Management Accounting Report: Excite Entertainment Financial Analysis

VerifiedAdded on 2020/10/22

|18

|5609

|260

Report

AI Summary

This report examines management accounting practices within Excite Entertainment, a UK-based leisure and entertainment company. It begins by differentiating management accounting from financial accounting, outlining essential requirements like cost accounting and inventory management systems. The report explores various management accounting reporting methods, including budget reports, accounts receivable reports, cost accounting reports, and performance reports. It evaluates the benefits and applications of cost accounting, inventory management, and job costing systems. Furthermore, the report delves into marginal and absorption costing calculations and examines budgetary control planning tools, including their advantages and disadvantages. Finally, the report addresses the adaptation of management accounting systems to solve financial problems and achieve organizational success, including a cost-profit-volume analysis.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

P1. Explaining management accounting and essential requirements of the various

management accounting systems. ..............................................................................................4

P2. Explaining several methods used for management accounting reporting. ..........................6

M1 & D1. Evaluating the benefits and the application of management accounting systems

within the organization................................................................................................................7

LO2..................................................................................................................................................9

P3 Calculation of marginal absorption costing...........................................................................9

LO 3...............................................................................................................................................11

P4. Budgetary control planning tools with advantages and disadvantages...............................11

M3. Application of different planning tools..............................................................................13

LO 4...............................................................................................................................................14

Part A.........................................................................................................................................14

P5 & M4 Adaption of management accounting system for solving financial problems to

achieve organisational success..................................................................................................14

Part B ........................................................................................................................................16

Cost profit volume analysis.......................................................................................................16

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

P1. Explaining management accounting and essential requirements of the various

management accounting systems. ..............................................................................................4

P2. Explaining several methods used for management accounting reporting. ..........................6

M1 & D1. Evaluating the benefits and the application of management accounting systems

within the organization................................................................................................................7

LO2..................................................................................................................................................9

P3 Calculation of marginal absorption costing...........................................................................9

LO 3...............................................................................................................................................11

P4. Budgetary control planning tools with advantages and disadvantages...............................11

M3. Application of different planning tools..............................................................................13

LO 4...............................................................................................................................................14

Part A.........................................................................................................................................14

P5 & M4 Adaption of management accounting system for solving financial problems to

achieve organisational success..................................................................................................14

Part B ........................................................................................................................................16

Cost profit volume analysis.......................................................................................................16

CONCLUSION .............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION

Management accounting means the methods and the concepts that are necessary for

making effective planning, for selecting the best course of action among various alternatives and

for controlling by the interpretation of the performances. The present study is based on Excite

Entertainment, Operates in the business of leisure and the entertainment industry in the UK. The

main activities of the firm include the promotion of the concerts and the festivals at several

locations throughout UK. Furthermore, the report describes the difference between management

accounting and financial accounting with the essential requirements of the systems of

management accounting. The report also includes the different methods that are used by the firm

and the calculation of the profits by applying marginal and absorption costing. Moreover, the

study explains about different planning tools of budgetary control and the technique used for

resolving the financial problems in the organization.

MAIN BODY

LO 1

P1. Explaining management accounting and essential requirements of the various management

accounting systems.

Management accounting is the branch of accounting that facilitates the information to the people

that are present in Excite entertainment. However, financial accounting is majorly evaluated for

communicating both internal and the external users that is the stakeholders. Management

accounting aims for providing the quantitative as well as the qualitative information to managers

which enables them in making decisions so that profits could be maximized. Financial

accounting focuses on providing the true and the fair view of the financial performance and the

position of Excite entertainment to several parties (Messner, 2016). Management accounting is

not compulsory as per the laws for the enterprise while financial accounting is compulsory in

accordance with the laws for each and every firm. Management accounting includes both type of

information monetary and non-monetary whereas financial accounting includes only the

monetary information.

Essential requirements of the management accounting systems-

Cost accounting systems- It is the framework that is required by Excite entertainment for

3

Management accounting means the methods and the concepts that are necessary for

making effective planning, for selecting the best course of action among various alternatives and

for controlling by the interpretation of the performances. The present study is based on Excite

Entertainment, Operates in the business of leisure and the entertainment industry in the UK. The

main activities of the firm include the promotion of the concerts and the festivals at several

locations throughout UK. Furthermore, the report describes the difference between management

accounting and financial accounting with the essential requirements of the systems of

management accounting. The report also includes the different methods that are used by the firm

and the calculation of the profits by applying marginal and absorption costing. Moreover, the

study explains about different planning tools of budgetary control and the technique used for

resolving the financial problems in the organization.

MAIN BODY

LO 1

P1. Explaining management accounting and essential requirements of the various management

accounting systems.

Management accounting is the branch of accounting that facilitates the information to the people

that are present in Excite entertainment. However, financial accounting is majorly evaluated for

communicating both internal and the external users that is the stakeholders. Management

accounting aims for providing the quantitative as well as the qualitative information to managers

which enables them in making decisions so that profits could be maximized. Financial

accounting focuses on providing the true and the fair view of the financial performance and the

position of Excite entertainment to several parties (Messner, 2016). Management accounting is

not compulsory as per the laws for the enterprise while financial accounting is compulsory in

accordance with the laws for each and every firm. Management accounting includes both type of

information monetary and non-monetary whereas financial accounting includes only the

monetary information.

Essential requirements of the management accounting systems-

Cost accounting systems- It is the framework that is required by Excite entertainment for

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

estimating the cost in terms of their products for analyzing the profitability, valuing the inventory

and for cost control (Gaynor and et.al., 2016). Anticipating the cost of the products is crucial for

the making the operations profitable as it enables the firm in knowing the products that are

profitable and unprofitable or irrelevant. This can only be ascertained by estimating the correct

and the true cost of product. The two major cost accounting systems includes the job order

costing and the process costing.

Job costing- It is the system that assigns and accumulates the manufacturing costs for

each of the job. It is the most suitable approach for Excite entertainment as it deals in event

management.

Process costing- the system of cost accounting that accumulates the manufacturing cost

for each of the process within the firm (Francis and et.al., 2015). It is appropriate in for the

enterprise in evaluating the cost involved in different departments and the flow of the cost from

one division to the another.

Direct costing- This method is the specialized form that analyzes the cost using only the

variable costs for making the decisions. It never considers the fixed costs that are

assumed to be attached with the time in which they had been incurred. Such cost

disappears when the production line is been shut down. Standard costing- It is the accounting system that is used by Excite entertainment in

identifying the variances between the actual and the budgeted figures (Drake, Roulstone

and Thornock, 2016). It evaluates the difference between the actual cost of the product

that were to be produced and the cost that could have occurred for actual production of

the goods.

Inventory management system- This system of management accounting is adopted by Excite

entertainment for supervising its non-capitalized assets and the stock items. An element of the

supply chain management, this system supervises the flowing of the goods from the

manufacturer to the warehouses and this leads to point of the scale. It is very important for the

firm as it enables them in tracking the level of the inventory, sales, orders etc (Usenko and et.al.,

2018). For maintaining the optimum inventory in the organization so that it can meet its needs

and could remove the over and the under inventory which can affect the financial figures.

Job costing systems- It includes the process of accumulating the information relating to the cost

attached with particular job or production unit. This information is required by the firm for

4

and for cost control (Gaynor and et.al., 2016). Anticipating the cost of the products is crucial for

the making the operations profitable as it enables the firm in knowing the products that are

profitable and unprofitable or irrelevant. This can only be ascertained by estimating the correct

and the true cost of product. The two major cost accounting systems includes the job order

costing and the process costing.

Job costing- It is the system that assigns and accumulates the manufacturing costs for

each of the job. It is the most suitable approach for Excite entertainment as it deals in event

management.

Process costing- the system of cost accounting that accumulates the manufacturing cost

for each of the process within the firm (Francis and et.al., 2015). It is appropriate in for the

enterprise in evaluating the cost involved in different departments and the flow of the cost from

one division to the another.

Direct costing- This method is the specialized form that analyzes the cost using only the

variable costs for making the decisions. It never considers the fixed costs that are

assumed to be attached with the time in which they had been incurred. Such cost

disappears when the production line is been shut down. Standard costing- It is the accounting system that is used by Excite entertainment in

identifying the variances between the actual and the budgeted figures (Drake, Roulstone

and Thornock, 2016). It evaluates the difference between the actual cost of the product

that were to be produced and the cost that could have occurred for actual production of

the goods.

Inventory management system- This system of management accounting is adopted by Excite

entertainment for supervising its non-capitalized assets and the stock items. An element of the

supply chain management, this system supervises the flowing of the goods from the

manufacturer to the warehouses and this leads to point of the scale. It is very important for the

firm as it enables them in tracking the level of the inventory, sales, orders etc (Usenko and et.al.,

2018). For maintaining the optimum inventory in the organization so that it can meet its needs

and could remove the over and the under inventory which can affect the financial figures.

Job costing systems- It includes the process of accumulating the information relating to the cost

attached with particular job or production unit. This information is required by the firm for

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

submitting the information in context of the cost to the customer under the contract where the

reimbursement of costs takes place. Information provided by this system is said to be most useful

in developing the accuracy in the entity's estimation system, which helps in quoting the prices

that results in reasonable profits. This information is also used for assigning the inventoriable

cost to the manufactured goods.

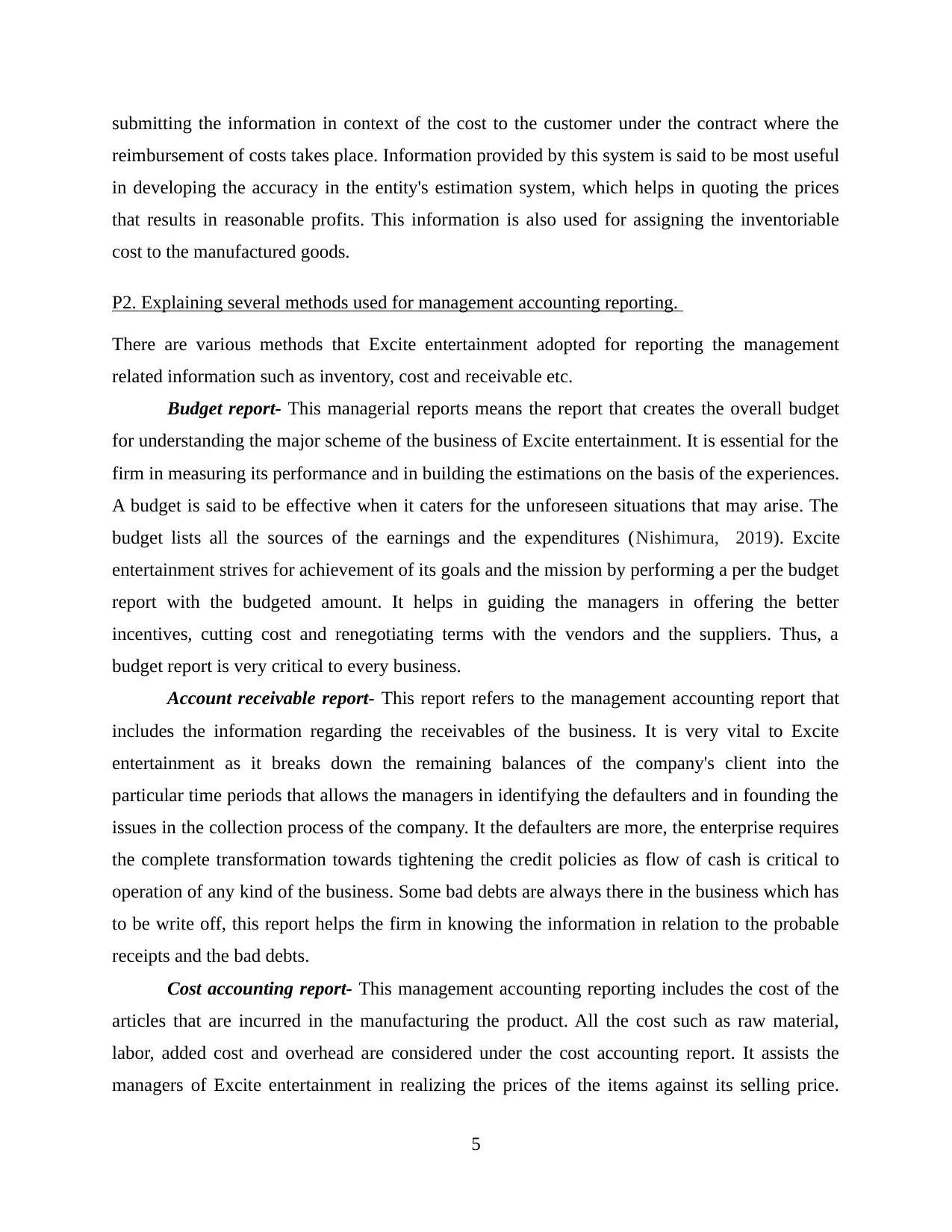

P2. Explaining several methods used for management accounting reporting.

There are various methods that Excite entertainment adopted for reporting the management

related information such as inventory, cost and receivable etc.

Budget report- This managerial reports means the report that creates the overall budget

for understanding the major scheme of the business of Excite entertainment. It is essential for the

firm in measuring its performance and in building the estimations on the basis of the experiences.

A budget is said to be effective when it caters for the unforeseen situations that may arise. The

budget lists all the sources of the earnings and the expenditures (Nishimura, 2019). Excite

entertainment strives for achievement of its goals and the mission by performing a per the budget

report with the budgeted amount. It helps in guiding the managers in offering the better

incentives, cutting cost and renegotiating terms with the vendors and the suppliers. Thus, a

budget report is very critical to every business.

Account receivable report- This report refers to the management accounting report that

includes the information regarding the receivables of the business. It is very vital to Excite

entertainment as it breaks down the remaining balances of the company's client into the

particular time periods that allows the managers in identifying the defaulters and in founding the

issues in the collection process of the company. It the defaulters are more, the enterprise requires

the complete transformation towards tightening the credit policies as flow of cash is critical to

operation of any kind of the business. Some bad debts are always there in the business which has

to be write off, this report helps the firm in knowing the information in relation to the probable

receipts and the bad debts.

Cost accounting report- This management accounting reporting includes the cost of the

articles that are incurred in the manufacturing the product. All the cost such as raw material,

labor, added cost and overhead are considered under the cost accounting report. It assists the

managers of Excite entertainment in realizing the prices of the items against its selling price.

5

reimbursement of costs takes place. Information provided by this system is said to be most useful

in developing the accuracy in the entity's estimation system, which helps in quoting the prices

that results in reasonable profits. This information is also used for assigning the inventoriable

cost to the manufactured goods.

P2. Explaining several methods used for management accounting reporting.

There are various methods that Excite entertainment adopted for reporting the management

related information such as inventory, cost and receivable etc.

Budget report- This managerial reports means the report that creates the overall budget

for understanding the major scheme of the business of Excite entertainment. It is essential for the

firm in measuring its performance and in building the estimations on the basis of the experiences.

A budget is said to be effective when it caters for the unforeseen situations that may arise. The

budget lists all the sources of the earnings and the expenditures (Nishimura, 2019). Excite

entertainment strives for achievement of its goals and the mission by performing a per the budget

report with the budgeted amount. It helps in guiding the managers in offering the better

incentives, cutting cost and renegotiating terms with the vendors and the suppliers. Thus, a

budget report is very critical to every business.

Account receivable report- This report refers to the management accounting report that

includes the information regarding the receivables of the business. It is very vital to Excite

entertainment as it breaks down the remaining balances of the company's client into the

particular time periods that allows the managers in identifying the defaulters and in founding the

issues in the collection process of the company. It the defaulters are more, the enterprise requires

the complete transformation towards tightening the credit policies as flow of cash is critical to

operation of any kind of the business. Some bad debts are always there in the business which has

to be write off, this report helps the firm in knowing the information in relation to the probable

receipts and the bad debts.

Cost accounting report- This management accounting reporting includes the cost of the

articles that are incurred in the manufacturing the product. All the cost such as raw material,

labor, added cost and overhead are considered under the cost accounting report. It assists the

managers of Excite entertainment in realizing the prices of the items against its selling price.

5

Information relating to the profit margins are anticipated and monitored with the use of this

report as it gives a clear picture of all the costs that occurred in the procurement and production

of articles. It provides an understanding of all expenses which is important for attaining

optimization of the resources among different departments. The report facilitates the information

that is accurate, reliable and relevant to the user.

Performance report- It means the report that is prepared for reviewing the performance

of Excite entertainment and for each its employees at the period end (Drake, Roulstone and

Thornock, 2016). Mangers of an entity uses this report for making the strategic decisions for

gaining growing success in the future. The employees who have worked beyond the targets are

been awarded for their excellence. Performance report also reflects the information regarding the

under performers so that corrective measures can be taken towards them.

Other managerial reports- It involves the other reports such as project report,

information report and competitors analysis report. Such reports are formulated either internally

or been outsourced through the professionals.

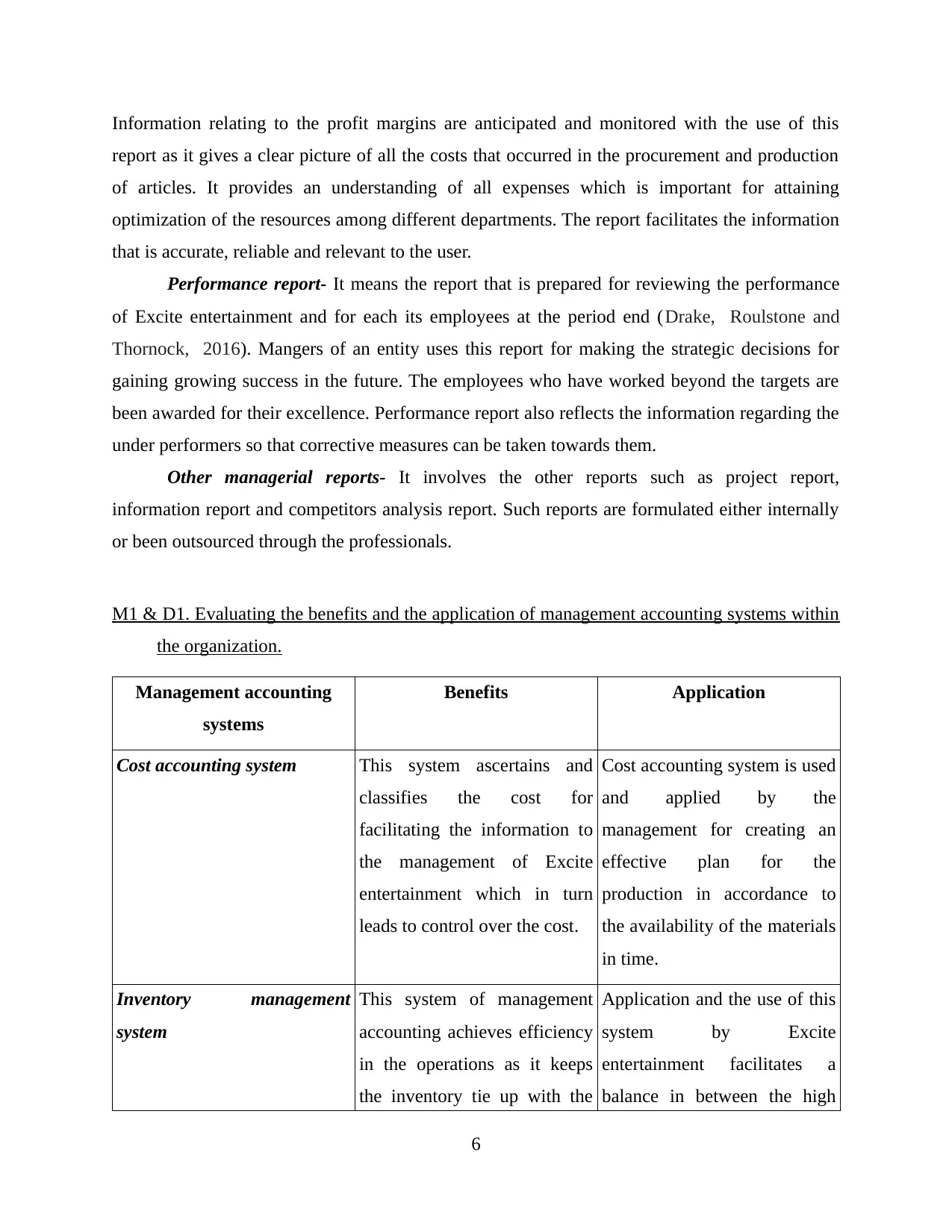

M1 & D1. Evaluating the benefits and the application of management accounting systems within

the organization.

Management accounting

systems

Benefits Application

Cost accounting system This system ascertains and

classifies the cost for

facilitating the information to

the management of Excite

entertainment which in turn

leads to control over the cost.

Cost accounting system is used

and applied by the

management for creating an

effective plan for the

production in accordance to

the availability of the materials

in time.

Inventory management

system

This system of management

accounting achieves efficiency

in the operations as it keeps

the inventory tie up with the

Application and the use of this

system by Excite

entertainment facilitates a

balance in between the high

6

report as it gives a clear picture of all the costs that occurred in the procurement and production

of articles. It provides an understanding of all expenses which is important for attaining

optimization of the resources among different departments. The report facilitates the information

that is accurate, reliable and relevant to the user.

Performance report- It means the report that is prepared for reviewing the performance

of Excite entertainment and for each its employees at the period end (Drake, Roulstone and

Thornock, 2016). Mangers of an entity uses this report for making the strategic decisions for

gaining growing success in the future. The employees who have worked beyond the targets are

been awarded for their excellence. Performance report also reflects the information regarding the

under performers so that corrective measures can be taken towards them.

Other managerial reports- It involves the other reports such as project report,

information report and competitors analysis report. Such reports are formulated either internally

or been outsourced through the professionals.

M1 & D1. Evaluating the benefits and the application of management accounting systems within

the organization.

Management accounting

systems

Benefits Application

Cost accounting system This system ascertains and

classifies the cost for

facilitating the information to

the management of Excite

entertainment which in turn

leads to control over the cost.

Cost accounting system is used

and applied by the

management for creating an

effective plan for the

production in accordance to

the availability of the materials

in time.

Inventory management

system

This system of management

accounting achieves efficiency

in the operations as it keeps

the inventory tie up with the

Application and the use of this

system by Excite

entertainment facilitates a

balance in between the high

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

money (Usenko and et.al.,

2018).

Inventory management system

helps provides for automation

in the manual task as it

includes the working on the

software.

This software integrates the

entire business of Excite

entertainment as it makes the

way from the sales to the

fulfillment.

and the low level of inventory.

It helps in tracing the

inventory during its

transportation between the

locations.

Job costing system Job costing involves

assessment of direct cost,

overhead charges and the labor

cost.

It acts as the gauge in

identifying the profitability of

job.

Job costing system helps for

future customers in deciding

whether to choose the job or

not.

It is used for ensuring that the

price of the product covers the

actual cost and the adequate

profit margins.

Thus, these above benefits and the application of the system leads to the effective or

better preparation of the report which in turn reflects the integration between the systems and the

reporting of management accounting. These systems facilitate the formulation of the report with

full accuracy, reliability and relevant for the users.

LO2

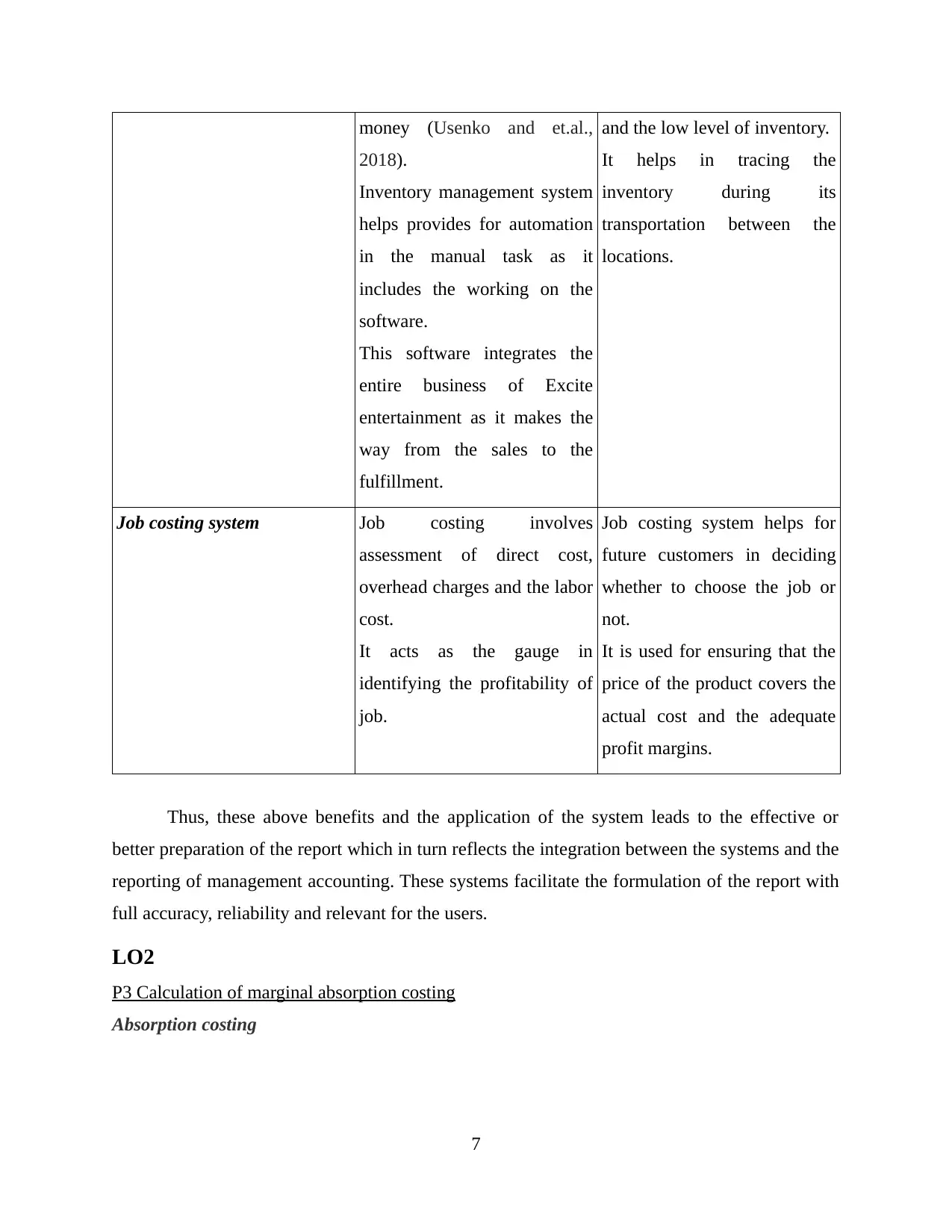

P3 Calculation of marginal absorption costing

Absorption costing

7

2018).

Inventory management system

helps provides for automation

in the manual task as it

includes the working on the

software.

This software integrates the

entire business of Excite

entertainment as it makes the

way from the sales to the

fulfillment.

and the low level of inventory.

It helps in tracing the

inventory during its

transportation between the

locations.

Job costing system Job costing involves

assessment of direct cost,

overhead charges and the labor

cost.

It acts as the gauge in

identifying the profitability of

job.

Job costing system helps for

future customers in deciding

whether to choose the job or

not.

It is used for ensuring that the

price of the product covers the

actual cost and the adequate

profit margins.

Thus, these above benefits and the application of the system leads to the effective or

better preparation of the report which in turn reflects the integration between the systems and the

reporting of management accounting. These systems facilitate the formulation of the report with

full accuracy, reliability and relevant for the users.

LO2

P3 Calculation of marginal absorption costing

Absorption costing

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Particulars Amount (in

£)

Per unit cost (in

£) Net figure (in £)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

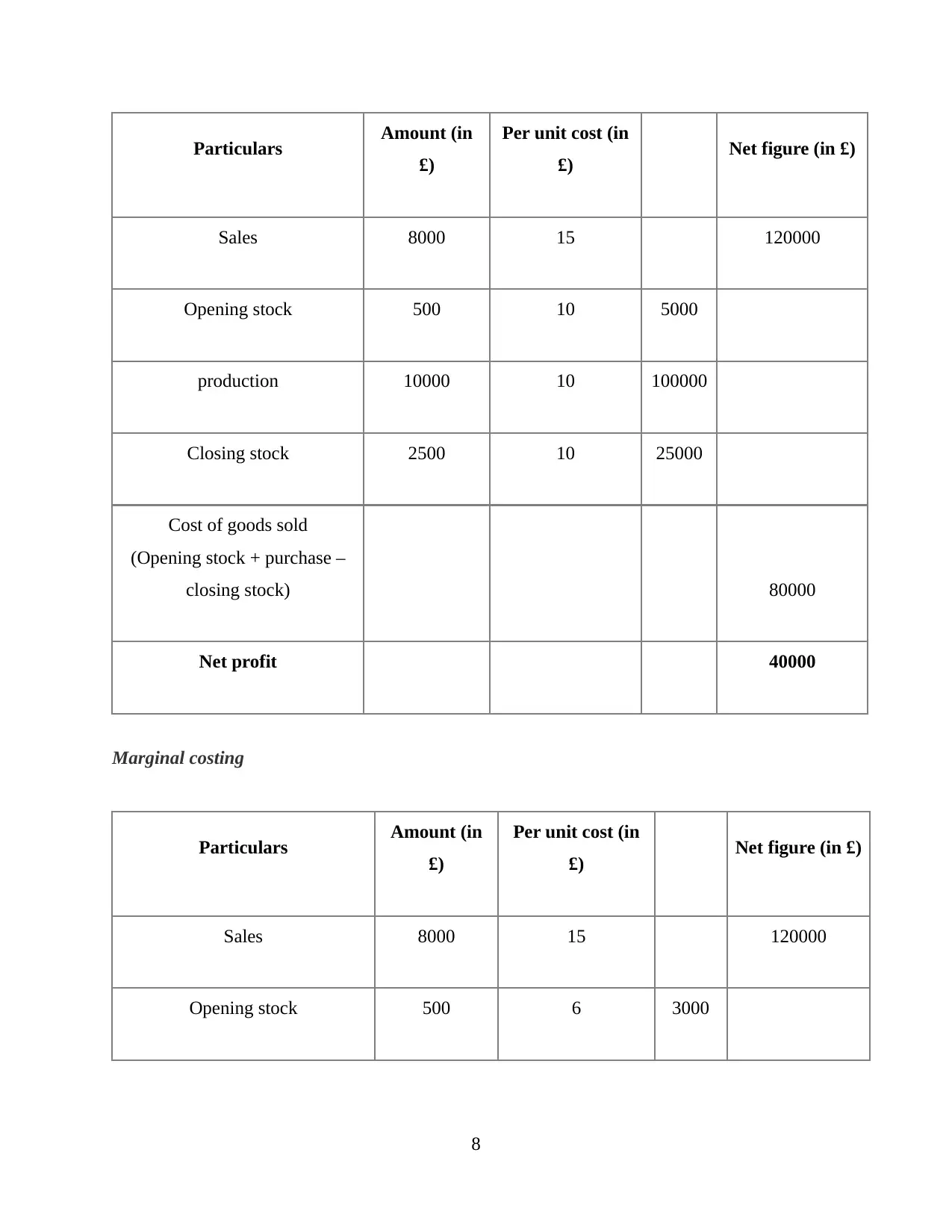

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£) Net figure (in £)

Sales 8000 15 120000

Opening stock 500 6 3000

8

£)

Per unit cost (in

£) Net figure (in £)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£) Net figure (in £)

Sales 8000 15 120000

Opening stock 500 6 3000

8

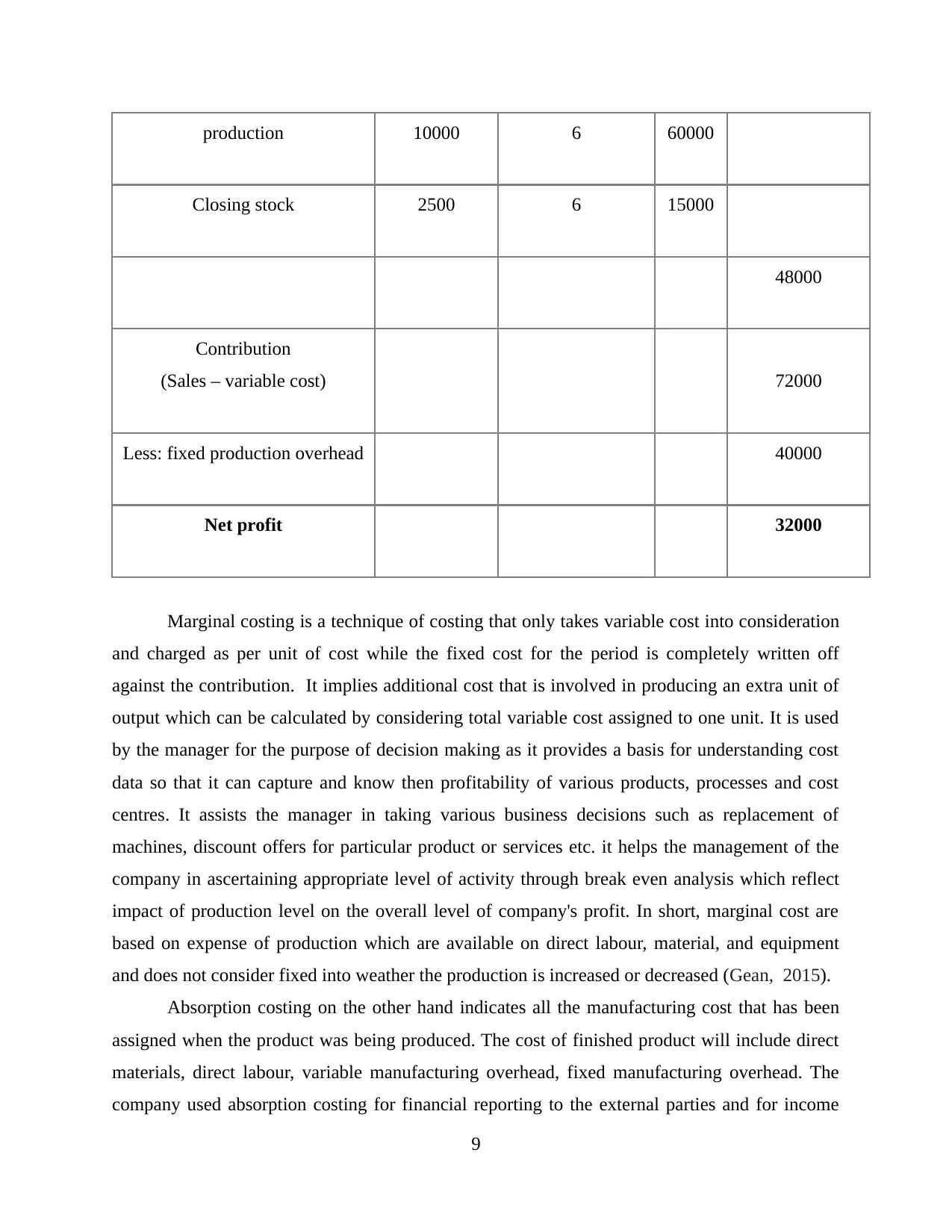

production 10000 6 60000

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Marginal costing is a technique of costing that only takes variable cost into consideration

and charged as per unit of cost while the fixed cost for the period is completely written off

against the contribution. It implies additional cost that is involved in producing an extra unit of

output which can be calculated by considering total variable cost assigned to one unit. It is used

by the manager for the purpose of decision making as it provides a basis for understanding cost

data so that it can capture and know then profitability of various products, processes and cost

centres. It assists the manager in taking various business decisions such as replacement of

machines, discount offers for particular product or services etc. it helps the management of the

company in ascertaining appropriate level of activity through break even analysis which reflect

impact of production level on the overall level of company's profit. In short, marginal cost are

based on expense of production which are available on direct labour, material, and equipment

and does not consider fixed into weather the production is increased or decreased (Gean, 2015).

Absorption costing on the other hand indicates all the manufacturing cost that has been

assigned when the product was being produced. The cost of finished product will include direct

materials, direct labour, variable manufacturing overhead, fixed manufacturing overhead. The

company used absorption costing for financial reporting to the external parties and for income

9

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Marginal costing is a technique of costing that only takes variable cost into consideration

and charged as per unit of cost while the fixed cost for the period is completely written off

against the contribution. It implies additional cost that is involved in producing an extra unit of

output which can be calculated by considering total variable cost assigned to one unit. It is used

by the manager for the purpose of decision making as it provides a basis for understanding cost

data so that it can capture and know then profitability of various products, processes and cost

centres. It assists the manager in taking various business decisions such as replacement of

machines, discount offers for particular product or services etc. it helps the management of the

company in ascertaining appropriate level of activity through break even analysis which reflect

impact of production level on the overall level of company's profit. In short, marginal cost are

based on expense of production which are available on direct labour, material, and equipment

and does not consider fixed into weather the production is increased or decreased (Gean, 2015).

Absorption costing on the other hand indicates all the manufacturing cost that has been

assigned when the product was being produced. The cost of finished product will include direct

materials, direct labour, variable manufacturing overhead, fixed manufacturing overhead. The

company used absorption costing for financial reporting to the external parties and for income

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

tax reporting. It gives more detailed, comprehensive and clear view on how much it will cost to

produce inventory as it includes both fixed and variable cost. It helps the management in

identifying the important fixed costs involved in the production. It is used by company to prepare

financial statements. It helps the managers in being more responsible for the cost and services

provided to their departments due to allocation of factory overheads that are fixed.

Interpretation – From the above calculation from both the methods it is concluded that

when profit is calculated by absorption costing method it gives net profit of 40000 by including

both fixed and variable cost. On the other hand when the profit is calculated by marginal costing

it gives the net profit of 32000 and included only variable cost which was used to produce

product.

The Excite limited will use absorption costing method to evaluate the profits of the

company as it includes both the cost that is fixed and variable cost as product cost which helps

the company in making accurate financial statement and tax assessment (Berger, 2016). Also, it

considers and show cost of each unit that has been incurred in manufacturing of the product. It

helps the company in finding accurate and fair treatment of product cost.

LO 3

P4. Budgetary control planning tools with advantages and disadvantages.

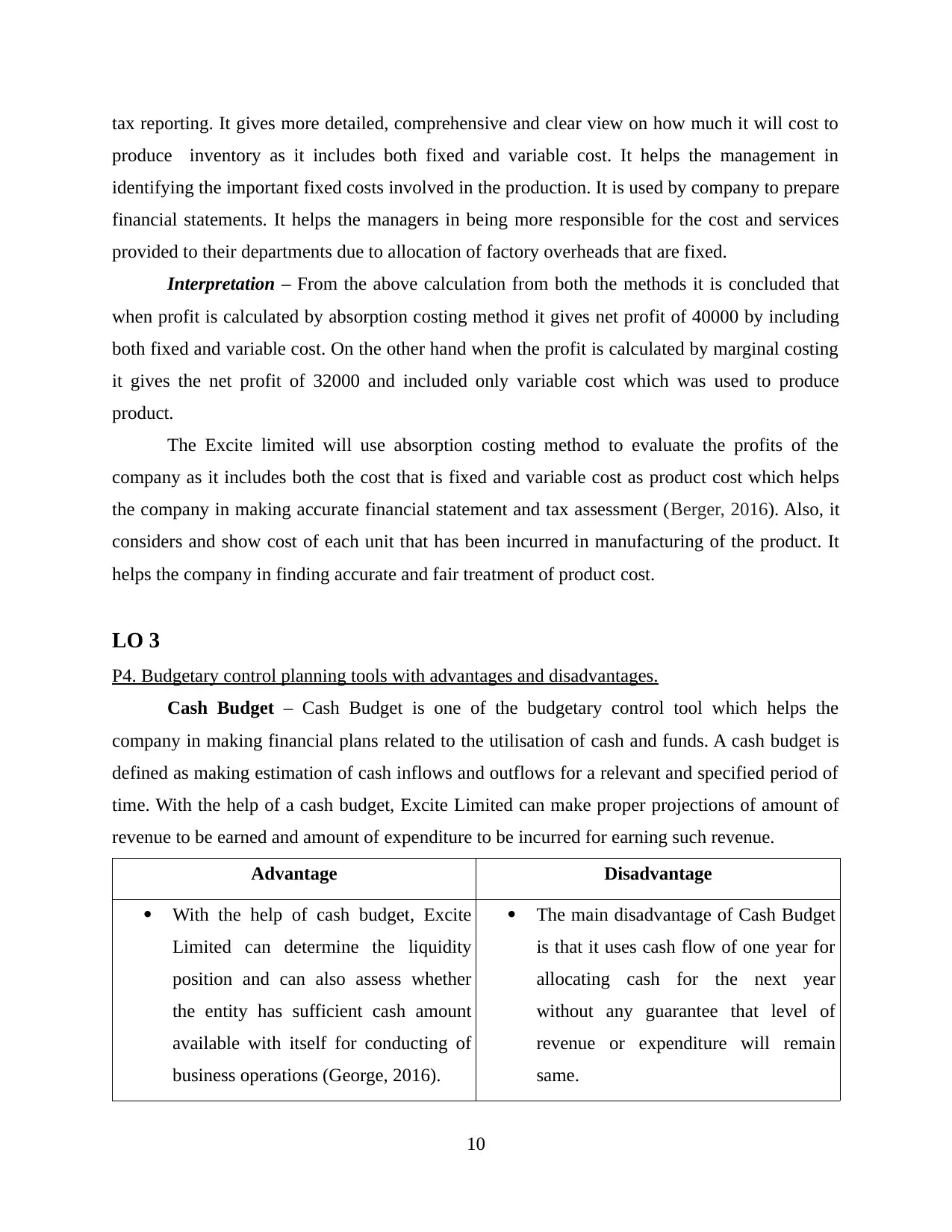

Cash Budget – Cash Budget is one of the budgetary control tool which helps the

company in making financial plans related to the utilisation of cash and funds. A cash budget is

defined as making estimation of cash inflows and outflows for a relevant and specified period of

time. With the help of a cash budget, Excite Limited can make proper projections of amount of

revenue to be earned and amount of expenditure to be incurred for earning such revenue.

Advantage Disadvantage

With the help of cash budget, Excite

Limited can determine the liquidity

position and can also assess whether

the entity has sufficient cash amount

available with itself for conducting of

business operations (George, 2016).

The main disadvantage of Cash Budget

is that it uses cash flow of one year for

allocating cash for the next year

without any guarantee that level of

revenue or expenditure will remain

same.

10

produce inventory as it includes both fixed and variable cost. It helps the management in

identifying the important fixed costs involved in the production. It is used by company to prepare

financial statements. It helps the managers in being more responsible for the cost and services

provided to their departments due to allocation of factory overheads that are fixed.

Interpretation – From the above calculation from both the methods it is concluded that

when profit is calculated by absorption costing method it gives net profit of 40000 by including

both fixed and variable cost. On the other hand when the profit is calculated by marginal costing

it gives the net profit of 32000 and included only variable cost which was used to produce

product.

The Excite limited will use absorption costing method to evaluate the profits of the

company as it includes both the cost that is fixed and variable cost as product cost which helps

the company in making accurate financial statement and tax assessment (Berger, 2016). Also, it

considers and show cost of each unit that has been incurred in manufacturing of the product. It

helps the company in finding accurate and fair treatment of product cost.

LO 3

P4. Budgetary control planning tools with advantages and disadvantages.

Cash Budget – Cash Budget is one of the budgetary control tool which helps the

company in making financial plans related to the utilisation of cash and funds. A cash budget is

defined as making estimation of cash inflows and outflows for a relevant and specified period of

time. With the help of a cash budget, Excite Limited can make proper projections of amount of

revenue to be earned and amount of expenditure to be incurred for earning such revenue.

Advantage Disadvantage

With the help of cash budget, Excite

Limited can determine the liquidity

position and can also assess whether

the entity has sufficient cash amount

available with itself for conducting of

business operations (George, 2016).

The main disadvantage of Cash Budget

is that it uses cash flow of one year for

allocating cash for the next year

without any guarantee that level of

revenue or expenditure will remain

same.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It also assists company in maintaining

the minimum cash balance requirement

as laid down by bank or any laws or

regulation pertaining to company.

It can identify requirement of cash

amount for fulfilling the immediate

short term obligation needs without

using lines of credit or overdraft

facility.

Sometime, Cash Budget can lower the

overall morale and productivity of

Excite Limited and its employees as a

whole if set defined targets are not

achieved or realistic in nature.

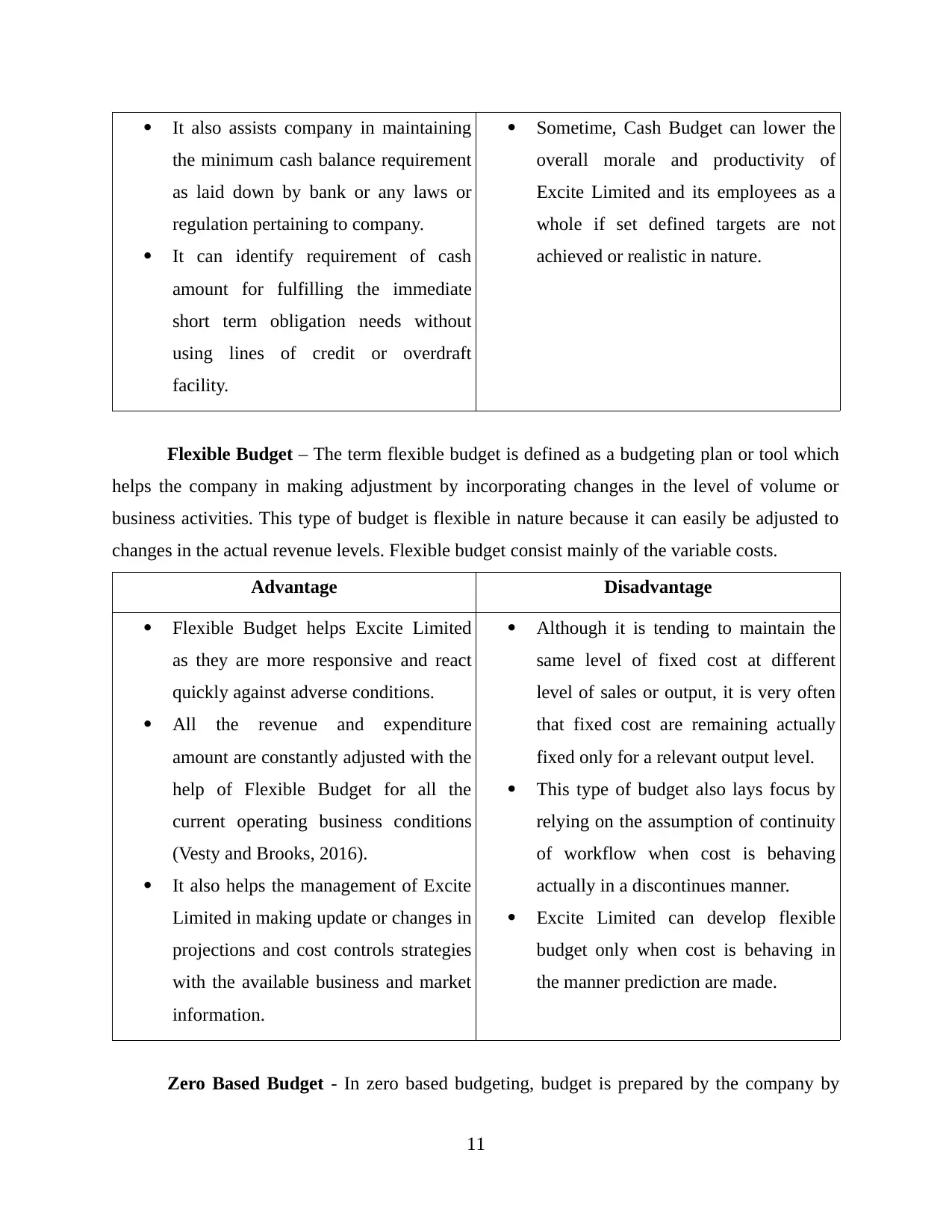

Flexible Budget – The term flexible budget is defined as a budgeting plan or tool which

helps the company in making adjustment by incorporating changes in the level of volume or

business activities. This type of budget is flexible in nature because it can easily be adjusted to

changes in the actual revenue levels. Flexible budget consist mainly of the variable costs.

Advantage Disadvantage

Flexible Budget helps Excite Limited

as they are more responsive and react

quickly against adverse conditions.

All the revenue and expenditure

amount are constantly adjusted with the

help of Flexible Budget for all the

current operating business conditions

(Vesty and Brooks, 2016).

It also helps the management of Excite

Limited in making update or changes in

projections and cost controls strategies

with the available business and market

information.

Although it is tending to maintain the

same level of fixed cost at different

level of sales or output, it is very often

that fixed cost are remaining actually

fixed only for a relevant output level.

This type of budget also lays focus by

relying on the assumption of continuity

of workflow when cost is behaving

actually in a discontinues manner.

Excite Limited can develop flexible

budget only when cost is behaving in

the manner prediction are made.

Zero Based Budget - In zero based budgeting, budget is prepared by the company by

11

the minimum cash balance requirement

as laid down by bank or any laws or

regulation pertaining to company.

It can identify requirement of cash

amount for fulfilling the immediate

short term obligation needs without

using lines of credit or overdraft

facility.

Sometime, Cash Budget can lower the

overall morale and productivity of

Excite Limited and its employees as a

whole if set defined targets are not

achieved or realistic in nature.

Flexible Budget – The term flexible budget is defined as a budgeting plan or tool which

helps the company in making adjustment by incorporating changes in the level of volume or

business activities. This type of budget is flexible in nature because it can easily be adjusted to

changes in the actual revenue levels. Flexible budget consist mainly of the variable costs.

Advantage Disadvantage

Flexible Budget helps Excite Limited

as they are more responsive and react

quickly against adverse conditions.

All the revenue and expenditure

amount are constantly adjusted with the

help of Flexible Budget for all the

current operating business conditions

(Vesty and Brooks, 2016).

It also helps the management of Excite

Limited in making update or changes in

projections and cost controls strategies

with the available business and market

information.

Although it is tending to maintain the

same level of fixed cost at different

level of sales or output, it is very often

that fixed cost are remaining actually

fixed only for a relevant output level.

This type of budget also lays focus by

relying on the assumption of continuity

of workflow when cost is behaving

actually in a discontinues manner.

Excite Limited can develop flexible

budget only when cost is behaving in

the manner prediction are made.

Zero Based Budget - In zero based budgeting, budget is prepared by the company by

11

taking base as a zero or start from the scratch every year. This budgeting tool helps the company

in laying emphasis on formulation of new economic proposal by evaluating all business

activities, operations and thus budget is set by starting from the scratch.

12

in laying emphasis on formulation of new economic proposal by evaluating all business

activities, operations and thus budget is set by starting from the scratch.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.