Management Accounting Report: Hochtief Company's Financial Strategy

VerifiedAdded on 2023/01/23

|23

|5053

|81

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and practices, focusing on their application within the Hochtief company. It delves into various management accounting systems, including cost accounting, inventory management, job costing, and price optimization, highlighting their benefits in enhancing operational efficiency and profitability. The report further explores different methods of management accounting reporting, such as budget reports, account receivable reports, performance reports, and cost reports, emphasizing their role in providing crucial financial information for internal decision-making. Additionally, the study analyzes and compares marginal costing and absorption costing techniques, demonstrating their impact on profit calculation and strategic decision-making. Through detailed analysis of financial data and practical examples, the report aims to equip readers with a thorough understanding of management accounting's significance in achieving sustainable growth and development for businesses.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

ACTIVITY 1....................................................................................................................................3

Methods of management accounting reporting......................................................................5

Management accounting techniques.......................................................................................6

ANNEX A..............................................................................................................................7

ANNEX B............................................................................................................................12

Particulars......................................................................................................................................13

Plan 1............................................................................................................................................13

Plan 2.............................................................................................................................................13

Plan 3.............................................................................................................................................13

ACTIVITY 2..................................................................................................................................14

Planning tools advantages and disadvantages......................................................................14

ANNEX C ...........................................................................................................................16

Comparison of ways in which management accounting is applied for confronting financial

problems...............................................................................................................................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION...........................................................................................................................3

ACTIVITY 1....................................................................................................................................3

Methods of management accounting reporting......................................................................5

Management accounting techniques.......................................................................................6

ANNEX A..............................................................................................................................7

ANNEX B............................................................................................................................12

Particulars......................................................................................................................................13

Plan 1............................................................................................................................................13

Plan 2.............................................................................................................................................13

Plan 3.............................................................................................................................................13

ACTIVITY 2..................................................................................................................................14

Planning tools advantages and disadvantages......................................................................14

ANNEX C ...........................................................................................................................16

Comparison of ways in which management accounting is applied for confronting financial

problems...............................................................................................................................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION

Management accounting is an effective technique which produces internal financial

reports which aids managers of the organization in effective decision making. Management

accounting is an effective tool which helps in planning, decision making, strategic management,

etc. it helps managers in forecasting and analysing the future prospects for long term growth and

sustainability (Kaplan and Atkinson, 2015). It is an effective process of analysing and presenting

financial information to the internal managers on a regular interval for strategic decision making.

This is a report which is used by internal management for solving financial problems and finding

effective solution for long term sustainable growth.

This study will highlight, management accounting and the essential requirements of

various types of management accounting system. It will also highlight different methods which

are used in management accounting report. Further it will also effectively include various

management accounting techniques. This study will further include planning tools which are

used for budgetary control. It will further analyse the advantages and disadvantage of these

budgetary control tool which helps in decision making. Furthermore, this study will evaluate and

compare two organizations in order to effectively respond to various financial problems.

Furthermore this study will critically evaluate the importance of planning tools in solving

financial problem and lead organization to sustainable growth and development.

Hochtief company is a construction engineering company which focuses on building

various projects like highways, bridges, stations, etc.

ACTIVITY 1

Management accounting: It is an effective process which helps internal management of

the organization to analyse various financial statement in order to take necessary strategic

decision for long term sustainable growth of the business (Quattrone, 2016). Management

accounting helps in capital budgeting analysis, stock valuation, forecasting, new product

analysis, break even analysis, forecasting, helps in financial accounting and solving financial

problems which leads to long term sustainable growth. Management accounting helps in

enhancing the operations of the business by eliminating cost and reducing risk.

Management accounting systems

Management accounting is an effective technique which produces internal financial

reports which aids managers of the organization in effective decision making. Management

accounting is an effective tool which helps in planning, decision making, strategic management,

etc. it helps managers in forecasting and analysing the future prospects for long term growth and

sustainability (Kaplan and Atkinson, 2015). It is an effective process of analysing and presenting

financial information to the internal managers on a regular interval for strategic decision making.

This is a report which is used by internal management for solving financial problems and finding

effective solution for long term sustainable growth.

This study will highlight, management accounting and the essential requirements of

various types of management accounting system. It will also highlight different methods which

are used in management accounting report. Further it will also effectively include various

management accounting techniques. This study will further include planning tools which are

used for budgetary control. It will further analyse the advantages and disadvantage of these

budgetary control tool which helps in decision making. Furthermore, this study will evaluate and

compare two organizations in order to effectively respond to various financial problems.

Furthermore this study will critically evaluate the importance of planning tools in solving

financial problem and lead organization to sustainable growth and development.

Hochtief company is a construction engineering company which focuses on building

various projects like highways, bridges, stations, etc.

ACTIVITY 1

Management accounting: It is an effective process which helps internal management of

the organization to analyse various financial statement in order to take necessary strategic

decision for long term sustainable growth of the business (Quattrone, 2016). Management

accounting helps in capital budgeting analysis, stock valuation, forecasting, new product

analysis, break even analysis, forecasting, helps in financial accounting and solving financial

problems which leads to long term sustainable growth. Management accounting helps in

enhancing the operations of the business by eliminating cost and reducing risk.

Management accounting systems

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting systems helps in improvising the productivity of the

organization in order to reach higher profitability and market share for future growth and

development. This mainly focus on formulating of various reports which helps in strategic

decision making. Management accounting systems can be further classified into:

Cost accounting system: It is a framework which helps Hochtief company in estimating

the cost of the activities for profitability analysis, cost control and inventory valuation. Cost

accounting system helps in effectively determining the cost of various production departments.

This helps management of the organization to determine the cost of the product for profitable

operations (What is a Cost Accounting System?, 2019). It helps in determining the work- in-

progress, material inventory, finished goods to prepare financial statements.

The key elements of cost accounting system mainly comprises of material i.e., direct

material and indirect material, labour i.e., direct labour and indirect labour and overhead i.e.,

variable O/h and fixed O/h. Cost accounting techniques is an effective way to analyse and

determine the future expenses for production. Cost accounting system take into consideration

direct costing, which can be attributed to the production of the goods. It mainly comprises of

commission, wages, manufacturing expense, piece rate, etc.

Inventory management system: It is a management accounting system which helps in

tracking levels of stocks, sales, orders and deliveries. Inventory management system helps

management of the organization to determine the requirements and reordering gods without any

delay (Granlund and Lukka, 2017) . It helps in effective decision making regarding ordering and

managing production in an effective and efficient manner. Inventory management system helps

in managing the supply chain which helps in placing order in an effective and efficient manner.

This helps in collection of surplus material and effectively control the orders according to the

production level. Inventory management techniques mainly includes last in first out method

(LIFO), first in first out method (FIFO), stock review, ABC analysis, just in time method and

weighted average method.

Job costing system: It is an effective process which helps in analysing and predicting the

cost attached with each job carried out at the time of production. It focuses on accumulating cost

to each individual unit of the production. It helps management of the Hochtief company to keep

proper record and track expenses of each product. This helps in determining the cost of the

organization in order to reach higher profitability and market share for future growth and

development. This mainly focus on formulating of various reports which helps in strategic

decision making. Management accounting systems can be further classified into:

Cost accounting system: It is a framework which helps Hochtief company in estimating

the cost of the activities for profitability analysis, cost control and inventory valuation. Cost

accounting system helps in effectively determining the cost of various production departments.

This helps management of the organization to determine the cost of the product for profitable

operations (What is a Cost Accounting System?, 2019). It helps in determining the work- in-

progress, material inventory, finished goods to prepare financial statements.

The key elements of cost accounting system mainly comprises of material i.e., direct

material and indirect material, labour i.e., direct labour and indirect labour and overhead i.e.,

variable O/h and fixed O/h. Cost accounting techniques is an effective way to analyse and

determine the future expenses for production. Cost accounting system take into consideration

direct costing, which can be attributed to the production of the goods. It mainly comprises of

commission, wages, manufacturing expense, piece rate, etc.

Inventory management system: It is a management accounting system which helps in

tracking levels of stocks, sales, orders and deliveries. Inventory management system helps

management of the organization to determine the requirements and reordering gods without any

delay (Granlund and Lukka, 2017) . It helps in effective decision making regarding ordering and

managing production in an effective and efficient manner. Inventory management system helps

in managing the supply chain which helps in placing order in an effective and efficient manner.

This helps in collection of surplus material and effectively control the orders according to the

production level. Inventory management techniques mainly includes last in first out method

(LIFO), first in first out method (FIFO), stock review, ABC analysis, just in time method and

weighted average method.

Job costing system: It is an effective process which helps in analysing and predicting the

cost attached with each job carried out at the time of production. It focuses on accumulating cost

to each individual unit of the production. It helps management of the Hochtief company to keep

proper record and track expenses of each product. This helps in determining the cost of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

project in an effective manner. It is very important to evaluate the cost which eventually results

in effective estimation, financial reporting and strategic decision.

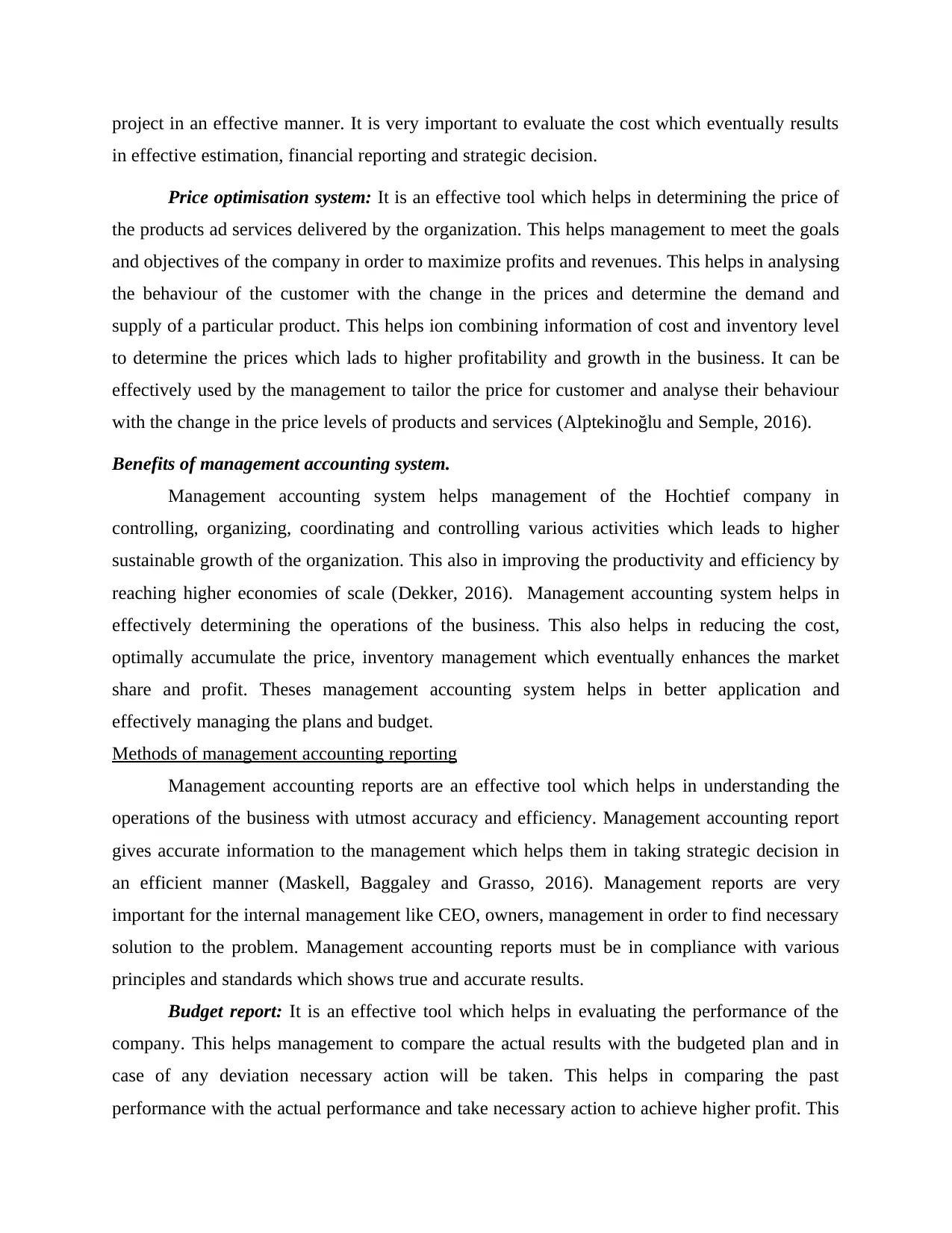

Price optimisation system: It is an effective tool which helps in determining the price of

the products ad services delivered by the organization. This helps management to meet the goals

and objectives of the company in order to maximize profits and revenues. This helps in analysing

the behaviour of the customer with the change in the prices and determine the demand and

supply of a particular product. This helps ion combining information of cost and inventory level

to determine the prices which lads to higher profitability and growth in the business. It can be

effectively used by the management to tailor the price for customer and analyse their behaviour

with the change in the price levels of products and services (Alptekinoğlu and Semple, 2016).

Benefits of management accounting system.

Management accounting system helps management of the Hochtief company in

controlling, organizing, coordinating and controlling various activities which leads to higher

sustainable growth of the organization. This also in improving the productivity and efficiency by

reaching higher economies of scale (Dekker, 2016). Management accounting system helps in

effectively determining the operations of the business. This also helps in reducing the cost,

optimally accumulate the price, inventory management which eventually enhances the market

share and profit. Theses management accounting system helps in better application and

effectively managing the plans and budget.

Methods of management accounting reporting

Management accounting reports are an effective tool which helps in understanding the

operations of the business with utmost accuracy and efficiency. Management accounting report

gives accurate information to the management which helps them in taking strategic decision in

an efficient manner (Maskell, Baggaley and Grasso, 2016). Management reports are very

important for the internal management like CEO, owners, management in order to find necessary

solution to the problem. Management accounting reports must be in compliance with various

principles and standards which shows true and accurate results.

Budget report: It is an effective tool which helps in evaluating the performance of the

company. This helps management to compare the actual results with the budgeted plan and in

case of any deviation necessary action will be taken. This helps in comparing the past

performance with the actual performance and take necessary action to achieve higher profit. This

in effective estimation, financial reporting and strategic decision.

Price optimisation system: It is an effective tool which helps in determining the price of

the products ad services delivered by the organization. This helps management to meet the goals

and objectives of the company in order to maximize profits and revenues. This helps in analysing

the behaviour of the customer with the change in the prices and determine the demand and

supply of a particular product. This helps ion combining information of cost and inventory level

to determine the prices which lads to higher profitability and growth in the business. It can be

effectively used by the management to tailor the price for customer and analyse their behaviour

with the change in the price levels of products and services (Alptekinoğlu and Semple, 2016).

Benefits of management accounting system.

Management accounting system helps management of the Hochtief company in

controlling, organizing, coordinating and controlling various activities which leads to higher

sustainable growth of the organization. This also in improving the productivity and efficiency by

reaching higher economies of scale (Dekker, 2016). Management accounting system helps in

effectively determining the operations of the business. This also helps in reducing the cost,

optimally accumulate the price, inventory management which eventually enhances the market

share and profit. Theses management accounting system helps in better application and

effectively managing the plans and budget.

Methods of management accounting reporting

Management accounting reports are an effective tool which helps in understanding the

operations of the business with utmost accuracy and efficiency. Management accounting report

gives accurate information to the management which helps them in taking strategic decision in

an efficient manner (Maskell, Baggaley and Grasso, 2016). Management reports are very

important for the internal management like CEO, owners, management in order to find necessary

solution to the problem. Management accounting reports must be in compliance with various

principles and standards which shows true and accurate results.

Budget report: It is an effective tool which helps in evaluating the performance of the

company. This helps management to compare the actual results with the budgeted plan and in

case of any deviation necessary action will be taken. This helps in comparing the past

performance with the actual performance and take necessary action to achieve higher profit. This

helps in controlling the activities for future sustainable growth (Brown and et.al., 2016). Budget

report helps in estimating the revenue and cost for a particular period of time. This helps in

planning the future by controlling the variance with utmost accuracy.

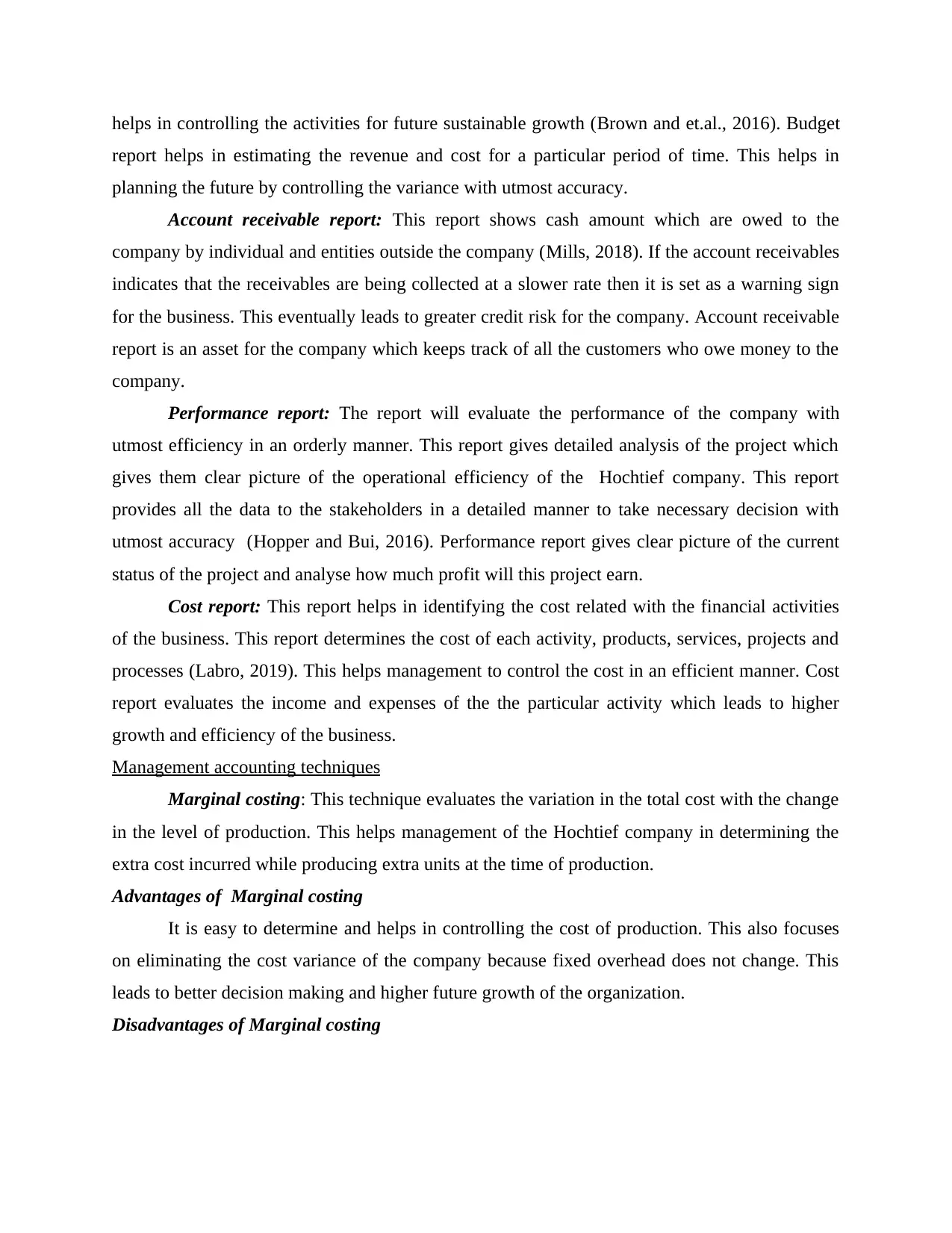

Account receivable report: This report shows cash amount which are owed to the

company by individual and entities outside the company (Mills, 2018). If the account receivables

indicates that the receivables are being collected at a slower rate then it is set as a warning sign

for the business. This eventually leads to greater credit risk for the company. Account receivable

report is an asset for the company which keeps track of all the customers who owe money to the

company.

Performance report: The report will evaluate the performance of the company with

utmost efficiency in an orderly manner. This report gives detailed analysis of the project which

gives them clear picture of the operational efficiency of the Hochtief company. This report

provides all the data to the stakeholders in a detailed manner to take necessary decision with

utmost accuracy (Hopper and Bui, 2016). Performance report gives clear picture of the current

status of the project and analyse how much profit will this project earn.

Cost report: This report helps in identifying the cost related with the financial activities

of the business. This report determines the cost of each activity, products, services, projects and

processes (Labro, 2019). This helps management to control the cost in an efficient manner. Cost

report evaluates the income and expenses of the the particular activity which leads to higher

growth and efficiency of the business.

Management accounting techniques

Marginal costing: This technique evaluates the variation in the total cost with the change

in the level of production. This helps management of the Hochtief company in determining the

extra cost incurred while producing extra units at the time of production.

Advantages of Marginal costing

It is easy to determine and helps in controlling the cost of production. This also focuses

on eliminating the cost variance of the company because fixed overhead does not change. This

leads to better decision making and higher future growth of the organization.

Disadvantages of Marginal costing

report helps in estimating the revenue and cost for a particular period of time. This helps in

planning the future by controlling the variance with utmost accuracy.

Account receivable report: This report shows cash amount which are owed to the

company by individual and entities outside the company (Mills, 2018). If the account receivables

indicates that the receivables are being collected at a slower rate then it is set as a warning sign

for the business. This eventually leads to greater credit risk for the company. Account receivable

report is an asset for the company which keeps track of all the customers who owe money to the

company.

Performance report: The report will evaluate the performance of the company with

utmost efficiency in an orderly manner. This report gives detailed analysis of the project which

gives them clear picture of the operational efficiency of the Hochtief company. This report

provides all the data to the stakeholders in a detailed manner to take necessary decision with

utmost accuracy (Hopper and Bui, 2016). Performance report gives clear picture of the current

status of the project and analyse how much profit will this project earn.

Cost report: This report helps in identifying the cost related with the financial activities

of the business. This report determines the cost of each activity, products, services, projects and

processes (Labro, 2019). This helps management to control the cost in an efficient manner. Cost

report evaluates the income and expenses of the the particular activity which leads to higher

growth and efficiency of the business.

Management accounting techniques

Marginal costing: This technique evaluates the variation in the total cost with the change

in the level of production. This helps management of the Hochtief company in determining the

extra cost incurred while producing extra units at the time of production.

Advantages of Marginal costing

It is easy to determine and helps in controlling the cost of production. This also focuses

on eliminating the cost variance of the company because fixed overhead does not change. This

leads to better decision making and higher future growth of the organization.

Disadvantages of Marginal costing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is very difficult to determine the degree of deviation because it does not take into

consideration all variable overheads. The marginal costing remains constant only for the short

duration of time.

Absorption costing:

Absorption costing takes into account all cost attached to the manufacturing process. This

includes direct cost, indirect cost to give accurate results and helps in strategic decision making.

Advantages of Absorption costing

Absorption costing is an effective method which helps in effective decision making and

also has less fluctuations in the profit margins (Absorption Costing: Meaning, Advantages and

Disadvantages, 2019). This method can determine profits more accurately by taking into account

all production cost.

Disadvantages of Absorption costing

This method is not beneficial in improvising the operations of the business. This method

can also skew the profits of the company. This method is difficult to compare different product

lines.

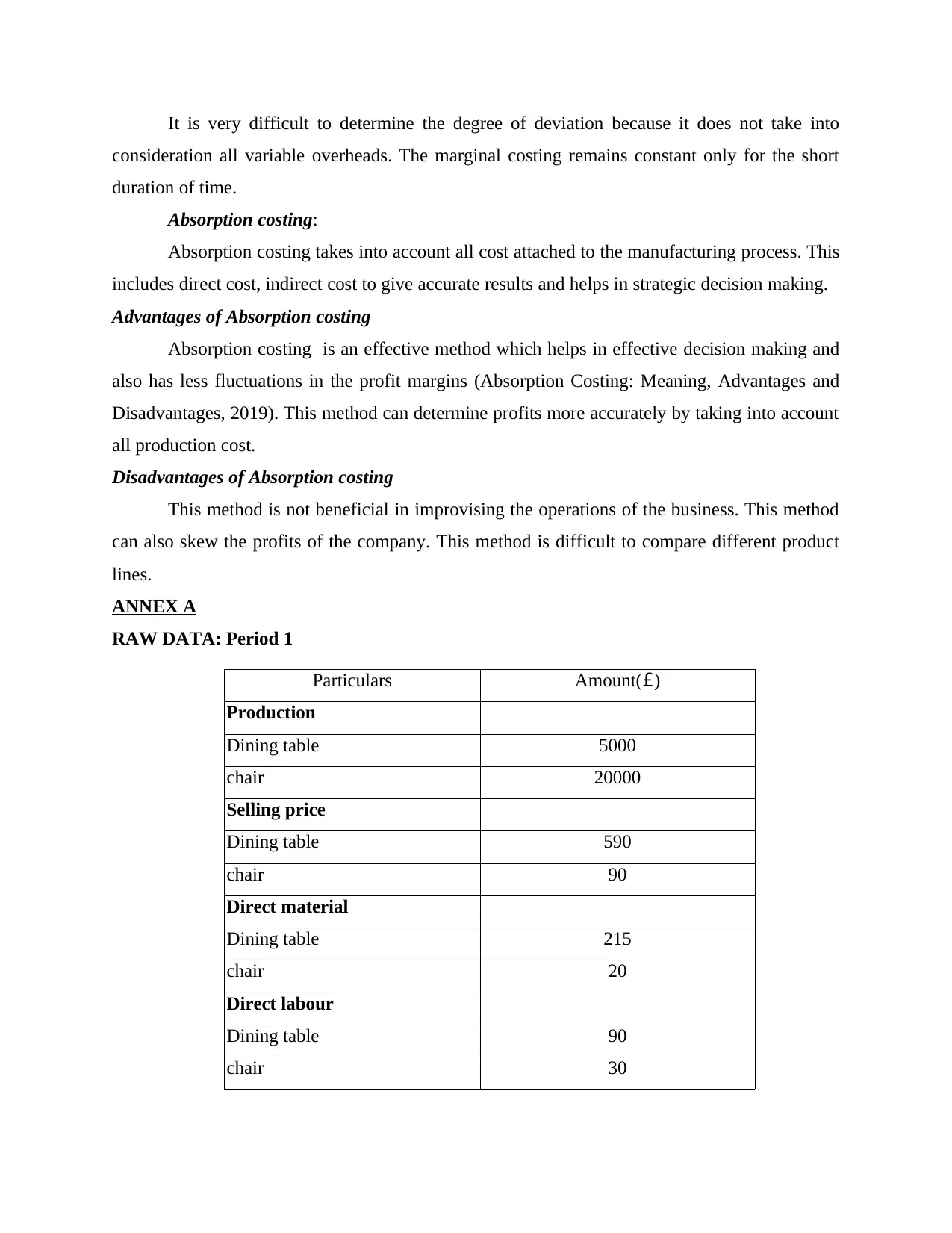

ANNEX A

RAW DATA: Period 1

Particulars Amount(£)

Production

Dining table 5000

chair 20000

Selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

Direct labour

Dining table 90

chair 30

consideration all variable overheads. The marginal costing remains constant only for the short

duration of time.

Absorption costing:

Absorption costing takes into account all cost attached to the manufacturing process. This

includes direct cost, indirect cost to give accurate results and helps in strategic decision making.

Advantages of Absorption costing

Absorption costing is an effective method which helps in effective decision making and

also has less fluctuations in the profit margins (Absorption Costing: Meaning, Advantages and

Disadvantages, 2019). This method can determine profits more accurately by taking into account

all production cost.

Disadvantages of Absorption costing

This method is not beneficial in improvising the operations of the business. This method

can also skew the profits of the company. This method is difficult to compare different product

lines.

ANNEX A

RAW DATA: Period 1

Particulars Amount(£)

Production

Dining table 5000

chair 20000

Selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

Direct labour

Dining table 90

chair 30

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable production O/H

Dining table 25

chair 5

Fixed cots 410000

Sales units

Dining table 4350

chairs 16000

production cost

Dining table 330

chair 55

fixed cost per unit 16.4

total production cost

Dining table 346.4

chair 71.4

Profit and loss statement under marginal costing method

Particulars Details Amount(£)

Sales revenue

Dining table 2566500

chair 1440000

4006500 4006500

less

Direct material 935250

Dining table 320000

chair 1255250 1255250

Direct labour 391500

Dining table 480000

Dining table 25

chair 5

Fixed cots 410000

Sales units

Dining table 4350

chairs 16000

production cost

Dining table 330

chair 55

fixed cost per unit 16.4

total production cost

Dining table 346.4

chair 71.4

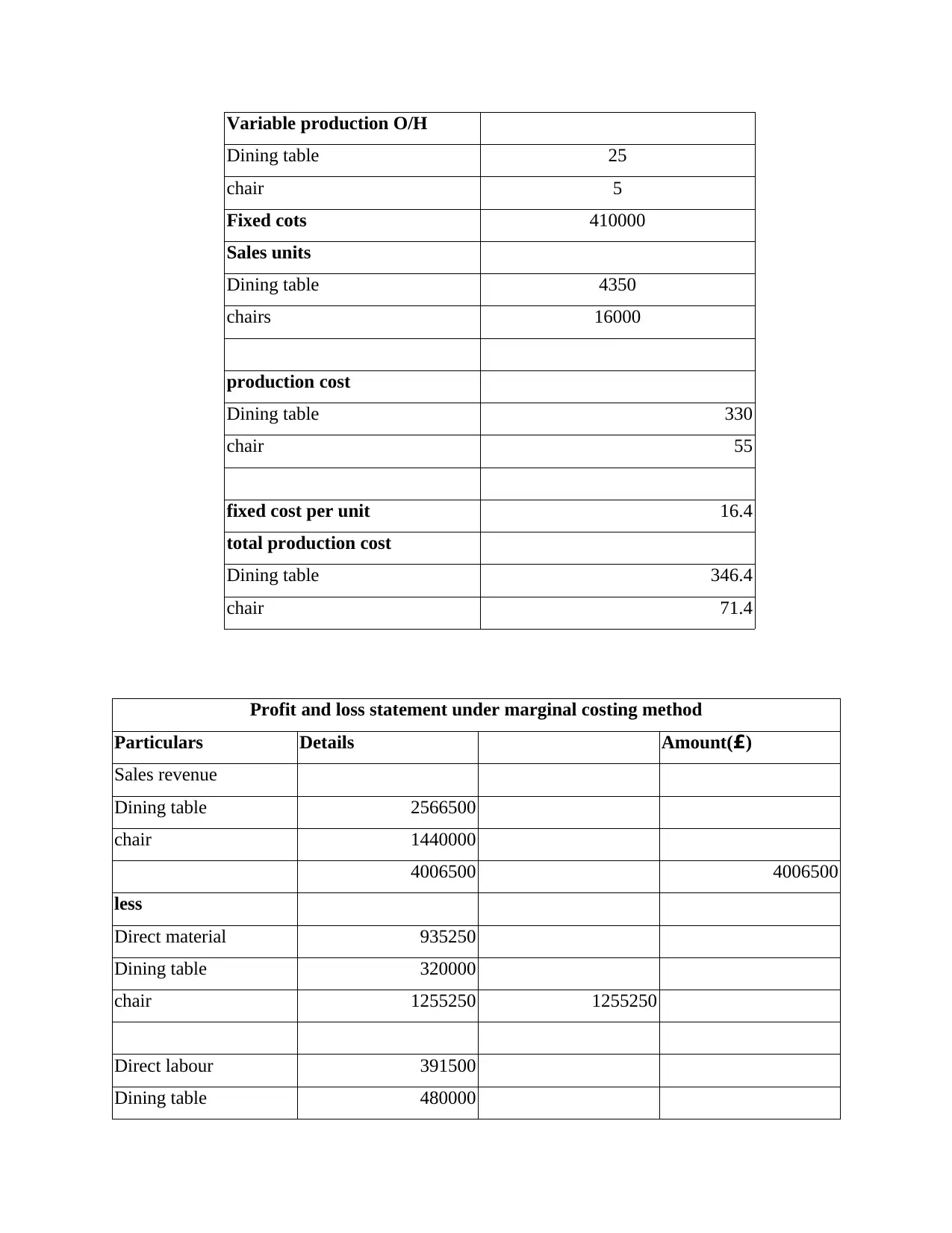

Profit and loss statement under marginal costing method

Particulars Details Amount(£)

Sales revenue

Dining table 2566500

chair 1440000

4006500 4006500

less

Direct material 935250

Dining table 320000

chair 1255250 1255250

Direct labour 391500

Dining table 480000

chair 871500 871500

Variable production

overheads 108750

Dining table 80000

chair 188750 188750

2315500 2315500

Less-closing stock 214500

Dining table 220000

chair 434500 434500

Contribution 1256500

less- Fixed cots 410000

Net profit 846500

Income statement under absorption costing method

Particulars details Amount(£)

Sales revenue 2566500

Dining table 1440000

chair 4006500

less 4006500

Direct material 935250

Dining table 320000

chair 1255250 1255250

Direct labour 391500

Dining table 480000

chair 871500 871500

Variable production

overheads 108750

Dining table 80000

chair 188750 188750

2315500 2315500

Less-closing stock 214500

Dining table 220000

chair 434500 434500

Contribution 1256500

less- Fixed cots 410000

Net profit 846500

Income statement under absorption costing method

Particulars details Amount(£)

Sales revenue 2566500

Dining table 1440000

chair 4006500

less 4006500

Direct material 935250

Dining table 320000

chair 1255250 1255250

Direct labour 391500

Dining table 480000

chair 871500 871500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable production

overheads

Dining table 108750

chair 80000

188750 188750 2315500

less- Fixed cots 410000

Less-closing stock 410000

Dining table 225160

chair 285600 510760

510760

Net profit 770240

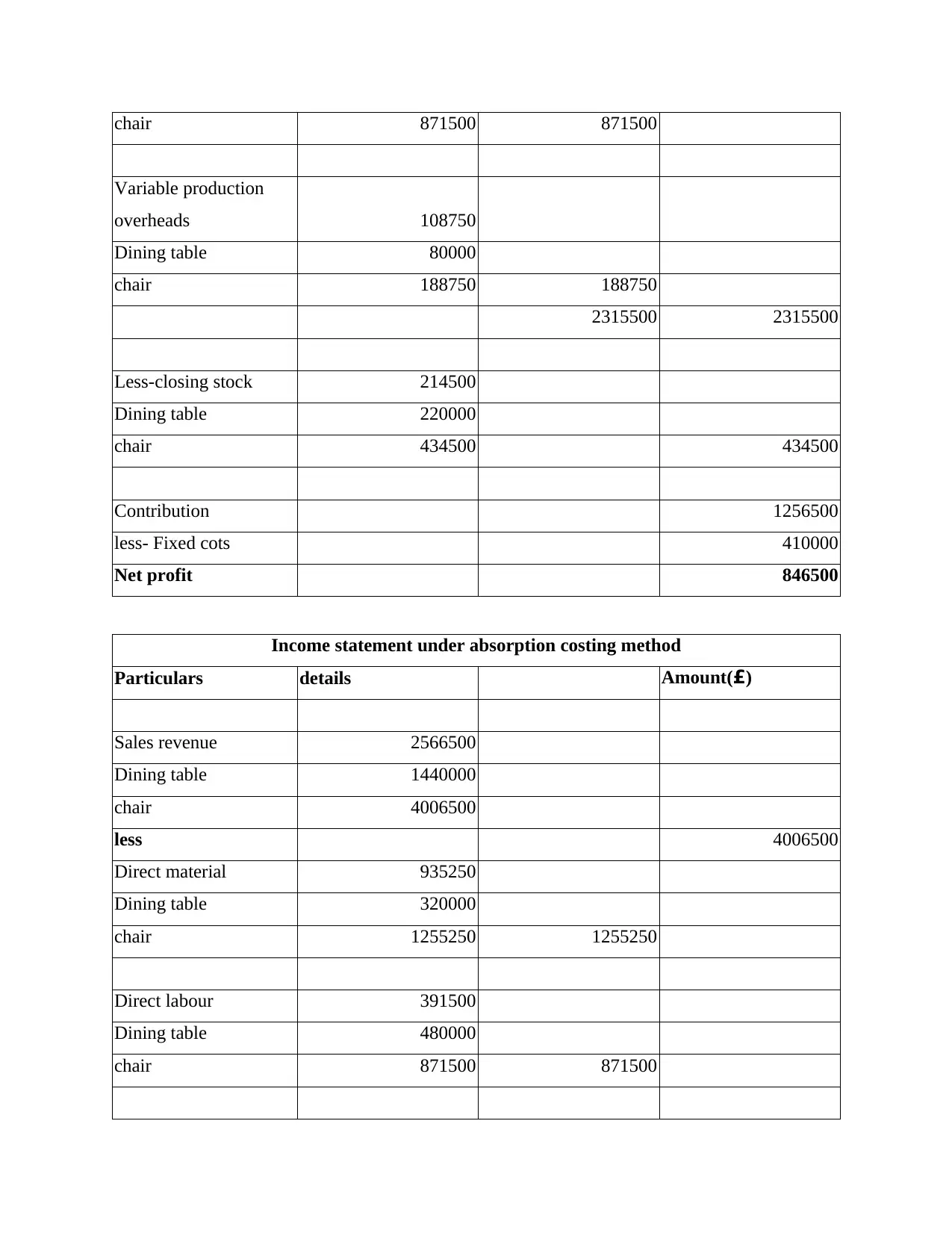

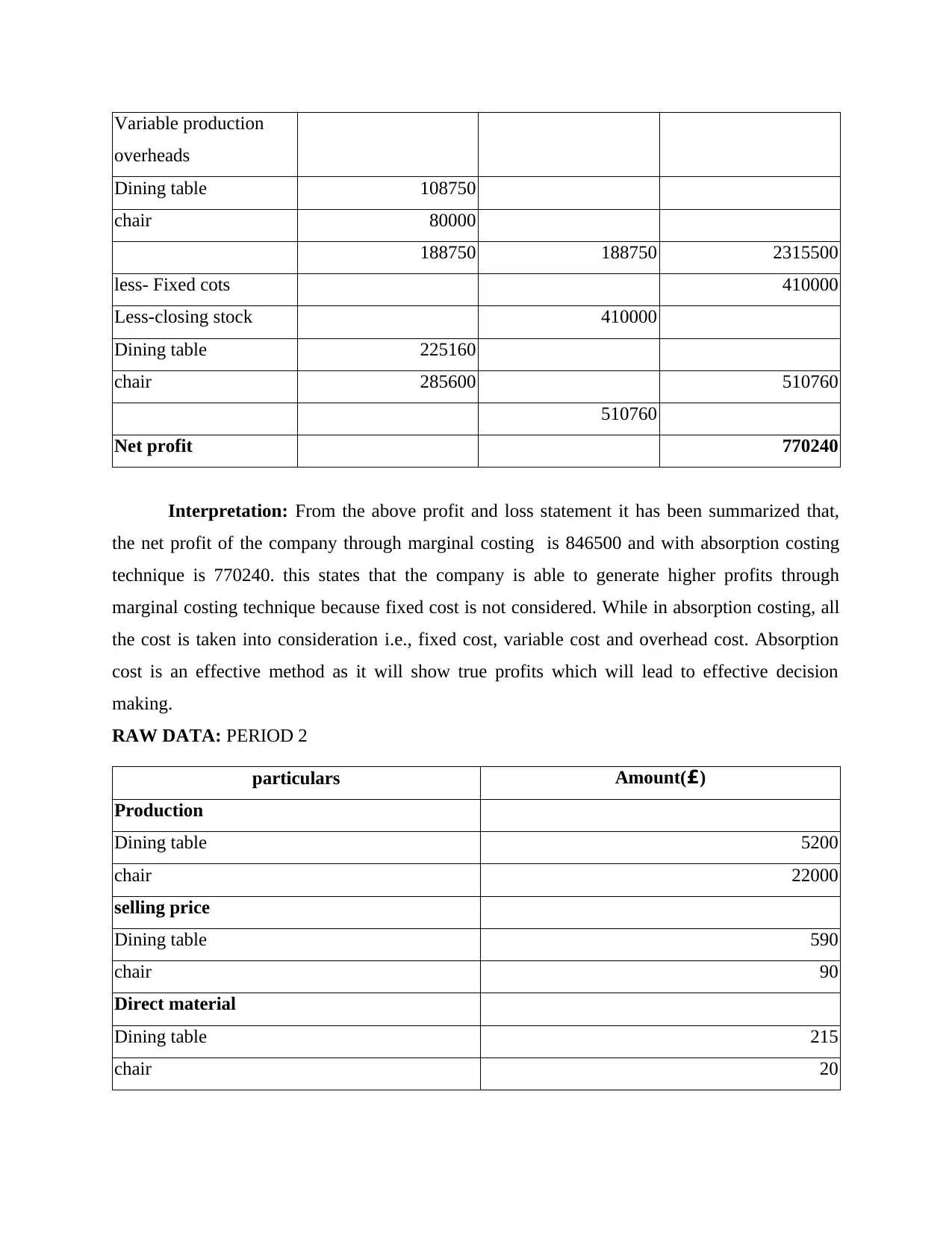

Interpretation: From the above profit and loss statement it has been summarized that,

the net profit of the company through marginal costing is 846500 and with absorption costing

technique is 770240. this states that the company is able to generate higher profits through

marginal costing technique because fixed cost is not considered. While in absorption costing, all

the cost is taken into consideration i.e., fixed cost, variable cost and overhead cost. Absorption

cost is an effective method as it will show true profits which will lead to effective decision

making.

RAW DATA: PERIOD 2

particulars Amount(£)

Production

Dining table 5200

chair 22000

selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

overheads

Dining table 108750

chair 80000

188750 188750 2315500

less- Fixed cots 410000

Less-closing stock 410000

Dining table 225160

chair 285600 510760

510760

Net profit 770240

Interpretation: From the above profit and loss statement it has been summarized that,

the net profit of the company through marginal costing is 846500 and with absorption costing

technique is 770240. this states that the company is able to generate higher profits through

marginal costing technique because fixed cost is not considered. While in absorption costing, all

the cost is taken into consideration i.e., fixed cost, variable cost and overhead cost. Absorption

cost is an effective method as it will show true profits which will lead to effective decision

making.

RAW DATA: PERIOD 2

particulars Amount(£)

Production

Dining table 5200

chair 22000

selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct labour

Dining table 90

chair 30

Variable production overheads

Dining table 25

chair 5

Fixed cots 482000

Sales units

Dining table 1700

chairs 19100

production cost (variable)

Dining table 330

chair 55

fixed cost per unit 17.72

total production cost (variable+fixed)

Dining table 347.7

chair 72.7

closing stock units==opening

stock+purchases-sales

Dining table

650

4000

opening stock

Dining table 4150

chair 6900

Income statement under marginal costing method

Dining table 90

chair 30

Variable production overheads

Dining table 25

chair 5

Fixed cots 482000

Sales units

Dining table 1700

chairs 19100

production cost (variable)

Dining table 330

chair 55

fixed cost per unit 17.72

total production cost (variable+fixed)

Dining table 347.7

chair 72.7

closing stock units==opening

stock+purchases-sales

Dining table

650

4000

opening stock

Dining table 4150

chair 6900

Income statement under marginal costing method

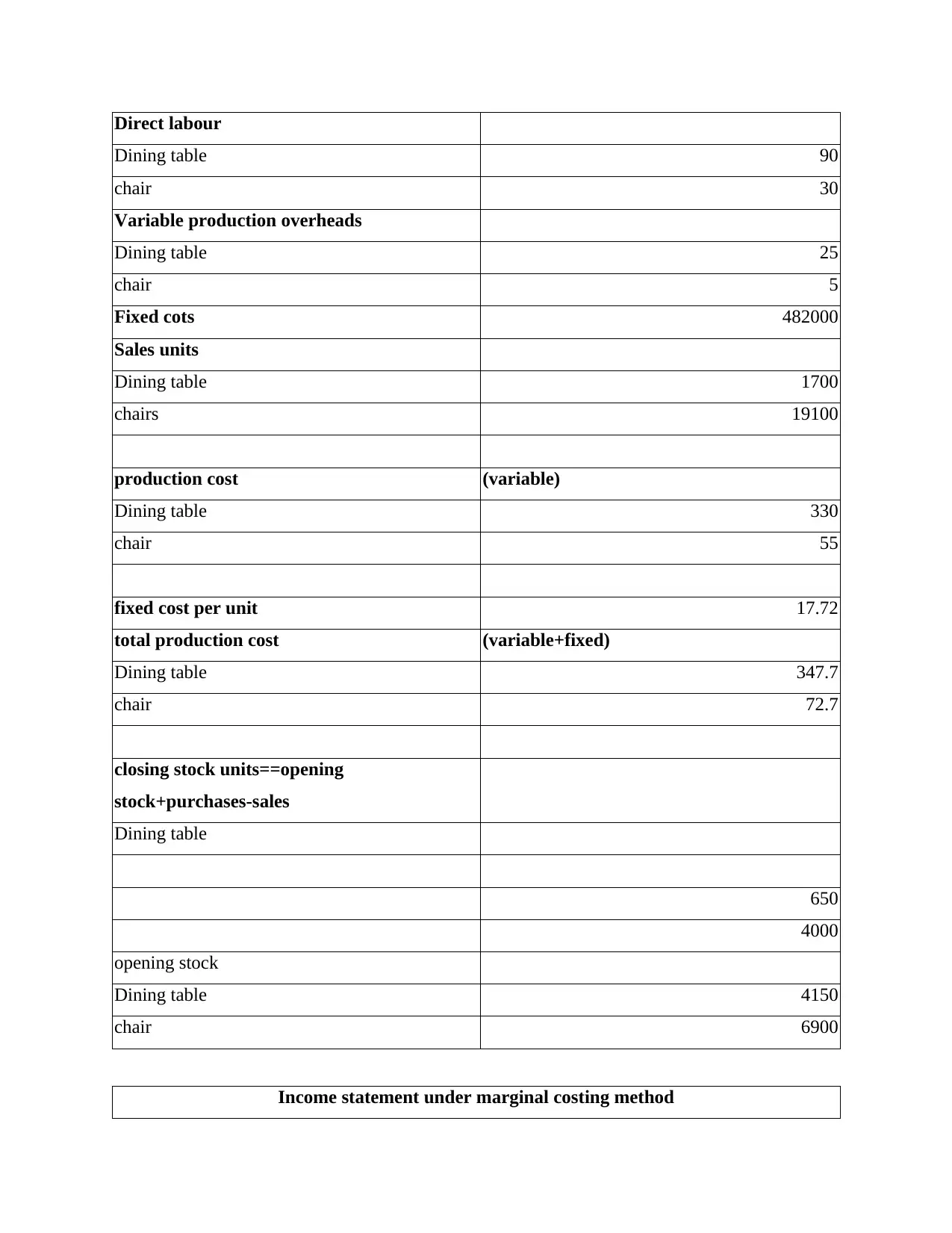

Particulars details Amount(£)

Sales revenue

Dining table 1003000

chair 1719000

2722000 2722000

less

Direct material

Dining table 365500

chair 382000

747500

Direct labour

Dining table 153000

chair 573000 726000

Variable production

overheads

Dining table 42500

chair 95500 138000 1611500

Less-closing stock

Dining table 1369500

chair 379500 1749000 1749000

Contribution -638500

less- Fixed cots 482000 482000

Net loss -1120500

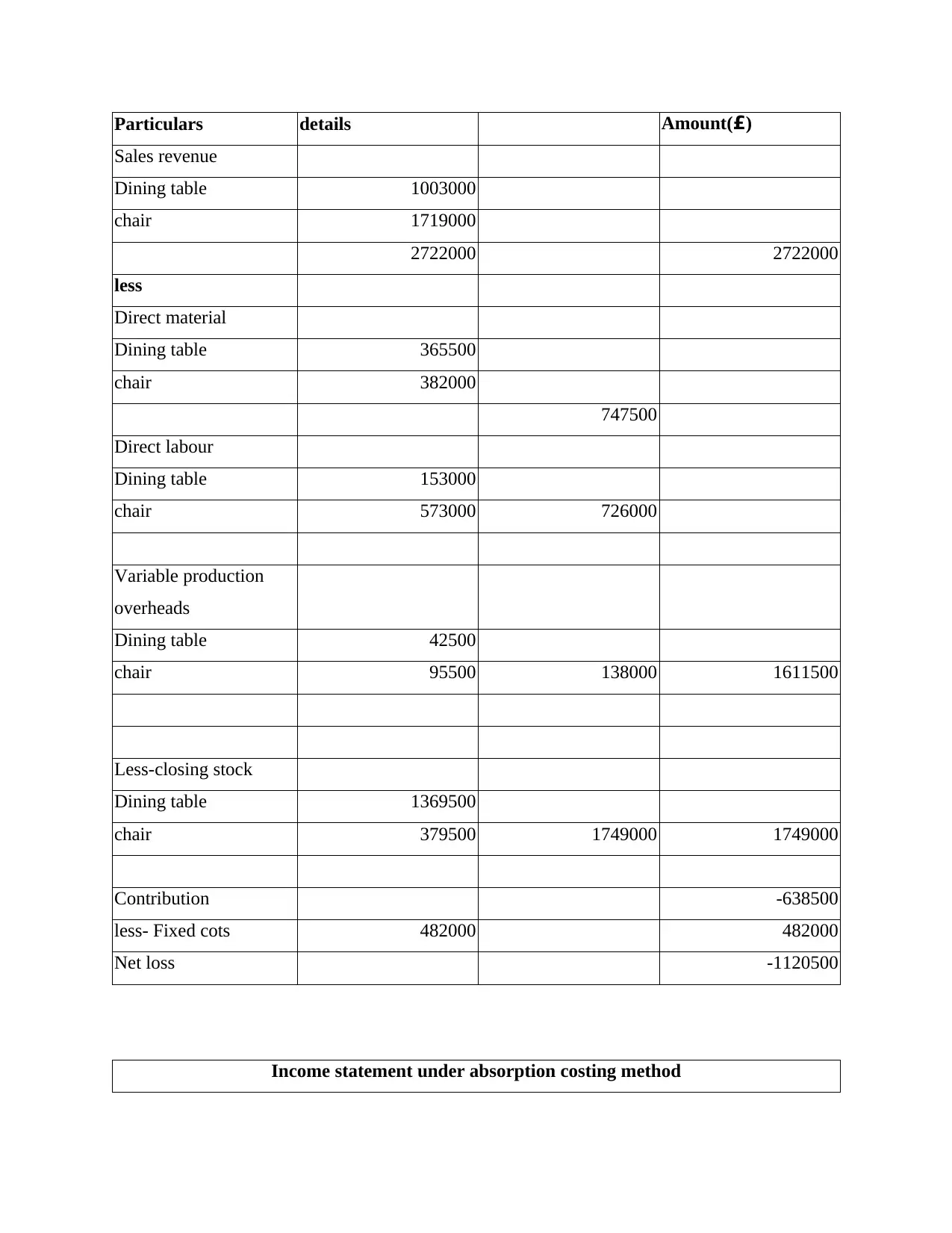

Income statement under absorption costing method

Sales revenue

Dining table 1003000

chair 1719000

2722000 2722000

less

Direct material

Dining table 365500

chair 382000

747500

Direct labour

Dining table 153000

chair 573000 726000

Variable production

overheads

Dining table 42500

chair 95500 138000 1611500

Less-closing stock

Dining table 1369500

chair 379500 1749000 1749000

Contribution -638500

less- Fixed cots 482000 482000

Net loss -1120500

Income statement under absorption costing method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.