Management Accounting: Costing, Planning, and Financial Solutions

VerifiedAdded on 2023/01/10

|18

|3918

|82

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and practices, focusing on a case study of ABC Ltd, a manufacturing company. The report explores the management accounting system, including its essential requirements and the integration of various systems such as cost accounting, inventory management, and price optimization. It evaluates different management accounting reporting methods, including budget reports, performance reports, and inventory management reports, along with the advantages of each. The report then delves into costing techniques, specifically marginal and absorption costing, providing detailed calculations and interpretations. Additionally, it examines various planning tools like budgets and master budgets, outlining their advantages and disadvantages. Finally, the report discusses how management accounting aids in solving financial problems and contributes to organizational success. The conclusion summarizes the key findings and emphasizes the importance of management accounting in improving operational efficiency and strategic decision-making. References are included for further study.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................................3

TASK 1..........................................................................................................................................................3

P1 Management accounting system and essential requirements of management accounting system.......3

P2 Evaluate different methods which is used for the management accounting reporting........................4

M1.Evaluation of advantages of management accounting.......................................................................5

D1. Integration with the organizational process of management accounting system and reporting.........6

TASK 2..........................................................................................................................................................6

P3 Calculating cost by using appropriate costing techniques...................................................................6

TASK 3........................................................................................................................................................11

P4 Advantage or disadvantage of different types of planning tools.......................................................11

M2 Analysis the use of different planning tools and application for building and forecasting the budget

...............................................................................................................................................................13

TASK 4........................................................................................................................................................13

P5 How management accounting helps in solving financial problems..................................................13

Management accounting in solving financial problems that lead to organizational success..................15

Evaluation planning tools for accounting help to solve problems and support industry with sustainable

success...................................................................................................................................................16

CONCLUSION.............................................................................................................................................16

REFERENCES..............................................................................................................................................17

INTRODUCTION...........................................................................................................................................3

TASK 1..........................................................................................................................................................3

P1 Management accounting system and essential requirements of management accounting system.......3

P2 Evaluate different methods which is used for the management accounting reporting........................4

M1.Evaluation of advantages of management accounting.......................................................................5

D1. Integration with the organizational process of management accounting system and reporting.........6

TASK 2..........................................................................................................................................................6

P3 Calculating cost by using appropriate costing techniques...................................................................6

TASK 3........................................................................................................................................................11

P4 Advantage or disadvantage of different types of planning tools.......................................................11

M2 Analysis the use of different planning tools and application for building and forecasting the budget

...............................................................................................................................................................13

TASK 4........................................................................................................................................................13

P5 How management accounting helps in solving financial problems..................................................13

Management accounting in solving financial problems that lead to organizational success..................15

Evaluation planning tools for accounting help to solve problems and support industry with sustainable

success...................................................................................................................................................16

CONCLUSION.............................................................................................................................................16

REFERENCES..............................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is procedures that involve the different procedures that help the

organization’s operating operations improve. This is also called strategic accounting, that lets the

director develop successful methods for the system of more making decision. Accounting

management uses the account statements that also help to improve and regulate multiple tasks

(Armitage, Webb and Glynn, 2016). Director analyzes the cost of business in this process which

helps to generate financial statements. This report based on the ABC Ltd which is a

manufacturing company and it is a medium sized organisation. This report covers the

different concepts including such accounting management and the basic features of accounting

management system. This also contains the numerous accounting reports, leadership accounting

methods, and effective treatment resources for addressing the company's monetary issues.

TASK 1

P1 Management accounting system and essential requirements of management accounting

system

Management Accounting: It is a continual way of processing numerous reports with the

assistance of financial details. It will assist the director in designing various successful plans as

well as in making decisions. Prospective buyers should follow the appropriate decisions

according to the company's financial statements

Management accounting system: Managerial accounting system is made up of the

structural components a company uses to determine and analyze its organizational management

procedures. The accounting management system, manager analyses the internal mechanism or

framework, or calculates it. It explains the main tools that help ABC Ltd handle its

organizational processes, and is described below:

Cost accounting system: This is the most accessible structure in the manufacturing industry,

since describes the actions the expense within each product or group of products with either the

assistance of all this. It is an analysis in which the cost of output is measured for revenue

recognition, productivity and cost containment. The essential requirement of this system can cut

Management accounting is procedures that involve the different procedures that help the

organization’s operating operations improve. This is also called strategic accounting, that lets the

director develop successful methods for the system of more making decision. Accounting

management uses the account statements that also help to improve and regulate multiple tasks

(Armitage, Webb and Glynn, 2016). Director analyzes the cost of business in this process which

helps to generate financial statements. This report based on the ABC Ltd which is a

manufacturing company and it is a medium sized organisation. This report covers the

different concepts including such accounting management and the basic features of accounting

management system. This also contains the numerous accounting reports, leadership accounting

methods, and effective treatment resources for addressing the company's monetary issues.

TASK 1

P1 Management accounting system and essential requirements of management accounting

system

Management Accounting: It is a continual way of processing numerous reports with the

assistance of financial details. It will assist the director in designing various successful plans as

well as in making decisions. Prospective buyers should follow the appropriate decisions

according to the company's financial statements

Management accounting system: Managerial accounting system is made up of the

structural components a company uses to determine and analyze its organizational management

procedures. The accounting management system, manager analyses the internal mechanism or

framework, or calculates it. It explains the main tools that help ABC Ltd handle its

organizational processes, and is described below:

Cost accounting system: This is the most accessible structure in the manufacturing industry,

since describes the actions the expense within each product or group of products with either the

assistance of all this. It is an analysis in which the cost of output is measured for revenue

recognition, productivity and cost containment. The essential requirement of this system can cut

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the cost that will immediately enhance the sales or gross profit. ABC Ltd's boss uses this method

to measure or monitor the price of its service (Chenhall, 2012).

Inventory management system: It is a method of inventory management that allows the

director assesses the inventory levels in their stores. Accordingly, they may take more steps,

which reduce waste in manufacturing. The ABC Ltd is intended to maintain count of the number

of stock in the sector that avoids both the scarcity and waste production. The essential

requirement of inventory system increases the productivity or performance of management

activities.

Price optimization system: It is a mathematical method which includes multiple consumer

requirement details. With this method, manager analysis the client purchase habits. Market price

based on the requirements of multiple goods & services that the company is providing to

maximize their profitability or gross margin. It comprises multiple details that are additionally

needed for value management and stock management. This program needed different prices;

multiple techniques are used to monitor buyer activity. Essential requirement of this system by

ABC Ltd managing director appears to help chose the right brand value by increasing their

clients.

P2 Evaluate different methods which is used for the management accounting reporting

Management Accounting Report: This is the procedure that encompasses financial

consistency that allows employees produce reports that have been further needed for choice-

making. Such information is published daily, weekly, monthly or quarterly. In essence, it can be

used for investment developments by the key customers. There's many distinct variety of

financial management accounts that may be used against the company and will be mentioned

elsewhere here:

Budget report: This is an evaluation report that contains both the income and the

expenses. Company describes the difference between expected expense and money spent, using

this study. So ABC ltd's supervisor will use this summary to estimate the entity expenses or

income. It is the role of the manager to operate according to the expenditure, for this

management has to practice regularly correctly so that company aims and objectives can be

to measure or monitor the price of its service (Chenhall, 2012).

Inventory management system: It is a method of inventory management that allows the

director assesses the inventory levels in their stores. Accordingly, they may take more steps,

which reduce waste in manufacturing. The ABC Ltd is intended to maintain count of the number

of stock in the sector that avoids both the scarcity and waste production. The essential

requirement of inventory system increases the productivity or performance of management

activities.

Price optimization system: It is a mathematical method which includes multiple consumer

requirement details. With this method, manager analysis the client purchase habits. Market price

based on the requirements of multiple goods & services that the company is providing to

maximize their profitability or gross margin. It comprises multiple details that are additionally

needed for value management and stock management. This program needed different prices;

multiple techniques are used to monitor buyer activity. Essential requirement of this system by

ABC Ltd managing director appears to help chose the right brand value by increasing their

clients.

P2 Evaluate different methods which is used for the management accounting reporting

Management Accounting Report: This is the procedure that encompasses financial

consistency that allows employees produce reports that have been further needed for choice-

making. Such information is published daily, weekly, monthly or quarterly. In essence, it can be

used for investment developments by the key customers. There's many distinct variety of

financial management accounts that may be used against the company and will be mentioned

elsewhere here:

Budget report: This is an evaluation report that contains both the income and the

expenses. Company describes the difference between expected expense and money spent, using

this study. So ABC ltd's supervisor will use this summary to estimate the entity expenses or

income. It is the role of the manager to operate according to the expenditure, for this

management has to practice regularly correctly so that company aims and objectives can be

achieved. Budgets are necessary if their balance is to be retained to address expected

eventualities (Lavia López and Hiebl, 2014).

Performance report: The report covers the characteristics of successful workers and

also the company overall. Using this aid, managers describe the difference between the planned

result as well as the real result. The assessment allows the company defines specific results that

will further assist in delivering different options or rewards. So ABC Ltd’s manager used the

document to assess the performance of the management and to provide preparation for the

required change. Identifying efficiency which also includes taking efficient strategy is useful for

the employees.

Inventory management report: Under this study, before beginning any venture, company

creates an estimation of the overall cost and budget. Company gives the rank to inventory and

monitoring according to the reliability, requirement or cost. Using this aid, administrators

classify the amount of the stock and its function according to the requirement. ABC Ltd

supervisor, are using this summary and arrange the stock levels according to

manufacturing requirement. It would further assist with strategic management and better decision

- making. This budget for ongoing missions can be planned on a weekly, quarterly or annual

basis (Maas, Schaltegger and Crutzen, 2016).

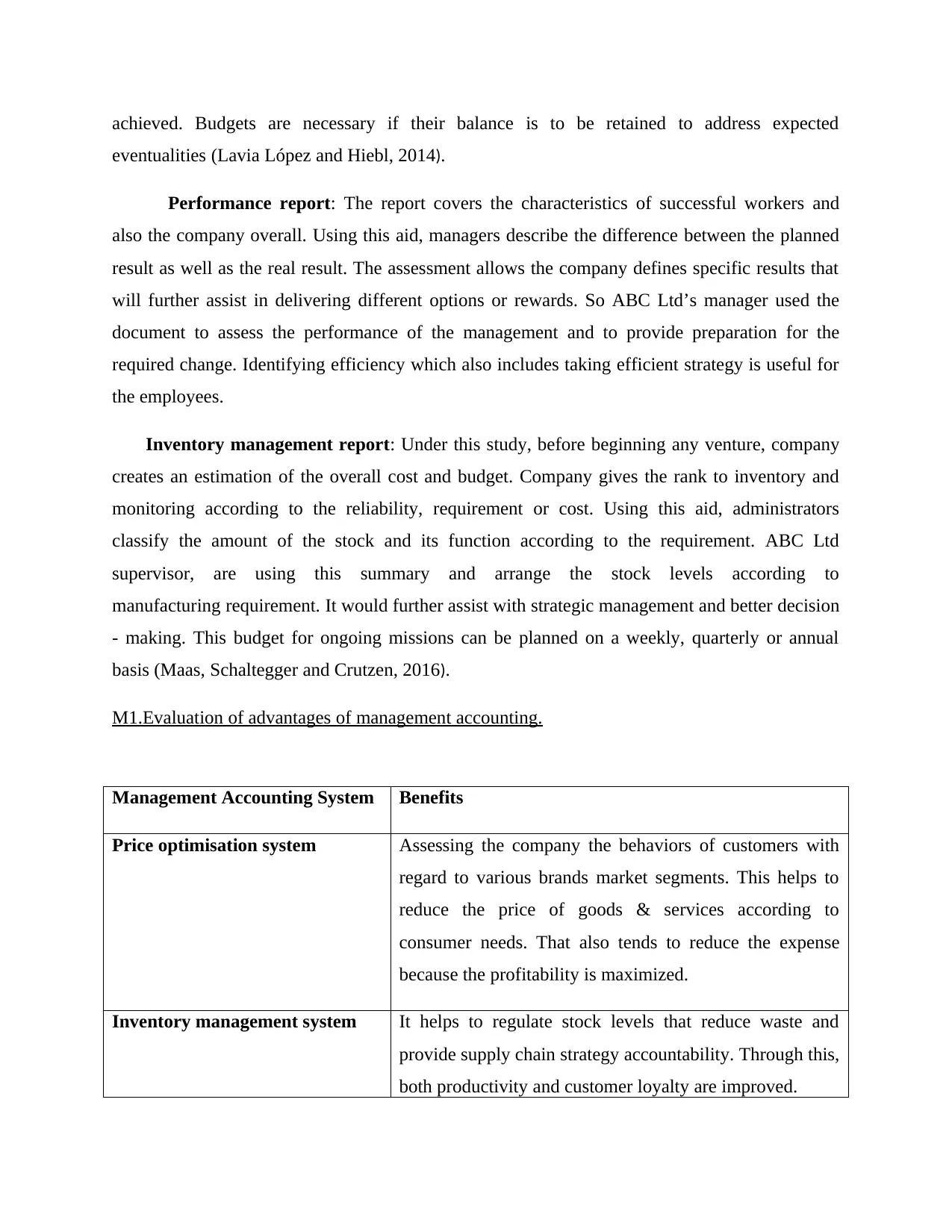

M1.Evaluation of advantages of management accounting.

Management Accounting System Benefits

Price optimisation system Assessing the company the behaviors of customers with

regard to various brands market segments. This helps to

reduce the price of goods & services according to

consumer needs. That also tends to reduce the expense

because the profitability is maximized.

Inventory management system It helps to regulate stock levels that reduce waste and

provide supply chain strategy accountability. Through this,

both productivity and customer loyalty are improved.

eventualities (Lavia López and Hiebl, 2014).

Performance report: The report covers the characteristics of successful workers and

also the company overall. Using this aid, managers describe the difference between the planned

result as well as the real result. The assessment allows the company defines specific results that

will further assist in delivering different options or rewards. So ABC Ltd’s manager used the

document to assess the performance of the management and to provide preparation for the

required change. Identifying efficiency which also includes taking efficient strategy is useful for

the employees.

Inventory management report: Under this study, before beginning any venture, company

creates an estimation of the overall cost and budget. Company gives the rank to inventory and

monitoring according to the reliability, requirement or cost. Using this aid, administrators

classify the amount of the stock and its function according to the requirement. ABC Ltd

supervisor, are using this summary and arrange the stock levels according to

manufacturing requirement. It would further assist with strategic management and better decision

- making. This budget for ongoing missions can be planned on a weekly, quarterly or annual

basis (Maas, Schaltegger and Crutzen, 2016).

M1.Evaluation of advantages of management accounting.

Management Accounting System Benefits

Price optimisation system Assessing the company the behaviors of customers with

regard to various brands market segments. This helps to

reduce the price of goods & services according to

consumer needs. That also tends to reduce the expense

because the profitability is maximized.

Inventory management system It helps to regulate stock levels that reduce waste and

provide supply chain strategy accountability. Through this,

both productivity and customer loyalty are improved.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting system It helps to reduce the cost for every department, saving

time and enhancing productivity. Managers also boost the

effectiveness or gross profit only with help of this

information.

D1. Integration with the organizational process of management accounting system and reporting

Both of these accounting systems are related to managerial accounting reports as the data

requested arises from accounting reports compiled by the company manager. In the absent of

such documents business could not get consistent results and business selling price. There, the

ABC Ltd director used accounting information systems with the aid of financial accounts

compiled by the administrator and describing the organization's total costs. Therefore, in

management objectives, both the management accounting information and the accounting report

are connected with one another.

TASK 2

P3 Calculating cost by using appropriate costing techniques

Marginal Costing: In this costing method, differential expenses are associated because

this technique does not take into account any extra unit production and fixed costs. It covers the

value of overhead material, labor, selling & distribution, office & distribution costs,

manufacturing & production expenditures that are appropriate in terms of the value of

development market value (Mahesha and Akash, 2013). Several of the equations set out

elsewhere:

Quarter 1

Particulars

Amoun

t

Sales 66000

Less: Cost of sales

Opening inventory 0

time and enhancing productivity. Managers also boost the

effectiveness or gross profit only with help of this

information.

D1. Integration with the organizational process of management accounting system and reporting

Both of these accounting systems are related to managerial accounting reports as the data

requested arises from accounting reports compiled by the company manager. In the absent of

such documents business could not get consistent results and business selling price. There, the

ABC Ltd director used accounting information systems with the aid of financial accounts

compiled by the administrator and describing the organization's total costs. Therefore, in

management objectives, both the management accounting information and the accounting report

are connected with one another.

TASK 2

P3 Calculating cost by using appropriate costing techniques

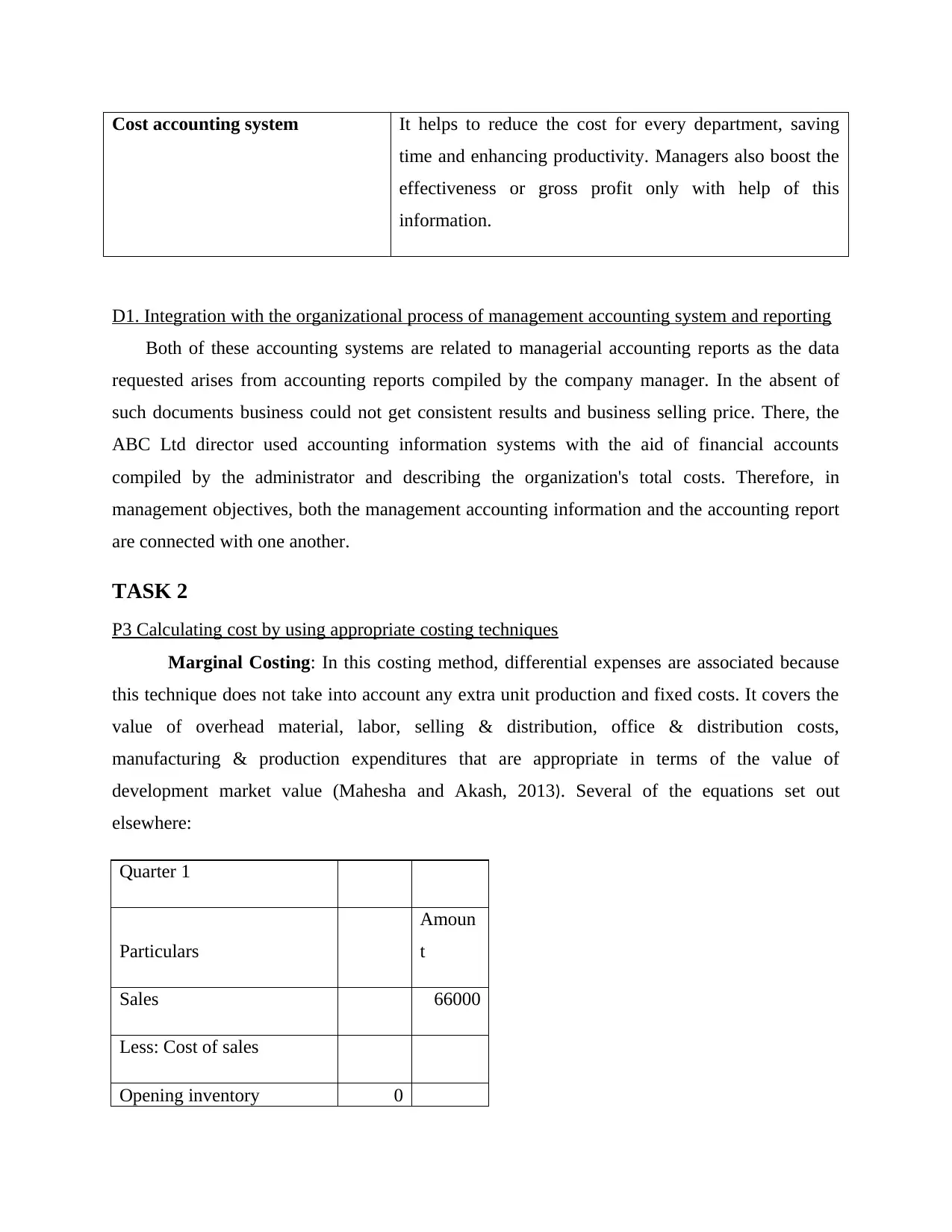

Marginal Costing: In this costing method, differential expenses are associated because

this technique does not take into account any extra unit production and fixed costs. It covers the

value of overhead material, labor, selling & distribution, office & distribution costs,

manufacturing & production expenditures that are appropriate in terms of the value of

development market value (Mahesha and Akash, 2013). Several of the equations set out

elsewhere:

Quarter 1

Particulars

Amoun

t

Sales 66000

Less: Cost of sales

Opening inventory 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Production cost

(780000*0.65) 50700

Less: Closing stock

(12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed selling expenses 5200 21200

Net profit 1900

Interpretation: As per the above calculation

it has been analyzed that there are getting

results of 1900 in the quarter 1 after submit

all the items and put in the formulas and get

results.

Quarter 2

Marginal

Sales

Less: Cost of sales

Opening inventory

(12000*0.65) 7800

Production cost

(66000*0.65) 42900

Less: Closing stock

(4000*0.65) 2600

48100

Contribution 25900

Less:

Fixed overhead 16000

Fixed selling expenses 5200 21200

Net profit 4700

Reconciliation

Variable costing profit 1900 4700

opening profit 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

(780000*0.65) 50700

Less: Closing stock

(12000*0.65) 7800

42900 42900

Contribution 23100

Less:

Fixed overhead 16000

Fixed selling expenses 5200 21200

Net profit 1900

Interpretation: As per the above calculation

it has been analyzed that there are getting

results of 1900 in the quarter 1 after submit

all the items and put in the formulas and get

results.

Quarter 2

Marginal

Sales

Less: Cost of sales

Opening inventory

(12000*0.65) 7800

Production cost

(66000*0.65) 42900

Less: Closing stock

(4000*0.65) 2600

48100

Contribution 25900

Less:

Fixed overhead 16000

Fixed selling expenses 5200 21200

Net profit 4700

Reconciliation

Variable costing profit 1900 4700

opening profit 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

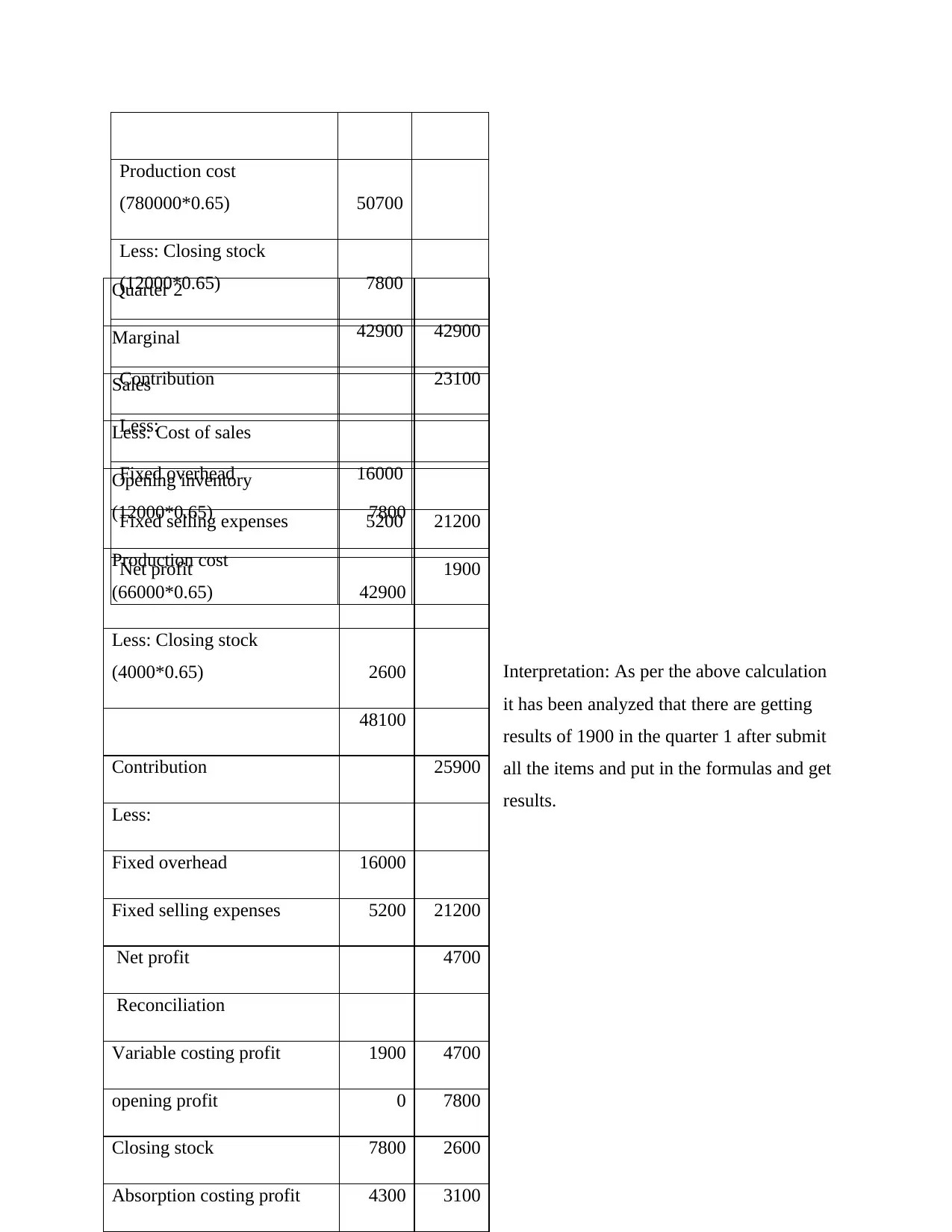

Absorption costing: This technique has been used to calculate every other unit costs and

other costs the indirectly or directly costs. According to these ideas, enhanced care the entire

factor and also the fixed cost assigned for the particular time length to the manufacturing. So

here's some cost estimation with either the aid of system of absorption costing (McLellan, 2014).

Quarter 1

Particulars

Amoun

t

Sales 66000

Less: Cost of sales

Production Cost (78000*

0.65) 50700

Semi variable (78000 *

0.20) 15600

Total variable cost 66300

Less: Closing stock 10200 56100

other costs the indirectly or directly costs. According to these ideas, enhanced care the entire

factor and also the fixed cost assigned for the particular time length to the manufacturing. So

here's some cost estimation with either the aid of system of absorption costing (McLellan, 2014).

Quarter 1

Particulars

Amoun

t

Sales 66000

Less: Cost of sales

Production Cost (78000*

0.65) 50700

Semi variable (78000 *

0.20) 15600

Total variable cost 66300

Less: Closing stock 10200 56100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

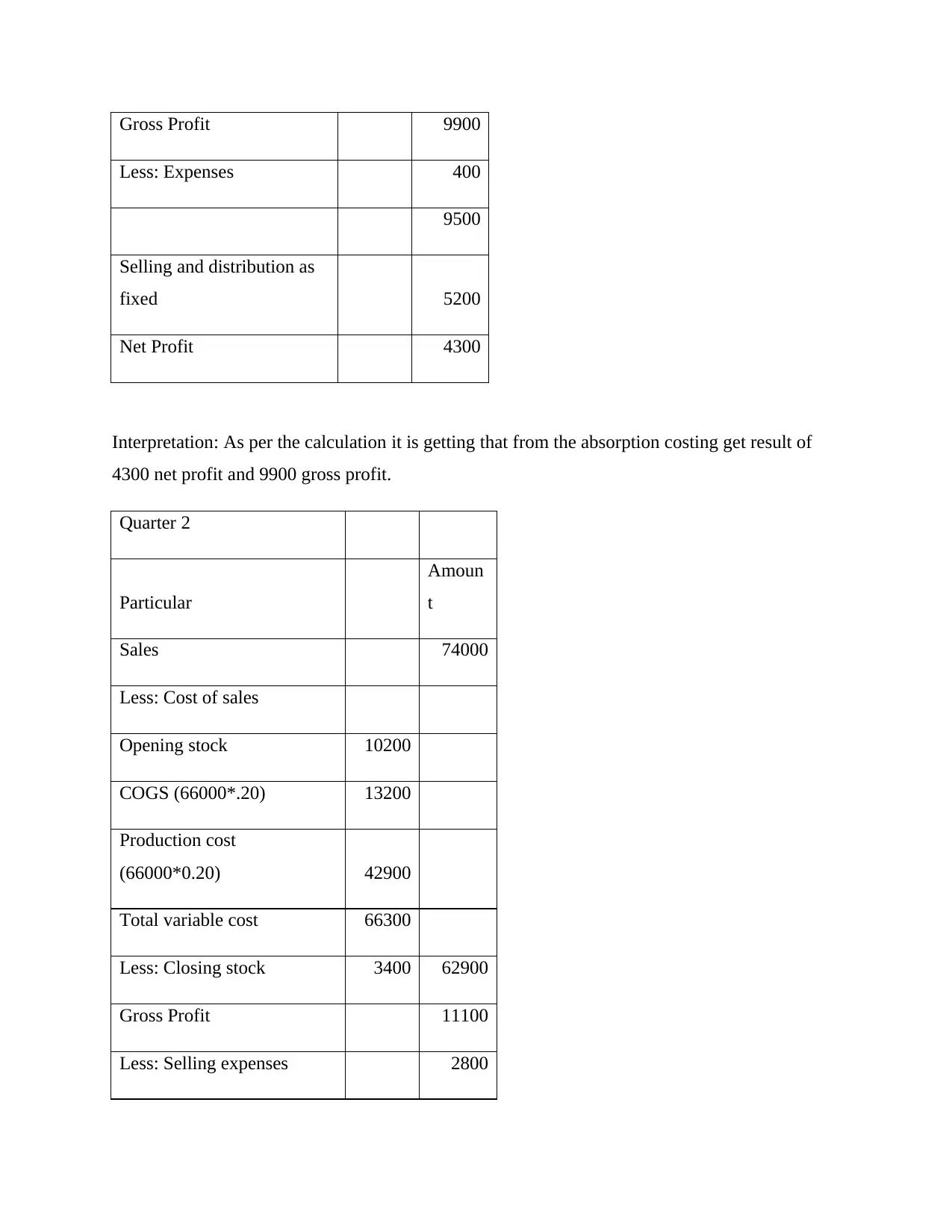

Gross Profit 9900

Less: Expenses 400

9500

Selling and distribution as

fixed 5200

Net Profit 4300

Interpretation: As per the calculation it is getting that from the absorption costing get result of

4300 net profit and 9900 gross profit.

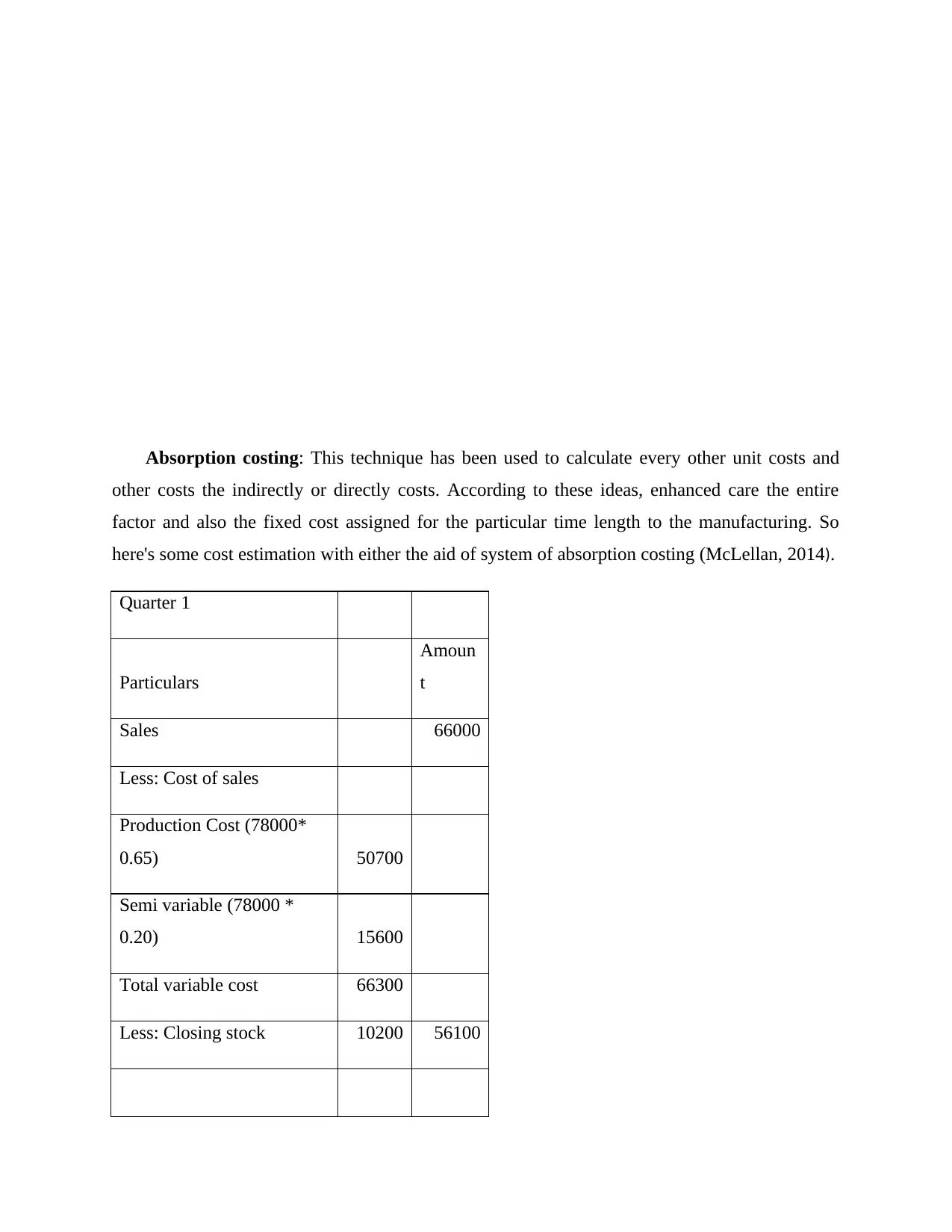

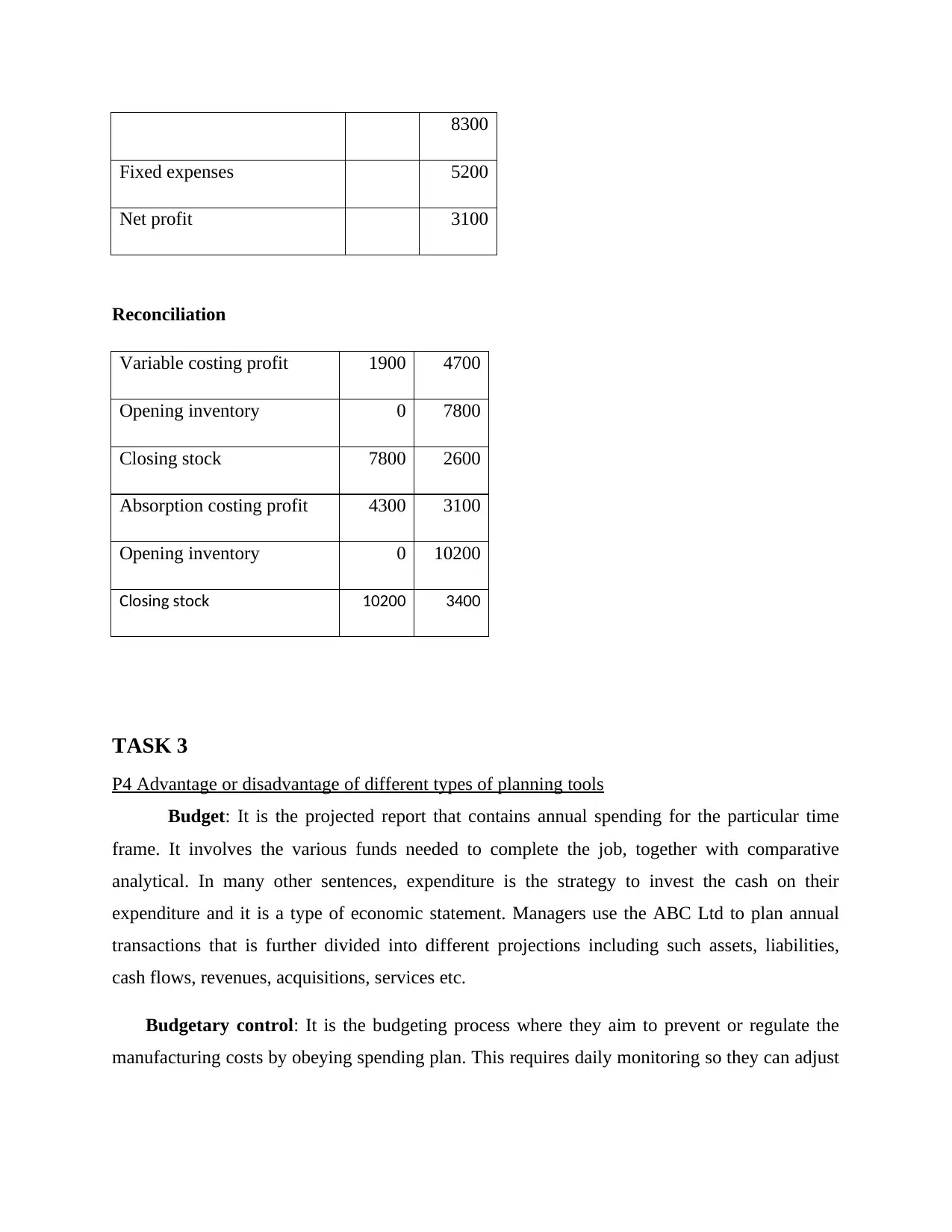

Quarter 2

Particular

Amoun

t

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*.20) 13200

Production cost

(66000*0.20) 42900

Total variable cost 66300

Less: Closing stock 3400 62900

Gross Profit 11100

Less: Selling expenses 2800

Less: Expenses 400

9500

Selling and distribution as

fixed 5200

Net Profit 4300

Interpretation: As per the calculation it is getting that from the absorption costing get result of

4300 net profit and 9900 gross profit.

Quarter 2

Particular

Amoun

t

Sales 74000

Less: Cost of sales

Opening stock 10200

COGS (66000*.20) 13200

Production cost

(66000*0.20) 42900

Total variable cost 66300

Less: Closing stock 3400 62900

Gross Profit 11100

Less: Selling expenses 2800

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8300

Fixed expenses 5200

Net profit 3100

Reconciliation

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

TASK 3

P4 Advantage or disadvantage of different types of planning tools

Budget: It is the projected report that contains annual spending for the particular time

frame. It involves the various funds needed to complete the job, together with comparative

analytical. In many other sentences, expenditure is the strategy to invest the cash on their

expenditure and it is a type of economic statement. Managers use the ABC Ltd to plan annual

transactions that is further divided into different projections including such assets, liabilities,

cash flows, revenues, acquisitions, services etc.

Budgetary control: It is the budgeting process where they aim to prevent or regulate the

manufacturing costs by obeying spending plan. This requires daily monitoring so they can adjust

Fixed expenses 5200

Net profit 3100

Reconciliation

Variable costing profit 1900 4700

Opening inventory 0 7800

Closing stock 7800 2600

Absorption costing profit 4300 3100

Opening inventory 0 10200

Closing stock 10200 3400

TASK 3

P4 Advantage or disadvantage of different types of planning tools

Budget: It is the projected report that contains annual spending for the particular time

frame. It involves the various funds needed to complete the job, together with comparative

analytical. In many other sentences, expenditure is the strategy to invest the cash on their

expenditure and it is a type of economic statement. Managers use the ABC Ltd to plan annual

transactions that is further divided into different projections including such assets, liabilities,

cash flows, revenues, acquisitions, services etc.

Budgetary control: It is the budgeting process where they aim to prevent or regulate the

manufacturing costs by obeying spending plan. This requires daily monitoring so they can adjust

according to product demand if any change is needed. ABC Ltd's supervisor performs periodic

process analysis and compares total costs with normal thing (Modell, 2014).

There are different forms of budget that can be adopted by the company to fulfill its

company's operations according to the schedule. All of this was addressed with their benefit or

disadvantage following.

Operating budget: It is the expenditure that contains the expense of the single item over the

revenue. This is essentially evolving over a specified period of time which can be on a monthly,

half-yearly, or yearly basis. The ABC Ltd prepares this budget to identify the changes in certain

period of time. After that they are taking right decision in regard of business operations.

Advantage

• Allows the company accomplishes its mission within the timelines.

• It seeks to enhance communication between the different tasks.

That provide required knowledge to assist improve individual & threats of the firm.

Disadvantage

• Precise documentation can be somewhat hard to gauge (RW Hiebl, 2013).

• It can contra-motivate workers when higher expectations are set by the company that are not

too convenient.

• leading to a shortage of interaction, confusion will create between the different departments.

• This budget takes a considerable amount of time to analyze the final results.

Master budget: This is the mixture of different accounting method that involves the

entire departmental rate this is why it is named master budget. It is the summarizing of the total

funding preparing for the yearly basis and it has some advantage or disadvantage as well. The

ABC limited company produce the master budget in order to collect all the income and expenses

summary of each department to prepare effective strategy.

Advantage

process analysis and compares total costs with normal thing (Modell, 2014).

There are different forms of budget that can be adopted by the company to fulfill its

company's operations according to the schedule. All of this was addressed with their benefit or

disadvantage following.

Operating budget: It is the expenditure that contains the expense of the single item over the

revenue. This is essentially evolving over a specified period of time which can be on a monthly,

half-yearly, or yearly basis. The ABC Ltd prepares this budget to identify the changes in certain

period of time. After that they are taking right decision in regard of business operations.

Advantage

• Allows the company accomplishes its mission within the timelines.

• It seeks to enhance communication between the different tasks.

That provide required knowledge to assist improve individual & threats of the firm.

Disadvantage

• Precise documentation can be somewhat hard to gauge (RW Hiebl, 2013).

• It can contra-motivate workers when higher expectations are set by the company that are not

too convenient.

• leading to a shortage of interaction, confusion will create between the different departments.

• This budget takes a considerable amount of time to analyze the final results.

Master budget: This is the mixture of different accounting method that involves the

entire departmental rate this is why it is named master budget. It is the summarizing of the total

funding preparing for the yearly basis and it has some advantage or disadvantage as well. The

ABC limited company produce the master budget in order to collect all the income and expenses

summary of each department to prepare effective strategy.

Advantage

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.