HNBS 305: Management Accounting Report on Costing and Budgeting

VerifiedAdded on 2023/01/12

|16

|3360

|71

Report

AI Summary

This report provides a comprehensive overview of management accounting, addressing key concepts and techniques essential for organizational decision-making. It begins by defining management accounting and its importance, exploring various systems like inventory management, job costing, price optimization, and cost accounting. The report then delves into costing techniques, comparing marginal and absorption costing with detailed cost card preparation, merits, demerits, and income statement analysis. Furthermore, it examines management accounting techniques such as margin analysis, break-even analysis, constraint analysis, and capital budgeting. The report also includes practical applications of financial reports, demonstrating the high-low method for cost calculation and different inventory valuation techniques (FIFO, LIFO, AVCO). Finally, the report discusses budgeting, covering different types of budgets and their applications, alongside a comparison of organizations adapting management accounting and its role in improving financial performance. This report aims to equip readers with a solid understanding of management accounting principles and their practical applications.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

PART 1............................................................................................................................................1

Section 1..........................................................................................................................................1

1.1 & 1.3 Management accounting and its essential requirements with benefits and its

application....................................................................................................................................1

1.2 Management accounting reporting systems...........................................................................3

Section 2..........................................................................................................................................4

2.1 Calculation of cost under marginal and absorption costing...................................................4

2.2 Management accounting techniques.....................................................................................7

2.3 Financial reports accurately applying and interpreting data..................................................7

PART 2............................................................................................................................................9

Section 3..........................................................................................................................................9

3.1 Budget and different types of budget.....................................................................................9

Section 4........................................................................................................................................11

4.1 Comparison of organizations adapting management accounting........................................11

4.2Management accounting in improving the financial performance.......................................12

4.3 Planning tools in MA for reducing financial problems.......................................................12

CONCLUSION..............................................................................................................................13

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

PART 1............................................................................................................................................1

Section 1..........................................................................................................................................1

1.1 & 1.3 Management accounting and its essential requirements with benefits and its

application....................................................................................................................................1

1.2 Management accounting reporting systems...........................................................................3

Section 2..........................................................................................................................................4

2.1 Calculation of cost under marginal and absorption costing...................................................4

2.2 Management accounting techniques.....................................................................................7

2.3 Financial reports accurately applying and interpreting data..................................................7

PART 2............................................................................................................................................9

Section 3..........................................................................................................................................9

3.1 Budget and different types of budget.....................................................................................9

Section 4........................................................................................................................................11

4.1 Comparison of organizations adapting management accounting........................................11

4.2Management accounting in improving the financial performance.......................................12

4.3 Planning tools in MA for reducing financial problems.......................................................12

CONCLUSION..............................................................................................................................13

INTRODUTION

Management accounting refers to the practice of gathering, analysing, interpreting the

financial information for the preparation of reports and records essential for decision making.

MA helps the management in establishing internal control of operations. This provides the

company to manage its business operations appropriately with the objective of maximising the

profits of company and minimising the costs and expenditures. Report will address the concepts

and methods of management accounting and its importance in the organisational context.

PART 1

Section 1

1.1 & 1.3 Management accounting and its essential requirements with benefits and its

application.

Management Accounting

It refers to the method of identifying, collection, measurement, communication and the

interpretation of financial information that is used by company to plan, evaluate and control the

operations of organisation.

Management Accounting Systems

Management accounting involves number of management accounting system.

Inventory management

This refers to system for management of inventory of the organisations. There are various

type of inventory in the organisation such as capital assets, raw materials and finished goods.

Inventory management helps the business in keeping proper track of all the inventory

movements. Inventory management involves practices such as jut-in-time that prevents storage

cost of inventory and makes the inventory available on time (Turner and et.al., 2017). Other is

material requisition that analyses the trend and stores inventory accordingly.

Application

Inventory management provides information that is used by management for taking

decisions related to inventory requirements.

Benefits

Help in making forecasts about the inventory requirements of production.

Saves time and cost of the enterprise in managing the inventory.

Prevents overstocks for goods that go out of fashion very fast.

1

Management accounting refers to the practice of gathering, analysing, interpreting the

financial information for the preparation of reports and records essential for decision making.

MA helps the management in establishing internal control of operations. This provides the

company to manage its business operations appropriately with the objective of maximising the

profits of company and minimising the costs and expenditures. Report will address the concepts

and methods of management accounting and its importance in the organisational context.

PART 1

Section 1

1.1 & 1.3 Management accounting and its essential requirements with benefits and its

application.

Management Accounting

It refers to the method of identifying, collection, measurement, communication and the

interpretation of financial information that is used by company to plan, evaluate and control the

operations of organisation.

Management Accounting Systems

Management accounting involves number of management accounting system.

Inventory management

This refers to system for management of inventory of the organisations. There are various

type of inventory in the organisation such as capital assets, raw materials and finished goods.

Inventory management helps the business in keeping proper track of all the inventory

movements. Inventory management involves practices such as jut-in-time that prevents storage

cost of inventory and makes the inventory available on time (Turner and et.al., 2017). Other is

material requisition that analyses the trend and stores inventory accordingly.

Application

Inventory management provides information that is used by management for taking

decisions related to inventory requirements.

Benefits

Help in making forecasts about the inventory requirements of production.

Saves time and cost of the enterprise in managing the inventory.

Prevents overstocks for goods that go out of fashion very fast.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job Costing System

Job costing is a method used in management accounting that allows the management to

calculate the cost of each job separately. It identifies the detailed cost of the job such as the raw

material, direct labour and overheads. This provides important information to management that is

essential for deciding the profit margins of the product. Job Costing system helps to identify the

cost of different jobs individually for preparing the finished goods.

Application

Job costing is used for getting accurate information related to the costs of job when

company wants to identify the cost for special orders.

Benefits

Helps in identifying the costing of each job separately.

Management after analysing the cost of job can decide the profit margins.

To identify the cost of special orders by big clients.

Price Optimisation System

Price optimisation is a mathematical model used in management accounting. This is used

by managers of the company to evaluate the demand of products or services at different level of

prices. Demand of products varies according to the variation in prices which requires the

company to decide the prices after analysing the demand (Bui and De Villiers, 2017. This helps

in deciding the prices so that the demands could be increased and appropriate profit margins

could be earned.

Applications

This is system is used by organisation to decide the prices of its product after analysing

the demand at various prices.

Benefits

Provides consistency to the business reducing the errors.

Helps the management in deciding the profit margins of products or services.

To decide optimum prices of the product to reach break even points.

Cost Accounting

Cost accounting system refers to management accounting system that records all the cost

information of the company. It is used to records all the cost incurred by the company for the

2

Job costing is a method used in management accounting that allows the management to

calculate the cost of each job separately. It identifies the detailed cost of the job such as the raw

material, direct labour and overheads. This provides important information to management that is

essential for deciding the profit margins of the product. Job Costing system helps to identify the

cost of different jobs individually for preparing the finished goods.

Application

Job costing is used for getting accurate information related to the costs of job when

company wants to identify the cost for special orders.

Benefits

Helps in identifying the costing of each job separately.

Management after analysing the cost of job can decide the profit margins.

To identify the cost of special orders by big clients.

Price Optimisation System

Price optimisation is a mathematical model used in management accounting. This is used

by managers of the company to evaluate the demand of products or services at different level of

prices. Demand of products varies according to the variation in prices which requires the

company to decide the prices after analysing the demand (Bui and De Villiers, 2017. This helps

in deciding the prices so that the demands could be increased and appropriate profit margins

could be earned.

Applications

This is system is used by organisation to decide the prices of its product after analysing

the demand at various prices.

Benefits

Provides consistency to the business reducing the errors.

Helps the management in deciding the profit margins of products or services.

To decide optimum prices of the product to reach break even points.

Cost Accounting

Cost accounting system refers to management accounting system that records all the cost

information of the company. It is used to records all the cost incurred by the company for the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

production of products or services. It helps in deciding the cost of goods and services using

different costing techniques. It also helps the company in keeping its cost under control.

Application

Cost accounting is used for measuring the cost of different products and services on the

basis of all direct costs and overheads incurred in its manufacturing.

Benefits

Helps to record all the cost of products.

Variance analysis helps in reducing the variations between actual and budgeted figures.

Provide essential financial information for decision making.

1.2 Management accounting reporting systems.

Management accounting systems provide important information to management for decision

making.

Inventory management report

Report contains all the information related to the movement of all the inventory of the

organisation from raw materials and finished goods. Report contains all the information related

to the frequency of movement of the inventories. This provides important information related to

management for making the purchase orders of inventory required in production on timely basis.

It also provides information related to inventory purchased and consumed during the specified

period. To take decisions.

Performance report

Performance report contains information related to the organisational performance. It

provides the management to measure the efficiency and effectiveness in achieving its targets.

Performance report ensures whether management has been able to achieve its target with the

available resources or not (Collis and Hussey, 2017). This enables the managers to take effective

decisions for increasing the productivity and efficiency of the management. It gives the

management information essential to frame strategies for the business.

Budgetary Report

Budgetary report is prepared for making projection related to the future incomes and

expenditures of the business. Budgetary report refers to the spending plans of business that gives

direction to company to follow. This helps the management in efficient allocation of its resources

between the departments. This ensures optimum utilisation of the available resources. Budgets

3

different costing techniques. It also helps the company in keeping its cost under control.

Application

Cost accounting is used for measuring the cost of different products and services on the

basis of all direct costs and overheads incurred in its manufacturing.

Benefits

Helps to record all the cost of products.

Variance analysis helps in reducing the variations between actual and budgeted figures.

Provide essential financial information for decision making.

1.2 Management accounting reporting systems.

Management accounting systems provide important information to management for decision

making.

Inventory management report

Report contains all the information related to the movement of all the inventory of the

organisation from raw materials and finished goods. Report contains all the information related

to the frequency of movement of the inventories. This provides important information related to

management for making the purchase orders of inventory required in production on timely basis.

It also provides information related to inventory purchased and consumed during the specified

period. To take decisions.

Performance report

Performance report contains information related to the organisational performance. It

provides the management to measure the efficiency and effectiveness in achieving its targets.

Performance report ensures whether management has been able to achieve its target with the

available resources or not (Collis and Hussey, 2017). This enables the managers to take effective

decisions for increasing the productivity and efficiency of the management. It gives the

management information essential to frame strategies for the business.

Budgetary Report

Budgetary report is prepared for making projection related to the future incomes and

expenditures of the business. Budgetary report refers to the spending plans of business that gives

direction to company to follow. This helps the management in efficient allocation of its resources

between the departments. This ensures optimum utilisation of the available resources. Budgets

3

are prepared by management on the basis of information related to previous years and making

necessary adjustments to prepare budgets of current year.

Integration of management accounting and reporting.

MA systems deals with management and control of all the transaction and events that are

occurring within the organisation. Systems such as inventory helps in tracking record of every

inventory and inventory reports helps in making timely information. Cost accounting system

records all the cost information and calculates cost of the product and cost report provides

analysis between the budgeted and actual figures. This helps in reducing the variances and errors.

In this manner it could be interpreted that management accounting systems and report are

integrated within the organisation.

Section 2

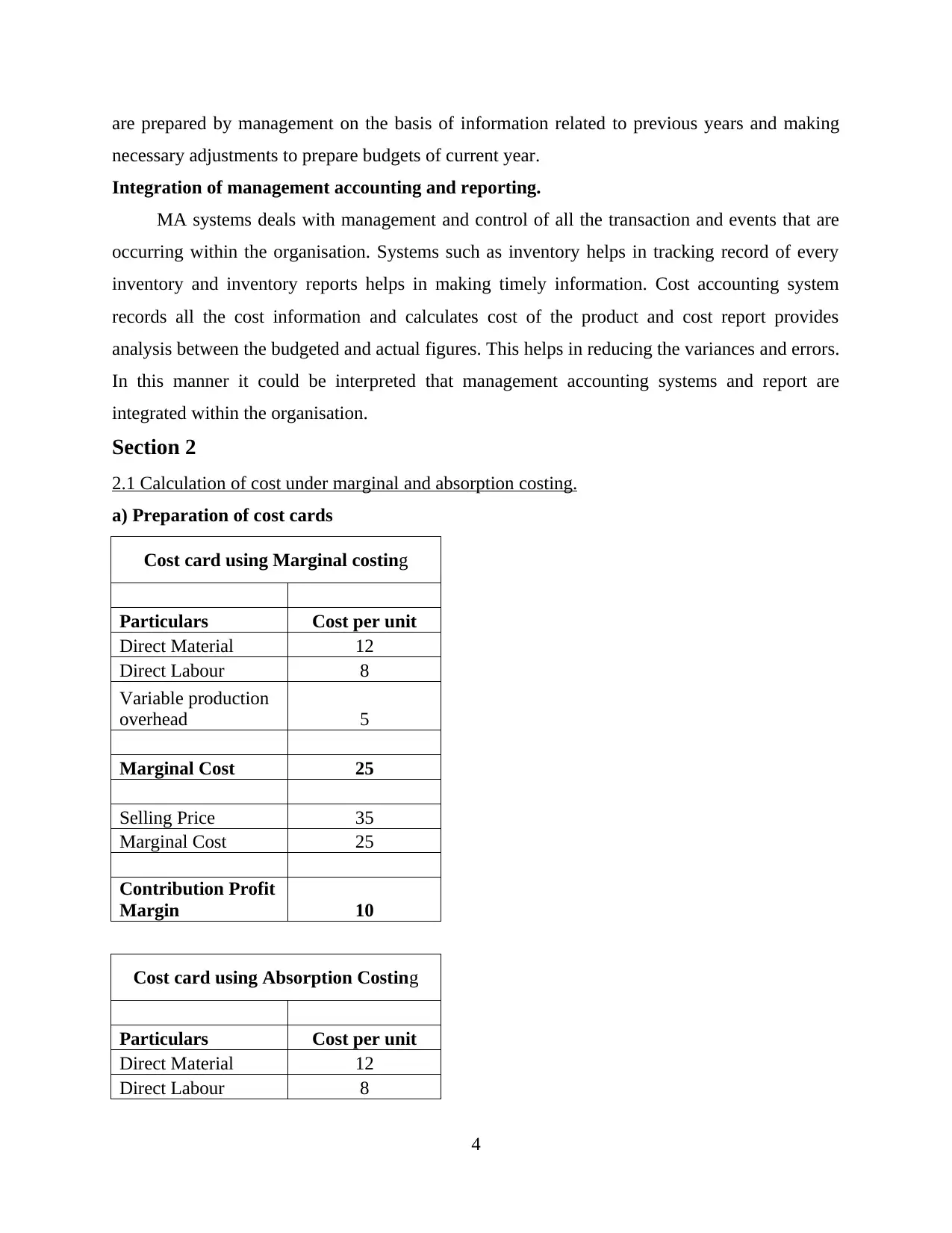

2.1 Calculation of cost under marginal and absorption costing.

a) Preparation of cost cards

Cost card using Marginal costing

Particulars Cost per unit

Direct Material 12

Direct Labour 8

Variable production

overhead 5

Marginal Cost 25

Selling Price 35

Marginal Cost 25

Contribution Profit

Margin 10

Cost card using Absorption Costing

Particulars Cost per unit

Direct Material 12

Direct Labour 8

4

necessary adjustments to prepare budgets of current year.

Integration of management accounting and reporting.

MA systems deals with management and control of all the transaction and events that are

occurring within the organisation. Systems such as inventory helps in tracking record of every

inventory and inventory reports helps in making timely information. Cost accounting system

records all the cost information and calculates cost of the product and cost report provides

analysis between the budgeted and actual figures. This helps in reducing the variances and errors.

In this manner it could be interpreted that management accounting systems and report are

integrated within the organisation.

Section 2

2.1 Calculation of cost under marginal and absorption costing.

a) Preparation of cost cards

Cost card using Marginal costing

Particulars Cost per unit

Direct Material 12

Direct Labour 8

Variable production

overhead 5

Marginal Cost 25

Selling Price 35

Marginal Cost 25

Contribution Profit

Margin 10

Cost card using Absorption Costing

Particulars Cost per unit

Direct Material 12

Direct Labour 8

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable production

overhead 5

Fixed production

overhead

2

Absorption Cost of

the product 27

Selling Price 35

Total Cost 27

Gross profit 8

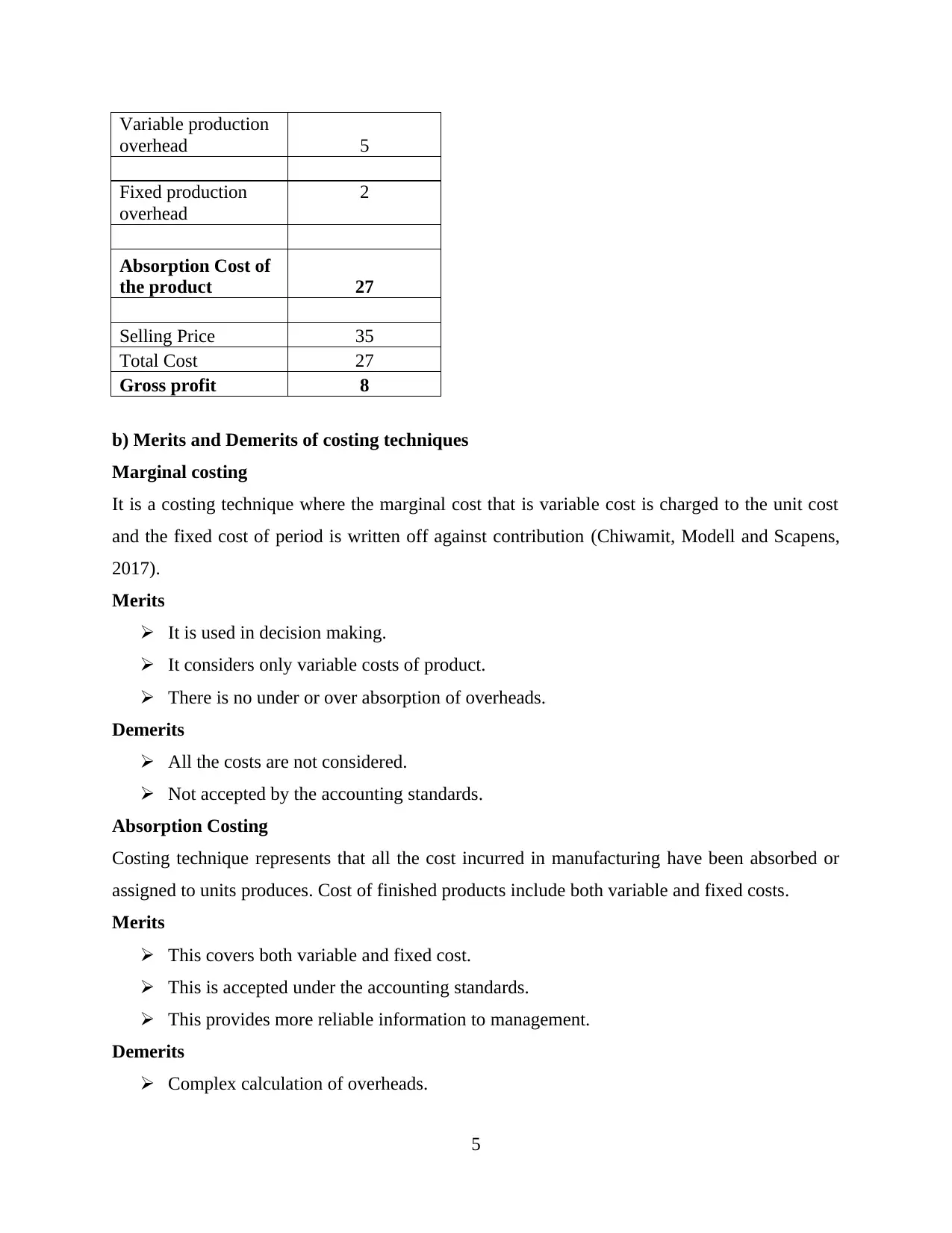

b) Merits and Demerits of costing techniques

Marginal costing

It is a costing technique where the marginal cost that is variable cost is charged to the unit cost

and the fixed cost of period is written off against contribution (Chiwamit, Modell and Scapens,

2017).

Merits

It is used in decision making.

It considers only variable costs of product.

There is no under or over absorption of overheads.

Demerits

All the costs are not considered.

Not accepted by the accounting standards.

Absorption Costing

Costing technique represents that all the cost incurred in manufacturing have been absorbed or

assigned to units produces. Cost of finished products include both variable and fixed costs.

Merits

This covers both variable and fixed cost.

This is accepted under the accounting standards.

This provides more reliable information to management.

Demerits

Complex calculation of overheads.

5

overhead 5

Fixed production

overhead

2

Absorption Cost of

the product 27

Selling Price 35

Total Cost 27

Gross profit 8

b) Merits and Demerits of costing techniques

Marginal costing

It is a costing technique where the marginal cost that is variable cost is charged to the unit cost

and the fixed cost of period is written off against contribution (Chiwamit, Modell and Scapens,

2017).

Merits

It is used in decision making.

It considers only variable costs of product.

There is no under or over absorption of overheads.

Demerits

All the costs are not considered.

Not accepted by the accounting standards.

Absorption Costing

Costing technique represents that all the cost incurred in manufacturing have been absorbed or

assigned to units produces. Cost of finished products include both variable and fixed costs.

Merits

This covers both variable and fixed cost.

This is accepted under the accounting standards.

This provides more reliable information to management.

Demerits

Complex calculation of overheads.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Do not enable comparison between the two products.

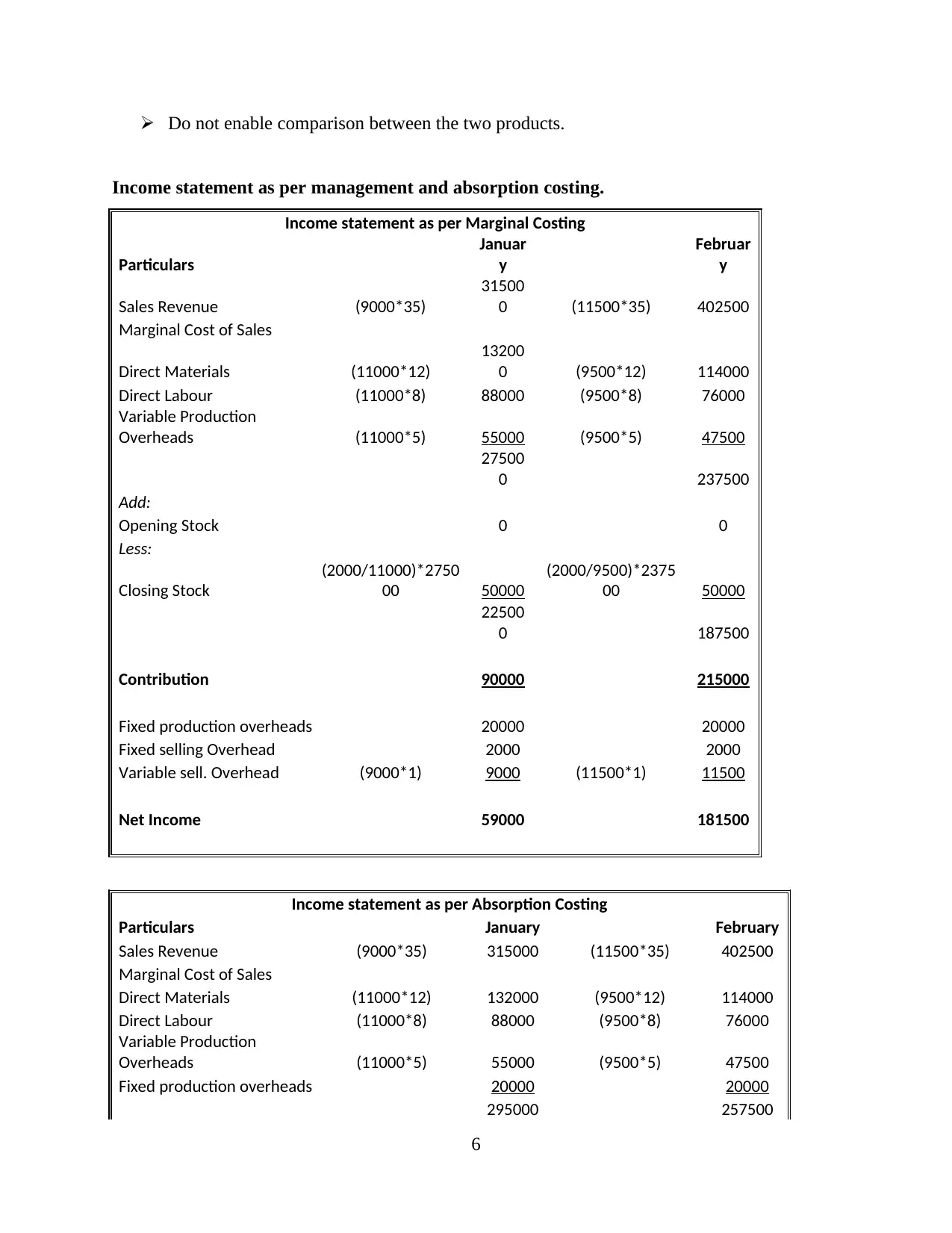

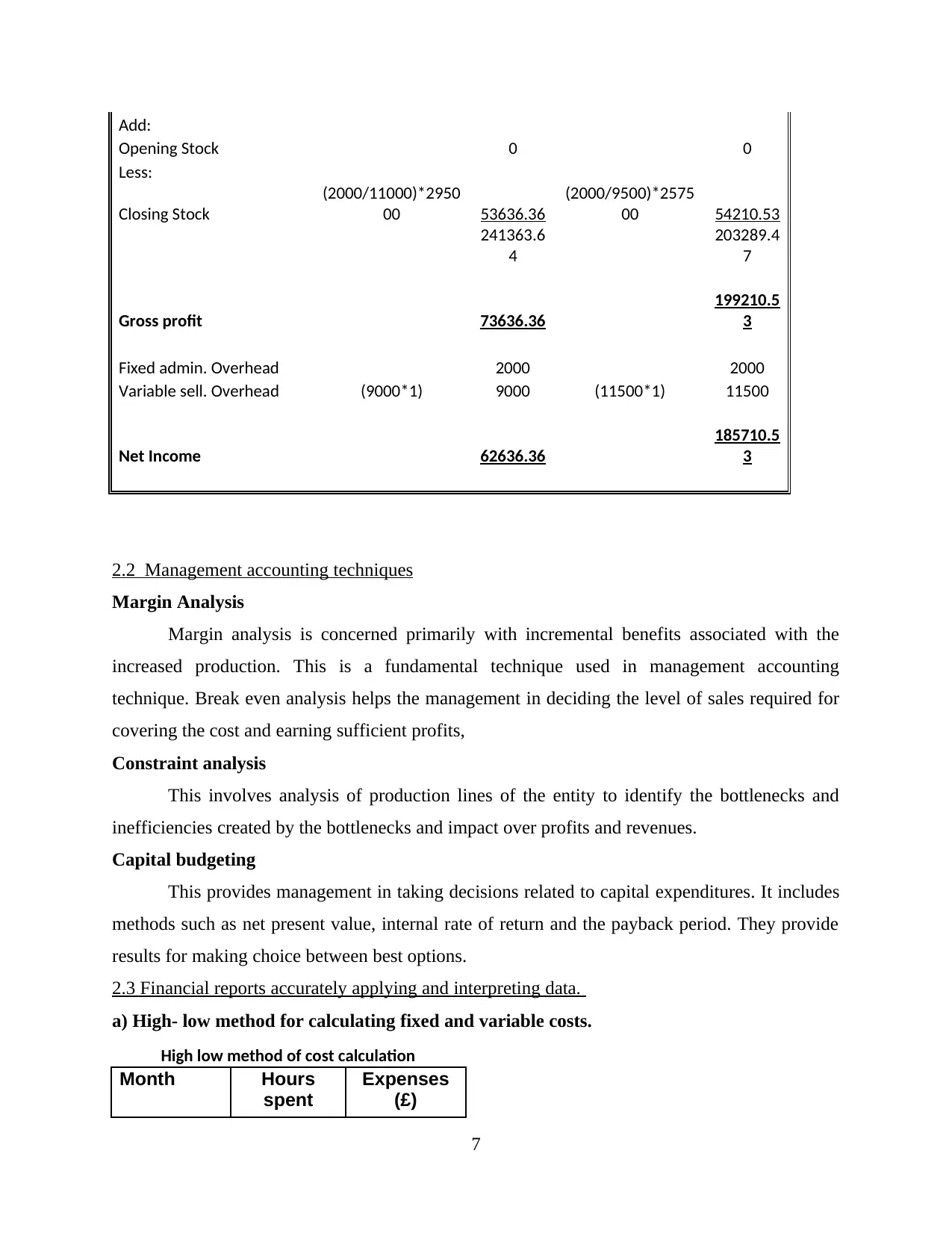

Income statement as per management and absorption costing.

Income statement as per Marginal Costing

Particulars

Januar

y

Februar

y

Sales Revenue (9000*35)

31500

0 (11500*35) 402500

Marginal Cost of Sales

Direct Materials (11000*12)

13200

0 (9500*12) 114000

Direct Labour (11000*8) 88000 (9500*8) 76000

Variable Production

Overheads (11000*5) 55000 (9500*5) 47500

27500

0 237500

Add:

Opening Stock 0 0

Less:

Closing Stock

(2000/11000)*2750

00 50000

(2000/9500)*2375

00 50000

22500

0 187500

Contribution 90000 215000

Fixed production overheads 20000 20000

Fixed selling Overhead 2000 2000

Variable sell. Overhead (9000*1) 9000 (11500*1) 11500

Net Income 59000 181500

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (9000*35) 315000 (11500*35) 402500

Marginal Cost of Sales

Direct Materials (11000*12) 132000 (9500*12) 114000

Direct Labour (11000*8) 88000 (9500*8) 76000

Variable Production

Overheads (11000*5) 55000 (9500*5) 47500

Fixed production overheads 20000 20000

295000 257500

6

Income statement as per management and absorption costing.

Income statement as per Marginal Costing

Particulars

Januar

y

Februar

y

Sales Revenue (9000*35)

31500

0 (11500*35) 402500

Marginal Cost of Sales

Direct Materials (11000*12)

13200

0 (9500*12) 114000

Direct Labour (11000*8) 88000 (9500*8) 76000

Variable Production

Overheads (11000*5) 55000 (9500*5) 47500

27500

0 237500

Add:

Opening Stock 0 0

Less:

Closing Stock

(2000/11000)*2750

00 50000

(2000/9500)*2375

00 50000

22500

0 187500

Contribution 90000 215000

Fixed production overheads 20000 20000

Fixed selling Overhead 2000 2000

Variable sell. Overhead (9000*1) 9000 (11500*1) 11500

Net Income 59000 181500

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (9000*35) 315000 (11500*35) 402500

Marginal Cost of Sales

Direct Materials (11000*12) 132000 (9500*12) 114000

Direct Labour (11000*8) 88000 (9500*8) 76000

Variable Production

Overheads (11000*5) 55000 (9500*5) 47500

Fixed production overheads 20000 20000

295000 257500

6

Add:

Opening Stock 0 0

Less:

Closing Stock

(2000/11000)*2950

00 53636.36

(2000/9500)*2575

00 54210.53

241363.6

4

203289.4

7

Gross profit 73636.36

199210.5

3

Fixed admin. Overhead 2000 2000

Variable sell. Overhead (9000*1) 9000 (11500*1) 11500

Net Income 62636.36

185710.5

3

2.2 Management accounting techniques

Margin Analysis

Margin analysis is concerned primarily with incremental benefits associated with the

increased production. This is a fundamental technique used in management accounting

technique. Break even analysis helps the management in deciding the level of sales required for

covering the cost and earning sufficient profits,

Constraint analysis

This involves analysis of production lines of the entity to identify the bottlenecks and

inefficiencies created by the bottlenecks and impact over profits and revenues.

Capital budgeting

This provides management in taking decisions related to capital expenditures. It includes

methods such as net present value, internal rate of return and the payback period. They provide

results for making choice between best options.

2.3 Financial reports accurately applying and interpreting data.

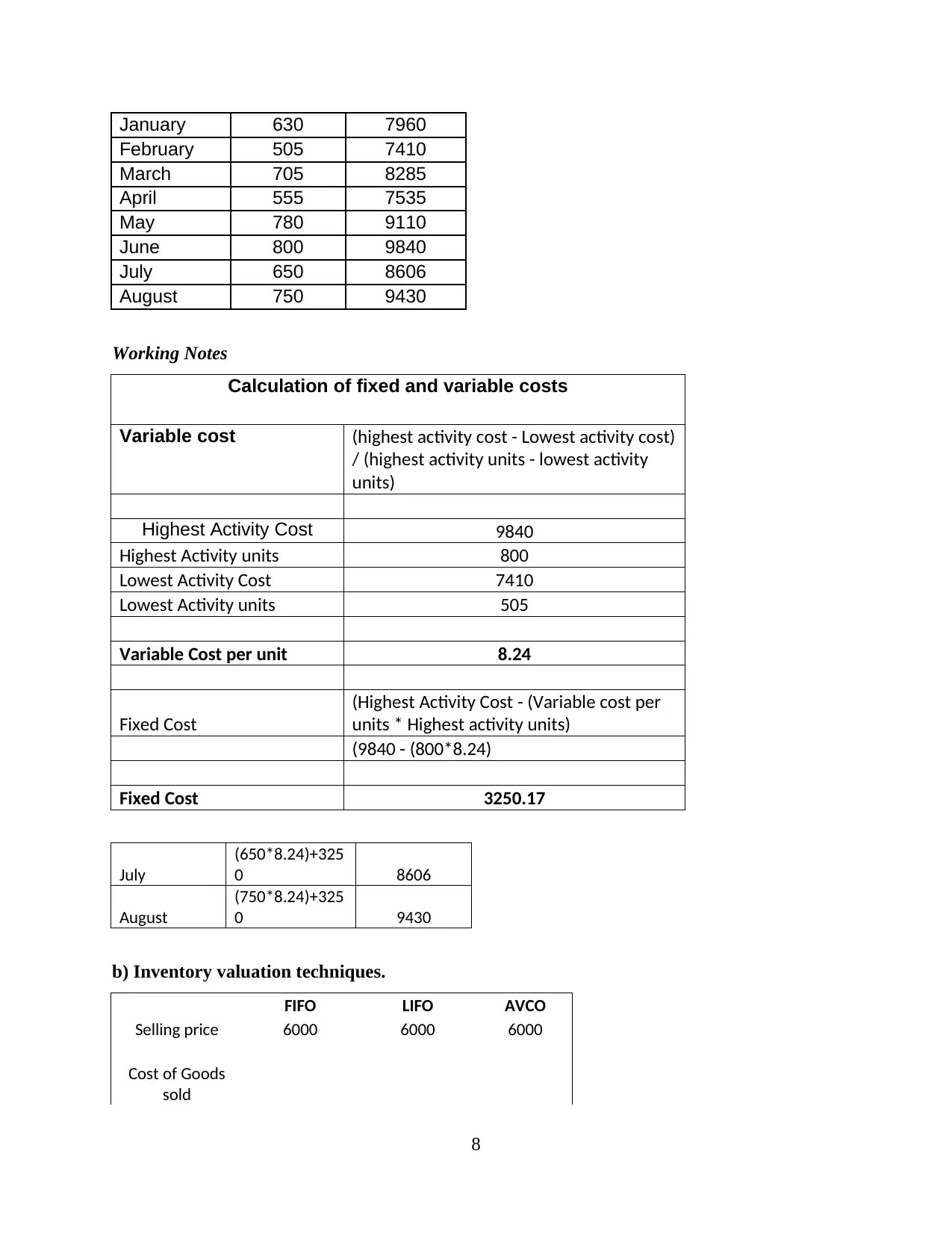

a) High- low method for calculating fixed and variable costs.

High low method of cost calculation

Month Hours

spent

Expenses

(£)

7

Opening Stock 0 0

Less:

Closing Stock

(2000/11000)*2950

00 53636.36

(2000/9500)*2575

00 54210.53

241363.6

4

203289.4

7

Gross profit 73636.36

199210.5

3

Fixed admin. Overhead 2000 2000

Variable sell. Overhead (9000*1) 9000 (11500*1) 11500

Net Income 62636.36

185710.5

3

2.2 Management accounting techniques

Margin Analysis

Margin analysis is concerned primarily with incremental benefits associated with the

increased production. This is a fundamental technique used in management accounting

technique. Break even analysis helps the management in deciding the level of sales required for

covering the cost and earning sufficient profits,

Constraint analysis

This involves analysis of production lines of the entity to identify the bottlenecks and

inefficiencies created by the bottlenecks and impact over profits and revenues.

Capital budgeting

This provides management in taking decisions related to capital expenditures. It includes

methods such as net present value, internal rate of return and the payback period. They provide

results for making choice between best options.

2.3 Financial reports accurately applying and interpreting data.

a) High- low method for calculating fixed and variable costs.

High low method of cost calculation

Month Hours

spent

Expenses

(£)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

January 630 7960

February 505 7410

March 705 8285

April 555 7535

May 780 9110

June 800 9840

July 650 8606

August 750 9430

Working Notes

Calculation of fixed and variable costs

Variable cost (highest activity cost - Lowest activity cost)

/ (highest activity units - lowest activity

units)

Highest Activity Cost 9840

Highest Activity units 800

Lowest Activity Cost 7410

Lowest Activity units 505

Variable Cost per unit 8.24

Fixed Cost

(Highest Activity Cost - (Variable cost per

units * Highest activity units)

(9840 - (800*8.24)

Fixed Cost 3250.17

July

(650*8.24)+325

0 8606

August

(750*8.24)+325

0 9430

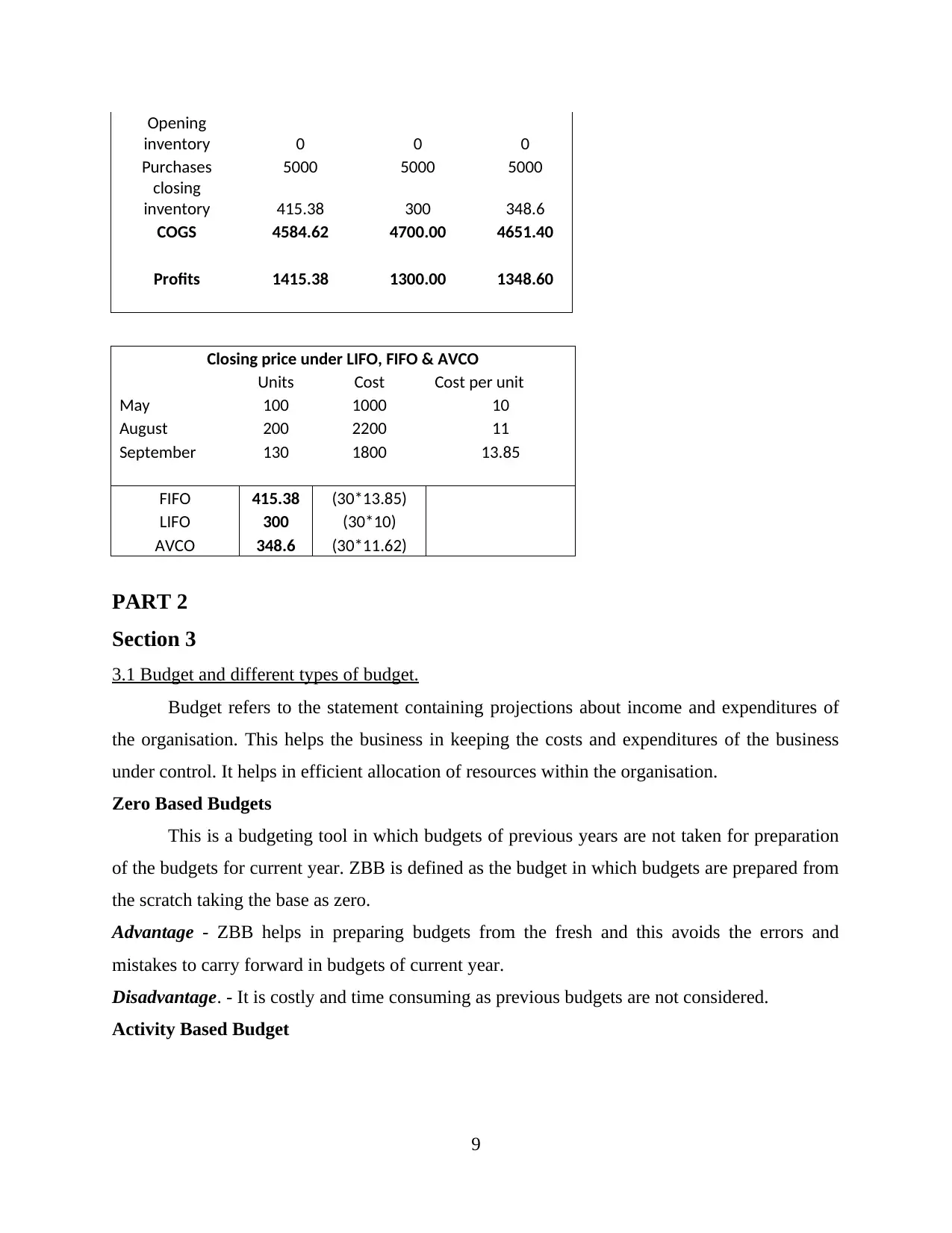

b) Inventory valuation techniques.

FIFO LIFO AVCO

Selling price 6000 6000 6000

Cost of Goods

sold

8

February 505 7410

March 705 8285

April 555 7535

May 780 9110

June 800 9840

July 650 8606

August 750 9430

Working Notes

Calculation of fixed and variable costs

Variable cost (highest activity cost - Lowest activity cost)

/ (highest activity units - lowest activity

units)

Highest Activity Cost 9840

Highest Activity units 800

Lowest Activity Cost 7410

Lowest Activity units 505

Variable Cost per unit 8.24

Fixed Cost

(Highest Activity Cost - (Variable cost per

units * Highest activity units)

(9840 - (800*8.24)

Fixed Cost 3250.17

July

(650*8.24)+325

0 8606

August

(750*8.24)+325

0 9430

b) Inventory valuation techniques.

FIFO LIFO AVCO

Selling price 6000 6000 6000

Cost of Goods

sold

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Opening

inventory 0 0 0

Purchases 5000 5000 5000

closing

inventory 415.38 300 348.6

COGS 4584.62 4700.00 4651.40

Profits 1415.38 1300.00 1348.60

Closing price under LIFO, FIFO & AVCO

Units Cost Cost per unit

May 100 1000 10

August 200 2200 11

September 130 1800 13.85

FIFO 415.38 (30*13.85)

LIFO 300 (30*10)

AVCO 348.6 (30*11.62)

PART 2

Section 3

3.1 Budget and different types of budget.

Budget refers to the statement containing projections about income and expenditures of

the organisation. This helps the business in keeping the costs and expenditures of the business

under control. It helps in efficient allocation of resources within the organisation.

Zero Based Budgets

This is a budgeting tool in which budgets of previous years are not taken for preparation

of the budgets for current year. ZBB is defined as the budget in which budgets are prepared from

the scratch taking the base as zero.

Advantage - ZBB helps in preparing budgets from the fresh and this avoids the errors and

mistakes to carry forward in budgets of current year.

Disadvantage. - It is costly and time consuming as previous budgets are not considered.

Activity Based Budget

9

inventory 0 0 0

Purchases 5000 5000 5000

closing

inventory 415.38 300 348.6

COGS 4584.62 4700.00 4651.40

Profits 1415.38 1300.00 1348.60

Closing price under LIFO, FIFO & AVCO

Units Cost Cost per unit

May 100 1000 10

August 200 2200 11

September 130 1800 13.85

FIFO 415.38 (30*13.85)

LIFO 300 (30*10)

AVCO 348.6 (30*11.62)

PART 2

Section 3

3.1 Budget and different types of budget.

Budget refers to the statement containing projections about income and expenditures of

the organisation. This helps the business in keeping the costs and expenditures of the business

under control. It helps in efficient allocation of resources within the organisation.

Zero Based Budgets

This is a budgeting tool in which budgets of previous years are not taken for preparation

of the budgets for current year. ZBB is defined as the budget in which budgets are prepared from

the scratch taking the base as zero.

Advantage - ZBB helps in preparing budgets from the fresh and this avoids the errors and

mistakes to carry forward in budgets of current year.

Disadvantage. - It is costly and time consuming as previous budgets are not considered.

Activity Based Budget

9

Activity based budget analyse the costs and expenses related to the each activity

separately that is carried out by the organisation (Abernethy and Campbell, 2018). The budget

for current year is prepared by the management on the previous budgets.

Advantage - This helps in efficient allocation of resources to the activities separately which helps

in reducing the variations.

Disadvantage - This is time consuming and expensive to implement in the company.

Operational Budgets

The budgets are prepared by the management on the basis of budgets of last year.

Budgets for current year are prepared by analysing the trends of past year and making necessary

adjustments for expenses related to the operations of business.

Advantage - This helps in keeping the operational costs and expenditures of the business under

control by analysing the variances.

Disadvantage - Operational budgets are prepared on forecast and it is not possible to predict

future accurately.

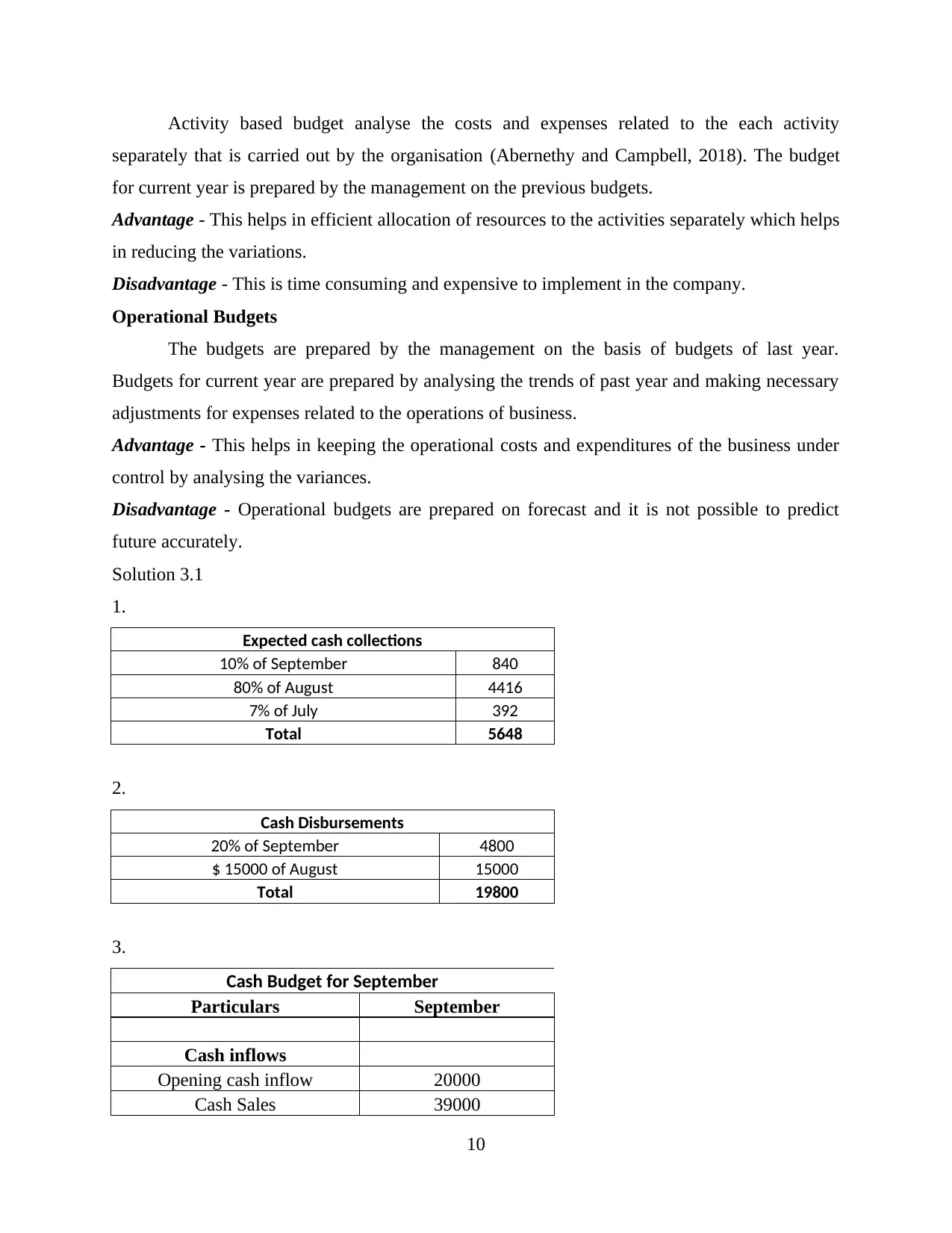

Solution 3.1

1.

Expected cash collections

10% of September 840

80% of August 4416

7% of July 392

Total 5648

2.

Cash Disbursements

20% of September 4800

$ 15000 of August 15000

Total 19800

3.

Cash Budget for September

Particulars September

Cash inflows

Opening cash inflow 20000

Cash Sales 39000

10

separately that is carried out by the organisation (Abernethy and Campbell, 2018). The budget

for current year is prepared by the management on the previous budgets.

Advantage - This helps in efficient allocation of resources to the activities separately which helps

in reducing the variations.

Disadvantage - This is time consuming and expensive to implement in the company.

Operational Budgets

The budgets are prepared by the management on the basis of budgets of last year.

Budgets for current year are prepared by analysing the trends of past year and making necessary

adjustments for expenses related to the operations of business.

Advantage - This helps in keeping the operational costs and expenditures of the business under

control by analysing the variances.

Disadvantage - Operational budgets are prepared on forecast and it is not possible to predict

future accurately.

Solution 3.1

1.

Expected cash collections

10% of September 840

80% of August 4416

7% of July 392

Total 5648

2.

Cash Disbursements

20% of September 4800

$ 15000 of August 15000

Total 19800

3.

Cash Budget for September

Particulars September

Cash inflows

Opening cash inflow 20000

Cash Sales 39000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.