profit 9200 12000

Less: Fixed Costs

Fixed selling expenses 4000 4000

Fixed admin expenses 2000 2000

Less: Sales commission 750 1250

Net Profit 2450 4750

Budgeted and actual cost of metal used in

producing Product A

Budgeted material cost

per unit of the product 2kg at £10/kg

Actual output 1000 units

Actual material 2200kg

4

Production cost: Fixed 10 3000 3800

Total 11000 9880

Less: Opening

inventory - 5200

Add: Closing Inventory 5200 2080

Gross Profit 9200 12000

Less: Fixed Costs

Fixed selling expenses 4000 4000

Fixed admin expenses 2000 2000

Less: Sales commission 750 1250

Net Profit 2450 4750

Budgeted and actual cost of metal used in

producing Product A

Budgeted material cost

per unit of the product 2kg at £10/kg

Actual output 1000 units

Actual material 2200kg

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

purchased and used

Actual material cost £20,900

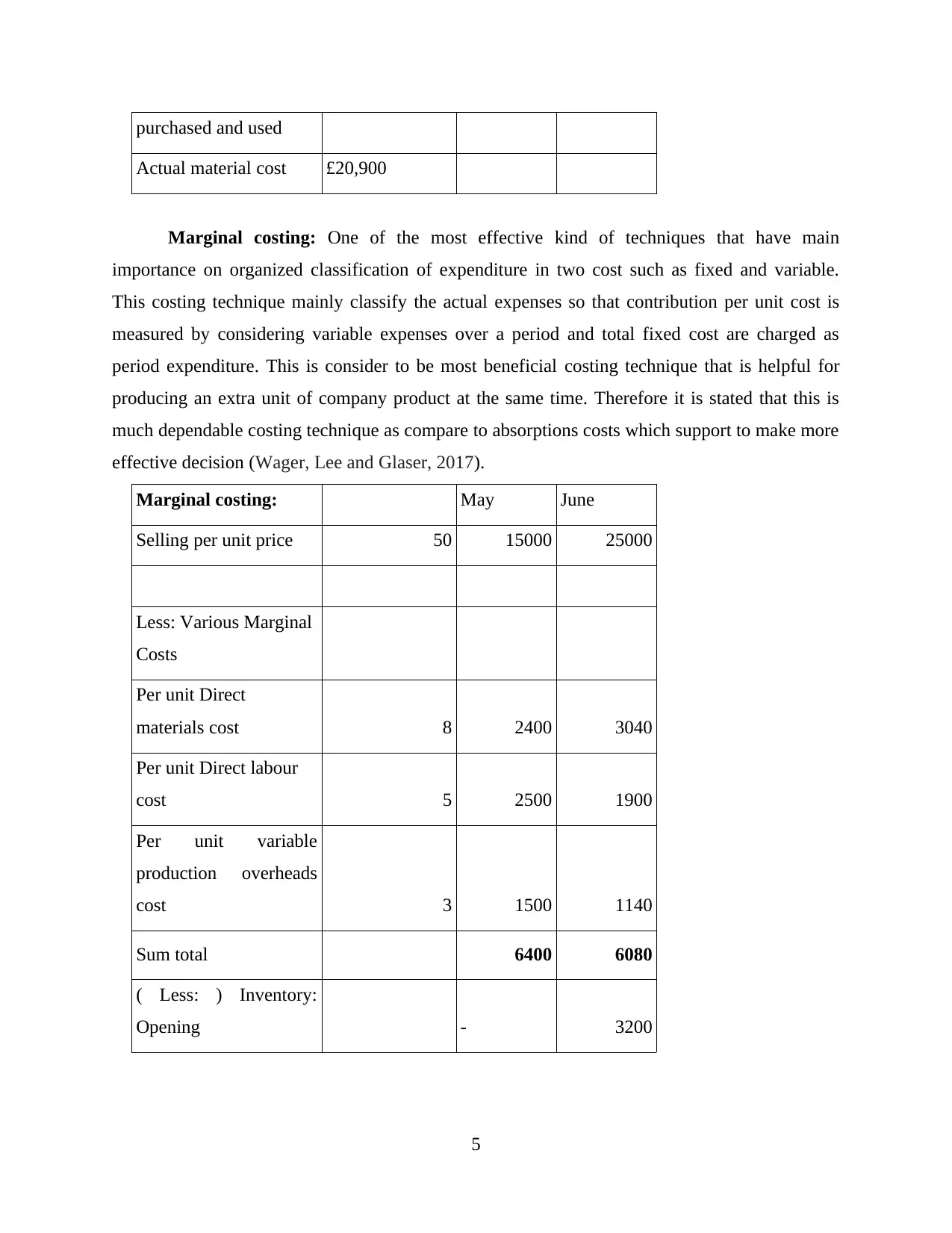

Marginal costing: One of the most effective kind of techniques that have main

importance on organized classification of expenditure in two cost such as fixed and variable.

This costing technique mainly classify the actual expenses so that contribution per unit cost is

measured by considering variable expenses over a period and total fixed cost are charged as

period expenditure. This is consider to be most beneficial costing technique that is helpful for

producing an extra unit of company product at the same time. Therefore it is stated that this is

much dependable costing technique as compare to absorptions costs which support to make more

effective decision (Wager, Lee and Glaser, 2017).

Marginal costing: May June

Selling per unit price 50 15000 25000

Less: Various Marginal

Costs

Per unit Direct

materials cost 8 2400 3040

Per unit Direct labour

cost 5 2500 1900

Per unit variable

production overheads

cost 3 1500 1140

Sum total 6400 6080

( Less: ) Inventory:

Opening - 3200

5

Actual material cost £20,900

Marginal costing: One of the most effective kind of techniques that have main

importance on organized classification of expenditure in two cost such as fixed and variable.

This costing technique mainly classify the actual expenses so that contribution per unit cost is

measured by considering variable expenses over a period and total fixed cost are charged as

period expenditure. This is consider to be most beneficial costing technique that is helpful for

producing an extra unit of company product at the same time. Therefore it is stated that this is

much dependable costing technique as compare to absorptions costs which support to make more

effective decision (Wager, Lee and Glaser, 2017).

Marginal costing: May June

Selling per unit price 50 15000 25000

Less: Various Marginal

Costs

Per unit Direct

materials cost 8 2400 3040

Per unit Direct labour

cost 5 2500 1900

Per unit variable

production overheads

cost 3 1500 1140

Sum total 6400 6080

( Less: ) Inventory:

Opening - 3200

5

( Add: ) Inventory:

Closing 3200 1280

Gross Profit 11800 17000

( Less: ) Fixed Cost

Fixed selling expenses 4000 4000

Fixed admin expenses 2000 2000

Fixed Production cost 4000 4000

Less: Sales commission 750 1250

Net Profit 1050 5750

6

Closing 3200 1280

Gross Profit 11800 17000

( Less: ) Fixed Cost

Fixed selling expenses 4000 4000

Fixed admin expenses 2000 2000

Fixed Production cost 4000 4000

Less: Sales commission 750 1250

Net Profit 1050 5750

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.