Management Accounting Report: Financial Analysis of Entertainment Firm

VerifiedAdded on 2020/12/09

|17

|5395

|312

Report

AI Summary

This report provides a detailed analysis of management accounting principles and their application within Excite Entertainment Ltd. It begins by differentiating between management and financial accounting, outlining the key features and purposes of each. The report then explores various management accounting systems, including cost accounting, inventory management, and job costing, highlighting their benefits and practical applications. Furthermore, it examines different methods of management accounting reporting, such as budget reports, cost managerial accounting reports, and performance reports, emphasizing their role in organizational decision-making. The report also presents a comparative analysis of absorption and marginal costing methods, illustrated with income statements for Excite Entertainment Ltd. Finally, it discusses the integration of management accounting systems and reporting within the organizational process, emphasizing their importance in providing timely and relevant financial data for effective management. The report draws on credible sources to support its findings and offers a practical perspective on management accounting in the context of a real-world entertainment company.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Section (A). Understanding of management accounting systems...............................................1

Section (B). Methods used for management accounting reporting............................................4

TASK 2............................................................................................................................................6

Calculation of absorption and marginal costing from credible sources......................................6

TASK 3............................................................................................................................................8

Explanation of the advantages and disadvantages of different types planning tools..................8

TASK 4 .........................................................................................................................................10

Compare how organisations and adapting management accounting systems to respond the

financial issues..........................................................................................................................10

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Section (A). Understanding of management accounting systems...............................................1

Section (B). Methods used for management accounting reporting............................................4

TASK 2............................................................................................................................................6

Calculation of absorption and marginal costing from credible sources......................................6

TASK 3............................................................................................................................................8

Explanation of the advantages and disadvantages of different types planning tools..................8

TASK 4 .........................................................................................................................................10

Compare how organisations and adapting management accounting systems to respond the

financial issues..........................................................................................................................10

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Management accounting refers to a process of designing management accounts and

reports that help in providing correct and timely financial and statistical data to the mangers of

the company so that they can take day to day and short term decisions. It can be a type of

accounting which help in offering financial and non financial data to the managers so that they

can help in the organisational development by taking suitable decision in context of the company

(Bobryshev and et. al., 2015). Management accounting play an essential role in the inner or

internal management of a firm. This assignment is based on Excite Entertainment Ltd company

which is a client of a leading accountancy organisation. This firm operating its business in

promotion of concerts, festivals at various locations of UK. In this report will be discussed about

different methods that can be used by the company for management accounting reporting.

Further will be defined about the planning tools that can be used in management accounting for

budgetary control. Apart for it, financial problems will also be explained and income statement

of Excite Entertainment Ltd will be defined.

TASK 1

Section (A). Understanding of management accounting systems

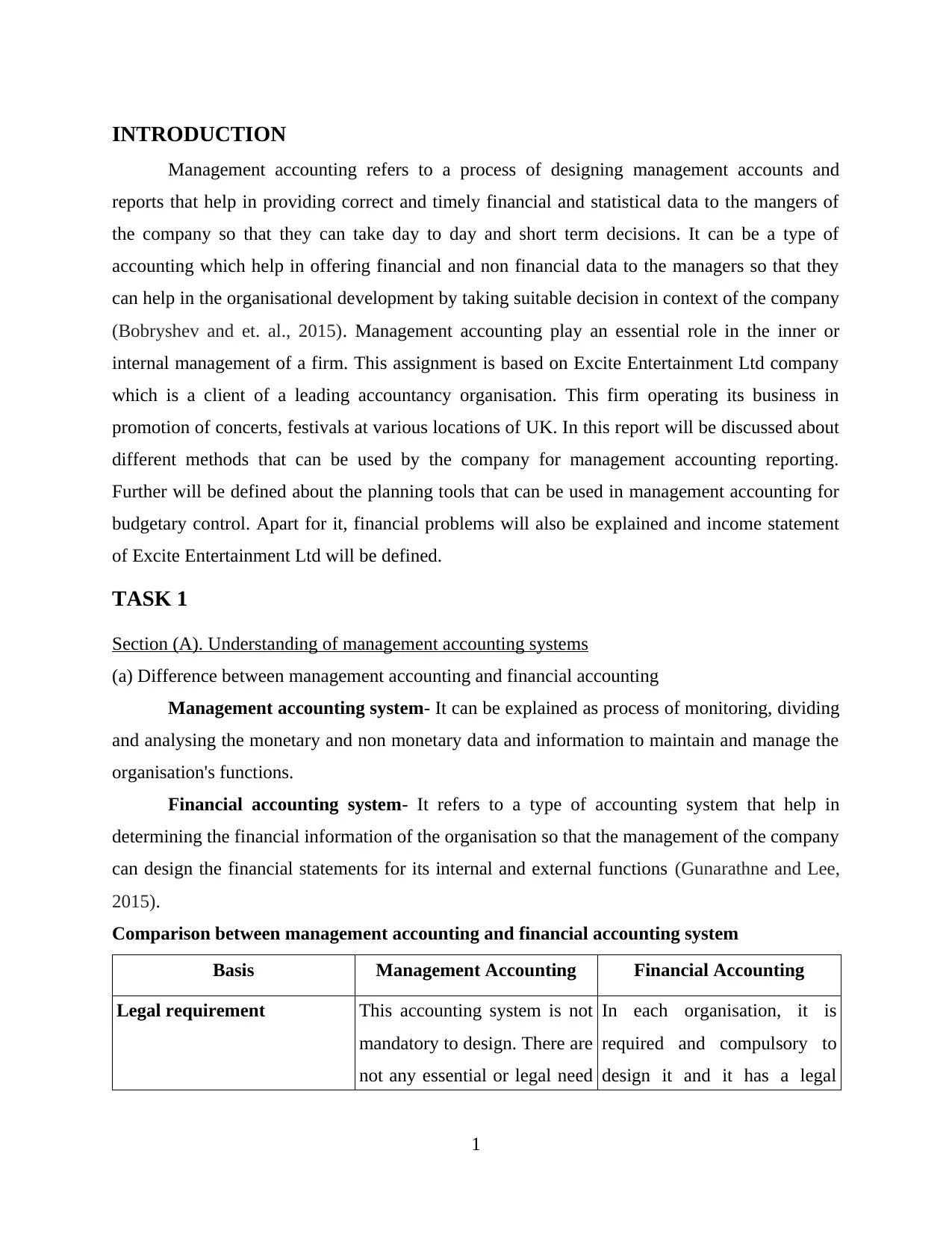

(a) Difference between management accounting and financial accounting

Management accounting system- It can be explained as process of monitoring, dividing

and analysing the monetary and non monetary data and information to maintain and manage the

organisation's functions.

Financial accounting system- It refers to a type of accounting system that help in

determining the financial information of the organisation so that the management of the company

can design the financial statements for its internal and external functions (Gunarathne and Lee,

2015).

Comparison between management accounting and financial accounting system

Basis Management Accounting Financial Accounting

Legal requirement This accounting system is not

mandatory to design. There are

not any essential or legal need

In each organisation, it is

required and compulsory to

design it and it has a legal

1

Management accounting refers to a process of designing management accounts and

reports that help in providing correct and timely financial and statistical data to the mangers of

the company so that they can take day to day and short term decisions. It can be a type of

accounting which help in offering financial and non financial data to the managers so that they

can help in the organisational development by taking suitable decision in context of the company

(Bobryshev and et. al., 2015). Management accounting play an essential role in the inner or

internal management of a firm. This assignment is based on Excite Entertainment Ltd company

which is a client of a leading accountancy organisation. This firm operating its business in

promotion of concerts, festivals at various locations of UK. In this report will be discussed about

different methods that can be used by the company for management accounting reporting.

Further will be defined about the planning tools that can be used in management accounting for

budgetary control. Apart for it, financial problems will also be explained and income statement

of Excite Entertainment Ltd will be defined.

TASK 1

Section (A). Understanding of management accounting systems

(a) Difference between management accounting and financial accounting

Management accounting system- It can be explained as process of monitoring, dividing

and analysing the monetary and non monetary data and information to maintain and manage the

organisation's functions.

Financial accounting system- It refers to a type of accounting system that help in

determining the financial information of the organisation so that the management of the company

can design the financial statements for its internal and external functions (Gunarathne and Lee,

2015).

Comparison between management accounting and financial accounting system

Basis Management Accounting Financial Accounting

Legal requirement This accounting system is not

mandatory to design. There are

not any essential or legal need

In each organisation, it is

required and compulsory to

design it and it has a legal

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of this accounting system. requirement for the firm.

Types of data used This accounting system use

both type of data such as

monetary of non monetary

(Hopper and Bui, 2016).

Financial accounting system

use only financial information

to develop and design different

kind of documents.

Format of demonstration Management accounting does

not include any specific format

to display the reports.

Financial accounting system

needs to implement a specific

format to provide information

of financial statements.

Domain of reporting within

the firm

This accounting system

monitor all the field of internal

management of the

organisation.

This accounting system

determine both internal and

external area of the firm.

(a)Cost accounting system- It is a type of accounting system which is affiliated with the

approximation of the entire cost that generates during the process of products and services

offering. It includes various cost like process cost, direct cost, standard cost and others. In Excite

Entertainment Ltd., this accounting system can be helpful for calculating the overall cost in the

publicity of various types of occasions. The examples of cost accounting systems are as

following:

Direct cost- It refers to those cost which can be instantly derived to a particular cost

centre such as department, process, goods and others.

Standard cost- It indicates to a type of cost accounting system which help in the

determination of variances among actual and estimated costs. With the help of this accounting

system organisations can monitor the level of difference among standard cost and actual cost.

This accounting method help the firm in maintaining awareness about the difference of cost.

(b)Inventory management system- It is a part of accounting system which consists following

of levels of inventory, sales, deliveries, orders and others. In Excite Entertainment Ltd., the

management of the company follow this accounting system so that they can negotiate their

various media assets and can monitor the demands of buying new appliances regarding events

2

Types of data used This accounting system use

both type of data such as

monetary of non monetary

(Hopper and Bui, 2016).

Financial accounting system

use only financial information

to develop and design different

kind of documents.

Format of demonstration Management accounting does

not include any specific format

to display the reports.

Financial accounting system

needs to implement a specific

format to provide information

of financial statements.

Domain of reporting within

the firm

This accounting system

monitor all the field of internal

management of the

organisation.

This accounting system

determine both internal and

external area of the firm.

(a)Cost accounting system- It is a type of accounting system which is affiliated with the

approximation of the entire cost that generates during the process of products and services

offering. It includes various cost like process cost, direct cost, standard cost and others. In Excite

Entertainment Ltd., this accounting system can be helpful for calculating the overall cost in the

publicity of various types of occasions. The examples of cost accounting systems are as

following:

Direct cost- It refers to those cost which can be instantly derived to a particular cost

centre such as department, process, goods and others.

Standard cost- It indicates to a type of cost accounting system which help in the

determination of variances among actual and estimated costs. With the help of this accounting

system organisations can monitor the level of difference among standard cost and actual cost.

This accounting method help the firm in maintaining awareness about the difference of cost.

(b)Inventory management system- It is a part of accounting system which consists following

of levels of inventory, sales, deliveries, orders and others. In Excite Entertainment Ltd., the

management of the company follow this accounting system so that they can negotiate their

various media assets and can monitor the demands of buying new appliances regarding events

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and festivals (Kaplan and Atkinson, 2015). The concept of this management system can be

analysed by FIFO and LIFO methods. FIFO explains that stock which comes first in the store

and sold out first. On the other hand, LIFO indicates those stock and inventory which comes in

last but sold out first. This method of management accounting system divides the cost of goods

which are accessible for sale in form of number of units available for sale.

(C) Job costing systems- It refers to the process of gathering the data about the cost which is

connected with a particular job (Klychova and et. al., 2015). In Excite Entertainments Ltd., the

management of the company can use this method for monitoring the cost which is calculating by

the cost of every job which is allotted in various forms and activities.

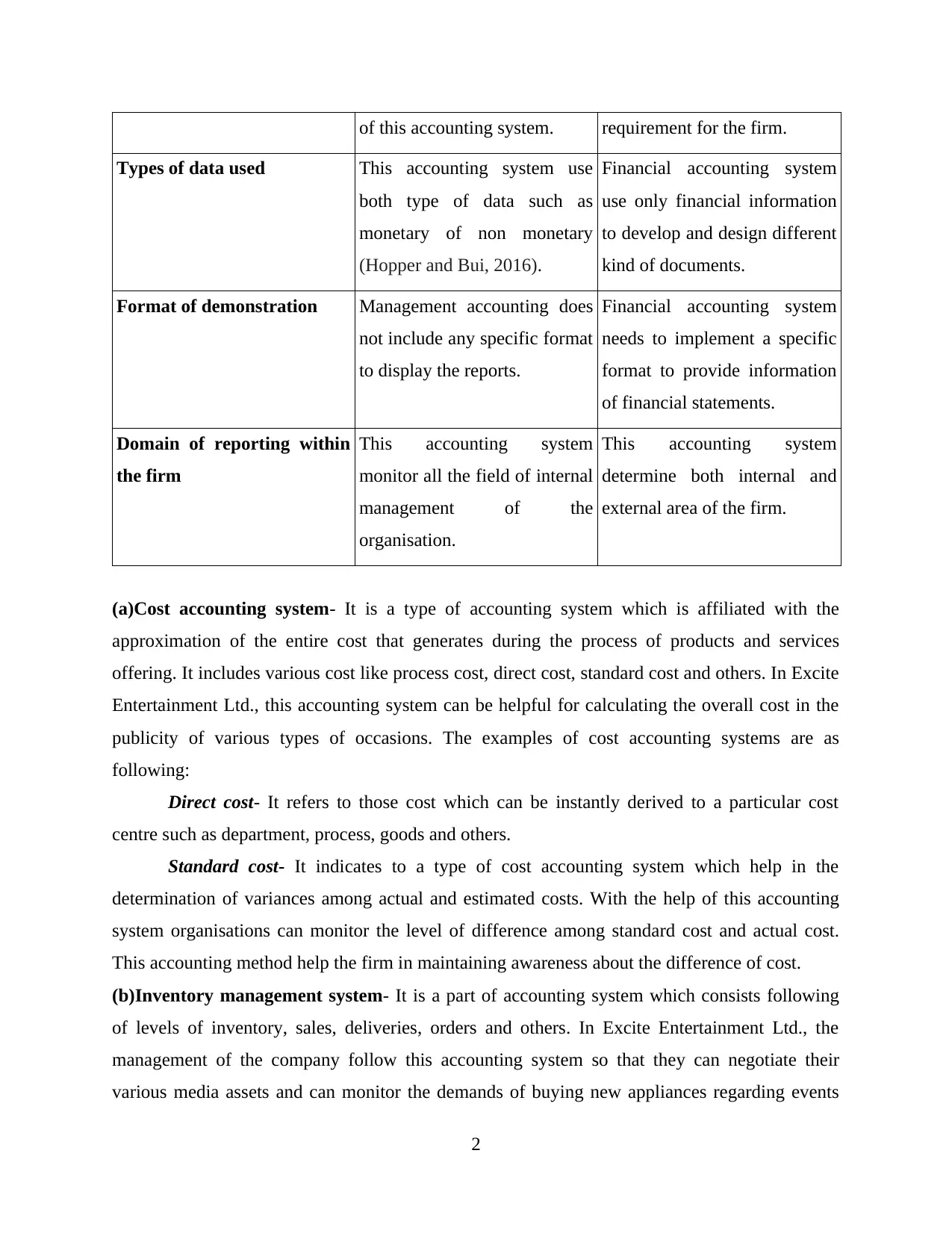

Benefits of management accounting systems

There are various management accounting systems and they al, are beneficial and

important for the organisations. Some of them are as following which are essential for Excite

Entertainment Ltd.:

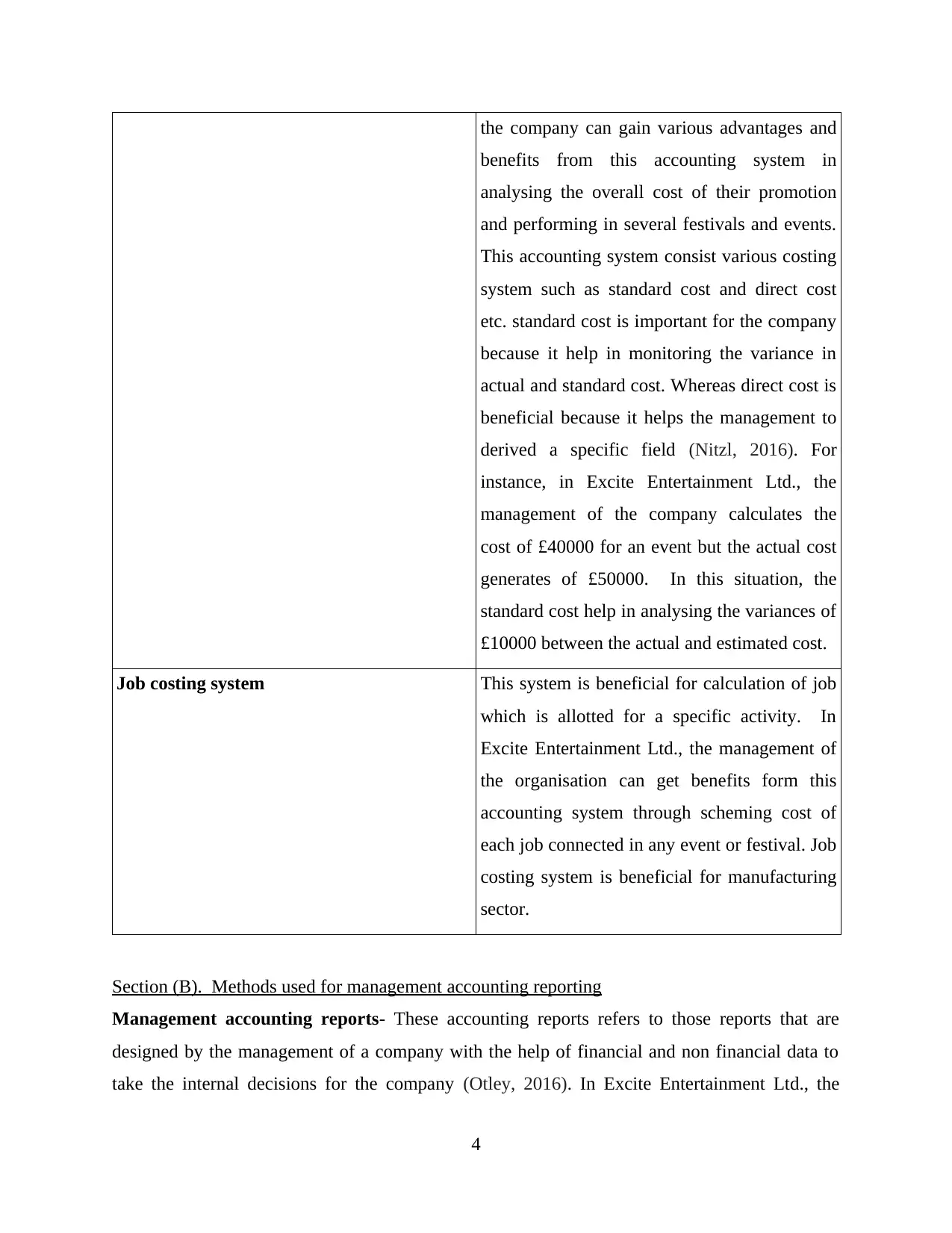

Accounting Systems Benefits

Inventory management system It is an important effective management system

for the company to monitor the available stock

in the warehouse. It is beneficial because it

helps in saving the time and minimizing the

cost of the firm. In Excite Entertainment Ltd.

The management of the company can manage

their media appliances with the help of

inventory management system. This

management system helps in checking that

how many appliances are in process of use at

various locations and how many are stored in

the stock.

Cost Accounting system It is an important and essential accounting

system which help in calculating entire cost

(Nielsen, Mitchell and Nørreklit, 2015). In

Excite Entertainment Ltd., the management of

3

analysed by FIFO and LIFO methods. FIFO explains that stock which comes first in the store

and sold out first. On the other hand, LIFO indicates those stock and inventory which comes in

last but sold out first. This method of management accounting system divides the cost of goods

which are accessible for sale in form of number of units available for sale.

(C) Job costing systems- It refers to the process of gathering the data about the cost which is

connected with a particular job (Klychova and et. al., 2015). In Excite Entertainments Ltd., the

management of the company can use this method for monitoring the cost which is calculating by

the cost of every job which is allotted in various forms and activities.

Benefits of management accounting systems

There are various management accounting systems and they al, are beneficial and

important for the organisations. Some of them are as following which are essential for Excite

Entertainment Ltd.:

Accounting Systems Benefits

Inventory management system It is an important effective management system

for the company to monitor the available stock

in the warehouse. It is beneficial because it

helps in saving the time and minimizing the

cost of the firm. In Excite Entertainment Ltd.

The management of the company can manage

their media appliances with the help of

inventory management system. This

management system helps in checking that

how many appliances are in process of use at

various locations and how many are stored in

the stock.

Cost Accounting system It is an important and essential accounting

system which help in calculating entire cost

(Nielsen, Mitchell and Nørreklit, 2015). In

Excite Entertainment Ltd., the management of

3

the company can gain various advantages and

benefits from this accounting system in

analysing the overall cost of their promotion

and performing in several festivals and events.

This accounting system consist various costing

system such as standard cost and direct cost

etc. standard cost is important for the company

because it help in monitoring the variance in

actual and standard cost. Whereas direct cost is

beneficial because it helps the management to

derived a specific field (Nitzl, 2016). For

instance, in Excite Entertainment Ltd., the

management of the company calculates the

cost of £40000 for an event but the actual cost

generates of £50000. In this situation, the

standard cost help in analysing the variances of

£10000 between the actual and estimated cost.

Job costing system This system is beneficial for calculation of job

which is allotted for a specific activity. In

Excite Entertainment Ltd., the management of

the organisation can get benefits form this

accounting system through scheming cost of

each job connected in any event or festival. Job

costing system is beneficial for manufacturing

sector.

Section (B). Methods used for management accounting reporting

Management accounting reports- These accounting reports refers to those reports that are

designed by the management of a company with the help of financial and non financial data to

take the internal decisions for the company (Otley, 2016). In Excite Entertainment Ltd., the

4

benefits from this accounting system in

analysing the overall cost of their promotion

and performing in several festivals and events.

This accounting system consist various costing

system such as standard cost and direct cost

etc. standard cost is important for the company

because it help in monitoring the variance in

actual and standard cost. Whereas direct cost is

beneficial because it helps the management to

derived a specific field (Nitzl, 2016). For

instance, in Excite Entertainment Ltd., the

management of the company calculates the

cost of £40000 for an event but the actual cost

generates of £50000. In this situation, the

standard cost help in analysing the variances of

£10000 between the actual and estimated cost.

Job costing system This system is beneficial for calculation of job

which is allotted for a specific activity. In

Excite Entertainment Ltd., the management of

the organisation can get benefits form this

accounting system through scheming cost of

each job connected in any event or festival. Job

costing system is beneficial for manufacturing

sector.

Section (B). Methods used for management accounting reporting

Management accounting reports- These accounting reports refers to those reports that are

designed by the management of a company with the help of financial and non financial data to

take the internal decisions for the company (Otley, 2016). In Excite Entertainment Ltd., the

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management of the company can use these kind of reports to create and design various types of

management accounting reports which are as following:

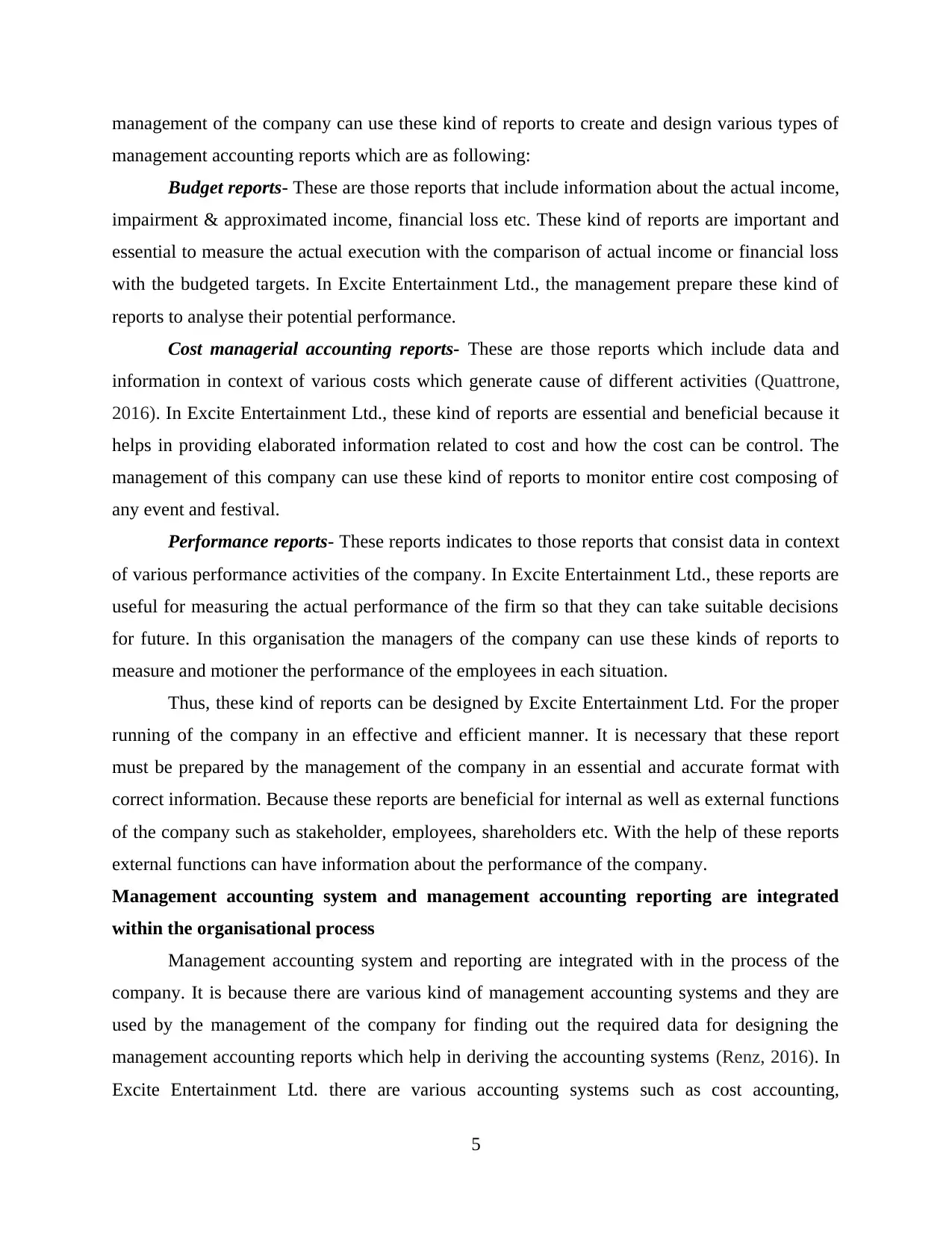

Budget reports- These are those reports that include information about the actual income,

impairment & approximated income, financial loss etc. These kind of reports are important and

essential to measure the actual execution with the comparison of actual income or financial loss

with the budgeted targets. In Excite Entertainment Ltd., the management prepare these kind of

reports to analyse their potential performance.

Cost managerial accounting reports- These are those reports which include data and

information in context of various costs which generate cause of different activities (Quattrone,

2016). In Excite Entertainment Ltd., these kind of reports are essential and beneficial because it

helps in providing elaborated information related to cost and how the cost can be control. The

management of this company can use these kind of reports to monitor entire cost composing of

any event and festival.

Performance reports- These reports indicates to those reports that consist data in context

of various performance activities of the company. In Excite Entertainment Ltd., these reports are

useful for measuring the actual performance of the firm so that they can take suitable decisions

for future. In this organisation the managers of the company can use these kinds of reports to

measure and motioner the performance of the employees in each situation.

Thus, these kind of reports can be designed by Excite Entertainment Ltd. For the proper

running of the company in an effective and efficient manner. It is necessary that these report

must be prepared by the management of the company in an essential and accurate format with

correct information. Because these reports are beneficial for internal as well as external functions

of the company such as stakeholder, employees, shareholders etc. With the help of these reports

external functions can have information about the performance of the company.

Management accounting system and management accounting reporting are integrated

within the organisational process

Management accounting system and reporting are integrated with in the process of the

company. It is because there are various kind of management accounting systems and they are

used by the management of the company for finding out the required data for designing the

management accounting reports which help in deriving the accounting systems (Renz, 2016). In

Excite Entertainment Ltd. there are various accounting systems such as cost accounting,

5

management accounting reports which are as following:

Budget reports- These are those reports that include information about the actual income,

impairment & approximated income, financial loss etc. These kind of reports are important and

essential to measure the actual execution with the comparison of actual income or financial loss

with the budgeted targets. In Excite Entertainment Ltd., the management prepare these kind of

reports to analyse their potential performance.

Cost managerial accounting reports- These are those reports which include data and

information in context of various costs which generate cause of different activities (Quattrone,

2016). In Excite Entertainment Ltd., these kind of reports are essential and beneficial because it

helps in providing elaborated information related to cost and how the cost can be control. The

management of this company can use these kind of reports to monitor entire cost composing of

any event and festival.

Performance reports- These reports indicates to those reports that consist data in context

of various performance activities of the company. In Excite Entertainment Ltd., these reports are

useful for measuring the actual performance of the firm so that they can take suitable decisions

for future. In this organisation the managers of the company can use these kinds of reports to

measure and motioner the performance of the employees in each situation.

Thus, these kind of reports can be designed by Excite Entertainment Ltd. For the proper

running of the company in an effective and efficient manner. It is necessary that these report

must be prepared by the management of the company in an essential and accurate format with

correct information. Because these reports are beneficial for internal as well as external functions

of the company such as stakeholder, employees, shareholders etc. With the help of these reports

external functions can have information about the performance of the company.

Management accounting system and management accounting reporting are integrated

within the organisational process

Management accounting system and reporting are integrated with in the process of the

company. It is because there are various kind of management accounting systems and they are

used by the management of the company for finding out the required data for designing the

management accounting reports which help in deriving the accounting systems (Renz, 2016). In

Excite Entertainment Ltd. there are various accounting systems such as cost accounting,

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inventory management and job costing system etc. for getting the proper information about the

organisation's performance.

TASK 2

Calculation of absorption and marginal costing from credible sources

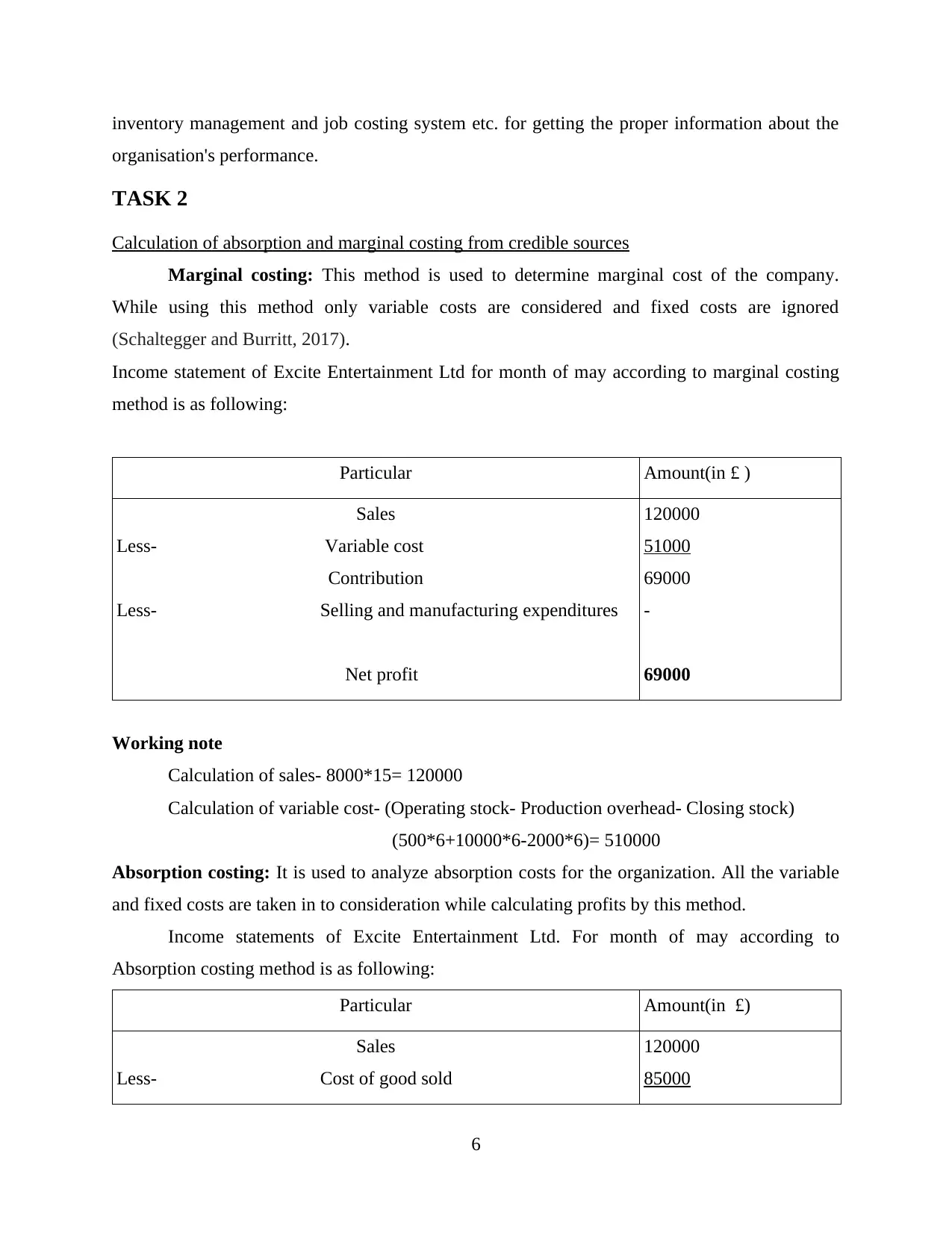

Marginal costing: This method is used to determine marginal cost of the company.

While using this method only variable costs are considered and fixed costs are ignored

(Schaltegger and Burritt, 2017).

Income statement of Excite Entertainment Ltd for month of may according to marginal costing

method is as following:

Particular Amount(in £ )

Sales

Less- Variable cost

Contribution

Less- Selling and manufacturing expenditures

Net profit

120000

51000

69000

-

69000

Working note

Calculation of sales- 8000*15= 120000

Calculation of variable cost- (Operating stock- Production overhead- Closing stock)

(500*6+10000*6-2000*6)= 510000

Absorption costing: It is used to analyze absorption costs for the organization. All the variable

and fixed costs are taken in to consideration while calculating profits by this method.

Income statements of Excite Entertainment Ltd. For month of may according to

Absorption costing method is as following:

Particular Amount(in £)

Sales

Less- Cost of good sold

120000

85000

6

organisation's performance.

TASK 2

Calculation of absorption and marginal costing from credible sources

Marginal costing: This method is used to determine marginal cost of the company.

While using this method only variable costs are considered and fixed costs are ignored

(Schaltegger and Burritt, 2017).

Income statement of Excite Entertainment Ltd for month of may according to marginal costing

method is as following:

Particular Amount(in £ )

Sales

Less- Variable cost

Contribution

Less- Selling and manufacturing expenditures

Net profit

120000

51000

69000

-

69000

Working note

Calculation of sales- 8000*15= 120000

Calculation of variable cost- (Operating stock- Production overhead- Closing stock)

(500*6+10000*6-2000*6)= 510000

Absorption costing: It is used to analyze absorption costs for the organization. All the variable

and fixed costs are taken in to consideration while calculating profits by this method.

Income statements of Excite Entertainment Ltd. For month of may according to

Absorption costing method is as following:

Particular Amount(in £)

Sales

Less- Cost of good sold

120000

85000

6

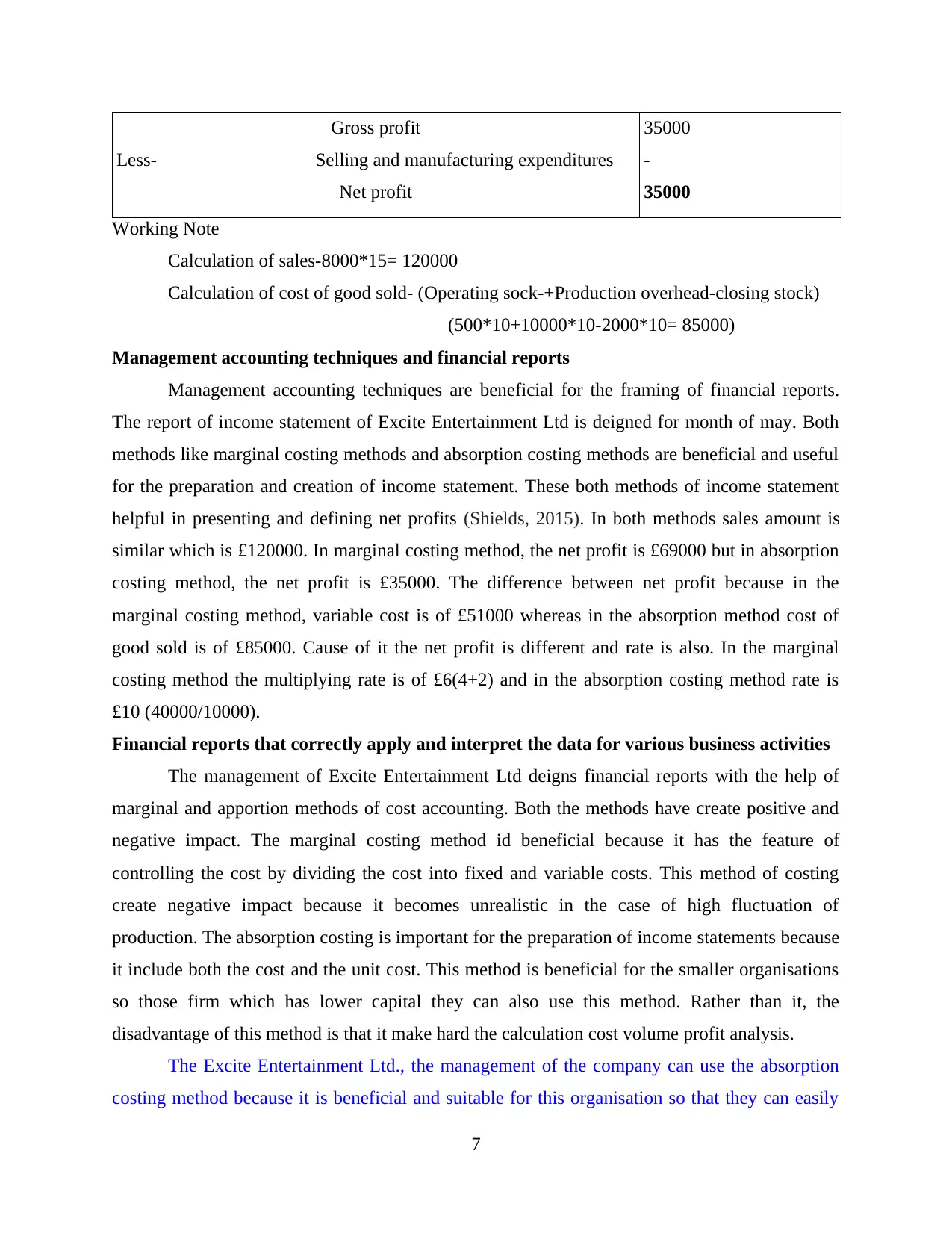

Gross profit

Less- Selling and manufacturing expenditures

Net profit

35000

-

35000

Working Note

Calculation of sales-8000*15= 120000

Calculation of cost of good sold- (Operating sock-+Production overhead-closing stock)

(500*10+10000*10-2000*10= 85000)

Management accounting techniques and financial reports

Management accounting techniques are beneficial for the framing of financial reports.

The report of income statement of Excite Entertainment Ltd is deigned for month of may. Both

methods like marginal costing methods and absorption costing methods are beneficial and useful

for the preparation and creation of income statement. These both methods of income statement

helpful in presenting and defining net profits (Shields, 2015). In both methods sales amount is

similar which is £120000. In marginal costing method, the net profit is £69000 but in absorption

costing method, the net profit is £35000. The difference between net profit because in the

marginal costing method, variable cost is of £51000 whereas in the absorption method cost of

good sold is of £85000. Cause of it the net profit is different and rate is also. In the marginal

costing method the multiplying rate is of £6(4+2) and in the absorption costing method rate is

£10 (40000/10000).

Financial reports that correctly apply and interpret the data for various business activities

The management of Excite Entertainment Ltd deigns financial reports with the help of

marginal and apportion methods of cost accounting. Both the methods have create positive and

negative impact. The marginal costing method id beneficial because it has the feature of

controlling the cost by dividing the cost into fixed and variable costs. This method of costing

create negative impact because it becomes unrealistic in the case of high fluctuation of

production. The absorption costing is important for the preparation of income statements because

it include both the cost and the unit cost. This method is beneficial for the smaller organisations

so those firm which has lower capital they can also use this method. Rather than it, the

disadvantage of this method is that it make hard the calculation cost volume profit analysis.

The Excite Entertainment Ltd., the management of the company can use the absorption

costing method because it is beneficial and suitable for this organisation so that they can easily

7

Less- Selling and manufacturing expenditures

Net profit

35000

-

35000

Working Note

Calculation of sales-8000*15= 120000

Calculation of cost of good sold- (Operating sock-+Production overhead-closing stock)

(500*10+10000*10-2000*10= 85000)

Management accounting techniques and financial reports

Management accounting techniques are beneficial for the framing of financial reports.

The report of income statement of Excite Entertainment Ltd is deigned for month of may. Both

methods like marginal costing methods and absorption costing methods are beneficial and useful

for the preparation and creation of income statement. These both methods of income statement

helpful in presenting and defining net profits (Shields, 2015). In both methods sales amount is

similar which is £120000. In marginal costing method, the net profit is £69000 but in absorption

costing method, the net profit is £35000. The difference between net profit because in the

marginal costing method, variable cost is of £51000 whereas in the absorption method cost of

good sold is of £85000. Cause of it the net profit is different and rate is also. In the marginal

costing method the multiplying rate is of £6(4+2) and in the absorption costing method rate is

£10 (40000/10000).

Financial reports that correctly apply and interpret the data for various business activities

The management of Excite Entertainment Ltd deigns financial reports with the help of

marginal and apportion methods of cost accounting. Both the methods have create positive and

negative impact. The marginal costing method id beneficial because it has the feature of

controlling the cost by dividing the cost into fixed and variable costs. This method of costing

create negative impact because it becomes unrealistic in the case of high fluctuation of

production. The absorption costing is important for the preparation of income statements because

it include both the cost and the unit cost. This method is beneficial for the smaller organisations

so those firm which has lower capital they can also use this method. Rather than it, the

disadvantage of this method is that it make hard the calculation cost volume profit analysis.

The Excite Entertainment Ltd., the management of the company can use the absorption

costing method because it is beneficial and suitable for this organisation so that they can easily

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

monitor the cost and the unit cost (Tappura and et. al., 2015). This method is also beneficial for

small organisation so they can also implement it for preparing income statement.

TASK 3

Explanation of the advantages and disadvantages of different types planning tools

Budget

It refers to a financial plan for a specific time period such as one year. It also consist

planned sales volumes and revenues, resources quantities, costs and expenses, assets, liabilities

and cash flows etc. according to K. Amjaroen, Budget refers to a predetermined statements of

managerial policy during the given period which offers a standard comparison with the outputs

actually achieved (van Helden and Uddin, 2016). In Excite Entertainment Ltd., the management

of the company create and develop budget to determine the financial performance of a company

in a predetermined period of time like one year. There are different types of budget that can be

used by the management department of this company. They are as following:

Sales budget- It indicates to a system which help in standard of goods and services that a

firm need to mercantilism in particular sector in particular time period and evaluate to gain cost

and fund from them in from of profit margins. In Excite Entertainment, this budget consists the

sales in terms of units and the calculated income from these sales. Without the help of sales

budget, this organisation cannot monitor process and will not make improvement in the process.

Sales budget can be an idea and system that help the organisation in the production of the goods

and trading of them in a particular time period.

Advantages- Sales budgets are important and essential for the allocation and distribution

of resources to various products, sales territories so that they can concreting the prediction sales.

It is useful for framing sales systems so the organisation can achieve its sales target. It helps in

managing expenses and making them in under control so that the aims of net profit can be

achieved by the firm.

Disadvantages- Sales budgets cannot efficiently articulation the future ways of events. It

is time consuming process and not easily adopted by the employees of the company.

Production budget- It refers to a budget which compute the number of units of products that are

produced and traced from a collection of the sales prediction. In Excite Entertainment Ltd.,

8

small organisation so they can also implement it for preparing income statement.

TASK 3

Explanation of the advantages and disadvantages of different types planning tools

Budget

It refers to a financial plan for a specific time period such as one year. It also consist

planned sales volumes and revenues, resources quantities, costs and expenses, assets, liabilities

and cash flows etc. according to K. Amjaroen, Budget refers to a predetermined statements of

managerial policy during the given period which offers a standard comparison with the outputs

actually achieved (van Helden and Uddin, 2016). In Excite Entertainment Ltd., the management

of the company create and develop budget to determine the financial performance of a company

in a predetermined period of time like one year. There are different types of budget that can be

used by the management department of this company. They are as following:

Sales budget- It indicates to a system which help in standard of goods and services that a

firm need to mercantilism in particular sector in particular time period and evaluate to gain cost

and fund from them in from of profit margins. In Excite Entertainment, this budget consists the

sales in terms of units and the calculated income from these sales. Without the help of sales

budget, this organisation cannot monitor process and will not make improvement in the process.

Sales budget can be an idea and system that help the organisation in the production of the goods

and trading of them in a particular time period.

Advantages- Sales budgets are important and essential for the allocation and distribution

of resources to various products, sales territories so that they can concreting the prediction sales.

It is useful for framing sales systems so the organisation can achieve its sales target. It helps in

managing expenses and making them in under control so that the aims of net profit can be

achieved by the firm.

Disadvantages- Sales budgets cannot efficiently articulation the future ways of events. It

is time consuming process and not easily adopted by the employees of the company.

Production budget- It refers to a budget which compute the number of units of products that are

produced and traced from a collection of the sales prediction. In Excite Entertainment Ltd.,

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

production budget indicates to a financial plan that consist various units which are manufacture

in a specific time period (Bobryshev and et. al., 2015). In this organisation, it is armoured by the

senior so that they can analyse that how much units must be produced according to the future

requirement. With th help of this financial plan, the management can gather information about

the manufacturing units and producing units which are needed to fulfil the consumers desires and

demands.

Advantages- It is beneficial for minimizing manufacturing cost fro managing production

units to monitor inventory. This budget is useful for devising act of raw material, finished good

stock and work in progress.

Disadvantages- In production budget, there are lack of flexibility when the management

of the company organise production process then there are numerous covariants that are changed

rapidly (Gunarathne and Lee, 2015). It is a decomposable process because in Excite

Entertainment Ltd., when the mangers participated in it then they analyse several manufacturing

units.

Cash Flow budget- It indicates to the calculation of all cash and fund expenditures that are

expected to generate during a specific time period. This approximation can be made monthly,

quarterly, annually and others or can consist nonfarm income, financial loss and farm items.

Advantages- This budget is beneficial for the firm and help in determining the cash

weather it is maintained and where it used in numerous activities.

Disadvantages- It is a time taking process and there are lack of flexibility because this

process consist commercial the budget digits and dispense it to the organisation's management

department.

Budget variances- It refers to the deviation between the monetary fund and baseline amount of

disbursement or revenue and the actual amount. In Excite Entertainment Ltd., it indicates to the

to a standard that is applied by the management to specify the variance between assuming and

actual figures for a particular accounting class. Within organisations, these kind of variances

generates cause of forecasters because they are incapable to monitor the upcoming costs and

revenue with entire accuracy.

Importance of Budget variance- Budget variance is important because it help in managing

budgets by controlling budgeted and actual costs. In Excite Entertainment Ltd., it is beneficial

because if the material are analysed an monitored than they are essential for identifying to

9

in a specific time period (Bobryshev and et. al., 2015). In this organisation, it is armoured by the

senior so that they can analyse that how much units must be produced according to the future

requirement. With th help of this financial plan, the management can gather information about

the manufacturing units and producing units which are needed to fulfil the consumers desires and

demands.

Advantages- It is beneficial for minimizing manufacturing cost fro managing production

units to monitor inventory. This budget is useful for devising act of raw material, finished good

stock and work in progress.

Disadvantages- In production budget, there are lack of flexibility when the management

of the company organise production process then there are numerous covariants that are changed

rapidly (Gunarathne and Lee, 2015). It is a decomposable process because in Excite

Entertainment Ltd., when the mangers participated in it then they analyse several manufacturing

units.

Cash Flow budget- It indicates to the calculation of all cash and fund expenditures that are

expected to generate during a specific time period. This approximation can be made monthly,

quarterly, annually and others or can consist nonfarm income, financial loss and farm items.

Advantages- This budget is beneficial for the firm and help in determining the cash

weather it is maintained and where it used in numerous activities.

Disadvantages- It is a time taking process and there are lack of flexibility because this

process consist commercial the budget digits and dispense it to the organisation's management

department.

Budget variances- It refers to the deviation between the monetary fund and baseline amount of

disbursement or revenue and the actual amount. In Excite Entertainment Ltd., it indicates to the

to a standard that is applied by the management to specify the variance between assuming and

actual figures for a particular accounting class. Within organisations, these kind of variances

generates cause of forecasters because they are incapable to monitor the upcoming costs and

revenue with entire accuracy.

Importance of Budget variance- Budget variance is important because it help in managing

budgets by controlling budgeted and actual costs. In Excite Entertainment Ltd., it is beneficial

because if the material are analysed an monitored than they are essential for identifying to

9

determine the reason (Hopper and Bui, 2016). With the help of it, financial mangers can asked to

program mangers in context of explaining substantial variances and provide solutions.

Use of various planning tools and their application to design and forecast budgets

Budget control is useful because it help in providing a actual condition of an

organisation. In Excite Entertainment Ltd. It help in designing and formulating future financial

performance and objectives which are analysed through past budgets (Kaplan and Atkinson,

2015). This type of control help the firm in analysing the result and financial place for same

future fundamental measure. In this organisation, sales budget can be used by the management to

hold and determine the sales units of the products and services which are developed by the firm.

Production budget is useful for the company because it help the production department to

produce required goods and services in a particular time. These all planning tools are essential

for the organisation because they are important for generating profit and help in maintaining a

monetary position in combative environment.

Evaluation of planning tools for accounting respond in context of solving financial issues

Planning is beneficial for formulating action plan for the future to support good textured

running of the operations of the organisation. In Excite Entertainment Ltd., the firm faced several

issues due to different unexpected situations. In this organisation, the management of the

company can applied various planning tools like sales budget, cash flow and production budget

etc. to overcome different awaited problems in context of improving and increasing the

profitability and productivity by solving and reducing conflicts.

TASK 4

Compare how organisations and adapting management accounting systems to respond the

financial issues

The management accounting system is beneficial and useful fro solving the various kind

of problems and issues related to finance and fund. In Excite Entertainment Ltd., the

management of the company can use accounting system according to the issues and problem

(Klychova and et. al., 2015). The project report of financial conflicts of Excite Entertainment

Ltd. is minimized and resolved which is defined as following:

Calculation of contribution per unit

Selling price per unit 40

10

program mangers in context of explaining substantial variances and provide solutions.

Use of various planning tools and their application to design and forecast budgets

Budget control is useful because it help in providing a actual condition of an

organisation. In Excite Entertainment Ltd. It help in designing and formulating future financial

performance and objectives which are analysed through past budgets (Kaplan and Atkinson,

2015). This type of control help the firm in analysing the result and financial place for same

future fundamental measure. In this organisation, sales budget can be used by the management to

hold and determine the sales units of the products and services which are developed by the firm.

Production budget is useful for the company because it help the production department to

produce required goods and services in a particular time. These all planning tools are essential

for the organisation because they are important for generating profit and help in maintaining a

monetary position in combative environment.

Evaluation of planning tools for accounting respond in context of solving financial issues

Planning is beneficial for formulating action plan for the future to support good textured

running of the operations of the organisation. In Excite Entertainment Ltd., the firm faced several

issues due to different unexpected situations. In this organisation, the management of the

company can applied various planning tools like sales budget, cash flow and production budget

etc. to overcome different awaited problems in context of improving and increasing the

profitability and productivity by solving and reducing conflicts.

TASK 4

Compare how organisations and adapting management accounting systems to respond the

financial issues

The management accounting system is beneficial and useful fro solving the various kind

of problems and issues related to finance and fund. In Excite Entertainment Ltd., the

management of the company can use accounting system according to the issues and problem

(Klychova and et. al., 2015). The project report of financial conflicts of Excite Entertainment

Ltd. is minimized and resolved which is defined as following:

Calculation of contribution per unit

Selling price per unit 40

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.